UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.:

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction |

|

(IRS Employer Identification No.) |

|

of incorporation or organization) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Address of Principal Executive Office) |

|

(Zip Code) |

Registrant’s telephone number including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of the Registrant’s voting and non-voting common equity held by non-affiliates of the Registrant as of June 30, 2019, the last business day of the Registrant’s most recently completed second fiscal quarter, based on the closing price of the voting stock on the NASDAQ Global Select Market on such date, was approximately $

As of February 12, 2020, the Registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Certain information that will be contained in the definitive proxy statement for the Registrant’s annual meeting to be held in 2020 is incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

|

1 |

|||

|

1 |

|||

|

2 |

|||

|

3 |

|||

|

|

|

||

|

ITEM 1. |

|

3 |

|

|

|

3 |

||

|

|

7 |

||

|

|

8 |

||

|

|

15 |

||

|

|

15 |

||

|

|

18 |

||

|

|

18 |

||

|

|

21 |

||

|

|

23 |

||

|

|

23 |

||

|

|

25 |

||

|

|

25 |

||

|

|

26 |

||

|

|

28 |

||

|

|

28 |

||

|

|

29 |

||

|

|

31 |

||

|

ITEM 1A. |

|

32 |

|

|

ITEM 1B. |

|

46 |

|

|

ITEM 2. |

|

46 |

|

|

ITEM 3. |

|

48 |

|

|

ITEM 4. |

|

48 |

|

|

49 |

|||

|

ITEM 5. |

|

49 |

|

|

ITEM 6. |

|

51 |

|

|

53 |

|||

|

ITEM 7. |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

54 |

|

|

54 |

||

|

|

Year Ended December 31, 2019 Compared to Year Ended December 31, 2018 |

58 |

|

|

|

62 |

||

|

|

62 |

||

|

|

64 |

||

|

|

64 |

||

|

|

65 |

||

|

|

66 |

||

|

|

66 |

||

|

|

66 |

||

|

|

67 |

||

|

|

67 |

||

|

|

70 |

||

|

ITEM 7A. |

|

71 |

|

|

|

71 |

||

|

|

72 |

||

|

|

72 |

||

|

|

72 |

||

|

|

73 |

||

|

|

73 |

||

(i)

|

ITEM 8. |

|

74 |

|

|

ITEM 9. |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

74 |

|

ITEM 9A. |

|

74 |

|

|

|

74 |

||

|

|

Management’s Report on Internal Control Over Financial Reporting |

75 |

|

|

|

75 |

||

|

ITEM 9B. |

|

75 |

|

|

76 |

|||

|

ITEM 10. |

|

76 |

|

|

|

76 |

||

|

|

77 |

||

|

|

79 |

||

|

|

79 |

||

|

|

79 |

||

|

|

80 |

||

|

|

80 |

||

|

|

Code of Business Conduct and Ethics and Anti-Corruption Policy |

80 |

|

|

|

80 |

||

|

ITEM 11. |

|

80 |

|

|

ITEM 12. |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

81 |

|

ITEM 13. |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

81 |

|

|

Review, Approval or Ratification of Transactions with Related Persons |

81 |

|

|

ITEM 14. |

|

81 |

|

|

82 |

|||

|

ITEM 15. |

|

82 |

|

|

ITEM 16. |

|

84 |

|

(ii)

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans”, “seeks” or words of similar meaning, or future or conditional verbs, such as “will”, “should”, “could”, “may”, “aims”, “intends” or “projects”. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak only as of the date of this annual report on Form 10-K. These forward-looking statements are all based on currently available operating, financial and competitive information and are subject to various risks and uncertainties. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed under Item 1. “Business”, Item 1A. “Risk Factors” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this annual report on Form 10-K and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

INDUSTRY AND MARKET DATA

In this annual report on Form 10-K, we rely on and refer to information and statistics regarding our market share and the markets in which we compete. We have obtained some of this market share information and industry data from internal surveys, market research, publicly available information and industry publications. Such reports generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed. Although we believe this information is reliable, we have not independently verified, nor can we guarantee, the accuracy or completeness of that information.

Statements in this annual report on Form 10-K concerning the production capacity of our mills are management estimates based primarily on historically achieved levels of production and assumptions regarding maintenance downtime. Statements concerning electrical generating capacity at our mills are also management estimates based primarily on our expected production (which largely determines the amount of electricity we can generate) and assumptions regarding maintenance downtime, in each case within manufacturers’ specifications of capacity.

(1)

CURRENCY

The following table sets out exchange rates, based on the noon buying rates in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York, referred to as the “Noon Buying Rate”, for the conversion of dollars to euros and Canadian dollars in effect at the end of the following periods, the average exchange rates during these periods (based on daily Noon Buying Rates) and the range of high and low exchange rates for these periods:

|

|

|

Year Ended December 31, |

|

|

|||||||||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|

|||||

|

|

|

($/€) |

|

|

|||||||||||||||||

|

End of period |

|

|

1.1227 |

|

|

|

1.1456 |

|

|

|

1.2022 |

|

|

|

1.0552 |

|

|

|

1.0859 |

|

|

|

High for period |

|

|

1.0905 |

|

|

|

1.1281 |

|

|

|

1.0416 |

|

|

|

1.0375 |

|

|

|

1.0524 |

|

|

|

Low for period |

|

|

1.1524 |

|

|

|

1.2488 |

|

|

|

1.2041 |

|

|

|

1.1516 |

|

|

|

1.2015 |

|

|

|

Average for period |

|

|

1.1194 |

|

|

|

1.1817 |

|

|

|

1.1301 |

|

|

|

1.1072 |

|

|

|

1.1096 |

|

|

|

|

|

($/C$) |

|

|

|||||||||||||||||

|

End of period |

|

|

0.7715 |

|

|

|

0.7329 |

|

|

|

0.7989 |

|

|

|

0.7448 |

|

|

|

0.7226 |

|

|

|

High for period |

|

|

0.7358 |

|

|

|

0.7326 |

|

|

|

0.7275 |

|

|

|

0.6853 |

|

|

|

0.7148 |

|

|

|

Low for period |

|

|

0.7715 |

|

|

|

0.8143 |

|

|

|

0.8243 |

|

|

|

0.7972 |

|

|

|

0.8529 |

|

|

|

Average for period |

|

|

0.7537 |

|

|

|

0.7722 |

|

|

|

0.7710 |

|

|

|

0.7558 |

|

|

|

0.7830 |

|

|

On February 10, 2020, the most recent weekly publication of the daily Noon Buying Rate before the filing of this annual report on Form 10-K reported that the Noon Buying Rate as of February 7, 2020 for the conversion of dollars to euros and Canadian dollars was $1.0950 per euro and $0.7517 per Canadian dollar.

(2)

PART I

|

ITEM 1. |

BUSINESS |

In this document, please note the following:

|

|

• |

references to “we”, “our”, “us”, the “Company” or “Mercer” mean Mercer International Inc. and its subsidiaries, unless the context clearly suggests otherwise, and references to “Mercer Inc.” mean Mercer International Inc. excluding its subsidiaries; |

|

|

• |

references to “$” or “dollars” shall mean U.S. dollars, which is our reporting currency, unless otherwise stated; “€” refers to euros; and “C$” refers to Canadian dollars; |

|

|

• |

references to “NBHK” mean northern bleached hardwood kraft; |

|

|

• |

references to “NBSK” mean northern bleached softwood kraft; |

|

|

• |

references to “ADMTs” mean air-dried metric tonnes; |

|

|

• |

references to “MW” mean megawatts and “MWh” mean megawatt hours; |

|

|

• |

references to “Mfbm” mean thousand board feet; |

|

|

• |

references to “MMfbm” mean million board feet; and |

|

|

• |

our lumber metrics are converted from cubic meters to Mfbm using a conversion ratio of 1.6 cubic meters of lumber equaling one Mfbm, which is the ratio commonly used in the industry. |

Due to rounding, numbers presented throughout this report may not add up precisely to totals we provide and percentages may not precisely reflect the absolute figures.

Mercer

General

We are a global forest products company and have two reportable operating segments:

|

|

• |

Pulp – consists of the manufacture, sale and distribution of pulp, electricity and other by-products at our pulp mills. |

|

|

• |

Wood Products – consists of the manufacture, sale and distribution of lumber, electricity and other wood residuals at the Friesau mill. |

We have consolidated annual production capacity of approximately 2.2 million ADMTs of kraft pulp, 550 MMfbm of lumber and approximately 416.5 MW of electrical generation.

Pulp Segment

We are one of the world’s largest producers of “market” NBSK pulp, which is pulp that is sold on the open market. Our size provides us increased presence, better industry information in our markets and close customer relationships with many large pulp consumers.

We operate two modern and highly efficient NBSK mills in Eastern Germany and one NBSK mill and a “swing” kraft mill in Western Canada, referred to as “MPR”, which we acquired in December 2018. MPR produces both NBSK and NBHK and has a 50% joint venture interest in the Cariboo NBSK mill in Quesnel, British Columbia. MPR also holds two 20-year renewable governmental forest management agreements and three deciduous timber allocations in Alberta with an aggregate allowable annual cut of approximately 2.4 million cubic meters of hardwood and softwood allocations totaling 400,000 cubic meters.

(3)

We are the sole NBSK producer, and the only significant market pulp producer in Germany, which is the largest pulp import market in Europe. We supply the growing pulp demand in China both through our Canadian mills’ ready access to the Port of Vancouver and through our Stendal mill’s existing logistics arrangements. In addition, as a result of the significant investments made in cogeneration equipment, all of our mills generate and sell a significant amount of surplus “green” energy. We also produce and sell tall oil, a by-product of our production process, which is used as both a chemical additive and as a green energy source.

Of our consolidated annual production capacity of approximately 2.2 million ADMTs of kraft pulp, approximately 1.9 million ADMTs or 86% is NBSK and the balance is NBHK.

Key operating details for each of our pulp mills are as follows:

|

|

• |

Rosenthal mill. Our Rosenthal mill is a modern, efficient ISO 9001, 14001 and 50001 certified NBSK pulp mill that has an annual production capacity of approximately 360,000 ADMTs and 57 MW of electrical generation. The Rosenthal mill exported 156,828 MWh of electricity in 2019, resulting in approximately $15.9 million in revenues. The Rosenthal mill is located in the town of Rosenthal am Rennsteig, Germany, approximately 300 kilometers south of Berlin. |

|

|

• |

Stendal mill. Our Stendal mill is a state-of-the-art, single line, ISO 9001, 14001 and 50001 certified NBSK pulp mill that has an annual production capacity of approximately 660,000 ADMTs and 148 MW of electrical generation. The Stendal mill exported 492,825 MWh of electricity in 2019, resulting in approximately $46.7 million in revenues. The Stendal mill is located near the town of Stendal, Germany, approximately 130 kilometers west of Berlin. |

|

|

• |

Celgar mill. Our Celgar mill is a modern, efficient ISO 9001 and 14001 certified NBSK pulp mill that has an annual production capacity of approximately 520,000 ADMTs and 100 MW of electrical generation. The Celgar mill exported 105,741 MWh of electricity in 2019, resulting in approximately $7.4 million in revenues. The Celgar mill is located near the city of Castlegar, British Columbia, Canada, approximately 600 kilometers east of Vancouver. |

|

|

• |

Peace River mill. Our Peace River mill is a modern ISO 14001 certified “swing” mill that produces both NBSK and NBHK pulp and has an annual production capacity of approximately 475,000 ADMTs and 70 MW of electrical generation. The Peace River mill exported 67,447 MWh of electricity in 2019, resulting in approximately $5.0 million in revenues. The Peace River mill is located near the town of Peace River, Alberta, approximately 490 kilometers north of Edmonton. Through our Peace River mill, we have a 50% proportionate share of the annual production capacity of the Cariboo mill, which is approximately 170,000 ADMTs and 28.5 MW of electrical generation. The Cariboo mill is located in Quesnel, British Columbia, approximately 660 kilometers north of Vancouver. |

Our pulp mills are some of the newest and most modern pulp mills in Europe and North America. We believe the relative age, production capacity and electrical generation capacity of our mills provide us with certain manufacturing cost and other advantages over many of our competitors. We believe our competitors’ older mills do not have the equipment or capacity to produce or sell surplus power or chemicals in a meaningful amount. In addition, since our mills are relatively new, they benefit from lower maintenance capital requirements and higher efficiency relative to many of our competitors’ mills.

The following table sets out our pulp production and pulp revenues for the periods indicated:

|

|

|

Year Ended December 31, |

|

|

|||||||||

|

|

|

2019 |

|

|

2018(1) |

|

|

2017 |

|

|

|||

|

Pulp production ('000 ADMTs) |

|

|

2,040.6 |

|

|

|

1,472.6 |

|

|

|

1,507.0 |

|

|

|

Pulp sales ('000 ADMTs) |

|

|

2,098.8 |

|

|

|

1,440.9 |

|

|

|

1,515.1 |

|

|

|

Pulp revenues (in thousands) |

|

$ |

1,370,742 |

|

|

$ |

1,190,588 |

|

|

$ |

979,645 |

|

|

|

(1) |

Includes results of MPR since December 10, 2018. |

(4)

Our pulp mills generate and sell surplus electricity, providing us with a stable revenue source unrelated to pulp prices. Our German pulp mills also generate tall oil from black liquor, which is sold to third parties for use in numerous applications, including bio-fuels. Since our energy and chemical production are by-products of our pulp production process, there are minimal incremental costs and our surplus energy and chemical sales are highly profitable. All of our mills generate and sell surplus energy to regional utilities or the regional electrical market. Our German mills benefit from special tariffs under Germany’s Renewable Energy Sources Act, referred to as the “Renewable Energy Act”, which provides for premium pricing on green energy. Our recently acquired Peace River mill sells surplus energy to its regional electrical market. Each of our Celgar mill and the Cariboo mill is party to a fixed electricity purchase agreement with the regional public utility provider for the sale of surplus power through October 2020 and December 2022, respectively, and, in the case of the Cariboo mill, renewable at the option of the joint venture for an additional ten-year term. Our Celgar mill is currently in negotiations with the regional utility to try to secure a new agreement beyond 2020. See Item 1A. “Risk Factors – We sell surplus energy pursuant to statutory energy programs in Germany and electricity purchase agreements with a utility in Western Canada”.

The following table sets out the amount of surplus energy we produced and sold and revenues from the sale of such surplus energy and chemicals in our pulp segment for the periods indicated:

|

|

|

Year Ended December 31, |

|

|

|||||||||||||||||||||

|

|

|

2019(1) |

|

|

2018(1)(2) |

|

|

2017 |

|

|

|||||||||||||||

|

|

|

(MWh) |

|

|

($) |

|

|

(MWh) |

|

|

($) |

|

|

(MWh) |

|

|

($) |

|

|

||||||

|

|

|

|

|

|

(in thousands) |

|

|

|

(in thousands) |

|

|

|

(in thousands) |

||||||||||||

|

Surplus electricity |

|

|

822,841 |

|

|

|

75,018 |

|

|

|

615,182 |

|

|

|

63,189 |

|

|

|

822,120 |

|

|

|

77,867 |

|

|

|

Chemicals |

|

|

|

|

|

|

11,363 |

|

|

|

|

|

|

|

14,427 |

|

|

|

|

|

|

|

14,203 |

|

|

|

Total |

|

|

|

|

|

|

86,381 |

|

|

|

|

|

|

|

77,616 |

|

|

|

|

|

|

|

92,070 |

|

|

|

(1) |

Does not include our 50% joint venture interest in the Cariboo mill, which is accounted for using the equity method. |

|

(2) |

Includes results of MPR since December 10, 2018. |

We serve pulp customers in Europe, Asia and North America. We primarily work directly with customers to capitalize on our geographic diversity, coordinate sales and enhance customer relationships. We believe our ability to deliver high-quality pulp on a timely basis and our customer service make us a preferred supplier for many customers.

Wood Products Segment

We entered the wood products segment in April 2017 when we acquired substantially all of the assets of the Friesau sawmill, one of Germany’s largest sawmills.

Our Friesau mill has an annual production capacity of approximately 550 MMfbm of lumber and 13 MW of electrical generation from a modern biomass fueled cogeneration power plant built in 2009. The Friesau mill is located approximately 16 kilometers west of our Rosenthal mill and has historically been one of the Rosenthal mill’s largest fiber suppliers.

We manufacture, sell and distribute lumber, electricity and other wood residuals at the Friesau mill which produces lumber for European, U.S. and other lumber export markets.

The European and U.S. lumber markets are very different. In the European market, lumber is generally customized in terms of dimensions and finishing, whereas the U.S. market is driven primarily by demand from new housing starts and dimensions and finishing are generally standardized.

Additionally, lumber production and sales in Europe are commonly measured in cubic meters, whereas in the U.S. they are measured in thousand board feet or Mfbm.

(5)

The following table sets out our lumber production and lumber revenues for the periods indicated:

|

|

|

Year Ended December 31, |

|

|

|||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2017(1) |

|

|

|||

|

Lumber production (MMfbm) |

|

|

414.7 |

|

|

|

398.7 |

|

|

|

281.3 |

|

|

|

Lumber sales (MMfbm) |

|

|

408.8 |

|

|

|

412.9 |

|

|

|

213.5 |

|

|

|

Lumber revenues (in thousands) |

|

$ |

142,243 |

|

|

$ |

168,663 |

|

|

$ |

82,176 |

|

|

|

(1) |

Includes results of the Friesau mill since April 12, 2017. |

The Friesau mill generates electricity for minimal incremental costs, all of which is sold, providing a stable revenue source unrelated to lumber prices. The Friesau mill’s modern biomass fueled cogeneration power plant has a production capacity of approximately 13 MW of electricity. The plant sells electricity pursuant to a long-term fixed price green power tariff that runs to 2029.

The following table sets out the amount of surplus energy we produced and sold and revenues from the sale of surplus energy by our Friesau mill for the periods indicated.

|

|

|

Year Ended December 31, |

|

|

|||||||||||||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2017(1) |

|

|

|||||||||||||||

|

|

|

(MWh) |

|

|

($) |

|

|

(MWh) |

|

|

($) |

|

|

(MWh) |

|

|

($) |

|

|

||||||

|

|

|

|

|

|

(in thousands) |

|

|

|

(in thousands) |

|

|

|

(in thousands) |

||||||||||||

|

Surplus electricity |

|

|

83,490 |

|

|

|

9,721 |

|

|

|

86,325 |

|

|

|

10,831 |

|

|

|

73,698 |

|

|

|

8,872 |

|

|

|

(1) |

Includes results of the Friesau mill since April 12, 2017. |

Corporate Structure, History and Development of Business

Mercer Inc. is a corporation organized under the laws of the State of Washington whose common stock is quoted and listed for trading on the NASDAQ Global Select Market (MERC).

We currently employ approximately 2,325 people and have our headquarters in Vancouver, Canada.

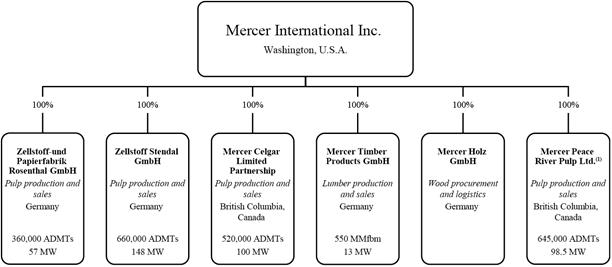

The following simplified chart sets out our principal operating subsidiaries, their jurisdictions of organization, their principal activities and their annual pulp or lumber production and electrical generation capacity:

Mercer International Inc. Washington, U.S.A. 100% Zellstoff-und Papierfabrik Rosenthal GmbH Pulp production and sales Germany 360,000 ADMTs 57 MW 100% Zellstoff Stendal GmbH Pulp production and sales Germany 660,000 ADMTs 148 MW 100% Mercer Celgar Limited Partnership Pulp production and sales British Columbia, Canada 520,000 ADMTs 100 MW 100% Mercer Timber Products GmbH Lumber production and sales Germany 550 MMfbm 13 MW 100% Mercer Holz GmbH Wood procurement and logistics Germany 100% Mercer Peace River Pulp Ltd.(1) Pulp production and sales British Columbia, Canada 645,000 ADMTs 98.5 MW

|

(1) |

Includes 170,000 ADMTs and 28.5 MW based on MPR’s 50% joint venture interest in the Cariboo mill. |

(6)

We entered into the pulp business in 1994 by acquiring our Rosenthal mill and in 1999 converted it to the production of kraft pulp.

In September 2004, we expanded our pulp operations when we completed construction of the Stendal mill at a cost of approximately $1.1 billion, which was financed through a combination of government grants, long-term project debt and equity. We initially had a 63.6% interest in Stendal which increased over time through acquisitions and/or further investments until September 2014, when we acquired all of the economic interest in Stendal.

We further expanded our pulp operations into Western Canada in February 2005 when we acquired the Celgar mill for $210.0 million plus defined working capital.

In April 2017, we entered into the wood products segment when we acquired the Friesau mill for $61.6 million in cash.

In October 2018, we acquired the Santanol Group, which operates Indian sandalwood plantations and an oil extractives plant in Australia, for $35.7 million in cash.

In December 2018, we significantly expanded our pulp business when we acquired MPR for approximately $344.0 million in cash.

Corporate Strategy

Our corporate strategy is to grow in businesses where we have clear competencies while maintaining modern facilities, managing the integrity of our balance sheet and liquidity and a high standard of environmental, social and governance performance. Key elements of our strategy include:

|

|

• |

Operate World Class Assets. The maintenance of modern, reliable and energy efficient operations is key to our ability to produce stable returns through the economic cycle. The markets for our principal products are cyclical and subject to global economic influences. Further, our manufacturing operations are capital intensive and complex. Maintaining a high standard of maintenance and strategic capital expenditure programs differentiates us from older, higher cost, lower efficiency competitors. We believe that over time this will reduce our exposure to product price volatility, unexpected downtime and changes in environmental and regulatory conditions. We operate four modern pulp mills and one of the most modern sawmills in the world. In 2019, the majority of our capital expenditures focused on projects to increase production and operational efficiency, reduce costs and increase electricity and chemical sales. Additionally, we continuously strive to enhance our maintenance systems to improve and increase production by improving reliability. We also seek to reduce operating costs by better managing our fiber procurement, sales, marketing and logistics activities. We believe this continued focus on operational excellence enhances our profitability and cash flows. |

|

|

• |

Growth and Diversification Where We Have Core Competencies. We are focused on growth in areas where we have a clear leadership position or high degree of competence to ensure that we can add value for shareholders. We believe that a larger company will benefit shareholders in terms of improved equity trading, liquidity and reduced variability of earnings. Our core competencies lend themselves to growth in one or more of the following areas: |

|

|

o |

Pulp. The core of our business is NBSK pulp. We are one of the largest producers of market NBSK in the world and have deep expertise and a market reputation as a reliable, efficient and high quality producer. We believe that the global demand for kraft pulp will continue to grow and that the supply of fiber to meet that demand is limited. In 2018, we expanded our pulp segment with the acquisition of MPR, an acquisition that fortified our position as a leading kraft pulp producer and added NBHK to our product line. |

(7)

|

|

o |

Wood Products. We have significant expertise in forestry and wood procurement services and have utilized that expertise and our logistics networks in support of our pulp operations. In 2017, we began leveraging this foundation into the solid wood products business with the acquisition of one of the world’s largest and most flexible sawmills at Friesau, Germany. The Friesau mill created synergies with our wood procurement and pulp businesses. We believe that further strategic expansion within this segment can add more value for shareholders in future. We are in the midst of a three-year upgrade to the Friesau sawmill that will make it one of the most technologically advanced and largest in the world. |

|

|

o |

Wood Extractives. We believe that we are very well positioned to fully extract all of the value from wood including those elements that were traditionally wasted or burned. We have applied considerable resources to manufacturing products such as tall oil, which is upgraded by our customers and used in adhesives and bio-fuels that are displacing fossil fuel based alternatives. We are also expanding our production of turpentine for use in aromatics and fragrances. We also acquired sandalwood plantations and an essential sandalwood oil extraction and sales business to further develop such operations and move closer to the end customer. We are also focused on researching and commercializing other complex and novel products based on wood and have established various partnerships and working relationships to advance these products. |

|

|

o |

Green Energy. Our modern, highly efficient mills allow us to produce green, cogenerated electricity. Our mills are all self-sufficient in power and net exporters of electricity and our power is sold to regional utilities or the regional market. We are very experienced at building and operating cogeneration facilities and we have increased our electricity production by 48% since 2010. |

|

|

• |

Managing the Integrity of our Balance Sheet and Liquidity. We focus on maintaining a balance sheet that allows us to advance our objectives through the full economic cycle, while at the same time, giving us some flexibility to take advantage of strategic growth opportunities as they arise. We maintain a foundation of long term, unsecured, senior notes with expiry dates to 2024 and beyond. In addition to cash on hand, we have a series of revolving credit facilities intended to provide liquidity and flexibility in times of opportunity or economic slowdown. We commenced a dividend in 2015 and remain committed to returning capital to our shareholders through the economic cycle. |

|

|

• |

Sustainable Operations. We seek to operate to exceed or meet best in class standards in environmental performance, social conditions and governance (often referred to as "ESG" standards). We believe that sustainably-focused businesses can flourish if they align themselves with societal objectives, and that the diminishing tolerance of stakeholders for under-performing companies in regards to sustainability will lead to their decline. Further, we believe that our products, which are renewable wood-based fiber, carbon sequestering solid wood products, green energy and naturally sourced wood extractives, are becoming more important for a world seeking to limit its reliance on fossil fuel-based products. We will continue to grow these products, enhance our environmental performance and stakeholder engagement and maintain strong governance and ethical business practices. |

The Pulp Industry

General

Pulp is used in the production of paper, tissues and paper-related products. Pulp is generally classified according to fiber type, the process used in its production and the degree to which it is bleached. Kraft pulp, a type of chemical pulp, is produced through a sulphate chemical process in which lignin, the component of wood which binds individual fibers, is dissolved in a chemical reaction. Chemically prepared pulp allows the wood’s fiber to retain its length and flexibility, resulting in stronger paper products. Kraft pulp can be bleached to increase its brightness. Softwood kraft pulp is noted for its strength, brightness and absorption properties and is used to produce a variety of products, including lightweight publication grades of paper, tissues and other paper-related products.

(8)

There are two main types of bleached kraft pulp, being softwood kraft made from coniferous trees and hardwood kraft made from deciduous trees. Softwood species generally have long, flexible fibers which add strength to paper while fibers from species of hardwood contain shorter fibers which lend bulk and opacity.

We primarily produce and sell NBSK pulp, which is a bleached kraft pulp manufactured using northern softwood and is considered a premium grade because of its strength. It generally obtains the highest price relative to other kraft pulps.

Prior to our acquisition of the Peace River mill in December 2018, NBSK pulp was the sole pulp product of our mills. The Peace River mill is a “swing mill” as it produces both NBSK and NBHK pulp. The mill expands our product offering and its swing capabilities allow us to adjust our production mix to respond to market developments and take advantage of pricing differentials between NBSK and NBHK pulp.

Most paper users of market kraft pulp use a mix of softwood and hardwood grades to optimize production and product qualities. In 2019, market kraft pulp consumption was approximately 55% hardwood bleached kraft and 41% softwood bleached kraft, with the remainder comprised of unbleached pulp. Over the last several years, production of hardwood pulp, based on fast growing plantation fiber primarily from Asia and South America, has increased much more rapidly than that of softwood grades, based on fiber that has longer growth cycles. Hardwood kraft generally has a cost advantage over softwood kraft as a result of lower fiber costs, higher wood yields and, for newer hardwood mills, economies of scale. As a result of this growth in supply and lower costs, kraft pulp customers have substituted some of the pulp content in their products to hardwood pulp.

Counteracting customers’ ability to substitute lower priced hardwood pulp for NBSK pulp is the requirement for strength and formation characteristics in finished goods. Paper and tissue makers focus on larger paper machines with higher speeds and lower basis weights for certain papers which require the strength characteristics of softwood pulp. Additionally, where paper products are lightweight or specialized, like direct mail, magazine paper or premium tissue, or where strength or absorbency are important, softwood kraft forms a significant proportion of the fiber used. As a result, we believe that the ability of kraft pulp users to further substitute hardwood for softwood pulp is limited by such requirements.

Kraft pulp can be made in different grades, with varying technical specifications, for different end uses. Softwood kraft pulp is valued for its reinforcing role in mechanical printing papers and is sought after by producers of paper for the publishing industry, primarily for magazines and advertising materials. Softwood kraft pulp is also an important ingredient for tissue manufacturing and tissue demand tends to increase with living standards in developing countries. NBSK pulp produced for reinforcement fibers is considered the highest grade of kraft pulp and generally obtains the highest price.

Markets

We believe that over 140 million ADMTs of chemical pulp are converted annually into tissues, printing and writing papers, carton boards and other specialty grades of paper and paperboard around the world. We also believe that approximately 40% of this pulp is sold on the open market as market pulp, while the remainder is produced for internal purposes by integrated paper and paperboard manufacturers.

The pulp business is highly cyclical in nature and markets are characterized by periods of supply and demand imbalance, which in turn affect prices. Pulp markets are highly competitive and are sensitive to cyclical changes in the global economy, industry capacity and foreign exchange rates, all of which can have a significant influence on selling prices and our operating results. The length and magnitude of industry cycles have varied over time but generally reflect changes in macro-economic conditions and levels of industry capacity. Pulp is a commodity that is generally available from other producers. Because commodity products have few distinguishing qualities from producer to producer, competition is generally based upon price, which is generally determined by supply relative to demand.

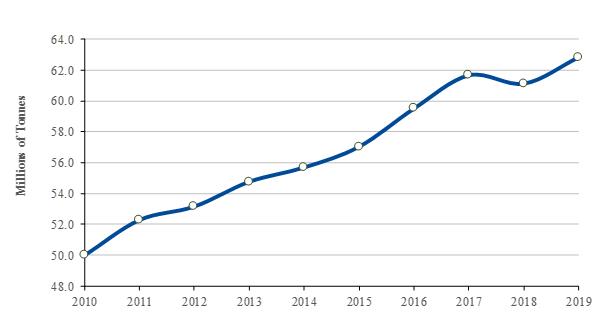

Between 2010 and 2019, worldwide demand for chemical market pulp grew at an average rate of approximately 2% annually, with worldwide demand for bleached softwood kraft market pulp having grown at an average of approximately 2% per annum.

(9)

The following chart illustrates the global demand for chemical market pulp for the periods indicated:

Estimated Global Chemical Market Pulp Demand

The most significant macro-economic trends that have affected worldwide NBSK pulp demand are:

|

|

• |

a significant increase in demand from emerging markets, and in particular China, which has more than offset declining and stagnating demand in the mature markets of Europe, North America and Japan; and |

|

|

• |

a significant shift in demand by end use, as demand from tissue and specialty producers has increased markedly and offset the secular decline in demand for printing and writing paper resulting from the rapid growth in digital media. |

Over the last ten years, demand for chemical softwood market pulp has grown in the emerging markets of Asia, particularly China and Eastern Europe. In China, imports of chemical softwood market pulp grew by approximately 9% per annum between 2010 and 2019. We believe the emerging markets now account for approximately 57% of total global demand for bleached softwood kraft market pulp and China itself now accounts for approximately 34% of global bleached softwood kraft market pulp demand compared to approximately 21% in 2010. Western Europe currently accounts for approximately 22% of global bleached softwood kraft market pulp demand compared to approximately 33% in 2010.

(10)

The following chart sets forth industry-wide bleached softwood kraft deliveries to China for the periods indicated:

12 Month Rolling Bleached Softwood Kraft Pulp Deliveries to China

Growth in NBSK pulp demand in China and other emerging markets has been primarily driven by increased demand from tissue and specialty paper producers, as a result of economic growth and rising income levels and living standards in such markets. These factors generally contribute to a greater demand for personal hygiene products in such regions. In China alone, tissue production capacity has increased by approximately 5.8 million ADMTs over the last five years.

This has also led to an overall shift in demand for NBSK pulp, as demand from tissue producers has increased, while demand from printing and writing end uses has decreased.

The following chart compares worldwide NBSK pulp demand by end use in each of 2003 and 2018 (the latest year for which figures are currently available):

NBSK Pulp Demand by End Use

We believe 2019 NBSK demand by end use was generally consistent with the trend in the chart above.

(11)

A measure of demand for kraft pulp is the ratio obtained by dividing the worldwide demand of kraft pulp by the worldwide capacity for the production of kraft pulp, or the “demand/capacity ratio”. An increase in this ratio generally occurs when there is an increase in global and regional levels of economic activity. An increase in this ratio also generally indicates greater demand as consumption increases, which often results in rising kraft pulp prices and a reduction of inventories by producers and buyers. As prices continue to rise, producers continue to run at higher operating rates. However, an adverse change in global and regional levels of economic activity generally negatively affects demand for kraft pulp, often leading buyers to reduce their purchases and rely on existing pulp inventories. As a result, producers run at lower operating rates by taking downtime to limit the build-up of their own inventories. The demand/capacity ratio for bleached softwood kraft pulp was approximately 92% and 89% in 2019 and 2018, respectively.

In 2019, chemical pulp capacity decreased by approximately 0.4 million ADMTs, consisting primarily of softwood kraft pulp. In January 2020, an NBSK pulp mill in Nova Scotia, Canada closed, removing approximately 280,000 ADMTs of capacity. Currently, we are not aware of any material announced capacity increases of NBSK or NBHK pulp in 2020.

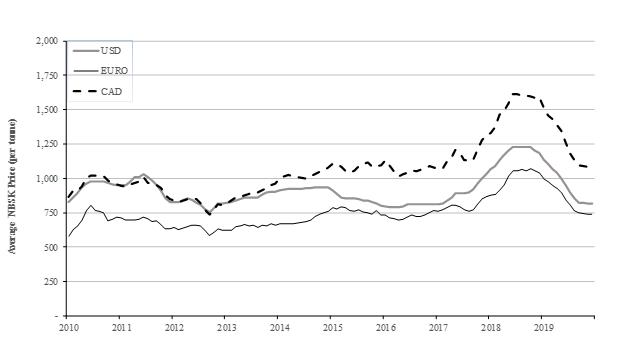

NBSK Pulp Pricing

Kraft pulp is a globally traded commodity and prices are highly cyclical. Kraft pulp prices are generally quoted in dollars. Pricing is primarily influenced by the balance between supply and demand, as affected by global macro-economic conditions, changes in consumption and capacity, the level of customer and producer inventories and fluctuations in exchange rates. Generally, we and other producers consider global NBSK pulp supply and demand to be evenly balanced when world inventory levels are at about 30 days’ supply.

General macro-economic conditions are closely tied to overall global business activity, which helps determine pulp demand and, in turn, impacts pricing.

As the majority of market NBSK pulp is produced and sold by Canadian and Northern European producers, while the price of NBSK pulp is generally quoted in dollars, pricing is often affected by fluctuations in the currency exchange rates for the dollar versus the euro and the Canadian dollar. As NBSK pulp producers generally incur costs in their local currency, while pulp is quoted in dollars, a dollar strengthening generally benefits producers’ businesses and operating margins. Conversely, a weakening of the dollar versus the local currency of producers generally adversely affects producers’ businesses and operating margins.

As a corollary to changes in exchange rates between the dollar and the euro and Canadian dollar, a stronger dollar generally increases costs to customers of NBSK pulp producers and results in downward pressure on prices. Conversely, a weakening dollar generally supports higher pulp pricing. However, there is invariably a time lag between changes in currency exchange rates and pulp prices. This lag can vary and is not predictable with any certainty.

As Northern Europe has historically been the world’s largest market and NBSK pulp is the premium grade, the European market NBSK price is generally used as a benchmark price by the industry. The average European list prices for NBSK pulp since 2010 have fluctuated between a low of approximately $760 per ADMT in 2012 and a high of $1,230 per ADMT in 2018.

(12)

The following chart sets out the changes in list prices for NBSK pulp in Europe, as stated in dollars, Canadian dollars and euros for the periods indicated:

NBSK Pulp Price History (European Delivery)

The following table sets out list prices for NBSK pulp in the regions indicated at the dates indicated:

|

|

|

December 31, |

|

|

|||||

|

|

|

2019 |

|

|

2018 |

|

|

||

|

|

|

($/ADMT) |

|

|

|||||

|

Europe |

|

|

820 |

|

|

|

1,185 |

|

|

|

China |

|

|

580 |

|

|

|

725 |

|

|

|

North America |

|

|

1,115 |

|

|

|

1,430 |

|

|

A producer’s net sales realizations are list prices, net of customer discounts, rebates and other selling concessions. The nature of the pricing structure in Asia is different in that, while quoted list prices tend to be lower than Europe, customer discounts and rebates are much lower, resulting in net sales realizations that are generally similar to other markets.

(13)

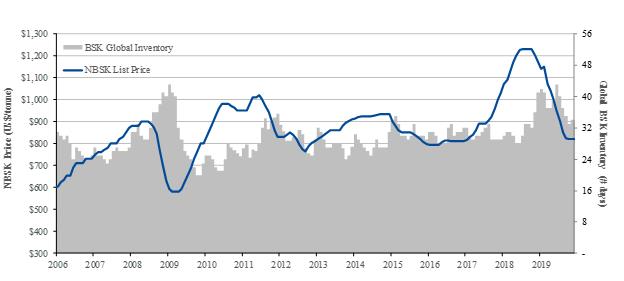

The following chart sets forth changes in FOEX PIX Pulp Index prices for NBSK pulp in Europe and global bleached softwood kraft inventory levels between 2006 and 2019:

Pulp Price and Global Inventory History

Seasonality

We are exposed to fluctuations in quarterly sales volumes and expenses due to seasonal factors. These factors are common in the kraft pulp industry. We generally have weaker pulp demand in Europe during the summer holiday months and in China in the period relating to the lunar new year. We typically have a seasonal build-up in raw material inventories in the early winter months as our mills build up their fiber supply for the winter when there is reduced availability.

Competition

Pulp markets are large and highly competitive. Producers ranging from small independent manufacturers to large integrated companies produce pulp worldwide. Our pulp and customer services compete with similar products manufactured and distributed by others. While many factors influence our competitive position, particularly in weak economic times, a key factor is price. Other factors include service, quality and convenience of location. Some of our competitors are larger than we are in certain markets and have substantially greater financial resources. These resources may afford those competitors more purchasing power, increased financial flexibility, more capital resources for expansion and improvement and enable them to compete more effectively. Our key NBSK pulp competitors are principally located in Northern Europe and Canada and include Canfor Pulp, Stora Enso, Metsä Fibre, Ilim, Södra Cell and Paper Excellence.

(14)

Pulp Production

Our pulp production capacity and actual production by mill for the periods indicated is set out below:

|

|

|

Annual Production |

|

|

Year Ended December 31, |

|

|

||||||

|

Pulp Production by Mill |

|

Capacity(1) |

|

|

2019 |

|

|

2018(2) |

|

|

|||

|

|

|

|

|

|

|

(ADMTs) |

|

|

|||||

|

Rosenthal |

|

|

360,000 |

|

|

|

352,575 |

|

|

|

351,566 |

|

|

|

Stendal |

|

|

660,000 |

|

|

|

656,714 |

|

|

|

636,863 |

|

|

|

Celgar |

|

|

520,000 |

|

|

|

433,432 |

|

|

|

442,620 |

|

|

|

Peace River |

|

|

475,000 |

|

|

|

444,102 |

|

|

|

30,438 |

|

|

|

Cariboo(3) |

|

|

170,000 |

|

|

|

153,759 |

|

|

|

11,103 |

|

|

|

Total pulp production |

|

|

2,185,000 |

|

|

|

2,040,582 |

|

|

|

1,472,590 |

|

|

|

(1) |

Capacity is the rated capacity of the plants for the year ended December 31, 2019. |

|

(2) |

Includes results of MPR and MPR’s 50% joint venture interest in the Cariboo mill from December 10, 2018. |

|

(3) |

MPR’s 50% joint venture interest in the Cariboo mill. |

Generation and Sales of Green Energy and Chemicals

General

Our pulp mills are large scale bio-refineries that, in addition to pulp, also produce surplus “carbon neutral” or green energy. As part of the pulp production process, our mills generate green energy using carbon neutral bio-fuels such as black liquor and wood waste. Through the incineration of bio-fuels in the recovery and power boilers, our mills produce sufficient steam to cover all of our steam requirements and allow us to produce surplus electricity which we sell to third-party utilities and, in the case of the Peace River mill, into the regional electricity market. As a result, we have benefited from green energy legislation, incentives and commercialization that have developed over the last decade in Europe and Canada. In addition, in recent years we have applied considerable resources to increasing our capacity to produce and sell chemicals, primarily tall oil for use in numerous applications including bio-fuels.

Our Friesau mill also generates and sells green energy produced from its biomass cogeneration power plant.

Our surplus energy and chemical sales provide us with a stable revenue source unrelated to pulp or lumber prices. Since our energy and chemical production are by-products of our production processes, there are minimal incremental costs and our surplus energy and chemical sales are highly profitable. We believe that this revenue source gives our mills a competitive advantage over other older mills which do not have the equipment or capacity to produce and/or sell surplus power and/or chemicals in a meaningful amount.

(15)

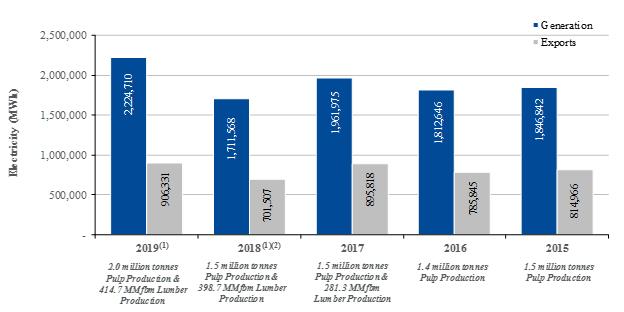

The following table sets out our electricity generation and surplus electricity sales for the five years ended December 31, 2019:

Electricity Generation and Exports

|

(1) |

Does not include electricity generation and exports of our 50% joint venture interest in the Cariboo mill, which is accounted for using the equity method. |

|

(2) |

Includes results of MPR from December 10, 2018. |

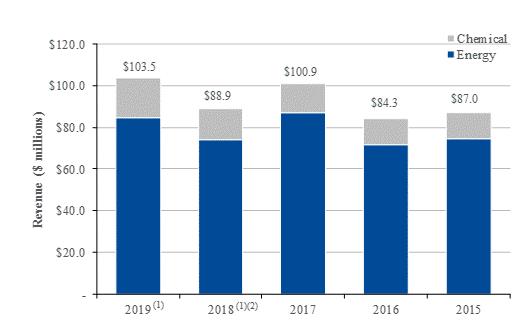

The following chart sets forth our consolidated revenues from electricity and chemical sales for the five years ended December 31, 2019:

Energy and Chemical Revenue

|

(1) |

Does not include energy revenues of our 50% joint venture interest in the Cariboo mill, which is accounted for using the equity method. |

|

(2) |

Includes results of MPR from December 10, 2018. |

(16)

Germany

Our German pulp mills and the Friesau mill participate in a program established pursuant to the Renewable Energy Act, which requires that public electric utilities give priority to electricity produced from renewable energy sources by independent power producers and pay a fixed tariff for such electricity for a period of 20 years. Currently we expect such tariff to expire on December 31, 2020 for our Rosenthal mill, December 31, 2024 for our Stendal mill and in 2029 for the Friesau mill. Recent amendments to the Renewable Energy Act will extend the initial terms for our pulp mills for a further 10-year period, based upon the price received in the last year prior to renewal, regressing at a rate of 8% per annum commencing in the second year. Such amendments are subject to compliance with European Union, referred to as the “EU”, state aid rules. While we expect them to be effective, we can provide no assurance that the current proposed amendments will be implemented or when.

In 2019, energy sales for our German pulp mills and the Friesau mill were $72.4 million or 733,143 MWh.

In 2019, our Rosenthal and Stendal mills generated $11.4 million from the sale of tall oil, a by-product of our production process, and other chemicals.

Canada

The Celgar mill has an electricity sales agreement with the British Columbia Hydro and Power Authority, referred to as “B.C. Hydro”, for the sale of power generated, pursuant to which the mill agreed to supply a minimum of approximately 238,000 MWh of surplus electrical energy annually to the utility over a ten-year term. The agreement expires in October 2020.

In 2019, our Celgar mill sold approximately 105,741 MWh of renewable electricity for proceeds of approximately $7.4 million.

The Peace River mill has a production capacity of approximately 70 MW of electrical generation. The mill’s surplus electricity is sold into the Alberta market.

In 2019, our Peace River mill sold approximately 67,447 MWh of renewable electricity for proceeds of approximately $5.0 million.

The Cariboo mill has two generators, only one of which is used for pulp production. The other generator produces and sells electricity to B.C. Hydro at a fixed rate pursuant to a long-term electricity purchase agreement that runs until December 2022 and may be extended for an additional ten-year term at the option of the joint venture.

(17)

Cash Production Costs

The following table sets forth our consolidated cash production costs and cash production costs per ADMT for our pulp segment, and a reconciliation of such amounts to cost of sales, excluding depreciation and amortization, as presented in our consolidated financial statements, for the periods indicated:

|

|

|

Year Ended December 31, |

|

|

|||||||||||||

|

|

|

2019 |

|

|

2018(1) |

|

|

||||||||||

|

|

|

(in thousands) |

|

(per ADMT)(2) |

(in thousands) |

|

(per ADMT)(2) |

||||||||||

|

Fiber |

|

$ |

491,834 |

|

|

$ |

261 |

|

|

$ |

452,878 |

|

|

$ |

307 |

|

|

|

Labor |

|

|

117,245 |

|

|

|

62 |

|

|

|

89,740 |

|

|

|

61 |

|

|

|

Chemicals |

|

|

109,226 |

|

|

|

58 |

|

|

|

89,395 |

|

|

|

61 |

|

|

|

Energy |

|

|

40,646 |

|

|

|

22 |

|

|

|

38,579 |

|

|

|

26 |

|

|

|

Other |

|

|

163,059 |

|

|

|

86 |

|

|

|

127,706 |

|

|

|

87 |

|

|

|

Pulp segment cash production costs(3) |

|

|

922,010 |

|

|

$ |

489 |

|

|

|

798,298 |

|

|

$ |

542 |

|

|

|

Purchased pulp(4) |

|

|

97,384 |

|

|

|

|

|

|

|

6,114 |

|

|

|

|

|

|

|

Pulp segment other direct costs(5) |

|

|

180,426 |

|

|

|

|

|

|

|

62,616 |

|

|

|

|

|

|

|

Pulp segment cost of sales, excluding depreciation and amortization |

|

|

1,199,820 |

|

|

|

|

|

|

|

867,028 |

|

|

|

|

|

|

|

Wood products segment and corporate and other cost of sales, excluding depreciation and amortization |

|

|

155,750 |

|

|

|

|

|

|

|

183,610 |

|

|

|

|

|

|

|

Intercompany eliminations |

|

|

(15,190 |

) |

|

|

|

|

|

|

(18,537 |

) |

|

|

|

|

|

|

Cost of sales, excluding depreciation and amortization |

|

$ |

1,340,380 |

|

|

|

|

|

|

$ |

1,032,101 |

|

|

|

|

|

|

|

(1) |

Includes results of MPR from December 10, 2018. |

|

(2) |

Cash production costs per ADMT are cash production costs divided by pulp production for the year. |

|

(3) |

Cash production costs exclude depreciation and amortization. |

|

(4) |

Pulp purchased from the 50% owned Cariboo mill, which is accounted for using the equity method. |

|

(5) |

Other direct costs primarily consist of freight and the net change in finished goods inventory. |

Production Costs

Our major costs of pulp production are fiber, labor, chemicals and energy.

Fiber, comprised of wood chips and pulp logs, is our most significant operating expense for our pulp segment, representing about 53% of our pulp cash production costs in 2019. Further, fiber, in the form of sawlogs, represents about 75% of lumber cash production costs.

Given the significance of fiber to our total operating expenses and our limited ability to control its cost compared with our other operating costs, volatility in fiber costs can materially affect our margins and results of operations.

Fiber

General

Our mills are situated in regions which generally provide a relatively stable supply of fiber. The fiber consumed by our pulp mills consists of wood chips produced by sawmills as a by-product of the sawmilling process and pulp logs. Wood chips are small pieces of wood used to make pulp and are either wood residuals from the sawmilling process or pulp logs chipped especially for this purpose. Pulp logs consist of lower quality logs not used in the production of lumber. The Friesau mill consumes sawlogs and waste wood, which are cyclical in both price and supply.

Generally, the cost of wood chips, pulp logs and sawlogs is primarily affected by the supply and demand for lumber. Additionally, regional factors such as harvesting levels and weather conditions can also have a material effect on the supply, demand and price for fiber.

While fiber costs and supply are subject to cyclical changes, we expect that we will be able to continue to obtain an adequate supply of fiber on reasonably satisfactory terms for our mills due to their locations and our long-term relationships with suppliers. We have not historically experienced any significant fiber supply interruptions for our operations.

(18)

During the past few years, certain customers have endeavored to purchase pulp that is produced using fiber that meets certain recognized wood certification requirements from forest certification agencies like the Forest Stewardship Council (FSC), the Programme for the Endorsement of Forest Certification (PEFC), the Sustainable Forestry Initiative (SFI) and the Canadian Standards Association (CSA). If the fiber we purchase does not meet certain wood certifications required by customers, it may make it more difficult to, or prevent us from, selling our pulp to such customers. The chain of custody wood certification process is a voluntary process which allows a company to demonstrate that they use forest resources in accordance with strict principles and standards in the areas of sustainable forest management practices and environmental management. In an effort to procure wood only from sustainably managed sources, we employ an FSC Chain of Custody protocol for controlled wood and PEFC certification, which requires tracking of fiber origins and preparing risk based assessments regarding the region and operator. In the areas where we operate, we are actively engaged in the further development of certification processes. However, there is competition among private certification systems along with efforts by supporters to further these systems by having customers of forest products require products to be certified to their preferred system. Such wood certification standards continue to evolve and are not consistent from jurisdiction to jurisdiction or how they are interpreted and applied. We currently do not expect certification requirements to have a material adverse impact on our fiber procurement and sales. However, if sufficient marketplace demand requires wood raw materials to be sourced from standards that are inconsistent with those in our fiber supply regions, it could increase our operating costs and available harvest levels.

Germany

We believe we are the largest consumer of wood chips and pulp logs in Germany and often provide the best long-term economic outlet for the sale of wood chips in Eastern Germany. We coordinate the wood procurement activities for our German mills to reduce overall personnel and administrative costs, provide greater purchasing power and coordinate buying and trading activities. This coordination and integration of fiber flows also allows us to optimize transportation costs, and the species and fiber mix for our mills. In addition, in 2016, we entered into a joint wood purchasing arrangement with another significant wood consumer in Europe, being the Mondi Group.

In 2019, our German pulp mills consumed an aggregate of approximately 5.1 million cubic meters of fiber. Approximately 58% was in the form of pulp logs and approximately 42% was in the form of sawmill wood chips.

In 2019, our per unit pulp fiber costs in Germany decreased compared to 2018, primarily as a result of the availability of storm and beetle damaged wood.

Our Rosenthal mill sources wood chips from approximately 27 sawmills located primarily in the states of Bavaria, Baden-Württemberg and Thuringia and primarily within a 300 kilometer radius of the Rosenthal mill. Within this radius, the Rosenthal mill is the largest consumer of wood chips. Given its location and size, the Rosenthal mill is often the best economic outlet for the sale of wood chips in the area. In 2019, approximately 85% of the fiber consumed by the Rosenthal mill was spruce and the remainder was pine. Wood chips for the Rosenthal mill are normally sourced from sawmills under one-year contracts with quarterly adjustments for market pricing. Substantially all of our chip supply is sourced from suppliers with which we have long-standing relationships. Pulp logs are sourced from the state forest agencies in Thuringia, Saxony and Bavaria and from private and municipal forest owners. In addition, the Rosenthal mill buys relevant volumes from traders and via imports from the Czech Republic and Poland.

The core wood supply region for the Stendal mill includes most of the Northeastern and Western part of Germany, primarily within an approximate 400 kilometer radius of the mill. We also purchase wood chips from Southwestern and Southern Germany as well as the Baltic Sea region. The fiber consumed by the Stendal mill consisted of approximately 50% pine, 47% spruce and 3% other species in 2019. The Stendal mill has sufficient chipping capacity to fully operate solely using pulp logs, if required. We source pulp logs from private forest holders, municipal forest owners and from state forest agencies in Saxony-Anhalt, Mecklenburg-Western Pomerania, Saxony, Lower Saxony, North Rhine-Westphalia, Hesse, Brandenburg, Schleswig-Holstein, Rhineland-Palatinate and the City of Berlin. The volumes are distributed at optimal costs between the mills. In addition, over the last three years, the Stendal mill also imported fiber from Poland and the Baltic Sea region.

Our Friesau mill is dependent on the consistent supply of sawlog fiber. Wood fiber is the single largest input cost and accounts for about 75% of its cash costs of producing lumber. Our Friesau mill is located in an area where there is a significant amount of high-quality fiber within economic reach. The wood fiber requirements of the Friesau mill are met primarily through open market purchases and contract purchases from state forestry agencies and private timberland owners.

(19)

In Germany, the price and supply of wood chips has been affected by increasing demand from alternative or renewable energy producers and government initiatives for carbon neutral energy. Declining energy prices, weaker economies or periodically warm winters tempered the demand for wood chips resulting from initiatives by European governments to promote the use of wood as a carbon neutral energy. There can be no assurance that such non-traditional demand for fiber will remain strong in the long-term.

Offsetting some of the increases in demand for wood fiber have been initiatives to increase harvest levels in Germany, particularly from small private forest owners. We believe that Germany has the highest availability of softwood forests in Europe suitable for harvesting and manufacturing. We believe private ownership of such forests is approximately 48%. Many of these forest ownership stakes are very small and have been harvested at rates much lower than their rate of growth.

Canada

In 2019, the Celgar mill consumed approximately 2.3 million cubic meters of fiber. Approximately 67% of such fiber was in the form of sawmill wood chips and the remaining 33% came from pulp logs processed through its woodroom or chipped by a third-party. Celgar’s woodroom is able to process about 40% of the mill’s fiber needs. The source of fiber at the mill is characterized by a mixture of species (pine, douglas fir, hemlock, cedar and spruce) and the mill sources fiber from a number of Canadian and U.S. suppliers.

In 2019, our Celgar mill’s per unit fiber costs increased compared to 2018, due to strong demand in the mill’s fiber procurement area resulting from reduced sawmilling activity and wood chip availability.

The availability of fiber for the Celgar mill is in large part influenced by the strength of the lumber market. Lumber markets are primarily driven by U.S. housing starts and, to a lesser degree, demand from China.

In 2019, the Celgar mill had access to approximately 30 different chip suppliers from Canada and the United States. Chips are purchased in Canada and the United States in accordance with chip purchase agreements. Generally, pricing is reviewed and adjusted periodically to reflect market conditions. The contracts are generally for one year with quarterly adjustments or on three-month terms.

To secure the volume of pulp logs required by its woodroom and field chippers, the Celgar mill has entered into pulp log supply agreements, which can range from three-month to one-year terms, with a number of different suppliers, many of whom are also contract chip suppliers to the mill. All of the pulp log agreements can be terminated by either party for any reason, upon seven days’ written notice. The Celgar mill also bids on British Columbia timber sales from time to time.

In 2019, our Peace River mill consumed approximately 2.3 million cubic meters of softwood and hardwood fiber. Approximately 62% of such fiber was in the form of hardwood chips from portable chippers and the remaining 38% came from sawmills in the form of residual softwood chips. The source of fiber at the mill is characterized by a mixture of softwood (spruce and pine) and hardwood species (aspen and balsam poplar) and the mill sources fiber from a number of Canadian suppliers.

MPR holds two 20-year renewable governmental forest management agreements and three deciduous timber allocations in Alberta with an aggregate allowable annual cut of approximately 2.4 million cubic meters of hardwood, of which it currently harvests approximately 44%, and 400,000 cubic meters of softwood, which it sells to sawmills surrounding the Peace River mill in exchange for wood chips. The forest management agreements were last renewed for a 20-year term expiring in 2029. Approximately 85% of our Peace River mill’s hardwood fiber requirements are satisfied through MPR’s forest management agreements and timber allocations with the remainder sourced from trees harvested from third-party owned timberlands. Softwood fiber supply is from residual sawmill chips from local surrounding sawmills.

In 2019, the Peace River mill had access to five different softwood chip suppliers from Canada. Chips are purchased in Canada in accordance with chip purchase agreements. Generally, pricing is reviewed and adjusted periodically to reflect market prices. All contracts are generally for three to five years with monthly adjustments indexed on the average pulp price for the previous three months.

(20)

The Cariboo mill has a secure supply of high-quality residual wood chips primarily supplied by surrounding sawmills located at a short distance. The majority of the mill’s fiber is currently sourced from sawmills owned by MPR’s joint venture partner. The supply of fiber is characterized by a mix of lodgepole pine, white spruce and interior douglas fir.

Labor

Our labor costs are generally steady, with small overall increases due to inflation in wages and health care costs. We have been able to largely offset such increases by increasing our efficiencies and production and streamlining operations; however, such costs increased in 2018 and 2019 as a result of maintenance work at the mills.

Energy

Our energy is primarily generated from renewable carbon neutral sources, such as black liquor and wood waste. Our mills produce all of our energy requirements and generate excess energy which we sell to third-party utilities and, in the case of the Peace River mill, into the Alberta market. In 2019, we generated 2,224,710 MWh and sold 906,331 MWh of surplus energy. See also “– Generation and Sales of Green Energy and Chemicals”. We utilize fossil fuels, such as natural gas, primarily in our lime kilns and we use a limited amount for start-up and shut-down operations. Additionally, from time to time, mill process disruptions occur and we consume small quantities of purchased electricity and fossil fuels to maintain operations. As a result, all of our mills are subject to fluctuations in the prices for fossil fuels.

Chemicals

Our pulp mills use certain chemicals which are generally available from several suppliers and sourcing is primarily based upon pricing and location. Overall, our chemical costs have remained generally stable over the last two years.

In connection with our focus on the growing bio-energy market, we sell tall oil, a by-product of our pulp production process which is used as both a chemical additive and as a green energy source. In 2019, we generated $11.4 million from the sale of tall oil and other chemicals from our pulp segment.

Sales, Marketing and Distribution

Our pulp revenues by geographic area are set out in the following table for the periods indicated:

|

|

|

Year Ended December 31, |

|

|

|||||

|

|

|

2019 |

|

|

2018(1) |

|

|

||

|

|

|

(in thousands) |

|

|

|||||

|

Revenues by Geographic Area |

|

|

|

|

|

|

|

|

|

|

Germany |

|

$ |

356,803 |

|

|

$ |

432,055 |

|

|

|

Italy |

|

|

40,782 |

|

|

|

70,968 |

|

|

|

Other EU countries(2) |

|

|

207,870 |

|

|

|

268,204 |

|

|

|

United States |

|

|

168,197 |

|

|

|

55,692 |

|

|

|

China |

|

|

430,508 |

|

|

|

291,657 |

|

|

|

Other Asia |

|

|

150,012 |

|

|

|

61,132 |

|

|

|

Other countries |

|

|

16,570 |

|

|

|

10,880 |

|

|

|

Total(3) |

|

$ |

1,370,742 |

|

|

$ |

1,190,588 |

|

|

|

(1) |

Includes results of MPR from December 10, 2018. |

|

(2) |

Excluding Germany and Italy. |

|

(3) |

Excluding intercompany sales. |

(21)

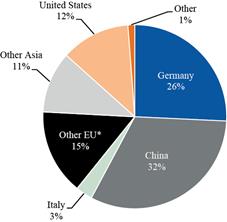

The following charts illustrate the geographic distribution of our pulp revenues as a percentage of our total pulp revenues for the periods indicated:

|

2019 Geographically Segmented Pulp Sales

|

|

2018 Geographically Segmented Pulp Sales |

|

|

|

|

|

* |

Excluding Germany and Italy. |