UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JUNE 30, 2015

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OF 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _____ TO _____

COMMISSION FILE NUMBER:

CHINA GINSENG HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 20-3348253 | |

|

(State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification or Organization No.) |

64 Jie Fang Da Road, Ji Yu Building A, Suite 1208

Changchun City, China, 130022

011-86-4318-5790-039

(Address and telephone number of principal executive offices

and principal place of business)

Securities registered under Section 12 (b) of the Exchange Act: NONE

Securities registered under Section 12 (g) of the Exchange Act:

COMMON STOCK WITH $.001 PAR VALUE

(Title of Class)

Indicate by check mark if the Registrant is a well known seasoned issuer as defined in Rule 405 of the securities Act. Yes ☐ No ☒

Indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated Filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant as of December 31, 2014 (the last business day of the Registrant’s most recently completed second fiscal quarter) was approximately $398,4601 .

As of October 13, 2015, the Registrant has 44,397,297 shares of common stock outstanding.

1 We based our market value on the closing bid of our stock in the public market which was $0.01 per share as of December 31, 2014, as well as 39,846,047 shares held by non-affiliates as of December 31, 2014.

CHINA GINSENG HOLDINGS, INC

FORM 10-K INDEX

ITEM 1. DESCRIPTION OF BUSINESS

China Ginseng Holdings, Inc. (the “Company”, together with its subsidiaries, herein referred to as “we” “us” and “our”) was incorporated on June 24, 2004 in the State of Nevada. Since our inception in 2004, we have been engaged in the business of farming, processing, distribution and marketing of fresh ginseng. Starting August 2010, we have gradually shifted our business focus from farming and selling ginseng to producing and selling ginseng juice and wine with our crops as raw materials, although we still maintain our farming and selling ginseng business. Through leases, we control 3,705 acres of land approved by the Chinese government for ginseng planting. During the year ended June 30, 2014, the Forest Bureau governing one of the farms approximating 700 hectacres (1,730 acres) of land notified the Company that this lease is no longer recognized. As a result, the Company is prevented from developing and planting ginseng in undeveloped areas of this farm.

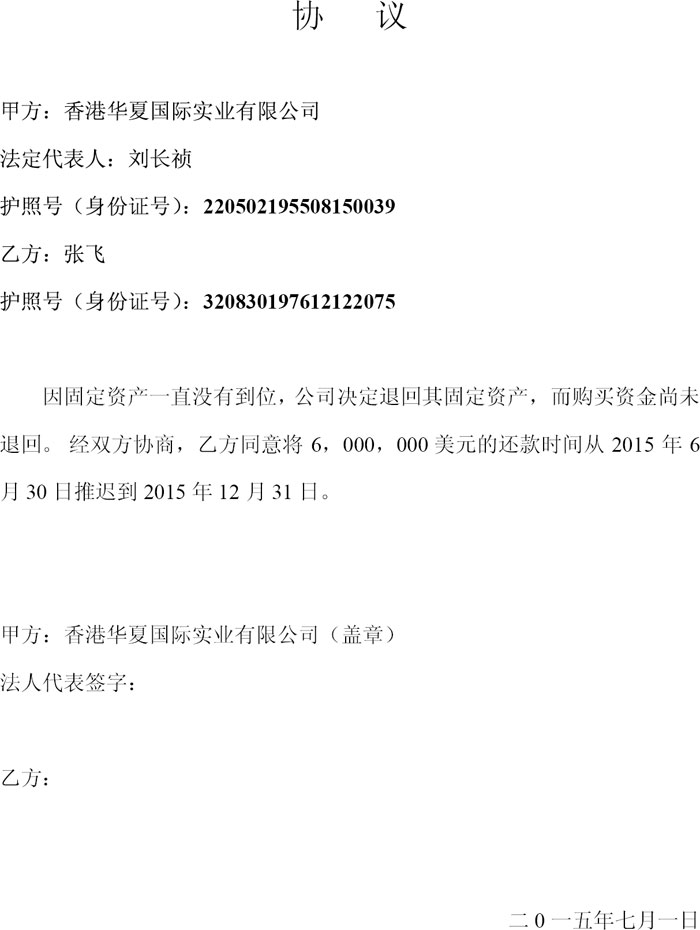

OUR ORGANIZATIONAL STRUCTURE

Below is a chart of our current organizational structure:

Note: All the wholly foreign owned enterprises have duly obtained the approval from the relevant government. Pursuant to PRC laws, a wholly foreign owned enterprise needs to apply for and obtain an approval certificate from the competent approval government authorities (the Ministry of Commerce of PRC or its local branch) and then a business license from the competent registration authorities (the Administration for industry and commerce of the PRC or its local branches) before it legally starts its business operation. Each foreign owned enterprise has not only obtained the approval certificate from the competent local approval government authorities but also the business license for the competent local registration authorities.

On August 8, 2006, six PRC regulatory agencies, including the Ministry of Commerce of the People’s Republic of China, the China Securities Regulatory Commission, the State-owned Assets Supervision and Administration Commission of the State Council, the State Administration of Taxation, the State Administration for Industry and Commerce, and the State Administration of Foreign Exchange, jointly amended and released the Merger & Acquisition Rules, which became effective on September 8, 2006 (the “2006 M&A rules”). This regulation, among other things, includes provisions that purport to require that an offshore special purpose vehicle formed for purposes of overseas listing of equity interest in PRC companies and controlled directly or indirectly by PRC companies or individuals obtain the approval of the China Securities Regulatory Commission prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. However, the 2006 M&A rules do not apply to any foreign owned enterprise. Our PRC wholly owned subsidiaries, Jilin Ganzhi, Yanbian Huaxing and Jilin Huamei, became wholly foreign owned enterprises before September 8, 2006. Therefore, the 2006 M&A rules are not applicable to Jilin Ganzhi, Yanbian Huaxing or Jilin Huamei. Tonghua Linyuan became a wholly foreign owned enterprise after September 8, 2006. According to the 2006 M&A rules, where a special purpose company is to be listed overseas for transaction, it shall be subject to the approval of the securities regulatory organization under the State Council of the PRC. Under the said rules, the “special purpose company” refers to an overseas company directly or indirectly controlled by a domestic company or Chinese person to realize the interests of a domestic company actually owned by the aforesaid domestic company or Chinese person by means of overseas listing. The current shareholders of Tonghua Linyuan are not the original shareholders of Tonghua Linyuan before Tonghua Linyuan became a wholly foreign owned enterprise on January 15, 2008. Thus the Company is not of the opinion that China Ginseng Holdings, Inc. is a “special purpose company” as defined in the 2006 M&A rules. As a result, we believe that our structure is not subject to the 2006 M&A rules.

| 1 |

Yanbian Huaxing Ginseng Industry Co. Limited (“Yanbian Huaxing”) - Ginseng farming and sales

| · | The registered capital of Yanbian Huaxing is $614,000. Yanbian Huaxing is operated to plant ginseng and our revenue in the past was mainly from the sales of ginseng produced and sold by Yanbian Huaxing. With the shift of our business focus to canned ginseng juice, we have started to reserve the high quality grown ginseng for ginseng beverage production and sold only those not qualified to make ginseng juice. However, in past three years, we were not able to reserve any grown ginseng due to various reasons such as extensive rain and typhoon. We plan to purchase high quality ginseng in the market to produce ginseng juice going forward. |

Jilin Ganzhi Ginseng Products Co. Ltd. (“Jilin Ganzhi”) - Producing Canned Ginseng Juice.

| · | The registered capital of Jilin Ganzhi is $100,000. Jilin Ganzhi is operated to process ginseng and produce canned ginseng juice. Jilin Ganzhi started production of canned ginseng juice during the three months ended December 31, 2010. |

Tonghua Linyuan Grape Planting Co. (“Tonghua Linyuan”) - Growing grapes and producing wine through a winery producer, currently inactive.

| · | On January 15, 2008, we acquired Tonghua Linyuan from two PRC individual shareholders at a price of $1,000,000 with an intention to grow grapes for wine production. | |

| · | As of June 2013, the planned production of wine and grape juice had not been commenced due to the poor quality of the harvests which were not suitable for the production of wine or grape juice, and therefore we decided to abandon the growing and harvesting of grapes. On June 30, 2013, we transferred all assets and debts of Tonghua Linyuan to Mr. Wenkai Wang for $0 (zero) consideration, including the ownership of machinery and equipment, the right to the use of the plant and the debt of $2 million of Tonghua Linyuan, effective immediately. Pursuant to the sale of all assets and debts, Tonghua Linyuan became a shell with no operations. |

Jinlin Huamei Beverage Co. Ltd (“Jilin Huamei”) - Marketing our canned ginseng juice

| · | The registered capital of Jilin Huamei is $200,000. Jilin Huamei operates as a sales department for our canned ginseng juice. We commenced sales of ginseng beverage in October 2010 and Jilin Huamei started generating revenue in November 2010. |

Hong Kong Huaxia International Industrial Co., Ltd (“Hong Kong Huaxia”) - Sale of health products and specialized local goods

| · | Hong Kong Huaxia was incorporated by us on March 18, 2012 as a wholly-owned subsidiary to sell health and specialized local products. The registered capital of Hong Kong Huaxia is HKD 1,000,000 (approximately $129,032). Hong Kong Huaxia began operations in April 2012. |

BUSINESS OVERVIEW:

Our business in China is currently conducted through the above four wholly-owned subsidiaries. Below is the operational status of each of these businesses as of the date of this filing:

| · | Yanbian Huaxing: In the past, our revenue was mainly from the sales of ginseng produced and sold by Yanbian Huaxing which consists of Yanbian farm and Mudanjiang farm. In August 2010, we shifted our business focus to canned ginseng juice and started to store fresh ginseng for producing canned ginseng juice. Qualified ginseng produced by Yanbian Huaxing has been and will continue to be used as raw material of canned ginseng juice and only those oxidized ginseng not qualified to be used for canned ginseng juice will be sold directly through Yanbian Huaxing. Yanbian farm’s harvest was substantially complete by December 31, 2012. The other farm, Mudaniang, will harvest no ginseng until about 2018 due to the damages caused by a typhoon in August 2012. However, our decision to shift our business focus mainly to production and sale of ginseng juice remains unchanged. We currently have stored sufficient ginseng to produce approximately one million ginseng juice cans and we plan to continue purchasing ginseng from the market as raw material for ginseng juice production. | |

| · | Jilin Ganzhi: Jilin Ganzhi processes fresh ginseng and produce canned ginseng juice. |

| 2 |

| · | Jilin Huamei: Jilin Huamei operates as a sale department for canned ginseng juice. We plan to recruit new distributors in 2016 if our capital allows. |

| · | Hong Kong Huaxia: Hong Kong was set up as a part of our adjusted marketing strategy so that we can explore the Asia Market through Hong Kong Huaxia while Jilin Huamei focuses on domestic sales. Hong Kong Huaxia started operation in April 2012 and generated approximately 100% of revenue during the year ended June 30, 2015 through resales of cosmetic products under the brand of Aoweisi and Ruiersui Capsules. The focus of Hong Kong Huaxia is sales of our ginseng juice in Asia market. | |

| · | Jilin Huaxia: Jilin Huaxia is a wholly owned subsidiary of Hong Kong Huaxia. We plan on opening an online store through Taobao, the biggest online business-to-consumer and consumer-to-consumer platform in Asia. Because Taobao only accepts stores with a domestic business address, we established Jilin Huaxia to facilitate our expansion into these markets. |

OUR PRODUCTS:

Previously, through Yanbian Huaxing, we focused on the farming, processing, distribution and marketing of Asian and American Ginseng and related byproducts in the following varieties:

| · | Fresh Ginseng: For pharmaceutical, health supplement, cosmetic industry and fresh consumption. | |

| · | Dry Ginseng: Dried form for pharmaceutical and health supplement consumption. | |

| · | Ginseng Seeds: Selling of ginseng seeds. | |

| · | Ginseng Seedling: Selling of ginseng seedling. |

We obtained 20 years land use rights to 3,705 acres of land approved by the local government for ginseng growing on June 12, 2005. During the year ended June 30, 2014, the Forest Bureau governing one of the farms approximating 700 hectacres (1,730 acres) of land notified the Company that this lease is no longer recognized. As a result, the Company is prevented from developing and planting ginseng in undeveloped areas of this farm.

We currently focus on developing our canned ginseng juice business. We have started selecting and reserving high quality ginseng produced by Yanbian Huaxing to be used to produce canned ginseng since August 2010. Meanwhile, as there is higher standard for ginseng used in canned ginseng juice, we are able to sell some of the ginseng produced by Yanbian Huaxing which is not qualified for use in canned ginseng juice to the market through Yanbian Huaxing. Meanwhile, we receive orders for ginseng and its byproducts because of our reputation in the industry for selling high-quality ginseng. We intend to maintain this part of our business even though it is no longer our business focus. In addition, if we receive large orders for ginseng and/or ginseng byproducts, we will directly purchase ginseng and/or ginseng byproducts from the market if we can get a lower price of the products. This part of sale of ginseng is generated on order-to-order basis and conditioned on whether we can get a lower price for such demanded products in the market.

Through Jilin Ganzhi, we produce two types of canned ginseng juice.

| · | Ganzhi Asian Ginseng Beverage | |

| · | Ganzhi American Ginseng Beverage |

In 2008, we started storing fresh ginseng as a raw material in a rented refrigerated warehouse. We entered into a 5-year lease agreement with Meat Union Refrigerated Warehouse for the rented refrigerated warehouse in 2008 for the rental of 160 cubic meters with a monthly rental of 57RMB (about USD $ 8.1) per cubic meter. In October 2010, we renewed the lease agreement with a rental of 4500 RMB (about USD $678.86, approximately $4.2 per cubic meter) per month. The principal terms of the lease agreement are as follows:

| · | Parties: Meat Union Refrigerated Warehouse (“Meat Union”) and Jilin Ganzhi Ginseng Products Co Ltd. (“Jilin Ganzhi”); |

| 3 |

| · | Meat Union leases out three refrigerated warehouses for Jilin Ganzhi to store ginseng. During the refrigerated period, Meat Union is required to keep the temperature at 12 - 15 degrees below zero, if there are any changes of the temperature Meat Union needs to notify Jilin Ganzhi immediately. If Meat Union fails to notify Jilin Ganzhi and consequently caused the molding or rotting of ginseng, Meat Union shall be responsible for all the losses. Jilin Ganzhi shall inspect warehouse temperature periodically. |

| · | The contracts starts from October 15, 2010 and will remain valid until terminated by the parties, monthly rent is 4500 RMB. When Jilin Ganzhi vacates a warehouse, both parties will renegotiate the rent for the refrigerated warehouse. |

We purchased a production factory for ginseng beverage for the total consideration of 9,000,000 RMB (USD $1,472,128) under a written contract dated March 2, 2010. We paid 500,000 RMB (about USD $81,785) on June 24, 2010; obtained an 8 million RMB (about USD $1,308,558) bank loan from Meihekou City Rural Credit Union to pay the seller on September 10, 2010; and paid 100,000 RMB (about USD $16,357) in December 2010. The remaining balance of 400,000 RMB (about USD $65,428) was to be paid off by the end of June 2010 pursuant to the written contract; however, on March 22, 2010, we obtained oral consent from the seller to extend the due date to December 31, 2011. We were not able to pay off the remaining balance by December 31, 2011 and the seller orally agreed to further extend the due date to the date when we have sufficient cash to pay off the remaining balance. Nevertheless, if our cash flow do not improve and cannot obtain a further extension from the seller or the seller revokes its oral consent of extension, the seller has the right to repossess the production factory, confiscate the deposit paid to the seller and we will be liable to compensate the seller for an amount equivalent to 6 month’s rental expenses for using the production factory. The principal terms of the written contract are as follows:

| · | Parties: Meihekou City Hengyide Warehouse Logistics Co., Ltd. (“Meihekou”) and Ganzhi Ginseng Products Co Ltd & China Ginseng Holdings, Inc. (collectively “Ginseng Group.”) |

| · | Meihekou and Ginseng Group shall go to the PRC auction company Jilin Mingshi Auction Co. Ltd. together to apply for the change of the purchaser’s name from Meihekou to Ginseng Group. The application fee is borne by Ginseng Group. |

| · | All details/content of the location, land area and facilities that to be acquired originally by Meihekou remain unchanged. The amount of the consideration of RMB 9,000,000 (about USD $1,472,128) and the agency commission that was to be originally paid by Meihekou shall remain unchanged and payment shall be made by Ginseng Group to Meihekou. |

| · | Payment method: This agreement became effective upon date of signing, Ginseng Group shall pay Meihekou of RMB 500,000 (about USD $81,785) before March 20, 2010, the remaining balance shall be repaid in full by June 30, 2010. |

| · | Meihekou shall waive the rental expenses incurred by Ginseng Group for using the premise for the period from January 2010 to February 2010. |

| · | If the remaining balance was not settled by June 2010, Meihekou has the right to repossess the premise and confiscate the deposit paid to Meihekou. And Ginseng Group is liable to compensate Meihekou for an amount equivalent to 6 month’s rental expenses for using the premise. |

Ginseng Group has not paid off the remaining balance of 400,000 RMB (about USD $65,428) until now; however, Meihekou has orally agreed to extend the due date of the payment to the date that we have sufficient cash flow to pay off the remaining balance, with all other terms and conditions remain the same.

On August 30, 2012, we paid off the 8 million RMB bank loan which we obtained from Meihekou City Rural Credit Union on November 8, 2010 by a new loan of 8 million RMB from the same lender. The principal terms of the new 8 million RMB bank loan agreement are as follows:

| · | Parties: Jilin Ganzhi Ginseng Products Co., Ltd (“Jilin Ganzhi”) and Meihekou City Rural Credit Union (“Meihekou Credit Union”); |

| · | Meihekou Credit Union granted a loan of 8 million RMB (about USD $1,308,558) to Jilin Ganzhi to be used in calling in and refunding and the term of the loan is 24 months from August 30, 2012 to August 29, 2014. |

| 4 |

| · | The loan carries a benchmark interest rate which is the rate announced by the People’s Bank of China as an interest rate of same type and class of loans at the date of the loan and changes with the adjustment of national bank rate. Meihekou Credit Union calculates the interest on a monthly basis applying this annual floating rate which is payable on the 21st day of each month. The monthly interest rate of August 2012 was 10.513 and we paid interest of 94,126.63 RMB (about USD $15,396) on August 21, 2012. During the year ended June 30, 2014, the Company repaid interest of 950,000 RMB (USD $155,391). We will assume the payment of the remaining interest when we have enough cash. |

| · | Repay the principal by installments according to the following repayment plan |

| Repayment time | Amount (Million) |

| 09-20-2012 | 1 |

| 08-29-2013 | 1 |

| 12-20-2013 | 1 |

| 08-29-2014 | 5 |

As of the date of this filing, no payments have been made for any of the installments and the loan is in default.

Our ginseng sales revenue includes revenue from our ginseng production and revenue from resale of ginseng purchased from outside farmers. Our ginseng production is constituted of our own farmed ginseng production and ginseng purchased from the farmers who leased land from us. We sell ginseng directly to the market without distributors and to customers who purchase ginseng from us on an order-to-order basis. Though purchases from a few customers aggregately accounted for more than 10% of our sales of ginseng, we do not have any written or oral agreement with those customers. We consider a purchase to be completed once cash is paid by a customer. For large orders, as is custom in the ginseng business, when ginseng is shipped to a customer, the customer pays approximately 20%-30% of the invoice and is entitled to an inspection process which could take up to 60 days. Upon completion of the inspection and approval process, the customer notifies us and sends us the balance of the invoice price, and a sale is recorded. For smaller orders, customers pick up the Ginseng from the Company, pay in cash at time of pick up and receive an invoice with appropriate sales tax applied and a cash acknowledgement. On these orders, revenue is recognized upon shipment/payment. During the years ended June 30, 2015 and 2014, no orders were subject to the inspection process.

However, as we have shifted the focus of our business from sale of ginseng to canned ginseng juice, there is no assurance that there will be sufficient demand for our beverages to allow us to operate profitably in the short term until our new products are more widely recognized and sold. Accordingly, past revenues and other financial results will not provide a meaningful basis for future performance given the material change in our business.

PRINCIPAL EXECUTIVE OFFICE:

Our principal executive offices are located at 1562 Jie Fang Great Road, 16 FL, Zhongji Building, Suite 1062-1063, Nanguan District, Changchun City, China, Tel: (86) 43188952022. Our website is http://www.chinaginsengs.com.

OUR PRODUCTS:

Ginseng Production

Sales of Ginseng

We sell ginseng directly to the market without distributors and to customers who purchase ginseng from us on an order-to-order basis. However, as of this filing, the Company has not sold any Ginseng in 2015.

In the past, if ginseng produced by us or the farmers who leased land from us were not qualified to produce canned ginseng juice, we sold it to the market. In addition, as we have been engaged in the business of farming, processing and selling ginseng for more than eight years, we are very familiar with the local ginseng planting and have good connection with ginseng farmers. Therefore, sometimes we are able to purchase ginseng with good quality from the outside farmers at a price lower than market price and then directly sell those ginseng we purchased to the market. Starting in 2008, we began reserving fresh ginseng as raw material to produce canned ginseng juice. As of the date of this filing, we are no longer selling fresh ginseng or dry ginseng directly to the market except such portions of our product that are not qualified for use in our canned ginseng juice and the ginseng we purchased from outside farmers which is oxidized ginseng. Ginseng’s growing season is from April to September. Normally we sow the seed in April and harvest in September. Excessive rain in June to August will normally cause oxidation on the ginseng because that is the grow season for ginseng. Our average yearly rain volume in the past ten years is approximately 500 millimeter and we usually have approximately 30% of ginseng oxidized each year. However, because we intend to produce high quality canned ginseng juice, we apply very strict and much higher standards when we select ginseng as raw materials for ginseng juice production. Therefore, only portion of non-oxidized with high quality grown ginseng will be reserved for ginseng juice production. For the year ended June 30, 2015, we did not reserve any of our grown ginseng for ginseng juice production due to the damage caused by the typhoon in 2012. Once ginseng is oxidized, it is no longer qualified as raw material for ginseng beverage; however, we can still sell it to the market at a lower price compared to the price of non-oxidized ginseng.

| 5 |

Sources and Availability of Raw Materials

Ginseng can only be cultivated under severely limited conditions demanding an almost perfect combination of terrain, altitude, and temperature. The growth cycle requires 5-6 years, although, senior maturity can be 8 years, and once harvested, the land can not be used again for ginseng planting for at least 25-30 years. Because the suitable lands for ginseng farming are very limited, the key to success in this industry is to control suitable land, as well as to continually develop techniques to increase production per acre.

We have been granted land use rights to 1,500 hectares (about 3,705 acres) of land resources for ginseng planting by the local government including Yanbian farm and Mudanjiang farm. Currently, we have planted approximately 287,984 square meters of land. Yanbian farm was substantially completely harvested by December 31, 2012. We only planted small amounts of Ginseng at Yanbian farm during the fiscal year ended June 30, 2013 because the climate and soil conditions have deteriorated. The other farm Mudaniang will harvest no ginseng until about 2018 due to the damages caused by a typhoon strike which occurred in August 2012. During the year ended June 30, 2014, the Forest Bureau governing Yanbian Huaxin’s farms approximately 700 hectacres (1,730 acres) of land notified the Company that this lease is no longer recognized. As a result, the Company is prevented from developing and planting ginseng in undeveloped areas of this farm.

With regard to the land resources we developed, we have hired our own employees to plant ginseng on part of the lands. When we have enough capital to plant new ginseng, we plan to enter into contacts with local farmers to grow, cultivate and harvest ginseng.

Inventory

All of our high quality ginseng is currently reserved for use by us in the manufacture of ginseng juice. Fresh ginseng can be placed in refrigerated storage for two years and still be used in the production of ginseng beverages. We plan to begin to use the reserve ginseng to manufacture the ginseng juice in the second quarter of fiscal year ended June 30, 2016.

Seasonality

Sales of ginseng products are seasonal, with most customers placing orders in the first and fourth quarter in any year as our ginseng is harvested in autumn, after necessary processing procedures, and available for sale in winter. However, as we no longer sell these products to any significant extent, seasonality is no longer an issue.

Canned Ginseng Juice

We are selling the following two products:

| · | Ganzhi Ginseng Beverage, Approval No. State Food & Drug Administration G20090249 | |

| · | Ganzhi American Ginseng Beverage, Approval No. State Food & Drug Administration G20090208 |

To produce canned ginseng juice, we take ginseng juice extracted from fresh ginseng as the main material plus natural extracts like xylitol, citric acid and steviosides as subsidiary ingredients. We have farming technicians periodically inspect farmers to ensure they follow our growing guidelines to control the quality of the fresh ginseng. We use low residue pesticide and biodegradable fertilizer for ginseng planting. And we use xylitol instead of sugar to lower calories. Further, products made with xylitol do not cause a sour taste.

Currently, there are about 10 kinds of ginseng drinks on the market; all of them are Chinese. The price range for those products is 6 -40 RMB per can (about USD $0.97-$ 4.51) and one fresh ginseng juice imported from Korea, about 49 RMB (about USD 7.96) based on our market research.

The most important component of ginseng is ginsenoside. Through reading our competitor’s labels, we found that nearly all of their ginseng drinks are produced by blending after extracting ginsenosides through chemical methods. The extraction for ginsenosides will cause damage to its nutritional components. Our technology is different from that traditional method. We squeeze out the natural juice from fresh ginseng so as to preserve freshness and nutrition in the final product.

The reason direct squeezing is not commonly used in canned ginseng juice is that it needs fresh ginseng as a raw material and preservation of fresh ginseng is very difficult. Fresh ginseng rots very fast. The harvest time concentrates in September and October, which is a fairly short period. After that, one can only buy dried ginseng from market such as sun-dried ginseng from which we cannot squeeze juice. However, our drink formula enables us to use refrigerated ginseng as a raw material to produce canned ginseng juice and still be able to maintain its freshness and nutrition in our final products. The drink formula for our ginseng beverages is a registered patent approved by the Chinese government, patent number ZL 03111397.6. This patent was issued on January 23, 2008 and expires 20 years after issuance.

| 6 |

This is why we store our fresh ginseng in refrigerated warehouse space. We are currently renting a refrigerated warehouse (-20 C degree) to store all fresh ginseng inventory necessary for production of the ginseng beverages. Monthly rent for refrigerated warehouse is RMB 4,500 (about USD $676.86). We commenced production in August 2010 and sales in October 2010 which was reflected in our financial statement for the three months ended December 31, 2010. We initiated our sales of canned ginseng juice in China and we plan to expand our business to overseas provided that we obtain sufficient funding. Our Ganzhi Ginseng Beverage costs approximately $1.13 per bottle (160 ml) and our American Ginseng Beverage will cost approximately $1.12 per bottle (160 ml). However, as we are in the initial stage of ginseng beverage business, we cannot assure the demands for our ginseng beverage will be profitable in the short term and there is no guarantee that we will be able to generate revenue with ginseng beverage business.

We own the production plant for ginseng juice. The plant is certified by the Chinese government as a Good Manufacturing Process facility, which is required for our production of these products. Good Manufacturing Process standards cover organization and personnel, building and facilities, equipment, materials, hygiene and sanitation, validation, documentation, production management, quality management, production distribution and recall, complaints and adverse reactions report, and self-inspections.

The estimated total one-time costs associated with the production of our ginseng beverage is approximately 50 million RMB (about USD $7,549,791) including 2 million RMB for research and governmental approval, 6 million RMB for GMP adjustment construction, 8 million RMB for equipment, 11 million RMB for facility construction and upgrades, 20 million for working capital and 3 million RMB for other expenses.

We plan to fund these costs through a combination of short-term borrowings, bank loans, cash from operations and sales of our equity.

Distribution Methods

There are 667 cities in China. We plan to recruit one general distributor for canned ginseng juice in each city through Jilin Huamei if our capital allows. The general distributor can recruit the second level distributors. In addition to recruiting general distributors, in some major cities, Jilin Huamei will establish sale branch offices to facilitate the local sales. Our direct sale will target at customers of high end retailers such as supermarkets, pharmacies, hotels, gift shops, entertainment centers, tourists attractions, airport and high speed trains, etc.

We recruited distributors in the past. However, we have not renewed any distribution agreement upon expiration or recruited new distributors because of lack of funds. We plan to recruit distributor once we resume our production and have enough fund.

Sources and Availability of Raw Materials

We obtain fresh ginseng for beverage production from two sources, our grown ginseng including self-planted ginseng and the ginseng sold to us by farmers in accordance with the contracts we entered into with them, and the ginseng we purchase from the outside farmers. However, due to various reasons, we were not able to reserve high quality ginseng from self-planted ginseng in the past three years. We plan to purchase high quality ginseng from the market for ginseng juice production going forward.

Seasonality

There is no seasonality for sale of ginseng beverages.

MARKETING ACTIVITIES

Once our capital allows, we plan to recruit general distributors to sell our products through our subsidiaries Jilin Huamei and Hong Kong Huaxia. IAnd we plan to set up Jilin Huamei sale brach offices in some major cities in addition to the online sale through Hong Kong Huaxia’s e-commerce.

RESEARCH AND DEVELOPMENT

Due to lack of funds, we have had no research and development expenses in the past two years.

INTELLECTUAL PROPERTY

We rely primarily on a combination of patent, certificates and administrative protections to safeguard our intellectual property.

The drink formula for our ginseng beverages is a registered patent approved by the Chinese government, patent number ZL 03111397.6. This patent was issued on January 23, 2008 and expires 20 years after issuance.

| 7 |

Although our other products have no patent protection, our two types of ginseng beverages have been certified as PRC domestic healthcare food by SFDA (State Food and Drug Administration) and received approval certificates (“GMP Healthcare Food Certificate”) from the SFDA, each of which is valid for a term of 5 years and renewable at the expiration thereof. According to the Rules for Administration over Registration of Healthcare Food (Trial Implementation) issued by SFDA on April 30, 2005, the healthcare food applying for GMP Health Food Certificate refers to such food as claimed to have special health function or focuses on supplementing vitamins or minerals, that is, food which is suitable for special population, has function of regulating the institutions instead of treating diseases, and will not bring any acute, sub-acute or chronic damages to the body. The application for registration of healthcare food shall be subject to an examination and approval process in which the SDFA evaluates and examines systematically the safety, effectiveness, quality controllability as well as the specifications of the healthcare food being applied for registration and make a decision as approving the registration or not according to the application and based on the lawful procedures, conditions and requirements. As of the date of this filing, we have received the following SFDA approvals for renewal:

| a. | Health food production permit for Jilin Ganzhi Beverage Company, Approval No. 2014-0001, issued on February 17, 2014, valid until February 16, 2018. |

| b. | SFDA approval for Ganzhi Ginseng Beverage, No. SFDA G20090249 issued by the State Food & Drug Administration on May 31, 2009 which is valid indefinitely until and unless the SFDA issues a stop order (*). | |

| c. | SFDA approval for Ganzhi American Ginseng Beverage, No. SFDA G20090208 issued by the State Food & Drug Administration on May 27, 2009 which is valid indefinitely until and unless the SFDA issues a stop order (*). |

* Circular of Health Food Re-registering, SFDA No.[2010]300, July 23, 2010.

REGULATORY ENVIRONMENT

In addition to U.S. securities laws, banking laws and laws applicable to all companies, such as The Foreign Corrupt Practices Act, as a China-based entity, we are subject to various Chinese regulations. This section sets forth a summary of the most significant China regulations or requirements that may affect our business activities operated in China or our shareholders’ right to receive dividends and other distributions of profits from the PRC subsidiary.

Foreign Investment in PRC Operating Companies

The Foreign Investment Industrial Catalogue jointly issued by China’s Ministry of Commerce (MOFCOM) and NDRC in 2011 classified various industries/businesses into three different categories: (i) encouraged for foreign investment; (ii) restricted to foreign investment; and (iii) prohibited from foreign investment. For any industry/business not covered by any of these three categories, they will be deemed industries/businesses permitted for foreign investment. Except for those expressly provided with restrictions, encouraged and permitted industries/businesses are usually 100% open to foreign investment and ownership. With regard to those industries/businesses restricted to foreign investment, there is always a limitation on foreign investment and ownership. Foreign investment is prohibited in prohibited industries/business. The PRC subsidiary’s business does not fall under the industry categories that are restricted to, or prohibited from foreign investment and is not subject to limitation on foreign investment and ownership.

Regulation of Foreign Currency Exchange

Foreign currency exchange in the PRC is governed by a series of regulations, including the Foreign Currency Administrative Rules (1996), as amended, and the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), as amended. Under these regulations, the Renminbi is freely convertible for trade and service-related foreign exchange transactions, but not for direct investment, loans or investments in securities outside the PRC without the prior approval of State Administration of Foreign Exchange (SAFE). Pursuant to the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), foreign investment enterprises, or FIEs may purchase foreign exchange without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange to satisfy foreign exchange liabilities or to pay dividends. However, the relevant Chinese government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside the PRC are still subject to limitations and require approvals from SAFE.

| 8 |

Regulation of FIEs’ Dividend Distribution

The principal laws and regulations in the PRC governing distribution of dividends by FIEs include:

| (i) | The Sino-foreign Equity Joint Venture Law (1979), as amended, and the Regulations for the Implementation of the Sino-foreign Equity Joint Venture Law (1983), as amended; |

| (ii) | The Sino-foreign Cooperative Enterprise Law (1988), as amended, and the Detailed Rules for the Implementation of the Sino-foreign Cooperative Enterprise Law (1995), as amended; |

| (iii) | The Foreign Investment Enterprise Law (1986), as amended, and the Regulations of Implementation of the Foreign Investment Enterprise Law (1990), as amended. |

Under these regulations, FIEs in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, the wholly-owned foreign enterprises in the PRC are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds unless such reserve funds have reached 50% of their respective registered capital. These reserves are not distributable as cash dividends.

Regulation of a Foreign Currency’s Conversion into RMB and Investment by FIEs

On August 29, 2008, SAFE issued a Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises or Notice 142, to further regulate the foreign exchange of FIEs. According to Notice 142, FIEs shall obtain a verification report from a local accounting firm before converting its registered capital in foreign currency into Renminbi, and the converted Renminbi shall be used for the business within its permitted business scope. Notice 142 explicitly prohibits FIEs from using RMB converted from foreign capital to make equity investments in the PRC, unless the domestic equity investment is within the approved business scope of the FIE and has been approved by SAFE in advance. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Violations of Notice 142 may result in severe penalties, including substantial fines as set forth in the SAFE rules.

In addition, SAFE promulgated the Notice on Relevant Issues Concerning Strengthening the Administration of Foreign Exchange Businesses in November 2010, which requires the authenticity of settlement of the funds raised from offshore offerings to be closely examined and the settlement of funds should conform to their intended use as listed in the offering document. For the settlement of funds in excess of those intended by the offering document or for a purpose other than that listed in the offering document, a board resolution relating to the use of funds shall be submitted as a separate application document. SAFE further promulgated a circular in November 2011, which prohibits a foreign-invested enterprise from using Renminbi funds converted from its foreign currency registered capital to provide entrustment loans or repay loans borrowed from non-financial enterprises. These circulars may limit our ability to transfer the net proceeds from the offshore offering to our wholly foreign-owned subsidiaries in China, and we may not be able to convert the proceeds from the offshore offering into Renminbi to invest in or acquire any other PRC companies.

On November 19, 2012, SAFE promulgated the Circular of Further Improving and Adjusting Foreign Exchange Administration Policies on Foreign Direct Investment, or Circular 59, which became effective on December 17, 2012. Circular 59 substantially amends and simplifies the then current foreign exchange procedures. Under Circular 59, the opening of various special purpose foreign exchange accounts (e.g. pre-establishment expenses account, foreign exchange capital account, guarantee account) no longer requires the approval of SAFE. Reinvestment of Renminbi proceeds by foreign investors in the PRC no longer requires SAFE approval or verification.

On May 10, 2013, SAFE promulgated the Circular on Printing and Distributing the Provisions on Foreign Exchange Administration over Domestic Direct Investment by Foreign Investors and the Supporting Documents, which specifies that the administration by SAFE or its local branches over direct investment by foreign investors in the PRC shall be conducted by way of registration. Institutions and individuals shall register with SAFE and/or its local branches for their direct investment in the PRC. Banks shall process foreign exchange business relating to the direct investment in the PRC based on the registration information provided by SAFE and its branches.

Regulation of Foreign Exchange in Certain Onshore and Offshore Transactions

In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Return Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or SAFE Notice 75, which became effective as of November 1, 2005. SAFE has also issued implemented rules to SAFE Notice 75. SAFE Notice 75 and its implementation rules require PRC residents (including both corporate entities and natural persons) to register with SAFE or its competent local branch in connection with their direct or indirect shareholding in any company outside of China referred to as an “offshore special purpose company” established for the purpose of raising fund from overseas to acquire assets of, or equity interests in, PRC companies. Under SAFE Notice 75, a “special purpose vehicle”, or SPV, refers to an offshore entity established or controlled, directly or indirectly, by PRC residents for the purpose of seeking offshore equity financing using assets or interests owned by such PRC residents in onshore companies. In addition, any PRC resident that is the shareholder of an offshore special purpose company is required to amend his or her SAFE registration with the SAFE or its competent local branch, with respect to that offshore special purpose company in connection with any of its increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China. The SAFE regulations require retroactive approval and registration of direct or indirect investments previously made by PRC residents in offshore special purpose companies. PRC subsidiaries of an offshore special purpose company are required to coordinate and supervise the filing of SAFE registrations by the offshore holding company’s shareholders who are PRC residents in a timely manner. In the event that a PRC resident shareholder with a direct or indirect investment in an offshore parent company fails to obtain the required SAFE approval and make the required registration, the PRC subsidiaries of such offshore parent company may be prohibited from making distributions of profit to the offshore parent and from paying the offshore parent proceeds from any reduction in capital, share transfer or liquidation in respect of the PRC subsidiaries. Further, failure to comply with the various SAFE approval and registration requirements described above, as currently drafted, could result in liability under PRC law for foreign exchange evasion.

| 9 |

There still remain uncertainties as to how certain procedures and requirements under the aforesaid SAFE regulations will be enforced, and it remains unclear how these existing regulations, and any future legislation concerning offshore or cross-border transactions, will be interpreted, amended and implemented by the relevant government authorities. Although we have requested PRC residents who, to our knowledge, hold direct or indirect interests in our Company to make the necessary applications, filings and amendments as required under the SAFE Notice 75 and other related rules, our PRC resident beneficial holders have not completed such approvals and registrations required by the SAFE regulations due to the complexity and procedural requirements involved in securing such SAFE approval. We will attempt to comply, and attempt to ensure that all of our shareholders subject to these rules comply with the relevant requirements. We cannot, however, assure the compliance of all of our China-resident shareholders. Any current or future failure to comply with the relevant requirements could subject us to fines or sanctions imposed by the Chinese government, including restrictions on certain of our subsidiaries’ ability to pay dividends or hinder our investment in those subsidiaries or affect our ownership structure, which could adversely affect our business and prospects.

Regulations on Employee Stock Option Plans

In December 2006, the People’s Bank of China promulgated the Administrative Measures of Foreign Exchange Matters for Individuals, which set forth the respective requirements for foreign exchange transactions by individuals (both PRC or non-PRC citizens) under either the current account or the capital account. In January 2007, SAFE issued implementing rules for the Administrative Measures of Foreign Exchange Matters for Individuals, which, among other things, specified approval requirements for certain capital account transactions such as a PRC citizen’s participation in the employee stock ownership plans or stock option plans of an overseas publicly-listed company. In March 2007, SAFE promulgated the Application Procedures of Foreign Exchange Administration for Domestic Individuals Participating in Employee Stock Ownership Plan or Stock Option Plan of Overseas-Listed Company, or the 2007 Stock Option Rules. In February 2012, SAFE promulgated the Notice on Issues Related to Foreign Exchange Administration on Domestic Individuals’ Participation in Equity Incentive Plans of Overseas-Listed Company, which replaced the 2007 Stock Option Rules. Under current effective rules, if a PRC resident participates in any equity incentive plan of an overseas publicly-listed company, a qualified PRC domestic agent must, among other things, file on behalf of such participant an application with SAFE to conduct the SAFE registration with respect to such equity incentive plan and obtain approval for an annual allowance with respect to the purchase of foreign exchange in connection with the exercise or sale of stock options or stock such participant holds. Such participating PRC residents’ foreign exchange income received from the sale of stock and dividends distributed by the overseas publicly-listed company must be fully remitted into a PRC collective foreign currency account opened and managed by the PRC agent before distribution to such participants.

Further, a notice concerning the individual income tax on earnings from employee share options jointly issued by Ministry of Finance, or the MOF, and the State Administration of Taxation, or the SAT, and its implementing rules, provide that domestic companies that implement employee share option programs shall (a) file the employee share option plans and other relevant documents to the local tax authorities having jurisdiction over them before implementing such employee share option plans; (b) file share option exercise notices and other relevant documents with the local tax authorities having jurisdiction over them before exercise by the employees of the share options, and clarify whether the shares issuable under the employee share options mentioned in the notice are the shares of publicly listed companies; and (c) withhold taxes from the PRC employees in connection with the PRC individual income tax.

We and our PRC citizen employees who participate in the employee stock incentive plan, which we adopted in 2010, will be subject to these regulations. We and our PRC option grantees have not completed the registrations under these regulations. We cannot assure you that we and our PRC option grantees will be able to complete the required registrations. Any current or future failure to comply with the relevant requirements could subject us to fines or sanctions imposed by the Chinese government, which could adversely affect our business and prospects.

| 10 |

Government Regulations Relating to Taxation

On March 16, 2007, the National People’s Congress or NPC, approved and promulgated the PRC Enterprise Income Tax Law, which we refer to as the EIT Law. The EIT Law took effect on January 1, 2008. Under the EIT Law, FIEs and domestic companies are subject to a uniform tax rate of 25%. The EIT Law provides a five-year transition period starting from its effective date for those enterprises which were established before the promulgation date of the EIT Law and which were entitled to a preferential lower tax rate under the then-effective tax laws or regulations.

On December 26, 2007, the State Council issued a Notice on Implementing Transitional Measures for Enterprise Income Tax, or the Notice, providing that the enterprises that have been approved to enjoy a low tax rate prior to the promulgation of the EIT Law will be eligible for a five-year transition period beginning January 1, 2008, during which time the tax rate will be increased step by step to the 25% unified tax rate set out in the EIT Law. From January 1, 2008, for the enterprises whose applicable tax rate was 15% before the promulgation of the EIT Law, the tax rate will be increased to 18% for 2008, 20% for 2009, 22% for 2010, 24% for 2011, and 25% for 2012. For the enterprises whose applicable tax rate was 24%, the tax rate was changed to 25% from January 1, 2008.

The new tax law provides only a framework of the enterprise tax provisions, leaving many details on the definitions of numerous terms as well as the interpretation and specific applications of various provisions unclear and unspecified. Any increase in the combined Company’s tax rate in the future could have a material adverse effect on our financial condition and results of operations.

The current EIT Law, which became effective on January 1, 2008, imposes a uniform enterprise income tax rate of 25% on all PRC resident enterprises, including foreign-invested enterprises and domestic enterprises, unless they qualify for certain exceptions.

The new tax law provides only a framework of the enterprise tax provisions, leaving many details on the definitions of numerous terms as well as the interpretation and specific applications of various provisions unclear and unspecified. Any increase in the combined company’s tax rate in the future could have a material adverse effect on its financial conditions and results of operations.

Food Safety Law of the People’s Republic of China

The Food Safety Law of the People’s Republic of China as adopted at the 7th Session of the Standing Committee of the 11th National People’s Congress of the People’s Republic of China and effective on June 1, 2009, governs the food safety in food production and business operation activities. Pursuant to the Food Safety Law of the People’s Republic of China, food producers must establish an internal inspection and record system for raw materials and predelivery products, and food distributors must also establish internal systems to record and inspect food products procured from suppliers. In addition, any food additives that are not in the approved government catalog must not be used and no food products can be sold inspection-free.

Regulations on the Implementation of the Food Safety Law of the People’s Republic of China

The Regulations on the Implementation of the Food Safety Law of the People’s Republic of China as adopted at the 73rd Standing Committee Meeting of the State Council on July 8, 2009 and effective on July 20, 2009, are promulgated in accordance with the Food Safety Law of the People’s Republic of China. The Regulations require that the local People’s Government at or above the country level shall perform the responsibility specified in the Food Safety Law of the People’s Republic of China, improve the ability for supervision and administration of food safety, ensure supervision and administration of food safety; establish and improve the coordination mechanism between food safety regulatory authorities, integrate and improve the food safety information network, and realize the sharing of food safety and food inspection information and other technical resources.

Law of the People’s Republic of China on Quality and Safety of Agricultural Products

The Law of the People’s Republic of China on Quality and Safety of Agricultural Products was adopted at the 21st Meeting of the Standing Committee of the Tenth National People’s Congress on April 29, 2006. This Law was enacted in order to ensure the quality and safety of agricultural products, maintain the health of the general public, and promote the development agriculture and rural economy. Pursuant to this Law, agricultural products distribution enterprises shall establish a sound system of inspection and acceptance for their purchases. In addition, agricultural products that fail to pass the inspection based on the quality and safety standards of agricultural products cannot be marketed.

Compliance with Environmental Law

We comply with the Environmental Protection Law of China and its local regulations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. Our costs of compliance with applicable environmental laws are minimal, since the manufacturing of our products generates very limited damages, if any, to the environment. Accordingly we had no expenditures for compliance with environmental law in 2014 and 2015 and do not anticipate incurring any such costs in the future. Penalties would be levied upon us if we fail to adhere to and maintain certain standards. Such failure has not occurred in the past, and we generally do not anticipate that it may occur in the future, but no assurance can be given in this regard.

| 11 |

Competition

Ginseng

The market in China for ginseng is extremely competitive. Based upon management’s knowledge of the industry in China, we believe that there are more than four companies engaged in ginseng production in China. The significant competition within the ginseng industry for planting land is compounded by the Chinese government’s recent promotion of forestation in state-owned forests. This has dramatically reduced the woodland available for ginseng planting.

Our major competitors are Changbai Baoquan Mountain, Changbai Ni Li River, Ji An Ginseng and Antler Company & The First Fu Song Ginseng Farm. Based upon its significant knowledge of the ginseng industry in China, management believes that we rank in the middle of these competitors, the larger of which in general have greater financial and personnel resources and have achieved greater market penetration than we have. However, because there are no published statistics concerning our competitors, this is based solely upon management’s experience in the industry.

We believe we compete in this market based upon our patented technology to produce our ginseng beverage and land resources controlled directly by land use rights granted to us

Ginseng Beverage

In the market there are about 10 kinds of ginseng beverage. The prices of these products range from approximately $0.60 to $4.51 per bottle.

The Company currently is a small competitor in the market. Some of our competitors have greater financial and personnel resources and all have achieved greater market penetration than we have.

We believe we have some competitive advantage in the China market due to the technology we use to produce our ginseng beverage. Based upon reading of competitors’ labels, all of their ginseng drinks are produced by blending after extracting ginsenosides through chemical methods. Management believes that the extraction for ginsenosides will cause damage to its nutritional components because high heat is used in the process of the extraction. Our technology is different from the method used by our competitors. We squeeze out the natural juice from fresh ginseng. However, our drink formula enables us to use refrigerated ginseng as raw material to produce canned ginseng juice and still able to maintain its freshness and nutrition in final products. The drink formula for our ginseng beverages is a registered patent approved by the Chinese government, patent number ZL 03111397.6. This patent was issued on January 23, 2008 and expires 20 years after issuance. In order to store the fresh ginseng, we rent a refrigerated warehouse (-20 C degree). We currently have fresh ginseng inventory to produce approximately one million cans of ginseng juice.

Employees

We have the following employees as of the date of this filing. The seasonal field workers listed below are part-time employees.

| Total | Officers | Admin | Accounting | Full-time Employee |

Part -time Employee |

|||||||||||||||||||

| China Ginseng Holding | 10 | 1 | 4 | 2 | 3 | 0 | ||||||||||||||||||

| Jilin Huamei | 5 | 1 | 1 | 2 | 1 | 0 | ||||||||||||||||||

| Yanbian Huaxing | 5 | 1 | 2 | 2 | 0 | 0 | ||||||||||||||||||

| Jilin Ganzhi | 42 | 1 | 11 | 2 | 28 | 0 | ||||||||||||||||||

| Jinlin Huaxia | 5 | 1 | 1 | 2 | 1 | 0 | ||||||||||||||||||

| Hong Kong Huaxia | 19 | 1 | 1 | 2 | 15 | 0 | ||||||||||||||||||

| Total | 86 | 6 | 20 | 12 | 48 | 0 | ||||||||||||||||||

We consider our relationship with our employees to be excellent.

| 12 |

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

Our principal executive offices are located at 1562 Jie Fang Great Road, 16 FL, Zhongji Building, Suite 1062-1063, Nanguan District, Changchun City, China. The corporate headquarters occupy approximately 749.17 square meters and is on a one-year lease from January 1, 2014 to December 31, 2015. Rent is approximately $22,108 for one year.

We own free and clear the office building located in the City of Yanbian, which is approximately 4,519 square feet, and it is used for office/administrative purposes. We also own free and clear processing center in the City of Yanbian, which is consisted of 7,090 square feet of space; warehouse space of 1366 square feet; and seasonal worker dormitory of 688 square feet. In the City of Yanbian, we also own the right to use the parcel of land (129,120 square feet approximately) where these facilities are located. The land use right is for 30 years commencing November 2002 and there is no rent required due to the preferential policies.

Currently, we rent refrigerated warehouse space of 160 cubic meters and we pay approximately $678.86 per month. The refrigerated warehouse space is 160 cubic meters, which is not enough for our future refrigerated storage needs. We will need to at least double the space. Our current refrigerated storage space is sufficient to store 20 tons of fresh ginseng. However, we might need more refrigerated space in the future after we start production and sales of canned ginseng juice. In the future, we plan to build our own refrigerated warehouse, with approximately 1,000 cubic meters storage space, after we are able to generate stable net income from sales of our ginseng beverage and anticipate that it will take about two months to complete building.

On June 15, 2000, we were granted 20 years land use rights of approximately 2000 acres of Ermu Forestry land by Ermu County Government, Tunhua. On January 8, 2005, we entered into a land lease agreement with Heilongjiang Province Muling Forestry Bureau and Huaxing Ginseng Industry Co. for 1,750 acres of forest to grow ginseng for 20 years and pursuant to the lease agreement, our annual aggregate lease payments are approximately $91,500. However, during the year ended June 30, 2014, the Forest Bureau governing Yanbian Huaxin farm approximately 700 hectacres (1,730 acres) of land notified the Company that this lease is no longer recognized.

We do not intend to renovate, improve, or develop properties, except as set forth above. We do not carry property or crop insurance on our land. We have no policy with respect to investments in real estate or interests in real estate and no policy with respect to investments in real estate mortgages. Further, we have no policy with respect to investments in securities of or interests in persons primarily engaged in real estate activities.

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. We are not aware of any pending or threatened legal proceeding that, if determined in a manner adverse to us, could have a material adverse effect on our business and operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the OTCBB under the symbol “CSNG” and has very limited trading. The closing price for our Common Stock on the OTCBB on October 12, 2015 was $0.03 per share.

As of October 10, 2015, we had 278 record holders of common stock. This number excludes any estimate by us of the number of beneficial owners of shares held in street name, the accuracy of which cannot be guaranteed.

| 13 |

Effective August 11, 1993, the SEC adopted Rule 15g-9, which established the definition of a “penny stock,” for purposes relevant to the Company, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person’s account for transactions in penny stocks; and (ii) that the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person’s account for transactions in penny stocks, the broker or dealer must (i) obtain financial information and investment experience and objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form, (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) states that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Disclosure also has to be made about the risks of investing in penny stock in both public offerings and in secondary trading, and about commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Options, Warrants, Convertible Securities

Currently, we do not have any warrants, options or convertible securities outstanding.

Dividends

We have not declared any cash dividends on our common stock since our inception and do not anticipate paying such dividends in the foreseeable future. We plan to retain any future earnings for use in our business. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the board of directors deems relevant.

Reports to Shareholders

As required under Section 12(g) of the Securities Exchange Act of 1934, we are required to file quarterly and annual reports with the SEC and will also be subject to the proxy rules of the SEC. In addition, our officers, directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity.

Description of Equity Compensation Plans

We do not have any equity compensation plans. Our Board of Directors may adopt one or more equity compensation plans in the future.

Recent Sales of Unregistered Securities

None.

Where You Can Find Additional Information

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. For further information with respect to the Company, you may read and copy its reports, proxy statements and other information, at the SEC public reference rooms at 100 F. Street, N.E., Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the public reference rooms. The Company’s SEC filings are also available at the SEC’s web site at http://www.sec.gov.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

FORWARD-LOOKING INFORMATION

This report contains forward-looking statements regarding our plans, expectations, estimates and beliefs. Actual results could differ materially from those discussed in, or implied by, these forward-looking statements. Forward-looking statements are identified by words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “will,” “may,” and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. We have based these forward-looking statements largely on our expectations.

| 14 |

Forward-looking statements are subject to risks and uncertainties, certain of which are beyond our control. Due to these risks and uncertainties, the forward-looking events and circumstances discussed in this report or incorporated by reference might not transpire. The following discussion contains forward-looking statements and involves numerous risks and uncertainties. Actual results may differ materially from those contained in any forward-looking statements.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of financial condition and results of operations relates to the operations and financial condition reported in the financial statements of the Company for the fiscal years ended June 30, 2015 and 2014 and should be read in conjunction with such financial statements and related notes included in this report.

Overview

Our company, China Ginseng Holdings Inc., was incorporated on June 24, 2004 in the State of Nevada.

We were granted 20 year land use rights to 3,705 acres of lands by the Chinese government for ginseng planting. However, during the year ended June 30, 2014, the Forest Bureau governing Yandian Huaxin farms, approximately 700 hectacres (1,730 acres) of land, notified the Company that this lease is no longer recognized. As a result, the Company is prevented from developing and planting ginseng in undeveloped areas of this farm. As of now, we have the 20-year land use rights to approximately 2,020 acres of lands for ginseng planting.

Since our inception in 2004, we have been engaged in the business of farming, processing, distribution and marketing of fresh ginseng, dry ginseng, ginseng seeds, and seedlings. Starting in August 2010, we have gradually shifted the focus of our business from direct sales of ginseng to canned ginseng juice and have started to store our raw material and sell very limited self-produced ginseng. We also purchase ginseng from outside sources, and then resell them to generate revenue and those sales are based on the order from the market. However, due to the global recession and local market conditions, demand for ginseng exports declined beginning in 2008, creating a significant oversupply in China. In addition, our ginseng beverage business needs more capital to develop and promote. All those factors caused us to have losses in recent years.

As of June 30, 2015, the cash balance on hand for the Company was about $10,016. Our auditors have determined that we do not currently have sufficient working capital necessary and have raised substantial doubt about our ability to continue as a going concern.

In order to meet the challenge, we are taking the following actions:

On July 21, 2015, we raised 1.6 million dollars through private placement. With those capital, the Company plans to restart ginseng beverage production and apply a new reduced size ginseng beverage (40 ML) in October 2015. We estimate that it will be approved by the SFDA by the end of 2015.

On August 18, 2015, our Board appointed Mr. Yin to be CEO and Chairman of the Company. Mr. Yin is a very successful and experienced entrepreneur and a leader. He received Glory Star issued by Zhenjiang City Danyang Commerce and Industry Bureau for five consecutive years. Under the leadership of Mr. Yin, the Company will focus on the ginseng beverage business in 2016 and might bring more health products to the Company’s business in 2017. We believe that it is the right time to make the Company a diversified health products company because healthcare and wellness is a growing industry in China which brings us opportunities to become a long term growth company and to be a benchmarking enterprise in ginseng beverage industry.

Our Products:

Previously, through Yanbian Huaxing, we focused on the farming, processing, distribution and marketing of Asian and American Ginseng and related byproducts in the following varieties:

| · | Fresh Ginseng: For pharmaceutical, health supplement, cosmetic industry and fresh consumption. |

| · | Dry Ginseng: Dried form for pharmaceutical and health supplement consumption. |

| · | Ginseng Seeds: Selling of ginseng seeds. |

| · | Ginseng Seedling: Selling of ginseng seedling. |

Ginseng’s growing season is from April to September, six months a year. Normally we sow the seed in April and harvest in September. Ginseng seeds are obtained after the blossom in autumn, the seed can be sowed in September or next Spring, it takes 10 days to germinate and 10 days for seedling. And the whole growing cycle for ginseng from seeding to harvest usually takes around 5-6 years to ensure the growth of ginseng and the nutrition it contains in the root. For ginseng, every hectare can harvest 18 to 20 kg ginseng. As of June 30, 2015, the planting area for ginseng is 287.984 square meter.

| 15 |

Since August 2010, we have gradually shifted our business focus from direct sale of ginseng and ginseng byproducts to production and sale of canned ginseng juice and wine.

Through Jilin Ganzhi, we produce two types of canned ginseng juice.

| · | Ganzhi Asian Ginseng Beverage |

| · | Ganzhi American Ginseng Beverage |

New Focus of Our Business

Canned Ginseng Juice

Currently, there are about 10 kinds of ginseng drinks on the market in China; all of them are imported from Korea. The price range for those products is 10 -30 RMB per can (about USD $1.50-$4.51).

The most important component of ginseng is ginsenoside. Based upon reading competitor labels, all of their ginseng drinks are produced by blending after extracting ginsenosides through chemical methods. The extraction for ginsenosides will cause damage to its nutritional components. Our technology is different from that traditional method used by our competitors. We squeeze out the natural juice from fresh ginseng as the main material plus natural extracts like xylitol, citric acid and steviosides as subsidiary ingredients. We have farming technicians periodically inspect farmers to ensure they follow our growing guidelines to control the quality of the fresh ginseng. We use low residue pesticide and biodegradable fertilizer for ginseng planting. And we use xylitol instead of sugar to lower calories. Further, products made with xylitol do not cause a sour taste.

The reason direct squeezing is not commonly used in canned ginseng juice is that it needs fresh ginseng as a raw material and preservation of fresh ginseng is very difficult. However, our drink formula enables us to use refrigerated ginseng as raw material to produce canned ginseng juice and still able to preserve its freshness and nutrition in final products. The drink formula for our ginseng beverages is a registered patent approved by the Chinese government, patent number ZL 03111397.6. This patent was issued on January 23, 2008 and expires 20 years after issuance.

In order to produce canned ginseng juice, we store our fresh ginseng in refrigerated warehouse space. We are currently renting a refrigerated warehouse (-20 C degree) to store all fresh ginseng inventory necessary for production of the ginseng beverages. Monthly rent for refrigerated warehouse is RMB 4,500 (about USD $676.86). We commenced production in August 2010 and sales in October 2010. However, as we are in the initial stage of ginseng beverage business, we cannot assure the demands for our ginseng beverage will be high enough to make our business profitable in the short term and there is no guarantee that we will be able to generate the revenue from ginseng beverage business.

We own the production plant. The plant is certified by the Chinese government as a Good Manufacturing Process facility, which is required for our production of these products. Good Manufacturing Process standards cover organization and personnel, building and facilities, equipment, materials, hygiene and sanitation, validation, documentation, production management, quality management, production distribution and recall, complaints and adverse reactions report, and self-inspections.

Distribution

We intend to recruit one general distributor for our products of ginseng beverage and wine in every city in China. The city level distributor can recruit the second level distributors. In addition to recruiting general distributors, in some major cities, Jilin Huamei will establish sale branch offices to facilitate the local sales. Our direct sale will target customers of high end retailers such as supermarkets, pharmacies, hotels, gift shops, entertainment centers, tourists’ attractions, airport and high speed trains, etc.