UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| [X] |

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended June 30, 2014 |

| [_] |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

For the transition period from ____________

to ______________

Commission file number: 333-139117

EPAZZ, Inc.

(Exact name of registrant

as specified in its charter)

| Illinois |

36-4313571 |

|

(State or other jurisdiction of

incorporation or organization) |

(IRS Employer Identification No.) |

205 W. Wacker Drive. Suite 1320

Chicago, IL 60606

(Address of principal executive offices)

(312) 955-8161

(Registrant's telephone number)

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes [X] No [_]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes [X] No [_]

Indicate by check mark whether the registrant is a large accelerated

filer, and accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [_] |

|

Accelerated filer [_] |

| Non-accelerated filer [_] |

|

Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act.

Yes [_] No [X]

The number of shares of the issuer’s Class A common stock

outstanding as of September 29, 2014, was 7,213,383,508 shares, par value $0.0001 per share.

EPAZZ, INC.

FORM 10-Q

Quarterly Period Ended June 30, 2014

| |

Page |

| |

|

| INDEX |

|

| |

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

|

| PART I. FINANCIAL INFORMATION |

2 |

| Item 1. |

Financial Statements |

2 |

| |

Balance Sheets as of June 30, 2014 (Unaudited) and December 31, 2013 |

2 |

| |

Statements of Operations for the Three and Six Months ended June 30, 2014 and 2013 (Unaudited) |

3 |

| |

Statements of Cash Flows for the Three and Six Months ended June 30, 2014 and 2013 (Unaudited) |

4 |

| |

Notes to the Condensed Consolidated Financial Statements (Unaudited) |

5 |

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

47 |

| Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

58 |

| Item 4. |

Controls and Procedures |

58 |

| |

|

|

| PART II. OTHER INFORMATION |

59 |

| Item 1. |

Legal Proceedings |

59 |

| Item 1A. |

Risk Factors |

59 |

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

59 |

| Item 3. |

Defaults Upon Senior Securities |

60 |

| Item 4. |

Mine Safety Disclosures |

60 |

| Item 5. |

Other Information |

60 |

| Item 6. |

Exhibits |

61 |

| |

|

|

| SIGNATURES |

63 |

EPAZZ, INC.

CONDENSED CONSOLIDATED

BALANCE SHEETS

| | |

June 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| Assets | |

(Unaudited) | | |

| |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 101,871 | | |

$ | 208,567 | |

| Accounts receivable, net | |

| 71,762 | | |

| 25,248 | |

| Other current assets | |

| 65,396 | | |

| 106,114 | |

| Total current assets | |

| 239,029 | | |

| 339,929 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 130,973 | | |

| 113,410 | |

| Intangible assets, net | |

| 476,418 | | |

| 374,162 | |

| Goodwill | |

| 1,149,041 | | |

| 255,460 | |

| | |

| | | |

| | |

| Total assets | |

$ | 1,995,461 | | |

$ | 1,082,961 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity (Deficit) | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Dividends payable | |

$ | 11,000 | | |

$ | 11,000 | |

| Accounts payable | |

| 312,005 | | |

| 258,163 | |

| Accrued expenses | |

| 55,193 | | |

| 45,298 | |

| Accrued expenses, related parties | |

| 47,681 | | |

| 28,741 | |

| Deferred revenue | |

| 496,510 | | |

| 322,130 | |

| Lines of credit | |

| 86,544 | | |

| 73,232 | |

| Current maturities of capital lease obligations payable | |

| 4,987 | | |

| 17,421 | |

| Current maturities of notes payable, related parties ($841,618 currently in default) | |

| 930,868 | | |

| 397,368 | |

| Convertible debts, net of discounts of $1,112 and

$105,300, respectively ($119,275 currently in default) | |

| 151,163 | | |

| 115,128 | |

| Current maturities of long term debts | |

| 612,898 | | |

| 354,786 | |

| Total current liabilities | |

| 2,708,849 | | |

| 1,623,267 | |

| | |

| | | |

| | |

| Capital lease obligations payable, net of current maturities | |

| 3,174 | | |

| – | |

| Notes payable, related parties | |

| – | | |

| 85,000 | |

| Convertible debts, net of discounts of $-0- and $4,283, respectively | |

| – | | |

| 42,166 | |

| Long term debts, net of current maturities | |

| 1,039,472 | | |

| 857,143 | |

| Total liabilities | |

| 3,751,495 | | |

| 2,607,576 | |

| | |

| | | |

| | |

| Stockholders' equity (deficit): | |

| | | |

| | |

| Convertible preferred stock, Series A, $0.0001 par value, 1,000 shares authorized, 1,000 shares issued and outstanding |

|

|

– |

|

|

|

– |

|

| Convertible preferred stock, Series B, $0.0001 par value, 1,000 shares authorized, 1,000 shares issued and outstanding |

|

|

– |

|

|

|

– |

|

| Convertible preferred stock, Series C, $0.0001 par

value, 3,000,000,000 shares authorized, 2,924,722,200 shares issued and outstanding at June 30, 2014 |

|

|

292,472 |

|

|

|

– |

|

| Common stock, Class A, $0.0001 par value, 6,000,000,000 shares authorized, 6,796,730,730 and 3,468,358,708 shares issued and outstanding, respectively |

|

|

679,673 |

|

|

|

346,836 |

|

| Convertible common stock, Class B, $0.0001 par value, 60,000,000 shares authorized, 23,000,000 and 10,500,000 shares issued and outstanding, respectively |

|

|

2,300 |

|

|

|

1,050 |

|

| Additional paid in capital | |

| 9,240,766 | | |

| 6,429,493 | |

| Stockholders' payable, consisting of 19,000,000 shares of Series C Convertible Preferred Stock and 28,875,000 shares of Class A Common Stock at June 30, 2014 |

|

|

26,353 |

|

|

|

– |

|

| Stockholders' receivable, consisting of -0- and 20,000,000 shares of Class A Common Stock, respectively |

|

|

– |

|

|

|

(800,000 |

) |

| Accumulated deficit | |

| (11,997,598 | ) | |

| (7,501,994 | ) |

| Total stockholders' equity (deficit) | |

| (1,756,034 | ) | |

| (1,524,615 | ) |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity (deficit) | |

$ | 1,995,461 | | |

$ | 1,082,961 | |

See accompanying notes to financial statements.

EPAZZ, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

For the Three Months Ended | | |

For the Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 327,525 | | |

$ | 279,119 | | |

$ | 580,077 | | |

$ | 487,129 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 278,446 | | |

| 166,403 | | |

| 570,139 | | |

| 287,634 | |

| Salaries and wages | |

| 108,502 | | |

| 1,555,081 | | |

| 2,444,999 | | |

| 1,771,234 | |

| Depreciation and amortization | |

| 51,398 | | |

| 67,385 | | |

| 97,555 | | |

| 144,160 | |

| Bad debts (recoveries) | |

| (5,250 | ) | |

| 45 | | |

| (5,262 | ) | |

| (8,740 | ) |

| Total operating expenses | |

| 433,096 | | |

| 1,788,914 | | |

| 3,107,431 | | |

| 2,194,288 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net operating loss | |

| (105,571 | ) | |

| (1,509,795 | ) | |

| (2,527,354 | ) | |

| (1,707,159 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 1 | | |

| – | | |

| 55 | | |

| – | |

| Interest expense | |

| (501,712 | ) | |

| (143,543 | ) | |

| (1,017,777 | ) | |

| (262,958 | ) |

| Loss on debt modifications, related parties | |

| (172,864 | ) | |

| (14,240 | ) | |

| (172,864 | ) | |

| (96,032 | ) |

| Change in derivative liabilities | |

| 15,915 | | |

| – | | |

| (777,664 | ) | |

| – | |

| Total other income (expense) | |

| (658,660 | ) | |

| (157,783 | ) | |

| (1,968,250 | ) | |

| (358,990 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (764,231 | ) | |

$ | (1,667,578 | ) | |

$ | (4,495,604 | ) | |

$ | (2,066,149 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares | |

| | | |

| | | |

| | | |

| | |

| outstanding - basic and fully diluted | |

| 5,939,090,272 | | |

| 2,045,979,796 | | |

| 4,783,826,881 | | |

| 1,666,897,778 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and fully diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

See accompanying notes to financial statements.

EPAZZ, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

For the Six Months Ended | |

| | |

June 30, | |

| | |

2014 | | |

2013 | |

| Cash flows from operating

activities | |

| | | |

| | |

| Net loss | |

$ | (4,495,604 | ) | |

$ | (2,066,149 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Bad debts (recoveries) | |

| (5,262 | ) | |

| (8,740 | ) |

| Depreciation and amortization | |

| 25,949 | | |

| 56,837 | |

| Amortization of intangible

assets | |

| 71,606 | | |

| 87,324 | |

| Amortization of deferred

financing costs | |

| 233,277 | | |

| 19,905 | |

| Amortization of discounts

on convertible debts | |

| 495,683 | | |

| 128,612 | |

| Loss on debt modifications,

related parties | |

| 172,864 | | |

| 96,032 | |

| Loss on default provisions

of convertible debt | |

| 77,375 | | |

| – | |

| Change in fair market value

of derivative liabilities | |

| 777,664 | | |

| – | |

| Stock based compensation

issued for services | |

| 37,500 | | |

| – | |

| Stock based compensation

issued for services, related parties | |

| 2,243,402 | | |

| 1,522,000 | |

| Decrease (increase) in assets: | |

| | | |

| | |

| Accounts receivable | |

| 1,130 | | |

| (29,759 | ) |

| Other current assets | |

| 42,835 | | |

| 1,743 | |

| Increase (decrease)

in liabilities: | |

| | | |

| | |

| Accounts payable | |

| 44,656 | | |

| 41,662 | |

| Accrued expenses | |

| 20,085 | | |

| (2,914 | ) |

| Accrued expenses,

related parties | |

| 54,002 | | |

| 10,536 | |

| Deferred

revenues | |

| (74,059 | ) | |

| (30,252 | ) |

| Net

cash used in operating activities | |

| (276,897 | ) | |

| (173,163 | ) |

| | |

| | | |

| | |

| Cash flows from investing

activities | |

| | | |

| | |

| Cash acquired in merger | |

| 736 | | |

| – | |

| Purchase of equipment | |

| (43,512 | ) | |

| (1,697 | ) |

| Acquisition of subsidiaries | |

| (482,945 | ) | |

| – | |

| Net cash used in

investing activities | |

| (525,721 | ) | |

| (1,697 | ) |

| | |

| | | |

| | |

| Cash flows from financing

activities | |

| | | |

| | |

| Payments on capital

lease obligations payable | |

| (9,260 | ) | |

| (9,713 | ) |

| Proceeds from notes payable,

related parties | |

| 675,152 | | |

| 203,950 | |

| Repayment of notes payable,

related parties | |

| (82,879 | ) | |

| (119,167 | ) |

| Proceeds from convertible

notes | |

| – | | |

| 30,000 | |

| Repayment of convertible

notes | |

| (1,500 | ) | |

| (27,500 | ) |

| Proceeds from long term

debts | |

| 345,696 | | |

| 271,095 | |

| Repayment

of long term debts | |

| (231,287 | ) | |

| (172,719 | ) |

| Net cash provided

by financing activities | |

| 695,922 | | |

| 175,946 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| (106,696 | ) | |

| 1,086 | |

| Cash - beginning | |

| 208,567 | | |

| 46,101 | |

| Cash - ending | |

$ | 101,871 | | |

$ | 47,187 | |

| | |

| | | |

| | |

| Supplemental disclosures: | |

| | | |

| | |

| Interest

paid | |

$ | 187,563 | | |

$ | 106,869 | |

| Income

taxes paid | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Acquisition

of subsidiary in exchange for debt | |

$ | 312,000 | | |

$ | – | |

| Value of shares issued

for conversion of debt | |

$ | 533,360 | | |

$ | 120,160 | |

| Value

of shares issued for conversion of debt, related parties | |

$ | 112,183 | | |

$ | 100,239 | |

| Discount

on beneficial conversion feature of convertible debt | |

$ | 35,028 | | |

$ | 33,000 | |

| Discount

on derivatives | |

$ | 422,240 | | |

$ | – | |

| Deferred

financing costs | |

$ | 235,394 | | |

$ | 32,076 | |

| Value

of derivative adjustment due to debt conversions | |

$ | 1,199,904 | | |

$ | – | |

| Dividends

payable declared | |

$ | – | | |

$ | 18,000 | |

See accompanying notes to financial statements.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 – Basis of Presentation and Consolidation

The interim condensed consolidated financial

statements of Epazz, Inc. (“Epazz” or the “Company”), an Illinois corporation, included herein, presented

in accordance with United States generally accepted accounting principles and stated in US dollars, have been prepared by the Company,

without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote

disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have

been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate

to not make the information presented misleading.

These statements reflect all adjustments,

which in the opinion of management, are necessary for fair presentation of the information contained therein. Except as otherwise

disclosed, all such adjustments are of a normal recurring nature. It is suggested that these interim condensed financial statements

be read in conjunction with the financial statements of the Company for the year ended December 31, 2013 and notes thereto included

in the Company's 10-K annual report. The Company follows the same accounting policies in the preparation of interim reports.

Principles of Consolidation

The accompanying condensed consolidated

financial statements include the accounts of the following entities, all of which are under common control and ownership:

| |

|

State of |

|

|

|

Abbreviated |

| Name of Entity(2) |

|

Incorporation |

|

Relationship(1) |

|

Reference |

| Epazz, Inc. |

|

Illinois |

|

Parent |

|

Epazz |

| IntelliSys, Inc. |

|

Wisconsin |

|

Subsidiary |

|

IntelliSys |

| Professional Resource Management, Inc. |

|

Illinois |

|

Subsidiary |

|

PRMI |

| Desk Flex, Inc. |

|

Illinois |

|

Subsidiary |

|

DFI |

| K9 Bytes, Inc. |

|

Illinois |

|

Subsidiary |

|

K9 Bytes |

| MS Health, Inc. |

|

Illinois |

|

Subsidiary |

|

MS Health |

| Terran Power, Inc.(5) |

|

Illinois |

|

Subsidiary |

|

Terran |

| Telecorp Products, Inc. |

|

Michigan |

|

Subsidiary |

|

Telecorp |

| Jadian, Inc. |

|

Illinois |

|

Subsidiary |

|

Jadian |

| FlexFridge, Inc.(3) |

|

Illinois |

|

Subsidiary(4) |

|

FlexFridge |

______________

(1)All subsidiaries, with the

exception of FlexFridge, are wholly-owned subsidiaries.

(2)All entities are in the form

of Corporations.

(3)Formerly Z Fridge, Inc. and

Cooling Technology Solutions, Inc.

(4)FlexFridge, Inc. was spun-off

on November 21, 2013, and distributed on a 1:10 basis to shareholders of record on September 15, 2013. Epazz has a controlling

financial interest in FlexFridge. As such, FlexFridge is consolidated within these financial statements pursuant to Accounting

Standards Codification (“ASC”) 810-10. There has been no material activity within FlexFridge to date.

(5)Entity formed for prospective

purposes, but has not incurred any income or expenses to date.

The condensed consolidated financial statements

herein contain the operations of the wholly-owned subsidiaries listed above. All significant inter-company transactions have been

eliminated in the preparation of these financial statements. The parent company, Epazz and subsidiaries, IntelliSys, PRMI, DFI,

K9 Bytes, MS Health, Terran, Telecorp, Jadian and FlexFridge will be collectively referred to herein as the “Company”,

or “Epazz”. The Company's headquarters are located in Chicago, Illinois and substantially all of its customers are

within the United States.

These statements reflect all adjustments,

consisting of normal recurring adjustments, which in the opinion of management are necessary for fair presentation of the information

contained therein.

Segment Reporting

FASB ASC 280-10-50 requires annual and

interim reporting for an enterprise’s operating segments and related disclosures about its products, services, geographic

areas and major customers. An operating segment is defined as a component of an enterprise that engages in business activities

from which it may earn revenues and expenses, and about which separate financial information is regularly evaluated by the chief

operating decision maker in deciding how to allocate resources. All of the Company’s software products are considered operating

segments, and will be aggregated into one reportable segment given the similarities in economic characteristics among the operations

represented by the common nature of the products, customers and methods of distribution.

Reclassifications

Certain amounts in the financial statements

of the prior year have been reclassified to conform to the presentation of the current year for comparative purposes.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Use of Estimates

The preparation of financial statements

in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements

and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

Under FASB ASC 820-10-05, the Financial

Accounting Standards Board establishes a framework for measuring fair value in generally accepted accounting principles and expands

disclosures about fair value measurements. This Statement reaffirms that fair value is the relevant measurement attribute. The

adoption of this standard did not have a material effect on the Company’s financial statements as reflected herein. The carrying

amounts of cash, accounts payable and accrued expenses reported on the balance sheets are estimated by management to approximate

fair value primarily due to the short term nature of the instruments. The Company had debt instruments that required fair value

measurement on a recurring basis.

Intangible Assets

Intangible assets are amortized using the

straight-line method over their estimated period of benefit of five to fifteen years. We evaluate the recoverability of intangible

assets periodically and take into account events or circumstances that warrant revised estimates of useful lives or that indicate

that impairment exists. All of our intangible assets are subject to amortization. No material impairments of intangible assets

have been identified during any of the periods presented. Amortization expense on intangible assets totaled $71,606 and $87,324

for the six months ended June 30, 2014 and 2013, respectively.

Goodwill

The Company evaluates the carrying value

of goodwill during the fourth quarter of each year and between annual evaluations if events occur or circumstances change that

would more likely than not reduce the fair value of the reporting unit below its carrying amount. Such circumstances could include,

but are not limited to (1) a significant adverse change in legal factors or in business climate, (2) unanticipated competition,

or (3) an adverse action or assessment by a regulator. When evaluating whether goodwill is impaired, the Company compares the fair

value of the reporting unit to which the goodwill is assigned to the reporting unit's carrying amount, including goodwill. The

fair value of the reporting unit is estimated using a combination of the income, or discounted cash flows, approach and the market

approach, which utilizes comparable companies' data. If the carrying amount of a reporting unit exceeds its fair value, then the

amount of the impairment loss must be measured. The impairment loss would be calculated by comparing the implied fair value of

reporting unit goodwill to its carrying amount. In calculating the implied fair value of reporting unit goodwill, the fair value

of the reporting unit is allocated to all of the other assets and liabilities of that unit based on their fair values. The excess

of the fair value of a reporting unit over the amount assigned to its other assets and liabilities is the implied fair value of

goodwill. An impairment loss would be recognized when the carrying amount of goodwill exceeds its implied fair value. The Company's

evaluation of goodwill completed during the year ended December 31, 2013 resulted in no impairment losses.

Beneficial Conversion Features

From time to time, the Company may issue

convertible notes that may contain an imbedded beneficial conversion feature. A beneficial conversion feature exists on the date

a convertible note is issued when the fair value of the underlying common stock to which the note is convertible into is in excess

of the remaining unallocated proceeds of the note after first considering the allocation of a portion of the note proceeds to the

fair value of warrants, if related warrants have been granted. The intrinsic value of the beneficial conversion feature is recorded

as a debt discount with a corresponding amount to additional paid in capital. The debt discount is amortized to interest expense

over the life of the note using the effective interest method.

Derivative Liability

The Company evaluates its convertible instruments,

options, warrants or other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives

to be separately accounted for under ASC Topic 815, “Derivatives and Hedging.” The result of this accounting treatment

is that the fair value of the derivative is marked-to-market each balance sheet date and recorded as a liability. In the event

that the fair value is recorded as a liability, the change in fair value is recorded in the statement of operations as other income

(expense). Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date

and then that fair value is reclassified to equity. Equity instruments that are initially classified as equity that become subject

to reclassification under ASC Topic 815 are reclassified to liabilities at the fair value of the instrument on the reclassification

date. We analyzed the derivative financial instruments (the Convertible Note and tainted Warrant), in accordance with ASC 815.

The objective is to provide guidance for determining whether an equity-linked financial instrument is indexed to an entity’s

own stock. This determination is needed for a scope exception which would enable a derivative instrument to be accounted for under

the accrual method. The classification of a non-derivative instrument that falls within the scope of ASC 815-40-05 “Accounting

for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock” also hinges on

whether the instrument is indexed to an entity’s own stock. A non-derivative instrument that is not indexed to an entity’s

own stock cannot be classified as equity and must be accounted for as a liability. There is a two-step approach in determining

whether an instrument or embedded feature is indexed to an entity’s own stock. First, the instrument's contingent exercise

provisions, if any, must be evaluated, followed by an evaluation of the instrument's settlement provisions. The Company utilized

multinomial lattice models that value the derivative liability within the notes based on a probability weighted discounted cash

flow model. The Company utilized the fair value standard set forth by the Financial Accounting Standards Board, defined as the

amount at which the assets (or liability) could be bought (or incurred) or sold (or settled) in a current transaction between willing

parties, that is, other than in a forced or liquidation sale.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Basic and Diluted Net Earnings per Share

Basic net earnings (loss) per common share

is computed by dividing net earnings (loss) applicable to common shareholders by the weighted-average number of common shares outstanding

during the period. Diluted net earnings (loss) per common share is determined using the weighted-average number of common shares

outstanding during the period, adjusted for the dilutive effect of common stock equivalents, consisting of shares that might be

issued upon exercise of common stock options. In periods where losses are reported, the weighted-average number of common shares

outstanding excludes common stock equivalents, because their inclusion would be anti-dilutive. There were no outstanding potential

common stock equivalents for the periods presented. As such, basic and diluted earnings per share resulted in the same figure for

the six months ending June 30, 2014 and 2013.

Stock-Based

Compensation

Under FASB ASC 718-10-30-2, all share-based

payments to employees, including grants of employee stock options, are to be recognized in the income statement based on their

fair values. Pro forma disclosure is no longer an alternative. Common stock issued for services and compensation was $2,280,902

and $1,522,000 for the six months ended June 30, 2014 and 2013, respectively.

Revenue Recognition

The Company designs and sells various software

programs to business enterprises including, among others, hospitals, pet stores, and Government and post-secondary institutions.

Prior to shipment, each software product is tested extensively to meet Company specifications. The software is shipped fully functional

via electronic delivery, but some installation and setup is required. No other entities sell the same or largely interchangeable

software.

Installation is a standard process, outlined

in the owner's manual, consisting principally of setup, calibrating, and testing the software. A purchaser of the software could

complete the process using the information in the owner's manual, although it would probably take significantly longer than it

would take the Company’s technicians to perform the tasks. Although other vendors do not install the Company’s software,

they do provide largely interchangeable installation services for a fee. Historically, the Company has never sold the software

without installation. Most installations are performed by the Company within 7 to 24 days of shipment and are included in the overall

sales price of the software. In addition, the customer must pay for support contracts and training packages, depending on their

desired level of service. The Company is the only manufacturer of the software and it only sells software on a standalone basis

directly to the end user.

The sales price of the arrangement consists

of the software, installation, and training and support services, which the customer is obligated to pay in full upon delivery

of the software. In addition, there are no general rights of return involved in these arrangements. Therefore, the software is

accounted for as a separate unit of accounting.

The Company does not have vendor-specific

objective evidence of selling price for the software because it does not sell the software separately (without installation services

and support contracts). In addition, third-party evidence of selling price does not exist as no vendor separately sells the same

or largely interchangeable software. Therefore, the Company uses its best estimate of selling price when allocating such arrangement

consideration.

In estimating its selling price for the

software, the Company considers the cost to produce the software, profit margin for similar arrangements, customer demand, effect

of competitors on the Company’s software, and other market constraints. When applying the relative selling price method,

the Company uses its best estimate of selling price for the software, and third-party evidence of selling price for the installation.

Accordingly, without considering whether any portion of the amount allocable to the software is contingent upon delivery of the

other items, the Company allocates the selling price to the software, support, and installation.

The Company doesn’t currently provide

product warranties, but if it does in the future it will provide for specific product lines and accrue for estimated future warranty

costs in the period in which the revenue is recognized.

Recent Accounting Pronouncements

In June 2014, the Financial Accounting

Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2014-12, Compensation – Stock Compensation (Topic

718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after

the Requisite Service Period. The new guidance requires that share-based compensation that require a specific performance target

to be achieved in order for employees to become eligible to vest in the awards and that could be achieved after an employee completes

the requisite service period be treated as a performance condition. As such, the performance target should not be reflected in

estimating the grant-date fair value of the award. Compensation costs should be recognized in the period in which it becomes probable

that the performance target will be achieved and should represent the compensation cost attributable to the period(s) for which

the requisite service has already been rendered. If the performance target becomes probable of being achieved before the end of

the requisite service period, the remaining unrecognized compensation cost should be recognized prospectively over the remaining

requisite service period. The total amount of compensation cost recognized during and after the requisite service period should

reflect the number of awards that are expected to vest and should be adjusted to reflect those awards that ultimately vest. The

requisite service period ends when the employee can cease rendering service and still be eligible to vest in the award if the performance

target is achieved. This new guidance is effective for fiscal years and interim periods within those years beginning after December

15, 2015. Early adoption is permitted. Entities may apply the amendments in this Update either (a) prospectively to all awards

granted or modified after the effective date or (b) retrospectively to all awards with performance targets that are outstanding

as of the beginning of the earliest annual period presented in the financial statements and to all new or modified awards thereafter.

The adoption of ASU 2014-12 is not expected to have a material impact on our financial position or results of operations.

In June 2014, the FASB issued ASU No. 2014-10:

Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable

Interest Entities Guidance in Topic 810, Consolidation, to improve financial reporting by reducing the cost and complexity

associated with the incremental reporting requirements of development stage entities. The amendments in this update remove all

incremental financial reporting requirements from U.S. GAAP for development stage entities, thereby improving financial reporting

by eliminating the cost and complexity associated with providing that information. The amendments in this Update also eliminate

an exception provided to development stage entities in Topic 810, Consolidation, for determining whether an entity is a variable

interest entity on the basis of the amount of investment equity that is at risk. The amendments to eliminate that exception simplify

U.S. GAAP by reducing avoidable complexity in existing accounting literature and improve the relevance of information provided

to financial statement users by requiring the application of the same consolidation guidance by all reporting entities. The elimination

of the exception may change the consolidation analysis, consolidation decision, and disclosure requirements for a reporting entity

that has an interest in an entity in the development stage. The amendments related to the elimination of inception-to-date information

and the other remaining disclosure requirements of Topic 915 should be applied retrospectively except for the clarification to

Topic 275, which shall be applied prospectively. For public companies, those amendments are effective for annual reporting periods

beginning after December 15, 2014, and interim periods therein. Early adoption is permitted. The adoption of ASU 2014-10 is not

expected to have a material impact on our financial position or results of operations.

Note 2 – Going Concern

As shown in the accompanying condensed

consolidated financial statements, the Company has incurred recurring losses from operations resulting in an accumulated deficit

of $11,997,598, and as of June 30, 2014, the Company’s current liabilities exceeded its current assets by $2,469,820 and

its total liabilities exceeded its total assets by $1,756,034. These factors raise substantial doubt about the Company’s

ability to continue as a going concern.

The financial statements do not include

any adjustments that might result from the outcome of any uncertainty as to the Company’s ability to continue as a going

concern. These financial statements also do not include any adjustments relating to the recoverability and classification of recorded

asset amounts, or amounts and classifications of liabilities that might be necessary should the Company be unable to continue as

a going concern.

Note 3 – Subsidiary Formation

Formation of Subsidiary – Terran

Power, Inc., September 19, 2013

On September 19, 2013, the Board of Directors,

consisting solely of Shaun Passley, Ph.D., the Company’s majority shareholder, approved the formation of a new wholly-owned

subsidiary of the Company named Terran Power, Inc. The Company plans to file a non-provisional patent application to develop a

mobile power device that allows iPhone and other smartphone users to power up their phone on the go without needing an outlet or

a second battery, however, as of the date of this filing there has been no activity and, as such, there are no revenues or expenses.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Subsidiary Formation – FlexFridge,

Inc., March 4, 2013

On March 4, 2013, the Board of Directors

of Epazz, Inc. (the “Company”), consisting solely of Shaun Passley, Ph.D., the Company’s majority shareholder,

approved the formation of a new wholly-owned subsidiary of the Company named Cooling Technology Solutions, Inc., which was later

renamed, Z Fridge, Inc., and ultimately again renamed as, FlexFridge, Inc. (“FlexFridge”) on May 29, 2014.

The Company has filed a non-provisional patent application for its Project Flex product, which consists of a patent pending foldable

mini-fridge. On November 21, 2013, the Company was spun off to shareholders of record on September 15, 2013, whereby shareholders

of Epazz, Inc. received one (1) share of FlexFridge in exchange for each ten (10) shares held of Epazz, Inc. Epazz has a controlling

financial interest in FlexFridge. As such, FlexFridge is consolidated within these financial statements pursuant to Accounting

Standards Codification (“ASC”) 810-10. There has been no material activity within FlexFridge to date.

Note 4 – Mergers and Acquisitions

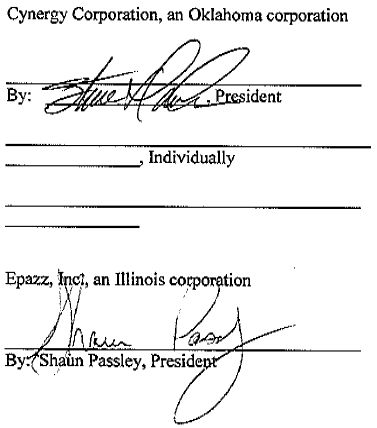

Zinergy (DBA) formerly Cynergy Software,

Asset Purchase

On April 4, 2014, we closed on a March

13, 2014 Asset Purchase Agreement with Cynergy Corporation, an Oklahoma corporation (“Cynergy”). Pursuant to the Purchase

Agreement, we purchased substantially all of the intangible assets and certain tangible assets used in connection with Cynergy’s

help desk software business, including all of its intellectual property, its business trademarks and copyrights, equipment, computers,

software, machinery and accounts receivable in consideration for an aggregate of $75,000, of which $25,000 was paid at the closing,

$25,000 was paid within fifteen (15) days after the closing and the remaining $25,000 was paid within forty (40) days after the

closing. We did not purchase and Cynergy agreed to retain and be responsible for any and all liabilities of Cynergy Corporation.

The acquisition was financed in part with a software financing agreement. The financing agreement has a lien against the software

assets of Zinergy.

Zinergy Service Desk Software is very customizable

for business processes. Zinergy integrates with just about every other business tool available. Help Desk Support Software, Help

Desk Ticketing Software, Customer Support Software, HRIS Ticketing Solution and much more.

This acquisition

was accounted for as a business combination under the purchase method of accounting, given that substantially all of the Company’s

assets and ongoing operations were acquired. The purchase resulted in $65,139 of goodwill. According to the purchase method of

accounting, the Company recognized the identifiable assets acquired and liabilities assumed as follows:

| | |

April 4, | |

| | |

2014 | |

| Consideration: | |

| | |

| Cash paid at, and prior to, closing | |

$ | 75,000 | |

| | |

| | |

| Fair value of identifiable assets acquired assumed: | |

| | |

| Software | |

$ | 8,035 | |

| Trade name | |

| 1,826 | |

| Total fair value of assets assumed | |

| 9,861 | |

| Consideration paid in excess of fair value (Goodwill)(1) | |

$ | 65,139 | |

_________

(1) The consideration paid in excess of the net fair value of assets acquired and liabilities assumed has been recognized as goodwill.

Management believes the product line of

Cynergy, software and other assets acquired will enable the Company to enhance their business model and strengthen its future cash

flows to fund operations and take advantage of additional growth opportunities.

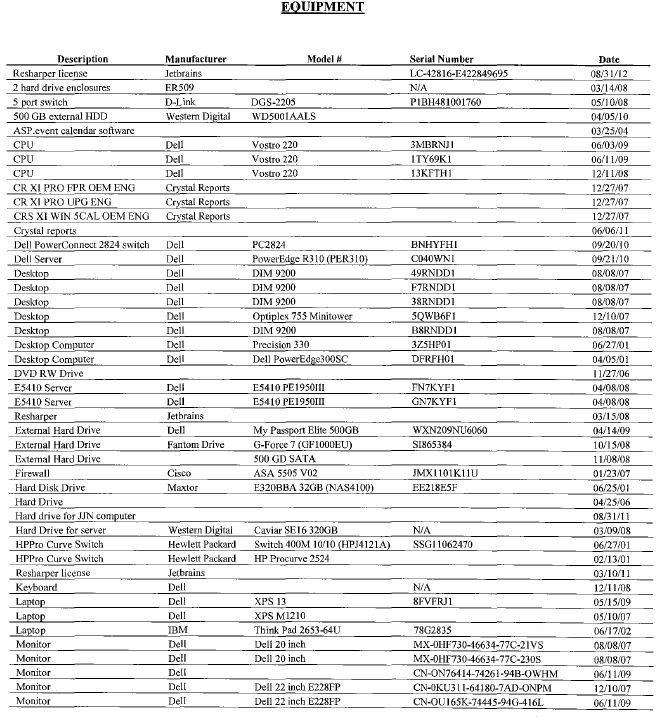

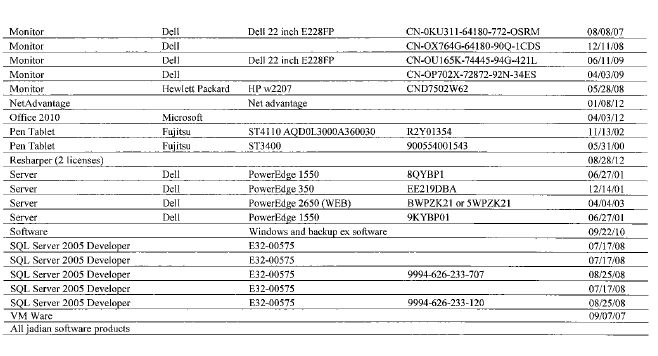

Jadian Enterprises, Inc., Asset Purchase

Agreement

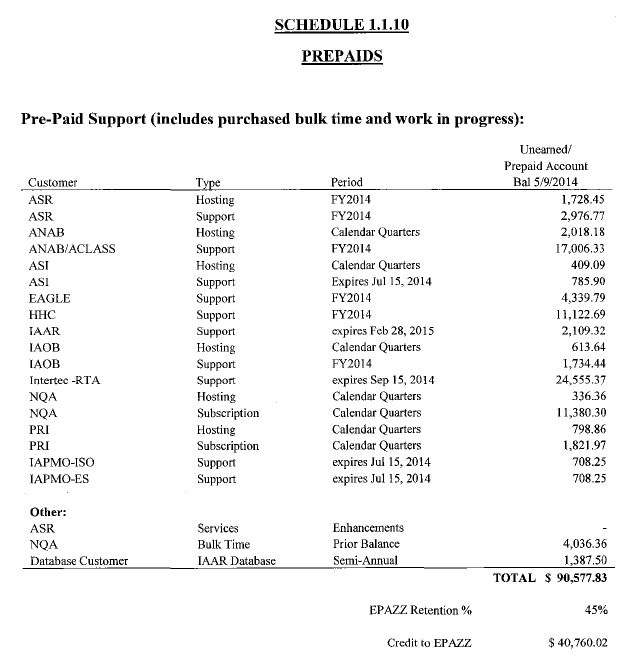

On May 9, 2014, the Company, through a

newly-formed wholly-owned Illinois subsidiary, Jadian Enterprises, Inc. (“Jadian Enterprises”), closed on an Asset

Purchase Agreement (“APA”) with Jadian, Inc., a Michigan corporation (“Jadian”). Pursuant to the APA, we

purchased substantially all of the intangible assets and certain tangible assets used in connection with Jadian’s software

business, including all of its intellectual property, its business trademarks and copyrights, equipment, computers, software, machinery

and accounts receivable in consideration for an aggregate of $425,000, of which $207,945 was paid at the closing, $7,055 was settled

as a result of certain offsets, including an offset for $40,760 for prepaid maintenance contracts received by the seller prior

to Closing, as diminished by a credit for Accounts Receivable of $33,705, and $210,000 was financed by way of a Promissory Note

(the “Jadian Note”). The terms of the Jadian Note include interest at 6% per annum, a ten (10) year amortization, full

right of offset, no payments of either principal or interest for thirty (30) days after Closing and equal payments of principal

and interest commencing thereafter, no prepayment penalty, and a balloon payment consisting of full payment of all amounts due

after three (3) years. The Jadian Note is secured by a lien on the assets of Jadian. We did not purchase and Jadian agreed to retain

and be responsible for any and all liabilities of Jadian. We did not purchase and Jadian agreed to retain and be responsible for

any and all liabilities of Jadian.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company also agreed to provide the

seller with additional earn-out rights in connection with the purchase, which provide that the seller will receive up to a maximum

of $100,000 per year for the three twelve month periods following the Closing (any delinquent earn-out payment shall bear interest

at the rate of 10% per annum until the delinquent amount is paid), based on the gross revenues generated by Jadian during such

applicable year based on the following schedule (the “Earn-Out”):

| Revenue for the Relevant Year |

Earn-Out |

| $-0- to $500,000 |

$ |

– |

| $500,000 to $600,000 |

$ |

25,000 |

| $600,000 to $700,000 |

$ |

50,000 |

| $700,000 to $800,000 |

$ |

75,000 |

| $800,000 or more |

$ |

100,000 |

Provided that in no event shall the total

amount payable to Jadian Enterprises in connection with the Earn-Out exceed $100,000 per year, or $300,000 in aggregate. Management

has determined the probability of having to pay out any of these Earn-Out provisions as Medium and accordingly, has not recorded

a contingent liability.

This acquisition

was accounted for as a business combination under the purchase method of accounting, given that substantially all of the Company’s

assets and ongoing operations were acquired. The purchase resulted in $399,865 of goodwill. According to the purchase method of

accounting, the Company recognized the identifiable assets acquired and liabilities assumed as follows:

| | |

May 9, | |

| | |

2014 | |

| Consideration: | |

| | |

| Cash paid at, and prior to, closing | |

$ | 215,000 | |

| Seller financed note payable(1)(2) | |

| 210,000 | |

| Adjustments to cash paid at closing(3) | |

| (7,055 | ) |

| | |

| 417,945 | |

| Fair value of identifiable liabilities acquired: | |

| | |

| Deferred revenue | |

| 86,423 | |

| Fair value of total consideration exchanged | |

$ | 504,368 | |

| | |

| | |

| Fair value of identifiable assets acquired assumed: | |

| | |

| Accounts receivable | |

$ | 42,382 | |

| Software | |

| 37,180 | |

| Trade name | |

| 24,941 | |

| Total fair value of assets assumed | |

| 104,503 | |

| Consideration paid in excess of fair value (Goodwill)(4) | |

$ | 399,865 | |

(1)Consideration

included an unsecured $210,000 seller financed note payable (“Jadian Note”), which bears interest at 6% per annum

until the maturity date of May 9, 2017, and provides for equal monthly principal and interest payments of $6,389 commencing on

June 1, 2014. The Jadian Note includes a balloon payment, consisting of the remaining outstanding balance of principal and interest

upon maturity at May 9, 2017. The interest rate shall be 8% per annum with an additional 5% late payment fee upon default.

(2)The

fair value of the seller financed note in excess of the $210,000 principal balance attributable to the deferred payment terms

will be amortized to interest expense over the deferred financing period.

(3)The

Company agreed to adjust the purchase price in connection with the Closing by paying an additional $33,705 for the accounts receivable

acquired, less $40,760 attributable to deferred revenues recognized on previously collected sales for which services are still

pending. The net total of $7,055 was credited as payment at the Closing.

(4)The consideration paid in

excess of the net fair value of assets acquired and liabilities assumed has been recognized as goodwill.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Management believes the product line of

Jadian, software and other assets acquired will enable the Company to enhance their business model and strengthen its future cash

flows to fund operations and take advantage of additional growth opportunities.

The unaudited supplemental pro forma results

of operations of the combined entities had the dates of the acquisitions been January 1, 2014 or January 1, 2013 are

as follows:

| | |

Combined Pro Forma: | |

| | |

For the six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| Revenue: | |

$ | 748,952 | | |

$ | 745,071 | |

| | |

| | | |

| | |

| Expenses: | |

| | | |

| | |

| Operating expenses | |

| 3,249,648 | | |

| 2,440,624 | |

| | |

| | | |

| | |

| Net operating income (loss) | |

| (2,500,696 | ) | |

| (1,695,553 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| (1,972,184 | ) | |

| (366,946 | ) |

| | |

| | | |

| | |

| Net income (loss) | |

$ | (4,472,880 | ) | |

$ | (2,062,499 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares | |

| | | |

| | |

| Outstanding – basic and fully diluted | |

| 4,783,826,881 | | |

| 1,666,897,778 | |

| | |

| | | |

| | |

| Net income (loss) per share – basic and fully diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

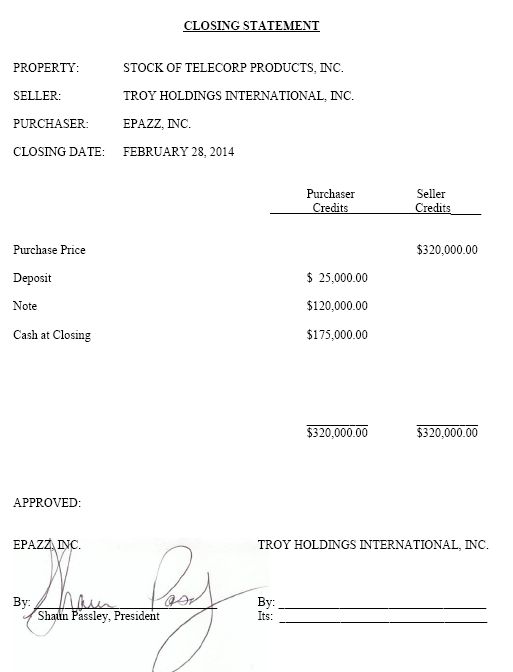

Stock Purchase Acquisition – Telecorp

Products, Inc., February 28, 2014

On February 28, 2014, the Company entered

into a Stock Purchase Agreement (the “Telecorp Purchase Agreement”) with Troy Holdings International, Inc., an Ontario

Canada corporation (“Troy Holdings”), Telecorp Products, Inc. a Michigan corporation and Troy, Inc., a shareholder

and the sole stockholder of Telecorp. Pursuant to the Telecorp Purchase Agreement, the Company purchased 100% of the outstanding

shares of Telecorp from Troy Holdings, for an aggregate purchase price of $302,000 (the “Purchase Price”). The Purchase

Price was payable as follows:

| |

(a) |

The Company paid Troy Holdings $200,000 at the Closing (the “Cash Consideration”) of the Telecorp Purchase Agreement; and |

| |

(b) |

The Company provided Troy Holdings with a Promissory Note in the amount of $102,000 (the “Telecorp Note”), as adjusted from an original $120,000 by $18,000 of liabilities acquired in excess of the agreed upon limit of $50,000 of liabilities, which provides for six (6) equal monthly payments of $20,000 commencing thirty (30) days after the Closing. The Telecorp Note is non-interest bearing except upon default, in which case the interest rate shall be 10% per annum. |

Additionally, the Company agreed to assume

aggregate outstanding Telecorp liabilities of up to $50,000 in connection with the Closing. A total of $68,000 of liabilities was

actually acquired, and the resulting $18,000 of excess liabilities was credited as payment against the Telecorp Note. As a result

of the Closing, Telecorp became a wholly-owned subsidiary of the Company.

Telecorp developed and sells software to

effectively operate contact centers. Telecorp’s solutions work with equipment from the giants of the computer telephony industry,

such as Avaya, Cisco and Nortel Networks. In connection with the Stock Purchase Agreement, the shareholders of Telecorp and the

Company entered into a Non-Disclosure/Non-Compete Agreement, pursuant to which the shareholders of Telecorp and the Company, each

agreed to not for a period of one (1) year, communicate or divulge to, or use for the benefit of itself or any other person, firm,

association or corporation, any information in any way relating to the Proprietary Property, in competition with the business of

the Company, and pursuant to the agreement, the shareholders of Telecorp agreed not to compete against the Company for one (1)

year from the closing of the acquisition.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

This acquisition

was accounted for as a business combination under the purchase method of accounting, given that substantially all of the Company’s

assets and ongoing operations were acquired. The purchase resulted in $428,577 of goodwill. According to the purchase method of

accounting, the Company recognized the identifiable assets acquired and liabilities assumed as follows:

| | |

February 28, | |

| | |

2014 | |

| Consideration: | |

| | |

| Cash paid at, and prior to, closing | |

$ | 200,000 | |

| Seller financed note payable(1)(2) | |

| 120,000 | |

| Excess liability adjustment to seller financed note payable(3) | |

| (18,000 | ) |

| | |

| 302,000 | |

| Fair value of identifiable liabilities acquired: | |

| | |

| Accounts payable and accrued expenses | |

| 43,500 | |

| Deferred revenue | |

| 162,016 | |

| Line of credit | |

| 24,500 | |

| Fair value of total consideration exchanged | |

$ | 532,016 | |

| | |

| | |

| Fair value of identifiable assets acquired assumed: | |

| | |

| Cash | |

$ | 736 | |

| Other current assets | |

| 823 | |

| Technology-based intangible assets | |

| 72,490 | |

| Trade name | |

| 29,390 | |

| Total fair value of assets assumed | |

| 103,439 | |

| Consideration paid in excess of fair value (Goodwill)(4) | |

$ | 428,577 | |

(1)Consideration

included an unsecured $120,000 seller financed note payable (“Telecorp Note”), which provides for six (6) equal monthly

payments of $20,000 commencing thirty (30) days after the Closing. The Telecorp Note is non-interest bearing except upon default,

in which case the interest rate shall be 10% per annum.

(2)The

fair value of the seller financed note in excess of the $102,000 principal balance attributable to the deferred payment terms

will be amortized to interest expense over the deferred financing period.

(3)The

Company agreed to assume aggregate outstanding Telecorp liabilities of up to $50,000 in connection with the Closing. A total of

$68,000 of liabilities was actually acquired, and the resulting $18,000 of excess liabilities was credited as payment against

the Telecorp Note.

(4)The consideration paid in excess of the net fair value of assets acquired and liabilities

assumed has been recognized as goodwill.

Management believes the product line of

Telecorp, customer base and other assets acquired will enable the Company to enhance their business model and strengthen its future

cash flows to fund operations and take advantage of additional growth opportunities.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The unaudited supplemental pro forma results

of operations of the combined entities had the dates of the acquisitions been January 1, 2014 or January 1, 2013 are

as follows:

| |

|

Combined pro Forma: |

| |

|

For the six months ended

June 30, |

| |

|

2014 |

|

2013 |

| Revenue: |

$ |

668,780 |

|

$ |

775,668 |

| |

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

| |

Operating expenses |

|

3,190,846 |

|

|

2,550,029 |

| |

|

|

|

|

|

|

| Net operating income (loss) |

|

(2,522,066) |

|

|

(1,774,361) |

| |

|

|

|

|

|

|

| |

Other income (expense) |

|

(1,968,126) |

|

|

(359,687) |

| |

|

|

|

|

|

|

| Net income (loss) |

$ |

(4,490,192) |

|

$ |

(2,134,048) |

| |

|

|

|

|

|

|

| Weighted average number of common shares |

|

|

|

|

|

| |

Outstanding – basic and fully diluted |

|

4,783,826,881 |

|

|

1,666,897,778 |

| |

|

|

|

|

|

|

| Net income (loss) per share – basic and fully diluted |

$ |

(0.00) |

|

$ |

(0.00) |

Note 5 – Related Parties

Debt Financings

From time to time we have received and

repaid loans from our CEO and his immediate family members to fund operations. These related party debts are fully disclosed in

Note 13 below.

In addition to the debts disclosed in

Note 13, we had a convertible note with a related party that is disclosed in Note 14 as follows:

| | |

June 30,

2014 | | |

December 31,

2013 | |

| Originated April 2, 2014, an unsecured $51,000 convertible promissory note, carried a 15% interest rate, matured on August 1, 2014, (“First Vivienne Passley Note”) owed to Vivienne Passley, a related party. The convertible promissory note was issued in exchange for a promissory note originally issued on August 12, 2013 to the same debt holder, which did not carry conversion terms. The principal and accrued interest was convertible into shares of common stock at the discretion of the note holder at a fixed conversion price of $0.0001 per share. The debt holder was limited to owning 4.99% of the Company’s issued and outstanding shares. The debt modification resulted in a loss on debt modifications, related party of $172,864. The assigned principal of $51,000, interest of $4,933 and liquidated damages incurred prior to assignment of $2,500 was subsequently converted to a total of 584,333,745 shares of common stock over various dates from April 2, 2014 to June 17, 2014 in complete satisfaction of the debt. | |

$ | – | | |

$ | – | |

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| | |

| | | |

| | |

| Unsecured $440,849 convertible promissory note due to a related party, carries a 10% interest rate (“Star Convertible Note”), matures on July 2, 2017. The principal and unpaid interest is convertible into shares of common stock at the discretion of the note holder at a price equal to 75% of the average closing price of the Company’s common stock over the five (5) consecutive trading days immediately preceding the date of conversion, or the fixed price of $0.005 per share, whichever is greater. The note carries a fourteen percent (14%) interest rate in the event of default, and the debt holder is limited to owning 9.99% of the Company’s issued and outstanding shares. This note was subsequently amended on March 5, 2013 to change the conversion price to, "equal to the greater of, (a) 50% of the Market Price, or (b) the fixed conversion price of $0.00075 per share". The modification resulted in a loss on debt modification of $81,792. The note holder converted $250,000 of outstanding principal into 50,000,000 shares pursuant to debt conversion on September 15, 2012, $46,000 into 50,000,000 shares pursuant to debt conversion on March 14, 2013, $40,000 into 50,000,000 shares pursuant to debt conversion on April 10, 2013, $26,400 into 80,000,000 shares pursuant to debt conversion on July 9, 2013 and $32,000 into 40,000,000 shares pursuant to debt conversion on August 7, 2013, $18,750 into 125,000,000 shares pursuant to debt conversion on April 7, 2014, $20,000 into 200,000,000 shares pursuant to debt conversion on May 3, 2014, and $15,000, consisting of $7,699 of principal and $7,301 of interest into 150,000,000 shares pursuant to the final debt conversion on May 22, 2014. | |

| – | | |

| 46,449 | |

| | |

| | | |

| | |

| Total convertible debts, related parties | |

| – | | |

| 46,449 | |

| Less: unamortized discount on beneficial conversion feature | |

| – | | |

| (5,653 | ) |

| Convertible debts | |

| – | | |

| 40,796 | |

| Less: current maturities of convertible debts, related parties included in convertible debts | |

| – | | |

| – | |

| Long term convertible debts, related parties included in convertible debts | |

$ | – | | |

$ | 40,796 | |

Changes in Stockholders’ Equity,

Related Parties

Dividends Payable

On January 1, 2013, the Company declared

and accrued dividends quarterly on its Convertible Series B Preferred Stock pursuant to the recognition of revenues in excess of

$1 million during the year ended December 31, 2012. Dividends equal to 1.5% of the Company’s revenues per quarter during

the year ending December 31, 2013 accrue quarterly, resulting in a dividend payable of $11,000, which was subsequently paid on

September 11, 2014, with the issuance of 110,000,000 shares of Class A Common Stock in lieu of cash.

Shares of Convertible Series C Preferred

Stock Issued for Services to Related Parties

On January 17, 2014, the Company issued

600,000,000 shares of the recently designated Series C Convertible Preferred Stock to the Company’s CEO in exchange for 600,000,000

shares of his previously issued Class A Common Stock. The total fair value of the Series C Convertible Preferred Stock was $568,283

based on an independent valuation on the date of grant; therefore the Company recognized additional compensation expense of $345,427

due to the difference in the fair value of the Class A Common Stock exchanged.

On February 7, 2014, the Company issued

2,000,000 shares of Convertible Series C Preferred Stock to GG Mars Capital, a related party entity owned by Vivienne Passley,

as a loan origination cost in consideration for a $26,000 short term promissory note. The total fair value of the common stock

was $2,385 based on an independent valuation on the date of grant.

On February 21, 2014, the Company issued

10,000,000 shares of Convertible Series C Preferred Stock to Star Financial, a company owned by our CEO’s family member,

a related party, as a loan origination cost in consideration for a $75,000 short term promissory note. The total fair value of

the common stock was $9,562 based on an independent valuation on the date of grant.

On February 22, 2014, the Company issued

15,000,000 shares of Convertible Series C Preferred Stock to GG Mars Capital, a related party entity owned by Vivienne Passley,

as a loan origination cost in consideration for a $100,000 short term promissory note. The total fair value of the common stock

was $14,266 based on an independent valuation on the date of grant.

On March 7, 2014, the Company issued 3,000,000

shares of Convertible Series C Preferred Stock to Star Financial, a company owned by our CEO’s family member, a related party,

as a loan origination cost in consideration for a $30,000 short term promissory note. The total fair value of the common stock

was $2,912 based on an independent valuation on the date of grant.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On March 22, 2014, the Company issued 200,000,000

shares of Convertible Series C Preferred Stock to GG Mars Capital, a related party entity owned by Vivienne Passley, for providing

a personal guaranty on an acquisition loan. The total fair value of the common stock was $127,746 based on an independent valuation

on the date of grant.

On March 22, 2014, the Company issued 200,000,000

shares of Convertible Series C Preferred Stock to Star Financial, a company owned by our CEO’s family member, a related party,

for providing a personal guaranty on an acquisition loan. The total fair value of the common stock was $127,746 based on an independent

valuation on the date of grant.

On March 22, 2014, the Company issued 1,821,052,632

shares of the Series C Convertible Preferred Stock to the Company’s CEO in exchange for 1,821,052,632 shares, consisting

of 1,730,526,316 previously issued and unvested shares of Class A Common Stock and 90,526,316 shares of his previously issued and

vested Class A Common Stock. The vesting terms were accelerated commensurate with the exchange. The total fair value of the Series

C Convertible Preferred Stock was $1,163,162 based on an independent valuation on the date of grant; therefore the Company recognized

additional compensation expense of $707,025 due to the difference in the fair value of the Class A Common Stock exchanged.

On March 22, 2014, the Company issued 13,669,568

shares of the Series C Convertible Preferred Stock to L&F Lawn Services, a company owned by our CEO’s family member,

a related party, in exchange for 13,669,568 of their previously issued Class A Common Stock. The total fair value of the Series

C Convertible Preferred Stock was $8,731 based on an independent valuation on the date of grant; therefore the Company recognized

additional compensation expense of $5,370 due to the difference in the fair value of the Class A Common Stock exchanged.

On March 22, 2014, the Company issued 60,000,000

shares of the Series C Convertible Preferred Stock to the Company’s CEO in exchange for 60,000,000 shares, consisting of

54,000,000 previously issued and unvested shares of Class A Common Stock and 6,000,000 shares of his previously issued and vested

Class A Common Stock. The vesting terms were accelerated commensurate with the exchange. The total fair value of the Series C Convertible

Preferred Stock was $38,324 based on an independent valuation on the date of grant; therefore the Company recognized additional

compensation expense of $23,295 due to the difference in the fair value of the Class A Common Stock exchanged.

Debt Conversions into Class A Common

Stock – Related Parties

On April 2, 2014, the Company issued 250,000,000

shares of Class A Common Stock pursuant to the conversion of $25,000 of convertible debt held by Vivienne Passley, a related party,

which consisted entirely of principal. The note was converted in accordance with the conversion terms; therefore no gain or loss

has been recognized.

On April 7, 2014, the Company issued 125,000,000

shares of Class A Common Stock pursuant to the conversion of $18,750 of convertible debt held by Star Financial Corporation, a

related party, which consisted entirely of principal. The note was converted in accordance with the conversion terms; therefore

no gain or loss has been recognized.

On May 3, 2014, the Company issued 200,000,000

shares of Class A Common Stock pursuant to the conversion of $20,000 of convertible debt held by Star Financial Corporation, a

related party, which consisted entirely of principal. The note was converted in accordance with the conversion terms; therefore

no gain or loss has been recognized.

On May 22, 2014, the Company issued 150,000,000

shares of Class A Common Stock pursuant to the conversion of $15,000 of convertible debt held by Star Financial Corporation, a

related party, which consisted entirely of principal. The note was converted in accordance with the conversion terms; therefore

no gain or loss has been recognized.

On June 17, 2014, the Company issued 334,333,745

shares of Class A Common Stock pursuant to the conversion of $33,433 of convertible debt held by Vivienne Passley, a related party,

which consisted of $26,000 of principal, $4,933 of interest and $2,500 of liquidated damages. The note was converted in accordance

with the conversion terms; therefore no gain or loss has been recognized.

Convertible

Class B Common Stock Issuance for Services

On March 22, 2014, the Company issued 12,500,000

shares of Convertible Class B Common Stock to the Company’s CEO in consideration for providing services. The total fair value

of the common stock was $44,737 based on the closing price of the Company’s common stock on the date of grant.

Subscriptions Payable Issued for Shares

of Class A Common Stock Granted for Services

On April 23, 2014, the Company granted

3,500,000 shares of Class A Common Stock to Star Financial, a company owned by our CEO’s family member, a related party,

as a loan origination cost in consideration for a $35,000 short term promissory note. The total fair value of the common stock

was $1,050 based on the closing price of the Company’s common stock on the date of grant. The shares were subsequently issued

on August 29, 2014.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On April 24, 2014, the Company granted

10,000,000 shares of Class A Common Stock to GG Mars Capital, a related party entity owned by Vivienne Passley, as a loan origination

cost in consideration for a $150,000 short term promissory note. The total fair value of the common stock was $3,000 based on the

closing price of the Company’s common stock on the date of grant. The shares were subsequently issued on August 29, 2014.

On May 7, 2014, the Company granted 10,000,000

shares of Class A Common Stock to GG Mars Capital, a related party entity owned by Vivienne Passley, as a loan origination cost

in consideration for a $125,000 short term promissory note. The total fair value of the common stock was $2,000 based on the closing

price of the Company’s common stock on the date of grant. The shares were subsequently issued on August 29, 2014.

On May 28, 2014, the Company granted 3,250,000

shares of Class A Common Stock to Star Financial, a company owned by our CEO’s family member, a related party, as a loan

origination cost in consideration for a $32,500 short term promissory note. The total fair value of the common stock was $650 based

on the closing price of the Company’s common stock on the date of grant. The shares were subsequently issued on August 29,

2014.

On June 12, 2014, the Company granted 2,125,000

shares of Class A Common Stock to Star Financial, a company owned by our CEO’s family member, a related party, as a loan

origination cost in consideration for a $5,000 short term promissory note. The total fair value of the common stock was $213 based

on the closing price of the Company’s common stock on the date of grant. The shares were subsequently issued on August 29,

2014.

Subscriptions Payable Issued for Shares

of Convertible Series C Preferred Stock Granted for Services

On January 15, 2014, the Company granted

5,000,000 shares of Convertible Series C Preferred Stock to Star Financial, a company owned by our CEO’s family member, a

related party, as a loan origination cost in consideration for a $43,000 short term promissory note. The total fair value of the

common stock was $6,465 based on an independent valuation on the date of grant. The shares were subsequently issued on July 7,

2014.

On February 8, 2014, the Company granted

1,000,000 shares of Convertible Series C Preferred Stock to Star Financial, a company owned by our CEO’s family member, a

related party, as a loan origination cost in consideration for a $13,000 short term promissory note. The total fair value of the

common stock was $1,193 based on an independent valuation on the date of grant. The shares were subsequently issued on July 7,

2014.

On March 7, 2014, the Company granted

2,000,000 shares of Convertible Series C Preferred Stock to GG Mars Capital, a related party entity owned by Vivienne Passley,

as a loan origination cost in consideration for a $22,000 short term promissory note. The total fair value of the common stock

was $1,942 based on an independent valuation on the date of grant. The shares were subsequently issued on July 7, 2014.

On March 26, 2014, the Company granted

3,000,000 shares of Convertible Series C Preferred Stock to GG Mars Capital, a related party entity owned by Vivienne Passley,

as a loan origination cost in consideration for a $37,500 short term promissory note. The total fair value of the common stock

was $2,928 based on an independent valuation on the date of grant. The shares were subsequently issued on July 7, 2014.

On March 26, 2014, the Company granted

3,000,000 shares of Convertible Series C Preferred Stock to Star Financial, a company owned by our CEO’s family member, a

related party, as a loan origination cost in consideration for a $25,000 short term promissory note. The total fair value of the

common stock was $2,928 based on an independent valuation on the date of grant. The shares were subsequently issued on July 7,

2014.

On March 28, 2014, the Company granted

2,000,000 shares of Convertible Series C Preferred Stock to GG Mars Capital, a related party entity owned by Vivienne Passley,

as a loan origination cost in consideration for a $18,750 short term promissory note. The total fair value of the common stock

was $1,594 based on an independent valuation on the date of grant. The shares were subsequently issued on July 7, 2014.

On March 28, 2014, the Company granted

3,000,000 shares of Convertible Series C Preferred Stock to Star Financial, a company owned by our CEO’s family member, a

related party, as a loan origination cost in consideration for a $25,000 short term promissory note. The total fair value of the

common stock was $2,390 based on an independent valuation on the date of grant. The shares were subsequently issued on July 7,

2014.

Equity Based Debt Settlement Financing,

Conversions into Class A Common Stock – IBC Funds, LLC

On February 14, 2014, IBC Funds, LLC (“IBC”)

filed a Joint Motion for Approval of Settlement Agreement and Stipulation, and Request for Fairness Hearing in the Circuit Court

of the Twelfth Judicial Circuit in and for Sarasota County, Florida, Case No. 2014-CA-000899. IBC has contracted with various note

holders of the Company to acquire approximately $314,021 of Company debt and subsequently converted the debt to common stock of

the Company at 50% of the lowest trading price over the 15 days prior to, and including the conversion request date pursuant to

Section 3(a)(10) of the Securities Act of 1933, which allows the exchange of claims, securities, or property for stock when the

arrangement is approved for fairness by a court proceeding. In addition, the Company agreed to issue 75,000,000 settlement shares

to IBC. The Company has agreed to these terms as the acquisition of these debts and subsequent conversion would alleviate a significant

portion of the Company’s liabilities. A fairness hearing was held on February 14, 2014 and the arrangement was approved.

A total of 3,040,823,600 shares of Class A Common Stock was issued, in addition to the 75,000,000 settlement shares, in complete

satisfaction of the debt, as disclosed in detail below.

EPAZZ, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Employment Agreement

On September 6, 2012, we entered into an

employment agreement with Shaun Passley, Ph.D., our Chief Executive Officer, President, and Chairman of the Board of Directors

which had a term of ten (10) years. Compensation pursuant to the agreement calls for a base salary of $180,000 per year; of which

$30,000 shall be payable annually in cash and $150,000 shall be payable in shares of the Company’s Common Stock at the rate

of $0.006 per share, or 25,000,000 shares per year. In addition, the Company issued 1 billion shares of Class A Common Stock to