Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-233354

The Information in this preliminary prospectus supplement and the accompanying prospectus is incomplete and subject to completion and amendment. This preliminary prospectus supplement and the accompanying prospectus is not an offer to sell, nor does it seek an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 16, 2022

PRELIMINARY PROSPECTUS SUPPLEMENT

(To prospectus dated August 19, 2019)

Mizuho Financial Group, Inc.

U.S.$ % Senior Callable Fixed-to-Fixed Reset Rate Notes due 2026

U.S.$ % Senior Callable Fixed-to-Fixed Reset Rate Notes due 2030

U.S.$ Senior Callable Floating Rate Notes due 2026

U.S.$ % Senior Fixed Rate Notes due 2042

Mizuho Financial Group, Inc., a joint stock corporation incorporated with limited liability under the laws of Japan (“Mizuho Financial Group” or the “Issuer”), will issue an aggregate principal amount of $ of senior callable fixed-to-fixed reset rate notes due May , 2026 (the “4-year Notes”) and an aggregate principal amount of $ of senior callable fixed-to-fixed reset rate notes due May , 2030 (the “8-year Notes” and, together with the 4-year Notes, the “Fixed-to-Fixed Reset Rate Notes”).

The 4-year Notes will bear interest (i) from (and including) February , 2022 to (but excluding) May , 2025 (the “4-year Notes Reset Date”), at the fixed rate of % per annum, payable semi-annually in arrears on May and November of each year, with the first interest payment to be made on November , 2022 (there will therefore be a long first coupon on the 4-year Notes), and (ii) from (and including) the 4-year Notes Reset Date to (but excluding) the maturity date, at a fixed per annum rate equal to the applicable U.S. Treasury Rate (as defined below) as determined by the Calculation Agent (as defined below) on the 4-year Notes Reset Determination Date (as defined below) as described under “Description of the Notes—Fixed-to-Fixed Reset Rate Notes—Reset Fixed Rate Period,” plus %, payable semi-annually in arrears on November , 2025 and May , 2026. The 4-year Notes will mature on May , 2026.

The 8-year Notes will bear interest (i) from (and including) February , 2022 to (but excluding) May , 2029 (the “8-year Notes Reset Date”), at the fixed rate of % per annum, payable semi-annually in arrears on May and November of each year, with the first interest payment to be made on November , 2022 (there will therefore be a long first coupon on the 8-year Notes), and (ii) from (and including) the 8-year Notes Reset Date to (but excluding) the maturity date, at a fixed per annum rate equal to the applicable U.S. Treasury Rate as determined by the Calculation Agent on the 8-year Notes Reset Determination Date (as defined below) as described under “Description of the Notes—Fixed-to-Fixed Reset Rate Notes—Reset Fixed Rate Period,” plus %, payable semi-annually in arrears on November , 2029 and May , 2030. The 8-year Notes will mature on May , 2030.

Mizuho Financial Group will also issue an aggregate principal amount of $ of senior callable floating rate notes due May , 2026 (the “Floating Rate Notes”). The Floating Rate Notes will bear interest commencing February , 2022 at a floating per annum rate equal to Compounded Daily SOFR (as defined below), plus %, determined as described under “Description of the Notes—Floating Rate Notes,” payable quarterly in arrears on February , May , August and November of each year, beginning on May , 2022, subject to adjustments. The Floating Rate Notes will mature on May , 2026.

Mizuho Financial Group will also issue an aggregate principal amount of $ of senior fixed rate notes due May , 2042 (the “Fixed Rate Notes” and, together with the Fixed-to-Fixed Reset Rate Notes and the Floating Rate Notes, the “Notes”). The Fixed Rate Notes will bear interest commencing February , 2022 at the fixed rate of % per annum, payable semi-annually in arrears on May and November of each year, with the first interest payment to be made on November , 2022 (there will therefore be a long first coupon on the Fixed Rate Notes). The Fixed Rate Notes will mature on May , 2042.

Mizuho Financial Group may redeem, at its option, each series of the Fixed-to-Fixed Reset Rate Notes and the Floating Rate Notes, in whole, but not in part, on the date that is one year prior to the maturity date of such series of Notes, at the applicable redemption price, subject to certain conditions. See “Description of Notes—Optional Redemption.” In addition, Mizuho Financial Group may at its option redeem the Notes of each series, in whole, but not in part, upon the occurrence of certain changes in Japanese tax law, subject to certain conditions. See “Description of the Notes—Optional Tax Redemption.” Each series of the Notes will not be subject to any sinking fund. The Notes will be represented by one or more global notes deposited with a custodian for and registered in the name of a nominee of The Depository Trust Company (“DTC”), as depositary. Beneficial interests in the Notes will be shown on, and transfers thereof will be effected only through, records maintained by DTC and its direct and indirect participants, including Euroclear Bank SA/NV (“Euroclear”), and Clearstream Banking S.A. (“Clearstream”). The Notes will be issued only in registered form in minimum denominations of $200,000 and integral multiples of $1,000 in excess thereof.

The net proceeds from the issuance and sale of each series of the 4-year Notes, the Floating Rate Notes and the Fixed Rate Notes will be used to make a loan to Mizuho Bank (as defined below), which intends to utilize such funds for its general corporate purposes. The net proceeds from the issuance and sale of the 8-year Notes will be used to make a loan to Mizuho Bank, which intends to utilize such funds to finance and/or refinance, in whole or in part, certain Eligible Green Projects (as defined below). See “Use of Proceeds.”

Each series of the Notes is intended to qualify as external total loss-absorbing capacity (“TLAC”) debt under the Japanese TLAC Standard (as defined below). The Notes will be Mizuho Financial Group’s direct, unconditional, unsubordinated and unsecured obligations and rank pari passu and without preference among themselves and with all other unsecured obligations, other than subordinated obligations of Mizuho Financial Group (except for statutorily preferred exceptions) from time to time outstanding. See also “Risk Factors—Risks Relating to the Notes—The Notes will be structurally subordinated to the liabilities of our subsidiaries, including Mizuho Bank and Mizuho Trust & Banking.”

Approval-in-principle has been received for the listing and quotation of the Notes on the Official List of the Singapore Exchange Securities Trading Limited (the “SGX-ST”). The SGX-ST assumes no responsibility for the correctness of any of the statements made, opinions expressed or reports contained herein. Admission of the Notes to the Official List of the SGX-ST and quotation of the Notes on the SGX-ST are not to be taken as an indication of the merits of Mizuho Financial Group, its subsidiaries and associated companies or the Notes.

Investing in the Notes involves risks. You should carefully consider the risk factors set forth in “Item 3.D. Key Information—Risk Factors” of our most recent annual report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”), and in the “Risk Factors” section beginning on page S-11 of this prospectus supplement before making any decision to invest in the Notes.

| Per 4-year Note |

Per 8-year Note |

Per Floating Rate Note |

Per Fixed Rate Note |

Total | ||||||||||||||||

| Public offering price(1) |

% | % | % | % | $ | |||||||||||||||

| Underwriting commission |

% | % | % | % | $ | |||||||||||||||

| Proceeds, before expenses, to us(1) |

% | % | % | % | $ | |||||||||||||||

| (1) | Plus accrued interest from February , 2022, if settlement occurs after that date. |

Neither the SEC nor any state securities commission has approved or disapproved of the Notes or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The Notes offered by this prospectus supplement and the accompanying prospectus are being offered by the underwriters, subject to prior sale, withdrawal, cancellation or modification of the offer without notice, to delivery to and acceptance by the underwriters and to certain further conditions. It is expected that the Notes will be delivered in book-entry form only, on or about February , 2022, through the facilities of DTC and its participants, including Euroclear and Clearstream.

Joint Lead Managers and Joint Bookrunners

| Mizuho Securities | BofA Securities |

The date of this prospectus supplement is February , 2022.

Table of Contents

Prospectus Supplement

| Page | ||||

| S-iv | ||||

| S-iv | ||||

| S-v | ||||

| S-1 | ||||

| S-5 | ||||

| S-11 | ||||

| S-24 | ||||

| S-28 | ||||

| S-29 | ||||

| Supplemental Financial and Other Information (Japanese GAAP) |

S-32 | |||

| S-43 | ||||

| S-56 | ||||

| S-64 | ||||

| S-66 | ||||

| S-73 | ||||

| S-73 | ||||

| S-74 | ||||

Prospectus

| Page | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

S-i

Table of Contents

Japan

The Notes have not been and will not be registered under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948), as amended, (the “Financial Instruments and Exchange Act”) and are subject to the Special Taxation Measures Act of Japan (Act No. 26 of 1957), as amended (the “Special Taxation Measures Act”). The Notes may not be offered or sold in Japan or to, or for the benefit of, any resident of Japan (which term as used in this sentence means any person resident of Japan, including any corporation or other entity organized under the laws of Japan) or to others for reoffering or resale, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the Financial Instruments and Exchange Act and any other applicable laws, regulations and governmental guidelines of Japan. See “Underwriting (Conflicts of Interest).” The Notes are not, as part of the distribution by the underwriters pursuant to the underwriting agreement dated the date hereof at any time, to be directly or indirectly offered or sold to, or for the benefit of, any person other than a beneficial owner that is, (i) for Japanese tax purposes, neither (x) an individual resident of Japan or a Japanese corporation, nor (y) an individual non-resident of Japan or a non-Japanese corporation that in either case is a person having a special relationship with Mizuho Financial Group as described in Article 6, Paragraph 4 of the Special Taxation Measures Act (a “specially-related person of Mizuho Financial Group”) or (ii) a Japanese designated financial institution, designated in Article 6, Paragraph 11 of the Special Taxation Measures Act, except as specifically permitted under the Special Taxation Measures Act. BY SUBSCRIBING FOR THE NOTES, AN INVESTOR WILL BE DEEMED TO HAVE REPRESENTED IT IS A PERSON WHO FALLS INTO THE CATEGORY OF (i) OR (ii) ABOVE.

Interest payments on the Notes generally will be subject to Japanese withholding tax unless it is established that such Notes are held by or for the account of a beneficial owner that is (i) for Japanese tax purposes, neither (x) an individual resident of Japan or a Japanese corporation, nor (y) an individual non-resident of Japan or a non-Japanese corporation that in either case is a specially-related person of Mizuho Financial Group, (ii) a Japanese designated financial institution described in Article 6, Paragraph 11 of the Special Taxation Measures Act which complies with the requirement for tax exemption under that paragraph or (iii) a Japanese public corporation, a Japanese financial institution or a Japanese financial instruments business operator described in Article 3-3, Paragraph 6 of the Special Taxation Measures Act which complies with the requirement for tax exemption under that paragraph.

Interest payments on the Notes to an individual resident of Japan, to a Japanese corporation not described in the preceding paragraph, or to an individual non-resident of Japan or a non-Japanese corporation that in either case is a specially-related person of Mizuho Financial Group will be subject to deduction in respect of Japanese income tax at a current rate of 15.315% (15% on or after January 1, 2038) of the amount of such interest.

The European Economic Area

PROHIBITION OF SALES TO EEA RETAIL INVESTORS—The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (the “EEA”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, or MiFID II as amended; or (ii) a customer within the meaning of Directive 2016/97/EU, as amended, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II. Consequently, no key information document required by Regulation (EU) No 1286/2014, or the PRIIPs Regulation as amended, for offering or selling the Notes or otherwise making them available to any retail investors in the EEA has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

United Kingdom

PROHIBITION OF SALES TO UK RETAIL INVESTORS—The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail

S-ii

Table of Contents

investor in the United Kingdom (“UK”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”); or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (“FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

There are restrictions on the offer and sale of the Notes in the UK. All applicable provisions of the FSMA with respect to anything done by any person in relation to the Notes in, from, or otherwise involving, the UK must be complied with. See “Underwriting (Conflicts of Interest)—Notice to Prospective Investors in the UK.”

This prospectus supplement is being distributed only to and is directed only at persons located outside the UK or in the UK to (i) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”); or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Financial Promotion Order; or (iii) persons to whom it may otherwise lawfully be communicated (all such persons together being referred to as “relevant persons”). This prospectus supplement must not be acted on or relied on in the UK by persons who are not relevant persons. In the UK, any investment or investment activity to which this prospectus supplement relates is only available to, and will be engaged in with, relevant persons.

Singapore

SINGAPORE SFA PRODUCT CLASSIFICATION: Solely in connection with its obligations under Section 309B of the Securities and Futures Act (Chapter 289) of Singapore (the “SFA”) and the Securities and Futures (Capital Markets Products) Regulations 2018 of Singapore (the “CMP Regulations 2018”), the Issuer has determined, and hereby notifies all relevant persons (as defined in Section 309(A)(1) of the SFA) of the classification of the Notes as prescribed capital markets products (as defined in the CMP Regulations 2018) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12: Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

S-iii

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of the offering of the Notes and also adds to, updates and changes information contained in the prospectus filed with the SEC dated August 19, 2019, and the documents incorporated by reference in this prospectus supplement. The second part is the above-mentioned prospectus, to which we refer as the “accompanying prospectus.” The accompanying prospectus contains a description of the senior and subordinated debt securities and gives more general information, some of which may not apply to the Notes. If the description of the Notes in this prospectus supplement differs from the description in the accompanying prospectus, the description in this prospectus supplement supersedes the description in the accompanying prospectus.

We have not, and the underwriters have not, authorized any other person to provide you with any information other than that contained in or incorporated by reference into this prospectus supplement, in the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. “Incorporated by reference” means that we can disclose important information to you by referring you to another document filed separately with the SEC. We are not responsible for, and can provide no assurance as to the accuracy of, any other information that any other person may give you. We are not making, nor are the underwriters making, an offer to sell the Notes in any jurisdiction where the offer or sale is not permitted. You should not assume that the information appearing in this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you, including any information incorporated by reference herein or therein, is accurate as of any date other than its respective date. Our business, financial condition, results of operations and prospects may have changed since those respective dates.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain in a number of places forward-looking statements regarding our intent, belief, targets or current expectations of our management with respect to our financial condition and future results of operations. These statements constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. In many cases, but not all, we use such words as “aim,” “anticipate,” “believe,” “endeavor,” “estimate,” “expect,” “intend,” “may,” “plan,” “probability,” “project,” “risk,” “seek,” “should,” “strive,” “target” and similar expressions in relation to us or our management to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results may vary materially from those we currently anticipate.

We have identified some of the risks inherent in forward-looking statements in “Item 3.D. Key Information—Risk Factors” of our most recent annual report on Form 20-F and in the “Risk Factors” section of this prospectus supplement. Other factors could also adversely affect our results or the accuracy of forward-looking statements in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein and therein, and you should not consider these to be a complete set of all potential risks or uncertainties.

The forward-looking statements included or incorporated by reference in this prospectus supplement and the accompanying prospectus are made only as of the dates on which such statements were made. We expressly disclaim any obligation or undertaking to release any update or revision to any forward-looking statement contained herein or therein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based.

S-iv

Table of Contents

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

In this prospectus supplement, the accompanying prospectus and any documents incorporated by reference herein or therein, “MHFG,” “Mizuho Group,” “we,” “us,” and “our” refer to Mizuho Financial Group, Inc. and, unless the context indicates otherwise, its consolidated subsidiaries. “Mizuho Financial Group” refers to Mizuho Financial Group, Inc. Furthermore, unless the context indicates otherwise, these references are intended to refer to us as if we had been in existence in our current form for all periods referred to herein. We use the word “you” to refer to prospective investors in the Notes and the word “Noteholder” or “Noteholders” to refer to the holders of the Notes.

Our primary financial statements for SEC reporting purposes are prepared on an annual and semi-annual basis in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), while our financial statements for reporting in our jurisdiction of incorporation and Japanese bank regulatory purposes are prepared in accordance with accounting principles generally accepted in Japan (“Japanese GAAP”). Unless otherwise specified, for purposes of this prospectus supplement, we have presented our financial information in accordance with U.S. GAAP. Unless otherwise stated or otherwise required by the context, all amounts in our financial statements are expressed in yen.

There are certain differences between U.S. GAAP and Japanese GAAP. For a description of certain differences between U.S. GAAP and Japanese GAAP, see “Item 5. Operating and Financial Review and Prospects—Reconciliation with Japanese GAAP” in our most recent annual report on Form 20-F filed with the SEC. You should consult your own professional advisers for a more complete understanding of the differences between U.S. GAAP, Japanese GAAP and the generally accepted accounting principles of other countries and how those differences might affect the financial information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus.

Financial information for us contained or incorporated by reference herein or in the accompanying prospectus is presented in accordance with U.S. GAAP or Japanese GAAP, as specified herein or in the relevant document being incorporated by reference. See “Incorporation by Reference” for a list of documents being incorporated by reference herein.

In this prospectus supplement and the accompanying prospectus, references to “U.S. dollars,” “dollars,” “U.S. $” and “$” refer to the lawful currency of the United States, those to “EUR” and “€” refer to the currency of the European Economic and Monetary Union and those to “yen” and “¥” refer to the lawful currency of Japan. This prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein and therein may contain a translation of certain Japanese yen amounts into U.S. dollars for your convenience. However, these translations should not be construed as representations that such yen amounts have been, could have been or could be converted into dollars at the relevant rate or at all.

In this prospectus supplement and the accompanying prospectus, yen figures and percentages presented in accordance with U.S. GAAP have been rounded to the figures shown, and yen figures and percentages presented in accordance with Japanese GAAP have been truncated to the figures shown, except for figures based on managerial accounting, which are rounded, and, in each case, unless otherwise specified. However, in some cases, figures presented in tables have been adjusted to match the sum of the figures with the total amount, and such figures may also be referred to in the related text.

Our fiscal year end is March 31. References to years not specified as being fiscal years are to calendar years.

In this prospectus supplement, all of our financial information is presented on a consolidated basis, unless we state otherwise.

S-v

Table of Contents

This summary highlights key information described in greater detail elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus. You should read carefully the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference before making an investment decision.

The Mizuho Group

Mizuho Financial Group is a Japanese bank holding company that is the ultimate parent company of the Mizuho Group, one of the largest financial institution groups in the world. We provide a broad range of financial services in domestic and overseas markets. The principal activities and subsidiaries are the following:

| • | Mizuho Bank, Ltd. (“Mizuho Bank”) provides a wide range of financial products and services mainly in relation to deposits, lending and exchange settlement to individuals, small and medium enterprises (“SMEs”), large corporations, financial institutions, public sector entities and foreign corporations, including foreign subsidiaries of Japanese corporations; |

| • | Mizuho Trust & Banking Co., Ltd. (“Mizuho Trust & Banking”) provides products and services related to trust, real estate, securitization and structured finance, pension and asset management and stock transfer agency; and |

| • | Mizuho Securities Co., Ltd. (“Mizuho Securities”) provides full-line securities services to individuals, corporations, financial institutions and public sector entities. |

We also provide products and services such as those related to trust and custody, asset management, private banking, research services, information technology-related services and advisory services for financial institutions through various subsidiaries and affiliates.

See “Item 4.B. Information on the Company—Business Overview” in our annual report for the fiscal year ended March 31, 2021 on Form 20-F, which is incorporated herein by reference.

As of March 31, 2021, we had total assets of ¥221.7 trillion, total deposits of ¥151.0 trillion and total MHFG shareholders’ equity of ¥9.1 trillion. As of September 30, 2021, we had total assets of ¥222.8 trillion, total deposits of ¥149.0 trillion and total MHFG shareholders’ equity of ¥9.3 trillion. For the six months ended September 30, 2021, we recorded net income attributable to MHFG shareholders of ¥312.7 billion.

Our corporate headquarters are located at 1-5-5 Otemachi, Chiyoda-ku, Tokyo, Japan. Our main telephone number is +81-3-5224-1111, and our corporate website is https://www.mizuhogroup.com. The information on the website is not incorporated by reference into this prospectus supplement.

S-1

Table of Contents

Recent Developments and Outlook

The effects of the outbreak of the COVID-19 Pandemic

The ongoing COVID-19 pandemic has put pressure on the global economy, including Japan. This challenging market environment adversely affected our financial results for the fiscal year ended March 31, 2021, resulting in an increase in credit-related costs to ¥204.9 billion (including approximately ¥72.3 billion of additional reserves recorded from a forward-looking perspective), an increase of ¥33.2 billion from the previous fiscal year (based on Japanese GAAP). The increase in credit-related costs was due mainly to the prolonged effects of the outbreak of the COVID-19 pandemic. For more information related to the impact that the COVID-19 pandemic has had on our business, refer to “Item 3.D. Key Information—Risk Factors” in our most recent annual report on Form 20-F filed with the SEC and “Recent Developments—Operating Environment” in our current report on Form 6-K, dated December 27, 2021, as amended on Form 6-K/A, dated December 29, 2021, each of which is incorporated by reference herein. For the nine months ended December 31, 2021, credit-related costs were ¥147.9 billion as compared to ¥98.1 billion for the same period in the previous fiscal year (based on Japanese GAAP). The increase was primarily due to the recording by Mizuho Bank of a provision for specific reserve for possible losses on loans of ¥265.0 billion, almost all of which was due to a deterioration, during the three months ended December 31, 2021, of the credit quality of a corporate borrower that has been experiencing financial distress. For more information, please refer to our current report on Form 6-K, dated February 2, 2022, containing our financial condition and results of operations, presented under Japanese GAAP, as of and for the nine months ended December 31, 2021, which is incorporated by reference herein.

As for the fiscal year ending March 31, 2022 and beyond, there can be no assurance that we will not incur significant additional credit-related costs as a result of the effect of developments related to the COVID-19 pandemic, heightening geopolitical tensions, tightening governmental monetary policies and other factors that may impact the credit quality of this and other borrowers.

Although vaccine rollouts and easing pandemic-related restrictions contributed to a recovery in the Japanese economy during the first half of the fiscal year ending March 31, 2022, we anticipate a resurgence in domestic infection rates during 2022, as illustrated by recent increases in infections as a result of the “Omicron” variant. In addition, we expect multiple factors to contribute to downward pressure on corporate earnings, including the continuing semiconductor shortage, restrictions on procurement from the ASEAN region, increasing energy prices and a delayed recovery for private consumption levels. Depending on the severity of these impacts, the negative impacts of the COVID-19 pandemic on economic activity in 2022 could be significant. The full extent to which COVID-19 impacts our business, clients and borrowers will depend on future developments, which are highly uncertain and cannot be predicted.

Our Common Equity Tier 1 capital ratio as of March 31, 2021 improved to 9.1% (on a fully-effective basis under the Basel III finalization framework, excluding net unrealized gains/losses on other securities, as described in more detail in notes 12 and 13 to “Supplemental Financial and Other Information (Japanese GAAP)—Selected Consolidated Financial Data for Mizuho Group” of this prospectus supplement), reaching our target level range, and further improved to 9.5% as of December 31, 2021. We expect that our Common Equity Tier 1 capital ratio will stay at the same level or slightly decline during the remainder of the fiscal year ending March 31, 2022. In the event that the continuing effects of the outbreak of the COVID-19 pandemic are more significant than our management’s current expectations, there may be downward pressure on our capital adequacy ratios. However, even under such circumstances where we may experience a deterioration in net income, we expect that our Common Equity Tier 1 capital ratio would likely remain within the target level range.

The outlook for the fiscal year ending March 31, 2022 set forth above is based on earnings estimates that we prepared under Japanese GAAP, which is the basis of accounting that we use for financial reporting purposes in

S-2

Table of Contents

Japan and Japanese bank regulatory purposes. We do not prepare estimates of our results of operations based on U.S. GAAP, and it is uncertain whether our outlook for the fiscal year ending March 31, 2022 would be substantially different if it had been based on U.S. GAAP. For a description of certain differences between U.S. GAAP and Japanese GAAP, see “Item 5. Operating and Financial Review and Prospects—Reconciliation with Japanese GAAP” in our most recent annual report on Form 20-F filed with the SEC. You should consult your own professional advisers for a more complete understanding of the differences between U.S. GAAP, Japanese GAAP and the generally accepted accounting principles of other countries and how those differences might affect the financial information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus.

Our current expectations of the effects of the outbreak of the COVID-19 pandemic are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such forward-looking statements are based on management’s current views with respect to future events and are subject to risks, uncertainties and assumptions. The forward-looking statements are based on specific estimates, judgments and assumptions, including prospective assumptions about the operating environment, macroeconomic conditions and the financial and operating conditions of our customers and counterparties. Due to the significant risks and uncertainties associated with these estimates, judgments and assumptions, as well as the continuously evolving nature of the COVID-19 pandemic, there can be no assurance that the actual effects of the outbreak of the COVID-19 pandemic on our financial condition, results of operations and capital adequacy ratios will be in line with our estimates or current expectations. We expressly disclaim any obligation or undertaking to release any update or revision to any forward-looking statement contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based.

See “Cautionary Statement Regarding Forward-Looking Statements” and “Item 3.D. Key Information—Risk Factors” in our most recent annual report on Form 20-F filed with the SEC for a further discussion of risks and uncertainties, including risks specifically related to the effects of the outbreak of the COVID-19 pandemic on our business, financial condition and results of operations, and other factors that could cause actual results to differ materially because of those risks and uncertainties.

Information Systems Incidents

In February, March, August and September 2021, there were several system failure incidents at Mizuho Bank that resulted in aborted customer transactions across our network in Japan, including ATM and internet banking transactions and foreign exchange remittances. As a result of the system failure that occurred on September 30, 2021, certain confirmation obligations required of banks in connection with certain banking transactions under the Foreign Exchange and Foreign Trade Act of Japan were not adequately performed. These incidents are described in our Form 6-K filed on November 26, 2021 under the heading “Reference: Outline of the system failures that occurred between February 28 and September 30, 2021,” which is incorporated by reference in this prospectus supplement. In addition, on December 30, 2021 and January 11, 2022, there were delays with respect to inter-bank transfers and certain functions for our online banking website, and on February 11, 2022, certain ATMs in our network experienced technical issues and service interruptions for several hours.

In September and November 2021, the Financial Services Agency of Japan (the “FSA”) issued business improvement orders to us and Mizuho Bank that required us, among other matters, to formulate and implement business improvement plans in response to these incidents, which we submitted in January 2022.

In November 2021, the Ministry of Finance of Japan issued a corrective action order to Mizuho Bank in connection with its failure to adequately perform its confirmation obligations set forth above, and Mizuho Bank has submitted a report to the Ministry of Finance of Japan.

S-3

Table of Contents

In connection with these incidents, certain of our executive officers have resigned or are scheduled to resign as of April 1, 2022, and Masahiro Kihara became our President and Group CEO on February 1, 2022.

See “Item 3.D. Key Information—Risk Factors—Problems relating to our information technology (IT) systems could significantly disrupt our business operations,” and “Item 4.B. Information on the Company—Business Overview—General—Investigations into Incidents of System Failure and Measures to Prevent Further Incidents” in our most recent annual report on Form 20-F, which is incorporated by reference in this prospectus supplement. See also our current reports on Form 6-K, dated September 22, October 6, November 26 and December 17, 2021 and January 18, 2022, which are incorporated by reference into this prospectus supplement.

S-4

Table of Contents

| Issuer |

Mizuho Financial Group, Inc. |

| Notes Offered |

$ aggregate principal amount of % senior callable fixed-to-fixed reset rate notes due May , 2026. |

| $ aggregate principal amount of % senior callable fixed-to-fixed reset rate notes due May , 2030. |

| $ aggregate principal amount of senior callable floating rate notes due May , 2026. |

$ aggregate principal amount of % senior fixed rate notes due May , 2042.

| The Notes will be issued in fully registered form, without coupons, in denominations of $200,000 in principal amount and integral multiples of $1,000 in excess thereof. |

| Offering Prices |

% for the 4-year Notes, |

| % for the 8-year Notes, |

| % for the Floating Rate Notes, and |

| % for the Fixed Rate Notes, |

| plus, in each case, accrued interest from February , 2022, if settlement occurs after that date. |

| Ranking of the Notes |

Each series of the Notes will constitute direct, unconditional, unsubordinated and unsecured obligations of Mizuho Financial Group and rank pari passu and without preference among themselves and with all other unsecured obligations, other than subordinated obligations of Mizuho Financial Group (except for statutorily preferred exceptions) from time to time outstanding. See also “Risk Factors—Risks Relating to the Notes—The Notes will be structurally subordinated to the liabilities of our subsidiaries, including Mizuho Bank and Mizuho Trust & Banking.” |

| Interest on the 4-year Notes |

From (and including) February , 2022 to (but excluding) the 4-year Notes Reset Date, the 4-year Notes will bear interest at the fixed rate of % per annum, payable semi-annually in arrears on May and November of each year, with the first interest payment to be made on November , 2022. There will therefore be a long first coupon on the 4-year Notes. |

| From (and including) the 4-year Notes Reset Date to (but excluding) May , 2026, the 4-year Notes will bear interest at a fixed per annum rate equal to the applicable U.S. Treasury Rate as determined by the Calculation Agent on the 4-year Notes Reset Determination Date as described under “Description of the Notes—Fixed-to-Fixed Reset Rate Notes—Reset Fixed Rate Period,” plus %, payable semi-annually in arrears on November , 2025 and May , 2026. |

S-5

Table of Contents

| Interest on the 4-year Notes will be computed on the basis of a 360-day year consisting of twelve 30-day months and rounding the resulting figure to the nearest cent (half a cent being rounded upwards). |

| See “Description of the Notes—General” and “Description of the Notes—Fixed-to-Fixed Reset Rate Notes.” See also “Risk Factors—Risks Relating to the Fixed-to Fixed Reset Rate Notes.” |

| Interest on the 8-year Notes |

From (and including) February , 2022 to (but excluding) the 8-year Notes Reset Date, the 8-year Notes will bear interest at the fixed rate of % per annum, payable semi-annually in arrears on May and November of each year, with the first interest payment to be made on November , 2022. There will therefore be a long first coupon on the 8-year Notes. |

| From (and including) the 8-year Notes Reset Date to (but excluding) May , 2030, the 8-year Notes will bear interest at a fixed per annum rate equal to the applicable U.S. Treasury Rate as determined by the Calculation Agent on the 8-year Notes Reset Determination Date as described under “Description of the Notes—Fixed-to-Fixed Reset Rate Notes—Reset Fixed Rate Period,” plus %, payable semi-annually in arrears on November , 2029 and May , 2030. |

| Interest on the 8-year Notes will be computed on the basis of a 360-day year consisting of twelve 30-day months and rounding the resulting figure to the nearest cent (half a cent being rounded upwards). |

| See “Description of the Notes—General” and “Description of the Notes—Fixed-to-Fixed Reset Rate Notes.” See also “Risk Factors—Risks Relating to the Fixed-to Fixed Reset Rate Notes.” |

| Interest on the Floating Rate Notes |

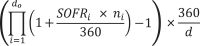

The Floating Rate Notes will bear interest from and including February , 2022 at a floating rate, payable quarterly in arrears on February , May , August and November of each year, with the first interest payment to be made on May , 2022. The interest rate on the Floating Rate Notes for each interest period will be a per annum rate equal to Compounded Daily SOFR, plus %, determined as described under “Description of the Notes—Floating Rate Notes” in this prospectus supplement. |

| Floating Rate Interest will be computed on an actual/360 basis and rounding the resulting figure to the nearest cent (half a cent being rounded upwards). |

| See “Description of the Notes—General” and “Description of the Notes—Floating Rate Notes.” See also “Risk Factors—Risks Relating to the Floating Rate Notes.” |

S-6

Table of Contents

| Interest on the Fixed Rate Notes |

The Fixed Rate Notes will bear interest from and including February , 2022 at the fixed rate of % per annum, payable semi-annually in arrears on May and November of each year, with the first interest payment to be made on November , 2022. There will therefore be a long first coupon on the Fixed Rate Notes. |

Interest on the Fixed Rate Notes will be computed on the basis of a 360-day year consisting of twelve 30-day months and rounding the resulting figure to the nearest cent (half a cent being rounded upwards).

| See “Description of the Notes—General” and “Description of the Notes—Fixed Rate Notes.” |

| Additional Amounts |

All payments of principal and interest in respect of the Notes will be made without withholding or deduction for or on account of withholding taxes imposed by or within Japan, unless such withholding or deduction is required by law. Interest payments on the Notes generally will be subject to Japanese withholding tax with certain exceptions. See “Taxation—Japanese Taxation.” If the payments are subject to Japanese withholding tax, Mizuho Financial Group will pay such additional amounts (subject to certain exceptions) in respect of Japanese taxes as will result in the payment of amounts otherwise receivable absent any deduction or withholding on account of such Japanese taxes. See “Description of the Debt Securities—Payment of Additional Amounts” in the accompanying prospectus. |

| References to principal or interest in respect of the Notes shall be deemed to include any additional amounts which may be payable as set forth in the senior indenture dated September 13, 2016 between Mizuho Financial Group and The Bank of New York Mellon, as trustee (as amended and supplemented from time to time, the “Indenture”). |

| Optional Redemption |

Mizuho Financial Group may redeem each series of the Fixed-to-Fixed Reset Rate Notes and the Floating Rate Notes, at its option, in whole, but not in part, on the date that is one year prior to the maturity date of such series of Notes, upon at least 15 days and not more than 60 days prior notice, subject to the prior confirmation of FSA (if and to the extent required under the then applicable Japanese banking laws or regulations), at a redemption price equal to the sum of 100% of the principal amount of the relevant series of the Notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the redemption date. See “Description of the Notes—Optional Redemption.” |

| Optional Tax Redemption |

Each series of the Notes may be redeemed at any time, at the option of Mizuho Financial Group, in whole, but not in part, upon not less than 30 nor more than 60 days’ prior notice, subject to the prior confirmation of the FSA (if and to the extent required under the then applicable Japanese banking laws and regulations), at a redemption price equal to 100% of the principal amount of the relevant series of |

S-7

Table of Contents

| the Notes then outstanding plus accrued and unpaid interest to, but excluding, the redemption date and additional amounts, if any, if Mizuho Financial Group is, or on the next interest payment date would be, obligated to pay additional amounts as described under “Description of the Debt Securities—Payment of Additional Amounts” in the accompanying prospectus as a result of any change in, or amendment to, the laws, regulations or rulings of Japan (or of any political subdivision or taxing authority thereof or therein) affecting taxation, or any change in the official position regarding the application or interpretation of such laws, regulations or rulings, which change, amendment, application or interpretation becomes effective on or after the date of this prospectus supplement, and the obligation cannot be avoided by Mizuho Financial Group taking reasonable measures available to it. |

| No notice of redemption may be given earlier than 90 days prior to the earliest date on which Mizuho Financial Group would be obligated to pay the additional amounts if a payment in respect of the Notes were then due. |

| See “Description of the Notes—Optional Tax Redemption.” |

| Use of Proceeds |

We intend to use the net proceeds from the issuance and sale of each series of the 4-year Notes, the Floating Rate Notes and the Fixed Rate Notes to make a loan that is intended to qualify as Internal TLAC (as defined below) under the Japanese TLAC Standard to Mizuho Bank. Mizuho Bank intends to utilize such funds for its general corporate purposes. |

| We intend to use the net proceeds from the issuance and sale of the 8-year Notes to make a loan that is intended to qualify as Internal TLAC under the Japanese TLAC Standard to Mizuho Bank, which intends to utilize such funds to finance and/or refinance, in whole or in part, existing and/or new Eligible Green Projects (as defined below) under the Green Bond Framework (as further described below) adopted by us. |

| See “Use of Proceeds.” |

| Limitation on Actions for Attachment |

Each Noteholder acknowledges, accepts, consents and agrees, for a period of 30 days from and including the date upon which the Prime Minister confirms that specified item 2 measures (tokutei dai nigo sochi), which are the measures set forth in Article 126-2, Paragraph 1, Item 2 of the Deposit Insurance Act of Japan (Act No. 34 of 1971, as amended) (the “Deposit Insurance Act”) (or any successor provision thereto), need to be applied to us, not to initiate any action to attach any of our assets, the attachment of which has been prohibited by designation of the Prime Minister pursuant to Article 126-16 of the Deposit Insurance Act (or any successor provision thereto). See “Description of the Debt Securities—Limitation on Actions for Attachment” in the accompanying prospectus. |

S-8

Table of Contents

| Permitted Transfer of Assets or Liabilities |

Each Noteholder acknowledges, accepts, consents and agrees to any transfer of our assets (including shares of our subsidiaries) or liabilities, or any portions thereof, with permission of a Japanese court in accordance with Article 126-13 of the Deposit Insurance Act (or any successor provision thereto), including any such transfer made pursuant to the authority of the Deposit Insurance Corporation of Japan (the “Deposit Insurance Corporation”) to represent and manage and dispose of our assets under Article 126-5 of the Deposit Insurance Act (or any successor provision thereto), and that any such transfer shall not constitute a sale, assignment, transfer, lease or conveyance restricted under the terms of the Notes as set forth in “Description of the Debt Securities—Covenants” in the accompanying prospectus. See “Description of the Debt Securities—Permitted Transfer of Assets or Liabilities” in the accompanying prospectus. |

| Limited Right of Set-off |

Subject to applicable law, each Noteholder agrees that, by acceptance of any interest in the Notes, if (a) we shall institute proceedings seeking adjudication of bankruptcy or seeking reorganization under the Bankruptcy Act of Japan (Act No. 75 of 2004, as amended), the Civil Rehabilitation Act of Japan (Act No. 225 of 1999, as amended), the Corporate Reorganization Act of Japan (Act No. 154 of 2002, as amended), the Companies Act of Japan (Act No. 86 of 2005, as amended; the “Companies Act”) or any other similar applicable law of Japan, and as long as such proceedings shall have continued, or a decree or order by any court having jurisdiction shall have been issued adjudging us bankrupt or insolvent or approving a petition seeking reorganization under any such laws, and as long as such decree or order shall have continued undischarged or unstayed, or (b) the Prime Minister confirms that specified item 2 measures (tokutei dai nigo sochi) need to be applied to us, it will not, and waives its right to, exercise, claim or plead any right of set off, compensation or retention in respect of any amount owed to it by us arising under, or in connection with, the Notes or the Indenture. See “Description of the Debt Securities—Limited Rights to Set Off by Holders” in the accompanying prospectus. |

| Settlement |

The Notes of each series will initially be issued to investors only in book-entry form. Fully registered global notes (the “Global Notes”), without coupons, representing the total aggregate principal amount of the Notes will be issued and registered in the name of a nominee for DTC, securities depositary for the Notes. Unless and until the Notes in definitive certificated form (“Definitive Notes”) are issued, the only Noteholder will be the nominee of DTC, or the nominee of a successor depositary. Except as described in this prospectus supplement, a beneficial owner of any interest in a Global Note will not be entitled to receive physical delivery of Definitive Notes. |

S-9

Table of Contents

| Accordingly, each beneficial owner of any interest in a Global Note must rely on the procedures of DTC to exercise any rights under the Notes. |

| Security Codes | Common Code: | ISIN: | CUSIP No.: | |||||||

| 4-year Notes |

||||||||||

| 8-year Notes |

||||||||||

| Floating Rate Notes Fixed Rate Notes |

| Governing Law |

The Indenture is, and the Notes will be, governed by, and construed in accordance with, the laws of the State of New York. |

| Listing and Trading |

Approval-in-principle has been received for the listing of, and quotation for, the Notes on the SGX-ST. The SGX-ST assumes no responsibility for the correctness of any statements made, opinions expressed or reports contained herein. Admission of the Notes to the Official List of the SGX-ST is not to be taken as an indication of the merits of the Issuer, its subsidiaries and associated companies or the Notes. |

| So long as the Notes are listed on the SGX-ST and the rules of the SGX-ST so require, in the event that the Global Note representing such Notes is exchanged for Definitive Notes in certificated form, the Issuer will appoint and maintain a paying agent in Singapore, where the Notes may be presented or surrendered for payment or redemption. In addition, in the event that the Global Note is exchanged for Definitive Notes in certificated form, an announcement of such exchange shall be made by or on behalf of the Issuer through the SGX-ST and such announcement will include all material information with respect to the delivery of the Definitive Notes in certificated form, including details of the paying agent in Singapore. |

| The Notes will be traded on the SGX-ST in a minimum board lot size of U.S. $200,000 for so long as such Notes are listed on the SGX-ST and the rules of the SGX-ST so require. |

| Trustee, Paying Agent, Transfer Agent, Registrar and Calculation Agent |

The Bank of New York Mellon |

| Delivery of the Notes |

Delivery of the Notes is expected on or about February , 2022. |

| Conflicts of Interest |

Mizuho Securities USA LLC is an affiliate of ours and, as a result, has a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority, Inc. (FINRA) (“Rule 5121”). Consequently, this offering is being conducted in compliance with the provisions of Rule 5121. Because this offering is of notes that are rated investment grade, pursuant to Rule 5121, the appointment of a “qualified independent underwriter” is not necessary. See “Underwriting (Conflicts of Interest)” beginning on page S-66 of this prospectus supplement. |

S-10

Table of Contents

Investing in the Notes involves risks. You should consider carefully the risks relating to the Notes described below, as well as the other information presented in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus, before you decide whether to invest in the Notes. If any of these risks actually occurs, our business, financial condition and results of operations could suffer, and the trading price and liquidity of the Notes offered could decline, in which case you may lose all or part of your investment. The following does not describe all the risks of an investment in the Notes. Prospective investors should consult their own financial and legal advisers about risks associated with investment in the Notes and the suitability of investing in the Notes in light of their particular circumstances.

This prospectus supplement and the accompanying prospectus also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the risks described below, elsewhere in this prospectus supplement and in “Item 3.D. Key Information—Risk Factors” of our annual report on Form 20-F for the fiscal year ended March 31, 2021, which is incorporated herein by reference.

Risks Relating to Our Business

For information on risks relating to our business, see “Item 3.D. Key Information—Risk Factors” in our most recent annual report on Form 20-F, which is incorporated by reference in this prospectus supplement, and similar information in any other documents incorporated by reference herein.

Risks Relating to the Notes

The Notes will be structurally subordinated to the liabilities of our subsidiaries, including Mizuho Bank and Mizuho Trust & Banking.

Your claim as a Noteholder is structurally subordinated to the liabilities of our banking and other subsidiaries, including our subsidiaries’ liabilities for deposits, borrowed money, derivative transactions and trade payables. As a Noteholder, you will only be entitled to assert a claim as a creditor of Mizuho Financial Group that is to be paid out of Mizuho Financial Group’s assets. If any of our subsidiaries becomes subject to insolvency or liquidation proceedings, you will have no right to proceed against such subsidiary’s assets.

Mizuho Financial Group is a holding company that currently has no significant assets other than its investments in, or loans to, its subsidiaries, including Mizuho Bank and Mizuho Trust & Banking. Mizuho Financial Group’s ability to service its debt obligations, including its obligations under the Notes, thus depends on the dividends, loan payments and other funds Mizuho Financial Group receives from its subsidiaries. Mizuho Financial Group may not be able to receive such funds from a subsidiary due to adverse changes in its financial performance or material deterioration in its financial condition, restrictions imposed as a result of such adverse change or deterioration by relevant laws and regulations, including banking and other regulations (such as loss absorption requirements) and limitations under general corporate law, or any contractual obligations applicable to such subsidiary. Furthermore, if a subsidiary becomes subject to insolvency or liquidation proceedings, Mizuho Financial Group’s right to participate in such subsidiary’s assets will be subject to the prior claims of the creditors and any preference shareholders of the subsidiary, except where Mizuho Financial Group is a creditor or preference shareholder with claims that are recognized to be ranked either ahead of or pari passu with such claims. As a result, you may not recover your investment in the Notes in full or at all even though the investors in or creditors of our subsidiaries may recover their investments in full.

Mizuho Financial Group’s loans to, or investments in capital instruments issued by, its subsidiaries made or to be made with the net proceeds from the sale of its instruments may contain contractual mechanisms that, upon the occurrence of a trigger event relating to prudential or financial condition or other events applicable to Mizuho

S-11

Table of Contents

Financial Group or its subsidiaries under regulatory requirements, including the Internal TLAC (as defined below) requirements in Japan, will result in a write-down, write-off or conversion into equity of such loans or investments, or other changes in the legal or regulatory form or the ranking of the claims Mizuho Financial Group has against the subsidiaries. For example, to ensure that each of its material subsidiaries in Japan deemed systemically important by the FSA maintains the required minimum level of Internal TLAC under the Internal TLAC requirements in Japan, Mizuho Financial Group may extend to such subsidiaries, using the net proceeds from the sale of the senior debt securities and other debt instruments, subordinated loans that qualify as Internal TLAC instruments pursuant to the Internal TLAC requirements in Japan, including those containing contractual loss absorption provisions (“Contractual Loss Absorption Provisions”) that will discharge or extinguish the loans or convert them into ordinary shares of the subsidiaries if the FSA determines that the relevant subsidiaries are non-viable due to material deterioration in their financial condition after recognizing that they are or are likely to be unable to fully perform their obligations with their assets, or that they have suspended, or are likely to suspend, repayment of their obligations. Any such write-down, write-off or conversion into equity, or changes in the legal or regulatory form or the ranking, or the triggering of Contractual Loss Absorption Provisions, could adversely affect Mizuho Financial Group’s ability to obtain repayment of such loans and investments and to meet its obligations under the Notes as well as the value of the Notes.

The Notes may become subject to loss absorption if Mizuho Financial Group becomes subject to orderly resolution measures under the Deposit Insurance Act of Japan and Japanese insolvency laws. As a result, the value of the Notes could be materially adversely affected, and you may lose all or a portion of your investments.

In November 2015, the Financial Stability Board issued the final TLAC standard for global systemically important banks (“G-SIBs”), including us. The Financial Stability Board’s TLAC standard is designed to ensure that, if a G-SIB fails, it has sufficient loss-absorbing and recapitalization capacity available in resolution to implement an orderly resolution that minimizes the impact on financial stability, thereby ensuring the continuity of critical functions and avoiding exposing public funds to loss. The Financial Stability Board’s TLAC standard defines a minimum requirement for the instruments and liabilities that should be readily available to absorb losses in resolution. For more information regarding the Financial Stability Board’s TLAC standards, see “Item 4.B. Information on the Company—Business Overview—Supervision and Regulation—Japan—Total Loss Absorbing Capacity” in our annual report on Form 20-F for the fiscal year ended March 31, 2021, which is incorporated herein by reference. The FSA published its policy describing its approach for the introduction of this standard in Japan in April 2016, and a revised version of this document was published in April 2018 (the “FSA’s Approach”). In March 2019, the FSA published regulatory notices and related materials to implement the TLAC requirements in Japan. The TLAC standard set forth in these FSA documents (the “Japanese TLAC Standard”), which became applicable to (i) G-SIBs in Japan from March 31, 2019, and (ii) a financial group designated as a domestic systemically important bank in Japan by the FSA which is deemed to be in particular need of a cross-border resolution arrangement and to be of particular systemic significance to the Japanese financial system in the event of its failure (such domestic systemically important bank, together with G-SIBs in Japan, the “Covered SIBs”) from March 31, 2021, and the FSB’s TLAC standard requires Domestic Resolution Entities (as defined below) designated for Covered SIBs to meet certain minimum external TLAC requirements and to cause any of their material subsidiaries in Japan deemed systemically important by the FSA or their foreign subsidiaries subject to TLAC or similar requirements in the relevant jurisdictions to maintain a certain minimum level of capital and debt having internal loss-absorbing and recapitalization capacity (“Internal TLAC”). The FSA designated as resolution entities in Japan (the “Domestic Resolution Entities”) the ultimate holding company in Japan of each Covered SIB. Under the Japanese TLAC Standard, the FSA designated us as the Domestic Resolution Entity for the Mizuho Group, which is subject to the external TLAC requirements in Japan, and also designated Mizuho Bank, Mizuho Trust & Banking and Mizuho Securities as our material subsidiaries in Japan, which are subject to the Internal TLAC requirements in Japan. Under the Japanese TLAC Standard, unsecured senior debt issued by the Domestic Resolution Entity for a Japanese G-SIB is not required to include any contractual write-down, write-off or conversion provisions in order to qualify as external TLAC debt. In addition, unsecured senior debt issued by the Domestic Resolution Entity for a Japanese G-SIB is not required

S-12

Table of Contents

to include any subordination provisions in order to qualify as external TLAC debt, so long as its creditors are recognized as structurally subordinated to the creditors of its subsidiaries and affiliates by the FSA on the grounds that the amount of excluded liabilities as defined in the Japanese TLAC Standard of such Domestic Resolution Entity ranking pari passu or junior to its unsecured senior liabilities does not exceed 5% of its external TLAC in principle, while the Internal TLAC incurred by material subsidiaries of a Japanese G-SIB is required to include the Contractual Loss Absorption Provisions and to be subordinated to such entity’s excluded liabilities. The Notes are intended to qualify as external TLAC debt under the Japanese TLAC Standard, due in part to their structural subordination.

The Notes are expected to become subject to loss absorption if Mizuho Financial Group becomes subject to orderly resolution measures under the Deposit Insurance Act and Japanese insolvency laws. The resolution framework for financial institutions under current Japanese laws and regulations includes (i) measures applied to financial institutions that are solvent on a balance sheet basis and (ii) orderly resolution measures applied to financial institutions that have failed or are deemed likely to fail. The framework applies to banks and certain other financial institutions as well as financial holding companies, such as Mizuho Financial Group. In the Japanese TLAC Standard and the FSA’s Approach, the FSA expressed its view that Single Point of Entry (“SPE”) resolution, in which a single national resolution authority applies its resolution tools to the ultimate holding company in Japan of a group, would be the preferred strategy for resolution of Covered SIBs. However, it is uncertain which resolution strategy or specific measures will be taken in a given case, including whether or not the SPE resolution strategy is to be chosen and implemented in a given case, and orderly resolution measures may be applied without implementing any of the measures described in (i) above. Under a possible model of SPE resolution described in the Japanese TLAC Standard, if the FSA determines that a material subsidiary in Japan of a financial institution that is a Japanese G-SIB is non-viable due to a material deterioration in its financial condition after recognizing that it is, or is likely to be, unable to fully perform its obligations with its assets, or that it has suspended, or is likely to suspend, repayment of its obligations, and issues an order concerning restoration of financial soundness, including recapitalization and restoration of liquidity of such material subsidiary, to the Domestic Resolution Entity for the financial institution under Article 52-33, Paragraph 1 of the Banking Act of Japan (Act No. 59 of 1981, as amended), the material subsidiary’s Internal TLAC instruments will be written off or, if applicable, converted into equity in accordance with the applicable Contractual Loss Absorption Provisions of such Internal TLAC instruments. Following the write-off or conversion of Internal TLAC instruments, if the Prime Minister recognizes that the financial institution is or is likely to be unable to fully perform its obligations with its assets, or that it has suspended, or is likely to suspend, repayment of its obligations, as a result of the financial institution’s loans to, or other investment in, its material subsidiaries that are designated by FSA as being systemically important or that are subject to TLAC requirements or similar requirements imposed by a relevant foreign authority, becoming subject to loss absorption or otherwise, and further recognizes that the failure of such financial institution is likely to cause a significant disruption to the Japanese financial market or system, the Prime Minister may, following deliberation by the Financial Crisis Management Meeting, confirm that measures set forth in Article 126-2, Paragraph 1, Item 2 of the Deposit Insurance Act, generally referred to as specified item 2 measures (tokutei dai nigo sochi), need to be applied to the financial institution for its orderly resolution. Any such confirmation by the Prime Minister would also trigger the point of non-viability clauses of Additional Tier 1 and Tier 2 instruments issued by the financial institution, causing such instruments to be written off, or if applicable, converted into equity.

Under current Japanese laws and regulations, upon the application of specified item 2 measures (tokutei dai nigo sochi), a financial institution will be placed under special supervision (tokubetsu kanshi) by, or if the Prime Minister so orders, under special control (tokutei kanri) of, the Deposit Insurance Corporation. In an orderly resolution, if the financial institution is placed under special control (tokutei kanri), pursuant to Article 126-5 of the Deposit Insurance Act, the Deposit Insurance Corporation would control the operation and management of the financial institution’s business, assets and liabilities, including the potential transfer to a bridge financial institution established by the Deposit Insurance Corporation as its subsidiary, or such other financial institution as the Deposit Insurance Corporation may determine, of the financial institution’s systemically important assets and liabilities, which in the case of Mizuho Financial Group would be expected to include the shares of Mizuho

S-13

Table of Contents

Bank, Mizuho Trust & Banking, Mizuho Securities and other material subsidiaries based on the Japanese TLAC Standard. Under the Japanese TLAC Standard, to facilitate that transfer, the Prime Minister may prohibit by its designation creditors of the financial institution from attaching any of our assets and claims which are to be transferred to a bridge financial institution or another financial institution pursuant to Article 126-16 of the Deposit Insurance Act. See also “Item 4. B. Information on the Company—Business Overview—Supervision and Regulation—Japan—Governmental Measures to Treat Troubled Institutions” in our annual report on Form 20-F for the fiscal year ended March 31, 2021, which is incorporated herein by reference. In addition, with respect to the Notes, given they are governed by the laws of the State of New York, the terms of the Notes will, in order to satisfy the requirements under the Japanese TLAC Standard, expressly limit the ability of the Noteholders to initiate any action to attach any of our assets, the attachment of which is so prohibited by the Prime Minister under Article 126-16 of the Deposit Insurance Act (or any successor provision thereto) for a period of 30 days from and including the date upon which the Prime Minister confirms that specified item 2 measures (tokutei dai nigo sochi) need to be applied to Mizuho Financial Group. See “Description of the Debt Securities—Limitation on Actions for Attachment” in the accompanying prospectus. The value of assets subject to a prohibition of attachment may decline while such prohibition is in effect, and following such period, Noteholders will be unable to attach any assets that have been transferred to a bridge financial institution or such other financial institution as part of our orderly resolution. The Deposit Insurance Corporation would also control the repayment of liabilities of the financial institution, and, ultimately, facilitate the orderly resolution of the financial institution through court-administrated insolvency proceedings. The Deposit Insurance Corporation has broad discretion in its application of these measures in accordance with the Deposit Insurance Act, Japanese insolvency laws and other relevant laws.

Under current Japanese laws and regulations, if Mizuho Financial Group becomes subject to specified item 2 measures (tokutei dai nigo sochi), the application of specified item 2 measures (tokutei dai nigo sochi) or other measures by, or any decision of, the Prime Minister, the Deposit Insurance Corporation or a Japanese court may result in your rights as a Noteholder or the value of your investment in the Notes being adversely affected. Under the Japanese TLAC Standard, it is currently expected that the Notes will not be transferred to a bridge financial institution or other transferee in the orderly resolution process but will remain as Mizuho Financial Group’s liabilities subject to court-administered insolvency proceedings. On the other hand, in an orderly resolution process, the shares of Mizuho Financial Group’s material subsidiaries may be transferred to a bridge financial institution or other transferee, pursuant to the authority of the Deposit Insurance Corporation to represent and manage and dispose of Mizuho Financial Group’s assets under Article 126-5 of the Deposit Insurance Act, with the permission of a Japanese court in accordance with Article 126-13 of the Deposit Insurance Act, which permission may be granted by court in accordance with the Deposit Insurance Act if (i) the financial institution is under special supervision (tokubetsu kanshi) by, or under special control (tokutei kanri) of, the Deposit Insurance Corporation pursuant to the Deposit Insurance Act, and (ii) the financial institution is, or is likely to be, unable to fully perform its obligations with its assets, or the financial institution has suspended, or is likely to suspend, repayment of its obligations, and Mizuho Financial Group would only be entitled to receive consideration representing the fair values of such shares, which could be significantly less than the book values of such shares. With respect to such transfer, given the Notes are governed by the laws of the State of New York, in order to satisfy the requirements under the Japanese TLAC Standard, Noteholders expressly acknowledge, accept, consent and agree to any transfer of our assets (including shares of our subsidiaries) or liabilities, or any portions thereof, with the permission of a Japanese court in accordance with Article 126-13 of the Deposit Insurance Act (or any successor provision thereto), including any such transfer made pursuant to the authority of the Deposit Insurance Corporation to represent and manage and dispose of Mizuho Financial Group’s assets under Article 126-5 of the Deposit Insurance Act (or any successor provision thereto). See “Description of the Debt Securities—Permitted Transfer of Assets or Liabilities” in the accompanying prospectus. Following such transfer, the recoverable value of Mizuho Financial Group’s residual assets in court-administered insolvency proceedings may not be sufficient to fully satisfy any payment obligations that Mizuho Financial Group may have under its liabilities, including the Notes. Moreover, the Notes will not be insured or guaranteed by the Deposit Insurance Corporation or any other government agency or insurer. Accordingly, the Noteholders may lose all or a portion of their investments in the Notes in court-administered insolvency proceedings.

S-14

Table of Contents

The circumstances surrounding or triggering orderly resolution are unpredictable, and the Japanese TLAC Standard is subject to change.

The application of orderly resolution under the Deposit Insurance Act is inherently unpredictable and depends on a number of factors that may be beyond Mizuho Financial Group’s control. The commencement of the orderly resolution process under the Deposit Insurance Act depends on, among other things, a determination by the Prime Minister, following deliberation by the Financial Crisis Management Meeting, regarding Mizuho Financial Group’s viability, or the viability of one or more of Mizuho Financial Group’s subsidiaries, and the risk that their failures may cause a significant disruption to the financial market or systems in Japan. Under the Japanese TLAC Standard, it is possible that specified item 2 measures (tokutei dai nigo sochi) may be applied to us as a result of, among other things, absorption of losses by us on our loans to or investments in, or any other Internal TLAC of, any of our material subsidiaries or material sub-groups in Japan that are designated as systemically important by the FSA or any of our foreign subsidiaries that are subject to TLAC requirements or similar requirements imposed by a relevant foreign authority, prior to the failure of such subsidiary, pursuant to the terms of such loans, investments or other Internal TLAC or in accordance with applicable Japanese or foreign laws or regulations then in effect. However, under the Japanese TLAC Standard, the actual measures to be taken will be determined by the relevant authorities on a case-by-case basis, and, as a result, it may be difficult to predict when, if at all, Mizuho Financial Group may become subject to an orderly resolution process. Accordingly, the market value of the Notes may not necessarily be evaluated in a manner similar to other types of notes issued by non-financial institutions or by financial institutions subject to different regulatory regimes. For example, any indication that Mizuho Financial Group is approaching circumstances that could result in Mizuho Financial Group becoming subject to an orderly resolution process could also have an adverse effect on the market price and liquidity of the Notes.