United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-21822

(Investment Company Act File Number)

Federated Hermes Managed Pool Series

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 12/31/20

Date of Reporting Period: 12/31/20

| Item 1. | Reports to Stockholders |

|

Ticker FCSPX

|

Federated Hermes Corporate Bond Strategy Portfolio

A Portfolio of Federated Hermes Managed Pool Series

|

|

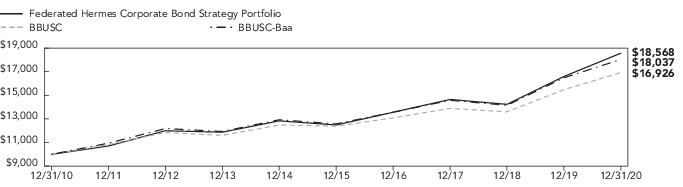

1 Year

|

5 Years

|

10 Years

|

|

Fund

|

11.88%

|

8.25%

|

6.38%

|

|

BBUSC

|

9.35%

|

6.44%

|

5.40%

|

|

BBUSC-Baa

|

9.43%

|

7.48%

|

6.08%

|

|

Security Type

|

Percentage of

Total Net Assets

|

|

Corporate Debt Securities

|

92.9%

|

|

Foreign Government/Agency

|

4.0%

|

|

Cash Equivalents2

|

2.2%

|

|

Securities Lending Collateral3

|

0.5%

|

|

Derivative Contracts4,5

|

0.0%

|

|

Other Assets and Liabilities—Net6

|

0.4%

|

|

TOTAL

|

100%

|

|

1

|

See the Fund’s Prospectus and Statement of Additional Information for a description of these security types.

|

|

2

|

Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements.

|

|

3

|

Represents cash collateral received for portfolio securities on loan that may be invested in affiliated money market funds,

other money market instruments and/or

repurchase agreements.

|

|

4

|

Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts

may consist of futures, forwards,

options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may

indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More

complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values

or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report.

|

|

5

|

Represents less than 0.1%.

|

|

6

|

Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities.

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—92.9%

|

|

|

|

|

Basic Industry - Chemicals—0.9%

|

|

|

$ 90,000

|

|

Albemarle Corp., 4.150%, 12/1/2024

|

$99,909

|

|

90,000

|

|

Albemarle Corp., Sr. Unsecd. Note, 5.450%, 12/1/2044

|

107,921

|

|

110,000

|

|

Nutrition & Biosciences, Inc., Sr. Unsecd. Note, 144A, 1.832%, 10/15/2027

|

113,395

|

|

300,000

|

|

Nutrition & Biosciences, Inc., Sr. Unsecd. Note, 144A, 2.300%, 11/1/2030

|

309,095

|

|

200,000

|

|

RPM International, Inc., Sr. Unsecd. Note, 4.550%, 3/1/2029

|

233,279

|

|

300,000

|

|

RPM International, Inc., Sr. Unsecd. Note, 5.250%, 6/1/2045

|

368,240

|

|

|

|

TOTAL

|

1,231,839

|

|

|

|

Basic Industry - Metals & Mining—0.9%

|

|

|

235,000

|

|

Anglogold Ashanti Holdings PLC, Sr. Note, 6.500%, 4/15/2040

|

295,802

|

|

40,000

|

|

Carpenter Technology Corp., Sr. Unsecd. Note, 4.450%, 3/1/2023

|

41,910

|

|

225,000

|

|

Reliance Steel & Aluminum Co., Sr. Unsecd. Note, 4.500%, 4/15/2023

|

242,815

|

|

250,000

|

|

Southern Copper Corp., Sr. Unsecd. Note, 6.750%, 4/16/2040

|

376,307

|

|

170,000

|

|

Worthington Industries, Inc., Sr. Unsecd. Note, 4.300%, 8/1/2032

|

197,405

|

|

105,000

|

|

Worthington Industries, Inc., Sr. Unsecd. Note, 4.550%, 4/15/2026

|

119,638

|

|

|

|

TOTAL

|

1,273,877

|

|

|

|

Basic Industry - Paper—0.5%

|

|

|

150,000

|

|

International Paper Co., Sr. Unsecd. Note, 3.000%, 2/15/2027

|

165,314

|

|

300,000

|

|

International Paper Co., Sr. Unsecd. Note, 4.400%, 8/15/2047

|

392,843

|

|

100,000

|

|

Weyerhaeuser Co., Sr. Unsecd. Note, 7.375%, 3/15/2032

|

150,064

|

|

|

|

TOTAL

|

708,221

|

|

|

|

Capital Goods - Aerospace & Defense—4.3%

|

|

|

230,000

|

|

BAE Systems Holdings, Inc., Sr. Unsecd. Note, 144A, 3.850%, 12/15/2025

|

261,109

|

|

200,000

|

|

BAE Systems PLC, Sr. Unsecd. Note, 144A, 3.000%, 9/15/2050

|

209,310

|

|

300,000

|

|

Boeing Co., Sr. Unsecd. Note, 2.700%, 2/1/2027

|

312,096

|

|

995,000

|

1

|

Boeing Co., Sr. Unsecd. Note, 2.950%, 2/1/2030

|

1,030,056

|

|

745,000

|

|

Boeing Co., Sr. Unsecd. Note, 3.950%, 8/1/2059

|

797,384

|

|

500,000

|

|

Boeing Co., Sr. Unsecd. Note, 4.508%, 5/1/2023

|

540,618

|

|

175,000

|

|

Boeing Co., Sr. Unsecd. Note, 5.705%, 5/1/2040

|

226,718

|

|

360,000

|

|

Embraer Netherlands BV, Sr. Unsecd. Note, 5.050%, 6/15/2025

|

382,144

|

|

100,000

|

|

Embraer SA, Sr. Unsecd. Note, 5.150%, 6/15/2022

|

102,813

|

|

170,000

|

|

Hexcel Corp., Sr. Unsecd. Note, 3.950%, 2/15/2027

|

183,830

|

|

240,000

|

|

Huntington Ingalls Industries, Inc., Sr. Unsecd. Note, 3.483%, 12/1/2027

|

269,327

|

|

125,000

|

|

Leidos, Inc., Unsecd. Note, 144A, 3.625%, 5/15/2025

|

139,917

|

|

350,000

|

|

Leidos, Inc., Unsecd. Note, 144A, 4.375%, 5/15/2030

|

419,692

|

|

740,000

|

|

Northrop Grumman Corp., Sr. Unsecd. Note, 3.250%, 1/15/2028

|

836,979

|

|

136,000

|

2

|

Textron Financial Corp., Jr. Sub. Note, 144A, 1.956% (3-month USLIBOR +1.735%), 2/15/2042

|

99,511

|

|

370,000

|

|

Textron, Inc., Sr. Unsecd. Note, 2.450%, 3/15/2031

|

381,548

|

|

50,000

|

|

Textron, Inc., Sr. Unsecd. Note, 4.300%, 3/1/2024

|

54,960

|

|

|

|

TOTAL

|

6,248,012

|

|

|

|

Capital Goods - Building Materials—0.6%

|

|

|

100,000

|

|

Allegion PLC, Sr. Unsecd. Note, 3.500%, 10/1/2029

|

111,085

|

|

125,000

|

|

Allegion US Holdings Co., Inc., Sr. Unsecd. Note, 3.200%, 10/1/2024

|

133,622

|

|

220,000

|

|

Allegion US Holdings Co., Inc., Sr. Unsecd. Note, 3.550%, 10/1/2027

|

240,863

|

|

200,000

|

|

Carrier Global Corp., Sr. Unsecd. Note, 2.700%, 2/15/2031

|

215,134

|

|

170,000

|

|

Masco Corp., Sr. Unsecd. Note, 4.500%, 5/15/2047

|

213,562

|

|

|

|

TOTAL

|

914,266

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Capital Goods - Construction Machinery—0.4%

|

|

|

$ 480,000

|

|

CNH Industrial NV, Sr. Unsecd. Note, Series MTN, 3.850%, 11/15/2027

|

$541,346

|

|

|

|

Capital Goods - Diversified Manufacturing—3.6%

|

|

|

1,900,000

|

|

General Electric Co., Sr. Unsecd. Note, 3.375%, 3/11/2024

|

2,066,772

|

|

400,000

|

|

General Electric Co., Sr. Unsecd. Note, 4.250%, 5/1/2040

|

472,899

|

|

415,000

|

|

Lennox International, Inc., Sr. Unsecd. Note, 1.700%, 8/1/2027

|

422,535

|

|

155,000

|

|

Otis Worldwide Corp., Sr. Unsecd. Note, Series WI, 2.565%, 2/15/2030

|

166,620

|

|

110,000

|

|

Roper Technologies, Inc., Sr. Unsecd. Note, 2.950%, 9/15/2029

|

120,926

|

|

60,000

|

|

Roper Technologies, Inc., Sr. Unsecd. Note, 3.850%, 12/15/2025

|

68,408

|

|

245,000

|

|

Roper Technologies, Inc., Sr. Unsecd. Note, 4.200%, 9/15/2028

|

292,374

|

|

600,000

|

|

United Technologies Corp., Sr. Unsecd. Note, 4.125%, 11/16/2028

|

715,458

|

|

350,000

|

|

United Technologies Corp., Sr. Unsecd. Note, 4.150%, 5/15/2045

|

443,808

|

|

160,000

|

|

Wabtec Corp., Sr. Unsecd. Note, 3.200%, 6/15/2025

|

172,760

|

|

285,000

|

|

Xylem, Inc., Sr. Unsecd. Note, 2.250%, 1/30/2031

|

300,378

|

|

|

|

TOTAL

|

5,242,938

|

|

|

|

Capital Goods - Packaging—0.6%

|

|

|

180,000

|

|

Packaging Corp. of America, Sr. Unsecd. Note, 3.650%, 9/15/2024

|

197,389

|

|

80,000

|

|

Packaging Corp. of America, Sr. Unsecd. Note, 4.500%, 11/1/2023

|

88,249

|

|

220,000

|

|

Sonoco Products Co., Sr. Unsecd. Note, 5.750%, 11/1/2040

|

299,265

|

|

120,000

|

|

WestRock Co., Sr. Unsecd. Note, 4.000%, 3/1/2023

|

127,534

|

|

150,000

|

|

WestRock Co., Sr. Unsecd. Note, Series WI, 4.000%, 3/15/2028

|

174,068

|

|

|

|

TOTAL

|

886,505

|

|

|

|

Communications - Cable & Satellite—1.8%

|

|

|

440,000

|

|

CCO Safari II LLC, 6.484%, 10/23/2045

|

624,798

|

|

380,000

|

|

Charter Communications Operating LLC, 5.375%, 5/1/2047

|

474,299

|

|

250,000

|

|

Charter Communications Operating, LLC/Charter Communications Operating Capital Corp., Sec. Fac. Bond, 3.850%, 4/1/2061

|

251,941

|

|

600,000

|

|

Charter Communications, Inc., 4.200%, 3/15/2028

|

692,467

|

|

165,000

|

|

Cox Communications, Inc., Sr. Unsecd. Note, 144A, 3.350%, 9/15/2026

|

185,580

|

|

300,000

|

|

Time Warner Cable, Inc., Company Guarantee, 5.500%, 9/1/2041

|

386,231

|

|

|

|

TOTAL

|

2,615,316

|

|

|

|

Communications - Media & Entertainment—2.7%

|

|

|

500,000

|

|

Discovery Communications LLC, Sr. Unsecd. Note, 4.650%, 5/15/2050

|

625,941

|

|

135,000

|

|

Fox Corp, Sr. Unsecd. Note, Series WI, 4.709%, 1/25/2029

|

163,887

|

|

375,000

|

|

Fox Corp, Sr. Unsecd. Note, Series WI, 5.576%, 1/25/2049

|

548,175

|

|

250,000

|

|

Grupo Televisa S.A., 6.625%, 3/18/2025

|

304,600

|

|

250,000

|

|

Grupo Televisa S.A., Sr. Unsecd. Note, 5.000%, 5/13/2045

|

302,268

|

|

70,000

|

|

Interpublic Group of Cos., Inc., Sr. Unsecd. Note, 4.000%, 3/15/2022

|

72,748

|

|

200,000

|

|

Omnicom Group, Inc., Sr. Unsecd. Note, 3.650%, 11/1/2024

|

220,849

|

|

300,000

|

|

Omnicom Group, Inc., Sr. Unsecd. Note, 4.200%, 6/1/2030

|

360,579

|

|

200,000

|

|

ViacomCBS, Inc., Sr. Unsecd. Note, 3.700%, 8/15/2024

|

219,366

|

|

200,000

|

|

ViacomCBS, Inc., Sr. Unsecd. Note, 4.900%, 8/15/2044

|

249,808

|

|

475,000

|

|

ViacomCBS, Inc., Sr. Unsecd. Note, 4.950%, 1/15/2031

|

595,568

|

|

190,000

|

|

ViacomCBS, Inc., Sr. Unsecd. Note, Series WI, 3.700%, 6/1/2028

|

217,201

|

|

|

|

TOTAL

|

3,880,990

|

|

|

|

Communications - Telecom Wireless—4.4%

|

|

|

300,000

|

|

American Tower Corp., Sr. Unsecd. Note, 2.100%, 6/15/2030

|

308,255

|

|

300,000

|

|

American Tower Corp., Sr. Unsecd. Note, 3.100%, 6/15/2050

|

309,024

|

|

250,000

|

|

American Tower Corp., Sr. Unsecd. Note, 3.800%, 8/15/2029

|

290,942

|

|

100,000

|

|

American Tower Corp., Sr. Unsecd. Note, 4.400%, 2/15/2026

|

115,939

|

|

200,000

|

|

American Tower Corp., Sr. Unsecd. Note, 5.000%, 2/15/2024

|

226,509

|

|

280,000

|

|

Bell Canada, Sr. Unsecd. Note, 4.464%, 4/1/2048

|

374,507

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Communications - Telecom Wireless—continued

|

|

|

$ 300,000

|

|

Crown Castle International Corp., Sr. Unsecd. Note, 2.250%, 1/15/2031

|

$311,411

|

|

400,000

|

|

Crown Castle International Corp., Sr. Unsecd. Note, 4.450%, 2/15/2026

|

463,041

|

|

200,000

|

|

Crown Castle International Corp., Sr. Unsecd. Note, 5.200%, 2/15/2049

|

272,593

|

|

300,000

|

|

TELUS Corp., Sr. Unsecd. Note, 2.800%, 2/16/2027

|

329,935

|

|

600,000

|

|

T-Mobile USA, Inc., Sec. Fac. Bond, 144A, 3.875%, 4/15/2030

|

695,556

|

|

415,000

|

|

T-Mobile USA, Inc., Sec. Fac. Bond, 144A, 4.500%, 4/15/2050

|

512,633

|

|

550,000

|

|

T-Mobile USA, Inc., Sr. Sub. Note, 144A, 3.000%, 2/15/2041

|

571,227

|

|

230,000

|

|

Vodafone Group PLC, Sr. Unsecd. Note, 4.125%, 5/30/2025

|

263,112

|

|

350,000

|

|

Vodafone Group PLC, Sr. Unsecd. Note, 4.250%, 9/17/2050

|

434,332

|

|

580,000

|

|

Vodafone Group PLC, Sr. Unsecd. Note, 5.250%, 5/30/2048

|

806,963

|

|

|

|

TOTAL

|

6,285,979

|

|

|

|

Communications - Telecom Wirelines—6.6%

|

|

|

877,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 2.550%, 12/1/2033

|

903,752

|

|

350,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 2.750%, 6/1/2031

|

374,238

|

|

300,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 3.500%, 6/1/2041

|

323,912

|

|

1,000,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 3.650%, 6/1/2051

|

1,047,143

|

|

255,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 3.850%, 6/1/2060

|

267,863

|

|

500,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 4.300%, 2/15/2030

|

597,710

|

|

500,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 4.350%, 3/1/2029

|

596,322

|

|

400,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 5.450%, 3/1/2047

|

541,536

|

|

245,000

|

|

AT&T, Inc., Sr. Unsecd. Note, 6.375%, 3/1/2041

|

360,147

|

|

545,000

|

|

AT&T, Inc., Sr. Unsecd. Note, Series WI, 5.300%, 8/15/2058

|

719,351

|

|

225,000

|

|

Telefonica Emisiones SAU, Company Guarantee, 5.462%, 2/16/2021

|

226,263

|

|

180,000

|

|

Telefonica Emisiones SAU, Sr. Unsecd. Note, 5.213%, 3/8/2047

|

232,418

|

|

240,000

|

|

Telefonica Emisiones SAU, Sr. Unsecd. Note, 5.520%, 3/1/2049

|

323,867

|

|

40,000

|

|

Telefonica SA, Company Guarantee, 7.045%, 6/20/2036

|

59,729

|

|

500,000

|

|

Verizon Communications, Inc., Sr. Unsecd. Note, 1.680%, 10/30/2030

|

498,577

|

|

30,000

|

|

Verizon Communications, Inc., Sr. Unsecd. Note, 4.000%, 3/22/2050

|

36,394

|

|

750,000

|

|

Verizon Communications, Inc., Sr. Unsecd. Note, 4.125%, 3/16/2027

|

884,763

|

|

390,000

|

|

Verizon Communications, Inc., Sr. Unsecd. Note, 4.125%, 8/15/2046

|

479,667

|

|

210,000

|

|

Verizon Communications, Inc., Sr. Unsecd. Note, 4.522%, 9/15/2048

|

273,870

|

|

534,000

|

|

Verizon Communications, Inc., Sr. Unsecd. Note, 4.672%, 3/15/2055

|

717,610

|

|

|

|

TOTAL

|

9,465,132

|

|

|

|

Consumer Cyclical - Automotive—3.0%

|

|

|

470,000

|

|

Fiat Chrysler Automobiles NV, Sr. Unsecd. Note, 5.250%, 4/15/2023

|

504,663

|

|

200,000

|

|

Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.336%, 3/18/2021

|

200,750

|

|

250,000

|

|

Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.339%, 3/28/2022

|

252,813

|

|

250,000

|

|

Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 3.350%, 11/1/2022

|

254,715

|

|

200,000

|

|

General Motors Co., Sr. Unsecd. Note, 4.000%, 4/1/2025

|

221,666

|

|

455,000

|

|

General Motors Co., Sr. Unsecd. Note, 5.200%, 4/1/2045

|

552,585

|

|

110,000

|

|

General Motors Co., Sr. Unsecd. Note, 6.750%, 4/1/2046

|

158,904

|

|

50,000

|

|

General Motors Financial Co., Inc., Sr. Unsecd. Note, 2.700%, 8/20/2027

|

53,085

|

|

400,000

|

|

General Motors Financial Co., Inc., Sr. Unsecd. Note, 3.950%, 4/13/2024

|

435,815

|

|

250,000

|

|

General Motors Financial Co., Inc., Sr. Unsecd. Note, 4.300%, 7/13/2025

|

280,615

|

|

300,000

|

|

General Motors Financial Co., Inc., Unsecd. Note, 3.500%, 11/7/2024

|

324,481

|

|

235,000

|

|

Hyundai Capital America, Sr. Unsecd. Note, 144A, 2.375%, 2/10/2023

|

242,431

|

|

380,000

|

|

Hyundai Capital America, Sr. Unsecd. Note, 144A, 2.375%, 10/15/2027

|

398,862

|

|

200,000

|

|

Volkswagen Group of America Finance LLC, Sr. Unsecd. Note, 144A, 4.000%, 11/12/2021

|

206,163

|

|

200,000

|

|

Volkswagen Group of America Finance LLC, Sr. Unsecd. Note, 144A, 4.250%, 11/13/2023

|

220,158

|

|

|

|

TOTAL

|

4,307,706

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Consumer Cyclical - Retailers—4.5%

|

|

|

$ 150,000

|

|

Advance Auto Parts, Inc., Sr. Unsecd. Note, 1.750%, 10/1/2027

|

$152,510

|

|

675,000

|

|

Advance Auto Parts, Inc., Sr. Unsecd. Note, Series WI, 3.900%, 4/15/2030

|

777,311

|

|

600,000

|

|

Alimentation Couche-Tard, Inc., Sr. Unsecd. Note, 144A, 3.800%, 1/25/2050

|

712,846

|

|

130,000

|

|

AutoNation, Inc., Sr. Unsecd. Note, 4.500%, 10/1/2025

|

144,620

|

|

430,000

|

|

AutoNation, Inc., Sr. Unsecd. Note, 4.750%, 6/1/2030

|

517,763

|

|

55,000

|

|

AutoZone, Inc., Sr. Unsecd. Note, 3.125%, 4/21/2026

|

60,920

|

|

345,000

|

|

AutoZone, Inc., Sr. Unsecd. Note, 4.000%, 4/15/2030

|

409,305

|

|

50,000

|

|

CVS Health Corp., Sr. Unsecd. Note, 3.875%, 7/20/2025

|

56,692

|

|

880,000

|

|

CVS Health Corp., Sr. Unsecd. Note, 5.050%, 3/25/2048

|

1,192,749

|

|

520,000

|

|

CVS Health Corp., Sr. Unsecd. Note, 5.125%, 7/20/2045

|

700,136

|

|

300,000

|

|

Dollar General Corp., Sr. Unsecd. Note, 4.125%, 5/1/2028

|

354,109

|

|

310,000

|

|

Dollar General Corp., Sr. Unsecd. Note, 4.150%, 11/1/2025

|

355,868

|

|

450,000

|

|

Dollar Tree, Inc., Sr. Unsecd. Note, 3.700%, 5/15/2023

|

481,836

|

|

260,000

|

|

O’Reilly Automotive, Inc., Sr. Unsecd. Note, 1.750%, 3/15/2031

|

260,835

|

|

160,000

|

|

O’Reilly Automotive, Inc., Sr. Unsecd. Note, 4.200%, 4/1/2030

|

193,012

|

|

160,000

|

|

Tractor Supply Co., Sr. Unsecd. Note, 1.750%, 11/1/2030

|

161,072

|

|

|

|

TOTAL

|

6,531,584

|

|

|

|

Consumer Cyclical - Services—0.9%

|

|

|

235,000

|

|

Booking Holdings, Inc., Sr. Unsecd. Note, 4.625%, 4/13/2030

|

292,191

|

|

350,000

|

|

Expedia Group, Inc., Sr. Unsecd. Note, 3.800%, 2/15/2028

|

376,231

|

|

450,000

|

|

IHS Markit Ltd., Sr. Unsecd. Note, 4.750%, 8/1/2028

|

555,032

|

|

|

|

TOTAL

|

1,223,454

|

|

|

|

Consumer Non-Cyclical - Food/Beverage—6.8%

|

|

|

500,000

|

|

Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 3.650%, 2/1/2026

|

565,252

|

|

1,000,000

|

|

Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.900%, 2/1/2046

|

1,305,516

|

|

100,000

|

|

Anheuser-Busch InBev Finance, Inc., 4.900%, 2/1/2046

|

128,706

|

|

300,000

|

|

Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.350%, 6/1/2040

|

368,597

|

|

500,000

|

|

Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.439%, 10/6/2048

|

622,387

|

|

500,000

|

|

Anheuser-Busch InBev Worldwide, Inc., Sr. Unsecd. Note, 4.750%, 1/23/2029

|

616,994

|

|

125,000

|

|

Bacardi Ltd., Sr. Unsecd. Note, 144A, 2.750%, 7/15/2026

|

132,593

|

|

710,000

|

|

Conagra Brands, Inc., Sr. Unsecd. Note, 1.375%, 11/1/2027

|

716,846

|

|

250,000

|

|

Constellation Brands, Inc., Sr. Unsecd. Note, 5.250%, 11/15/2048

|

351,773

|

|

210,000

|

|

Flowers Foods, Inc., Sr. Unsecd. Note, 3.500%, 10/1/2026

|

234,330

|

|

365,000

|

|

General Mills, Inc., Sr. Unsecd. Note, 4.550%, 4/17/2038

|

469,997

|

|

80,000

|

|

General Mills, Inc., Sr. Unsecd. Note, 4.700%, 4/17/2048

|

112,201

|

|

200,000

|

|

Grupo Bimbo S.A.B. de CV, Sr. Unsecd. Note, 144A, 3.875%, 6/27/2024

|

219,619

|

|

300,000

|

|

Grupo Bimbo S.A.B. de CV, Sr. Unsecd. Note, 144A, 4.500%, 1/25/2022

|

312,109

|

|

150,000

|

|

Heineken NV, Sr. Unsecd. Note, 144A, 4.350%, 3/29/2047

|

193,534

|

|

250,000

|

|

Kerry Group Financial Services, Sr. Unsecd. Note, 144A, 3.200%, 4/9/2023

|

262,481

|

|

220,000

|

|

Keurig Dr Pepper, Inc., Sr. Unsecd. Note, 4.417%, 5/25/2025

|

253,747

|

|

250,000

|

|

Keurig Dr Pepper, Inc., Sr. Unsecd. Note, 5.085%, 5/25/2048

|

353,657

|

|

250,000

|

|

McCormick & Co., Inc., Sr. Unsecd. Note, 3.400%, 8/15/2027

|

281,239

|

|

140,000

|

|

Smithfield Foods, Inc., Sr. Unsecd. Note, 144A, 2.650%, 10/3/2021

|

141,274

|

|

150,000

|

|

Smithfield Foods, Inc., Sr. Unsecd. Note, 144A, 3.000%, 10/15/2030

|

158,993

|

|

300,000

|

|

Smithfield Foods, Inc., Sr. Unsecd. Note, 144A, 4.250%, 2/1/2027

|

333,754

|

|

350,000

|

|

Smucker (J.M.) Co., Sr. Unsecd. Note, 2.375%, 3/15/2030

|

371,027

|

|

300,000

|

|

Smucker (J.M.) Co., Sr. Unsecd. Note, 3.500%, 3/15/2025

|

334,707

|

|

200,000

|

|

Tyson Foods, Inc., 3.950%, 8/15/2024

|

222,283

|

|

585,000

|

|

Tyson Foods, Inc., Sr. Unsecd. Note, 3.550%, 6/2/2027

|

668,909

|

|

|

|

TOTAL

|

9,732,525

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Consumer Non-Cyclical - Health Care—2.1%

|

|

|

$ 165,000

|

|

Agilent Technologies, Inc., Sr. Unsecd. Note, 2.100%, 6/4/2030

|

$171,592

|

|

155,000

|

|

Agilent Technologies, Inc., Sr. Unsecd. Note, 2.750%, 9/15/2029

|

169,332

|

|

120,000

|

|

Agilent Technologies, Inc., Sr. Unsecd. Note, 3.200%, 10/1/2022

|

124,796

|

|

350,000

|

|

Alcon Finance Corp., Sr. Unsecd. Note, 144A, 2.600%, 5/27/2030

|

373,217

|

|

220,000

|

|

Alcon Finance Corp., Sr. Unsecd. Note, 144A, 3.000%, 9/23/2029

|

240,167

|

|

55,000

|

|

Becton Dickinson & Co., Sr. Unsecd. Note, 3.734%, 12/15/2024

|

60,999

|

|

300,000

|

|

Becton Dickinson & Co., Sr. Unsecd. Note, 4.669%, 6/6/2047

|

393,934

|

|

204,000

|

|

Becton Dickinson & Co., Sr. Unsecd. Note, 4.685%, 12/15/2044

|

263,539

|

|

295,000

|

|

Danaher Corp., Sr. Unsecd. Note, 2.600%, 10/1/2050

|

306,314

|

|

125,000

|

|

Dentsply Sirona, Inc., Sr. Unsecd. Note, 3.250%, 6/1/2030

|

139,309

|

|

40,000

|

|

Laboratory Corp. of America Holdings, Sr. Unsecd. Note, 3.750%, 8/23/2022

|

41,854

|

|

550,000

|

|

PerkinElmer, Inc., Sr. Unsecd. Note, 3.300%, 9/15/2029

|

620,979

|

|

85,000

|

|

Thermo Fisher Scientific, Inc., Sr. Unsecd. Note, 4.133%, 3/25/2025

|

96,669

|

|

|

|

TOTAL

|

3,002,701

|

|

|

|

Consumer Non-Cyclical - Pharmaceuticals—5.1%

|

|

|

955,000

|

|

AbbVie, Inc., Sr. Unsecd. Note, 3.200%, 11/21/2029

|

1,071,352

|

|

1,060,000

|

|

AbbVie, Inc., Sr. Unsecd. Note, 4.250%, 11/21/2049

|

1,333,312

|

|

750,000

|

|

Amgen, Inc., Sr. Unsecd. Note, 2.450%, 2/21/2030

|

803,974

|

|

300,000

|

|

AstraZeneca PLC, Sr. Unsecd. Note, 2.375%, 6/12/2022

|

308,418

|

|

500,000

|

|

AstraZeneca PLC, Sr. Unsecd. Note, 4.000%, 1/17/2029

|

595,916

|

|

300,000

|

|

Bayer US Finance II LLC, Sr. Unsecd. Note, 144A, 4.625%, 6/25/2038

|

364,633

|

|

300,000

|

|

Bayer US Finance II LLC, Sr. Unsecd. Note, 144A, 4.875%, 6/25/2048

|

386,393

|

|

600,000

|

|

Biogen, Inc., Sr. Unsecd. Note, 3.150%, 5/1/2050

|

622,782

|

|

790,000

|

|

Royalty Pharma PLC, Sr. Unsecd. Note, 144A, 1.750%, 9/2/2027

|

813,534

|

|

52,000

|

|

Shire Acquisitions Investments Ireland DAC, Sr. Unsecd. Note, 2.400%, 9/23/2021

|

52,684

|

|

375,000

|

|

Takeda Pharmaceutical Co. Ltd., Sr. Unsecd. Note, 2.050%, 3/31/2030

|

383,940

|

|

500,000

|

|

Takeda Pharmaceutical Co. Ltd., Sr. Unsecd. Note, 3.025%, 7/9/2040

|

527,885

|

|

|

|

TOTAL

|

7,264,823

|

|

|

|

Consumer Non-Cyclical - Supermarkets—0.5%

|

|

|

250,000

|

|

Kroger Co., 3.950%, 1/15/2050

|

303,908

|

|

300,000

|

|

Kroger Co., Bond, 6.900%, 4/15/2038

|

453,445

|

|

|

|

TOTAL

|

757,353

|

|

|

|

Consumer Non-Cyclical - Tobacco—1.7%

|

|

|

200,000

|

|

Altria Group, Inc., Sr. Unsecd. Note, 4.800%, 2/14/2029

|

239,984

|

|

500,000

|

|

Altria Group, Inc., Sr. Unsecd. Note, 5.950%, 2/14/2049

|

700,508

|

|

500,000

|

|

Bat Capital Corp., Sr. Unsecd. Note, Series WI, 3.557%, 8/15/2027

|

556,846

|

|

200,000

|

|

Bat Capital Corp., Sr. Unsecd. Note, Series WI, 4.540%, 8/15/2047

|

222,100

|

|

300,000

|

|

Reynolds American, Inc., Sr. Unsecd. Note, 5.850%, 8/15/2045

|

383,912

|

|

300,000

|

|

Reynolds American, Inc., Sr. Unsecd. Note, 7.000%, 8/4/2041

|

403,725

|

|

|

|

TOTAL

|

2,507,075

|

|

|

|

Energy - Independent—1.4%

|

|

|

250,000

|

|

Canadian Natural Resources Ltd., Sr. Unsecd. Note, 2.050%, 7/15/2025

|

262,471

|

|

590,000

|

1

|

Canadian Natural Resources Ltd., Sr. Unsecd. Note, 3.800%, 4/15/2024

|

642,753

|

|

390,000

|

|

Cimarex Energy Co., Sr. Unsecd. Note, 3.900%, 5/15/2027

|

430,030

|

|

175,000

|

|

Cimarex Energy Co., Sr. Unsecd. Note, 4.375%, 3/15/2029

|

199,384

|

|

500,000

|

|

Marathon Oil Corp., Sr. Unsecd. Note, 3.850%, 6/1/2025

|

536,415

|

|

|

|

TOTAL

|

2,071,053

|

|

|

|

Energy - Integrated—0.9%

|

|

|

250,000

|

|

Husky Energy, Inc., 4.000%, 4/15/2024

|

268,157

|

|

240,000

|

1

|

Husky Energy, Inc., Sr. Unsecd. Note, 4.400%, 4/15/2029

|

267,276

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Energy - Integrated—continued

|

|

|

$ 100,000

|

|

Petro-Canada, Bond, 5.350%, 7/15/2033

|

$122,117

|

|

130,000

|

|

Petroleos Mexicanos, Sr. Unsecd. Note, 6.500%, 3/13/2027

|

137,142

|

|

470,000

|

|

Suncor Energy, Inc., Sr. Unsecd. Note, 2.800%, 5/15/2023

|

494,778

|

|

|

|

TOTAL

|

1,289,470

|

|

|

|

Energy - Midstream—6.0%

|

|

|

130,000

|

|

Boardwalk Pipeline Partners LP, Sr. Unsecd. Note, 3.400%, 2/15/2031

|

135,855

|

|

400,000

|

|

Boardwalk Pipeline Partners LP, Sr. Unsecd. Note, 4.800%, 5/3/2029

|

458,772

|

|

100,000

|

|

Columbia Pipeline Group, Inc., Sr. Unsecd. Note, 4.500%, 6/1/2025

|

115,093

|

|

100,000

|

|

Columbia Pipeline Group, Inc., Sr. Unsecd. Note, 5.800%, 6/1/2045

|

136,815

|

|

350,000

|

|

Energy Transfer Operating, Sr. Unsecd. Note, 5.000%, 5/15/2050

|

379,327

|

|

600,000

|

|

Energy Transfer Partners LP, Sr. Unsecd. Note, 4.900%, 2/1/2024

|

657,235

|

|

250,000

|

|

Energy Transfer Partners LP, Sr. Unsecd. Note, 5.300%, 4/15/2047

|

279,201

|

|

250,000

|

|

Energy Transfer Partners LP, Sr. Unsecd. Note, 6.125%, 12/15/2045

|

296,975

|

|

200,000

|

|

Enterprise Products Operating LLC, Sr. Unsecd. Note, 3.700%, 1/31/2051

|

220,574

|

|

200,000

|

|

Enterprise Products Operating LLC, Sr. Unsecd. Note, 4.250%, 2/15/2048

|

234,900

|

|

500,000

|

|

Enterprise Products Operating LLC, Sr. Unsecd. Note, 4.850%, 3/15/2044

|

621,219

|

|

400,000

|

|

Kinder Morgan Energy Partners LP, 4.250%, 9/1/2024

|

446,130

|

|

495,000

|

|

Kinder Morgan Energy Partners LP, Sr. Unsecd. Note, 6.375%, 3/1/2041

|

650,913

|

|

300,000

|

|

Kinder Morgan, Inc., 5.050%, 2/15/2046

|

367,695

|

|

300,000

|

|

Kinder Morgan, Inc., Sr. Unsecd. Note, 4.300%, 3/1/2028

|

352,115

|

|

350,000

|

|

MPLX LP, Sr. Unsecd. Note, 2.650%, 8/15/2030

|

367,211

|

|

395,000

|

|

MPLX LP, Sr. Unsecd. Note, 4.125%, 3/1/2027

|

455,769

|

|

200,000

|

|

MPLX LP, Sr. Unsecd. Note, 4.900%, 4/15/2058

|

238,162

|

|

80,000

|

|

MPLX LP, Sr. Unsecd. Note, Series WI, 4.250%, 12/1/2027

|

94,034

|

|

500,000

|

|

ONEOK, Inc., Sr. Unsecd. Note, 4.950%, 7/13/2047

|

558,664

|

|

290,000

|

|

TC Pipelines, LP, Sr. Unsecd. Note, 3.900%, 5/25/2027

|

326,503

|

|

200,000

|

|

Texas Eastern Transmission LP, Sr. Unsecd. Note, 144A, 2.800%, 10/15/2022

|

206,831

|

|

290,000

|

|

Williams Partners LP, Sr. Unsecd. Note, 3.900%, 1/15/2025

|

321,825

|

|

650,000

|

|

Williams Partners LP, Sr. Unsecd. Note, 4.900%, 1/15/2045

|

768,672

|

|

|

|

TOTAL

|

8,690,490

|

|

|

|

Energy - Refining—1.1%

|

|

|

200,000

|

|

Marathon Petroleum Corp., Sr. Unsecd. Note, 3.625%, 9/15/2024

|

218,437

|

|

150,000

|

|

Marathon Petroleum Corp., Sr. Unsecd. Note, 6.500%, 3/1/2041

|

201,397

|

|

245,000

|

|

Phillips 66, Sr. Unsecd. Note, 1.300%, 2/15/2026

|

249,354

|

|

190,000

|

|

Phillips 66, Sr. Unsecd. Note, 4.875%, 11/15/2044

|

240,008

|

|

140,000

|

|

Valero Energy Corp., Sr. Unsecd. Note, 4.000%, 4/1/2029

|

157,538

|

|

400,000

|

|

Valero Energy Corp., Sr. Unsecd. Note, 4.900%, 3/15/2045

|

466,546

|

|

|

|

TOTAL

|

1,533,280

|

|

|

|

Financial Institution - Banking—6.1%

|

|

|

410,000

|

|

Associated Banc-Corp., Sub. Note, 4.250%, 1/15/2025

|

444,645

|

|

200,000

|

|

Bank of America Corp., Sub. Note, Series L, 3.950%, 4/21/2025

|

225,538

|

|

300,000

|

|

Bank of America Corp., Sub. Note, Series L, 4.183%, 11/25/2027

|

348,213

|

|

800,000

|

|

Bank of America Corp., Sub. Note, Series MTN, 4.000%, 1/22/2025

|

899,437

|

|

500,000

|

|

Capital One Financial Corp., Sr. Unsecd. Note, 3.750%, 3/9/2027

|

570,872

|

|

255,000

|

|

Capital One Financial Corp., Sr. Unsecd. Note, 3.900%, 1/29/2024

|

279,442

|

|

480,000

|

|

Citigroup, Inc., 4.125%, 7/25/2028

|

561,658

|

|

250,000

|

|

Citigroup, Inc., 5.500%, 9/13/2025

|

300,762

|

|

750,000

|

|

Citigroup, Inc., Sub. Note, 3.875%, 3/26/2025

|

837,567

|

|

580,000

|

|

Citizens Financial Group, Inc., Sub. Note, 144A, 2.638%, 9/30/2032

|

614,710

|

|

200,000

|

|

Comerica, Inc., 3.800%, 7/22/2026

|

227,534

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Financial Institution - Banking—continued

|

|

|

$ 200,000

|

|

Compass Bank, Birmingham, Sub. Note, Series BKNT, 3.875%, 4/10/2025

|

$224,367

|

|

120,000

|

|

Fifth Third Bancorp, Sr. Unsecd. Note, 3.650%, 1/25/2024

|

130,932

|

|

200,000

|

|

Fifth Third Bancorp, Sr. Unsecd. Note, 3.950%, 3/14/2028

|

235,183

|

|

245,000

|

|

FNB Corp. (PA), Sr. Unsecd. Note, 2.200%, 2/24/2023

|

249,784

|

|

900,000

|

|

Goldman Sachs Group, Inc., Sub. Note, 4.250%, 10/21/2025

|

1,032,701

|

|

395,000

|

|

Huntington Bancshares, Inc., Sr. Unsecd. Note, 2.550%, 2/4/2030

|

423,897

|

|

450,000

|

|

Morgan Stanley, Sub. Note, 5.000%, 11/24/2025

|

538,682

|

|

175,000

|

|

Morgan Stanley, Sub. Note, Series MTN, 4.100%, 5/22/2023

|

189,980

|

|

250,000

|

|

Synovus Bank GA, Sr. Unsecd. Note, 2.289%, 2/10/2023

|

253,254

|

|

200,000

|

|

Truist Bank, Sub. Note, Series BKNT, 3.300%, 5/15/2026

|

223,909

|

|

|

|

TOTAL

|

8,813,067

|

|

|

|

Financial Institution - Broker/Asset Mgr/Exchange—1.0%

|

|

|

575,000

|

|

Jefferies Group LLC, Sr. Unsecd. Note, 2.750%, 10/15/2032

|

604,554

|

|

200,000

|

|

Raymond James Financial, Inc., Sr. Unsecd. Note, 4.650%, 4/1/2030

|

245,577

|

|

300,000

|

|

Stifel Financial Corp., 4.250%, 7/18/2024

|

337,336

|

|

200,000

|

|

Stifel Financial Corp., Sr. Unsecd. Note, 4.000%, 5/15/2030

|

228,865

|

|

|

|

TOTAL

|

1,416,332

|

|

|

|

Financial Institution - Finance Companies—1.4%

|

|

|

500,000

|

|

Discover Bank, Sr. Unsecd. Note, Series BKNT, 4.650%, 9/13/2028

|

598,652

|

|

575,000

|

|

GE Capital Funding LLC, Sr. Unsecd. Note, 144A, 4.400%, 5/15/2030

|

678,000

|

|

650,000

|

|

GE Capital International Funding, Inc., Sr. Unsecd. Note, 4.418%, 11/15/2035

|

775,961

|

|

|

|

TOTAL

|

2,052,613

|

|

|

|

Financial Institution - Insurance - Health—1.0%

|

|

|

500,000

|

|

CIGNA Corp., Sr. Unsecd. Note, 3.750%, 7/15/2023

|

540,629

|

|

500,000

|

|

CIGNA Corp., Sr. Unsecd. Note, 4.125%, 11/15/2025

|

576,075

|

|

250,000

|

|

CIGNA Corp., Sr. Unsecd. Note, 4.900%, 12/15/2048

|

343,799

|

|

|

|

TOTAL

|

1,460,503

|

|

|

|

Financial Institution - Insurance - Life—1.5%

|

|

|

300,000

|

|

American International Group, Inc., 4.500%, 7/16/2044

|

384,346

|

|

255,000

|

|

American International Group, Inc., Sr. Unsecd. Note, 4.125%, 2/15/2024

|

282,429

|

|

400,000

|

|

American International Group, Inc., Sr. Unsecd. Note, 4.375%, 1/15/2055

|

514,721

|

|

75,000

|

|

AXA-UAP, Sub. Note, 8.600%, 12/15/2030

|

116,890

|

|

110,000

|

|

Lincoln National Corp., Sr. Note, 7.000%, 6/15/2040

|

168,521

|

|

400,000

|

|

Lincoln National Corp., Sr. Unsecd. Note, 3.050%, 1/15/2030

|

446,776

|

|

100,000

|

|

MetLife, Inc., Jr. Sub. Note, 10.750%, 8/1/2039

|

171,524

|

|

50,000

|

|

Penn Mutual Life Insurance Co., Sr. Note, 144A, 7.625%, 6/15/2040

|

72,275

|

|

|

|

TOTAL

|

2,157,482

|

|

|

|

Financial Institution - Insurance - P&C—0.9%

|

|

|

500,000

|

|

CNA Financial Corp., Sr. Unsecd. Note, 3.900%, 5/1/2029

|

595,501

|

|

120,000

|

|

Hartford Financial Services Group, Inc., Sr. Unsecd. Note, 6.625%, 4/15/2042

|

173,124

|

|

13,000

|

|

Liberty Mutual Group, Inc., Sr. Unsecd. Note, 144A, 4.250%, 6/15/2023

|

14,154

|

|

412,000

|

|

Liberty Mutual Group, Inc., Sr. Unsecd. Note, 144A, 4.569%, 2/1/2029

|

506,708

|

|

|

|

TOTAL

|

1,289,487

|

|

|

|

Financial Institution - REIT - Apartment—0.8%

|

|

|

160,000

|

|

Mid-America Apartment Communities LP, 4.000%, 11/15/2025

|

181,301

|

|

150,000

|

|

Mid-America Apartment Communities LP, Sr. Unsecd. Note, 3.750%, 6/15/2024

|

163,528

|

|

160,000

|

|

Mid-America Apartment Communities LP, Sr. Unsub. Note, 1.700%, 2/15/2031

|

159,681

|

|

100,000

|

|

Post Apartment Homes LP, Sr. Unsecd. Note, 3.375%, 12/1/2022

|

104,387

|

|

80,000

|

|

UDR, Inc., Sr. Unsecd. Note, 3.100%, 11/1/2034

|

90,044

|

|

200,000

|

|

UDR, Inc., Sr. Unsecd. Note, Series GMTN, 3.500%, 1/15/2028

|

224,503

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Financial Institution - REIT - Apartment—continued

|

|

|

$ 250,000

|

|

UDR, Inc., Sr. Unsecd. Note, Series MTN, 2.100%, 8/1/2032

|

$255,034

|

|

|

|

TOTAL

|

1,178,478

|

|

|

|

Financial Institution - REIT - Healthcare—1.1%

|

|

|

375,000

|

|

Healthcare Trust of America, Sr. Unsecd. Note, 2.000%, 3/15/2031

|

375,634

|

|

245,000

|

|

Healthcare Trust of America, Sr. Unsecd. Note, 3.100%, 2/15/2030

|

267,900

|

|

300,000

|

|

Physicians Realty Trust, Sr. Unsecd. Note, 3.950%, 1/15/2028

|

325,186

|

|

500,000

|

|

Welltower, Inc., Sr. Unsecd. Note, 4.125%, 3/15/2029

|

585,834

|

|

|

|

TOTAL

|

1,554,554

|

|

|

|

Financial Institution - REIT - Office—0.8%

|

|

|

65,000

|

|

Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 1.875%, 2/1/2033

|

65,024

|

|

90,000

|

|

Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 3.950%, 1/15/2027

|

103,665

|

|

100,000

|

|

Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 3.950%, 1/15/2028

|

116,249

|

|

250,000

|

|

Alexandria Real Estate Equities, Inc., Sr. Unsecd. Note, 4.900%, 12/15/2030

|

318,612

|

|

500,000

|

|

Boston Properties LP, Sr. Unsecd. Note, 2.900%, 3/15/2030

|

538,963

|

|

|

|

TOTAL

|

1,142,513

|

|

|

|

Financial Institution - REIT - Other—0.7%

|

|

|

160,000

|

|

ProLogis LP, Sr. Unsecd. Note, 4.375%, 2/1/2029

|

196,619

|

|

240,000

|

|

WP Carey, Inc., Sr. Unsecd. Note, 2.400%, 2/1/2031

|

249,652

|

|

175,000

|

|

WP Carey, Inc., Sr. Unsecd. Note, 3.850%, 7/15/2029

|

201,222

|

|

300,000

|

|

WP Carey, Inc., Sr. Unsecd. Note, 4.600%, 4/1/2024

|

333,251

|

|

|

|

TOTAL

|

980,744

|

|

|

|

Financial Institution - REIT - Retail—1.1%

|

|

|

140,000

|

|

Kimco Realty Corp., Sr. Unsecd. Note, 2.800%, 10/1/2026

|

152,670

|

|

80,000

|

|

Kimco Realty Corp., Sr. Unsecd. Note, 3.400%, 11/1/2022

|

84,052

|

|

290,000

|

|

Kimco Realty Corp., Sr. Unsecd. Note, 3.800%, 4/1/2027

|

328,396

|

|

300,000

|

|

Regency Centers LP, Sr. Unsecd. Note, 3.700%, 6/15/2030

|

340,358

|

|

170,000

|

|

Regency Centers LP, Sr. Unsecd. Note, 4.125%, 3/15/2028

|

194,007

|

|

460,000

|

|

Tanger Properties LP, Sr. Unsecd. Note, 3.125%, 9/1/2026

|

475,139

|

|

45,000

|

|

Tanger Properties LP, Sr. Unsecd. Note, 3.875%, 12/1/2023

|

46,778

|

|

|

|

TOTAL

|

1,621,400

|

|

|

|

Technology—5.2%

|

|

|

1,380,000

|

|

Broadcom, Inc., Sr. Unsecd. Note, 4.110%, 9/15/2028

|

1,581,275

|

|

200,000

|

|

Broadcom, Inc., Sr. Unsecd. Note, 4.150%, 11/15/2030

|

231,659

|

|

250,000

|

|

Dell International LLC / EMC Corp., 144A, 4.000%, 7/15/2024

|

275,882

|

|

840,000

|

|

Diamond 1 Finance Corp./Diamond 2 Finance Corp., Sr. Secd. Note, 144A, 6.020%, 6/15/2026

|

1,026,112

|

|

205,000

|

|

Equifax, Inc., Sr. Unsecd. Note, 2.600%, 12/1/2024

|

219,769

|

|

250,000

|

|

Equifax, Inc., Sr. Unsecd. Note, Series 5Y, 3.950%, 6/15/2023

|

270,263

|

|

100,000

|

|

Equifax, Inc., Sr. Unsecd. Note, Series FXD, 3.600%, 8/15/2021

|

101,888

|

|

200,000

|

|

Experian Finance PLC., Sr. Unsecd. Note, 144A, 4.250%, 2/1/2029

|

241,001

|

|

90,000

|

|

Fidelity National Information Services, Inc., Sr. Unsecd. Note, 3.750%, 5/21/2029

|

105,685

|

|

375,000

|

|

Fiserv, Inc., Sr. Unsecd. Note, 3.500%, 7/1/2029

|

428,766

|

|

285,000

|

|

Fiserv, Inc., Sr. Unsecd. Note, 3.800%, 10/1/2023

|

310,558

|

|

100,000

|

|

Ingram Micro, Inc., Sr. Unsecd. Note, 5.000%, 8/10/2022

|

103,197

|

|

70,000

|

|

Ingram Micro, Inc., Sr. Unsecd. Note, 5.450%, 12/15/2024

|

80,586

|

|

450,000

|

|

Keysight Technologies, Inc., 4.550%, 10/30/2024

|

509,250

|

|

155,000

|

|

Lam Research Corp., Sr. Unsecd. Note, 4.000%, 3/15/2029

|

185,981

|

|

450,000

|

|

Micron Technology, Inc., Sr. Unsecd. Note, 4.640%, 2/6/2024

|

501,320

|

|

200,000

|

|

Micron Technology, Inc., Sr. Unsecd. Note, 4.975%, 2/6/2026

|

236,555

|

|

350,000

|

|

Molex Electronics Technologies LLC, Unsecd. Note, 144A, 3.900%, 4/15/2025

|

362,471

|

|

160,000

|

|

Total System Services, Inc., Sr. Unsecd. Note, 4.450%, 6/1/2028

|

190,035

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Technology—continued

|

|

|

$ 80,000

|

|

Total System Services, Inc., Sr. Unsecd. Note, 4.800%, 4/1/2026

|

$95,251

|

|

220,000

|

|

Verisk Analytics, Inc., Sr. Unsecd. Note, 4.125%, 9/12/2022

|

233,081

|

|

150,000

|

|

Verisk Analytics, Inc., Sr. Unsecd. Note, 4.125%, 3/15/2029

|

180,300

|

|

|

|

TOTAL

|

7,470,885

|

|

|

|

Transportation - Airlines—0.3%

|

|

|

140,000

|

|

Southwest Airlines Co., Sr. Unsecd. Note, 4.750%, 5/4/2023

|

152,206

|

|

175,000

|

|

Southwest Airlines Co., Sr. Unsecd. Note, 5.250%, 5/4/2025

|

202,797

|

|

|

|

TOTAL

|

355,003

|

|

|

|

Transportation - Railroads—1.1%

|

|

|

100,000

|

|

Canadian Pacific Railway Co., 7.125%, 10/15/2031

|

148,210

|

|

105,000

|

|

Canadian Pacific Railway Co., Sr. Unsecd. Note, 2.050%, 3/5/2030

|

110,492

|

|

200,000

|

|

Canadian Pacific Railway Co., Sr. Unsecd. Note, 4.450%, 3/15/2023

|

215,241

|

|

305,000

|

|

Kansas City Southern Industries, Inc., Sr. Unsecd. Note, 3.000%, 5/15/2023

|

317,923

|

|

200,000

|

|

Kansas City Southern Industries, Inc., Sr. Unsecd. Note, 4.700%, 5/1/2048

|

252,214

|

|

490,000

|

|

Union Pacific Corp., Sr. Unsecd. Note, 2.400%, 2/5/2030

|

528,265

|

|

|

|

TOTAL

|

1,572,345

|

|

|

|

Transportation - Services—1.6%

|

|

|

330,000

|

|

Enterprise Rent-A-Car USA Finance Co., Sr. Unsecd. Note, 144A, 5.625%, 3/15/2042

|

463,431

|

|

200,000

|

|

FedEx Corp., Sr. Unsecd. Note, 3.100%, 8/5/2029

|

223,643

|

|

550,000

|

|

FedEx Corp., Sr. Unsecd. Note, 4.050%, 2/15/2048

|

664,840

|

|

400,000

|

|

Penske Truck Leasing Co. LP & PTL Finance Corp., Sr. Unsecd. Note, 144A, 3.950%, 3/10/2025

|

448,284

|

|

220,000

|

|

Ryder System, Inc., Sr. Unsecd. Note, Series MTN, 2.900%, 12/1/2026

|

241,890

|

|

200,000

|

|

Ryder System, Inc., Sr. Unsecd. Note, Series MTN, 3.400%, 3/1/2023

|

211,930

|

|

|

|

TOTAL

|

2,254,018

|

|

|

|

Utility - Electric—5.0%

|

|

|

130,000

|

|

AEP Texas, Inc., Sr. Unsecd. Note, 3.850%, 10/1/2025

|

146,300

|

|

80,000

|

|

Ameren Corp., Sr. Unsecd. Note, 3.650%, 2/15/2026

|

90,316

|

|

95,000

|

|

American Electric Power Co., Inc., Sr. Unsecd. Note, Series F, 2.950%, 12/15/2022

|

99,239

|

|

200,000

|

|

Appalachian Power Co., Sr. Unsecd. Note, 7.000%, 4/1/2038

|

308,276

|

|

170,000

|

|

Black Hills Corp., Sr. Unsecd. Note, 2.500%, 6/15/2030

|

178,816

|

|

195,000

|

|

Dominion Energy, Inc., Jr. Sub. Note, 3.071%, 8/15/2024

|

210,584

|

|

130,000

|

|

Dominion Energy, Inc., Sr. Unsecd. Note, 4.250%, 6/1/2028

|

156,061

|

|

240,000

|

|

Duke Energy Corp., Sr. Unsecd. Note, 2.650%, 9/1/2026

|

261,638

|

|

500,000

|

|

EDP Finance BV, Sr. Unsecd. Note, 144A, 1.710%, 1/24/2028

|

500,247

|

|

300,000

|

|

EDP Finance BV, Sr. Unsecd. Note, 144A, 3.625%, 7/15/2024

|

327,632

|

|

740,000

|

|

Emera US Finance LP, Sr. Unsecd. Note, 4.750%, 6/15/2046

|

947,853

|

|

290,000

|

|

Enel Finance International NV, Sr. Unsecd. Note, 144A, 4.625%, 9/14/2025

|

337,808

|

|

200,000

|

|

Enel Finance International NV, Sr. Unsecd. Note, 144A, 4.875%, 6/14/2029

|

249,947

|

|

100,000

|

|

Exelon Corp., Sr. Unsecd. Note, 3.950%, 6/15/2025

|

113,208

|

|

95,000

|

|

Exelon Corp., Sr. Unsecd. Note, 4.700%, 4/15/2050

|

126,552

|

|

180,000

|

|

FirstEnergy Transmission LLC, Sr. Unsecd. Note, 144A, 4.550%, 4/1/2049

|

210,219

|

|

242,000

|

|

Fortis, Inc. / Canada, Sr. Unsecd. Note, 3.055%, 10/4/2026

|

266,639

|

|

290,000

|

|

National Rural Utilities Cooperative Finance Corp., Sr. Sub. Note, 5.250%, 4/20/2046

|

321,597

|

|

200,000

|

|

NextEra Energy Capital Holdings, Inc., Sr. Unsecd. Note, 3.550%, 5/1/2027

|

227,951

|

|

300,000

|

|

NiSource Finance Corp., Sr. Unsecd. Note, 3.950%, 3/30/2048

|

369,184

|

|

100,000

|

|

NiSource Finance Corp., Sr. Unsecd. Note, 4.375%, 5/15/2047

|

127,089

|

|

250,000

|

|

Northeast Utilities, Sr. Unsecd. Note, Series H, 3.150%, 1/15/2025

|

272,747

|

|

200,000

|

|

PPL Capital Funding, Inc., Sr. Unsecd. Note, 3.950%, 3/15/2024

|

218,499

|

|

200,000

|

|

PPL WEM Holdings PLC, Sr. Unsecd. Note, 144A, 5.375%, 5/1/2021

|

200,723

|

|

Principal

Amount

or Shares

|

|

|

Value

|

|

|

|

CORPORATE BONDS—continued

|

|

|

|

|

Utility - Electric—continued

|

|

|

$ 800,000

|

|

Southern Co., Jr. Sub. Note, Series B, 4.000%, 1/15/2051

|

$848,182

|

|

|

|

TOTAL

|

7,117,307

|

|

|

|

Utility - Natural Gas—1.9%

|

|

|

50,000

|

|

Dominion Energy Gas Holdings LLC, Sr. Unsecd. Note, Series B, 3.000%, 11/15/2029

|

55,468

|

|

65,000

|

|

Dominion Energy Gas Holdings LLC, Sr. Unsecd. Note, Series C, 3.900%, 11/15/2049

|

76,860

|

|

300,000

|

|

Enbridge Energy Partners LP, 5.875%, 10/15/2025

|

367,033

|

|

80,000

|

|

Enbridge Energy Partners LP, Sr. Unsecd. Note, 5.500%, 9/15/2040

|

98,906

|

|

300,000

|

|

Enbridge, Inc., Sr. Unsecd. Note, 3.125%, 11/15/2029

|

330,322

|

|

200,000

|

|

National Fuel Gas Co., Sr. Unsecd. Note, 3.750%, 3/1/2023

|

210,055

|

|

130,000

|

|

National Fuel Gas Co., Sr. Unsecd. Note, 3.950%, 9/15/2027

|

138,195

|

|

90,000

|

|

National Fuel Gas Co., Sr. Unsecd. Note, 4.900%, 12/1/2021

|

92,489

|

|

200,000

|

|

National Fuel Gas Co., Sr. Unsecd. Note, 5.500%, 1/15/2026

|

230,893

|

|

300,000

|

|

Sempra Energy, Sr. Unsecd. Note, 3.400%, 2/1/2028

|

342,349

|

|

200,000

|

|

Sempra Energy, Sr. Unsecd. Note, 3.550%, 6/15/2024

|

218,059

|

|

250,000

|

|

Sempra Energy, Sr. Unsecd. Note, 4.000%, 2/1/2048

|

297,897

|

|

250,000

|

|

Southern Natural Gas, Sr. Unsecd. Note, 144A, 4.800%, 3/15/2047

|

292,860

|

|

|

|

TOTAL

|

2,751,386

|

|

|

|

Utility - Natural Gas Distributor—0.1%

|

|

|

110,000

|

|

The East Ohio Gas Company, Sr. Unsecd. Note, 144A, 3.000%, 6/15/2050

|

119,952

|

|

|

|

TOTAL CORPORATE BONDS

(IDENTIFIED COST $117,555,730)

|

133,514,004

|

|

|

|

FOREIGN GOVERNMENTS/AGENCIES—4.0%

|

|

|

|

|

Sovereign—4.0%

|

|

|

400,000

|

|

Colombia, Government of, Sr. Unsecd. Note, 3.000%, 1/30/2030

|

419,204

|

|

450,000

|

|

Colombia, Government of, Sr. Unsecd. Note, 3.875%, 4/25/2027

|

500,850

|

|

855,000

|

|

Colombia, Government of, Sr. Unsecd. Note, 4.500%, 3/15/2029

|

988,594

|

|

700,000

|

|

Mexico, Government of, 3.750%, 1/11/2028

|

786,492

|

|

200,000

|

|

Mexico, Government of, Series MTN, 4.750%, 3/8/2044

|

237,750

|

|

206,000

|

|

Mexico, Government of, Series MTNA, 6.750%, 9/27/2034

|

289,430

|

|

800,000

|

|

Mexico, Government of, Sr. Unsecd. Note, 3.250%, 4/16/2030

|

863,816

|

|

700,000

|

|

Mexico, Government of, Sr. Unsecd. Note, 3.600%, 1/30/2025

|

779,569

|

|

300,000

|

|

Mexico, Government of, Sr. Unsecd. Note, 4.500%, 1/31/2050

|

351,375

|

|

250,000

|

|

Mexico, Government of, Sr. Unsecd. Note, 4.500%, 4/22/2029

|

293,500

|

|

190,000

|

|

Peru, Government of, 6.550%, 3/14/2037

|

288,325

|

|

|

|

TOTAL FOREIGN GOVERNMENTS/AGENCIES

(IDENTIFIED COST $5,149,954)

|

5,798,905

|

|

|

|

REPURCHASE AGREEMENT—2.2%

|

|

|

3,247,000

|

|

Interest in $1,000,000,000 joint repurchase agreement 0.08%, dated 12/31/2020 under which Bank of Montreal will repurchase

securities provided as collateral for $1,000,008,889 on 1/4/2021. The securities provided as collateral at the end of the

period

held with BNY Mellon as tri-party agent, were U.S. Government Agency and U.S. Treasury securities with various maturities

to

5/20/2069 and the market value of those underlying securities was $1,022,038,963.

(IDENTIFIED COST $3,247,000)

|

3,247,000

|

|

|

|

INVESTMENT COMPANY—0.5%

|

|

|

700,235

|

|

Federated Hermes Government Obligations Fund, Premier Shares, 0.01%3

(IDENTIFIED COST $700,235)

|

700,235

|

|

|

|

TOTAL INVESTMENT IN SECURITIES—99.6%

(IDENTIFIED COST $126,652,919)4

|

143,260,144

|

|

|

|

OTHER ASSETS AND LIABILITIES - NET—0.4%5

|

515,245

|

|

|

|

TOTAL NET ASSETS—100%

|

$143,775,389

|

|

Description

|

Number of

Contracts

|

Notional

Value

|

Expiration

Date

|

Value and

Unrealized

Appreciation

(Depreciation)

|

|

Long Futures:

|

|

|

|

|

|

6U.S. Treasury Notes 2-Year Long Futures

|

66

|

$14,584,453

|

March 2021

|

$12,752

|

|

6U.S. Treasury Ultra Bond Long Futures

|

7

|

$1,494,937

|

March 2021

|

$(29,055)

|

|

Short Future:

|

|

|

|

|

|

6U.S. Treasury Notes 10-Year Short Futures

|

58

|

$8,008,531

|

March 2021

|

$(7,101)

|

|

NET UNREALIZED DEPRECIATION ON FUTURES CONTRACTS

|

$(23,404)

|

|||

|

|

Federated Hermes

Government

Obligations Fund,

Premier Shares*

|

|

Value as of 12/31/2019

|

$3,660,975

|

|

Purchases at Cost

|

$26,073,269

|

|

Proceeds from Sales

|

$(29,034,009)

|

|

Change in Unrealized Appreciation/Depreciation

|

N/A

|

|

Net Realized Gain/(Loss)

|

N/A

|

|

Value as of 12/31/2020

|

$700,235

|

|

Shares Held as of 12/31/2020

|

700,235

|

|

Dividend Income

|

$18,792

|

|

*

|

All or a portion of the balance/activity for the fund relates to cash collateral received on securities lending transactions.

|

|

1

|

All or a portion of these securities are temporarily on loan to unaffiliated broker/dealers.

|

|

2

|

Floating/variable note with current rate and current maturity or next reset date shown.

|

|

3

|

7-day net yield.

|

|

4

|

Also represents cost for federal tax purposes.

|

|

5

|

Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

|

|

6

|

Non-income-producing security.

|

|

Valuation Inputs

|

||||

|

|

Level 1—

Quoted

Prices

|

Level 2—

Other

Significant

Observable

Inputs

|

Level 3—

Significant

Unobservable

Inputs

|

Total

|

|

Debt Securities:

|

|

|

|

|

|

Corporate Bonds

|

$—

|

$133,514,004

|

$—

|

$133,514,004

|

|

Foreign Governments/Agencies

|

—

|

5,798,905

|

—

|

5,798,905

|

|

Investment Company

|

700,235

|

—

|

—

|

700,235

|

|

Repurchase Agreement

|

—

|

3,247,000

|

—

|

3,247,000

|

|

TOTAL SECURITIES

|

$700,235

|

$142,559,909

|

$—

|

$143,260,144

|

|

Other Financial Instruments:1

|

|

|

|

|

|

Assets

|

$12,752

|

$—

|

$—

|

$12,752

|

|

Liabilities

|

(36,156)

|

—

|

—

|

(36,156)

|

|

TOTAL OTHER FINANCIAL INSTRUMENTS

|

$(23,404)

|

$—

|

$—

|

$(23,404)

|

|

1

|

Other financial instruments are futures contracts.

|

|

The following acronym(s) are used throughout this portfolio:

|

|

|

|

BKNT

|

—Bank Notes

|

|

|

GMTN

|

—Global Medium Term Note

|

|

|

LIBOR

|

—London Interbank Offered Rate

|

|

|

MTN

|

—Medium Term Note

|

|

|

REIT

|

—Real Estate Investment Trust

|

|

|

|

Year Ended December 31,

|

||||

|

|

2020

|

2019

|

2018

|

2017

|

2016

|

|

Net Asset Value, Beginning of Period

|

$11.48

|

$10.26

|

$11.10

|

$10.71

|

$10.29

|

|

Income From Investment Operations:

|

|

|

|

|

|

|

Net investment income (loss)

|

0.43

|

0.45

|

0.46

|

0.45

|

0.46

|

|

Net realized and unrealized gain (loss)

|

0.91

|

1.22

|

(0.77)

|

0.39

|

0.42

|

|

TOTAL FROM INVESTMENT OPERATIONS

|

1.34

|

1.67

|

(0.31)

|

0.84

|

0.88

|

|

Less Distributions:

|

|

|

|

|

|

|

Distributions from net investment income

|

(0.43)

|

(0.45)

|

(0.46)

|

(0.45)

|

(0.46)

|

|

Distributions from net realized gain

|

(0.01)

|

—

|

(0.07)

|

—

|

—

|

|

TOTAL DISTRIBUTIONS

|

(0.44)

|

(0.45)

|

(0.53)

|

(0.45)

|

(0.46)

|

|

Net Asset Value, End of Period

|

$12.38

|

$11.48

|

$10.26

|

$11.10

|

$10.71

|

|

Total Return1

|

11.88%

|

16.56%

|

(2.82)%

|

8.01%

|

8.61%

|

|

Ratios to Average Net Assets:

|

|

|

|

|

|

|

Net expenses2, 3

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

|

Net investment income

|

3.64%

|

4.11%

|

4.30%

|

4.14%

|

4.28%

|

|

Expense waiver/reimbursement4

|

0.27%

|

0.30%

|

0.32%

|

0.29%

|

0.33%

|

|

Supplemental Data:

|

|

|

|

|

|

|

Net assets, end of period (000 omitted)

|

$143,775

|

$105,126

|

$85,243

|

$85,052

|

$78,255

|

|

Portfolio turnover

|

13%

|

18%

|

16%

|

22%

|

25%

|

|

1

|

Based on net asset value.

|

|

2

|

Federated Investment Management Company (the “Adviser”) has contractually agreed to reimburse all operating expenses, excluding extraordinary expenses,

incurred by the Fund.

|

|

3

|

Amount does not reflect net expenses incurred by investment companies in which the Fund may invest.

|

|

4

|

This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not

reflect expense waiver/

reimbursement recorded by investment companies in which the Fund may invest.

|

|

Assets:

|

|

|

Investment in securities, at value including $681,912 of securities loaned and $700,235 of investments in an affiliated holding* (identified cost

$126,652,919)

|

$143,260,144

|

|

Cash

|

573

|

|

Due from broker (Note 2)

|

30,694

|

|

Income receivable

|

1,288,397

|

|

Receivable for shares sold

|

396,560

|

|

Receivable for variation margin on futures contracts

|

4,044

|

|

Total Assets

|

144,980,412

|

|

Liabilities:

|

|

|

Payable for shares redeemed

|

53,755

|

|

Payable for collateral due to broker for securities lending

|

700,235

|

|

Income distribution payable

|

377,192

|

|

Payable to adviser (Note 5)

|

726

|

|

Payable for administrative fee (Note 5)

|

305

|

|

Payable for portfolio accounting fees

|

31,648

|

|

Accrued expenses (Note 5)

|

41,162

|

|

Total Liabilities

|

1,205,023

|

|

Net assets for 11,609,815 shares outstanding

|

$143,775,389

|

|

Net Assets Consist of:

|

|

|

Paid-in capital

|

$127,071,115

|

|

Total distributable earnings (loss)

|

16,704,274

|

|

Total Net Assets

|

$143,775,389

|

|

Net Asset Value, Offering Price and Redemption Proceeds Per Share:

|

|

|

$143,775,389 ÷ 11,609,815 shares outstanding, no par value, unlimited shares authorized

|