UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| S | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2013 |

| £ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

For the transition period from ____________ to ______________

Commission file number: 333-139117

EPAZZ, Inc.

(Exact name of registrant as specified in its charter)

| Illinois | 36-4313571 |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

309 W. Washington St. Suite 1225

Chicago, IL 60606

(Address of principal executive offices)

(312) 955-8161

(Registrant's telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes T No £

Indicate by check mark whether the registrant is a large accelerated filer, and accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer £ | Accelerated filer £ |

| Non-accelerated filer £ | Smaller reporting company T |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

Yes £ No T

The number of shares of the issuer’s Class A common stock outstanding as of June 12, 2013, was 2,426,246,028 shares, par value $0.01 per share.

EPAZZ, INC.

FORM 10-Q

Quarterly Period Ended March 31, 2013

| Page | ||

| INDEX | ||

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | ||

| PART I. FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 2 |

| Balance Sheets as of March 31, 2013 (Unaudited) and December 31, 2012 | 2 | |

| Statements of Operations for the Three Months ended March 31, 2013 and 2012 (Unaudited) | 3 | |

| Statements of Cash Flows for the Three Months ended March 31, 2013 and 2012 (Unaudited) | 4 | |

| Notes to the Condensed Consolidated Financial Statements (Unaudited) | 5 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 27 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 36 |

| Item 4. | Controls and Procedures | 36 |

| PART II. OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 37 |

| Item 1A. | Risk Factors | 37 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 37 |

| Item 3. | Defaults Upon Senior Securities | 38 |

| Item 4. | Mine Safety Disclosures | 38 |

| Item 5. | Other Information | 38 |

| Item 6. | Exhibits | 39 |

| SIGNATURES | 41 | |

| 1 |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

EPAZZ, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Assets | (Unaudited) | |||||||

| Current assets: | ||||||||

| Cash | $ | 14,022 | $ | 46,101 | ||||

| Accounts receivable, net | 38,465 | 36,995 | ||||||

| Other current assets | 42,309 | 22,027 | ||||||

| Total current assets | 94,796 | 105,123 | ||||||

| Property and equipment, net | 163,927 | 196,297 | ||||||

| Intangible assets, net | 777,488 | 821,150 | ||||||

| Goodwill | 255,460 | 255,460 | ||||||

| Total assets | $ | 1,291,671 | $ | 1,378,030 | ||||

| Liabilities and Stockholders' Equity (Deficit) | ||||||||

| Current liabilities: | ||||||||

| Dividends payable | $ | 18,000 | $ | – | ||||

| Accounts payable and accrued expenses | 118,287 | 129,651 | ||||||

| Accrued expenses, related parties | 24,488 | 19,205 | ||||||

| Deferred revenue | 231,644 | 219,590 | ||||||

| Lines of credit | 76,003 | 77,047 | ||||||

| Current maturities of capital lease obligations payable | 28,928 | 25,699 | ||||||

| Notes payable, related parties | 20,868 | 22,085 | ||||||

| Convertible debts, net of discounts of $51,092 and $101,192, respectively | 83,788 | 74,708 | ||||||

| Current maturities of long term debts | 245,106 | 218,699 | ||||||

| Total current liabilities | 847,112 | 786,684 | ||||||

| Capital lease obligations payable, net of current maturities | 9,309 | 17,421 | ||||||

| Convertible debts, net of discounts of $15,730 and $37,876, respectively | 90,139 | 152,973 | ||||||

| Long term debts, net of current maturities | 930,901 | 892,463 | ||||||

| Total liabilities | 1,877,461 | 1,849,541 | ||||||

| Stockholders' equity (deficit): | ||||||||

| Convertible preferred stock, Series A, $0.0001 par value, 1,000 shares authorized, 1,000 shares issued and outstanding | – | – | ||||||

| Convertible preferred stock, Series B, $0.0001 par value, 1,000 shares authorized, 1,000 shares issued and outstanding | – | – | ||||||

| Common stock, Class A, $0.0001 par value, 6,000,000,000 shares authorized, 1,600,828,697 and 1,177,789,125 shares issued and outstanding, respectively | 160,082 | 117,779 | ||||||

| Convertible common stock, Class B, $0.0001 par value, 60,000,000 shares authorized, 5,500,000 and 2,500,000 shares issued and outstanding, respectively | 550 | 550 | ||||||

| Additional paid in capital | 4,584,905 | 4,324,916 | ||||||

| Stockholders' receivable, consisting of 20,000,000 shares | (800,000 | ) | (800,000 | ) | ||||

| Accumulated deficit | (4,531,327 | ) | (4,114,756 | ) | ||||

| Total stockholders' equity (deficit) | (585,790 | ) | (471,511 | ) | ||||

| Total liabilities and stockholders' equity (deficit) | $ | 1,291,671 | $ | 1,378,030 | ||||

See accompanying notes to financial statements.

| 2 |

EPAZZ, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| For the Three Months | ||||||||

| Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Revenue | $ | 208,010 | $ | 114,477 | ||||

| Expenses: | ||||||||

| General and administrative | 121,231 | 130,750 | ||||||

| Salaries and wages | 216,153 | 93,515 | ||||||

| Depreciation and amortization | 76,775 | 47,474 | ||||||

| Bad debts (recoveries) | (8,785 | ) | 7,775 | |||||

| Total operating expenses | 405,374 | 279,514 | ||||||

| Net operating loss | (197,364 | ) | (165,037 | ) | ||||

| Other income (expense): | ||||||||

| Other income | – | 180 | ||||||

| Loss on convertible debt modification, related party | (81,792 | ) | – | |||||

| Interest income | – | 5 | ||||||

| Interest expense | (119,415 | ) | (41,075 | ) | ||||

| Total other income (expense) | (201,207 | ) | (40,890 | ) | ||||

| Net loss | $ | (398,571 | ) | $ | (205,927 | ) | ||

| Weighted average number of common shares outstanding - basic and fully diluted | 1,283,603,738 | 31,112,972 | ||||||

| Net loss per share - basic and fully diluted | $ | (0.00 | ) | $ | (0.01 | ) | ||

See accompanying notes to financial statements.

| 3 |

EPAZZ, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| For the Three Months | ||||||||

| Ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (398,571 | ) | $ | (205,927 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Bad debts (recoveries) | (8,785 | ) | 7,775 | |||||

| Depreciation and amortization | 33,113 | 22,547 | ||||||

| Amortization of intangible assets | 43,662 | 24,462 | ||||||

| Amortization of deferred financing costs | 9,903 | 465 | ||||||

| Amortization of discounts on convertible notes payable | 72,246 | 14,978 | ||||||

| Loss on convertible debt modification, related party | 81,792 | – | ||||||

| Stock based compensation issued for services, related parties | 91,500 | – | ||||||

| Decrease (increase) in assets: | ||||||||

| Accounts receivable | 7,315 | 94,198 | ||||||

| Other current assets | (14,258 | ) | (2,295 | ) | ||||

| Increase (decrease) in liabilities: | ||||||||

| Accounts payable and accrued expenses | (8,364 | ) | 21,153 | |||||

| Accrued expenses, related parties | 5,283 | – | ||||||

| Deferred revenues | 12,054 | (9,270 | ) | |||||

| Net cash used in operating activities | (73,110 | ) | (31,914 | ) | ||||

| Cash flows from investing activities | ||||||||

| Proceeds from the sale of equipment | – | 14,175 | ||||||

| Purchase of equipment | (743 | ) | – | |||||

| Acquisition of subsidiaries | – | (39,200 | ) | |||||

| Net cash used in investing activities | (743 | ) | (25,025 | ) | ||||

| Cash flows from financing activities | ||||||||

| Payments on capital lease obligations payable | (4,883 | ) | (18,820 | ) | ||||

| Proceeds from notes payable, related parties | 41,600 | 16,580 | ||||||

| Repayment of notes payable, related parties | (42,817 | ) | – | |||||

| Proceeds from long term debts | 108,432 | 110,603 | ||||||

| Repayment of long term debts | (60,558 | ) | (43,224 | ) | ||||

| Net cash provided by financing activities | 41,774 | 65,139 | ||||||

| Net increase (decrease) in cash | (32,079 | ) | 8,200 | |||||

| Cash - beginning | 46,101 | 12,668 | ||||||

| Cash - ending | $ | 14,022 | $ | 20,868 | ||||

| Supplemental disclosures: | ||||||||

| Interest paid | $ | 32,991 | $ | 23,934 | ||||

| Income taxes paid | $ | – | $ | – | ||||

| Non-cash investing and financing activities: | ||||||||

| Acquisition of subsidiary in exchange for debt | $ | – | $ | 460,800 | ||||

| Acquisition of leased assets for debt | $ | – | $ | 17,855 | ||||

| Value of shares issued for conversion of debt | $ | 83,000 | $ | 10,000 | ||||

| Value of shares issued for conversion of debt, related parties | $ | 46,000 | $ | – | ||||

| Dividends payable declared | $ | 18,000 | $ | – | ||||

| Deferred financing costs | $ | 15,927 | $ | – | ||||

See accompanying notes to financial statements.

| 4 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 – Basis of Presentation and Consolidation

The interim condensed consolidated financial statements of Epazz, Inc. (“Epazz” or the “Company”), an Illinois corporation, included herein, presented in accordance with United States generally accepted accounting principles and stated in US dollars, have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to not make the information presented misleading.

These statements reflect all adjustments, which in the opinion of management, are necessary for fair presentation of the information contained therein. Except as otherwise disclosed, all such adjustments are of a normal recurring nature. It is suggested that these interim condensed financial statements be read in conjunction with the financial statements of the Company for the year ended December 31, 2012 and notes thereto included in the Company's 10-K annual report. The Company follows the same accounting policies in the preparation of interim reports.

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the following entities, all of which are under common control and ownership:

| State of | Abbreviated | |||||

| Name of Entity(2) | Incorporation | Relationship(1) | Reference | |||

| Epazz, Inc. | Illinois | Parent | Epazz | |||

| IntelliSys, Inc. | Wisconsin | Subsidiary | IntelliSys | |||

| Professional Resource Management, Inc. | Illinois | Subsidiary | PRMI | |||

| Desk Flex, Inc. | Illinois | Subsidiary | DFI | |||

| K9 Bytes, Inc. | Illinois | Subsidiary | K9 Bytes | |||

| MS Health, Inc. | Illinois | Subsidiary | MS Health | |||

| Cooling Technology Solutions, Inc. | Illinois | Subsidiary | CTS |

(1)All subsidiaries are wholly-owned subsidiaries of Epazz, Inc.

(2)All entities are in the form of Corporations.

The condensed consolidated financial statements herein contain the operations of the wholly-owned subsidiaries listed above. All significant inter-company transactions have been eliminated in the preparation of these financial statements. The parent company, Epazz and subsidiaries, IntelliSys, PRMI, DFI, K9 Bytes, MS Health and CTS will be collectively referred to herein as the “Company”, or “Epazz”. The Company's headquarters are located in Chicago, Illinois and substantially all of its customers are within the United States.

These statements reflect all adjustments, consisting of normal recurring adjustments, which in the opinion of management are necessary for fair presentation of the information contained therein.

Segment Reporting

FASB ASC 280-10-50 requires annual and interim reporting for an enterprise’s operating segments and related disclosures about its products, services, geographic areas and major customers. An operating segment is defined as a component of an enterprise that engages in business activities from which it may earn revenues and expenses, and about which separate financial information is regularly evaluated by the chief operating decision maker in deciding how to allocate resources. All of the Company’s software products are considered operating segments, and will be aggregated into one reportable segment given the similarities in economic characteristics among the operations represented by the common nature of the products, customers and methods of distribution.

| 5 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Reclassifications

Certain amounts in the financial statements of the prior year have been reclassified to conform to the presentation of the current year for comparative purposes.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

Under FASB ASC 820-10-05, the Financial Accounting Standards Board establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. This Statement reaffirms that fair value is the relevant measurement attribute. The adoption of this standard did not have a material effect on the Company’s financial statements as reflected herein. The carrying amounts of cash, accounts payable and accrued expenses reported on the balance sheets are estimated by management to approximate fair value primarily due to the short term nature of the instruments. The Company had debt instruments that required fair value measurement on a recurring basis.

Intangible Assets

Intangible assets are amortized using the straight-line method over their estimated period of benefit of five to fifteen years. We evaluate the recoverability of intangible assets periodically and take into account events or circumstances that warrant revised estimates of useful lives or that indicate that impairment exists. All of our intangible assets are subject to amortization. No material impairments of intangible assets have been identified during any of the periods presented. Amortization expense on intangible assets totaled $43,662 and $24,462 for the three months ended March 31, 2013 and 2012, respectively.

Goodwill

The Company evaluates the carrying value of goodwill during the fourth quarter of each year and between annual evaluations if events occur or circumstances change that would more likely than not reduce the fair value of the reporting unit below its carrying amount. Such circumstances could include, but are not limited to (1) a significant adverse change in legal factors or in business climate, (2) unanticipated competition, or (3) an adverse action or assessment by a regulator. When evaluating whether goodwill is impaired, the Company compares the fair value of the reporting unit to which the goodwill is assigned to the reporting unit's carrying amount, including goodwill. The fair value of the reporting unit is estimated using a combination of the income, or discounted cash flows, approach and the market approach, which utilizes comparable companies' data. If the carrying amount of a reporting unit exceeds its fair value, then the amount of the impairment loss must be measured. The impairment loss would be calculated by comparing the implied fair value of reporting unit goodwill to its carrying amount. In calculating the implied fair value of reporting unit goodwill, the fair value of the reporting unit is allocated to all of the other assets and liabilities of that unit based on their fair values. The excess of the fair value of a reporting unit over the amount assigned to its other assets and liabilities is the implied fair value of goodwill. An impairment loss would be recognized when the carrying amount of goodwill exceeds its implied fair value. The Company's evaluation of goodwill completed during the year resulted in no impairment losses.

Beneficial Conversion Features

From time to time, the Company may issue convertible notes that may contain an imbedded beneficial conversion feature. A beneficial conversion feature exists on the date a convertible note is issued when the fair value of the underlying common stock to which the note is convertible into is in excess of the remaining unallocated proceeds of the note after first considering the allocation of a portion of the note proceeds to the fair value of warrants, if related warrants have been granted. The intrinsic value of the beneficial conversion feature is recorded as a debt discount with a corresponding amount to additional paid in capital. The debt discount is amortized to interest expense over the life of the note using the effective interest method.

| 6 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Basic and Diluted Net Earnings per Share

Basic net earnings (loss) per common share is computed by dividing net earnings (loss) applicable to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted net earnings (loss) per common share is determined using the weighted-average number of common shares outstanding during the period, adjusted for the dilutive effect of common stock equivalents, consisting of shares that might be issued upon exercise of common stock options. In periods where losses are reported, the weighted-average number of common shares outstanding excludes common stock equivalents, because their inclusion would be anti-dilutive. There were no outstanding potential common stock equivalents for the periods presented. As such, basic and diluted earnings per share resulted in the same figure for the three and three months ending March 31, 2013 and 2012.

Stock-Based Compensation

The Company adopted FASB guidance on stock based compensation on January 1, 2006. Under FASB ASC 718-10-30-2, all share-based payments to employees, including grants of employee stock options, are to be recognized in the income statement based on their fair values. Pro forma disclosure is no longer an alternative. Common stock issued for services and compensation was $91,500 and $-0- for the three months ended March 31, 2013 and 2012, respectively.

Revenue Recognition

The Company designs and sells various software programs to business enterprises, hospitals and Government and post-secondary institutions. Prior to shipment, each software product is tested extensively to meet Company specifications. The software is shipped fully functional via electronic delivery, but some installation and setup is required. No other entities sell the same or largely interchangeable software.

Installation is a standard process, outlined in the owner's manual, consisting principally of setup, calibrating, and testing the software. A purchaser of the software could complete the process using the information in the owner's manual, although it would probably take significantly longer than it would take the Company’s technicians to perform the tasks. Although other vendors do not install the Company’s software, they do provide largely interchangeable installation services for a fee. Historically, the Company has never sold the software without installation. Most installations are performed by the Company within 7 to 24 days of shipment and are included in the overall sales price of the software. In addition, the customer must pay for support contracts and training packages, depending on their desired level of service. The Company is the only manufacturer of the software and it only sells software on a standalone basis directly to the end user.

The sales price of the arrangement consists of the software, installation, and training and support services, which the customer is obligated to pay in full upon delivery of the software. In addition, there are no general rights of return involved in these arrangements. Therefore, the software is accounted for as a separate unit of accounting.

The Company does not have vendor-specific objective evidence of selling price for the software because it does not sell the software separately (without installation services and support contracts). In addition, third-party evidence of selling price does not exist as no vendor separately sells the same or largely interchangeable software. Therefore, the Company uses its best estimate of selling price when allocating such arrangement consideration.

In estimating its selling price for the software, the Company considers the cost to produce the software, profit margin for similar arrangements, customer demand, effect of competitors on the Company’s software, and other market constraints. When applying the relative selling price method, the Company uses its best estimate of selling price for the software, and third-party evidence of selling price for the installation. Accordingly, without considering whether any portion of the amount allocable to the software is contingent upon delivery of the other items, the Company allocates the selling price to the software, support, and installation.

The Company doesn’t currently provide product warranties, but if it does in the future it will provide for specific product lines and accrue for estimated future warranty costs in the period in which the revenue is recognized.

| 7 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Recent Accounting Pronouncements

In February 2013, Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income, to improve the transparency of reporting these reclassifications. Other comprehensive income includes gains and losses that are initially excluded from net income for an accounting period. Those gains and losses are later reclassified out of accumulated other comprehensive income into net income. The amendments in the ASU do not change the current requirements for reporting net income or other comprehensive income in financial statements. All of the information that this ASU requires already is required to be disclosed elsewhere in the financial statements under U.S. GAAP. The new amendments will require an organization to:

| - | Present (either on the face of the statement where net income is presented or in the notes) the effects on the line items of net income of significant amounts reclassified out of accumulated other comprehensive income - but only if the item reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period; and |

| - | Cross-reference to other disclosures currently required under U.S. GAAP for other reclassification items (that are not required under U.S. GAAP) to be reclassified directly to net income in their entirety in the same reporting period. This would be the case when a portion of the amount reclassified out of accumulated other comprehensive income is initially transferred to a balance sheet account (e.g., inventory for pension-related amounts) instead of directly to income or expense. |

The amendments apply to all public and private companies that report items of other comprehensive income. Public companies are required to comply with these amendments for all reporting periods (interim and annual). The amendments are effective for reporting periods beginning after December 15, 2012, for public companies. Early adoption is permitted. The adoption of ASU No. 2013-02 did not have a material impact on our financial position or results of operations.

In January 2013, the FASB issued ASU No. 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities, which clarifies which instruments and transactions are subject to the offsetting disclosure requirements originally established by ASU 2011-11. The new ASU addresses preparer concerns that the scope of the disclosure requirements under ASU 2011-11 was overly broad and imposed unintended costs that were not commensurate with estimated benefits to financial statement users. In choosing to narrow the scope of the offsetting disclosures, the Board determined that it could make them more operable and cost effective for preparers while still giving financial statement users sufficient information to analyze the most significant presentation differences between financial statements prepared in accordance with U.S. GAAP and those prepared under IFRSs. Like ASU 2011-11, the amendments in this update will be effective for fiscal periods beginning on, or after January 1, 2013. The adoption of ASU 2013-01 did not have a material impact on our financial position or results of operations.

Note 2 – Going Concern

As shown in the accompanying condensed consolidated financial statements, the Company has incurred recurring losses from operations resulting in an accumulated deficit of $(4,531,327), and as of March 31, 2013, the Company’s current liabilities exceeded its current assets by $752,316 and its total liabilities exceeded its total assets by $585,790. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The financial statements do not include any adjustments that might result from the outcome of any uncertainty as to the Company’s ability to continue as a going concern. These financial statements also do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern.

| 8 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 3 – Subsidiary Formation

Subsidiary Formation – Cooling Technology Solutions, Inc., March 4, 2013

On March 4, 2013, the Board of Directors of Epazz, Inc. (the “Company”), consisting solely of Shaun Passley, the Company’s majority shareholder, approved the formation of a new wholly-owned subsidiary of the Company named Cooling Technology Solutions, Inc. The Company plans to file a non-provisional patent application for its Project Flex product in the name of Cooling Technology Solutions, Inc., however, as of the date of this filing there has been no activity and, as such, there are no revenues or expenses.

Note 4 – Asset Purchase Acquisitions

Asset Purchase Acquisition – MS Health, Inc., March 28, 2012

On March 28, 2012, we, through a newly-formed wholly-owned Illinois subsidiary, MS Health, Inc. (“MS Health”), closed on an Asset Purchase Agreement (“APA”) with MS Health Software Corporation, a New Jersey corporation (“MSHSC”). Pursuant to the APA, we purchased all of MSHSC’s assets, including all of its intellectual property, its business trademarks and copyrights, furniture, fixtures, equipment and software in consideration for an aggregate of $500,000, of which $39,200 was paid in cash at the closing, $360,800 was financed using a small business loan and $100,000 was paid by way of a Promissory Note (the “MSHSC Note”). The terms of the MSHSC Note include interest at 6% per annum, a ten (10) year amortization, a right of offset, no payments of either principal or interest for two (2) years and equal payments of principal and interest commencing in year 3, no prepayment penalty, and full payment of all amounts due after five (5) years. The MSHSC Note is secured by a security interest over the assets of MS Health. We did not purchase and MSHSC agreed to retain and be responsible for any and all liabilities of MSHSC. The acquisition was financed in part with a $360,800 Small Business Administration (“SBA”) loan, bearing interest at fixed and variable rates. The initial interest rate is 5.5% per year for three (3) years, consisting of the Prime Rate in effect on the first business day of the month in which the SBA loan application was received, plus 2.25%. The loan terms then transition to a variable interest rate over the remaining seven (7) years of the ten (10) year maturity term, calculated at 2.25% above the Prime Rate, as adjusted quarterly. The Company must pay principal and interest payments of $3,916 monthly. The SBA Loan is guaranteed by PRMI, K9 Bytes, Desk Flex, Inc., MS Health and the Company, and secured by the assets of MS Health and the Company.

MSHSC developed and sells CHMCi, an enterprise wide solution that includes tools to effectively provide, manage, bill, and track behavioral healthcare and social services. With CMHCi, an organization will realize the benefits of increased efficiency, accountability, and productivity. CMHCi offers server-based, internet, and secure cloud computing enabling the user to access information as required. By maintaining a complete electronic client record, including data collection and reporting across multiple programs, locations, episodes of care, and service providers, CMHCi helps eliminate redundant record keeping. The scheduler component tracks client, staff, and group appointments. Easy to use, it interfaces seamlessly with service authorization tracking, service history, and billing. The integrated financial reporting component provides the basis for an efficient and comprehensive accounting system, including electronic claims and remittance, third party insurance, and client, municipality, and grantor billing.

In connection with the Asset Purchase, the shareholders of MSHSC and the Company (through MS Health) entered into a Covenant Not to Compete; Consulting Agreement, Non-Competition and Consulting Agreement, pursuant to which the shareholders of MSHSC agreed to provide consulting services to the Company for a period of six months following closing. Pursuant to the agreement, the shareholders of MSHSC agreed not to compete against the Company for two years from the closing of the acquisition.

| 9 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

This acquisition was accounted for as a business combination under the purchase method of accounting, given that substantially all of the Company’s assets and ongoing operations were acquired. The purchase resulted in $114,627 of goodwill. According to the purchase method of accounting, the Company recognized the identifiable assets acquired and liabilities assumed as follows:

| March 28, | ||||

| 2012 | ||||

| Consideration: | ||||

| Cash paid at closing | $ | 39,200 | ||

| Small business loan(1) | 360,800 | |||

| Seller financed note payable(2)(3) | 124,697 | |||

| Fair value of total consideration exchanged | $ | 524,697 | ||

| Fair value of identifiable assets acquired assumed: | ||||

| Other current assets | $ | 7,367 | ||

| Equipment | 2,703 | |||

| Contracts | 258,000 | |||

| Technology-based intangible assets | 124,000 | |||

| Non-compete agreement | 18,000 | |||

| Total fair value of assets assumed | 410,070 | |||

| Consideration paid in excess of fair value (Goodwill)(4) | $ | 114,627 | ||

(1)Consideration included partial proceeds obtained from a $360,800 Small Business Association (“SBA”) loan, bearing interest at fixed and variable rates. The initial interest rate is 5.5% per year for three (3) years, consisting of the Prime Rate in effect on the first business day of the month in which the SBA loan application was received, plus 2.25%. The loan terms then transition to a variable interest rate over the remaining seven (7) years of the ten (10) year maturity term, calculated at 2.25% above the Prime Rate, as adjusted quarterly. The Company must pay principal and interest payments of $3,916 monthly. The SBA Loan is guaranteed by PRMI, K9 Bytes, Desk Flex, Inc., MS Health and the Company, and secured by the assets of MS Health and the Company.

(2)Consideration included an unsecured $100,000 seller financed note payable (“MSHSC Note”), bearing interest at 6% per annum, a ten (10) year amortization, a right of offset, no payments of either principal or interest for two (2) years and equal payments of principal and interest commencing in year 3, no prepayment penalty, and full payment of all amounts due after five (5) years. The MSHSC Note is secured by a security interest over the assets of MS Health. We did not purchase and MSHSC agreed to retain and be responsible for any and all liabilities of MSHSC.

(3)The fair value of the seller financed note in excess of the $100,000 principal balance attributable to the deferred payment terms will be amortized to interest expense over the deferred financing period.

(4)The consideration paid in excess of the net fair value of assets acquired and liabilities assumed has been recognized as goodwill.

Management believes the product line of MS Health, customer base and other assets acquired will enable the Company to enhance their business model and strengthen its future cash flows to fund operations and take advantage of additional growth opportunities.

| 10 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The unaudited supplemental pro forma results of operations of the combined entities had the dates of the acquisitions been January 1, 2013 or January 1, 2012 are as follows:

| Combined Pro Forma: | ||||||||

| For the three months ended | ||||||||

| March 31, | ||||||||

| 2013 | 2012 | |||||||

| Revenue: | $ | 208,010 | $ | 177,314 | ||||

| Expenses: | ||||||||

| Operating expenses | 405,374 | 347,686 | ||||||

| Net operating income (loss) | (197,364 | ) | (170,372 | ) | ||||

| Other income (expense) | (201,207 | ) | (41,071 | ) | ||||

| Net income (loss) | $ | (398,571 | ) | $ | (211,443 | ) | ||

| Weighted average number of common shares outstanding – basic and fully diluted | 1,283,603,738 | 31,112,972 | ||||||

| Net income (loss) per share – basic and fully diluted | $ | (0.00 | ) | $ | (0.01 | ) | ||

Note 5 – Fair Value of Financial Instruments

Under FASB ASC 820-10-5, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). The standard outlines a valuation framework and creates a fair value hierarchy in order to increase the consistency and comparability of fair value measurements and the related disclosures. Under GAAP, certain assets and liabilities must be measured at fair value, and FASB ASC 820-10-50 details the disclosures that are required for items measured at fair value.

The Company does not have any financial instruments that must be measured under the new fair value standard. The Company’s financial assets and liabilities are measured using inputs from the three levels of the fair value hierarchy. The three levels are as follows:

Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 - Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market corroborated inputs).

Level 3 - Unobservable inputs that reflect our assumptions about the assumptions that market participants would use in pricing the asset or liability.

| 11 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The following schedule summarizes the valuation of financial instruments at fair value on a non-recurring basis in the balance sheets as of March 31, 2013 and December 31, 2012:

| Fair Value Measurements at March 31, 2013 | ||||||||||||

| Level 1 | Level 2 | Level 3 | ||||||||||

| Assets | ||||||||||||

| Intangible assets | $ | – | $ | – | $ | 777,488 | ||||||

| Goodwill | – | – | 255,460 | |||||||||

| Total assets | – | – | 1,032,948 | |||||||||

| Liabilities | ||||||||||||

| Lines of credit | – | 76,003 | – | |||||||||

| Capital leases | – | 38,237 | – | |||||||||

| Long term debts | – | 1,111,162 | – | |||||||||

| Notes payable, related parties | – | 20,868 | – | |||||||||

| Convertible debts, net of discount of $66,822 | – | 173,927 | – | |||||||||

| Total Liabilities | – | 1,485,042 | – | |||||||||

| $ | – | $ | (1,485,042 | ) | $ | 1,032,948 | ||||||

| Fair Value Measurements at December 31, 2012 | ||||||||||||

| Level 1 | Level 2 | Level 3 | ||||||||||

| Assets | ||||||||||||

| Intangible assets | $ | – | $ | – | $ | 821,150 | ||||||

| Goodwill | – | – | 255,460 | |||||||||

| Total assets | – | – | 1,076,610 | |||||||||

| Liabilities | ||||||||||||

| Lines of credit | – | 77,047 | – | |||||||||

| Capital leases | – | 43,120 | – | |||||||||

| Long term debts | – | 1,111,162 | – | |||||||||

| Notes payable, related parties | – | 22,085 | – | |||||||||

| Convertible debts, net of discount of $139,068 | – | 227,681 | – | |||||||||

| Total Liabilities | – | 1,481,095 | – | |||||||||

| $ | – | $ | (1,481,095 | ) | $ | 1,076,610 | ||||||

There were no transfers of financial assets or liabilities between Level 1 and Level 2 inputs for the three months ended March 31, 2013 and the year ended December 31, 2012.

Level 2 liabilities consist of various debt arrangements, and Level 3 assets consist of intangible assets and goodwill. No fair value adjustment was necessary during the three months ended March 31, 2013 and the year ended December 31, 2012.

| 12 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 6 – Property and Equipment

Property and Equipment consists of the following at March 31, 2013 and December 31, 2012, respectively:

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Furniture and fixtures | $ | 2,187 | $ | 2,187 | ||||

| Computers and equipment | 319,018 | 318,275 | ||||||

| Software | 67,986 | 67,986 | ||||||

| Assets held under capital leases | 134,800 | 134,800 | ||||||

| 523,991 | 523,248 | |||||||

| Less accumulated depreciation and amortization | (360,064 | ) | (326,951 | ) | ||||

| $ | 163,927 | $ | 196,297 | |||||

Depreciation expense totaled $33,113 and $22,547 for the three months ended March 31, 2013 and 2012, respectively.

Note 7 – Intangible Assets

Intangible assets consisted of the following at March 31, 2013 and December 31, 2012, respectively:

| Useful | March 31, | December 31, | ||||||||

| Description | Life | 2013 | 2012 | |||||||

| Technology-based intangible assets - PRMI | 15 Years | $ | 480,720 | $ | 480,720 | |||||

| Technology-based intangible assets - IntelliSys | 5 Years | 200,000 | 200,000 | |||||||

| Technology-based intangible assets - K9 Bytes | 5 Years | 42,000 | 42,000 | |||||||

| Technology-based intangible assets – MS Health | 5 Years | 124,000 | 124,000 | |||||||

| Contracts – MS Health | 6 Years | 258,000 | 258,000 | |||||||

| Trade name - K9 Bytes | 5 Years | 22,000 | 22,000 | |||||||

| Other intangible assets – MS Health | 2 Years | 18,000 | 18,000 | |||||||

| Other intangible assets - K9 Bytes | 2 Years | 26,000 | 26,000 | |||||||

| Total intangible assets | 1,170,720 | 1,170,720 | ||||||||

| Less: accumulated amortization | (393,232 | ) | (349,570 | ) | ||||||

| Intangible assets, net | $ | 777,488 | $ | 821,150 | ||||||

Amortization expense on intangible assets totaled $43,662 and $24,462 for the three months ended March 31, 2013 and 2012, respectively.

| 13 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 8 – Lines of Credit

Lines of credit consisted of the following at March 31, 2013 and December 31, 2012, respectively:

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Line of credit of $50,000 from PNC bank, originating on February 16, 2012. The outstanding balance on the line of credit bears interest at an introductory rate of 4.25% for the first year, subject to renewal thereafter. Payments of $739 are due monthly. | $ | 49,939 | $ | 49,606 | ||||

| Line of credit of $20,000 from US Bank, originating on June 8, 2012. The outstanding balance on the line of credit bears interest at 9.75%, maturing on June 5, 2019. Payments of $500 are due monthly. | 19,658 | 19,641 | ||||||

| Line of credit of $40,000 from Dell Business Credit available for the purchase of Dell products, such as computer and software equipment. The outstanding balance on the line of credit bears interest at a rate of 26.99%. Variable payments are due monthly. | 6,406 | 7,800 | ||||||

| Total line of credit | 76,003 | 77,047 | ||||||

| Less: current portion | (76,003 | ) | (77,047 | ) | ||||

| Line of credit, less current portion | $ | – | $ | – | ||||

Note 9 – Capital Lease Obligations Payable

The Company leases certain equipment under agreements that are classified as capital leases as follows:

Lease #1 - Commenced on March 12, 2010 with monthly lease payments of $2,455 and two months paid in advance, and the remaining payments paid over the next 43 months.

Lease #2 – Commenced on March 16, 2010 with monthly lease payments of $2,258 over the following 36 months.

Lease #3 – Commenced on January 12, 2012 with monthly lease payments of $480 over the next 48 months, and a bargain purchase price of $1 at the end of the lease.

The cost of equipment under capital leases is included in the Balance Sheets as property and equipment and was $134,800 and $134,800 at March 31, 2013 and December 31, 2012, respectively. Accumulated amortization of the leased equipment at March 31, 2013 and December 31, 2012 was $116,292 and $108,090, respectively. Amortization of assets under capital leases is included in depreciation and amortization expense.

| 14 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The future minimum lease payments required under the capital leases and the present value of the net minimum lease payments as of March 31, 2013, are as follows:

| Twelve Months | ||||

| Ending | ||||

| March 31, | Amount | |||

| 2014 | $ | 35,783 | ||

| 2015 | 5,757 | |||

| 2016 | 4,750 | |||

| Total minimum payments | $ | 54,715 | ||

| Less: amount representing interest | (8,053 | ) | ||

| Present value of net minimum lease payments | 38,237 | |||

| Less: Current maturities of capital lease obligations | (28,928 | ) | ||

| Long-term capital lease obligations | $ | 9,309 | ||

Note 10 – Notes Payable, Related Parties

Notes payable, related parties consist of the following at March 31, 2013 and December 31, 2012, respectively:

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Originated October 9, 2012, unsecured promissory note payable owed to an immediate family member of the Company’s CEO carries a 15% interest rate, matures on July 15, 2013. In addition, a loan origination fee, consisting of 1,088,957 shares of Series A Common Stock with a fair market value of $6,630 was issued as consideration for the loan on October 9, 2012. | $ | 13,000 | $ | 13,000 | ||||

| Originated October 9, 2012, unsecured promissory note payable owed to a Company owned by an immediate family member of the Company’s CEO carries a 15% interest rate, matures on July 15, 2013. In addition, a loan origination fee, consisting of 144,928 shares of Series A Common Stock with a fair market value of $884 was issued as consideration for the loan on October 9, 2012. | 2,000 | 2,000 | ||||||

| Unsecured promissory note payable owed to a Company owned by an immediate family member of the Company’s CEO carries a 15% interest rate, matured on July 31, 2007. Currently in default. | 5,868 | 7,085 | ||||||

| Total notes payable, related parties | 20,868 | 22,085 | ||||||

| Less: current portion | (20,868 | ) | (22,085 | ) | ||||

| Notes payable, related parties, less current portion | $ | – | $ | – | ||||

The Company recorded interest expense on notes payable to related parties in the amounts of $791 and $13,449 during the three months ended March 31, 2013 and 2012, respectively.

| 15 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 11 – Convertible Debts

Convertible debts consist of the following at March 31, 2013 and December 31, 2012, respectively:

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| Unsecured $440,849 convertible promissory note due to a related party, carries a 10% interest rate (“Star Convertible Note”), matures on July 2, 2017. The principal and unpaid interest is convertible into shares of common stock at the discretion of the note holder at a price equal to 75% of the average closing price of the Company’s common stock over the five (5) consecutive trading days immediately preceding the date of conversion, or the fixed price of $0.005 per share, whichever is greater. The note carries a fourteen percent (14%) interest rate in the event of default, and the debt holder is limited to owning 9.99% of the Company’s issued and outstanding shares. This note was subsequently amended on March 5, 2013 to change the conversion price to, "equal to the greater of, (a) 50% of the Market Price, or (b) the fixed conversion price of $0.00075 per share". The modification resulted in a loss on debt modification of $81,792. The note holder converted $250,000 of outstanding principal into 50,000,000 shares pursuant to debt conversion on September 15, 2012, $46,000 into 50,000,000 shares pursuant to debt conversion on March 14, 2013 and subsequently $40,000 into another 50,000,000 shares pursuant to debt conversion on April 10, 2013. | $ | 144,849 | $ | 190,849 | ||||

| Unsecured $56,900 convertible promissory note, including an Original Issue Discount (“OID”) of $4,400 and legal fees of $2,500, carries an 8% interest rate (“First Tonaquint Note”), matures on May 31, 2013. The principal is convertible into shares of common stock at the discretion of the note holder at a price equal to sixty percent (60%) of the average of the two lowest trading bid prices of the Company’s common stock for the ten (10) trading days prior to the conversion date, or $0.00009 per share, whichever is greater. The note carries a twenty two percent (22%) interest rate in the event of default, and the debt holder is limited to owning 4.99% of the Company’s issued and outstanding shares. The note holder converted $5,000 of outstanding principal into 4,504,505 shares pursuant to debt conversion on March 12, 2013. | 51,900 | 56,900 | ||||||

| Unsecured $16,500 convertible promissory note carries an 8% interest rate (“Sixth Asher Note”), matures on September 14, 2013. The principal is convertible into shares of common stock at the discretion of the note holder at a price equal to forty-one percent (41%) of the average of the three lowest trading bid prices of the Company’s common stock for the ninety (90) trading days prior to the conversion date, or $0.00005 per share, whichever is greater. The note carries a twenty two percent (22%) interest rate in the event of default, and the debt holder is limited to owning 4.99% of the Company’s issued and outstanding shares. The promissory note, consisting of $16,500 of principal and $1,827 of accrued interest, was subsequently repaid in full on April 15, 2013. | 16,500 | 16,500 | ||||||

| Unsecured $27,500 convertible promissory note carries an 8% interest rate (“Fifth Asher Note”), matures on July 18, 2013. The principal is convertible into shares of common stock at the discretion of the note holder at a price equal to forty-one percent (41%) of the average of the three lowest trading bid prices of the Company’s common stock for the ninety (90) trading days prior to the conversion date, or $0.00005 per share, whichever is greater. The note carries a twenty two percent (22%) interest rate in the event of default, and the debt holder is limited to owning 4.99% of the Company’s issued and outstanding shares. The promissory note, consisting of $27,500 of principal and $3,389 of accrued interest, was subsequently repaid in full on April 15, 2013. | 27,500 | 27,500 | ||||||

| 16 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Unsecured $32,500 convertible promissory note carries an 8% interest rate (“Fourth Asher Note”), matured on April 26, 2013. The principal is convertible into shares of common stock at the discretion of the note holder at a price equal to fifty-nine percent (59%) of the average of the five lowest trading bid prices of the Company’s common stock for the ten (10) trading days prior to the conversion date, or $0.00009 per share, whichever is greater. The note carries a twenty two percent (22%) interest rate in the event of default, and the debt holder is limited to owning 4.99% of the Company’s issued and outstanding shares. The note holder subsequently converted a total of $32,500 of principal and $1,300 of interest into a total of 24,461,538 shares in settlement of the outstanding debt on March 4, 2013 and March 6, 2013. | – | 32,500 | ||||||

| Unsecured $42,500 convertible promissory note carries an 8% interest rate (“Third Asher Note”), matured on March 29, 2013. The principal is convertible into shares of common stock at the discretion of the note holder at a price equal to fifty-nine percent (59%) of the average of the three lowest trading bid prices of the Company’s common stock for the ten (10) trading days prior to the conversion date, or $0.00009 per share, whichever is greater. The note carries a twenty two percent (22%) interest rate in the event of default, and the debt holder is limited to owning 4.99% of the Company’s issued and outstanding shares. The note holder subsequently converted a total of $42,500 of principal and $1,700 of interest into a total of 23,573,529 shares of common stock in settlement of the outstanding debt between January 3, 2013 and February 26, 2013. | – | 42,500 | ||||||

| Total convertible debts | 240,749 | 366,749 | ||||||

| Less: unamortized discount on beneficial conversion feature | (66,822 | ) | (139,068 | ) | ||||

| Convertible debts | 173,927 | 227,681 | ||||||

| Less: current maturities of convertible debts | (83,788 | ) | (74,708 | ) | ||||

| Long term convertible debts | $ | 90,139 | $ | 152,973 |

The Company recognized interest expense in the amount of $6,484 and $1,542 for the three months ended March 31, 2013 and 2012, respectively, related to convertible debts.

In addition, the Company recognized and measured the embedded beneficial conversion feature present in the convertible debts by allocating a portion of the proceeds equal to the intrinsic value of the feature to additional paid-in-capital. The intrinsic value of the feature was calculated on the commitment date using the effective conversion price of the convertible debt. This intrinsic value is limited to the portion of the proceeds allocated to the convertible debt.

The aforementioned accounting treatment resulted in a total debt discount equal to $-0- and $277,323 during the three months ended March 31, 2013 and the year ended December 31, 2012, respectively. The discount is amortized on a straight line basis from the dates of issuance until the stated redemption date of the debts, as noted above.

The convertible notes, consisting of total original face values of $440,849 from Star Financial, $206,500 from Asher Enterprises and $56,900 from Tonaquint Inc., that created the beneficial conversion feature carry default provisions that place a “maximum share amount” on the note holders that can be owned as a result of the conversions to common stock by the note holders is 9.99% and 4.99%, respectively, of the issued and outstanding shares of Epazz.

During the three months ended March 31, 2013 and 2012, the Company recorded debt amortization expense in the amount of $72,246 and $-0-, respectively, attributed to the aforementioned debt discount, including $1,506 of amortization on the $4,400 OID during the three months ended March 31, 2013.

| 17 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

During the three months ended March 31, 2013, the Company issued a total of 102,539,572 shares pursuant to debt conversions in settlement of $126,000 of outstanding principal and $3,000 of unpaid interest, including 50,000,000 shares pursuant to debt conversion in settlement of $46,000 of outstanding principal owed to a related party (“Star Convertible Note”). The principal and interest was converted in accordance with the conversion terms, therefore no gain or loss has been recognized.

During the year ended December 31, 2012, the Company issued a total of 71,292,329 shares pursuant to debt conversions in settlement of $374,228 of outstanding principal and $3,500 of unpaid interest, including 50,000,000 shares pursuant to debt conversion in settlement of $250,000 of outstanding principal owed to a related party (“Star Convertible Note”). The principal and interest was converted in accordance with the conversion terms, therefore no gain or loss has been recognized.

On May 27, 2011, we entered into a Securities Purchase Agreement with Asher Enterprises, Inc., pursuant to which we sold to Asher an 8% Convertible Promissory Note in the original principal amount of $50,000. The First Asher Note had a maturity date of February 28, 2012, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 59% multiplied by the Market Price (representing a discount rate of 41%). “Market Price” means the average of the lowest five (5) Trading Prices for the Common Stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00009 per share. The shares of common stock issuable upon conversion of the First Asher Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the First Asher Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

The Company evaluated the First Asher Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.02603 below the market price on May 27, 2011 of $0.056 provided a value of $43,421 of which $-0- and $7,769 was amortized during the three months ended March 31, 2013 and 2012, respectively.

On June 28, 2011, we entered into a Securities Purchase Agreement with Asher Enterprises, Inc., pursuant to which we sold to Asher an 8% Convertible Promissory Note in the original principal amount of $37,500. The Second Asher Note had a maturity date of March 30, 2012, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 59% multiplied by the Market Price (representing a discount rate of 41%). “Market Price” means the average of the lowest five (5) Trading Prices for the Common Stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00009 per share. The shares of common stock issuable upon conversion of the Second Asher Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the Second Asher Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

The Company evaluated the Second Asher Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.01298 below the market price on June 28, 2011 of $0.035 provided a value of $22,108 of which $-0- and $7,209 was amortized during the three months ended March 31, 2013 and 2012, respectively.

| 18 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On July 2, 2012, we modified a previously outstanding non-convertible debt of $342,321, consisting of $296,103 of principal and $46,218 of accrued interest in exchange for a Convertible Promissory Note with Star Financial Corporation (“Star”), a company owned by our CEO’s family member, pursuant to which we issued to Star a 10% Convertible Promissory Note in the original principal amount of $440,849. The modification resulted in a loss on debt modification of $98,528. The Star Convertible Note has a maturity date of July 2, 2017, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 75% multiplied by the Market Price (representing a discount rate of 25%). “Market Price” means the average of the five (5) Closing Prices for the Common Stock during the five (5) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.005 per share. The shares of common stock issuable upon conversion of the Star Convertible Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the Star Convertible Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

The Company evaluated the Star Convertible Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.00141 below the market price on July 2, 2012 of $0.012 provided a value of $112,382 of which $13,377 and $-0- was amortized during the three months ended March 31, 2013 and 2012, respectively.

On July 2, 2012, we entered into a Securities Purchase Agreement with Asher Enterprises, Inc., pursuant to which we sold to Asher an 8% Convertible Promissory Note in the original principal amount of $42,500. The Third Asher Note has a maturity date of March 29, 2013, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 59% multiplied by the Market Price (representing a discount rate of 41%). “Market Price” means the average of the lowest three (3) Trading Prices for the Common Stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00009 per share. The shares of common stock issuable upon conversion of the Third Asher Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the Third Asher Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

The Company evaluated the Third Asher Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.00551 below the market price on July 2, 2012 of $0.012 provided a value of $36,082 of which $11,760 and $-0- was amortized during the three months ended March 31, 2013 and 2012, respectively.

On July 24, 2012, we entered into a Securities Purchase Agreement with Asher Enterprises, Inc., pursuant to which we sold to Asher an 8% Convertible Promissory Note in the original principal amount of $32,500. The Fourth Asher Note has a maturity date of April 26, 2013, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 59% multiplied by the Market Price (representing a discount rate of 41%). “Market Price” means the average of the lowest five (5) Trading Prices for the Common Stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00009 per share. The shares of common stock issuable upon conversion of the Fourth Asher Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the Fourth Asher Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

| 19 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company evaluated the Fourth Asher Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.00583 below the market price on July 24, 2012 of $0.0126 provided a value of $27,959 of which $11,751 and $-0- was amortized during the three months ended March 31, 2013 and 2012, respectively.

On September 10, 2012, we entered into a Securities Purchase Agreement with Tonaquint, Inc., pursuant to which we sold to Tonaquint an 8% Convertible Promissory Note in the original principal amount of $56,900. The First Tonaquint Note has a maturity date of May 31, 2013, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 60% multiplied by the Market Price (representing a discount rate of 40%). “Market Price” means the average of the lowest two (2) Trading Prices for the Common Stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00009 per share. The shares of common stock issuable upon conversion of the First Tonaquint Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the First Tonaquint Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

The Company evaluated the First Tonaquint Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.0047 below the market price on September 10, 2012 of $0.0033 provided a value of $56,900 of which $19,472 and $-0- was amortized during the three months ended March 31, 2013 and 2012, respectively.

On October 16, 2012, we entered into a Securities Purchase Agreement with Asher Enterprises, Inc., pursuant to which we sold to Asher an 8% Convertible Promissory Note in the original principal amount of $27,500. The Fifth Asher Note has a maturity date of July 18, 2013, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 41% multiplied by the Market Price (representing a discount rate of 59%). “Market Price” means the average of the lowest three (3) Trading Prices for the Common Stock during the ninety (90) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00005 per share. The shares of common stock issuable upon conversion of the Fifth Asher Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the Fifth Asher Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

The Company evaluated the Fifth Asher Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.00603 below the market price on October 16, 2012 of $0.008 provided a value of $27,500 of which $9,000 and $-0- was amortized during the three months ended March 31, 2013 and 2012, respectively.

On December 12, 2012, we entered into a Securities Purchase Agreement with Asher Enterprises, Inc., pursuant to which we sold to Asher an 8% Convertible Promissory Note in the original principal amount of $16,500. The Sixth Asher Note has a maturity date of September 14, 2013, and is convertible into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 41% multiplied by the Market Price (representing a discount rate of 59%). “Market Price” means the average of the lowest three (3) Trading Prices for the Common Stock during the ninety (90) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00005 per share. The shares of common stock issuable upon conversion of the Sixth Asher Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The issuance of the Sixth Asher Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

| 20 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company evaluated the Sixth Asher Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The beneficial conversion feature discount resulting from the conversion price of $0.00518 below the market price on December 12, 2012 of $0.0064 provided a value of $16,500 of which $5,380 and $-0- was amortized during the three months ended March 31, 2013 and 2012, respectively.

Note 12 – Long Term Debts

Long term debts consist of the following at March 31, 2013 and December 31, 2012, respectively:

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

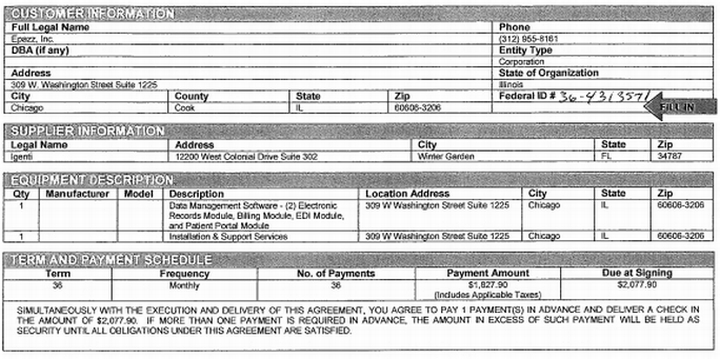

| On February 22, 2013, the Company purchased licenses to develop data management software in the total amount of $102,500 from Igenti, Inc., of which $51,250 was financed pursuant to an equipment financing agreement with Baytree National Bank & Trust Company on March 7, 2013 bearing an effective interest rate of 11.48%, consisting of 36 monthly payments of $1,674. The loan is collateralized with the data management software. Igenti retained a total of $3,000 of financing fees and paid the remaining proceeds of $99,500 to the Company for future payment to Sveltoz Solutions for the development of the data management software. Given the nature and status of the software development, no equipment costs have been capitalized. | $ | 49,577 | $ | – | ||||

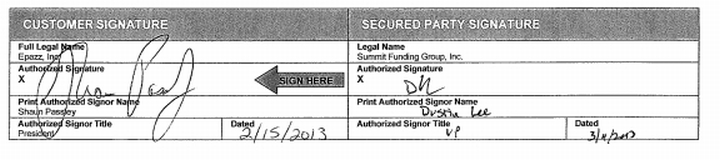

| On February 22, 2013, the Company purchased licenses to develop data management software in the total amount of $102,500 from Igenti, Inc., of which $51,250 was financed with an equipment finance loan from Summit Funding Group, Inc. equipment with a three year loan term consisting of monthly loan payments of $1,828, with $2,078 paid at signing. The loan is collateralized with the data management software. Igenti retained a total of $3,000 of financing fees and paid the remaining proceeds of $99,500 to the Company for future payment to Sveltoz Solutions for the development of the data management software. Given the nature and status of the software development, no equipment costs have been capitalized. | 51,250 | – | ||||||

| On August 10, 2012, the Company purchased $13,870 of equipment with a three year equipment finance loan. The loan bears interest at an effective interest rate of 31.55%, along with monthly principal and interest payments of $585. The loan is collateralized with the purchased equipment. Matures on August 9, 2015. | 12,734 | 13,448 | ||||||

| On April 1, 2012, the Company purchased $129,747 of equipment with a three year equipment finance loan. The loan bears interest at an effective interest rate of 8.3%, along with monthly principal and interest payments of $4,078. The loan is collateralized with the purchased equipment. Matures on April 1, 2015. | 104,772 | 104,129 | ||||||

| Consideration for the MS Health acquisition included partial proceeds obtained from a $360,800 Small Business Association (“SBA”) loan, bearing interest at fixed and variable rates. The initial interest rate is 5.5% per year for three (3) years, consisting of the Prime Rate in effect on the first business day of the month in which the SBA loan application was received, plus 2.25%. The loan terms then transition to a variable interest rate over the remaining seven (7) years of the ten (10) year maturity term, calculated at 2.25% above the Prime Rate, as adjusted quarterly. The Company must pay principal and interest payments of $3,916 monthly. The SBA Loan is guaranteed by PRMI, K9 Bytes, Desk Flex, Inc., MS Health and the Company, and secured by the assets of MS Health and the Company. | 335,329 | 343,060 | ||||||

| 21 |

EPAZZ, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Consideration for the MS Health acquisition included an unsecured $100,000 seller financed note payable (“MSHSC Note”), bearing interest at 6% per annum, a ten (10) year amortization, a right of offset, no payments of either principal or interest for two (2) years and equal payments of principal and interest commencing in year three (3), no prepayment penalty, and full payment of all amounts due after five (5) years. Pursuant to an amendment to a consulting agreement with the seller on March 23, 2012, the Company agreed to begin to repay principal of $1,000 per month, and had repaid a total of $6,000 during the year ended December 31, 2012. The MSHSC Note is secured by a security interest over the assets of MS Health. We did not purchase and MSHSC agreed to retain and be responsible for any and all liabilities of MSHSC. | 94,000 | 94,000 | ||||||

|

On Deck Capital Loan – DeskFlex, Inc.:

On November 7, 2011, DeskFlex entered into a four month $20,000 note payable agreement with On Deck Capital. Payments of $183 were originally due daily on the loan. Origination fees of $500 were added to the initial loan, agreed to pay additional fees of $387 per month in servicing fees during the term of the loan and to repay the loan via daily payments of $183. The total payments due on the loan equate to an annual interest rate of 18%.

On February 15, 2012, we amended this loan agreement to increase the loan balance to $35,400, consisting of additional proceeds of $19,200, a rolled over loan balance of $10,050, an origination fee of $750 and interest amount of $5,400 to be paid over the restarted four month term of the loan via daily payments of $274.

On July 23, 2012, we amended this loan agreement again to increase the remaining unpaid loan balance to $35,400 again, consisting of additional proceeds of $23,883, a rolled over loan balance of $5,367, an origination fee of $750 and interest amount of $5,400 to be paid over the restarted four month term of the loan via daily payments of $274.

On October 30, 2012, we amended this loan agreement again to increase the remaining unpaid loan balance to $41,300, consisting of additional proceeds of $18,085, a rolled over loan balance of $16,040, an origination fee of $875 and interest amount of $6,300 to be paid over the restarted four month term of the loan via daily payments of $320.