| Ternium S.A., Société anonyme Registered office: 26 Boulevard Royal, 4th floor L-2449 Luxembourg R.C.S. Luxembourg B 98 668 www.ternium.com | |||||||

TERNIUM S.A. HAS CLAIMED CONFIDENTIAL TREATMENT OF PORTIONS

OF THIS LETTER IN ACCORDANCE WITH 17 C.F.R. §200.83

November 2, 2022

Office of Manufacturing, Division of Corporation Finance,

Securities and Exchange Commission,

100 F Street, N.E.,

Washington, D.C. 20549-4631.

Attention: Mr. Charles Eastman

Ms. Claire Erlanger

Re: Ternium S.A.

Form 20-F For the Year Ended December 31, 2021

Form 6-K furnished April 27, 2022

File No. 1-32734

Set out below are the responses of Ternium S.A. (“Ternium” or the “Company”), to the comments of the Staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) set forth in its letter dated October 18, 2022, to Mr. Pablo Brizzio, the Company’s Chief Financial Officer. The responses below are keyed to the headings indicated in the Staff’s comments and are designated with the letter “R” below the comment number. The comments themselves are set forth in boldface type.

Response Letter dated August 11, 2022

Note 4. Segment Information, page F-40

1.In the September 27, 2022 conference call with the Staff, you stated that you currently manage and operate your business as two operating and reportable segments: Mining and Steel. Please reconcile the differences in this segment structure to the structure disclosed on page F-40 in your Form 20-F for the year ended December 31, 2021 and also described in your comment letter responses dated July 19, 2022 and August 11, 2022. Specifically, address the change from the previously disclosed aggregation of the Mexico, Southern Region, Brazil, and Other Markets operating segments into the Steel reportable segment. Also, clarify for us whether you have aggregated operating segments within the two operating and reporting segments.

R: The Company confirms to the Staff that, as stated in the September 27, 2022 videoconference with the Staff, Ternium manages and operates its business as two operating and reportable segments: Mining and Steel.

In response to the Staff’s comment, the Company acknowledges that while its previous Form 20-F disclosure and responses in its letters to the Staff dated July 19, 2022 and August 11, 2022, indicated that the Company has four operating segments within its reportable operating segment of Steel, upon further reflection and discussions with the Staff, the Company believes that it is more appropriate to state that the Company only has two operating segments—Mining and Steel, and that its regional operations do not qualify as operating segments under IFRS 8.

In addition, the Company confirms that –contrary to what was stated in its previous Form 20-F disclosure and responses to the Staff– it does not aggregate operating segments. As regional operations are not operated independently of each other; resources are allocated and performance is assessed at the Steel segment as a whole, and not to specific regional operations; and, accordingly, none of Ternium’s regional operations constitutes a separate operating reportable segment.

Consequently, the Company proposes to revise its financial statements footnote disclosure in its filings going forward to clarify that it operates in two operating segments. The Company’s proposed revised disclosure, which will be presented for all the applicable periods, is set forth as follows:

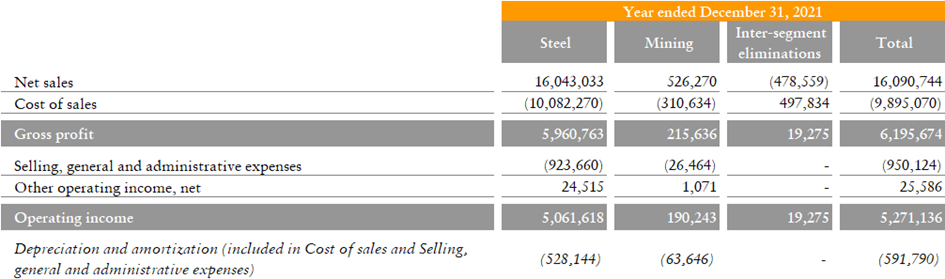

SEGMENT INFORMATION

The Company is organized in two operating segments: Steel and Mining.

The Steel segment includes the sales of steel products, which comprises slabs, hot rolled coils and sheets, cold rolled coils and sheets, tin plate, welded pipes, hot dipped galvanized and electro-galvanized sheets, pre-painted sheets, billets (steel in its basic, semi-finished state), wire rod and bars and other tailor-made products to serve its customers’ requirements. It also includes the sales of energy.

The Mining segment includes the sales of mining products, mainly iron ore and pellets, and comprises the mining activities of Las Encinas, an iron ore mining company in which Ternium holds a 100% equity interest and the 50% of the operations and results performed by Peña Colorada, another iron ore mining company in which Ternium maintains that same percentage over its equity interest. For Peña Colorada, the Company recognizes its assets, liabilities, revenue and expenses in relation to its interest in the joint operation.

Ternium’s Chief Operating Decision Maker (CEO) holds monthly meetings in which operating and financial performance information is reviewed, including financial information that differs from IFRS principally as follows:

- The use of direct cost methodology to calculate the inventories, while under IFRS is at full cost, including absorption of production overheads and depreciation.

- The use of costs based on previously internally defined cost estimates, while, under IFRS, costs are calculated at historical cost (with the FIFO method).

- Other timing and non-significant differences.

Most information on segment assets is not disclosed as it is not reviewed by the CEO.

GEOGRAPHICAL INFORMATION

Until December 31, 2021, the Company had revenues attributable to the Company’s country of incorporation (Luxembourg) related to a contract acquired as a part of the acquisition of the participation in Ternium Brasil Ltda.

For purposes of reporting geographical information, net sales are allocated based on the customer’s location. Allocation of depreciation and amortization is based on the geographical location of the underlying assets.

REVENUES BY PRODUCT

(1) Hot rolled includes hot rolled flat products, merchant bars, reinforcing bars, stirrups and rods.

(2) Coated includes tin plate and galvanized products.

(3) Roll-formed and tubular includes tubes, beams, insulated panels, roofing and cladding, roof tiles, steel decks and pre-engineered metal building systems.

(4) Other products include mainly sales of energy and pig iron.

2. Please provide us with your operating segment identification analysis performed in accordance with paragraphs 5 to 10 of IFRS 8. As part of your response, please provide us with the following:

• Provide us with details about your management structure and how your company is organized;

• Describe the role of your CODM and each of the individuals reporting to the CODM;

• Identify and describe the role of each of your segment managers;

• Describe the key operating decisions, who makes these decisions, how performance is assessed and how resources are allocated within your business;

• Tell us how often the CODM meets with his direct reports, the financial information the CODM reviews in conjunction with those meetings, and the other participants at those meetings;

• Explain how budgets are prepared, who approves the budget at each step of the process, the level of detail discussed at each step, and the level at which the CODM makes changes to the budget; and

• Describe the basis for determining the compensation for each individual that reports to the CODM.

R: Under IFRS 8, an operating segment is a component of an entity:

•that engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same entity),

•whose operating results are reviewed regularly by the entity's chief operating decision maker (“CODM”) to make decisions about resources to be allocated to the segment and assess its performance, and

•for which discrete financial information is available.

In response to the Staff’s comment, the Company informs the Staff that:

•Ternium’s Chief Executive Officer (“CEO”) functions as the Company’s CODM with respect to decisions made both in the Steel and Mining segments.

•The Company’s board of directors has delegated to the CEO the power to manage the Company’s affairs in the ordinary course of business, to direct and supervise the business activities of the Company’s subsidiaries and to represent the Company in relation to such matters. Accordingly, the CEO is responsible for the allocation of resources and for assessing the performance of the Company’s operating segments.

•Area Managers (or Presidents) are responsible for industrial operations and local sales in the jurisdictions where Ternium’s main production facilities are located, but they are not responsible for selling the products manufactured in such countries to other markets. The Global Planning Direction, who reports to the CEO, approves the production and the commercial strategies- to match production to customer demand and determines which production facility supplies the products for sales made outside of the area. Ternium has a geographically diversified customer base and, therefore, a portion of its sales is directed to regions in which it does not have production facilities.

•The following is a chart outlining the Company’s organization structure:

•Key operating decisions are made by the CODM. The CODM evaluates the operations and performance of the Steel business as a whole, using operating income as the key performance measure. In addition, decision-making is carried out with respect to Ternium’s Steel business in all markets in the aggregate.

•The CODM allocates resources to the Steel segment as a whole and not based on the regional operations; no regional operation is operated independently of each other.

•The CODM meets with his direct reports monthly and reviews at that time a consolidated commercial and industrial performance report (the “Commercial and Industrial Performance Report”) for purposes of making decisions, allocating resources and assessing performance. Additionally, the CODM presents to the board of directors on a quarterly basis the results and performance of the Company. In each meeting with the board, the CODM presents financial information at a consolidated level without disaggregation of results by geographical areas. The CFO is present in the board, while the Area Managers do not participate in the CODM’s presentation to the board.

•The budget is prepared annually through a process that requires gathering information from all the Company departments (named “Direcciones”, or directions) that report directly to the CEO. The budget is prepared by the Global Planning Direction and approved by the CEO. Each department/direction has the following responsibilities in connection with the preparation of the annual budget:

◦Global Planning Direction determines (i) general assumptions, (ii) reference prices of products sold and of main raw materials, and (iii) gross product and inflation in different countries, etc. Likewise, it is responsible for coordinating and consolidating the information received from the different directions.

◦Global Industrial and Engineering plans industrial investments and defines the different variables that determine industrial costs (line productivity, use of workforce, metallic loads, etc.)

◦Commercial Vice-Presidencies reporting to Area Managers determine the volumes and dispatch plans, prices, intercompany transfers and inventory levels of finished products, except for export markets sales, which are determined by the Global Planning Direction.

◦Vice-Presidencies of Industrial Operations reporting to Area Managers establish schedules of plant shutdowns, schedules for production lines, inventory levels of products in process, and the production plan for each production unit.

◦Vice-Presidency of Mining prepares the budget for the Mining segment.

◦Global Human Resources Department prepares the budget for employees, contracted staff, and determines employment projections and cost.

◦In addition, each department estimates its own costs, while the Financial Department estimates the Company’s overall financial costs, taxes, etc.

The information so reported for purposes of preparing the annual budget is presented following the same structure of the Commercial and Industrial Performance Report (as further described in our response to question #3 below). Those responsible for each department/direction meet with the CEO, who makes his observations, determines any required amendments and, finally, approves the budget.

[CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION]

In addition, as explained during our September 27, 2022 videoconference with the Staff, the Company’s production process is as follows:

•The production process is fully integrated across all regional units. Ternium specializes in manufacturing and processing finished steel products. The four regional units share similar production processes, which start from iron ore or, in some cases, semi-finished steel (slabs and billets) either produced by Ternium in other facilities or purchased from third parties and the four regional units obtain similar final products. Ternium’s facilities use different technologies and have different levels of integration. The basic inputs for steel production are iron ore and energy, mainly in the form of natural gas, coal and electricity. Ternium produces semi-finished steel through the blast furnace and the electric arc furnace methods. Semi-finished steel is then processed into finished

products using hot-rolling, cold-rolling, coating, tubing, paneling, slitting and cut-to-length facilities among other processes.

•No regional operation is operated independently of any other region; rather, all regional operations are operated as one single business. For instance, it is quite common for steel manufactured in one region to be sold in another region, given that Ternium produces different types of steel in its different regional operations while demand for steel is based on product type, not on location of origin.

•As discussed in the Company’s July 26, 2022 response letter to the Staff, Ternium sells, in the different markets where it operates, steel products that share similar characteristics but have different grades of added value. The products manufactured in a given country are not necessarily the products that are sold in such market, and, in some instances, steel first produced in one location is then processed in another. For example, in Brazil, the Company manufactures only steel slabs, whereas in Mexico, those products are not manufactured. These steel slabs are often then processed in other jurisdictions. For instance, in Mexico and Argentina, the Company has been processing steel slabs produced in Brazil and/or purchased in the marketplace, as the Company’s steel processing capacity in Mexico is higher than its steel production capacity, and the Company’s steel processing capacity utilization in Argentina has been higher in recent years than its steel production capacity. The Company would refer the Staff back to its description of the different steel products and processing capabilities described in its July 26, 2022 response letter to the Staff for additional explanation of the ways in which the operating activities of the regional operations are intertwined. As a result of the intertwined nature of the operations among these regions, the Steel business must be, and is, operated as a whole and not based on the regional operations.

3. Describe the financial information reviewed by the CODM for the purpose of allocating resources and assessing performance. Tell us how frequently that information is prepared and reviewed. Also describe the financial information reviewed by your Board of Directors and how frequently that information is reviewed. In this regard, we note that you present disaggregated revenue information for Mexico, Southern Region, and Brazil and Other Markets on pages 46, 77, and 81 of your Form 20-F. Tell us whether the CODM or the Board of Directors receives any profitability and/or expense information for these regions separately. If so, describe the nature, type and frequency of that information.

R: In response to the Staff’s comment, the Company advises the Staff that:

•As indicated in the previous response, the CODM monthly reviews a Commercial and Industrial Performance Report, which includes a table disclosing two profit centers: Steel and Mining. Each profit center meets the requirements of IFRS 8 to qualify as an operating segment.

•The profitability measures used in each profit center table included in the Commercial and Industrial Performance Report, and presented to the CODM, are earnings before interest and tax (EBIT or operating income) and its corresponding earnings before interest, tax, depreciation and amortization (EBITDA).

The managerial information included in the Commercial and Industrial Performance Report is also shared with the Area Managers, who assess the performance of the industrial areas under their responsibility.

The Company is organized in several Business Units and Production Units. Business Units are the markets where Ternium sells to third parties; Production Units are the countries or regions where Ternium has manufacturing facilities. Management prepares disaggregated operational and financial information for Business Units and Production Units based on the most relevant key performance indicators.

The reporting period for managerial information is from July of a given year through June of the next year.

The two main schedules of the Commercial and Industrial Performance Report are the following:

1. Profit centers table. The first table [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION] discloses the two profit centers: Steel (identified as “PC Siderurgia”) and Mining (identified as “PC Minería”), and the eliminations between them.

The measures of profitability that are included in this table and presented to the CODM, used for the purposes of making decisions on segment resource allocation and for purposes of assessing performance are: earnings before interest and tax (EBIT, or operating income) and its corresponding earnings before interest, tax, depreciation and amortization (EBITDA). The Company has concluded that operating income is the measure of profitability that meets the requirements for disclosure under paragraph 26 of IFRS 8. Additionally, this table includes, but only at the consolidated level of the Company without any segment segregation: income tax, financial results and equity in results of non-consolidated companies, to finally present the net managerial result.

[CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION]

2. Steel profit center regional detailed table. The second table [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION] has two sub-tables: the Business Units’ commercial result and the Production Units’ result.

The Steel profit center (“PC Siderurgia”) regional detailed table includes information of the different Business Units and Production Units. Accordingly, (i) the Mexico Business Unit regional information comprises sales in Mexico and industrial activities of the facilities located in the country; (ii) the information for the Southern Region Business Unit includes sales in Argentina, Paraguay, Chile, Bolivia and Uruguay, and the industrial activities of the facilities located in Argentina; (iii) the Brazil Business Unit regional information consists of sales in Brazil and industrial activities of the facilities located in Brazil; and (iv) the Other Markets Business Unit regional information reports sales in the United States, Colombia, Guatemala, Costa Rica, Honduras, El Salvador and Nicaragua and the industrial activities of the facilities located in some of those countries.

The above-mentioned commercial results show only the margin attributed to sales to third parties located in the country/ies that comprise the Business Units but does not consider inter-regional sales within subsidiaries. For example, in the case of Brazil, the information includes only sales to third parties in the Brazil Business Unit (and, therefore excludes most of the sales of Ternium’s Brazilian facility, which are destined to other Ternium subsidiaries), along with total fixed costs for the Brazilian Production Unit.

Notably, there is a large number of direct sales between Ternium companies located in different countries/regions, which are finally included as sales in the Business Unit where the product is finally sold to a third party.

The Production Unit results include expenses and other results directly related to the production plants, such as the total of production inefficiencies, amortizations, and various manufacturing costs.

The Functional areas results included in the last column of this table represent expenses not directly related to production (i.e., mainly administration, planning, systems, human resources, quality management, legal, engineering and environmental expenses), which are attributed to specific geographical areas.

As presented in the schedule, the table does not have a unit of measurement presented to the CODM for purposes of allocating resources and evaluating performance. Because of the reasons explained above, the aggregation of results from the Business Units and the Production Units would not represent a consistent measure of result for decision making purposes. For example, the Brazil Production Unit sells most of its products to Ternium’s Mexican subsidiary and, consequently, the Brazil Business Unit’s "commercial result" is very low. Likewise, maintenance expenses, amortization and fixed costs of the industrial facilities located in Brazil are allocated to the Brazil Production Unit, and, accordingly, adding the Brazil Business Unit’s commercial result to the Brazil Production Unit’s industrial result would not be reasonable.

In addition, the CODM reviews for each of the Production Unit located in the geographical areas all the information related to level of production, consumption and inefficiencies of the respective production plants.

[CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION]

To conclude, the CODM does not receive disaggregated financial reports with complete profitability data by geographic region. The CODM receives from time to time a variety of financial and non-financial reports and reviews certain information by geographic region to assess the industrial and commercial performance in the different areas. However, for the reasons articulated above, this information is not used to determine how to allocate resources.

•The Company concluded that operating income for Steel and Mining is the measure of profitability that meets the requirements for disclosure under paragraph 26 of IFRS 8.

•As indicated above, the Company’s board of directors meets every quarter to, among other things, review the Company’s performance and annually approves Ternium’s consolidated financial statements. In connection therewith, the board members review in each case a presentation prepared by management, which generally includes the financial highlights for the quarter, including the quarterly evolution of key consolidated financial indicators (such as shipments, EBITDA, net cash and margin), consolidated statement of income, consolidated cash flow, consolidated financial debt evolution and consolidated debt maturity. The Company’s board of directors does not regularly review revenue or other performance information disaggregated by geographic region.

•For example, in the most recent board’s meeting, the only disaggregated information reviewed by the board was the evolution of volumes sold per country and country price variation per ton, as well as information on effective tax rates in each jurisdiction. Such information was presented with respect to the different countries in which Ternium operates, i.e., Mexico, Argentina, Brazil, other South American countries, Europe, Andean region, Central America and the U.S./Canada. The financial information described in the immediately preceding paragraph does not include results by geographic area and is presented only at a consolidated level.

* * * * *

If you have any questions relating to this letter, please feel free to call Patrick S. Brown of Sullivan & Cromwell LLP at (310) 712-6603. He may also be reached by e-mail at brownp@sullcrom.com.

Very truly yours,

/s/ Pablo Brizzio

Pablo Brizzio

Chief Financial Officer

cc: Magalie Cormier

(PricewaterhouseCoopers)

Diego E. Parise

(Mitrani Caballero & Ruiz Moreno)

Patrick S. Brown

(Sullivan & Cromwell LLP)