UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————————————

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File No. 001-38469

————————————————

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices) (Zip Code)

(212 ) 554-1234

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an “emerging growth company”. See definition of “accelerated filer,” “large accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. o | |||||||||||||||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant at June 30, 2021 was approximately $11.9 billion.

As of February 20, 2022, 389,557,860 shares of the registrant’s Common Stock, $0.01 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| Page | ||||||||

NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

Certain of the statements included or incorporated by reference in this Annual Report on Form 10-K constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “intends,” “seeks,” “aims,” “plans,” “assumes,” “estimates,” “projects,” “should,” “would,” “could,” “may,” “will,” “shall” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Equitable Holdings, Inc. (“Holdings”) and its consolidated subsidiaries. “We,” “us” and “our” refer to Holdings and its consolidated subsidiaries, unless the context refers only to Holdings as a corporate entity. There can be no assurance that future developments affecting Holdings will be those anticipated by management. Forward-looking statements include, without limitation, all matters that are not historical facts.

These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including, among others: (i) conditions in the financial markets and economy, including the impact of COVID-19 and related economic conditions, equity market declines and volatility, interest rate fluctuations, impacts on our goodwill and changes in liquidity and access to and cost of capital; (ii) operational factors, including reliance on the payment of dividends to Holdings by its subsidiaries, protection of confidential customer information or proprietary business information, operational failures by us or our service providers, and catastrophic events, such as the outbreak of pandemic diseases including COVID-19; (iii) credit, counterparties and investments, including counterparty default on derivative contracts, failure of financial institutions, defaults by third parties and affiliates and economic downturns, defaults and other events adversely affecting our investments; (iv) our reinsurance and hedging programs; (v) our products, structure and product distribution, including variable annuity guaranteed benefits features within certain of our products, variations in statutory capital requirements, financial strength and claims-paying ratings, state insurance laws limiting the ability of our insurance subsidiaries to pay dividends and key product distribution relationships; (vi) estimates, assumptions and valuations, including risk management policies and procedures, potential inadequacy of reserves and experience differing from pricing expectations, amortization of deferred acquisition costs and financial models; (vii) our Investment Management and Research segment, including fluctuations in assets under management and the industry-wide shift from actively-managed investment services to passive services; (viii) legal and regulatory risks, including federal and state legislation affecting financial institutions, insurance regulation and tax reform; (ix) risks related to our common stock and (x) general risks, including strong industry competition, information systems failing or being compromised and protecting our intellectual property.

You should read this Annual Report on Form 10-K completely and with the understanding that actual future results may be materially different from expectations. All forward-looking statements made in this Annual Report on Form 10-K are qualified by these cautionary statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law.

Other risks, uncertainties and factors, including those discussed under “Risk Factors,” could cause our actual results to differ materially from those projected in any forward-looking statements we make. Readers should read carefully the factors described in “Risk Factors” to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements.

Throughout this Annual Report on Form 10-K we use certain defined terms and abbreviations, which are defined or summarized in the “Glossary” and “Acronyms” sections.

3

Part I, Item 1.

BUSINESS

Overview

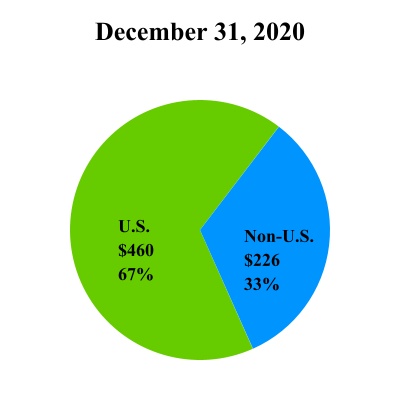

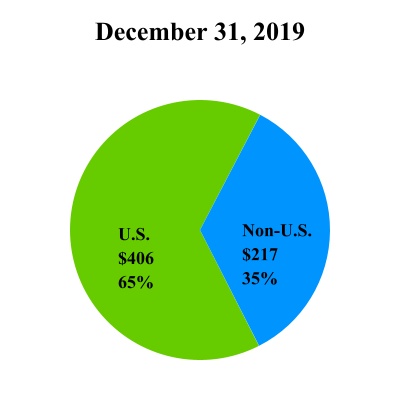

We are one of America’s leading financial services companies and have helped clients prepare for their financial future with confidence since 1859. Our approximately 12,200 employees and advisors are entrusted with more than $900 billion of AUM through two complementary and well-established principal franchises, Equitable and AllianceBernstein, providing:

•Advice and solutions for helping Americans set and meet their retirement goals and protect and transfer their wealth across generations; and

•A wide range of investment management insights, expertise and innovations to drive better investment decisions and outcomes for clients and institutional investors worldwide.

We aim to be a trusted partner to our clients by providing advice, products and services that help them navigate complex financial decisions. Our financial strength and the quality of our people, their ingenuity and the service they provide help us build relationships of trust with our clients.

We have market-leading positions in our four segments: Individual Retirement, Group Retirement, Investment Management and Research, and Protection Solutions.

We distribute our products through a premier affiliated and third-party distribution platform, consisting of:

Affiliated Distribution:

•Our affiliated retail sales force, Equitable Advisors, which has approximately 4,400 licensed financial professionals who advise on retirement, protection and investment advisory solutions; and

•More than 200 Bernstein Financial Advisors, who are responsible for the sale of investment products and solutions to Private Wealth Management clients.

Third-Party Distribution:

•Distribution agreements with more than 500 third-party firms including broker-dealers, banks, insurance partners and brokerage general agencies, giving us access to more than 145,000 financial professionals to market our retirement, protection and investment solutions; and

•An AB global distribution team of more than 500 professionals, who engage with more than 5,000 retail distribution partners and more than 500 institutional clients.

4

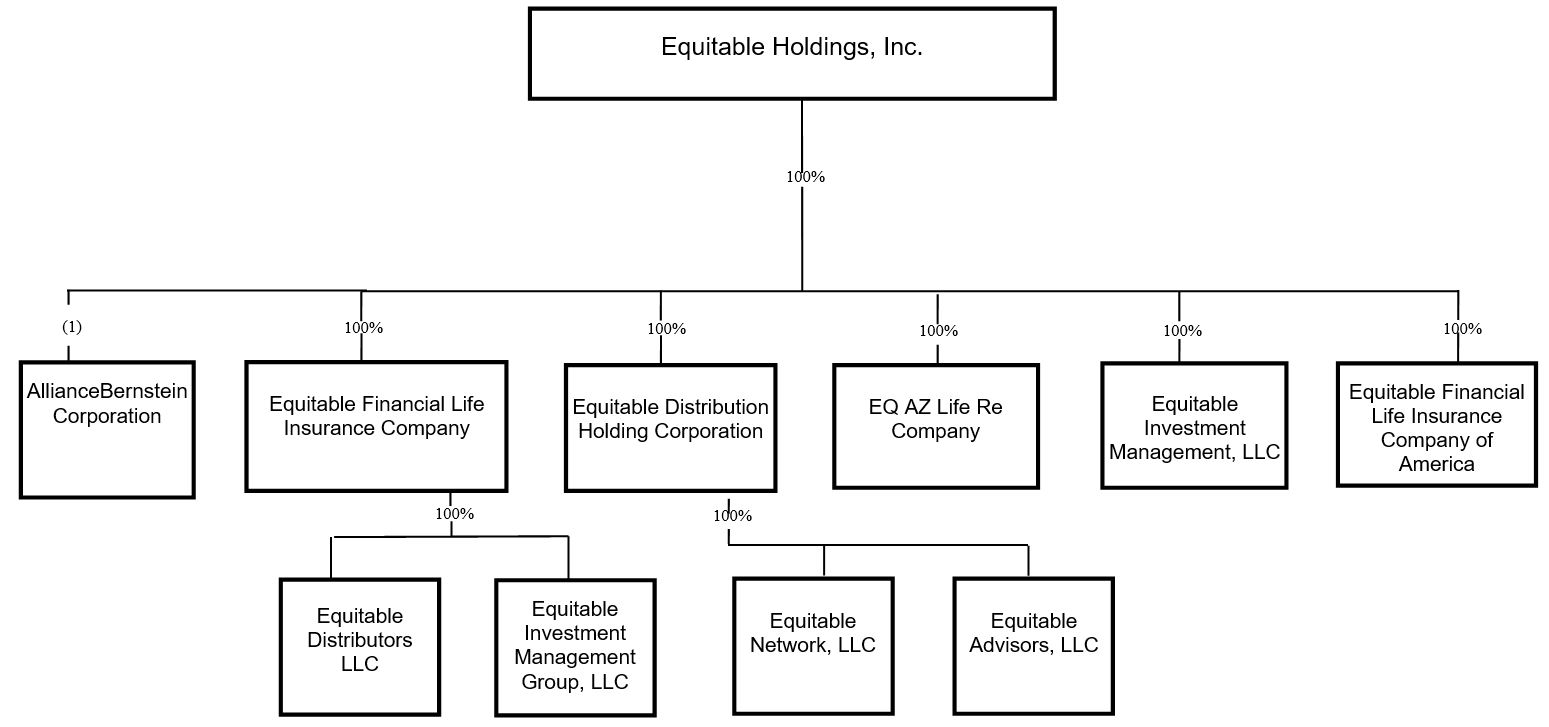

Our Organizational Structure

We are a holding company that operates our business through a number of direct and indirect subsidiaries. Our two principal franchises include Equitable and AllianceBernstein. The following organizational chart presents the ownership of our principal subsidiaries as of December 31, 2021

(1)We own an approximate 65% economic interest in AB through various wholly-owned subsidiaries. Our economic interest consists of approximately 63% of the AB Units, approximately 4% of the AB Holding Units (representing an approximate 1% economic interest in ABLP), and 1% of the AB Units held by the GP. Our indirect, wholly-owned subsidiary, AllianceBernstein Corporation, is the General Partner of AB with the authority to manage and control AB, and accordingly, AB is consolidated in our financial statements. AB has been in the investment management and research business for more than 50 years. ABLP is the operating partnership for the AB business, and AB Holding’s activities consist of owning AB Units and engaging in related activities. AB Holding Units trade on the NYSE under the ticker symbol “AB”. AB Units do not trade publicly.

Venerable Transaction

On June 1, 2021, we completed the sale (the “ Venerable Transaction”) of CS Life, to Venerable Insurance and Annuity Company, an insurance company domiciled in Iowa (“VIAC”), pursuant to the Master Transaction Agreement, dated October 27, 2020 (the “Master Transaction Agreement”), among the Company, VIAC and, solely with respect to Article XIV thereof, Venerable Holdings, Inc., a Delaware corporation (“Venerable”).

Pursuant to the Master Transaction Agreement, immediately prior to the closing of the Venerable Transaction, CS Life effected the recapture of all of the business that was ceded to CS Life Re Company, a wholly owned subsidiary of CS Life (“Reinsurance Subsidiary”), and sold 100% of the equity of the Reinsurance Subsidiary to another wholly owned subsidiary of the Company. Immediately following the closing of the Venerable Transaction, CS Life and Equitable Financial entered into a coinsurance and modified coinsurance agreement (the “Reinsurance Agreement”), pursuant to which Equitable Financial ceded to CS Life, on a combined coinsurance and modified coinsurance basis, legacy variable annuity policies sold by Equitable Financial between 2006-2008 (the “Block”), comprised of non-New York “Accumulator” policies containing fixed rate Guaranteed Minimum Income Benefit and/or Guaranteed Minimum Death Benefit guarantees. In addition, upon the completion of the Venerable Transaction, EIMG acquired an approximate 9.09% equity interest in Venerable’s parent holding company, VA Capital Company LLC. In connection with such investment, EIMG designated a member to the Board of Managers of VA Capital Company LLC.

For additional information regarding the Venerable Transaction, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Summary—Reinsurance of Legacy Variable Annuity Block and Sale of Runoff Variable Annuity Reinsurance Entity”and Note 1 of the Notes to these Consolidated Financial Statements.

5

Segment Information

We are organized into four segments: Individual Retirement, Group Retirement, Investment Management and Research, and Protection Solutions. We report certain activities and items that are not included in our segments in Corporate and Other.

•Individual Retirement—We are a leading provider of variable annuity products, which primarily meet the needs of individuals saving for retirement or seeking retirement income by allowing them to invest in various markets through underlying investment options.

•Group Retirement—We offer tax-deferred investment and retirement services or products to plans sponsored by educational entities, municipalities and not-for-profit entities, as well as small and medium-sized businesses.

•Investment Management and Research—We are a leading provider of diversified investment management, research and related services to a broad range of clients globally.

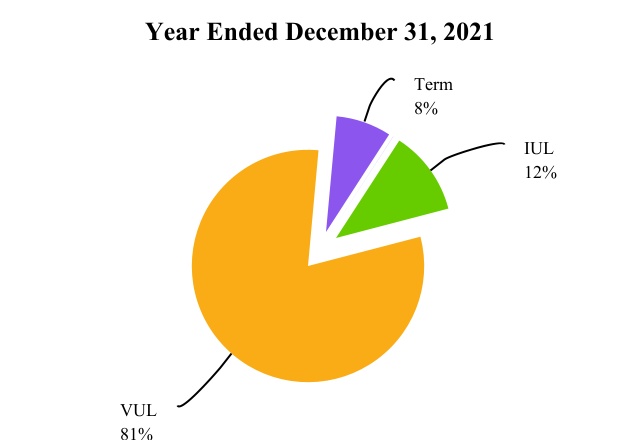

•Protection Solutions—We focus our life insurance products on attractive protection segments such as VUL insurance and IUL insurance and our employee benefits business on small and medium-sized businesses.

For financial information on segments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations by Segment” and Note 1 of the Notes to these Consolidated Financial Statements.

Individual Retirement

Our Individual Retirement segment is a leading provider of individual variable annuity products, which are primarily sold to affluent and high net worth individuals saving for retirement or seeking guaranteed retirement income. We have a long history of innovation, as one of the first companies, in 1968, to enter the variable annuity market, as the first company, in 1996, to provide variable annuities with living benefits, and as the first company, in 2010, to bring to market an index-linked variable annuity product. Our Individual Retirement business is an important source of earnings and cash flow for our company, and we believe our hedging strategy preserves a substantial portion of these cash flows across a wide range of risk scenarios. The primary sources of revenue for our Individual Retirement segment include fee revenue and investment income.

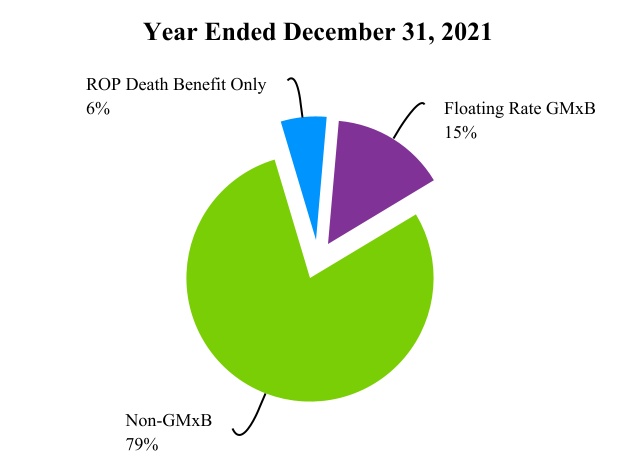

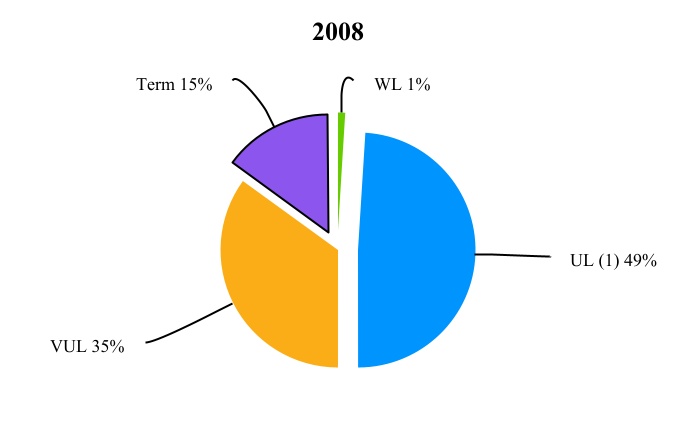

We principally focus on selling three variable annuity products, each of which provides policyholders with distinct benefits, features and return profiles. We continue to innovate our offering, periodically updating our product benefits and introducing new variable annuity products to meet the evolving needs of our clients while managing the risk and return of these variable annuity products to our company. Due to our innovation, our product mix has evolved considerably since 2008. The majority of our sales in 2021 consisted of products without variable annuity guarantee benefits features (“GMxB features”) (other than the ROP death benefit), and less than 1% of 2021 FYP was attributable to products with fixed rate guarantees. To further our growth, we plan to continue to innovate our product portfolio, expand and deepen our distribution channels and effectively manage risk in our business.

Products

We primarily sell three variable annuity products each providing policyholders with distinct features and return profiles. Our current primary product offering, ordered below according to sales volume for the year ended December 31, 2021, includes:

•Structured Capital Strategies. Our index-linked variable annuity product allows the policyholder to invest in various investment options, whose performance is tied to one or more securities indices, commodities indices or ETF, subject to a performance cap, over a set period of time. The risks associated with such investment options are borne entirely by the policyholder, except the portion of any negative performance that we absorb (a buffer) upon investment maturity. Prior to November 2021, this variable annuity did not offer GMxB features, other than an optional return of premium death benefit that we had introduced on some versions. In November 2021, we introduced a new version of this variable annuity offering a GMxB feature.

•Retirement Cornerstone. Our Retirement Cornerstone product offers two platforms: (i) RC Performance, which offers access to a broad selection of funds with annuitization benefits based solely on non-guaranteed account investment performance and (ii) RC Protection, which offers access to a focused selection of funds and an optional floating-rate GMxB feature providing guaranteed income for life.

•Investment Edge. Our investment-only variable annuity is a wealth accumulation variable annuity that defers current taxes during accumulation and provides tax-efficient distributions on non-qualified assets through scheduled payments over a set period of time with a portion of each payment being a return of cost basis, thus excludable from taxes. In

6

2021, we introduced an optional SIO feature that allows the policyholder to invest in various investment options whose performance is tied to one or more securities indices, subject to a performance cap, with some downside protection over a set period of time. This optional SIO feature leverages our innovative SCS offering. Investment Edge does not offer any GMxB feature other than an optional return of premium death benefit.

•Other products. We offer other products which offer optional GMxB benefits. These other products do not contribute significantly to our sales.

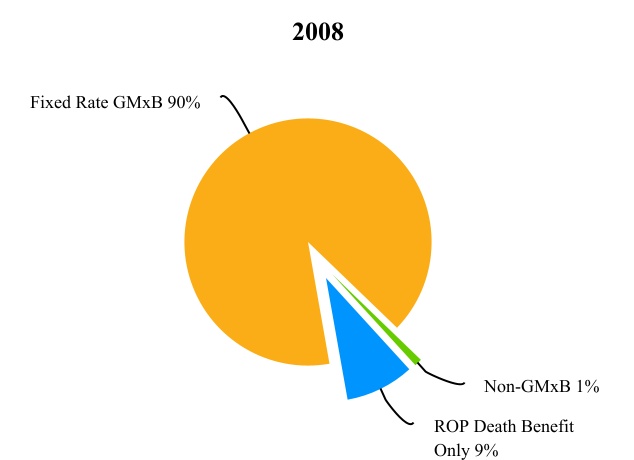

Our variable annuity portfolio is mature. Since 2008, we shifted our business from selling variable annuity products with GMxB features with fixed roll-up rates, to predominantly (i) variable annuity products without GMxB features (other than the return of premium death benefit in some cases) and (ii) variable annuity products with GMxB features with floating roll-up rates. Based on FYP, we have shifted our portfolio from 90% fixed rate GMxB products in 2008 to 94% floating rate GMxB products and non-GMxB products in 2021. In addition, AV has shifted from 77% Fixed Rate GMxB products in 2008 to 27% in 2021.

| Evolution of Variable Annuity FYP | ||||||||||||||

The following tables present the relative contribution to FYP of each of the above products and GMxB features for the years ended December 31, 2021, 2020 and 2019.

| Year Ended December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| FYP by Product | |||||||||||||||||

| SCS | $ | 7,627 | $ | 4,891 | $ | 5,138 | |||||||||||

| Retirement Cornerstone | 1,951 | 1,506 | 2,156 | ||||||||||||||

| Investment Edge | 1,048 | 448 | 548 | ||||||||||||||

| Other | 357 | 328 | 349 | ||||||||||||||

| Total FYP | $ | 10,983 | $ | 7,173 | $ | 8,191 | |||||||||||

7

| Year Ended December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| FYP by Guarantee Feature | |||||||||||||||||

| Non-GMxB | $ | 8,648 | $ | 5,342 | $ | 5,728 | |||||||||||

| ROP Death Benefit Only | 703 | 532 | 551 | ||||||||||||||

| Total Non-GMxB & ROP Death Benefit Only | $ | 9,351 | $ | 5,874 | $ | 6,279 | |||||||||||

| Floating Rate GMxB | $ | 1,623 | $ | 1,278 | $ | 1,864 | |||||||||||

| Fixed Rate GMxB | 3 | 21 | 48 | ||||||||||||||

| Total GMxB | $ | 1,626 | $ | 1,299 | $ | 1,912 | |||||||||||

| Other | 6 | — | — | ||||||||||||||

| Total FYP | $ | 10,983 | $ | 7,173 | $ | 8,191 | |||||||||||

Our sales for the years ended December 31, 2021, 2020 and 2019 further demonstrate the result of our product sales evolution, as 79%, 74% and 70% of FYP, respectively, came from variable annuity products that do not contain GMxB riders, and of the GMxB riders sold, they overwhelmingly featured floating, as opposed to fixed, roll-up rates.

Our Individual Retirement segment works with EIMG to identify and include appropriate underlying investment options in its products, as well as to control the costs of these options and increase profitability of the products. For a discussion of EIMG, see below “—Equitable Investment Management.”

Variable Annuities Policy Feature Overview

Variable annuities allow the policyholder to make deposits into accounts offering variable investment options. For deposits allocated to Separate Accounts, the risks associated with the investment options are borne entirely by the policyholder, except where the policyholder elects GMxB features in certain variable annuities, for which additional fees are charged. Additionally, certain variable annuity products permit policyholders to allocate a portion of their account to investment options backed by the General Account and are credited with interest rates that we determine, subject to certain limitations. As of December 31, 2021, the total AV of our variable annuity products was $111.9 billion, consisting of $74.2 billion of Separate Accounts AV and $37.7 billion of General Account AV.

Certain variable annuity products offer one or more GMxB features in addition to the standard return of premium death benefit guarantee. GMxB features (other than the return of premium death benefit guarantee) provide the policyholder a minimum return based on their initial deposit adjusted for withdrawals (i.e., the benefit base), thus guarding against a downturn in the markets. The rate of this return may increase the specified benefit base at a guaranteed minimum rate (i.e., a fixed roll-up rate) or may increase the benefit base at a rate tied to interest rates (i.e., a floating roll-up rate). GMxB riders must be chosen by the policyholder no later than at the issuance of the contract.

The following table presents our variable annuity AV by GMxB feature for our variable annuity business in our Individual Retirement segment as of December 31, 2021, 2020 and 2019:

| December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| Account Value | |||||||||||||||||

| Non-GMxB | $ | 43,843 | $ | 36,162 | $ | 30,694 | |||||||||||

| ROP Death Benefit Only (1) | 11,438 | 10,438 | 9,620 | ||||||||||||||

| Total Non-GMxB & ROP Death Benefit Only | 55,281 | 46,600 | 40,314 | ||||||||||||||

| Floating Rate GMxB | 26,486 | 25,168 | 23,891 | ||||||||||||||

| Fixed Rate GMxB (1) | 30,137 | 45,622 | 44,717 | ||||||||||||||

| Total Variable Annuity AV | $ | 111,904 | $ | 117,390 | $ | 108,922 | |||||||||||

8

(1) AV is net of amounts ceded to Venerable during 2021. See Note 1 of the Notes to these Consolidated Financial Statements.

The following table presents our variable annuity benefit base by GMxB feature for the Individual Retirement segment as of December 31, 2021, 2020 and 2019. Many of our variable annuity contracts offer more than one type of GMxB feature such that the amounts listed below are not mutually exclusive. Thus, the benefit base cannot be totaled.

| December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| Benefit Base | |||||||||||||||||

| ROP Death Benefit Only (1) | $ | 6,444 | $ | 6,141 | $ | 6,048 | |||||||||||

| Floating Rate GMxB | |||||||||||||||||

| GMDB | $ | 23,574 | $ | 23,095 | $ | 22,793 | |||||||||||

| GMIB | $ | 24,123 | $ | 23,029 | $ | 22,108 | |||||||||||

| Fixed Rate GMxB | |||||||||||||||||

| GMDB (1) | $ | 34,017 | $ | 58,028 | $ | 59,365 | |||||||||||

| GMIB (1) | $ | 34,719 | $ | 60,695 | $ | 61,775 | |||||||||||

(1) Benefit base is net of amounts ceded to Venerable during 2021. See Note 1 of the Notes to these Consolidated Financial Statements.

The guaranteed benefit received by a policyholder pursuant to a GMxB feature is calculated based on the benefit base. The benefit base is defined as a hypothetical amount (i.e., not actual cash value) used to calculate the policyholder’s optional benefits within a variable annuity. A benefit base cannot be withdrawn for cash and is used solely to calculate the variable annuity’s optional guarantee values. Generally, the benefit base is not subject to a cap on the value. However, the benefit base stops increasing after a defined time period or at a maximum age, usually age 85 or 95, as defined in the contract.

The calculation of the benefit base varies by benefit type and may differ in value from the policyholder’s AV for the following reasons:

•The benefit base is defined to exclude the effects of a decline in the market value of the policyholder’s AV. Accordingly, actual claim payments to be made in the future to the policyholder will be determined without giving effect to market declines.

•The terms of the benefit base may allow it to increase at a guaranteed rate irrespective of the rate of return on the policyholder’s AV.

We currently offer GMxB riders. Their principal features are as follows:

•GMDBs provide that in the event of the death of the policyholder, the beneficiary will receive the higher of the current contract account balance or the benefit base upon the death of the owner (or annuitant).

•GMIBs provide, if elected by the policyholder after a stipulated waiting period from contract issuance, guaranteed minimum annual lifetime payments based on predetermined guaranteed annuity purchase factors that may exceed what the contract AV can purchase at then-current annuity purchase rates.

For a detailed discussion of GMxB riders, see “—Overview of GMxB Features.”

Markets

For our Individual Retirement segment, we target sales of our products to affluent and high net worth individuals and families saving for retirement or seeking retirement income. As the retirement age population in the United States continues to grow and employers continue to shift away from defined benefit plans, we expect the need for these retirement savings and income products to expand.

Our customers can prioritize certain features based on their life-stage and investment needs. In addition, our products offer features designed to serve different market conditions. SCS serves clients with investable assets who want exposure to equity markets, but also want to guard against a market correction. Retirement Cornerstone serves clients who want growth potential

9

and guaranteed income with increases in a rising interest rate environment. Investment Edge serves clients concerned about rising taxes.

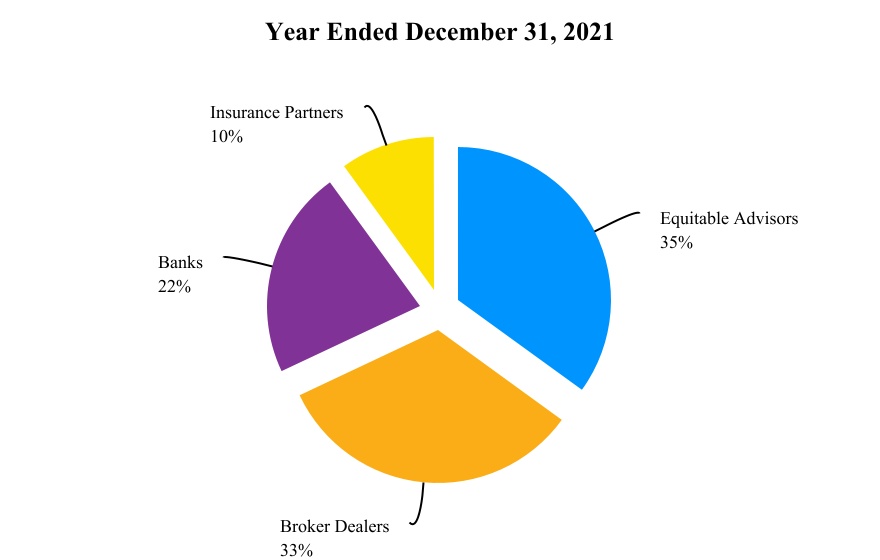

Distribution

We distribute our variable annuity products through Equitable Advisors, and through third-party distribution channels. For the year ended December 31, 2021, Equitable Advisors represented 35% of our variable annuity FYP in this segment, while our third-party distribution channel represented 65% of our variable annuity FYP in this segment. We employ over 150 external and internal wholesalers who distribute our variable annuity products across both channels.

Affiliated Distribution. We offer our variable annuity products on a retail basis through our affiliated retail sales force of financial professionals, Equitable Advisors. These financial professionals have access to and offer a broad array of variable annuity, life insurance, employee benefits and investment products and services from affiliated and unaffiliated insurers and other financial service providers.

Third-Party Distribution. We have shifted the focus of our third-party distribution significantly over the last decade, growing our distribution in the bank, broker-dealer and insurance partner channels. For example, in 2011, we began distributing our variable annuity products to insurance partners. Today, we work with some of the country’s largest insurance partners and our sales through this channel have grown to comprise 10% of our total FYP for the year ended December 31, 2021.

The table below presents the contributions to and percentage of FYP of our variable annuity products by distribution channel for the year ended December 31, 2021.

| FYP by Distribution | ||||||||||||||

Other than Equitable Advisors, no single distribution firm contributed more than 10% of our sales in 2021.

Competition

Our Individual Retirement business competes with traditional life insurers, as well as banks, mutual fund companies and other investment managers. The variable annuities market is highly competitive, with no single provider dominating the market across products. The main factors that distinguish competitors to clients include product features, access to capital, access to diversified sources of distribution, financial and claims-paying ratings, investment options, brand recognition, quality of service, technological capabilities and tax-favored status of certain products. It is difficult to provide unique variable annuities products because, once such products are made available to the public, they often are reproduced and offered by our competitors. Competition may affect, among other matters, both the growth of our business and the pricing and features of our products.

10

Underwriting and Pricing

We generally do not underwrite our variable annuity products on an individual-by-individual basis. Instead, we price our products based upon our expected investment returns and assumptions regarding mortality, longevity and persistency for our policyholders collectively, while taking into account historical experience, volatility of expected earnings on our AV, and the expected time to retirement. Our product pricing models also take into account capital requirements, hedging costs and operating expenses. Investment-oriented products are priced based on various factors, which may include investment return, expenses, persistency and optionality.

Our variable annuity products generally include penalties for early withdrawals. From time to time, we reevaluate the type and level of GMxB and other features we offer. We have previously changed the nature and pricing of the features we offer and will likely do so from time to time in the future as the needs of our clients, the economic environment and our risk appetite evolve.

Fees on AV, Fund Assets, Benefit Base and Investment Income

We earn various types of fee revenue based on AV, fund assets and benefit base. In general, fees from GMxB features that are calculated based on the benefit base are more stable compared to fees calculated based on the AV.

Mortality & Expense, Administrative Charges and Distribution Charges. We deduct a daily charge from the net assets in each variable investment option to compensate us for mortality risks, administrative expenses and a portion of our sales expenses under the variable annuity contract. These charges are calculated based on the portion of the policyholder’s AV allocated to the Separate Accounts and are expressed as an annual percentage.

Withdrawal Charges. Some variable annuity contracts may also impose charges on withdrawals for a period after the purchase, and in certain products for a period after each subsequent contribution, also known as the withdrawal charge period. A withdrawal charge is calculated as a percentage of the contributions withdrawn. The percentage of the withdrawal charge that applies to each contribution depends on how long each contribution had been invested in the contract. Withdrawal charges generally decline gradually over the withdrawal charge period. Contracts may also specify circumstances when no surrender charges apply (for example, upon payment of a death benefit or due to disability, terminal illness or confinement to a nursing home).

Investment Management Fees. We charge investment management fees for the proprietary funds managed by EIMG that are offered as investments under the variable annuities. Investment management fees are also paid on the non-proprietary funds managed by investment advisers unaffiliated with us to the unaffiliated investment advisers. Investment management fees differ by fund. A portion of the investment management fees charged on funds managed by sub-advisers unaffiliated with us are paid by us to the sub-advisers. Investment management fees reduce the net returns on the variable annuity investments.

12b-1 Fees and Other Revenue. 12b-1 fees are paid by the mutual funds which our policyholders choose to invest in and are calculated based on the net assets of the funds allocated to our sub-accounts. These fees reduce the returns policyholders earn from these funds. Additionally, mutual fund companies with funds that are available to policyholders through the variable annuity sub-accounts pay us fees consistent with the terms of administrative service agreements. These fees are funded from the fund companies’ net revenues.

Death Benefit Rider Charges. We deduct a charge annually from the policyholders’ AV on each contract date anniversary for most of our optional death benefits. This charge is in addition to the base mortality and expense charge for promising to pay the GMDB. The charges earned vary by generation and rider type. For some death benefits, the charges are calculated based on AV, but for enhanced death benefits, the charges are normally calculated based on the benefit base.

Living Benefit Riders Charges. We deduct a charge annually from the policyholders’ AV on each contract date anniversary. We earn these fees for promising to pay guaranteed benefits while the policyholder is alive, such as for any type of GMLB (including GMIB, GWBL, GMWB and GMAB). The fees earned vary by generation and rider type and are calculated based on the benefit base.

Investment Income. We earn revenue from investment income on our General Account investments.

11

Risk Management

We approach risk management of our variable annuity products: (i) prospectively, by assessing, and from time to time, modifying our current product offerings to manage our risk and (ii) retrospectively, by implementing actions to reduce our exposure and manage the risks associated with in-force variable annuity contracts.

Current GMxB Product Strategy

Since 2008, we redesigned our variable annuity product offering by introducing new variable annuities without GMxB features, discontinuing the offering of certain GMxB features and adding or adjusting other features to better enable us to manage the risk associated with these products. Through the increase in sales of our products without GMxB features, sales of our variable annuity contracts with GMxB features have decreased significantly as a percentage of our total sales. We continue to offer certain GMxB features to meet evolving consumer demand while maintaining attractive risk-adjusted returns and effectively managing our risk.

Some of the features of our GMxB products have been redesigned over the past several years to better manage our risk and to meet customer demand. For example:

•we primarily offer floating (tied to interest rates), as opposed to fixed, roll-up rates;

•we offer lower risk investment options, including passive investments and bond funds with reduced credit risk if certain optional guaranteed benefits are elected; and

•we offer managed volatility funds, which seek to reduce the risk of large, sudden declines in AV during market downturns by managing the volatility or draw-down risk of the underlying fund holdings through re-balancing the fund holdings within certain guidelines or overlaying hedging strategies at the fund level.

To further manage our risk, features in our current GMxB products provide us with the right to make adjustments post-sale, including the ability to increase benefit charges. For more information on GMxB features contained in our current and in-force products, see below “—Overview of GMxB Features.”

In-force Variable Annuity Management

Since the financial crisis, we have implemented several actions to reduce our exposure and manage the risks associated with in-force variable annuity contracts while ensuring policyholder rights are fully respected. We manage the risks associated with our in-force variable annuity business through our dynamic hedging program, reinsurance and product design. The dynamic hedging program was implemented in the early 2000s. In addition, we use reinsurance for the GMxB riders on our older variable annuity products (generally issued 1996-2004). We have also introduced several other risk management programs, some of which are described in this section below.

To actively manage and protect against the economic risks associated with our in-force variable annuity products, our management team has taken a multi-pronged approach. Our in-force variable annuity risk management programs include:

Hedging

We use a dynamic hedging strategy supplemented by static hedges to offset changes in our economic liability from changes in equity markets and interest rates. In addition to our dynamic hedging strategy, we have static hedge positions to maintain a target asset level for all variable annuities. A wide range of derivatives contracts are used in these hedging programs, such as futures and total return swaps (both equity and fixed income), options and variance swaps, as well as, to a lesser extent, bond investments and repurchase agreements. For GMxB features, we retain certain risks including basis, credit spread, and some volatility risk and risk associated with actual versus expected assumptions for mortality, lapse and surrender, withdrawal and contract-holder election rates, among other things.

Reinsurance

We have used reinsurance to mitigate a portion of the risks that we face in certain of our variable annuity products with regard to a portion of the GMxB features. Under our reinsurance arrangements, other insurers assume a portion of the obligation to pay claims and related expenses to which we are subject. However, we remain liable as the direct insurer on all risks we reinsure and, therefore, are subject to the risk that our reinsurer is unable or unwilling to pay or reimburse claims at the time demand is made. We evaluate the financial condition of our reinsurers in an effort to minimize our exposure to significant losses from reinsurer insolvencies. Also, we ensure that we obtain collateral to mitigate our risk of loss.

12

Non-affiliate Reinsurance. We have reinsured to non-affiliated reinsurers a portion of our exposure on variable annuity products that offer a GMxB feature issued through February 2005. As of December 31, 2021, we had reinsured to non-affiliated reinsurers, subject to certain maximum amounts or caps in any one period, approximately 59.8% of our NAR resulting from the GMIB feature and approximately 47.6% of our NAR to the GMDB obligation on variable annuity contracts in force as of December 31, 2021.

In June 2021, as part of the Venerable Transaction, Equitable Financial ceded to CS Life on a combined coinsurance and modified coinsurance basis, legacy variable annuity policies sold by Equitable Financial between 2006-2008, comprised of non-New York “Accumulator” policies containing fixed rate GMIB and/or GMDB guarantees. For additional information regarding the Venerable Transaction, see “—Overview—Venerable Transaction” and Note 1 of the Notes to these Consolidated Financial Statements.

Captive Reinsurance. In addition to non-affiliated reinsurance, Equitable Financial has ceded to its affiliate, EQ AZ Life RE, a captive reinsurance company, a 100% quota share of all liabilities for variable annuities with GMIB riders issued on or after May 1, 1999 through August 31, 2005 in excess of the liability assumed by two unaffiliated reinsurers, which are subject to certain maximum amounts or limitations on aggregate claims. We use captive reinsurance as part of our capital management strategy. For additional information regarding our use of captives, see “—Regulation—Insurance Regulation—Captive Reinsurance Regulation and Variable Annuity Capital Standards”, “Risk Factors—Risks Relating to Our Retirement and Protection Businesses—Risks Relating to Reinsurance and Hedging—Our reinsurance arrangement with an affiliated captive” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Captive Reinsurance Company.”

Other Programs

We have introduced several other programs that reduced gross reserves and reduced the risk in our in-force block and, in many cases, offered a benefit to our clients by offering liquidity or flexibility:

Investment Option Changes. We made several changes to our investment options within our variable annuity products over the years to manage risk, employ more passive strategies and offer our clients attractive risk-adjusted investment returns. To reduce the differential between hedging instruments performance and fund performance, we added many passive investment strategies and reduced the credit risk of some of the bond portfolios, which is designed to provide a better risk adjusted return to clients. We also introduced managed volatility funds in 2009. Our volatility management strategy seeks to reduce the portfolio’s equity exposure during periods when certain market indicators indicate that market volatility is above specific thresholds set for the portfolio. Historically when market volatility is high, equity markets generally are trending down, and therefore this strategy is intended to reduce the clients’ overall risk of investing in the portfolio.

Optional Buyouts. We have implemented several successful buyout programs on contracts issued between 2002 and 2009 that benefited clients whose needs had changed since buying the initial contract and reduced our exposure to certain types of GMxB features.

Premium Suspension Programs. We have suspended the acceptance of subsequent premiums to certain GMxB contracts.

Lump Sum Option. We have provided certain policyholders with the optional benefit to receive a one-time lump sum payment rather than systematic lifetime payments if their AV falls to zero. This option provides the same advantages as a buyout. However, because the availability of this option is contingent on future events, their actual effectiveness will only be known over a long-term horizon.

Overview of GMxB Features

We have historically offered a variety of variable annuity benefit features, including GMxB features, to our policyholders in our Individual Retirement segment.

Guaranteed Minimum Death Benefits Summary

We have historically offered GMDB features in isolation or together with GMLB features, including the following (with no additional charge unless noted):

•Return of Premium Death Benefit. This death benefit pays the greater of the AV at the time of a claim following the owner’s death or the total contributions to the contract (subject to adjustment for withdrawals). The charge for this

13

benefit is usually included in the Mortality & Expense charge that is deducted daily from the net assets in each variable investment option.

•RMD Wealthguard Death Benefit. This death benefit features a benefit base that does not decrease by the amount of any IRS-mandated withdrawals, or RMD, from the contract. The benefit base automatically increases to equal the highest AV on the current or any prior contract anniversary until RMD withdrawals begin or until the owner reaches a specified maximum age, even if the AV is reduced by negative investment performance. The charges for this benefit are calculated based on the benefit base value and deducted annually from the AV.

•Annual Ratchet (also referred to as Highest Anniversary Value). This death benefit features a benefit base that is reset each year to equal the higher of total contributions to the contract or the highest AV on the current or any prior contract anniversary (subject to adjustment for withdrawals), even if the AV is reduced by negative investment performance. The charge for this benefit is calculated based on the benefit base value and deducted annually from the AV.

•Roll-up Death Benefit. This death benefit features a benefit base that increases (or “rolls up”) at a specified guaranteed annual rate (subject to adjustment for withdrawals), even if the AV is reduced by negative investment performance. The charge for this benefit is calculated based on the benefit base value and deducted annually from the AV. This GMxB feature was discontinued in 2003.

•Greater of Roll-up or Annual Ratchet. This death benefit features a benefit base that increases each year to equal the higher of the initial benefit base accumulated at a specified guaranteed rate or the highest AV on the current or any prior contract anniversary (subject to adjustment for withdrawals), even if the AV is reduced by negative investment performance. The charge for this benefit is calculated based on the benefit base value and deducted annually from the AV.

In addition, we offered two guaranteed minimum death benefits with our GWBL rider, available at issue.

•GWBL Standard Death Benefit. This death benefit features a benefit base that is equal to total contributions to the contract less a deduction reflecting the amount of any withdrawals made.

•GWBL Enhanced Death Benefit. This death benefit features a benefit base that is equal to total contributions to the contract plus the amounts of any ratchets and deferral bonus, less a deduction reflecting the amount of any withdrawals made. This benefit was available for an additional fee.

The following table presents the AV and benefit base by type of guaranteed minimum death benefit. Because variable annuity contracts with GMDB features may also offer GMLB features, the GMDB amounts listed are not mutually exclusive from the GMLB amounts provided in the table below.

| December 31, | |||||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||||||||||||||||||||

Account | Benefit | Account | Benefit | Account | Benefit | ||||||||||||||||||||||||||||||

Value | Base | Value | Base | Value | Base | ||||||||||||||||||||||||||||||

(in millions) | |||||||||||||||||||||||||||||||||||

| GMDB In-Force (1) | |||||||||||||||||||||||||||||||||||

| ROP Death Benefit Only (3) | $ | 11,437 | $ | 6,443 | $ | 10,437 | $ | 6,141 | $ | 9,620 | $ | 6,048 | |||||||||||||||||||||||

| Floating Rate GMDB | |||||||||||||||||||||||||||||||||||

| Greater of Ratchet or Roll-up | $ | 7,105 | $ | 7,867 | $ | 7,121 | $ | 7,995 | $ | 7,017 | $ | 7,891 | |||||||||||||||||||||||

| All Other (2) | 19,381 | 15,707 | 18,047 | 15,100 | 16,874 | 14,902 | |||||||||||||||||||||||||||||

| Total Floating Rate GMDB | $ | 26,486 | $ | 23,574 | $ | 25,168 | $ | 23,095 | $ | 23,891 | $ | 22,793 | |||||||||||||||||||||||

| Fixed Rate GMDB | |||||||||||||||||||||||||||||||||||

| Greater of Ratchet or Roll-up (3) | $ | 14,748 | $ | 21,518 | $ | 26,800 | $ | 42,521 | $ | 26,239 | $ | 42,896 | |||||||||||||||||||||||

| All Other (2) (3) | 15,390 | 12,689 | 18,822 | 15,507 | 18,478 | 16,469 | |||||||||||||||||||||||||||||

| Total Fixed Rate GMDB | $ | 30,138 | $ | 34,207 | $ | 45,622 | $ | 58,028 | $ | 44,717 | $ | 59,365 | |||||||||||||||||||||||

| Total GMDB | $ | 68,061 | $ | 64,224 | $ | 81,227 | $ | 87,264 | $ | 78,228 | $ | 88,206 | |||||||||||||||||||||||

______________

14

(1) See table summarizing the NAR and reserves of policyholders by type of GMxB feature for variable annuity contracts as of December 31, 2021, 2020 and 2019 under “—Net Amount at Risk.”

(2) All Other includes individual variable annuity policies with Annual Ratchet or Roll-up GMDB, either stand-alone or in conjunction with a GMLB, or with ROP GMDB in conjunction with a GMLB.

(3) AV and Benefit base is net of amounts ceded to Venerable during 2021. See Note 1 of the Notes to the Consolidated Financial Statements.

Guaranteed Living Benefits Summary

We have historically offered a variety of guaranteed living benefits to our policyholders in our Individual Retirement segment. Our block of variable annuities includes four types of guaranteed living benefit riders: GMIB, GWBL/GMWB, GMAB and GIB. Based on total AV, approximately 51% of our variable annuity block included living benefit guarantees as of December 31, 2021.

•GMIB. GMIB is our largest block of living benefit guarantees based on in-force AV. Policyholders who purchase the GMIB rider will be eligible, at the end of a defined waiting period, to receive annuity payments for life that will never be less than a guaranteed minimum amount, regardless of the performance of their investment options prior to the first payment. During this waiting period, which is often referred to as the accumulation phase of the contract, policyholders can invest their contributions in a range of variable and guaranteed investment options to grow their AV on a tax-deferred basis while increasing the value of the GMIB benefit base that helps determine the minimum annuity payment amount. Policyholders may elect to continue the accumulation phase beyond the waiting period if they wish to maintain the ability to take withdrawals from their AV or continue to participate in the growth of both their AV and GMIB benefit base.

The second phase of the contract starts when the policyholder annuitizes the contract, either by exercising the GMIB or through the contract’s standard annuitization provisions. Upon exercise of their GMIB, policyholders receive guaranteed lifetime income payments that are calculated as the higher of: (i) application of their GMIB benefit base to the GMIB guaranteed annuity purchase factors specified in the contract; or (ii) application of their AV to our then current or guaranteed annuity purchase factors. Beginning in 2005 we started offering a no-lapse guarantee on our GMIB riders that provides for the automatic exercise of the GMIB in the event that the policyholder’s AV falls to zero and provided no “excess withdrawals” (as defined in the contract) have been taken.

The charge for the GMIB is calculated based on the GMIB benefit base value and deducted annually from the AV.

•GWBL. This benefit guarantees that a policyholder can take lifetime withdrawals from their contract up to a maximum amount per year without reducing their GWBL benefit base. The amount of each guaranteed annual withdrawal is based on the value of the GWBL benefit base. The GWBL benefit base is equal to the total initial contributions to the contract and will increase by subsequent contributions (where permitted), ratchets or deferral bonuses (if applicable), and will be reduced by any “excess withdrawals,” which are withdrawals that exceed the guaranteed annual withdrawal amount. The policyholder may elect one of our automated withdrawal plans or take ad hoc withdrawals. This benefit can be purchased on a single life or joint life basis. The charge for the GWBL is calculated based on the GWBL benefit base value and deducted annually from the AV.

•GMWB. This benefit guarantees that the policyholder can take withdrawals from their contract up to the amount of their total contributions, even if the AV subsequently falls to zero, provided that during each contract year total withdrawals do not exceed annual GMWB withdrawal amount that is calculated under the terms of the contract. The policyholder may choose either a 5% GMWB Annual withdrawal option or a 7% GMWB Annual withdrawal option. Annual withdrawal amounts are not cumulative year over year. The charge for the GMWB is calculated based on the GMWB benefit base value and deducted annually from the AV. We ceased offering GMWB riders in 2008.

•GMAB. This benefit guarantees that the AV can never fall below a minimum amount for a set period, which can also include locking in capital market gains. This rider protects the policyholder from market fluctuations. Two options we offered were a 100% principal guarantee and a 125% principal guarantee. Each option limited the policyholder to specified investment options. The charge for the GMAB is calculated based on the GMAB benefit base value and deducted annually from the AV. We ceased offering GMAB riders in 2008.

•GIB. This benefit provides the policyholder with a guaranteed lifetime annuity based on predetermined annuity purchase rates applied to a GIB benefit base, with annuitization automatically triggered if and when the contract AV falls to zero. The charge for the GIB is calculated based on the GIB benefit base value and deducted annually from the AV. We ceased offering the GIB in 2012.

Below are examples of policyholder benefit utilization choices that can affect benefit payment patterns and reserves:

15

•Lapse. The policyholder may lapse or exit the contract, at which time the GMIB and any other GMxB guarantees are terminated. If the policyholder partially exits, the GMIB benefit base and any other GMxB benefit bases will be reduced in accordance with the contract terms.

•Dollar-for-Dollar Withdrawals. A policyholder may request a onetime withdrawal or take systematic withdrawals from his or her contract at any time. All withdrawals reduce a contract’s AV by the dollar amount of a withdrawal. However, the impact of withdrawals on the GMIB and any other guaranteed benefit bases may vary depending on the terms of the contract. Withdrawals will reduce guaranteed benefit bases on a dollar-for-dollar basis as long as the sum of withdrawals in a contract year is equal to or less than the dollar-for-dollar withdrawal threshold defined in the contract, beyond which all withdrawals are considered “excess withdrawals.” An excess withdrawal may reduce the guaranteed benefit bases on a pro rata basis, which can have a significantly adverse effect on their values. A policyholder wishing to take the maximum amount of dollar-for-dollar withdrawals on a systematic basis may sign up for our dollar-for-dollar withdrawal service at no additional charge. Withdrawals under this automated service will never result in a pro rata reduction of the guaranteed benefit bases, provided that no withdrawals are made outside the service. If making dollar-for-dollar withdrawals in combination with negative investment reduces the AV to zero, the contract may have a no-lapse guarantee that triggers the automatic exercise of the GMIB, providing the policyholder with a stream of lifetime annuity payments determined by the GMIB benefit base value, the age and gender of the annuitant and predetermined annuity purchase factors.

•Voluntary Annuitization. The policyholder may choose to annuitize their AV or exercise their GMIB (if eligible). GMIB annuitization entitles the policyholder to receive a stream of lifetime (with or without period certain) annuity payments determined by the GMIB benefit base value, the age and gender of the annuitant and predetermined annuity purchase factors. GMIB annuitization cannot be elected past the maximum GMIB exercise age as stated in the contract, generally age 85 or 95. The policyholder may otherwise annuitize the AV and choose one of several payout options.

•Convert to a GWBL. In some products, policyholders have the option to convert their GMIB into a GWBL to receive guaranteed income through a lifetime withdrawal feature. This choice can be made as an alternative to electing to annuitize at the maximum GMIB exercise age and may be appealing to policyholders who would prefer the ability to withdraw higher annual dollar-for-dollar amounts from their contract than permitted under the GMIB, for as long as their AV remains greater than zero.

•Remain in Accumulation Phase. If the policyholder chooses to remain in the contract’s accumulation phase past the maximum GMIB exercise age—that is, by not electing annuitization or converting to a GWBL—and as long as the AV has not fallen to zero, then the GMIB will terminate and the contract will continue until the contractual maturity date. In these circumstances, depending on the GMDB elected at issue (if any) and the terms of the contract, the benefit base for the GMDB may be equal to the GMIB benefit base at the time the GMIB was terminated, may no longer increase and will be reduced by future withdrawals.

The likelihood of a policyholder choosing a particular option cannot be predicted with certainty at the time of contract issuance. Accordingly, we make assumptions as to policyholder benefit elections and resulting benefit payments at the time of issuance and while it is in-force based on our experience. The incidents and timing of benefit elections and the amounts of resulting benefit payments may materially differ from those we anticipate at that time. As we observe actual policyholder behavior, we update our assumptions at least annually with respect to future policyholder activity and take appropriate action with respect to the amount of the reserves we establish for the future payment of such benefits. Additionally, upon the death of a policyholder (or annuitant), if the sole beneficiary is a surviving spouse, they can choose to continue the contract and benefits subject to age restrictions.

The following table presents the AV and benefit base by type of guaranteed living benefit. Because variable annuity contracts with GMLB features may also offer GMDB features, the GMLB amounts listed are not mutually exclusive from the GMDB amounts provided in the table above.

16

| December 31, | |||||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||||||||||||||||||||

Account | Benefit | Account | Benefit | Account | Benefit | ||||||||||||||||||||||||||||||

Value | Base | Value | Base | Value | Base | ||||||||||||||||||||||||||||||

(in millions) | |||||||||||||||||||||||||||||||||||

| GMLB In-Force (1) | |||||||||||||||||||||||||||||||||||

| Floating Rate GMLB | |||||||||||||||||||||||||||||||||||

| GMIB | $ | 23,435 | $ | 24,123 | $ | 22,002 | $ | 23,029 | $ | 20,699 | $ | 22,108 | |||||||||||||||||||||||

| Other (GIB) | 2,623 | 2,796 | 2,762 | 2,978 | 2,812 | 3,128 | |||||||||||||||||||||||||||||

| Total Floating Rate GMLB | $ | 26,058 | $ | 26,919 | $ | 24,764 | $ | 26,007 | $ | 23,511 | $ | 25,236 | |||||||||||||||||||||||

| Fixed Rate GMLB | |||||||||||||||||||||||||||||||||||

| GMIB | $ | 40,065 | $ | 59,341 | $ | 39,369 | $ | 60,695 | $ | 38,846 | $ | 61,775 | |||||||||||||||||||||||

| All Other (e.g., GWBL / GMWB, GMAB, other) (2) | 846 | 1,153 | 830 | 1,165 | 806 | 1,175 | |||||||||||||||||||||||||||||

| Total Fixed Rate GMLB | $ | 40,911 | $ | 60,494 | $ | 40,199 | $ | 61,860 | $ | 39,652 | $ | 62,950 | |||||||||||||||||||||||

| Total GMLB | $ | 66,969 | $ | 87,413 | $ | 64,963 | $ | 87,867 | $ | 63,163 | $ | 88,186 | |||||||||||||||||||||||

______________

(1)See table summarizing the NAR and reserves of policyholders by type of GMxB feature for variable annuity contracts as of December 31, 2021, 2020 and 2019 under “—Net Amount at Risk.”

(2) All Other includes individual variable annuity policies with stand-alone Annual Ratchet or stand-alone Roll-up GMDB.

Net Amount at Risk

The NAR for the GMDB is the amount of death benefits payable in excess of the total AV (if any) as of the balance sheet date, net of reinsurance. It represents the amount of the claim we would incur if death claims were made on all contracts with a GMDB on the balance sheet date and includes any additional contractual claims associated with riders purchased to assist with covering income taxes payable upon death.

The NAR for the GMIB is the amount (if any) that would be required to be added to the total AV to purchase a lifetime income stream, based on current annuity rates, equal to the minimum amount provided under the GMIB. This amount represents our potential economic exposure to such guarantees in the event all policyholders were to annuitize on the balance sheet date, even though the guaranteed amount under the contracts may not be annuitized until after the waiting period of the contract.

The NAR for the GWBL, GMWB and GMAB is the actuarial present value in excess of the AVs (if any) as of the balance sheet date. The NAR assumes utilization of benefits by all policyholders as of the balance sheet date. For the GMWB and GWBL benefits, only a small portion of the benefit base is available for withdrawal on an annual basis. For the GMAB, the NAR would not be available until the GMAB maturity date.

NAR reflects the difference between the benefit base (as adjusted, in some cases, as described above) and the AV. We believe that NAR alone provides an inadequate presentation of the risk exposure of our in-force variable annuity portfolio. NAR does not take into consideration the aggregate amount of reserves and capital that we hold against our variable annuity portfolio.

The NAR and reserves of contract owners by type of GMxB feature for variable annuity contracts are summarized below as of December 31, 2021, 2020 and 2019. Many of our variable annuity contracts offer more than one type of guarantee such that the GMIB amounts are not mutually exclusive to the amounts in the GMDB table.

17

| December 31, | |||||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||||||||||||||||||||

| NAR | Reserves | NAR | Reserves | NAR | Reserves | ||||||||||||||||||||||||||||||

(in millions) | |||||||||||||||||||||||||||||||||||

| GMDB | |||||||||||||||||||||||||||||||||||

| ROP Death Benefit Only (1) (2) | $ | 75 | N/A | $ | 84 | N/A | $ | 95 | N/A | ||||||||||||||||||||||||||

| Floating Rate GMDB | 851 | 377 | 943 | 332 | 904 | 272 | |||||||||||||||||||||||||||||

| Fixed Rate GMDB (2) | 8,061 | 2,360 | 17,244 | 4,674 | 18,123 | 4,402 | |||||||||||||||||||||||||||||

| Total | $ | 8,987 | $ | 2,737 | $ | 18,271 | $ | 5,006 | $ | 19,122 | $ | 4,674 | |||||||||||||||||||||||

| December 31, | |||||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||||||||||||||||||||

| NAR | Reserves | NAR | Reserves | NAR | Reserves | ||||||||||||||||||||||||||||||

(in millions) | |||||||||||||||||||||||||||||||||||

| GMIB | |||||||||||||||||||||||||||||||||||

| Floating Rate GMIB | $ | — | $ | 172 | $ | — | $ | 136 | $ | — | $ | 91 | |||||||||||||||||||||||

| Fixed Rate GMIB (2) | 3,910 | 4,441 | 10,461 | 14,110 | 8,746 | 10,573 | |||||||||||||||||||||||||||||

| Total | $ | 3,910 | $ | 4,613 | $ | 10,461 | $ | 14,246 | $ | 8,746 | $ | 10,664 | |||||||||||||||||||||||

______________

(1) U.S. GAAP reserves for ROP death benefit only are not available, as U.S. GAAP reserve valuation basis applies on policy contracts grouped by issue year.

(2) NAR is net of amounts ceded to Venerable during 2021. See Note 1 of the Notes to these Consolidated Financial Statements for details of the Venerable Transaction.

18

Group Retirement

Our Group Retirement segment offers tax-deferred investment and retirement services or products to plans sponsored by educational entities, municipalities and not-for-profit entities, as well as small and medium-sized businesses. We operate in the 403(b), 457(b) and 401(k) markets where we sell variable annuity and mutual fund-based products. RBG, is the primary distributor of our products and related solutions to individuals in the K-12 education market with more than 1,000 advisors dedicated to helping educators prepare for retirement as of December 31, 2021.

The tax-exempt 403(b)/457(b) market, which includes our 403(b) K–12 education market business, accounted for 71% of sales within the Group Retirement business for the year ended December 31, 2021. The corporate 401(k) market accounts for 22% and the remaining 7% is Other as of December 31, 2021.

The recurring nature of the revenues from our Group Retirement business makes this segment an important and stable contributor of earnings and cash flow to our business. The primary sources of revenue for the Group Retirement business include fee revenue and investment income.

Products

Our products offer educators, municipal employees and corporate employees a savings opportunity that provides tax-deferred wealth accumulation. Our innovative product offerings address all retirement phases with diverse investment options.

Variable Annuities

Our variable annuities offer defined contribution plan record-keeping, as well as administrative and participant services combined with a variety of proprietary and non-proprietary investment options. Our variable annuity investment lineup mostly consists of proprietary variable investment options that are managed by EIMG, which provides discretionary investment management services for these investment options that include developing and executing asset allocation strategies and providing rigorous oversight of sub-advisors for the investment options. This helps to ensure that we retain high quality managers and that we leverage our scale across both the Individual Retirement and Group Retirement products. In addition, our variable annuity products offer the following features:

•Guaranteed Investment Option (GIO) —Provides a fixed interest rate and guarantee of principal.

•Structured Investment Option (SIO) —Provides upside market participation that tracks either the S&P 500, Russell 2000 or the MSCI EAFE index subject to a performance cap, with a downside buffer that limits losses in the investment over a one, three or five-year period. This option leverages our innovative SCS individual annuity offering, and we believe that we are the only provider that offers this type of offering combined in a variable annuity offering in the defined contribution market today.

•Personal Income Benefit—An optional GMxB feature that enables participants to obtain a guaranteed withdrawal benefit for life for an additional fee.

While GMxB features provide differentiation in the market, only approximately $9 million, or 0.02%, of our total AV is invested in products with GMxB features (other than ROP death benefits) as of December 31, 2021, and based on current utilization, we do not expect significant flows into these types of GMxB features.

Open Architecture Mutual Fund Platform

We also offer a mutual fund-based product to complement our variable annuity products. This platform provides a similar service offering to our variable annuities. The program allows plan sponsors to select from thousands of mutual funds. The platform also offers a group fixed annuity that operates very similarly to the GIO as an available investment option on this platform. In January 2021 we launched the successor product to our existing mutual fund based product.

Services

Both our variable annuity and open architecture mutual fund products offer a suite of tools and services to enable plan participants to obtain education and guidance on their contributions and investment decisions and plan fiduciary services. Education and guidance are available online or in person from a team of plan relationship and enrollment specialists and/or the advisor that sold the product. Our clients’ retirement contributions come through payroll deductions, which contribute significantly to stable and recurring sources of renewals.

19

The chart below illustrates our net flows for the years ended December 31, 2021, 2020 and 2019.

| Year Ended December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| Net Flows | |||||||||||||||||

| Gross Premiums | $ | 3,623 | $ | 3,343 | $ | 3,533 | |||||||||||

| Surrenders, Withdrawals and Benefits | (3,929) | (3,047) | (3,266) | ||||||||||||||

| Net Flows | $ | (306) | $ | 296 | $ | 267 | |||||||||||

The following table presents the gross premiums for each of our markets for the periods specified.

| Year Ended December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| Gross Premiums by Market | |||||||||||||||||

| Tax-Exempt | $ | 809 | $ | 724 | $ | 902 | |||||||||||

| Corporate | 435 | 392 | 537 | ||||||||||||||

| Other | 62 | 60 | 49 | ||||||||||||||

| Total FYP | 1,306 | 1,176 | 1,488 | ||||||||||||||

| Tax-Exempt | 1,757 | 1,632 | 1,531 | ||||||||||||||

| Corporate | 369 | 342 | 330 | ||||||||||||||

| Other | 191 | 193 | 184 | ||||||||||||||

| Total Renewal Premiums | 2,317 | 2,167 | 2,045 | ||||||||||||||

| Gross Premiums | $ | 3,623 | $ | 3,343 | $ | 3,533 | |||||||||||

Markets

We primarily operate in the tax-exempt 403(b)/457(b), corporate 401(k) and other markets.

•Tax-exempt 403(b)/457(b). We primarily serve individual employees of public school systems. To a lesser extent, we also market to government entities that sponsor 457(b) plans.

Overall, the 403(b) and 457(b) markets represent 62% of FYP in the Group Retirement segment for the year ended December 31, 2021. We seek to grow in these markets by increasing our presence in the school districts where we currently operate and also by potentially growing our presence in school districts where we currently do not have access.

•Corporate 401(k). We target small and medium-sized businesses with 401(k) plans that generally have under $20 million in assets. Our product offerings accommodate start up plans and plans with accumulated assets. Typically, our products appeal to companies with strong contribution flows and a smaller number of participants with relatively high average participant balances. The under $20 million asset plan market is well aligned with our advisor distribution, which has a strong presence in the small and medium-sized business market, and complements our other products focused on this market (such as life insurance and employee benefits products aimed at this market).

•Other. Our other business includes an affinity-based direct marketing program where we offer retirement and individual products to employers that are members of industry or trade associations and various other sole proprietor and small business retirement accounts.

The following table presents the relative contribution of each of our markets to AV as of the dates indicated.

20

| December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| AV by Market | |||||||||||||||||

| Tax-Exempt | $ | 37,072 | $ | 32,586 | $ | 28,895 | |||||||||||

| Corporate | 5,367 | 4,920 | 4,387 | ||||||||||||||

| Other | 4,914 | 4,953 | 4,598 | ||||||||||||||

| AV | $ | 47,353 | $ | 42,459 | $ | 37,880 | |||||||||||

Distribution

We primarily distribute our products and services to this market through Equitable Advisors and third-party distribution firms. For the year ended December 31, 2021, these channels represented approximately 88% and 12% of our sales, respectively. We also distribute through direct online sales. We employ internal and external wholesalers to exclusively market our products through Equitable Advisors and third-party firms that are licensed to sell our products.

Equitable Advisors, through RBG, is the primary distribution channel for our products. The cornerstone of the RBG model is a repeatable and scalable advisor recruiting and training model that we believe is more effective than the overall industry model. RBG advisors complete several levels of training that are specific to the education market and give them the requisite skills to assess the educators’ retirement needs and how our products can help to address those needs. Equitable Advisors also accounted for 98% of our 403(b) sales in 2021.

Group Retirement products are also distributed through third-party firms and directly to customers online. We have a digital engagement strategy to supplement our traditional advisor-based model. This includes engaging existing clients to increase contributions online. The program uses data analysis combined with digital media to engage educators, teach them about their retirement needs and increase awareness of our products and services. Due to effects of the COVID-19 pandemic, we accelerated our digital adoption programs, leading to improved outcomes for clients, advisors, and the Company. We developed digital tools and enhanced our remote engagement with our educator clients, which is resulting in improved retention and increases in retirement plan contributions.

The following table presents first year premium by distribution channel for the periods indicated:

| Year Ended December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

(in millions) | |||||||||||||||||

| FYP by Distribution | |||||||||||||||||

Equitable Advisors | $ | 1,155 | $ | 1,078 | $ | 1,341 | |||||||||||

| Third-Party | 151 | 98 | 147 | ||||||||||||||

| Total | $ | 1,306 | $ | 1,176 | $ | 1,488 | |||||||||||

Competition

We compete with select insurance companies, asset managers, record keepers and diversified financial institutions that target similar market segments. Competition varies in all market segments with no one company dominating. In the K–12 public education market, competitors are primarily insurance-based providers that focus on school districts. In the small and medium-sized business market, the primary competitors are insurance-based providers and mutual fund companies. The main features that distinguish our offering to clients include our RBG distribution model, the product features we offer to clients, including guarantees, and our financial strength.

Underwriting and Pricing

We generally do not underwrite our annuity products on an individual-by-individual basis. Instead, we price our products based upon our expected investment returns and assumptions regarding mortality, longevity and persistency for our policyholders collectively, while taking into account historical experience, volatility of expected earnings on our AV, and the expected time to retirement. Our product pricing models also take into account capital requirements, hedging costs and operating expenses. Investment-oriented products are priced based on various factors, which may include investment return, expenses, persistency and optionality.

21

Our variable annuity products generally include penalties for early withdrawals. From time to time, we reevaluate the type and level of guarantees and other features we offer. We have previously changed the nature and pricing of the features we offer and will likely do so from time to time in the future as the needs of our clients, the economic environment and our risk appetite evolve.

Fees

We earn various types of fee revenue based on AV, fund assets and benefit base. Fees that we collect include mortality & expense, administrative charges and distribution charges; withdrawal charges; investment management fees, 12b-1 fees, death benefit rider charges, and living benefit riders charges. For a more detailed description of these types of fees, see “—Individual Retirement—Fees on AV, Fund Assets, Benefit Base and Investment Income.”

Risk Management

We design our Group Retirement products with the goal of providing attractive features to clients that also minimize risks to us. To mitigate risks to our General Account from fluctuations in interest rates, we apply a variety of techniques that align well with a given product type. We designed our GIO to comply with the NAIC minimum rate (1.0% for new issues), and our 403(b) products that we currently sell include a contractual provision that enables us to limit transfers into the GIO. As most defined contribution plans allow participants to borrow against their accounts, we have made changes to our loan repayment processes to minimize participant loan defaults and to facilitate loan repayments to the participant’s current investment allocation as opposed to requiring repayments only to the GIO. In the 401(k) and 457(b) markets, we may charge a market value adjustment on the assets of the GIO when a plan sponsor terminates its agreement with us. We also prohibit direct transfers to fixed income products that compete with the GIO, which protects the principal in the General Account in a rising interest rate environment.

In the Tax-Exempt market, the benefits include a minimum guaranteed interest rate on our GIO, return of premium death benefits and limited optional GMxB features. The utilization of GMxB features is low. In the Corporate market, the products that we sell today do not offer death benefits in excess of the AV.

As of December 31, 2021, approximately 59% of our General Account AV has a minimum guaranteed rate of 3-4%. Given the growth in net flows to our newer products and the slowing in flows to older blocks due to retirement, we expect that guarantees at a rate over 3% will continue to diminish as a percentage of our overall General Account AV. The table below illustrates the guaranteed minimum rates applicable to our General Account AV for products with the GIO, as of December 31, 2021.

| Total General | |||||

| Guaranteed Minimum Interest Rate | Account AV | ||||

(in billions) | |||||

| 1 – < 2% | $ | 3.7 | |||

| 2 – < 3% | 1.4 | ||||