RGP 12.31.2011 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

Form 10-K

_____________________________________________________

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35262

_____________________________________________________

REGENCY ENERGY PARTNERS LP

(Exact name of registrant as specified in its charter)

_____________________________________________________

|

| | |

Delaware | | 16-1731691 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

2001 Bryan Street Suite 3700, Dallas, Texas | | 75201 |

(Address of principal executive offices) | | (Zip Code) |

(214) 750-1771

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report): None

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Units of Limited Partner Interests | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_____________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such file). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer, accelerated filer and small reporting company” in Rule 12b-2 of the Exchange Act. ý Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer (Do not check if a smaller reporting company) ¨ Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 30, 2011, the aggregate market value of the registrant’s common units held by non-affiliates of the registrant was $3,092,104,793 based on the closing sale price on such date as reported on the NASDAQ Global Select Market.

There were 157,437,608 common units outstanding as of February 15, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

None

REGENCY ENERGY PARTNERS LP

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2011

TABLE OF CONTENTS

|

| | |

| | PAGE |

| Cautionary Statement about Forward-Looking Statements | |

PART I | | |

Item 1 | | |

Item 1A | | |

Item 1B | | |

Item 2 | | |

Item 3 | | |

Item 4 | | |

PART II | | |

Item 5 | | |

Item 6 | | |

Item 7 | | |

Item 7A | | |

Item 8 | | |

Item 9 | | |

Item 9A | | |

Item 9B | | |

PART III | | |

Item 10 | | |

Item 11 | | |

Item 12 | | |

Item 13 | | |

Item 14 | | |

PART IV | | |

Item 15 | | |

Introductory Statement

References in this report to the “Partnership,” “we,” “our,” “us” and similar terms refer to Regency Energy Partners LP and its subsidiaries. We use the following definitions in this annual report on Form 10-K:

|

| |

Name | Definition or Description |

/d | Per day |

Alinda Investors | Alinda Gas Pipelines I, L.P. and Alinda Gas Pipelines II, L.P. |

ACESA | The American Clean Energy and Security Act of 2009 |

AOCI | Accumulated Other Comprehensive Income |

APM | Anadarko Pecos Midstream LLC |

Bbls | Barrels |

Bcf | One billion cubic feet |

BTU | A unit of energy needed to raise the temperature of one pound of water by one degree Fahrenheit |

CDM | CDM Resource Management LLC, a wholly-owned subsidiary of the Partnership |

CERCLA | Comprehensive Environmental Response, Compensation and Liability Act |

CFTC | Commodity Futures Trading Commission |

CM | Chesapeake West Texas Processing, L.L.C. |

DHS | U.S. Department of Homeland Security |

DOT | U.S. Department of Transportation |

EFS Haynesville | EFS Haynesville, LLC, a wholly-owned subsidiary of GECC |

EIA | Energy Information Administration |

ELG | Edwards Lime Gathering LLC

|

EPA | Environmental Protection Agency |

EPD | Enterprise Products Partners L.P. |

ERISA | Employee Retirement Income Security Act of 1974 |

ETC | Energy Transfer Company, the name assumed by La Grange Acquisition, L.P. for conducting business and shared services, a wholly-owned subsidiary of ETP |

ETE | Energy Transfer Equity, L.P. |

ETE GP | ETE GP Acquirer LLC |

ETP | Energy Transfer Partners, L.P. |

FASB | Financial Accounting Standards Board |

FASB ASC | FASB Accounting Standards Codification |

FERC | Federal Energy Regulatory Commission |

Finance Corp. | Regency Energy Finance Corp., a wholly-owned subsidiary of the Partnership |

GAAP | Accounting principles generally accepted in the United States of America |

GE | General Electric Company |

GE EFS | General Electric Energy Financial Services, a unit of GECC, combined with Regency GP Acquirer, L.P. and Regency LP Acquirer, L.P. |

GECC | General Electric Capital Corporation, an indirect wholly-owned subsidiary of GE |

General Partner | Regency GP LP, the general partner of the Partnership, or Regency GP LLC, the general partner of Regency GP LP, which effectively manages the business and affairs of the Partnership through Regency Employees Management LLC |

GPM | Gallons per minute |

GP Seller | Regency GP Acquirer, L.P. |

Gulf States | Gulf States Transmission LLC, a wholly-owned subsidiary of the Partnership |

HLPSA | Hazardous Liquid Pipeline Safety Act |

HPC | RIGS Haynesville Partnership Co., a general partnership, and its wholly-owned subsidiary, Regency Intrastate Gas LP |

|

| |

Name | Definition or Description |

ICA | Interstate Commerce Act |

IDRs | Incentive Distribution Rights |

IPO | Initial Public Offering of Securities |

IRC | Internal Revenue Code |

IRS | Internal Revenue Service |

Kayne Anderson | Kayne Anderson Capital Advisors, L.P. |

KMP | Kinder Morgan Energy Partners, L.P. |

LDH | LDH Energy Asset Holdings LLC |

LIBOR | London Interbank Offered Rate |

Lone Star | Lone Star NGL LLC, a joint venture that is 70% owned by ETP and 30% owned by the Partnership |

LTIP | Long-Term Incentive Plan |

MBbls | One thousand barrels |

MEP | Midcontinent Express Pipeline LLC |

MLP | Master Limited Partnership |

MMbtu | One million BTUs |

MMcf | One million cubic feet |

MQD | Minimum Quarterly Distribution ($0.35 per common unit) |

NGA | Natural Gas Act of 1938 |

NGLs | Natural gas liquids, including ethane, propane, normal butane, iso butane and natural gasoline |

NGPA | Natural Gas Policy Act of 1978 |

NGPSA | Natural Gas Pipeline Safety Act of 1968, as amended |

NPDES | National Pollutant Discharge Elimination System |

NYMEX | New York Mercantile Exchange |

NASDAQ | NASDAQ Global Select Market |

NYSE | New York Stock Exchange |

OSHA | Occupational Safety and Health Act |

Partnership | Regency Energy Partners LP |

PHMSA | DOT's Pipeline and Hazardous Material Safety Administration |

PTO | Paid time off |

Ranch JV | Ranch Westex JV LLC, a joint venture that is 1/3 owned by the Partnership, 1/3 owned by APM and 1/3 owned by CM |

RCRA | Resource Conservation and Recovery Act |

Regency HIG | Regency Haynesville Intrastate Gas LLC, a wholly-owned subsidiary of the Partnership |

RFS | Regency Field Services LLC, a wholly-owned subsidiary of the Partnership |

RGS | Regency Gas Services LP, a wholly-owned subsidiary of the Partnership |

RIG | Regency Intrastate Gas LP |

RIGS | Regency Intrastate Gas System |

SEC | Securities and Exchange Commission |

Series A Preferred Units | Series A convertible redeemable preferred units |

Services Co. | ETE Services Company, LLC |

TCEQ | Texas Commission on Environmental Quality |

TRRC | Texas Railroad Commission |

WTI | West Texas Intermediate Crude |

Zephyr | Zephyr Gas Services LLC, a wholly-owned subsidiary of the Partnership |

Cautionary Statement about Forward-Looking Statements

Certain matters discussed in this report include “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or similar expressions help identify forward-looking statements. Although we believe our forward-looking statements are based on reasonable assumptions and current expectations and projections about future events, we cannot give assurances that such expectations will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions, including without limitation the following:

| |

• | volatility in the price of oil, natural gas and NGLs; |

| |

• | declines in the credit markets and the availability of credit for us as well as for producers connected to our pipelines and our gathering and processing facilities, and for customers of our contract compression and contract treating businesses; |

| |

• | the level of creditworthiness of, and performance by, our counterparties and customers; |

| |

• | our access to capital to fund organic growth projects and acquisitions, and our ability to obtain debt or equity financing on satisfactory terms; |

| |

• | our use of derivative financial instruments to hedge commodity and interest rate risks; |

| |

• | the amount of collateral required to be posted from time-to-time in our transactions; |

| |

• | changes in commodity prices, interest rates and demand for our services; |

| |

• | changes in laws and regulations impacting the midstream sector of the natural gas industry, including those that relate to climate change and environmental protection and safety; |

| |

• | weather and other natural phenomena; |

| |

• | industry changes including the impact of consolidations and changes in competition; |

| |

• | regulation of transportation rates on our natural gas pipelines; |

| |

• | our ability to obtain indemnification related to cleanup liabilities and to clean up any hazardous materials release on satisfactory terms; |

| |

• | our ability to obtain required approvals for construction or modernization of our facilities and the timing of production from such facilities; and |

| |

• | the effect of accounting pronouncements issued periodically by accounting standard setting boards. |

If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may differ materially from those anticipated, estimated, projected or expected.

Other factors that could cause our actual results to differ from our projected results are discussed in Item 1A of this annual report.

Each forward-looking statement speaks only as of the date of the particular statement and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Part I

Item 1. Business

OVERVIEW

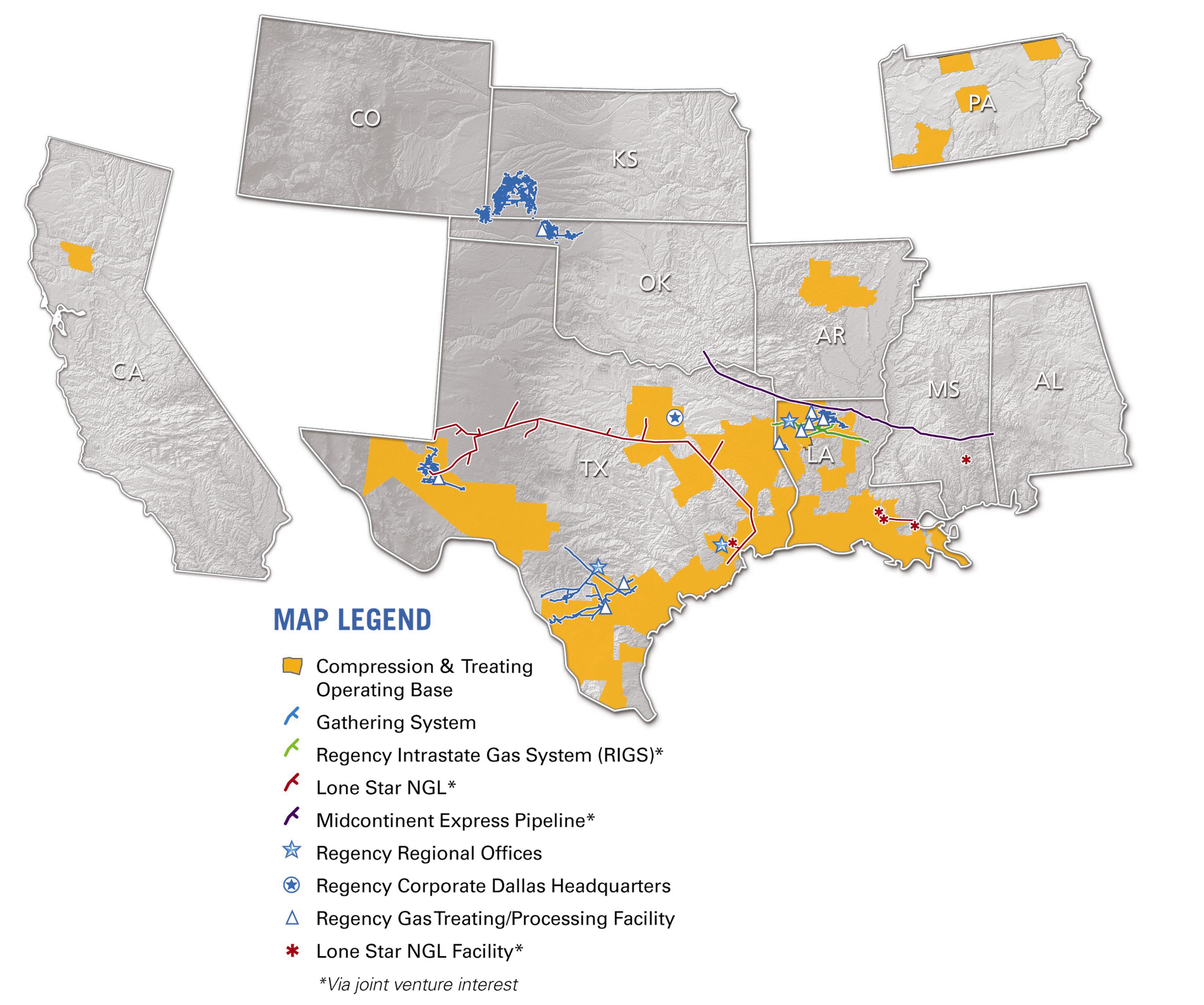

We are a growth-oriented publicly-traded Delaware limited partnership formed in 2005 engaged in the gathering and processing, contract compression, treating and transportation of natural gas and the transportation, fractionation and storage of NGLs. We focus on providing midstream services in some of the most prolific natural gas producing regions in the United States, including the Eagle Ford, Haynesville, Barnett, Fayetteville, Marcellus, Bone Spring, and Avalon shales as well as the Permian Delaware basin and the mid-continent region. Our assets are primarily located in Texas, Louisiana, Arkansas, Pennsylvania, California, Mississippi, Alabama, West Virginia and the mid-continent region of the United States, which includes Kansas, Colorado and Oklahoma.

We divide our operations into five business segments:

| |

• | Gathering and Processing. We provide “wellhead-to-market” services to producers of natural gas, which include transporting raw natural gas from the wellhead through gathering systems, processing raw natural gas to separate NGLs and selling or delivering the pipeline-quality natural gas and NGLs to various markets and pipeline systems. |

| |

• | Joint Ventures. We own investments in four joint ventures: |

| |

◦ | a 49.99% general partner interest in HPC, which owns RIGS, a 450-mile intrastate pipeline that delivers natural gas from northwest Louisiana to downstream pipelines and markets; |

| |

◦ | a 50% membership interest in MEP, which owns an interstate natural gas pipeline with approximately 500 miles stretching from southeast Oklahoma through northeast Texas, northern Louisiana and central Mississippi to an interconnect with the Transcontinental Gas Pipe Line system in Butler, Alabama; |

| |

◦ | a 30% membership interest in Lone Star, an entity owning a diverse set of midstream energy assets including NGL pipelines, storage, fractionation and processing facilities located in the states of Texas, Mississippi and Louisiana; and |

| |

◦ | a 33.33% membership interest in Ranch JV, which, upon completion of construction in 2012, will process natural gas delivered from the NGLs-rich Bone Spring and Avalon shale formations in west Texas. |

| |

• | Contract Compression. We own and operate a fleet of compressors used to provide turn-key natural gas compression services for customer specific systems. |

| |

• | Contract Treating. We own and operate a fleet of equipment used to provide treating services, such as carbon dioxide and hydrogen sulfide removal, natural gas cooling, dehydration and BTU management, to natural gas producers and midstream pipeline companies. |

| |

• | Corporate and Others. Our Corporate and Others segment comprises a small regulated pipeline and our corporate offices. |

See Note 16 in the Notes to our Consolidated Financial Statements for additional financial information about our segments.

The following map depicts the geographic areas of our operations:

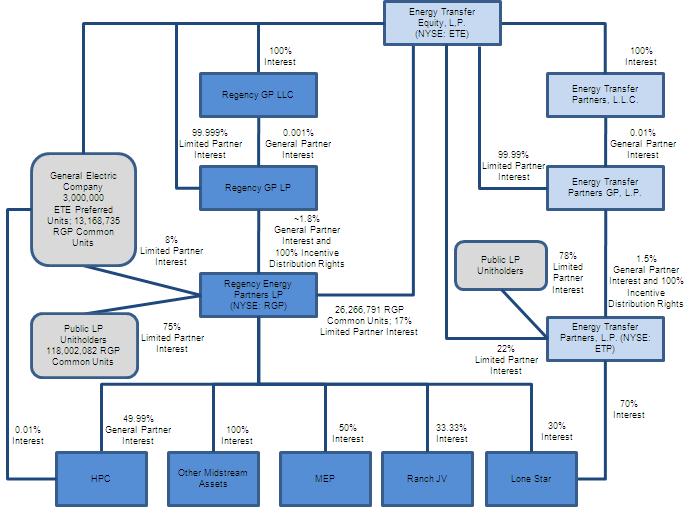

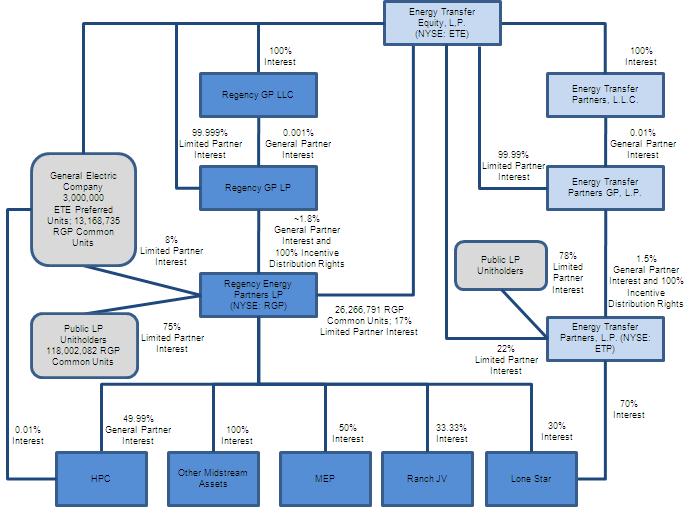

ORGANIZATIONAL STRUCTURE

The chart below depicts our organizational and ownership structure as of December 31, 2011:

INDUSTRY OVERVIEW

INDUSTRY OVERVIEWGeneral. The midstream natural gas industry is the link between exploration and production of raw natural gas and the delivery of its components to end-user markets. It consists of natural gas gathering, compression, dehydration, processing, amine treating, fractionation and transportation. Raw natural gas produced from the wellhead is gathered and often delivered to a plant located near the production, where it is treated, dehydrated and/or processed. Natural gas processing involves the separation of raw natural gas into pipeline quality natural gas, principally methane and mixed NGLs. Natural gas treating entails the removal of impurities, such as water, sulfur compounds, carbon dioxide and nitrogen. Pipeline-quality natural gas is delivered by interstate and intrastate pipelines to markets. Mixed NGLs are typically transported via NGL pipelines or by truck to fractionators, which separate the NGLs into their components, such as ethane, propane, normal butane, isobutane and natural gasoline. The NGL components are then sold to end users.

Natural Gas Gathering. A gathering system typically consists of a network of small diameter pipelines and, if necessary, a compression system which together collects natural gas from points near producing wells and transports it to processing or treating plants or larger diameter pipelines for further transportation.

Compression. Ideally designed gathering systems are operated at pressures that maximize the total throughput volumes from all connected wells. Natural gas compression is a mechanical process in which a volume of gas at a lower pressure is boosted, or compressed, to a desired higher pressure, allowing the gas to flow into a higher pressure downstream pipeline to be transported to market. Since natural gas wells produce gas at progressively lower field pressures as they age, this raw natural gas must be compressed to deliver the remaining production at higher pressures in the existing connected gathering system. This field compression is typically used to lower the suction (entry) pressure, while maintaining or increasing the discharge (exit) pressure to the gathering system which allows the well production to flow at a lower receipt pressure while providing sufficient pressure to deliver gas into a higher pressure downstream pipeline.

Dehydration. Dehydration removes water from the natural gas stream, which can form ice when combined with natural gas and cause corrosion when combined with carbon dioxide or hydrogen sulfide.

Processing. Natural gas processing involves the separation of natural gas into pipeline quality natural gas and a mixed NGL stream. The principal component of natural gas is methane, but most natural gas also contains varying amounts of heavier hydrocarbon components, or NGLs. Natural gas is described as lean or rich depending on its content of NGLs. Most natural gas produced by a well is not suitable for long-haul pipeline transportation or commercial use because it contains NGLs and impurities. Removal and separation of individual hydrocarbons by processing is possible because of differences in weight, boiling point, vapor pressure and other physical characteristics.

Amine Treating. The amine treating process involves a continuous circulation of a liquid chemical called amine that physically contacts with the natural gas. Amine has a chemical affinity for hydrogen sulfide and carbon dioxide that allows it to absorb these impurities from the gas. After mixing in the contact vessel, the gas and amine are separated, and the impurities are removed from the amine by heating. The treating plants are sized according to the amine circulation rate in terms of GPM.

Fractionation. NGL fractionation facilities separate mixed NGL streams into discrete NGL products: ethane, propane, normal butane, isobutane and natural gasoline. Ethane is primarily used in the petrochemical industry as feedstock for ethylene, one of the basic building blocks for a wide range of plastics and other chemical products. Propane is used both as a petrochemical feedstock in the production of propylene and as a heating fuel, an engine fuel and an industrial fuel. Normal butane is used as a petrochemical feedstock in the production of butadiene (a key ingredient in synthetic rubber) and as a blend stock for motor gasoline. Isobutane is typically fractionated from mixed butane (a stream of normal butane and isobutane in solution), principally for use in enhancing the octane content of motor gasoline. Natural gasoline, a mixture of pentanes and heavier hydrocarbons, is used primarily as motor gasoline blend stock or petrochemical feedstock.

Transportation. Natural gas transportation consists of moving pipeline-quality natural gas from gathering systems, processing or treating plants and other pipelines and delivering it to wholesalers, end users, local distribution companies and other pipelines.

Storage. Natural gas can be injected into underground storage facilities which are located near market centers that do not have a ready supply of locally produced natural gas.

INDUSTRY OUTLOOK

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—General Trends and Outlook”.

GATHERING AND PROCESSING OPERATIONS

General. We operate gathering and processing assets in four geographic regions of the United States: north Louisiana, the mid-continent region of the United States, south Texas and west Texas. We contract with producers to gather raw natural gas from individual wells or central receipt points, which may have multiple wells behind them, located near our processing plants, treating facilities and/or gathering systems. Following the execution of a contract, we connect wells and central receipt points to our gathering lines through which the raw natural gas flows to a processing plant, treating facility or directly to interstate or intrastate gas transportation pipelines. At our processing plants and treating facilities, we remove impurities from the raw natural gas stream and extract the NGLs. We also perform a producer service function, whereby we purchase natural gas from producers at gathering systems and plants and sell this gas at downstream outlets.

All raw natural gas flowing through our gathering and processing facilities is supplied under gathering and processing contracts having terms ranging from month-to-month to the life of the oil and gas lease. For a description of our contracts, read “—Our Contracts” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Operations.”

The pipeline-quality natural gas remaining after separation of NGLs through processing is either returned to the producer or sold, for our own account or for the account of the producer, at the tailgates of our processing plants for delivery to interstate or intrastate gas transportation pipelines.

The following table sets forth information regarding our gathering systems and processing plants as of December 31, 2011:

|

| | | | | | | | |

Region | Pipeline Length (Miles) | | Plants | | Compression (Horsepower) |

North Louisiana | 442 |

| | 6 |

| | 116,734 |

|

South Texas | 565 |

| | 2 |

| | 82,133 |

|

West Texas | 806 |

| | 1 |

| | 50,945 |

|

Mid-Continent | 3,470 |

| | 1 |

| | 30,060 |

|

Total | 5,283 |

| | 10 |

| | 279,872 |

|

North Louisiana Region. Our north Louisiana assets gather, compress, treat and dehydrate natural gas in five Parishes (Claiborne, Union, DeSoto, Lincoln and Ouachita) of north Louisiana and Shelby County, Texas. Our assets also include two cryogenic natural gas processing facilities, a refrigeration plant located in Bossier Parish, a conditioning plant located in Webster Parish, an amine treating plant in DeSoto Parish, and an amine treating plant in Lincoln Parish.

Through the gathering and processing systems described above and their interconnections with RIGS in north Louisiana described in “Joint Venture Operations,” we offer producers wellhead-to-market services, including natural gas gathering, compression, processing, treating and transportation.

South Texas Region. Our south Texas assets gather, compress, treat and dehydrate natural gas in LaSalle, Webb, Karnes, Atascosa, McMullen, Frio and Dimmitt counties. Some of the natural gas produced in this region can have significant quantities of hydrogen sulfide and carbon dioxide that require treating to remove these impurities. The pipeline systems that gather this gas are connected to third-party processing plants and our treating facilities that include an acid gas reinjection well located in McMullen County, Texas.

The natural gas supply for our south Texas gathering systems is derived from a combination of natural gas wells located in a mature basin that generally have long lives and predictable gas flow rates and the NGLs-rich Eagle Ford shale formation, which lies directly under our existing south Texas gathering system infrastructure.

One of our treating plants consists of inlet gas compression, a 60 MMcf/d amine treating unit, a 55 MMcf/d amine treating unit and a 40 ton (per day) liquid sulfur recovery unit. This plant removes hydrogen sulfide from the natural gas stream, recovers condensate, delivers pipeline quality gas at the plant outlet and reinjects acid gas. In January 2012, we completed an expansion of the treating plant, adding an incremental 20 MMcf/d of treating capacity to the facility.

In June 2011, we entered into agreements to provide gas and condensate gathering services for a producer in the Eagle Ford shale and to construct facilities to perform these services, including a wellhead gathering system, at an expected cost of approximately $450 million. The expansion will be owned and operated by us and will connect with our existing gathering system. The expansion is scheduled to be completed in phases by 2014. Upon its completion, our entire south Texas system will be capable of gathering, compressing, treating and transporting up to 1 Bcf/d of natural gas and 26,500 Bbls/d of condensate to downstream outlets.

We own a 60% interest in ELG that includes a treating plant in Atascosa County with a 500 GPM amine treater, pipeline interconnect facilities and approximately 13 miles of ten inch diameter pipeline. Talisman Energy USA Inc. and Statoil Texas Onshore Properties LP own the remaining 40% interest. We operate this plant and the pipeline for the joint venture while our joint venture partner operates a lean gas gathering system in the Edwards Lime natural gas trend that delivers to this system.

West Texas Region. Our west Texas gathering system assets offer wellhead-to-market services to producers in Ward, Winkler, Reeves, and Pecos counties which surround the Waha Hub, one of Texas' major NGLs-rich natural gas market areas. As a result of the proximity of our system to the Waha Hub, the Waha gathering system has a variety of market outlets for the natural gas that we gather and process, including several major interstate and intrastate pipelines serving California, the mid-continent region of the United States and Texas natural gas markets. The NGL market outlets include Lone Star's west Texas NGL pipeline.

We offer producers four different levels of natural gas compression on the Waha gathering system, as compared to the two levels typically offered in the industry. By offering multiple levels of compression, our gathering system is often more cost-effective for our producers, since the producer is typically not required to pay for a level of compression that is higher than the level they require.

The Waha processing plant is a cryogenic natural gas processing plant that processes raw natural gas gathered in the Waha gathering system. The Waha processing plant also includes an amine treating facility, which removes carbon dioxide and hydrogen sulfide from raw natural gas gathered before moving the natural gas to the processing plant. The acid gas is injected underground.

Mid-Continent Region. Our mid-continent region includes natural gas gathering systems located primarily in Kansas and Oklahoma. Our mid-continent gathering assets are extensive systems that gather, compress and dehydrate low-pressure gas from approximately 1,500 wells. These systems are geographically concentrated, with each central facility located within 90 miles of the others. We operate our mid-continent gathering systems at low pressures to maximize the total throughput volumes from the connected wells. Wellhead pressures are therefore adequate to allow for flow of natural gas into the gathering lines without the cost of wellhead compression.

We also own the Hugoton gathering system that has approximately 1,875 miles of pipeline extending over nine counties in Kansas and Oklahoma. This system is operated by a third party.

Our mid-continent systems are located in two of the largest and most prolific natural gas producing regions in the United States, the Hugoton Basin in southwest Kansas and the Anadarko Basin in western Oklahoma. These mature basins have continued to provide generally long-lived, predictable production volume.

JOINT VENTURES OPERATIONS

We own a 49.99% general partner interest in HPC, which owns RIGS, a 450-mile intrastate pipeline that delivers natural gas from northwest Louisiana to downstream pipelines and markets.

We own a 50% membership interest in MEP, a joint venture entity operated by an affiliate of KMP. MEP owns an interstate natural gas pipeline with approximately 500 miles stretching from southeast Oklahoma through northeast Texas, northern Louisiana and central Mississippi to an interconnect with the Transcontinental Gas Pipe Line system in Butler, Alabama.

We own a 30% membership interest in Lone Star, an entity owning a diverse set of midstream energy assets including NGL pipelines, storage, fractionation and processing facilities located in Texas, Mississippi and Louisiana.

We own a 33.33% membership interest in Ranch JV, which, upon completion of construction in the 4th quarter of 2012, will process natural gas delivered from the NGLs-rich Bone Spring and Avalon shale formations in west Texas.

CONTRACT COMPRESSION OPERATIONS

The natural gas contract compression segment services include designing, sourcing, owning, installing, operating, servicing, repairing and maintaining compressors and related equipment for which we guarantee our customers 98% mechanical availability for land installations and 96% mechanical availability for over-water installations. We focus on meeting the complex requirements of field-wide compression applications, as opposed to targeting the compression needs of individual wells within a field. These field-wide applications include compression for natural gas gathering and natural gas processing. We believe that we improve the stability of our cash flow by focusing on field-wide compression applications because such applications generally involve long-term installations of multiple large horsepower compression units. Our contract compression operations are primarily located in Texas, Louisiana, Arkansas, Pennsylvania and California.

CONTRACT TREATING OPERATIONS

We own and operate a fleet of equipment used to provide treating services, such as carbon dioxide and hydrogen sulfide removal, natural gas cooling, dehydration and BTU management, to natural gas producers and midstream pipeline companies. Our contract treating operations are primarily located in Texas, Louisiana and Arkansas.

CORPORATE AND OTHERS OPERATIONS

Our Corporate and Others segment comprises a small interstate natural gas pipeline and our corporate offices. The interstate natural gas pipeline consists of 10 miles of pipeline that extends from Harrison County, Texas to Caddo Parish, Louisiana.

OUR CONTRACTS

The table below provides the margin by product in percentages for the years ended December 31, 2011 and 2010 for all of our operating segments including our proportional shares in our unconsolidated affiliates:

|

| | | | | |

Margin by Product | 2011 | | 2010 |

Net Fee | 83 | % | | 76 | % |

NGLs | 9 |

| | 13 |

|

Gas | 5 |

| | 5 |

|

Condensate | 3 |

| | 6 |

|

Total | 100 | % | | 100 | % |

Gathering and Processing Contracts. We contract with producers to gather raw natural gas from individual wells or central receipt points located near our gathering systems and processing plants. Following the execution of a contract with the producer, we connect the producer's wells or central receipt points to our gathering lines through which the natural gas is delivered to a processing plant owned and operated by us or a third party. We obtain supplies of raw natural gas for our gathering and processing facilities under contracts having terms ranging from month-to-month to life of the lease. We categorize our processing contracts in increasing order of commodity price risk as fee-based, percentage-of-proceeds or keep-whole contracts. The following is a summary of our most common contractual arrangements:

| |

• | Fee-Based Arrangements. Under these arrangements, we are generally paid a fixed cash fee for performing the gathering and processing service. This fee is directly related to the volume of natural gas that flows through our systems and is not directly dependent on commodity prices. A sustained decline in commodity prices, however, could result in a decline in volumes and, thus, a decrease in our fee revenues. These arrangements provide stable cash flows, but minimal, if any, upside in higher commodity price environments. |

| |

• | Percent-of-Proceeds Arrangements. Under these arrangements, we generally gather raw natural gas from producers at the wellhead or central receipt points, transport it through our gathering system, process it and sell the processed gas and NGLs at prices based on published index prices. In this type of arrangement, we retain the sales proceeds less amounts remitted to producers and the retained sales proceeds constitute our margin. These arrangements provide upside in high commodity price environments, but result in lower margins in low commodity price environments. Under these arrangements, our margins typically cannot be negative. The price paid to producers is based on an agreed percentage of one of the following: (1) the actual sale proceeds; (2) the proceeds based on an index price; or (3) the proceeds from the sale of processed gas or NGLs or both. Under this type of arrangement, our margin correlates directly with the prices of natural gas and NGLs (although there is often a fee-based component to these contracts in addition to the commodity sensitive component). |

| |

• | Keep-Whole Arrangements. Under these arrangements, we process raw natural gas to extract NGLs and pay to the producer the full thermal equivalent volume of raw natural gas received from the producer in processed gas or its cash equivalent. We are generally entitled to retain the processed NGLs and to sell them for our account. Accordingly, our margin is a function of the difference between the value of the NGLs produced and the cost of the processed gas used to replace the thermal equivalent value of those NGLs. The profitability of these arrangements is subject not only to the commodity price risk of natural gas and NGLs, but also to the price of natural gas relative to NGL prices. These arrangements can provide large profit margins in favorable commodity price environments, but also can be subject to losses if the cost of natural gas exceeds the value of its thermal equivalent of NGLs. Many of our keep-whole contracts include provisions that reduce our commodity price exposure, including (1) embedded discounts to the applicable natural gas index price under which we may reimburse the producer an amount in cash for the thermal equivalent volume of raw natural gas acquired from the producer, (2) fixed cash fees for ancillary services, such as gathering, treating, and compression, or (3) the ability to bypass processing in unfavorable price environments. |

We also perform a producer service function. We purchase natural gas from producers or gas marketers at receipt points or plant tailgates, including points on HPC's RIGS, and we sell the natural gas to other market participants, often after transporting the gas to delivery points on HPC's RIGS or other transportation pipeline systems.

Joint Ventures Contracts. We own a 49.99% general partner interest in HPC, a 50% membership interest in MEP and a 30% membership interest in Lone Star. HPC and MEP, through their respective pipeline systems, provide natural gas transportation services pursuant to contracts with natural gas shippers. These contracts are primarily fee-based. HPC's long-term firm transportation contracts will expire between 2012 and 2022; and MEP's long-term firm service agreements will expire between 2012 and 2021.

Lone Star owns and operates approximately 1,400 miles of NGL pipelines, two cryogenic refinery off-gas processing plants, one fractionation facility, and two NGL storage facilities with aggregate working storage capacity of approximately 47 million Bbls. Lone Star also has a non-operating interest in an additional cryogenic processing plant. Revenue is principally generated from fees charged to customers under dedicated contracts, take-or-pay contracts and commodity pricing. Under a dedicated contract, the customer agrees to deliver the total output from particular processing plants that are connected to the NGL pipeline. Take-or-pay contracts have minimum throughput commitments requiring the customer to pay regardless of whether a fixed volume is transported. Transportation fees are market-based, negotiated with customers and competitive with regional regulated pipelines.

Compression Contracts. We generally enter into a new contract with respect to each distinct application for which we will provide contract compression services. Our compression contracts typically have an initial term between one and five years, after which the contract continues on a month-to-month basis until renewal or cancellation. Our customers generally pay a fixed monthly fee, or, in rare cases, a fee based on the volume of natural gas actually compressed. We are not responsible for acts of force majeure and our customers are generally required to pay our monthly fee for fixed fee contracts, or a minimum fee for throughput contracts, even during periods of limited or disrupted production. We are generally responsible for the costs and expenses associated with operation and maintenance of our compression equipment, such as providing necessary lubricants, although certain fees and expenses are the responsibility of the customers under the terms of their contracts. For example, all fuel gas is provided by our customers without cost to us, and in many cases customers are required to provide all water and electricity. We also are reimbursed by our customers for certain ancillary expenses such as trucking, crane and installation labor costs, depending on the terms agreed to in a particular contract.

Treating Contracts. Our treating contracts are application specific, having an initial term between one and three years, after which the contract continues on a month-to-month basis. Our customers generally pay a fixed monthly fee that not only includes the amine plant, but may also include additional equipment as required by the application. We are not responsible for acts of force majeure and our customers are generally required to pay our monthly fee even during periods of limited or disrupted production. We are generally responsible for the costs and expenses associated with the operation and maintenance of our treating equipment, such as providing the necessary makeup fluids, filters and charcoal. However, our customers are typically responsible for all fuel, gas and electricity without cost to us. Our fees include costs for all mobilization, installation, commissioning and startup.

COMPETITION

Gathering and Processing. We face strong competition in each region in acquiring new gas supplies. Our competitors in acquiring new gas supplies and in processing new natural gas supplies include major integrated oil companies, major interstate and intrastate pipelines and other natural gas gatherers that gather, process and market natural gas. Competition for natural gas supplies is primarily based on the reputation, efficiency and reliability of the gatherer and the pricing arrangements offered by the gatherer.

Many of our competitors have capital resources and control supplies of natural gas substantially greater than ours. Our major competitors for gathering and related services in each region include:

| |

• | North Louisiana: CenterPoint Energy Field Services and DCP Midstream’s PELICO Pipeline, LLC (Pelico), ETP, KMP and Chesapeake Midstream Partners, L.P.; |

| |

• | South Texas: Enterprise Products Partners LP, DCP Midstream Partners, L.P, KMP, ETP and Copano Energy, L.L.C; |

| |

• | West Texas: Southern Union Gas Services, Enterprise Products Partners LP and Targa Resources Partners L.P.; and |

| |

• | Mid-Continent: DCP Midstream Partners, L.P., ONEOK Partners L.P. and Penn Virginia Resource Partners, L.P. |

Joint Ventures. We own a 49.99% general partner interest in HPC, which owns RIGS, a 450-mile intrastate pipeline that delivers natural gas from northwest Louisiana to downstream pipelines and markets. Competitors in natural gas transportation differentiate themselves by the price of transportation, the nature of the markets accessible from a transportation pipeline and the type of service provided. HPC's major competitors in the natural gas transportation business are DCP Midstream Partners, L.P., CenterPoint Energy Transmission, Gulf South Pipeline, L.P., Texas Gas Transmission, LLC, ETP and Enterprise Products Partners LP.

We own a 50% membership interest in MEP, which owns the approximate 500-mile Midcontinent Express natural gas pipeline system. An affiliate of KMP owns a 50% interest in MEP and acts as the operator of MEP. Capacity on the MEP pipeline system is 99% contracted under long-term firm service agreements. The majority of volume is contracted to producers moving supply from the Barnett shale and Oklahoma supply basins. These agreements provide the pipeline with fixed monthly reservation revenues for the primary term of such contracts. Although there are other pipeline competitors providing transportation from these supply basins, the MEP pipeline system was designed and constructed to realize economies of scale and offers its shippers competitive fuel rates and variable costs to transport gas supplies from these midcontinent supply areas to pipelines serving Eastern markets. MEP's competitors include Gulf Crossing Pipeline, Centerpoint Energy Gas Transmission and Natural Gas Pipeline Co. of America.

We own a 30% membership interest in Lone Star which owns and operates approximately 1,400 miles of NGL pipelines, two cryogenic refinery off-gas processing plants, one fractionation facility, two NGL storage facilities and has a non-operating interest in an additional cryogenic processing plant. In markets served by its NGL pipelines, Lone Star competes with other pipeline companies and barge, rail and truck fleet operations. Lone Star also faces competition with other storage facilities based on fees charged and the ability to receive and distribute the customer's products.

Contract Compression. We believe that the superior mechanical availability of our standardized compressor fleet is the primary basis on which we compete and a significant distinguishing factor from our competition. All of our competitors attempt to compete on the basis of price. We believe our pricing is competitive because of the superior mechanical availability we deliver, the quality of our compression units, as well as the technical expertise we provide to our customers. We believe our focus on addressing customers' more complex natural gas compression needs related primarily to field-wide compression applications differentiates us from many of our competitors who target smaller horsepower projects related to individual wellhead applications. The natural gas contract compression services business is highly competitive. We face competition from large national and multinational companies with greater financial resources and, on a regional basis, from numerous smaller companies. Our main competitors in the natural gas contract compression business, based on horsepower, are Exterran Holdings, Inc., Compressor Systems, Inc., USA Compression, Valerus Compression Services LP, and J-W Energy Company.

Contract Treating. The natural gas treating business is highly competitive. We face competition from large national and multinational companies with greater financial resources and, on a regional basis, from numerous smaller companies. Our main competitors in the natural gas treating business are KMP, Valerus Compression Services LP, TransTex Gas Services, LP, Cardinal Midstream LLC, SouthTex Treaters, Interstate Treating Inc., Exterran Holdings, Inc., Thomas Russell Co. and Spartan Energy Group.

RISK MANAGEMENT

To manage commodity price and interest rate risks, we have implemented a risk management program under which we seek to:

| |

• | match sales prices of commodities (especially NGLs) with purchases under our contracts; |

| |

• | manage our portfolio of contracts to reduce commodity price risk; |

| |

• | optimize our portfolio by active monitoring of basis, swing, and fractionation spread exposure; and |

| |

• | hedge a portion of our exposure to commodity prices. |

As a result of our gathering and processing contract portfolio, we derive a portion of our earnings from a long position in NGLs, natural gas and condensate, resulting from the purchase of natural gas for our account or from the payment of processing charges in kind. This long position is exposed to commodity price fluctuations in both the NGLs and natural gas markets. Operationally, we mitigate this price risk by generally purchasing natural gas and NGLs at prices derived from published indices, rather than at a contractually fixed price and by selling natural gas and NGLs under similar pricing mechanisms. In addition, we optimize the operations of our processing facilities on a daily basis, for example by rejecting ethane in processing when recovery of ethane as an NGL is uneconomical. We hedge this commodity price risk by entering into a series of swap contracts or put option contracts for individual NGLs, natural gas and WTI. Our hedging positions are maintained within limits established by the Audit and Risk Committee of the Board of Directors. Read “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” for information regarding the status of these contracts. As a matter of policy, we do not acquire forward contracts or derivative products for the purpose of speculating on price changes.

Neither our contract compression business nor our contract treating business has direct exposure to natural gas commodity price risk because we do not take title to the natural gas we compress or treat and because the natural gas we use as fuel for our compressors is supplied by our customers or treating units without cost to us.

REGULATION

Industry Regulation

Intrastate Natural Gas Pipeline Regulation. HPC owns RIGS, an intrastate pipeline regulated by the Louisiana Department of Natural Resources, Office of Conservation (DNR). The DNR is generally responsible for regulating intrastate pipelines and gathering facilities in Louisiana and has authority to review and authorize natural gas transportation transactions and the construction, acquisition, abandonment and interconnection of physical facilities. RIGS transports interstate natural gas in Louisiana for many of its shippers pursuant to Section 311 of the NGPA. To the extent that RIGS transports natural gas in interstate service, its rates and terms and conditions of service are subject to the jurisdiction of FERC, including its non-discrimination requirements. FERC has substantial enforcement authority to impose administrative, civil and criminal penalties of up to $1 million per day per violation and to order the disgorgement of unjust profits for non-compliance.

Under Section 311 of the NGPA, rates charged for transportation services must be fair and equitable. FERC approved RIGS' NGPA Section 311 rates as fair and equitable effective February 1, 2010, under a settlement. As part of the settlement and consistent with FERC policy, RIGS is required to justify its current rates or propose new rates every five years. Accordingly, RIGS must make a rate filing on or before February 1, 2015. At that that time, RIGS' rates will be in effect, but subject to refund with interest until FERC has determined that the rates are fair and equitable.

FERC continually proposes and implements new rules and regulations affecting Section 311 transportation. FERC Order No. 735 became effective as of April 1, 2010, and required the public disclosure of the primary commercial terms of RIGS' contracts through a quarterly transactional report filing. Such regulations increase administration costs for HPC and require the public disclosure of commercial information that was previously not public for intrastate pipelines. However, since the new regulations were required of all intrastate pipelines providing Section 311 service, including our competitors, we do not believe the new regulations place RIGS at a competitive disadvantage.

On October 21, 2010, the FERC issued a Notice of Inquiry regarding the applicability of the FERC's buy-sell rules to intrastate pipelines that provide Section 311 transportation service, including whether the FERC should impose capacity release requirements on such pipelines that offer firm transportation service. FERC's interstate pipeline rules prohibit shippers on interstate pipelines from buying gas from a party at one point, transporting that gas using its interstate pipeline capacity, and re-selling the same quantity of gas to the same party at a different point (an illegal “buy-sell” transaction). The intrastate pipeline market has not been subject to such rules in the past and the FERC, through the notice of inquiry, asked market participants to comment on whether the rules should apply to shippers on Section 311 pipelines. The notice of inquiry also asked commenters to indicate whether some form of capacity release requirements should be imposed on intrastate pipelines providing firm Section 311 transportation service. We cannot predict the outcome of this notice of inquiry, but it could lead to a proposed rulemaking that would impose greater regulatory requirements on intrastate pipelines that provide Section 311 services, including RIGS.

Under FERC Order No. 720, certain major non-interstate pipelines, including gathering pipelines, were required to post on their internet websites receipt and delivery point capacities and scheduled flow information on a daily basis. In October 2011, the United States Court of Appeals for the Fifth Circuit vacated FERC Order No. 720 as it applied to non-interstate pipelines. The Court of Appeals found that FERC had no authority under the Natural Gas Act to promulgate such rules.

Interstate Natural Gas Pipeline Regulation. FERC also has broad regulatory authority over the business and operations of interstate natural gas pipelines. Under the NGA, rates charged for interstate natural gas transmission must be just and reasonable. Gulf States and MEP hold FERC-approved tariffs setting forth cost-based rates and terms and conditions of service for shippers wishing to secure capacity for interstate transportation service. Rates charged on MEP are largely governed by long-term negotiated rate agreements, an arrangement approved by FERC in its July 25, 2008 order granting MEP the certificate of public convenience and necessity to build, own and operate these facilities. MEP and Gulf States are NGA-jurisdictional interstate pipelines subject to FERC’s broad regulatory oversight. FERC’s authority extends to:

| |

• | rates and charges for natural gas transportation and related services; |

| |

• | certification and construction of new facilities; |

| |

• | extension or abandonment of services and facilities; |

| |

• | maintenance of accounts and records; |

| |

• | relationships between the pipeline and its energy affiliates; |

| |

• | terms and conditions of service; |

| |

• | depreciation and amortization policies; |

| |

• | accounting rules for ratemaking purposes; |

| |

• | acquisition and disposition of facilities; |

| |

• | initiation and discontinuation of service; |

| |

• | prevention of market manipulation in connection with interstate sales, purchase or transportation of natural gas; and |

| |

• | information posting requirements. |

FERC regularly conducts audits of interstate pipelines and has multiple means to receive complaints of alleged violations of its rules, including anonymous complaints through a toll-free hotline. Any failure to comply with the laws and regulations governing interstate transportation service could result in the imposition of significant administrative, civil and criminal penalties. FERC has authority to impose civil penalties of up to $1 million per day per violation.

Gathering Pipeline Regulation. Section 1(b) of the NGA exempts natural gas gathering facilities from FERC jurisdiction under the NGA. We own a number of natural gas pipelines that we believe meet the traditional tests that FERC has used to establish a pipeline’s status as a gatherer not subject to FERC’s interstate pipeline jurisdiction. The distinction between FERC-regulated transmission facilities and federally unregulated gathering facilities is the subject of substantial, on-going litigation. As a result, the classification and regulation of one or more of our gathering systems may be subject to change based on future determinations by FERC, the courts or the U.S. Congress.

State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements and, in other instances, complaint-based rate regulation. We are subject to state ratable take and common purchaser statutes. The ratable take statutes generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, common purchaser statutes generally require gatherers that purchase gas to purchase without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another or one source of supply over another. These statutes have the effect of restricting our right as an owner of gathering facilities to decide with whom we contract to purchase or gather natural gas.

In addition, many of the producing states have adopted some form of complaint-based regulation that generally allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to natural gas gathering access and rate discrimination. Our gathering operations could be adversely affected should they be subject in the future to the application of state or federal regulation of rates and services. Our gathering operations also may be subject to safety and operational regulations relating to the design, installation, testing, construction, operation, replacement and management of gathering facilities. Additional rules, ordinances and legislation pertaining to these matters may be considered or adopted from time to time at either the federal, state or local level. We cannot predict what effect, if any, such changes might have on our operations, but we and our competitors could be required to incur additional capital expenditures and increased costs depending on future legislative and regulatory changes.

Regulation of NGL and Crude Oil Transportation. We have a pipeline in Louisiana that transports NGLs in interstate commerce pursuant to a FERC-approved tariff. Under the ICA, the Energy Policy Act of 1992, and rules and orders promulgated thereunder, the transportation tariff is required to be just and reasonable and not unduly discriminatory or confer any undue preference. FERC has established an indexing system of transportation rates for oil, NGLs and other products that allows for an annual inflation based increase in the cost of transporting these liquids to shipper. Any failure on our part to comply with the laws and regulations governing interstate transmission of NGLs could result in the imposition of administrative, civil and criminal penalties and could have a material adverse effect on our results of operations.

Lone Star has pipelines that transport NGLs in intrastate commerce pursuant to state common carrier regulation. We also have or are constructing pipelines that are subject to state common carrier regulation for the transportation of NGLs, crude oil or condensate. Under state common carrier regulation, pipelines must charge rates that are non-discriminatory and operate pursuant to a tariff.

Sales of Natural Gas and NGLs. Our ability to sell gas in interstate markets is subject to FERC authority and oversight. The price at which we buy and sell natural gas currently is not subject to federal regulation and, for the most part, is not subject to state regulation. The price at which we sell NGLs is not subject to state or federal regulation. However, with regard to our physical purchases and sales of these energy commodities, our gathering or transportation of these energy commodities, and any related hedging activities that we undertake, we are required to observe anti-market manipulation laws and related regulations enforced by FERC and/or the CFTC.

The prices at which we sell natural gas are affected by many competitive factors, including the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation. FERC has also imposed new rules requiring wholesale purchasers and sellers of natural gas to report certain aggregated annual volume and other information beginning in 2009.

We also have firm and interruptible transportation contracts with interstate pipelines that are subject to FERC regulation. As a shipper on an interstate pipeline, we are subject to FERC requirements related to use of interstate capacity. Any failure on our part to comply with the FERC’s regulations or an interstate pipeline’s tariff could result in the imposition of administrative, civil and criminal penalties and the disgorgement of unjust profits.

Sales of crude oil, natural gas, condensate and NGLs are not currently regulated. Prices of these products are set by the market rather than by regulation.

Anti-Market Manipulation Requirements. Under the Energy Policy Act of 2005, FERC possesses regulatory oversight over natural gas markets, including the purchase, sale and transportation activities of non-interstate pipelines and other natural gas market participants. The CFTC also holds authority to monitor certain segments of the physical and futures energy commodities market

pursuant to the Commodity Exchange Act. With regard to our physical purchases and sales of natural gas, NGLs and crude oil, our gathering (of natural gas) or transportation of these energy commodities, and any related hedging activities that we undertake, we are required to observe these anti- market manipulation laws and related regulations enforced by FERC and/or the CFTC. These agencies hold substantial enforcement authority, including the ability to assess civil penalties of up to $1 million per day per violation in connection with the sale, purchase or transportation of natural gas, to order disgorgement of profits and to recommend criminal penalties. Should we violate the anti-market manipulation laws and regulations, we could also be subject to related third party damage claims by, or among others, sellers, royalty owners and taxing authorities.

Anti-Terrorism Regulations. We may be subject to future anti-terrorism requirements of the DHS. The DHS has issued its National Infrastructure Protection Plan calling for broadened efforts to “reduce vulnerability, deter threats, and minimize the consequences of attacks and other incidents” as they relate to pipelines, processing facilities and other infrastructure. The precise parameters of DHS regulations and any related sector-specific requirements are not currently known, and there can be no guarantee that any final anti-terrorism rules that might be applicable to our facilities will not impose costs and administrative burdens on our operations.

Eminent Domain. Gas utilities, common carrier pipelines, intrastate pipelines and interstate pipelines typically have eminent domain authority granted by the state or federal government. In 2011, the Texas Supreme Court issued a decision impacting the ability of common carriers to acquire land through the use of eminent domain. The decision could require common carrier pipelines to prove “public use” separately in each condemnation proceeding along the entire route of a pipeline. Several parties have requested the court's reconsideration of the decision. The decision could impact our ability to acquire right-of-way using condemnation for the construction of new common carrier pipeline projects in the state of Texas.

Local Laws and Regulations. With the rapid expansion of natural gas development in shale plays, local governmental authorities are seeking to impose additional regulatory requirements on natural gas market participants, including producers, gatherers, and pipeline companies, which may result in additional cost burdens and permitting requirements for new and existing facilities.

Environmental Matters

General. Our operation of processing plants, pipelines and associated facilities, including compression, in connection with the gathering and processing of natural gas and the transportation of NGLs is subject to stringent and complex federal, state and local laws and regulations, including those governing, among other things, air emissions, wastewater discharges, the use, management and disposal of hazardous and nonhazardous materials and wastes, and the cleanup of contamination. Noncompliance with such laws and regulations, or incidents resulting in environmental releases, could cause us to incur substantial costs, penalties, fines and other criminal sanctions, third party claims for personal injury or property damage, investments to retrofit or upgrade our facilities and programs, or curtailment of operations. As with the industry generally, compliance with existing and anticipated environmental laws and regulations increases our overall cost of doing business, including our cost of planning, constructing and operating our plants, pipelines and other facilities. Included in our construction and operation costs are capital cost items necessary to maintain or upgrade our equipment and facilities to remain in compliance with environmental laws and regulations.

We have implemented procedures to ensure that all governmental environmental approvals for both existing operations and those under construction are updated as circumstances require. We believe that our operations and facilities are in substantial compliance with applicable environmental laws and regulations and that the cost of compliance with such laws and regulations will not have a material adverse effect on our business, results of operations and financial condition. We cannot be certain, however, that identification of presently unidentified conditions, more rigorous enforcement by regulatory agencies, enactment of more stringent laws and regulations or other unanticipated events will not arise in the future and give rise to material environmental liabilities that could have a material adverse effect on our business, financial condition or results of operations.

Hazardous Substances and Waste Materials. To a large extent, the environmental laws and regulations affecting our operations relate to the release of hazardous substances and waste materials into soils, groundwater and surface water and include measures to prevent, minimize or remediate contamination of the environment. These laws and regulations generally regulate the generation, storage, treatment, transportation and disposal of hazardous substances and waste materials and may require investigatory and remedial actions at sites where such material has been released or disposed. For example, CERCLA, also known as the “Superfund” law, and comparable state laws, impose liability without regard to fault or the legality of the original conduct on certain classes of persons that contributed to a release of a “hazardous substance” into the environment. These persons include the owner and operator of the site where a release occurred and companies that disposed or arranged for the disposal of the hazardous substance that has been released into the environment. Under CERCLA, these persons may be subject to joint and several liability, without regard to fault, for, among other things, the costs of investigating and remediating the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. CERCLA and comparable state law also authorize the federal EPA, its state counterparts, and, in some instances, third parties to take actions in response to threats to the public health or the environment and to seek to recover from the responsible classes of persons the costs they incur. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly

caused by hazardous substances or other pollutants released into the environment. Although “petroleum” as well as natural gas and NGLs are excluded from CERCLA's definition of a “hazardous substance,” in the course of our ordinary operations we generate wastes that may fall within that definition or that may be subject to other waste disposal laws and regulations. We may be responsible under CERCLA or state laws for all or part of the costs required to clean up sites at which such substances or wastes have been disposed. We have not received any notification that we may be potentially responsible for cleanup costs under CERCLA or comparable state laws.

We also generate both hazardous and nonhazardous wastes that are subject to requirements of the federal RCRA, and comparable state statutes. We are not currently required to comply with a substantial portion of the RCRA requirements at many of our facilities because the minimal quantities of hazardous wastes generated there make us subject to less stringent management standards. From time to time, the EPA has considered the adoption of stricter handling, storage and disposal standards for nonhazardous wastes, including crude oil and natural gas wastes. It is possible that some wastes generated by us that are currently classified as nonhazardous may in the future be designated as “hazardous wastes,” resulting in the wastes being subject to more rigorous and costly disposal requirements, or that the full complement of RCRA standards could be applied to facilities that generate lesser amounts of hazardous waste. Changes in applicable regulations may result in a material increase in our capital expenditures or plant operating and maintenance expense.

We currently own or lease sites that have been used over the years by prior owners and by us for natural gas gathering, processing and transportation. Solid waste disposal practices within the midstream gas industry have improved over the years with the passage and implementation of various environmental laws and regulations. Nevertheless, some hydrocarbons and wastes have been disposed of or released on or under various sites during the operating history of those facilities that are now owned or leased by us. Notwithstanding the possibility that these dispositions may have occurred during the ownership of these assets by others, these sites may be subject to CERCLA, RCRA and comparable state laws. Under these laws, we could be required to remove or remediate previously disposed wastes (including wastes disposed of or released by prior owners or operators) or contamination (including soil and groundwater contamination) or to prevent the migration of contamination.

Air Emissions. Our operations are subject to the federal Clean Air Act and comparable state laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources, including our processing plants, and also impose various monitoring and reporting requirements. Such laws and regulations may require that we obtain pre-approval for the construction or modification of certain projects or facilities, such as our processing plants and compression facilities, expected to produce air emissions or to result in the increase of existing air emissions, that we obtain and strictly comply with air permits containing various emissions and operational limitations, or that we utilize specific emission control technologies to limit emissions. We will be required to incur capital expenditures in the future for air pollution control equipment in connection with obtaining and maintaining operating permits and approvals for air emissions. In addition, our processing plants, pipelines and compression facilities are subject to increasingly stringent regulations, including regulations that require the installation of control technology or the implementation of work practices to control hazardous air pollutants. Moreover, the Clean Air Act requires an operating permit for major sources of emissions and this requirement applies to some of our facilities. We believe that our operations are in substantial compliance with the federal Clean Air Act and comparable state laws. The EPA and state agencies are continually proposing new rules and regulations that could impact our existing operations and the costs and timing of new infrastructure development. Specifically, EPA has recently proposed new source performance standards (NSPS) for the oil and gas source category. New Subpart OOOO would expand the NSPS oil and gas source category to include all segments of the oil and gas industry. It would impose new controls for emissions of volatile organic compounds (VOCs) on well completions, pneumatic devices, compressors, storage vessels and equipment leaks. In addition, EPA has also recently proposed revisions to Subparts HH and HHH that would further reduce emissions of hazardous air pollutants from storage tanks and tri-ethylene glycol dehydrators at major sources. If passed, these new regulations would significantly increase our cost of compliance.

On October 19, 2010, the EPA adopted new national emission standards for hazardous air pollutants for existing stationary spark ignition reciprocating internal combustion engines that are either located at area sources of hazardous air pollutant emissions or that have a site rating of less than or equal to 500 brake horsepower and are located at major sources of hazardous air pollutant emissions. All engines subject to these “Quad Z” regulations are required to comply by October 19, 2013. Many of our facilities, including our leased compressors are impacted by these new rules. We will incur increased costs resulting from the replacement of existing equipment to bring engines into compliance with the new emission requirements. Petitions have been filed in the court of appeals for review and reconsideration of the new rules, but we cannot predict the outcome of those proceedings.

2008 Ozone NAAQS Designations. EPA Region 6 is proposing to modify the Governor of Texas' recommended designations for the 2008 ozone National Ambient Air Quality Standards (NAAQS). EPA's proposal expands the Dallas-Ft Worth and Houston-Galveston-Brazoria Counties nonattainment areas to include three additional counties. If EPA's proposal is adopted, the state of Texas will be under an obligation to develop a state implementation plan to control new and existing sources of ozone precursor emissions in those counties, which would significantly increase the cost of operations in those counties. In addition, new sources

would be required to offset emissions and the major source threshold for construction permits would be lower than otherwise, triggering more stringent control technology and impacts reviews.

New TCEQ Rule. On January 26, 2011, the TCEQ adopted a new Section 106.352. Oil and Gas Handling and Production Facilities Permit by Rule (“PBR”), which is applicable to oil and gas facilities in the Barnett shale area of Texas and provides an authorization for activities that produce more than a de minimis level of emissions. The PBR requires additional recordkeeping and reporting requirements, additional best management practices, increased emissions modeling, increased stack testing and an increase in project/facility registrations, all of which would increase our capital and operating costs in the Barnett shale in Texas. Additionally, only one PBR may be claimed or registered for each combination of dependent facilities at an oil and gas site, which is defined as all facilities that are located on contiguous or adjacent properties, under common control and designated under the same two digit standard industrial classification (SIC) code. The construction of new facilities or modification of existing facilities at an oil and gas site will subject the existing, operationally-dependent, unmodified facilities to a protectiveness review and to emissions limits for its planned maintenance, startup and shutdown activities, which may require the installation of additional emissions control equipment thereby increasing the costs of new projects and increasing capital expenditures in the Barnett shale in Texas. Currently, our facilities located in the Barnett shale are part of our Compressor Segment, and most compliance costs resulting from the PBR will be borne by our customers. Oil and gas handling and production facilities not located in the Barnett shale regions remain subject to the provisions of the PBR that was in place prior to the adoption of new Section 106.352.

Clean Water Act. The Clean Water Act and comparable state laws impose restrictions and strict controls regarding the discharge of pollutants, including NGL-related wastes, into waters of the United States. Pursuant to the Clean Water Act and similar state laws, a NPDES, or state permit, or both, must be obtained to discharge pollutants into federal and state waters. In addition, the Clean Water Act and comparable state laws require that individual permits or coverage under general permits be obtained by subject facilities for discharges of storm water runoff. We believe that we are in substantial compliance with Clean Water Act permitting requirements as well as the conditions imposed thereunder, and that our continued compliance with such existing permit conditions will not have a material adverse effect on our business, financial condition or results of operations.

Endangered Species Act. The Endangered Species Act restricts activities that may affect endangered or threatened species or their habitat. We may operate in areas that are currently designated as a habitat for endangered or threatened species, the discovery of previously unidentified endangered species, or the designation of additional species as endangered or threatened, which could cause us to incur additional costs, to develop habitat conservation plans, to become subject to expansion or operating restrictions, or bans in the affected areas.