Use these links to rapidly review the document

TABLE OF CONTENTS

Part IV

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the year ended December 31, 2014 |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission file number 001-34835

Envestnet, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

20-1409613 (I.R.S Employer Identification No.) |

|

35 East Wacker Drive, Suite 2400, Chicago, IL (Address of principal executive offices) |

60601 (Zip Code) |

Registrant's

telephone number, including area code:

(312) 827-2800

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on Which Registered: | |

|---|---|---|

| Common stock, par value $0.005 per share | NYSE |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ý |

Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

Aggregate market value of registrant's common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant's common stock on June 30, 2014 as reported on The New York Stock Exchange on that date: $1,088,337,378. For purposes of this calculation, shares of common stock held by (i) persons holding more than 5% of the outstanding shares of stock, and (ii) officers and directors of the registrant, as of June 30, 2014, are excluded in that such persons may be deemed to be affiliates. This determination is not necessarily conclusive of affiliate status.

As of February 20, 2015, 34,547,210 shares of the common stock with a par value of $0.005 per share were outstanding.

2

Unless the context requires otherwise, the words "Envestnet," "the Company," "we," "us" and "our" are references to Envestnet, Inc. and its subsidiaries as a whole.

This annual report on Form 10-K contains forward-looking statements regarding future events and our future results within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, in particular, statements about our plans, strategies and prospects under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations." These statements are based on our current expectations and projections about future events and are identified by terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "expected," "intend," "will," "may," or "should" or the negative of those terms or variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our business and other characteristics of future events or circumstances are forward-looking statements. Forward-looking statements may include, among others, statements relating to:

- •

- difficulty in sustaining rapid revenue growth, which may place significant demands on the Company's

administrative, operational and financial resources,

- •

- fluctuations in the Company's revenue,

- •

- the concentration of nearly all of the Company's revenues from the delivery of investment solutions and

services to clients in the financial advisory industry,

- •

- the impact of market and economic conditions on the Company's

revenues,

- •

- the Company's reliance on a limited number of clients for a material portion of its

revenue,

- •

- the renegotiation of fee percentages or termination of the Company's services by its

clients,

- •

- the Company's ability to identify potential acquisition candidates, complete acquisitions and successfully

integrate acquired companies,

- •

- compliance failures,

- •

- regulatory actions against the Company,

- •

- the failure to protect the Company's intellectual property

rights,

- •

- the Company's inability to successfully execute the conversion of its clients' assets from their technology

platform to the Company's technology platforms in a timely and accurate manner,

- •

- general economic conditions, political and regulatory

conditions,

- •

- the impact of fluctuations in interest rates on our business,

- •

- market conditions and our ability to issue additional debt and equity,

and

- •

- management's response to these factors.

In addition, there may be other factors of which we are presently unaware or that we currently deem immaterial that could cause our actual results to be materially different from the results referenced in the forward-looking statements. All forward-looking statements contained in this annual report and documents incorporated herein by reference are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date they are made, and we do not intend to update or otherwise revise the forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except as required by applicable law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements.

3

Although we believe that our plans, intentions and expectations are reasonable, we may not achieve our plans, intentions or expectations.

These forward-looking statements involve risks and uncertainties. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this annual report are set forth in Part I under "Risk Factors"; accordingly, investors should not place undue reliance upon our forward-looking statements.

You should read this annual report on Form 10-K completely and with the understanding that our actual future results, levels of activity, performance and achievements may be different from what we expect and that these differences may be material. We qualify all of our forward-looking statements by these cautionary statements.

The following discussion and analysis should also be read along with our consolidated financial statements and the related notes included elsewhere in this annual report. Except for the historical information contained herein, this discussion contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those discussed below.

Except where we have otherwise indicated or the context otherwise requires, dollar amounts presented in this Form 10-K are in thousands, except for Item 9, Exhibits and per share amounts.

General

We are a leading provider of unified wealth management software and services to financial advisors and institutions. By integrating a wide range of investment solutions and services, our technology platforms provide financial advisors with the flexibility to address their clients' needs. As of December 31, 2014, approximately 40,000 advisors used our technology platforms, supporting approximately $713 billion of assets in approximately 2.9 million investor accounts.

Envestnet empowers financial advisors to deliver fee-based advice to their clients. We work with both Independent Registered Investment Advisors ("RIAs"), as well as advisors associated with financial institutions such as broker-dealers and banks. The services we offer and market to financial advisors address advisors' ability to grow their practice as well as to operate more efficiently—the Envestnet platforms span the various elements of the wealth management process, from the initial meeting an advisor has with a prospective client to the ongoing day-to-day operations of managing an advisory practice.

Our centrally-hosted technology platforms, which we refer to as having "open architecture" because of their flexibility, provides financial advisors with access to a series of integrated services to help them better serve their clients. These services include risk assessment and selection of investment strategies and solutions, asset allocation models, research and due diligence, portfolio construction, proposal generation and paperwork preparation, model management and account rebalancing, account monitoring, customized fee billing, overlay services covering asset allocation, tax management and socially responsible investing, aggregated multi-custodian performance reporting and communication tools, as well as access to a wide range of leading third-party asset custodians.

We offer these solutions principally through the following product and services suites:

- •

- Envestnet's wealth management software empowers advisors to better manage client outcomes and strengthen their practice. Our software unifies the applications and services advisors use to manage their practice and advise their clients, including financial planning; capital markets assumptions; asset allocation guidance; research and due diligence on investment managers and funds; portfolio management, trading and rebalancing; multi-custodial, aggregated performance reporting; and billing calculation and administration.

4

- •

- Envestnet | PMC®, our Portfolio Management Consultants

group primarily engages in consulting services aimed at providing financial advisors with additional support in addressing their clients' needs, as well as the creation of proprietary investment

solutions and products. Envestnet | PMC's investment solutions and products include managed account and multi-manager portfolios, mutual fund portfolios and Exchange

Traded Fund ("ETF") portfolios. Envestnet | PMC also offers Prima Premium Research, comprising institutional-quality research and due diligence on investment managers,

mutual funds, ETFs and liquid alternatives funds.

- •

- Envestnet | TamaracTM provides leading portfolio

accounting, rebalancing, trading, performance reporting and client relationship management ("CRM") software, principally to high-end RIAs.

- •

- Vantage Reporting SolutionTM software aggregates and manages investment

data, provides performance reporting and benchmarking, giving advisors an in-depth view of clients' various investments, empowering advisors to give holistic, personalized advice and consulting.

- •

- Envestnet | WMSTM offers financial institutions access

to an integrated wealth platform, which helps construct and manage sophisticated portfolio solutions across an entire account life cycle, particularly in the area of unified managed account ("UMA")

trading. Envestnet | WMS's Overlay Portfolio Management console helps wealth managers efficiently build customized client portfolios that consider both proprietary and

open-architecture investment solutions.

- •

- Envestnet | PlacemarkTM develops UMA programs and other portfolio management outsourcing solutions, including patented portfolio overlay and tax optimization services, for banks, full service broker-dealers and RIA firms.

We believe that our business model results in a high degree of recurring and predictable financial results. The majority of our revenue is asset-based, meaning it is derived from fees charged as a percentage of the assets that are managed or administered on our technology platforms by financial advisors. We also generate revenues from recurring, contractual licensing fees for providing access to our technology platforms and from professional services.

For the year ended December 31, 2014, we earned fees of $294,200 from assets under management ("AUM") or assets under administration ("AUA" and collectively "AUM/A"), representing a 47% increase over earned fees from AUM/A in 2013. Asset-based fees accounted for approximately 84%, 83% and 81% of our total revenues for the years ended December 31, 2014, 2013 and 2012, respectively. For the year ended December 31, 2014, licensing and professional services revenues were $54,500, representing a 30% increase over licensing and professional services revenues in 2013.

Licensing and professional services revenues accounted for 16%, 17% and 19% of our total revenues for the years ended December 31, 2014, 2013 and 2012, respectively.

For over 85% of our asset-based fee arrangements, we bill customers at the beginning of each quarter based on the market value of customer assets on our technology platforms as of the end of the prior quarter, providing for a high degree of revenue visibility in the current quarter while inherently revenue from quarter to quarter may fluctuate based on changes in asset values or fee rates on those asset values. Furthermore, our licensing fees are highly predictable because they are generally established in multi-year contracts providing longer-term visibility regarding that portion of our total revenues.

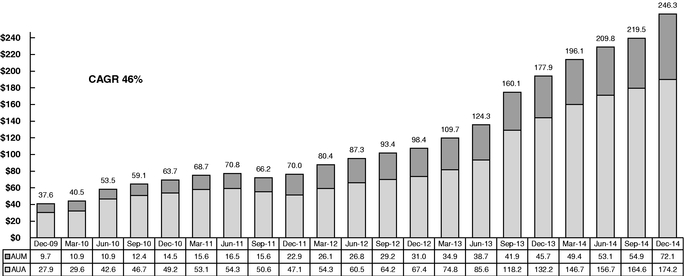

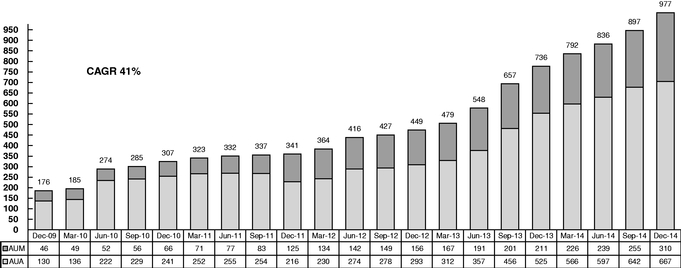

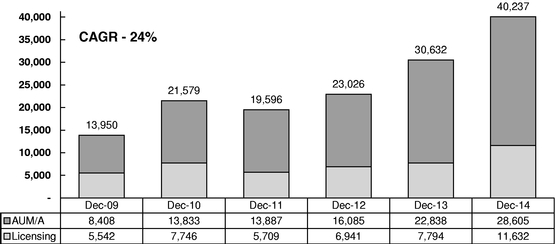

As the tables below indicate, our business has experienced steady and significant growth over the last several years. We believe this growth is attributable to secular trends in the wealth management industry as described below, the uniqueness and comprehensiveness of our products, as well as acquisitions.

5

The following table sets forth the AUM or AUA as of the end of the quarters indicated:

Assets Under Management or Administration

($ in billions)

The following table sets forth the number of accounts with AUM or AUA as of the end of the quarters indicated:

Accounts Under Management or Administration

(in thousands)

6

The following table sets forth as of the end of the years indicated the number of financial advisors that had client accounts on our technology platforms:

We were founded in 1999 and through organic growth and strategic transactions we have grown to become a leading independent provider of integrated wealth management software and services to financial advisors and institutions. Our headquarters are located in Chicago, Illinois and we have offices in New York, New York; Denver, Colorado; Seattle, Washington; Sunnyvale, California; Boston and Wellesley, Massachusetts; Landis and Raleigh, North Carolina; Addison, Texas and Trivandrum, India.

Our Market Opportunity

The wealth management industry has experienced significant growth in terms of assets invested by retail investors in the past several years. According to the Federal Reserve, U.S. household and non-profit organization financial assets totaled $66.8 trillion as of September 30, 2014, up 2.7% from $65.0 trillion at December 31, 2013.

In addition to experiencing significant growth in financial assets, the wealth management industry is characterized by a number of important trends, including those described below, which we believe create a significant market opportunity for technology-enabled investment solutions and services like ours.

Increase in independent financial advisors. Based on industry news reports and channel shifts in the advisor population, we believe that over the past several years an increasing number of financial advisors have elected to leave large financial institutions and start their own financial advisory practices or move to smaller, more independent firms. According to an analysis done by Cerulli Associates, the number of RIAs and dually-registered advisors has grown 26% over the past five years from 42,000 in 2008 to 53,000 in 2013.

Increased reliance on technology among independent financial advisors. In order to compete effectively in the marketplace, independent financial advisors are increasingly relying on technology service providers to help them provide comparable services cost effectively and efficiently.

Increased use of financial advisors. We believe that the volatility and increasing complexity in securities markets have resulted in increased investor interest in receiving professional financial advisory services. In a 2014 survey of US households by Phoenix Marketing International, 35% of households responded that they needed more financial and investment advice than they have in the past, up from 29% who expressed such need in 2009.

7

Increased use of fee-based investment solutions. Based on our industry experience, we believe that in order for financial advisors to effectively manage their clients' assets, advisors are seeking account types that offer the flexibility to choose among the widest range of investment solutions. Financial advisors typically charge their fees for these types of flexible accounts based on a percentage of assets rather than on a commission or other basis. We estimate, based on an analysis done by Cerulli Associates, fee-based investment advisory assets totaled $7 trillion in 2014 based on Q3 2014 managed account assets of $3.9 trillion and estimated RIA and dually-registered advisor assets of $3.1 trillion.

More stringent standards applicable to financial advisors. Increased scrutiny of financial advisors to ensure compliance with current laws, coupled with the possibility of new laws focused on a fiduciary standard, may require changes to the way financial advisors offer advice. In order to adapt to these changes, we believe that financial advisors may benefit from utilizing technology platforms, such as ours, that allows them to address their clients' wealth management needs.

Our Business Model

We believe that a number of attractive characteristics contribute significantly to the success of our business model, including:

- •

- Positioned to capitalize on favorable industry

trends. As a leading provider of unified wealth management software and services to financial advisors, we believe we are well

positioned to take advantage of favorable secular trends in the wealth management industry, particularly the increased prevalence and use of independent financial advisors, the movement toward

fee-based pricing structures and advisors' increased reliance on technology.

- •

- Recurring and resilient revenue

base. The substantial majority of our revenues is recurring and derived either from asset-based fees, which generally are billed at the

beginning of each quarter or from fixed fees under multi-year license agreements. For the year ended December 31, 2014, we derived 84% of our total revenues from asset-based fees and 16% from

licensing and professional services revenues.

- •

- Strong customer

retention. We believe that the breadth of access to investment solutions and the multitude of services that we provide allow financial

advisors to address a wide range of their clients' needs and, as a result, financial advisors are less likely to move away from our technology platforms. Because a technology platform is involved in

nearly all of a financial advisor's activities needed to serve their clients, once a financial advisor has moved clients and their assets onto our technology platforms, significant time, costs and/or

resources would be required for the financial advisor to shift to another technology platform.

- •

- Substantial operating leverage. Because we have designed our systems architecture to accommodate growth in the number of advisors and accounts we support and to provide the flexibility to add new investment solutions and services, our technology platforms and infrastructure allow us to grow our business efficiently, without the need for significant additional expenditures as assets grow. This, combined with low marginal costs required to add additional accounts and new investment solutions and services, enables us to generate substantial operating leverage during the course of our relationship with a financial advisor as the advisor adds accounts to our platforms and the assets of the advisor's clients grow through financial advisors' use of additional investment solutions and services we provide.

8

Our Growth Strategy

Envestnet serves the fastest growing segments of the wealth management industry: independent financial advisors; fee-based solutions; and outsourced investment and technology solutions. We intend to increase revenue and profitability by continuing to pursue the following strategies:

- •

- Increase the advisor

base. Through the outreach and marketing activities of our sales and client service teams, we continue the process of leveraging

existing enterprise client relationships to add new financial advisors to our technology platforms, and building new relationships to add additional advisors. Generally, when we establish an

enterprise client relationship, we are provided access to the client's financial advisors and are given the opportunity to convert them to our technology platforms. During the five-year period ended

December 31, 2014, within existing enterprises, we increased the number of advisors with AUM or AUA on our platforms at a compound annual growth rate of 12%. We further increased the number of

advisors through acquisitions and new enterprise relationships established during the past five years, resulting in the total number of advisors with AUM or AUA on our platforms growing at a compound

annual growth rate of 28%. Even with that steady growth, we continue to have the opportunity to increase the number of financial advisors we serve within our existing enterprise client relationships

as advisors increasingly shift their businesses to fee-based practices.

- •

- Extend the account base within a given advisor

relationship. We work with existing clients to shift an increasing portion of their business to the Envestnet platforms. During the

five-year period ended December 31, 2014, the average number of AUM or AUA accounts per advisor on our technology platforms grew from approximately 21 to 34, an increase of over 64%. As a

result, total AUM or AUA accounts increased at a compound annual growth rate of 41% during the same period.

- •

- Expand the services utilized by each

advisor. In most cases, an advisor will use only a portion of Envestnet's services. Accordingly, through our sales and marketing

efforts, we will continue to educate our financial advisor customers regarding our capabilities in order to expand the scope of our investment solutions and services they employ.

- •

- Obtain new enterprise

clients. Growing fee-based offerings has become a strategic priority for financial services firms. Envestnet is positioned in the

marketplace to empower these firms to deliver fee-based solutions to their advisors. These enterprise clients provide us with access to a large number of financial advisors that may be interested in

utilizing our technology platforms, as well as to the assets that are managed by these financial advisors. We believe that the current market opportunity for enterprise conversions continues to be

significant. New enterprise clients also provide further opportunities to execute on the other strategies discussed above.

- •

- Continue to invest in our technology

platforms. We intend to continue to invest in our technology platforms to provide financial advisors with access to investment solutions

and services that address the widest range of financial advisors' front-, middle-and back-office needs. In the years ended December 31, 2014, 2013 and 2012, our technology development costs

totaled $11,560, $9,141, and $8,659, respectively.

- •

- Continue to pursue strategic transactions and other

relationships. We intend to continue to selectively pursue acquisitions, investments and other relationships that we believe can enhance

the attractiveness of our technology platforms or expand our client base. Given our scale of operations and record of past transactions and access to capital, we believe we are well-positioned to

engage in such transactions in the future. During the past three years we have acquired the following entities:

- •

- In April 2012, we acquired Prima Capital Holding, Inc. ("Prima"). Prima, now part of Envestnet | PMC, provides Prima Premium Research, including investment manager due diligence, consulting, and custom research to the wealth management and retirement industries. Prima's clientele includes banks, independent RIAs, regional broker-dealers, family offices and trust companies.

9

- •

- In May 2012, we acquired Tamarac, Inc. ("Tamarac"). Tamarac, now operating as

Envestnet | Tamarac, provides leading portfolio accounting, rebalancing, trading, performance reporting and client relationship management software, principally to

high-end RIAs.

- •

- In July 2013, we acquired the Wealth Management Solutions ("WMS") division of Prudential Investments. WMS offers

financial institutions access to an integrated wealth platform, which helps construct and manage sophisticated portfolio solutions across an entire account life cycle, particularly in the area of UMA

trading.

- •

- In February 2014, we formed Envestnet Retirement Solutions, LLC ("ERS, LLC") with various third parties.

ERS, LLC offers advisory and technology enabled services to financial advisors and retirement plans. As of December 31, 2014, our ownership in ERS, LLC was 57%.

- •

- In October 2014, we acquired Placemark Holdings, Inc. ("Placemark"). Placemark, now operating as Envestnet | Placemark develops UMA programs and other portfolio management outsourcing solutions, including patented portfolio overlay and tax optimization services, for banks, full-service broker-dealers and RIA firms.

Our Technology Platforms

Our proprietary Web-based platforms provide financial advisors with access to investment solutions and services that address, in one unified, centrally-hosted platform, based on our knowledge of the industry, the widest range of front-, middle-and back-office needs in our industry. The "open architecture" design of our technology platforms provide financial advisors with flexibility in terms of the investment solutions and services they access, and configurability in the manner in which the financial advisors utilize particular investment solutions and services. The multi-tenant platform architecture ensures that this level of flexibility and customization is achieved without requiring us to create unique applications for each client, thereby reducing the need for additional technology personnel and associated expenses. In addition, though our technology platforms are designed to deliver a breadth of functions, financial advisors are able to select from the various investment solutions and services we offer, without being required to subscribe to or purchase more than what they believe is necessary.

Envestnet's wealth management software enables advisors to better advise their clients, invest portfolios, manage their practice and those portfolios, and report on their clients' holdings.

10

Advise. Our technology platforms provide financial advisors with a flexible proposal and presentation tool that is capable of creating highly customized documents, including signature-ready forms needed to open client accounts. Also, our platforms include a number of financial planning tools such as Monte Carlo simulations, portfolio diagnostics and retirement planning which enable financial advisors to create and implement financial plans that are tailored to each client's investment goals, risk tolerance and assets. Our technology platforms provide financial advisors with a customizable risk tolerance questionnaire, which assists advisors in understanding the investment objectives and preferences of their clients and also helps the advisor comply with applicable regulatory requirements regarding the suitability of investments and fiduciary obligations. Based on answers to the questionnaire, the advisor can analyze whether the current portfolio is appropriate to reach the client's goals and suggest an investment policy. We also empower advisors to improve their research and advice through the institutional quality research we provide on investment managers, funds, and alternative investments, and asset allocation guidance through Envestnet | PMC and Prima Premium Research.

Invest. Once the investment solutions have been selected, our technology platforms, through relationships we have established with a variety of investment managers, allow the financial advisor to access and choose from a wide range of investment programs, including separately managed accounts, unified managed accounts, third-party strategist programs, mutual fund and ETF programs, and others, depending on the financial advisor's assessment of the client's needs. Because our technology platforms support nearly every investment program type that is currently available, financial advisors are able to keep more of a client's assets on one technology platform, thereby simplifying the operation of their practice, saving time and lowering costs. Envestnet | PMC provides consulting services aimed at providing financial advisors with additional support in addressing their clients' needs, including asset allocation modeling, asset manager and mutual fund due diligence, manager and fund selection and ongoing monitoring, investment portfolio construction and overlay services, principally relating to ongoing portfolio management and asset allocation rebalancing. Envestnet | PMC also creates proprietary investment solutions and products, including separate account strategies, multi-manager portfolios, mutual funds, mutual fund wrap and ETF asset allocation strategies.

11

Manage. Once a financial advisor has created a client account and selected investment solutions and programs, our technology platforms provide access to ongoing account management services. Additionally, Envestnet | PMC portfolio managers and research analysts review all Envestnet | PMC models and proprietary portfolios to determine when to rebalance across asset classes. We also offer overlay services that can help enhance an advisor's ability to carry out his or her fiduciary responsibility. Financial advisors can receive risk and style drift alerts, enabling them to adjust their clients' portfolios to ensure that the portfolios remain in compliance with their clients' stated investment objectives and risk tolerance levels. These services include ongoing review of investment portfolios for compliance with asset allocation criteria, with rebalancing recommendations made as necessary, assistance with investment portfolio tax management and review of investment accounts to ensure that investment decisions are consistent with the client's investment objectives. We also offer a socially responsible overlay which the financial advisor may use to maintain compliance with clients' investment restrictions. These may include securities issued by specific companies or from issuers in certain industries that clients want to exclude from their investment accounts.

Envestnet | Tamarac Advisor Xi integrates portfolio accounting, model management, monitoring, rebalancing, trading, performance reporting, and enterprise-level client relationship management software. Advisor Xi also empowers advisors to receive drift alerts and rebalancing notifications to help ensure that asset allocations conform to a client's investment policy. Envestnet | Tamarac's rebalancing software also can be configured to rebalance assets in the most tax-efficient manner for the client.

Report. Our technology platforms help advisors to better report on their clients' consolidated holdings through our Vantage Reporting Solution and Envestnet | Tamarac offerings, which provide trade-ready, fully-reconciled aggregated performance reports to advisors and their end clients. Our technology platforms provide financial advisors with access to more than 40 third-party custodians, real-time data and Web-based service tools. Our platforms generate highly configurable aggregated reports showing holdings, investment performance, capital gains and losses and other information for financial advisors to provide to their clients that can be downloaded, viewed online or printed. In addition, through our India operations, our technology platforms provide financial advisors with access to client account data reconciled daily with records maintained by multiple custodians. Accordingly, when securities markets open each day, financial advisors have the most up-to-date account data available. Our technology platforms also support a wide range of fee and billing structures. These include breakpoint pricing, where lower fee rates are applied as asset levels meet or exceed pre-established thresholds, fees based on aggregated client funds across several accounts held by family members, fees tailored to different investment programs and investment solution types and other customized fee and billing arrangements. Our technology platforms include configurable Fiduciary Oversight Notes ("FONs") that help advisors understand implications of the decisions they make via educational text boxes, and then memorialize those decisions for client service and reporting. The FONs may be searched and reviewed by home offices or the advisors themselves.

Our Customers

Independent financial advisors that are working alone or as part of financial advisory firms. Our principal value proposition aimed at independent financial advisors working alone or as part of financial advisory firms is that our technology platforms allow them to compete effectively with financial advisors employed by large financial institutions. We provide independent financial advisors with access to as many or more of the investment solutions and services that are typically available to financial advisors working at the largest firms. An example of one of our independent financial advisory firm clients is Commonwealth Financial Network.

Enterprise clients. We provide enterprise clients with customized, private-labeled technology platforms that enable them to support their affiliated financial advisors with a broad range of investment solutions and services. Our contracts with enterprise clients establish the applicable terms

12

and conditions, including pricing terms, service level agreements and basic platform configurations. For the years ended December 31, 2014, 2013 and 2012, revenues associated with our relationship with our single largest enterprise client, FMR LLC, an affiliate of FMR Corp., or Fidelity, accounted for 19%, 20%, and 22%, respectively, of our total revenues. No other client accounted for more than 10% of our total revenues. Examples of our other enterprise clients include Northwestern Mutual, National Financial Partners and National Planning Holdings.

Sales and Marketing

Our sales and marketing staff of approximately 177 employees is organized by sales channel and product offering. Our enterprise sales team focuses on entering into agreements with enterprise clients, which enable us to sell our platform capabilities to those firms and the advisors associated with them. Our advisory sales team sells to the individual financial advisors of broker-dealers and enters into agreements with RIA firms. Envestnet | Tamarac sells rebalancing, performance reporting and CRM solutions principally to large RIA firms. Envestnet | PMC offers portfolio and investment management consulting services, including Prima Premium Research and due diligence capabilities. Envestnet | WMS offers financial institutions access to an integrated wealth platform, particularly in the area of UMA trading. Envestnet | Placemark is a leading provider of active overlay portfolio management solutions for UMA programs for banks, full-service broker-dealers and RIA firms.

The principal aim of our marketing efforts is to create greater visibility of our company and our brands, and to provide thought leadership to the wealth management industry. Our marketing efforts are focused on our core markets: financial advisors and enterprise clients. We use advertising and public relations to communicate our message to these target markets. Examples of these marketing efforts include:

- •

- quotes in wealth management industry publications regarding our views on financial advisor trends and challenges;

- •

- advertising and other marketing materials promoting our investment solutions and services;

- •

- frequent participation in industry conferences and tradeshows, including events sponsored by our custodian partners, by sponsorship,

making presentations and speaking on panels;

- •

- hosting conferences on wealth management solutions;

- •

- providing insights on industry trends through internal research and sponsoring and writing industry white papers; and

- •

- creating marketing tools for financial advisors to better communicate with their current and prospective clients.

To implement our marketing efforts, we generally employ paid print and online advertisements in a variety of industry publications, as well as promotions that include e-blast campaigns and sponsored webinars. We also partner with independent broker-dealers ("IBDs") on direct mail campaigns targeting such firms' financial advisors to describe the investment solutions and services that we offer, produce brochures and presentations for financial advisors to use with their clients and we create Internet pages or sites to promote our investment solutions and services.

Competition

We generally compete on the basis of several factors, including the breadth and quality of investment solutions and services to which we provide access through our technology platforms, the number of custodians that are connected through our technology platforms, the price of our investment solutions and services, the ease of use of our technology platforms and the nature and scope of investment solutions and services that each client believes are necessary to address their needs. Our

13

competitors offer a variety of products and services that compete with one or more of the investment solutions and services provided through our technology platforms, although, based on our industry experience, we believe that none offers a more comprehensive set of products and services than we do. Our principal competitors include:

- •

- Turnkey Asset Management Platform

Providers. Providers of turnkey asset management platforms, including SEI Investments Company, AssetMark, Inc. and Lockwood

Advisors (a subsidiary of BNY Mellon Corporation), typically provide financial advisors with one or more types of products and services but generally offer fewer choices in terms of custodians, asset

managers, technology features and functionality.

- •

- Providers of Specific Service

Applications. A number of our competitors, including Advent Software, Inc., provide financial advisors with a product or service

designed to address one specific issue or need, such as financial planning or performance reporting. While our technology platforms also provide access to these investment solutions or services,

financial advisors may elect to utilize a single application rather than a fully integrated platform.

- •

- Custodians. A number of leading asset custodians, such as Pershing LLC (a subsidiary of BNY Mellon Corporation) and The Charles Schwab Corporation, have expanded beyond their custodial businesses to also offer advisor trading tools that compete with our financial advisor-directed solutions.

Technology

Our technology platforms feature a three-tier architecture integrating a Web-based user interface, an application tier that houses the business logic for all of the platforms' functionality and a SQL Server databases. The application tier resides behind load balancers which distribute the workload demands across our servers. We believe our technology design allows for significant scalability.

We devote significant resources to ensuring sufficient platform capacity and system uptime. In 2014, our actual uptime was 99.8%. We have achieved Service Organization Control Report ("SOC1") compliance with our platforms and we maintain multiple redundancies, back up our databases and safeguard technologies and proprietary information consistent with industry best practices. We also maintain a comprehensive business continuity plan and company-wide risk assessment program that is consistent with industry best practices and that complies with applicable regulatory requirements.

We have historically made significant investments in platform development in order to enhance and expand our technology platforms and expect to continue to make significant investments in the future. In the years ended December 31, 2014, 2013 and 2012, we incurred technology development costs totaling approximately $11,560, $9,141 and $8,659, respectively. Of these costs, we capitalized approximately $3,382, $3,143 and $2,350, respectively, as internally developed software. The increase in the amount of technology development expenditures and the increase in the amount we capitalized in 2013 compared to 2012 is a result of technology development expenditures related to Envestnet | Tamarac and Envestnet | WMS products. We expect to continue focusing our technology development efforts principally on adding features to increase our market competitiveness, enhancements to improve operating efficiency and reduce risk, and client-driven requests for new capabilities.

Intellectual Property and Proprietary Rights

We rely on a combination of trademark, copyright and trade secret protection laws to protect our proprietary technology and our intellectual property. We seek to control access to and distribution of our proprietary information. We enter into confidentiality agreements with our employees, consultants, customers and vendors that generally provide that any confidential or proprietary information

14

developed by us or on our behalf be kept confidential. In the normal course of business, we provide our intellectual property to third parties through licensing or restricted use agreements. We have proprietary know-how in algorithms, implementation and business on-boarding functions, along with a wide variety of applications software. We have registered the mark "ENVESTNET" with the U.S. Patent and Trademark Office in addition to several marks commonly used by Envestnet. We also pursue the registration of certain of our other trademarks and service marks in the United States. In addition, we have registered our domain name, www.envestnet.com and several other websites, such as www.envestnetpmc.com, www.placemark.com, www.tamaracinc.com and www.primacapital.com. We have established a system of security measures to protect our computer systems from security breaches and computer viruses. We have employed various technology and process-based methods, such as clustered and multi-level firewalls, intrusion detection mechanisms, vulnerability assessments, content filtering, antivirus software and access control mechanisms. We also use encryption techniques for data transmissions. We control and limit access to confidential and proprietary information on a "need to know" basis.

Regulation

Overview

The financial services industry is among the most extensively regulated industries in the United States. We operate investment advisory, broker-dealer and mutual fund advisory businesses, each of which is subject to a specific regulatory scheme, including regulation at the federal and state level, as well as regulation by self-regulatory organizations and non-U.S. regulatory authorities. In addition, we are subject to numerous laws and regulations of general application.

Our subsidiaries Envestnet Asset Management, Inc., Portfolio Management Consultants, Inc., ERS, LLC. and EPS operate investment advisory businesses. These subsidiaries are registered with the U.S. Securities and Exchange Commission ("SEC") as "investment advisers" under the Investment Advisers Act of 1940, as amended (the "Advisers Act"), and are regulated thereunder. They may also provide fiduciary services as defined in Section 3(21)(A)(ii) of the Employee Retirement Income Security Act of 1974 ("ERISA"), including acting as an "investment manager" (as defined in Section 3(38) of ERISA). As described further below, many of our investment advisory programs are conducted pursuant to the non-exclusive safe harbor from the definition of an "investment company" provided for under Rule 3a-4 of the Investment Company Act of 1940, as amended (the "Investment Company Act"). If Rule 3a-4 were to cease to be available, or if the SEC were to modify the rule or its interpretation of how the rule is applied, it could have a substantial effect on our business. Envestnet Asset Management, Inc. serves as the investment adviser to two mutual funds and a series of collective investment trusts managed towards retirement target dates. Mutual funds are registered as "investment companies" under the Investment Company Act. The Advisers Act, Investment Company Act and ERISA, together with related regulations and interpretations of the SEC, impose numerous obligations and restrictions on investment advisers and mutual funds, including recordkeeping requirements, limitations on advertising, disclosure and reporting obligations, prohibitions on fraudulent activities, and detailed operating requirements, including restrictions on transactions between an adviser and its clients, and between a mutual fund and its advisers and affiliates. The fiduciary obligations of investment advisers to their clients require advisers to, among other things, consider the suitability of the investment products and advice they provide, seek "best execution" for their clients' securities transactions, conduct due diligence on third-party products offered to clients, consider the appropriateness of the adviser's fees, and provide extensive and ongoing disclosure to clients. The application of these requirements to wrap fee programs is particularly complex and the SEC has in the past scrutinized firms' compliance with these requirements. The SEC is authorized to institute proceedings and impose fines and sanctions for violations of the Advisers Act and the Investment Company Act and has the power to restrict or prohibit an investment adviser from carrying on its

15

business in the event that it fails to comply with applicable laws and regulations. Although we believe we are in compliance in all material respects with the requirements of the Advisers Act and the Investment Company Act and the rules and interpretations promulgated thereunder, our failure to comply with such laws, rules and interpretations could have a material adverse effect on us. Collective investment trusts are unregistered funds operated by a trust company or a bank regulated by the Office of the Comptroller of Currency (the "OCC"). In our role as advisor to these funds, we operate under substantially similar obligations to those discussed above for mutual funds.

Portfolio Brokerage Services, Inc., ("PBS"), our broker-dealer subsidiary, is registered as a broker-dealer with the SEC under the Securities Exchange Act of 1934, ("Exchange Act"), in all 50 states and the District of Columbia. In addition, PBS is a member of the Financial Industry Regulatory Authority ("FINRA"), the securities industry self-regulatory organization that supervises and regulates the conduct and activities of broker-dealers. Broker-dealers are subject to regulations that cover all aspects of their business, including sales practices, market making and trading among broker-dealers, use and safekeeping of customers' funds and securities, capital structure, record-keeping and the conduct of directors, officers, employees, representatives and associated persons. FINRA and the SEC conduct periodic examinations of the operations of its members, including PBS. Violation of applicable regulations can result in the suspension or revocation of a broker-dealer's registration, the imposition of censures or fines and the suspension or expulsion of the broker-dealer from FINRA. PBS is subject to minimum net capital requirements under the Exchange Act, SEC and FINRA rules and conducts its business pursuant to the exemption from the SEC's customer protection rule provided by Rule 15c3-3(k)(2)(i) under the Exchange Act. As of December 31, 2014, PBS was required to maintain a minimum of $100 in net capital and its actual net capital was $1,049.

Our regulated subsidiaries are subject to various federal and state laws and regulations that grant supervisory agencies, including the SEC, broad administrative powers. In the event of a failure to comply with these laws and regulations, the possible sanctions that may be imposed include the suspension of individual employees, limitations on the permissibility of our regulated subsidiaries and our other subsidiaries to engage in business for specified periods of time, censures, fines, and the revocation of registration as a broker-dealer or investment adviser, as applicable. Additionally, the securities laws and other regulations applicable to us and our subsidiaries provide for certain private rights of action that could give rise to civil litigation. Any litigation could have significant financial and non-financial consequences including monetary judgments and the requirement to take action or limit activities that could ultimately affect our business.

Additional legislation and regulations, including those relating to the activities of investment advisers and broker-dealers, changes in rules imposed by the SEC or other regulatory authorities and self-regulatory organizations, or changes in the interpretation or enforcement of existing laws and rules may adversely affect our business and profitability. Our businesses may be materially affected not only by regulations applicable to it as an investment adviser or broker-dealer, but also by regulations that apply to companies generally.

Investment Advisory Program Conducted Under Rule 3a-4

Under the Investment Company Act, an issuer that is engaged in the business of investing, reinvesting or trading in securities may be deemed an "investment company," in which case the issuer may be subject to registration requirements and regulation as an investment company under the Investment Company Act. In order to provide assurance that certain discretionary investment advisory programs would not be considered investment companies, the SEC adopted Rule 3a-4 under the Investment Company Act, which provides a non-exclusive safe harbor from the definition of an investment company for programs that meet the requirements of the rule. We conduct the following programs pursuant to the Rule 3a-4 safe harbor:

- •

- Separately managed accounts;

16

- •

- Unified managed account portfolios;

- •

- Mutual fund portfolios and exchange-traded fund portfolios; and

- •

- Advisor as portfolio manager.

We believe that, to the extent we exercise discretion over accounts in any of these programs, these programs qualify for the safe-harbor because all of the programs have the following characteristics, which are generally required in order for a program to be eligible for the Rule 3a-4 safe harbor:

- •

- Each client account is managed on the basis of the client's financial situation, investment objectives and reasonable client-imposed

investment restrictions;

- •

- At the opening of the account, the client's financial advisor obtains information from the client and provides us with the client's

financial situation, investment objectives and reasonable restrictions;

- •

- On no less than an annual basis, the client's financial advisor contacts the client to determine whether there have been any changes

in the client's financial situation or investment objectives, and whether the client wishes to impose any reasonable restrictions on the management of the account or reasonably modify existing

restrictions. This information is communicated to us and reflected in our management of client accounts;

- •

- On a quarterly basis, we or another designated person (in most cases this will be the client's financial advisor) notify the client to

contact us or another designated person if there have been any changes to the client's financial position or investment objectives or if the client wishes to impose any reasonable restrictions on the

management of the account;

- •

- We, the client's financial advisor and the manager of the client's account, all of whom are knowledgeable about the account and its

management, are reasonably available to the client for consultation;

- •

- All of the programs allow each client to impose reasonable restrictions on the management of his or her account;

- •

- On at least a quarterly basis, the client is provided with a statement containing a description of all activity in the client's

account during the preceding period, including all transactions made on behalf of the account, all contributions and withdrawals made by the client, all fees and expenses charged to the account, and

the value of the account at the beginning and end of the period; and

- •

- For all of the programs, each client retains, with respect to all securities and funds in the client's account, the right to withdraw securities or cash, vote securities, or delegate the authority to vote securities to another person, receive written confirmation or other notification of each securities transaction by the client's independent custodian, and proceed directly as a security holder against the issuer of any security in the client's account without the obligation to include us or any other client of the program in any such action as a condition precedent to initiating such proceeding.

Employees

As of December 31, 2014, we had 1,257 employees, including 177 in sales and marketing, 362 in engineering and systems, 570 in operations, 34 in investment management and research, and 114 in executive and corporate functions. Of these 1,257 employees, 478 were located in India. None of our employees is represented by a labor union. We have never experienced a work stoppage and believe our relationship with our employees is good.

17

Executive Officers of the Registrant

The following table summarizes information about each one of our executive officers.

Name

|

Age | Position(s) | |||

|---|---|---|---|---|---|

Judson Bergman |

58 | Chairman, Chief Executive Officer, Director | |||

William Crager |

50 | President | |||

Peter D'Arrigo |

47 | Chief Financial Officer | |||

Scott Grinis |

53 | Chief Technology Officer | |||

Shelly O'Brien |

49 | Chief Legal Officer, General Counsel and Corporate Secretary | |||

Brandon Thomas |

51 | Chief Investment Officer | |||

Josh Mayer |

41 | Chief Operating Officer | |||

Judson Bergman, Age 58. Mr. Bergman is the founder of our company and has served as our Chairman, Chief Executive Officer and a director since 1999. Prior to founding our company, Mr. Bergman was Managing Director at Nuveen Investments, Inc. ("Nuveen"), a diversified investment manager. Mr. Bergman serves as a trustee of RS Investment Trust and RS Variable Products Trust, registered investment companies. Mr. Bergman received an MBA in finance and accounting from Columbia University and a BA from Wheaton College.

William Crager, Age 50. Mr. Crager has served as our President since 2002. Prior to joining us, Mr. Crager served as Managing Director of Marketing and Client Services at Rittenhouse Financial Services, Inc., an investment management firm affiliated with Nuveen. Mr. Crager received an MA from Boston University and a BA from Fairfield University, with a dual major in economics and English.

Peter D'Arrigo, Age 47. Mr. D'Arrigo has served as our Chief Financial Officer since 2008. Prior to joining us, Mr. D'Arrigo worked at Nuveen where he served as Treasurer since 1999, as well as holding a variety of other titles after joining them in 1990. Mr. D'Arrigo received an MBA from the Northwestern University Kellogg Graduate School of Management and an undergraduate degree in applied mathematics from Yale University.

Scott Grinis, Age 53. Mr. Grinis has served as our Chief Technology Officer since 2004. Prior to joining us, Mr. Grinis co-founded Oberon Financial Technology, Inc., our subsidiary, prior to its acquisition by us. Mr. Grinis received a BS and an MS degree in electrical engineering from Stanford University.

Shelly O'Brien, Age 49. Ms. O'Brien has served as our Chief Legal Officer, General Counsel and Corporate Secretary since 2002. Prior to joining us, Ms. O'Brien was General Counsel and Director of Legal and Compliance for ING (U.S.) Securities, Futures & Options Inc., a broker-dealer, and futures commission merchant. Ms. O'Brien received a degree in political science from Northwestern University, a JD from Hamline University School of Law, and an LLM in taxation from John Marshall Law School.

Brandon Thomas, Age 51. Mr. Thomas is a co-founder of our company and has served as Chief Investment Officer and Managing Director of Portfolio Management Consultants, our internal investment management and portfolio consulting group, since 1999. Prior to joining us, Mr. Thomas was Director of Equity Funds for Nuveen. Mr. Thomas received an MBA from the University of Chicago, a JD from DePaul University and is a graduate of Brown University.

Josh Mayer, Age 41. Mr. Mayer was appointed Chief Operating Officer in April 2014. Previously, he served as Envestnet's Executive Vice President and Director of Operations from January 2011 to April 2014, and as Envestnet's Senior Vice President, Head of Operations from 2004 to January 2011. From 2000 to 2004, Mr. Mayer served as the Director of Operations for Oberon Financial Technology, which was acquired by Envestnet in 2004. Mr. Mayer holds a Bachelor of Arts and Sciences from Georgetown University.

18

Investment in our securities involves risk. An investor or potential investor should consider the risks summarized in this section when making investment decisions regarding our securities. These risks and uncertainties include, but are not limited to, the risk factors set forth below. The risks and uncertainties described in this section are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also affect our business. If any of these known or unknown risks or uncertainties actually occurs, our business, financial condition and results of operations could be materially adversely affected.

We have experienced rapid revenue growth, which may be difficult to sustain and which may place significant demands on our administrative, operational and financial resources and any inability to maintain or manage our growth could have a material adverse effect on our results of operations, financial condition or business.

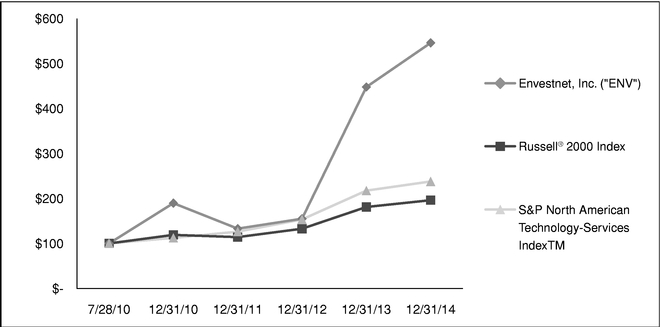

Our revenues during the three years ended December 31, 2014 have grown at a compound annual growth rate of 49%. We expect our growth to continue, which could place additional demands on our resources and increase our expenses. Our future growth will depend on, among other things, our ability to successfully grow our total assets under management and administration and add additional clients. If we are unable to implement our growth strategy, develop new investment solutions and services and gain new clients, our results of operations, financial condition or business may be materially adversely affected.

Sustaining growth will also require us to commit additional management, operational and financial resources and to maintain appropriate operational and financial systems. In addition, continued growth increases the challenges involved in:

- •

- recruiting, training and retaining sufficiently skilled technical, marketing, sales and management personnel;

- •

- preserving our culture, values and entrepreneurial environment;

- •

- successfully expanding the range of investment solutions and services offered to our clients;

- •

- developing and improving our internal administrative infrastructure, particularly our financial, operational, compliance,

record-keeping, communications and other internal systems; and

- •

- maintaining high levels of satisfaction with our investment solutions and services among clients.

There can be no assurance that we will be able to maintain or accelerate our growth, and any failure to do so could adversely affect our results of operations, financial condition or business.

Our revenue can fluctuate from period to period, which could cause our share price to fluctuate.

Our revenue may fluctuate from period-to-period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following events, as well as other factors described elsewhere in this document:

- •

- a decline or slowdown of the growth in the value of financial market assets, which may reduce the value of assets under management and

administration and therefore our revenues and cash flows;

- •

- negative public perception and reputation of the financial services industry, which would reduce demand for our investment solutions

and services;

- •

- unanticipated changes to economic terms in contracts with clients, including renegotiations;

19

- •

- downward pressure on fees we charge our clients, which would therefore reduce our revenue;

- •

- changes in laws or regulations that could impact our ability to offer investment solutions and services;

- •

- failure to obtain new clients;

- •

- cancellation or non-renewal of existing contracts with clients;

- •

- failure to protect our proprietary technology and intellectual property rights;

- •

- unanticipated delays in connection with the conversion of client assets onto our technology platforms;

- •

- changes to or a reduction in the suite of investment solutions and services provided to or used by existing clients; or

- •

- changes in our pricing policies or the pricing policies of our competitors to which we have to adapt.

As a result of these and other factors, the results of operations for any quarterly or annual period may differ materially from the results of operations for any prior or future quarterly or annual period and should not be relied upon as indications of our future performance.

We have a significant amount of debt and servicing our debt requires a significant amount of cash, and we may not have sufficient cash flow from our business to service our debt.

As of December 31, 2014, we had $172,500 in outstanding indebtedness related to our 1.75% convertible notes due 2019 (the "Convertible Notes"). Additionally, $100,000 is available under our amended credit facility dated December 8, 2014 ("Credit Agreement"). This indebtedness could, among other things:

- •

- make it difficult for us to pay other obligations;

- •

- make it difficult to obtain favorable terms for any necessary future financing for working capital, capital expenditures, debt service

requirements or other purposes;

- •

- require us to dedicate a substantial portion of our cash flow from operations to service the indebtedness, reducing the amount of cash

flow available for other purposes; and

- •

- limit our flexibility in planning for and reacting to changes in our business.

We operate in a highly competitive industry, with many firms competing for business from financial advisors on the basis of a number of factors, including the quality and breadth of investment solutions and services, ability to innovate, reputation and the prices of services and this competition could hurt our financial performance.

We compete with many different types of companies that vary in size and scope, including Pershing LLC (a subsidiary of BNY Mellon Corporation), The Charles Schwab Corporation, SEI Investments Company, AssetMark, Inc., Advent Software, Inc., and Lockwood Advisors (a subsidiary of BNY Mellon Corporation) and which are discussed in greater detail under "Business—Competition" included in this Form 10-K. In addition, some of our clients have developed or may develop the in-house capability to provide the technology and/or investment advisory services they have retained us to perform. These clients may also offer internally developed services to their financial advisors, obviating the need to hire us, and they may offer these services to third-party financial advisors or financial institutions, thereby competing directly with us for that business.

20

Many of our competitors have significantly greater resources than we do. These resources may allow our competitors to respond more quickly to changes in demand for investment solutions and services, to devote greater resources to developing and promoting their services and to make more attractive offers to potential clients and strategic partners, which could hurt our financial performance.

We may lose clients as a result of the sale or merger of a client, a change in a client's senior management, competition from other financial advisors and financial institutions and for other reasons. We also face increased competition due to the current trend of industry consolidation. If large financial institutions that are not our clients are able to attract assets from our clients, our ability to grow revenues and earnings may be adversely affected.

Our Envestnet | PMC group competes with other providers of investment solutions and products. These competitors may offer broader solutions and/or products and their solutions and/or products may have better investment returns during one or more periods. If the investment returns on our investment products are not perceived to be competitive, we could experience outflows of assets from these products and face difficulty attracting new assets to these products.

Our failure to successfully compete in any of the above-mentioned areas could have a material adverse effect on our results of operations, financial condition or business. Competition could also affect the revenue mix of services we provide, resulting in decreased revenues in lines of business with higher profit margins.

We derive nearly all of our revenues from the delivery of investment solutions and services to clients in the financial advisory industry and our revenue could suffer if that industry experiences a downturn.

A decline or lack of growth in demand for financial advisory services would adversely affect our clients and, in turn, our results of operations, financial condition and business. For example, the availability of free or low-cost investment information and resources, including research and information relating to publicly traded companies and mutual funds available on the Internet or on company websites, could lead to lower demand by investors for the services provided by financial advisors. In addition, demand for our investment solutions and services among financial advisors could decline for many reasons. Consolidation or limited growth in the financial advisory industry could reduce the number of our clients and potential clients. Events that adversely affect our clients' businesses, rates of growth or the numbers of customers they serve, including decreased demand for our clients' products and services, adverse conditions in our clients' markets or adverse economic conditions generally, could decrease demand for our investment solutions and services and thereby decrease our revenues. Any of the foregoing could have a material adverse effect on our results of operations, financial condition or business.

A limited number of clients account for a material portion of our revenue. Termination of our contracts with any of these clients could have a material adverse effect on our results of operations, financial condition or business.

For the years ended December 31, 2014, 2013 and 2012, revenues associated with our relationship with our single largest client, FMR LLC, an affiliate of FMR Corp., or Fidelity, accounted for 19%, 20% and 22% respectively, of our total revenues and our ten largest clients accounted for 48%, 46% and 47%, respectively, of our total revenues. Our license agreements with large financial institutions are generally multi-year contracts that may be terminated upon the expiration of the contract term or prior to such time for cause, which may include breach of contract, bankruptcy, insolvency and other reasons. The Fidelity agreement, as amended, which expires in March 2017, includes receiving ongoing platform services fees through the Fidelity relationship based upon asset-based fees. A majority of our agreements with financial advisors generally provides for termination at any time. If our contractual relationship with Fidelity were to terminate, or if a significant number of our most important clients

21

were to terminate their contracts with us and we were unable to obtain a significant number of new clients, our results of operations, financial condition or business could be materially adversely affected.

Our clients that pay us an asset-based fee may seek to negotiate a lower fee percentage or may cease using our services, which could limit the growth of, or decrease, our revenues.

A significant portion of our revenues are derived from asset-based fees. Our clients may, for a number of reasons, seek to negotiate a lower asset-based fee percentage. For example, an increase in the use of index-linked investment products by the clients of our financial advisor clients may result in lower fees being paid to our clients, and our clients may in turn seek to negotiate lower asset-based fee percentages for our services. In addition, as competition among our clients increases, they may be required to lower the fees they charge to their clients, which could cause them to seek to decrease our fees accordingly. Any of these factors could result in fluctuation or a decline in our asset-based fees, which would have a material adverse effect on our results of operations, financial condition or business.

Changes in market and economic conditions could lower the value of assets on which we earn revenues and could decrease the demand for our investment solutions and services.

Asset-based fees make up a significant portion of our revenues. Asset-based fees represented 84%, 83% and 81% of our total revenues for the years ended December 31, 2014, 2013 and 2012, respectively. We expect that asset-based fees will continue to represent a significant percentage of our total revenues in the future. Significant fluctuations in securities prices may materially affect the value of the assets managed by our clients and may also influence financial advisor and investor decisions regarding whether to invest in, or maintain an investment in, a mutual fund or other investment solution. If such market fluctuation led to less investment in the securities markets, our revenues and earnings derived from asset-based fees could be materially adversely affected.

We provide our investment solutions and services to the financial services industry. The financial markets, and in turn the financial services industry, are affected by many factors, such as U.S. and foreign economic conditions and general trends in business and finance that are beyond our control. In the event that the U.S. or international financial markets suffer a severe or prolonged downturn, investors may choose to withdraw assets from financial advisors, which we refer to as "redemptions", and transfer them to investments that are perceived to be more secure, such as bank deposits and Treasury securities. For example, in late 2007 and through the first quarter of 2009, the financial markets experienced a broad and prolonged downturn, our redemption rates were higher than our historical average, and our results of operations, financial condition and business were materially adversely affected. Any prolonged downturn in financial markets or increased levels of asset withdrawals could have a material adverse effect on our results of operations, financial condition or business.

Investors' decisions regarding their investment assets are affected by many factors and investors may redeem or withdraw their investment assets generally at any time. Significant changes in investing patterns or large-scale withdrawal of investment funds could have a material adverse effect on our results of operations, financial condition or business.

The clients of our financial advisors are generally free to change financial advisors, forgo the advice and other services provided by financial advisors or withdraw the funds they have invested with financial advisors. These clients of financial advisors may elect to change their investment strategies, by moving their assets away from equity securities to fixed income or other investment options, or by withdrawing all or a portion of their assets from their accounts to avoid all securities markets-related risks. These actions by investors are outside of our control and could materially adversely affect the market value of the investment assets that our clients manage, which could materially adversely affect the asset-based fees we receive from our clients.

22

We are subject to liability for losses that result from a breach of our fiduciary duties.

Our investment advisory services involve fiduciary obligations that require us to act in the best interests of our clients, and we may be sued and face liabilities for actual or claimed breaches of our fiduciary duties. Because we provide investment advisory services, both directly and indirectly, with respect to substantial assets we could face substantial liability to our clients if it is determined that we have breached our fiduciary duties. In certain circumstances, which generally depend on the types of investment solutions and services we are providing, we may enter into client agreements jointly with advisors and retain third-party investment money managers on behalf of clients. As a result, we may be included as a defendant in lawsuits against financial advisors and third-party investment money managers that involve claims of breaches of the duties of such persons, and we may face liabilities for the improper actions and/or omissions of such advisors and third-party investment money managers. In addition, we may face claims based on the results of our investment advisory recommendations, even in the absence of a breach of our fiduciary duty. Such claims and liabilities could therefore have a material adverse effect on our results of operations, financial condition or business.

We are subject to liability for losses that result from potential, perceived or actual conflicts of interest.

Potential, perceived and actual conflicts of interest are inherent in our existing and future business activities and could give rise to client dissatisfaction, litigation or regulatory enforcement actions. In particular, we pay varying fees to third-party asset managers and custodians and our financial advisor customers, or their clients, could accuse us of directing them toward those asset managers or custodians that charge us the lowest fees. In addition, we offer proprietary mutual funds and portfolios of mutual funds through our internal investment management and portfolio consulting group, and financial advisors or their clients could conclude that we favor our proprietary investment products because of their belief that we earn higher fees when our proprietary investment products are used. Adequately addressing conflicts of interest is complex and difficult. If we fail, or appear to fail, to adequately address potential, perceived or actual conflicts of interest, the resulting negative public perception and reputational harm could materially adversely affect our client relations or ability to enter into contracts with new clients and, consequently, our results of operations, financial condition and business.