UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

For the fiscal year ended December 31 , 2023

OR

For the transition period from ____ to ____

Commission file number: 001-33071

_____________________________________________

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S Employer Identification No) | |||||||

(Address of principal executive offices) (Zip Code)

(737 ) 248-2340

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

_____________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth Company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Based on the closing price of the registrant’s common stock on the last business day of the registrant’s most recently completed second fiscal quarter, which was June 30, 2023, the aggregate market value of its shares (based on a closing price of $8.04 per share) held by non-affiliates was $220.9 million. Shares of the registrant’s common stock held by each executive officer and director and by each person who may be deemed to be an affiliate of the registrant have been excluded from this computation. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock, par value $0.001 per share, outstanding as of February 23, 2024 was 28,938,509 shares.

DOCUMENTS INCORPORATED BY REFERENCE

EHEALTH, INC.

FORM 10-K

Table of Contents

PAGE | ||||||||

PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

Item 1C. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

1

Summary of Risk Factors

The following is a summary of the principal risks we face, any of which could adversely affect our business, operating results, financial condition or prospects:

•The markets in which we participate are intensely competitive, and if we cannot compete effectively against current and future competitors, including government-run health insurance exchanges, our business, operating results and financial condition could suffer.

•Our business may be harmed if we lose our relationship with health insurance carriers or our relationship with health insurance carriers is modified.

•We derive a significant portion of our revenue from a small number of health insurance carriers, and any impairment of our relationship with them or impairment of their business could adversely affect our business, operating results and financial condition.

•If we are unable to successfully attract and convert qualified prospects into members for whom we receive commissions, our business, operating results and financial condition would be harmed.

•Our business may be harmed if we do not enroll subsidy-eligible individuals through government-run health insurance exchanges efficiently.

•Our business, operating results and financial condition will be adversely impacted if we are unable to retain our existing members.

•Our marketing efforts may not be successful or may become more expensive, either of which could adversely affect our business, operating results and financial condition.

•If our carrier advertising and sponsorship program is not successful, our business, operating results and financial condition could be harmed.

•Our business is seasonal in nature, and if we are not successful in responding to changes in the seasonality of our business, our business, operating results and financial condition could be harmed.

•Changes in our management or key employees could affect our business, operating results and financial condition.

•Our business success depends on our ability to timely hire, train and retain qualified licensed insurance agents, or benefit advisors, and other employees to provide superior customer service and support our strategic initiatives while also controlling our labor costs.

•Our business may be harmed if we are not successful in executing on our operational and strategic plans, including our growth strategies, cost-saving and enrollment quality initiatives.

•Our failure to effectively manage our operations and maintain our company culture as our business evolves and our work practices change could harm us.

•Our operations in China involve many risks that could increase expenses, expose us to increased liability and adversely affect our business, operating results and financial condition.

•Our self-insurance programs may expose us to significant and unexpected costs and losses.

•The marketing and sale of Medicare plans are subject to numerous, complex and frequently changing laws, regulations and guidelines, and non-compliance with or changes in laws, regulations and guidelines could harm our business, operating results and financial condition.

•Changes and developments in the health insurance industry or system, including changes in laws and regulations, could harm our business, operating results and financial condition.

•From time to time, we are subject to various legal proceedings which could adversely affect our business.

•We may be unable to operate our business if we fail to maintain our health insurance licenses and otherwise comply with the numerous laws and regulations applicable to the sale of health insurance.

•Increasing regulatory focus on privacy and data security issues and expanding laws could impact our business and expose us to increased liability.

•Any legal liability, regulatory penalties, complaints or negative publicity related to us or our services could harm our business, operating results and financial condition.

•Our commission revenue could be negatively impacted by changes in our estimated conversion rate of an approved member to a paying member, our forecast of average plan duration or our forecast of likely commission amounts.

•Our operating results will be impacted by factors that impact our estimate of the constrained lifetime value of commissions per approved member.

2

•If commission reports we receive from carriers are inaccurate or not sent to us in a timely manner, our business and operating results could be harmed and we may not recognize trends in our membership.

•We do not receive information about membership cancellations from our health insurance carriers directly, which makes it difficult for us to determine the impact of current conditions on our membership retention and to accurately estimate membership as of a specific date.

•Our agreements with our lender and our convertible preferred stock investor contain restrictions that impact our business and expose us to risks that could materially adversely affect our liquidity and financial condition.

•Operating and growing our business is likely to require additional capital, and if capital is not available to us, our business, operating results and financial condition may suffer.

•If we fail to properly maintain existing or implement new information systems, our business may be materially adversely affected.

•Our business is subject to security risks and, if we experience a successful cyberattack, a security breach or are otherwise unable to safeguard the confidentiality and integrity of the data we hold, including sensitive personal information, our business will be harmed.

•We may not be able to adequately protect our intellectual property, which could harm our business and operating results.

•Our future operating results are likely to fluctuate and could fall short of expectations, which could negatively affect the value of our common stock.

•Our actual operating results may differ significantly from our guidance.

•The price of our common stock has been and may continue to be volatile, and the value of your investment could decline.

•Our convertible preferred stock investor has rights, preferences and privileges that are not held by, and are preferential to, the rights of our common stockholders, which could adversely affect our liquidity and financial condition, result in the interests of our convertible preferred stock investor differing from those of our common stockholders and make an acquisition of us more difficult.

•We are subject to risks associated with public health crises, pandemics, natural disasters, changing climate conditions and other extreme events, including legal, regulatory and social responses thereto, which have and could have an adverse effect on our business.

•We face risks related to heightened inflation, recession, financial and credit market disruptions and other economic conditions.

Our Risk Factors are not guarantees that no such conditions exist as of the date of this report and should not be interpreted as an affirmative statement that such risks or conditions have not materialized, in whole or in part.

3

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “expect,” “anticipate,” “believe,” “estimate,” “target,” “goal,” “project,” “hope,” “intend,” “plan,” “seek,” “continue,” “may,” “could,” “should,” “might,” “forecast,” “depends,” “predict” and variations or the negative of such words and similar expressions are intended to identify such forward-looking statements. These statements include, among other things, statements regarding the following:

•our expectations relating to estimated membership and approved members;

•our estimates regarding the constrained lifetime value of commissions and commissions receivable;

•our expectations relating to revenue, operating costs, cash flows and profitability;

•our expectations regarding our strategy and investments;

•our expectations regarding our business, industry and market trends, including market opportunity, consumer demand and our competitive advantage;

•our expectations regarding our individual and family business, Medicare Supplement and other ancillary products, including anticipated trends and our ability to enroll individuals and families into qualified health plans;

•our expectation regarding our growth strategies and cost-saving initiatives;

•the impact of future and existing laws and regulations on our business;

•the impact of public health crises, pandemics, natural disasters, changing climate conditions and other extreme events;

•the impact of macroeconomic conditions, including adverse events or perceptions affecting the U.S. or international financial systems, inflationary pressures and the political climate on our business;

•our expectations regarding commission rates, conversion rates, plan termination rates and duration, membership retention rates and membership acquisition costs;

•our expectations regarding insurance agent licensing and productivity;

•our expectations regarding beneficiary complaints, customer experience and enrollment quality;

•our expectations relating to the seasonality of our business;

•expected competition, including from government-run health insurance exchanges and other sources;

•our expectations relating to marketing and advertising investments and expected contributions from our marketing and strategic partnership channels;

•the timing of our receipt of commission and other payments;

•our critical accounting policies and related estimates;

•liquidity and capital needs;

•political, legislative, regulatory and legal challenges;

•the merits or potential impact of any lawsuits filed against us; and

•other statements regarding our future operations, financial condition, prospects and business strategies.

We have based these forward-looking statements on our current expectations about future events. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Our actual results may differ materially from those suggested by these forward-looking statements for various reasons, including our ability to retain existing members and enroll new members during the annual healthcare open enrollment period, the Medicare annual enrollment period, the Medicare Advantage annual open enrollment period and other special enrollment periods; changes in laws, regulations and guidelines, including in connection with healthcare reform or with respect to the marketing and sale of Medicare plans; competition, including competition from government-run health insurance exchanges and other sources; the seasonality of our business and the fluctuation of our operating results; our ability to accurately estimate membership, lifetime value of commissions and commissions receivable; changes in product offerings among carriers on our ecommerce platform and changes in our estimated conversion rate of an approved member to a paying member and the resulting impact of each on our commission revenue; the concentration of our revenue with a small number of health insurance carriers; our ability to execute on our growth strategy and other business initiatives; changes in our management and key employees; our ability to hire, train, retain and ensure the productivity of licensed insurance agents, or benefit advisors, and other employees; exposure to security risks and our ability to safeguard the security and privacy of confidential data; our relationships with health insurance carriers; the success of our carrier advertising and sponsorship program; our success in marketing and selling health insurance plans and our unit cost of

4

acquisition; our ability to effectively manage our operations as our business evolves and execute on our transformation plan and other strategic initiatives; the need for health insurance carrier and regulatory approvals in connection with the marketing of Medicare-related insurance products; changes in the market for private health insurance; consumer satisfaction of our service and actions we take to improve the quality of enrollments; changes in member conversion rates; changes in commission rates; our ability to sell qualified health insurance plans to subsidy-eligible individuals and to enroll subsidy-eligible individuals through government-run health insurance exchanges; our ability to derive desired benefits from investments in our business, including membership growth and retention initiatives; our reliance on marketing partners; the success and cost of our marketing efforts, including branding, online advertising, direct-to-consumer mail, email, social media, telephone. television, radio and other marketing efforts; timing of receipt and accuracy of commission reports; payment practices of health insurance carriers; dependence on our operations in China; the restrictions in our debt obligations; the restrictions in our investment agreement with our convertible preferred stock investor; our ability to raise additional capital; compliance with insurance, privacy, cybersecurity and other laws and regulations; the outcome of litigation in which we may from time to time be involved; the performance, reliability and availability of our information technology systems, ecommerce platform and underlying network infrastructure, including any new systems we may implement; public health crises, pandemics, natural disasters, changing climate conditions and other extreme events; general economic conditions, including inflation, recession, financial, banking and credit market disruptions; our ability to effectively administer our self-insurance program; and those identified under the heading “Risk Factors” in Part I, Item 1A. of this report and those discussed in our other Securities and Exchange Commission filings. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this report are made only as of the date hereof. Except as required by applicable law, we do not undertake, and specifically decline, any obligation to update any of these statements or to publicly announce the results of any revisions to any forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements.

5

PART I

ITEM 1. BUSINESS

Overview

eHealth, Inc. and its subsidiaries, referred to throughout this report as “eHealth,” the “Company,” “we,” “us” or “our”, is a leading private health insurance marketplace with a technology and service platform that provides consumer engagement, education and health insurance enrollment solutions. Our mission is to expertly guide consumers through their health insurance enrollment and related options, when, where, and how they prefer. Our platform leverages technology to solve a critical problem in a large and growing market by aiding consumers in what has traditionally been a complex, confusing and opaque health insurance purchasing process.

Our omnichannel consumer engagement platform differentiates our offering from other brokers and enables consumers to use our services online, by telephone with a licensed insurance agent, or benefit advisor, or through a hybrid online assisted interaction that includes live agent chat and co-browsing capabilities. We have created a consumer-centric marketplace that offers consumers a broad choice of insurance products that includes thousands of Medicare Advantage, Medicare Supplement, Medicare Part D prescription drug, individual, family, small business, and other ancillary health insurance products from over 180 health insurance carriers nationwide. Our plan recommendation tool curates this broad plan selection by analyzing customer health-related information against plan data for insurance coverage fit. This tool is supported by a unified data platform and is available to our ecommerce customers and our benefit advisors. We strive to be the most trusted partner to the consumer in their life’s journey through the health insurance market.

Our Business Model

We operate our business in two segments: (1) Medicare and (2) Employer and Individual (“E&I”). In the fourth quarter of 2023, the Individual, Family and Small Business segment was renamed “Employer and Individual”. The E&I segment name change was to the name only and had no impact on our historical financial position, results of operations, cash flow or segment level results previously reported. Our Medicare segment represents the majority of our business and constituted approximately 90% of our revenue in 2023. We derive the majority of our revenues from commission payments paid to us by health insurance carriers related to insurance plans that have been purchased by members who used our services. Our platform and services are free to the consumer, and, as an insurance agency, we do not take on underwriting risk.

In our Medicare segment, we have benefited from (1) demographic trends, with an average of approximately 10,000 people projected to turn 65 every day for the next several years; (2) the strong value proposition of the Medicare Advantage program, which we believe has provided overall superior health outcomes compared to traditional Medicare and a wide selection of plans that are increasingly offering extra benefits, including gym memberships, medical transportation and nutritional services; (3) the increasing proportion of the Medicare eligible population that is choosing commercial insurance solutions such as Medicare Advantage and Medicare Supplement plans, rather than obtaining healthcare through the original Medicare program; and (4) consumers’ growing propensity to comparison shop, including for healthcare insurance. In addition, our digital platform provides us with a strong competitive advantage as adoption of the Internet for research, social interaction, shopping, and other daily needs is continuously growing for seniors.

In our E&I segment, we temporarily reduced our investment in member acquisition as we focused on reengineering key operational processes. While our new enrollment growth in this business has slowed down, we have benefited from the favorable plan retention dynamics with our existing customers.

6

Our management evaluates our business performance and manages our operations in the following two segments:

Medicare Segment

Through a combination of demand generation strategies, we actively market a large selection of Medicare-related health insurance plans and, to a lesser extent, ancillary products such as dental and vision insurance and indemnity plans, to our Medicare-eligible consumers. Our Medicare ecommerce platform, which can be accessed through our websites (www.eHealthMedicare.com, www.PlanPrescriber.com and www.GoMedigap.com), and telephonic enrollment capabilities enable consumers to research, compare and purchase Medicare-related health insurance plans, including Medicare Advantage, Medicare Supplement, and Medicare Part D prescription drug plans. To the extent that we assist in the sale of Medicare-related insurance plans as a health insurance agent, either online, telephonically, or through a hybrid online assisted enrollment, we generate revenue from the commissions we receive from health insurance carriers. Our commissions may include certain bonus payments, which are generally based on attaining predetermined target sales levels or other objectives, as determined by the health insurance carriers. For Medicare Advantage and Medicare Part D prescription drug plans, our commissions also include regular administrative payments related to administrative services we perform.

In the first effective plan year of a Medicare Advantage and Medicare Part D prescription drug plan, for which we are the broker of record, we receive a fixed, annual commission payment from insurance carriers generally after the plan is approved by the carrier and becomes effective. If applicable, after the health insurance carrier approves the application but during the effective year of the plan, we are paid a fixed commission payment that is prorated for the number of months remaining in the calendar year. Additionally, if the plan is the first Medicare Advantage or Medicare Part D prescription drug plan issued to the member because the beneficiary just became eligible for these products or has previously been covered through the traditional Medicare program, we may receive a higher commission amount that covers a full 12-month period, regardless of the month the plan was effective. Beginning with the second plan year and for as long as the member remains on that plan, we typically receive fixed, monthly commissions for Medicare Advantage and Medicare Part D prescription drug plans and generally continue to receive commissions until either the plan is cancelled or we otherwise do not remain the agent on the plan. Commission payments we receive for Medicare Supplement plans sold by us typically are a percentage of the premium on the plan and are paid to us monthly until either the plan is cancelled or we otherwise do not remain the agent on the plan.

For Medicare Supplement plans, our commissions generally represent a flat amount per member per month or a percentage of the premium amount collected by the carrier during the period that a member maintains coverage under a plan. Premium-based commissions are reported to us after the premiums are collected by the carrier, generally on a monthly basis. We generally continue to receive the commission payment from the relevant insurance carrier until the health insurance plan is cancelled or we otherwise do not remain the agent on the plan.

Medicare Advantage and Medicare Part D prescription drug plan pricing is approved by the Centers for Medicare and Medicaid Services (“CMS”), an agency of the United States Department of Health and Human Services, and is not subject to negotiation or discounting by health insurance carriers or our competitors. Similarly, Medicare Supplement plan pricing is set by the health insurance carrier and approved by state regulators and is not subject to negotiation or discounting by health insurance carriers or our competitors.

Employer and Individual Segment

We actively market individual and family health insurance plans (“IFP”) and small business health insurance plans through our ecommerce platform, which can be accessed through our websites (www.eHealth.com and www.eHealthInsurance.com), and generate revenue as a result of commissions we receive from health insurance carriers whose health insurance plans are purchased through us, as well as commission override payments we receive for achieving sales volume thresholds or other objectives. In addition, we market a variety of ancillary products, including but not limited to, short-term, dental and vision plans. These ancillary products are offered to individual and family and small business consumers and are also sold on a standalone basis. The commission payments we receive for individual and family, small business, and ancillary health insurance plans are either a percentage of the premium consumers pay for those plans or a flat amount per member per month, and vary

7

depending on the carrier that is offering the plan, the state where the plan was sold and the size of the business. Commission payments are typically made to us on a monthly basis until either the plan is cancelled or we otherwise do not remain the agent on the plan. Health insurance pricing, which is set by the health insurance carrier and approved by state regulators, is not subject to negotiation or discounting by health insurance carriers or our competitors.

Non-Commission Revenue Sources

Within our two operating segments, we earn commission revenue, as well as non-commission revenue, or other revenue, which includes online sponsorship and advertising, non-broker of record arrangements, performance of other services, technology licensing and lead referral revenue.

Online Sponsorship and Advertising. We generate revenue from our sponsorship and advertising program that allows carriers to purchase advertising space for non-Medicare products on our website and potentially Medicare plan related advertising on separate websites that we develop, host and maintain. In addition, in connection with our Medicare plan advertising program, we may engage in other activities, including marketing. In return for our services, we typically are paid either a flat amount, a monthly amount, or, in our individual and family health insurance sponsorship advertising program, a performance-based fee based on metrics such as submitted health insurance applications.

Non-Broker of Record. In certain arrangements, we facilitate beneficiary enrollment in Medicare-related health insurance plans with health insurance carriers without remaining the agent of record. Under these arrangements, we receive one-time fees determined by contract terms and our services are complete once the submitted application is approved by the relevant health insurance carrier. We recognize fee income based upon the fee we expect to receive for selling the plan after the carrier approves an application.

Other Services. We generate revenue from agreements with carriers to perform various post-enrollment services for members in Medicare health insurance plans. We typically are paid a fixed fee upon completion of the specific service and the revenue is recognized in the period the service was completed.

Technology Licensing. We generate revenue from licensing the use of our health insurance ecommerce technology. Our technology platform enables health insurance carriers to market and distribute health insurance plans online. Health insurance carriers that license our technology typically pay us implementation fees and performance-based fees that are based on metrics such as submitted health insurance applications.

Lead Referrals. We may generate revenue from the sale of individual and family health insurance leads generated by our ecommerce platforms and our marketing activities.

Additional financial information about our company is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Industry Background

The purchase of health insurance is a high-stakes decision for a consumer. Historically it has been a complex, time-consuming and paper-intensive process. The complexity and large number of plan options with a variety of coverage, provider networks, and out-of-pocket cost combinations can make it difficult to make informed health insurance decisions. The Internet’s convenient, information-rich and interactive nature offers the opportunity to provide consumers with more organized and transparent information, a broader choice of plans and a more efficient and accurate process than have typically been available from traditional health insurance distribution channels. We believe that the Internet is becoming an increasingly important channel for researching and enrolling into health insurance plans, similar to other consumer-focused industries such as travel, financial services and shopping.

8

Medicare is a federal program that provides persons sixty-five years of age and older, and some persons under the age of sixty-five who meet certain conditions, with hospital and medical insurance benefits. Medicare beneficiaries choose between Medicare Fee-For-Service and Medicare Advantage plans. Medicare Fee-For-Service is a government plan where the consumer is responsible for select health care related payments with no limit on out-of-pocket expenses and can be used at any doctor or hospital that accepts Medicare. To increase coverage, Medicare Fee-For-Service beneficiaries can purchase commercially offered Medicare Supplement plans. Medicare Advantage is an alternative to Medicare Fee-For-Service that provides health and drug coverage in a single offering from private health insurance carriers that CMS has contracted with under the Medicare Advantage and Medicare Part D prescription drug programs. Under these programs, the government pays health insurance carriers per enrollee to cover health care expenses rather than the government making payments directly to providers under Medicare Fee-For-Service. Medicare Advantage plans are required to cover the same services as Medicare Fee-For-Service and usually cover a variety of other health care services and include a cap on out-of-pocket spending for the consumer. In many cases, Medicare Advantage plans only allow consumers to use doctors who are in the specific plan’s network.

Individual and family products are typically purchased by consumers under 65 years of age that do not have coverage through their employer. Small business group health insurance addresses the health insurance needs of businesses typically with 100 or fewer employees and is evolving towards products such as Individual Coverage Health Reimbursement Arrangements (“ICHRA”), which are available to businesses with employees of any size. Individual, family and small business health insurance has historically been sold by independent insurance agents and, to a lesser degree, directly by insurance companies. Many of these agents are self-employed or work for small agencies, and they typically service only their local communities. In addition, many of these agents sell health insurance from a limited number of insurance carriers (in some cases only one), resulting in a reduced selection of plans for the consumer.

Our Growth Strategies

We believe that our consumer-centric omnichannel distribution model provides us competitive strengths in customer engagement and health insurance distribution and creates opportunities for growth in our core Medicare business and in other areas of the health insurance market. We intend to pursue the following strategies to further advance our business.

Pursue Deliberate Enrollment and Revenue Growth

In 2022, we purposefully slowed down our enrollment volume and revenue growth as we worked to implement a number of transformation initiatives aimed at increasing the effectiveness of our sales and marketing organizations and rationalizing our cost structure. In 2023, we successfully returned to growth on an enhanced operational foundation with an emphasis on enrollment quality, member experience, and engagement. We expect to build on this foundation in 2024 by pursuing further enrollment growth while continuing to enhance key aspects of our platform.

We intend to pursue deliberate, targeted growth focusing on products, demand generation channels, fulfillment processes, and market segments that best leverage our competitive differentiation. We believe that consumers are increasingly favoring choice and the ability to comparison shop to achieve optimal health insurance coverage. Our omnichannel choice model that supports telephonic, online-unassisted and online-assisted interactions with eHealth is well aligned with the evolving needs and preferences of our customers and allows us to reach a large portion of the Medicare and broader health insurance markets.

Continue To Build Out Our Unified Omnichannel Marketing Engine

In 2023, we scaled our existing successful demand generation channels and launched new channels, some on a full-scale basis and others in a pilot mode. We expect to continue to expand and diversify our channel mix through a disciplined, test-based approach as we pursue enrollment growth.

We also completed a comprehensive rebrand to more effectively communicate eHealth’s differentiated value proposition and to reflect the transformational work that has taken place over the past two years. We plan to

9

communicate this value proposition in our branded materials throughout the customer journey, starting with a consistent message across our marketing channels, during customer interaction with our omnichannel platform as they research and shop for plans, and extending to post-enrollment member engagement activities. We will continue our efforts to achieve greater customer loyalty and brand recognition as a trusted, transparent advisor in a complex health insurance industry.

Our marketing outreach will be optimized through audience targeting strategies and a disciplined, return-on-investment driven approach to lead generation. Our audience segmentation and targeting reflects the diverse nature of our end markets. For example, customers who are just aging into Medicare and looking for their first plan respond to marketing materials and interact with our platform differently from those who are familiar with the program and are looking to switch from an existing plan to a new one. We believe a more tailored approach geared to specific needs of an audience will lead to further improvement in lead quality and enhance customer engagement. We also will continue to align our marketing engine more closely with the new structure of our telesales organization by emphasizing local-market and product-specific campaigns.

Focus on Enrollment Quality and Member Retention

Our goal is to build a leadership position in our industry by establishing our omnichannel distribution platform as the gold standard for customer experience. We believe that success and sustainability of Medicare brokers is increasingly determined by customer satisfaction, retention, and other quality tracking metrics. This trend is redefining the competitive landscape in our business and has created significant competitive advantages for agents and brokers that emphasize member experience and collaborate with carriers on attaining quality goals.

Through continued improvements to our online experience and plan recommendation engine, enhancement to agent training, and comprehensive post-enrollment retention strategy, we strive to present Medicare beneficiaries with choices that best align with their unique circumstances and assist them in making future decisions should their insurance plan needs or personal circumstances change.

As a next phase of our retention strategy, we have introduced additional initiatives including updating our member onboarding experience, launching our loyalty program and personalized communications with our new and existing customers over a variety of channels meant to foster year-round awareness of eHealth and the services we provide. We also developed targeted retention programs for audiences with higher propensity for attrition, which include coordinated marketing outreach and specialized training for our benefit advisors to cater to specific member needs.

Drive Higher Conversions on our Platform

We plan to continue improving consumer experience and conversion rates across our entire omnichannel platform, regardless of how a customer first interacts with eHealth or how the final enrollment is made. This includes increasing the effectiveness of our telesales organization through a redesigned hiring, training, and career pathing program. We are also expanding the percentage of our benefit advisors who specialize in specific geographies and/or products, which has demonstrated a positive impact on the depth of their expertise and effectiveness in serving our customers. The changes to our demand generation strategy are also expected to contribute to higher conversion rates through better lead quality.

On the technology side, we plan to further enhance customers’ shopping and enrollment experience on our platform through multiple touchpoints. This includes advanced plan recommendation tools, online educational content, real-time customer data verification, and new platform features aimed at bridging online and offline experience, such as online chat and agent co-browsing. Our goal is to allow customers to interact with us on their terms, moving seamlessly between our website, advisor enrollment center, and electronic communications with licensed benefit advisors, and to provide them with personalized and consistent end-to-end experiences across mobile and website throughout critical customer journeys.

Diversify Our Revenue Streams

We intend to leverage our technology leadership, carrier relationships and distribution capabilities to pursue the diversification of our core business and revenue base. This will include investing for growth in existing product

10

lines outside of the core Medicare Advantage business, including Medicare Supplement, individual and family and small business plans and ancillary products. We also expect to add new products and services and explore adjacent markets within the broader health insurance industry.

Going forward, the E&I segment will be an important element of our diversification plan, and we expect to pursue both direct-to-consumer strategies as well as business-to-business strategies for employers of all sizes, including the emerging ICHRA opportunity. Another important element of our diversification program involves supplementing our core broker-of-record business with dedicated carrier arrangements and business process outsourcing deals that leverage our advisor enrollment center capabilities to help field inbound call volumes for specific carriers.

Carrier Relationships

We have developed strategic relationships with leading health insurance carriers in the United States, enabling us to offer thousands of health insurance plans online. We have relationships with over 180 Medicare-related, individual and family, small business and ancillary health insurance plan carriers, including large national carriers and well-established regional carriers. Many of these major carriers have been selling their products through us for over ten years. In many cases, we have back-office integration with major carriers allowing us to submit applications efficiently and cost-effectively, which is an area of competitive differentiation for our business. We typically enter into contractual agency relationships with health insurance carriers that are non-exclusive and terminable on short notice by either party for any reason.

Our Platforms and Technology

Our ecommerce platforms and consumer engagement solutions are built to provide market-leading information, decision support, customer engagement, and transactional services to a broad group of health insurance consumers nationwide while prioritizing accessibility to health insurance. Our ecommerce platforms organize and present voluminous and complex health insurance information in an objective format that empowers individuals, families, and businesses to research, analyze, compare, and purchase a wide variety of health insurance plans.

Our technology platform also allows eHealth to provide omni-channel capabilities to our customers who can shop and enroll in health insurance through an intuitive online interface, by speaking with a live benefit advisor or utilizing one of the hybrid enrollment methods such as agent chat and co-browsing tools. These omni-channel capabilities represent a differentiated offering relative to other brokers in our sector.

We have a technology and content team that is responsible for ongoing enhancements to the features and functionality of our ecommerce platforms, which are critical to maintaining our technology leadership position in the industry. Many of our technology and content employees are employed by our Xiamen, China subsidiary.

Elements of our platforms include:

Plan Comparisons and Recommendations. We offer online comparison and recommendation tools that process and simplify voluminous information across thousands of health insurance plans that are available through our platform. Our technology enables consumers to compare and evaluate health insurance options based on each consumer’s specific needs and plan characteristics such as price, plan type, coverage limits, deductible amount, co-payment amount, and in-network and out-of-network benefits. After entering relevant information on our website or giving such information to one of our licensed benefit advisors, our platforms allow consumers to instantly receive a list of applicable health insurance plans and rate and benefit information in an easy-to-understand format. Our proprietary recommendation algorithms are carrier-agnostic and were designed based on the several million customer assistance interactions that we have facilitated.

Online Application and Enrollment Forms. Health insurance applications vary widely by carrier and state. Our proprietary application tool lets us capture each insurance application’s unique business rules and build a corresponding online application. Our online application process offers our consumers significant improvements

11

over the traditional, paper-intensive application process. It employs dynamic business logic to help individuals and families correctly complete the application and enrollment forms in real time. This reduces delays resulting from application rework, a significant problem with traditional health insurance distribution, where incomplete applications are mailed back and forth between the consumer, the traditional agent, and the carrier. We further simplify the enrollment process by accepting electronic signatures.

Customer and Carrier Data Interchange. Our digital data interface technology integrates our online application process with health insurance carriers’ technology systems, enabling us to deliver our consumers’ applications to health insurance carriers electronically. Our digital interface technology also expedites the loading of insurance product inventory into our various shopping experiences and accelerates the application process by eliminating manual delivery. We also receive alerts and data from carriers, such as notification of approval or a request from a carrier for a consumer’s medical records for underwriting purposes, which we then relay electronically to the consumer. These features of our service help prevent applications from becoming delayed or rejected through inactivity of the consumer or the carrier.

Advisor Enrollment Center Technology Systems. Our proprietary agent-assist management systems enable us to provide a full range of personalized customer service tasks efficiently while complying with Medicare and health insurance regulatory requirements. Our benefit advisors have script-on-screen tools that align to customer and compliance needs and leverage a common back-office platform that powers our direct-to-consumer shopping experience. Our systems also have customer relationship management tools that can track each consumer throughout the application process, obtain real-time updates from the carrier, generate automated emails specific to each consumer and access a cross-sell engine and dashboard to identify and track cross-sell opportunities. Our auto-email system is feature-rich with HTML capability, customizable merge tags, granular segmentation and tracking capability.

Customer Center. Our customer center enables members to create a secure personal profile that stores their prescription drug regimen, preferred doctors and pharmacies, current coverage, and other relevant data. This data is available to members and our licensed benefit advisors that they contact. After members create a customer center account, our technology will import details provided to an agent over the telephone to the account. The following are important benefits of our customer center:

•Empower Medicare beneficiaries to take control of their personal information — Our customer center puts our members in the driver's seat by helping them track and update the information they need when it is time to reconsider their coverage options.

•Identification of Medicare plan options — With their relevant information securely stored in our customer center, it is easier for shoppers to find the best plan options for their personal needs and budget, and also incentivizes them to return to us when their needs change.

•Drive retention through communication — Our customer center allows beneficiaries to track the status of their applications over time and connects them with us if they have questions.

Information Security

Information security is an integral part of our business. We emphasize that information security is “everyone’s responsibility.” We are committed to maintaining information security through responsible management, appropriate use, and protection according to relevant legal and regulatory requirements and our contractual relationships. We maintain an office of the chief information security officer (“CISO”) focused on information and systems technology and corporate governance to drive a common security framework practice. The CISO office concentrates on technology, behaviors, and safeguarding information from unauthorized or inappropriate access, use, or disclosure. The audit committee of our board of directors oversees information and cybersecurity risks and periodically reviews the status with our CISO. We utilize various industry-recognized information security frameworks, including SOC-2, Health Information Trust Alliance (HITRUST), National Institute of Standards and Technology, Payment Card Industry Data Security Standard, Center for Internet Security (“CIS”) Controls, and CIS Benchmarks. For more information about our cybersecurity risk management and governance, see Part I, Item 1C, Cybersecurity, of this Annual Report on Form 10-K.

12

Intellectual Property

We rely on a combination of patent, trademark, copyright and trade secret laws in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions, to protect our proprietary technology and our brand. We also have filed patent applications that relate to certain of our technology and business processes.

Marketing

We focus on building brand awareness, increasing Medicare, individual, family and business customer visits to our websites and telephonic sales centers, converting these visitors into members and retaining these members as long-term advocates. Our marketing initiatives are tailored to each consumer segment, ensuring each message resonates, is deployed into the channels that are relevant to each segment and connects throughout the entirety of the end-to-end experience. Our priority channels across audiences include:

Direct Marketing. Our direct marketing consists of channels that drive consumers to call our advisor enrollment centers directly or access our website, including direct mail, search engines such as Google, paid social platforms like Facebook, email marketing, search engine optimization, radio, and television/video (including linear, connect television devices, and over the top media).

Marketing Partners. Our marketing partner channel comprises a network of partners that drive consumers to our ecommerce platform and advisor enrollment centers. These partners include health care industry participants, such as insurance carriers; affiliate organizations; online advertisers and content providers that are specialists in paid and unpaid (algorithmic) search, as well as specialists in other types of Internet marketing; pharmacies and hospital networks; financial and online services partners in industries such as banking, insurance and mortgage; and off-line lead generators who specialize in traditional direct marketing channels, such as direct mail.

Strategic Partner Marketing. Our strategic partner marketing channel consists of co-branded direct marketing with partners to serve their constituencies across key industry vertical categories. We also offer a suite of product integrations to assist in optimizing partner traffic through our online and telephonic flows and provide business process outsourcing that leverages our advisor enrollment center capabilities to help field inbound call volumes for specific carriers. This in turn drives value for our strategic partner by helping fill a need of their clients.

Competition

The market for selling health insurance plans is highly competitive. Our competitors include government entities, including government-run health insurance exchanges; health insurance carriers; other health insurance agents and brokers; and companies that use the Internet and other means to attract individuals interested in purchasing health insurance and generate revenue by referring these individuals to us or one of our competitors.

Other agents and brokers. We compete with agents and brokers who offer and sell health insurance plans utilizing traditional offline distribution channels as well as the Internet. Our current competitors include the tens of thousands of local insurance agents across the United States who sell health insurance plans in their communities. A number of these agents as well as larger brokers operate websites and provide an online shopping experience to a varying degree for consumers interested in purchasing health insurance. In addition, there are a number of direct-to-consumer Medicare platforms that generate demand through a combination of online and traditional marketing channels and fulfill it through their call center operations.

Government. In connection with our marketing of Medicare related health insurance plans, we compete with the federal government’s original Medicare program. CMS also offers Medicare plan online enrollment, information and comparison tools and has established call centers for the sale of Medicare Advantage and Medicare Part D prescription drug plans. CMS has regulatory authority over the Medicare Advantage and Medicare Part D prescription drug program and can influence the competitiveness of Medicare Advantage and Medicare Part D

13

prescription drug plans compared to the original Medicare program, as well as the compensation that health insurance carriers are allowed to pay us.

Insurance carriers. Many health insurance carriers directly market and sell their plans to consumers through call centers and their own websites. Although we offer health insurance plans for many of these carriers, they also compete with us by offering their plans directly to consumers and, to a much lesser extent, to small businesses. Health insurance carriers have become more experienced in marketing their products directly to consumers, both over the Internet and through more traditional channels, which has resulted in increased competition.

Internet marketers and other advertisers. There are many Internet marketing companies and other advertisers that use the Internet and other means to find consumers interested in purchasing health insurance and are compensated for referring those consumers to agents and health insurance carriers. We compete with these companies for individuals who are looking to purchase health insurance.

Seasonality

The majority of our commission revenue is recognized in the fourth quarter of each calendar year under Accounting Standards Codification, Revenue from Contracts with Customers (“ASC 606”), which we adopted using the full retrospective transition method on January 1, 2018. We have historically sold a significant portion of Medicare plans for the year in the fourth quarter during the Medicare annual enrollment period, when Medicare-eligible individuals are permitted to change their Medicare Advantage and Medicare Part D prescription drug coverage for the following year. During 2023, 2022, and 2021, 56%, 45%, and 49%, respectively, of our Medicare plan-related applications were submitted during the fourth quarter. As a result, we generate a significant portion of our commission revenues related to new Medicare plan-related enrollments in the fourth quarter.

Beginning January 1, 2019, CMS revived the Medicare Advantage open enrollment period during which Medicare Advantage plan enrollees may enroll in another Medicare Advantage plan or disenroll from their Medicare Advantage plan and return to original Medicare. The Medicare Advantage open enrollment period is scheduled to occur between January 1 and March 31 of each year. As a result, we expect to generate higher commission revenue in the first quarter compared to the second and third quarters.

The annual open enrollment period for individual and family health insurance takes place in the fourth quarter of the calendar year, as prescribed under the federal Patient Protection and Affordable Care Act and related amendments in the Health Care and Education Reconciliation Act. During 2023, 2022, and 2021, 46%, 55%, and 38%, respectively, of our individual and family plan-related applications were submitted during the fourth quarter. As a result, we generate a significant portion of our commission revenues related to individual and family plan-related enrollments in the fourth quarter. In the states where the Federally Facilitated Marketplace (“FFM”) operates as the state health insurance exchange, individuals and families generally are not able to purchase individual and family health insurance outside of the annual enrollment period, unless they qualify for a special enrollment period as a result of certain qualifying events, such as losing employer-sponsored health insurance or moving to another state. Extended open enrollment or special enrollment periods may change the seasonality of our individual and family health insurance business. For example, the COVID-19 related special enrollment period for individual and family health insurance that ended on August 15, 2021 caused increased sales of individual and family health insurance plans outside of the open enrollment period.

We incur a significant portion of our marketing and advertising expenses in the fourth quarter as a result of the Medicare annual enrollment period and the open enrollment period under the Affordable Care Act. We expect this seasonal trend in marketing and advertising expenses to continue in the foreseeable future.

Full-time internal benefit advisors represent the majority of our telesales capacity. We plan to maintain our internal telesales benefit advisors year-round, net of natural attrition, and expect to increase our internal benefit advisors’ utilization outside of the enrollment periods by expanding our offerings of ancillary products and carrier call center outsourcing programs. We typically start ramping our telesales capacity during the second quarter, in preparation for the fourth quarter Annual Enrollment Period. The magnitude of new agent hiring is driven by our

14

enrollment growth goals for that year. Our customer care and enrollment expenses are typically highest in the fourth quarter and lowest in the second quarter.

Macroeconomic Conditions

Recent macroeconomic events, including rising consumer prices and interest rates, have led to uncertainty as it pertains to consumer shopping patterns. Given that our core product, Medicare Advantage, is characterized by low premiums, including a large selection of zero premium plans, the demand for our services is relatively unimpacted by the economic cycles. At the same time, purchasing power of consumers and businesses has a greater impact on activity in the individual and family and business markets.

We believe the COVID-19 pandemic had a lasting impact on consumer behavior when it comes to selecting and utilizing health insurance. We believe that more seniors have become more likely to shop for Medicare products online or over the phone versus a face-to-face meeting with a traditional broker, which could have a positive impact on comparison Medicare platforms such as ours.

Additionally, we have seen and may continue to see cost savings from the shift to remote and distributed work for all of our employees in areas including events, travel, utilities, and other benefits. Certain of these cost savings may continue beyond the resolution of the COVID-19 pandemic in connection with our remote first workplace model, as described below.

Government Regulation and Compliance

Insurance and Healthcare Regulations. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act which became law in March 2010 (collectively, the “Affordable Care Act”), have primarily impacted our business of selling individual, family and small business insurance plans. The Affordable Care Act, among other things, established annual open enrollment periods for the purchase of individual and family health insurance. Individuals and families generally are not able to purchase individual and family health insurance outside of the annual enrollment periods, unless they qualify for a special enrollment period as a result of certain qualifying events, such as losing employer-sponsored health insurance or moving to another state. Moreover, in order to be eligible for a subsidy, qualified individuals must purchase subsidy-qualifying health plans, known as qualified health plans, through a government-run health insurance exchange during the open enrollment period or a special enrollment period. While they are not required to do so, government-run exchanges are permitted to allow agents and brokers to enroll individuals and families into qualified health plans through them. The FFM run by CMS operated some part of the health insurance exchange in 33 states during the last health care open enrollment period. Our enrollment of individuals and families into qualified health plans to date has generally occurred through the FFM.

We currently distribute health insurance plans nationwide. The health insurance industry is heavily regulated. Each of these jurisdictions has its own rules and regulations relating to the offer and sale of health insurance plans, typically administered by a department of insurance. State insurance departments have administrative powers relating to, among other things: regulating premium prices; granting and revoking licenses to transact insurance business; approving individuals and entities to which, and circumstances under which, commissions can be paid; regulating advertising, marketing and trade practices; monitoring broker and agent conduct; and imposing continuing education requirements. We are required to maintain valid life and/or health agency and/or agent licenses in each jurisdiction in which we transact health insurance business.

In addition to state regulations, we also are subject to federal laws, regulations and guidelines issued by CMS that place a number of requirements on health insurance carriers and agents and brokers in connection with the marketing and sale of Medicare Advantage and Medicare Part D prescription drug plans. We are subject to similar requirements of state insurance departments with respect to our marketing and sale of Medicare Supplement plans. Medicare plans are not generally able to be purchased outside of an annual enrollment period that occurs in the fourth quarter of the year, subject to exception for individuals aging into Medicare eligibility and for individuals who qualify for a special enrollment period as a result of certain qualifying events. In addition, Medicare Advantage plan enrollees may enroll in another Medicare Advantage plan or disenroll from their Medicare Advantage plan and

15

return to original Medicare during the Medicare Advantage open enrollment period that generally occurs in the first quarter of the year. CMS and state insurance department regulations and guidelines include a number of prohibitions regarding the ability to contact Medicare-eligible individuals and place many restrictions on the marketing of Medicare-related plans. For example, we or our health insurance carrier partners are required to file with CMS and state departments of insurance certain of our websites, our advisor enrollment center scripts and other marketing materials we, or in some cases our partners, use to market Medicare-related plans and require publication or additional notice and disclaimers. In some instances, CMS or state departments of insurance must approve the material before we use it. In addition, the laws and regulations applicable to the marketing and sale of Medicare-related plans are ambiguous, complex and, particularly with respect to regulations and guidance issued by CMS for Medicare Advantage and Medicare Part D prescription drug plans, change frequently. CMS frequently proposes and implements new regulations, or amends or clarifies existing regulations, in ways that may make operating our business more difficult. For example, in recent years, CMS has expanded the set of materials requiring filing or approval and added required disclaimers to certain types of marketing and communications. Most recently, CMS has proposed new rules to limit compensation to brokers and agents like us for certain types of services in connection with Medicare Advantage and Medicare Part D prescription drug programs.

Data Privacy and Security Regulations. We are subject to various federal and state privacy and security laws, regulations and requirements. These laws govern our collection, use, disclosure, protection and maintenance of the individually-identifiable information that we collect from consumers. For example, we are subject to the Health Insurance Portability and Accountability Act (“HIPAA”). HIPAA and regulations adopted pursuant to HIPAA require us to maintain the privacy of individually-identifiable health information that we collect on behalf of health insurance carriers, implement measures to safeguard such information and provide notification in the event of a breach in the privacy or confidentiality of such information. In addition to our obligations we may have under contracts with health insurance carriers and others regarding the collection, maintenance, protection, use, transmission, disclosure or disposal of sensitive personal information, the use and disclosure of certain data that we collect from consumers is also regulated in some instances by other federal laws, including the Gramm-Leach-Bliley Act (“GLBA”) and state statutes implementing GLBA. GLBA generally requires brokers to provide customers with notice regarding how their non-public personal health and financial information is used and the opportunity to “opt out” of certain disclosures before sharing such information with a third party, and which generally require safeguards for the protection of personal information. We regularly assess our compliance with privacy and security requirements. These requirements are evolving, and many states continue to adopt additional state-specific requirements, that vary in their scope and application to our business. Such state privacy laws currently, or may in the future, establish, among other things, new privacy rights for residents of the relevant state, such as the right to know what personal information has been collected about them, how we use and disclose this information, and the right to request deletion of that information. In addition to government action, health insurance carrier expectations relating to privacy and security protections are increasing and evolving. We have incurred significant costs to develop new processes and procedures and to adopt new technology in an effort to comply with privacy and security laws and regulations and carrier expectations and to protect against cyber security risks and security breaches. We expect to continue to do so in the future. Violations of federal and state privacy and security laws and other contractual requirements may result in significant liability and expense, damage to our reputation or termination of relationships with government-run health insurance exchanges and our members, marketing partners and health insurance carriers.

Human Capital Resources

Employees are our most valuable asset, and we strive to put them first. We are a creative and collaborative group with a single, shared mission. As of December 31, 2023, we had 1,903 full-time employees, of which 1,322 were in customer care and enrollment, 273 were in technology and content, 235 were in general and administrative, and 73 were in marketing and advertising. Of the 1,903 full-time employees, 249 were non-US employees based in our subsidiary in China. None of our U.S. employees are represented by a labor union. As required under Chinese law, the employees in our Xiamen, China office established what is referred to as a labor union in China in January 2014. We have not experienced any work stoppages and consider our employee relations to be strong.

We value our employees for their critical role in the success of our business. We focus on our culture and connect with our employees through engagement programs, by offering learning and professional development

16

opportunities, by providing a generous and competitive benefits package, and by championing diversity and inclusion through our corporate philosophy and polices. We conduct one full engagement survey per year involving a broad range of questions and one pulse survey per year to review specific questions more comprehensively. Throughout the year we leverage business unit engagement champions to obtain ongoing, real-time feedback for continuous improvement opportunities. We offer free online courses and a robust manager development program across all our operations. We provide specialized training within Sales Mastery University to enable our benefit advisors to onboard, obtain certification, and equip them with the tools necessary to be productive within their roles. For manager level employees, eHealth has introduced a meeting series titled Leaders Leading Leaders, which are virtual monthly gatherings of all eHealth leaders with the goal of providing critical and timely business updates to align organization-based objectives to the company’s strategic objectives and prepare leaders to disseminate vital internal information to their teams. This meeting also facilitates functional leadership growth opportunities and the development of business acumen within our leader pool.

We offer all employees a competitive base salary and an annual cash bonus award earned based on achieving goals relating to company performance and personal performance, and our full-time employees enjoy a generous Total Rewards package of benefits. Our pay and benefits structure is designed to motivate, incentivize and reward our employees at all levels of the organization for their skill development, demonstration of our values and performance. Our benefits package generally includes the following:

Core Benefits: | |||||

Health Insurance, including Medical, Dental and Vision | Mental Health and Employee Assistance Programs | ||||

Life & Disability | Flexible Spending Accounts | ||||

401(k) Retirement Plan with Company Match Program | |||||

Additional Benefits: | |||||

Tuition Reimbursement | Back-up Care | ||||

Student Loan Repayment Programs | Financial Planning Assistance | ||||

Fertility & Adoption Assistance | Legal Program | ||||

Employee Stock Purchase Plan | Recognition Program through Spotlight | ||||

Paid Time Off | Phone and Internet Reimbursement | ||||

Parental Leave | Donation with Matching & Volunteering Program | ||||

We stand for inclusion and believe people are our greatest resource. Embracing individuality, unique ideas, experiences and perspectives fuels innovation and drives our mission forward. We recognize the importance of cultivating a company culture that is diverse, equal and inclusive, in which everyone is treated with respect and dignity, and in which we can learn from one another’s unique experiences and capabilities. We are proud of the diverse makeup of our workforce and recognize that a mix of backgrounds, skills and experiences makes us stronger as an organization. An inclusive culture also allows us to better understand and serve our customers who represent diverse socio-economic and demographic backgrounds. Our Diversity and Inclusion committee continues to identify ways in which we can further support a culture of acceptance and inclusivity. The breakdown of our employees by gender is as follows:

| United States | China | |||||||

| Female | 899 | 150 | ||||||

| Male | 743 | 99 | ||||||

| Not disclosed | 12 | 0 | ||||||

17

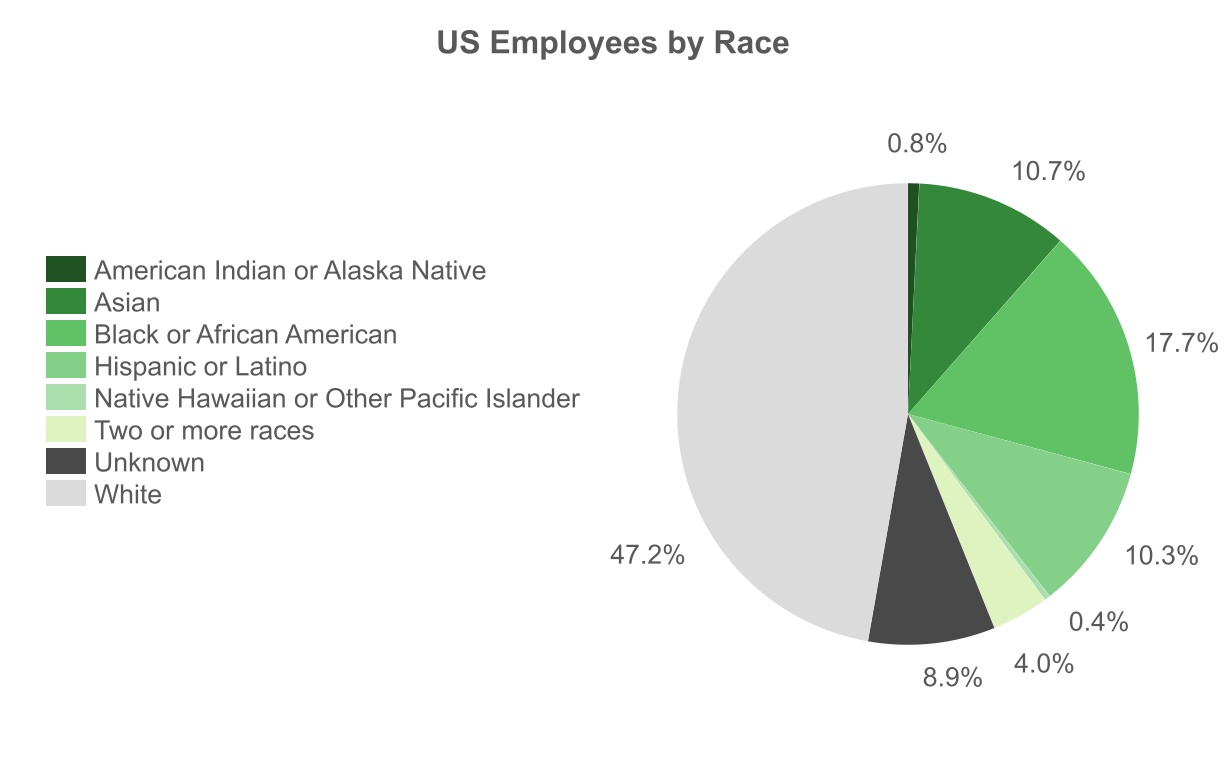

The breakdown of our US employees by race is as follows:

The members of our Board of Directors represent a diverse perspective. The Board currently is made up of eight members and has always included a majority of independent directors. Our board membership includes three women, one director who is a member of the LGBTQ+ community and one director who is of Hispanic and Asian heritage. Our Board of Directors also oversees our policies and procedures as they relate to environmental, social and corporate governance matters through its Nominating and Corporate Governance Committee,

Environmental, Social and Corporate Governance (“ESG”)

We have published annual sustainability reports since 2021, which marked the beginning of our ESG journey as we made a company-wide commitment to a stronger focus on our long-term ESG opportunities and risks while also embedding them into our corporate strategy. Our report and future strategy are informed by an internal materiality assessment, and relevant topics identified through third-party reporting frameworks including Sustainability Accounting Standards Board, Global Reporting Initiative, and the United Nations Sustainable Development Goals. We are dedicated to making a difference in the lives of consumers, associates, partners and broader society.

Information about our ESG efforts is available on our website (www.ehealth.com) under “ESG Resources” which provides information on our public commitments, policies, social and environmental programs, sustainability, strategy and ESG data. The information contained in, or referred to, on our website is not deemed to be incorporated into this Annual Report on Form 10-K unless otherwise expressly noted.

Climate Change

Though our direct environmental impact is limited, we believe that we all have a role to play in effectively planning for, and mitigating the effects of, climate change. Therefore, we consider climate-related risks when assessing our larger enterprise-level risks. We support science-based climate policies and decarbonization actions in alignment with the Paris Agreement and the Intergovernmental Panel on Climate Change. We believe we have made a significant positive impact on sustainability by dramatically reducing the amount of paper used not just in our operation but in the wider health insurance industry through our pioneering work in digitizing the purchase of insurance plans. We also helped reduce the carbon footprint associated with the process of researching and

18

enrolling in health insurance by allowing seniors to go through the entire process from their homes and removing the need for a face-to-face meeting with a broker, which is the traditional way these products used to be marketed and sold. Our transition to being a remote first company in 2022 has significantly reduced our real estate footprint. For the office space we do use, we plan to incorporate design that promotes the health, well-being, and productivity of our workforce and plan to consider the environmental impacts of our facilities. In 2022, we completed a large data migration project, shifting our data centers from physical infrastructure to cloud-based storage in order to reduce environmental impacts and more effectively manage and access our data. We also consider green and sustainably sourced materials when making procurement decisions for our office supplies, including equipment. The majority of our equipment purchased in the United States is energy efficient, including ENERGY Star Certified. We use recycled paper when available and take advantage of opportunities to recycle materials. We continue to extend our data tracking mechanisms to better understand our organizational footprint and to identify ways to further mitigate our impact on the environment.

Corporate Information

We were incorporated in Delaware in November 1997. Our principal executive offices are located at 13620 Ranch Road 620 N, Suite A250, Austin, TX 78717, and our telephone number is (737) 248-2340.

Available Information