UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21829

BBH TRUST

On behalf of the following series:

BBH Core Select

BBH International Equity Fund

BBH Limited Duration Fund

(Exact name of registrant as specified in charter)

140 Broadway, New York, NY 10005

(Address of principal executive offices) (Zip Code)

Corporation Services Company

2711 Centerville Road, Suite 400, Wilmington, DE 19808

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 625-5759

Date of fiscal year end: October 31

Date of reporting period: October 31, 2012

Item 1. Report to Stockholders.

Annual Report

OCTOBER 31, 2012

BBH Core Select

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| October 31, 2012 |

BBH Core Select (the “Fund” or “Core Select”) Class N Shares rose by 17.86%, net of fees, during its fiscal year ending October 31, 2012. During the same twelve month period, the S&P 500 Index1 (“S&P 500”) rose by 15.21%. For the five years ending October 31, 2012, Core Select has returned 5.80% per year while the S&P 500 has increased by 0.36% per year.

Core Select seeks to provide shareholders with long term growth of capital. Fundamental analysis and a discount to intrinsic value2 framework provide the basis for each Core Select investment. We look for companies that offer all, or most, of the following business and financial attributes: (i) essential products and services, (ii) loyal customers, (iii) leadership in an attractive market niche or industry, (iv) sustainable competitive advantages, (v) high returns on invested capital, and (vi) strong free cash flow. We believe businesses possessing these traits are favorably positioned to protect and grow capital through varying economic and market environments. In addition, we seek to invest in companies whose managers have high levels of integrity, are excellent operators, and are good capital allocators. Pursuant to our goal of not losing money on any single investment, we explicitly identify key risks outside of company management’s control so that we can fully consider the range of potential outcomes for each business. When a company meets our investment criteria and desired risk profile, we will consider establishing a position if its market price reaches 75% or less of our intrinsic value estimate. We maintain a buy-and-own approach, typically owning a company’s shares for 3-5 years or longer, and we will usually sell an investment as it appreciates to a level near our estimate of intrinsic value.

U.S. equity markets performed quite well in fiscal 2012 albeit in a distinctly roundabout fashion, as economic uncertainties, sovereign debt3 issues and key policy decisions throughout the year created large swings in short-term investor sentiment. The post-crisis global economic recovery has clearly slowed in its third year, most notably in Europe but also in other export-oriented markets such as China and Brazil. Despite this mounting headwind, we have observed that many large companies have executed well by controlling costs and limiting their expansion. Nonetheless, we are monitoring these trends closely given the risks posed by a financial market environment that is quick to reward macroeconomic ‘fixes’ while seemingly downplaying actual earnings trends. While macro-level analysis is a component of our qualitative risk assessments, the Core Select team’s far deeper focus remains the careful allocation of capital to high quality businesses that are reasonably priced relative to our intrinsic value estimates.

| 1 | The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investments cannot be made in an index. |

| 2 | We prepare proprietary financial models for each Core Select company in order to determine an estimate of intrinsic value. Discounted cash flow analysis is the primary quantitative model used in our research process. We supplement our discounted cash flow work with other quantitative analyses, such as economic profit models, internal rate of return models, and free cash flow multiples. |

| 3 | A debt instrument that is guaranteed by a government. |

| 2 |

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2012 |

Through our fundamental due diligence efforts, we constantly measure companies against our demanding set of investment criteria and study the long-term downside risks posed by competitive pressures, industry issues and growth challenges.

During fiscal 2012 we added four new companies to the Core Select portfolio: Google, Celanese, Praxair and Qualcomm. These companies are all excellent examples of competitively advantaged businesses that we believe are well positioned to generate solid long-term growth in free cash flow and earn high returns on capital. The management teams of these businesses have built strong and durable franchises that leverage technological advantages, operational skills and attractive market opportunities. In each case, we sought a margin of safety in our purchases by investing at attractive price-to-intrinsic value ratios. We believe a margin of safety exists when we are able to mitigate both business risk (our business, financial, and management criteria have been met; sustainable competitive advantages exist) and price risk (when we believe there is a significant discount to estimated intrinsic value at the time of purchase – we aim to purchase at 75% of our estimate to intrinsic value or less).

We exited several positions in fiscal 2012: Costco, Liberty Global, Ecolab, Visa and the small amount of tradable rights we received in a one-time distribution that accompanied the creation of the Liberty Ventures tracking stock. Costco, Ecolab and Visa were very successful investments for Core Select, and the dominant factor in each decision to sell was that the stocks had achieved our intrinsic value estimates. We sold our shares in Liberty Global in late 2011 amid ramping concerns about the stability of the Euro zone. We trimmed our holdings of several companies in the second half of the fiscal year as their prices approached estimated intrinsic value.

Our leading positive contributors in fiscal 2012 were Comcast, Diageo and eBay. Comcast, which was a top five position as of the fiscal year’s end, has performed exceptionally well as investors have been attracted to its compelling fundamental profile, which features recurring revenue, a strong technology platform, multiple growth initiatives, a solid balance sheet and a highly capable management team. Diageo has benefited from very solid execution in the areas of pricing, product mix and marketing, which together have resulted in stronger revenue growth and profitability over the last year. eBay continues to generate strong growth in revenue and cash flow from both its Marketplaces and Payments businesses. Other strong performers in fiscal 2012 included U.S. Bancorp, Wal-Mart, Anheuser-Busch InBev and Wells Fargo.

Our largest negative performer during fiscal 2012 was Dell, which fell sharply as the PC market was negatively impacted by macroeconomic pressures, aggressive low-end competition and crowding out effects from tablets and smartphones in the consumer market. In our view, the management team at Dell is taking the right actions to respond to these challenges by prioritizing the more profitable market segments, trimming costs, and most importantly, driving the continued corporate migration from being a ‘transactional’ technology vendor to much more of an IT solutions provider with a comprehensive set of scalable offerings based on open standards. Dell’s shares continue to trade at a low single-digit multiple of free cash flow. Other negative contributors for fiscal 2012 were Southwestern Energy, Occidental Petroleum and Celanese.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 3 |

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2012 |

As of October 31, 2012, the Core Select portfolio was trading at 80% of our weighted average intrinsic value estimate. While we do not consider this overall valuation to be indicative of severe market excess, our clear preference is to have the portfolio be closer to the 75% level, which is also our purchase threshold for individual securities. Our somewhat elevated cash position in the Fund (8.3% at the fiscal year’s end) reflects the general conditions we are seeing in the market and the actions we have taken this year to trim or sell positions that have achieved our intrinsic value estimates. We do not use cash as a hedge or an expression of a macro-economic perspective. Our distinct preference is to own the equities of high quality businesses at attractive valuations.

The Core Select team remains focused on the consistent application of our investment criteria and valuation discipline. We aspire to buy and own a portfolio of well positioned, cash generative companies that exhibit both resiliency in the context of challenges and the ability to participate during periods of stronger economic expansion.

As was disclosed previously, subject to certain exceptions, Core Select was closed to new investors effective November 30, 2012. Please see the Fund’s prospectus for details.

| 4 |

| BBH CORE SELECT |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

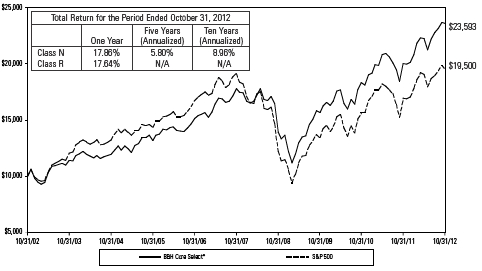

Growth of $10,000 Invested in BBH Core Select

The graph below illustrates the hypothetical investment of $10,0001 in the Class N shares of the Fund over the ten years ended October 31, 2012 as compared to the S&P 500.

* net of fees and expenses

The annualized gross expense ratios as in the February 28, 2012 prospectus for Class N and Retail Class shares were 1.14% and 1.59%, respectively.

Performance data quoted represents no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after tax returns, contact the Fund at 1-800-625-5759.

| 1 | The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500 has been adjusted to reflect reinvestment of dividends on securities. The S&P 500 is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund’s performance. The index is unmanaged. Investments cannot be made in an index. |

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 5 |

| BBH CORE SELECT |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Trustees of the BBH Trust and Shareholders of

BBH Core Select Fund:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of BBH Core Select Fund (a series of BBH Trust) (the “Fund”) as of October 31, 2012, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2012, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of BBH Core Select Fund as of October 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

December 20, 2012

| 6 |

| BBH CORE SELECT |

| PORTFOLIO ALLOCATION |

| October 31, 2012 |

SECTOR DIVERSIFICATION

| U.S. $ Value | Percent of Net Assets | ||||

| Basic Materials | $ | 90,931,342 | 2.7 | % | |

| Communications | 489,080,946 | 14.8 | |||

| Consumer Cyclical | 190,338,973 | 5.7 | |||

| Consumer Non-Cyclical | 995,848,088 | 30.0 | |||

| Energy | 247,177,011 | 7.5 | |||

| Financials | 689,806,488 | 20.8 | |||

| Industrials | 118,568,728 | 3.6 | |||

| Technology | 191,690,382 | 5.8 | |||

| Repurchase Agreements | 270,000,000 | 8.1 | |||

| Cash and Other Assets in Excess of Liabilities | 33,232,289 | 1.0 | |||

| NET ASSETS | $ | 3,316,674,247 | 100.0 | % | |

All data as of October 31, 2012. The Fund’s sector breakdown is expressed as a percentage of net assets and may vary over time.

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 7 |

| BBH CORE SELECT |

| PORTFOLIO OF INVESTMENTS |

| October 31, 2012 |

| Shares | Value | |||

| COMMON STOCKS (90.9%) | ||||

| BASIC MATERIALS (2.7%) | ||||

| 1,067,207 | Celanese Corp. (Series A) | $ | 40,543,194 | |

| 474,420 | Praxair, Inc. | 50,388,148 | ||

| Total Basic Materials | 90,931,342 | |||

| COMMUNICATIONS (14.8%) | ||||

| 3,966,276 | Comcast Corp. (Class A) | 148,775,013 | ||

| 1,807,033 | eBay, Inc.1 | 87,261,624 | ||

| 204,109 | Google, Inc. (Class A)1 | 138,747,175 | ||

| 5,085,637 | Liberty Media Corp. – Interactive A1 | 101,712,740 | ||

| 221,128 | Liberty Ventures1 | 12,584,394 | ||

| Total Communications | 489,080,946 | |||

| CONSUMER CYCLICAL (5.7%) | ||||

| 2,067,301 | Target Corp. | 131,790,439 | ||

| 780,439 | Wal-Mart Stores, Inc. | 58,548,534 | ||

| Total Consumer Cyclical | 190,338,973 | |||

| CONSUMER NON-CYCLICAL (30.0%) | ||||

| 846,970 | Anheuser-Busch InBev NV ADR | 70,976,086 | ||

| 1,151,344 | Automatic Data Processing, Inc. | 66,536,170 | ||

| 2,417,374 | Baxter International, Inc. | 151,400,134 | ||

| 1,997,444 | DENTSPLY International, Inc. | 73,585,837 | ||

| 1,100,040 | Diageo, Plc. ADR | 125,668,569 | ||

| 786,884 | Henry Schein, Inc.1 | 58,056,301 | ||

| 1,073,228 | Johnson & Johnson | 76,006,007 | ||

| 2,343,643 | Nestle SA ADR | 148,446,348 | ||

| 2,332,544 | Novartis AG ADR | 141,025,610 | ||

| 1,215,295 | PepsiCo, Inc. | 84,147,026 | ||

| Total Consumer Non-Cyclical | 995,848,088 | |||

| ENERGY (7.5%) | ||||

| 791,267 | EOG Resources, Inc. | 92,174,693 | ||

| 891,705 | Occidental Petroleum Corp. | 70,409,027 | ||

| 2,437,847 | Southwestern Energy Co.1 | 84,593,291 | ||

| Total Energy | 247,177,011 | |||

The accompanying notes are an integral part of these financial statements.

| 8 |

| BBH CORE SELECT |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2012 |

| Shares | Value | |||

| COMMON STOCKS (continued) | ||||

| FINANCIALS (20.8%) | ||||

| 1,390 | Berkshire Hathaway, Inc. (Class A)1 | $ | 180,011,950 | |

| 1,643,633 | Chubb Corp. | 126,526,868 | ||

| 4,647,150 | Progressive Corp. | 103,631,445 | ||

| 5,001,294 | US Bancorp | 166,092,974 | ||

| 3,370,236 | Wells Fargo & Co. | 113,543,251 | ||

| Total Financials | 689,806,488 | |||

| INDUSTRIALS (3.6%) | ||||

| 3,621,525 | Waste Management, Inc. | 118,568,728 | ||

| Total Industrials | 118,568,728 | |||

| TECHNOLOGY (5.8%) | ||||

| 4,075,349 | Dell, Inc. | 37,615,471 | ||

| 3,073,310 | Microsoft Corp. | 87,696,901 | ||

| 1,133,214 | QUALCOMM, Inc. | 66,378,010 | ||

| Total Technology | 191,690,382 | |||

| TOTAL COMMON STOCKS (Identified cost $2,670,452,695) | 3,013,441,958 | |||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 9 |

| BBH CORE SELECT |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2012 |

| Principal Amount |

Maturity Date |

Interest Rate |

||||||||

| REPURCHASE AGREEMENTS (8.1%) | ||||||||||

| $ | 100,000,000 | BNP Paribas SA (Agreement dated 10/31/12 | ||||||||

| collateralized by U.S Treasury Bond | ||||||||||

| 1.875-3.250% due 07/15/13-05/31/16, | ||||||||||

| par value $85,395,000) | 11/01/12 | 0.24 | % | 100,000,000 | ||||||

| 170,000,000 | Deutsche Bank AG (Agreement dated | |||||||||

| 10/31/12 collateralized by U.S Treasury | ||||||||||

| Bond 0.250% due 01/15/15, | ||||||||||

| par value $173,618,000) | 11/01/12 | 0.27 | % | 170,000,000 | ||||||

| TOTAL REPURCHASE AGREEMENTS | ||||||||||

| (Identified cost $270,000,000) | 270,000,000 | |||||||||

| TOTAL INVESTMENTS (Identified cost $2,940,452,695)2 | 99.0 | % | $ | 3,283,441,958 | ||||||

| CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES | 1.0 | 33,232,289 | ||||||||

| NET ASSETS | 100.0 | % | $ | 3,316,674,247 | ||||||

| 1 | Non-income producing security. |

| 2 | The aggregate cost for federal income tax purposes is $2,940,574,863, the aggregate gross unrealized appreciation is $364,209,991 and the aggregate gross unrealized depreciation is $21,342,896, resulting in net unrealized appreciation of $342,867,095. |

Abbreviations:

ADR – American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| 10 |

| BBH CORE SELECT |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2012 |

FAIR VALUE MEASUREMENTS

The Fund is required to disclose information regarding the fair value measurements of the Fund’s assets and liabilities. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The disclosure requirement established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the Fund’s own considerations about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three levels defined by the fair value hierarchy are as follows:

| — | Level 1 – (unadjusted) quoted prices in active markets for identical investments. |

| — | Level 2 – significant other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.). |

| — | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs are used in applying the various valuation techniques and broadly refer to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Investment Adviser. The Investment Adviser considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Investment Adviser’s perceived risk of that instrument.

Financial assets within level 1 are based on quoted market prices in active markets. The Fund does not adjust the quoted price for these instruments.

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 11 |

| BBH CORE SELECT |

| PORTFOLIO OF INVESTMENTS (continued) |

| October 31, 2012 |

Financial instruments that trade in markets that are not considered to be active but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within level 2. These include investment-grade corporate bonds, U.S. Treasury notes and bonds, and certain non-U.S. sovereign obligations, listed equities and over-the counter derivatives. As level 2 financial assets include positions that are not traded in active markets and/or are subject to transfer restrictions, valuations may be adjusted to reflect illiquidity and/or non-transferability, which are generally based on available market information.

Financial assets classified within level 3 have significant unobservable inputs, as they trade infrequently. Level 3 financial assets include private equity and corporate debt securities. As observable prices are not available for these securities, valuation techniques are used to derive fair value.

Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon the actual sale of those investments.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of October 31, 2012.

| Investments, at value | (Unadjusted) Quoted Prices in Active Markets for Identical Investments (Level 1)* |

Significant Other Observable Inputs (Level 2)* |

Significant Unobservable Inputs (Level 3)* |

Balance as of October 31, 2012 | ||||||||

| Basic Materials | $ | 90,931,342 | $ | — | $ | — | $ | 90,931,342 | ||||

| Communications | 489,080,946 | — | — | 489,080,946 | ||||||||

| Consumer Cyclical | 190,338,973 | — | — | 190,338,973 | ||||||||

| Consumer Non-Cyclical | 995,848,088 | — | — | 995,848,088 | ||||||||

| Energy | 247,177,011 | — | — | 247,177,011 | ||||||||

| Financials | 689,806,488 | — | — | 689,806,488 | ||||||||

| Industrials | 118,568,728 | — | — | 118,568,728 | ||||||||

| Technology | 191,690,382 | — | — | 191,690,382 | ||||||||

| Repurchase Agreements | — | 270,000,000 | — | 270,000,000 | ||||||||

| Total Investments, at value | $ | 3,013,441,958 | $ | 270,000,000 | $ | — | $ | 3,283,441,958 | ||||

| * | The Fund’s policy is to disclose transfers between levels based on valuations at the end of the reporting period. There were no transfers between levels 1, 2 or 3 as of October 31, 2012, based on the valuation input levels on October 31, 2011. |

The accompanying notes are an integral part of these financial statements.

| 12 |

| BBH CORE SELECT |

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2012 |

| ASSETS: | ||

| Investments in securities, at value (Identified cost $2,670,452,695) | $ | 3,013,441,958 |

| Repurchase agreements (Identified cost $270,000,000) | 270,000,000 | |

| Cash | 5,069,011 | |

| Receivables for: | ||

| Investments sold | 21,607,806 | |

| Shares sold | 20,862,372 | |

| Investment advisory and administrative fees waiver reimbursement | 597,156 | |

| Dividends | 104,822 | |

| Interest | 1,942 | |

| Prepaid assets | 16,821 | |

| Total Assets | 3,331,701,888 | |

| LIABILITIES: | ||

| Payables for: | ||

| Investments purchased | 10,453,914 | |

| Investment advisory and administrative fees | 2,188,496 | |

| Shares redeemed | 1,073,529 | |

| Shareholder servicing fees | 683,905 | |

| Custody and fund accounting fees | 135,646 | |

| Distribution fees | 64,148 | |

| Transfer agent fees | 53,753 | |

| Professional fees | 44,298 | |

| Board of Trustees’ fees | 786 | |

| Accrued expenses and other liabilities | 329,166 | |

| Total Liabilities | 15,027,641 | |

| NET ASSETS | $ | 3,316,674,247 |

| Net Assets Consist of: | ||

| Paid-in capital | $ | 2,914,466,921 |

| Undistributed net investment income | 10,315,796 | |

| Accumulated net realized gain on investments in securities | 48,902,267 | |

| Net unrealized appreciation/(depreciation) on investments in securities | 342,989,263 | |

| Net Assets | $ | 3,316,674,247 |

| NET ASSET VALUE AND OFFERING PRICE PER SHARE | |

| CLASS N SHARES | |

| ($3,049,341,996 ÷ 174,615,697 shares outstanding) | $17.46 |

| RETAIL CLASS SHARES | |

| ($267,332,251 ÷ 23,035,345 shares outstanding) | $11.61 |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 13 |

| BBH CORE SELECT |

| STATEMENT OF OPERATIONS |

| For the Year Ended October 31, 2012 |

| NET INVESTMENT INCOME: | |||

| Income: | |||

| Dividends (net of foreign withholding taxes of $910,668) | $ | 31,527,728 | |

| Interest and other income | 247,050 | ||

| Total Income | 31,774,778 | ||

| Expenses: | |||

| Investment advisory and administrative fees | 15,356,315 | ||

| Shareholder servicing fees | 4,798,848 | ||

| Distribution fees | 924,911 | ||

| Custody and fund accounting fees | 403,454 | ||

| Transfer agent fees | 223,191 | ||

| Board of Trustees’ fees | 103,846 | ||

| Professional fees | 66,090 | ||

| Miscellaneous expenses | 698,413 | ||

| Total Expenses | 22,575,068 | ||

| Expense offset arrangement | (11,652 | ) | |

| Investment advisory and administrative fees waiver | (2,486,320 | ) | |

| Net Expenses | 20,077,096 | ||

| Net Investment Income | 11,697,682 | ||

| NET REALIZED AND UNREALIZED GAIN: | |||

| Net realized gain on investments in securities | 49,028,320 | ||

| Net change in unrealized appreciation/(depreciation) | |||

| on investments in securities | 246,390,832 | ||

| Net Realized and Unrealized Gain | 295,419,152 | ||

| Net Increase in Net Assets Resulting from Operations | $ | 307,116,834 |

The accompanying notes are an integral part of these financial statements.

| 14 |

| BBH CORE SELECT |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the years ended October 31, | |||||||

| 2012 | 2011 | ||||||

| INCREASE IN NET ASSETS: | |||||||

| Operations: | |||||||

| Net investment income | $ | 11,697,682 | $ | 5,153,848 | |||

| Net realized gain on investments in securities | 49,028,320 | 13,263,835 | |||||

| Net change in unrealized appreciation/(depreciation) | |||||||

| on investments in securities | 246,390,832 | 50,722,838 | |||||

| Net increase in net assets resulting from operations | 307,116,834 | 69,140,521 | |||||

| Dividends and distributions declared: | |||||||

| From net investment income: | |||||||

| Class N | (4,275,899 | ) | (2,615,790 | ) | |||

| Retail Class | (1,053,704 | ) | — | ||||

| From net realized gains: | |||||||

| Class N | (10,156,709 | ) | (1,269,835 | ) | |||

| Retail Class | (3,114,913 | ) | — | ||||

| Total dividends and distributions declared | (18,601,225 | ) | (3,885,625 | ) | |||

| Share transactions: | |||||||

| Proceeds from sales of shares | 2,758,236,879 | 640,726,072 | |||||

| Net asset value of shares issued to shareholders for | |||||||

| reinvestment of dividends and distributions | 17,905,795 | 3,685,787 | |||||

| Proceeds from short-term redemption fees | 62,466 | 25,230 | |||||

| Cost of shares redeemed | (742,113,834 | ) | (77,616,532 | ) | |||

| Net increase in net assets resulting from | |||||||

| share transactions | 2,034,091,306 | 566,820,557 | |||||

| Total increase in net assets | 2,322,606,915 | 632,075,453 | |||||

| NET ASSETS: | |||||||

| Beginning of year | 994,067,332 | 361,991,879 | |||||

| End of year (including undistributed net investment | |||||||

| income of $10,315,796 and $3,950,998, respectively) | $ | 3,316,674,247 | $ | 994,067,332 | |||

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 15 |

| BBH CORE SELECT |

| FINANCIAL HIGHLIGHTS |

Selected per share data and ratios for a Class N share outstanding throughout each year.

| For the years ended October 31, | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

| Net asset value, beginning of year | $ | 15.07 | $ | 13.91 | $ | 11.93 | $ | 10.71 | $ | 13.71 | |||||||||

| Income from investment operations: | |||||||||||||||||||

| Net investment income1 | 0.10 | 0.12 | 0.07 | 0.06 | 0.01 | ||||||||||||||

| Net realized and unrealized gain (loss) | 2.54 | 1.15 | 1.96 | 1.25 | (2.99 | ) | |||||||||||||

| Total income (loss) from investment | |||||||||||||||||||

| operations | 2.64 | 1.27 | 2.03 | 1.31 | (2.98 | ) | |||||||||||||

| Less dividends and distributions: | |||||||||||||||||||

| From net investment income | (0.07 | ) | (0.07 | ) | (0.05 | ) | (0.02 | ) | (0.02 | ) | |||||||||

| From net realized gains | (0.18 | ) | (0.04 | ) | — | (0.07 | ) | — | |||||||||||

| Total dividends and distributions | (0.25 | ) | (0.11 | ) | (0.05 | ) | (0.09 | ) | (0.02 | ) | |||||||||

| Net asset value, end of year | $ | 17.46 | $ | 15.07 | $ | 13.91 | $ | 11.93 | $ | 10.71 | |||||||||

| Total return | 17.86 | % | 9.19 | % | 17.11 | % | 12.44 | % | (21.76 | )% | |||||||||

| Ratios/Supplemental data: | |||||||||||||||||||

| Net assets, end of year (in millions) | $ | 3,049 | $ | 809 | $ | 362 | $ | 237 | $ | 166 | |||||||||

| Ratio of expenses to average net assets | |||||||||||||||||||

| before reductions | 1.12 | % | 1.14 | % | 1.18 | % | 1.21 | % | 1.18 | % | |||||||||

| Fee waiver | 0.12 | %2 | 0.13 | %2 | 0.06 | %2 | 0.00 | % | 0.00 | % | |||||||||

| Expense offset arrangement | 0.00 | %3 | 0.01 | % | 0.01 | % | 0.02 | % | 0.02 | % | |||||||||

| Ratio of expenses to average net assets | |||||||||||||||||||

| after reductions | 1.00 | % | 1.00 | % | 1.11 | % | 1.19 | % | 1.16 | % | |||||||||

| Ratio of net investment income to average | |||||||||||||||||||

| net assets | 0.63 | % | 0.85 | % | 0.55 | % | 0.61 | % | 0.14 | % | |||||||||

| Portfolio turnover rate | 14 | % | 17 | % | 19 | % | 15 | % | 31 | % | |||||||||

| 1 | Calculated using average shares outstanding for the year. |

| 2 | The ratio of expenses to average net assets for the fiscal years ended October 31, 2012, 2011 and 2010, reflect fees reduced as result of a contractual operating expense limitation of the Fund to 1.00%. The agreement is effective for the period beginning on July 14, 2010 and will terminate on March 1, 2014, unless it is renewed by all parties to the agreement. For the fiscal years ended October 31, 2012, 2011 and 2010, the waived fees were $1,853,202, $793,607 and $177,639, respectively. |

| 3 | Less than 0.01%. |

The accompanying notes are an integral part of these financial statements.

| 16 |

| BBH CORE SELECT |

| FINANCIAL HIGHLIGHTS (continued) |

Selected per share data and ratios for a Retail Class share outstanding throughout each period.

| For the year ended October 31, 2012 |

For the period from March 25, 2011 (commencement of operations) to October 31, 2011 |

|||||

| Net asset value, beginning of year | $ | 10.11 | $ | 10.00 | ||

| Income from investment operations: | ||||||

| Net investment income1 | 0.05 | 0.02 | ||||

| Net realized and unrealized gain | 1.69 | 0.09 | ||||

| Total income from investment operations | 1.74 | 0.11 | ||||

| Less dividends and distributions: | ||||||

| From net investment income | (0.06 | ) | — | |||

| From net realized gains | (0.18 | ) | — | |||

| Total dividends and distributions | (0.24 | ) | — | |||

| Net asset value, end of year | $ | 11.61 | $ | 10.11 | ||

| Total return | 17.64 | % | 1.10 | % | ||

| Ratios/Supplemental data: | ||||||

| Net assets, end of year (in millions) | $ | 267 | $ | 185 | ||

| Ratio of expenses to average net assets before reductions | 1.43 | % | 1.59 | %2 | ||

| Fee waiver | 0.18 | %3 | 0.33 | %2,3 | ||

| Expense offset arrangement | 0.00 | %4 | 0.01 | %2 | ||

| Ratio of expenses to average net assets after reductions | 1.25 | % | 1.25 | %2 | ||

| Ratio of net investment income to average net assets | 0.50 | % | 0.37 | %2 | ||

| Portfolio turnover rate | 14 | % | 17 | %5 | ||

| 1 | Calculated using average shares outstanding for the year. |

| 2 | Annualized. |

| 3 | The ratio of expenses to average net assets for fiscal year ended October 31, 2012, and period ended October 31, 2011, reflect fees reduced as result of a contractual operating expense limitation of the Fund to 1.00%. The agreement is effective for the period beginning on July 14, 2010 and will terminate on March 1, 2014, unless it is renewed by all parties to the agreement. For the fiscal year ended October 31, 2012 and period ended October 31, 2011, the waived fees were $633,118 and $133,178, respectively. |

| 4 | Less than 0.01%. |

| 5 | Represents Fund portfolio turnover for the twelve months ended October 31, 2011. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 17 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS |

| October 31, 2012 |

| 1. | Organization. The Fund is a separate, non-diversified series of BBH Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust was originally organized under the laws of the State of Maryland on July 16, 1990 as BBH Fund, Inc. and re-organized as a Delaware statutory trust on June 12, 2007. The Fund commenced operations on November 2, 1998. On February 20, 2001, the Board of Trustees (“Board”) of the Trust reclassified the Fund’s outstanding shares as “Class N”. On October 1, 2010, the Board established a new class of shares designated as “Retail Class”, which commenced operations on March 25, 2011. Neither Class N shares nor Retail Class shares convert to any other share class of the Fund. As of October 31, 2012, there were four series of the Trust. |

| 2. | Significant Accounting Policies. The Fund’s financial statements are prepared in accordance with Generally Accepted Accounting Principles in the United States of America (“GAAP”). The following summarizes significant accounting policies of the Fund: |

| A. | Valuation of Investments. (1) The value of investments listed on a securities exchange is based on the last sale price on that exchange prior to the time when assets are valued, or in the absence of recorded sales, at the average of readily available closing bid and asked prices on such exchange; (2) unlisted securities are valued at the average of the quoted bid and asked prices in the over-the-counter market; (3) securities or other assets for which market quotations are not readily available are valued at fair value in accordance with procedures established by and under the general supervision and responsibility of the Board; (4) short-term investments, which mature in 60 days or less are valued at amortized cost if their original maturity was 60 days or less, or by amortizing their value on the 61st day prior to maturity, if their original maturity when acquired by the Fund was more than 60 days, unless this is determined not to represent fair value by the Board. |

| B. | Accounting for Investments and Income. Investment transactions are accounted for on the trade date. Realized gains and losses on investment transactions are determined based on the identified cost method. Dividend income and other distributions from portfolio securities are recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of securities received. Distributions received on securities that represent a return of capital or a capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued daily. Investment income is recorded net of any foreign taxes withheld where recovery of such tax is uncertain. |

| C. | Fund Expenses. Most expenses of the Trust can be directly attributed to a specific fund. Expenses which cannot be directly attributed to a fund are apportioned amongst each fund in the Trust equally. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known. |

| 18 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2012 |

| D. | Repurchase Agreements. The Fund may enter into repurchase agreements. Repurchase agreements are transactions in which the Fund buys a security from a dealer or bank and agrees to sell the security back at a mutually agreed upon time and price. The repurchase price normally is in excess of the purchase price, reflecting an agreed upon interest rate. The rate is effective for the period of time that assets of the Fund are invested in the agreement and is not related to the coupon rate on the underlying security. The Fund will enter into repurchase agreements only with banks and other recognized financial institutions, such as securities dealers, deemed creditworthy by the investment adviser. The Fund’s custodian or sub-custodian will take possession of the securities subject to repurchase agreements. The investment adviser, custodian or sub-custodian will monitor the value of the underlying security each day to ensure that the value of the security always equals or exceeds the repurchase price. Repurchase agreements are subject to credit risks. Information regarding repurchase agreements held by the Fund is included in the Portfolio of Investments. |

| E. | Federal Income Taxes. It is the Trust’s policy to comply with the requirements of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Accordingly, no federal income tax provision is required. The Fund files a tax return annually using tax accounting methods required under provisions of the Code, which may differ from GAAP, the basis on which these financial statements are prepared. Accordingly, the amount of net investment income and net realized gain reported in these financial statements may differ from that reported on the Fund’s tax return due to certain book-to-tax timing differences such as losses deferred due to “wash sale” transactions and utilization of capital loss carryforwards. These differences result in temporary over-distributions for financial statement purposes and are classified as distributions in excess of accumulated net realized gains or net investment income. These distributions do not constitute a return of capital. |

Permanent differences are reclassified on the Statement of Assets & Liabilities based upon their tax classification. As such, the character of distributions to shareholders reported in the Financial Highlights table may differ from that reported to shareholders on Form 1099-DIV.

The Fund is subject to the provisions of Accounting Standards Codification (“ASC”) 740 Income Taxes (“ASC 740”). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The Fund did not have any unrecognized tax benefits as of October 31, 2012, nor were there any increases or decreases in unrecognized tax benefits for the year then ended. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as an income tax expense in the Statement of Operations. During the year ended October 31, 2012, the Fund did not incur any such interest or penalties. The Fund is subject to examination by U.S. federal and state tax authorities for returns filed for the prior three fiscal years. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 19 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2012 |

| F. | Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, if any, are paid annually and are recorded on the ex-dividend date. Distributions from net capital gains, if any, are generally declared and paid annually and are recorded on the ex-dividend date. |

The tax character of distributions paid during the fiscal years ended October 31, 2012 and 2011, respectively, were as follows:

| Distributions paid from: | ||||||||||||

| Ordinary income |

Net long-term capital gain |

Long-term distribution adjustment |

Total taxable distributions |

Tax return of capital |

Total distributions paid | |||||||

| 2012: | $6,132,108 | $12,469,117 | — | $18,601,225 | — | $18,601,225 | ||||||

| 2011: | 2,615,790 | 1,269,835 | — | 3,885,625 | — | 3,885,625 | ||||||

As of October 31, 2012 and 2011, respectively, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Components of accumulated earnings/(deficit): | ||||||||||||||

| Undistributed ordinary income |

Undistributed long-term capital gain |

Accumulated earnings |

Accumulated capital and other losses |

Other book/tax temporary differences |

Unrealized appreciation/ (depreciation) |

Total accumulated earnings/ (deficit) | ||||||||

| 2012: | $10,315,796 | $49,024,436 | $59,340,232 | — | — | $342,867,094 | $402,207,326 | |||||||

| 2011: | 4,750,222 | 12,462,104 | 17,212,326 | — | — | 96,479,391 | 113,691,717 | |||||||

The Fund did not have a net capital loss carry forward at October 31, 2012.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010, for an unlimited period and will retain their character as either short-term or long-term capital losses rather than being considered all short term capital losses.

Total distributions paid may differ from the Statements of Changes in Net Assets because, for tax purposes, dividends are recognized when actually paid.

The differences between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax deferral of losses on wash sales.

To the extent future capital gains are offset by capital loss carry forwards; such gains will not be distributed.

| 20 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2012 |

| G. | Use of Estimates. The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from these estimates. |

| 3. | Recent Accounting Pronouncements. In December 2011, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update (“ASU”) No. 2011-11 “Disclosures about Offsetting Assets and Liabilities.” The amendments in this update require an entity to disclose both gross and net information for derivatives and other financial instruments that are either offset in the statement of assets and liabilities or subject to an enforceable master netting arrangement or similar agreement. The ASU is effective during interim or annual reporting periods beginning on or after January 1, 2013. Management is currently evaluating the implications of this ASU and its impact on the financial statements has not been determined. |

In May 2011, the FASB issued ASU No. 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS.” The ASU establishes common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with U.S. GAAP and International Financial Reporting Standards (“IFRS”) and is effective for interim and annual periods beginning after December 15, 2011. Management adopted ASU No. 2011-04 effective January 1, 2012 and has concluded that the adoption of ASU No. 2011-04 does not have a material impact on the Fund’s financial statements and the accompanying notes.

In April 2011, the FASB released ASU No. 2011-03 “Reconsideration of Effective Control for Repurchase Agreements.” This ASU amends FASB Accounting Standards Codification (“ASC”) Topic 860, “Transfers and Servicing;” specifically the criteria required to determine whether a repurchase agreement and similar agreements should be accounted for as sales of financial assets or secured borrowings with commitments. This ASU is effective for fiscal years and interim periods beginning after December 15, 2011. Management has concluded that the adoption of ASU No. 2011-03 did not have a material impact on the Fund’s financial statements and the accompanying notes, net assets or results of operations.

| 4. | Fees and Other Transactions with Affiliates. |

| A. | Investment Advisory and Administrative Fees. Effective June 12, 2007, under a combined Investment Advisory and Administrative Services Agreement (“Agreement”) with the Trust, Brown Brothers Harriman & Co. (“BBH”) through a separately identifiable department (“SID” or “Investment Adviser”) provides investment advisory and portfolio management services to the Fund. BBH also provides administrative services to the Fund. The Fund pays a combined fee for investment |

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 21 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2012 |

advisory and administrative services calculated daily and paid monthly at an annual rate equivalent to 0.80% of the Fund’s average daily net assets. For the year ended October 31, 2012, the Fund incurred $15,356,315 under the Agreement.

| B. | Investment Advisory and Administrative Fee Waivers. Effective July 14, 2010, the SID contractually agreed to limit the annual fund operating expenses (excluding interest, taxes, brokerage commissions, other expenditures that are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business and for Retail Class, amounts payable pursuant to any plan adopted in accordance with Rule 12b-1) of Class N and Retail Class to 1.00%. The agreement will terminate on March 1, 2014, unless it is renewed by all parties to the agreement. The agreement may only be terminated during its term with approval of the Fund’s Board of Trustees. For the year ended October 31, 2012, the SID waived fees in the amount of $1,853,202 and $633,118 for Class N and Retail Class, respectively. |

| C. | Shareholder Servicing Fees. The Trust has a shareholder servicing agreement with BBH. BBH receives a fee from the Fund calculated daily and paid monthly at an annual rate of 0.25% of Class N and Retail Class shares’ average daily net assets. For the year ended October 31, 2012, the Fund incurred shareholder servicing fees in the amount of $3,920,386 and $878,462 for Class N and Retail Class, respectively. |

| D. | Distribution (12b-1) Fees. The Fund has adopted a distribution plan pursuant to Rule 12b-1 for Retail Class shares that allows the Fund to pay distribution and other fees for the sale of its shares and for services provided to shareholders. Because these fees are paid out of the Fund’s assets continuously, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. The maximum annual distribution fee for Retail Class shares is 0.25% of the average daily net assets of the Retail Class shares of the Fund. With this agreement, it is anticipated that total operating expenses for Retail Class shares will be 1.25% of the average daily net assets. For the year ended October 31, 2012, Retail Class shares of the Fund incurred $881,378 for Distribution (12b-1) Fees. |

| E. | Custody and Fund Accounting Fees. BBH acts as a custodian and fund accountant and receives custody and fund accounting fees from the Fund calculated daily and incurred monthly. BBH holds all of the Fund’s cash and investments and calculates the Fund’s daily net asset value. The custody fee is an asset and transaction based fee. The fund accounting fee is an asset based fee calculated at 0.04% per annum on the first $100,000,000 of average daily net assets and 0.02% per annum on the next $400,000,000 of average daily net assets and 0.01% per annum on all average daily net assets over $500,000,000. For the year ended October 31, 2012, the Fund incurred $403,454 in custody and fund accounting fees. These fees for the Fund were reduced by $11,652 as a result of an expense offset arrangement with the Fund’s custodian. The credit amount (if any) is disclosed in |

| 22 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2012 |

the Statement of Operations as a reduction to the Fund’s expenses. In the event that the Fund is overdrawn, under the custody agreement with BBH, BBH will make overnight loans to the Fund to cover overdrafts. Pursuant to their agreement, the Fund will pay the Federal Funds overnight investment rate on the day of the overdraft. The total interest incurred by the Fund for the year ended October 31, 2012, was $261.

| F. | Board of Trustees’ Fees. Each Trustee who is not an “interested person” as defined under the 1940 Act receives an annual fee as well as reimbursement for reasonable out-of-pocket expenses from the Fund. For the year ended October 31, 2012, the Fund incurred $103,846 in non-interested Trustee compensation and reimbursements. |

| 5. | Investment Transactions. For the year ended October 31, 2012, the cost of purchases and the proceeds of sales of investment securities, other than short-term investments, were $1,981,412,498 and $243,768,664, respectively. |

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 23 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2012 |

| 6. | Shares of Beneficial Interest. The Trust is permitted to issue an unlimited number of Class N and Retail Class shares of beneficial interest at no par value. Transactions in Class N and Retail Class shares were as follows: |

| For the year ended October 31, 2012 |

For the year ended October 31, 2011 | ||||||||||||

| Shares | Dollars | Shares | Dollars | ||||||||||

| Class N | |||||||||||||

| Shares sold | 135,774,669 | $ | 2,254,711,799 | 31,839,985 | $ | 457,075,686 | |||||||

| Shares issued in connection | |||||||||||||

| with reinvestments | |||||||||||||

| of dividends | 952,018 | 13,747,144 | 258,470 | 3,685,787 | |||||||||

| Proceeds from short-term | |||||||||||||

| redemption fees | NA | 56,066 | NA | 15,729 | |||||||||

| Shares redeemed | (15,812,605 | ) | (252,722,028 | ) | (4,429,689 | ) | (64,528,429 | ) | |||||

| Net increase | 120,914,082 | $ | 2,015,792,981 | 27,668,766 | $ | 396,248,773 | |||||||

| Retail Class* | |||||||||||||

| Shares sold | 46,672,538 | $ | 503,525,080 | 19,642,983 | $ | 183,650,386 | |||||||

| Shares issued in connection | |||||||||||||

| with reinvestments | |||||||||||||

| of dividends | 432,292 | 4,158,651 | — | — | |||||||||

| Proceeds from short-term | |||||||||||||

| redemption fees | NA | 6,400 | NA | 9,501 | |||||||||

| Shares redeemed | (42,346,156 | ) | (489,391,806 | ) | (1,366,312 | ) | (13,088,103 | ) | |||||

| Net increase | 4,758,674 | $ | 18,298,325 | 18,276,671 | $ | 170,571,784 | |||||||

| * | For the Retail Class year ended October 31, 2011, the period represented is from March 25, 2011 (commencement of operations) to October 31, 2011. |

| 7. | Principal Risk Factors and Indemnifications. |

| A. | Principal Risk Factors. Investing in the Fund may involve certain risks, as discussed in the Fund’s prospectus, including but not limited to, those described below: |

A shareholder may lose money by investing in the Fund (investment risk). In the normal course of business, the Fund invests in securities and enters into transactions where risks exist due to assumption of large positions in securities of a small number of issuers (non-diversification risk), or certain risks associated with investing in foreign securities not present in domestic investments

| 24 |

| BBH CORE SELECT |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| October 31, 2012 |

(foreign investment risk). The value of securities held by the Fund may fall due to changing economic, political, regulatory or market conditions, or due to a company’s or issuer’s individual situation (market risk). The Fund is actively managed and the decisions by the Investment Adviser may cause the Fund to incur losses or miss profit opportunities (management risk). The Fund’s shareholders may be adversely impacted by asset allocation decisions made by an investment adviser whose discretionary clients make up a large percentage of the Fund’s shareholders (shareholder concentration risk). The extent of the Fund’s exposure to these risks in respect to these financial assets is included in their value as recorded in the Fund’s Statement of Assets and Liabilities.

Please refer to the Fund’s prospectus for a complete description of the principal risks of investing in the Fund.

| B. | Indemnifications. Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund, and shareholders are indemnified against personal liability for the obligations of the Trust. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote. |

| 8. | Subsequent Events. Management has evaluated events and transactions that may have occurred since October 31, 2012 through the date the financial statements were issued, that would merit recognition or additional disclosure in the financial statements. |

Subject to certain exceptions, effective November 30, 2012, BBH Core Select was closed to new investors. An existing investor that has been a shareholder in the Fund continuously since November 30, 2012, either directly or as the beneficial owner of shares held in another account, may make additional investments in the Fund and reinvest dividends and capital gain distributions. See the Fund’s Prospectus for details.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 25 |

| BBH CORE SELECT |

| DISCLOSURE OF FUND EXPENSES |

| October 31, 2012 (unaudited) |

EXAMPLE

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested distributions, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution 12b-1 fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2012 to October 31, 2012).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. You may use information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% Hypothetical Example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| 26 |

| BBH CORE SELECT |

| DISCLOSURE OF FUND EXPENSES (continued) |

| October 31, 2012 (unaudited) |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value May 1, 2012 |

Ending Account Value October 31, 2012 |

Expenses Paid During Period May 1, 2012 to October 31, 20121 | |||

| Class N | |||||

| Actual | $1,000 | $1,060 | $5.18 | ||

| Hypothetical2 | $1,000 | $1,020 | $5.08 |

| Beginning Account Value May 1, 2012 |

Ending Account Value October 31, 2012 |

Expenses Paid During Period May 1, 2012 to October 31, 20121 | |||

| Retail Class | |||||

| Actual | $1,000 | $1,058 | $6.47 | ||

| Hypothetical2 | $1,000 | $1,019 | $6.34 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio of 1.00% and 1.25% for Class N and Retail Class shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| 2 | Assumes a return of 5% before expenses. For the purposes of the calculation, the applicable annualized expenses ratio for each class of shares is subtracted from the assumed return before expenses. |

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 27 |

| BBH CORE SELECT |

| CONFLICTS OF INTEREST |

| October 31, 2012 (unaudited) |

Conflicts of Interest

Certain conflicts of interest may arise in connection with a portfolio manager’s management of the Fund’s investments, on the one hand, and the investments of other accounts for which the portfolio manager is responsible, on the other. For example, it is possible that the various accounts managed could have different investment strategies that, at times, might conflict with one another to the possible detriment of the Fund. Alternatively, to the extent that the same investment opportunities might be desirable for more than one account, possible conflicts could arise in determining how to allocate them.

Other potential conflicts might include conflicts between the Fund and its affiliated and unaffiliated service providers (e.g., conflicting duties of loyalty). In addition to providing investment management services through the Investment Adviser, BBH provides administrative, custody, fund accounting, shareholder servicing and securities lending services to the Fund. BBH may have conflicting duties of loyalty while servicing the Fund and/or opportunities to further its own interest to the detriment of the Fund. For example, in negotiating fee arrangements with affiliated service providers, BBH may have an incentive to agree to higher fees than it would in the case of unaffiliated providers. Also, because its advisory fees are calculated by reference to the Fund’s net assets, the Investment Adviser and its affiliates may have an incentive to seek to overvalue certain assets. From time to time, BBH may buy or sell shares of the Fund on behalf of discretionary wealth management clients.

The SID may direct brokerage transactions and/or payment of a portion of client commissions (“soft dollars”) to specific brokers or dealers or other providers to pay for research or brokerage services. The use of a broker that provides research and securities transaction services may result in a higher commission than that offered by a broker who does not provide such services. The Investment Adviser will determine in good faith whether the amount of commission is reasonable in relation to the value of research and brokerage services provided and whether the services provide lawful and appropriate assistance in its investment decision-making responsibilities.

Arrangements regarding compensation and delegation of responsibility may create conflicts relating to selection of brokers or dealers to execute Fund portfolio trades and/or specific uses of commissions from Fund portfolio trades, administration of investment advice and valuation of securities. BBH may enter into advisory and/or referral arrangements with third parties. Such arrangements may include compensation paid by BBH to the third party. BBH may pay a solicitation fee for referrals and/or advisory or incentive fees.

| 28 |

| BBH CORE SELECT |

| CONFLICTS OF INTEREST (continued) |

| October 31, 2012 (unaudited) |

BBH, including the Investment Adviser, seeks to meet its fiduciary obligation with respect to all clients including the Fund. BBH has adopted and implemented policies and procedures that seek to manage conflicts. The Investment Adviser monitors a variety of areas, including compliance with fund investment guidelines, review of allocation decisions, the investment in only those securities within the parameters of which have been approved for purchase by an oversight committee, and compliance with the Investment Adviser’s Code of Ethics. With respect to the allocation of investment opportunities, BBH has adopted and implemented policies designed to achieve fair and equitable allocation of investment opportunities among its clients over time. BBH has structured the portfolio managers’ compensation in a manner it believes is reasonably designed to safeguard the Fund from being negatively affected as a result of any such potential conflicts.

The Trust also manages these conflicts. For example, the Fund has designated a chief compliance officer and has adopted and implemented policies and procedures designed to address the conflicts identified above and other conflicts that may arise in the course of the Fund’s operations in such a way as to safeguard the Fund from being negatively affected as a result of any such potential conflicts. The Trustees receive regular reports from the Investment Adviser and the Fund’s chief compliance officer on areas of potential conflict.

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 29 |

| BBH CORE SELECT |

| ADDITIONAL FEDERAL TAX INFORMATION |

| October 31, 2012 (unaudited) |

BBH Core Select hereby designates $12,469,117 as an approximate amount of capital gain dividend for the purpose of dividends paid deduction.

Under Section 854(b)(2) of the Internal Revenue Code (the “Code”), the Fund designates up to a maximum of $6,132,108 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended October 31, 2013. In January 2013, shareholders will receive Form 1099-DIV, which will include their share of qualified dividends distributed during the calendar year 2012. Shareholders are advised to check with their tax advisers for information on the treatment of these amounts on their individual income tax returns.

100% of the ordinary income dividends paid by the Fund during the year ended October 31, 2012 qualifies for the dividends received deduction available to corporate shareholders.

| 30 |

| TRUSTEES AND OFFICERS OF BBH CORE SELECT |

| (unaudited) |

Information pertaining to the Trustees of the BBH Trust (the “Trust”) and executive officers of the Trust is set forth below. The Statement of Additional Information for the BBH Core Select includes additional information about the Fund’s Trustees and is available upon request without charge by contacting the Fund at 1-800-625-5759.

| Name and Birth Date |

Position(s) Held with the Trust |

Term of Office# and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex Overseen By Trustee^ |

Other Directorships held by Trustee During Past 5 Years |

| Independent Trustees | |||||

| Joseph V. Shields Jr. Birth Date: March 17, 1938 |

Chairman of the Board and Trustee |

Since 2007 1990-2007 with the Predecessor Trust |

Managing Director and Chairman of Wellington Shields & Co. LLC (member of New York Stock Exchange (“NYSE”)). | 4 | Chairman of Capital Management Associates, Inc. (registered investment adviser); Director of Flowers Foods, Inc. (NYSE listed company) |

| David P. Feldman Birth Date: November 16, 1939 |

Trustee | Since 2007 1990-2007 with the Predecessor Trust |

Retired. | 4 | Director of Dreyfus Mutual Funds (59 Funds) |

| Arthur D. Miltenberger Birth Date: November 8, 1938 |

Trustee | Since 2007 1992-2007 with the Predecessor Trust |

Retired. | 4 | None |

| H. Whitney Wagner Birth Date: March 3, 1956 |

Trustee | Since 2007 2006-2007 with the Predecessor Trust |

President, Clear Brook Advisors, a registered investment advisor. | 4 | None |

| Andrew S. Frazier Birth Date: April 8, 1948 |

Trustee | Since 2010 | Consultant to Western World Insurance Group, Inc. (“WWIG”) (January 2010 to January 2012); President and CEO of WWIG (1992-2009). | 4 | Director of WWIG |

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 31 |

| TRUSTEES AND OFFICERS OF BBH CORE SELECT |

| (unaudited) |

| Name, Birth Date and Address |

Position(s) Held with Trust |

Term of Office and Length of Time Served# |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Fund Complex Overseen by Trustee^ |

Other Directorships Held by Trustee |

| Mark M. Collins Birth Date: November 8, 1956 |

Trustee | Since 2011 | Partner of Brown Investment Advisory Incorporated, a registered investment advisor. | 4 | Chairman of Dillon Trust Company; Chairman of Keswick Management; Director of Domaine Clarence Dillon, Bordeaux, France; and Director of Pinnacle Care International |

| Interested Trustees | |||||

| Susan C. Livingston+ 40 Water Street Boston, MA 02109 Birth Date: February 18, 1957 |

Trustee | Since 2011 | Partner (since 1998) and Senior Client Advocate (since 2010) for BBH&Co., Director of BBH Luxembourg S.C.A. (since 1992); Director of BBH Trust Company (Cayman) Ltd. (2007 to April 2011); and BBH Investor Services (London) Ltd (2001 to April 2011). | 4 | None |

| John A. Gehret+ 140 Broadway New York, NY 10005 Birth Date: April 11, 1959 |

Trustee | Since 2011 | Limited Partner of BBH&Co.

(2012-present); General Partner of BBH&Co. (1998 to 2011); President and Principal Executive Officer of

the Trust (2008-2011). |

4 | None |

| 32 |

| TRUSTEES AND OFFICERS OF BBH CORE SELECT |

| (unaudited) |

OFFICERS

| Name and Birth Date |

Position(s) Held with the Trust |

Term of Office# and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

| Radford W. Klotz 140 Broadway New York, NY 10005 Birth Date: December 1, 1955 |

President and Principal Executive Officer |

Since 2011 | Joined BBH&Co. in 1977 and has been a Partner of the firm since 1995. |

| Charles H. Schreiber 140 Broadway New York, NY 10005 Birth Date: December 10, 1957 |

Treasurer and Principal Financial Officer |

Since 2007 2006-2007 with the Predecessor Trust |

Senior Vice President of BBH&Co. since September 2001; joined BBH&Co. in 1999. |

| Mark B. Nixon 140 Broadway New York, NY 10005 Birth Date: January 14, 1963 |

Assistant Secretary |

Since 2007 2006-2007 with the Predecessor Trust |

Vice President of BBH&Co. (since October 2006). |

| Mark A. Egert 140 Broadway New York, NY 10005 Birth Date: May 25, 1962 |

Chief Compliance Officer |

Since 2011 | CCO for Brown Brothers Harriman & Co. (June 2011 – present); Partner at Crowell & Moring LLP (from April 2010 to May 2011); CCO of Cowen and Company (from January 2005 to April 2010). |

| Sue M. Rim-An 140 Broadway New York, NY 10005 Birth Date: September 10, 1970 |

Anti-Money Laundering Officer |

Since 2008 | Anti-Money Laundering (“AML”) Officer, Vice President of BBH&Co. (September 2007-present); AML Officer at UBS Investment Bank (April 2006-August 2007). |

| Suzan Barron 50 Milk Street Boston, MA 02109 Birth Date: September 5, 1964 |

Secretary | Since 2009 | Senior Vice President and Senior Investor Services Counsel, Corporate Secretary and Regulatory Support Practice of Fund Administration, BBH&Co. since November 2005. |

| FINANCIAL STATEMENT OCTOBER 31, 2012 | 33 |

| TRUSTEES AND OFFICERS OF BBH CORE SELECT |

| (unaudited) |

| Name and Birth Date |

Position(s) Held with the Trust |

Term of Office# and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

| Alexander Tikonoff 50 Milk Street Boston, MA 02109 Birth Date: December 23, 1974 |

Assistant Secretary |

Since 2009 | Assistant Vice President and Investor Services Counsel, BBH&Co. (since August 2006). |

| Rowena Rothman 140 Broadway New York, NY 10005 Birth Date: October 24, 1967 |

Assistant Treasurer |

Since 2011 | Vice President of BBH&Co. (since 2009); Finance and Accounting Consultant at The Siegfried Group (2007-2009). |

| 34 |

| Administrator | Investment Adviser |

| Brown Brothers Harriman & Co. | Brown Brothers Harriman |

| 140 Broadway | Mutual Fund Advisory |

| New York, NY 10005 | Department |

| 140 Broadway | |

| Distributor | New York, Ny 10005 |

| Alps Distributors, Inc. | |

| 1290 Broadway, Suite 1100 | |

| Denver, Co 80203 | |

| Shareholder Servicing Agent | |

| Brown Brothers Harriman | |

| 140 Broadway | |

| New York, Ny 10005 | |

| (800) 625-5759 | |

To obtain information or make shareholder inquiries:

| By telephone: | Call 1-800-575-1265 |

| By E-mail send your request to: | bbhfunds@bbh.com |

| On the internet: | www.bbhfunds.com |

This report is submitted for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or a solicitation of an offer to buy shares of the Fund. Such offering is made only by the prospectus, which includes details as to offering price and other material information.

The Fund files with the SEC a complete schedule of its portfolio holdings, as of the close of the first and third quarters of its fiscal year, on “Form N-Q.” Information on Form N-Q is available without charge and upon request by calling the Funds at the toll-free number listed above. A text only version can be viewed online or downloaded from the SEC’s website at http://www.sec.gov; and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC (call 1-800-SEC-0330 for information on the operation of the Public Reference Room). You may also access this information from the BBH Funds website at www.bbhfunds.com.

A summary of the Fund’s Proxy Voting Policy that the Fund uses to determine how to vote proxies, if any, relating to securities held in the Fund’s portfolio, as well as a record of how the Fund voted any such proxies during the most recent 12-month period ended June 30, is available upon request by calling the toll-free number listed above. This information is also available from the Edgar database on the SEC’s website at www.sec.gov.

Annual Report

OCTOBER 31, 2012

BBH International Equity Fund

| BBH INTERNATIONAL EQUITY FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE |

| October 31, 2012 |

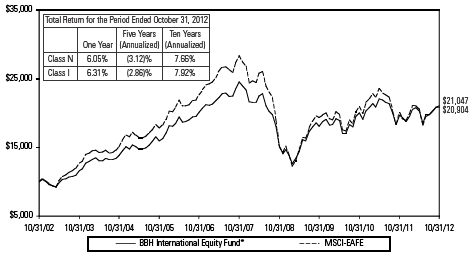

For the 12-month period ended October 31, 2012, The BBH International Equity Fund (the “Fund”) Class N Shares and Class I shares returned 6.05% and 6.31%, net of fees, respectively. The Fund’s benchmark, MSCI Europe, Australasia Far East Index (the “EAFE”)1, returned 4.61% over the same period. The Fund continues to employ two sub-advisers who are monitored by the investment adviser. One sub-adviser, Mondrian Investment Partners Limited (“Mondrian”), employs a value strategy while the other, Walter Scott & Partners Limited (“Walter Scott”), employs a growth strategy. New assets continue to be allocated equally between both sub-advisers.

The Fund outperformed its benchmark during the year due to a combination of stock selection and good sector positioning. Sub-adviser, Mondrian, benefited from solid stock picking in the Consumer Discretionary sector and an underweight to the Materials sector which was hurt by falling commodity prices. Walter Scott’s results were aided by stock selection in the Healthcare sector as well as an overweight to the Consumer Discretionary space. In addition, both sub-advisers profited from a higher-than-index allocation to the emerging markets. Detractors to the Fund’s performance over the fiscal year included Mondrian’s underweight to Financials and Australian companies coupled with overweights to Information Technology and companies in Spain. Mondrian’s defensive hedging of a strengthening Australian dollar, along with an overweight to a weakening Euro also hurt returns as the Euro strengthened against the dollar during the year. On the other hand, Walter Scott suffered mostly as a result of its exposure to Japanese stocks. Walter Scott’s significant overweight to the country and weak stock selection both negatively impacted full year results.

Both managers continued to employ strategies focused on an objective of total return, primarily through capital appreciation, rather than focus on particular benchmarks. They invest in what they believe are quality businesses with clear plans for the future, competitive positions among peers and strong management teams dedicated to increasing shareholder value.

| 1 | MSCI Europe, Australasia and Far East Index (EAFE) is an unmanaged market capitalization-weight equity index comprising 20 of 48 countries in the MSCI universe and representing the developed world outside of North America. Each MSCI country index is created separately, then aggregated, without change, into regional MSCI indices. EAFE performance data is calculated in U.S. dollars and in local currency. Investments cannot be made in an index. |

| 2 |

| BBH INTERNATIONAL EQUITY FUND |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (continued) |

| October 31, 2012 |

Growth of $10,000 Invested in BBH International Equity