UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ________________ to ________________ |

Commission file number:

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

| | | |

| (State or other jurisdiction of incorporation of organization) | (I.R.S. Employer Identification No.) |

| | | |||

| (U.S. corporate headquarters) | (Zip Code) | |||

| 1830 – 1188 West Georgia Street | V6E 4A2 | |

| (Canadian corporate headquarters) | (Zip Code) |

(Address of principal executive offices)

| ( | ||

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: |

| | | |

Securities registered pursuant to Section 12(g) of the Act:

N/A

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | ☐ Accelerated filer |

| ☐ Non-accelerated filer | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter ($4.03 on January 31, 2023) was approximately $

The registrant had

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K Annual Report and any documents incorporated herein by reference (collectively, the “Annual Report”) include statements and information about our strategy, objectives, plans and expectations for the future that are not statements or information of historical fact. These statements and information are considered to be forward-looking statements, or forward-looking information, within the meaning of and under the protection provided by the safe harbor provisions for forward-looking statements as contained in the Private Securities Litigation Reform Act of 1995 and similar Canadian securities laws.

Forward-looking statements, and any estimates and assumptions upon which they are based, are made in good faith and reflect our views and expectations for the future as of the date of this Annual Report, which can change significantly. Furthermore, forward-looking statements are subject to known and unknown risks and uncertainties which may cause actual results, performance, achievements or events to be materially different from any future results, performance, achievements or events implied, suggested or expressed by such forward-looking statements. Accordingly, forward-looking statements in this Annual Report should not be unduly relied upon.

Forward-looking statements may be based on a number of material estimates and assumptions, of which any one or more may prove to be incorrect. Forward-looking statements may be identifiable by terminology concerning the future, such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “forecast”, “intend”, “goal”, “likely”, “may”, “might”, “outlook”, “plan”, “predict”, “potential”, “project”, “should”, “schedule”, “strategy”, “target”, “will” or “would”, and similar expressions or variations thereof including the negative use of such terminology. Examples in this Annual Report include, but are not limited to, such forward-looking statements reflecting or pertaining to:

| ● |

our overall strategy, objectives, plans and expectations for the fiscal year ended July 31, 2023 (“Fiscal 2023”) and beyond; |

| ● |

our expectations for worldwide nuclear power generation and future uranium supply and demand, including long-term market prices for uranium oxide (“U3O8”); |

| ● |

our belief and expectations of in-situ recovery mining for our uranium projects, where applicable; |

| ● |

our estimation of mineralized materials, which are based on certain estimates and assumptions, and the economics of future extraction for our uranium projects including our Palangana Mine and Christensen Ranch Mine (collectively, the “ISR Mines”); |

| ● |

our plans and expectations including anticipated expenditures relating to exploration, pre-extraction, extraction and reclamation activities for our uranium projects including our ISR Mines; |

| ● |

our ability to obtain, maintain and amend, within a reasonable period of time, required rights, permits and licenses from landowners, governments and regulatory authorities; |

| ● |

our ability to obtain adequate additional financing including access to the equity and credit markets; |

| ● |

our ability to remain in compliance with the terms of our indebtedness; and |

| ● |

our belief and expectations including the possible impact of any legal proceedings or regulatory actions against the Company. |

Forward-looking statements, and any estimates and assumptions upon which they are based, are made as of the date of this Annual Report, and we do not intend or undertake to revise, update or supplement any forward-looking statements to reflect actual results, future events or changes in estimates and assumptions or other factors affecting such forward-looking statements, except as required by applicable securities laws. Should one or more forward-looking statements be revised, updated or supplemented, no inference should be made that we will revise, update or supplement any other forward-looking statements.

Forward-looking statements are subject to known and unknown risks and uncertainties. As discussed in more detail under Item 1A. Risk Factors herein, we have identified a number of material risks and uncertainties which reflect our outlook and conditions known to us as of the date of this Annual Report, including but not limited to the following:

| ● |

our limited financial and operating history; |

| ● |

our need for additional financing; |

| ● |

our ability to service our indebtedness; |

| ● |

our limited uranium extraction and sales history; |

| ● |

our operations are inherently subject to numerous significant risks and uncertainties, of which many are beyond our control; |

| ● |

our exploration activities on our mineral properties may not result in commercially recoverable quantities of uranium; |

| ● |

limits to our insurance coverage; |

| ● |

the level of government regulation, including environmental regulation; |

| ● |

changes in governmental regulation and administrative practices; |

| ● |

nuclear incidents; |

| ● |

the marketability of uranium concentrates; |

| ● |

the competitive environment in which we operate; |

| ● |

our dependence on key personnel; and |

| ● |

conflicts of interest of our directors and officers.3 |

Any one of the foregoing material risks and uncertainties has the potential to cause actual results, performance, achievements or events to be materially different from any future results, performance, achievements or events implied, suggested or expressed by any forward-looking statements made by us or by persons acting on our behalf. Furthermore, there is no assurance that we will be successful in preventing the material adverse effects that any one or more of these material risks and uncertainties may cause on our business, prospects, financial condition and operating results, or that the foregoing list represents a complete list of the material risks and uncertainties facing us. There may be additional risks and uncertainties of a material nature that, as of the date of this Annual Report, we are unaware of or that we consider immaterial that may become material in the future, any one or more of which may result in a material adverse effect on us.

Forward-looking statements made by us or by persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary information.

CAUTIONARY NOTE TO U.S. RESIDENTS CONCERNING DISCLOSURE OF MINERAL RESOURCES

The Company is a U.S. Domestic Issuer for United States Securities and Exchange Commission (“SEC”) purposes, most of its shareholders are U.S. residents, the Company is required to report its financial results under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) and its only trading market is the NYSE American. However, because the Company is a reporting issuer in Canada, certain prior regulatory filings required of the Company in Canada contain or incorporate by reference therein certain disclosure that satisfies the additional requirements of Canadian securities laws, which differ from the requirements of United States’ securities laws. Unless otherwise indicated, all Company resource estimates included in those Canadian filings, and in the documents incorporated by reference therein, had been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

On October 31, 2018, the SEC adopted the Modernization of Property Disclosures for Mining Registrants (the “New Rule”), introducing significant changes to the existing mining disclosure framework to better align it with international industry and regulatory practice, including NI 43-101. The New Rule was codified as 17 CFR Subpart 220.1300 and 229.601(b)(96) (collectively, “S-K 1300”) and replaced SEC Industry Guide 7. The New Rule became effective as of February 25, 2019, and issuers are required to comply with the New Rule as of the annual report for their first fiscal year beginning on or after January 1, 2021, and earlier in certain circumstances. The Company has been complying with the New Rule since the filing of its Annual Report for the fiscal year ended July 31, 2022 and its related filings.

All mineral estimates constituting mining operations that are material to our business or financial condition included in this Annual Report for Fiscal 2023, and in the documents incorporated by reference herein, have been prepared in accordance with S-K 1300 and are supported by initial assessments prepared in accordance with the requirements of S-K 1300. S-K 1300 provides for the disclosure of: (i) “Inferred Mineral Resources,” which investors should understand have the lowest level of geological confidence of all mineral resources and thus may not be considered when assessing the economic viability of a mining project and may not be converted to a Mineral Reserve; (ii) “Indicated Mineral Resources,” which investors should understand have a lower level of confidence than that of a “Measured Mineral Resource” and thus may be converted only to a “Probable Mineral Reserve”; and (iii) “Measured Mineral Resources,” which investors should understand have sufficient geological certainty to be converted to a “Proven Mineral Reserve” or to a “Probable Mineral Reserve.” Investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves as defined by S-K 1300. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable, or that an Inferred Mineral Resource will ever be upgraded to a higher category.

REFERENCES

As used in this Annual Report: (i) the terms “we”, “us”, “our”, “Uranium Energy”, “UEC” and the “Company” mean Uranium Energy Corp., including our wholly-owned subsidiaries and a controlled partnership; (ii) “SEC” refers to the United States Securities and Exchange Commission; (iii) “Securities Act” refers to the United States Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

Uranium Energy Corp. is a fast growing, uranium mining company listed on the NYSE American. UEC is working towards fueling the global demand for carbon-free nuclear energy, a key solution to climate change, and energy source for the low-carbon future.

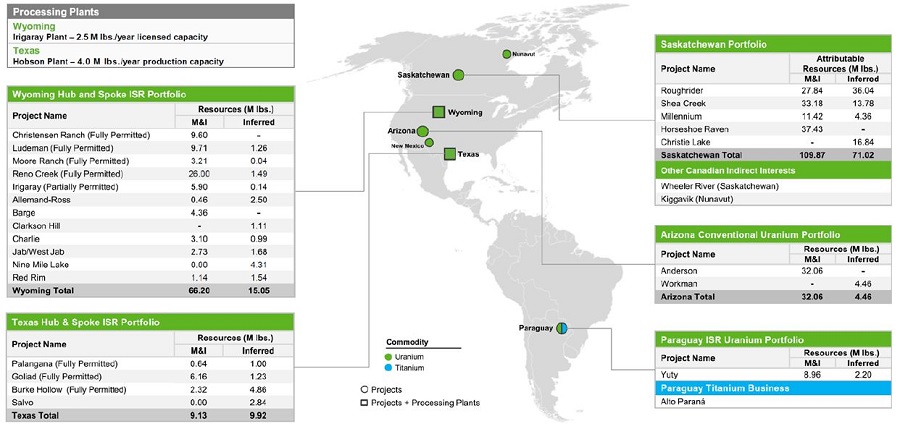

UEC is a pure-play uranium company and is advancing its next generation of low-cost, environmentally friendly, in-situ recovery (“ISR”) mining uranium projects. The Company has two extraction ready ISR hub and spoke platforms in South Texas and Wyoming, anchored by fully licensed and operational processing capacity at its Hobson and Irigaray plants.

UEC also has seven U.S. ISR uranium projects with all of their major permits in place, with additional diversified holdings of uranium assets across the U.S., Canada and Paraguay.

We believe nuclear energy will continue to be an important part of the energy transition and the energy mix of a future low carbon economy. As such, we are focused on scaling our business to meet the future energy needs for nuclear in the U.S. and globally.

Corporate Organization

Uranium Energy Corp. was incorporated under the laws of the State of Nevada on May 16, 2003 under the name Carlin Gold Inc. During 2004 we changed our business operations and focus from precious metals exploration to uranium exploration in the United States. On January 24, 2005, we completed a reverse stock split of our common stock on the basis of one share for each two outstanding shares and amended our Articles of Incorporation to change our name to Uranium Energy Corp. Effective February 28, 2006, we completed a forward stock split of our common stock on the basis of 1.5 shares for each outstanding share and amended our Articles of Incorporation to increase our authorized capital from 75,000,000 shares of common stock, with a par value of $0.001 per share, to 750,000,000 shares of common stock, with a par value of $0.001 per share. In June 2007 we changed our fiscal year end from December 31st to July 31st (in each instance our “Fiscal” year now).

On December 31, 2007, we incorporated a wholly-owned subsidiary, UEC Resources Ltd., under the laws of the Province of British Columbia, Canada. On December 18, 2009, we acquired a 100% interest in the South Texas Mining Venture, L.L.P. (“STMV”), a Texas limited liability partnership, from each of URN Resources Inc., a subsidiary of Uranium One Inc., and Everest Exploration, Inc. On September 3, 2010, we incorporated a wholly-owned subsidiary, UEC Paraguay Corp., under the laws of the State of Nevada. On May 24, 2011, we acquired a 100% interest in Piedra Rica Mining S.A., a private company incorporated in Paraguay. On September 9, 2011, we acquired a 100% interest in Concentric Energy Corp. (“Concentric”), a private company incorporated in the State of Nevada. On March 30, 2012, we acquired a 100% interest in Cue Resources Ltd. (“Cue”), a formerly publicly-traded company incorporated in the Province of British Columbia, Canada. On March 4, 2016, we acquired a 100% interest in JDL Resources Inc., a private company incorporated in the Cayman Islands. On July 7, 2017, we acquired a 100% interest in CIC Resources (Paraguay) Inc., a private company incorporated in the Cayman Islands. On August 9, 2017, we acquired a 100% interest in AUC Holdings (US), Inc. (“AUC”). On January 31, 2018, we incorporated a wholly-owned subsidiary, UEC Resources (SK) Corp. (“UEC SK”), under the laws of the Province of Saskatchewan, Canada. On December 17, 2021, we acquired a 100% interest in Uranium One Americas, Inc. (“U1A”) (now UEC Wyoming Corp.). On August 19, 2022, we, through UEC 2022 Acquisition Co. (“UEC Acquisition Co.”) (now UEX Corporation), acquired all of the issued and outstanding common shares of UEX Corporation (“UEX”), which we did not already own, by way of a statutory plan of arrangement (the “Arrangement”) under the Canada Business Corporations Act. As part of the final steps of the Arrangement, UEC Acquisition Co. and UEX amalgamated to continue as one corporation under the name UEX Corporation. UEX Corporation holds a development stage uranium property portfolio in Saskatchewan, Canada, and Nunavut, Canada. On October 14, 2022, we acquired, through UEC SK, Roughrider Mineral Holdings Inc., a Saskatchewan corporation and wholly-owned subsidiary of Rio Tinto Fer Et Titane Inc., which, in turn, owns all of the issued and outstanding shares of Roughrider Mineral Assets Inc., also a Saskatchewan corporation, that holds certain mineral leases totaling approximately 598 hectares in northern Saskatchewan that is commonly referred to as the “Roughrider Project” located in the Athabasca Basin in Saskatchewan, Canada.

Our principal executive office (U.S. corporate headquarters) is located at 500 North Shoreline, Ste. 800, Corpus Christi, Texas, 78401, and our administrative office (Canadian corporate headquarters) is located at 1188 West Georgia Street, Suite 1830, Vancouver, British Columbia, Canada, V6E 4A2.

General Business

UEC’s goal is to provide the much needed fuel for the global energy transition. The International Energy Outlook projects that worldwide electricity generation will grow by 1.8% per year, through to 2050. As the global community calls on all governments and industries to curb their carbon emissions to stop the effects of climate change, there is growing need to combine intermittent renewable energy sources, such as wind and solar, with one or more “firm” zero-carbon sources, such as nuclear energy, to ensure the affordability and accessibility of the net-zero electricity grid.

We are predominantly engaged in uranium mining and related activities, including exploration, pre-extraction, extraction and processing, on uranium projects located in the United States, Canada and the Republic of Paraguay. We utilize ISR mining where possible which we believe, when compared to conventional open pit or underground mining, requires lower capital and operating expenditures with a shorter lead time to extraction and a reduced impact on the environment. We do not expect, however, to utilize ISR mining for all of our uranium projects in which case we would expect to rely on conventional open pit and/or underground mining techniques. We have one uranium mine located in the State of Texas, our Palangana Mine, which utilizes ISR mining and commenced extraction of U3O8, or yellowcake, in November 2010. We have one uranium processing facility located in the State of Texas, our Hobson Processing Facility, which processes material from our ISR Mines into drums of U3O8, our only sales product and source of revenue, for shipping to a third-party storage and sales facility. Since commencement of uranium extraction from our ISR Mines in November 2010 to July 31, 2023, our Hobson Processing Facility has processed 578,000 pounds of U3O8. As at July 31, 2023, we had no uranium supply or “off-take” agreements in place. Future sales of U3O8 are therefore expected to generally occur through the uranium spot market, with any fluctuations in the market price continuing to have a direct impact on our revenues and cash flows.

Our fully-licensed and 100%-owned Hobson Processing Facility forms the basis for our regional operating strategy in the State of Texas, specifically in the South Texas Uranium Belt, where we utilize ISR mining. We utilize a “hub-and-spoke” strategy whereby the Hobson Processing Facility acts as the central processing site (the “hub”) for our Palangana Mine and future satellite uranium mining activities, such as our Burke Hollow and Goliad Projects, located within the South Texas Uranium Belt (the “spokes”). The Hobson Processing Facility has a physical capacity to process uranium-loaded resins up to a total of two million pounds of U3O8 annually and is licensed to process up to four million pounds of U3O8 annually.

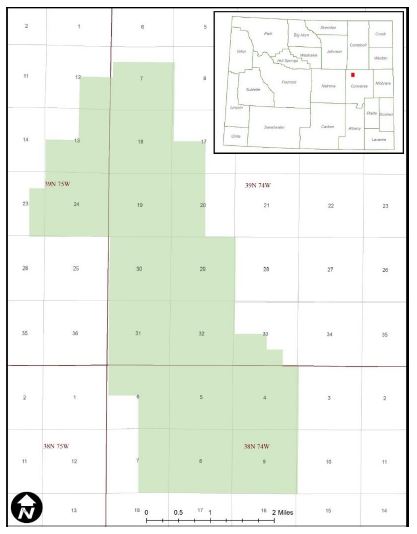

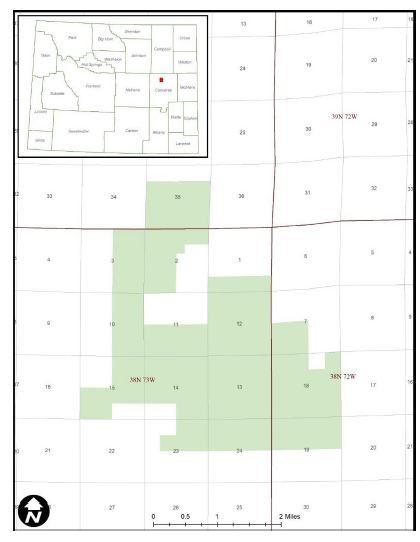

With the acquisition of U1A in Fiscal 2022, the Irigaray Processing Facility forms the focus of our regional operating strategy in the Powder River and Great Divide uranium districts in the state of Wyoming. The Irigaray plant has a licensed capacity of 2.5 million pounds of U3O8 per year, with the potential to process uranium from eleven satellite ISR projects in the state, including four fully permitted projects.

Recently, we acquired a substantial portfolio of projects in Canada, with the purchase of UEX and the Roughrider Project from a subsidiary of Rio Tinto plc (“Rio Tinto”). The UEX portfolio consists of a mix of uranium deposits, primarily focused on the Athabasca Basin uranium district in Saskatchewan, Canada. This includes interests in the Shea Creek, Christie Lake, Horseshoe Raven, Millennium and Wheeler River projects. In addition to advancing its uranium development projects through its ownership interest in JCU (Canada) Exploration Company, Limited, UEX was advancing several other uranium deposits in the Athabasca Basin which include the Paul Bay, Ken Pen and Ōrora deposits at the Christie Lake Project, the Kianna, Anne, Colette and 58B deposits at its currently 49.1%-owned Shea Creek Project, and the Horseshoe and Raven deposits located on its 100%-owned Horseshoe-Raven Project. The Roughrider Project is an exploration stage asset, having been advanced by Rio Tinto over a decade of work. The acquisition brought in an exploration stage, high-grade, conventional asset into UEC’s portfolio that, along with the UEX acquisition, begins to develop a critical mass of 100% owned resources in the Athabasca Basin to accelerate extraction and/or production plans. The two transactions provide a portfolio of medium to long term, high-grade, conventional projects that complement our nearer term, U.S. ISR assets.

In August 2023, we acquired a portfolio of exploration-stage projects in the Athabasca Basin, Saskatchewan, Canada, for CAD$1.5 million from Rio Tinto Exploration Canada Inc., a subsidiary of Rio Tinto, whereby we acquired a 60% equity stake in the Henday Lake joint venture, 100% of the Milliken project and a 50% equity stake in the Carswell joint venture project. With this transaction, we added an additional 44,444 acres of prospective ground in the Athabasca Basin to our existing portfolio.

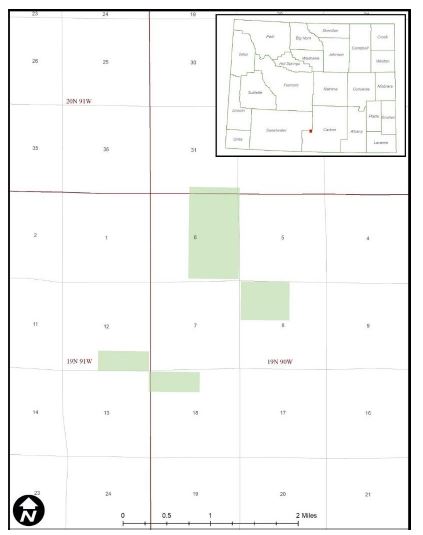

As at July 31, 2023, we hold certain mineral rights in various stages in the States of Arizona, Colorado, New Mexico, Texas and Wyoming, in Canada and in the Republic of Paraguay, many of which are located in historically successful mining areas and have been the subject of past exploration and pre-extraction activities by other mining companies. We do not expect, however, to utilize ISR mining for all of our uranium projects in which case we would expect to rely on conventional open pit and/or underground mining techniques.

Our operating and strategic framework is based on expanding our uranium extraction activities, which includes advancing certain uranium projects with established mineralized materials towards uranium extraction, and establishing additional mineralized materials on our existing uranium projects or through acquisition of additional uranium projects.

Physical Uranium Program

The Company is investing in building the next generation of low-cost and environmentally friendly uranium projects that will be competitive on a global basis. Despite our focus on low cost ISR mining with its low capital requirements, we saw a unique opportunity to purchase drummed uranium at prevailing spot prices which are below most global industry mining costs. Hence, we established a physical uranium portfolio (the “Physical Uranium Program”) and, as of July 31, 2023, we had entered into agreements to purchase 1,695,000 pounds of U.S. warehoused uranium from Fiscal 2024 to Fiscal 2026 at the ConverDyn conversion facility located in Metropolis, Illinois, at a volume weighted average price of approximately $42.78 per pound.

During Fiscal 2023, we generated revenue of $164.0 million from sales of 3,150,000 pounds of uranium, which included $17.85 million from sales of 300,000 pounds of U.S. origin uranium concentrates to the U.S. Department of Energy.

Our Physical Uranium Program will support three objectives for our Company: (i) to bolster our balance sheet as uranium prices appreciate; (ii) to provide strategic inventory to support future marketing efforts with utilities that could compliment production and accelerate cash flows; and (iii) to increase the availability of our Texas and Wyoming production capacity for emerging U.S. origin specific opportunities which may command premium pricing due to the scarcity of domestic uranium. One such U.S. origin specific opportunity is the Company’s plan to participate in supplying the Uranium Reserve, as outlined in the Nuclear Fuel Working Group report published by the U.S. Department of Energy.

During Fiscal 2023, we made significant advancements in various aspects of our operations, including:

| ● |

we completed and filed TRS reports in accordance with S-K 1300 disclosing mineral resources for each of our Texas ISR Hub and Spoke, updated Wyoming ISR Hub and Spoke, Shea Creek, Horseshoe-Raven, Workman Creek and Roughrider Projects on August 11, 2022, September 14, 2022, January 13, 2023, January 24, 2023, March 16, 2023 and May 2, 2023, respectively; |

| ● |

we completed the acquisition of UEX on August 19, 2022, making us one of the largest diversified North American focused uranium companies; |

| ● |

we completed the acquisition of the Roughrider Project on October 14, 2022. The acquisition of the Roughrider Project represented an opportunity to scale-up in the high-grade Eastern Athabasca Basin of Saskatchewan, Canada; |

| ● |

we generated revenue of $164.0 million from sales of 3,150,000 pounds of uranium, which included $17.85 million from sales of 300,000 pounds of U.S. origin uranium concentrates to the U.S. Department of Energy; |

| ● |

we published our inaugural sustainability report; |

| ● |

we expanded licensed capacity to four million pounds of U3O8 annually at our Hobson Processing Facility, distinguishing the plant as having the largest licensed capacity in Texas and the second largest in the United States; and |

| ● |

we commenced a drilling campaign at our 82.77% owned Christie Lake Project and drilled 19,778.9 meters. |

Uranium Market Developments

Over the past few years, global uranium market fundamentals have been improving as the market transitions from an inventory driven market to a production driven market. The spot market bottomed in November 2016 at about $17.75 per pound U3O8 and stood at $56.25 per pound on July 31, 2023 (UxC U3O8 Daily Spot Price). Production dropped to a multi-year low in 2020 at about 122 million pounds but began to recover in 2021 and totalled about 129 million pounds in 2022, still well below reactor requirements. Global supply and demand projections show a structural deficit between production and utility requirements averaging over 44 million pounds a year over the next 10 years and increasing thereafter (UxC 2023 Q2 Uranium Market Outlook). The current gap is being filled with secondary market sources, including finite inventory that is projected to decline in coming years. As secondary supplies diminish, and as existing mines deplete their resources, new production will be needed to meet utility demand. This will require higher prices to stimulate new mining investment but market prices are still below the incentive prices for many producers.

Uranium supply has become more complicated due to Russia’s invasion of Ukraine as Russia is a significant supplier of nuclear fuel around the globe. Economic sanctions, transportation restrictions, pending legislation and buyer avoidance of Russian fuel is causing a fundamental change to the nuclear fuel markets. We believe this is resulting in a bifurcation of the uranium market, increasing an already notable supply gap for western utilities. More recently, the coup in Niger has raised questions about uranium supply from that country that provided about 25% of European supply this past year. Secondary supply is also likely to be further reduced with western enrichers reversing operations from underfeeding to overfeeding that requires more uranium to increase the production of enrichment services. While these situations are still unfolding, new trends appear to be pointing towards U.S. and European utilities beginning to shift more focus to security of supply with production from areas of low geopolitical risk.

On the demand side of the equation, the global nuclear energy industry continues robust growth, with 69 new reactors connected to the grid since 2013 and another 59 reactors under construction as of August 2023 (PRIS and WNA August 2023 data). In October 2022, World Nuclear News reported that: “The International Energy Agency projects more than a doubling of nuclear generation by 2050 with at least 30 countries increasing their use of nuclear power, in the Net Zero Emissions by 2050 scenario of its latest World Energy Outlook”. Additional upside market pressure is also emerging as utilities return to a longer-term contracting cycle to replace expiring contracts; something the market has not experienced for several years. Increasing demand has also occurred with financial entities and various producers, including our Company, purchasing significant quantities of drummed uranium inventory, further removing excess near term supplies.

Titanium (TiO2) Industry Updates

During Fiscal 2023, the market fundamentals for titanium dioxide remained positive although some softening is expected during the latter part of 2023. There is no economical substitute or environmentally safe alternative to titanium dioxide. Titanium dioxide is used in many “quality of life” products for which demand historically has been linked to global gross domestic product (“GDP”), ongoing urbanization trends and discretionary spending. 90% of all the mined titanium feedstocks are used to manufacture pure titanium dioxide – a pigment that enhances brightness and opacity in paints, inks, paper, plastics, food products and cosmetics. The remaining 10% of supply is used in the production of titanium metal and steel fabrication.

Demand for titanium feedstocks, such as ilmenite, is closely tied to titanium dioxide pigment demand. The global titanium pigment demand fundamentals are underpinned by urbanization and rising living standards and as such the long-term demand fundamentals remain robust. Demand for titanium pigment is expected to soften during the latter half of 2023 mainly due to slower growth in China. During 2023, China has seen increasing competition for pigment sales in both the domestic and export markets which has led to reduced pigment production from some operations and in turn has impacted the demand for ilmenite during the first part of the year.

Longer-term, China, the world’s largest feedstock market, is becoming increasingly more reliant on higher quality imported feedstocks. Chinese domestic ilmenite is mainly unsuitable for processing under the stricter environmental regulations and, as such, the long-term global shift towards chloride pigment production will continue to drive overall high-quality feedstock demand and prices.

In our view, what appear to be longer-term supply and demand fundamentals and, more specifically, the long-term global shift towards higher grade feedstocks, have the potential to keep upward pressure on high-quality feedstock prices and hence the potential product from the Alto Parana Project.

In-Situ Recovery (ISR) Mining

We utilize in-situ recovery or ISR uranium mining for our South Texas projects as well as our Reno Creek Project in Wyoming, and will continue to utilize ISR mining whenever such an alternative is available to conventional mining. When compared to conventional mining, ISR mining requires lower capital expenditures, has a reduced impact on the environment and results in a shorter lead time to uranium recovery.

ISR mining is considered considerably more environmentally friendly compared to alternative, traditional mining approaches, as the ISR process does not require blasting or waste rock movement, resulting in less damage to the environment, minimal dust, and no resulting tailings or tailings facilities. Further, ISR mining is more discrete and, therefore, land access does not typically have to be restricted, and the area may be restored to its pre-mining usage faster than when applying traditional mining approaches.

ISR mining involves circulating oxidized water through an underground uranium deposit, dissolving the uranium and then pumping the uranium-rich solution to the surface for processing. Oxidizing solution enters the formation through a series of injection wells and is drawn to a series of communicating extraction wells. To create a localized hydrologic cone of depression in each wellfield, more groundwater will be produced than injected. Under this gradient, the natural groundwater movement from the surrounding area is toward the wellfield, providing control of the injection fluid. Over-extraction is adjusted as necessary to maintain a cone of depression which ensures that the injection fluid does not move outside the permitted area.

The uranium-rich solution is pumped from an ore zone to the surface and circulated through a series of ion exchange columns located at the mine site. The solution flows through resin beds inside an ion exchange column where the uranium bonds to small resin beads. As the solution exits the ion exchange column, it is mostly void of uranium and is re-circulated back to the wellfield and through the ore zone. Once the resin beads are fully-loaded with uranium, they are transported by truck to our Hobson Processing Facility and transferred to a tank for flushing with a brine solution, or elution, which strips the uranium from the resin beads. The stripped resin beads are then transported back to the mine and reused in the ion exchange columns. The uranium solution, now free from the resin, is precipitated out and concentrated into a slurry mixture and fed to a filter press to remove unwanted solids and contaminants. The slurry is then dried in a zero-emissions rotary vacuum dryer, packed in metal drums and shipped out as uranium concentrates, or yellowcake, to a conversion facility for storage and sales.

Each project is divided into a mining unit, known as a Production Area Authorization (“PAA”), which lies inside an approved Mine Permit Boundary. Each PAA will be developed, extracted and restored as one unit and will have its own set of monitor wells. It is common to have multiple PAAs in extraction at any one time with additional units in various states of exploration, pre-extraction and/or restoration.

After mining is complete in a PAA, aquifer restoration will begin as soon as practicable and will continue until the groundwater is restored to pre-mining conditions. Once restoration is complete, a stability period of no less than one year is scheduled with quarterly baseline and monitor well sampling. Wellfield reclamation will follow after aquifer restoration is complete and the stability period has passed.

Hobson Processing Facility

Our Hobson Processing Facility is located in Karnes County, Texas, about 100 miles northwest of Corpus Christi. It was originally licensed and constructed in 1978, serving as the hub for several satellite mining projects until 1996, and completely refurbished in 2008. On December 18, 2009, we acquired the Hobson Processing Facility as part of our acquisition of STMV.

With a physical capacity to process uranium-loaded resins up to a total of two million pounds of U3O8 annually and licensed to process up to four million pounds of U3O8 annually, our fully-licensed and 100%-owned Hobson Processing Facility forms the basis for our “hub-and-spoke” strategy in the State of Texas, specifically in the South Texas Uranium Belt, where we utilize ISR mining.

Palangana Mine

We hold various mining lease and surface use agreements generally having an initial five-year term with extension provisions, granting us the exclusive right to explore, develop and mine for uranium at our Palangana Mine, a 6,969-acre property located in Duval County, Texas, approximately 100 miles south of the Hobson Processing Facility. These agreements are subject to certain royalty and overriding royalty interests indexed to the sales price of uranium.

On December 18, 2009, we acquired the Palangana Mine as part of our acquisition of STMV. In November 2010, the Palangana Mine commenced uranium extraction utilizing ISR mining and in January 2011 the Hobson Processing Facility began processing resins received from the Palangana Mine.

Material Relationships Including Long-Term Delivery Contracts

As at July 31, 2023, we had no uranium supply or “off-take” agreements in place.

Given that there are up to approximately 60 different companies as potential buyers in the uranium market, we are not substantially dependent upon any single customer to purchase uranium extracted by us.

Seasonality

The timing of our uranium concentrate sales is dependent upon factors such as extraction results from our mining activities, cash requirements, contractual requirements and perception of the uranium market. As a result, our sales are neither tied to nor dependent upon any particular season. In addition, our ability to extract and process uranium does not change on a seasonal basis. Over the past ten years uranium prices have tended to decline during the calendar third quarter before rebounding during the fourth quarter, but there does not appear to be a strong correlation.

Mineral Rights

In Texas our mineral rights are held exclusively through private leases from the owners of the land/mineral/surface rights with varying terms. In general, these leases provide for uranium and certain other specified mineral rights only including surface access rights for an initial term of five years and renewal for a second five-year term. We have amended the majority of the leases to extend the time period for an additional five years past the original five-year renewal periods. Our Burke Hollow and some of our Goliad Project leases have a fixed royalty amount based on net proceeds from sales of uranium, and our other projects have production royalties calculated on a sliding-scale basis tied to the gross sales price of uranium. Remediation of a property is required in accordance with regulatory standards, which may include the posting of reclamation bonds.

In Arizona, Colorado, New Mexico and Wyoming our mineral rights are held either exclusively or through a combination of federal mining claims and state and private mineral leases. Remediation of a property is required in accordance with regulatory standards, which may include the posting of reclamation bonds. Our federal mining claims consist of both unpatented lode and placer mining claims registered with the U.S. Bureau of Land Management (“BLM”) and the appropriate counties. These claims provide for all mineral rights including surface access rights for an indefinite period. Annual maintenance requirements include BLM claim fees of $165 per claim due yearly on September 1st. Our state mineral leases are registered with their respective states. These leases provide for all mineral rights, including surface access rights, to be subject to a production royalty of 4% in Wyoming and 5% to 6% in Arizona, ranging from a five-year term in Arizona to a ten-year term in Wyoming. Annual maintenance requirements include lease fees of between $1 and $3 per acre and minimum exploration expenditure requirements of between $10 and $20 per acre in Arizona. Our private mineral leases are negotiated directly with the owners of the land/mineral/surface rights with varying terms. These leases provide for uranium and certain other specified mineral rights only, including surface access rights, subject to production royalties, ranging from an initial term of five to seven years and renewal for a second five-year to seven-year term, and some of which have an initial term of 20 years.

Under the mining laws of Saskatchewan, Canada, title to mineral rights for our projects in Saskatchewan is held through The Crown Minerals Act of the Province of Saskatchewan. In addition, The Mineral Resources Act, 1985 and The Mineral Tenure Registry Regulations affect the rights and administration of mineral tenure in Saskatchewan. Our lands of Saskatchewan projects are currently claimed as “Crown dispositions” or “mineral dispositions”. Subject to section 19 of The Crown Minerals Act, a claim grants to the holder the exclusive right to explore for any Crown minerals that are subject to these regulations within the claim lands. Claims are renewed annually and the claim holder is required to satisfy work expenditure requirements. Expenditure requirements are $Nil for the first year, $15 per hectare for the second year to the tenth year of assessment work periods and $25 per hectare for the eleventh year and subsequent assessment work periods. For registering exploration expenditures, mineral dispositions may be grouped at the time of submission if the total mineral disposition area is not greater than 18,000 hectares. The holder may also submit a cash payment or cash deposit in lieu of a work assessment submission for not more than three consecutive work periods. A claim may be converted to a mineral lease upon application and payment of a registration fee.

Under the mining laws of the Republic of Paraguay, title to mineral rights for our Yuty Project is held through a “Mineral Concession Contract” approved by the National Congress and signed between the Government of the Republic of Paraguay and the Company, and titles to mineral rights for our Oviedo Project and our Alto Paraná Titanium Project are held through “Exploration Mining Permits” granted by the Ministry of Public Works and Communications (“MOPC”), the mining regulator in Paraguay. These mineral rights provide for the exploration of metallic and non-metallic minerals and precious and semi-precious gems within the territory of Paraguay for up to a six-year period, and for the exploitation of minerals for a minimum period of 20 years from the beginning of the production phase, extendable for an additional ten years.

Environmental, Social and Governance Overview

UEC is dedicated to preserving the environment in which we operate, and to being a responsible neighbor to our local communities. We believe in mining in a responsible manner, such as through the deployment of ISR technology when possible, adhering to all applicable environmental regulations and managing and reducing our carbon emissions. UEC believes that uranium and nuclear energy will be an important part of the energy transition as it can provide reliable and consistent power to the grid. Ensuring responsible mining practices better positions nuclear to be an energy source of choice to governments, and enables us to be a better partner and corporate citizen to our local communities.

Environmental Management

Environmental Governance

UEC approved an Environmental, Health and Safety Policy in Fiscal 2022 which sets out objectives and provides overarching guidelines for the management of the environment. This enterprise-wide policy can be found at https://www.uraniumenergy.com/about/corporate-governance/. Topics covered in this policy include the management of hazardous waste, water, biodiversity and land use, air quality and pollutants, green-house gas (“GHG”) emissions and energy management. Adherence to and performance against this policy will be reviewed by our Board of Directors’ (the “Board of Directors” or “Board”) Sustainability Committee annually.

U.S. Environmental Regulations

We believe that we comply with all federal, state and local applicable laws and regulations which govern environmental quality and pollution control. Our operations are subject to stringent environmental regulation by state and federal authorities including the Railroad Commission of Texas (“RCT”), the Texas Commission on Environmental Quality (“TCEQ”), the Wyoming Department of Environmental Quality (“WDEQ”) Land, Water and Air Quality Divisions, the United States BLM(Wyoming) and the United States Environmental Protection Agency (“EPA”).

Texas

In Texas, where the Company’s hub-and-spoke operations are anchored by the fully-licensed Hobson Processing Facility, surface extraction and exploration for uranium is regulated by the RCT, while ISR uranium extraction is regulated by the TCEQ. An exploration permit is the initial permit granted by the RCT that authorizes exploration drilling activities inside an approved area. This permit authorizes specific drilling and plugging activities requiring documentation for each borehole drilled. All documentation is submitted to the RCT on a monthly basis and each borehole drilled under the exploration permit is inspected by an RCT inspector to ensure compliance. As at July 31, 2023, we held one exploration permit in each of Bee, Duval and Goliad Counties in Texas.

As an example of the regulation that guides our industry, before ISR uranium extraction can begin in Texas, a number of permits must be granted by the TCEQ.

A Mine Area Permit (“MAP”) application is required for submission to the TCEQ to establish a specific permit area boundary, aquifer exemption boundary and the mineral zones of interests or production zones. The application also includes a financial surety plan to ensure funding for all plugging and abandonment requirements. Funding for surety is in the form of cash or bonds, including an excess of 15% for contingencies and 10% for overhead, adjusted annually for inflation. As at July 31, 2023, we held MAPs for our Palangana Mine and our Goliad and Burke Hollow Projects.

A Radioactive Material License (“RML”) application is also required for submission to the TCEQ for authorization to operate a uranium recovery facility. The application includes baseline environmental data for soil, vegetation, surface water and groundwater along with operational sampling frequencies and locations. A Radiation Safety Manual is a key component of the application which defines the environmental health and safety programs and procedures to protect employees and the environment. Another important component of the application is a financial surety mechanism to ensure plant and wellfield decommissioning is properly funded and maintained. Surety funding is in the form of cash or bonds, and includes an excess of 15% for contingencies and 10% for overhead, adjusted annually for inflation. As at July 31, 2023, we held RMLs for our Palangana Mine, Burke Hollow and Goliad Projects and Hobson Processing Facility.

PAA applications are also required for submission to the TCEQ to establish specific extraction areas inside the MAP boundary. These are typically 30 to 100-acre units that have been delineated and contain extractible quantities of uranium. The PAA application includes baseline water quality data that is characteristic of that individual unit, proposes upper control limits for monitor well analysis and establishes restoration values. The application will also include a financial security plan for wellfield restoration and reclamation which must be funded and in place prior to commencing uranium extraction. As at July 31, 2023, we held four PAA permits for our Palangana Mine and one for our Goliad Project. An application for PAA-1 at Burke Hollow was submitted in February 2023.

A Class I disposal well permit application is also required for submission to the TCEQ for authorization for deep underground wastewater injection. It is the primary method for disposing of excess fluid from the extraction areas and for reverse osmosis concentrate during the restoration phase. This permit authorizes injection into a specific injection zone within a designated injection interval. The permit requires continuous monitoring of numerous parameters including injection flow rate, injection pressure, annulus pressure and injection/annulus differential pressure. Mechanical integrity testing is required initially and annually to ensure the well is mechanically sound. Surety funding for plugging and abandonment of each well is in the form of cash or bonds, including 15% for contingencies and 10% for overhead, adjusted annually for inflation. As at July 31, 2023, we held two Class I disposal well permits for each of our Hobson Processing Facility, Palangana Satellite Facility and Burke Hollow and Goliad Projects.

The federal Safe Drinking Water Act (“SDWA”) creates a regulatory program to protect groundwater and is administered by the EPA. The SDWA allows states to issue underground injection control (“UIC”) permits under two conditions: the state’s program must have been granted primacy; and the EPA must have granted an aquifer exemption upon the state’s request (an “Aquifer Exemption”). Texas, being a primacy state, is therefore authorized to grant UIC permits and makes the official requests for an Aquifer Exemption to the EPA. The Aquifer Exemption request is submitted by the Company to the TCEQ and, once approved, is then submitted by the TCEQ to the EPA for concurrence and final issuance. As at July 31, 2023, we held an Aquifer Exemption for each of our Palangana Mine and our Goliad and Burke Hollow Projects.

Wyoming

In Wyoming ISR mining activities are regulated by the Wyoming Department of Environmental Quality (“WDEQ”), Land Quality Division (“LQD”), under Wyoming Administrative Code §35-11-401 through §35-11-437. Before ISR uranium mining is allowed to proceed in Wyoming, certain permits and licenses must be granted by WDEQ, which are subject to financial assurance plans to ensure anticipated future costs for decontamination, decommissioning, reclamation, groundwater restoration, disposal, or any other reclamation requirements are adequately funded. Bonding regulations for ISR facilities are discussed in §35-11-417 of the Wyoming Administrative Code and further in WDEQ/LQD regulations contained in Non-Coal Chapters 1 through 13.

There are two major permits/licenses required for ISR uranium mining in Wyoming. The first is the Permit to Mine, issued by the WDEQ/LQD. The second is the RML, previously issued by the U.S. Nuclear Regulatory Commission (“NRC”), now issued by the WDEQ/LQD Uranium Recovery Program (“URP”). In 2018 the State of Wyoming became an NRC agreement state for the licensing of uranium recovery operations. RMLs are now issued and regulated by the WDEQ/LQD/URP. Annual financial surety updates are required on the Mine Permit anniversary date and are reviewed by both the WDEQ/LQD and WDEQ/LQD/URP as part of the approval process. As at July 31, 2023, UEC held Permits to Mine and RMLs for each of its Christensen Ranch, Irigaray, Ludeman, Moore Ranch and Reno Creek Projects.

In Wyoming, a Class I disposal well permit is required for deep underground wastewater injection (same process as in Texas). It is the primary method for disposing of excess fluid from the extraction areas and for reverse osmosis concentrate during the restoration phase. Permits for Class I Injection wells are authorized by the WDEQ Water Quality Division who has primacy for this program under EPA. In Wyoming, as at July 31, 2023, UEC holds Class I Injection well permits for four disposal wells at the Christensen Ranch Project, two disposal wells at the Irigaray Project, four disposal wells at the Moore Ranch Project and four disposal wells at its Reno Creek Project.

Exploration drilling outside of areas within a Permit to Mine is regulated by the WDEQ LQD. To conduct exploration drilling, an application must be filed with LQD that provides location details of the areas to be explored, the number of drill holes anticipated, the methods of drill hole abandonment to be used; location of access roads to be used or constructed, and an estimate of the cost to reclaim all drill holes and surfaces impacted by the drilling program. If approved, LQD will approve the reclamation cost estimate and the company will post a bond or other financial assurance instrument acceptable to LQD. After the financial assurance instrument is approved by LQD, they will issue a Drilling Notification permit to the company to conduct the exploration drilling. After reclamation is completed, LQD will inspect the drill hole sites and either approve the reclamation and release the bond, or make recommendations for further corrective action. As at July 31, 2023, UEC holds three Drilling Notification Permits, two for various exploration projects in the Powder River Basin and one for exploration in the Great Divide Basin of Wyoming.

Under the WDEQ the Bonding Provisions (§35-11-417) and regulations for Financial Assurance Requirements for Closure, Post Closure, and Corrective Action outlines financial assurance for in-situ uranium sites to include costs relating to: decommissioning, decontamination, demolition and waste disposal for buildings, structures, foundations, equipment and utilities; well plugging and abandonment; surface reclamation of operating areas, roads, wellfields and surface impoundments; groundwater restoration in mining areas; and radiological surveying for final release of the lands. Funding for the financial assurance is in the form of cash, reclamation bonds, letters of credit, and other mechanisms approved by the WDEQ. The financial assurance calculations include an excess of 15% for contingencies and 10% for overhead, adjusted annually for inflation. As at July 31, 2023, UEC held reclamation bonds for all of the Permits to Mine and RMLs Licenses plus three Drilling Notifications (exploration by drilling permits).

As in Texas, the State of Wyoming is allowed to issue UIC permits under two conditions: the state’s program must have been granted primacy; and the EPA must have granted an aquifer exemption upon the state’s request (an Aquifer Exemption). Wyoming issues UIC Class I permits (disposal wells) and UIC Class III permits for ISR wells. Wyoming requests the official aquifer exemption from the EPA for these permits. As at July 31, 2023, UEC held Aquifer Exemptions for each of its Christensen Ranch, Irigaray, Ludeman, Moore Ranch and Reno Creek Projects, as well as the Christensen Ranch Class I disposal wells.

Canada Environmental Regulations

Uranium mining and milling projects in Canada are among the most heavily regulated types of projects in the country with full regulatory oversight from both the federal and provincial levels of government. That full regulatory oversight includes a strong, independent federal nuclear regulator, the Canadian Nuclear Safety Commission (“CNSC”), which is charged with regulating all aspects of nuclear activities in Canada. Modern uranium mines, despite their strong safety and environmental protection record, operate in this heavily regulated environment effectively using integrated management systems maintain compliance and extensive reporting to demonstrate ongoing compliance. Monitoring includes community groups (e.g., North Environmental Quality Committee), First Nations, periodic state of the environment reporting and occasional independent third-party monitoring funded by the CNSC.

For mining in Saskatchewan, a surface lease is required prior to work commencing on site. The surface lease will generally cover all areas that are predicted to be disturbed and accrues annual fees per hectare. Surface leases are coordinated through the Ministry of Government Relations, Northern Engagement Branch, and the Ministry of Environment (“MOE”), Lands Branch, and includes input from other government agencies where appropriate. While negotiations can start early, and in parallel with a provincial Environmental Impact Assessment (“EIA”) process, a precondition of the issuance of a surface lease is the successful outcome of the EIA process. In Saskatchewan, the EIA and licensing process are sequential, as the EIA process must be completed prior to the issuance of specific leases, licenses and permits.

To require an EIA, a project must be deemed a Development per section 2(d) of the Saskatchewan Environmental Assessment Act (“EAA”) and a formal Ministerial Determination to that effect. The work required for an EIA includes any delegated Duty to Consult engagement and consultation along with environmental baseline work.

Once an EIA is submitted and the provincial internal reviews are finished, the EASB compiles the comments and produces the technical review comments (“TRC”) document. If there are deficiencies in the EIA, the proponent will be required to address them before the TRC document and the final EIS are placed into public review. Public review is generally 30 or 60 days. When the public comments period is complete, EASB will produce an EIA decision document for the Minister of Environment. While there are three outcomes possible, the likely outcome for a project that gets to this stage is approval of the EIA with conditions. With approval of the EIA, licensing and permitting can be completed.

While the EIA is in progress, the proponent can develop the surface lease application, and other provincial licensing packages for review by the government, although approval of these cannot occur until the EIA process is completed and a positive outcome obtained. Provincially, the licensing is through the MOE Environmental Protection Branch, which largely provides a one window approach for mining project licensing on behalf of other branches and ministries. There will be other ministries and permitting required related to health and safety, labour, employment, and royalties. Overall, a number of permissions, of one form or another, are required to complete the project, but when compared to the EIA process, they are rarely material to the schedule or budget if organized properly. Most ministries will indicate their interest and the need for any permits at the Technical Proposal and EIA review stages and those comments will come forward in the TRC.

The federal Impact Assessment Act, 2019 (“IAA”) and the need to produce an Impact Assessment (“IA”) can be triggered in two ways. The first is by triggering one of the activity thresholds in the Physical Activities Regulations, 2019, and the second is that the project can be designated by the federal Minister of Environment and Climate Change (the “Minister”) in response to a request to designate the project and a supporting recommendation from the Canadian Impact Assessment Agency (“CIAA”). Currently, the proposed project does not trigger any thresholds in the Physical Activities Regulations.

The CNSC and Saskatchewan MOE have historically worked closely together and the CNSC will have the ability to review the provincial EIA. The regulators have demonstrated recently that they can cooperate in their review of projects despite the expiration of their cooperation agreement. The CNSC can review and provide comments on any submission to EASB. In addition, the CNSC will act as a technical advisor and is a participant in the EIA process; however, the provincial EIA decision is independent of the federal government.

The main federal licensing agency for the Project, the CNSC, will need to be satisfied that the environment, writ large, is protected. The CNSC will conduct an environmental protection review (“EPR”) for the license application in accordance with their mandate under the NSCA to ensure the protection of the environment and the health of persons. The CNSC follows the federal mandates with respect to Indigenous peoples and other initiatives such as Climate Change.

The CNSC and Saskatchewan MOE have historically worked closely together and the CNSC will have the ability to review the provincial EIA. The regulators have demonstrated recently that they can cooperate in their review of projects despite the expiration of their cooperation agreement. The CNSC can review and provide comments on any submission to EASB. In addition, the CNSC will act as a technical advisor and is a participant in the EIA process; however, the provincial EIA decision is independent of the federal government.

Per the NSCA, a project needs to initiate the licensing process in order to have meaningful discussions with the CNSC and early discussions with the CNSC on the licensing process, engagement and consultation expectations, and the scope of the Project’s licensing are meaningful to help advance a project. While the option of sequentially doing the provincial EIA and the CNSC licensing is available to the proponent, the CNSC suggests doing these two distinct processes in parallel to save time. Effectively, while the EIA process is proceeding, the development and submission of the provincial and CNSC licensing packages can proceed in parallel. It is assumed that a successful outcome for the provincial EIA would be an important part of the CNSC’s EPR, which would be presented to the Commission Tribunal as part of the licensing reviews. As for Saskatchewan, a positive environmental decision is required prior to the Commission approving any licensing packages. The CNSC’s licensing and oversight processes are done on a cost recovery basis through the Cost Recovery Fees Regulations.

In support of licensing, proponents are required to develop management systems complete with policies, systems/programs, procedures, and monitoring commensurate with the proposed scope of activities. To protect human health and the environment, the CNSC focusses on their regulated areas of safety and control in their assessment of projects, including areas of higher risk such as quality management, occupational health and safety, environmental protection, radiation protection, tailings management, and safeguards and non-proliferation, to name a few.

There may be a need to engage with Fisheries and Oceans Canada (under the Fisheries Act) regarding treated effluent discharge or pump stations for fresh water. Transport Canada authorization may be required if there are any in-water works with a potential to impact navigation (under the Canadian Navigable Waters Act or under the Canadian Aviation Regulations). Water quality and the monitoring of biological effects will be governed by the Metal and Diamond Mining Effluent Regulations to the Fisheries Act, in addition to any provincial requirements. Other federal legislation of importance to a project will be compliance with the Species at Risk Act (e.g. the need for a woodland caribou management plan) and the Migratory Birds Convention Act. It is not clear whether the proposed federal Policy on Biodiversity will have an impact on the project, but if enacted, it could mean more bio-physical offsets will be required for disturbed ground.

As part of the environmental assessment process, projects are required to develop conceptual decommissioning plans for inclusion in the EIA, which detail the steps to be taken to decommission project facilities and reclaim the land at the end of project life. As part of licensing, the conceptual plan is expanded into a more detailed Preliminary Decommissioning Plan (“PDP”) and a cost estimate for implementation is prepared from that: The Preliminary Decommissioning Cost (“PDC”). The Company will then be required to provide some form of surety or bond to cover the cost of carrying out the PDP. The surety is designed to cover the unlikely situation whereby the proponent is unable to complete the decommissioning and reclamation and the government must step in to complete the work in a ‘decommission tomorrow’ scenario. While salvage of some materials is likely, these cannot be considered in the PDC. The plan and costs are periodically reviewed and updated and can be scaled to reflect the current state of a project. As operations progress, progressive decommissioning is encouraged as it lowers close-out liabilities, which, in turn, can reduce the amount of a surety bond, and often reduces the cost of disturbed-land lease fees.

For a uranium mining and milling project, once operations have stopped, the first step is to conduct systematic surveys to determine the extent of contamination, if any. Contamination may be chemical or radiological. Areas that can be decontaminated will be cleaned and re-surveyed to ensure that the clean-up criteria are met. Material that cannot be decontaminated to release standards would be disposed of on site or at an approved off-site disposal facility. The remainder of the site will be decommissioned as the facilities are no longer required with the material salvaged for reuse, recycling, or disposal.

In Saskatchewan, reclaimed land can be returned to the Crown under The Reclaimed Industrial Sites Act and The Reclaimed Industrial Sites Regulations, which establish an Institutional Control Program. This program is implemented once a decommissioned site has been deemed to be reclaimed in a stable, self-sustaining and non-polluting manner. The property can then be transferred back to the province for monitoring and maintenance. For this to happen, the proponent pays a calculated sum into the Institutional Control Monitoring and Maintenance Fund, and the Institutional Control Unforeseen Events Fund for long term monitoring of the property and maintenance, if required. In the unlikely event that the site does not behave as predicted, the government can seek redress from the proponent if the costs exceed the funds available.

Indigenous Engagement in Saskatchewan

For both the federal and provincial EIA and permitting/licensing processes, engagement and consultation are required with Indigenous groups. Engagement in Saskatchewan consists of the Crown’s Duty to Consult, a legal requirement, and interest-based engagement, which is essential to a Project’s social license. Both levels of government (‘the Crown’) have a Duty to Consult First Nations and Métis groups on any decision within their purview with the potential to affect Aboriginal or Treaty Rights. As the project progresses through the regulatory process, several provincial and federal decisions will be made that must be informed by engagement and consultation. Implementation of the Duty to Consult is guided by a combination of provincial and federal regulatory requirements and guidance documents (e.g. Section 35, The Constitution Act, 1982).

Although the Duty to Consult lies with the federal and provincial governments, the procedural aspects of the Duty to Consult are frequently delegated to the proponent to undertake. This often results in the proponent entering into engagement agreements with some First Nations and Metis governments to do studies to identify any potential impacts to rights. Companies are expected to meet with each potentially affected community to discuss engagement plans and an appropriate budget for the communities to complete the necessary meetings and studies, although the level of effort is generally commensurate with proximity to the site. The engagement plan should include opportunities to inform communities of the nature of the proposed activities, the potential impacts of a project, and proposed mitigation strategies. The purpose is to receive feedback or information on current traditional land uses and potential impacts to Treaty and Aboriginal rights. Companies are expected to work with the communities to determine the impacts of the projects and mitigation strategies.

Waste Disposal

The Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes affect mineral exploration and production activities by imposing regulations on the generation, transportation, treatment, storage, disposal and cleanup of “hazardous wastes” and on the disposal of non-hazardous wastes. Under the auspices of the EPA, the individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements.

Comprehensive Environmental Response, Compensation and Liability Act

The federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) imposes joint and several liability for costs of investigation and remediation and for natural resource damages, without regard to fault or the legality of the original conduct, on certain classes of persons with respect to the release into the environment of substances designated under CERCLA as hazardous substances (collectively, “Hazardous Substances”). These classes of persons or potentially responsible parties include the current and certain past owners and operators of a facility or property where there is or has been a release or threat of release of a Hazardous Substance and persons who disposed of or arranged for the disposal of the Hazardous Substances found at such a facility. CERCLA also authorizes the EPA and, in some cases, third parties, to take actions in response to threats to the public health or the environment and to seek to recover the costs of such action. We may also in the future become an owner of facilities on which Hazardous Substances have been released by previous owners or operators. We may in the future be responsible under CERCLA for all or part of the costs to clean up facilities or properties at which such substances have been released and for natural resource damages.

Air Emissions

Our operations are subject to local, state and federal regulations for the control of emissions of air pollution. Major sources of air pollutants are subject to more stringent, federally imposed permitting requirements. Administrative enforcement actions for failure to comply strictly with air pollution regulations or permits are generally resolved by payment of monetary fines and correction of any identified deficiencies. Alternatively, regulatory agencies could require us to forego construction, modification or operation of certain air emission sources. In Texas the TCEQ issues an exemption for those processes that meet the criteria for low to zero emission by issuing a permit by rule. Presently our Palangana Mine, our Hobson Processing Facility and our Goliad Project all have permits by rule covering air emissions.

Water Management

UEC commits its management team, employees and contractors to be good stewards of the water it utilizes in all parts of its operations. From exploration to restoration, water is the critical factor for ISR mining and responsibly managing that water is crucial to our business.

At all UEC’s ISR projects the ore hosted groundwater does not meet either primary or secondary drinking water standards and should only be used for industrial or agricultural use without proper treatment.

Water consumption at UEC’s ISR mining projects is primarily natural groundwater. During the recovery process, water is pumped from the ore hosted aquifer and piped to the satellite facility. The groundwater is filtered for solids, stripped of uranium, allowed to settle and then approximately 95% is reinjected or recirculated back into the same aquifer it was recovered from. This recycling process is an overwhelming advantage of ISR mining compared to other methods such as conventional or open pit.

In order to ensure appropriate water management, and to ensure our team can continuously make decisions to reduce our water usage, UEC closely monitors our water consumption. UEC is identifying ways to reduce water consumption on an ongoing basis.

Compliance with the Clean Water Act

The Clean Water Act (“CWA”) imposes restrictions and strict controls regarding the discharge of wastes, including mineral processing wastes, into waters of the U.S., a term broadly defined. Permits must be obtained to discharge pollutants into federal waters. The CWA provides for civil, criminal and administrative penalties for unauthorized discharges of hazardous substances and other pollutants. It imposes substantial potential liability for the costs of removal or remediation associated with discharges of oil or hazardous substances. State laws governing discharges to water also provide varying civil, criminal and administrative penalties and impose liabilities in the case of a discharge of petroleum or its derivatives, or other hazardous substances, into state waters. In addition, the EPA has promulgated regulations that may require us to obtain permits to discharge storm water runoff. Management believes that we are in substantial compliance with current applicable environmental laws and regulations.

GHG Emissions Management

Mining is an essential industry to enable the global transition to net-zero. Uranium mining, at the heart of UEC’s business, fuels nuclear energy, which is an essential carbon-free energy source. Beyond this, we understand that our operational activities do contribute to climate change through the release of emissions. Therefore, over the next several years, we will begin a process to understand our emissions profile, as well as identify and implement opportunities to reduce emissions, where and when possible.

In 2022, we have created an emissions inventory of all sources (mobile and stationary) for each Texas project, including tracking fuel consumption by individual source at each project. In Fiscal 2023, we expanded our emissions measurement approach to cover all sites, including Wyoming, Saskatchewan and Paraguay. Scope 1 emissions covers direct emissions from owned or controlled sources. Scope 2 emissions covers indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the Company.

Through developing this inventory, we have been able to identify, assess and conduct a cost benefit analysis for emission reduction opportunities at UEC’s Texas projects. Such opportunities include exploring ways to upgrade our Hobson plant into a zero-emissions processing plant.

Aligned to responsibly managing our emissions in the short-term, we will look to purchase carbon offset credits for our Scope 1 and 2 emissions for our corporate sites.

Health and Safety

Health and safety is one of our top priorities. We pride ourselves on employing safe practices in all aspects of its work.

In Fiscal 2022, UEC’s Board approved an Environmental, Health and Safety Policy that provides overall objectives and guidance for our health and safety management. Supporting this Policy, at each site, UEC has a number of operational policies and practices covering radiation safety and procedures, spills and leakage reporting, equipment training and emergency response procedures. There is also a company-wide Injury and Incident Policy covered in the employee handbook that all employees are familiar with and are required to comply against.

Training for employees on health and safety protocols are essential to ensuring we employ best safety practices at all times. Although exact training hours have not been recorded for this fiscal year, UEC has provided training to staff on a variety of safety topics, including, but not limited to, the following topics:

| ● |

Annual radiation safety training for all plant and wellfield employees; |

| ● |

Bi-Annual Radiation Safety Officer training; |

| ● |

Radiation Safety Technician training; |

| ● |

Logging training; |

| ● |

First Aid/CPR training every two years; |

| ● |

Rig Safety/Inspections training; and |

| ● |

Annual DOT Training/HazMat training. |

UEC’s health and safety practices are developed to ensure that all regulatory requirements are met. Across all of our sites, our employees are required to report all injuries to their supervisor. On an annual basis, all reports are analyzed and tracked as required by the Occupational Health and Safety Association (“OSHA”). Given the nature of UEC’s specialized industry, there are site-specific emergency procedures in place that identify the steps employees should take in the event of a health and safety emergency.

Competition