% Average Annual Total Returns 1 |

Inception Date |

Six Months |

One Year |

Five Years |

Ten Years |

| Fund at NAV | 11/30/2006 | 19.42% | 22.04% | 11.07% | 10.16% |

| Fund at Market Price | — | 23.56 | 21.48 | 10.61 | 10.60 |

| S&P 500® Index | — | 20.98% | 22.66% | 13.18% | 12.40% |

| Cboe S&P 500 BuyWrite Index SM |

— | 9.70 | 9.12 | 5.31 | 5.68 |

% Premium/Discount to NAV 2 |

|

| As of period end | ( |

Distributions 3 |

|

| Total Distributions per share for the period | $0.502 |

| Distribution Rate at NAV | 8.88% |

| Distribution Rate at Market Price | 9.10 |

1 |

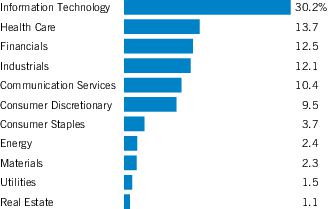

Depictions do not reflect the Fund’s option positions. Excludes cash and cash equivalents. |

1 |

S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Cboe S&P 500 BuyWrite Index SM measures the performance of a hypothetical buy-write strategy on the S&P 500® Index. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

2 |

The shares of the Fund often trade at a discount or premium to their net asset value. The discount or premium may vary over time and may be higher or lower than what is quoted in this report. For up-to-date premium/discount information, please refer to https://funds.eatonvance.com/closed-end-fund-prices.php. |

3 |

The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. For additional information about nondividend distributions, please refer to Eaton Vance Closed-End Fund Distribution Notices (19a) posted on our website, eatonvance.com. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099-DIV and provided to the shareholder shortly after each year-end. For information about the tax character of distributions made in prior calendar years, please refer to Performance-Tax Character of Distributions on the Fund’s webpage available at eatonvance.com. In recent years, a significant portion of the Fund’s distributions has been characterized as a return of capital. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. Fund distributions may be affected by numerous factors including changes in Fund performance, the cost of financing for leverage, portfolio holdings, realized and projected returns, and other factors. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. |

| Fund profile subject to change due to active management. | |

| Important Notice to Shareholders | |

| On January 26, 2023, the Fund’s Board of Trustees voted to exempt, on a going forward basis, all prior and, until further notice, new acquisitions of Fund shares that otherwise might be deemed “Control Share Acquisitions” under the Fund’s By-Laws from the Control Share Provisions of the Fund’s By-Laws. |