false0001333274DEF 14A0001333274merc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2020-01-012020-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMembermerc:DavidGandossiMember2022-01-012022-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMembermerc:DavidGandossiMember2021-01-012021-12-310001333274merc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMember2023-01-012023-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMember2021-01-012021-12-3100013332742023-01-012023-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMember2020-01-012020-12-310001333274merc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2023-01-012023-12-310001333274merc:JuanCarlosBuenoMembermerc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2023-01-012023-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMember2022-01-012022-12-310001333274merc:DavidGandossiMembermerc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMember2021-01-012021-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMember2023-01-012023-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMembermerc:DavidGandossiMember2021-01-012021-12-310001333274merc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMember2020-01-012020-12-3100013332742021-01-012021-12-310001333274merc:DavidGandossiMembermerc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMember2020-01-012020-12-310001333274merc:DavidGandossiMembermerc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMember2022-01-012022-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMember2021-01-012021-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMembermerc:DavidGandossiMember2022-01-012022-12-310001333274merc:DavidGandossiMembermerc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2020-01-012020-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMember2022-01-012022-12-310001333274merc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2021-01-012021-12-310001333274merc:DavidGandossiMember2020-01-012020-12-3100013332742020-01-012020-12-31000133327452023-01-012023-12-310001333274merc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMembermerc:JuanCarlosBuenoMember2023-01-012023-12-31000133327422023-01-012023-12-310001333274merc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2020-01-012020-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMember2023-01-012023-12-310001333274merc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2022-01-012022-12-310001333274merc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMember2022-01-012022-12-3100013332742022-01-012022-12-310001333274merc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMember2021-01-012021-12-310001333274merc:JuanCarlosBuenoMembermerc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2022-01-012022-12-310001333274merc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2022-01-012022-12-31000133327412023-01-012023-12-31000133327432023-01-012023-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMembermerc:JuanCarlosBuenoMember2023-01-012023-12-310001333274merc:DavidGandossiMember2022-01-012022-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMembermerc:JuanCarlosBuenoMember2022-01-012022-12-31000133327462023-01-012023-12-310001333274merc:DavidGandossiMembermerc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2022-01-012022-12-310001333274merc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2021-01-012021-12-310001333274merc:DavidGandossiMembermerc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2021-01-012021-12-310001333274merc:JuanCarlosBuenoMember2023-01-012023-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMember2020-01-012020-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMembermerc:JuanCarlosBuenoMember2023-01-012023-12-310001333274merc:TotalFairValueOfStockAndOptionAwardsReportedInSctMembermerc:DavidGandossiMember2020-01-012020-12-310001333274merc:DavidGandossiMember2021-01-012021-12-310001333274merc:ChangeInFairValueAtVestingDateOfPriorYearAwardsThatVestedIn2023FiscalYearMembermerc:JuanCarlosBuenoMember2023-01-012023-12-310001333274merc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2023-01-012023-12-310001333274merc:DavidGandossiMembermerc:ChangeInFairAtEndOfFiscalYearValueOfPriorYearAwardsThatAreOutstandingAndUnvestedMember2021-01-012021-12-31000133327442023-01-012023-12-310001333274merc:FairValueAtEndOfPriorFiscalYearOfPriorYearAwardsThatFailedToVestIn2023FiscalYearMembermerc:DavidGandossiMember2020-01-012020-12-310001333274merc:JuanCarlosBuenoMember2022-01-012022-12-310001333274merc:DavidGandossiMembermerc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2022-01-012022-12-310001333274merc:DavidGandossiMembermerc:FairValueAtEndOfFiscalYearOfAwardsGrantedIn2023FiscalYearThatAreUnvestedAndOutstandingMember2020-01-012020-12-31iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

|

Filed by the Registrant |

☒ |

Filed by a party other than the Registrant |

☐ |

Check the appropriate box:

|

|

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

MERCER INTERNATIONAL INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

MERCER INTERNATIONAL INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

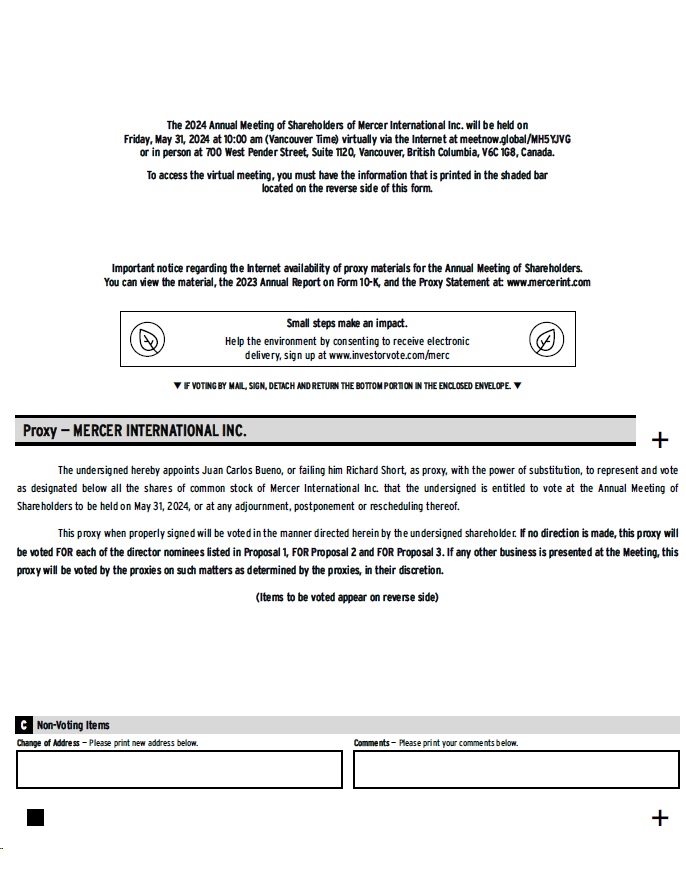

The 2024 Annual Meeting of Shareholders (the "Annual Meeting") of Mercer International Inc. (the "Company") will be held at Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada on May 31, 2024 at 10:00 a.m. (Vancouver time) (doors open at 9:30 a.m. (Vancouver time)) for the following purposes:

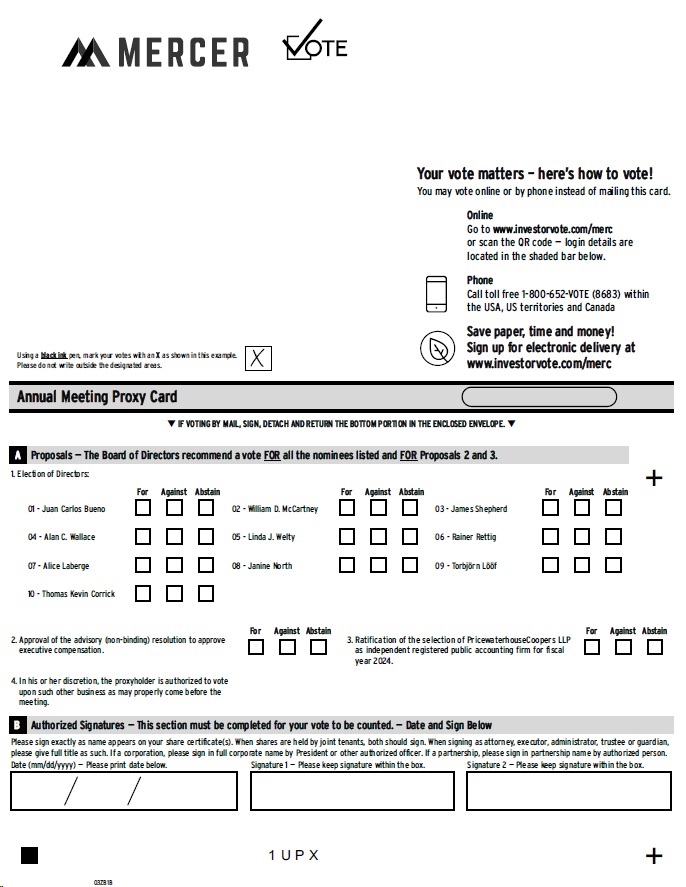

1.To elect ten directors to serve until the 2025 Annual Meeting of Shareholders;

2.To approve, on a non-binding advisory basis, the compensation of the Company's executive officers as disclosed in these materials;

3.To ratify the selection of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm for fiscal year 2024; and

4.To transact such other business as may properly come before the meeting.

For those who are not able to attend in person, the Company is offering a virtual shareholder meeting in which shareholders may listen to the Annual Meeting, submit questions and vote online at: www.meetnow.global/MH5YJVG.

Only shareholders of record at the close of business on March 28, 2024 will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment, postponement or rescheduling thereof.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend our Annual Meeting in person or through the virtual meeting, we urge you to cast your vote and submit your proxy as promptly as possible by one of the methods below. Make sure to have your proxy card or voting instruction form (VIF) in hand. You do not need to attend the Annual Meeting to vote if you submitted your proxy in advance of the Annual Meeting. A proxy may be revoked in the manner described in the accompanying proxy statement.

|

|

|

|

|

By using the Internet at •www.investorvote.com/merc (for registered shareholders) (for beneficial shareholders) |

|

By calling toll-free 1-800-652-VOTE (8683) within the United States, U.S. territories and Canada |

|

By scanning the QR code provided in your proxy with your smartphone |

|

By mailing your signed proxy or voting instruction form |

For further information on how to vote, please refer to the instructions on the accompanying proxy card and the accompanying proxy statement.

|

|

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

/s/ William D. McCartney |

|

William D. McCartney |

|

Interim Chairperson |

April 18, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 31, 2024: Our proxy statement and our 2023 Annual Report to Shareholders are available at www.mercerint.com/investors/reports-filings/. Additionally, you may access our proxy materials at www.proxyvote.com or www.investorvote.com/merc, a site that does not have "cookies" that identify visitors to the site.

PROXY STATEMENT

TABLE OF CONTENTS

Notice Regarding Forward-Looking Statements

This Proxy Statement includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements contained in this Proxy Statement other than statements of historical fact, including statements relating to trends in or expectations relating to the expected effects of our initiatives, strategies and plans, as well as trends in or expectations regarding our financial results and long-term growth model and drivers, and regarding our business strategy and plans and our objectives for future operations, are forward-looking statements. Statements herein that describe our business, strategy, plans, goals, future capital spending levels and potential for growth, improved profit margins and cash generation are forward-looking statements. The words "can", "believe", "may", "will", "continue", "anticipate", "intend", "expect", "seek", and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results and amounts to differ materially from those in forward-looking statements. For a detailed discussion of the risks and uncertainties, see the "Risk Factors" discussion in Item 1A of our 2023 Annual Report. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Proxy Statement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results. The forward-looking statements included in this Proxy Statement are made only as of the date of this Proxy Statement and we undertake no obligation to update the forward-looking statements to reflect subsequent events or circumstances.

Non-GAAP Financial Measures

This Proxy Statement contains "non-GAAP financial measures", that is, financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles in the United States ("GAAP"). Specifically, we make use of the non-GAAP measure "Operating EBITDA" which is not a measure of financial performance under GAAP and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. We use Operating EBITDA as a benchmark measurement of our own operating results and as a benchmark relative to our competitors. We consider it to be a meaningful supplement to operating income as a performance measure primarily because depreciation expense and non-recurring capital asset impairment charges are not actual cash costs, and depreciation expense varies widely from company to company in a manner that we consider largely independent of the underlying cost efficiency of our operating facilities. In addition, we believe Operating EBITDA is commonly used by securities analysts, investors and other interested parties to evaluate our financial performance.

The following table provides a reconciliation of net income (loss) to operating income and Operating EBITDA for the years indicated:

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(in millions) |

|

Net income (loss) |

|

$ |

(242.1 |

) |

|

$ |

247.0 |

|

Income tax provision (recovery) |

|

(27.8 |

) |

|

98.3 |

|

Interest expense |

|

88.2 |

|

|

71.5 |

|

Other income |

|

|

(7.1 |

) |

|

(24.4 |

) |

Operating income (loss) |

|

|

(188.8 |

) |

|

|

392.4 |

|

Add: Depreciation and amortization |

|

172.5 |

|

|

144.1 |

|

Add: Impairment of sandalwood business held for sale |

|

33.7 |

|

|

- |

|

Operating EBITDA |

|

$ |

17.4 |

|

|

$ |

536.5 |

|

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider and you should read the entire Proxy Statement carefully before voting.

Annual Meeting Information

|

|

Time and Date: |

10:00 a.m. (Vancouver time) on May 31, 2024 |

|

|

Place: |

Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada |

|

|

Record Date: |

March 28, 2024 (the "Record Date") |

|

|

Voting: |

•Shareholders of the Company ("Shareholders") as of the Record Date are entitled to vote. |

|

•Please vote your shares of our common stock (the "Shares") as soon as possible. Your broker will NOT be able to vote your shares with respect to any of the matters presented at the meeting, other than the ratification of the selection of our independent registered public accounting firm, unless you give your broker specific voting instructions. •Registered holders may vote in person at the annual meeting. |

|

•See page 93 of this Proxy Statement for more information. |

|

|

Attending the Annual Meeting: |

•In Person. Meeting starts at 10:00 a.m. (Vancouver time); doors open at 9:30 a.m. (Vancouver time). •Virtual Meeting. Meeting starts at 10:00 a.m. (Vancouver time). You also may vote at the annual meeting via the Internet by visiting www.meetnow.global/MH5YJVG and following the instructions. You will need the information included on your proxy card to access the meeting. •If you hold your Shares through a broker or nominee, you will need a legal proxy from such broker or nominee to attend the annual meeting in person or virtually. See "General Information" on page 1 for more information. |

|

•You do not need to attend the annual meeting to vote if you submitted your proxy in advance of the annual meeting. |

Even if you plan to attend our annual meeting in person or through the virtual meeting, please cast your vote as soon as possible. Make sure to have your proxy card or voting instruction form (VIF) in hand:

|

|

|

|

|

By using the Internet at •www.investorvote.com/merc (for registered Shareholders) (for beneficial Shareholders) |

|

By calling toll-free 1-800-652-VOTE (8683) within the United States, U.S. territories and Canada |

|

By scanning the QR code provided in your proxy with your smartphone |

|

By mailing your signed proxy or voting instruction form |

Annual Meeting Agenda and Voting Recommendations

|

|

|

Proposal |

Board Voting Recommendation |

Page Reference

(for more detail) |

Management proposals |

|

|

Election of ten directors |

FOR each director nominee FOR each director nominee

|

3 |

Advisory resolution to approve our executive compensation |

FOR FOR

|

89 |

Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal 2024 |

FOR FOR

|

90 |

Snapshot of Board Nominees

The following table provides summary information about each director nominee. Each director nominee is elected annually by a majority of votes cast.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Since |

|

|

Committee Memberships(1) |

|

|

Name |

Age |

|

Principal Occupation |

Independent |

AC |

HRC |

GNC |

EHSC |

|

|

|

|

|

|

|

|

|

|

|

|

|

William D. McCartney |

68 |

2003 |

President and Chief Executive Officer of Pemcorp Management Inc. |

* *

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Juan Carlos Bueno |

55 |

2022 |

President and Chief Executive Officer of the Company, since May 1, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James Shepherd |

71 |

2011 |

Past director of Buckman Laboratories International Inc.; past President and Chief Executive Officer of Canfor Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alan C. Wallace |

64 |

2018 |

Chief Executive Officer of Peloton Advisors Inc.; past Vice Chairman, Investment Banking of CIBC World Markets Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Linda J. Welty |

68 |

2018 |

Director of Huber Engineered Materials, a portfolio company of J.M. Huber Corporation; past director of GCP Applied Technologies, a global provider of specialty construction chemicals and building materials; past president of Flint Ink Corp. and the Specialty Group of H.B. Fuller Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rainer Rettig |

65 |

2020 |

Former Senior Vice President Strategic Projects, BU Polycarbonates of Bayer MaterialScience; Head of Circular Economy Program at Covestro (Deutschland) AG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alice Laberge |

68 |

2021 |

Director of Nutrien Ltd. and Russel Metals Inc., past President and Chief Executive Officer of Fincentric Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Janine North |

63 |

2021 |

Director of Conifex Timber Inc. and Imperial Metals Corporation. Past Chief Executive Officer of Northern Development Initiative Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Torbjörn Lööf |

59 |

2023 |

Director of Essity AB, Husqvarna Group and AB Blåkläder. Former Chief Executive Officer of Inter IKEA Holding from 2013 to 2020. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas Kevin Corrick |

68 |

2023 |

Former Chief Executive Officer of Boise Cascade. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chair |

|

Member |

* |

Interim Chairperson since February 26, 2024 (Formerly, Lead Independent Director) |

AC Audit Committee HRC Human Resources Committee GNC Governance and Nominating Committee EHSC Environmental, Health and Safety Committee |

|

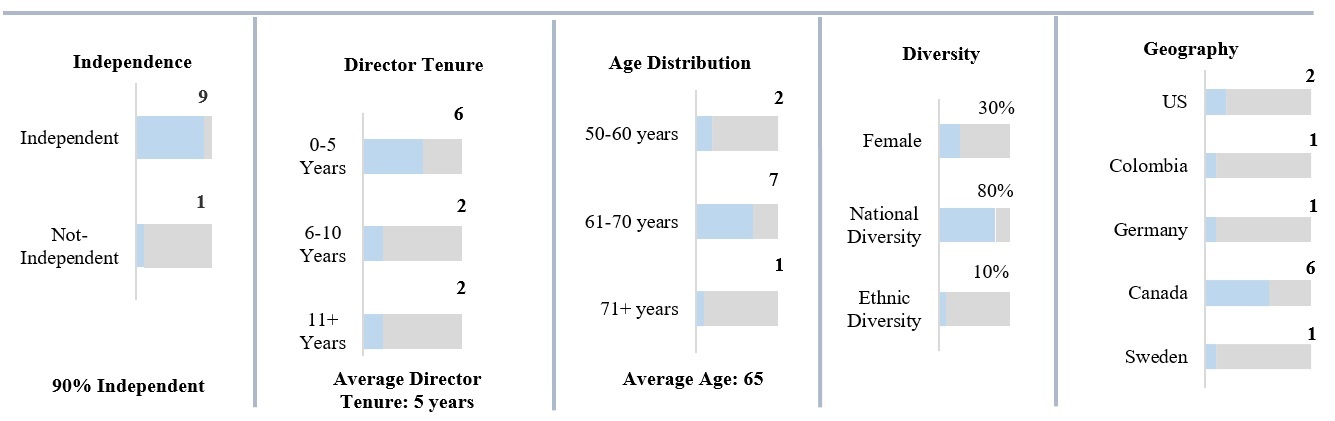

Board Snapshot

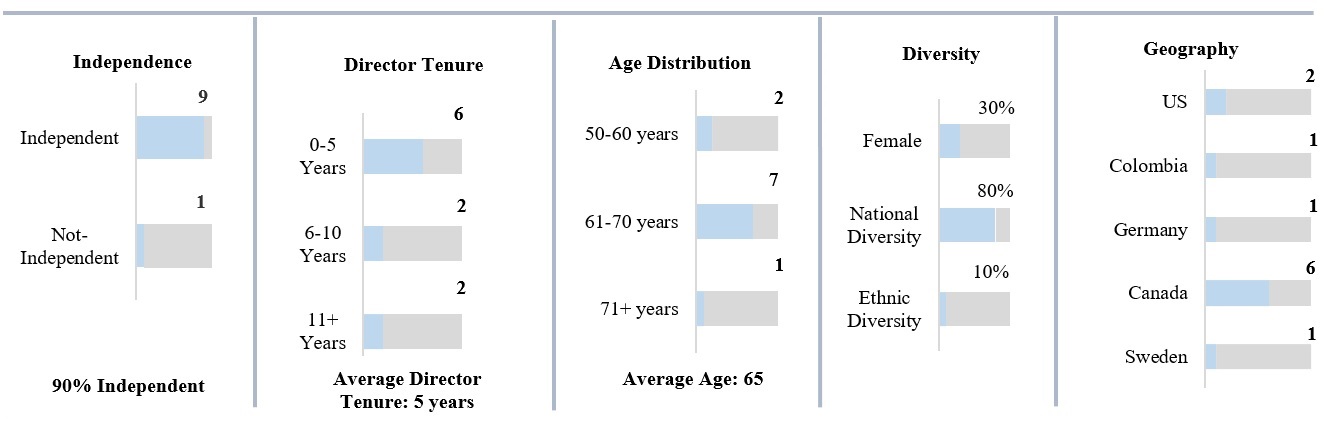

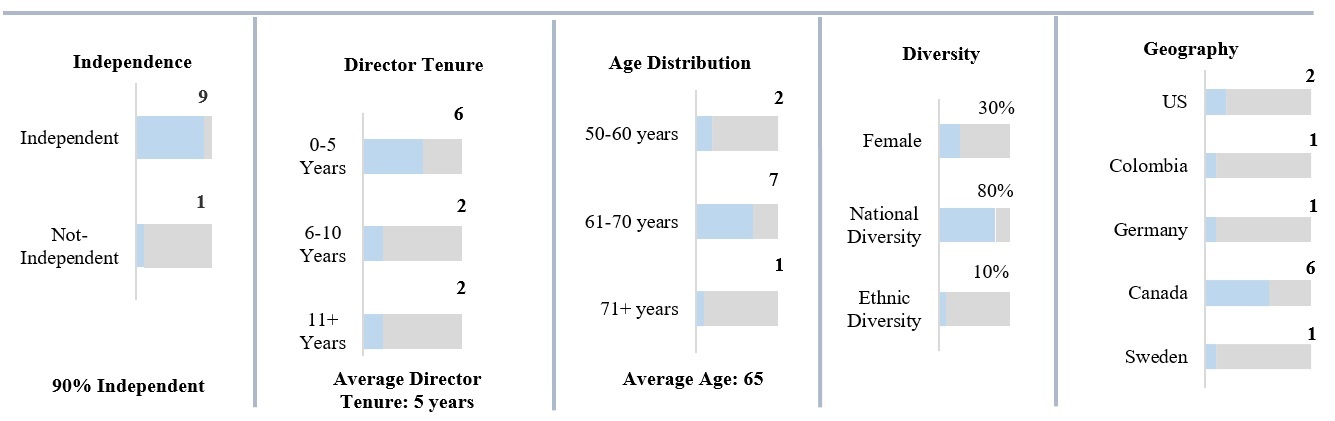

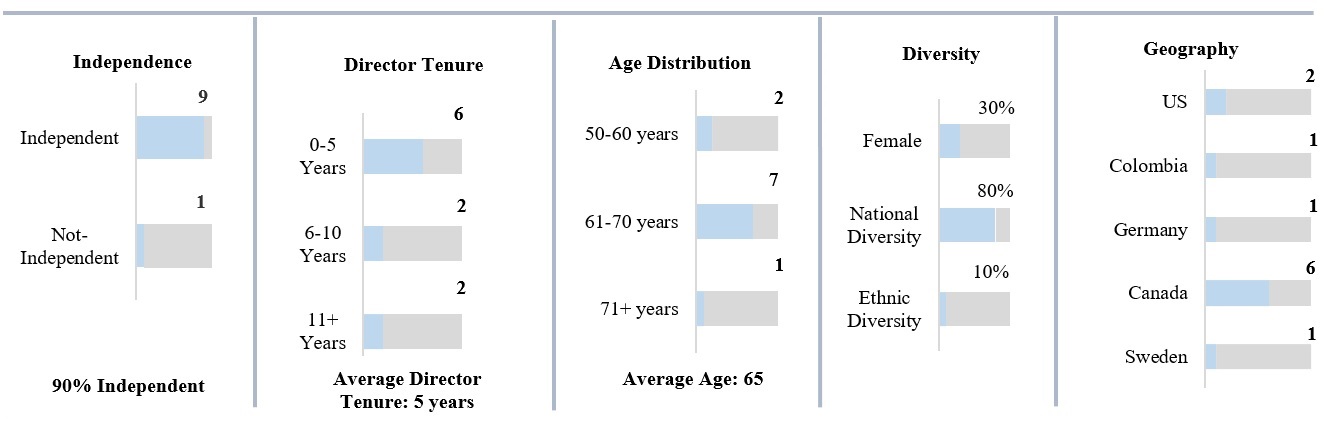

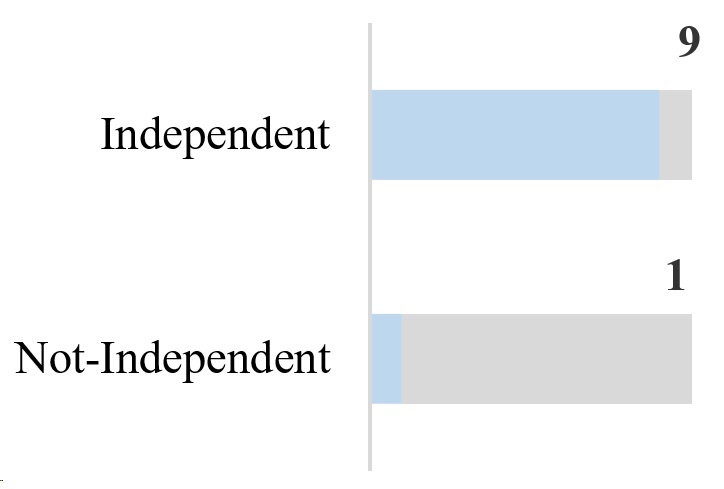

The following tables provide a snapshot of the independence, tenure, age, diversity and geographic mix of our director nominees.

In 2024, we revised our internal governance structure and Governance Guidelines to replace the lead director role with an independent Chairperson.

Board Refreshment

Over the last three years, we have identified and added five new directors including our new Chief Executive Officer, Juan Carlos Bueno. If our new nominees are elected at the meeting, we will have added five new independent directors to the board of directors (the "Board") over the last five years. Their expertise in senior leadership, capital markets, public company boards, the forest products industry and international business complements and adds to the existing skills and expertise of other continuing directors.

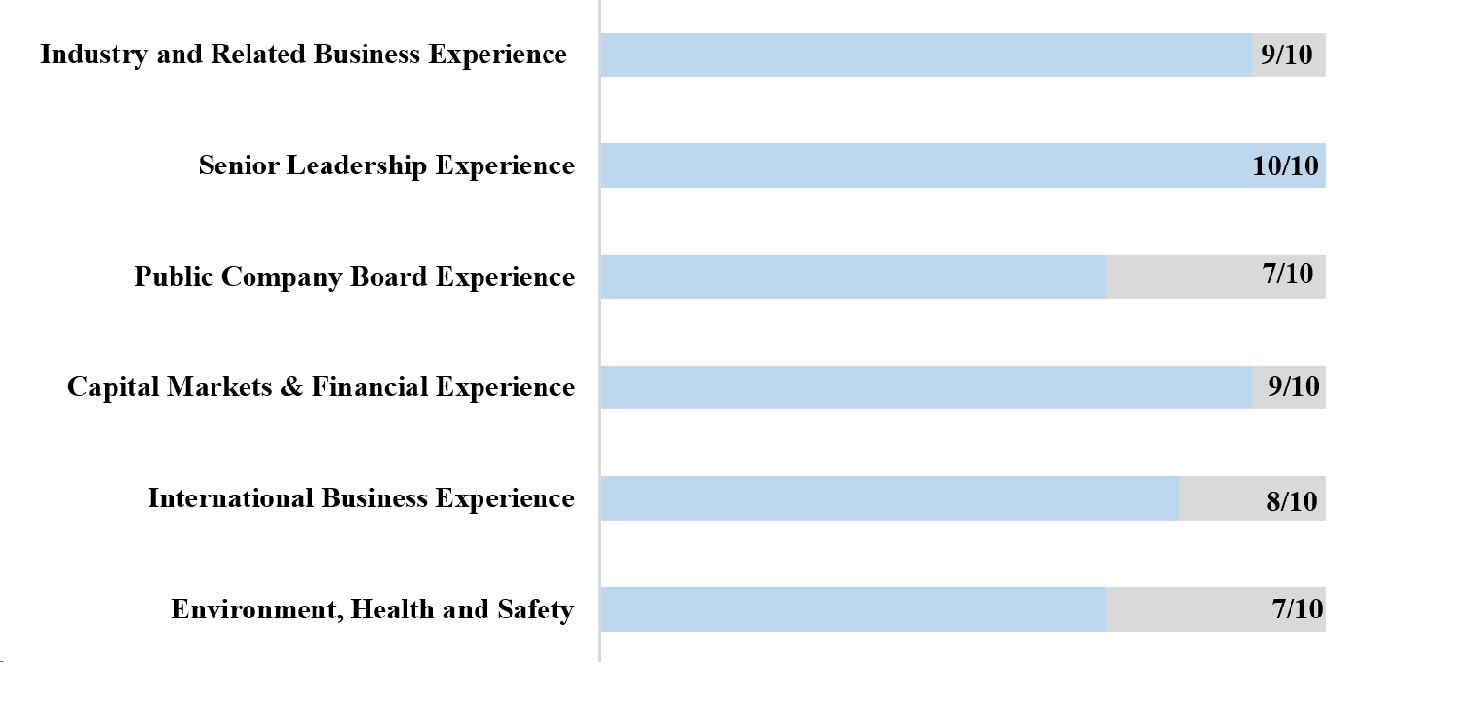

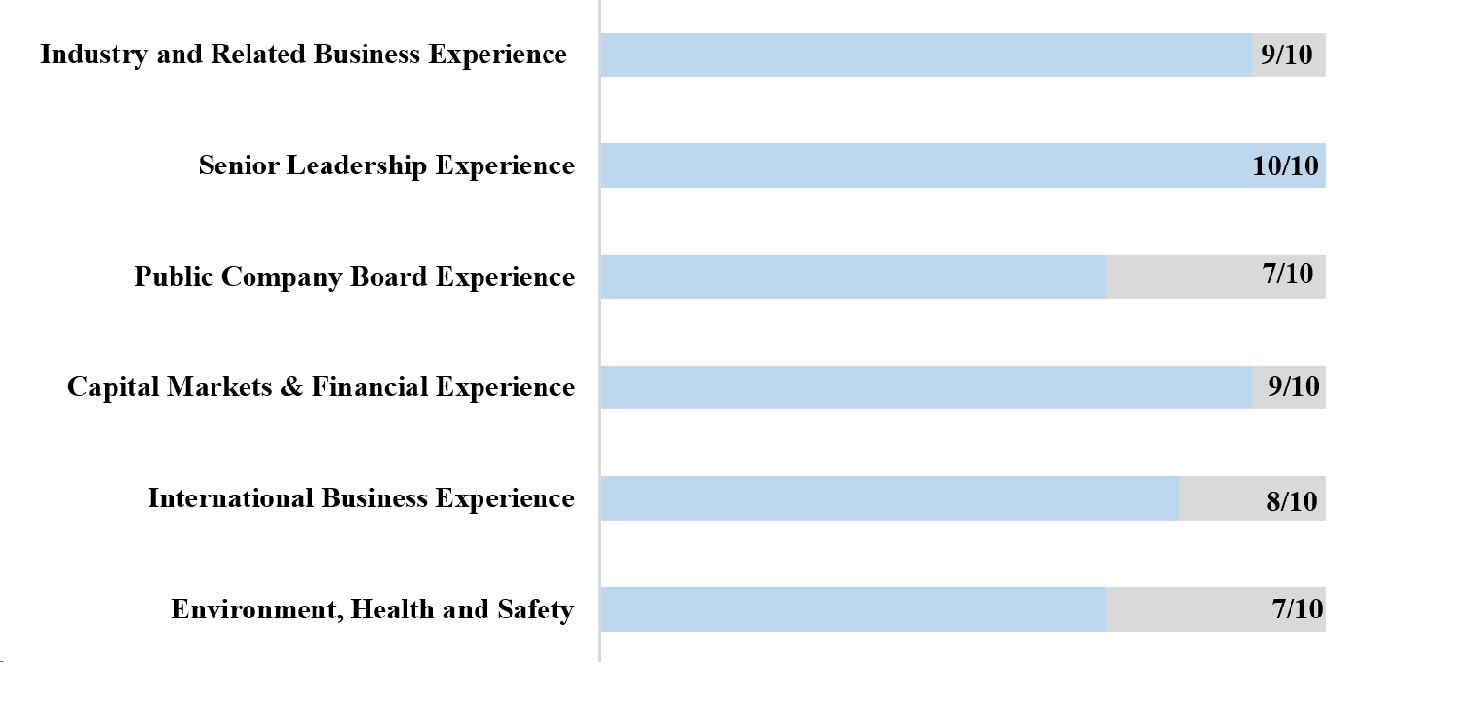

Snapshot of Attributes of Director Nominees

All director nominees exhibit the following personal attributes:

|

|

|

|

|

|

•Prepared to represent the best interests of all Shareholders |

•A proven record of success |

|

•Prepared to participate actively in Board activities |

|

|

Our director nominees also have the following qualifications:

Corporate Governance Highlights

We are committed to good corporate governance, which promotes the long-term interests of our Shareholders, strengthens Board and management accountability and helps build public trust in us. The "Corporate Governance and Board Matters" section beginning on page 14 describes our governance framework, which includes the following highlights:

|

|

|

Board Independence |

|

|

•Independent director nominees |

|

9 of 10 |

•Independent Interim Chairperson |

|

William D. McCartney |

•Independent Board committees |

|

AC, HRC, GNC |

|

|

|

Director Elections |

|

|

•Frequency of Board elections |

|

Annual |

•Voting standard for uncontested elections |

|

Majority of votes cast |

|

|

|

Board and Independent Director Meetings in 2023 |

|

|

|

|

15 |

•Independent director-only meetings |

|

4 |

|

|

|

Board Committee Meetings in 2023 |

|

|

|

|

5 |

•Human Resources Committee |

|

5 |

•Governance and Nominating Committee |

|

4 |

•Environmental, Health and Safety Committee |

|

5 |

|

|

|

Evaluating and Improving Board Performance |

|

|

|

|

Yes |

|

|

Annually |

|

|

Annually |

•Board recruitment and composition |

|

Annually |

|

|

Yes |

•Continuing Board education |

|

Yes |

|

|

|

Aligning Director and Shareholder Interests |

|

|

•Director stock ownership guidelines |

|

Yes |

|

|

Yes |

•Risk oversight by full Board and committees |

|

Yes |

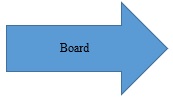

Fiscal 2023

In fiscal 2023, our operating results were impacted by the low pricing environment for our products, higher fiber costs as a result of reduced availability and economic uncertainty. Despite these challenges, we focused on managing costs and liquidity and achieving strong production at our mills, achieving many of our targets and objectives in 2023.

Selected Financial Highlights

In fiscal 2023, we:

•increased pulp production by approximately 4.6% to 1.97 million ADMTs from 1.88 million ADMTs in the prior year;

•increased wood production by approximately 4.5% to 462.3 MMfbm from 442.2 MMfbm in 2022;

•further grew our mass timber business with the acquisition of a mass timber production facility in Conway, Arkansas (the "Mercer Conway facility") and three mass timber production facilities in British Columbia, Canada which we combined into one facility (the "Mercer Okanagan facility"), which increased both our production capacity and our product range to include glulam;

•continued to ramp up operations, securing customer contracts and building up the order book of our mass timber business;

•despite 2023 being a challenging cyclical year, we were disciplined in controlling costs and reducing capital expenditures to manage working capital and maintain healthy liquidity;

•enhanced our liquidity with the issue of $200.0 million 2028 Senior Notes and expanding availability under our German Revolving Facility by €70.1 million;

•completed the Rosenthal lignin plant, which has a production capacity of approximately 250 tonnes of lignin per year; and

•paid dividends of $20.0 million.

Selected Strategic Highlights

In addition to their contributions and leadership, the following outlines an overall assessment of our executives' contribution in fiscal 2023 to achieving our strategic objectives and targets:

Operations

The operation and maintenance of modern, low-cost, reliable and energy efficient operations is key to produce stable returns through the economic cycle. In fiscal 2023, we:

•achieved record quarterly production volumes at each of our Stendal and Peace River pulp mills, Friesau sawmill and our Torgau facility;

•responded to challenging market conditions by aggressively targeting costs, implementing cost controls and reducing planned capital expenditures significantly; and

•implemented $136.3 million of capital projects at our operations, primarily to increase production and operational efficiency, and reduce costs.Such capital expenditures for our pulp segment related primarily to upgrades to the woodrooms at our Canadian mills, costs to complete construction of the Rosenthal lignin pilot plant, the rebuild of the wood chip conveying systems at our Stendal mill and maintenance and optimization projects at our German mill. Capital expenditures for our solid wood segment primarily related to optimization projects, including sorter line upgrades at our Friesau mill and Mercer Spokane facility, logyard improvements at our Torgau facility and other maintenance projects.

Growth and Diversification in Our Core Competencies

We are focused on growth in areas where we have a clear leadership position or high degree of competence to ensure that we can add value for Shareholders. In fiscal 2023, we:

•expanded our solid wood business through the acquisition of substantially all of the assets of the Structurlam Group in June 2023 for approximately $82.1 million, which included the Mercer Conway

facility and the Mercer Okanagan facility. The Mercer Conway facility and Mercer Okanagan facility have respective annual production capacities of approximately 75,000m3 and 40,000m3 of CLT and glulam;

•continued to ramp up operations of our mass timber business, significantly building out its order book; and

•completed the construction of and commissioned the lignin pilot production and research and development facility at our Rosenthal mill.

Sustainable Operations

We manage and operate our business, including the natural resources under our care or direction, with a long-term view and focus on sustainability. We believe by doing so we will be able to deliver value to our customers, employees, shareholders, communities and other stakeholders. We strive to maintain the highest environmental, social and governance ("ESG") standards. We believe that by caring for the health and safety of our workers, maintaining the environmental quality of our operations and being part of and actively engaged in the communities in which we operate, we enhance the value for all of our various stakeholders and our social licence to operate.

In fiscal 2023, we:

•increased our focus on sustainability including with improved sustainability management, goal setting and recording capabilities that will be communicated with stakeholders to ensure proper acknowledgment of our sustainability accomplishments and initiatives;

•further enhanced our procurement policies with an updated Supplier Code of Conduct to align with the emerging legal supply chain due diligence requirements;

•validated our greenhouse gas ("GHG") reduction targets with the Science Based Target Initiative to support our climate change ambition in line with a trajectory well below a 2 degree Celsius increase for Earth;

•incorporated the key learnings from our second climate change scenario analysis that evaluated the risks and opportunities of climate change as part of our adoption of the Task Force on Climate-related Financial Disclosure recommendations. We evaluated our business resilience to the climate change scenarios model that were developed by the Network for Greening the Financial System with extensive input from the climate community, and augmented with industry trends and climate projections. The scenarios were analyzed to identify and assess the potential impacts of climate change-related risks and opportunities on the Company. As a result of this process, we identified three areas of our strategy that may incur risks and opportunities across the scenarios: (i) shifting market demand; (ii) wood and fiber supply; and (iii) supply chain resilience. Further information on the key parameters and assumptions used to develop the various models is available on our website;

•conducted a water risk evaluation for each of our pulp mill operations to better understand water quality and availability in the respective watersheds where our mills operate. This evaluation will support our efforts in reducing water consumption and improving effluent quality;

•completed a multi-site forest certification process for our North American operations, including our mass timber business, to support our effort to increase our percentage of wood sourced from certified forests;

•published our second annual sustainability report (the "Sustainability Report") with improved alignment of our 2030 aspirational goals to the United Nations Sustainable Development Goals;

•incorporated our scope 1 GHG emissions intensity reduction targets into our management incentives program;

•enhanced our environmental tracking, measuring and reporting system which included scope 3 GHG emissions for our global operations;

•spent considerable time with our stakeholders including governments and First Nations to expand our relationships in all areas of our business; and

•achieved third party ESG risk scores in the 62nd percentile of our pulp and paper peers.

Develop Top Talent to Drive Sustainability and Execute our Strategy

A key component of our focus on sustainability is developing our talent through effective human capital management. In fiscal 2023, we:

•continued our commitment to health and safety; our Senior Safety Leadership Committee met throughout the year to enhance and implement policies, strategies, expenditures, and training for our employees;

•conducted a search and evaluation of potential internal and external candidates for a new Chief Financial Officer candidate, and ultimately promoted our former Vice President, Controller, Richard Short, who has extensive experience in finance and accounting and familiarity with our operations, to succeed David Ure as our Chief Financial Officer and Secretary;

•undertook a thorough annual review process for each of our executives using feedback from all levels to assess potential, increase accountability, encourage succession planning and identify areas for development; and

•conducted succession planning at all levels using specific talent objectives and skills development targets for each position and employee.

The chart below summarizes our selected key financial and operating results for 2023 compared to 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

Change (%) |

|

|

|

(in millions, other than where indicated) |

|

Pulp Segment |

|

|

|

|

|

|

|

|

|

|

|

|

Pulp production ('000 ADMTs) |

|

|

1,965.6 |

|

|

|

1,878.6 |

|

|

|

4.6 |

|

Average pulp sales realizations ($/ADMT)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

$ |

729 |

|

|

$ |

876 |

|

|

|

(16.8) |

|

NBHK |

|

$ |

627 |

|

|

$ |

869 |

|

|

|

27.8 |

|

Pulp sales ('000 ADMTs) |

|

|

1,951.2 |

|

|

|

1,917.8 |

|

|

|

1.7 |

|

Energy production ('000 MWh)(2) |

|

|

2,142.0 |

|

|

|

2,028.1 |

|

|

|

5.6 |

|

Energy sales ('000 MWh)(2) |

|

|

832.6 |

|

|

|

751.7 |

|

|

|

10.8 |

|

Pulp segment revenues |

|

$ |

1,516.1 |

|

|

$ |

1,866.1 |

|

|

|

(18.8) |

|

Pulp segment operating income (loss) |

|

$ |

(48.3) |

|

|

$ |

340.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solid Wood Products Segment |

|

|

|

|

|

|

|

|

|

|

|

|

Lumber production (MMfbm) |

|

|

462.3 |

|

|

|

442.2 |

|

|

|

4.5 |

|

Lumber sales (MMfbm) |

|

|

500.5 |

|

|

|

409.9 |

|

|

|

22.1 |

|

Energy production and sales ('000 MWh) |

|

|

160.2 |

|

|

|

109.6 |

|

|

|

46.2 |

|

Solid Wood products segment revenues |

|

$ |

472.1 |

|

|

$ |

408.5 |

|

|

|

15.6 |

|

Solid Wood products segment operating income (loss) |

|

$ |

(87.7) |

|

|

$ |

70.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

1,993.8 |

|

|

$ |

2,280.9 |

|

|

|

(12.6) |

|

Costs and expenses |

|

$ |

2,182.6 |

(3) |

|

$ |

1,888.5 |

|

|

|

15.6 |

|

Total operating income (loss) |

|

$ |

(188.8) |

|

|

$ |

392.4 |

|

|

|

(148.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating EBITDA |

|

$ |

17.5 |

|

|

$ |

536.5 |

|

|

|

(96.7) |

|

Net income (loss) |

|

$ |

(242.1) |

|

|

$ |

247.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Change (%) |

|

Balance Sheet and Other Data: |

|

(in millions, other than ratio) |

|

Cash and cash equivalents |

|

$ |

314.0 |

|

|

$ |

354.0 |

|

|

|

(11.3) |

|

Net debt |

|

$ |

1,295.4 |

|

|

$ |

992.5 |

|

|

|

30.5 |

|

Total equity |

|

$ |

635.4 |

|

|

$ |

838.8 |

|

|

|

24.2 |

|

Net debt to equity ratio |

|

2.0 to 1 |

|

|

1.2 to 1 |

|

|

|

66.7 |

|

Return on Average Assets(4) |

|

|

(9.0) |

% |

|

|

9.7 |

% |

|

|

|

|

Return on Average Equity(4) |

|

|

(32.8) |

% |

|

|

32.2 |

% |

|

|

|

|

Total Recordable Incident Rate |

|

|

3.68 |

|

|

|

2.23 |

|

|

|

65.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Change (%) |

|

Share Price and Dividend Data |

|

|

|

|

|

|

|

|

|

|

|

|

Price per Share as of fiscal year end(5) |

|

$ |

9.48 |

|

|

$ |

11.64 |

|

|

|

(18.6) |

|

Price per Share – High for year |

|

$ |

12.93 |

|

|

$ |

17.29 |

|

|

|

(25.2) |

|

Dividends declared per Share |

|

$ |

0.3000 |

|

|

$ |

0.3000 |

|

|

|

|

|

(1)Sales realizations after customer discounts, rebates and other selling concessions. Incorporates the effect of pulp price variations occurring between the order and shipment dates.

(2)Excludes energy production and sales relating to our 50% joint venture interest for the Cariboo mill, which is accounted for as an equity investment. In April 2024, we announced that we dissolved our 50/50 joint venture interest relating to the Cariboo mill.

(3)Includes a non-cash impairment recognized in connection with the classification of our sandalwood business as held for sale.

(4)Return on Average Assets and Return on Average Equity are calculated by dividing net income (loss) by the average of the total asset and equity balances, respectively, based on the beginning and ending balances of the same period used for net income (loss).

(5)Represents the closing market price of our Shares on the NASDAQ Global Select Market on December 29, 2023 and December 30, 2022, respectively.

Executive Compensation Highlights

Our executive compensation program is designed to achieve the following key objectives:

•Attract and retain top talent by competing effectively for high quality individuals whose efforts and judgments are vital to our continued success;

•Closely align compensation with our business purpose and commitment to Shareholder value creation by focusing on long-term sustainable growth;

•Create an environment in which our executives are motivated to achieve and maintain superior performance levels and goals consistent with our overall business strategy;

•Reward and compensate our executives for their contribution to our overall success and for their individual performance during the relevant fiscal year;

•Align the interests of our executives with the long-term interests and value performance of our Shareholders; and

•Given the cyclicality of the industry in which we operate, provide the Board the discretion to modify compensation targets to meet business needs at the time.

Some of the compensation practices we employ to achieve our objectives include:

|

|

What We Do |

What We Don't Do |

•Pay for performance philosophy with a large majority of pay at risk •Utilize performance-based equity awards with vesting requirements determined and judged by our Human Resources Committee •Manage Share usage conservatively •Conduct annual "say-on-pay" advisory votes •Maintain a clawback policy that covers cash and equity and that is beyond what is required by the Sarbanes-Oxley Act of 2002 and applicable stock exchange requirements •Assess risks to our compensation policies and practices •Maintain a stock ownership policy for our directors and NEOs •Utilize an independent executive compensation consultant •Annually review the Human Resources Committee's charter |

•Do not have single-trigger change-in-control executive contracts •Do not provide significant perquisites •Do not provide "defined benefit" retirement plans for our executives •Do not provide supplemental executive retirement plans for our executives •Do not provide excise tax gross-ups of perquisites •Do not re-price stock options without Shareholder approval; no grants below fair market value •Do not pay dividends on unvested long-term equity incentives to our executives •Do not allow executives to engage in hedging, short sales or derivative transactions with respect to our stock |

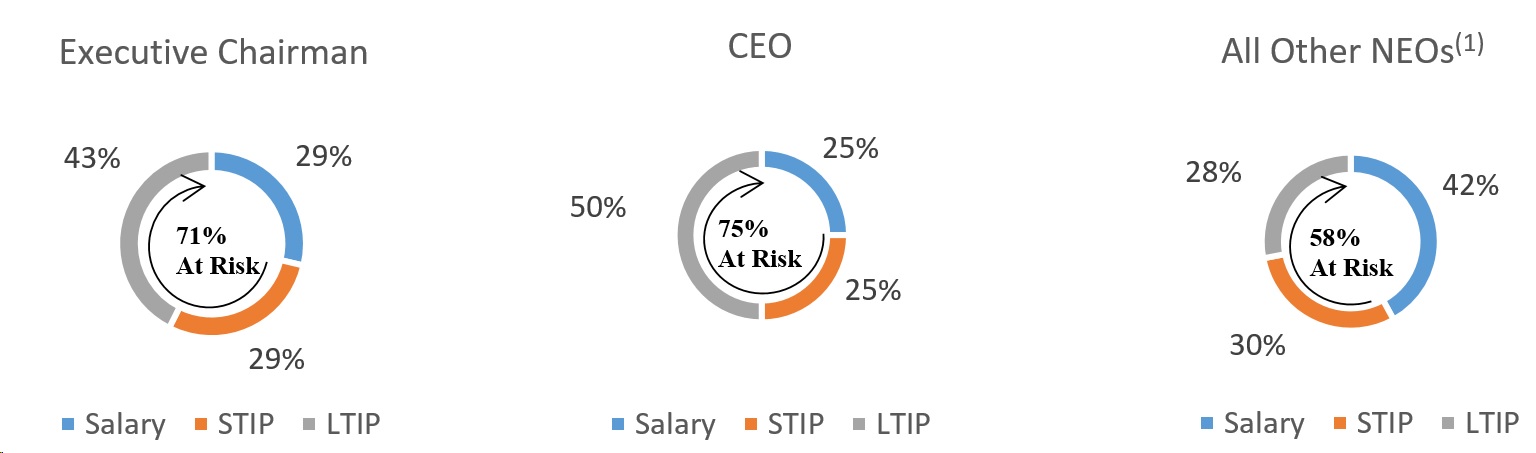

Variable Pay at Risk

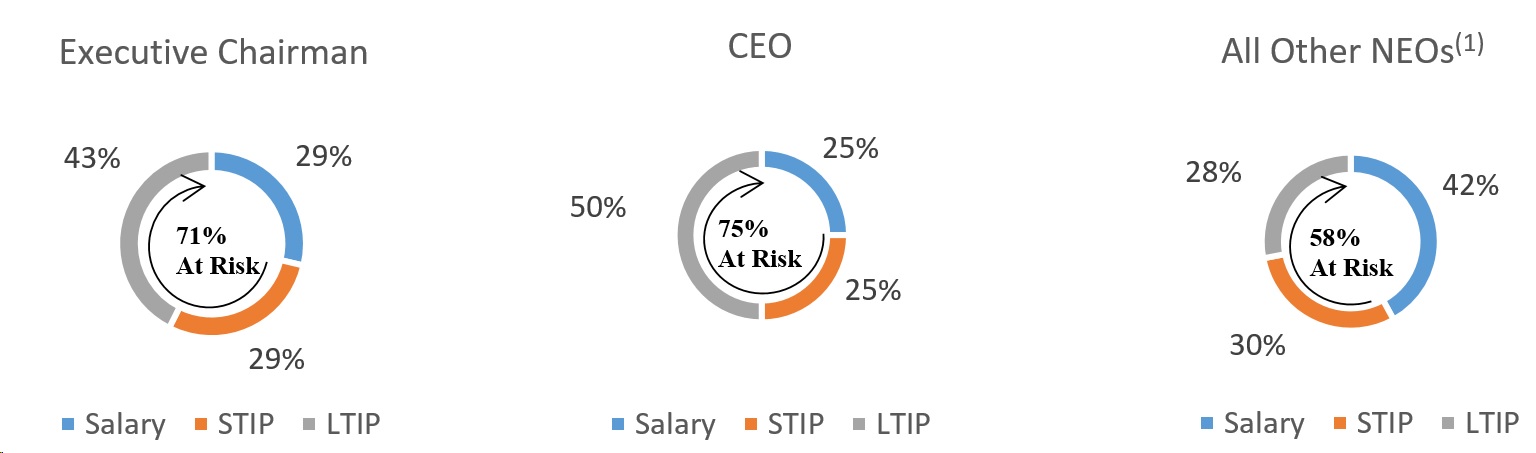

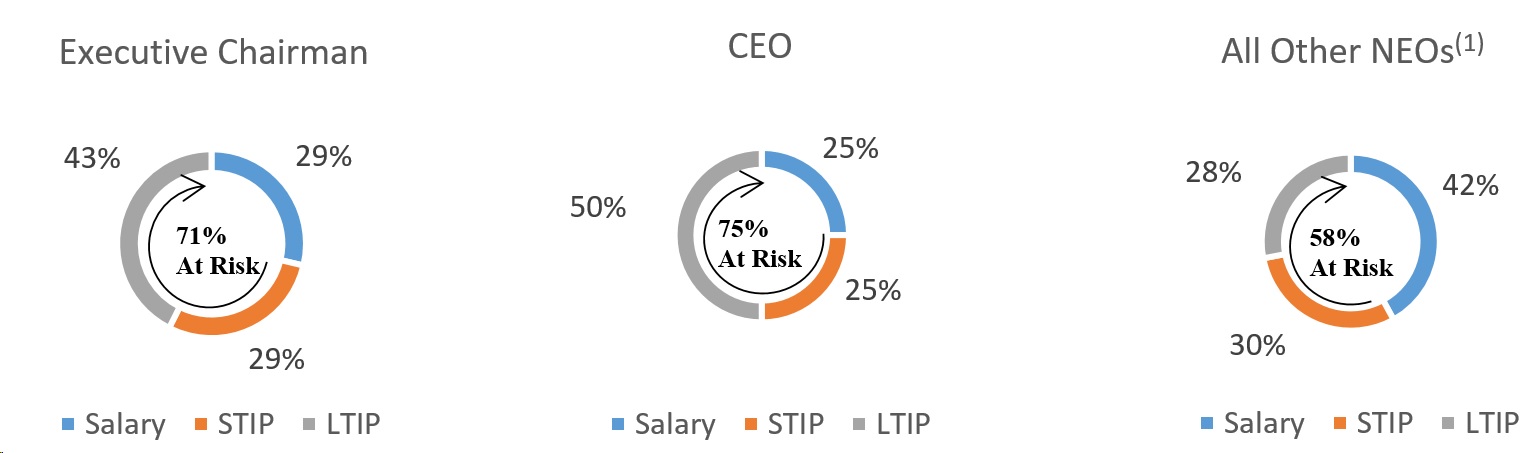

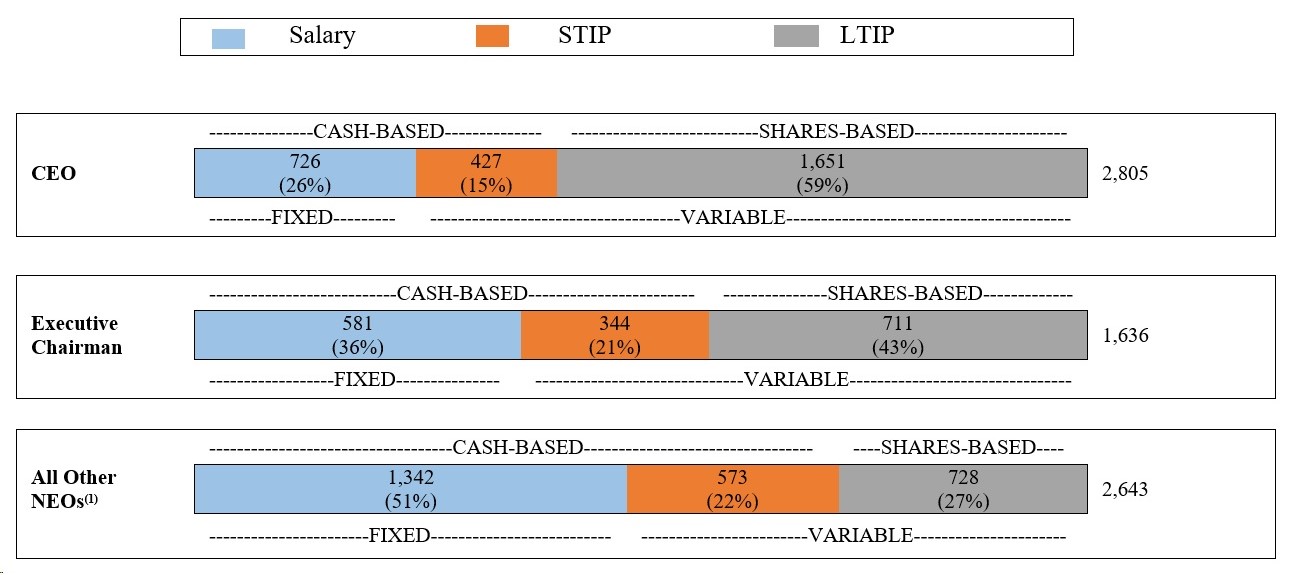

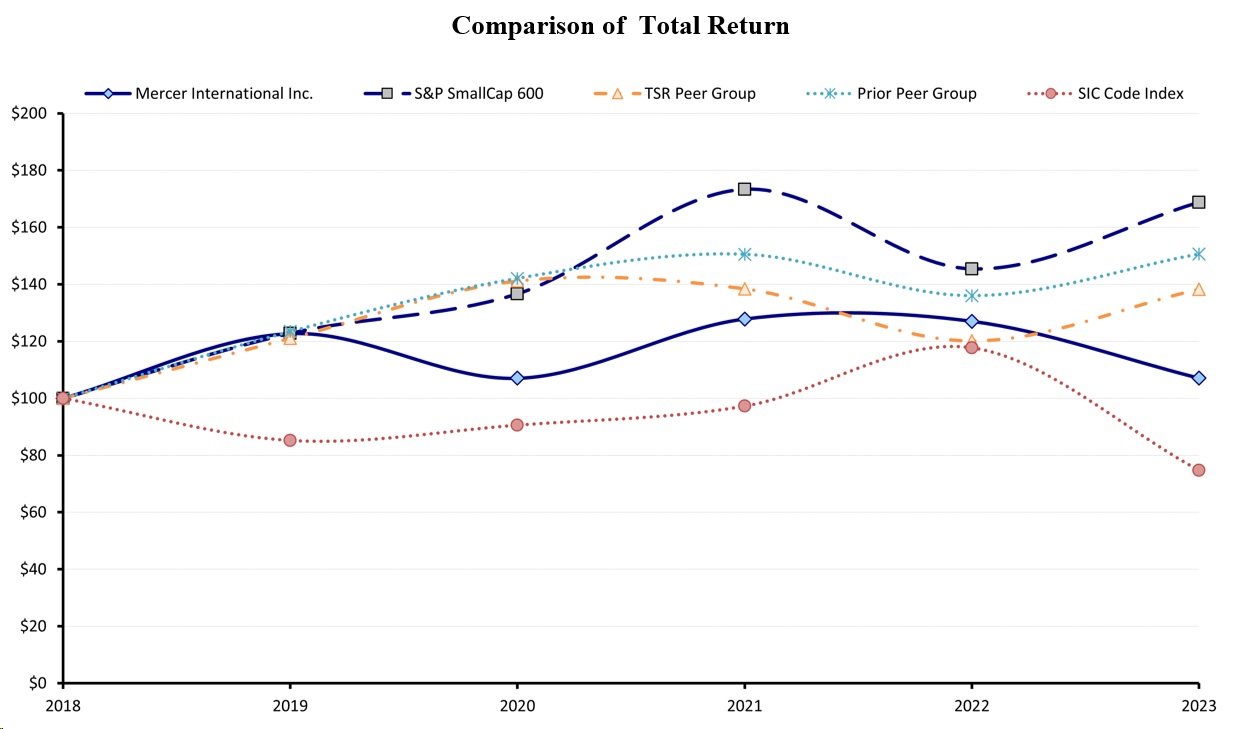

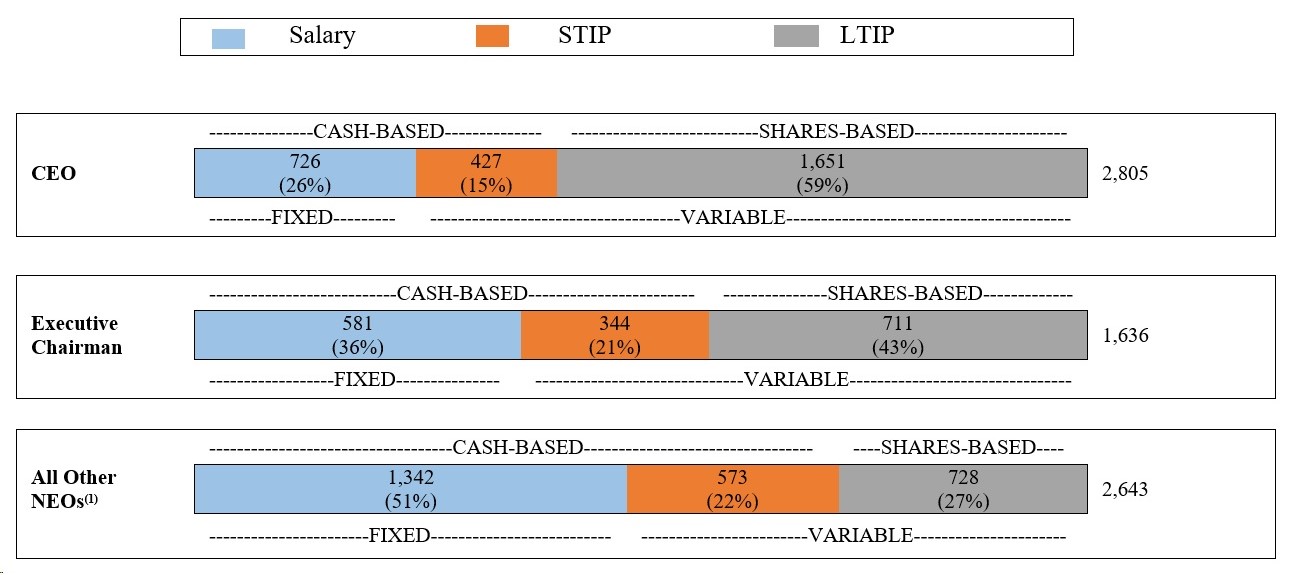

Our executive compensation program provides that a majority of compensation awarded to our named executive officers (or "NEOs"), especially our Chief Executive Officer and, also in 2023, our former Executive Chairman, is variable, performance-based compensation and "at risk". The percentage of our executives' compensation opportunity that is variable or at risk versus fixed is based primarily upon the executive's role and, to a lesser extent, geographic location. Generally, executives with more ability to directly influence overall performance have a greater portion of pay at risk through both short- and long-term incentive programs. Further, as a result of local market practices and customs, our North American executives generally have a greater portion of their compensation at risk, including the opportunity to earn greater rewards, than our European-based executives.

The graph below shows the balance of the elements that comprised total direct target compensation for our former Executive Chairman, Chief Executive Officer and our other NEOs, as a group, paid in 2023, including the percentage of variable compensation. The percentage of variable compensation listed below each chart is calculated by dividing (i) the

value of variable target compensation by (ii) the amount of total direct target compensation, which includes variable compensation plus fiscal 2023 base salary.

Fiscal 2023 Total Direct Target Compensation Paid

(1)David Ure stepped down as Chief Financial Officer and Secretary effective May 31, 2023. Richard Short was appointed as Chief Financial Officer and Secretary on June 1, 2023. Each of Mr. Ure's and Mr. Short's employment compensation for fiscal 2023 are included in "All Other NEOs".

Advisory Resolution to Approve Our Executive Compensation

We are asking Shareholders to approve, on an advisory basis, our executive compensation policies and practices as described in our Compensation Discussion and Analysis, accompanying tables and related narrative contained in this Proxy Statement. The advisory vote, commonly referred to as a "say-on-pay vote", gives Shareholders the opportunity to vote on the compensation for our NEOs that is disclosed in this Proxy Statement. This vote is not intended to address any specific item of executive compensation, but rather the overall compensation for our NEOs and the philosophy, policies and practices described in this Proxy Statement.

Since this say-on-pay vote is advisory, it will not be binding on our Board or our Human Resources Committee. However, both the Board and such committee value the opinion of Shareholders and will review the voting results and take them into consideration when making future decisions regarding executive compensation.

The non-binding resolution approving our executive compensation was approved by approximately 91.2% of the votes cast by Shareholders present or represented by proxy at our 2023 Annual Meeting of Shareholders.

Independent Registered Public Accounting Firm

As a matter of governance practices, our Audit Committee is asking Shareholders to ratify the selection of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for 2024. The following table sets forth the aggregate fees billed by PricewaterhouseCoopers LLP for 2023 and 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

Audit Fees |

|

|

$ |

1,550,379 |

|

|

$ |

1,440,100 |

|

Audit-Related Fees |

|

|

$ |

345,688 |

|

|

$ |

227,804 |

|

Tax Fees |

|

|

$ |

440,183 |

|

|

$ |

321,008 |

|

All Other Fees |

|

|

$ |

116,130 |

|

|

$ |

38,256 |

|

Total |

|

|

$ |

2,452,380 |

|

|

$ |

2,027,168 |

|

MERCER INTERNATIONAL INC.

Suite 1120, 700 West Pender Street, Vancouver, B.C., V6C 1G8, Canada

PROXY STATEMENT

GENERAL INFORMATION

This proxy statement ("Proxy Statement") is furnished in connection with the solicitation by management of Mercer International Inc. of proxies for use at the annual meeting of our Shareholders to be held at Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada at 10:00 a.m. (Vancouver time) on May 31, 2024 (the "Meeting"), or any adjournment, postponement or rescheduling thereof.

References to "we", "our", "us", the "Company" or "Mercer" in this Proxy Statement mean Mercer International Inc. and its subsidiaries unless the context clearly suggests otherwise. References to "fiscal year" means an annual period ended December 31. Information herein for 2023 generally refers to our 2023 fiscal year.

If a proxy (a "Proxy") is properly executed and received by us prior to the Meeting or any adjournment, postponement or rescheduling thereof, the Shares represented by such Proxy will be voted in the manner directed. Please see the Proxy for voting instructions. In the absence of voting instructions, the Shares will be voted for the proposals set out in the accompanying Notice of Annual Meeting of Shareholders and as shown in the table below and in accordance with the best judgment of the named proxies on any other matter properly brought before the Meeting:

|

|

|

|

|

|

Proposal No. |

Vote |

Board Recommendation |

Broker Non-Vote |

Vote Required for Approval |

Effect of Abstentions and Broker Non-Votes |

1 |

Election of ten directors |

FOR |

This matter is non-routine, thus if you hold your shares in street name, your broker may not vote your shares for you |

Majority of votes cast |

No effect |

2 |

Approval, on a nonbinding, advisory basis, of the compensation paid to our named executive officers |

FOR |

This matter is non-routine, thus if you hold your shares in street name, your broker may not vote your shares for you |

Majority of votes cast |

No effect |

3 |

Ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2024 |

FOR |

This matter is routine, thus if you hold your shares in street name, your broker may vote your shares for you |

Majority of votes cast |

Abstention has no effect and broker has discretion to vote |

A Proxy may be revoked at any time prior to its use by filing a written notice of revocation of proxy or a later dated Proxy with our registrar and transfer agent at Mercer International Legal Proxy c/o Computershare, Inc., P.O. Box 43001, Providence, RI 02940-3001. A Proxy may also be revoked by submitting another Proxy with a later date over the Internet, by telephone, to our registrar and transfer agent or by voting in person at the Meeting. Attending the Meeting will not, in and of itself, constitute revocation of a Proxy.

The holders of one-third of the outstanding Shares entitled to vote at the Meeting, present in person or represented by Proxy, constitutes a quorum for the Meeting. Shares represented by proxies that reflect abstentions or broker non-votes (i.e., Shares held by a broker/dealer or other nominee that are not voted because the broker/dealer or other nominee does not have the authority to vote on a particular matter) will be counted as Shares that are present and entitled to vote for the purposes of determining the presence of a quorum for the Meeting.

In accordance with rules of the Securities and Exchange Commission (the "SEC"), we are furnishing our proxy materials related to the Meeting primarily via the Internet, instead of mailing printed copies of those materials to each

Shareholder. Beginning on or around April 19, 2024, we will mail a Notice of Internet Availability to our Shareholders (other than those who had previously requested electronic or paper delivery) containing instructions on how to access our proxy materials, including this Proxy Statement and our annual report for 2023 (the "2023 Annual Report"), which includes our annual report on Form 10-K for the fiscal year ended December 31, 2023 (the "Form 10-K" or "2023 Form 10-K"). The Notice of Internet Availability also instructs you on how to vote over the Internet. This process is designed to expedite Shareholders' receipt of proxy materials, lower the cost of the Meeting and help conserve natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise. This Proxy Statement, accompanying Proxy and the 2023 Annual Report will be available on or around April 19, 2024 on our corporate website and at www.proxyvote.com and www.investorvote.com/merc for Shareholders.

Proxies may also be solicited by mail, telephone, facsimile or personal contact by our directors, officers or regular employees without additional compensation. All proxy-soliciting expenses in connection with the solicitation of votes for the Meeting will be borne by us. We also will request brokerage firms, banks, nominee custodians and fiduciaries to forward proxy materials to beneficial owners of our Shares as of the Record Date (as defined below) and will reimburse them for the cost of forwarding the proxy materials in accordance with customary practice.

Our Board has set the close of business on March 28, 2024 as the record date (the "Record Date") for the determination of Shareholders entitled to notice of and to vote at the Meeting or any adjournment, postponement or rescheduling thereof.

You are entitled to attend the Meeting only if you were a Shareholder as of the close of business on the Record Date, or hold a valid Proxy for the Meeting. In order to be admitted to the Meeting, you must present proof of ownership of Shares on the Record Date. This can be any of the following:

•a brokerage statement or letter from a bank or broker indicating ownership on the Record Date;

•the Notice of Internet Availability of proxy materials;

•a printout of the proxy distribution email (if you received your materials electronically);

•a voting instruction form; or

•a legal Proxy provided by your broker, bank or nominee.

Shareholders and Proxy holders must also present a form of photo identification such as a driver's license. We will be unable to admit anyone who does not present identification or refuses to comply with our security procedures. You may also attend the Meeting via the Internet. The accompanying proxy materials include instructions on how to participate in the Meeting and how you may vote your Shares if you participate electronically. To submit your questions during the Meeting, please log on to www.meetnow.global/MH5YJVG. You will need to enter the 15-digit control number received with your Proxy or Notice of Internet Availability of proxy materials to enter the Meeting.

If you hold your Shares through a broker or other nominee and wish to attend the Meeting you will need to obtain a legal proxy from such broker or other nominee and send it, along with your name and email address to our registrar transfer agent by email at legalproxy@computershare.com or mail at Mercer International Legal Proxy c/o Computershare, Inc., P.O. Box 43001, Providence, RI 02940-3001. Such requests must be labelled "Legal Proxy" and must be received by Computershare no later than 5:00 p.m. (Eastern Time) on May 28, 2024.

PROPOSAL 1 – ELECTION OF DIRECTORS

In accordance with our articles of incorporation and bylaws, each as may be amended from time to time, our Board is authorized to fix the number of our directors at not less than three (3) and not more than thirteen (13) and has fixed the number of directors at ten (10) for election at the Meeting. Directors are elected at each annual meeting of Shareholders to hold office until the next annual meeting. The persons identified below are nominated to be elected at the Meeting for the ensuing year. All of the nominees are currently directors previously elected by Shareholders. Despite the expiration of a director's term, the director shall continue to serve until the director's successor is elected and qualified or until there is a decrease in the number of directors. If for any unforeseen reason any of the nominees for director declines or is unable to serve, Proxies will be voted for the election of such other person or persons as shall be designated by the directors. Our Board has no reason to believe that any of the nominees will be unable or will decline to serve, if elected. Proxies received which do not specify a choice for the election of the nominees will be voted "FOR" each of the nominees. Proxies cannot be voted for more than ten (10) persons since that is the total number of nominees.

Set forth below is certain information furnished to us by the director nominees. There are no family relationships among any of our current directors, nominees or executive officers. None of the corporations or other organizations referenced in the biographical information below is a parent, subsidiary or other affiliate of ours.

We believe that our directors should satisfy a number of qualifications, including demonstrated integrity, a record of personal accomplishments, a commitment to participation in Board activities and other traits discussed below in "Our Director Nominations Process". We believe that Mercer and all of its stakeholders benefit from the broader exchange of perspectives and balance brought by a diversity of background, thought and experience. We further believe that a diverse and balanced Board enhances our sustainability, understanding of risks and opportunities, decision-making processes and achievement of our strategic goals. We also endeavor to have a Board representing a range of skills and depth of experience in areas that are relevant to and contribute to the Board's oversight of our operations. The Board believes its current size is appropriate for the size and scope of our business.

We believe that the following nominees represent a desirable mix of backgrounds, skills and experiences. Additionally, we believe that the specific leadership skills and other experiences of the nominees described below, particularly in the areas of forest products industry or related business experience, senior executive leadership, financial accounting/reporting, public company board experience, investment management, capital markets and finance, provide us with the perspectives and judgment necessary to guide our strategies and monitor their execution.

Each nominee elected as a director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of such directors' duties, including by attending meetings of our shareholders and meetings of the Board and committees of which such director is a member.

Following the biographical information for each director nominee, we describe the key experience, qualifications and skills our director nominees bring to the Board that, for reasons discussed below, are important in our business and a Board diversity mix.

The Board considered these experiences, qualifications and skills and the directors' other qualifications in determining to recommend that the directors be nominated for election:

|

|

Industry and related business experience |

We seek directors who have knowledge of and experience in the forest products industry, which is useful in understanding the operations of large manufacturing facilities, fiber procurement and harvesting, pulp, lumber and energy production, logistics and sales aspects of our business. Relevant experiences might include, among other things, forest products Chief Executive Officer or senior executive experience, international experience and relevant senior-level expertise in one or more of the following areas: forest products, bioenergy, chemicals, wood extractives, capital markets, finance and accounting. |

Senior leadership experience |

We believe that it is important for our directors to have served in senior leadership roles at other organizations, which demonstrates strong abilities to motivate and manage others, to identify and develop leadership qualities in others and to manage organizations. Senior leadership experience is necessary to ensure achievement of our strategic priorities and objectives. |

|

|

|

Public company board experience |

Directors who have served on other public company boards can offer advice and perspective with respect to Board dynamics and operations, oversight and leadership, the relationship between the Board and management and other matters, including: |

|

•oversight of strategic risk-management; |

•oversight of sustainability and ESG matters; •operational and compliance-related matters; and •relations with Shareholders. |

Capital markets and financial experience |

Directors who have capital markets experience can offer advice and perspective on investor expectations and perspectives, capital raising, appropriate capital structure, financing strategic transactions, including mergers and acquisitions, financial statements and financial reporting matters. |

International business experience |

We operate internationally and a significant majority of our employees and operations are outside the United States and primarily in Canada and Germany. Further, a significant majority of our customers are located in Europe and China. Accordingly, international business experience is desirable for our directors to have. |

ESG |

We value and seek directors who have experience in ESG and corporate social responsibility matters, as their advice and perspective can strengthen the Board's oversight and assure that our strategic goals are achieved within a responsible and sustainable business model. We value directors who have experience in advocating for gender and racial equality, human rights and corporate citizenship to ensure that we continue to advance diversity, inclusivity and human rights. |

Business development and growth in strategic areas |

Directors who have experience in business development and mergers and acquisitions can offer advice and insight of both organic and inorganic growth strategies, the identification of acquisition targets, and analyzing cultural and strategic fit that is instrumental to our long-term success. |

Risk management |

We value directors who have experience in taking a thoughtful and coordinated approach to risk management, including a clear understanding and oversight of the various risks that we face. |

Diversity |

We value representation on the Board of gender, ethnic, racial and cultural perspectives that reflect the diversity of our shareholders, employees, customers, suppliers and communities. |

|

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS. |

Nominees for Election as Directors

|

|

|

Juan Carlos Bueno

|

|

JUAN CARLOS BUENO, age 55, has served as Chief Executive Officer and President since May 1, 2022 and as a director since May 2022. His previous roles included, from 2018 to March 2022, serving as the Chairman of the board and co-founder of Global Energy, which produces novel green energy generation devices. Prior to that, from 2011 to 2017, Mr. Bueno was Executive Vice President and Divisional CEO, Biomaterials for Stora Enso, a manufacturer of pulp, paper and other forest products. At Stora Enso he designed and led their new biomaterials division, growing sales and profitability. The business included six manufacturing sites and a team of approximately 2,000 employees. Mr. Bueno created a vision and strategy to expand into new sectors such as lignin and hemicellulose. He also has broad experience in investor relations, board interaction and other key CEO functions. Prior to that, Mr. Bueno served in executive positions including Vice President, Crop Protection, President Agar Cross, Commercial Manager, Global Financial Analyst and Business Consultant with EI DuPont de Nemours & Company in Brazil, UK, Argentina, Colombia and USA. EI DuPont de Nemours & Company merged with the Dow Chemical Company to create DowDuPont. Mr. Bueno holds, among other things, a BSc., Industrial Engineering degree and a graduate degree in Negotiation & International Relations. |

|

Director Qualifications |

•Mr. Bueno has extensive knowledge and experience in biomaterials, sales, marketing, strategy development and management. He brings to the Board global industrial experience and product experience and a proven track record of achieving commercial and operational excellence over a 30-year career. As our Chief Executive Officer, Mr. Bueno provides the Board with exposure to our executive team and insight into our specific strategic and operational challenges and opportunities. |

|

|

|

William D. McCartney

|

|

WILLIAM D. MCCARTNEY, age 68, has served as a director since January 2003 and Interim Chairperson since February 26, 2024. He previously served as Lead Director from May 28, 2021 to February 26, 2024. He has been the President and Chief Executive Officer of Pemcorp Management Inc., a corporate finance and management consulting firm, since its inception in 1990. From 1984 to 1990, he was a founding partner of Davidson & Company, Chartered Accountants, where he specialized in business advisory services. He has been involved with numerous capital restructuring and financing events involving several public companies and brings substantial knowledge relating to the financial accounting and auditing processes. He is a chartered professional accountant and has been a member of the Chartered Professional Accountants of Canada since 1980. He holds a Bachelor of Arts degree in Business Administration from Simon Fraser University. |

|

Director Qualifications |

•As Interim Chairperson, Mr. McCartney leads and assists the Board in the discharge of its duties and responsibilities and provides the requisite leadership to ensure that the Board functions effectively and cohesively. He has extensive experience in accounting, financial and capital and international markets. |

|

|

|

James Shepherd

|

|

JAMES SHEPHERD, age 71, has served as a director since June 2011. Mr. Shepherd was President and Chief Executive Officer of Canfor Corporation from 2004 to 2007 and Slocan Forest Products Ltd. from 1999 to 2004. He is also the former President of Crestbrook Forest Industries Ltd. and Finlay Forest Industries Limited and the former Chairman of the Forest Products Association of Canada. Mr. Shepherd has previously served as a director of Conifex Timber Inc., Canfor Corporation and Canfor Pulp Income Fund (now Canfor Pulp Products Inc.). Mr. Shepherd holds a degree in Mechanical Engineering from Queen's University. |

|

Director Qualifications |

•Mr. Shepherd has held several chief executive officer leadership and other senior positions in the forest industry. As a result, Mr. Shepherd brings to the Board extensive senior executive experience relevant to our operations, public company board experience and an understanding of all aspects of the forest products business, ranging from fiber harvesting to lumber and pulp and paper operations. He also brings to our Board significant experience and background in the designing, execution and implementation of large, complex capital projects at large manufacturing facilities like our mills. |

|

|

|

Alan C. Wallace

|

|

ALAN WALLACE, age 64, has served as a director since June 2018. Mr. Wallace is currently the Chief Executive Officer of Peloton Advisors Inc., a corporate financial advisory firm. Since 2021, Mr. Wallace has served as a director and is the chair of the board of directors of Swiss Water Decaffeinated Coffee Inc., a global provider of decaffeinated coffee. He is based in Vancouver, British Columbia. Mr. Wallace was the Vice Chairman, Investment Banking, CIBC World Markets Inc. from 1987 to 2013 where he was also the Co-Head of its Paper and Forest Products Group from 1995 to 2013. Mr. Wallace holds a Master of Business Administration from the University of Chicago and a Bachelor of Applied Science (Mech) from the University of Toronto. |

|

Director Qualifications |

•Mr. Wallace has significant capital markets and mergers and acquisitions experience, including relating to debt and equity financings, corporate credit facilities and financial advisory assignments. He also has extensive forest products experience relating to financings and strategic transactions in the industry. He brings to the Board extensive experience in capital markets, cyclical industries, risk management, mergers and acquisitions, securities regulatory matters, financial and accounting matters, talent management, international business, equity and debt investors and corporate strategic planning. |

|

|

|

Linda J. Welty

|

|

LINDA WELTY, age 68, has served as a director since June 2018. Ms. Welty is currently an independent director of Huber Engineered Materials, a global manufacturer of engineered specialty ingredients, a portfolio company of J.M. Huber Corporation and has served in that role since 2014. From 2020 to September 2022, Ms. Welty was also elected as a director of GCP Applied Technologies Inc., which is a global provider of specialty construction chemicals and building materials. She formerly served as chairman and a director of the Atlanta Chapter of the National Association of Corporate Directors, whose mission is to advance excellence in corporate governance. From 2010 to 2011 she served as a director and member of the special committee of Massey Energy Company. She served as an independent director of Vertellus Specialties, Inc. from 2007 to 2016. Ms. Welty was President and Chief Operating Officer of Flint Ink Corp., a global producer of printing inks for packaging and publication from 2003 to 2005. From 1998 to 2003, she served as President of the Specialty Group of H.B. Fuller Company, a global manufacturer of adhesives, sealants and coatings. She also served for over twenty years in global leadership roles for Hoechst AG and its former U.S. subsidiary, Celanese. Ms. Welty is a National Association of Corporate Directors (NACD) Certified Director and NACD Board Leadership Fellow and holds a Bachelor of Science in Chemical Engineering from the University of Kansas. |

|

Director Qualifications |

•Ms. Welty brings to the Board extensive U.S. public company board experience and global industrial experience in corporate governance, executive leadership, operations, sales, marketing and manufacturing roles in the chemicals, specialty chemicals and energy industries. |

|

|

|

Rainer Rettig

|

|

RAINER RETTIG, age 65, has served as a director since February, 2020. Mr. Rettig has served as Senior Vice President of the Circular Economy Program at Covestro AG (formerly known as Bayer Material Science, a subgroup of Bayer AG), one of the world's leading manufacturers of high-tech polymer materials. Mr. Rettig brings significant experience in sales, marketing and strategy development in the field of chemicals and plastics. He had several senior leadership roles in Germany, Japan, Hong Kong and China. Mr. Rettig holds a Ph.D in polymer chemistry and polymer processing from the Technical University of Darmstadt in Germany. |

|

Director Qualifications |

•Mr. Rettig has extensive knowledge and experience in manufacturing, sales, marketing, strategy development and management. He brings to the Board extensive global industrial experience and insight into the European and Asia-Pacific markets. |

|

|

|

Alice Laberge

|

|

ALICE LABERGE, age 68, has served as a director since February, 2021. Ms. Laberge is currently a director of Nutrien Ltd., an agriculture products and services company, and Russel Metals Inc., a metal distribution company, and has served in such roles since 2018 and 2007, respectively. Ms. Laberge is also a director of the Canadian Public Accountability Board. She most recently retired from the board of the Royal Bank of Canada in January 2021, on which she served for over 15 years. She formerly served as President and Chief Executive Officer of Fincentric Corporation, a global provider of software solutions to financial institutions, until 2005, and was previously Chief Financial Officer and Senior Vice President, Finance for MacMillan Bloedel Ltd. Ms. Laberge is a Fellow of the Institute of Corporate Directors, and holds an MBA from the University of British Columbia and a Bachelor of Science from the University of Alberta. |

|

Director Qualifications |

•Ms. Laberge brings to the Board extensive senior executive experience relevant to our operations and an understanding of the forest products business. She also brings significant corporate governance and public company board experience from a wide variety of companies. Ms. Laberge also has extensive knowledge in financial and accounting matters. |

|

|

|

Janine North

|

|

JANINE NORTH, age 63, has served as a director since February 2021. Ms. North is currently a director of Conifex Timber Inc., a forest products company, and Imperial Metals Corporation, a Canadian mining company. She is also a director of the Fraser Basin Council and formerly a director of the BC Ferry Services Corp. Ms. North retired from the Northern Development Initiative Trust in 2016 after serving 11 years as the founding Chief Executive Officer. Ms. North holds a Diploma in Management Studies from the Executive MBA Program at Simon Fraser University and a Bachelor of Science from the University of Alberta. |

|

Director Qualifications |

•Ms. North brings with her significant public company board experience, and in particular, with companies involved in the resource sector. In particular, she has extensive knowledge and experience relevant to our operations in the forest products industry, including financings and strategic transactions in the industry, as well as corporate governance and talent management. |

|

|

|

Torbjörn Lööf

|

|

TORBJÖRN LÖÖF, age 59, has served as a director since May 2023. Mr. Lööf is currently a director of Essity AB, a leading global hygiene and health company, listed on Nasdaq Stockholm, Husqvarna Group, a Swedish manufacturer of outdoor power products listed on the Nasdaq Stockholm, and AB Blåkläder, a family-owned company within the workwear industry. Since March 2024, Mr. Lööf has been the chairman of the board of directors of Electrolux AB, a leading global appliance company listed on Nasdaq Stockholm. He was Chief Executive Officer of Inter IKEA Holding (The Netherlands) from 2016 to 2020 and Chief Executive Officer of Inter IKEA Systems, the world-wide IKEA franchisor and owner of the IKEA concept and brand, from 2013 to 2016. From 1989 to 2013 he held a number of leading positions and roles in different areas at IKEA in Sweden and in Italy, including Managing Director, IKEA of Sweden as of 2007. His role also included different board assignments both as Chairman and member for different IKEA companies, as well as being a member of IKEA Group Management. Mr. Lööf led the acquisition and transaction of 70 companies consisting of 26,000 employees in 30 different countries within two years. He developed and launched a new IKEA direction, Three Roads Forward, which is valid until 2025 and constitutes a major strategic shift for IKEA. In addition, he developed and implemented a new strategy which resulted in a complete restructuring for IKEA with the goal to become a global leader in furniture production with world class development and innovation capabilities. Torbjörn Lööf graduated from a Technical Industry program in Sweden and completed his financial education at MCE Management. |

|

Director Qualifications |

•Mr. Lööf brings with him extensive senior executive experience relevant to our operations and has extensive knowledge and experience in manufacturing, sales, marketing and strategy development in the European market. |

|

|

|

Thomas Kevin Corrick

|

|