Exhibit 2.1

__________________________________________________

SHARE PURCHASE

AGREEMENT

BETWEEN

URANIUM ONE INVESTMENTS

INC.

AND

URANIUM ENERGY

CORP.

__________________________________________________

_______________

DATED AS OF

November 8, 2021

_______________

Table

of Contents

Page

| Article I. DEFINITIONS AND TERMS |

1 |

| 1.1. | Certain Definitions |

1 |

| Article II. PURCHASE AND SALE OF THE TRANSFERRED SHARES |

12 |

| 2.1. | Purchase and Sale. |

12 |

| Article III. PURCHASE PRICE |

12 |

| 3.1. | Base Purchase Price |

12 |

| 3.2. | Closing Adjustment. |

12 |

| 3.3. | Post-Closing Adjustment. |

13 |

| 3.4. | Additional Consideration |

15 |

| 3.5. | General Method of Payment. |

15 |

| 3.6. | Withholding Matters |

16 |

| Article IV. CONDITIONS TO CLOSING |

16 |

| 4.1. | Conditions to Buyer’s Obligations |

16 |

| 4.2. | Conditions to Seller’s Obligations |

17 |

| 4.4. | Frustration of Closing Conditions |

18 |

| 5.2. | Seller’s Closing Deliveries |

18 |

| 5.3. | Buyer’s Closing Deliveries |

19 |

| Article VI. REPRESENTATIONS AND WARRANTIES OF SELLER |

19 |

| 6.2. | Capitalization, Title to the Shares. |

20 |

| 6.3. | Authority and Binding Effect |

20 |

| 6.5. | Real Property and Leases. |

21 |

| 6.8. | Consents; No Options |

23 |

| 6.10. | Reference Accounts |

23 |

| 6.12. | Compliance with Law. |

24 |

| 6.13. | Intellectual Property. |

24 |

| 6.16. | Employee Benefits. |

25 |

| 6.17. | Environmental Matters |

26 |

| 6.20. | Brokers, Finders and Agents |

29 |

| 6.22. | Absence of Certain Changes |

30 |

| 6.23. | No Other Representations or Warranties; Schedules |

30 |

| Article VII. REPRESENTATIONS AND WARRANTIES OF BUYER |

30 |

| 7.3. | Brokers, Finders and Agents |

31 |

| 7.4. | Financial Capacity |

31 |

| 7.5. | Absence of Litigation |

31 |

| 7.6. | Compliance with DEQ and NRC Criteria |

31 |

| 7.7. | Purchase as Investment |

32 |

| Article VIII. COVENANTS OF SELLER |

32 |

| 8.1. | Management of the Company and U1USA; Conduct of the Business. |

32 |

| 8.2. | Intercompany Indebtedness |

33 |

| 8.3. | Intragroup Agreements |

34 |

| 8.6. | After-Acquired Title |

35 |

| 8.7. | Financial Statements |

35 |

| 8.8. | Representation and Warranty Insurance |

35 |

| Article IX. COVENANTS OF BUYER |

35 |

| 9.1. | Financial Assurances; Remediation Obligations |

35 |

| 9.3. | Replacement of Benefit Plans |

36 |

| Article X. MUTUAL COVENANTS |

36 |

| 10.1. | Appropriate Action; Consents; Filings. |

36 |

| 10.2. | Press Releases and Disclosure |

37 |

| 10.3. | Confidentiality Agreement |

37 |

| 10.4. | Costs and Expenses |

37 |

| 10.5. | Use of the Retained Names |

38 |

| 10.6. | Maintenance of, Access to, Records, Cooperation. |

38 |

| 10.7. | Further Assurances |

39 |

| 10.8. | Disclosure Schedules; Supplements and Amendments to Disclosure Schedules |

39 |

| Article XI. TERMINATION |

43 |

| 11.2. | Procedure Upon Termination |

44 |

| 11.3. | Effect of Termination. |

44 |

| Article XII. INDEMNIFICATION |

45 |

| 12.1. | Indemnification by Seller |

45 |

| 12.2. | Indemnification by Buyer |

45 |

| 12.4. | Notice of Claim; Right to Participate in and Defend Third Party Claims; Specified Procedures for Tax Matters. |

46 |

| 12.5. | Survival of Indemnification Obligations |

47 |

| 12.6. | Certain Limitations on Indemnification. |

48 |

| 12.9. | Remedies Exclusive |

50 |

| 12.10. | Calculation of Losses. |

50 |

| 12.11. | Tax Treatment of Indemnity Payments |

51 |

| Article XIII. MISCELLANEOUS |

51 |

| 13.1. | Amendments; Waivers |

51 |

| 13.4. | Dispute Resolution. |

52 |

| 13.10. | Independent Assessment; No Additional Representations |

54 |

| 13.11. | Schedules and Exhibits |

55 |

LIST OF EXHIBITS

Schedule 1.1(a) – Persons having Knowledge as to Buyer

Schedule 1.1(b) – Persons having Knowledge as to Seller

Schedule 4.3.1 – Required Governmental Approvals

Schedule 5.2.2 – Directors and Officers Resigning

Schedule 6.1 – Other Equity Interests

Schedule 6.4 –Governmental Approvals

Schedule 6.5.1 – Owned Real Property, Leased Real Property, Mineral

Leases and Mining Claims

Part 1 – Wyoming Mining Claims

Part 2 – Wyoming State Mineral Leases

Part 3 – Fee Lease Agreements

Part 5 – Right of Way Agreements

Schedule 6.5.2 – Additional Permitted Liens

Schedule 6.5.5 – Royalties

Schedule 6.6.1 –Intragroup Agreements to be terminated prior

to or on Closing and Material Contracts

Schedule 6.7 – Schedule of Material Personal Property

Schedule 6.8 – Third Person Consents / Options to Purchase Assets

Schedule 6.11 – Litigation

Schedule 6.12.1 – Compliance with Law

Schedule 6.12.2 – List of Material Permits

Schedule 6.14 – List of Insurance Policies

Schedule 6.15 – List of Employees with Job Titles, Annual Compensation

and Applicable Benefits

Schedule 6.16.1 – List of Benefit Plans

Schedule 6.17 – Environmental Matters

Schedule 6.17.2 – List of Material Environmental Permits

Schedule 6.17.5 – U1 Financial Assurances

Schedule 6.18 – Taxes

Schedule 6.19 – Bank Accounts

Schedule 6.20 – Brokers, Finders and Investment Bankers of the

Company or U1USA

Schedule 6.22 – Absence of Certain Changes

Schedule 7.3 - Brokers, Finders and Investment Bankers of the Buyer

Schedule 8.1 – Conduct of Business in the Ordinary Course

LIST OF SCHEDULES

Exhibit 1.1.1 – Accounting Principles (Modifications to IFRS)

Exhibit 3.6.1 – Tax Escrow Account

Exhibit 3.6.2 – Tax Escrow Agreement

Exhibit 5.2.4 – Intragroup Agreements to be Terminated

Exhibit 6.10 – Reference Accounts

Exhibit 7.1.2 – Corporate Approvals of the Buyer

Exhibit 7.4 – Buyer’s Financing Arrangements

SHARE PURCHASE

AGREEMENT

This SHARE PURCHASE AGREEMENT (this “Agreement”)

is entered into as of November 8, 2021 (the “Execution Date”) between URANIUM ONE INVESTMENTS INC., a Canadian

corporation, having an address of Suite 1250-10 King St E Toronto, ON M5C 1C3, Canada (“Seller”), and URANIUM

ENERGY CORP., a Nevada corporation, having an address of 500 North Shoreline Boulevard, Suite 800N, Corpus Christi, Texas 78401 (“Buyer”).

Terms used herein with initial capital letters have the respective meanings ascribed to them in Article I.

RECITALS:

WHEREAS, Seller directly owns all issued and outstanding

shares of Uranium One Americas, Inc., a Nevada corporation, having an address of 907 N. Poplar St, Casper, WY 82601 (the “Company”);

WHEREAS, the Company owns all of the issued and

outstanding shares of Uranium One USA Inc., a Delaware corporation, having an address of 907 N. Poplar St, Casper, WY 82601 (“U1USA”).

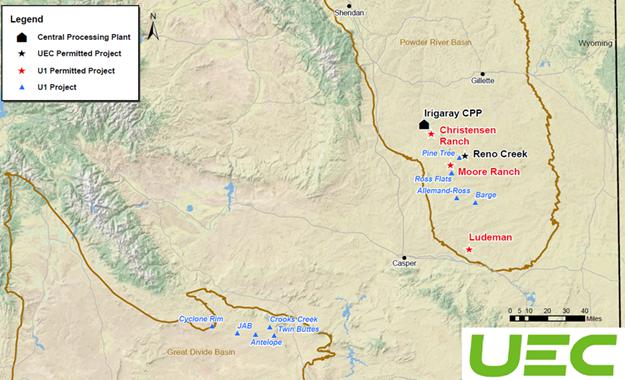

WHEREAS, the Company and U1USA are engaged in ownership,

operations, activities or services with respect to mining sites located in Wyoming; and

WHEREAS, Seller desires to sell and transfer to

Buyer all of the issued and outstanding shares of the Company (the “Transferred Shares”), and Buyer desires

to purchase the Transferred Shares and accept their transfer from Seller, in each case on the terms and subject to the conditions set

forth in this Agreement.

NOW, THEREFORE, in consideration of the mutual

covenants and undertakings contained herein, subject to and on the terms and conditions herein set forth, the Parties agree as follows:

Article

I.

DEFINITIONS AND TERMS

1.1.

Certain Definitions. As used in this Agreement, the following terms have the meanings set forth or referenced below:

“AAA” means the American

Arbitration Association.

“AAA Rules” has the meaning

set forth in Section 13.4.2.

“Accounting Principles”

means IFRS, as modified by the items set forth in Exhibit 1.1.1.

“Acquisition Proposal”

has the meaning set forth in Section 8.4.

“Additional Consideration”

has the meaning set forth in Section 3.4.

“Affiliate” means any

Person that, directly or indirectly, through one or more Persons, controls, is controlled by, or is under common control with, the Person

specified. For the purpose of this definition, the term “control” as applied to any Person means the direct

or indirect ownership of fifty percent (50%) or more of the outstanding voting securities or interests of, or the power to direct or cause

the direction of the affairs or management of, any such Person, whether through voting rights, equity ownership, as a general partner

or trustee, by contract or otherwise.

“Agreement” means this

agreement, including the Recitals, Exhibits and Schedules hereto, as the same may be amended or supplemented from time to time in accordance

with the terms hereof.

“Application for Withholding Certificate”

means an Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests (Form 8288-B) to

authorize reduced or eliminated withholding under Section 1445 of the Code.

“Bank Accounts” has the

meaning set forth in Section 6.19.

“Base Purchase Price”

has the meaning set forth in Section 3.1.

“Basket” has the meaning

set forth in Section 12.6.1(b).

“Benefit Plans” means

any Employee Plan that is sponsored, maintained or contributed to, or required to be contributed to, by the Company or U1USA, or under

or respect to which the Company or U1USA has or would reasonably expect to have any liability, for the benefit of any current or former

Employee.

“Bonuses” has the meaning

set forth in Section 8.1.1(c).

“Books and Records” means

all books, ledgers, files, reports, plans and operating records of the Company and U1USA.

“Business Day” means

any day which is not a Saturday, a Sunday or any other day on which banks are required by Law to be closed in Canada or in the United

States of America.

“Buyer” has the meaning

set forth in the preamble to this Agreement.

“Buyer Indemnified Parties”

has the meaning set forth in Section 12.1.

“Buyer Indemnifying Party”

has the meaning set forth in Section 12.2.

“Buyer Tax Act” means

any action taken by Buyer, or any of its Affiliates (including the Company, U1USA or any of their respective Affiliates) at or after the

Closing and that would directly or indirectly result in an incremental Tax liability for a pre-Closing Tax Period or pre-Closing Straddle

Period until the statute of limitation applicable to such incremental Tax liability has expired, except for any such action required by

applicable Law or for which Buyer has obtained the prior written consent of Seller pursuant to Section 10.9.5 or otherwise.

“Cap” has the meaning

set forth in Section 12.6.1.

“Cash Collateral Deposit”

means that certain cash deposit held at BNY Mellon Capital Markets, LLC for the benefit of Lexon Insurance Co., as trustee for the Company,

which deposit is collateral securing certain reclamation bonds of the Company and U1USA.

“Closing” has the meaning

set forth in Section 5.1.2.

“Closing Date” has the

meaning set forth in Section 5.1.1.

“Closing Date Adjustment”

has the meaning set forth in Section 3.2.2.

“Closing Purchase Price”

has the meaning set forth in Section 3.1.

“Closing Working Capital”

means: (a) the Current Assets of the Company and/or U1USA, as applicable; less (b) the Current Liabilities of the Company and/or U1USA,

as applicable, determined as of the open of business on the Closing Date.

“Closing Working Capital Statement”

has the meaning set forth in Section 3.3.1.

“Code” means the Internal

Revenue Code of 1986, as amended, and the rules and Treasury regulations thereunder.

“Company” has the meaning

set forth in the Recitals.

“Company 401(k) Plan”

has the meaning set forth in Section 5.2.6.

“Confidentiality Agreement”

has the meaning set forth in Section 10.3.

“Continuing Employee”

has the meaning set forth in Section 9.3.

“Contract” means any

written agreement, commitment, lease, license or contract, but excluding Benefit Plans.

“Corporate Approvals”

means the corporate approvals required to be obtained by Seller or Buyer, as the case may be, prior to or on the Closing Date in order

to consummate the transactions contemplated by this Agreement.

“Current Assets” means,

as of the Closing Date, the current assets of the Company and/or U1USA, as applicable, as determined in accordance with GAAP, including

cash and cash equivalents, accounts receivable, inventory and prepaid expenses, but excluding (a) the portion of any prepaid expense of

which Buyer will not receive the benefit following the Closing, (b) deferred Tax assets and (c) receivables from any of the Company’s

and/or U1USA’s (as applicable) Affiliates, managers, employees, officers or members and any of their respective Affiliates.

“Current Liabilities”

means, with respect to the Company and/or U1USA, as applicable, as of the Closing Date, the current liabilities of the Company and/or

U1USA, as applicable, as determined in accordance with GAAP, including accounts payable, accrued Taxes and accrued expenses, but excluding

payables to any of the Company’s and/or U1USA’s (as applicable) Affiliates, managers, employees, officers or members and any

of their respective Affiliates, deferred Tax liabilities and the current portion of any Indebtedness of the Company and/or U1USA, as applicable.

“Data Room” means the

electronic data room administered by iDeals, in which the documents and information related to the Company and U1USA and their respective

business operations were disclosed to Buyer’s Representatives.

“DEQ” has the meaning

set forth in Section 7.6.

“Direct Claim” has the

meaning set forth in Section 12.4.1.

“Directors and Officers Liability Policy”

has the meaning set forth in Section 8.5.

“Dispute” has the meaning

set forth in Section 13.4.1.

“Disputed Amounts” has

the meaning set forth in Section 3.3.5.

“Employee” means any

individual who is employed by the Company or U1USA.

“Employee Plan” means

any pension, profit sharing, retirement, stock purchase, stock option, stock ownership, stock appreciation rights, phantom stock or other

equity, leave of absence, layoff, vacation, dependent care, cafeteria, life, health, accident, disability, worker’s compensation

or other insurance, severance, separation, deferred compensation, fringe benefit or other employee benefit plan, agreement, arrangement

or program, whether written or oral, including, but not limited to, any “employee benefit plan” within the meaning of Section

3(3) of ERISA.

“Environment” means the

ambient air; surface water; groundwater; surface and subsurface soil.

“Environmental Claim”

means any threatened or actual action, cause of action, litigation, claim, inquiry, investigation by any Person arising out of or resulting

from: (a) the presence, Release of, or exposure to, any Hazardous Materials; or (b) any actual or alleged non-compliance with any Environmental

Law or term or condition of any Environmental Permit.

“Environmental Laws”

means all currently applicable Laws pertaining or relating to: (a) uranium mining and processing and radioactive materials; (b) pollution

or pollution control; (c) protection of the Environment or of human health, including from the, management, use, Release of, or exposure

to Hazardous Materials; or (d) employee safety in the workplace. Environmental Laws include the Laws listed below: The Hazardous Materials

Transportation Act (49 U.S.C. §§ 5101 et seq.); the Federal Solid Waste Act as amended by the Resource Conservation and Recovery

Act of 1976 (42 U.S.C. §§ 6901 et seq.); the Clean Air Act (42 U.S.C. §§ 7401 et seq.); the Federal Water Pollution

Control Act (33 U.S.C. § 1251) also known as the Clean Water Act of 1972 (33 U.S.C. §§ 1251 et seq.); the Safe Drinking

Water Act (42 U.S.C. §§ 300f et seq.); the Comprehensive Environmental Response, Compensation and Liability Act of 1980 as amended

by the Superfund Amendments and Reauthorization Act of 1986 (42 U.S.C. §§ 9601 et seq.); the Toxic Substances Control Act (15

U.S.C. §§ 2601 et seq.); the Emergency Planning and Community Right to Know Act (42 U.S.C. §§ 11001, et seq.); the

Pollution Prevention Act of 1990 (42 U.S.C. §§ 13101 et seq.); the Occupational Health and Safety Act of 1970 (29 USC §§

651 et seq.); the Federal Land Policy and Management Act (43 U.S.C. §§ 1701 et seq.); the Atomic Energy Act of 1954, as amended

(42 U.S.C. §§ 2011 et seq.); the Uranium Mill Tailings Radiation Control Act (42 U.S.C. §§ 7901 et seq.).

“Environmental Notice”

means any written directive, notice of violation or infraction, or notice respecting any Environmental Claim relating to actual or alleged

non-compliance with any Environmental Law or any term or condition of any Environmental Permit.

“Environmental Permits”

means any licenses, consents, decrees, plans, variances, registrations, permits, authorizations and approvals issued by any Governmental

Authorities and required to be obtained by the Company or U1USA pursuant to any Environmental Laws for the conduct and the operation of

the business of the Company or U1USA as currently conducted.

“ERISA” means the Employee

Retirement Income Security Act of 1974, as amended.

“Estimated Closing Working Capital”

has the meaning set forth in Section 3.2.3.

“Estimated Closing Working Capital

Statement” has the meaning set forth in Section 3.2.3.

“Execution Date” has

the meaning set forth in the preamble to this Agreement.

“Exhibit” means any exhibit

to this Agreement.

“GAAP” means generally

accepted accounting principles of the United States, consistently applied.

“Governmental Approvals”

means the approvals, consents and/or clearances of Governmental Authorities.

“Governmental Authority”

means any federal, state, regional, local government or other political subdivision thereof, any entity, authority or body exercising

executive, legislative, judicial or regulatory authority, or any court of competent jurisdiction, administrative agency or commission

or other governmental authority.

“Hazardous Materials”

means any chemicals, materials or substances, whether solid, liquid or gaseous: (a) which are defined, listed, identified or regulated

as a “hazardous material,” “hazardous waste” or “hazardous substance” or otherwise classified as hazardous

or toxic in or under any applicable Environmental Laws; or (b) which is or contains asbestos, polychlorinated biphenyls, radon, urea formaldehyde

foam insulation or explosives; or (c) which is any petroleum, hydrocarbons, petroleum products or crude oil, and any components, fractions,

or derivatives thereof listed, defined or regulated under any Environmental Law or other applicable Law. The term “Hazardous Materials”

specifically excludes any source, byproduct or other nuclear material.

“IFRS” means International

Financial Reporting Standards, consistently applied.

“Indebtedness” means

(without duplication) the sum of all amounts owing by the Company or U1USA, as applicable, to repay in full all amounts due and to terminate

all obligations (other than indemnity obligations that are not owing or outstanding) with respect to the following, other than pursuant

to the U1 Financial Assurances: (a) all obligations for the payment of principal, interest, penalties, fees or other liabilities for borrowed

money (including guarantees and notes payable) and collection costs thereof, incurred or assumed; (b) all obligations to reimburse the

issuer of any letter of credit, surety bond, debentures, promissory notes, performance bond or other guarantee of contractual performance,

in each case to the extent drawn or otherwise not contingent; (c) the capitalized portion of all obligations under direct financing leases

and purchase money and/or vendor financing (in each case other than with respect to trade payables, accrued expenses, current accounts

and similar obligations incurred in the ordinary course of business); (d) all obligations under any leases constituting capitalized leases

in accordance with GAAP; (e) all indebtedness for the deferred purchase price of property or services and all earnouts and contingent

payment obligations arising pursuant to any acquisition or divestiture; (f) all liabilities pursuant to or under any interest rate protection

agreement and all hedging, derivative and swap liabilities; (g) all obligations secured by an encumbrance on property owned or acquired

by the Company or U1USA, as applicable; (h) any unpaid Pre-Closing Taxes payable by the Company or U1USA, regardless of when due and payable,

and (i) all guarantee or keep well obligations, including those in respect of obligations of the kind referred to in clauses (a) through

(h) above; provided, however, except in the case of Section 6.6.1, Indebtedness shall not include any amount included in Current

Assets, Current Liabilities or Closing Working Capital.

“Indemnified Party” has

the meaning set forth in Section 12.4.1.

“Indemnifying Party”

has the meaning set forth in Section 12.4.1.

“Independent Accountant”

has the meaning set forth in Section 3.3.5.

“Insolvent” has the meaning

set forth in Section 7.4.

“Intellectual Property”

has the meaning set forth in Section 6.13.1.

“Intercompany Indebtedness”

has the meaning set forth in Section 8.2.

“Intragroup Agreements”

has the meaning set forth in Section 6.6.1(f).

“IRS” means the United

States Internal Revenue Service.

“Knowledge” as to Buyer

means the actual knowledge of those persons listed on Schedule 1.1(a), and as to Seller means the actual knowledge of those

persons listed on Schedule 1.1(b).

“Law” means any applicable

foreign or federal, tribal, state, or local statute, law, rule, regulation, Permit, order, ordinance, code, or decree, judicial decision

issued by any Governmental Authority.

“Leased Real Property”

has the meaning set forth in Section 6.5.1.

“Legal Proceeding” means

any judicial, administrative or arbitration actions, suits, proceedings (public, private, civil or criminal) by or before a Government

Authority.

“Liens” means any lien,

security interests, mortgages, charges, pledges, conditional sales contracts, and other title retention arrangements, restrictions (including,

in the case of real property, rights of way, use restrictions, and other reservations or limitations of any nature) or encumbrances whatsoever.

“Losses” has the meaning

set forth in Section 12.1.

“Management Presentations”

means the presentations, site visits, question and answer sessions and other meetings held between Seller and/or any of its Representatives

on the one hand, and Buyer and/or any of its Representatives on the other hand, for the purpose of informing the Buyer with respect to

the Company and U1USA and the operations of the business of the Company and U1USA in view of the transactions contemplated hereby.

“Material Adverse Effect”

means, with respect to any Person, any material adverse effect on the business, financial condition or results of operations of such Person

taken as a whole, other than any effect resulting or arising from:

(i) general

business or economic conditions in the industries or markets in which the Company and U1USA operate;

(ii) national

or international political conditions, including any engagement in hostilities, whether or not pursuant to the declaration of a national

emergency or war or the occurrence of any military or terrorist attack;

(iii) changes

in Law or GAAP;

(iv) the

entry into or announcement of this Agreement, the compliance by the Parties to this Agreement with the provisions of this Agreement, or

the consummation of the transactions contemplated hereby;

(v) any

action taken by Seller, the Company or U1USA at the request, or with the consent, of the Buyer;

(vi) any

changes or developments affecting the global mining, uranium and nuclear industries in general;

(vii) any

changes in the price of uranium;

(viii) any general outbreak of illness,

pandemic (including COVID 19), epidemic or similar event or the worsening thereof;

(ix) any

natural disaster, man-made disaster or any climatic or other natural events or conditions or the commencement or continuation of war or

armed hostilities, including the escalation or worsening of them or acts of terrorism;

(x) any

occurrence, event or circumstance with respect to which the Buyer has knowledge as of the Execution Date; or

(xi) any

change in financial, banking, securities, commodities, derivatives or futures markets (including any disruption thereof and any decline

in price of any security, commodity or derivative or any futures contract or any related market index).

“Material Contracts”

has the meaning set forth in Section 6.6.1.

“Mineral Leases” has

the meaning set forth in Section 6.5.1.

“Mining Claims” has the

meaning set forth in Section 6.5.1.

“Notice” has the meaning

set forth in Section 12.4.1.

“NRC” has the meaning

set forth in Section 7.6.

“Order” means any order,

injunction, judgment, decree, writ, assessment or arbitration award of a Governmental Authority.

“Ordinary Course” means

the ordinary course of the normal, day-to-day operations of the Company or U1USA, consistent with its past practice.

“Organizational Documents”

means the certificate of incorporation, the articles of incorporation or other constituent documents of any corporate entity, each as

amended to date.

“Owned Real Property”

has the meaning set forth in Section 6.5.1.

“Party” or “Parties”

means Seller and/or Buyer, as applicable.

“Permits” means all licenses,

permits and approvals issued to the Company or U1USA by any Governmental Authority and used in the operation of the business of the Company

or U1USA, other than Environmental Permits.

“Permitted Liens” means:

(a) Liens for Taxes, impositions, assessments, fees, rents or other governmental charges levied or assessed or imposed not yet delinquent

or being contested in good faith by appropriate proceedings; (b) statutory Liens (including materialmen’s, warehousemen’s,

mechanic’s, repairmen’s, landlord’s and other similar Liens) arising in the Ordinary Course securing payments not yet

delinquent or being contested in good faith by appropriate proceedings; (c) Liens of public record; (d) the rights of lessors

and lessees under leases, and the rights of third parties under any Material Contracts or any Contracts executed in the Ordinary Course;

(e) the rights of licensors and licensees under licenses executed in the Ordinary Course; (f) restrictive covenants, easements

and defects, imperfections or irregularities of title or Liens, if any, as would not reasonably be expected to materially interfere with

the conduct of the business of the Company or U1USA; (g) purchase money Liens and Liens securing rental payments under leases that

constitute capital leases under GAAP; (h) restrictions on transfer with respect to which consents or waivers will be obtained prior

to the Closing; (i) Liens entered into in the Ordinary Course which do not secure the payment of indebtedness for borrowed money

and which do not materially and adversely affect the ability of the Company or U1USA to conduct its respective business; (j) Liens

referenced in any title policies, title opinions or reports or real property files listed in the Schedules; (k) Liens contained in

the Organizational Documents of the Company or U1USA; (l) Liens listed on Schedule 6.5.2; and (m) Liens created

by Buyer or its Affiliates or their respective successors and assigns.

“Person” means any individual,

partnership, corporation, association, joint stock company, trust, joint venture, limited liability company or Governmental Authority.

“Post-Closing Adjustment”

has the meaning set forth in Section 3.3.2.

“Post-Closing Straddle Period”

has the meaning set forth in Section 10.9.3.

“Pre-Closing Straddle Period”

has the meaning set forth in Section 10.9.3.

“Pre-Closing Taxes” means

(a) all Taxes of the Company and U1USA for any Pre-Closing Tax Period or Pre-Closing Straddle Period (as determined under Section 10.9.3),

(b) all Taxes of Seller, (c) all Taxes of any member of an affiliated, consolidated, combined or unitary group of which the Company or

U1USA is or was a member on or prior to the Closing Date, including pursuant to Section 1.1502-6 of the Treasury Regulations (or any analogous

or similar state, local, or non-U.S. Law), (d) all Taxes of any Person (other than the Company or U1USA) imposed on the Company or U1USA

as a transferee or successor, by contract (other than any commercial contract the primary purpose of which is not Taxes), pursuant to

any Law or otherwise, as result of an event or transaction occurring before the Closing, (e) all Transfer Taxes allocated to Seller pursuant

to Section 10.9.8, and (f) any items disclosed with respect to Section 6.18.11 to the extent a carryover of a pre-closing

tax attribute is not available to reduce such Tax.

“Pre-Closing Tax Period”

means any Tax period ending on or before the Closing Date.

“Real Property” has the

meaning set forth in Section 6.5.1.

“Reference Accounts”

means the unaudited, unreviewed and unconsolidated financial statements of each of the Company and U1USA as of and for the year ended

December 31, 2019 and 2020, and the unaudited, unreviewed and consolidated balance sheet and income statement of the Company as of and

for the six month period ended on the Reference Date.

“Reference Date” means

June 30, 2021.

“Release” means any spilling,

leaking, emitting, discharging, depositing, escaping, leaching, dumping, emanating, migrating or other releasing into the environment,

whether intentional or unintentional.

“Representatives” means,

with respect to any Person, the directors, officers, employees, accountants, agents, attorneys, consultants, advisors and other representatives

of such Person.

“Required Governmental Approvals”

has the meaning set forth in Section 4.3.1.

“Required Section 1445 Notice”

means a notice that Seller has applied for a Withholding Certificate on or before Closing that complies with Section 1.1445-1(c)(2)(i)(B)

of the Treasury Regulations, along with a copy and proof of mailing of the Application for Withholding Certificate.

“Resolution Period”

has the meaning set forth in Section 3.3.4.

“Retained Names” has

the meaning set forth in Section 10.5.

“Review Period” has the

meaning set forth in Section 3.3.3.

“Schedules” has the meaning

set forth in Article VI.

“Section 1445 Deduction”

means the 15% of the Closing Purchase Price and Additional Consideration, and 15% of each subsequent purchase price payment, required

to be deducted and withheld as a tax by Buyer at the time of such payment under Section 1445 of the Code.

“Seller” has the meaning

set forth in the preamble to this Agreement.

“Seller Indemnified Parties”

has the meaning set forth in Section 12.2.

“Seller Indemnifying Party”

has the meaning set forth in Section 12.1.

“Statement of Objections”

has the meaning set forth in Section 3.3.4.

“Straddle Period”

has the meaning set forth in Section 10.9.3.

“Sub-Basket” has the

meaning set forth in Section 12.6.1(a).

“Target Working Capital”

means $0.

“Tax Authority” means

any Governmental Authority having jurisdiction over the assessment, determination, collection or imposition of any Tax.

“Tax Escrow Account”

means an interest bearing escrow account to be established by Seller and Buyer with J.P. Morgan in substantially the form attached hereto

as Exhibit 3.6.1.

“Tax Escrow Agreement”

means the Escrow Agreement to be entered into at Closing substantially in the form attached hereto as Exhibit 3.6.2 by and among

Seller, Buyer and Escrow Agent (as defined in the Tax Escrow Agreement).

“Tax Returns” means any

report, return, election, document, schedule, attachment, estimated tax filing, declaration or other filing with respect to Taxes provided

to any Tax Authority including any amendments thereto.

“Taxes” means any federal,

state, local, or non-U.S. income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall

profits, environmental (including taxes under Code Section 59A), customs duties, capital stock, franchise, profits, withholding, social

security (or similar), unemployment, disability, real property, personal property, escheat, unclaimed property, sales, use, transfer,

registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty,

or addition thereto, whether disputed or not.

“Third Party Claim” has

the meaning set forth in Section 12.4.1.

“Third Persons” means

Persons other than Seller, Buyer, the Company, U1USA and any of their Affiliates.

“Transfer Tax” has the

meaning set forth in Section 10.9.8.

“Transferred Shares”

has the meaning set forth in the Recitals.

“Treasury Regulations”

means the United States Treasury Department regulations promulgated under the Code.

“U1 Financial Assurances”

has the meaning set forth in Section 6.17.5.

“UEC Financial Assurances”

has the meaning set forth in Section 9.1.

“UEC Financial Assurance Amount”

means the face amount, as determined by Seller’s submittals to applicable Governmental Authorities on behalf of the Company and

U1USA, of the UEC Financial Assurances.

“U1USA” has the meaning

set forth in the Recitals.

“Withholding Certificate”

means the withholding certificate issued by the IRS upon final determination for an Application for Withholding Certificate.

1.2.

Other Terms. Other terms may be defined elsewhere in the text of this Agreement and, unless otherwise indicated, have the

meanings given to them throughout this Agreement.

1.3.

Interpretation. Words of the masculine gender will be deemed and construed to include correlative words of the feminine

and neuter genders. Words importing the singular number will include the plural number, and vice versa, unless the context will otherwise

indicate. References to Articles, Sections and other subdivisions of this Agreement and Exhibits and Schedules to this Agreement are,

when underlined, made to the Articles, Sections and other subdivisions of, and Exhibits and Schedules to, this Agreement.

1.4.

Certain Terms. The words “hereof”, “herein” and “hereunder”

and words of similar import, when used in this Agreement, refer to this Agreement as a whole and not to any particular provision of this

Agreement unless otherwise specifically stated to the contrary. The word “including” means “including

without limitation.” All references to “$” or dollar amounts are to lawful currency of the United

States of America.

Article

II.

PURCHASE AND SALE OF THE TRANSFERRED SHARES

2.1.

Purchase and Sale.

2.1.1.

On the terms and subject to the conditions set forth herein, at the Closing and effective as of the Closing Date, Seller shall

sell and transfer to Buyer all of the Transferred Shares, and Buyer shall purchase all of the Transferred Shares and accept their transfer

from Seller. The Transferred Shares will consist of all of the issued and outstanding shares of capital stock of the Company.

2.1.2.

On the Closing Date Buyer will acquire all of the Transferred Shares from Seller free and clear of all Liens other than: (a) transfer

restrictions imposed by applicable Law; and (b) Liens on the Transferred Shares created by Buyer or its Affiliates. Buyer acknowledges

that it has no right to separately or partially acquire the Transferred Shares.

Article

III.

PURCHASE PRICE

3.1.

Base Purchase Price. The unadjusted purchase price for the Transferred Shares (the “Base Purchase Price”)

is $111,646,169 cash. The Base Purchase Price is subject to closing adjustments in accordance with Section 3.2 (the Base Purchase

Price, as so adjusted, being referred to herein as the “Closing Purchase Price”). The Closing Purchase Price

is subject to adjustment after Closing in accordance with Section 3.3.

3.2.

Closing Adjustment.

3.2.1.

At the Closing, the Base Purchase Price shall be adjusted downward or upward, in the following manner:

(i)

a decrease by the amount, if any, by which the Estimated Closing Working Capital is less than the Target Working Capital;

(ii)

an increase by the amount, if any, by which the Estimated Closing Working Capital is more than the Target Working Capital;

(iii)

a decrease by the amount of any increase in the aggregate Indebtedness of the Company and U1USA as of the time of Closing, after

giving effect to the elimination of Intercompany Indebtedness pursuant to Section 8.2;

(iv)

an increase by the amount of any reduction in the aggregate Indebtedness of the Company and U1USA as of the time of Closing, after

giving effect to the elimination of Intercompany Indebtedness pursuant to Section 8.2; and

(v)

an increase by the amount of any prepaid insurance premiums (from the Closing Date through the end of the coverage period) and

any prepaid property taxes (from the Closing Date through the end of the tax period, except to the extent taken into account as a Current

Asset in the determination of Estimated Closing Working Capital).

3.2.2.

The net amount after giving effect to the adjustments listed above shall be the “Closing Date Adjustment.”

Notwithstanding the foregoing, in the event the Closing Date Adjustment is less than $10,000, the Closing Date Adjustment shall be deemed

to be zero ($0).

3.2.3.

At least three (3) Business Days before the Closing, Seller shall prepare and deliver to Buyer statements setting forth its good

faith estimate of Closing Working Capital (collectively, the “Estimated Closing Working Capital”), which statements

shall contain an estimated balance sheet of the Company and U1USA as of the Closing Date (without giving effect to the transactions contemplated

herein), a calculation of Estimated Closing Working Capital of the Company and U1USA (collectively, the “Estimated Closing

Working Capital Statement”), and a certificate of a duly authorized officer of the Company that the Estimated Closing Working

Capital Statement was prepared in accordance with GAAP applied using the same accounting methods, practices, principles, policies and

procedures, with consistent classifications, judgments and valuation and estimation methodologies, that were used in the preparation of

the financial statements for the most recent fiscal year end as if such Estimated Closing Working Capital Statement was being prepared

as of a fiscal year end.

3.3.

Post-Closing Adjustment.

3.3.1.

Within sixty (60) days after the Closing Date, Seller shall prepare and deliver to Buyer statements setting forth its calculation

of Closing Working Capital, which statements shall contain a balance sheet of the Company and U1USA as of the Closing Date (without giving

effect to the transactions contemplated herein), a calculation of Closing Working Capital (collectively, the “Closing Working

Capital Statement”) and a certificate of a duly authorized officer of the Company that the Closing Working Capital Statement

was prepared in accordance with GAAP applied using the same accounting methods, practices, principles, policies and procedures, with consistent

classifications, judgments and valuation and estimation methodologies, that were used in the preparation of the financial statements for

the most recent fiscal year end as if such Closing Working Capital Statement was being prepared as of a fiscal year end.

3.3.2.

The post-closing adjustment shall be an amount equal to the Closing Working Capital minus the Estimated Closing Working Capital

(the “Post-Closing Adjustment”). If the Post-Closing Adjustment is a negative number, then the Purchase Price

will be decreased by such amount. If the Post-Closing Adjustment is a positive number, the Purchase Price will be increased by such amount.

Notwithstanding the forgoing, in the event the Post-Closing Adjustment is less than $20,000, then the Post-Closing Date Adjustment shall

be deemed to be zero dollars ($0).

3.3.3.

After receipt of the Closing Working Capital Statement, Buyer shall have thirty (30) days (the “Review Period”)

to review the Closing Working Capital Statement. During the Review Period, Buyer and Buyer’s accountants shall have full access

to the Books and Records of the Company and U1USA, the personnel of, and work papers prepared by, Seller and/or Seller’s accountants

to the extent that they relate to the Closing Working Capital Statement and to such historical financial information (to the extent in

Seller’s possession) relating to the Closing Working Capital Statement as Buyer may reasonably request for the purpose of reviewing

the Closing Working Capital Statement and to prepare a Statement of Objections (defined below); provided that such access shall be in

a manner that does not interfere with the normal business operations of the Company or U1USA.

3.3.4.

On or prior to the last day of the Review Period, Buyer may object to the Closing Working Capital Statement by delivering to Seller

a written statement setting forth Buyer’s objections in reasonable detail, indicating each disputed item or amount and the basis

for Buyer’s disagreement therewith (the “Statement of Objections”). If Buyer fails to deliver the Statement

of Objections before the expiration of the Review Period, the Closing Working Capital Statement and the Post-Closing Adjustment, as the

case may be, reflected in the Closing Working Capital Statement shall be deemed to have been accepted by Buyer. If Buyer delivers the

Statement of Objections before the expiration of the Review Period, Buyer and Seller shall negotiate in good faith to resolve such objections

within thirty (30) days after the delivery of the Statement of Objections (the “Resolution Period”), and, if

the same are so resolved within the Resolution Period, the Post-Closing Adjustment and the Closing Working Capital Statement with such

changes as may have been previously agreed in writing by Buyer and Seller, shall be final and binding.

3.3.5.

If Seller and Buyer fail to reach an agreement with respect to all of the matters set forth in the Statement of Objections before

expiration of the Resolution Period, then any amounts remaining in dispute (“Disputed Amounts”) shall be submitted

for resolution to the office of PricewaterhouseCoopers or, if PricewaterhouseCoopers is unable to serve, Buyer and Seller shall appoint

by mutual agreement the office of an impartial nationally recognized firm of independent certified public accountants other than Seller’s

accountants or Buyer’s accountants (the “Independent Accountant”) who, acting as experts and not arbitrators,

shall resolve the Disputed Amounts only and make any adjustments to the Post-Closing Adjustment, as the case may be, and the Closing Working

Capital Statement. The Parties hereto agree that all adjustments shall be made without regard to materiality. The Independent Accountant

shall only decide the specific items under dispute by the Parties and their decision for each Disputed Amount must be within the range

of values assigned to each such item in the Closing Working Capital Statement and the Statement of Objections, respectively.

3.3.6.

The fees and expenses of the Independent Accountant shall be paid by Seller, on the one hand, and by Buyer, on the other hand,

based upon the percentage that the amount actually contested but not awarded to Seller or Buyer, respectively, bears to the aggregate

amount actually contested by Seller and Buyer.

3.3.7.

The Parties shall use commercially reasonable efforts to cause the Independent Accountant to make a determination as soon as practicable,

but in any event within thirty (30) days (or such other time as the Parties hereto shall agree in writing) after its engagement, and its

resolution of the Disputed Amounts and their adjustments to the Closing Working Capital Statement and/or the Post-Closing Adjustment shall

be conclusive and binding upon the Parties hereto.

3.3.8.

Any payments made pursuant to this Section 3.3 shall be treated as an adjustment to the Closing Purchase Price by the Parties

for Tax purposes, unless otherwise required by Law.

3.4.

Additional Consideration. In addition to the Base Purchase Price, Buyer shall make the following payments to Seller (the

“Additional Consideration”):

3.4.1.

An amount equal to the difference between $19,000,000 and the UEC Financial Assurance Amount, provided that in the event the UEC

Financial Assurance Amount is more than $19,000,000, the amount under this Section 3.4.1 shall be zero dollars ($0); and

3.4.2.

An amount equal to the balance of the Cash Collateral Deposit as of the Closing Date; provided that Buyer and Seller shall work

together with BNY Mellon Capital Markets, LLC to have the balance of the Cash Collateral Deposit released to the Company contemporaneously

with Closing or as soon thereafter as BNY Mellon Capital Markets, LLC will allow.

3.5.

General Method of Payment.

3.5.1.

Payments at Closing. At the Closing, simultaneous with the release of the Seller closing deliverables to Buyer under Section

5.2, and subject to the provisions of Section 3.6, Buyer will pay to Seller the Closing Purchase Price and the Additional Consideration

by irrevocable wire transfer of immediately available funds to such bank accounts as Seller designates in writing to Buyer at least two

(2) Business Days prior to the Closing.

3.5.2.

Post-Closing Adjustments. Except as otherwise provided herein, any payment of the Post-Closing Adjustment, together with

interest calculated as set forth below, shall: (A) be due (x) within five (5) Business Days of acceptance of the applicable Closing Working

Capital Statement, or (y) if there are Disputed Amounts, then within five (5) Business Days of the resolution described in Section

3.3.5 above; and (B) be paid by wire transfer of immediately available funds to such account as is directed by Buyer or Seller, as

the case may be.

3.5.3.

Interest. All sums payable hereunder which are not paid in a timely manner will bear interest at a rate per annum equal

to ten percent (10%). Such interest shall be calculated daily on the basis of a 365-day year and the actual number of days elapsed.

3.6.

Withholding Matters. Under Section 1445 of the Code, Buyer is required to deduct and withhold a tax equal to the Section

1445 Deduction from the Closing Purchase Price and Additional Consideration paid at Closing and each subsequent purchase payment paid

by Buyer to Seller after Closing. Buyer shall be required to make the following disposition of the Section 1445 Deduction:

3.6.1.

In the event that Seller fails to provide the Required Section 1445 Notice to Buyer on or before Closing, Buyer shall pay the Section

1445 Deduction to the IRS within twenty (20) days after the Closing Date with respect to Closing Purchase Price and Additional Consideration

paid at the Closing as required by Section 1.1445-1(c) of the Treasury Regulations.

3.6.2.

In the event that Seller provides the Required Section 1445 Notice to Buyer on or before Closing, then, at the time of Closing,

Buyer shall deposit the Section 1445 Deduction related to the Closing Purchase Price and Additional Consideration paid at Closing into

the Tax Escrow Account by wire transfer in immediately available funds. The Section 1445 Deduction shall then be held in the Tax Escrow

Account pending determination by the IRS of the Application for Withholding Certificate. On notification from the IRS that the Application

for Withholding Certificate has been denied, within twenty (20) days after the date of the mailing of said notification by the IRS the

Section 1445 Deduction shall be paid out of the Escrow Account to the IRS. Alternatively, on the receipt of a copy of the Withholding

Certificate from the IRS, there shall be paid out of the Escrow Account and over to the IRS within twenty (20) days after the date of

the mailing of said Withholding Certificate by the IRS the amount, if any, required to be paid over to the IRS as indicated on the Withholding

Certificate with respect to the Closing Purchase Price and Additional Consideration paid at Closing, and the balance in the Escrow Account

held with respect to such payments shall be paid over to Seller in accordance with the terms of the Tax Escrow Agreement. The Parties

shall promptly provide each other with copies of all notices and other documents received from the IRS with respect to this matter.

3.6.3.

With respect to any payments made by Buyer to Seller after the Closing, procedures similar to those set forth in Sections 3.6.1

and 3.6.2 shall apply at the time such payments are made; provided, however, if the Withholding Certificate from the IRS has been

received by the date of such payment, Buyer shall deduct from such payment and pay over to the IRS the required Section 1445 Deduction

as indicated on the Withholding Certificate by the applicable due date.

Article

IV.

CONDITIONS TO CLOSING

4.1.

Conditions to Buyer’s Obligations. The obligation of Buyer to consummate the transactions provided for in this Agreement

is subject to the satisfaction, at or prior to the Closing, of each of the following conditions, any of which may be waived by Buyer:

4.1.1.

Representations and Warranties. The representations and warranties of Seller contained in this Agreement or in any certificate

delivered pursuant hereto will be true and correct at and as of the Closing Date (except for any representation and warranty qualified

by materiality (or similarly qualified), which representation and warranty shall be true and correct in all respects), except to

the extent such representations and warranties relate to an earlier date (in which case such representations and warranties will be true

as of such earlier date); provided that in the event of a breach of a representation or warranty, the condition set forth in this Section

4.1.1 will be deemed satisfied unless the effect of all such breaches of representations and warranties taken together result or could

be reasonably expected to result in a Material Adverse Effect to Seller, the Company or U1USA.

4.1.2.

Performance of Covenants. Seller has performed or complied in all material respects with all agreements and covenants required

by this Agreement to be performed or complied with by it on or prior to the Closing Date.

4.1.3.

Deliveries. Seller has delivered or caused to be delivered the documents, instruments, certificates and evidence required

to be delivered by Seller pursuant to Section 5.2.

4.2.

Conditions to Seller’s Obligations. The obligations of Seller to consummate the transactions provided for by this

Agreement are subject to the satisfaction, at or prior to the Closing, of each of the following conditions, any of which may be waived

by Seller:

4.2.1.

Representations and Warranties. The representations and warranties of Buyer contained in this Agreement or in any certificate

delivered pursuant hereto will be true and correct at and as of the Closing Date (except for any representation and warranty qualified

by materiality (or similarly qualified), which representation and warranty shall be true and correct in all respects), except to

the extent such representations and warranties relate to an earlier date (in which case such representations and warranties will be true

as of such earlier date) provided that in the event of a breach of a representation or warranty, the condition set forth in this Section

4.2.1 will be deemed satisfied unless the effect of all such breaches of representations and warranties taken together result or could

be reasonably expected to result in a Material Adverse Effect on Buyer’s ability to consummate the transactions contemplated by

this Agreement.

4.2.2.

Performance of Covenants. Buyer has performed or complied in all material respects with all agreements and covenants required

by this Agreement to be performed or complied with by it on or prior to the Closing Date.

4.2.3.

Deliveries. Buyer has delivered or caused to be delivered the documents, instruments, certificates and evidence required

to be delivered by Buyer pursuant to Section 5.3.

4.3.

Mutual Conditions. The obligations of Seller and Buyer to consummate the transactions provided for by this Agreement are

subject to the satisfaction, at or prior to the Closing, of each of the following conditions:

4.3.1.

Required Governmental Approvals. All of the Governmental Approvals set forth on Schedule 4.3.1 (the “Required

Governmental Approvals”) have been obtained by the Party or Parties responsible, and the applicable waiting periods, as

the case may be, have expired or been terminated.

4.3.2.

No Prohibition. There is no Order issued, pending or threatened in writing, by any court of competent jurisdiction or any

other Governmental Authority: (a) that prohibits, invalidates or materially modifies or threatens to prohibit, invalidate or materially

modify any of the transactions contemplated to take place at Closing; or (b) that could reasonably be expected to (i) have a Material

Adverse Effect on the Company or U1USA or (ii) materially and adversely affect the right of Buyer to own or operate the Company or U1USA.

4.4.

Frustration of Closing Conditions. Neither Seller nor Buyer may rely on the failure of any condition set forth in Sections 4.1

or 4.2, as the case may be, if such failure was caused by such Party’s failure to comply with any provision of this Agreement.

Article

V.

CLOSING

5.1.

General.

5.1.1.

The Closing will take place at 10:00 a.m. (MT) in the particular manner and on a date to be specified by the Parties (the “Closing

Date”), which date will be no later than the fifth (5th) Business Day after satisfaction or waiver of the conditions

set forth in Article IV (other than conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction

or waiver of those conditions at such time), unless another time, date or place is agreed to in writing by the Parties.

5.1.2.

As used in this Agreement, “Closing” means the time at which Seller and Buyer consummate the transactions

contemplated by this Agreement.

5.2.

Seller’s Closing Deliveries. At the Closing Seller shall deliver, or shall cause to be delivered, to Buyer the following

documents:

5.2.1.

share certificates representing the Transferred Shares, duly endorsed for transfer to Buyer or accompanied by stock powers duly

executed in blank;

5.2.2.

resignation letters (effective upon and subject to the occurrence of Closing) from the directors and officers of the Company and

U1USA, as listed in Schedule 5.2.2;

5.2.3.

a certificate of an authorized officer of Seller confirming the matters set forth in Sections 4.1.1 and 4.1.2;

5.2.4.

evidence of the termination of the Intragroup Agreements listed in Schedule 6.6.1 hereto, effective prior to or on Closing,

and repayment of all sums due by any of the parties thereunder;

5.2.5.

evidence of the release of all monetary Liens or other material Liens (other than Permitted Liens) with respect to the Company

and U1USA; and

5.2.6.

effective no later than the Business Day prior to the Closing Date, Seller shall terminate any Benefit Plan intended to be qualified

under Section 401(a) of the Code (the “Company 401(k) Plan”) and deliver to Buyer evidence (reasonably satisfactory

to Buyer) of such termination at the Closing, including executed written resolutions duly adopted by the applicable plan sponsor (i) terminating

such Company 401(k) Plan, (ii) ceasing contributions to such Company 401(k) Plan and (iii) fully vesting all participants thereunder,

all of which to be effective as of at least one Business Day prior to the Closing Date.

5.3.

Buyer’s Closing Deliveries. At the Closing Buyer will deliver, or will cause to be delivered, to Seller:

5.3.1.

the Closing Purchase Price and the Additional Consideration pursuant to Section 3.5.1;

5.3.2.

evidence of the replacement of the U1 Financial Assurances by the UEC Financial Assurances as required by Section 9.1; and

5.3.3.

a certificate of an authorized officer of Buyer confirming the matters set forth in Sections 4.2.1 and 4.2.2.

Article

VI.

REPRESENTATIONS AND WARRANTIES OF SELLER

Subject to all exceptions disclosed (by actual

disclosure or incorporation by reference) in the schedules attached to this Agreement (the “Schedules” as such

may be amended by Seller from time to time between the Execution Date and the Closing Date) Seller hereby represents and warrants to Buyer

as follows:

6.1.

Corporate Status.

6.1.1.

Seller. Seller is a corporation duly organized, validly existing and in good standing under the Laws of Canada. Seller has

full corporate power and authority to enter into this Agreement and to perform the transactions contemplated hereby.

6.1.2.

The Company. The Company is a corporation duly organized, validly existing and in good standing under the Laws of the State

of Nevada and has all requisite corporate power to carry out its business as currently conducted.

6.1.3.

U1USA. U1USA is a corporation duly organized, validly existing and in good standing under the Laws of the State of Delaware

and has all requisite corporate power to carry out its business as currently conducted.

6.1.4.

No Other Equity Interest. Except as set forth on Schedule 6.1, the Company and U1USA do not own directly or indirectly

any capital stock of or other equity interests in any corporation, partnership, or other Person, or are members of or participants in

any partnership, joint venture or similar enterprise.

6.1.5.

Organizational Documents. Seller has made available to Buyer true, correct and complete copies of the Organizational Documents

of the Company and U1USA.

6.2.

Capitalization, Title to the Shares.

6.2.1.

The authorized capital stock of the Company consists solely of 10,000 shares of no-par common stock, of which 745 shares are issued

and outstanding. The Transferred Shares represent all of the issued and outstanding shares of capital stock of the Company and, except

as set forth in the previous sentence, there are no other authorized, issued or outstanding shares of capital stock of the Company. All

of the Transferred Shares are owned by Seller free and clear of any Liens, and all of such Transferred Shares have been validly issued,

are fully paid and non-assessable, and have not been issued in violation of any pre-emptive or similar rights or applicable Law. Subject

to the above, there are no commitments providing for the issuance of any additional shares of capital stock of the Company, providing

for the issuance of securities convertible into shares of capital stock of the Company or providing for the issuance of other securities

of the Company in the future.

6.2.2.

The authorized capital stock of U1USA consists solely of 1,000 shares of common stock, par value $0.01 per share, of which 283

shares are issued and outstanding. Except as set forth in the previous sentence, there are no other authorized, issued or outstanding

shares of capital stock of U1USA. All of the capital stock of U1USA is owned by the Company free and clear of any Liens, and all of such

capital stock has been validly issued, is fully paid and non-assessable, and has not been issued in violation of any pre-emptive or similar

rights or applicable Law. Subject to the above, there are no commitments providing for the issuance of any additional shares of capital

stock of U1USA, providing for the issuance of securities convertible into shares of capital stock of U1USA or providing for the issuance

of other securities of U1USA in the future.

6.3.

Authority and Binding Effect. This Agreement and the transactions contemplated hereby have been duly approved by the relevant

corporate body of Seller and constitute the valid and binding obligation of Seller, enforceable against Seller in accordance with its

terms.

6.4.

No Conflicts. Neither the execution and delivery of this Agreement by Seller, nor (subject to the procurement of the Governmental

Approvals listed in Schedule 6.4) the performance of Seller’s obligations hereunder, will: (a) violate any applicable

Law or require any filing with, consent, approval or authorization of, or notice to, any Governmental Authority; (b) (i) result

in the creation of any Lien upon any of the Transferred Shares, the capital stock of U1USA or any assets or properties of the Company

or U1USA or (ii) constitute an event which, after notice or lapse of time or both, could result in any such creation of a Lien upon

any of the Transferred Shares owned by Seller, the capital stock of U1USA or any assets or properties of the Company or U1USA; or (c)

conflict with, result in a breach of, constitute (with or without due notice or lapse of time) a default under, result in the acceleration

of obligations under, create in any Third Person the right to terminate, accelerate, modify or cancel, or require any notice, consent

or waiver under, any Contract to which the Company or U1USA is a party, by which the Company or U1USA is bound or to which the assets

of the Company or U1USA are subject.

6.5.

Real Property and Leases.

6.5.1.

Schedule 6.5.1 hereto contains a complete list of: (a) all real property, including rights of way, owned by the

Company and U1USA (the “Owned Real Property”); (b) all real property leased by the Company and U1USA (the

“Leased Real Property”, and collectively with the Owned Real Property, the “Real Property”);

(c) all state mineral leases issued to the Company and U1USA (the “Mineral Leases”); and (d) all mining

claims owned by the Company and U1USA (the “Mining Claims”) as of the Execution Date. Neither the Company nor

U1USA uses or occupies in any manner whatsoever any real property other than the Real Property and the Mining Claims.

6.5.2.

The Company and U1USA have good and valid title to the Owned Real Property free and clear of Liens other than Permitted Liens.

No written notice has been received from any Governmental Authority or Third Person and, to Seller’s Knowledge, there is no claim

from any Governmental Authority or Third Person pending against the Company or U1USA with respect to any planned expropriation or condemnation

of any material Owned Real Property.

6.5.3.

Each of the Company and U1USA has a valid leasehold interest in the Leased Real Property leased by it. To Seller’s Knowledge,

all Mineral Leases and all leases of Leased Real Property are in full force and effect and enforceable in accordance with their respective

terms. Neither the Company nor U1USA has received any written notice of termination or cancellation of any Mineral Lease or any lease

agreement under which the Company or U1USA uses the Leased Real Property. Neither the Company nor U1USA are in material default under

any Leased Real Property agreement or Mineral Lease and to Seller’s Knowledge no other party is in material default under any Leased

Real Property agreement or Mineral Lease. The Company or U1USA, as applicable, is in exclusive possession of such leased premises. All

payments required to be made under each Leased Real Property agreement and Mineral Lease have been timely and properly made in all material

respects.

6.5.4.

The Company and U1USA have good valid title to the Mining Claims, subject to the paramount title of the United States in the underlying

minerals and Permitted Liens. Neither the Company nor U1USA has received any written notice of termination or cancellation of any Mining

Claim. With respect to the Mining Claims: (A) all affidavits of assessment work, including fee payments required to maintain the Mining

Claims in good standing during the period from January 1, 2011 or such later date as the Company or U1USA acquired such Mining Claim through

the assessment year ending September 1, 2022, have been properly and timely recorded, filed and paid with appropriate governmental

agencies; (B) either the Company or U1USA are the sole owner and have the exclusive possession of the Mining Claims free and clear of

all Liens except for Permitted Liens, and subject to the paramount title of the United States; and (C) except for customary buffer and

perimeter areas, there are no senior third-party unpatented mining claims that conflict with the Mining Claims.

6.5.5.

To Seller’s Knowledge, Schedule 6.5.5 contains a complete list of all royalties, overriding royalties and payments

out of production or sale on or in respect of the Real Property, Mineral Leases and Mining Claims. Except as set forth on Schedule

6.5.5, to Seller’s Knowledge, no Person is entitled to any royalty or other payment in the nature of a royalty on any minerals,

metals or concentrates or any other such products removed or produced from the Real Property, Mineral Lease or Mining Claims.

6.6.

Contracts.

6.6.1.

Schedule 6.6.1 contains a list of the following material Contracts to which the Company or U1USA is a party as of the

Execution Date:

(a)

each written Contract which involves the purchase or the sale of goods or the rendering of services outside the Ordinary Course

and involves aggregate payments in excess of $250,000 in any single year;

(b)

each loan or credit agreement, security agreement, mortgage, pledge or other agreement or instrument evidencing Indebtedness of

the Company or U1USA in excess of $250,000;

(c)

any Contract or agreement which includes a covenant from the Company or U1USA not to compete in any geographic area with respect

to business operations;

(d)

any joint venture agreement, partnership agreement or similar agreement relating to a common enterprise with any Person (other

than the Company or U1USA);

(e)

any agreement for capital expenditures of more than $250,000 during the twelve (12) months following the Execution Date;

(f)

any agreement between the Company or U1USA and their respective Affiliates (as identified on Schedule 6.6.1; the “Intragroup

Agreements”) which is in full force and effect on the Execution Date;

(g)

any Contract that provides for the sale of any material asset owned or used by the Company or U1USA (excluding any sale Contracts

that have been fulfilled and closed prior to the Execution Date) or the grant of any preferential rights to purchase any asset owned or

used by the Company or U1USA;

(h)

any Contract containing any exclusivity provision or any “most-favored nation”, “most favored pricing”

or similar clause in favor of any Person; and

(i)

any non-Ordinary Course agreement valued at more than $250,000, that cannot be terminated within thirty (30) days of termination

notice or without material termination fees or penalties;

(the items described in clauses (a) through (i) being

herein collectively referred to as the “Material Contracts”).

6.6.2.

Each Material Contract to which the Company or U1USA is a party: (a) is in full force and effect; and (b) represents

the legal, valid and binding obligation of the Company or U1USA, as applicable, and, to Seller’s Knowledge, represents the legal,

valid and binding obligation of the other parties thereto, in each case enforceable in accordance with its terms. Neither the Company

nor U1USA is in material breach of any Material Contract, and neither Seller, the Company nor U1USA has received any written notice of

termination or breach of any Material Contract.

6.7.

Personal Property. Except as set forth on Schedule 6.7 neither the Company nor U1USA owns or leases any material

personal property. Except as disclosed on Schedule 6.7, the Company and U1USA have good and valid title to their personal property,

free and clear of any Liens other than Permitted Liens.

6.8.

Consents; No Options. Except as set forth on Schedule 6.8, no authorization, consent or approval of any Third Person

(except and excluding any Governmental Authority) is required to be obtained by Seller, the Company or U1USA in connection with the execution

of this Agreement or the consummation of the transactions contemplated herein. Except as set forth on Schedule 6.8, no Third Person

holds an option to purchase, a right of first refusal or right of first offer, on any assets owned by the Company or U1USA.

6.9.

Books and Records. Seller has made available to Buyer true and complete copies of all Books and Records of the Company and

U1USA from and after January 1, 2011. Since January 1, 2011 (or such later date on which the Company may have acquired the subject of

any such Books and Records), the Books and Records of the Company and U1USA have been kept and maintained in all material respects as

required by applicable Laws and the applicable organizational documents and contain true, correct and complete copies of the governing

documents, material meetings and consents in lieu of meetings of the members or managers, and such records accurately reflect in all material

respects all transactions referred to in such minutes and consents.

6.10.

Reference Accounts. True, correct and complete copies of the Reference Accounts are attached hereto as Exhibit 6.10.

The Reference Accounts have been prepared in accordance with the Accounting Principles. The Reference Accounts have been derived from

the Books and Records of the Company and U1USA for the purpose of establishing the accounts of the Company and U1USA and, to Seller’s

Knowledge, fairly present the financial position and results of operations of the Company and U1USA in all material respects as of the

dates and for the periods presented therein.

6.11.

Litigation. Except as reserved or noted in the Reference Accounts or as set forth on Schedule 6.11, there is no Legal

Proceeding pending or to Seller’s Knowledge threatened against the Company or U1USA, except as would not, in the aggregate, have

a Material Adverse Effect to Seller, the Company or U1USA.

6.12.

Compliance with Law.

6.12.1.

To Seller’s Knowledge, except as set forth on Schedule 6.12.1, the Company and U1USA are in compliance in all

material respects with all applicable Laws.

6.12.2.

Schedule 6.12.2 sets forth a true, correct and complete list of all material Permits of the Company and U1USA as of

the Execution Date. The Company and U1USA possess all Permits necessary to conduct the business operations of the Company and U1USA as

currently conducted. All such Permits are in full force and effect and there are no Legal Proceedings pending or, to Seller’s Knowledge,

threatened, seeking the revocation, cancellation, suspension or adverse modification thereof, except as would not, in the aggregate, reasonably

be expected have a Material Adverse Effect on the Company and U1USA.

6.13.

Intellectual Property.

6.13.1.

The Company and U1USA own, possess, or have the right to use pursuant to a license, all patents, trademarks, trade names and copyrights

currently used in and material to the operations of their respective businesses (the “Intellectual Property”).

6.13.2.

To Seller’s Knowledge, none of the Intellectual Property is the subject of any current or to Seller’s Knowledge threatened

Legal Proceeding.

6.14.

Insurance. Schedule 6.14 sets forth a list of all of the Company’s and U1USA’s insurance policies. With

respect to the insurance information listed in Schedule 6.14, each policy listed as currently in effect is in good standing, all

premiums required to be paid have been properly paid, there have been no misrepresentations or failures to disclose material facts, there

has been no refusal to renew any of the policies and Seller has no Knowledge of any facts which might reasonably be expected to render

any of such insurance policies invalid or unenforceable.

6.15.

Employees. Schedule 6.15 lists all Employees as of the Execution Date, together with a description of their

respective job titles, annual compensation and applicable benefits (including salaries, bonuses, consulting or directors’ or managers’

fees and incentive or deferred compensation), other than the Bonuses.

6.16.

Employee Benefits.

6.16.1.

Schedule 6.16.1 sets forth a true and complete list of each Benefit Plan other than any Benefit Plan relating to the

Bonuses. With respect to each Benefit Plan, Seller has made or, in the case of any Benefit Plan relating to the Bonuses, prior to the

Closing Seller will have made available to Buyer true, complete and accurate copies of: (i) each Benefit Plan document and all amendments

thereto (or, with respect to any unwritten Employee Benefit Plan, a written description thereof); and (ii) to the extent applicable: (A)

the most recent annual report on Form 5500 filed and all schedules thereto filed; (B) each current trust agreement, insurance contract

or policy, group annuity contract and any other funding arrangement; (C) the most recent IRS opinion or favorable determination letter;

(D) the most recent summary plan description, if any; and (E) all material correspondence to or from any governmental entity.

6.16.2.

Each Benefit Plan that is intended to qualify under Section 401(a) of the Code has received a current favorable determination or

approval letter from the IRS with respect to such qualification, or may rely on a current opinion letter issued by the IRS with respect

to a prototype plan adopted in accordance with the requirements for such reliance, and no event has occurred that would reasonably be

expected to adversely affect or cause any Benefit Plan to lose such qualification.

6.16.3.

Each Benefit Plan is and has been established, maintained, funded and operated in all material respects in compliance with all

applicable Laws and is and has been administered in all material respects in compliance with all applicable Laws and in accordance with

its terms. No Proceeding is pending or, to Seller’s Knowledge, threatened with respect to any Benefit Plan or any fiduciary or service

provider thereof, other than claims for the payment of benefits in the Ordinary Course. All payments, reimbursements, distributions, and

contributions with respect to all Benefit Plans, and to the extent required to have been made by the Company or U1USA, either have been