Exhibit 99.1

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED MARCH 31, 2024

DATED AS OF June 4, 2024

SILVERCORP METALS INC.

Suite 1750 – 1066 West Hastings Street

Vancouver, BC V6E 3X1

Tel: (604) 669-9397

Fax: (604) 669-9387

Email: investor@silvercorp.ca

Website: http://www.silvercorpmetals.com

Contents

| ITEM 1 | GENERAL | 3 |

| 1.1 | Date of Information | 3 |

| 1.2 | Forward Looking Statements | 3 |

| 1.3 | Cautionary Note to U.S. Investors Concerning Preparation of Mineral Resource and Mineral Reserve Estimates | 4 |

| 1.4 | Currency and Financial Information | 5 |

| 1.5 | Non-IFRS Measures | 5 |

| ITEM 2 | CORPORATE STRUCTURE | 7 |

| 2.1 | Names, Addresses and Incorporation | 7 |

| 2.2 | Intercorporate Relationships | 8 |

| ITEM 3 | GENERAL DEVELOPMENT OF THE BUSINESS | 10 |

| 3.1 | Business of Silvercorp | 10 |

| 3.2 | Three Year History | 10 |

| ITEM 4 | DESCRIPTION OF THE BUSINESS | 16 |

| 4.1 | General | 16 |

| 4.2 | Corporate Governance, Safety, Environment and Social Responsibility | 20 |

| 4.3 | Laws and Regulations Related to Mining and Foreign Investment in China | 21 |

| 4.4 | Risk Factors | 27 |

| ITEM 5 | MINERAL PROPERTIES | 45 |

| 5.1 | Ying Mining District, Henan Province, China | 45 |

| 5.2 | GC Mine | 69 |

| ITEM 6 | DIVIDENDS AND DISTRIBUTIONS | 81 |

| ITEM 7 | DESCRIPTION OF CAPITAL STRUCTURE | 82 |

| ITEM 8 | MARKET FOR SECURITIES | 82 |

| ITEM 9 | ESCROWED SECURITIES | 83 |

| ITEM 10 | DIRECTORS AND OFFICERS | 84 |

| ITEM 11 | AUDIT COMMITTEE | 86 |

| ITEM 12 | PROMOTERS | 88 |

| ITEM 13 | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 88 |

| ITEM 14 | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 88 |

| ITEM 15 | TRANSFER AGENTS AND REGISTRARS | 88 |

| ITEM 16 | MATERIAL CONTRACTS | 89 |

1

| ITEM 17 | INTERESTS OF EXPERTS | 89 |

| ITEM 18 | ADDITIONAL INFORMATION | 91 |

| SCHEDULE “A” | 92 |

2

| ITEM 1 | GENERAL |

| 1.1 | Date of Information |

All information in this Annual Information Form (“AIF”) is as of March 31, 2024, unless otherwise indicated.

| 1.2 | Forward Looking Statements |

Certain statements and information in this AIF for Silvercorp Metals Inc. (“Silvercorp” or the “Company”) constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and also are “forward-looking information” within the meaning of applicable Canadian provincial securities laws (collectively, “forward-looking statements or information”). Forward-looking statements or information include, but are not limited to, information concerning mineral resource and mineral reserve estimates to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Forward-looking statements or information relate to, among other things: the price of silver, lead, zinc and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company’s material properties; the Company’s guidance and outlook including estimated production from the Company’s mines in the Ying Mining District (defined herein) and from the GC Mine; information related to the proposed transaction between the Company and Adventus Mining Corporation; availability of funds from production to finance the Company’s operations; access to and availability of funding for future construction and development of the Company’s properties or for acquisitions; future profitability, cash flow, growth, mine life, dividends, mergers or acquisition, and other forecasts and predictions with respect to the Company and its properties.

Forward-looking statements are based on the opinions, assumptions, factors and estimates of management considered reasonable at the date the statements are made. The opinions, assumptions, factors and estimates which may prove to be incorrect, include, but are not limited to: the specific assumptions set forth in this AIF, or incorporated by reference herein; the expectations and beliefs of management; that prices for minerals, particularly silver, gold, lead and zinc remain consistent with the Company’s expectations; that there are no significant disruptions affecting operations, including labour disruptions, supply disruptions, power disruptions, security disruptions, damage to or loss of equipment, whether due to flooding, political changes, title issues, intervention by local communities, environmental concerns, pandemics (including COVID-19) or otherwise; that operations, development and exploration at the Company’s projects proceed on a basis consistent with expectations and the Company does not change its development and exploration plans and forecasts; that prices for key mining supplies, including labour costs and consumables remain consistent with the Company’s current expectations; that plant, equipment and processes will operate as anticipated; that there are no material variations in the current tax and regulatory environment or the tax positions taken by the Company; that the Company will maintain access to surface rights; that the Company will be able to obtain and maintain government approvals, permits and licenses in connection with its current and planned operations, development and exploration activities; that the Company is able to meet current and future obligations; and that the Company can access adequate financing, appropriate equipment and sufficient labour, all at acceptable rates.

3

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to the matters described in this AIF under Item 4.4 Risk Factors under the following headings: fluctuating commodity prices; recent market events and condition; estimation of mineral resources, mineral reserves and mineralization and metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; climate change; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into existing operations; permits and licences for mining and exploration in China; title to properties; non-controlling interest shareholders; acquisition of commercially mineable mineral rights; financing; competition; operations and political conditions; regulatory environment in China; regulatory environment and political climate in Bolivia; environmental risks; natural disasters; dependence on management and key personnel; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; conflicts of interest; internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act; outcome of current or future litigation or regulatory actions; bringing actions and enforcing judgments under U.S. securities laws; cyber-security risks; public health crises; the Company’s investment in New Pacific Metals Corp. and in Tincorp Metals Inc. (formerly Whitehorse Gold Corp.).

This list of risk factors described in this AIF and the Company's other disclosure documents are not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated, described or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements or information involve statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this AIF under the heading “Risk Factors” and elsewhere.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this AIF, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable as of the date of this AIF, forward-looking statements are not guarantees of future performance. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.

| 1.3 | Cautionary Note to U.S. Investors Concerning Preparation of Mineral Resource and Mineral Reserve Estimates |

Unless otherwise indicated, all reserve and resource estimates included in this AIF and the documents incorporated by reference herein have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), including under subpart 1300 of Regulation S-K (the “SEC

4

Modernization Rules”). Accordingly, reserve and resource information and other technical and scientific information included herein may not be comparable to similar information disclosed by U.S. companies.

| 1.4 | Currency and Financial Information |

The Company’s financial results are prepared and reported in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and are presented in United States dollars.

The symbol “CAD$” or “C$” denotes lawful money of Canada, “A$” denotes lawful money of Australia, and “RMB” denotes lawful money of the People’s Republic of China. The following table sets forth, for each of the periods indicated, the year-end exchange rate, the average closing rate and the high and low closing exchange rates for one Canadian dollar expressed in U.S. dollar, as quoted by the Bank of Canada:

| Years Ended March 31, | ||||||||||||

2024 | 2023 | 2022 | ||||||||||

| High | 0.7617 | 0.8031 | 0.8306 | |||||||||

| Low | 0.7207 | 0.7217 | 0.7727 | |||||||||

| Average | 0.7416 | 0.7565 | 0.7980 | |||||||||

| Period End | 0.7380 | 0.7389 | 0.8003 | |||||||||

The following table sets forth, for each of the periods indicated, the year-end exchange rate, the average closing rate and the high and low closing exchange rates for one Canadian dollar expressed in Chinese Renminbi (“RMB”), as quoted by the Bank of Canada:

| Years Ended March 31, | ||||||||||||

| 2024 | 2023 | 2022 | ||||||||||

| High | 5.5036 | 5.3937 | 5.3333 | |||||||||

| Low | 5.0761 | 4.9900 | 4.9116 | |||||||||

| Average | 5.3157 | 5.1809 | 5.1210 | |||||||||

| Period End | 5.3333 | 5.0761 | 5.0736 | |||||||||

| 1.5 | Non-IFRS Measures |

This AIF refers to alternative performance (non-IFRS) measures, such as cash cost per ounce of silver, net of by-product credits, all-in & all-in sustaining cost per ounce of silver, net of by-product credits, production cost per tonne, and all-in sustaining production costs per tonne. These measures do not have standardized meaning under IFRS and therefore are unlikely comparable to similar measures presented by other companies. Readers should refer to the section entitled “Alternative Performance (Non-IFRS) Measures” in our management’s discussion and analysis for the year ended March 31, 2024, for a detailed description and reconciliation of these non-IFRS measures.

5

Per Ounce Measures – Cash Costs and AISC

Cash costs and all-in sustaining costs (“AISC”) per ounce of silver, net of by-product credits, are non-IFRS measures. The Company produces by-product metals incidentally to its silver mining activities. The Company has adopted the practice of calculating a performance measure with the net costs of producing an ounce of silver, its primary payable metal, after deducting revenues gained from incidental by-product production. This performance measure has been commonly used in the mining industry for many years and was developed as a relatively simple way of comparing the net production costs of the primary metal for a specific period against the prevailing market price of such metal.

Cash costs is calculated by deducting revenue from the sales of all metals other than silver and is calculated per ounce of silver sold.

AISC is an extension of the “cash costs” metric and provides a comprehensive measure of the Company’s operating performance and ability to generate cash flows. AISC has been calculated based on World Gold Council (“WGC”) guidance released in 2013 and updated in 2018. The WGC is not a regulatory organization and does not have the authority to develop accounting standards for disclosure requirements.

AISC is based on the Company’s cash costs, net of by-product sales, and further includes general and administrative expense, mineral resources tax, government fees and other taxes, reclamation cost accretion, lease liability payments, and sustaining capital expenditures. Sustaining capital expenditures are those costs incurred to sustain and maintain existing assets at current productive capacity and constant planned levels of production output. Excluded are non-sustaining capital expenditures, which result in a material increase in the life of assets, materially increase resources or reserves, productive capacity, or future earning potential, or significant improvement in recovery or grade, or which do not relate to the current production activities. The Company believes that this measure represents the total sustainable costs of producing silver from current operations and provides additional information about the Company’s operational performance and ability to generate cash flows.

Per Tonne Measures – Cash Costs and AISC

The Company uses costs per tonne of ore processed to manage and evaluate operating performance at each of its mines. Costs per tonne of ore processed is calculated based on total production costs on a sales basis, adjusted for changes in inventory, to arrive at total production costs that relate to ore production during the period. These total production costs are then further divided into mining costs, shipping costs, and milling costs. Mining costs includes costs of material and supplies, labour costs, applicable mine overhead costs, and mining contractor costs for mining ore; shipping costs includes freight charges for shipping stockpile ore from mine sites and mill sites, and milling costs include costs of materials and supplies, labour costs, and applicable mill overhead costs related to ore processing. Mining costs per tonne is the mining costs divided by the tonnage of ore mined, shipping cost per tonne is the shipping costs divided by the tonnage of ore shipped from mine sites to mill sites; and milling costs per tonne is the milling costs divided by the tonnage of ore processed at the mill. Costs per tonne of ore processed are the total of per tonne mining costs, per tonne shipping costs, and per tonne milling costs.

All-in sustaining production costs per tonne is an extension of the production costs per tonne and provides a comprehensive measure of the Company’s operating performance and ability to generate cash flows. All-in sustaining production costs per tonne is based on the Company’s production costs, and further includes general and administrative expenses, government fees and other taxes, reclamation cost accretion, lease liability payments, and sustaining capital expenditures. The Company believes that this measure represents the total sustainable costs of processing ore from current operations and provides additional information about the Company’s operational performance and ability to generate cash flows.

6

ITEM 2 CORPORATE STRUCTURE

| 2.1 | Names, Addresses and Incorporation |

Silvercorp is a corporation incorporated under the laws of British Columbia, Canada, with its head office, principal address and registered and records office of the Company located at 1750 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1. The Company’s shares are listed for trading on the Toronto Stock Exchange (the “TSX”) and the NYSE American, LLC (“NYSE American”), both under the symbol “SVM”. The Company is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador.

Silvercorp was formed as Spokane Resources Ltd. pursuant to an amalgamation of Julia Resources Corporation and MacNeill International Industries Inc. under the Company Act (British Columbia) on October 31, 1991. By a special resolution dated October 5, 2000, Spokane Resources Ltd. consolidated its share capital on a ten for one basis and altered its Memorandum and Articles of Incorporation by changing its name to “SKN Resources Ltd.” At the Company’s Annual and Special General Meeting held on October 20, 2004, the shareholders approved an increase to the Company’s authorized capital to an unlimited number of common shares (each, a “Common Share”) and adopted new Articles consistent with the transition to the Business Corporations Act (British Columbia) and passed a special resolution to change the Company’s name. On May 2, 2005, the Company filed a Notice of Alteration with the British Columbia Registrar of Companies changing its name from “SKN Resources Ltd.” to “Silvercorp Metals Inc.” At the Company’s Annual and Special General Meeting held on September 28, 2007, shareholders approved a three-for-one share split for its common shares. The stock split was set at the close of business on October 31, 2007.

The Company’s operations in China are conducted through legal entities incorporated in China, over which the Company has control through holding majority equity interest and voting power. With respect to remitting funds outside of China to Silvercorp or its shareholders from these entities, it is prescribed in the Foreign Investment Law of China that foreign investors may, in accordance with laws, freely remit into or out of China, in Renminbi or any other foreign currency, their capital contributions, profits, capital gains, income from asset disposal, intellectual property royalties, lawfully acquired compensation, indemnity or liquidation income in China.

See “ITEM 2 – 2.2 Intercorporate Relationships” and “ITEM 4 – 4.4 Risk Factors” for more details.

7

| 2.2 | Intercorporate Relationships |

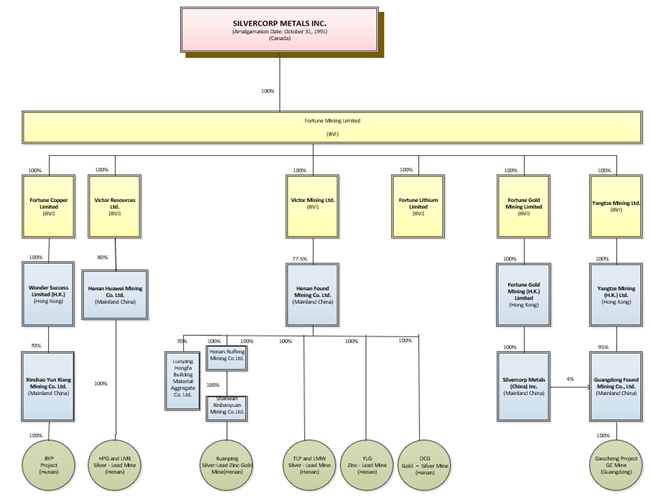

The chart set out below illustrates the corporate structure of the Company and its material subsidiaries, their respective jurisdictions of incorporation, the percentage of voting securities held and their respective interest in the Company’s material mining properties.

8

The Company is the sole shareholder of Fortune Mining Limited (“Fortune”) which was incorporated under the laws of BVI on August 23, 2002, to be the holding company of several other subsidiaries which are parties to agreements relating to mineral properties in China. Fortune owns 100% of the following material subsidiary companies:

| (a) | Victor Mining Ltd. (“Victor Mining”) was incorporated on October 23, 2003, under the laws of BVI and continued into Barbados on August 27, 2009, and back to the BVI on March 18, 2016. Victor Mining is a party to a cooperative agreement under which it has earned a 77.5% equity interest in Henan Found Mining Co. Ltd. (“Henan Found”), the Chinese company holding, among other assets: (i) the Ying Property’s flagship silver-lead-zinc project (the “SGX Mine”) and a satellite silver-lead mine (the “HZG Mine”) located approximately 5 km south of the SGX Mine; (ii) a silver-lead mine in Tieluping (“TLP Mine”) approximately 11 km southeast of the SGX Mine; (iii) a silver-gold-lead-zinc mine in Haopinggou (the “HPG Mine”) northeast of the SGX Mine; (iv) a silver-lead-zinc mine in Longmen EAST (“LME Mine”) approximately 12 km southeast of the SGX Mine; (v) a silver-lead-zinc mine in Longmen West (the “LMW Mine”) approximately 2.4 km to the west of the LME Mine; and (vi) a development project in Dong Cao Gou (the “DCG Mine”), each in Henan Province. Henan Found holds a 100% interest of Shanxian Xinbaoyuan Mining Co. Ltd., which holds a 100% interest in the Kuanping silver-lead-zinc-gold project (the “Kuanping project”). |

| (b) | Victor Resources Ltd. (“Victor Resources”) was incorporated on May 30, 2003, under the laws of the BVI and is a party to a cooperative agreement under which it earned an 80% equity interest in Henan Huawei Mining Co. Ltd. (“Henan Huawei”), the Chinese company, through agreements with Henan Found, holding a 100% beneficial interest in the HPG Mine and the LME Mine. |

| (c) | Yangtze Mining Ltd. (“Yangtze Mining”) was incorporated on February 11, 2002, under the laws of the BVI. It holds a 100% equity interest in Yangtze Mining (H.K.) Ltd. (“Yangtze Mining HK”). Yangtze Mining HK holds a 95% equity interest in Guangdong Found Mining Co. Ltd. (“Guangdong Found”), a company incorporated on October 26, 2008, under the laws of the People’s Republic of China, that holds a 100% interest in the silver-lead-zinc exploration mine in Gaocheng (the “GC Mine”, “GC”, or “Gaocheng”) in Guangdong Province. In October 2018, Silvercorp Metals (China) Inc., a wholly owned subsidiary of the Company, acquired an additional 4% equity interest in Guangdong Found, and as a result, the Company now beneficially owns a 99% interest in Guangdong Found. |

| (d) | Fortune Copper Limited was incorporated on August 23, 2002, under the laws of the BVI. It holds a 100% interest in Wonder Success Limited, a Hong Kong company which has a 70% equity interest in Xinshao Yun Xiang Mining Co. Ltd. (“Yunxiang”), which owns the BYP gold, lead, and zinc mine in Hunan Province (the “BYP Mine”). The BYP Mine is currently under care and maintenance. |

The Company’s operations in China are largely conducted through equity joint ventures, over which the Company has control. See “Item 4 General Description of Business, 4.2 Chinese Mining Law”.

9

ITEM 3 GENERAL DEVELOPMENT OF THE BUSINESS

| 3.1 | Business of Silvercorp |

Silvercorp is a Canadian mining company producing silver, gold, lead, zinc, and other metals with a long history of profitability and growth potential. The Company’s strategy is to create shareholder value by focusing on generating free cashflow from long life mines; growth through extensive drilling for discovery; ongoing merger and acquisition efforts to unlock value; and long-term commitment to responsible mining and sound environmental, social, and governance (“ESG”). Silvercorp operates several silver-lead- zinc mines at the Ying Mining District in Henan Province, China and the GC silver-lead-zinc mine in Guangdong Province, China.

| 3.2 | Three Year History |

Silvercorp has been acquiring, exploring, developing, and operating mineral properties in China since 2003. Production at the SGX Mine at the Ying Mining District commenced on April 1, 2006, and since that time, several of the Company’s other properties at the Ying Mining District in Henan Province, China also commenced production. In addition, the Company’s GC Mine commenced production in July 2014.

On April 26, 2024, Silvercorp announced that it has entered into a definitive arrangement agreement with Adventus Mining Corporation (“Adventus”) (TSXV: ADZN) (the “Arrangement Agreement”) pursuant to which Silvercorp agreed to acquire all of the issued and outstanding common shares of Adventus (the “Transaction”) by way of a plan of arrangement.

Under the Arrangement Agreement, each shareholder of Adventus will receive 0.1015 Silvercorp share for each Adventus share at the effective time of the Transaction.

The Transaction will be carried out by way of a court-approved Arrangement under the Canada Business Corporations Act and a resolution to approve the Transaction will be submitted to Adventus shareholders and holders of Adventus stock options and restricted share units at the Special Meeting expected to be held on June 26, 2024. The Transaction will require approval by (i) 66 2/3% of the votes cast by Adventus shareholders and holders of options and restricted share units voting as a single class, and (ii) a simple majority that excludes those not entitled to vote in accordance with Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions.

In addition to Adventus securityholder and court approval, the Transaction is also subject to the satisfaction of certain other closing conditions customary for a transaction of this nature. The Transaction has been conditionally approved by the TSXV, TSX, and NYSE American but remains subject to final approval of the TSXV on behalf of Adventus, and final approval of the TSX and NYSE American on behalf of Silvercorp, including the acceptance for listing of the Silvercorp Shares to be issued in connection with the Transaction. The Transaction is expected to be completed in the third quarter of 2024.

Concurrent with entering into the Arrangement Agreement, Silvercorp and Adventus entered into an investment agreement pursuant to which Silvercorp subscribed for 67,441,217 Adventus Shares at an issue price of C$0.38 per share, or C$25,627,662 in the aggregate (the “Adventus Placement”). The Adventus Placement was completed on May 1, 2024, and the Company currently holds approximately 15% of the total issued and outstanding shares of Adventus.

10

| (a) | Overview of Key Developments |

| i. | Fiscal 2024 (year ended March 31, 2024) |

For the year ended March 31, 2024 (“Fiscal 2024”), on a consolidated basis, the Company mined 1,117,118 tonnes of ore, up 5% compared to 1,068,983 tonnes of ore mined in the year ended March 31, 2023 (“Fiscal 2023”). Ore milled in Fiscal 2024 was 1,106,195 tonnes of ore, up 3% compared to 1,072,654 tonnes of ore milled in Fiscal 2023. A total of 58,262 tonnes of gold ore was processed in Fiscal 2024.

In Fiscal 2024, the Company produced approximately 7,268 ounces of gold, 6.2 million ounces of silver, plus 63.2 million pounds of lead and 23.4 million pounds of zinc, representing an increase of 65% in gold, essentially the same quantity of zinc, and decreases of 6% and 7%, respectively, in silver and lead produced over Fiscal 2023.

In Fiscal 2024, the Company reported revenue of $215.2 million up 3% compared to $208.1 million in Fiscal 2023; cash flow provided by operating activities of $91.6 million, up $5.9 million compared to $85.6 million in the prior year; and net income attributable to equity holders of the Company of $36.3 million, or $0.21 per share, compared to net income equity holders of the Company of $20.6 million or $0.12 per share in Fiscal 2023.

The Company announced on May 15, 2023 the signing of the non-binding term sheet (the “Term Sheet”) with Celsius Resources Limited (ASX/AIM: CLA) (“Celsius”) regarding a proposed transaction pursuant to which Silvercorp would acquire all of the issued and outstanding shares of Celsius at a price of A$0.03 per share, in exchange for consideration comprising 90% Silvercorp shares and 10% in cash. In August 9, 2023, Silvercorp announced that negotiation of a definitive agreement had ceased. In April 2024, Silvercorp exercised its right to participate in future equity offerings to maintain its relevant interest in Celsius above 10%, and participated in a private placement in Celsius whereby it subscribed for 19,552,752 Celsius shares, together with one free attaching unlisted warrant for every one share it subscribed for, at a subscription price of £0.006 per share.

On August 6, 2023, the Company announced the signing of a binding scheme implementation deed whereby Silvercorp would acquire all of the ordinary shares of OreCorp Limited (ASX: ORR) (“OreCorp”), with each shareholder of OreCorp to receive A$0.15 in cash and 0.0967 of a Silvercorp share per share of OreCorp by way of a scheme of arrangement. Concurrent with entering into the scheme implementation deed, Silvercorp and OreCorp also entered into a placement agreement, whereby Silvercorp agreed to purchase 70,411,334 new fully-paid ordinary shares of OreCorp at a price of A$0.40 per OreCorp Share for aggregate proceeds of approximately $18.5 million (A$28 million). The placement was completed in August 2023, and as a result, the Company held approximately 15% of the total outstanding ordinary shares of OreCorp. Subsequent to the private placement, the Company acquired additional 3,477,673 OreCorp Shares on the market through the Australian Securities Exchange (the “ASX”) for approximately $1.1 million, and as of December 31, 2023, the Company held 73,889,007 OreCorp Shares, representing 15.74% of the total outstanding ordinary shares of OreCorp.

In November 2023, the deed was amended so that each shareholder of OreCorp would receive A$0.19 in cash and 0.0967 Silvercorp Share per share of OreCorp. As a result of Perseus Mining Limited acquiring a 19.9% relevant interest in OreCorp and indicating they would vote against the Scheme, in December 2023, Silvercorp entered into a bid implementation deed pursuant to which Silvercorp agreed to acquire, by means of an off-market takeover offer, all of the shares of OreCorp for consideration comprising 0.0967 Silvercorp Shares and A$0.19 cash per share of OreCorp. On January 15, 2024, this offer was declared open. In March

11

2024, Silvercorp announced that it had been unable to obtain a minimum of 50.1% interest in OreCorp pursuant to its off-market takeover offer for OreCorp’s shares and elected not to exercise its right to match a competing offer for OreCorp. Subsequent to March 31, 2024, the Company received approximately A$42.5 million after accepting the competing offer to acquire OreCorp and a A$2.8 million break fee from OreCorp.

On September 15, 2023, the Company announced a normal course issuer bid which allowed the Company to acquire up to 8,487,191 common shares of the Company, representing approximately 4.8% of the common shares issued and outstanding as of September 5, 2023 (“2023 NCIB”). This 2023 NCIB program was valid from September 19, 2023, to September 18, 2024. Purchase will be made at the discretion of the directors at prevailing market prices, through the facilities of the TSX, the NYSE American, and alternative trading systems in Canada and the United States, in compliance with the regulatory requirements. The Company purchased and cancelled 191,770 shares in Fiscal 2024, and subsequent to March 31, 2024, the Company did not purchase any shares under this NCIB program.

In January 2024, Silvercorp and Tincorp Metals Inc. (TSXV:TIN) (“Tincorp”), a Canadian public company that the Company has 29.7% ownership, entered into an interest-free unsecured credit facility agreement with no conversion features to allow Tincorp to advance up to US$1.0 million from Silvercorp. Silvercorp advanced US$0.5 million to Tincorp and received 350,000 common shares of Tincorp for the granting of such facility, which has a maturity date of January 31, 2025. In April 2024, Silvercorp advanced the remaining $0.5 million to Tincorp.

In February 2024, Ms. Helen Cai was appointed to the board of directors of the Company as an independent director. Ms. Cai is a finance and investment professional with over two decades of experience, she is extensively versed in capital markets and all aspects of corporate finance from strategic planning to M&A transactions. Ms. Cai is currently an independent director of Barrick Gold Corporation and Largo Inc.

| ii. | Fiscal 2023 (year ended March 31, 2023) |

For the year ended March 31, 2023 (“Fiscal 2023”), on a consolidated basis, the Company mined 1,068,983 tonnes of ore and milled 1,072,654 tonnes of ore, both up 7% compared to 996,280 tonnes of ore mined and 1,002,335 tonnes of ore milled in the year ended March 31, 2022 (“Fiscal 2022”). In Fiscal 2023, the Company produced approximately 6.6 million ounces of silver, 4,400 ounces of gold, 68.1 million pounds of lead, and 23.5 million pounds of zinc, representing increases of 8%, 29% and 6%, respectively, in silver, gold and lead production, and a decrease of 12% in zinc production over Fiscal 2022.

In Fiscal 2023, the Company reported revenue of $208.1 million, down 4% compared to $217.9 million in Fiscal 2022; cash flow provided by operating activities of $85.6 million, down $21.7 million compared to $107.4 million in the prior year; and net income attributable to equity holders of the Company of $20.6 million, or $0.12 per share, compared to net income equity holders of the Company of $30.6 million or $0.17 per share in Fiscal 2022.

In December 2022, the Company’s Kuanping Silver-Lead-Zinc-Gold Project (“Kuanping Project”) received a mining license (the “Kuanping Mining License”) from the Department of Natural Resources, Henan Province, China. The Kuanping Mining License covers 6.97 square kilometres and is valid until March 13, 2029.

On November 7, 2022, the Company filed an updated NI 43-101 Technical Report on the Mineral Resources and Mineral Reserves for the Ying Mining District (“The Ying 2022 Technical Report “) prepared by AMC

12

Mining Consultants (Canada) Ltd. (“AMC”). The Ying 2022 Technical Report has an effective date of September 20, 2022 and covers all the mines in the Ying Mining District in Henan Province, China, namely the SGX, HZG, HPG, TLP, LME, LMW and DCG underground mines. The Ying 2022 Technical Report reflected a 3% increase in total Proven and Probable Mineral Reserves compared to the previous Technical Report of the Ying Mining District with effective date of July 31, 2020. The changes in total contained metal for silver, gold, lead, and zinc are -3%, +110%, -9% and -24% respectively. These Mineral Reserves are on top of approximately 11 million ounces of silver produced between January 2020 and December 2021.

On August 24, 2022, the Company announced another NCIB which allowed it to acquire up to 7,079,407 common shares of the Company, representing approximately 4% of the common shares issued and outstanding as of August 16, 2022 (“2022 NCIB”). The 2022 NCIB program is valid from August 29, 2022, to August 28, 2023. Purchase will be made at the discretion of the directors at prevailing market prices, through the facilities of the TSX, the NYSE American, and alternative trading systems in Canada and the United States, in compliance with the regulatory requirements. The Company purchased and cancelled 838,237 shares in Fiscal 2023, and subsequent to March 31, 2023, the Company did not purchase any shares under this NCIB program.

In Fiscal 2023, the Company completed the review and evaluation on the results of the drill program completed in Fiscal 2022. The Company does not plan to undertake further significant work at the La Yesca Project in the near future. As a result, the decision was taken to impair fully the value of the La Yesca Project and recognized an impairment charge of $20.2 million in the consolidated statements of income.

| iii. | Fiscal 2022 (year ended March 31, 2022) |

For the year ended March 31, 2022 (“Fiscal 2022”), on a consolidated basis, the Company mined 996,280 tonnes of ore, an increase of 3% or 31,355 tonnes of ore, compared to 964,925 tonnes in the year ended March 31, 2021 (“Fiscal 2021”). In Fiscal 2022, the Company sold approximately 6.3 million ounces of silver, 3,400 ounces of gold, 63.6 million pounds of lead, and 26.8 million pounds of zinc, representing decreases of 1%, 28%, 5% and 4% respectively, in silver, gold, lead and zinc sold. Gold sold in Fiscal 2021 included one-time sales of 1,200 ounces from pre 2014 concentrate inventories at the BYP Mine.

In Fiscal 2022, the Company reported revenue of $217.9 million, up 13% compared to $192.1 million in Fiscal 2021; cash flow provided by operating activities of $107.4 million, up 25% or $21.5 million compared to $85.9 million in Fiscal 2021; and net income attributable to equity holders of the Company of $30.6 million, or $0.17 per share, compared to net income attributable to equity holders of the Company of $46.4 million, or $0.27 per share.

In October 2021, the Company, through a 100% owned subsidiary of Henan Found, won an online open auction to acquire a 100% interest in the Kuanping Project. The transaction was successfully completed in November 2021 for a total consideration of $13.1 million, comprised of approximately $11.4 million in cash (RMB ¥73.5 million) plus the assumption of approximately $2.0 million (RMB ¥13.3 million) of debt, and net of $0.3 million cash received. The acquisition was through the acquisition of a 100% interest in the shares of Shanxian Xinbaoyuan Mining Co. Ltd. (“Xinbaoyuan”), an affiliate of a Henan Provincial government-controlled company located in Sanmenxia City, Henan Province. The material asset held by Xinbaoyuan is the Kuanping Project, which is located in Shanzhou District, Sanmenxia City, Henan Province, China, approximately 33 km north of the Ying Mining District. The Kuanping Project covers an area of 12.39 km², being approximately 3 km wide (east-west) and 5 km long (north-south).

13

In October 2021, the Company filed an updated NI 43-101 Technical Report on the GC Mine with an effective date of March 31, 2021 (Mineral Resources and Mineral Reserves effective December 31, 2020) prepared by AMC. Despite the production depletion, the Technical Report reflected an 8% increase in tonnage of combined Proven and Probable Mineral Reserves compared to the Mineral Reserves estimated in the previous Technical Report of the GC Mine with effective date of June 2019.

On August 25, 2021, the Company announced the 2021 NCIB which allowed it to acquire up to 7,054,000 common shares of the Company, representing approximately 4% of the common shares issued and outstanding as of August 22, 2021. This 2021 NCIB program was valid from August 27, 2021 to August 26, 2022. The Company did not purchase any of its own shares in Fiscal 2022.

| (b) | Production |

The following table summarizes the total metal produced, on a consolidated basis, in the past three years.

| Years Ended March 31 | ||||||||||||

| 2024 | 2023 | 2022 | ||||||||||

| Gold (ounce) | 7,268 | 4,400 | 3,400 | |||||||||

| Silver (‘000s ounces) | 6,204 | 6,617 | 6,149 | |||||||||

| Lead (‘000s pounds) | 63,171 | 68,068 | 64,431 | |||||||||

| Zinc (‘000s pounds) | 23,385 | 23,463 | 26,812 | |||||||||

Ying Mining District

The Ying Mining District is the Company’s primary source of production, and consists of four mining licenses, including the SGX-HZG, HPG, TLP-LME-LMW, and DCG mines.

In Fiscal 2024, a total of 827,112 tonnes of ore was mined at the Ying Mining District, up 8% compared to 769,024 tonnes mined in Fiscal 2023, and 816,145 tonnes of ore were milled, up 6% compared to 773,057 tonnes milled in Fiscal 2023.

Average head grades of ore processed were 231 g/t for silver, 3.4% for lead, and 0.7% for zinc compared to 261 g/t for silver, 3.8% for lead, and 0.7% for zinc in Fiscal 2023.

Metals produced at the Ying Mining District were approximately 7,268 ounces of gold, 5.7 million ounces of silver, 56.3 million pounds of lead, and 8.2 million pounds of zinc, representing increases of 65% and 15%, respectively, in gold and zinc, and decreases of 6% and 7%, respectively, in silver and lead, compared to 4,400 ounces of gold, 6.0 million ounces of silver, 60.3 million pounds of lead, and 7.2 million pounds of zinc in Fiscal 2023.

In Fiscal 2024, the mining cost at the Ying Mining District was $70.25 per tonne, down 11% compared to $78.63 in Fiscal 2023, while the milling cost was $12.01 per tonne, up 2% compared to $11.76 in Fiscal 2023. Correspondingly, the production cost per tonne of ore processed was $85.66, down 9% compared to $94.07 in Fiscal 2023, while the all-in sustaining cost per tonne of ore processed was $141.82, down 3% compared to $146.59 in Fiscal 2023. The

14

decrease was mainly due to i) a decrease of $1.6 million in production cost, offset by an increase of $5.2 million in sustaining capital expenditures and general administrative expenses; and ii) an increase of 6% in ore processed resulting in lower per tonne cost calculated.

The cash cost per ounce of silver, net of by-product credits, at the Ying Mining District was $nil, compared to $0.88 in Fiscal 2023. The decrease was mainly due to the decrease in per tonne production cost and the increase in by-product credits. The all-in sustaining cost per ounce of silver, net of by-product credits was $8.82, up 6% compared to $8.29 in Fiscal 2023. The increase was mainly due to i) an increase of $4.5 million in sustaining capital expenditures; and ii) an increase of $0.8 million in general administrative expenses and government fee, offset by the decrease in cash cost per ounce of silver as discussed above.

GC Mine

In Fiscal 2024, a total of 290,006 tonnes of ore were mined and 290,050 tonnes were milled at the GC Mine, both down 3% compared to 299,959 tonnes mined and 299,597 tonnes milled in Fiscal 2023. The decrease can be attributed mainly to a production disruption of five weeks in the second quarter of Fiscal 2024 (refer to the Company’s news release dated September 5, 2023).

Average head grades of ore milled were 69 g/t for silver, 1.2% for lead, and 2.6% for zinc compared to 75 g/t for silver, 1.3% for lead, and 2.8% for zinc in Fiscal 2023.

Metals produced at the GC Mine were approximately 527 thousand ounces of silver, 6.9 million pounds of lead, and 15.2 million pounds of zinc, down 11%, 12%, and 7%, respectively, in silver, lead and zinc production, compared to 593 thousand ounces of silver, 7.8 million pounds of lead, and 16.3 million pounds of zinc in Fiscal 2023. The decrease was mainly due to the decrease in ore production and lower head grades achieved due to mining sequence.

The mining cost at the GC Mine was $42.66 per tonne, up 3% compared to $41.36 in Fiscal 2023, and the milling cost was $16.69 per tonne, down 1% compared to $16.93 in Fiscal 2023. Correspondingly, the production cost per tonne of ore processed was $59.35, up 2% compared to $58.29 in Fiscal 2023. The all-in sustaining production cost per tonne of ore processed was $85.17, up 2% compared to $83.33 in Fiscal 2023. The increase was primarily due to the decrease of 3% in ore production resulting in a higher per tonne fixed cost allocation.

In Fiscal 2024, the cash cost per ounce of silver, net of by-product credits, at the GC Mine, was negative $4.70, compared to negative $13.72 in Fiscal 2023. The all-in sustaining cost per ounce of silver, net of by-product credits, was $11.08, compared to $0.50 in Fiscal 2023. The increase was mainly due to i) the increase of 2% in per tonne production cost and all-in sustaining production cost and ii) a decrease of $5.9 million in by-product credits.

| (c) | Capitalized Exploration and Development Expenditures |

Ying Mining District

In Fiscal 2024, a total of 221,161 metres or $6.6 million worth of diamond drilling were completed (Fiscal 2023 – 249,407 metres or $9.1 million), of which approximately 90,868 metres or $2.0 million worth of diamond drilling were expensed as part of mining costs (Fiscal 2023 – 124,874 metres or $3.4 million) and approximately 130,293 metres or $4.6 million worth of drilling were capitalized (Fiscal 2023 – 124,533 metres or $5.7 million). In addition, approximately 33,436 metres or $12.5 million worth of preparation tunnelling were completed and expensed as part of mining costs (Fiscal 2023 – 32,870 metres or $12.5 million), and approximately 87,860 metres or $40.1 million worth of horizontal tunnels, raises, ramps, and declines were completed and capitalized (Fiscal 2023 – 69,049 metres or $30.0 million).

15

GC Mine

In Fiscal 2024, approximately 74,859 metres or $2.1 million worth of diamond drilling were completed (Fiscal 2023 – 65,399 metres or $2.2 million), of which approximately 46,702 metres or $0.8 million worth of underground diamond drilling were expensed as part of mining costs (Fiscal 2023 – 43,375 metres or $1.3 million) and approximately 28,157 metres or $1.3 million of diamond drilling were capitalized (Fiscal 2023 – 22,024 metres or $0.8 million). In addition, approximately 7,787 metres or $2.7 million of tunnelling were completed and expensed as part of mining costs (Fiscal 2023 – 7,071 metres or $2.1 million), and approximately 11,804 metres or $4.9 million of horizontal tunnels, raises, and declines were completed and capitalized (Fiscal 2023 – 12,722 metres or $4.0 million).

Kuanping Project

Activities at the Kuanping Project in Fiscal 2024 have been focused on completing studies and reports as required to construct the mine. As of March 31, 2024, the Company has completed studies on environmental, water, and soil assessments, and all these reports have been submitted to and approved by the relevant provincial authorities. An updated mineral resources estimate report prepared as per Chinese standards has been reviewed and approved by the relevant provincial authorities. A report, incorporating the mineral resources development and utilization plan, reclamation plan, and environmental rehabilitation plan, was prepared by the Company and reviewed and approved by an external expert panel. Total capital expenditures at the Kuanping Project during the year ended March 31, 2024 was $0.3 million, compared to $0.9 million in prior year.

BYP Mine

The BYP Mine was placed on care and maintenance in August 2014 due to the required capital upgrades to sustain its ongoing production and the market environment. The Company is conducting activities to apply for a new mining license, but the process has taken longer than expected. No guarantee can be given that the new mining license for the BYP Mine will be issued, or if it is issued, that it will be issued under reasonable operational and/or financial terms, or in a timely manner, or that the Company will be in a position to comply with all conditions that are imposed thereon.

La Yesca Project

The La Yesca Project was placed on hold since last year and no further exploration activities are planned.

ITEM 4 DESCRIPTION OF THE BUSINESS

| 4.1 | General |

Silvercorp’s principal products and its sources of sales are silver-bearing lead and zinc concentrates. At present, Silvercorp sells all its products to local smelters or companies in the mineral products trading business.

For each of the Company’s two most recently completed fiscal years, revenues for each category of products that accounted for 10% or more of total consolidated revenues are as follows:

| Years ended March 31, | ||||||||

| In 000s’ US$ | 2024 | 2023 | ||||||

| Silver (Ag) | 124,234 | 113,592 | ||||||

16

| Lead (Pb) | 52,394 | 56,843 | ||||||

| Zinc (Zn) | 19,102 | 24,823 |

Additional information is provided in the Company’s financial statements and management’s discussion and analysis for its most recently completed fiscal year.

The mining industry is intensely competitive, and the Company competes with many companies possessing similar or greater financial and technical resources. The Company’s competitive position is largely reliant upon its ability to maintain a high margin operation, resulting from relatively high-grade resources, and lower production cost in China compared to the cost of other producers outside China. The Company’s competitive advantage also results from the quality of its concentrates and its proximity to local smelters.

In Fiscal 2024, the Company processed a total of 1,106,195 tonnes of ore and produced approximately 7,268 ounces of gold, 6.2 million ounces of silver, 63.2 million pounds of lead, and 23.4 million pounds of zinc. Ore processed was within the guidance and gold production surpassed the guidance, while silver, lead and zinc production were below the guidance due to lower head grade achieved. Ore and gold production at the Ying Mining District exceeded the guidance. Ore and metal production at the GC Mine was below the guidance, and the shortfall can be attributed to the lower head grades achieved and the production disruption of five weeks in the second quarter of Fiscal 2024 (refer to the Company’s news release dated September 5, 2023).

In Fiscal 2023, ore processed at the Ying Mining District reached the high end of the annual guidance and lead production was within the annual guidance, while silver, gold, and zinc were below the annual guidance due to lower head grades achieved. Ore and metal production at the GC Mine was below the guidance, and the shortfall can be attributed to the lower head grades achieved and the production interruption arising from the upgrades made to the ventilation and electric power facilities in the second quarter of Fiscal 2023.

In Fiscal 2022, ore processed at the Ying Mining District was in line with the annual guidance, while silver, lead and zinc production were below the low end of the annual guidance. The shortfall was mainly due to the disruptions arising from the mining contract renewal negotiation process, and the heavy rainfall experienced at the Ying Mining District in previous quarters. The per tonne cash production cost and all-in sustaining production cost were 7% and 4% above the high end of the annual guidance. In Fiscal 2022, silver, lead and zinc production at the GC Mine were in line with the annual guidance, and the ore processed was 3% above the high end of the annual guidance. The per tonne cash production was also in line with the annual guidance, and the per tonne all-in sustaining cost was 2% below the low end of the annual guidance.

As of March 31, 2024, the Company had 1,111 employees at the Ying Mining District, 272 at the GC Mine, 4 at the Kuanping Project, 3 at the BYP Mine, 32 at Silvercorp Metals (China) Inc., and 24 at the Vancouver corporate office.

Fiscal 2025 Outlook

Production and production costs

In Fiscal 2025, the Company expects to mine and process 1,151,000 to 1,256,000 tonnes of ore, yielding approximately 7,900 to 9,000 ounces of gold, 6.8 to 7.2 million ounces of silver, 64.2 to 69.3 million pounds of lead, and 27.1 to 30.1 million pounds of zinc. Fiscal 2025 production guidance represents production increases of approximately 4% to 14% in ores, 8% to 23% in gold, 9% to 17% in silver, 2% to 10% in lead, and 16% to 29% in zinc compared to the production results in Fiscal 2024.

17

In Fiscal 2025, the Company plans to mine and process 860,000 to 955,000 tonnes of ore at the Ying Mining District, including 63,000 – 70,000 tonnes of gold ore with an expected head grade of 2.4 g/t gold, to produce approximately 7,900 to 9,000 ounces of gold, 6.2 to 6.7 million ounces of silver, 57.2 to 61.9 million pounds of lead, and 8.9 to 11 million pounds of zinc. Fiscal 2025 production guidance at the Ying Mining District represents production increases of approximately 5% to 17% in ore, 8% to 23% in gold, 9% to 18% in silver, 2% to 10% in lead, and 8% to 34% in zinc compared to the production in Fiscal 2024. The cash production cost is expected to be $83.7 to $88.1 per tonne of ore, and the all-in sustaining production cost is estimated at $142.4 to $153.3 per tonne of ore processed.

In Fiscal 2025, the Company plans to mine and process 291,000 to 301,000 tonnes of ore at the GC Mine to produce 540 to 550 thousand ounces of silver, 7.1 to 7.5 million pounds of lead, and 18.2 to 19.1 million pounds of zinc. Fiscal 2025 production guidance at the GC Mine represents production increases of approximately 0% to 4% in ore, 2% to 4% in silver, 2% to 8% in lead, and 20% to 26% in zinc production compared to the production results in Fiscal 2024. The cash production cost is expected to be $54.4 to $55.5 per tonne of ore, and the all-in sustaining production cost is estimated at $99.3 to $99.7 per tonne of ore processed.

Development and Capital Expenditures

In Fiscal 2025, the Company expects to incur a total $90.8 million of capital expenditures.

The total capital expenditures for mine optimization and facilities improvement at the Ying Mining District are estimated at $78.7 million. For mine optimization, the Company plans to spend a total of $48.1 million comprised of the following capital expenditures:

i) Develop 45,100 metres of ramps and tunnels for transportation and access at estimated capitalized expenditures of $27.3 million (average $605/m). The main goal of these mine optimization programs is to have ramps and a trackless system replace current shafts, and to have more mechanized mining, such as using the shrinkage mining method to gradually replace the more labor intensive “resuing” mining;

ii) Develop 45,800 metres of exploration tunnels at estimated capitalized costs of $17.4 million ($380/m); and

iii) Drill 137,700 metres of exploration diamond drill holes for future production at an estimated capitalized cost of $3.4 million;

For the tailing storage facilities (“TSF”) and mill expansion and equipment, the Company plans to spend $30.6 million:

i) Complete the additional TSF by the 3rd quarter of 2024 with remaining expenditures of $15.9 million; and

ii) Add a 1,500 tonne per day flotation production line to the No. 2 Mill by the 4th Quarter of 2024 at a cost of $7.2 million per a signed EPCM contract, and add two XRT Ore Sorting systems for $1.7 million. The XRT Ore Sorting system will help to sort out waste rock resulting from the increased dilution rate as the Company shifts to more shrinkage mining method from the “resuing” mining method.

In addition to the capitalized tunneling and drilling work, the Ying Mining District also plans to complete and expense 37,800 metres of mining preparation tunnels and 117,300 metres of diamond drilling.

For the GC Mine, the Company plans to: i) complete and capitalize 8,000 metres of transportation ramps and mining development tunnels at estimated costs of $4.5 million ($562/m); ii) complete and capitalize 9,700 metres of exploration tunnels at estimated costs of $5.0 million ($515/m); iii) complete and capitalize 51,500 metres of

18

diamond drilling at an estimated cost of $1.3 million; and iv) spend $0.3 million on equipment and facilities. The total capital expenditures at the GC Mine are budgeted at $11.1 million in Fiscal 2025.

In addition to the capitalized tunneling and drilling work, the Company also plans to complete and expense 7,100 metres of mining preparation tunnels and 18,700 metres of diamond drilling at the GC Mine.

The Kuanping Project is expected to receive all permits and licenses in the third quarter of 2024, and $1.0 million of capital expenditures are budgeted for the startup of mine construction.

Specialized Skill and Knowledge

A majority of aspects of our business require specialized skills and knowledge, certain of which are in high demand and in limited supply. Such skills and knowledge include the areas of permitting, engineering, geology, metallurgy, logistical planning, implementation of exploration programs, mine construction and development, mine operation, as well as legal compliance, finance and accounting. We have highly qualified management personnel and staff, an active recruitment program, and believe that persons having the necessary skills are generally available. We have found that we can locate and retain competent employees and consultants in such fields. We do not anticipate having significant difficulty in recruiting other personnel as needed. Training programs are in place for workers that are recruited locally.

Competitive Conditions

The silver exploration and mining business is a competitive business. We compete with numerous other companies and individuals in the search for and the acquisition of quality properties, mineral claims, permits, concessions and other mineral interests, as well as recruiting and retaining qualified employees.

Business Cycles

The mining business is subject to mineral price and investment climate cycles. The marketability of minerals is also affected by worldwide economic and demand cycles. It is difficult to assess if the current commodity prices are long-term trends, and there is uncertainty as to the recovery, or otherwise, of the world economy. If global economic conditions weaken and commodity prices decline as a consequence, a continuing period of lower prices could significantly affect the economic potential of the Company’s projects.

International Operations

Our principal mining operations and assets are located in China. Our operations are exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties include, but are not limited to, government regulations (or changes to such regulations) with respect to restrictions on production, export controls, income taxes, royalties, excise and other taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, local ownership requirements and land claims of local people, regional and national instability and security, mine safety, and sanctions. The effect of these factors cannot be accurately predicted. See Item 4.3 Laws and Regulations Related to Mining and Foreign Investment in China and 4.4 Risk Factors below.

Economic Dependence

The Company’s business is not substantially dependent on any contract such as a contract to sell a major part of its products or services or to purchase a major part of its requirements for goods, services or raw materials, or on any

19

franchise, license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

Bankruptcy and Similar Procedures

There is no bankruptcy, receivership or similar proceedings against the Company, nor is the Company aware of any such pending or threatened proceedings. There have not been any voluntary bankruptcy, receivership or similar proceedings by the Company within the three most recently completed financial years or currently proposed for the current financial year.

| 4.2 | Corporate Governance, Safety, Environment and Social Responsibility |

The Company’s core objectives are to be safe, efficient, and sustainable, and operate responsibly with the environment and cooperatively with the local communities. The Company strives to build a strong cooperate culture centered around our key values of respect, equality, and responsibility, and aim to deliver social benefits while creating shareholder value.

As a responsible miner, the Company is committed to integrating environmental, social, and governance factors into our business strategies and generating impactful changes in the communities in which the Company works and lives. Through the integration of ESG factors into our strategic planning, operations, and management, the Company is able to bring about sustainable economic, social, and environmental value to all stakeholders. Details of our ESG performance will be provided in the Company’s Fiscal 2024 Sustainability Report, which is expected to be available in the second quarter of Fiscal 2025.

| 1. | Corporate Governance |

The Corporate Governance Committee of the Board of the Company reviews the Company’s policies on an annual basis, including Anti-Corruption Policy, Code of Ethical Conduct, Claw back Policy, Corporate Disclosure Policy, and Whistleblower Policy, which are then approved by the Board of the Company. All of the Company’s directors and officers were re-certified with all the policies, confirming they are familiar with and acknowledge the contents of the Company’s policies, and committing to fulfill them and to report any violation. The Company also regularly trains its critical employees in anti-corruption practices.

In Fiscal 2023, the Sustainability Committee of the Board of the Company adopted a Community Relations Policy, a Human Rights Protection Policy, an Environmental Protection Policy, and an Occupational Health and Safety Policy, which were then approved by the Board of the Company.

For more information on the Company’s Corporate Governance practices, please review the Company’s Annual Information Form and Management Information Circular available on the Company’s website at www.silvercorp.ca.

Health, Safety and Environment

The Company prioritizes environmental protection, as well as ensuring a safe workplace for all employees and contractors at all of our sites. In an effort to further illustrate the Company’s commitment to strengthening our management team, both the Ying Mining District and GC Mine have successfully passed the annual review for the Environmental Management System (ISO 14001) certification in Fiscal 2024.

Safety is top priority at Silvercorp. In Fiscal 2024, the Company arranged more than 2,000 safety training sessions, which covered 100% of workers at the Ying Mining District and the GC Mine.

20

In response to associated occupational health risks, the Company further improved its risk identification and management process. Both the Ying Mining District and GC Mine have successfully passed the annual review for the Occupational Health and Safety Management System (ISO 45001) certification in Fiscal 2024.

In addition to the “Green Mine” certification at SGX-HZG, TLP-LM, and HPG mines at the Ying Mining District and the GC Mine, the DCG mine at the Ying Mining District is also in the process to apply for the certification of the “Green Mine”. In Fiscal 2024, the Company processed approximately 534,000 tonnes of waste rock from the Ying Mining District. The Company also developed an automated chemical precipitation system to treat water from underground mines, and then through an automated control system to supply the treated water to the mill for ore processing and to local farmer for irrigation.

In Fiscal 2024, the Company spent approximately $2.4 million in the efforts to reduce its energy and water consumption, to minimize the negative impact of greenhouse gas emissions and water quality, and to comply with the requirements of the “Green Mine” certification.

| 2. | Social Responsibility and Economic Value |

The Company is committed to creating sustainable value in the communities where our people work and live. Guided by research conducted by our local offices, the Company participates in, and contributes to numerous community programs that typically centre on education and health, nutrition, environmental awareness, local infrastructure and fostering additional economic activity. In addition to the taxes and fees paid to various levels of government in China, in Fiscal 2024, the Company also contributed approximately $3.0 million to social programs, including:

| ● | $2.7 million contributions to the local county to help improve local infrastructure and environmental protection; |

| ● | $0.1 million donation to the charity association and local communities to promoted community health and poverty reduction in the local communities, with an emphasis on children and seniors, with periodic visits and subsidies; and |

| ● | $0.2 million donations to institutions in scholarship or education assistance programs to support children’s education at the local and national levels. |

| 4.3 | Laws and Regulations Related to Mining and Foreign Investment in China |

Currently, all of the Company’s material mineral properties are located in China.

Mineral Resources Law

Exploration for and exploitation of mineral resources in China are governed by the Mineral Resources Law of the People’s Republic of China, which was first enacted in 1986 and has been revised several times since then, most recently in 2009.

The Mineral Resources Law regulates the exploration, development, utilization, and management of mineral resources in China. It defines mineral resources as non-renewable natural resources found on or under the earth's surface, including metallic minerals, non-metallic minerals, and fossil fuels.

Some key provisions of the Mineral Resources Law include:

21

| ● | Ownership of mineral resources: The law states that all mineral resources in China belong to the state, and the state has the right to grant exploration and mining rights to qualified individuals or organizations. |

| ● | Exploration and mining rights: Individuals or organizations must obtain exploration and mining rights from the government before engaging in these activities. These rights are granted by governments through a competitive bidding process, auction or listing, unless in very limited circumstances such as when the projects are related to rare earth and radioactive minerals, or key construction projects approved by the State Council, where mining rights can be granted by written transfer agreement between the government and the applicants. |

| ● | Environmental protection: The law requires mining companies to take measures to protect the environment and minimize the impact of their operations on surrounding ecosystems. |

| ● | Resource conservation: The law also mandates the conservation of mineral resources and requires companies to adopt efficient mining practices. |

| ● | Safety regulations: The law includes provisions related to safety in mining operations, including requirements for safety equipment, training for workers, and regular safety inspections. |

| ● | Financial obligations: Mining companies are required to pay fees and taxes to the government, including exploration fees, mining rights fees, resource taxes, and land use fees. |

The Mineral Resources Law provides for equal legal status for domestic enterprises and enterprises with foreign investment, security and transferability of mineral titles and exclusivity of mining rights. Exploration and mining rights grant the right to explore and exploit minerals. The holder of an exploration right has the privileged priority to obtain mining right to the mineral resources within the exploration area, provided the holders meets the conditions and requirements specified in the Mineral Resources Laws.

The Mineral Resources Law is subject to further revision through various notices and guidelines issued by different government agencies to regulate and streamline the administrative approval process and promulgate new laws to improve the regulation of mineral resources. It also places a stronger emphasis on safety and environmental protection within the mining industry.

Environmental Protection Law

The Ministry of Ecology and Environment is responsible for the supervision of environmental protection in, establishment and implementation of national standards for environmental quality and discharge of pollutants for, and supervision of the environmental management system of, the PRC. Environmental protection bureaus at the county level or above are responsible for environmental protection within their jurisdictions.

The Environmental Protection Law of the PRC requires entities that operate production facilities that may cause pollution or produce other toxic materials to take steps to protect the environment and establish an environmental protection and management system. The system includes the adopting of effective measures to prevent and control exhaust gas, sewage, waste residues, dust or other waste materials. Entities discharging pollutants must register with the relevant environmental protection authorities.

The Environmental Protection Law of the PRC and the Administrative Regulations on Environmental Protection for Construction Project stipulate that prior to the construction of new facilities or expansion or transformation of

22

existing facilities that may cause a significant impact on the environment, a report on the environmental impact of the construction project needs to be submitted to the relevant environmental protection authority for approval. Environmental protection facilities shall be designed, constructed and put into use concurrently with the main production facilities. The newly constructed production facilities may not be operated until the relevant authority is satisfied after inspection that accompanied environmental protection facilities are in compliance with all relevant environmental protection standards.

Under the Mineral Resources Law of the PRC, the amended Land Administration Law of the PRC and Regulation on Land Rehabilitation, exploration of mineral resources must be in compliance with the legal requirements on environmental protection so as to prevent environmental pollution. If any damage is caused to cultivated land, grassland or forest as a result of exploration or mining activities, mining enterprises must restore the land to a state appropriate for use by reclamation, re-planting trees or grasses or such other measures as appropriate to the local conditions. Mining enterprises shall submit a rehabilitation plan when applying for construction land or mining rights and shall include land rehabilitation expenses in their production costs or in their gross investment in construction projects. At completion of the rehabilitation stipulated in the plan, the rehabilitation shall pass an acceptance examination conducted by the relevant government authority. If the rehabilitation is not completed or does not comply with the relevant examination requirements, the mining enterprise must pay a fee for land rehabilitation.

Upon closure of a mine, a report in relation to land rehabilitation and environmental protection must be submitted for approval. Enterprises which fail to perform or satisfy the requirements on land rehabilitation may be penalised by the relevant land administration authority.

The Ministry of Ecology and Environmental shall formulate national standards on emission of pollutants in accordance with the national standards on environmental quality, and the State economic and technological conditions. Governments at the provincial level and of the autonomous regions and municipalities may formulate their respective local standards on the discharge of pollutants for items not specified in the national standards. These local governments may formulate local standards which are more stringent than the national ones for items already specified in the national standards. Pursuant to the requirements under the amended Law on Prevention of Water Pollution of the PRC, the amended Law on Prevention of Air Pollution of the PRC, and Law on Environmental Protection Tax of the PRC, Enterprises and producers that directly discharge taxable pollutants into the environment are the taxpayers of environmental protection tax and shall pay environmental protection tax in accordance with the provisions of the Law. Taxpayers who file quarterly returns shall, within fifteen days from the end of the quarter, file tax returns and pay taxes to the tax authorities.

Under the amended Law on Prevention of Environmental Pollution Caused by Solid Waste of the PRC, entities and individuals collecting, storing, transporting, utilising or disposing of solid waste must take precautions against the spread, loss, and leakage of such solid waste or adopt such other measures to prevent such solid waste from polluting the environment.

The penalties for breach of the environmental protection laws vary from warnings, fines, suspending production or operation to other administrative sanctions, depending on the degree of damage or the results of the incidents. The responsible person of the entity may be subject to criminal liabilities for serious breaches resulting in significant damage to private or public property or personal injury or death.

As the environmental protection is under the administration and supervision of authorities that are distinct from the ones issuing the exploration and mining permits, the breach of the relevant environmental protection laws would not entail revocation of the exploration and mining permits directly. However, the environmental protection authorities may seek cooperation from the authorities in charge of the issuance of such permits, which are competent to revoke the exploration and mining permits pursuant to the Mineral Resources Law of the PRC.

23

Mine Safety Production Law

The PRC government has formulated a relatively comprehensive set of laws and regulations on production safety, including the Law on Production Safety of the PRC, the Law on Mine Safety of the PRC, the Law on Fire Protection of the PRC, the Law on Road Traffic Safety of the PRC, the Law on Special Equipment Safety of the PRC, the Law on Emergency Response of the PRC, the Law on Occupational Disease Prevention and Control of the PRC as well as several regulations, such as the Safety Production License, etc., which pertain to the mining, processing and smelting operation of the mining industry. The Ministry of Emergency Management is responsible for the overall supervision and management of the production safety nationwide while the departments in charge of production safety at the county level or above are responsible for the overall supervision and management of the production safety within their own jurisdictions.

The State implements a licensing system for production safety of mining enterprises. No mining enterprise may engage in production activities without holding a valid production safety certificate. Enterprises which fail to fulfil the production safety conditions are not allowed to carry out any production activity. Mining enterprises which have obtained the production safety certificate may not lower their production safety standards and are subject to the supervision and inspection by the licensing authorities from time to time. If the licensing authorities are of the opinion that the mining enterprises do not fulfil the production safety requirements, the production safety certificate may be withheld or revoked. At the same, the State implements a system of registered safety engineer and mining enterprises should have registered safety engineers engaged in safety production management work.

The State has also formulated a set of national standards on production safety for the mining industry. In general, the mine design must comply with the production safety requirements and industry practice.

A mining enterprise must establish a management body or a designated safety management team to be responsible for production safety matters. Education and training on production safety must be provided to workers to ensure that they fully understand the regulations and the procedures required for production safety and are able to master the necessary skills for operation safety for their own positions. Those who do not receive this education and training are not permitted to work at the mine.

The penalties for breach of production safety laws vary from warnings, fines, suspension of production or operation and other administrative sanctions, depending on the degree of damage and the nature of the incident. The person who is personally responsible for such incident may be subject to demotion or termination of employment, or criminal liability for serious breaches resulting in significant incidents. The State has implemented an accountability system over incidents relating to production safety.

As production safety is under the administration and supervision of authorities that are different from the ones issuing the exploration and mining permits, the breach of the relevant production safety laws would not entail revocation of the exploration and mining permits directly. However, the production safety authorities may seek cooperation from the authorities in charge of the issuance of such permits, which have the authority to revoke the exploration and mining permits according to the Mineral Resources Law of the PRC.

Foreign Investments

Additionally, companies with a foreign ownership component operating in China may be required to work within a framework which is different from that imposed on domestic Chinese companies. The Chinese government currently allows foreign investment in certain mining projects under central government guidelines. According to the 2021 Edition of the Special Administrative Measures for Access of Foreign Investment (“Negative List”) effective January

24

1, 2022, as long as the mineral resources are not tungsten, rare earth and radioactive minerals in the Negative List, foreign investors can engage in the mining activities in China, either directly or indirectly.