Exhibit 99.1

This summary highlights information contained elsewhere or incorporated by reference in this offering memorandum. This summary does not contain all of the information that you should consider before deciding to invest in the New Notes. You should read the entire offering memorandum carefully, including the “Risk Factors” sections contained in this offering memorandum, our condensed consolidated financial statements and the related notes and the other documents incorporated by reference in this offering memorandum. Unless we have indicated otherwise, or the context otherwise requires, references in this offering memorandum or the documents incorporated by reference herein and therein to (i) “H&E,” the “Issuer” and the “Company” each refer solely to H&E Equipment Services, Inc. and not its subsidiaries and (ii) “we,” “our,” and “us” refer to H&E Equipment Services, Inc. and its subsidiaries on a consolidated basis. The term “guarantors” refers to certain of H&E’s subsidiaries that guarantee, as described herein, the obligations of H&E under the New Notes. Some of the statements in this summary are forward-looking statements. For more information, see “Disclosure Regarding Forward-Looking Statements.”

Our Company

We are one of the largest integrated equipment services companies in the U.S. with 80 full-service locations focused on heavy construction and industrial equipment. We rent, sell and provide parts and services support for four core categories of specialized equipment: (1) hi-lift or aerial work platform equipment; (2) cranes; (3) earthmoving equipment; and (4) industrial lift trucks. We engage in five principal business activities in these equipment categories:

| • | equipment rentals; |

| • | new equipment sales; |

| • | used equipment sales; |

| • | parts sales; and |

| • | repair and maintenance services. |

By providing rental, sales, parts, repair and maintenance functions under one roof, we offer our customers a full solution for their equipment needs. This approach provides us with (1) multiple points of customer contact; (2) cross-selling opportunities among our rental, new and used equipment sales, parts sales and services operations; (3) an effective method to manage our rental fleet through efficient maintenance and profitable distribution of used equipment; and (4) a mix of business activities that enables us to operate effectively throughout economic cycles. We believe that the operating experience and extensive infrastructure we have developed throughout our history as an integrated equipment services company provide us with a competitive advantage over rental or distribution only focused companies. In addition, our focus on four core categories of heavy construction and industrial equipment enables us to offer specialized knowledge and support to our customers.

1

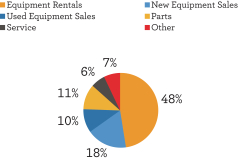

For the last twelve months ended September 30, 2017 and December 31, 2016, we generated total revenues of approximately $979.7 million and $978.1 million, respectively. The pie charts below illustrate the breakdown of our revenues and gross profits for the last twelve months ended September 30, 2017 by business segment (see note 11 to our unaudited consolidated financial statements and note 17 to our audited consolidated financial statements incorporated by reference herein for further information regarding our business segments):

| LTM 9/30/17 Revenue | LTM 9/30/17 Gross Profit | |

|

| |

Products and Services

Equipment Rentals. We rent our heavy construction and industrial equipment to our customers on a daily, weekly and monthly basis. We have a well-maintained rental fleet that, at September 30, 2017, consisted of approximately 31,015 pieces of equipment (as detailed in the table below) having an original acquisition cost (which we define as the cost originally paid to manufacturers or the original amount financed under operating leases) of approximately $1.4 billion and an average age of approximately 34.3 months. Our rental business creates cross-selling opportunities for us in sales and service support activities.

Rental Fleet Overview as of September 30, 2017

| Units | % of Total Units |

Original Acquisition Cost |

% of Original Acquisition Cost |

Average Age in Months |

||||||||||||||||

| Hi-Lift or Aerial Work Platforms |

21,438 | 69.1 | % | $ | 911.3 | 64.9 | % | 37.2 | ||||||||||||

| Cranes |

293 | 0.9 | % | 103.2 | 7.3 | % | 51.1 | |||||||||||||

| Earthmoving |

3,322 | 10.7 | % | 285.9 | 20.4 | % | 24.0 | |||||||||||||

| Industrial Lift Trucks |

977 | 3.2 | % | 32.2 | 2.3 | % | 26.9 | |||||||||||||

| Other |

4,985 | 16.1 | % | 71.1 | 5.1 | % | 28.9 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

31,015 | 100.0 | % | $ | 1,403.7 | 100.0 | % | 34.3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

New Equipment Sales. We sell new heavy construction and industrial equipment in all four core equipment categories, and are a leading U.S. distributor for nationally recognized suppliers including JLG Industries, Gehl, Genie Industries (Terex), Komatsu, and Doosan/Bobcat. In addition, we are the world’s largest distributor of Grove and Manitowoc crane equipment. Our new equipment sales operation is a source of new customers for our parts sales and service support activities, as well as for used equipment sales.

Used Equipment Sales. We sell used equipment primarily from our rental fleet, as well as inventoried equipment that we acquire through trade-ins from our customers and selective purchases of

2

high-quality used equipment. For the nine months ended September 30, 2017, approximately 88.2% of our used equipment sales revenues were derived from sales of rental fleet equipment. Used equipment sales, like new equipment sales, generate parts and services business for us.

Parts Sales. We sell new and used parts to customers and also provide parts to our own rental fleet. We maintain an extensive in-house parts inventory in order to provide timely parts and service support to our customers as well as to our own rental fleet. In addition, our parts operations enable us to maintain a high-quality rental fleet and provide additional product support to our end users.

Service Support. We provide maintenance and repair services for our customers’ owned equipment and for our own rental fleet. In addition to repair and maintenance on an as-needed or scheduled basis, we provide ongoing preventative maintenance services and warranty repairs for our customers. We devote significant resources to training our technical service employees and over time, we have built a full-scale services infrastructure that we believe would be difficult for companies without the requisite resources and lead time to effectively replicate.

In addition to our principal business activities mentioned above, we provide ancillary equipment support activities including transportation, hauling, parts shipping and loss damage waivers.

Competitive Strengths

Integrated Platform of Products and Services. We believe that the operating experience and extensive infrastructure we have developed throughout our history as an integrated equipment services company provides us with a competitive advantage over rental or distribution only focused companies. Key strengths of our integrated equipment services platform include:

| • | ability to strengthen customer relationships by providing a full-range of products and services; |

| • | purchasing power gained through purchases for our new equipment sales and rental operations; |

| • | high quality rental fleet supported by our strong product support capabilities; |

| • | established retail sales network resulting in profitable disposal of our used equipment; and |

| • | mix of business activities that enable effective operations through economic cycles. |

Complementary, High Margin Parts and Service Operations. Our parts and services businesses allow us to maintain our rental fleet in excellent condition and to offer our customers high-quality rental equipment. Our after-market parts and services businesses together provide us with a high-margin revenue source that has proven to be relatively stable throughout a range of economic cycles.

High-Quality, Multipurpose Fleet. Our focus on four core types of heavy construction and industrial equipment allows us to better provide the specialized knowledge and support that our customers demand when renting and purchasing equipment. These four types of equipment are attractive because they have a long useful life, high residual value and generally strong industry demand.

Well-Developed Infrastructure. We have built an infrastructure that as of November 1, 2017 included a network of 80 full-service facilities in 22 states, and a workforce that included a highly-skilled group of approximately 452 service technicians and 252 sales people in our specialized rental and equipment sales forces. We believe that our well-developed infrastructure helps us to serve large multi-regional customers better than our historically rental-focused competitors and provides an advantage when competing for lucrative fleet and project management business as well as the ability to quickly capitalize on new opportunities.

Leading Distributor for Suppliers. We are a leading U.S. distributor for nationally-recognized equipment suppliers, including JLG Industries, Gehl, Genie Industries (Terex), Komatsu and Doosan/

3

Bobcat. In addition, we are the world’s largest distributor of Grove and Manitowoc crane equipment. These relationships improve our ability to negotiate equipment acquisition pricing and allow us to purchase parts at wholesale costs. Further, because we are a leading distributor, we have greater insight into the overall business cycle relative to our peers.

Customized Information Technology Systems. Our information systems allow us to actively manage our business and our rental fleet. We have a customer relationship management system that provides our sales force with real-time access to customer and sales information. In addition, our enterprise resource planning system enhances our ability to provide more timely and meaningful information to manage our business.

Strong Customer Relationships. We have a diverse base of approximately 39,000 customers who we believe value our high level of service, knowledge and expertise. Our customer base includes a wide range of industrial and commercial companies, construction contractors, manufacturers, public utilities, municipalities, maintenance contractors and numerous and diverse other large industrial accounts. Our branches enable us to closely service local and regional customers, while our well-developed full-service infrastructure enables us to effectively service multi-regional and national accounts. We believe that our expansive presence and commitment to superior service at all levels of the organization is a key differentiator to many of our competitors. As a result, we spend a significant amount of time and resources to train all key personnel to be responsive and deliver high quality customer service and well-maintained equipment so that we can maintain and grow our customer relationships.

Experienced Management Team. Our senior management team is led by John M. Engquist, our Chief Executive Officer, who has approximately 42 years of industry experience. Our senior and regional managers have an average of approximately 23 years of industry experience. Our branch managers have extensive knowledge and industry experience as well.

Our Business Strategy

Our business strategy includes, among other things, leveraging our integrated business model, managing the life cycle of our rental equipment, further developing our parts and services operations and selectively entering new markets and pursuing acquisitions. However, the timing and extent to which we implement these various aspects of our strategy depend on a variety of factors, many of which are outside our control, such as general economic conditions and construction activity in the U.S.

Leverage Our Integrated Business Model. We intend to continue to actively leverage our integrated business model to offer a one-stop solution to our customers’ varied needs with respect to the four categories of heavy construction and industrial equipment on which we focus. We will continue to cross-sell our services to expand and deepen our customer relationships. We believe that our integrated equipment services model provides us with a strong platform for growth and enables us to effectively operate through economic cycles.

Managing the Life Cycle of Our Rental Equipment. We actively manage the size, quality, age and composition of our rental fleet. During the life of our rental equipment, we (1) aggressively negotiate on purchase price; (2) use our customized information technology systems to closely monitor and analyze, among other things, time utilization (equipment usage based on customer demand), rental rate trends and pricing optimization and equipment demand; (3) continuously adjust our fleet mix and pricing; (4) maintain fleet quality through regional quality control managers and our on-site parts and services support; and (5) dispose of rental equipment through our retail sales force. This allows us to purchase our rental equipment at competitive prices, optimally utilize our fleet, cost-effectively maintain our equipment quality and maximize the value of our equipment at the end of its useful life.

Make Selective Acquisitions. The equipment industry is fragmented and includes a large number of relatively small, independent businesses servicing discrete local markets. Some of these businesses may

4

represent attractive acquisition candidates. We intend to continue to evaluate and pursue, on an opportunistic basis, acquisitions, which meet our selection criteria, including favorable financing terms, with the objective of increasing our revenues, improving our profitability, entering additional attractive markets and strengthening our competitive position. We are focused on identifying and acquiring rental companies to complement our existing business, broaden our geographic footprint, and increase our density in existing markets.

Grow Our Parts and Services Operations. Our strong parts and services operations are keystones of our integrated equipment services platform and together provide us with a relatively stable high-margin revenue source. Our parts and services operations help us develop strong, ongoing customer relationships, attract new customers and maintain a high quality rental fleet. We intend to further grow this product support side of our business and further penetrate our customer base.

Enter Carefully Selected New Markets. We intend to continue our strategy of selectively expanding our network to solidify our presence in attractive and contiguous regions where we operate. We look to add new locations in those markets that offer attractive growth opportunities, high or increasing levels of demand for construction and heavy equipment, and contiguity to our existing markets. Fourteen of our current 80 locations have opened since January 1, 2014.

Recent Developments

Offering of Existing Notes. On August 24, 2017, we completed an offering of the Existing Notes and the settlement of a cash tender offer (the “Tender Offer”) with respect to our previously outstanding 7% senior notes due 2022 (the “Old Notes”). The Existing Notes and related guarantees were offered in a private placement solely to qualified institutional buyers in reliance on Rule 144A under the Securities Act, or outside the U.S. to persons other than “U.S. persons” in compliance with Regulation S under the Securities Act. The Existing Notes and related guarantees have not been registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the U.S. absent registration or an applicable exemption from the registration requirements thereunder.

Net proceeds, after deducting $10.3 million of estimated offering expenses, from the sale of the Existing Notes totaled approximately $739.7 million. We used a portion of the net proceeds from the sale of the Existing Notes to repurchase $329.7 million of its $630 million aggregate principal amount of the Old Notes in early settlement of the Tender Offer and used a portion of the remaining net proceeds to redeem the remaining outstanding Old Notes thereafter.

See “Description of Existing Indebtedness” for further information.

Credit Facility Amendments. On August 17, 2017, we amended our $602.5 million senior secured credit facility (the “Credit Facility”) with Wells Fargo Capital Finance, LLC (“Wells Fargo”), as agent to, among other things, permit the offer, issuance and sale of the Existing Notes and application of the proceeds thereof to, among other things, repurchase or otherwise redeem the Old Notes. On November 10, 2017, we further amended the Credit Facility to permit the offer, issuance and sale of the New Notes.

On November 20, 2017, we announced that we intend to amend, extend, increase and restate our Credit Facility in an amount up to $750 million (the “Amended Credit Facility”). The Amended Credit Facility is expected to mature five years after the date on which the definitive documentation (the “Amendment”) with respect to the Amended Credit Facility is entered into. The Amended Credit Facility is expected to contain customary negative and affirmative covenants and representations and warranties similar to the existing Credit Facility, and the effectiveness of the Amended Credit Facility is subject to customary conditions, including, without limitation, execution and delivery of the Amendment. There can be no assurances that we will complete the Amendment or as to the terms thereof.

5

Potential Acquisitions. In September 2017, we entered into non-binding letters of intent in connection with possible roll-up acquisitions of two rental companies, neither of which would be material to our business taken as a whole. If we consummate either of the proposed acquisitions, we would expect to fund the purchase price with cash on hand, which would include a portion of the net proceeds from this offering, and/or with borrowings under our Credit Facility of amounts previously repaid with a portion of the proceeds of this offering. Consummation of the proposed acquisition is, in each case, subject to various conditions, including the completion of our due diligence review and execution of a definitive transaction agreement. There can be no assurance that we will enter into or close either potential acquisition.

6