Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended June 30, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-32845

(Exact name of registrant as specified in its charter)

| Delaware | 32-0163571 | |

| (State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 39 East Union Street Pasadena, California 91103 |

(626) 584-9722 | |

| (Address of Principal Executive Offices) | (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange On Which Registered | |

| Common Stock, $0.0001 par value | NASDAQ Global Market | |

| 9.00% Series C Cumulative Redeemable Perpetual Preferred Stock (Liquidation Preference $100 per share) |

NASDAQ Global Market | |

| 8.125% Senior Notes due 2021 | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes ☒ | No ☐ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☑ | Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☐ | |||

| Emerging growth company ☐ | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of Common Stock held by non-affiliates of the Registrant on December 31, 2016 was approximately $54,473,000 based on a closing price of $5.55 for the Common Stock on such date. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

There were 26,611,688 shares of the Registrant’s Common Stock outstanding as of September 1, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for its 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K. In addition, certain exhibits are incorporated into Part IV, Item 15. of this Annual Report on Form 10-K by reference to other reports and registration statements of the Registrant, which have been filed with the Securities and Exchange Commission.

Table of Contents

GENERAL FINANCE CORPORATION

2017 ANNUAL REPORT ON FORM 10-K

| Page | ||

| ii | ||

| I-1 | ||

| I-19 | ||

| I-36 | ||

| I-37 | ||

| I-39 | ||

| I-39 | ||

| II-1 | ||

| II-4 | ||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

II-6 | |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk |

II-20 | |

| II-21 | ||

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

II-21 | |

| II-21 | ||

| II-22 | ||

| Item 10. Directors, Executive Officers and Corporate Governance |

III-1 | |

| III-1 | ||

| III-1 | ||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

III-1 | |

| III-1 | ||

| IV-1 | ||

| IV-4 | ||

| SIG | ||

i

Table of Contents

This Annual Report on Form 10-K, including the documents incorporated by reference into this Annual Report on Form 10-K, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, referred to in this Annual Report on Form 10-K as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, referred to in this Annual Report on Form 10-K as the Exchange Act. Forward-looking statements involve risks and uncertainties that could cause results or outcomes to differ materially from those expressed in the forward-looking statements. Forward-looking statements may include, without limitation, statements relating to our plans, strategies, objectives, expectations and intentions and are intended to be made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “should,” “could,” “seek,” “intends,” “plans,” “estimates,” “anticipates” or other comparable terms. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. The risks and uncertainties discussed in “Risk Factors” should be considered in evaluating our forward-looking statements. You should not place undue reliance on our forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statements.

ii

Table of Contents

References to “we,” “us,” “our” or the “Company” refer to General Finance Corporation, a Delaware corporation (“GFN”), and its consolidated subsidiaries. These subsidiaries include GFN U.S. Australasia Holdings, Inc., a Delaware corporation (“GFN U.S.”); GFN Insurance Corporation, an Arizona corporation (“GFNI”); GFN North America Leasing Corporation, a Delaware corporation (“GFNNA Leasing”); GFN North America Corp., a Delaware corporation (“GFNNA”); GFN Realty Company, LLC, a Delaware limited liability company (“GFNRC”); GFN Manufacturing Corporation, a Delaware corporation (“GFNMC”), and its subsidiary, Southern Frac, LLC, a Texas limited liability company (collectively “Southern Frac”); GFN Asia Pacific Holdings Pty Ltd, an Australian corporation (“GFNAPH”), and its subsidiary, GFN Asia Pacific Finance Pty Ltd, an Australian corporation (“GFNAPF”); Royal Wolf Holdings Limited, an Australian corporation (“RWH”), and its Australian and New Zealand subsidiaries (collectively, “Royal Wolf”); Pac-Van, Inc., an Indiana corporation, and its Canadian subsidiary, PV Acquisition Corp., an Alberta corporation (collectively “Pac-Van”); and Lone Star Tank Rental Inc., a Delaware corporation (“Lone Star”).

Overview

Founded in 2005, we are a leading specialty rental services company offering portable storage, modular space and liquid containment solutions, with a diverse and expanding lease fleet of 80,712 units as of June 30, 2017. Our 87 branch locations across North America and the Asia-Pacific offer a wide range of portable storage units, including our core 20-feet and 40-feet steel containers, office container, mobile office and modular space products and steel tanks that provide our customers a flexible, cost-effective and convenient way to meet their temporary storage and space needs. Our units are easily customized to satisfy our customers’ specific application needs and include numerous value-added components. We provide our storage solutions to a diverse base of over 44,000 customers across a broad range of industries, including the commercial, construction, transportation, industrial, energy, manufacturing, mining, retail, education and government sectors. Our customers utilize our storage and space units for a wide variety of applications, including the temporary storage of materials, supplies, equipment, retail merchandise inventories, documents and liquid storage and for office use.

We focus on leasing rather than selling our units. Approximately 65% of our total non-manufacturing revenues for the year ended June 30, 2017 (“FY 2017”) were derived from leasing activities. We believe our business model is compelling because it is driven by lease fleet assets that:

| ● | generate a recurring revenue stream with average lease durations of over 12 months; |

| ● | possess long useful lives of 20 to 30 years with high residual values; |

| ● | return the original equipment cost through revenue within four years on average; |

| ● | operate at high lease fleet utilization levels, historically between 70% and 85%; |

| ● | require low maintenance expenditures; and |

| ● | earn attractive margins. |

Our lease fleet is comprised of three distinct specialty rental equipment categories that possess attractive asset characteristics and serve our customers’ on-site temporary needs and applications. These categories match the sectors we serve and which we collectively refer to as the “portable services industry”—portable (or mobile) storage, modular space and liquid containment.

Our portable storage category is segmented into two products: (1) storage containers, which primarily consist of new and used steel shipping containers under International Organization for Standardization (“ISO”) standards, that provide a flexible, low cost alternative to warehousing, while offering greater security, convenience and immediate accessibility; and (2) freight containers, which are either designed for transport of products by road and rail and are only offered in our Asia-Pacific territory.

Our modular space category is segmented into three products: (1) office containers, which are referred to as portable container buildings in the Asia-Pacific, are either modified or specifically manufactured containers that provide self-contained office space with maximum design flexibility. Office containers in the United States are oftentimes referred to as ground level offices (“GLOs”); (2) modular buildings, which provide customers with flexible space solutions and are often modified to customer specifications and (3) mobile offices, which are re-locatable units with aluminum or wood exteriors and wood (or steel) frames on a steel carriage fitted with axles, and which allow for an assortment of “add-ons” to provide convenient temporary space solutions.

Our liquid containment category includes portable liquid storage tanks that are manufactured 500-barrel capacity steel containers with fixed axles for transport. These units can be utilized for a variety of applications across a wide range of industries, including refinery, petrochemical and industrial plant maintenance, oil and gas services, environmental remediation and field services, infrastructure building construction, marine services, pipeline construction and maintenance, tank terminal services, waste management, wastewater treatment and landfill services.

I-1

Table of Contents

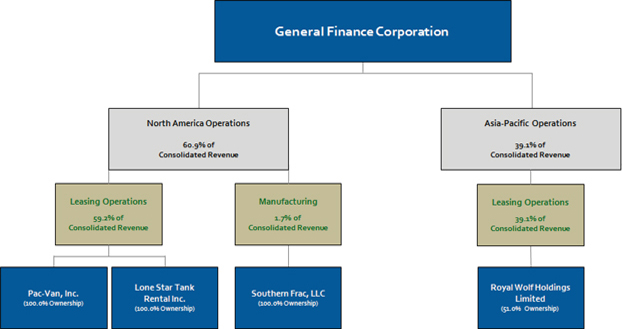

Summary Organization Chart (1) (2)

| (1) | Summary organization chart is illustrative and does not reflect our legal operating structure. |

| (2) | Reflects consolidated revenues for FY 2017. |

| (3) | We will be acquiring the 49.0% noncontrolling interest during the first half of the fiscal year ending June 30, 2018 (“FY 2018”). Reference is made to Note 13 of Notes to Consolidated Financial Statements for further discussion. |

Industry Overview

We compete in three distinct, but related, sectors of the specialty rental services industry: portable storage, modular space and liquid containment, which we refer to collectively as the “portable services industry.”

Portable Storage

The storage industry includes two principal markets, fixed self-storage and portable storage. The fixed self-storage market consists of permanent structures located away from customer locations used primarily by consumers to temporarily store excess household goods. We do not participate in the fixed self-storage market with permanent structures. The portable storage market, in which we primarily operate, differs from the fixed self-storage market in that it brings the storage solution to the customer’s location and addresses the need for secure, temporary storage with immediate access to the storage unit. The advantages of portable storage include convenience, immediate accessibility, improved security and lower costs. In contrast to fixed self-storage, the portable storage market is primarily used by businesses and offers a flexible, secure, cost-effective and convenient alternative to constructing permanent warehouse space or storing items at an offsite facility. A broad range of industries, including the construction, industrial, commercial, retail and government sectors, utilize portable storage equipment to meet both their short-term and permanent storage needs.

The portable storage industry is fragmented in each of our geographic markets, with numerous participants in local markets leasing and selling portable storage units. While we are not aware of any published third-party analysis of either the Asia-Pacific or North American portable storage markets, we believe the portable storage sector has experienced steady growth since the 1990s and is achieving increased market share compared to other storage alternatives because of an increasing awareness of the benefits that portable storage units offer, including the availability, convenience, security and cost benefits of portable storage, as well as an increasing number of new applications for portable storage units.

Modular Space

Modular space solutions, including modular buildings, mobile offices and portable container buildings, are used primarily by businesses to address either temporary or permanent space needs. We believe modular space delivers four core benefits compared to permanent buildings or structures: reusability, timely solutions, lower costs and flexibility. Modular buildings may offer customers significant cost savings over permanent construction and can generally be installed more quickly because site work and fabrication

I-2

Table of Contents

can take place concurrently. In addition, modular solutions are not site specific and can be configured in a number of ways to meet multiple needs. Finally, modular buildings are reusable and will generally serve a wide variety of uses during their life span. A variety of industries utilize modular space solutions, including construction, resources, government, education, retail and special events, among others.

The Modular Building Institute, in its 2017 Relocatable Buildings Annual Data Report, estimated that the North American modular space (or relocatable) sector generated approximately $4.0 billion in annual revenue. The sector has experienced growth over the last thirty plus years as the number of applications for modular space has expanded and recognition of the product’s positive attributes has grown. By outsourcing their space needs, customers are able to achieve flexibility, preserve capital for core operations, and convert fixed costs into variable costs. The IBIS World Industry Report published in October 2016 estimated that the portable container buildings market in Australia generated revenue of AUS$2.0 billion ($1.5 billion), of which approximately AUS$1.3 billion ($1.0 billion) related to the markets in which we offer a competing product. We believe that we are well positioned to benefit from any growth in the North American and Asia-Pacific modular space markets.

We expect that the modular space market will grow over the long-term, driven in part by increasing awareness of the advantages of modular space. Additionally, we believe that the advantages of modular space over permanent buildings and structures of reusability, timely solutions, lower costs, and flexibility are highly valued in many of the end markets we serve. We further believe the increased penetration of modular space solutions in additional end markets will also continue to drive market growth.

Liquid Containment

Portable liquid storage tank containers are used in environmental and industrial applications to temporarily store hazardous and nonhazardous liquids and semi-solids. The tanks are used by customers across a wide variety of end markets, including chemical, refinery and industrial plant maintenance, environmental remediation, infrastructure building construction, marine services, oil and gas exploration and field services, pipeline construction and maintenance, tank terminal services, wastewater treatment and waste management and landfill services. Liquid containment end market demand is recurring and is driven by the non-discretionary nature of required customer maintenance cycles, an increasing enforcement of existing environmental regulations, a growing outsourcing of liquid containment solutions and an increasing level of vendor consolidation. We believe that the rental industry in the U.S. for liquid containment equipment is fragmented and generated approximately $1.4 billion of annual rental revenues in 2013 – 2014 but, as a result of the decline in oil and gas prices during the latter part of our year ended June 30, 2015, the size of the liquid containment sector has contracted. While this is a relatively new product line for our North American leasing operations, we believe that over time we can leverage our branch network, existing relationships and operating philosophies to successfully compete in this sector. Our research indicated that many of the companies that used containment solutions also used portable storage and mobile office products.

Competitive Strengths

Leading Provider with Strong Presence in Served Markets

We believe we are a leading provider of portable storage, modular space and liquid containment solutions in all of the territories we serve. In North America, Pac-Van is a recognized national provider of portable storage, modular buildings and mobile offices on a national, regional and local basis. Lone Star is a market leader in portable liquid storage tank rental and related services in the Permian Basin in West Texas and the Eagle Ford Shale in South Texas. In the Asia-Pacific area, we believe Royal Wolf is the leading provider in Australia and New Zealand of portable storage containers, portable container buildings and freight containers. Royal Wolf is represented in all major metropolitan areas, and we believe it maintains the largest branch network and container fleet, with an estimated 37% market share, of any storage container company in Australia and New Zealand.

Superior Service Focus

Our operating infrastructure in each of our markets is designed to ensure that we consistently meet or exceed customer expectations. Our scalable management information systems and administrative support services enhance our customer service capabilities by enabling our operating management teams to access real time information on product availability, customer reservations, customer usage history and rates on a national, regional and local level. We believe these capabilities enable us to provide superior customer service, allowing us to attract new and retain existing customers. With the goal of delivering “best in class” customer service, we began collecting customer responses on net promoter scores (“NPS”) in North America at Pac-Van which track customer willingness to recommend our products and services, and for FY 2017 our customers gave us a NPS of 85%, which we believe is the leading score in our sector. In FY 2017, we began collecting customer responses on NPS in the Asia Pacific at Royal Wolf and our customers there gave us a NPS of 61%. In addition, over 85% of our consolidated total leasing revenues in FY 2017 were derived from repeat customers, which we believe is a result of our superior customer service.

I-3

Table of Contents

Extensive Reach and Capabilities

Through our expansive branch network of 87 locations, we maintain national service capabilities in our markets. In North America, our branches serve 47 of the top 100 U.S. Metropolitan Statistical Areas, or MSAs. With our expansion into Alberta and British Columbia, we are now also able to serve the western provinces in Canada. Our Lone Star branches are strategically positioned to be able to respond quickly and maximize service opportunities with customers in the Permian Basin and Eagle Ford Shale. We also have branch offices located in every state in Australia and on both the North and South Islands of New Zealand. We are the only portable storage container company in these Asia-Pacific markets with a national infrastructure and workforce.

Geographic, Product and End Market Diversification

Our specialty rental units are used in a wide variety of applications, and we have established strong relationships with a diversified customer base in both our North American and Asia-Pacific venues. Our customers range from large companies with a national presence to small local businesses. On a consolidated basis, during FY 2016 we served over 44,000 customers in over 20 industries. In FY 2017, our largest customer in each venue accounted for less than 3% of the respective venue’s revenues and our 20 largest customers in each venue accounted for less than 30% of the respective venue’s revenues. We believe that the breadth of our products and services limits the impact of changes within any given customer or industry.

High Quality Fleet with Attractive Asset Characteristics

Our branch offices maintain our lease fleet to consistent quality standards. Maintenance costs are expensed as incurred and branch managers and operations staff are responsible for managing a maintenance program aimed at providing equipment to customers that meets or exceeds customer expectations and industry standards. All of our lease fleet carries signage reflecting its respective brands, which is important to ongoing name recognition in our markets. Our lease fleet possesses attractive asset characteristics, including long economic useful lives with high residual values, predictable and recurring revenue streams, low maintenance expense, rapid payback periods, high incremental leasing margins and favorable tax attributes. We believe these characteristics allow us to generate high returns on invested capital relative to other rental services sectors and a level of discretion in investing this capital.

Experienced Management Team

We believe our management team’s experience and long tenure with our company and within the industry give us a strong competitive advantage. Our current senior executive management team, led by our Chief Executive Officer, Ronald F. Valenta, who has been with us since our inception, has successfully entered new markets, expanded our customer base and integrated a number of meaningful acquisitions. He will step down as Chief Executive Officer and assume the title of Executive Chairman of the Board in January 2018. Jody Miller, who became President in January 2017, will become our Chief Executive Officer in January 2018 and has been Chief Executive Officer of GFNNA Leasing since June 2015. He has spent over 25 years in the equipment rental industry.

Neil Littlewood, who became Chief Executive Officer of Royal Wolf in July 2016, has over 13 years of senior experience in the rental/hire industry and Pac-Van’s Chief Executive Officer and President, Theodore M. Mourouzis, joined Pac-Van in 1997 and has been integral to our successful growth in North America.

Lone Star’s management team has extensive experience in the oil and gas industry and emphasizes safety training and monitoring for all employees.

Our senior management, as well as corporate, regional and branch managers across all of our operating companies, has been integral in developing and maintaining our high level of customer service, deploying technology to improve operational efficiencies and successfully integrating acquisitions.

Business Strategy

Our business strategy consists of the following:

Focus on High Margin Core Leasing Business

We focus on growing our core leasing business because it provides recurring revenues from specialty rental assets that (1) have long useful lives of over 20 years; (2) generate rapid payback of unit investment through revenue in less than four years on average; and (3) have high residual values of up to 70% of original equipment cost. We have successfully increased leasing revenues as a

I-4

Table of Contents

percentage of our consolidated non-manufacturing revenues from 29% in fiscal year 2007 to 65% for FY 2017. We believe that we can continue to generate substantial demand for our leasing products as the industry is still relatively underdeveloped in our markets, particularly in the Asia-Pacific region. With new uses for our products continually emerging, we believe many more applications for our specialty rental solutions are still yet to be developed.

Generate Organic Growth

We define organic growth as an increase in lease revenues on a year-over-year basis at our branches in operation for at least one year, excluding leasing revenue attributed to same-market acquisitions. We continue to focus on increasing the number of our lease fleet units. We believe that our high quality lease fleet and superior customer service enable us to increase our lease rates and utilization rates over time. We generate organic growth within our existing markets through sales and marketing programs designed to increase brand recognition, expand market awareness of the uses of our specialty rental units and differentiate our products from our competitors.

Leverage Our Infrastructure

Our branch network infrastructure covers a broad geographic area and is capable of serving significant additional customer volume while incurring a minimal amount of incremental fixed costs. With our established branch network and infrastructure we generate significant adjusted earnings before interest, income taxes, impairment, depreciation and amortization and other non-operating costs and income (“Adjusted EBITDA”) margins on incremental units deployed. Our objective is to add volume by organically growing the lease fleet across our locations and through strategic acquisitions. Asset purchases of “tuck-in” competitors and adding new units to our fleet allow us to more effectively leverage our infrastructure. Between June 30, 2007 and June 30, 2017, our lease fleet grew from approximately 16,000 units to over 80,000 units, representing a 18% compound annual growth rate, and our Adjusted EBITDA margin expanded from 17% in the fiscal year ended June 30, 2008 to 22% in FY 2017.

Opportunistically Enter New Geographic Markets

We believe a long-term opportunity exists for us to significantly expand the size of our branch network in North America by opening up to 30 new locations in attractive markets. Additionally, we expect to open select satellite branch locations in our Asia-Pacific territory to expand our service reach to attractive but more remote areas of Australia and New Zealand.

Pursue Select Strategic Acquisitions

Acquisitions represent an attractive means for us to further leverage our infrastructure, add complementary product lines, enter new geographic regions and accelerate our growth and margin expansion opportunities. We operate in fragmented industries, and we seek to identify acquisition candidates that we believe would be earnings accretive. We have a proven integration model that we have effectively used to integrate 44 acquisitions since May 31, 2007.

Continue New Product Innovation

We have a history of developing innovative new product concepts to better service our customers’ needs. Our in-house capabilities and third party modification capabilities allow us to customize units to meet customer specifications. We have introduced many new product innovations, including temporary prison holding cells, hoarding units, blast-resistant units, workforce living accommodations, temporary retail frontage units and observatory units customized from storage containers. In the Asia-Pacific area we offer over 100 container-based designs for the portable services industry. We believe these innovative new product offerings differentiate us in the market.

Products and Services

Portable Storage

Our portable storage products primarily consist of steel storage containers and freight containers. Storage containers are steel structures, which are generally eight feet wide and eight and one-half feet high; and are built to ISO standards for carrying ocean cargo. They typically vary in size from 10 feet to 48 feet in length, with 20-foot and 40-foot length containers being the most common. Storage containers consist of new and used shipping containers that provide a flexible, low cost alternative to warehousing, while offering greater security, convenience and immediate accessibility. Storage containers include general purpose dry storage, refrigerated and specialty containers in a range of standard and modified sizes, designs and capacities. Specialty containers include blast-resistant, hoarding and hazardous waste units.

I-5

Table of Contents

Our freight containers are specifically designed for transport of products by road and rail, and include curtain-side, refrigerated and bulk cargo containers, together with a range of standard and industry-specific dry freight containers. Freight container products are only offered in our Asia-Pacific territory. These products are designed for long useful lives. A portion of our fleet consists of used storage containers of eight to thirteen years in age, a time at which their useful life as ocean-going shipping containers is over according to the standards promulgated by the ISO. Because we do not have the same stacking and strength requirements that apply in the ocean-going shipping industry, we have no need for these containers to meet ISO standards. We purchase these containers in large quantities, refurbish them by removing any rust and paint them with a rust inhibiting paint, and further customize them, and add our decals and branding.

Modular Space

Our modular space products include office container products, modular buildings and mobile offices. Our office container products (portable building containers and office containers, or GLOs) are either modified or specifically-manufactured containers that provide secure and convenient office space with maximum design flexibility. Floor plans can either be all office space, with features similar to those found in mobile offices, or a combination of office and storage space. Due to their construction, office containers provide greater security than traditional field offices, and since they sit at ground level they do not require stairs for entry and exit. Modular buildings are factory-built, highly customizable portable structures constructed for diverse applications, ranging from schools to restaurants to medical offices and ranging in size from 1,000 to over 30,000 square feet. Mobile offices are factory built, single-unit structures that are re-locatable and used primarily for temporary office space. Mobile offices are generally built on frames that are connected to axles and wheels and have either a fixed or removable hitch for easy transportation. Mobile offices can be equipped with HVAC systems, lighting, electrical wiring, phone jacks, desk tops, shelving and other features normally associated with basic office space. Mobile offices generally have wood siding, carpeting, high ceilings, custom windows and glass storefront doors, which provide a professional, customer-friendly building in which to conduct business. In addition to offering modular buildings for rent, in the Asia-Pacific area, we also provide customers with the ability to customize buildings using our in-house engineering team.

Liquid Containment

Our liquid containment products, primarily portable liquid storage tanks, are manufactured steel containers with fixed steel axles and rear wheels for transport designed to hold liquids and semi-solids. Our product line currently focuses on 500-barrel capacity steel tanks, but also includes acid, gas buster, oil test tanks and various specially-built tanks. Products typically include features such as guardrails, safety stairways, multiple entry ways, a sloped bottom for easy cleaning, an epoxy lining and various feed and drain lines. A number of value-added services are offered with liquid containment products, including transportation, on-site setup and the servicing of equipment 24 hours a day, 7 days a week.

I-6

Table of Contents

The tables below provide details of our lease fleet by product category and unit types at June 30, 2017, 2016 and 2015; and for FY 2017, the year ended June 30, 2016 (“FY 2016”) and the year ended June 30, 2015 (“FY 2015”).

| FY 2017 | ||||||||||||||||

| Product Category |

Unit Type | Description | Industry Applications | Number of Units as of June 30, 2017 |

Average Monthly Lease Rate |

Average Utilization | ||||||||||

| North America |

Asia- Pacific |

North America |

Asia- Pacific | |||||||||||||

|

Storage Containers |

Dry storage, refrigerated and specialty containers | Classroom equipment storage, Construction equipment and tool storage, Disaster shelters, Landscaping sheds, Recreational equipment storage, Retail inventory storage | 51,528 | $121 | A$139 | 75% | 86% | ||||||||

| Freight Containers |

Dry freight, curtain-side, refrigerated, bulk cargo containers | Freight transportation | 8,272 | NA | A$135 | NA | 70% | |||||||||

|

Office Containers |

Storage containers, modified to include office space | General administrative office space, Military installations, Workforce living accommodations, Bank branches, Classrooms /Education, Construction offices, Daycare facilities, Dormitories, General administrative office space, Healthcare facilities, Rental facilities, Retail space, Shelters | 11,157 | $321 | A$268 | 78% | 74% | ||||||||

| Modular Buildings |

Portable structures used for a variety of applications |

1,167 | $774 | NA | 81% | NA | ||||||||||

| Mobile Offices |

Relocatable wood-framed temporary office space | 4,491 | $282 | NA | 78% | NA | ||||||||||

|

Portable Liquid Storage Tanks |

Steel tanks, acid tanks, gas buster tanks and oil test tanks |

Well-site liquid containment needs, Expansion / upgrade projects, Highway construction/Groundwater sewage, Infrastructure projects, Major industrial projects, Mining pit pump work, Municipal sewer and water projects, Non-residential construction projects, Pipeline construction and maintenance, Refinery turnarounds | 4,097 | $533 | NA | 48% | NA | ||||||||

I-7

Table of Contents

| FY 2016 | ||||||||||||||||

| Product Category |

Unit Type | Description | Industry Applications | Number of Units as of June 30, 2016 |

Average Monthly Lease Rate |

Average Utilization | ||||||||||

| North America |

Asia- Pacific |

North America |

Asia- Pacific | |||||||||||||

|

Storage |

SEE PRECEDING CHART | 50,276 | $121 | A$139 | 74% | 85% | |||||||||

| Freight Containers

|

8,868 | NA | A$132 | NA | 70% | |||||||||||

|

Office

|

9,673 | $317 | A$308 | 80% | 70% | ||||||||||

| Modular Buildings

|

1,142 | $772 | NA | 81% | NA | |||||||||||

| Mobile Offices

|

4,590 | $278 | NA | 76% | NA | |||||||||||

|

Portable

|

4,056 | $699 | NA | 43% | NA | ||||||||||

I-8

Table of Contents

| FY 2015 | ||||||||||||||||

| Product Category |

Unit Type | Description | Industry Applications | Number of Units as of June 30, 2015 |

Average Monthly Lease Rate |

Average Utilization | ||||||||||

| North America |

Asia- Pacific |

North America |

Asia- Pacific | |||||||||||||

|

Storage |

SEE PRECEDING CHART | 45,757 | $114 | A$141 | 76% | 86% | |||||||||

|

Freight

|

9,128 | NA | A$129 | NA | 72% | |||||||||||

|

Office

|

8,115 | $299 | A$479 | 85% | 75% | ||||||||||

| Modular Buildings |

1,139 | $770 | NA | 79% | NA | |||||||||||

|

Mobile

|

4,690 | $259 | NA | 75% | NA | |||||||||||

|

Portable

|

4,027 | $1,314 | NA | 71% | NA | ||||||||||

Ancillary Products and Services

We deliver and, where necessary, install our products directly on customers’ premises. These services are either provided by our in-house personnel and transportation equipment or outsourced to third parties. We also provide ancillary products such as steps, ramps, furniture, portable toilets, security systems, shelving, mud pumps, hoses, splitter valves, tee connectors and other items to our customers for their use in connection with leased equipment. In addition, with our liquid containment products, a variety of spill prevention and secondary containment products are rented to our customers to ensure compliance with the Environmental Protection Agency’s Spill Prevention, Control and Countermeasure (SPCC) rule/regulations. Spill containment systems, or berms, are designed to protect against leaks or spills by covering the land under a steel tank with an impermeable plastic that has barrier walls. In the case of a spill, the liquid is captured within the containment system, thereby limiting danger to the environment.

In response to the reduced demand of its portable liquid storage tanks, our North American manufacturing operations began manufacturing a variety of other steel-based products during FY 2016, including:

| ● | Chassis |

| ● | Storm Shelters |

| ● | Blast-Resistant Modules |

| ● | Specialty Tanks |

Designed for transporting containers safely on the road, the chassis are made with high quality components, are fully customizable and all chassis sales are backed with both a five year limited warranty on axles as well as a five year warranty on workmanship.

I-9

Table of Contents

Storm shelters are designed for above ground installation, thereby protecting homeowners from a natural disaster. The shelters come in two different wall designs (corrugated or smooth) and in two different standard sizes. Custom sizes are also available to accommodate specific needs. All storm shelters are Texas Tech Wind Institute Certified and compliant with ICC 500 2014 and FEMA 361.

Blast resistant modules, designed to protect individuals and materials from external explosions, come in three standard sizes of 8 by 20 feet, 8 by 40 feet and 12 by 40 feet. All modules have an 8 PSI blast rating and can be fabricated with a ballistic rating upon request.

Specialty tanks consist primarily of portable fuel tanks and tanks used in the agriculture industry to store chemicals. In particular, portable fuel tanks allow the end user to work more efficiently and can reduce costs by accessing fleet fuel on the job site. Specialty tanks are manufactured similar to liquid containment tanks for the oil and gas industry using a structural steel understructure.

Sales

We complement our core leasing business by selling existing lease fleet assets or assets purchased specifically for resale. The sale of lease fleet units has historically been a cost effective method of replenishing and upgrading the lease fleet. We also provide additional services when selling units. These services range from delivery to full scale turnkey solutions. In a turnkey solution, we provide not only the underlying equipment but also a full range of project related services, which may include foundation, specialty interior finishes, and landscaping, as may be necessary to make the equipment fully operational for the customer.

Product Lives and Durability

Our portable storage, modular space and liquid containment units have long estimated useful lives of 20-30 years. The age of our rental equipment, which can be a key price factor in some rental businesses, has only a modest impact on rental rates. This high value retention is due to the fact that our lease fleet units have virtually no technology obsolescence risk, do not possess engines, have few moving parts, have low maintenance requirements and are used in non-destructive applications, all differentiating characteristics from many other classes of rental equipment.

Ongoing maintenance to our fleet is performed on an as-needed basis and is intended to maintain the value and rental-ready condition of our units. Maintenance requirements on portable storage units can include removing rust and dents, patching small holes, repairing floors, painting and replacing seals around the doors. Maintenance requirements for modular space units can include repairs of floors, doors, air conditioning units, windows, roofs and electric wiring. Maintenance requirements for liquid containment units include cleaning the unit to eliminate any residual material and inspecting the lining. Maintenance is performed by in-house fleet technicians and third-party vendors, depending on the branch and complexity of the work. Maintenance and repair costs of our lease fleet are included as direct costs of leasing operations and expensed as incurred whether performed by in house technicians or by third party vendors. We believe our maintenance program ensures a high quality fleet that supports both leasing and sales operations.

Our lease fleet units are recorded at cost and depreciated on the straight-line basis, in accordance with accounting principles generally accepted in the United States, up to 20 years after the date they are put in service, down to their estimated residual values. Because we have a history of selling units for gains, we believe our lease fleet’s estimated residual value is at or below net realizable value.

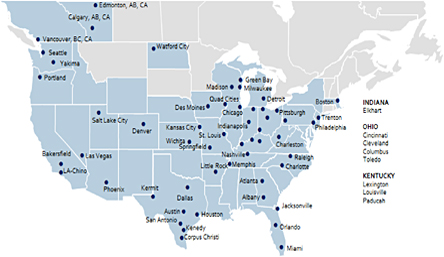

Geographic Network

Our service locations are segmented into two operating areas: North America and Asia-Pacific. In North America, these service locations are called branches and in our Asia-Pacific area they are referred to as Customer Service Centers, or “CSCs.” Our North American branch network consists of 52 branch locations in the United States and three in Canada, and our Asia-Pacific network consists of 21 CSCs in Australia and 11 in New Zealand.

Our network enables us to maintain product availability and provide customer service within regional and local markets. Customers benefit because they are provided with improved service availability, reduced time to occupancy, better access to sales representatives, the ability to inspect units prior to rental and lower freight costs. We, in turn, benefit because we are able to spread regional overhead and marketing costs over a large lease base, redeploy units within our network to optimize utilization, discourage potential competitors by providing ample local supply and service local customers in a more cost efficient manner. Through our network, we develop local market knowledge and strong customer relationships while our corporate-based marketing group manages our brand image, web presence and lead generation programs.

I-10

Table of Contents

The following maps show our existing branch and CSC locations as of June 30, 2017.

North America

Asia-Pacific

In North America, branch offices are generally headed by a branch manager and are organized into four regions, which are managed by four regional vice presidents each with more than 15 years of experience in the industry. In addition to a branch manager, each branch may also have its own sales force. We are introducing a transportation department that will deliver and pick up lease fleet units from customers in certain remote areas. Branch managers are integral to our success and performance-based incentive bonuses are a portion of their compensation.

Our two Lone Star branch locations allow us to be near our customers’ production and drilling sites. In addition to benefitting from greater product availability and timely service, these branch locations enable many of our customers to realize lower transportation costs, which is a significant value proposition as they aim to control costs. These locations are managed by a general manager working closely with the organization’s Department of Transportation (“DOT”) compliance and safety officer. Each location also has a superintendent that oversees the operations and yard foremen, who are responsible for the drivers and mechanics.

Asia-Pacific

We believe that our Asia-Pacific CSC network is the largest of any storage container company in Australia and New Zealand, and management estimates that we have approximately 37% market share in the region. We are represented in all major metropolitan areas and are the only container leasing and sales company with a nationally integrated infrastructure and workforce. A typical CSC consists of a leased site of approximately two to five acres with a sales office, forklifts and all-weather container repair workshop.

I-11

Table of Contents

CSC office staffing ranges from two to 15 people and include a branch manager supported by the appropriate level of sales, operations and administrative personnel. Yard and workshop staffing usually ranges between one and 12 people and can consist of welders, spray painters, boilermakers, forklift drivers and production supervisors. CSC inventory usually ranges between 150 and 700 storage containers at any one time, depending on market size and throughput demand. Each CSC has a branch manager who has overall supervisory responsibility for all activities of the CSC. Branch managers report to one of our State Managers for Australia and Sales Managers (North and South Islands) for New Zealand who in turn report to an Executive General Manager who reports to the CEO. Performance-based incentive bonuses are a portion of the compensation for the CSC, State, Island and branch managers. Each branch has its own sales force, forklifts to load, transport and unload units and a storage yard staff responsible for unloading and stacking units. Steel units can be stored by stacking them three-high to maximize usable ground area. Our larger branches also have a fleet maintenance department to make modifications to the containers and maintain the branch’s forklifts and other equipment. Our smaller branches perform preventative maintenance tasks and outsource major repairs.

We lease all of our branch locations and Royal Wolf’s corporate and administrative offices in Hornsby, New South Wales. All of our major leased properties have remaining lease terms of up to 22 years and we believe that satisfactory alternative properties can be found in all of our markets, if we do not renew these existing leased properties.

Reference is made to “Item 2. Properties” for a more detailed description of our geographic locations.

Customers and End Markets

We have a diverse customer base consisting of over 44,000 customers, who operate in a broad variety of over 20 industries in our North American and Asia-Pacific venues. Our customers consist of large national corporations, as well as many local companies and organizations. As a result, in each venue no customer contributed more than 3% of the respective venue’s FY 2017 revenues. Our end markets include construction, commercial, transportation, industrial, energy, manufacturing, mining, retail, education and government. We believe the end market and geographic diversification of our customer base reduces the business exposure to a significant downturn in any particular industry or geography.

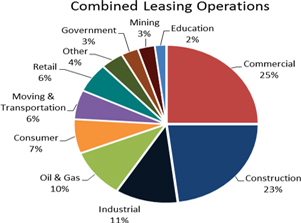

The diversity for our leasing operations is depicted in the following charts showing total revenue breakdown by end markets for FY 2017:

I-12

Table of Contents

The following provides an overview of the end markets served by our leasing operations:

| ● | Construction - general contractors, residential homebuilders and subcontractors |

| ● | Industrial - industrial and manufacturing customers including a broad array of manufacturers, telecommunications, distribution, utilities, refuse, recycling and bottling companies |

| ● | Commercial - businesses that provide service to both commercial businesses and individual consumers, including wholesalers, health care facilities, veterinary offices, entertainment companies and religious institutions |

| ● | Oil & Gas and Mining - Customers in specific sectors of the extractive industries |

| ● | Government - federal agencies, state and local governments, fire departments, correctional institutions, and the U.S. military |

| ● | Retail - large national chains, small local stores, shopping centers and restaurants |

| ● | Education - public schools, private schools and day care facilities |

| ● | Consumer – mass market of individuals or groups, not businesses, such as families, sporting teams and community groups in the Asia-Pacific area |

| ● | Moving & Transportation - freight providers for primarily road and rail transport in the Asia-Pacific area |

| ● | Other - all other customers |

We differentiate ourselves from competitors in several ways. In our portable storage and modular space businesses, we provide a diverse set of competitively priced products and, in our Asia-Pacific market, we leverage our engineering team to provide customized units upon customer request. In our liquid containment business, we leverage long-standing customer relationships and not only provide liquid containment units, but also bundle units with transportation, on-site set-up, and the servicing of equipment 24 hours a day, 7 days a week. Our customer-centric approach is designed to ensure that our businesses consistently meet or exceed customer expectations. We believe this focus on customer service attracts new and retains existing customers. With the goal of delivering “best in class” customer service, we began collecting customer responses on net promoter scores (“NPS”) in North America at Pac-Van during FY 2015, which track customer willingness to recommend our products and services, and from October 2014 to June 2015 our customers gave us a NPS of 82%. In FY 2016 and FY 2017, our customers gave us a NPS of 83% and 85%, respectively. In FY 2017, we began collecting customer responses on NPS in the Asia Pacific at Royal Wolf and our customers there gave us a NPS of 61%. In addition, over 85% of our consolidated total leasing revenues in FY 2017 were derived from repeat customers, which we believe is a result of our superior customer service.

Sales and Marketing

In North America, members of our sales teams act as primary customer service representatives and are responsible for fielding calls, obtaining credit applications, quoting prices, following up on quotes and handling orders. Our sales teams are responsible for developing and managing local relationships, as well as handling both inbound and outbound calls. They also assist customers in defining their space needs, assess potential opportunities, quote deals, close transactions and obtain the necessary documentation. Upon completing a lease or a sale, the sales team works closely with the local branch operations team to ensure that customer expectations are met or exceeded, relative to equipment quality and delivery timing. Our marketing group is primarily responsible for advertising campaigns, producing company literature, creating promotional sales tools and oversight of customer relationship management systems. We market services through a number of promotional vehicles, including the internet, signage on our equipment, telemarketing, targeted mailings, trade shows and advertising in publications. We believe this approach to marketing is consistent with the local nature of our business and allows each branch to employ a customized marketing plan that fosters growth within its particular market. We provide ongoing training to our sales teams, monitor call quality and survey our customers to ensure that customer interactions meet our quality and service standards. Our lease fleet carries signage reflecting our brands, which is important to ongoing name recognition.

Our sales and marketing strategy in the Asia-Pacific is designed to reach thousands of potential customers. Communication with potential customers is predominantly generated through a combination of internal advertising and search engine optimization (or SEO), print media advertising, telemarketing, web-site, customer referrals, signage and decal awareness, direct mail, television and radio. The customer hiring or buying process is being driven by customer awareness of the products combined with price shopping. We believe that while a typical customer may shop a limited number of suppliers, the customer does not spend much time doing so because the potential cost savings is relatively low compared to the value of their time. Our goals are to be one of the suppliers that potential customers call and to make the experience as easy as possible for that customer.

I-13

Table of Contents

Fleet Management and Information Systems

Fleet Management

Fleet information is updated daily at the branch level, which provides management with the ability to monitor branch operations on a daily, weekly, monthly and ad hoc basis with on-line access to utilization, leasing and sale fleet unit levels and revenues by branch or geographic region. In managing our fleet, we regularly relocate containers between branches to meet changes in regional demand and optimize inventory levels. We have close relationships with the national road and rail hauling companies that enable us to transport the majority of containers interstate at attractive rates.

Ongoing maintenance to our North American leasing fleet is performed on an as-needed basis and is intended to maintain the value and rental-ready condition of our units. We use both in-house fleet technicians and third-party vendors to perform maintenance, depending on the branch and complexity of the work. Maintenance requirements on containers are generally minor and include removing rust and dents, patching small holes, repairing floors, painting and replacing seals around the doors. Maintenance requirements for container offices, mobile offices and modular buildings tend to be more significant than for storage equipment and may involve repairs of floors, doors, air conditioning units, windows, roofs and electric wiring. Portable liquid storage tanks require simple maintenance, including cleaning the unit to eliminate any residual material and inspecting and repairing the lining, if needed. Whether performed by us or a third party, the cost of maintenance and repair of our lease fleet is included as direct costs of leasing operations and is expensed as incurred. We believe our maintenance program ensures a high quality fleet that supports both leasing and sales operations.

In the Asia-Pacific, most of our fleet is comprised of new and refurbished and customized storage containers, manufactured steel containers and record storage units, along with our freight and accommodation units. These products are designed for long useful lives. A portion of our fleet consists of used storage containers of eight to thirteen years in age, a time at which their useful life as ocean-going shipping containers is over according to the standards promulgated by ISO. Because we do not have the same stacking and strength requirements that apply in the ocean-going shipping industry, we have no need for these containers to meet ISO standards. We purchase these containers in large quantities, refurbish them by removing any rust and paint them with a rust inhibiting paint, further customize them and add our decals and branding. We maintain our steel containers on a regular basis by painting them on average once every three to five years, removing rust, spot welding and occasionally replacing the wooden floor or other parts. This periodic maintenance keeps the container in good condition and is designed to maintain the unit’s value and rental rates comparable to new units.

Information Systems

We utilize management information systems across each of our businesses to support fleet management and targeted marketing efforts, and we believe they are tailored to satisfactorily meet each of our businesses’ specific needs for efficient operation.

In our North American portable storage and modular space business, we utilize the Microsoft Dynamics NAV, or Navision, software at all of our branches to monitor operations at branches on a daily, weekly, monthly and ad hoc basis. Lease fleet information is updated daily at the branch level and verified through routine physical inventories by branch personnel, providing management with online access to utilization, lease fleet unit detail and rental revenues by branch and geographic region. In addition, an electronic file for each unit showing its lease history and current location and status is maintained in the information system. Branch salespeople utilize the system to obtain information regarding unit condition and availability. The database tracks individual units by serial number and provides comprehensive information including cost, condition and other financial and unit specific information. In FY 2016 we upgraded our Navision platform to the current version and installed a new rental module called Armada. In FY 2018 we intend on adding a business intelligence corporate performance management software package to our information system platform.

In our Asia-Pacific portable storage and modular space businesses, our management information systems, including Armada, Navision and TCM, are scalable and provide us with critical information to manage our business. Utilizing our systems, we track a number of key operating and financial metrics including utilization, lease rates, profitability, customer trends and fleet data. All our branches use RMI/Navision and our support office provides financial, inventory and customer reports for branch managers. In FY 2017, we upgraded our Navision platform in the Asia-Pacific to the current version and replaced RMI with a new rental module called Armada.

Our North American manufacturing business utilizes the enterprise resource planning (ERP) business system, SyteLine, which provides comprehensive functionality, including order processing, inventory, purchasing, planning and scheduling, production, cost management, project tracking, accounting and customer service.

I-14

Table of Contents

Product Procurement

North America

Our North American leasing operations closely monitor fleet capital expenditures, which include fleet purchases and any capitalized improvements to existing units. Pac-Van’s top four suppliers of units for FY 2017 represented approximately 40% of all fleet purchases and the top ten suppliers represented approximately 66% of all fleet purchases. We purchase our Pac-Van lease fleet from a network of third-party suppliers. All of our mobile offices are built by an established network of manufacturing partners to standard specifications, which may vary depending on regional preferences. In addition, we build these units to meet state building code requirements and generally obtain multi-state certificates enabling us to move equipment among our branch network to meet changing demand and supply conditions. Like mobile offices, we procure modular buildings from an established network of manufacturing partners to meet state building requirements and generally obtain multiple state certificates for each unit.

On October 1, 2012, we acquired 90% of the membership interests of Southern Frac. Southern Frac manufactures primarily portable liquid storage containers in Waxahachie, Texas for oil and gas exploration and production, but it can also manufacture for, among others, the chemical and industrial, environmental remediation, waste water treatment and waste management sectors. During FY 2016, Southern Frac introduced other high-quality steel-based products, including container chassis, under the name “Southern Fabrication Specialties.”

Our North American leasing operations has historically purchased its tank fleet from several manufacturers but expects Southern Frac to be its primary supplier of steel tanks going forward. However, if needed, we have an established network of steel tank manufacturing partners located throughout the United States. Lone Star purchases its other containment solutions, pumps and hoses from a network of other manufacturing providers.

We believe that Southern Frac will continue to provide a substantial portion of the portable liquid storage containers requirements to our North American leasing operations, including a portion of their GLO requirements, as well as generate leasing referrals.

Capital investments are adjusted to match business needs and to respond to changing economic conditions. We do not generally enter into long-term purchase contracts with manufacturers, and we can modify our capital investment activities in response to market conditions. Our North American leasing operations supplement fleet spending with acquisitions. Although the timing and amount of acquisitions are difficult to predict, management considers its acquisition strategy to be opportunistic and attempts to adjust its fleet spending patterns as favorable acquisition opportunities become available.

Asia-Pacific

In the Asia-Pacific area, we purchase marine cargo containers from a wide variety of international shipping lines and container leasing companies and new container products directly from storage container manufacturers in China. We believe we are the largest buyer of both new and used storage container products for the Australia and New Zealand markets. The majority of used storage containers purchased are standard 20-foot and 40-foot units which we convert, refurbish or customize. We purchase new storage container products in the Asia-Pacific area under purchase orders issued to container manufacturers, which the manufacturers may or may not accept or be able to fill. There are several alternative sources of supply for storage containers. Though we are not dependent upon any one manufacturer in purchasing storage container products, if one or more suppliers did not timely fill our purchase orders or did not properly manufacture the ordered products, our reputation and financial condition also could be harmed. The top four suppliers represented approximately 74% of all fleet purchases during FY 2017.

Competition

Portable Storage

The portable storage markets in North America, Australia and New Zealand are highly fragmented. In most locations within its markets, Pac-Van and Royal Wolf compete with several national and regional competitors. Our largest competitors in the portable storage sector in North America are Mobile Mini, Algeco Scotsman, McGrath RentCorp, Haulaway, Allied Leasing, Eagle Leasing and National Trailer Storage. We believe we are the market share leader in Australia and New Zealand. Our primary competitors in these markets include CGM-CMA Group, and the SCF Group (Simply Containers) as well as smaller, full and part-time operators. Local competitors are regionally focused, and are usually more capital-constrained. Therefore, in general, they are heavily reliant on monthly sales performance, have slow growing rental fleets and have limited ability to handle larger volume contracts or customer accounts. We believe that participants in this sector compete on the basis of customer relationships, price, service, as well as breadth and quality of equipment offered.

I-15

Table of Contents

Modular Space

The modular space sector is highly competitive in each of the markets in which we compete. Our largest North American competitors, ModSpace, Williams Scotsman (Algeco Scotsman), Mobile Modular (McGrath RentCorp) and Mobile Mini have greater market share or product availability in some markets, as well as greater financial resources and pricing flexibility. Other regional competitors include Acton Mobile, Vanguard Modular, Design Space and Satellite Shelters. In the Australian portable container buildings market, Royal Wolf maintains a small presence and competes primarily with three large participants who manufacture their own units and most of whom offer units for both lease and sale to customers. These competitors are Coates Hire, Atco Structures & Logistics and Ausco Modular (Algeco Scotsman). We believe we compete on the basis of service, quality, customer relationships and price. We believe that our reputation for customer service and a wide selection of units allow us to compete effectively. The major barrier to entry for new participants is the degree of market penetration necessary to create a wide profile with contractors and clients. Penetrating and competing with the range of products and number of depots and agencies offered by incumbent operators tend to inhibit new entrants. As we already maintain a national sale and distribution network, established supply channels and a strong profile in our target markets, many of the barriers to entry applicable to other new entrants are not applicable to us.

Liquid Containment

The liquid containment sector is highly competitive. We compete in this sector based upon product availability, product quality, price, service and reliability. As with the other industries we serve, the competition consists of national, regional and local companies. Some of the national competitors, notably BakerCorp, Rain For Rent and Adler Tanks (McGrath RentCorp), have significantly larger tank lease fleet and may have greater financial and marketing resources, more established relationships and greater name recognition in the market than we do. As a result, the competitors with these advantages may be better able to attract customers and provide their products and services at lower rental rates.

Employees

As of June 30, 2017, we had a total of 771 employees. None of our employees are covered by a collective bargaining agreement and management believes its relationship with employees is good. We have never experienced any material labor disruption and are unaware of any efforts or plan to organize our employees. The employee groups are as follows:

| North America | Asia-Pacific | |||||||||||||||

| Leasing | Manufacturing | Corporate | Leasing | |||||||||||||

| Corporate executive |

— | — | 5 | — | ||||||||||||

| Regional executive and administrative staff |

52 | 10 | 2 | 19 | ||||||||||||

| Senior and branch management |

56 | — | — | 30 | ||||||||||||

| Sales and marketing |

81 | — | — | 78 | ||||||||||||

| Branch operations and administration |

277 | — | — | 120 | ||||||||||||

| Manufacturing |

— | 41 | — | — | ||||||||||||

| 466 | 51 | 7 | 247 | |||||||||||||

I-16

Table of Contents

Executive Officers of the Registrant

The following information is provided as of June 30, 2017 regarding our executive officers. No family relationship exists between any executive officer.

| Name | Age | Position | ||||

| Ronald F. Valenta |

58 | Chairman of the Board, Chief Executive Officer and President | ||||

| Jody Miller |

50 | President and Chief Executive Officer of GFN North America Leasing Corporation | ||||

| Charles E. Barrantes |

65 | Executive Vice President and Chief Financial Officer | ||||

| Christopher A. Wilson |

50 | General Counsel, Vice President and Secretary | ||||

| Jeffrey A. Kluckman |

56 | Executive Vice President, Business Development | ||||

| Neil Littlewood |

56 | Chief Executive Officer of Royal Wolf Holdings Limited | ||||

| Theodore Mourouzis |

54 | Chief Executive Officer and President of Pac-Van, Inc. | ||||

Ronald F. Valenta has served as a director and as our Chief Executive Officer since our inception and Chairman of the Board since June 2014. He will step down as Chief Executive Officer and assume the title of Executive Chairman of the Board in January 2018. From 1988 to 2003, Mr. Valenta served as the President and Chief Executive Officer of Mobile Services Group, Inc., a portable storage company he founded. From 2003 to 2006, Mr. Valenta was a director of the National Portable Storage Association, a storage industry non-profit organization that he co-founded. From 1985 to 1989, Mr. Valenta was a Senior Vice President of Public Storage, Inc. From 1980 to 1985, Mr. Valenta was employed by the accounting firm of Arthur Andersen & Co. in Los Angeles.

Jody Miller became our President in January 2017 and will become our Chief Executive Officer in January 2018. He has been our Executive Vice President and the Chief Executive Officer of GFN North America Leasing Corporation since June 2015. Prior to joining us, Mr. Miller spent over 25 years in the equipment rental industry, including at Mobile Mini, Inc. as Executive Vice President and Chief Operations Officer for five years, Mobile Services Group, Inc. as Senior Vice President for five years, and RSC Holdings, Inc. as Regional Vice President for seven years. Prior to that, he worked in smaller rental businesses in various leadership roles. Mr. Miller is a 1990 graduate of Central Missouri State University.

Charles E. Barrantes has served as our Executive Vice President and Chief Financial Officer since September 2006. Prior to joining us, Mr. Barrantes was Vice President and Chief Financial Officer for Royce Medical Company from early 2005 to its sale in late 2005. From 1999 to early 2005, he was Chief Financial Officer of Earl Scheib, Inc., a public company that operated over 100 retail paint and body shops. Mr. Barrantes has over 35 years of experience in accounting and finance, starting with more than a decade with Arthur Andersen & Co.

Christopher A. Wilson has served as our General Counsel, Vice President and Secretary since December 2007. Prior to joining us, Mr. Wilson was the general counsel and assistant secretary of Mobile Services Group, Inc. from February 2002 to December 2007. Mr. Wilson practiced corporate law as an associate at Paul, Hastings, Janofsky & Walker LLP from 1998 to February 2002. Mr. Wilson graduated with a B.A. from Duke University in 1989 and a J.D. from Loyola Law School of Los Angeles in 1993.

Jeffrey A. Kluckman became our Executive Vice President, Business Development in September 2011. Prior to joining us, among other things, he held the role of vice president of mergers and acquisitions for portable storage solutions provider Mobile Mini, Inc. and, earlier, similar positions with Mobile Services Group, Inc., which was acquired by Mobile Mini in 2008, and RSC Equipment Rental, Inc. In his near 20-year background in the rental services sector, including the mobile storage, modular space and equipment rental industries, Mr. Kluckman successfully completed more than 145 transactions. Mr. Kluckman received an accounting degree from Northern Illinois University.

Neil Littlewood became Chief Executive Officer of Royal Wolf in July 2016. He joined Royal Wolf in March 2013 in the role of Executive General Manager, North East. Neil has over 13 years of senior experience in the rental/hire industry including executive roles at Coates Hire and Australian Temporary Fencing. Prior to this, Neil spent 20 years as an Army Officer including being in charge of recruiting for the Australian Army and retiring as Lieutenant Colonel. He is a graduate of the Royal Military College Duntroon and holds a Bachelor of Arts and Masters in Management from the University of New South Wales.

I-17

Table of Contents

Theodore Mourouzis became Chief Executive Officer of Pac-Van, Inc. in April 2017 and has served as its President since August 2006. He previously served as its Chief Operating Officer since 1999 and as its Vice President of Finance from 1997 until 1999. Prior to his employment with Pac-Van, Mr. Mourouzis was a controller for a 3M joint venture, served four years in management consulting with Deloitte & Touche, and was president of a picture framing distributor and the chief financial officer of its holding company. He received his undergraduate degree from Stanford University in 1985 and a Masters of Business Administration from The Wharton School of the University of Pennsylvania in 1991.

Trademarks

North America

We own trademarks important to our North American leasing operations, including Pac-Van®, “We’ve Put Thousands of U.S. Businesses In Space®,” “Expect More. We’ll Deliver®” and the “Container King” logo in Canada. Material trademarks are registered in the U.S. Patent and Trademark Office. Registrations for such trademarks in the U.S. will last indefinitely as long as we continue to use and maintain the trademarks and renew filings with the applicable governmental offices.

Asia-Pacific

We entered into a licensing agreement with Triton Corporation in May 2008 for the use of the “Royal Wolf” name and trademark in connection with its retail sales and leasing of intermodal cargo containers and other container applications in the domestic storage market within Australia and New Zealand and surrounding islands in the Pacific Islands region. We paid Triton Corporation $740,000 to license the trademark. The license will continue in perpetuity as long as Royal Wolf continues to use the “Royal Wolf” name and trademark as the exclusive name for its business and mark for its products, subject to the termination provisions of the license. The license may be terminated by the licensor upon 30 days notice in the event Royal Wolf breaches its obligations under the license and will terminate automatically if Royal Wolf becomes insolvent or ceases to sell products under the trademark for a continuous period of 30 months. GFN sold the “Royal Wolf” name and trademark to Royal Wolf in May 2011 in connection with the Australian initial public offering of Royal Wolf Holdings Limited. There are no claims pending against Royal Wolf challenging its right to use the “Royal Wolf” name and trade mark within Royal Wolf’s region of business.

Available information

Our Internet website address is www.generalfinance.com. This reference to our Internet website does not incorporate by reference the information contained on or hyperlinked from our Internet website into this Annual Report on Form 10-K. Such information should not be considered part of this Annual Report on Form 10-K. The Internet websites for Royal Wolf, Pac-Van, Lone Star and Southern Frac (Southern Fabrication Specialties) are www.royalwolf.com.au, www.pacvan.com, www.lonestartank.com and www.southernfrac.com (www.southernfabricationspecialties.com), respectively. We are required to file Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q with the Securities and Exchange Commission (“SEC”) on a regular basis and are required to disclose certain material events in a current report on Form 8-K. The public may read and obtain a copy of any materials we file with the SEC through our Internet website noted above, which is hyperlinked to the SEC’s Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The SEC’s Internet website is located at http://www.sec.gov.

I-18

Table of Contents

In addition to the other information in our Annual Report on Form 10-K, you should consider the risks described below that we believe may be material to investors in evaluating us. This section contains forward-looking statements, and in considering these statements, you should refer to the qualifications and limitations on our forward-looking statements that are described in SAFE HARBOR STATEMENT before the beginning of Item 1.

Economic conditions and global capital and credit market disruptions may adversely affect our business, financial condition and results of operations.

An economic slowdown in the United States and/or globally, including reduced oil or gas prices and non-residential construction spending, would adversely affect our business. Worsening conditions could adversely affect, among other things, the collection of our trade receivables on a timely basis, resulting in additional reserves for uncollectible accounts; and, in the event of continued contraction in product sales and leasing, could lead to a build-up of inventory and lease fleet levels and a decline in revenues. In addition, we engage in borrowing and repayment activities under our revolving credit facilities on an almost daily basis and have not had any disruption in our ability to access our revolving credit facilities as needed. However, disruptions in the global capital and credit markets, such as those that occurred in the global financial crisis during the latter part of the past decade, could increase the likelihood that one or more of our lenders may be unable to honor its commitments under our revolving credit facilities, which could have an adverse effect on our business, financial condition and results of operations.