UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 10-K

_________________________________________

For the year ended December 31 , 2023

Commission file number 001-34835

_________________________________________

(Exact name of registrant as specified in its charter)

_________________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

Registrant’s telephone number, including area code: (312 ) 827-2800

_________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading symbol(s) | Name of each exchange on which registered: | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☒

1

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Aggregate market value of registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock on June 30, 2023 as reported on The New York Stock Exchange on that date: $2.0 billion. For purposes of this calculation, shares of common stock held by (i) persons holding more than 5% of the outstanding shares of stock and (ii) officers and directors of the registrant, as of June 30, 2023, are excluded in that such persons may be deemed to be affiliates. This determination is not necessarily conclusive of affiliate status.

As of February 23, 2024, 54,788,793 shares of the common stock with a par value of $0.005 per share were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Part III incorporates by reference portions of the registrant’s definitive proxy statement for the annual meeting of stockholders, which will be filed within 120 days after the close of the 2023 fiscal year.

2

TABLE OF CONTENTS

| Page | ||||||||

3

Forward‑Looking Statements

Unless otherwise indicated, the terms “Envestnet,” “the Company,” “we,” “us” and “our” refer to Envestnet, Inc. and its subsidiaries as a whole.

This annual report on Form 10‑K for the year ended December 31, 2023 contains forward‑looking statements regarding future events and our future results within the meaning of the Private Securities Litigation Reform Act of 1995. These forward‑looking statements include, in particular, statements about our plans, strategies and prospects under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. These statements are based on our current expectations and projections about future events and are identified by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “expected,” “intend,” “will,” “may,” or “should” or the negative of those terms or variations of such words, and similar expressions are intended to identify such forward‑looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our business and other characteristics of future events or circumstances are forward‑looking statements. The potential risks, uncertainties and other factors that could cause actual results to differ from those expressed by the forward-looking statements in this Annual Report include, but are not limited to,

•our ability to recruit and retain senior executive leadership and other key employees and to successfully manage transitions, including the transition of our chief executive officer;

•adverse economic or global market conditions, including periods of rising inflation and market interest rates, and governmental responses to such conditions;

•the conflicts in the Middle East and between Russia and Ukraine, including related sanctions and their impact on the global economy and capital markets;

•the concentration of our revenue from the delivery of our solutions and services to clients in the financial services industry;

•our reliance on a limited number of clients for a material portion of our revenue;

•the renegotiation of fees by our clients;

•changes in the estimates of fair value of reporting units or of long-lived assets, particularly goodwill and intangible assets;

•the amount of our debt, our ability to service our debt and risks associated with derivative transactions associated with our debt;

•limitations on our ability to access information from third parties or charges for accessing such information;

•the targeting of some of our sales efforts at large financial institutions and large financial technology companies which prolongs sales cycles, requires substantial upfront sales costs and results in less predictability in completing some of our sales;

•changes in investing patterns on the assets on which we derive revenue and the freedom of investors to redeem or withdraw investments generally at any time;

•the impact of fluctuations in market conditions and interest rates on the demand for our products and services and the value of assets under management or administration;

•increased geopolitical unrest and other events outside of our control that could adversely affect the global economy or specific international, regional and domestic markets;

•our ability to keep up with rapid technological change, evolving industry standards or changing requirements of clients;

•risks associated with our international operations;

•the competitiveness of our solutions and services as compared to those of others;

•liabilities associated with potential, perceived or actual breaches of fiduciary duties and/or conflicts of interest;

•harm to our reputation;

•the failure to protect our intellectual property rights;

•our reliance on outsourcing arrangements;

•activist shareholders hindering the execution of our business strategy, diverting board and management attention and resources and causing us to incur substantial expenses;

•public health crises, pandemics or similar events;

•our ability to successfully identify potential acquisition candidates, complete acquisitions and successfully integrate acquired companies;

•our ability to successfully execute the conversion of clients’ assets from their technology platform to our technology platforms in a timely and accurate manner;

•our ability to introduce new solutions and services and enhancements;

4

•regulatory compliance failures;

•our ability to maintain the security and integrity of our systems and facilities and to maintain the privacy of personal information and potential liabilities for cybersecurity breaches;

•the effect of privacy laws and regulations, industry standards and contractual obligations and changes to these laws, regulations, standards and obligations on how we operate our business and the negative effects of failure to comply with these requirements;

•failure by our customers to obtain proper permissions or waivers for our use of disclosure of information;

•adverse judicial or regulatory proceedings against us;

•failure of our solutions, services or systems, or those of third parties on which we rely, to work properly;

•potential liability for use of inaccurate information by third parties provided by us;

•the occurrence of a deemed “change of control”;

•the uncertainty of the application and interpretation of certain tax laws;

•issuances of additional shares of common stock or issuances of shares of preferred stock or convertible securities on our existing stockholders;

•general economic, political and regulatory conditions;

•global events, natural disasters, environmental disasters, terrorist attacks and pandemics, including their impact on the economy and trading markets;

•management’s response to these factors.

More information on these important factors that could cause actual results to differ materially from the forward‑looking statements we make in this Annual Report are set forth in Part I, Item 1A under “Risk Factors”. In addition, there may be other factors of which we are presently unaware or that we currently deem immaterial that could cause our actual results to be materially different from the results referenced in the forward‑looking statements. All forward‑looking statements contained in this Annual Report and documents incorporated herein by reference are qualified in their entirety by this cautionary statement. Forward‑looking statements speak only as of the date they are made, and we do not intend to update or otherwise revise the forward‑looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events, except as required by applicable law. If we do update one or more forward‑looking statements, no inference should be made that we will make additional updates with respect to those or other forward‑looking statements.

You should read this Annual Report completely and with the understanding that our actual future results, levels of activity, performance and achievements may be different from what we expect and that these differences may be material. We qualify all of our forward‑looking statements by these cautionary statements.

The following discussion and analysis should also be read along with our consolidated financial statements and the related notes included elsewhere in this Annual Report. Except for the historical information contained herein, this discussion contains forward‑looking statements that involve risks and uncertainties. Actual results could differ materially from those discussed below.

5

Item 1. Business

For a summary of commonly used industry terms and abbreviations used in this annual report on Form 10-K, see the Glossary of Terms.

General

Envestnet, through its subsidiaries, is transforming the way financial advice and insight are delivered. Our mission is to empower financial advisors and service providers with innovative technology, solutions and intelligence. Envestnet is a leader in helping transform wealth management, working towards its goal of expanding a holistic financial wellness ecosystem so that our clients can better serve their clients.

Envestnet's clients include more than 108,000 advisors, 16 of the 20 largest U.S. banks, 48 of the 50 largest wealth management and brokerage firms, over 500 of the largest RIAs and hundreds of FinTech companies, all of which leverage Envestnet technology and services that help drive better outcomes for enterprises, advisors and their clients.

Through a combination of platform enhancements, partnerships and acquisitions, Envestnet uniquely provides a financial network connecting technology, solutions and data, delivering better intelligence and enabling its customers to drive better outcomes.

Envestnet, a Delaware corporation originally founded in 1999, serves clients from its headquarters in Berwyn, Pennsylvania, as well as other locations throughout the United States, India and other international locations.

Segments

Envestnet is organized around two business segments based on clients served and products provided to meet those needs. Financial information about each business segment is contained in Part II, Item 8, “Note 23—Segment Information”. Our business segments are as follows:

•Envestnet Wealth Solutions – a leading provider of comprehensive and unified wealth management software, services and solutions to empower financial advisors and institutions to enable them to deliver holistic advice to their clients.

•Envestnet Data & Analytics – a leading provider of financial data aggregation, analytics and digital experiences to meet the needs of financial institutions, enterprise FinTech firms and market investment research firms worldwide.

Envestnet Wealth Solutions Segment

Envestnet Wealth Solutions empowers financial advisors at broker-dealers, banks and RIAs with all the tools they require to deliver holistic wealth management to their end clients. In addition, the firm provides advisors with practice management support so that they can grow their practices and operate more efficiently. At the end of 2023, Envestnet Wealth Solutions’ platform assets were approximately $5.8 trillion in over 19.1 million accounts overseen by more than 108,000 advisors.

Services provided to advisors include: financial planning, risk assessment tools, investment strategies and solutions, asset allocation models, research, portfolio construction, proposal generation and paperwork preparation, model management and account rebalancing, account monitoring, customized fee billing, overlay services covering asset allocation, tax management and socially responsible investing, aggregated multi‑custodian performance reporting and communication tools and data analytics. We also have access to a wide range of leading third‑party asset managers.

Envestnet Wealth Solutions serves its clients principally through the following product and service suites:

•Envestnet | Enterprise provides an end-to-end open architecture wealth management platform, through which advisors can construct portfolios for clients. It begins with aggregated household data which then leads to the creation of a financial plan, asset allocation, investment strategy, portfolio management, rebalancing and performance reporting. Advisors have access to approximately 23,000 investment products. Envestnet | Enterprise also sells data aggregation and reporting, data analytics and digital advice capabilities to customers.

6

•Envestnet | Wealth Analytics delivers an end-to-end platform experience that transforms data into actionable intelligence that informs our client's next best course of action. The insights foster the acceleration of data-driven strategy with enterprise-level analytics including clients, fees, opportunities, attrition, benchmarking and firm valuation.

•Envestnet | Tamarac provides leading trading, rebalancing, portfolio accounting, performance reporting and client relationship management software, principally to high‑end RIAs.

•Envestnet | MoneyGuide provides leading goal-based financial planning solutions to the financial services industry. The highly adaptable software helps financial advisors add significant value for their clients using best-in-class technology with enhanced integrations to generate financial plans.

•Envestnet | Workplace Solutions offers a comprehensive suite of services for advisor-sold retirement plans. Our retirement solutions address the regulatory, data, and investment needs of retirement plans and delivers the information holistically. Workplace Solutions includes a digital 401(k) retirement plan marketplace that streamlines retirement plan distribution and due diligence among financial advisors and third-party administrators. With Envestnet's retirement solutions marketplace, advisors can employ Envestnet's outsourced fiduciary services for investment selection and monitoring in retirement plan portfolios and can access essential information to make investment recommendations and understand the impact of fund changes to the total cost of their plans.

•Envestnet | PMC®, or Portfolio Management Consultants provides research and consulting services to assist advisors in creating investment solutions for their clients. These solutions include over 5,000 vetted third-party managed account products, multi-manager portfolios and fund strategist portfolios, as well as approximately 850 proprietary products, such as quantitative portfolios and fund strategist portfolios. PMC also offers portfolio overlay and tax optimization services.

•Envestnet | Billing Solutions (Redi2) offers revenue management and hosted fee-billing solutions in the global financial services industry. Redi2's platform enables fee calculation, invoice creation, payouts and accounting, and billing compliance. Redi2 solutions caters to different segments of the market with three different product lines: Revenue Manager which provides client revenue accounting and billing services for asset managers; Wealth Manager which delivers multi-party billing and payouts for broker-dealers and turnkey asset management programs and BillFin™ which offers advisory billing and invoicing for financial advisors.

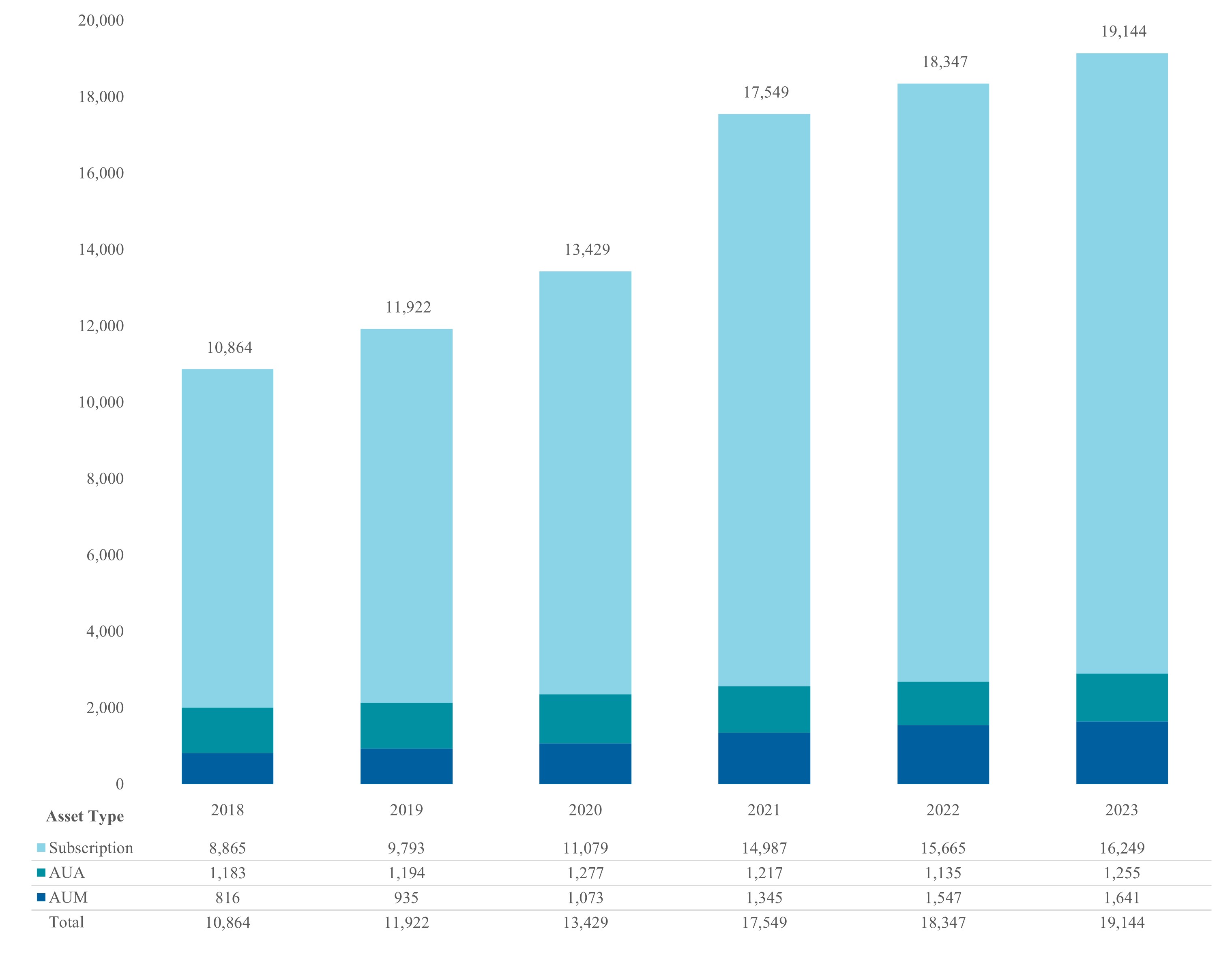

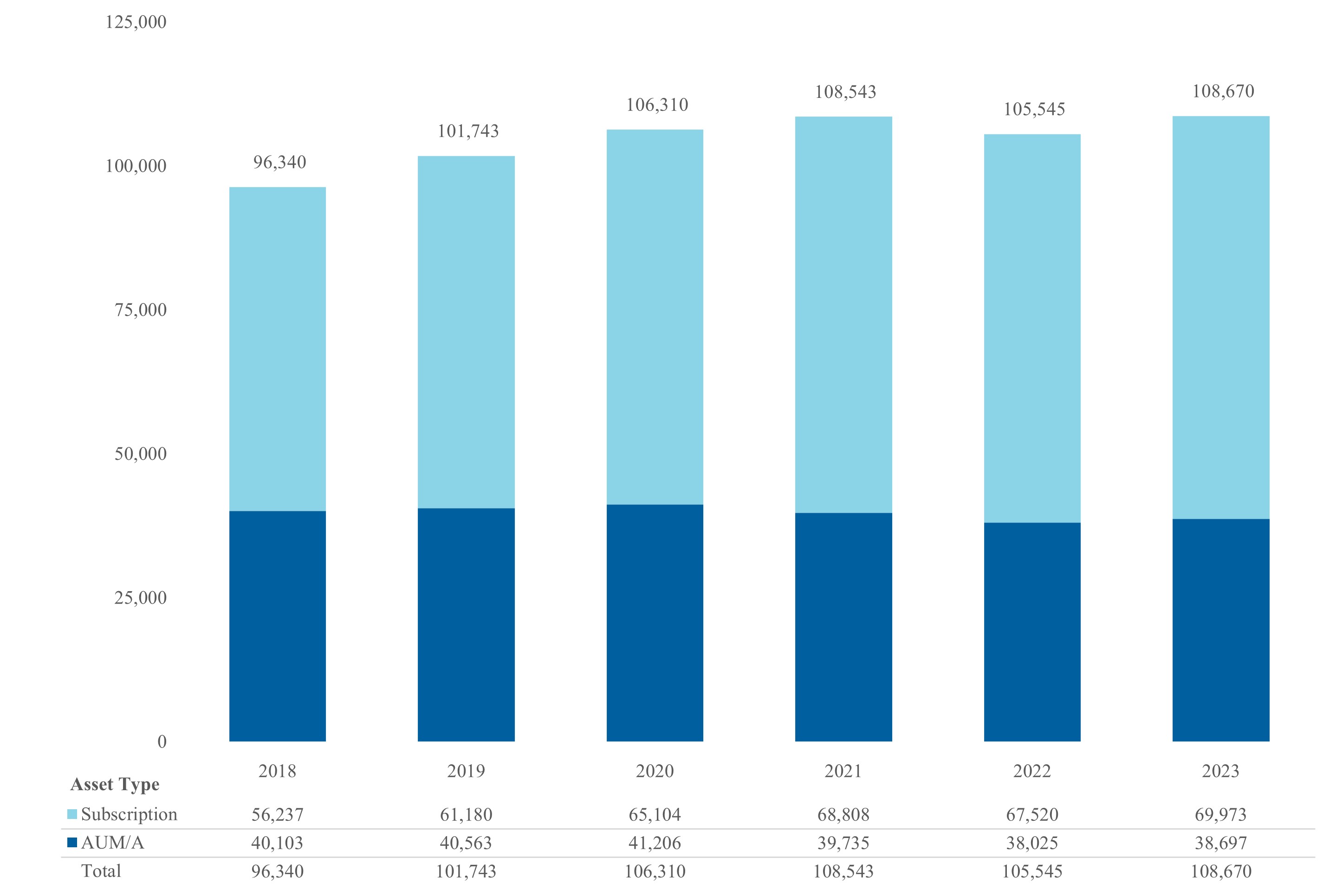

As the tables below indicate, Envestnet Wealth Solutions has experienced steady and significant growth over the last several years. We believe this growth is attributable to secular trends in the wealth management industry, the uniqueness and comprehensiveness of our products, as well as acquisitions. Periodically, clients choose to change the way they pay for our solution, whereby they switch from an asset-based pricing model to a subscription-based model.

7

The following charts show growth in assets, number of accounts and advisors supported by Envestnet Wealth Solutions, distinguishing those metrics between AUM/A and subscription.

AUM/A & Subscription

($ in billions)

($ in billions)

AUM/A & Subscription Accounts

(in thousands)

(in thousands)

AUM/A & Subscription Advisors

8

Envestnet Data & Analytics Segment

Envestnet Data & Analytics is a leading data aggregation, analytics and digital experiences platform. Envestnet Data & Analytics provides clients and their account holders with data connectivity via open APIs, data enrichment, AI-based analytics and digital experiences.

Over 1,300 clients, including financial institutions, financial technology innovators and financial advisory firms, including 16 of the 20 largest U.S. banks, subscribe to the Envestnet Data & Analytics platform to underpin personalized financial apps and services for more than 38 million paid end-users.

Envestnet Data & Analytics serves two primary markets:

•Open Banking provides personal financial management, wealth management, payments, credit/lending, business financial management and enterprise business intelligence solutions for retail and commercial banks, credit unions, credit card providers, wealth management firms, FinTech firms, E-commerce and payment solution providers.

•Alternative Data provides de-identified consumer spending insights for investment research and corporate and marketing research clients.

We believe that our brand recognition, innovative technology and intellectual property, large client base, and unique data gathering and enrichment capabilities provide us with competitive advantages that have enabled us to grow.

Market Opportunity

Envestnet Wealth Solutions Segment

The wealth management industry has experienced significant growth in terms of assets invested by retail investors over the past several years. According to the Federal Reserve, U.S. household financial assets totaled approximately $112 trillion as of September 30, 2023, representing a sizeable wealth management opportunity. According to Boston Consulting Group's Global Wealth Report 2023, total net wealth in North America is expected to grow by 5% annually between 2022 and 2027 to exceed $200 trillion. Based on data from Cerulli Associates, invested assets comprised an estimated 52% of overall U.S. household financial assets in 2022, advisor-directed assets totaled $26.9 trillion in 2022 and advisors had discretion over 57% of managed account assets as of September 30, 2023.

In the next 5-10 years, we believe the wealth management industry will continue to consolidate with fewer firms and fewer advisors managing more assets, making scale and operational efficiency increasingly important. This will require firms to integrate technology into all areas of their business.

The following trends are impacting our business and creating a large and growing market opportunity for data, technology and wealth solutions and services like ours:

•Scale and convergence: Scale is a defining theme across the financial services landscape, including wealth management. For example, in the independent broker-dealer channel, the number of firms with $10 billion in assets or more rose 19% between 2017 and 2022, just as the total number of firms decreased 14% over the same period. In the RIA channel, firms with at least $1 billion of assets represented 71% of assets in 2022. We expect consolidation of firms and assets to continue, driven by factors including advisor succession needs, private capital attracted to the space, and the growing expectations of end-investors for modern digital experiences and holistic advice relationships. Moreover, we believe wealth channels are converging. Broker-dealers are becoming more RIA-like in their approach as they embrace planning and grow fee-based assets, while RIAs are becoming more enterprise-like as they consolidate, scale, and unify brands, technology, and services. The digital client experience and ability to serve the specialized needs of high-net-worth investors are increasingly paramount to success. Envestnet is well positioned for this future. More specifically, as of December 31, 2023, we served more than 108,000 advisors, including those at 48 of the top 50 wealth management and brokerage firms and thousands of RIAs. Envestnet | MoneyGuide is the leading financial planning software provider, according to the 2024 T3/Inside Information Advisor Software Survey, and 2.4 million plans were created or updated using the software in 2023. Envestnet Data & Analytics has over 400 million linked accounts and more than 38 million paid end-users. From an operations standpoint, we handled over 200 million trades in 2023 across more than 30 trading and custody partners.

9

•Personalization: Consumers are increasingly demanding personalization in both their technology and their investments. On the technology front, Envestnet is delivering over 24 million insights per day to financial advisors, home offices and financial institutions. By surfacing actionable opportunities, we are enabling our customers to create a better client experience and drive business efficiency and growth. We also began the phased rollout of the new Envestnet platform user interface and enhanced our financial planning software through a generational technology release. On the investment side, direct indexing, tax overlay and sustainable investing enable advisors to tailor portfolios to meet specific client needs. We have invested in each of these capabilities for years and continue to enhance our offerings. For instance, over the last two years we have enhanced our tax overlay capabilities to include additional account types, and we are now able to tax manage third-party model portfolios, both on a stand-alone basis and when they are offered within a UMA account. Also, our longest-tenured direct indexing strategy achieved a 10-year, GIPS-compliant track record at year-end 2023.

•Integrated technology: Financial advisors and enterprises are looking for integrated, seamless WealthTech workflows; as such, spending on technology continues to climb. According to the Celent's North American IT spending report, North American wealth management firms expected to increase their technology budgets by 4.6% in 2023, with the largest level of investment being made in the front office. We are delivering a cloud-based, open architecture, end-to-end technology stack to the marketplace. Our technology platform is broad and integrated, encompassing portfolio management capabilities from proposal to planning to reporting and billing. We have invested in and connected our core technology offerings to the Envestnet Insurance Exchange, the Envestnet Credit Exchange, and the Envestnet Trust Exchange, among other offerings, to create a comprehensive digital ecosystem for advisors and their clients. In 2023, we rolled out our new proposal engine to 99% of client firms; the tool provides enhanced features, streamlined workflows, and seamless access to managed accounts. We enhanced integrations across the Envestnet ecosystem and with third-party software providers; for example, we fully integrated the Envestnet proposal tool into Envestnet | Tamarac, including new proposals and strategy modifications. We also expanded integrations with external CRM tools and simplified the account opening process with Docupace via our next generation proposal tool. We plan to continue to invest in software, APIs, developer tools, and integration points.

•Holistic advice: Consumers are increasingly demanding a wider range of services from their financial services providers, leading more firms to embrace holistic advice. In fact, a 2023 McKinsey survey found that 47% of wealth clients preferred an investment professional that can holistically address financial needs across investments, taxes, banking, and life insurance—up from 29% in 2018. In addition, we believe the movement toward holistic advice reflects a natural maturation of the industry and is being driven by competition from scaled wealth management firms and innovation from self-directed fintech companies which are adding more services. Financial planning tools—which are foundational to providing holistic advice—have, in tandem, become more widely used by advisors. 86% of advisors in the 2024 T3/Inside Information Advisor Software Survey have adopted financial planning software, up from 79% in the 2021 survey. Envestnet’s mission is to make financial wellness a reality for everyone and as such we continue to expand our ecosystem of technology, solutions and intelligence for advisors. In 2023, we launched Envestnet Retire Complete, providing wealth advisors access to a range of retirement savings resources to help their clients meet their retirement objectives.

•Leveraging data: Enterprises, advisors, and financial institutions need to leverage in-house and third-party data to make better, more timely decisions. According to Wavestone's 2024 Data and AI Leadership Executive Survey, 82% of senior executive respondents stated their organizations were increasing investments in data and analytics. We offer a variety of wealth data solutions. Our Insights Engine surfaces over 100 different types of insights for advisors and enterprises to enable them to grow and manage more efficient practices. Our enterprise data management capability gathers and ingests advisor client accounts, classifying them using a uniform process across account types and sources. Data comes from our portfolio accounting system, a client-permissioned source via account aggregation, or an account assigned to a firm within an institutional feed from a custodian, recordkeeper, trust accounting system, or data provider. All accounts are fully reconciled and packaged at the enterprise level, providing our customers with a single source of truth for wealth data. We also provide enterprise, advisor, and asset manager analytics which enable benchmarking and deeper business understanding. Finally, we use prescriptive and predictive analytics to create insights for next-best-actions, helping advisors grow and create more efficient practices.

10

•Independent and fee-based advice: We are a driver and beneficiary of the growth of financial advice, movement to independent channels, fee-based pricing and managed accounts. The financial advice industry is growing. According to an annual survey by MarketCast and Cerulli Associates, the percentage of affluent investors saying they are willing to pay for advice has increased from 53% in 2018 to 64% in 2023. Within the advice industry, Cerulli forecasts independent advice channels (where Envestnet has its largest market presence) to expand from 39% of advisor-mediated assets in 2022 to 44% in 2027, driven by growth in the RIA and hybrid RIA channels. Advice delivered with fee-based pricing—as opposed to commission-based pricing—also continues to take share, growing from 47% of industry assets in 2017 to 55% in 2022, according to Cerulli. Lastly, also per Cerulli, industrywide managed account assets have grown organically (excluding market appreciation) at an 8% annualized rate from December 31, 2017 through September 30, 2023. Envestnet’s managed account annualized organic asset growth rate, as measured by organic AUM growth, has been approximately double that of the industry over the same time period.

Envestnet Data & Analytics Segment

Envestnet Data & Analytics sits at the center of several important trends, including the movement toward Open Banking, personalization and insights and growth of alternative data.

•Open Banking: Generally, Open Banking is defined as the structured exchange of data by consumers with and between their financial providers, taking into account those consumers’ needs and informed consent. In 2023, the value of the Open Banking market was estimated to be $25 billion, according to Grand View Research, and is projected to grow at a 27% CAGR to reach $135 billion in 2030. Regulations are a key driver behind the growth of active Open Banking participation worldwide. For example, in the United States, the Consumer Financial Protection Bureau released its proposed rulemaking on personal financial data rights to implement Section 1033 of the Consumer Financial Protection Act of 2010 and, in Canada, Open Banking regulation is expected to go into effect in 2025. Accordingly, the percentage of financial institutions considering Open Banking a ‘must have’ has increased from 51% in 2021 to 61% in 2022, according to a global survey by Finastra. Today, Envestnet Data & Analytics works with clients and data providers across 37 different countries and, specifically in the United States, over 50% of our consumer-permissioned traffic now flows through Open Banking connections. As a leader in the space, we—along with our clients and end-consumers—benefit from improved data sharing success rates, higher connection resiliency and availability and faster access through APIs. Improved connectivity drives business growth for Envestnet by increasing usage and user engagement, while also potentially opening access to new providers and domains. Additionally, as Open Banking use cases expand beyond connectivity, we expect greater adoption of Envestnet Data & Analytics’ full offering of solutions, which already cover major use cases across retail wellness, wealth management, payment enablement, small to medium business, enterprise business intelligence, credit decisioning, fraud monitoring and others.

•Personalization and insights: Consumers expect more personalized experiences from their financial services providers, yet only 56% of consumers feel their bank is delivering in this area, per a Capgemini survey. As a result, an overwhelming majority of banks are planning to intensify their hyper-personalization programs, according to FICO, and 88% plan to support their personalization goals via analytics and machine learning to collect insights. Further, in the credit space, a Nova Credit study found that 75% of lenders think traditional credit data and scores aren't providing a complete picture of consumers' creditworthiness, and 59% of those lenders have incorporated some type of alternative data into their underwriting process. Through our insights, Envestnet Data & Analytics helps firms understand patterns of behavior and user segments, which provides valuable information on how to best serve their clientele, while also helping those firms build and scale hyper-personalized financial wellness experiences for their customers. In addition, firms use our insights to better understand their businesses. The Envestnet Bank Deposit Index, for example, delivers cash flow transparency with daily views and insights into bank deposits, enabling a bank to compare deposit flows at their institution to other regional and national banks and see other benchmark data for greater context.

•Alternative data: The alternative data market is forecast to reach $136 billion in 2030, up from $7 billion in 2023 and implying a 52% CAGR, according to Grand View Research. Envestnet Data & Analytics offers comprehensive data from hundreds of data sources which helps organizations generate insights and broad market research based on consumer spending from alternative data and make better business decisions. Additionally, alternative data adoption will be fueled, in part, by the growing popularity of AI technologies, as the data can be employed to train and enhance AI models. Our data practices around natural language processing and machine learning leverage several deep learning AI models to accurately identify signals and provide enriched dimensions from the data, helping organizations extract the full potential of AI and fine-tune its predictive power.

11

Revenue Model

Our business model lends itself to a high degree of recurring and predictable revenue.

Within the Envestnet Wealth Solutions segment, we provide asset-based, subscription-based and professional services on a business-to-business-to-consumer basis to financial services clients, whereby customers offer solutions to their end users based on our platform. Clients select the business model that works best for them based on their regulatory status and revenue model.

Within the Envestnet Data & Analytics segment, we provide, on a business-to-business basis, an open platform to customers and third-party developers through an open API framework.

We believe that a number of characteristics contribute to the success of our business model, including:

•Favorable trends with respect to growth in fee-based assets and need for advanced technology;

•Recurring and resilient revenue base;

•Strong customer retention/ enterprise relationships;

•Pricing model that captures industry growth; and

•Ability to operate and deliver at scale.

Our revenue is generated in the following manners:

Asset-based Recurring Revenue

In our Envestnet Wealth Solutions segment, asset-based recurring revenue primarily consists of fees for providing customers continuous access to platform services through the Company’s uniquely customized platforms. These platform services include investment manager research, portfolio diagnostics, proposal generation, investment model management, rebalancing and trading, portfolio performance reporting and monitoring solutions, billing and back office and middle-office operations and administration and are made available to customers throughout the contractual term from the date the customized platform is launched.

Asset-based fees that the Company earns are generally based upon variable percentages of assets managed or administered on our platforms. The fee percentage varies based on the level and type of services the Company provides to its customers, as well as the values of existing customer accounts. The values of the customer accounts are affected by inflows or outflows of customer funds and market fluctuations.

For approximately 75% of our asset‑based fee arrangements, customers are billed at the beginning of each quarter based on the market value of customer assets on our wealth management platforms as of the end of the prior quarter, providing for a high degree of revenue visibility in the current quarter. Revenue may fluctuate from quarter-to-quarter based on changes in asset values, asset flows and mix of holdings within the portfolio.

Subscription-based Recurring Revenue

In both our Envestnet Wealth Solutions and Envestnet Data & Analytics segments, subscription-based recurring revenue primarily consist of fees for providing customers continuous access to the Company’s technology platforms for wealth management and financial wellness. The subscription-based fees generally include fixed fees and/or usage-based fees.

Subscription fees vary based on the scope of technology solutions and services being used, and are priced in a variety of constructs based on the size of the business, number of users or number of accounts, and in many cases can increase over time based on the growth of these factors.

Despite this potential variance, we believe that our subscription fees are also highly predictable because they are generally established in multi‑year contracts providing longer‑term visibility regarding that portion of total revenue.

Professional Services and Other

In both our Envestnet Wealth Solutions and Envestnet Data & Analytics segments, we also generate revenue from professional services for client onboarding, technology development and other project related work as well as revenue resulting from our annual Advisor Summits.

12

Growth Strategy

We intend to increase revenue and profitability in both the Envestnet Wealth Solutions and Envestnet Data & Analytics segments by leveraging the strategies described below.

Envestnet Wealth Solutions Segment

As discussed above, several industry trends underpin and align with Envestnet’s growth opportunity. These trends include scale and convergence of the wealth management ecosystem, personalization of both technology and investments, integrated workflows, holistic advice, data and analytics, and the movement to independent and fee-based advice. Our growth strategy in the Wealth market seeks to capitalize on these themes and has three primary components:

•Drive and benefit from the growth of our established customer base. Growth of our configurable, open architecture managed accounts platform is aligned with a number of core industry trends. First, the wealth industry continues to shift toward planning-led and fee-based business models; as referenced earlier, fee-based assets as a percentage of total advisor industry assets rose substantially between 2017 and 2022. Second, advisors are gradually migrating away from packaged products and are emphasizing customization, tax optimization, and operational efficiency. Our personalization solutions such as direct indexing, tax overlay, sustainable investing, and high-net-worth consulting support these objectives. And third, enterprises and advisors are increasingly looking to outsource components of investment management, leveraging managed accounts to free up time for prospecting and servicing and to expand their value proposition beyond investments.

•Expand relationships with existing customers. As of December 31, 2023, Envestnet served more than 108,000 advisors in over 19.1 million accounts with approximately $5.8 trillion of assets, making us one of the most scaled wealth management technology, solutions, and data companies in North America. Foundational to our ability to sell more of Envestnet’s capabilities to our clients is providing excellent customer service; from the fourth quarter of 2022 to the fourth quarter of 2023, we increased our Net Promoter Score from 50 to 63. We intend to continue to bring the components of our ecosystem even closer together, integrating workflows and optimizing our customers’ technology experience. According to a January 2024 report from McKinsey & Company, there is growing consumer demand for one-stop-shop access to wealth management and adjacent financial services, and our internal research has shown that many advisors also prefer to partner with “all-in-one” wealth software firms. Enterprises and advisors can purchase our products either piecemeal or as packages, providing significant room to grow wallet share—including managed accounts, financial planning software, client and advisor portals, performance reporting, billing, trading and rebalancing, CRM, data management and insights, asset manager and advisor analytics, workplace solutions, Envestnet Insurance Exchange, and others.

•Add new capabilities and enhance revenue streams. Our broad set of customers and partners—including broker-dealers, RIAs, asset managers, insurance carriers, banks and fintech companies—provides us with significant opportunities to introduce and package new products and capabilities. For example, through our 2022 acquisition of Redi2 Technologies, we are modernizing our core billing engine, opening up the ability to sell revenue management software to our asset management partners and introducing new capabilities such as Envestnet Payments. In 2022, we acquired 401kplans.com, which, when combined with our Envestnet Retirement Solutions business, creates a compelling opportunity for generalist wealth advisors to offer 401(k) plans to their small business customers. We also announced our partnership with the FNZ Group in 2022 to integrate custody and clearing capabilities with our wealth platform, with the goal of providing a streamlined and real-time experience for the advisor while at the same time generating revenue for Envestnet.

Envestnet Data & Analytics Segment

•Expand our relationships with existing customers: Our business currently serves a footprint of over 1,300 clients and more than 38 million paid end-users across the financial ecosystem. Additionally, we have an entrenched, blue-chip customer base—our top 50 customers have an average tenure of 10 years—which provides us with a significant opportunity to cross-sell existing products and solutions. Our initiatives around product bundling enable customers to tap into the full power of our platform, ranging across corporate, consumer, small and midsize business and research applications. For enterprise users specifically, we look to monetize new product categories like enterprise business intelligence, product and marketing insights, and audience modelling.

13

•Add new capabilities and enhance revenue streams. The Envestnet Data & Analytics team has been focused on modernizing existing products and launching new solutions into our unified platform. In 2023, we expanded into new markets including subscription management and alternative lending by rolling out our Subscription & Bill Tracker and Credit Accelerator capabilities, respectively. Initiatives like these have, in part, yielded an increase in our Open Banking pipeline, as customers learn how our platform can benefit them in more ways. We expect future product launches will allow for additional cross-sell opportunities and customer acquisitions. Furthermore, as we expand our data supply, and as our Open Banking products achieve greater adoption, the value of our alternative data products increases as the additional data can be leveraged in existing and adjacent research markets. For example, we recently launched our SpendSignals product, which gives corporate and market research professionals access to insights on consumer spending and peer purchasing behavior.

Technology Platforms

Our technology platforms are primarily multi-tenant SaaS-based hybrid cloud offerings that afford us the flexibility to offer a highly scalable consolidated workflow via a web-based user interface that is complemented by an API led open strategy that enables us to offer an integrated omnichannel flexibility and collaboration ecosystem. This open ecosystem strategy has enabled us to abstract, integrate and modernize our offerings at a rapid pace while also enabling our customers and partners to add incremental value on top of our platform via a fit for a purpose managed open ecosystem model.

We are committed to our operational and information security capabilities as strategic differentiators. We undergo annual SSAE 16 SOC 2 Type II audits to validate the continued operation of our internal controls for our flagship offerings within the ecosystem; the Unified Managed platform, Envestnet Data & Analytics platform and Envestnet | Tamarac platform. The SOC reports confirm design and operating effectiveness of internal controls. We maintain multiple redundancies, back up our databases and safeguard technologies and proprietary information consistent with industry best practices. We also maintain a comprehensive business continuity plan and company‑wide risk assessment program that is consistent with industry best practices and that complies with applicable regulatory requirements.

Our proprietary ecosystem provides Enterprise clients in wealth management, financial advisors that are working alone or as part of financial advisory firms, financial institutions, and FinTech firms along with their respective customers, access to investment solutions and services, enriched financial data, analytics, and workflows that enable the foundational orchestration to deliver holistic wealth management to their end clients via one unified experience, with the widest range of front‑, middle‑ and back‑office needs. The “open architecture” design of our ecosystem and platforms provide our customers and their customers with flexibility in terms of the investment solutions, services they access, data they leverage, and configurability to meet their unique needs. The multi‑tenant platform architecture ensures that this level of flexibility and customization is achieved without requiring us to create unique applications for each client, thereby enabling improved efficacy and efficiency vs other offerings. In addition, though our technology platforms are designed to deliver a breadth of functions, our customers can select from the various investment solutions, services, data, and analytics we offer; without being required to subscribe to or purchase more than what they believe is necessary.

An integral part of our strategy is an open architecture approach to integration via our OpenENV integration platform. This strategy allows for robust integrations with 3rd party technology platforms and service providers and enables client firms to create unique client and advisor experiences powered by the Envestnet ecosystem.

Our Envestnet Data & Analytics platform is structured into three main layers:

•Connectivity: data aggregation layer of the platform;

•Analytics: artificial intelligence and machine learning engine layer of the platform; and

•Experiences: the digital services layer of the platform.

The connectivity layer of the platform collects a wide range of end user-permissioned transaction-level data from approximately 19,000 sources, including banking, investment, loan, and credit card information, with the ability to expand access to new data sources. Over 80% of this data is collected through structured feeds from our customers. These structured feeds, which consist of either open banking API’s or batch files, provide this critical data efficiently and at scale. Where we do not have direct connections, we capture data using our proprietary information-gathering techniques. As data is ingested, it goes through data quality control and anonymization engine e.g., financial transaction categorization, merchant identification, geographical location as well as investment transaction security identification, classification and normalization.

14

The analytics layer of the platform is comprised of real-time analytics and batch processing pipelines. A series of highly composable proprietary AI and machine learning models deployed and consumed by different workloads as required for each business functional use cases e.g., credit decisioning, marketing segmentation, product planning and research.

The experiences layer of the platform serves as the front-end services layer for the connectivity analytics layers into three core experiences – consumer, small business and corporate to include a shared experiences sub-layer e.g., conversational AI. API gateway is the common delivery mechanism of all real-time experiences to include embeddable financial applications and widgets. All APIs, applications and widgets are configurable, scalable and secure allowing our customers to accelerate their systems integration and deliver value to end their end users through their engagement layers.

In order to provide further details of our operation, we have revised our definition of technology development costs to include costs related to the design, development and deployment of our software and data science platforms. The below information is presented in conjunction with the current definition, with prior periods adjusted accordingly.

In the years ended December 31, 2023, 2022 and 2021, we incurred technology development costs for all our technology platforms totaling approximately $234 million, $239 million and $192 million, respectively. Of these costs, we capitalized approximately $94 million, $89 million and $65 million, respectively, as internally developed software.

Sales and Marketing

Envestnet's integrated sales and marketing capabilities exemplify our distinctive industry leadership. We are at the forefront of fostering the growth and productivity of wealth managers and integrated advice through our interconnected technology, advanced insights, comprehensive solutions and industry-leading service and support. Our efforts revolve around achieving three core objectives:

•Maintain Envestnet's position as the preferred platform of the industry: We engage with key decision-makers in the wealth management industry, positioning Envestnet as the advisors’ platform of choice.

•Drive advisor activation: Our focus is on increasing advisor adoption of Envestnet's new and enhanced platform features and solutions. This is achieved through cross-selling opportunities identified through data and insights, with a strategic emphasis on addressing advisor needs while maximizing revenue.

•Drive advisor organic growth: Leveraging marketing tools such as lead generation, practice management support, and advisor tools, we empower advisors and asset managers to achieve organic business growth, accelerating the expansion of assets on the Envestnet platform.

We have enhanced the use of technology and sales enablement tools to facilitate more predictive and effective conversations with our advisor client-base and prospective customers, optimizing the efficiency of our marketing spend. Our advisor-facing sales teams, comprising field sales and internal consultants, adopt a high-touch approach focused on consultancy, product demonstrations, and service and operational support.

For instance, our platform consulting group and business development directors assist advisors in utilizing our wealth management platform efficiently. Envestnet | PMC’s consulting team of investment professionals offers various portfolio and investment management consulting services to advisors.

Our sales teams are organized regionally or by firm segmentation, delivering a high-touch approach through consultancy, product demonstrations, and support to help advisors understand and access our investment solutions. The teams include enterprise consultants, who serve as the primary point of contact for Envestnet's enterprise clients, and direct advisor sales and pre-sales teams, which focus on servicing global financial institutions.

Client partner teams specialize in working closely with our existing advisor client-base to deepen relationships, identify cross-selling opportunities, and expand the use of our products and services.

Furthermore, our direct advisor sales and technical pre-sales teams cover financial technology providers in each region, supported by a client success and developer relations team specializing in API integration and account management. Together, these teams are responsible for the growth and expansion of Envestnet's client base.

15

Competition

Our competitors offer a variety of products and services that compete with one or more of the investment solutions and services provided through our ecosystem of technology platforms; although, based on our industry experience, we believe that none offers a more comprehensive set of products and services than we do.

Within our Envestnet Wealth Solutions segment, we compete on the basis of several factors, including:

•The breadth and quality of investment solutions and services to which we provide access through our technology platform;

•The number of custodians that are connected through our technology platforms;

•The price of our investment solutions and services;

•The ease of use of our technology platforms; and

•The nature and scope of investment solutions and services that each wealth management provider believes are necessary to address their needs.

Our Envestnet Data & Analytics group competes with other financial technology companies, credit bureaus and data, analytics and digital providers. Based on our global and multi-industry experience, we do not believe any other single company in the data aggregation, analytics and digital experiences space offers a diverse, comprehensive set of platforms with features such as ours.

Within our Envestnet Data & Analytics segment, we compete on the basis of several factors, including:

•Reputation;

•Global and multi-market and segments reach;

•Cloud-based delivery model;

•Data aggregation capability;

•Access to data through direct structured data feeds;

•Scale (size of customer base and level of user adoption);

•Security and open banking infrastructure;

•Time to market;

•Unique analytics capability;

•Breadth and depth of application functionality user experience;

•Access and integration to/with third-party applications;

•Ease of use, ease of integration, flexibility and configurability; and

•Competitive pricing.

We believe that we compete favorably with respect to all of these factors.

Regulation

The financial services industry is among the most extensively regulated industries in the United States. We operate investment advisory, broker dealer and fund advisory businesses, each of which is subject to a specific regulatory scheme, including regulation at the federal and state level, as well as regulation by self-regulatory organizations and non-U.S. regulatory authorities. In addition, we are subject to numerous laws and regulations of general application.

Our subsidiaries EAM, EPS, FDX Advisors, Inc., QRG, Envestnet Embedded Advisory, Inc., and Envestnet Retirement Solutions, LLC operate investment advisory businesses. These subsidiaries are registered with the SEC as “investment advisers” under the Advisers Act, and are regulated thereunder. They may also provide fiduciary services as defined in Section 3(21)(A)(ii) of ERISA, including acting as an “investment manager” (as defined in Section 3(38) of ERISA). As described further below, many of our investment advisory programs are conducted pursuant to the non-exclusive safe harbor from the definition of an “investment company” provided for under Rule 3a-4 of the Investment Company Act. EAM serves as the investment adviser to two mutual funds and four exchange-traded funds. The funds are registered as “investment companies” under the Investment Company Act. The Advisers Act, Investment Company Act and ERISA, together with related regulations and interpretations of the SEC and the DOL, impose numerous obligations and restrictions on investment advisers and funds, including recordkeeping requirements, limitations on advertising, disclosure and reporting obligations, prohibitions on fraudulent activities and the requirement that conflicts of interest be monitored, mitigated, and disclosed. The fiduciary obligations of investment advisers to their clients require advisers to, among other things, consider the suitability of the investment products and advice they provide, seek “best execution” for their clients’ securities transactions, conduct due

16

diligence on third-party products offered to clients, consider the appropriateness of the adviser’s fees and provide extensive and ongoing disclosure to clients. The SEC is authorized to institute proceedings and impose fines and sanctions for violations of the Advisers Act and the Investment Company Act and has the power to restrict or prohibit an investment adviser from carrying on its business in the event that it fails to comply with applicable laws and regulations. We believe we are in compliance in all material respects with the requirements of the Advisers Act, ERISA and the Investment Company Act and the rules and interpretations promulgated thereunder.

ESI and FIDx Markets are registered as a broker-dealers with the SEC under the Exchange Act and select state securities regulators. In addition, ESI and FIDx Markets are members of FINRA, the securities industry self-regulatory organization that supervises and regulates the conduct and activities of broker-dealers. Broker-dealers are subject to regulations that cover all aspects of their business, including sales practices, market making and trading among broker-dealers, use and safekeeping of customers’ funds and securities, capital structure, record-keeping and the conduct of directors, officers, employees, representatives and associated persons. FINRA and the SEC conduct periodic examinations of the operations of its members, including ESI and FIDx Markets. Violation of applicable regulations can result in the suspension or revocation of a broker-dealer’s registration, the imposition of censures or fines and the suspension or expulsion of the broker-dealer from FINRA. ESI and FIDx Markets are subject to minimum net capital requirements under the Exchange Act, SEC and FINRA rules.

Envestnet Data & Analytics is examined on a periodic basis by various regulatory agencies. For example, as a third-party technology service provider to financial institutions, Envestnet Data & Analytics is subject to multi-agency supervisory examinations based on published guidance by the Federal Financial Institutions Examination Council. These examinations include reviews of Envestnet Data & Analytics’ management, acquisition and development activities, support and delivery, IT and disaster preparedness and business recovery planning. The Office of the Comptroller of the Currency is the agency in charge of these examinations.

Either as a result of direct regulation or obligations under customer agreements, our subsidiaries are required to comply with certain provisions of the Gramm-Leach-Bliley Act, related to the privacy of consumer information and are subject to other privacy and cybersecurity laws because of the solutions we provide. In addition, numerous regulations continue to be proposed and promulgated that necessitate the implementation of additional controls of companies like ours.

Many of the laws and regulations to which our subsidiaries are subject are evolving, unclear and inconsistent across various jurisdictions, and ensuring compliance with them is difficult and costly. We continually develop improvements to our existing products and services as well as new products and services.

Investment Advisory Program Conducted Under Rule 3a-4

Under the Investment Company Act, an issuer that is engaged in the business of investing, reinvesting or trading in securities may be deemed an “investment company,” in which case the issuer may be subject to registration requirements and regulation as an investment company under the Investment Company Act. In order to provide assurance that certain discretionary investment advisory programs would not be considered investment companies, the SEC adopted Rule 3a-4 under the Investment Company Act, which provides a non-exclusive safe harbor from the definition of an investment company for programs that meet the requirements of the rule. We conduct and support the following programs pursuant to the Rule 3a-4 safe harbor:

•Separately managed accounts;

•Unified managed account portfolios;

•Fund portfolios and exchange-traded fund portfolios; and

•Advisor as portfolio manager.

Human Capital Resources

As of December 31, 2023, we had a total global workforce of approximately 3,100 employees, of which 99% are full-time employees and 54% are located in the United States and 46% are located outside of the United States, primarily in India. Envestnet’s global headcount has been reduced by approximately 10% since December 31, 2022. The reduced headcount is the result of terminations (both voluntary and involuntary) and a reduction in force initiative. The global voluntary turnover rate for the company is approximately 11%. In connection with the reduction in force initiative that began in the first quarter of 2023, as well as the fourth quarter 2022 organizational realignment, we incurred $35.4 million in total severance expense for the year ended December 31, 2023.

17

Diversity, Equity & Inclusion

We recognize that our workforce is made up of people of different backgrounds, cultures and beliefs. We welcome and encourage this diversity and inclusion. Respecting each person as an individual and welcoming the richness of ideas that come from such diversity help us meet our objective of being a great place to work. As of December 31, 2023, our global workforce was comprised of approximately 55% Asians, 34% Whites and the remaining 11% were Black or African American, Hispanic or Latino or other. Approximately 37% of our global workforce self-identified as female, 63% male and less than 1% as other. In addition, over 50% of our Board of Directors were women.

Professional Development

In 2023, employees had access to over 12,000 courses in our learning management system and registered and completed approximately 3,000 unique courses for a total learning and development time of approximately 30,000 hours. This includes mandatory training for compliance, audit, business ethics, data security, sexual harassment, diversity and inclusion as well as situational awareness and safety classes.

The Delegates Program is a nine-month professional development program for high-performing employees with diverse backgrounds and skill sets. This program is intended to develop and retain future leaders, strengthen soft skills, enhance self-awareness and further develop business competencies of its participants. This is an annual program and in 2023, 13 employees completed the program.

Total Rewards

Envestnet offers comprehensive total reward packages designed to incent achievement of performance goals and reward top performers. We ensure a competitive base pay for all employees by utilizing current survey data, and based on performance, employees may also be eligible for annual incentive cash bonus and long-term incentive awards. Employees are offered employer subsidized health, dental and vision insurance. Employees based in the U.S. are offered an employer match for retirement savings, group term life and disability insurance, college tuition and scholarships, paid parental leave for the birth or adoption of a child, parental stipend for children under six, military leave with pay differential, student loan payment assistance, 13 paid holidays and floating holidays, at least three weeks paid time off, paid sick leave, paid volunteer time off and an internet or cell phone reimbursement. Employees based in India receive standard health and welfare benefits, as well as additional family medical coverage, an internet stipend and free transportation home from late shifts. We support our employees’ mental and physical well-being with a confidential Employee Assistance Program and an opt-in Wellness program that rewards healthy choices and behaviors.

In Our Community

The Envestnet Cares program empowers our employees to engage in their local communities with paid time off for volunteer activities, charitable donation matching and partnerships with several non-profit organizations. In 2023, Envestnet employees used approximately 4,000 employer paid volunteer hours to support local charity initiatives.

Engagement

Employee feedback is important to us and we regularly conduct a global employee survey. In 2023, we conducted a global employee engagement survey with an 82% response rate. In addition, our CEO and senior leadership team regularly host live, online question and answer sessions and discussion panels that are available to all employees. We believe the calls demonstrate our commitment to authentic engagement and empower our employees to ask questions about our industry, products and services and overall direction as a company.

Information about our Executive Officers

The following table summarizes information about each one of our executive officers as of December 31, 2023.

| Name | Age | Position(s) | ||||||||||||

| William Crager | 59 | Chief Executive Officer, Director | ||||||||||||

| Joshua Warren | 43 | Chief Financial Officer | ||||||||||||

| Shelly O’Brien | 58 | Chief Legal Officer, General Counsel and Corporate Secretary | ||||||||||||

18

William Crager— Mr. Crager serves as our Chief Executive Officer and has served as a member of our Board since March 2020. Previously, Mr. Crager served as our Interim Chief Executive Officer between October 2019 and March 2020, Chief Executive of Envestnet Wealth Solutions since January 2019, and President of Envestnet since 2002. Prior to joining us, Mr. Crager served as Managing Director of Marketing and Client Services for Rittenhouse Financial Services, Inc., an investment management firm affiliated with Nuveen. Mr. Crager received a BA from Fairfield University where he majored in economics and now serves on the Board of Trustees. On January 7, 2024, the Company entered into a separation and release agreement with Mr. Crager in which it was agreed that Mr. Crager will step down as chief executive officer on March 31, 2024 and as a member of the Company’s Board of Directors promptly following Envestnet’s 2024 Annual Meeting. Beginning April 2024, Mr. Crager will serve as a senior advisor, focusing on client and partner relationships.

Joshua Warren—Mr. Warren has served as Chief Financial Officer since November 2023. Prior to joining us, Mr. Warren served BlackRock, Inc. as Managing Director and Global Head of Business Strategy for iShares and Index Investments, Managing Director in BlackRock's Corporate Strategy and Development team, and other roles. He also served on the Board of Directors and Audit and Risk Committee of iCapital, an alternative investments marketplace, from 2019 until 2023. Mr. Warren earned a JD from the New York University School of Law and a BA from Dartmouth College.

Shelly O’Brien—Ms. O’Brien has served as Chief Legal Officer, General Counsel and Corporate Secretary since 2002. Prior to joining us, Ms. O’Brien was General Counsel and Director of Legal and Compliance for ING (U.S.) Securities, Futures & Options Inc., a broker‑dealer, and futures commission merchant. Ms. O’Brien received a degree in political science from Northwestern University, a JD from Hamline University School of Law, and an LLM in taxation from John Marshall Law School.

Beginning April 1, 2024, James Fox will begin serving as our Interim Chief Executive Officer until our Board of Directors has appointed a new chief executive officer. Mr. Fox has served as a member of our Board of Directors since February 2015 and Chair of the Board of Directors since March 2020. Mr. Fox retired as Non-Executive Chairman of FundQuest, Inc., upon its acquisition by the Company, effective December 2011 after serving in that role since September 2010 and, prior to that, as President and Chief Executive Officer starting in October 2005. Mr. Fox has over 30 years of senior executive experience with the BISYS Group, Inc., First Data Corporation, eOne Global, and PFPC. He serves as a director of Madison CF (UK) Limited, The Ultimus Group LLC and Yukon YC Holdings LLC. He also served as a director of Brinker Capital Holdings, Inc. from July 2015 until September 2020. Mr. Fox participated in the Advanced Management Program at the Wharton School of the University of Pennsylvania. He earned an M.B.A. in Finance from Suffolk University and a B.A. in Economics from the State University of New York at Oswego.

Available Information

The Company maintains a website at the following address: http://www.envestnet.com. The information on the Company's website is not incorporated by reference in this Annual Report.

We make available on or through our website reports and amendments to those reports that we file with or furnish to the SEC in accordance with the Exchange Act, as amended. These include our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and amendments to these reports. We make this information available on our website free of charge as soon as reasonably practicable after we electronically file the information available with, or furnish it to, the SEC. The SEC also maintains a website at the following address, through which this information is available: http://www.sec.gov.

Item 1A. Risk Factors

An investment in any security involves risk. An investor or potential investor should consider the risks summarized in this section when making investment decisions regarding our securities. These risks and uncertainties include, but are not limited to, the risk factors set forth below. The risks and uncertainties described in this section are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also affect our business. If any of these known or unknown risks or uncertainties actually occurs, our business, financial condition and results of operations could be materially adversely affected.

19

Risks Related to Our Results of Operations and Financial Condition

We derive a substantial portion of our revenue from the delivery of investment solutions and services to clients in the financial services industry and our revenue could suffer if that industry experiences a downturn.

A substantial portion of our revenue is derived from clients in the financial services industry, particularly in financial advisory services. A decline or lack of growth in demand for financial services would adversely affect our clients and, in turn, our results of operations, financial condition and business. For example, the availability of free or low‑cost investment information and resources, including research and information relating to publicly traded companies and funds available on the internet or on company websites, could lead to lower demand by investors for the services provided by financial advisors. In addition, demand for our investment solutions and services could decline for many reasons. Negative public perception and reputation of the financial services industry could reduce demand for our broader services and investment advisory solutions. Consolidation or limited growth in the financial services and advisory industry could reduce the number of our clients and potential clients. Events that adversely affect our clients’ businesses, rates of growth or the numbers of customers they serve, including decreased demand for our clients’ products and services, adverse conditions in our clients’ markets or adverse economic conditions generally, could in turn decrease demand for our investment solutions and services and thereby decrease our revenue. Any of the foregoing could have a material adverse effect on our results of operations, financial condition or business.

A limited number of clients account for a material portion of our revenue. Renegotiation or termination of our contracts with any of these clients could have a material adverse effect on our results of operations, financial condition or business.

For the years ended December 31, 2023, 2022 and 2021, revenue associated with one major client, Fidelity, accounted for approximately 16%, 16% and 17%, respectively, of our total revenue and our ten largest clients accounted for approximately 37%, 34% and 33%, respectively, of our total revenue. Our license agreements with large financial institutions are generally multi-year contracts that may be terminated upon the expiration of the contract term or prior to such time for cause, which may include breach of contract, bankruptcy, insolvency and other reasons. A majority of our agreements with financial advisors generally provide for termination at any time.

A substantial majority of our revenue associated with Fidelity is derived from ongoing asset-based platform service fees paid by firms, advisors or advisors’ clients obtained through the Fidelity relationship. If Fidelity or a significant number of our most important clients were to renegotiate or terminate their contracts with us, our results of operations, financial condition or business could be materially adversely affected.

Changes in the estimates of fair value of reporting units or of long-lived assets, particularly goodwill and intangible assets, may result in future impairment charges, which could have a material adverse effect on our results of operations, financial condition, cash flows or business.

Over time, the fair values of long-lived assets change. At December 31, 2023, we had $806.6 million of goodwill and $338.1 million of intangible assets, net, collectively representing 61% of our total assets.

Goodwill is reviewed for impairment each year using a qualitative or quantitative process that is performed at least annually or whenever events or circumstances indicate that impairment may have occurred. We perform the annual impairment analysis on October 31 in order to provide management time to complete the analysis prior to year-end. Prior to performing the quantitative evaluation, an assessment of qualitative factors may be performed to determine whether it is more likely than not that the fair value of a reporting unit exceeds the carrying value. If it is determined that it is unlikely that the carrying value exceeds the fair value, we are not required to complete the quantitative goodwill impairment evaluation. If it is determined that the carrying value may exceed fair value when considering qualitative factors, a quantitative goodwill impairment evaluation is performed. When performing the quantitative evaluation, if the carrying value of the reporting unit exceeds its fair value, an impairment loss equal to the difference will be recorded. The identification of reporting units and consideration of aggregation criteria requires management’s judgment. Based on the relevant GAAP authoritative guidance, we aggregate components of a single operating segment into a reporting unit, if appropriate. Future goodwill impairment charges may occur if estimates of fair values decrease, which would reduce future earnings.

As part of the annual goodwill impairment analysis, we performed a quantitative goodwill impairment evaluation for each reporting unit in the fourth quarter of 2023. As a result of this impairment analysis, the carrying value of the Envestnet Data & Analytics reporting unit exceeded its fair value, which resulted in the recognition of a non-cash impairment charge to goodwill of $191.8 million during the fourth quarter of 2023. Although the Company recorded this impairment charge in the fourth quarter of 2023, future goodwill impairment charges may occur if certain estimates and assumptions used to estimate the

20

fair value of the Envestnet Data & Analytics reporting unit in the fourth quarter of 2023 fall below those estimates and assumptions and such impairment charges could be material.

We test our indefinite lived intangible assets on an annual basis and more often if an event occurs or circumstances change that would more likely than not reduce the fair value of the indefinite lived intangible asset below its carrying amount. We also test property and equipment and other long lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Future asset impairment charges may occur if asset utilization declines, if customer demand decreases, or for a number of other reasons, which would reduce future earnings. Any such impairment charges could have a material adverse effect on our business, financial condition, results of operations, and cash flows. Impairment charges would also reduce our consolidated stockholders’ equity and increase our debt-to-total-capitalization ratio, which could negatively impact our access to the debt and equity markets.