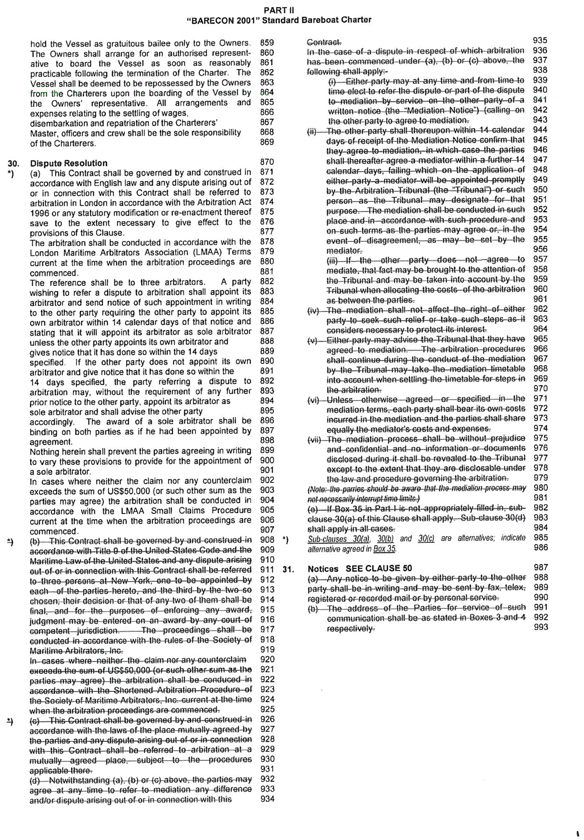

Form 20-F