UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM

(Mark One)

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ______________

Commission file number:

(Exact Name of Registrant as Specified in Its Charter)

| | |

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

| | |

| (Address of Principal Executive Offices) | (Zip Code) |

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Note —Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | | ☑ | ||

| Non-accelerated filer | ☐ | Smaller reporting company | | Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $

Note — If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of March 16, 2021:

| Business |

General

FutureFuel Corp. (sometimes referred to as the “Company,” “we,” “us,” or “our,” and includes our wholly owned subsidiaries) is a Delaware corporation, and, through its wholly-owned subsidiary, FutureFuel Chemical Company, manufactures diversified chemical products, bio-based fuel products, and bio-based specialty chemical products.

We are headquartered in St. Louis, Missouri, and our manufacturing operations are conducted at our facility in Batesville, Arkansas. Trading of our common stock on the New York Stock Exchange (“NYSE”) commenced on March 23, 2011 under the symbol “FF”.

During 2020, we distributed normal quarterly cash dividends of $0.06 per share and a special dividend of $3.00 per share on our common stock. Additionally, we have declared normal quarterly cash dividends of $0.06 per share on our common stock for the calendar year 2021.

Our business is managed in two segments: chemicals and biofuels. The chemicals segment manufactures a diversified listing of chemical products that are sold to third party customers. The majority of the revenues from the chemicals segment are derived from the custom manufacturing of specialty chemicals for specific customers. We have actively worked to develop our chemicals business with new customers in more diversified growth markets. Our specialty chemicals business is based on a solid reputation as a technology-driven, highly reliable, and globally competitive specialty chemicals producer. We retain a strong emphasis on operational excellence, cost control, and efficiency improvements to enable us to compete in the worldwide chemical industry.

With respect to our biofuels segment, our plant has a demonstrated capacity near 59 MMgy (million gallons per year) with production of 58 MMgy during 2020 with the reinstatement of the blenders’ tax credit (“BTC”), which strengthened a COVID-19 weakened market for renewable fuel volumes and resulting price declines. In late December 2019, the BTC was retroactively reinstated from its expiry on January 1, 2018 through December 31, 2022. The future production of biodiesel is uncertain and will depend on various factors including: (i) changes in feedstock prices relative to biodiesel prices; (ii) competition from alternative products, such as renewable diesel; (iii) whether government mandates with respect to biodiesel usage remain in effect; (iv) whether certain tax credits with respect to biodiesel production remain in effect; and (v) competitiveness and availability of foreign imports. See the discussion below, including “Risk Factors” beginning at page 15 below.

The COVID-19 pandemic and measures to address the pandemic have significantly reduced domestic demand for gasoline and diesel, thereby reducing demand for 2020 RINs. Renewable Volume Obligations (RVOs) are based on the volume of sales of gasoline and diesel of an obligated party under RFS2. As those volumes decrease, there is a corresponding decrease in the volume of RINs required for RFS compliance. As a result, demand for RINs and the value of RINs going forward is uncertain. Further, it is uncertain how long the impacts of COVID-19 will continue.

Narrative Description of Our Business

`

Principal Executive Offices

Our principal executive offices are located at 8235 Forsyth Blvd., 4th Floor, Clayton, Missouri 63105. Our telephone number is (314) 854-8352. FutureFuel Chemical Company’s principal executive offices are located at 2800 Gap Road, Highway 394 South, Batesville, Arkansas 72501-9680. Its telephone number is (870) 698-3000.

Plant Location

We own approximately 2,200 acres of land six miles southeast of Batesville in north central Arkansas fronting the White River. Approximately 500 acres of the site are occupied with batch and continuous manufacturing facilities, laboratories, and associated infrastructure, including on-site liquid waste treatment. Land and infrastructure are available to support expansion and business growth.

Operations

For the year ended December 31, 2020, approximately 61% of our revenue was derived from biofuels, 31% from manufacturing specialty chemicals for specific customers (“custom manufacturing”), and 8% of revenues from multi-customer specialty chemicals (“performance chemicals”).

Our biofuels business segment primarily involves the production and sale of biodiesel and petrodiesel blends and the buying, selling, and shipping of refined petroleum products on common carrier pipelines. Custom chemicals manufacturing involves producing unique products for strategic customers, generally under long-term contracts. Our custom chemicals manufacturing portfolio includes agrochemicals and intermediates, detergent additives, biocides intermediates, specialty polymers, dyes, stabilizers, and chemicals intermediates. Our performance chemicals product portfolio includes polymer modifiers that enhance stain resistance and dye-ability to nylon and polyester fibers, in addition to several small-volume specialty chemicals and solvents for diverse applications.

We are committed to growing our biofuels and chemicals businesses. For the biofuels business segment, we will continue to leverage our technical capabilities and quality certifications, secure local and regional markets, and expand marketing efforts to fleets and regional/national customers. For our chemicals segment, we intend to pursue commercialization of other products, including building block chemicals. While pursuing this strategy, we will continue our efforts to establish a name identity for both segments.

Biofuels Business Segment

Biofuel Products

Our biofuels business segment began in 2005 and primarily produces and sells biodiesel. In addition, we sell petrodiesel in blends with our biodiesel and, from time to time, with no biodiesel added. Finally, we are a shipper of refined petroleum products on common carrier pipelines, and we buy and sell petroleum products to maintain our active shipper status on these pipelines.

Biodiesel is a renewable energy product consisting of mono-alkyl esters of fatty acids. The mono-alkyl esters are typically produced from vegetable oil, fat, or grease feedstocks. Biodiesel is used primarily as a blend with petrodiesel (usually 5% (commonly referenced as “B5”) to 20% (commonly referenced as “B20”) by volume). A major advantage of biodiesel is that it can be used in most existing diesel engines and fuel injection equipment in blends up to B20 with no material impact to engine performance. In 1998, Congress approved the use of biodiesel as an Energy Policy Act compliance strategy, which allowed federal, state, and public fleets covered by this Act to meet their alternative fuel vehicle purchase requirements by simply buying biodiesel and burning it in new or existing diesel vehicles in a minimum B20 blend. Finally, biodiesel also benefits from favorable properties compared to petrodiesel (e.g., negligible sulfur content, lower particulate matter, lower greenhouse gas emissions, and a higher cetane number leading to better engine performance and lubrication). See https://afdc.energy.gov/files/pdfs/30882.pdf.

Our technical and operational competency acquired as a supplier of specialty chemicals enabled the development of a flexible manufacturing process, which can use a broad range of feedstock oils, including, but not limited to, soy oil, cottonseed oil, pork lard, poultry fat, inedible corn oil, yellow grease, inedible tallow, choice white grease, used cooking oil, and beef tallow. Our Batesville plant produces biodiesel, which is sometimes referenced as “B100.” A biodiesel blend is currently used in the facility’s diesel fleet and is available for retail sale at the site. We offer B100 and biodiesel blended with petrodiesel (B2, B5, B10, B20, and B50 blends) at our short-term leased storage facility in Little Rock, Arkansas. In addition, we deliver blended product to a small group of customers within our region.

Biodiesel Production/Capacity

While biodiesel can be made from various renewable sources, the choice of feedstock to be used at any particular facility is determined primarily by the price and availability of each feedstock variety, the yield loss of lower quality feedstock, and the capabilities of the producer’s biodiesel production facility. In addition, the chemical properties of the biodiesel (e.g., cloud point, pour point, and cetane number) depend on the type of feedstock. See EIA, Monthly Biodiesel Production Report, http://www.eia.gov/biofuels/biodiesel/production/biodiesel.pdf.

In the United States, the majority of biodiesel historically has been made from domestically produced crude soybean oil due to its widespread availability and ease of processing. Since we started our biodiesel production, the cost of crude soybean oil has increased due in part to its use in biodiesel production and competing food demands. As a result, the biodiesel feedstock market in the United States transitioned from this expensive first-generation soy feedstock to alternative second-generation lower-cost, non-food feedstocks, such as waste vegetable oil, tallow, and inedible corn oil. Our continuous production line produces biodiesel from these second-generation lower-cost feedstocks with high-free fatty acids and has demonstrated a biodiesel production capacity in excess of 58 MMgy.

Legislative Incentives

Biodiesel production and use in the United States continues to be driven in large part by legislative initiatives at both the federal and state levels.

Federal Renewable Fuels Mandate

The largest incentive program at this time is the federal mandate enacted by Congress as part of the Energy Policy Act of 2005 (the “2005 Act”). The 2005 Act included a number of provisions intended to spur the production and use of biodiesel. In particular, the 2005 Act’s provisions included biodiesel as part of the minimum volume (i.e., a mandate) of renewable fuels (the “renewable fuels standard” or “RFS”) to be included in the nationwide gasoline and diesel pool. The volume increased each year, from 4 billion gallons per year in 2006 to 16.55 billion gallons per year in 2013. The 2005 Act required the Environmental Protection Agency (the “USEPA”) to publish “renewable fuel obligations” applicable to refiners, blenders, and importers in the contiguous 48 states. The renewable fuel obligations are expressed in terms of a volume percentage of gasoline sold or introduced into commerce and consist of a single applicable percentage that applies to all categories of refiners, blenders, and importers. The renewable fuel obligations are based on estimates that the Energy Information Association provides to the USEPA on the volumes of gasoline it expects will be sold or introduced into commerce. The USEPA released the final rules to implement the RFS on April 10, 2007. Under those rules, the RFS compliance period began on September 1, 2007. No differentiation was made among the various types of renewable fuels (e.g., biodiesel or ethanol).

On December 19, 2007, the Energy Independence and Security Act of 2007 (the “2007 Act”) was enacted which, among other things, expanded the RFS (the “RFS2”). Prior to the enactment of the 2007 Act, the RFS requirement was mostly filled by ethanol. In contrast to the 2005 Act, the 2007 Act provided a renewable fuel standard carve-out specifically applicable to biodiesel. On July 1, 2010, RFS2’s biodiesel requirement became effective, thus requiring that a certain percentage of the diesel fuel consumed in the United States be made from renewable sources. The biomass-based diesel mandate rose annually and reached 2.10 billion gallons per year in 2019. Currently, the mandate is determined by the USEPA in coordination with the U.S. Secretaries of Energy and Agriculture. The last update to the mandate was issued on December 19, 2019, when the USEPA finalized the volume requirements and percentage standards under the RFS2 program for 2020 for cellulosic biofuel, biomass-based diesel, advanced biofuel, and total renewable fuel and for biomass-based diesel for 2021.

The following table shows the finalized volume requirement by the USEPA with a modest growth rate in biomass-based diesel.

| Final Renewable Fuel Volumes |

||||||||||||

| 2019 |

2020 |

2021 |

||||||||||

| Cellulosic biofuel (million gallons) |

418 | 593 | n/a | |||||||||

| Biomass-based diesel (billion gallons) |

2.10 | 2.43 | 2.43 | |||||||||

| Advanced biofuel (billion gallons) |

4.92 | 5.09 | n/a | |||||||||

| Renewable fuel (billion gallons) |

19.92 | 20.09 | n/a | |||||||||

| Implied conventional biofuel (billion gallons) |

15 | n/a | n/a | |||||||||

| ● |

Units for all volumes are ethanol-equivalent, except for biomass-based diesel volumes, which are expressed as physical gallons. |

|

| ● |

The 2020 biomass-based diesel volume requirement was established in the 2019 final rule (40 CFR 80.1405, December 19, 2019). |

|

| ● |

See https://www.epa.gov/renewable-fuel-standard-program/final-renewable-fuel-standards-2020-and-biomass-based-diesel-volume |

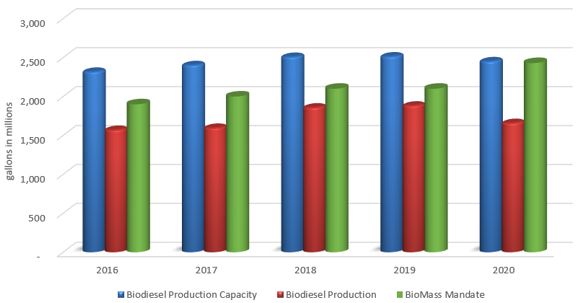

U.S. biomass-based diesel production capacity, of which biodiesel represents a significant amount, exceeded the federal mandate from 2016 through November 2020 as shown in the following chart:

Biomass Production Source: Total U.S. production of renewable fuels in the RFS2 program broken out by fuel type and category is reported by the USEPA at https://www.eia.gov/biofuels/biodiesel/production/.

Federal Blenders’ and Producers’ Credits

Biodiesel tax incentives have been provided through various federal statutes, including the 2005 Act and the American Jobs Creation Act, and later, the Emergency Economic Stabilization Act of 2008. The most important of these is the one dollar per gallon BTC applicable to all biodiesel. This credit has lapsed and been reinstated numerous times over the last decade. The BTC was not in place during 2012, 2014, 2015, 2018, and the majority of 2019. For each of these years, the BTC was retroactively reinstated. The longest period of retroactive reinstatement was in late December 2019 which reinstated the credit for 2018 through December 31, 2022 (the longest established period in law).

Like the BTC, the small agri-biodiesel credit was not in place for the majority of 2019. The small agri-biodiesel credit provides for an annual tax incentive in the amount of $0.10 per gallon on the first 15 million gallons of qualified agri-biodiesel produced. In late December 2019, the small agri-biodiesel credit was retroactively reinstated from its expiry on January 1, 2018 through December 31, 2022.

State Incentives

Our review of state statutes reveals that virtually all states provide user or producer incentives for biodiesel, several states provide both types of incentives, and more than 35 states provide incentives to biodiesel producers to build facilities in their states, typically offering tax credits, grants, and other financial incentives. We also are registered in the states of California and Oregon fuel programs, which incentivize the use of low carbon fuels specific to biomass-based diesel. Washington is in the process of implementing a similar program. As we expand our business, we will assess these and other state incentives and determine if we qualify. We will also stay abreast of regulations and update registrations if eligible.

Summary

We will continue to identify and pursue other legislative incentives to support our business. However, no assurances can be given that we will qualify for any such incentives or, if we do qualify, what the amount of such incentives will be or whether such incentives will continue to be available.

Quality

For quality specification purposes, and to qualify for the federal mandate, biodiesel must meet the requirements of American Society for Testing and Materials (“ASTM”) D6751. This specification ensures that blends up to B20 are compatible with diesel engines and associated fuel system hardware. See Status and Issues for Biodiesel in the United States, National Renewable Energy Laboratory, Theresa Alleman, Margo Melendez, and Wendy Dafoe et. al., Feb. 2015. All biodiesel manufactured at our Batesville plant is tested in on-site quality control laboratories and confirmed to meet, and typically exceed, the ASTM D6751 standard.

Commercially available biodiesels can contain small amounts of unreacted or partially reacted oils and fats as well as other minor impurities. The unreacted or partially reacted oils and fats are called glycerides. In rare instances, the glycerides and other minor components and impurities can clog engine filters. To address this issue, ASTM D6751 was amended in February 2012 to create two new grades of biodiesel. Grade No. 2 is essentially the specifications in effect before the amendment. Grade No. 1 provides for a maximum total monoglyceride content and a maximum cold soak filterability time and, in theory, would be used where the cloud point of No. 2 biodiesel does not provide adequate assurance of quality. Both grades of biodiesel qualify as “biodiesel” for purposes of the RFS2 mandate. FutureFuel continues to operate under the most recently published version of ASTM D6751, Standard Specifications for Biodiesel Fuel Blend Stock (B100) for Middle Distillate Fuels. All biodiesel made in our continuous process meets the specifications for No. 1 biodiesel.

The U.S. biodiesel industry created the BQ-9000 program to address quality issues that arose during the early years of the industry. This program is run by the National Biodiesel Accreditation Committee, which is a cooperative and voluntary program for the accreditation of biodiesel producers and marketers. The program is a quality system-oriented program that includes standards for storage, sampling, testing, blending, shipping, distribution, and fuel management practices. Since the creation and adoption of the BQ-9000 program, the quality of biodiesel in the U.S. market has markedly improved. Our plant has operated as a BQ-9000 accredited production facility since 2006.

The ISO 9000 family of standards represents an international consensus on good quality management practices. It consists of standards and guidelines relating to quality management systems and related supporting standards. ISO 9001 provides a set of standardized requirements for a quality management system, regardless of what the user organization does, its size, or whether it is in the private or public sector. It is the only international standard against which organizations can be certified, although certification is not a compulsory requirement of the standard. Our plant is an ISO 9001 accredited production facility for both chemicals and biofuels.

Renewable Identification Numbers

As noted above, the RFS2 mandates levels of various types of renewable fuels that are to be blended with U.S. gasoline and diesel fuel by U.S. refiners, blenders, and importers. Renewable Identification Numbers (“RINs”) are the mechanism for ensuring that the prescribed levels of blending are reached. As ethanol and biodiesel is produced or imported, the producer or importer has the responsibility to report the activity in the USEPA’s Moderated Transaction System (“EMTS”) where a series of numbers (i.e., a RIN) is assigned to their product. Assignment is made according to guidelines established by the USEPA. Currently, 1½ RINs are assigned for each gallon of biodiesel produced. When biofuels change ownership to the refiners, importers, and blenders of the fuel, the RINs are also transferred. The RINs ultimately are separated from the renewable fuel generally at the time the renewable fuel is blended. The refiners, importers, and blenders generally use the RINs to establish that they have blended their applicable percentage of renewable fuels during the applicable reporting period. However, once the RINs are separated from the underlying biofuels (e.g., by blending the underlying biodiesel with petrodiesel), they can also be sold separate and apart from the underlying biofuels.

We generate RINs with our biodiesel. At times, we sell biodiesel with the RIN attached to the fuel. If we blend the biodiesel with petrodiesel in blends of B80 or less (e.g., B5 or B20), we can either sell the RINs with our blended biodiesel or we can sell them as a separate, free-standing instrument removed from the biodiesel. The decision of whether or not to separate the RINs from the blended biodiesel depends on the desires of the customer and market conditions for separated RINs, particularly, market prices. While biodiesel RINs continue to be traded through market makers, no assurances can be given that a separate market for RINs will be sustained or what value will be realized upon the sale of biodiesel RINs.

Byproducts

Glycerin

A byproduct of the biodiesel process is crude glycerin, which is produced at the rate of approximately 10% by mass of the quantity of biodiesel produced. Countervailing duties levied in 2017 by the U.S. Commerce Department on biodiesel imported from Argentina and Indonesia reduced excess supply of imported glycerin. The U.S glycerin market corrected in 2018 with supply/demand more in balance. Crude glycerin (as generated from biodiesel production) is commonly sold into energy exploration and water treatment markets, the price of which is determined, among other factors, by energy prices, product supply, and corn commodity prices.

Crude glycerin can be refined into a pure form and then used in higher value markets such as specialty chemical production, agricultural formulations, food, pharmaceutical, and/or cosmetic applications. We have added the capability to refine our crude glycerin to an industrial grade with higher value applications. We currently market both crude and industrial grade glycerin with our product mix dependent upon refining capacity, product specifications, prices, and other market conditions.

Biodiesel Residue

An additional byproduct of the biodiesel production process is biodiesel residue. We use distillation columns in our biodiesel production process. Biodiesel residue accumulates in these columns as biodiesel is produced. This is a low-priced commodity that we aggregate and sell to multiple customers, primarily for use in Bunker C #6 Oil and as an asphalt release agent.

Biodiesel Production Capacity

According to Biodiesel Magazine (December 15, 2020) the United States had a total combined annual capacity of 2,806 million gallons from 105 biodiesel plants. See http://www.biodieselmagazine.com/plants/listplants/USA/. Available plant capacity increased 293 million gallons from 2017. We believe that the biodiesel industry will continue to be highly competitive given the excess capacity.

Customers and Markets

Biodiesel and biodiesel blends are currently used in nearly all of the end markets where petrodiesel is used. Most biodiesel in the United States is consumed in the on-road diesel fuel market, although some is used for off-road purposes such as farming, residential/commercial heating oil, and power generation.

We currently market our biodiesel products by truck, rail, and barge directly to customers in the United States. Through the utilization of liquid bulk storage facilities and barge loading capabilities, we are positioned to market biodiesel throughout the United States mainly for transportation. Although the regional market is still being developed, we estimate that the regional direct market available to us at maturity will be at least 30 million gallons per year.

For the twelve months ended December 31, 2020 and 2019, one customer represented approximately 20% and 22% of biofuel revenue (12% and 11% of total revenue). For the twelve months ended December 31, 2018 four customers represented approximately 58% of biofuel revenue (35% of total revenue), with the remaining biofuel revenue spread across multiple other customers. We do not have long term contracts with any biofuels customer, but rather sell on the basis of monthly or short-term, multi-month purchase orders at prices based upon then-prevailing market rates. We do not believe that the loss of any of these customers would have a material adverse effect on our biofuels segment or on us as a whole in that: (i) biofuels are a commodity with a large potential customer base; (ii) we believe that we could readily sell biofuels to other customers; (iii) the prices we receive from these customers are based upon then-market rates; and (iv) our sales to the customers are not under fixed terms, and the customers have no obligation to purchase any minimum quantities except as stipulated by short term purchase orders.

Competition

Renewable diesel is a rapidly growing competing biofuel with biodiesel. FutureFuel uses a conventional process of transesterification of feedstocks fats, vegetable oils, or waste cooking oils to make biodiesel. Renewable diesel is produced via hydro-processing of the same feedstocks. Renewable diesel, unlike conventional biodiesel, meets the fuel specification requirements of ASTM D975 (petrodiesel fuel) and ASTM D396 (home heating oil) and can be used as a direct substitute without requiring the need for petrodiesel blending. As a result, renewable diesel trades at a premium price to conventional biodiesel based on fungibility with petrodiesel, better cold weather performance and generation of a higher number of RINS on a per gallon basis.

According to the U.S. Department of Energy, five plants produce renewable diesel in the United States, with a combined capacity of nearly 400 million gallons per year. Production is expected to grow in the coming years due to expansions at existing plants and the construction of new plants. The U.S. Energy Information Administration (EIA) does not report renewable diesel production; however, the U.S. Environmental Protection Agency (EPA) reports RFS RIN data, which indicates that the United States consumed over 900 million gallons in 2019. Nearly all domestically produced and imported renewable diesel is used in California due to economic benefits under the Low Carbon Fuel Standard. See https://afdc.energy.gov/fuel/emerging_hydrocarbon.html#:~:text=Five%20plants%20produce%20renewable%20diesel, 400%20million%20gallons%20per%20year.

We compete with other producers of biodiesel regionally, nationally, and with foreign imports. The principal methods of competition in the biodiesel industry are price, supply reliability, biodiesel quality, and RIN integrity, i.e., the degree of confidence the market maintains in the validity of a biodiesel producer’s RINs. The ten largest producers in terms of production capacity of biodiesel in the United States in 2020 were Renewable Energy Group, Inc., Marathon and affiliates, World Energy and affiliates, RBF Port Neches, LLC, Cargill and affiliates, Ag Processing, Inc., Louis Dreyfus Agricultural Industries LLC, Hero BX, Archer Daniels Midland Co., and Seaboard Energy and affiliates. See http://www.biodieselmagazine.com/plants/listplants/USA/. These ten producers account for 59% of the total 2.8 billion gallons of production capacity available in 2020. Additionally, we compete with numerous other smaller producers and emerging renewable diesel and cellulosic based biodiesel technologies.

We cannot give any assurances that renewable diesel fuel, green diesel, natural gas or some other product produced by these or similar competing technologies will not supplant biodiesel as an alternative to conventional petrodiesel. A significant capital investment would be required for FutureFuel to produce renewable diesel, and the current economics and business uncertainty do not support this level of investment.

The biodiesel industry also is in competition with the petroleum-based diesel fuel industry. The biodiesel industry is small relative to the size of the petroleum-based diesel fuel industry, and large petroleum companies have greater resources than we do. Without government incentives and requirements, the consequent impact on processing economics would be uncertain.

Supply and Distribution

As a result of our feedstock-flexible process, we are able to source feedstock from a broad supplier base, which includes crude corn oil producers, reclaimed used cooking oil, and pork, chicken, and beef rendering facilities from both national and regional suppliers. Crude corn oil has been sourced from several national and regional producers. All feedstocks are currently supplied by either rail or truck. We believe that an adequate supply of feedstocks can be sourced to support our anticipated production.

We sell biodiesel from our plant site as well as ship it to liquid bulk storage facilities for further distribution. Sales from our plant site are made by railcar and tank truck. Biodiesel is being delivered by Company-owned tank trucks and common carriers to a liquid bulk storage facility leased by us for distribution there and for further transportation by barge or tank truck.

Several biodiesel producers and petroleum refiners are investing in large scale renewable diesel production. These include Neste Corporation with production facilities in Asia and Europe, Valero Corporation through its Diamond Green JV with Darling Ingredients in Norco, Louisiana and World Energy, Paramount California. Greenea reported a six times potential growth in U.S. installed capacity of Renewable Diesel over the next six years. http://www.greenea.com/wp-content/uploads/2021/01/Greenea-Horizon-2030-Which-investments-will-see-the-light-in-the-biofuel-industry-1.pdf

Cyclicality and Seasonality

Biodiesel producers have historically experienced seasonal fluctuations in demand for biodiesel. Biodiesel demand has tended to be lower during the winter in northern and Midwestern states due to concerns about biodiesel’s ability to operate optimally in cold weather as compared to petrodiesel. This seasonal fluctuation has been strongest for biodiesel made from animal fats and used cooking oils. Biodiesel made from such feedstocks has a higher cloud point (which is the point at which a fuel begins to gel) than biodiesel produced from vegetable oils, such as soybean, canola, or crude corn oil. This higher cloud point may cause cold weather performance issues.

The mandate for biodiesel usage as established by RFS2 may interject an additional seasonal fluctuation in our biodiesel business. Once the mandate for a calendar year is met, or is anticipated to be met, demand for biodiesel may decrease.

Outlook for the Biodiesel Industry/Our Future Strategy

In late December 2019, the BTC was retroactively reinstated from its expiry on January 1, 2018 and extended through December 31, 2022. Based on analysis from industry analysts, the biodiesel industry is entering a new era of transition to alternative feedstocks, emerging technologies, and revised government policies favoring sustainable feedstocks and fuels. Further, it is anticipated that the U.S. market may transition to larger plants, alternative feedstocks and second-generation technologies, resulting in consolidation among smaller, first-generation producers accompanied by a series of mergers and acquisitions in the field. Although it is unclear whether this trend will occur, if it does, we believe that producers who are proactive in responding to these changes can compete with foreign imports and benefit in this emerging market. These responses include: new and improved technologies; alternative feedstocks with higher yields; production scalability and flexibility options; supply chain, distribution and co-location strategies; the sale of RINs separate from the underlying biodiesel; and innovative risk management strategies.

Our future strategy for our biofuels segment is geared towards these responses. Notwithstanding our future strategy, our continued production of biodiesel may be severely limited, in part, by our ability to source feedstock given competitive growing renewable diesel markets, or eliminated entirely, in the event Congress eliminates the federal mandate of the RFS2. See “Risk Factors” beginning at page 15 below.

Chemicals Business Segment

Overview of the Segment

Our chemicals segment manufactures diversified chemical products that are sold to third party customers. This segment comprises two components: “custom manufacturing” (manufacturing specialty chemicals for specific customers) and “performance chemicals” (multi-customer specialty chemicals).

Chemical Products

Custom manufacturing involves producing unique products for strategic customers, generally under long-term contracts. Many of these products are produced under confidentiality agreements in order to protect each company’s intellectual property. This is a service-based business where customers value dependability, regulatory compliance, technical capabilities, responsiveness, product quality, process scale up and improvement, operational safety, and environmental protection. Our custom manufacturing products are manufactured by continuous production, dedicated batch or general-purpose batch mode depending on the volumes required. Management believes that we are a strategic production partner to our key customers in this segment, and our engineering and technology teams collaboratively work together with our customers to further develop the processes and drive continued improvement.

Our plant’s custom manufacturing product portfolio includes products that are used in the agricultural chemical, coatings, chemical intermediates, industrial and consumer cleaning, oil and gas, and specialty polymers industries. Historically, our custom manufacturing product portfolio has been highly concentrated on two significant legacy products, namely a laundry detergent additive for a leading consumer products company and a proprietary row crop herbicide. Our current custom manufacturing product portfolio is more diversified into multiple markets including agrochemicals, oilfield chemicals, industrial intermediates, and fabric care markets.

Performance chemicals comprise multi-customer products, which are sold based upon specification and/or performance in the end-use application. This portfolio includes a family of polymer (nylon and polyester) modifiers, glycerin products, and several small-volume specialty chemicals and solvents for diverse applications. We have added the capability to refine our crude glycerin to an industrial grade of glycerin for higher value specialty chemical applications.

Future Strategy

To build on and maintain our reputation as a technology-driven competitive chemical producer, we believe that we must continuously focus on customer relationship development, cost control, operational efficiency, capacity utilization, operational safety, and environmental protection to maximize earnings. We believe that the ability to use large-scale batch and continuous production processes and a continuous focus on process improvements allows us to compete effectively in the global custom manufacturing market and to remain cost competitive with, and for some products cost-advantaged over, our competitors. We intend to improve margins in this area of our business by careful management of product mix with regard to size of opportunity, timing to market, capital efficiency and matching of opportunities to assets and capabilities. We possess a core competency in chemical processing of bio-based feedstocks, and we believe this, combined with our expertise in specialty chemical synthesis, will position us favorably as a preferred manufacturer of a rapidly growing sustainable products market.

Customers and Markets

Our chemical products are used in a variety of markets and end uses, including detergent, agrochemical, automotive, oil and gas, coatings, nutrition, and polymer additives. Some of the chemical products can be cyclically driven by changes in energy and agricultural commodity prices. In the case of our custom manufacturing business, the customers are often the “brand owners” and, therefore, control factors related to demand, such as market development, patent expirations and external manufacturing strategy. In such cases, we may be unable to increase or maintain our level of sales revenue for these products.

We agreed to extend the supply of our laundry detergent additive to our customer through 2020. However, demand for the laundry detergent additive has continued to decrease, and this customer will not require further production of any of this laundry detergent additive. We believe it is unlikely that there is a profitable market for new customers for this product.

No chemical customer represented greater than 10% of total sales revenue in 2020. One of our chemical customers and its affiliates, represented 10% or more of our 2019 and 2018 consolidated sales revenues. This customer represented approximately 22%, and 27% of our chemicals revenue (11% of total revenues each year) in 2019 and 2018, respectively. We sell multiple products to various affiliates of this customer under both long-term and short-term contracts. One product contract was not renewed at December 31, 2020 representing 17%, 10%, and 12% of chemical revenue (7%, 5%, and 5% of total revenue) for 2020, 2019, and 2018, respectively. Another product contract was not renewed at December 31, 2019 representing 15% of chemical revenue in 2019 (7% of total revenue) and 14% of chemical revenue in 2018 (6% of total revenue). We are actively considering new business for the general purpose equipment vacated; however, there is no guarantee if or when we will be successful finding new business.

Competition

Historically, there have been significant barriers to entry for competitors with respect to specialty chemicals, primarily due to the fact that the relevant technology and manufacturing capability has been held by a small number of companies. As technology and investment have increasingly moved outside of North America, competition from international multi-national chemical manufacturers has intensified, primarily from manufacturers in India and China. We compete with these and other producers primarily based on price, customer service, technology, quality, and reliability. Our major competitors in this segment include large multi-national companies with internal specialty chemical manufacturing divisions and smaller independent producers. The international multi-national competitors are often disadvantaged by poor responsiveness and customer service, while the small producers often have limited technology and financial resources. We believe that we are well positioned for growth due to the combination of our scale of operations, technical capabilities, reputation, and financial strength.

Supply and Distribution

Specialty chemicals are generally high unit value products sold in packaged, or low-volume bulk form, and for which distribution is a relatively minor component of cost. Most products are sold FOB the Batesville site for distribution globally. Similarly, raw materials for these products are comparatively higher-value components that are sourced globally. An exception is the biofuels co-products, which are recovered from local processing.

Cyclicality and Seasonality

Some of the chemical products can be cyclical, driven by changes in energy prices and agricultural commodity prices. For example, demand for chemical products sold into energy exploration and transportation markets is influenced by oil prices. The use of chemical products in agricultural markets likewise is influenced by agricultural commodity prices. Supply and demand dynamics determine profitability at different stages of cycles and global economic conditions affect the length of each cycle. Despite sensitivity to cyclicality in these industries, many of the products in the chemical segment provide stable earnings.

Backlog

The majority of our chemical revenue is derived from custom manufacturing agreements with specific customers. These customers generally provide us with forecasts of demand on a monthly or quarterly basis. These forecasts are intended to enable us to optimize the efficiency of our production processes and generally are not firm sales orders. As such, we do not monitor or report backlog.

Intellectual Property

We consider our intellectual property portfolio to be a valuable corporate asset, which we intend to expand and protect globally through a combination of trade secrets, confidentiality and non-disclosure agreements, patents, trademarks, and copyrights. As a producer of a broad and diverse portfolio of chemicals, our intellectual property relates to a wide variety of products and processes acquired through the development and manufacture of over 300 specialty chemicals during the history of the site. Our primary strategy regarding our intellectual property portfolio is to appropriately protect all innovations and know-how in order to provide our business segments with a technology-based competitive advantage wherever possible. In the chemicals business segment, custom manufacturing projects are primarily conducted within the framework of confidentiality agreements with each customer to ensure that intellectual property rights are defined and protected. In the biofuels business segment, innovations and process know-how are vigorously protected as appropriate.

As may be necessary, we will seek to license technologies from third parties that complement our strategic business objectives. Neither our business as a whole, nor any particular segment, is materially dependent upon any one particular patent, copyright, or trade secret. As the laws of many foreign countries do not protect intellectual property to the same extent as the laws of the United States, we can make no assurance that we will be able to adequately protect all of our intellectual property assets.

Research and Development

We devote considerable resources to our research and development programs, which are primarily targeted towards three objectives:

| ● |

innovating, developing, and improving biofuels processes, in particular biodiesel and other biofuels, including value-up technology and applications for co-products; |

|

| ● |

developing and improving processes for custom manufacturing products; and |

|

| ● |

innovating, developing, and improving performance chemical products and manufacturing processes. |

Our research and development capabilities comprise analytical chemistry competencies to assay and characterize raw materials and products, organic chemistry expertise applied across a breadth of reaction chemistries and materials, design and process engineering capabilities for batch and continuous processing of both solid and liquid materials, and proficiency in process safety to design and scale-up safe chemical manufacturing processes. We believe that these core competencies, established in support of the legacy chemical business, are applicable to building a technology-based position in biofuels and associated bio-based specialty products and expanding our performance chemicals product line.

Research and development expense incurred by us for the years ended December 31, 2020, 2019, and 2018 were $2,988, $3,191, and $3,524, respectively. Substantially all of such research and development expense are related to the development of new products, services, and processes or the improvement of existing products, services, and processes.

Environmental Matters

Various aspects of our operations are subject to regulation by state and federal agencies. Biofuel and chemical operations are subject to numerous, stringent and complex laws and regulations at the federal, state, and local levels governing the discharge of materials into the environment or otherwise relating to environmental protection. These laws and regulations may:

| ● |

require acquisition of permits regarding discharges into the air and discharge of waste waters; |

|

| ● |

place restrictions on the handling and disposal of hazardous and other wastes; and |

|

| ● |

require capital expenditures to implement pollution control equipment. |

Compliance with such laws and regulations can be costly and noncompliance can result in substantial civil and even criminal penalties. Some environmental laws impose strict liability for environmental contamination, rendering a person liable for environmental damages and cleanup costs without regard to negligence or fault. Moreover, there is strong public interest in the protection of the environment. Our operations could be adversely affected to the extent laws are enacted or other governmental action is taken that imposes environmental protection requirements that result in increased costs to the biofuels and/or chemical manufacturing industry in general. The following provides a general discussion of some of the significant environmental laws and regulations that impact our activities.

The federal Comprehensive Environmental Response, Compensation and Liability Act (or “CERCLA”), and analogous state laws, impose joint and several liability, without regard to fault or the legality of the original act, on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include the owner and operator of the site where the release occurred, past owners and operators of the site, and companies that disposed of or arranged for the disposal of hazardous substances found at the site. Responsible parties under CERCLA may be liable for the costs of cleaning up hazardous substances that have been released into the environment and for damages to natural resources. Additionally, it is not uncommon for third parties to assert claims for personal injury and property damage allegedly caused by the release of hazardous substances or other pollutants into the environment.

The federal Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act (or “RCRA”), is the principal federal statute governing the management of wastes, including the treatment, storage and disposal of hazardous wastes. RCRA imposes stringent operating requirements, and liability for failure to meet such requirements, on a person who is either a generator or transporter of hazardous waste or an owner or operator of a hazardous waste treatment, storage, or disposal facility. Many of the wastes generated in our manufacturing facility are governed by RCRA.

The federal Oil Pollution Act of 1990 (or “OPA”) and regulations thereunder impose liability on responsible parties for damages resulting from oil spills into or upon navigable waters, adjoining shorelines, or in the exclusive economic zone of the United States. A responsible party includes the owner or operator of an onshore facility. Spill cleanup liability may not apply if a spill is caused by a party’s gross negligence or willful misconduct, the spill resulted from violation of a federal safety, construction, or operating regulation, or if a party fails to report a spill or to cooperate fully in a clean-up. Failure to comply with OPA’s requirements may subject a responsible party to civil, criminal, or administrative enforcement actions via the Water Pollution Control Act.

The federal Water Pollution Control Act (also referred to as the “Clean Water Act”) imposes restrictions and controls on the discharge of pollutants into navigable waters. These controls have become more stringent over the years, and it is possible that additional restrictions may be imposed in the future. Permits must be obtained to discharge pollutants into state and federal waters. The Clean Water Act provides for civil, criminal, and administrative penalties for discharges of oil and other pollutants, and imposes liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release. Comparable state statutes impose liability and authorize penalties in the case of an unauthorized discharge of petroleum or its derivatives, or other pollutants, into state waters.

The federal Clean Air Act and associated state laws and regulations restrict the emission of air pollutants from many sources, including facilities involved in manufacturing chemicals and biofuels. New facilities are generally required to obtain permits before operations can commence, and new or existing facilities may be required to incur certain capital expenditures to install air pollution control equipment in connection with obtaining and maintaining operating permits and approvals. Federal and state regulatory agencies can impose administrative, civil, and criminal penalties for non-compliance with permits or other requirements of the Clean Air Act and associated state laws and regulations.

The federal Endangered Species Act, the federal Marine Mammal Protection Act, and similar federal and state wildlife protection laws prohibit or restrict activities that could adversely impact protected plant and animal species or habitats. Manufacturing activities could be prohibited or delayed in areas where such protected species or habitats may be located, or expensive mitigation may be required to accommodate such activities.

The Toxic Substances Control Act (TSCA) seeks to reduce risks of injury to health or the environment associated with the manufacture, processing, distribution, use, or disposal of chemical substances. TSCA requires reporting, record-keeping and testing of certain chemicals and restricts use of some chemical substances and/or mixtures. Some substances are excluded from TSCA, including food, drugs, cosmetics and pesticides. Government agencies may initiate regulatory action to label, restrict, or ban a chemical, or to require the submission of additional data needed to determine the risk a chemical may pose. The statute contains enforcement provisions that include both criminal and civil penalties.

Our policy is to operate our plant and facilities in a manner that protects the environment and the health and safety of our employees and the public. We intend to continue to make expenditures for environmental protection and improvements in a timely manner consistent with our policies and with the technology available. In some cases, applicable environmental regulations such as those adopted under the Clean Air Act and RCRA, and related actions of regulatory agencies, determine the timing and amount of environmental costs incurred by us.

We establish reserves for closure/post-closure costs associated with the environmental and other assets we maintain. Environmental assets include waste management units, such as chemical waste destructors, storage tanks, and boilers. When these types of assets are constructed or installed, a reserve is established for the future costs anticipated to be associated with the closure of the site based on the expected life of the environmental assets, the applicable regulatory closure requirements, and our environmental policies and practices. These expenses are charged into earnings over the estimated useful life of the assets. Currently, we estimate the useful life of each individual asset up to 39 years.

In addition to our general environmental policies and policies for asset retirement obligations and environmental reserves, we accrue environmental costs when it is probable that we have incurred a liability and the amount can be reasonably estimated. In some instances, the amount cannot be reasonably estimated due to insufficient data, particularly in the nature and timing of the future performance. In these cases, the liability is monitored until such time that sufficient data exists. With respect to a contaminated site, the amount accrued reflects our assumptions about remedial requirements at the site, the nature of the remedy, the outcome of discussions with regulatory agencies and other potentially responsible parties at multi-party sites, and the number and financial viability of other potentially responsible parties. Changes in the estimates on which the accruals are based, unanticipated government enforcement action, or changes in health, safety, environmental, chemical control regulations, and testing requirements could result in higher or lower costs.

Our cash expenditures related to environmental protection and improvement were approximately $10,057, $10,024, and $10,940 for the years ended December 31, 2020, 2019, and 2018, respectively, and are included in costs of goods sold in the consolidated statements of income for each period. These amounts pertain primarily to operating costs associated with environmental protection equipment and facilities but also include expenditures for construction and development. While we do not expect future environmental capital expenditures arising from requirements of environmental laws and regulations to materially increase our planned level of annual capital expenditures for environmental control facilities, we can give no assurances that such requirements will not materialize in the future.

We believe that we have obtained, in all material respects, the necessary environmental permits and licenses to carry on our operations as presently conducted. We have reviewed environmental investigations of the properties owned by us and believe, on the basis of the results of the investigations carried out to date, that there are no material environmental issues that adversely impact us. In connection with our acquisition of our warehouse in Batesville, the seller agreed to remediate certain environmental conditions existing at the facility on the date that we acquired it and to indemnify us with respect to those environmental conditions. We continue to monitor the seller’s compliance with its remediation obligations.

Management Team and Human Capital

Our executive management team at the Batesville plant consists of individuals with a combined 90 plus years of experience in the chemicals industry, comprising technical, operational, and business responsibilities. The members of the executive team also have international experience, including assignments in Europe. The operational and commercial management group at the Batesville site includes additional degreed professionals with an average experience of over 25 years in the chemical industry.

Our Batesville workforce comprises approximately 470 full-time non-union employees, and includes degreed professionals including chemists (some with PhDs) and engineers (including licensed professional electrical, mechanical, and chemical engineers). Operations personnel have received extensive training and are highly skilled. Additionally, all site manufacturing and infrastructure is fully automated and computer-controlled. Due to the lack of locally-available process industry infrastructure, the workforce is substantially self-sufficient in the range of required operational skills and experience. Voluntary attrition at the site has averaged 6.5% over the past five years.

Available Information

We file annual, quarterly, and other reports, proxy statements, and other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers such as us that file electronically with the SEC. You may access that site at http://www.sec.gov.

Our Internet website address is www.futurefuelcorporation.com. We make available free of charge, through the “Investor Relations - SEC Filings” section of our Internet website (https://futurefuelcorporation.gcs-web.com/financial-information/sec-filings), our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (or the Exchange Act), as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the SEC.

We also make available free of charge, through the “Investor Relations - Corporate Governance” section of our website (https://futurefuelcorporation.gcs-web.com/corporate-governance), the corporate governance guidelines of our board of directors, the charters of each of the committees of our board of directors, and the code of business conduct and ethics for our directors, officers, and employees. Such materials will be made available in print upon the written request of any shareholder to FutureFuel Corp., 8235 Forsyth Blvd., 4th Floor, Clayton, Missouri 63105, Attention: Investor Relations.

| Risk Factors. |

An investment in us involves a high degree of risk and may result in the loss of all or part of your investment. You should consider carefully all of the information set out in this document and the risks attaching to an investment in us, including, in particular, the risks described below. The information below does not purport to be an exhaustive list and should be considered in conjunction with the contents of the rest of this document.

Risks Related to Economic Conditions, Governmental Action, and our Industry

We, along with global markets in general, may be significantly affected by the potential COVID-19 public health pandemic, which may adversely affect our business, results of operations or financial condition.

The global outbreak of the COVID-19 pandemic has caused governments to take measures to prevent spread of the virus. We source certain raw materials for our chemicals segment from China. Currently, the impact of COVID-19 on employees and industries in China and the global economy as a whole is uncertain. If COVID-19 is not stopped, the pandemic could further negatively affect the global economy and our business by negatively impacting our ability to competitively source raw materials, which would have a negative effect on our revenue, expenses and results of operations. We are currently supplied for these raw materials through the near term, however, our ability to competitively source these raw materials after such time is uncertain given the unknown impacts of COVID-19.

Additionally, the spread of COVID-19 could generally devastate companies globally, which could in turn have a negative impact on our customers and thus on our business, the extent to which depends on future developments, which are highly unpredictable. We cannot predict the degree to, or the time period over, which our sales and operations will be affected by this outbreak, and the effects could be material. The impacts include, but are not limited to:

| ● |

a significant decline in demand for our products due to market disruptions, resulting in a decline in sales and prices; |

| ● |

limitations of feedstocks, price volatility, or disruptions to our suppliers’ operations; |

| ● |

the complete or partial closure of our manufacturing facility; |

| ● |

the interruption of our distribution system, or temporary or long-term disruption in our supply chains, or delays in the delivery of our product; |

| ● |

suspension of renewable fuel and/or low carbon fuel policies; |

| ● |

limitations on our ability to operate our business as a result of federal, state or local regulations, including any changes to the designation of our business as “essential” by the US Department of Homeland Security; |

| ● |

decreases in the demand for and price of RINs and LCFS credits as a result of reduced demand for petroleum-based gasoline and diesel fuel; and |

| ● |

our management of the impact of COVID-19 has and will continue to require significant investment of time and may cause the Company to divert or delay the application of its resources toward other or new initiatives or investments, which may cause a material adverse impact on the results of operations. |

The extent of the impact of the COVID-19 pandemic on our business is highly uncertain as information is evolving with respect to the duration and severity of the pandemic. We cannot reasonably estimate the duration and severity of the COVID-19 pandemic, or its impact, which may be significantly harmful to our operations and profitability.

We operate within the biomass-based diesel industry, which relies on governmental programs requiring or incentivizing the consumption of biofuels, including the BTC. The expiration or loss of mandates or incentives would have a material adverse effect on our business.

The most significant tax incentive program in the biomass-based diesel industry has been the BTC. Under the BTC, the first person to blend pure biomass-based diesel with petroleum-based diesel fuel receives a one dollar per gallon refundable tax credit. The BTC was not in place during 2018 and not in place for the majority of 2019. However, in late December 2019, the BTC was retroactively reinstated from its expiry on January 1, 2018 through December 31, 2022. The BTC has not been extended past December 31, 2022. There is no guarantee that the BTC will be reinstated after 2022, which could have a material adverse effect on us and on the biodiesel industry in general.

We operate within the biomass-based diesel industry, which relies on governmental programs requiring or incentivizing the consumption of biofuels. Biomass-based diesel has historically been more expensive to produce than petroleum-based diesel fuel and these governmental programs support a market for biomass-based diesel that might not otherwise exist. The petroleum industry is opposed to many of these government incentives and can be expected to continue to challenge these incentives.

If biodiesel feedstock costs do not decrease significantly relative to biodiesel prices, we could realize a negative gross margin on biodiesel. As a result, we could cease producing biodiesel, which could have an adverse effect on our financial condition.

Our biofuels operations may be harmed if the federal or state governments were to change current laws and regulations.

Alternative fuels businesses benefit from government subsidies and mandates. If any of the state or federal laws and regulations relating to the government subsidies and mandates change, including failure to reinstate the federal biodiesel BTC, our ability to benefit from our alternative fuels business could be harmed.

With respect to our biofuels platform, the United States Congress could repeal, curtail or otherwise change the RFS2 program in a manner adverse to us. Similarly, the USEPA could curtail or otherwise change its administration of the RFS2 program in a manner adverse to us, including by not increasing or even decreasing the required renewable fuel volumes, by waiving compliance with the required renewable fuel volumes or otherwise. In addition, while Congress specified RFS2 renewable fuel volume requirements through 2022 (subject to adjustment in the rulemaking process), beginning in 2023 required volumes of renewable fuel will be largely at the discretion of the USEPA (in coordination with the Secretary of Energy and Secretary of Agriculture). We cannot predict what changes, if any, will be instituted or the impact of any changes on our business, although adverse changes could seriously harm our revenues, earnings and financial condition.

Further, our biofuels platform is subject to federal, state, and local laws and regulations governing the application and use of alternative energy products, including those related specifically to biodiesel. For instance, biodiesel benefits from successful completion of USEPA Tier I and Tier II health effects testing under Section 211(b) of the Clean Air Act. This testing verified biodiesel does not pose a threat to human health and improves air quality as a replacement for petroleum diesel. Also, portions of our biofuels may, from time to time, be registered in states where we obtain benefits from state specific subsidies, mandates or programs. If federal or state agency determinations, laws, and regulations relating to the application and use of alternative energy are changed, the marketability and sales of biodiesel production could be materially adversely affected.

We derive a significant portion of our revenues from sales of our biofuels in the State of California primarily as a result of California’s Low Carbon Fuel Standard ("LCFS"); adverse changes in this law or reductions in the value of LCFS credits would harm our revenues and profits.

The LCFS is designed to reduce greenhouse gas ("GHG") emissions associated with transportation fuels used in California by ensuring that the total amount of fuel consumed meets declining targets for such emissions. The regulation quantifies lifecycle GHG emissions by assigning a “carbon intensity” ("CI") score to each transportation fuel based on that fuel’s lifecycle assessment. Each petroleum fuel provider, generally the fuel’s producer or importer is required to ensure that the overall CI score for its fuel pool meets the annual carbon intensity target for a given year. This obligation is tracked through credits and deficits and credits can be traded. We generate LCFS credits when we sell qualified fuels which are used in California. As a result of the trading price of LCFS credits, California has become a desirable market in which to sell our biodiesel. If the value of LCFS credits were to materially decrease as a result of over-supply, as a result of reduced demand for our fuels, or for other reasons including the continued impact of the COVID-19 pandemic, if the fuel produced is deemed not to qualify for LCFS credits; or if the LCFS or the manner in which it is administered or applied were otherwise changed in a manner adverse to us, our revenues and profits could be seriously harmed.

The industries in which we compete are highly competitive.

The biodiesel and specialty chemical industries are highly competitive. There is competition within these industries and also with other industries in supplying the energy, fuel, and chemical needs of industry and individual customers. We compete with other firms in the sale or purchase of various goods or services in many national and international markets. We compete with large national and multi-national companies that have longer operating histories, greater financial, technical, and other resources, and greater name recognition than we do. In addition, we compete with several smaller companies capable of competing effectively on a regional or local basis, and the number of these smaller companies is increasing. Our competitors may be able to respond more quickly to new or emerging technologies and services and changes in customer requirements. As a result of competition, we may lose market share or be unable to maintain or increase prices for our products and/or services or to acquire additional business opportunities, which could have a material adverse effect on our business, financial condition, results of operations, and cash flows. Although we will employ all methods of competition that are lawful and appropriate for such purposes, no assurances can be made that they will be successful. A key component of our competitive position, particularly given the commodity-based nature of many of our products, will be our ability to manage expenses successfully, which requires continuous management focus on reducing unit costs and improving efficiency. No assurances can be given that we will be able to successfully manage such expenses.

Our competitive position in the markets in which we participate is, in part, subject to external factors, in addition to those that we can impact. Natural disasters, changes in laws or regulations, trade disputes, war or other outbreak of hostilities, or other political factors in any of the countries or regions in which we operate or do business, or in countries or regions that are key suppliers of strategic raw materials, could negatively impact our competitive position and our ability to maintain market share.

As to our biofuels segment, biodiesel produced in Canada, South America, Europe, Eastern Asia, the Pacific Rim, or other regions may be imported into the United States to compete with U.S. produced biodiesel. These regions may benefit from biodiesel production incentives or other financial incentives in their home countries that offset some of their biodiesel production costs and enable them to profitably sell biodiesel in the U.S. at lower prices than U.S.-based biodiesel producers. Under the RFS2, imported biodiesel may be eligible to satisfy an obligated party’s requirements and, therefore, may compete to meet the volumetric requirements of RFS2. This could make it more challenging for us to market or sell biodiesel in the United States, which would have a material adverse effect on our revenues.

The total 2019 U.S. production capacity for biodiesel of 2.47 billion gallons is in excess of the current 2.43 billion gallons per year RFS2 mandate for 2020 and 2021. Excess of production capacity over the 2020 and 2021 mandates could result in a decline in biodiesel prices and profitability, negatively impacting our ability to maintain the profitability of our biofuels segment and recover capital expenditures in this business segment.

Biodiesel is encountering increased competition from renewable diesel, which is produced via hydrotreating a biomass-based feedstock. Renewable diesel can be used interchangeably with conventional petroleum diesel, is not limited in blends, and can be transported via existing fuel pipeline infrastructure. A significant capital investment would be required for FutureFuel to produce renewable diesel, and the current economics and business uncertainty do not support this level of investment.

The primary manufacturers of renewable biodiesel include Neste, World Energy, Zymergen, Diamond Green Diesel, Fulcrum, Red Rock, Raj Renewables, and Dynamic Fuels. Biodiesel Magazine recently estimated in January 2021 that there is close to 5.5 billion gallons of new investments being made to expend capacity of renewable diesel. See http://www.biodieselmagazine.com/articles/2517318/renewable-diesels-rising-tide .

Fluctuations in commodity prices may cause a reduction in the demand or profitability of the products or services we produce.

Prices for alternative fuels tend to fluctuate widely based on a variety of political and economic factors. These price fluctuations heavily influence the oil and gas industry. Lower energy prices for existing products tend to limit the demand for alternative forms of energy services and related products and infrastructure. Historically, the markets for alternative fuels have been volatile, and they are likely to continue to be volatile. Wide fluctuations in alternative fuel prices may result from relatively minor changes in the supply of and demand for oil and natural gas, market uncertainty, and other factors that are beyond our control, including:

| ● |

worldwide and domestic supplies of oil and gas; |

|

| ● |

the price and/or availability of biodiesel feedstocks; |

|

| ● |

weather conditions; |

|

| ● |

the level of consumer demand; |

|

| ● |

the price and availability of alternative fuels; |

|

| ● |

the availability of pipeline and refining capacity; |

|

| ● |

the price and level of foreign imports; |

|

| ● |

domestic and foreign governmental regulations and taxes; |

|

| ● |

the ability of the members of the Organization of Petroleum Exporting Countries (OPEC) to agree to and maintain oil price and production controls; |

|

| ● |

political instability or armed conflict in oil-producing regions; and |

|

| ● |

the overall economic environment. |

These factors and the volatility of the commodity markets make it extremely difficult to predict future alternative fuel price movements with any certainty. There may be a decrease in the demand for our products or services and our profitability could be adversely affected.

We are reliant on certain strategic raw materials for our operations.

We are reliant on certain strategic raw materials (such as biodiesel feedstocks and methanol) for our operations. We have implemented certain risk management tools, such as multiple suppliers and hedging, to mitigate short-term market fluctuations in raw material supply and costs. There can be no assurance, however, that such measures will result in cost savings or supply stability or that all market fluctuation exposure will be eliminated. In addition, natural disasters, changes in laws or regulations, war or other outbreak of hostilities, or other political factors in any of the countries or regions in which we operate or do business, or in countries or regions that are key suppliers of strategic raw materials, could affect availability and costs of raw materials.

While temporary shortages of raw materials may occasionally occur, these items have historically been sufficiently available to cover current requirements. However, their continuous availability and price are impacted by natural disasters, plant interruptions occurring during periods of high demand, domestic and world market and political conditions, changes in government regulation, and war or other outbreak of hostilities. In addition, as we increase our biodiesel capacity, we will require larger supplies of raw materials, which have not yet been secured and may not be available for the foregoing reasons, or may be available only at prices higher than current levels. Our operations or products may, at times, be adversely affected by these factors.

Market conditions or transportation impediments may hinder access to raw goods and distribution markets.