Exhibit 99.1

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED MARCH 31, 2019

DATED AS AT JUNE 21, 2019

SILVERCORP METALS INC.

Suite 1378 - 200 Granville Street

Vancouver, BC, Canada V6C 1S4

Tel: (604) 669-9397

Fax: (604) 669-9387

Email: investor@silvercorp.ca

Website: www.silvercorp.ca

TABLE OF CONTENTS

| ITEM 1 | GENERAL | 3 | |

| 1.1 | Date of Information | 3 | |

| 1.2 | Forward Looking Statements | 3 | |

| 1.3 | Currency | 4 | |

| ITEM 2 | CORPORATE STRUCTURE | 5 | |

| 2.1 | Names, Address and Incorporation | 5 | |

| 2.2 | Inter-corporate Relationships | 6 | |

| ITEM 3 | GENERAL DEVELOPMENT OF THE BUSINESS | 7 | |

| 3.1 | Business of Silvercorp | 7 | |

| 3.2 | The Company’s Strategic Vision | 7 | |

| 3.3 | Three Year History | 7 | |

|

3.4 |

Other Matters | 10 | |

| ITEM 4 | DESCRIPTION OF THE BUSINESS | 10 | |

| 4.1 | General | 10 | |

| 4.2 | Corporate Governance, Safety, Environment and Social Responsibility | 12 | |

| 4.3 | Chinese Mining Law | 13 | |

| 4.4 | Risk Factors | 14 | |

| ITEM 5 | MINERAL PROPERTIES | 23 | |

| 5.1 | Ying Mining District, Henan Province, China | 23 | |

| 5.2 | GC Mine | 45 | |

| ITEM 6 | DIVIDENDS AND DISTRIBUTIONS | 61 | |

| ITEM 7 | DESCRIPTION OF CAPITAL STRUCTURE | 61 | |

| ITEM 8 | MARKET FOR SECURITIES | 62 | |

| ITEM 9 | ESCROWED SECURITIES | 63 | |

| ITEM 10 | DIRECTORS AND OFFICERS | 63 | |

| ITEM 11 | AUDIT COMMITTEE | 66 | |

| ITEM 12 | PROMOTERS | 67 | |

| ITEM 13 | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 67 | |

| ITEM 14 | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 68 | |

| ITEM 15 | TRANSFER AGENTS AND REGISTRARS | 68 | |

| ITEM 16 | MATERIAL CONTRACTS | 68 | |

| ITEM 17 | INTERESTS OF EXPERTS | 68 | |

| ITEM 18 | ADDITIONAL INFORMATION | 70 |

2

| ITEM 1 | GENERAL |

1.1 Date of Information

All information in this Annual Information Form (“AIF”) is as of March 31, 2019, unless otherwise indicated.

1.2 Forward Looking Statements

Certain statements and information in this AIF for Silvercorp Metals Inc. (“Silvercorp” or the “Company”) constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. All statements and information concerning mineral resource and mineral reserve estimates may also be deemed to constitute “forward-looking statements” to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Forward-looking statements or information relate to, among other things: the price of silver, lead, zinc and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company’s material properties; estimated production from the Company’s mines in the Ying Mining District (defined herein) and from the GC Mine; availability of funds from production to finance the Company’s operations; and access to and availability of funding for future construction and development of the Company’s properties or for acquisitions.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to the matters described in this AIF under Item 4.3 Risk Factors under the following headlines: fluctuating commodity prices; estimation of mineral resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; permits and licences; title to properties; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company’s existing operations; competition; operations and political conditions; regulatory environment in China; environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; dependence on management and key personnel; conflicts of interest; internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act; bringing actions and enforcing judgments under U.S. securities laws: and, the Company’s investments in New Pacific Metals Corp.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this AIF under the heading “Risk Factors” and elsewhere. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this AIF, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.

3

Cautionary Note to U.S. Investors – Information Concerning Preparation of Mineral Resource and Mineral Reserve Estimates

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource and mineral reserve estimates included in this AIF have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining Metallurgy and Petroleum (“CIM”) “Standards on Mineral Resources and Mineral Reserves Definitions and Guidelines” (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (“SEC”), and mineral resource and mineral reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable.

Disclosure of “contained metal” in a resource is permitted disclosure in certain circumstances under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

1.3 Currency

All sums of money which are referred to herein are expressed in lawful money of the United States, unless otherwise specified. The symbol “CAD$” denotes lawful money of Canada and “RMB” denotes lawful money of the People’s Republic of China. The following table sets forth, for each of the periods indicated, the year-end exchange rate, the average noon rate and the high and low noon exchange rates for one Canadian dollar expressed in U.S. dollar, as quoted by the Bank of Canada:

| Year Ended March 31, | |||||

| 2019 | 2018 | 2017 | |||

| High | 0.7967 | 0.8245 | 0.7972 | ||

| Low | 0.7330 | 0.7276 | 0.7363 | ||

| Average | 0.7625 | 0.7798 | 0.7621 | ||

| Period End | 0.7483 | 0.7756 | 0.7506 | ||

The exchange rate for one Canadian dollar expressed in U.S. dollar based upon the daily average exchange rate on June 20, 2019 provided by the Bank of Canada was $0.7581.

4

The following table sets forth, for each of the periods indicated, the year-end exchange rate, the average noon rate and the high and low noon exchange rates for one Canadian dollar expressed in Chinese Renminbi (“RMB”), as quoted by the Bank of Canada:

| Year Ended March 31, | |||||

| 2019 | 2018 | 2017 | |||

| High | 5.3648 | 5.4142 | 5.2854 | ||

| Low | 4.8662 | 4.8379 | 4.9092 | ||

| Average | 5.1149 | 5.1648 | 5.1263 | ||

| Period End | 5.0226 | 4.8780 | 5.1706 | ||

The exchange rate for one Canadian dollar expressed in RMB based upon the daily average exchange rate on June 20, 2019 provided by the Bank of Canada was RMB5.1948.

| ITEM 2 | CORPORATE STRUCTURE |

2.1 Names, Address and Incorporation

Silvercorp was formed as Spokane Resources Ltd. pursuant to an amalgamation of Julia Resources Corporation and MacNeill International Industries Inc. under the Company Act (British Columbia) on October 31, 1991. By a special resolution dated October 5, 2000, Spokane Resources Ltd. consolidated its share capital on a ten for one basis and altered its Memorandum and Articles of Incorporation by changing its name to “SKN Resources Ltd.” At the Company’s Annual and Special General Meeting held October 20, 2004, the shareholders (a) approved an increase to the Company’s authorized capital to an unlimited number of common shares and adopted new Articles consistent with the transition to the Business Corporations Act (British Columbia); and (b) passed a special resolution to change the Company’s name. On May 2, 2005, the Company filed a Notice of Alteration with the British Columbia Registrar of Companies changing its name from “SKN Resources Ltd.” to “Silvercorp Metals Inc.” The head office, principal address and registered and records office of the Company is located at 1378-200 Granville Street, Vancouver, British Columbia, V6C 1S4. The Company’s shares are listed for trading on the Toronto Stock Exchange (the “TSX”) and the NYSE American, both under the symbol “SVM”. The Company is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, Nova Scotia, and New Brunswick.

5

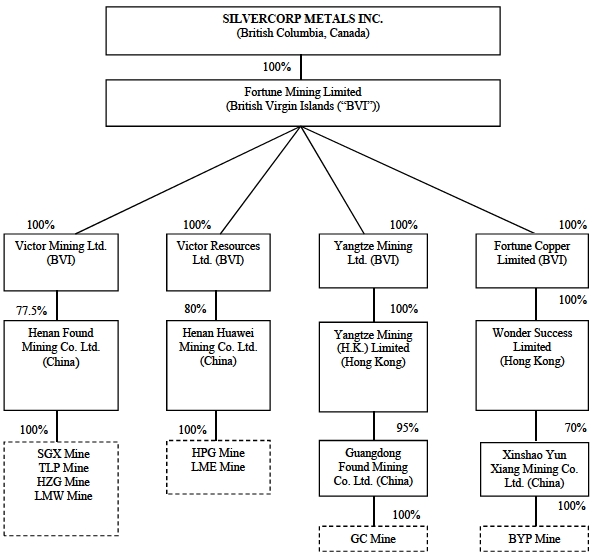

2.2 Inter-corporate Relationships

The corporate structure of the Company and its subsidiaries with mineral property interests as at the date of this AIF is as follows:

The Company is the sole shareholder of Fortune Mining Limited (“Fortune”) which was incorporated on August 23, 2002 to be the holding company of several other subsidiaries which are parties to agreements relating to mineral properties in China. Fortune beneficially owns 100% of the following material subsidiary companies:

| (a) |

Victor Mining Ltd. (“Victor Mining”) was incorporated on October 23, 2003 under the laws of the British Virgin Islands (the “BVI”) and continued into Barbados on August 27, 2009 and back to the BVI on March 18, 2016. Victor Mining is a party to a cooperative agreement under which it has earned a 77.5% interest in Henan Found Mining Co. Ltd. (“Henan Found”), the Chinese company holding, among other assets: (i) the Ying silver, lead and zinc project (the “SGX Mine”); (ii) the silver and lead project in Tieluping (the “TLP Mine”); (iii) the silver and lead project in Hou Zhang Gou and Po Cai Gou (the “HZG Mine”); (iv) the silver and lead project in Longmen West (the “LMW Mine”); and (v) the XHP project. |

| (b) |

Victor Resources Ltd. (“Victor Resources”) was incorporated on May 30, 2003, under the laws of the BVI and is a party to a cooperative agreement under which it earned an 80% interest in Henan Huawei Mining Co. Ltd. |

6

|

(“Henan Huawei”), the Chinese company holding the beneficial interests in the project in Haopinggou (the “HPG Mine”) and the project in Longmen East (the “LME Mine”) each in Henan Province. | |

| (c) |

Yangtze Mining Ltd. (“Yangtze Mining”) was incorporated on February 11, 2002, under the laws of the BVI. It holds a 100% interest in Yangtze Mining (H.K.) Ltd. (“Yangtze Mining HK”). Yangtze Mining HK holds a 95% interest in Guangdong Found Mining Co. Ltd. (“Guangdong Found”), a company incorporated on October 26, 2008 under the laws of the People’s Republic of China, that holds a 100% interest in the silver, lead and zinc exploration permits on the project in Gaocheng (the “GC Mine”) in Guangdong Province. |

| (d) |

Fortune Copper Limited was incorporated on August 23, 2002, under the laws of the BVI. It holds a 100% interest in Wonder Success Limited, a Hong Kong company which has a 70% equity interest in Xinshao Yun Xiang Mining Co. Ltd. (“Yunxiang”), which owns the BYP gold – lead zinc mine in Hunan Province (the “BYP Mine”). |

The Company’s operations in China are largely conducted through equity joint ventures, over which the Company has control. See “Item 4 General Description of Business, 4.2 Chinese Mining Law”.

| ITEM 3 | GENERAL DEVELOPMENT OF THE BUSINESS |

3.1 Business of Silvercorp

Silvercorp is engaged in the acquisition, exploration, development and mining of high-grade, silver-related, mineral properties in China through the operation of the silver-lead-zinc mines in the Ying Mining District in Henan Province and the GC Mine in Guangdong Province. The Ying Mining District consists of several mines, including the SGX Mine, HZG Mine, TLP Mine, HPG Mine, LMW Mine, and LME Mine.

3.2 The Company’s Strategic Vision

Silvercorp has a distinct long-term strategy characterized by three key steps. First, Silvercorp focuses on the acquisition and selective exploration of projects with significant resource and cash flow potential. It seeks out higher grade, underground, precious metals projects that may be too small for large companies and too large for juniors. Second, Silvercorp focuses on quickly developing high-margin operations with reasonable development capital profiles to generate cash flow before the project’s resource potential is fully delineated. Third, the initial cash flow Silvercorp generates from its operations is used to fund further exploration, resource expansion and production growth.

This strategy, with its focus on early production, provides earlier benefits to: (i) local communities through increased employment opportunities, (ii) local governments through payment of taxes, (iii) local joint venture partners through profit sharing, and (iv) shareholders of the Company through less dilution. The early benefits help build a base of strong stakeholder support necessary for further project growth.

3.3 Three Year History

Silvercorp has been acquiring, exploring, developing, and operating, mineral properties in China since 2003. Production at the SGX Mine at the Ying Mining District commenced on April 1, 2006, and since that time, several of the Company’s other properties in Henan Province, China have commenced production. In addition, the Company commenced production at the GC Mine in July 2014.

For the year ended March 31, 2019 (“Fiscal 2019”), on a consolidated basis, the Company mined 906,794 tonnes of ore, an increase of 5% or 46,870 tonnes, compared to 859,924 tonnes in the year ended March 31, 2018 (“Fiscal 2018”). For Fiscal 2019, the Company had sales of $170.5 million, a gross profit margin of 49%, and cash flow from operations of $67.8 million. For Fiscal 2019, net income attributable to equity holders of the Company was $39.7 million, or $0.23 per share.

For Fiscal 2018, on a consolidated basis, the Company had sales of $170.0 million, a gross profit margin of 52%, cash flow from operations of $67.9 million, and net income attributable to equity holders of the Company of $47.0 million, or $0.28 per share.

7

For the year ended March 31, 2017 (“Fiscal 2017”), on a consolidated basis, the Company mined 897,506 tonnes of ore, had sales of $163.5 million, a gross profit margin of 54%, cash flow from operations of $80.4 million, and net income attributable to equity holders of the Company of $43.7 million, or $0.26 per share.

The following table summarizes the total metal sales in the past three years.

| Years Ended March 31 | |||

| 2019 | 2018 | 2017 | |

| Silver (‘000s ounces) | 6,390 | 6,040 | 6,494 |

| Gold (‘000s ounces) | 3.5 | 3.1 | 3.3 |

| Lead (‘000s pounds) | 64,788 | 61,934 | 70,473 |

| Zinc (‘000s pounds) | 22,716 | 19,569 | 18,294 |

As reported in the Company’s news releases dated April 16, 2018 and May 1, 2018, the Company reported a spillage incident at the Ying Mining District of a small amount of tailings leaking from the No. 2 tailings facility into Chong Yang Creek at approximately 9:30 p.m. on April 12, 2018. Silvercorp’s subsidiary, Henan Found, took immediate actions and the leakage was fully controlled and stopped as of 12:00 p.m. on April 13, 2018. No personal injuries occurred and the results of ongoing water tests from Chong Yang Creek were within the acceptable national water quality standards. Due to the incident, milling operations at the Ying Mining District were temporarily suspended. On April 28, 2018, one flotation line of 1,000 tonnes per day at the No. 2 mill, using the No. 1 tailings storage facility resumed operation, and full mill operations resumed on May 23, 2018. As the milling capacity of Henan Found is approximately 25% greater than the mining capacity, the temporary suspension of the milling operations had minimal impact on overall annual production.

Production

Ying Mining District

The Ying Mining District consists of several mines, including the SGX, HZG, TLP, HPG, LMW, and LME Mines, and is the Company’s primary source of production.

In Fiscal 2019, total ore mined at the Ying Mining District was 622,576 tonnes, an increase of 1% or 8,435 tonnes, compared to 614,141 tonnes in Fiscal 2018. Correspondingly, ore milled in Fiscal 2019 increased to 619,851 tonnes from 618,732 tonnes in the prior year. Head grades were 311 g/t for silver, 4.4% for lead, and 0.9% for zinc, compared to 305 g/t for silver, 4.4% for lead and 0.9% for zinc in the prior year. The Company continues to achieve improvements in dilution control using its “Enterprise Blog” to assist in managing daily operations.

In Fiscal 2019, the Ying Mining District sold approximately 5.8 million ounces of silver, 56.1 million pounds of lead, and 6.6 million pounds of zinc, compared to 5.4 million ounces of silver, 55.2 million pounds of lead, and 6.1 million pounds of zinc in the prior year.

Total and cash mining costs1 at the Ying Mining District were $88.19 and $63.39 per tonne, respectively, in Fiscal 2019, compared to $84.59 and $61.46 per tonne, respectively, in Fiscal 2018. The increase in cash mining costs was mainly due to inflation resulting in an increase of (i)$0.6 million in mining contractor’s costs, (ii) $0.4 million in raw material costs, and (iii) $0.7 million in utility costs.

Total and cash milling costs1 at the Ying Mining District in Fiscal 2019 were $12.58 and $10.43 per tonne, respectively, compared to $11.71 and $9.49 per tonne, respectively, in Fiscal 2018.

Correspondingly, the cash production cost1 per tonne of ore processed in Fiscal 2019 at the Ying Mining District was $78.04, an increase of 4% compared to $74.96 in the prior year.

The cash cost1 per ounce of silver, net of by-product credits, in Fiscal 2019 at the Ying Mining District, was negative $3.35, compared to negative $3.88 in the prior year. The increase in the cash cost per ounce of silver, net of by-product

____________________

1 Non IFRS measure. Please refer reconciliation on section 13 of MD&A for the corresponding period.

8

credits, was mainly due to a $2.4 million increase in cash production cost expensed offset by a $0.6 million increase in by-product credits.

All-in sustaining costs1 per ounce of silver, net of by-product credits, in Fiscal 2019 at the Ying Mining District was $2.60 compared to $2.04 in the prior year. The increase was mainly due to increases of $2.4 million in cash production costs expensed and $2.2 million in sustaining capital expenditures.

GC Mine

In Fiscal 2019, the total ore mined at the GC Mine was 284,218 tonnes, an increase of 38,435 tonnes or 16%, compared to 245,783 tonnes in Fiscal 2018, while ore milled increased by 18% to 288,995 tonnes from 244,338 tonnes in the prior year.

Head grades were 86 g/t for silver, 1.5% for lead, and 3.0% for zinc in Fiscal 2019, compared to 98 g/t for silver, 1.5% for lead, and 2.8% for zinc in the prior year.

In Fiscal 2019, the GC Mine sold 626,000 ounces of silver, 8.7 million pounds of lead, and 16.1 million pounds of zinc, compared to 603,000 ounces of silver, 6.8 million pounds of lead, and 13.4 million pounds of zinc in Fiscal 2018.

Total and cash mining costs1 at the GC Mine in Fiscal 2019 were $46.04 and $37.73 per tonne, respectively, compared to $45.73 and $37.48 per tonne in Fiscal 2018.

Total and cash milling costs1 at the GC Mine in Fiscal 2019 were $17.01 and $14.39 per tonne, respectively, compared to $19.17 and $15.72 per tonne, respectively, in Fiscal 2018.

Correspondingly, the cash production costs1 per tonne of ore processed in Fiscal 2019 at the GC Mine decreased by 2% to $52.12 from $53.20 in the prior year.

The cash costs1 per ounce of silver, net of by-product credits, at the GC Mine, was negative $12.97 in Fiscal 2019 compared to negative $12.37 in the prior year. The decrease was mainly due to a 4% increase in by-product credits resulting from increases of 28% in lead and 20% in zinc sold offset by a decrease of 3% and 17% in net realized lead and zinc selling prices at the GC Mine.

All-in sustaining costs1 per ounce of silver, net of by-product credits, in Fiscal 2019 at the GC Mine was negative $6.28 compared to negative $3.69 in the prior year. The improvement was mainly due to an increase of $1.6 million in byproduct credits and a decrease of $0.9 million in sustaining capital expenditures.

BYP Mine

The BYP Mine was placed on care and maintenance in August 2014 due to the required capital upgrades to sustain its ongoing production and the current market environment. The Company continues to review alternatives for this project and is also carrying out activities to renew its mining license.

XHP project

Activities at the XHP project, a development-stage project, were suspended in Fiscal 2014. In April 2019, Henan Found, the Company’s 77.5% owned subsidiary, entered into a share transfer agreement (the “Agreement”) with an arm’s length private Chinese company to dispose of the XHP project. Pursuant to the Agreement, Henan Found will sell its 100% equity interest in SX Gold, the holding company of the XHP project, for $7.5 million (RMB ¥50 million), net of the amount SX Gold owes to Henan Found. As of the date of this AIF, Henan Found received partial payments of $4.5 million (RMB ¥30 million) for the sale. The transaction is expected to close in the first quarter of Fiscal 2020.

Capitalized Exploration and Development Expenditures

Ying Mining District

In Fiscal 2019, approximately 75,955 m or $1.8 million worth of underground diamond drilling (Fiscal 2018 – 104,798 m or $2.3 million) and 18,656 m or $5.4 million worth of preparation tunnelling (Fiscal 2018 – 19,723 m or $5.8 million) were completed and expensed as mining preparation costs at the Ying Mining District. In addition, approximately 65,653 m or $23.2 million worth of horizontal tunnels, raises and declines (Fiscal 2018 – 61,827 m or $20.1 million) were completed and capitalized.

9

GC Mine

In Fiscal 2019, approximately 24,727 m or $1.3 million worth of underground diamond drilling (Fiscal 2018 – 21,717 m or $1.1 million) and 19,844 m or $5.2 million worth of tunnelling (Fiscal 2018 – 15,811 m or $4.5 million) were completed and expensed as mining preparation costs at the GC Mine. In addition, approximately 1,374 m or $1.0 million worth of horizontal tunnels, raises and declines (Fiscal 2018 – 320 m or $0.3 million) were completed and capitalized.

3.4 Other Matters

Normal Course Issuer Bids

On February 20, 2019, the Company announced that the TSX had approved a Normal Course Issuer Bid (“2019 NCIB”) which permitted the Company to acquire (from February 25, 2019 to February 24, 2020) up to 8,484,682 of its common shares, representing approximately 5% of the Company’s 169,693,640 common shares issued and outstanding as of February 5, 2019.

On November 23, 2017, the Company announced that the TSX had approved a Normal Course Issuer Bid (“2018 NCIB”) which permitted the Company to acquire (from November 27, 2017 to November 26, 2018) up to 8,409,712 of its common shares, representing approximately 5% the Company’s 168,194,254 common shares issued and outstanding as of November 16, 2017. The Company acquired 1,717,100 common shares at an average price of CAD$3.09 per share under the 2018 NCIB up to March 31, 2018, and all such shares were cancelled.

On December 23, 2015, the Company announced that the TSX had approved a Normal Course Issuer Bid (“2016 NCIB”) which permitted the Company to acquire (from December 29, 2015 to December 28, 2016) up to 16,255,503 of its common shares, representing approximately 10% of the Company’s 168,837,356 common shares issued and outstanding as of December 15, 2015. The Company acquired 1,714,500 common shares at an average price of CAD$0.72 per share under the 2016 NCIB and all shares were cancelled.

| ITEM 4 | DESCRIPTION OF THE BUSINESS |

4.1 General

Silvercorp’s principal products and its sources of sales are silver-bearing lead and zinc concentrates and direct smelting ores. At present, Silvercorp sells all its products to local smelters or companies in the mineral products trading business.

For each of the Company’s two most recently completed fiscal years, revenues for each category of products that accounted for 10% or more of total consolidated revenues are as follows:

| Years ended March 31, | ||

| In 000s’US$ | 2019 | 2018 |

| Silver (Ag) | 80,654 | 82,354 |

| Lead (Pb) | 64,111 | 62,251 |

| Zinc | 20,654 | 21,462 |

Additional information is provided in the Company’s financial statements and management’s discussion and analysis for its most recently completed fiscal year.

The mining industry is intensely competitive and the Company competes with many companies possessing similar or greater financial and technical resources. The Company’s competitive position is largely reliant upon its ability to maintain a high margin operation, resulting from relatively high grade resources, and lower production costs in China compared to the costs of other producers outside China. The Company’s competitive advantage also results from the quality of its concentrates and its proximity to local smelters.

10

In Fiscal 2019, silver and zinc production at the Ying Mining District surpassed the guidance by 7% and 4%, respectively, while lead production was in line with the guidance. The higher silver production was mainly due to the increase of head grades offset by lower ore production achieved and the higher zinc production was mainly due to the improvement in recovery rates. Silver and lead head grades increased to 311 g/t for silver and 4.4% for lead from the guidance of 285 g/t and 4.3%, respectively. The cash production costs per tonne were higher than the guidance mainly due to inflation resulting in higher raw material and utility costs and adjustments to mining contractor’s costs.

In Fiscal 2018, silver, lead, and zinc production at the Ying Mining District surpassed the guidance by 3%, 1%, and 1%, respectively, mainly due to the increase in head grades offset by lower ore production achieved. Silver and lead head grades increased by 11% and 6%, respectively, to 305 g/t for silver and 4.4% for lead from the guidance of 275 g/t and 4.2%, respectively. The cash production costs per tonne were higher than the guidance mainly due to more drilling and tunnelling expensed and higher material costs, while the all-in sustaining costs per ounce of silver, net of by-product credits were better than the guidance.

In Fiscal 2019, silver, lead and zinc production at the GC Mine surpassed the guidance by 5%, 17% and 19%, respectively, mainly due to a 16% increase in ore production offset by lower head grades for silver and lead. The cash production costs per tonne and all-in sustaining costs per ounce were lower than the guidance.

In Fiscal 2018, silver production at the GC Mine surpassed the guidance by 42%, while there was a 6% and 1% short fall in lead and zinc production mainly due to 2% less ore processed and a 3% decrease in lead head grades. The cash production costs per tonne were higher than the guidance, while the all-in sustaining costs per ounce of silver, net of byproduct credits were better than the guidance, mainly due to higher by-product credits achieved with a 34% and 48% increase, respectively, in lead and zinc realized selling prices.

In Fiscal 2019, the Company had 899 employees at Henan Found, 243 at Guangdong Found, 4 at Hunan Yunxiang, 17 at Songxian, 28 at the Beijing representative office, and 16 in the Vancouver corporate office.

On June 20, 2017, the Company completed a corporate restructuring whereby Anhui Yangtze Mining Co. Ltd. (China) transferred its 5% interest in Guangdong Found, a company that holds a 100% interest in the GC Mine, to Yangtze Mining HK. As a result, Yangtze Mining HK currently holds a 95% interest in Guangdong Found.

Fiscal 2020 Outlook

Production

For the year ended March 31, 2020 (“Fiscal 2020”), the Company expects to produce approximately 900,000 tonnes of ore, which is anticipated to yield approximately 6.1 million ounces of silver, 65.1 million pounds of lead, and 21.8 million pounds of zinc.

At the Ying Mining District, production is expected to be 630,000 tonnes of ore with grades of 290 g/t silver, 4.3% lead and 0.9% zinc, with expected metal production of 5.5 million ounces of silver, 56.2 million pounds of lead and 6.3 million pounds of zinc. The cash production cost is expected to be $78.20 per tonne of ore. The all-in sustaining cost is forecast to be $130.20 per tonne of ore. In Fiscal 2020, the GC Mine plans to mine and process 270,000 tonnes of ore averaging 96 g/t silver, 1.7% lead and 3.1% zinc with expected metal production of 0.6 million ounces of silver, 8.9 million pounds of lead and 15.5 million pounds of zinc. The cash production cost is expected to be $56.70 per tonne of ore. The all-in sustaining cost at GC Mine is expected to be $77.40 per tonne of ore.

Capital Expenditures Budget

Capital expenditures at the Ying Mining District in Fiscal 2020 are budgeted at $31.7 million, including $24.4 million for mine tunnelling and ramp development and $7.3 million for equipment and infrastructure. Capital expenditures at the GC Mine in Fiscal 2020 are budgeted at $5.2 million, including $2.5 million for mine tunnelling and ramp development, $1.4 million for a paste backfill plant, and $1.3 million for other equipment and infrastructure.

Growth by Exploration and Acquisition

The Company continues to pursue future growth opportunities by carrying out exploration programs within existing permit areas at its projects. In addition, the Company continues to evaluate the acquisition of exploration, development

11

and production assets, or the acquisition of or merger with other entities. The Company regularly engages in discussions with respect to such possible opportunities. At any time, discussions and activities may be in progress on a number of initiatives, each at different stages of advancement. Although the Company may from time to time be a party to a number of letters of intent with respect to certain opportunities and other acquisitions, the Company currently does not have any binding agreements or binding commitments to enter into any such transactions. There is no assurance that any potential transaction will be successfully completed.

4.2 Corporate Governance, Safety, Environment and Social Responsibility

Corporate Governance

The Company adheres to high standards of corporate governance and closely follows the requirements established by both the Canadian Securities Administrators and the SEC. Silvercorp believes that our current corporate governance systems meet or exceed these requirements. The board of directors of the Company (the “Board”) oversees the direction and strategy of the business and the affairs of the Company. The Board is comprised of five directors, and as at March 31, 2019 and the date of this AIF, four of them are independent, and one is female. The Board’s wealth of experience allows it to effectively oversee the development of corporate strategies and the key risks of the business, provide management with long-term direction, consider and approve major decisions, oversee the business generally and evaluate corporate performance. The Corporate Governance and Nominating Committee, appointed by the Board, oversee the effective functioning of the Board and the implementation of governance best practices.

Corporate Philosophy on Sustainability

Silvercorp operates with the goal of achieving business success within a framework of principles and values that aims to minimize any negative impacts of its operations and maximize the benefits for the communities where it operates. The Company highly values sustainable development, as well as ensuring a safe workplace for all employees and contractors, at all of our sites. We will continue to engage and interact regularly, and in an open and honest way, with governments, shareholders, employees, local communities, business partners and other stakeholders affected by our operations. We will also report, on an ongoing basis, on topics of interest to our various stakeholders to keep them apprised of our efforts in the area of sustainability.

These corporate philosophies tie directly into the emphasis on efficient process design and effective management across all aspects of our operations. Significant, ongoing efforts are made to identify and minimize various risks, as well as streamline the collection, monitoring and reporting of relevant data. A social media platform, the “Enterprise-Blog”, is an instrumental tool used to ensure all mandatory procedures are being performed. Amongst other things, it allows for the recording of appropriate environmental, health and safety data that can be made available for inspection by various authorities. In addition, in Fiscal 2019, the Company invested $1.0 million in an on-line, real time, monitoring and GPS system to further the goal of creating an “intelligent mine”. This is expected to provide benefits in a number of areas.

Environmental and Social Responsibility

The Company has remained focused on sustainable development since its inception and is dedicated to fulfilling its environmental goals and responsibilities. We are committed to ensuring all our activities comply with all relevant industry standards, legislation and environmental regulations applicable in the various regions in which we operate. Our operations were all subject to inspections by government agencies in 2018 and, to the best of management’s knowledge, all were, and continue to be, in compliance in all material respects with applicable regulations.

Our management team has regular, constructive dialogue with regulators in order to stay abreast of potential new environment policies or regulations that could have an impact on our operations and determine how to best address any changes. For example, as the mining industry is experiencing worldwide, the Chinese government is scrutinizing the use of dams to store mining tailings and imposing more stringent requirements on their location, form of construction, and ultimate size. In response, the Company’s GC Mine is proceeding with the construction of a paste backfill plant, at a cost of approximately $1.5 million, to enable it to return a significant portion of the tailings created in the mill back underground as fill for mined out areas. While an incremental investment, this is expected to reduce the future costs and risks associated with the operation of above ground tailings facilities.

12

In the fiscal year ended March 31, 2019, our expenditures for concurrent reclamation included $0.2 million to re-forest more than 48,000 square metres through land reclamation and environmental restoration projects. The Company also made a $0.6 million investment to improve the tailings management facilities at the Ying Mining District. We currently estimate the aggregate present value of expenditures required for future closure and decommissioning costs to be approximately $13.7 million as of March 31, 2019. We are not aware of any material environmental matters requiring significant capital or operating outlays in the immediate future. We caution readers that actual closure and reclamation costs may vary, perhaps materially, from estimates.

The Company is committed to creating sustainable value in the communities where our people work and live. Guided by research conducted by our local offices, the Company participates in, and contributes to, numerous community programs that typically center on education and health, nutrition, environmental awareness, local infrastructure and fostering additional economic activity. In addition to the approximately $38.4 million in taxes and fees paid to various levels of government in China, in Fiscal 2019, the Company:

-

donated $0.7 million to over 600 families in a local community to help alleviate poverty;

-

donated $0.3 million to a local community for road construction and social activities;

-

supported 24 Chinese students with scholarships to further their educations; and

-

invested $1.0 million to construct a 7,600 square metre concrete facility for mining contractors’ living accommodations.

Health and Safety

The Company is dedicated to minimizing the potential health and safety risks faced by employees and contractors. In Fiscal 2019, the Company reviewed and refined all standard procedures at our mines and milling facilities and identified potential risks associated with each step of the operations. In Fiscal 2019, the Company:

-

invested $0.4 million to improve the fire prevention system and equipment;

-

invested $0.6 million to improve the explosive storage facilities;

-

for workers where comparable data is available, achieved a 26% reduction in the lost time injury rate; and

-

provided regular health and safety training sessions.

4.3 Chinese Mining Law

Currently, all of the Company’s material properties are located in China. Under the laws of China, mineral resources are owned by the state, and until 1997, state-owned enterprises have been the principal force in the development of mineral resources.

A new Mineral Resources Law became effective on January 1, 1997, and two regulations were promulgated on February 12, 1998, and later amended in July 2014. The new law provided for equal legal status for domestic enterprises and enterprises with foreign investment, security and transferability of mineral titles as well as the exclusivity of mining rights. The right to explore and exploit minerals is granted by way of exploration and mining rights. The holder of an exploration right has priority in obtaining the mining right to mineral resources within the exploration area provided the holder meets the conditions and requirements specified in the law. The Company’s interests in mineral properties are held though joint venture companies established under and governed by, the laws of China. The Company’s joint venture partners in China include state-sector entities and, like other state-sector entities, their actions and priorities may be dictated by government policies instead of purely commercial considerations.

Additionally, companies with a foreign ownership component operating in China may be required to work within a framework which is different from that imposed on domestic Chinese companies. The Chinese government currently allows foreign investment in certain mining projects under central government guidelines.

13

4.4 Risk Factors

An investment in the common shares of the Company involves a significant degree of risk and ought to be considered a highly speculative investment. The following risk factors, as well as risks not currently known to the Company, could materially adversely affect the Company’s future business, operations and financial condition and could cause them to differ materially from the estimates described in the forward-looking statements and information relating to the Company.

Fluctuating commodity prices

The Company’s sales price for silver is fixed against the Shanghai White Platinum & Silver Exchange as quoted at www.ex-silver.com; lead and zinc are fixed against the Shanghai Metals Exchange as quoted at www.shmet.com; and gold is fixed against the Shanghai Gold Exchange as quoted at www.sge.com.cn.

The Company’s revenues, if any, are expected to be in large part derived from the mining and sale of silver, lead, zinc, and gold contained in metal concentrates. The prices of those commodities have fluctuated widely, particularly in recent years, and are affected by numerous factors beyond the Company’s control including international and regional economic and political conditions; expectations of inflation; currency exchange fluctuations; interest rates; global or regional supply and demand for jewellery and industrial products containing silver and other metals; sale of silver and other metals by central banks and other holders, speculators and producers of silver and other metals; availability and costs of metal substitutes; and increased production due to new mine developments and improved mining and production methods. The effects of these factors on the price of base and precious metals, and therefore the viability of the Company’s exploration projects and mining operations, cannot be accurately predicted and thus the price of base and precious metals may have a significant influence on the market price of the Company’s shares and the value of its projects.

If silver and other metal prices were to decline significantly for an extended period of time, the Company may be unable to continue operations, develop its projects, or fulfil obligations under agreements with the Company’s joint venture partners or under its permits or licenses.

Recent market events and condition

Over the past several years market events and conditions, including disruptions in the Canadian, United States and international credit markets and other financial systems, along with the uncertainty of the Canadian, United States and global economic conditions, and the prior decline in precious metal prices, could, among other things, impede access to capital or increase the cost of capital, which would have an adverse effect on the Company’s ability to fund its working capital and other capital requirements.

Over the past several years, worldwide securities markets, particularly those in the United States and Canada, have experienced a high level of price and volume volatility, and the market price of securities of many resource companies, particularly those considered exploration-stage, development-stage, or single asset companies, have experienced unprecedented declines in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. Most significantly, the share prices of natural resource companies have in the past experienced an extraordinary decline in value and in the number of buyers willing to purchase such securities. In addition, significantly higher redemptions by holders of mutual funds has forced many of such funds (including those holding the Company’s securities) to sell such securities with little consideration to the price received.

Therefore, there can be no assurance that significant fluctuations in the trading price of the Company’s common shares will not occur, or that such fluctuations will not materially adversely impact the Company’s ability to raise equity funding without significant dilution to its existing shareholders, or at all.

Estimation of mineral resources, mineral reserves, mineralization, and metal recovery

There is a degree of uncertainty attributable to the estimation of mineral resources, reserves, mineralization and corresponding grades being mined or dedicated to future production. Until resources, reserves or mineralization are actually mined and processed, the quantity of metals and grades must be considered as estimates only. Any material change in quantity of resources, reserves, mineralization, or grade may affect the economic viability of the Company’s

14

projects. In addition, there can be no assurance that precious or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests or during production.

Interpretations and assumptions of mineral resource and mineral reserve estimates

Unless otherwise indicated, mineral resource and mineral reserve estimates presented in this AIF and in the Company’s other filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by the Company’s personnel and independent geologists/mining engineers. These estimates are imprecise and depend upon geologic interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. The mineral resource and mineral reserve estimates contained in this AIF have been determined based on assumed future prices, cut-off grades, operating costs and other estimates that may prove to be inaccurate. There can be no assurance that these estimates will be accurate; mineral reserve, resource or other mineralization figures will be accurate; or the mineralization could be mined or processed profitably. The interpretation of drill results, the geology, grade and continuity of the Company’s mineral deposits contains inherent uncertainty. Any material reductions in estimates of mineralization, or of the Company’s ability to extract this mineralization, could have a material adverse effect on its results of operations or financial condition.

Exploration and development programs

The long-term operation of the Company’s business and its profitability is dependent, in part, on the cost and success of its exploration and development programs. Mineral exploration and development involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. There can be no assurance that the Company’s mineral exploration and development programs will result in any discoveries of bodies of commercial mineralization. There can also be no assurance that even if commercial quantities of mineralization are discovered that a mineral property will be brought into commercial production. Development of the Company’s mineral properties will follow only upon obtaining satisfactory exploration results. Discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent upon a number of factors, some of which are the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metals prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. Most of the above factors are beyond the control of the Company. As a result, there can be no assurance that the Company’s exploration and development programs will yield reserves to replace or expand current resources. Unsuccessful exploration or development programs could have a material adverse effect on the Company’s operations and profitability.

Economic factors affecting the Company

Many industries, including the mining industry, are impacted by market conditions. Some of the key impacts of the recent financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metals markets, and a lack of market liquidity. A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates, and tax rates may adversely affect the Company’s growth and profitability. Specifically: the volatility of silver, lead and zinc prices may impact the Company’s revenues, profits, losses and cash flow; volatile energy prices, commodity and consumable prices and currency exchange rates would impact the Company’s production costs; and the devaluation and volatility of global stock markets may impact the valuation of the Company’s equity and other securities. These factors could have a material adverse effect on the Company’s financial condition and results of operations.

Timing, estimated amount, capital and operating expenditures and economic returns of future production

There are no assurances if and when a particular mineral property of the Company can enter into production. The amount of future production is based on the estimates prepared by or for the Company. The capital and operating costs to take the Company’s projects into production or maintain or increase production levels may be significantly higher than anticipated. Capital and operating costs of production and economic returns are based on estimates prepared by or for the Company and may differ significantly from their actual values. There can be no assurance that the Company’s actual capital and operating costs will not be higher than currently anticipated. In addition, the construction and

15

development of mines and infrastructure are complex. Resources invested in construction and development may yield outcomes that may differ significantly from those anticipated by the Company.

Integration of future acquisitions into existing operations

The Company may make select future acquisitions. If the Company does make acquisitions, any positive effect on the Company’s results will depend on a variety of factors, including, but not limited to: integrating the operations of an acquired business or property in a timely and efficient manner; maintaining the Company’s financial and strategic focus while integrating the acquired business or property; implementing uniform standards, controls, procedures and policies at the acquired business, as appropriate; and to the extent that the Company makes an acquisition outside of markets in which it has previously operated, conducting and managing operations in a new operating environment.

Acquiring additional businesses or properties could place pressure on the Company’s cash reserves if such acquisitions involve cash consideration or if such acquisitions involve share consideration existing shareholders may experience dilution.

The integration of the Company’s existing operations with any acquired business may require significant expenditures of time, attention and funds. Achievement of the benefits expected from consolidation may require the Company to incur significant costs in connection with, among other things, implementing financial and planning systems. The Company may not be able to integrate the operations of a recently acquired business or restructure the Company’s previously existing business operations without encountering difficulties and delays. In addition, this integration may require significant attention from the Company’s management team, which may detract attention from the Company’s day-to-day operations.

Over the short-term, difficulties associated with integration could have a material adverse effect on the Company’s business, operating results, financial condition and the price of the Company’s common shares. In addition, the acquisition of mineral properties may subject the Company to unforeseen liabilities, including environmental liabilities, which could have a material adverse effect on the Company. There can be no assurance that any future acquisitions will be successfully integrated into the Company’s existing operations.

Permits and licenses for mining and exploration

All mineral resources and mineral reserves of the Company’s subsidiaries are owned by their respective joint venture entities in China. Mineral exploration and mining activities in China may only be conducted by entities that have obtained or renewed exploration or mining permits and licenses, and other certificates in accordance with the relevant mining laws and regulations. These permits and license are also subject to annual inspection by government authorities. Failure to pass the annual inspections may result in penalties. No guarantee can be given that the necessary exploration and mining permits and licenses will be issued to the Company or, if they are issued, that they will be renewed, or if renewed under reasonable operational and/or financial terms, or in a timely manner, or that the Company will be in a position to comply with all conditions that are imposed. Please see “Table 1, Mining licenses”, on page 23 for information on the current status of mining licences at the Ying Project.

Nearly all mining projects require government approvals and permits relating to environmental, social, land and water usage, community, and other matters, including those discussed in Sections 20 of the respective NI 43-101 Technical Reports on the Company’s material properties (see the Ying Report and the GC Report respectively). Some of the permits or certificates that are subject to renewal in the next three years at the GC Mine, not otherwise discussed in the GC Report include:

16

| Permit | Expiry Date | Approving Authority |

| Safety Production Permit | October 25, 2020 | Bureau of Safety Production and Inspection of Yunfu City, Guangdong Province |

| Dry Stacking and Filling Safety Production Permit | September 3, 2020 | Bureau of Safety Production and Inspection of Yunfu City, Guangdong Province |

| Blasting Operation Permit | July 2, 2021 | Ministry of Public Security |

| Pollutant Discharge Permit | September 8, 2020 | Environment Protection Administration of Yunfu, Guangdong Province |

There can be no certainty that approvals necessary to develop and operate mines on the Company’s properties will be granted or renewed in a timely and/or economical manner, or at all.

Title to properties

With respect to the Company’s properties located in China, while the Company has investigated title to all of its mineral claims, and to the best of its knowledge, title to all of its properties is in good standing, the properties may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. There may be valid challenges to the title of the Company’s properties which, if successful, could impair development and/or operations. The Company cannot give any assurance that title to its properties will not be challenged. Title insurance is generally not available for mineral properties and the Company’s ability to ensure that it has obtained secure claims to individual mineral properties or mining concessions may be severely constrained. The Company’s mineral properties in China have not been surveyed, and the precise location and extent thereof may be in doubt.

Joint venture partners

The Company’s interests in various projects may, in certain circumstances, become subject to the risks normally associated with the conduct of joint ventures. The existence or occurrence of one or more of the following events could have a material adverse impact on the Company’s profitability or the viability of its interests held through joint ventures, which could have a material adverse impact on the Company’s business prospects, results of operations and financial conditions: (i) disagreements with joint venture partners on how to conduct exploration; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) disputes or litigation between joint venture partners regarding budgets, development activities, reporting requirements and other joint venture matters.

Acquisition of commercially mineable mineral rights

Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of recovery of mineral reserves will be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited.

The Company’s future growth and productivity will depend, in part, on its ability to identify and acquire additional mineral rights, and on the costs and results of continued exploration and development programs. Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to: establish mineral reserves through drilling and metallurgical and other testing techniques; determine metal content and metallurgical recovery processes to extract metal from the ore; and construct, renovate or expand mining and processing facilities.

In addition, if the Company discovers a mineral deposit, it would take several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change.

The Company’s success at completing any acquisitions will depend on a number of factors, including, but not limited to: identifying acquisitions that fit the Company’s business strategy; negotiating acceptable terms with the seller of the business or property to be acquired; and obtaining approval from regulatory authorities in the jurisdictions of the business or property to be acquired. As a result of these uncertainties, there can be no assurance that the Company will successfully acquire additional mineral rights.

17

Financing

The Company has limited financial resources. If the Company’s exploration programs are successful in establishing ore of commercial tonnage and grade, additional funds will be required for the development of the ore body and to place it in commercial production. Therefore, the Company’s ability to continue its exploration and development activities, if any, will depend in part on the Company’s ability to obtain suitable financing.

The Company intends to fund its plan of operations from working capital, proceeds of production, external financing, strategic alliances, sale of property interests and other financing alternatives. The sources of external financing that the Company may use for these purposes include project or bank financing, or public or private offerings of equity or debt. One source of future funds presently available to the Company is through the sale of equity capital. There is no assurance this source of financing will continue to be available as required, or at all. If it is available, future equity financings may result in substantial dilution to shareholders. Another alternative for the financing of further exploration would be the offering by the Company of an interest in the properties to be earned by another party or parties carrying out further exploration or development thereof. There can be no assurance the Company will be able to conclude any such agreements, on favourable terms or at all. The failure to obtain financing could have a material adverse effect on the Company’s growth strategy and results of operations and financial condition.

Competition

The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of ore are discovered, a ready market will exist for the sale of such ore, or concentrate, by the Company. Marketability of natural resources which may be discovered by the Company will be affected by numerous factors beyond the control of the Company, such as market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations including regulations relating to prices, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of such factors cannot be predicted but they may result in the Company not receiving an adequate return on its capital.

The Company may be at a competitive disadvantage in acquiring additional mining properties because it must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than the Company. The Company may also encounter increasing competition from other mining companies in its efforts to hire experienced mining professionals. Competition for exploration resources at all levels is currently very intense, particularly affecting the availability of manpower. Increased competition could adversely affect the Company’s ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

Operations and political conditions

All the Company’s operations are located in China. These operations are subject to the risks normally associated with conducting business in China, which has different regulatory and legal standards than North America. Some of these risks are more prevalent in countries which are less developed or have emerging economies, including uncertain political and economic environments, as well as risks of civil disturbances or other risks which may limit or disrupt a project, restrict the movement of funds or result in the deprivation of contractual rights or the taking of property by nationalization or expropriation without fair compensation, risk of adverse changes in laws or policies, increases in foreign taxation or royalty obligations, license fees, permit fees, delays in obtaining or the inability to obtain necessary governmental permits, limitations on ownership and repatriation of earnings, and foreign exchange controls and currency devaluations.

In addition, the Company may face import and export regulations, including export restrictions, disadvantages of competing against companies from countries that are not subject to similar laws, restrictions on the ability to pay dividends offshore, and risk of loss due to disease and other potential endemic health issues. Although the Company is not currently experiencing any significant or extraordinary problems in China arising from such risks, there can be no assurance that such problems will not arise in the future. The Company currently does not carry political risk insurance coverage.

The Company’s interests in its mineral properties are held through joint venture companies established under and governed by the laws of China. The Company’s joint venture partners in China include state-sector entities and, like

18

other state-sector entities, their actions and priorities may be dictated by government policies instead of purely commercial considerations. Additionally, companies with a foreign ownership component operating in China may be required to work within a framework which is different from that imposed on domestic Chinese companies. The Chinese government currently allows foreign investment in certain mining projects under central government guidelines. There can be no assurance that these guidelines will not change in the future.

Regulatory environment in China

The Company conducts operations in China. The laws of China differ significantly from those of Canada and all such laws are subject to change. Mining is subject to potential risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production.

Failure to comply with applicable laws and regulations may result in enforcement actions and may also include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws and regulations.

New laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations could have a material adverse impact on future cash flow, results of operations and the financial condition of the Company.

Environmental risks

The Company’s activities are subject to extensive laws and regulations governing environmental protection and employee health and safety, including environmental laws and regulations in China. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species, and reclamation of lands disturbed by mining operations. The Company’s Chinese subsidiaries are required to have been issued environmental permits and safety production permits with various expiration dates. These permits are also subject to annual inspection by government authorities. Failure to pass the annual inspections may result in penalties. No guarantee can be given that the necessary permits will be issued to the Company or, if they are issued, that they will be renewed, or if renewed under reasonable operational and/or financial terms, or in a timely manner, or that the Company will be in a position to comply with all conditions that are imposed.

Nearly all mining projects require government approval and permits relating to environmental, social, land and water usage, community matters, and other matters, including those discussed in Sections 20 of the respective NI 43-101 Technical Reports on the Company’s material properties (see the Ying Report and the GC Report respectively).

There are also laws and regulations prescribing reclamation activities on some mining properties. Environmental legislation in many countries, including China, is evolving and the trend has been toward stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on behalf of the Company and may cause material changes or delays in the Company’s intended activities. There can be no assurance that the Company has been or will be at all times in complete compliance with current and future environmental, and health and safety laws, and the status of permits will not materially adversely affect the Company’s business, results of operations or financial condition. It is possible that future changes in these laws or regulations could have a significant adverse impact on some portion of the Company’s business, causing the Company to re-evaluate those activities at that time. The Company’s compliance with environmental laws and regulations entail uncertain costs.

Dependence on management and key personnel

The executive director and the China operational management team all have extensive experience in the mineral resources industry in China. Most of the non-executive directors also have extensive experience in mining and/or exploration (or as advisors to companies in the field). The Company’s success depends to a significant extent upon its ability to retain, attract and train key management personnel, both in Canada and in China.

19

The Company depends on the services of a number of key personnel, including the Chief Executive Officer, Chief Financial Officer, and the China operational management team, the loss of any one of whom could have an adverse effect on the Company’s operations.

The Company’s ability to manage growth effectively will require it to continue to implement and improve management systems and to recruit and train new employees. The Company cannot be assured that it will be successful in attracting and retaining skilled and experienced personnel.

Foreign exchange rate fluctuations

The Company reports its financial statements in US dollars. The functional currency of the head office, Canadian subsidiaries and all intermediate holding companies is the Canadian dollar while the functional currency of all Chinese subsidiaries is Chinese Renminbi. The Company is exposed to foreign exchange risk when the Company undertakes transactions and holds assets and liabilities in currencies other than its functional currencies. The fluctuation of the exchange rate between the reporting currency and its functional currencies may materially and adversely affect the Company’s financial position.

Insurance

The Company’s mining activities are subject to the risks normally inherent in the industry, including, but not limited, to environmental hazards, flooding, fire, periodic or seasonal hazardous climate and weather conditions, unexpected rock formations, industrial accidents and metallurgical and other processing problems. These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties; personal injury; environmental damage; delays in mining; increased production costs; monetary losses; and possible legal liability. The Company may become subject to liability which it cannot insure or may elect not to insure due to high premium costs or other reasons. Where considered practical to do so, the Company maintains insurance against risks in the operation of its business in amounts which the Company believes to be reasonable. Such insurance, however, contains exclusions and limitations on coverage. The Company cannot provide any assurance that such insurance will continue to be available, be available at economically acceptable premiums or be adequate to cover any resulting liability. In some cases, coverage is not available or considered too expensive relative to the perceived risk.

Risks and hazards of mining operations

Mining is inherently dangerous and the Company’s operations are subject to a number of risks and hazards including, without limitation: environmental hazards; discharge of pollutants or hazardous chemicals; industrial accidents; failure of processing and mining equipment; labour disputes; supply problems and delays; encountering unusual or unexpected geologic formations or other geological or grade problems; encountering unanticipated ground or water conditions; cave-ins, pit wall failures, flooding, rock bursts and fire; periodic interruptions due to inclement or hazardous weather conditions; equipment breakdown; other unanticipated difficulties or interruptions in development, construction or production; and other acts of God or unfavourable operating conditions.

Such risks could result in damage to, or destruction of, mineral properties or processing facilities, personal injury or death, loss of key employees, environmental damage, delays in mining, monetary losses and possible legal liability. Satisfying such liabilities may be very costly and could have a material adverse effect on the Company’s future cash flow, results of operations and financial condition.

Conflicts of interest

Conflicts of interest may arise as a result of the directors and officers of the Company also holding positions as directors and/or officers of other companies. Some of those persons who are directors and officers of the Company have and will continue to be engaged in the identification and evaluation of assets and businesses and companies on their own behalf and on behalf of other companies, and situations may arise where the directors and officers may be in direct competition with the Company. Conflicts, if any, will be subject to the procedures and remedies under the Business Corporations Act (British Columbia).

20

Internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act

Management of the Company is responsible for establishing and maintaining an adequate system of internal control, including internal controls over financial reporting. Internal control over financial reporting is a process designed by, or under the supervision of, the Chief Executive Officer and the Chief Financial Officer and effected by the Board of Directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards. Management assesses the effectiveness of our internal control over financial reporting based on the criteria set forth in the Internal Control Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

The Company may fail to achieve and maintain the adequacy of our internal control over financial reporting as such standards are modified, supplemented, or amended from time to time, and the Company may not be able to ensure that the Company can conclude on an ongoing basis that the Company have effective internal control over financial reporting. Also, projections of any evaluation of the effectiveness of internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. No evaluation can provide complete assurance that our internal control over financial reporting will prevent or detect misstatements on a timely basis, or detect or uncover all failures of persons employed by the Company to disclose material information otherwise required to be reported. The effectiveness of the Company’s control and procedures could also be limited by simple errors or faulty judgments. In addition, as the Company continues to expand, the challenges involved in implementing appropriate internal control over financial reporting will increase and will require that the Company continues to improve our internal control over financial reporting.