Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-33098

Kabushiki Kaisha Mizuho Financial Group

(Exact name of Registrant as specified in its charter)

Mizuho Financial Group, Inc.

(Translation of Registrant’s name into English)

Japan

(Jurisdiction of incorporation or organization)

1-5-5 Otemachi

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal executive offices)

Yutaka Ueki, +81-3-5224-1111, +81-3-5224-1059, address is same as above

(Name, Telephone, Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, without par value | The New York Stock Exchange* | |

| American depositary shares, each of which represents two shares of common stock | The New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

At March 31, 2015, the following shares of capital stock were issued: (1) 24,621,897,967 shares of common stock (including 8,695,754 shares of common stock held by the registrant as treasury stock), (2) 914,752,000 shares of eleventh series class XI preferred stock (including 701,631,100 shares of eleventh series class XI preferred stock held by the registrant as treasury stock).

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x

|

Accelerated filer ¨ | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP x | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

| * | Not for trading, but only in connection with the registration and listing of the ADSs. |

Table of Contents

ANNUAL REPORT ON FORM 20-F

Table of Contents

| Page | ||||||||

| 3 | ||||||||

| 3 | ||||||||

| ITEM 1. |

5 | |||||||

| ITEM 2. |

5 | |||||||

| ITEM 3. |

5 | |||||||

| 3.A. | 5 | |||||||

| 3.B. | 10 | |||||||

| 3.C. | 10 | |||||||

| 3.D. | 10 | |||||||

| ITEM 4. |

19 | |||||||

| 4.A. | 19 | |||||||

| 4.B. | 20 | |||||||

| 4.C. | 45 | |||||||

| 4.D. | 47 | |||||||

| ITEM 4A. |

47 | |||||||

| ITEM 5. |

48 | |||||||

| ITEM 6. |

109 | |||||||

| 6.A. | 109 | |||||||

| 6.B. | 132 | |||||||

| 6.C. | 137 | |||||||

| 6.D. | 141 | |||||||

| 6.E. | 142 | |||||||

| ITEM 7. |

144 | |||||||

| 7.A. | 144 | |||||||

| 7.B. | 145 | |||||||

| 7.C. | 145 | |||||||

| ITEM 8. |

146 | |||||||

| 8.A. | 146 | |||||||

| 8.B. | 146 | |||||||

| ITEM 9. |

147 | |||||||

| 9.A. | 147 | |||||||

| 9.B. | 148 | |||||||

| 9.C. | 148 | |||||||

| 9.D. | 149 | |||||||

| 9.E. | 149 | |||||||

| 9.F. | 149 | |||||||

| ITEM 10. |

150 | |||||||

| 10.A. | 150 | |||||||

| 10.B. | 150 | |||||||

| 10.C. | 162 | |||||||

| 10.D. | 162 | |||||||

| 10.E. | 163 | |||||||

| 10.F. | 169 | |||||||

| 10.G. | 169 | |||||||

| 10.H. | 169 | |||||||

| 10.I. | 169 | |||||||

1

Table of Contents

| Page | ||||||||

| ITEM 11. |

170 | |||||||

| ITEM 12. |

194 | |||||||

| 12.A. | 194 | |||||||

| 12.B. | 194 | |||||||

| 12.C. | 194 | |||||||

| 12.D. | 194 | |||||||

| ITEM 13. |

195 | |||||||

| ITEM 14. |

Material Modifications to the Rights of Securities Holders and Use of Proceeds |

195 | ||||||

| ITEM 15. |

195 | |||||||

| ITEM 16A. |

196 | |||||||

| ITEM 16B. |

196 | |||||||

| ITEM 16C. |

197 | |||||||

| ITEM 16D. |

198 | |||||||

| ITEM 16E. |

Purchase of Equity Securities by the Issuer and Affiliated Purchasers |

198 | ||||||

| ITEM 16F. |

198 | |||||||

| ITEM 16G. |

198 | |||||||

| ITEM 16H. |

200 | |||||||

| ITEM 17. |

201 | |||||||

| ITEM 18. |

201 | |||||||

| ITEM 19. |

201 | |||||||

| A-1 | ||||||||

| F-1 | ||||||||

2

Table of Contents

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

In this annual report, “we,” “us,” and “our” refer to Mizuho Financial Group, Inc. and, unless the context indicates otherwise, its consolidated subsidiaries. “Mizuho Financial Group” refers to Mizuho Financial Group, Inc. Furthermore, unless the context indicates otherwise, these references are intended to refer to us as if we had been in existence in our current form for all periods referred to herein.

On July 1, 2013, a merger between the former Mizuho Bank, Ltd. and the former Mizuho Corporate Bank, Ltd. came into effect with the former Mizuho Corporate Bank as the surviving entity, which was renamed Mizuho Bank upon the merger. In this annual report, “Mizuho Bank” refers to the post-merger entity, while the “former Mizuho Bank” and the “former Mizuho Corporate Bank” refer to pre-merger Mizuho Bank and pre-merger Mizuho Corporate Bank, respectively.

In this annual report, “our principal banking subsidiaries” refer to Mizuho Bank and Mizuho Trust & Banking Co., Ltd. (or with respect to references as of a date, or for periods ending, before July 1, 2013, to the former Mizuho Bank, the former Mizuho Corporate Bank and Mizuho Trust & Banking).

In this annual report, references to “U.S. dollars,” “dollars” and “$” refer to the lawful currency of the United States and those to “yen” and “¥” refer to the lawful currency of Japan.

In this annual report, yen figures and percentages have been rounded to the figures shown. However, in some cases, figures presented in tables have been adjusted to match the sum of the figures with the total amount, and such figures may also be referred to in the related text. In addition, yen figures and percentages in “Item 3.A. Key Information—Selected Financial Data—Japanese GAAP Selected Consolidated Financial Information” and others that are specified have been truncated to the figures shown.

Our fiscal year end is March 31. References to years not specified as being fiscal years are to calendar years.

Unless otherwise specified, for purposes of this annual report, we have presented our financial information in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. Unless otherwise stated or the context otherwise requires, all amounts in our financial statements are expressed in yen.

We usually hold the ordinary general meeting of shareholders of Mizuho Financial Group in June of each year in Chiyoda-ku, Tokyo.

We may from time to time make written or oral forward-looking statements. Written forward-looking statements may appear in documents filed with the Securities and Exchange Commission, including this annual report, and other reports to shareholders and other communications.

The U.S. Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information to encourage companies to provide prospective information about themselves. We rely on this safe harbor in making these forward-looking statements.

This annual report contains forward-looking statements regarding the intent, belief, current expectations and targets of our management with respect to our financial condition and future results of operations. In many cases, but not all, we use such words as “aim,” “anticipate,” “believe,” “endeavor,” “estimate,” “expect,” “intend,” “may,” “plan,” “probability,” “project,” “risk,” “seek,” “should,” “strive,” “target” and similar expressions in relation to us or our management to identify forward-looking statements. You can also identify forward-looking

3

Table of Contents

statements by discussions of strategy, plans or intentions. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results may vary materially from those we currently anticipate. Potential risks and uncertainties include, without limitation, the following:

| • | incurrence of significant credit-related costs; |

| • | declines in the value of our securities portfolio, including as a result of the declines in stock markets and the impact of the dislocation in the global financial markets; |

| • | changes in interest rates; |

| • | foreign exchange rate fluctuations; |

| • | decrease in the market liquidity of our assets; |

| • | revised assumptions or other changes related to our pension plans; |

| • | a decline in our deferred tax assets; |

| • | the effect of financial transactions entered into for hedging and other similar purposes; |

| • | failure to maintain required capital adequacy ratio levels; |

| • | downgrades in our credit ratings; |

| • | our ability to avoid reputational harm; |

| • | our ability to implement our Medium-term Business Plan and other strategic initiatives and measures effectively; |

| • | the effectiveness of our operation, legal and other risk management policies; |

| • | the effect of changes in general economic conditions in Japan and elsewhere; and |

| • | amendments and other changes to the laws and regulations that are applicable to us. |

Our forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ from those in the forward-looking statements as a result of various factors. We identify in this annual report in “Item 3.D. Key Information—Risk Factors,” “Item 4.B. Information on the Company—Business Overview,” “Item 5. Operating and Financial Review and Prospects” and elsewhere, some, but not necessarily all, of the important factors that could cause these differences.

We do not intend to update our forward-looking statements. We are under no obligation, and disclaim any obligation, to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise.

4

Table of Contents

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

The following tables set forth our selected consolidated financial data.

The first table below sets forth selected consolidated financial data of Mizuho Financial Group as of and for the fiscal years ended March 31, 2011, 2012, 2013, 2014 and 2015 which have been derived from the audited consolidated financial statements of Mizuho Financial Group prepared in accordance with U.S. GAAP included in this annual report.

The second table below sets forth selected consolidated financial data of Mizuho Financial Group as of and for the fiscal years ended March 31, 2011, 2012, 2013, 2014 and 2015 derived from Mizuho Financial Group’s consolidated financial statements prepared in accordance with accounting principles generally accepted in Japan, or Japanese GAAP.

The consolidated financial statements of Mizuho Financial Group as of and for the fiscal years ended March 31, 2013, 2014 and 2015 prepared in accordance with U.S. GAAP have been audited in accordance with the standards of the Public Company Accounting Oversight Board (United States) by Ernst & Young ShinNihon LLC, independent registered public accounting firm.

You should read the U.S. GAAP selected consolidated financial information presented below together with the information included in “Item 5. Operating and Financial Review and Prospects” and the audited consolidated financial statements, including the notes thereto, included in this annual report. The information presented below is qualified in its entirety by reference to that information.

5

Table of Contents

U.S. GAAP Selected Consolidated Financial Information

| As of and for the fiscal years ended March 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| (in millions of yen, except per share data, share number information and percentages) | ||||||||||||||||||||

| Statement of income data: |

||||||||||||||||||||

| Interest and dividend income |

¥ | 1,460,184 | ¥ | 1,437,086 | ¥ | 1,423,375 | ¥ | 1,422,799 | ¥ | 1,457,659 | ||||||||||

| Interest expense |

448,857 | 415,959 | 412,851 | 401,565 | 411,982 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

1,011,327 | 1,021,127 | 1,010,524 | 1,021,234 | 1,045,677 | |||||||||||||||

| Provision (credit) for loan losses |

647 | (23,044 | ) | 139,947 | (126,230 | ) | (60,223 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision (credit) for loan losses |

1,010,680 | 1,044,171 | 870,577 | 1,147,464 | 1,105,900 | |||||||||||||||

| Noninterest income |

1,036,532 | 1,090,135 | 1,439,419 | 1,082,834 | 1,801,215 | |||||||||||||||

| Noninterest expenses |

1,435,855 | 1,471,471 | 1,424,816 | 1,503,955 | 1,639,462 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income tax expense (benefit) |

611,357 | 662,835 | 885,180 | 726,343 | 1,267,653 | |||||||||||||||

| Income tax expense (benefit) |

193,227 | 13,878 | 4,024 | 226,108 | 437,420 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

418,130 | 648,957 | 881,156 | 500,235 | 830,233 | |||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interests |

5,461 | (7,432 | ) | 5,744 | 1,751 | 27,185 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to MHFG shareholders |

¥ | 412,669 | ¥ | 656,389 | ¥ | 875,412 | ¥ | 498,484 | ¥ | 803,048 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to common shareholders |

¥ | 403,231 | ¥ | 647,717 | ¥ | 867,191 | ¥ | 491,739 | ¥ | 798,138 | ||||||||||

| Amounts per share: |

||||||||||||||||||||

| Basic earnings per common share—net income attributable to common shareholders |

¥ | 20.44 | ¥ | 28.07 | ¥ | 36.05 | ¥ | 20.33 | ¥ | 32.75 | ||||||||||

| Diluted earnings per common share—net income attributable to common shareholders |

¥ | 19.22 | ¥ | 26.78 | ¥ | 34.47 | ¥ | 19.64 | ¥ | 31.64 | ||||||||||

| Number of shares used to calculate basic earnings per common share (in thousands) |

19,722,818 | 23,073,544 | 24,053,282 | 24,189,670 | 24,368,116 | |||||||||||||||

| Number of shares used to calculate diluted earnings per common share (in thousands) |

21,415,109 | 24,469,539 | 25,365,229 | 25,371,252 | 25,381,047 | |||||||||||||||

| Cash dividends per share declared during the fiscal year(1): |

||||||||||||||||||||

| Common stock |

¥ | 8.00 | ¥ | 6.00 | ¥ | 6.00 | ¥ | 6.00 | ¥ | 6.50 | ||||||||||

| $ | 0.10 | $ | 0.07 | $ | 0.06 | $ | 0.06 | $ | 0.05 | |||||||||||

| Eleventh series class XI preferred stock |

¥ | 20.00 | ¥ | 20.00 | ¥ | 20.00 | ¥ | 20.00 | ¥ | 20.00 | ||||||||||

| $ | 0.24 | $ | 0.24 | $ | 0.21 | $ | 0.19 | $ | 0.17 | |||||||||||

| Thirteenth series class XIII preferred stock(2) |

¥ | 30.00 | ¥ | 30.00 | ¥ | 30.00 | ¥ | 30.00 | ¥ | — | ||||||||||

| $ | 0.36 | $ | 0.36 | $ | 0.32 | $ | 0.29 | $ | — | |||||||||||

6

Table of Contents

| As of and for the fiscal years ended March 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| (in millions of yen, except per share data, share number information and percentages) | ||||||||||||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Total assets |

¥ | 161,985,670 | ¥ | 166,361,633 | ¥ | 178,746,994 | ¥ | 175,699,346 | ¥ | 190,119,734 | ||||||||||

| Loans, net of allowance |

63,955,284 | 65,306,370 | 69,060,526 | 72,858,777 | 77,528,017 | |||||||||||||||

| Total liabilities |

157,950,314 | 161,714,609 | 172,889,899 | 169,077,975 | 181,929,890 | |||||||||||||||

| Deposits |

89,215,627 | 91,234,380 | 100,221,556 | 102,610,154 | 114,206,441 | |||||||||||||||

| Long-term debt |

8,953,496 | 8,461,818 | 8,802,223 | 9,853,941 | 14,582,241 | |||||||||||||||

| Common stock |

5,164,160 | 5,427,992 | 5,460,821 | 5,489,295 | 5,590,396 | |||||||||||||||

| Total MHFG shareholders’ equity |

3,673,487 | 4,470,766 | 5,728,120 | 6,378,470 | 7,930,338 | |||||||||||||||

| Other financial data: |

||||||||||||||||||||

| Return on equity and assets: |

||||||||||||||||||||

| Net income attributable to common shareholders as a percentage of total average assets |

0.25 | % | 0.39 | % | 0.50 | % | 0.27 | % | 0.42 | % | ||||||||||

| Net income attributable to common shareholders as a percentage of average MHFG shareholders’ equity |

12.63 | % | 15.56 | % | 18.76 | % | 9.64 | % | 13.86 | % | ||||||||||

| Dividends per common share as a percentage of basic earnings per common share |

29.35 | % | 21.38 | % | 16.64 | % | 31.97 | % | 22.90 | % | ||||||||||

| Average MHFG shareholders’ equity as a percentage of total average assets |

2.01 | % | 2.53 | % | 2.67 | % | 2.84 | % | 3.04 | % | ||||||||||

| Net interest income as a percentage of total average interest-earning assets |

0.75 | % | 0.71 | % | 0.66 | % | 0.64 | % | 0.63 | % | ||||||||||

Notes:

| (1) | Yen amounts are expressed in U.S. dollars at the rate of ¥82.76 = $1.00, ¥82.41 = $1.00, ¥94.16 = $1.00, ¥102.98 = $1.00 and ¥119.96= $1.00 for the fiscal years ended March 31, 2011, 2012, 2013, 2014 and 2015, respectively. These rates are the noon buying rates on the respective fiscal year-end dates in New York City for cable transfers in yen as certified for customs purposes by the Federal Reserve Bank of New York. |

| (2) | On July 11, 2013, we acquired and subsequently cancelled all of the thirteenth series class XIII preferred stock. |

7

Table of Contents

Japanese GAAP Selected Consolidated Financial Information

| As of and for the fiscal years ended March 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| (in millions of yen, except per share data and percentages) | ||||||||||||||||||||

| Statement of income data: |

||||||||||||||||||||

| Interest income |

¥ | 1,457,687 | ¥ | 1,423,564 | ¥ | 1,421,609 | ¥ | 1,417,569 | ¥ | 1,468,976 | ||||||||||

| Interest expense |

348,242 | 335,223 | 345,710 | 309,266 | 339,543 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

1,109,444 | 1,088,340 | 1,075,898 | 1,108,303 | 1,129,433 | |||||||||||||||

| Fiduciary income |

49,388 | 49,014 | 48,506 | 52,014 | 52,641 | |||||||||||||||

| Net fee and commission income(1) |

458,824 | 458,933 | 507,378 | 560,768 | 593,360 | |||||||||||||||

| Net trading income |

243,983 | 150,317 | 215,033 | 187,421 | 262,963 | |||||||||||||||

| Net other operating income |

163,680 | 256,468 | 324,899 | 126,774 | 209,340 | |||||||||||||||

| General and administrative expenses(1) |

1,277,848 | 1,283,847 | 1,244,647 | 1,258,227 | 1,351,611 | |||||||||||||||

| Other income |

156,212 | 263,024 | 198,063 | 344,275 | 301,652 | |||||||||||||||

| Other expenses |

268,261 | 265,803 | 407,299 | 135,962 | 207,147 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes and minority interests |

635,425 | 716,449 | 717,832 | 985,366 | 990,632 | |||||||||||||||

| Income taxes: |

||||||||||||||||||||

| Current(2) |

18,336 | 55,332 | 50,400 | 137,010 | 260,268 | |||||||||||||||

| Deferred |

120,123 | 97,494 | 7,461 | 77,960 | 44,723 | |||||||||||||||

| Income before minority interests |

496,965 | 563,621 | 659,970 | 770,396 | 685,640 | |||||||||||||||

| Minority interests in net income |

83,736 | 79,102 | 99,454 | 81,980 | 73,705 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

¥ | 413,228 | ¥ | 484,519 | ¥ | 560,516 | ¥ | 688,415 | ¥ | 611,935 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per share: |

||||||||||||||||||||

| Basic |

¥ | 20.47 | ¥ | 20.62 | ¥ | 22.96 | ¥ | 28.18 | ¥ | 24.91 | ||||||||||

| Diluted |

19.27 | 19.75 | 22.05 | 27.12 | 24.10 | |||||||||||||||

| Cash dividends per share declared during the fiscal year(3): |

||||||||||||||||||||

| Common stock(4) |

¥ | 8.00 | ¥ | 6.00 | ¥ | 6.00 | ¥ | 6.00 | ¥ | 6.50 | ||||||||||

| $ | 0.10 | $ | 0.07 | $ | 0.06 | $ | 0.06 | $ | 0.05 | |||||||||||

| Eleventh series class XI preferred stock(4) |

¥ | 20.00 | ¥ | 20.00 | ¥ | 20.00 | ¥ | 20.00 | ¥ | 20.00 | ||||||||||

| $ | 0.24 | $ | 0.24 | $ | 0.21 | $ | 0.19 | $ | 0.17 | |||||||||||

| Thirteenth series class XIII preferred stock(5) |

¥ | 30.00 | ¥ | 30.00 | ¥ | 30.00 | ¥ | 30.00 | ¥ | — | ||||||||||

| $ | 0.36 | $ | 0.36 | $ | 0.32 | $ | 0.29 | $ | — | |||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Total assets |

¥ | 160,812,006 | ¥ | 165,360,501 | ¥ | 177,411,062 | ¥ | 175,822,885 | ¥ | 189,684,749 | ||||||||||

| Loans and bills discounted(6) |

62,777,757 | 63,800,509 | 67,536,882 | 69,301,405 | 73,415,170 | |||||||||||||||

| Securities |

44,782,067 | 51,392,878 | 53,472,399 | 43,997,517 | 43,278,733 | |||||||||||||||

| Deposits(7) |

88,884,158 | 90,636,656 | 99,568,737 | 101,811,282 | 113,452,451 | |||||||||||||||

| Net assets |

6,623,999 | 6,869,295 | 7,736,230 | 8,304,549 | 9,800,538 | |||||||||||||||

| Risk-adjusted capital data |

||||||||||||||||||||

| Tier 1 capital |

¥ | 6,170,210 | ¥ | 6,398,953 | n.a. | n.a. | n.a. | |||||||||||||

| Total risk-based capital |

7,910,970 | 7,775,093 | n.a. | n.a. | n.a. | |||||||||||||||

| Risk-weighted assets |

51,693,835 | 50,144,934 | n.a. | n.a. | n.a. | |||||||||||||||

| Tier 1 capital ratio |

11.93 | % | 12.76 | % | n.a. | n.a. | n.a. | |||||||||||||

| Capital adequacy ratio |

15.30 | 15.50 | n.a. | n.a. | n.a. | |||||||||||||||

8

Table of Contents

| As of and for the fiscal years ended March 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| (in millions of yen, except per share data and percentages) | ||||||||||||||||||||

| Risk-adjusted capital data |

||||||||||||||||||||

| Common Equity Tier 1 capital |

n.a. | n.a. | ¥ | 4,802,418 | ¥ | 5,304,412 | ¥ | 6,153,141 | ||||||||||||

| Tier 1 capital |

n.a. | n.a. | 6,486,068 | 6,844,746 | 7,500,349 | |||||||||||||||

| Total capital |

n.a. | n.a. | 8,344,554 | 8,655,990 | 9,508,471 | |||||||||||||||

| Risk-weighted assets |

n.a. | n.a. | 58,790,617 | 60,274,087 | 65,191,951 | |||||||||||||||

| Common Equity Tier 1 capital ratio |

n.a. | n.a. | 8.16 | % | 8.80 | % | 9.43 | % | ||||||||||||

| Tier 1 capital ratio |

n.a. | n.a. | 11.03 | 11.35 | 11.50 | |||||||||||||||

| Total capital ratio |

n.a. | n.a. | 14.19 | 14.36 | 14.58 | |||||||||||||||

Notes:

| (1) | For the fiscal year ended March 31, 2012, certain items in expenses regarding stock transfer agency business and pension management business, which had been recorded as “General and administrative expenses” by Mizuho Trust & Banking until the previous fiscal year, have been included in “Net fee and commission income” as “Fee and commission expenses,” and reclassification of prior year figures has been made accordingly. |

| (2) | Includes refund of income taxes. |

| (3) | Yen amounts are expressed in U.S. dollars at the rate of ¥82.76 = $1.00, ¥82.41 = $1.00, ¥94.16 = $1.00, ¥102.98 = $1.00 and ¥119.96 = $1.00 for the fiscal years ended March 31, 2011, 2012, 2013, 2014 and 2015, respectively. These rates are the noon buying rates on the respective fiscal year-end dates in New York City for cable transfers in yen as certified for customs purposes by the Federal Reserve Bank of New York. |

| (4) | In June 2015, we declared and paid annual dividends of ¥7.5 per share of common stock and ¥20 per share of eleventh series class XI preferred stock for the fiscal year ended March 31, 2015. |

| (5) | On July 11, 2013, we acquired and subsequently cancelled all of the thirteenth series class XIII preferred stock. Accordingly, cash dividend payments related to the thirteenth series class XIII preferred stock for the fiscal year ended March 31, 2014 were not be made during the fiscal year ending March 31, 2015. |

| (6) | Bills discounted refer to a form of financing in Japan under which promissory notes obtained by corporations through their regular business activities are purchased by banks prior to their payment dates at a discount based on prevailing interest rates. |

| (7) | Includes negotiable certificates of deposit. |

| (8) | Risk-adjusted capital data are calculated on a Basel II basis until the fiscal year ended March 31, 2012, and on a Basel III basis from the fiscal year ended March 31, 2013. We adopted the advanced internal ratings-based approach (the “AIRB approach”) for the calculation of risk-weighted assets associated with credit risk from the fiscal year ended March 31, 2009. We also adopted the advanced measurement approach (the “AMA”) for the calculation of operational risk from the fiscal year ended March 31, 2010. For more details on capital adequacy requirements set by the Bank for International Settlements (“BIS”), and the guideline implemented by the Financial Services Agency in compliance thereto, see “Item 5. Operating and Financial Review and Prospects—Capital Adequacy.” |

There are certain differences between U.S. GAAP and Japanese GAAP. The differences between U.S. GAAP and Japanese GAAP applicable to us primarily relate to the accounting for derivative financial instruments and hedging activities, investments, loans, allowances for loan losses and off-balance-sheet instruments, premises and equipment, land revaluation, business combinations, pension liabilities, consolidation of variable interest entities, deferred taxes and foreign currency translation. See “Item 5. Operating and Financial Review and Prospects—Reconciliation with Japanese GAAP.”

9

Table of Contents

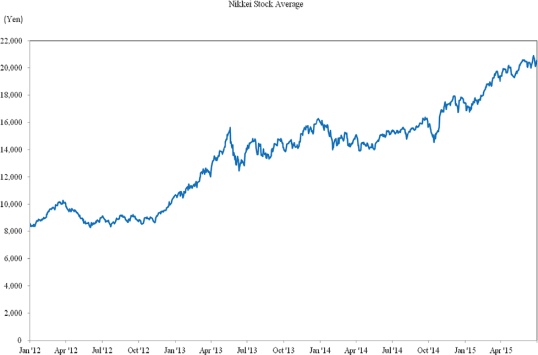

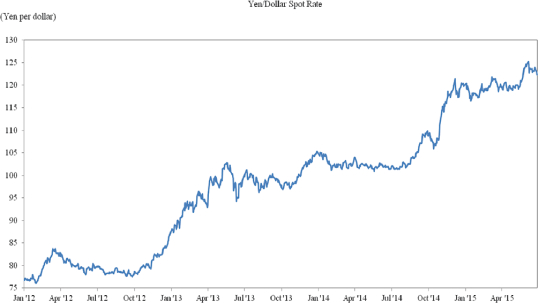

Exchange Rate Information

The following table sets forth, for each period indicated, the noon buying rate in New York City for cable transfers in yen as certified for customs purposes by the Federal Reserve Bank of New York, expressed in yen per $1.00. The exchange rates are reference rates and are not necessarily the rates used to calculate ratios or the rates used to convert yen to U.S. dollars in the financial statements contained in this annual report.

| Fiscal years ended (ending) March 31, |

High | Low | Average(1) | Period end |

||||||||||||

| (yen per dollar) | ||||||||||||||||

| 2011 |

¥ | 94.68 | ¥ | 78.74 | ¥ | 85.00 | ¥ | 82.76 | ||||||||

| 2012 |

85.26 | 75.72 | 78.86 | 82.41 | ||||||||||||

| 2013 |

96.16 | 77.41 | 83.26 | 94.16 | ||||||||||||

| 2014 |

105.25 | 92.96 | 100.46 | 102.98 | ||||||||||||

| 2015 |

121.50 | 101.26 | 110.78 | 119.96 | ||||||||||||

| 2016 (through July 10) |

125.58 | 118.80 | 122.17 | 122.75 | ||||||||||||

| Calendar year 2015 |

||||||||||||||||

| January |

¥ | 120.20 | ¥ | 116.78 | — | — | ||||||||||

| February |

120.38 | 117.33 | — | — | ||||||||||||

| March |

121.50 | 119.01 | — | — | ||||||||||||

| April |

120.36 | 118.80 | — | — | ||||||||||||

| May |

124.18 | 119.09 | — | — | ||||||||||||

| June |

125.58 | 122.10 | — | — | ||||||||||||

| July (through July 10) |

123.14 | 120.54 | — | — | ||||||||||||

Note:

| (1) | Calculated by averaging the exchange rates on the last business day of each month during the respective periods. The noon buying rate as of July 10, 2015 was ¥122.75 = $1.00. |

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable.

Investing in our securities involves a high degree of risk. You should carefully consider the risks described below as well as the other information in this annual report, including our consolidated financial statements and related notes, “Item 5. Operating and Financial Review and Prospects,” “Item 11. Quantitative and Qualitative Disclosures about Market Risk” and “Selected Statistical Data.”

Our business, financial condition and operating results could be materially adversely affected by any of the factors discussed below. The trading price of our securities could decline due to any of these factors. This annual report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the risks faced by us described below and elsewhere in this annual report. See “Forward-Looking Statements.”

10

Table of Contents

Risks Relating to Our Business

We may incur significant credit-related and other costs in the future due to problem loans.

We are the primary bank lender for a large number of our corporate customers, and the amount of our loans and other claims to each of our major customers is significant. In addition, while we have made efforts to diversify our credit exposure along industry lines, the proportion of credit exposure to customers in the construction and real estate, banks and other financial institutions, and wholesale and retail industries is relatively high. We manage our credit portfolio by regularly monitoring the credit profile of each of our customers, the progress made on restructuring plans and credit exposure concentrations in particular industries or corporate groups, and we also utilize credit derivatives for hedging and credit risk mitigation purposes. In addition, we regularly assess the value of collateral and guarantees. However, depending on trends in the domestic and global economic environment, the business environment in particular industries and other factors, the amount of our problem loans and other claims could increase significantly, including as a result of the deterioration in the credit profile of customers for which we are the primary bank lender, other major customers or customers belonging to industries to which we have significant credit exposure, and the value of collateral and guarantees could decline. There can be no assurance that credit-related and other costs will not increase in the future as a result of the foregoing or otherwise.

Our equity investment portfolio exposes us to market risks that could adversely affect our financial condition and results of operations.

We hold substantial investments in marketable equity securities, mainly common stock of Japanese listed companies. In addition to the partial hedges that we apply as we deem necessary in recent years, we sold a portion of such investments, and we may make further sales in the future. However, significant declines in Japanese stock prices in the future would lead to unrealized losses, losses on impairment and losses from sales of equity securities which could have a material adverse effect on our financial condition and results of operations. In addition, net unrealized gains and losses on such investments, based on Japanese GAAP, are taken into account when calculating the amount of capital for purposes of the calculation of our capital adequacy ratios, and as a result, a decline in the value of such investments would negatively affect such ratios. Accordingly, our financial condition and results of operations could be materially and adversely affected.

Changes in interest rates could adversely affect our financial condition and results of operations.

We hold a significant amount of bonds, consisting mostly of Japanese government bonds, and other instruments primarily for the purpose of investment. As a result of such holdings, an increase in interest rates, primarily yen interest rates, could lead to unrealized losses of bonds or losses from sales of bonds. In addition, due mainly to differences in maturities between financial assets and liabilities, changes in interest rates could have an adverse effect on our average interest rate spread. We manage interest rate risk under our risk management policies, which provide for adjustments in the composition of our bond portfolio and the utilization of derivatives and other hedging methods to reduce our exposure to interest rate risk. However, in the event of significant changes in interest rates, including as a result of a change in Japanese monetary policy, increased sovereign risk due to deterioration of public finances and market trends, our financial condition and results of operations could be materially and adversely affected.

Our financial condition and results of operations could be adversely affected by foreign exchange rate fluctuations.

A portion of our assets and liabilities is denominated in foreign currencies, mainly the U.S. dollar. The difference between the amount of assets and liabilities denominated in foreign currencies leads to foreign currency translation gains and losses in the event of fluctuations in foreign exchange rates. Although we hedge a portion of our exposure to foreign exchange rate fluctuation risk, our financial condition and results of operations could be materially and adversely affected if future foreign exchange rate fluctuations significantly exceed our expectations.

11

Table of Contents

We may incur further losses relating to decreases in the market liquidity of assets that we hold.

The market liquidity of the various marketable assets that we hold may decrease significantly due to turmoil in financial markets and other factors, and the value of such assets could decline as a result. If factors such as turmoil in global financial markets or the deterioration of economic or financial conditions cause the market liquidity of our assets to decrease significantly, our financial condition and results of operations could be materially and adversely affected.

Our pension-related costs could increase as a result of revised assumptions or changes in our pension plans.

Our pension-related costs and projected benefit obligations are calculated based on assumptions regarding projected returns on pension plan assets and various actuarial assumptions relating to the plans. If actual results differ from our assumptions or we revise our assumptions in the future, due to changes in the stock markets, interest rate environment or otherwise, our pension-related costs and projected benefit obligations could increase. In addition, any future changes to our pension plans could also lead to increases in our pension-related costs and projected benefit obligations. As a result, our financial condition and results of operations could be materially and adversely affected.

A decrease in deferred tax assets, net of valuation allowance, due to a change in our estimation of future taxable income or change in Japanese tax policy could adversely affect our financial condition and results of operations.

We recorded deferred tax assets, net of valuation allowance, based on a reasonable estimation of future taxable income in accordance with applicable accounting standards. Our financial condition and results of operations could be materially and adversely affected if our deferred tax assets decrease due to a change in our estimation of future taxable income, a change in tax rate as a result of tax system revisions or other factors. Because we consider the sale of available-for-sale securities to be a qualifying tax-planning strategy, turmoil in financial markets such as significant declines in stock prices could lead to a decrease in our estimated future taxable income.

Financial transactions entered into for hedging and other similar purposes could adversely affect our financial condition and results of operations.

The accounting and valuation methods applied to credit and equity derivatives and other financial transactions that we enter into for hedging and credit risk mitigation purposes are not always consistent with the accounting and valuation methods applied to the assets that are being hedged. Consequently, in some cases, due to changes in the market or otherwise, losses related to such financial transactions during a given period may adversely affect net income, while the corresponding increases in the value of the hedged assets do not have an effect on net income for such period. As a result, our financial condition and results of operations could be materially and adversely affected during the period.

Failure to maintain capital adequacy ratios above minimum required levels, as a result of the materialization of risks or regulatory changes, could result in restrictions on our business activities.

We endeavor to maintain sufficient levels of capital adequacy ratios, which are calculated pursuant to standards set forth by Japan’s Financial Services Agency and based on Japanese GAAP, taking into account our plans for investments in risk-weighted assets, the efficiency of our capital structure and other factors. However, our capital adequacy ratios could decline in the future, including as a result of the materialization of any of the risks enumerated in these “Risk Factors” and changes to the methods we use to calculate capital adequacy ratios. Also, there are regulatory adjustments such as goodwill and other intangibles, deferred tax assets, investments in the capital of banking, financial and insurance entities etc., that are deducted from our regulatory capital under certain conditions. Our or our banking subsidiaries’ regulatory capital and capital adequacy ratios could decline due to such regulations.

12

Table of Contents

In addition, if the framework set by the Basel Committee on Banking Supervision, upon which the Financial Services Agency’s rules concerning banks’ capital adequacy ratios are based, is changed or if the Financial Services Agency otherwise changes its banking regulations, we might not be able to meet the minimum regulatory requirements for capital adequacy ratios. For example, in December 2010, the Basel Committee on Banking Supervision issued its Basel III rules text, which presents the details of global regulatory standards on bank capital adequacy and liquidity. In March 2012, the Financial Services Agency published revisions to its capital adequacy guidelines which generally reflect rules in the Basel III text and became effective as of March 31, 2013. Furthermore, the Financial Stability Board (the “FSB”) named us as one of 30 global systemically important banks (“G-SIBs”) in November 2014. As a G-SIB, we will be subject to additional capital requirements. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Mizuho Financial Group—Capital Adequacy” and “Supervision and Regulation—Capital Adequacy.” The group of G-SIBs will be updated annually and published by the FSB each November.

If the capital adequacy ratios of us and our banking subsidiaries fall below specified levels, the Financial Services Agency could require us to take corrective actions, including, depending on the level of deficiency, submission of an improvement plan that would strengthen our capital base, a reduction of our total assets or a suspension of a portion of our business operations. In addition, some of our banking subsidiaries are subject to capital adequacy regulations in foreign jurisdictions such as the United States, and our business could be adversely affected if their capital adequacy ratios fall below specified levels.

Downgrades in our credit ratings could have negative effects on our funding costs and business operations.

Credit ratings are assigned to Mizuho Financial Group, our banking subsidiaries and a number of our other subsidiaries by major domestic and international credit rating agencies. The credit ratings are based on information furnished by us or obtained by the credit rating agencies from independent sources and are also influenced by credit ratings of Japanese government bonds and general views regarding the Japanese financial system as a whole. The credit ratings are subject to revision, suspension or withdrawal by the credit rating agencies at any time. A downgrade in our credit ratings could result in, among other things, the following:

| • | increased funding costs and other difficulties in raising funds; |

| • | the need to provide additional collateral in connection with financial market transactions; and |

| • | the termination or cancellation of existing agreements. |

As a result, our business, financial condition and results of operations could be materially and adversely affected.

For example, the additional collateral requirement in connection with our derivative contracts, absent other changes, assuming a downgrade occurred on March 31, 2015, would have been approximately $33 million for a one-notch downgrade and approximately $109 million for a two-notch downgrade.

Our business will be adversely affected if we encounter difficulties in raising funds.

We rely principally on deposits and bonds as our funding sources. In addition, we also raise funds in the financial markets. Our efforts to maintain stable funding, such as setting maximum limits on financial market funding and monitoring our liquidity position to apply appropriate funding policies, may not be sufficient to prevent significant increases in our funding costs or, in the case mainly of foreign currencies, cash flow problems if we encounter difficulties in attracting deposits or otherwise raising funds. Such difficulties could result, among other things, from any of the following:

| • | adverse developments with respect to our financial condition and results of operations; |

| • | downgrading of our credit ratings or damage to our reputation; or |

13

Table of Contents

| • | a reduction in the size and liquidity of the debt markets due for example to the decline in the domestic and global economy, concerns regarding the financial system or turmoil in financial markets and other factors. |

Our Medium-term Business Plan and other strategic initiatives and measures may not result in the anticipated outcome.

We have been implementing strategic initiatives and measures in various areas. In February 2013, we announced our new Medium-term Business Plan for the three fiscal years ending March 31, 2016, in which we set forth various strategic initiatives and measures and also established a number of key target figures that we aim to achieve by the end of the fiscal year ending March 31, 2016.

However, we may not be successful in implementing such initiatives and measures, or even if we are successful in implementing them, the implementation of such initiatives and measures may not have their anticipated effects. In addition, we may not be able to meet the key target figures announced in the Medium-term Business Plan due to these or other factors, including, but not limited to, differences in the actual economic environment compared to our assumptions underlying the Medium-term Business Plan, as well as the risks enumerated in these “Risk Factors.”

We will be exposed to new or increased risks as we expand the range of our products and services.

We offer a broad range of financial services, including banking, trust, securities and other services. As the needs of our customers become more sophisticated and broader in scope, and as the Japanese financial industry continues to be deregulated, we have been entering into various new areas of business, including through various business and equity alliances, which expose us to new risks. While we have developed and intend to maintain risk management policies that we believe are appropriate to address such risks, if a risk materializes in a manner or to a degree outside of our expectations, our business, financial condition and results of operations could be materially and adversely affected.

We are subject to various laws and regulations, and violations could result in penalties and other regulatory actions.

Our business and employees in Japan are subject to various laws and regulations, including those applicable to financial institutions as well as general laws applicable to our business activities, and we are under the regulatory oversight of the Financial Services Agency. Our businesses outside of Japan are also subject to the laws and regulations of the jurisdictions in which they operate and are subject to oversight by the regulatory authorities of those jurisdictions.

Our compliance and legal risk management structures are designed to prevent violations of such laws and regulations, but they may not be effective in preventing all future violations. Future violations of laws and regulations could result in regulatory action and harm our reputation, and our business, financial condition and results of operations could be materially and adversely affected.

Employee errors and misconduct could subject us to losses and reputational harm.

Because we process a large number of transactions in a broad range of businesses, we are subject to the risk of various operational errors and misconduct, including those caused by employees. Our measures to reduce employee errors, including establishment of operational procedures, regular reviews regarding compliance with these procedures, employee training and automation of our operations, may not be effective in preventing all employee errors and misconduct. Significant operational errors and misconduct in the future could result in losses, regulatory actions or harm to our reputation. As a result, our business, financial condition and results of operations could be materially and adversely affected.

14

Table of Contents

Problems relating to our information technology systems could significantly disrupt our business operations.

We depend significantly on information technology systems with respect to almost all aspects of our business operations. Our information technology systems network, including those relating to bank accounting and cash settlement systems, interconnects our branches and other offices, our customers and various clearing and settlement systems located worldwide. Our efforts to sustain stable daily operations and development of contingency plans for unexpected events, including the implementation of backup and redundancy measures, may not be effective in preventing significant disruptions to our information technology systems caused by, among other things, human error, accidents, hacking, computer viruses, cyber attacks, and development and renewal of computer systems. In the event of any such disruption, our business, financial condition and results of operations could be materially and adversely affected due to disruptions in our business operations, liability to customers and others, regulatory actions or harm to our reputation.

Our reputation could be harmed and we may be subject to liabilities and regulatory actions if we are unable to protect personal and other confidential information.

We handle various confidential or non-public information, including those of our individual and corporate customers, in the ordinary course of our business. The information management policies we maintain and enforce to prevent information leaks and improper access to such information, including those designed to meet the strict requirements of the Personal Information Protection Act of Japan, may not be effective in preventing all such problems. Leakage of important information in the future could result in liabilities and regulatory actions and may also lead to significant harm to our reputation. As a result, our business, financial condition and results of operations could be materially and adversely affected.

Our business would be harmed if we are unable to attract and retain skilled employees.

Many of our employees possess skills and expertise that are important to maintain our competitiveness and to operate our business efficiently. We may not be successful in attracting and retaining sufficient skilled employees through our hiring efforts and training programs aimed to maintain and enhance the skills and expertise of our employees, in which event our competitiveness and efficiency could be significantly impaired. As a result, our business, financial condition and results of operations could be materially and adversely affected.

Our failure to establish, maintain and apply adequate internal controls over financial reporting could negatively impact investor confidence in the reliability of our financial statements.

As a New York Stock Exchange-listed company and an SEC registrant, we have developed disclosure controls and procedures and internal control over financial reporting pursuant to the requirements of the Sarbanes-Oxley Act of 2002 and rules and regulations of the SEC promulgated pursuant thereto. Our management reports on, and our independent registered public accounting firm attests to, the effectiveness of our internal controls over financial reporting, as required, in our annual report on Form 20-F. In addition, our management is required to report on our internal control over financial reporting, and our independent registered public accounting firm is required to provide its opinion concerning the report of our management, in accordance with the Financial Instruments and Exchange Act of Japan. To the extent any issues are identified through the foregoing processes, there can be no assurance that we will be able to address them in a timely manner or at all. Furthermore, even if our management concludes that our internal control over financial reporting are effective, our independent registered public accounting firm may still be unable to issue a report that concludes that our internal control over financial reporting are effective. In either case, we may lose investor confidence in the reliability of our financial statements.

15

Table of Contents

We are subject to risk of litigation and other legal proceedings.

As a financial institution engaging in banking and other financial businesses in and outside of Japan, we are subject to the risk of litigation for damages and other legal proceedings in the ordinary course of our business. Adverse developments related to future legal proceedings could have a material adverse effect on our financial condition and results of operations.

Our risk management policies and procedures may not adequately address unidentified or unanticipated risks.

We devote significant resources to strengthening our risk management policies and procedures. Despite this, and particularly in light of the rapid evolution of our operations, our policies and procedures designed to identify, monitor and manage risks may not be fully effective. Some of our methods of managing risks are based upon our use of observed historical market behavior. As a result, these methods may not accurately predict future risk exposures, which could be significantly greater than the historical measures indicate. If our risk management policies and procedures do not function effectively, our financial condition and results of operations could be materially and adversely affected.

Transactions with counterparties in Iran and other countries designated by the U.S. Department of State as state sponsors of terrorism may lead some potential customers and investors to avoid doing business with us or investing in our securities or have other adverse effects.

U.S. law generally prohibits U.S. persons from doing business with countries designated by the U.S. Department of State as state sponsors of terrorism (the “Designated Countries”), which currently includes Iran, Sudan and Syria and we maintain policies and procedures to comply with U.S. law. Our non-U.S. offices engage in transactions relating to the Designated Countries on a limited basis and in compliance with applicable laws and regulations, including trade financing with respect to our customers’ export or import transactions and maintenance of correspondent banking accounts. In addition, we maintain a representative office in Iran. We do not believe our operations relating to the Designated Countries are material to our business, financial condition or results of operations. We maintain policies and procedures to ensure compliance with applicable Japanese and U.S. laws and regulations.

The laws and regulations applicable to dealings involving the Designated Countries are subject to further strengthening or changes. If the U.S. government considers that our compliance measures are inadequate, we may be subject to regulatory action which could materially and adversely affect our business. In addition, we may become unable to retain or acquire customers or investors in our securities, or our reputation may suffer, potentially having adverse effects on our business or the price of our securities.

Our common stock may be subject to dilution as a result of conversion of our convertible preferred stock.

Holders of our eleventh series class XI preferred stock may convert their shares to common stock by requesting us to acquire such shares and issue or transfer common stock to them at any time between July 1, 2008 and June 30, 2016, with mandatory conversion on July 1, 2016. Due to the dilution of our common stock that occurs as a result of the increase in the number of outstanding shares of common stock upon such conversion, the price of our common stock could decline.

We may be subject to risks related to dividend distributions.

As a holding company, we rely on dividend payments from our banking and other subsidiaries for almost all of our income. As a result of restrictions, such as those on distributable amounts under Japan’s Companies Act, or otherwise, our banking and other subsidiaries may decide not to pay dividends to us. In addition, we may experience difficulty in making, or become unable to make, dividend payments to our shareholders and dividend or interest payments on capital securities issued by our group due to the deterioration of our results of operations

16

Table of Contents

and financial condition and/or the restrictions under the Companies Act or due to the strengthening of bank capital regulations. For more information on restrictions to dividend payments under the Companies Act, see “Item 10.B. Additional Information—Memorandum and Articles of Association.”

We may be adversely affected if economic or market conditions in Japan or elsewhere deteriorate.

We conduct business operations in Japan as well as overseas, including in the United States, Europe and Asia. If general economic conditions in Japan or other regions were to deteriorate or if the financial markets become subject to turmoil, we could experience weakness in our business, as well as deterioration in the quality of our assets. Future deterioration in general economic conditions or financial market turmoil could materially and adversely affect our financial condition and results of operations.

Amendments and other changes to the laws and regulations that are applicable to us could have an adverse effect on us.

We are subject to general laws, regulations and accounting rules applicable to our business activities in and outside of Japan. We are also subject to various laws and regulations applicable to financial institutions such as the Banking Act, including capital adequacy requirements, in and outside of Japan. If the laws and regulations that are applicable to us are amended or otherwise changed, such as in a way that restricts us from engaging in business activities that we currently conduct, our business, financial condition and results of operations could be materially and adversely affected.

Intensification of competition in the market for financial services in Japan could have an adverse effect on us.

Ongoing deregulation in Japan has lowered the barriers to entry with respect to the provision of banking, trust, securities and other financial services. While such deregulation has the effect of increasing our own business opportunities, it also allows other major financial groups, foreign financial institutions, non-bank finance companies, government-affiliated entities such as Japan Post Bank and other financial services providers to enter into new business areas or expand existing businesses, resulting in the intensification of competition in the financial services industry. If we are unable to respond effectively to current or future competition, our business, financial condition and results of operations could be adversely affected. In addition, intensifying competition and other factors could lead to reorganization within the financial services industry, and this could have an adverse effect on our competitive position or otherwise adversely affect the price of our securities.

Our business could be significantly disrupted due to natural disasters, accidents or other causes.

Our headquarters, branch offices, information technology centers, computer network connections and other facilities are subject to the risk of damage from natural disasters such as earthquakes and typhoons as well as from acts of terrorism and other criminal acts. In addition, our business could be materially disrupted as a result of an epidemic such as new or reemerging influenza infections. Our business, financial condition and results of operations could be adversely affected if our recovery efforts, including our implementation of contingency plans that we have developed such as establishing back-up offices, are not effective in preventing significant disruptions to our business operations caused by natural disasters and criminal acts. Additionally, massive natural disasters such as the March 2011 Great East Japan Earthquake may have various adverse effects, including a deterioration in economic conditions, declines in the business performance of many of our corporate customers and declines in stock prices. As a result, our financial condition and results of operations could be materially and adversely affected due to an increase in the amount of problem loans and credit-related costs as well as an increase in unrealized losses on, or losses from sales of, equity securities and financial products.

Negative rumors about us could have an adverse effect on us.

Our business depends on maintaining the trust of depositors and other customers and market participants. Negative rumors about us, spread through media coverage, communications between market participants,

17

Table of Contents

Internet postings or otherwise, could lead to our customers and market participants believing factually incorrect information about us and harm our reputation. In the event we are unable to dispel such rumors or otherwise restore our reputation, our business, financial condition, results of operations and the price of our securities could be materially and adversely affected.

Risks Related to Owning Our Shares

Rights of shareholders under Japanese law may be more limited than under the law of other jurisdictions.

Our articles of incorporation, our regulations of board of directors and Japan’s Companies Act govern our corporate affairs. Legal principles relating to such matters as the validity of corporate procedures, directors’ and officers’ fiduciary duties and shareholders’ rights may be different from or less clearly defined than those that would apply if we were incorporated in another jurisdiction. For example, under the Companies Act, only holders of 3% or more of the total voting rights or total outstanding shares are entitled to examine our accounting books and records. Shareholders’ rights under Japanese law may not be as extensive as shareholders’ rights under the law of jurisdictions within the United States or other countries. For more information on the rights of shareholders under Japanese law, see “Item 10.B. Additional Information—Memorandum and Articles of Association.”

It may not be possible for investors to effect service of process within the United States upon us or our directors, executive officers or senior management, or to enforce against us or those persons judgments obtained in U.S. courts predicated upon the civil liability provisions of the federal securities laws of the United States.

We are a joint stock corporation incorporated under the laws of Japan. Almost all of our directors, executive officers and senior management reside outside the United States. Many of the assets of us and these persons are located in Japan and elsewhere outside the United States. It may not be possible, therefore, for U.S. investors to effect service of process within the United States upon us or these persons or to enforce, against us or these persons, judgments obtained in the U.S. courts predicated upon the civil liability provisions of the federal securities laws of the United States. We believe that there is doubt as to the enforceability in Japan, in original actions or in actions to enforce judgments of U.S. courts, of claims predicated solely upon the federal securities laws of the United States.

Risks Related to Owning Our ADSs

As a holder of ADSs, you have fewer rights than a shareholder and you must act through the depositary to exercise these rights.

The rights of our shareholders under Japanese law to take actions such as voting their shares, receiving dividends and distributions, bringing derivative actions, examining our accounting books and records and exercising appraisal rights are available only to shareholders of record. Because the depositary, through its custodian, is the record holder of the shares underlying the ADSs, a holder of ADSs may not be entitled to the same rights as a shareholder. In your capacity as an ADS holder, you are not able to bring a derivative action, examine our accounting books and records or exercise appraisal rights, except through the depositary.

Foreign exchange rate fluctuations may affect the U.S. dollar value of our ADSs and dividends payable to holders of our ADSs.

Market prices for our ADSs may fall if the value of the yen declines against the U.S. dollar. In addition, the U.S. dollar amount of cash dividends and other cash payments made to holders of our ADSs would be reduced if the value of the yen declines against the U.S. dollar.

18

Table of Contents

| ITEM 4. | INFORMATION ON THE COMPANY |

4.A. History and Development of the Company

The Mizuho Group

The Mizuho group was created on September 29, 2000 through the establishment of Mizuho Holdings, Inc. as a holding company of our three predecessor banks, The Dai-Ichi Kangyo Bank, The Fuji Bank and The Industrial Bank of Japan. On October 1, 2000, the respective securities subsidiaries of the predecessor banks merged to form Mizuho Securities Co., Ltd. and the respective trust bank subsidiaries merged on the same date to form Mizuho Trust & Banking.

A further major step in the Mizuho group’s development occurred in April 2002 when the operations of our three predecessor banks were realigned through a corporate split and merger process under Japanese law into a wholesale banking subsidiary, the former Mizuho Corporate Bank, and a banking subsidiary serving primarily retail and small and medium-sized enterprise customers, the former Mizuho Bank. As an additional step for realigning the group structure, Mizuho Financial Group was established on January 8, 2003 as a corporation organized under the laws of Japan, and on March 12, 2003, it became the holding company for the Mizuho group through a stock-for-stock exchange with Mizuho Holdings, which became an intermediate holding company focused on management of the Mizuho group’s banking and securities businesses. The legal and commercial name of the company is Mizuho Financial Group, Inc.

In May 2003, we initiated a project to promote early corporate revitalization of customers in need of revitalization or restructuring and to separate the oversight of restructuring borrowers from the normal credit origination function. In July 2003, our three principal banking subsidiaries, the former Mizuho Corporate Bank, the former Mizuho Bank and Mizuho Trust & Banking each transferred loans, equity securities and other claims outstanding relating to approximately 950 companies to new subsidiaries that they formed. In October 2005, based on the significant reduction in the balance of impaired loans held by these new subsidiaries, which we call the “revitalization subsidiaries,” we deemed the corporate revitalization project to be complete, and each of the revitalization subsidiaries was merged into its respective banking subsidiary parent.

In the fiscal year ended March 31, 2006, we realigned our entire business operations into a Global Corporate Group, Global Retail Group and Global Asset and Wealth Management Group. In October 2005, in connection with this realignment, we established Mizuho Private Wealth Management Co., Ltd., a private banking subsidiary, and converted Mizuho Holdings on October 1, 2005 from an intermediate holding company into Mizuho Financial Strategy Co., Ltd., an advisory company that provides advisory services to financial institutions.

In May 2009, Mizuho Securities and Shinko Securities Co., Ltd. conducted their merger, with the aim of improving our service-providing capabilities to our clients and to offer competitive cutting-edge financial services on a global basis.

In September 2011, Mizuho Trust & Banking became a wholly-owned subsidiary of Mizuho Financial Group, Mizuho Securities became an unlisted subsidiary of the former Mizuho Corporate Bank and Mizuho Investors Securities became a wholly-owned subsidiary of the former Mizuho Bank, through their respective stock-for- stock exchanges. The purpose of these stock-for-stock exchanges is to further enhance the “group collective capabilities” by integrating group-wide business operations and optimizing management resources such as workforce and branch network.

In January 2013, Mizuho Securities and Mizuho Investors Securities merged in order to provide integrated securities services as the full-line securities company of the Mizuho group. Mizuho Securities aims to further strengthen collaboration among banking, trust banking and securities businesses of the group, expand the company’s customer base to enhance the domestic retail business, and rationalize and streamline management infrastructure.

19

Table of Contents

In April 2013, we turned Mizuho Securities, a consolidated subsidiary of Mizuho Financial Group, into a directly-held subsidiary of Mizuho Financial Group, whereby we moved to a new group capital structure, placing banking, trust banking, securities and other major group companies under the direct control of the holding company.

In July 2013, the former Mizuho Bank and the former Mizuho Corporate Bank merged, and the former Mizuho Corporate Bank, the surviving company, changed its trade name to Mizuho Bank, Ltd. The purpose of the merger is to become able to provide directly and promptly diverse and functional financial services to both the former Mizuho Bank and the former Mizuho Corporate Bank customers, utilizing the current “strengths” and “advantages” of the former Mizuho Bank and the former Mizuho Corporate Bank, and to continue to improve customer services by further enhancing group collaboration among the banking, trust and securities functions and, at the same time, to realize further enhancement of the consolidation of group-wide business operations and optimization of management resources, such as workforce and branch network, by strengthening group governance and improving group management efficiency.

Other Information

Our registered address is 1-5-5, Otemachi, Chiyoda-ku, Tokyo 100-8176, Japan, and our telephone number is +81-3-5224-1111.

General

We engage in banking, trust banking, securities and other businesses related to financial services.

Since the fiscal year 2013, we have been promoting “One MIZUHO New Frontier Plan—Stepping up to the Next Challenge—,” the three year medium-term business plan.

This medium-term business plan is a proactive plan aimed at launching the new Mizuho toward the “new frontier” of the next generation of finance, in response to structural and regulatory changes in the economy and society both in Japan and overseas. In the medium-term business plan, we have developed five basic policies reflecting our vision for our future, the necessary elements for the new frontier of finance and our future direction based on an analysis of our current situation, and to add more detail to these five basic policies, we have also developed ten basic strategies in terms of business strategy as well as business management and management foundations, etc., as follows.

Mizuho’s Vision

The most trusted financial services group with a global presence and a broad customer base, contributing to the prosperity of the world, Asia and Japan.

| • | The most trusted financial services group |

| • | The best financial services provider |

| • | The most cohesive financial services group |

Five Basic Policies

| • | Further develop integrated strategies across the group for each customer segment to respond to the diverse needs of our customers. |

| • | Contribute to sustainable development of the world and Japan by proactively responding to change. |

| • | Mizuho Means Asia: accelerate globalizations. |

20

Table of Contents

| • | Build strong financial and management foundations to support the essence of Mizuho. |

| • | Form strong corporate governance and culture in the spirit of One MIZUHO. |

Ten Basic Strategies

Business Strategy

| • | Strengthen integrated financial services by unifying banking, trust banking and securities functions to respond to finely delineated corporate and personal banking segments. |

| • | Perform consulting functions taking advantage of our industry and business knowledge and forward-looking perspective. |

| • | Support formation of personal financial assets in Japan and invigorate their investment. |

| • | Strengthen proactive risk-taking functions for growth industries and corporations. |

| • | Strengthen and expand Asia-related business in Japan and on a global basis. |

| • | Cultivate multi-level transactions by capturing the accelerating global capital and trade flows. |

Business Management, Management Foundations, etc.

| • | Strengthen stable financial foundations based on abundant liquidity and appropriate capital levels. |

| • | Establish the optimal management foundations (human resources and business infrastructure) to support business strategy. |

| • | Further strengthen proactive governance and risk management. |

| • | Embed the new Mizuho corporate identity toward forming a common culture throughout the group and take actions toward becoming the best financial services provider. |

During the fiscal year 2014, the second fiscal year of the medium-term business plan, we have been striving to realize our commitment to become the most trusted financial services group.

Specifically, we have pursued unified strategies across the group-wide banking, trust banking and securities business areas with the intent of developing the cross-organizational financial know-how and industry knowledge of the group companies and thereby providing various financial services in a prompt manner through group-wide collaboration in response to various customer needs.

In addition, together with regional financial institutions, we have undertaken various regional revitalization activities, which include regional economic revitalization. We have also actively executed our policies to achieve even greater progress through, among other things, the execution of an agreement for the acquisition of a credit portfolio in respect of the wholesale market in North America from The Royal Bank of Scotland Group plc and the launch of preparations and discussions for integrating the asset management group companies in order to strengthen our asset management business.

With respect to corporate governance, we have endeavored to establish a corporate governance structure suitable for a global systemically important financial institution (“G-SIFI”), such as strengthening the functions of the holding company, as well as transforming Mizuho Financial Group into a Company with Three Committees (a Company with Committees under the Companies Act before the amendments thereto became effective as of May 1, 2015) in June 2014.

With respect to legal compliance, in conjunction with further enhancing its framework for the severance of business relations with anti-social elements, Mizuho Financial Group has intensified various efforts, including countermeasures against money laundering and terrorist financing.

21

Table of Contents

We consider the fiscal year ending March 31, 2016, which is the last fiscal year of the medium-term business plan, to be the year to concentrate our efforts on strengthening our competitive advantage and will further advance the unified strategies across the group-wide banking, trust banking and securities business areas in order to realize the purpose of the plan. At the same time, we will strive to further strengthen our corporate governance.