Use these links to rapidly review the document

Table of contents

Part III

Index of financial statements

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| (Mark One) | ||

o |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

or |

||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2017 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

or |

||

o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Date of event requiring this shell company report |

||

Commission file number 001-32749

FRESENIUS MEDICAL CARE AG & Co. KGaA

(Exact name of Registrant as specified in its charter)

FRESENIUS MEDICAL CARE AG & Co. KGaA

(Translation of Registrant's name into English)

Germany

(Jurisdiction of incorporation or organization)

Else-Kröner Strasse 1, 61352 Bad Homburg, Germany

(Address of principal executive offices)

Josef Dinger, +49 6172 608 2522, Josef.Dinger@FMC-AG.com,

Else-Kröner Strasse 1, 61352 Bad Homburg, Germany

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| American Depositary Shares representing Ordinary Shares | New York Stock Exchange | |

| Ordinary Shares, no par value | New York Stock Exchange(1) |

- (1)

- Not for trading, but only in connection with the registration of American Depositary Shares representing such shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's class in the period covered by the annual report:

Ordinary Shares, no par value: 306,451,049

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Security Act. ý Yes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. o Yes ý No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o |

Non-accelerated filer o Emerging growth company o |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act o

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

o U.S. GAAP ý International

Financial Reporting Standards as issued

by o Other

the International Accounting Standards Board

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes ý No

i

Certain defined terms

In this report, (1) the "Company" refers to both Fresenius Medical Care AG prior to the transformation of legal form discussed in Item 4.A, "Information on the Company – History and Development of the Company – History" below and to Fresenius Medical Care AG & Co. KGaA after the transformation; (2) "we", "us" and "our" refer either to the Company or the Company and its subsidiaries on a consolidated basis both before and after the transformation, as the context requires; (3) "Fresenius Medical Care AG" and "FMC-AG" refer to the Company as a German stock corporation before the transformation of legal form and "FMC-AG & Co. KGaA" refers to the Company as a German partnership limited by shares after the transformation and (4) "FMCH" and "D-GmbH" refer, respectively, to Fresenius Medical Care Holdings, Inc., the holding company for our North American operations and to Fresenius Medical Care Deutschland GmbH, one of our German subsidiaries. In addition, "Fresenius SE" and "Fresenius SE & Co. KGaA" refer to Fresenius SE & Co. KGaA, a German partnership limited by shares resulting from the change of legal form of Fresenius SE (effective as of January 2011), a European Company (Societas Europaea) previously called Fresenius AG, a German stock corporation. Fresenius SE owns 100% of the share capital of our general partner and 94,380,382 of our shares as of February 16, 2018, 30.80% based on 306,451,049 outstanding shares, as reported herein. In this report, we use Fresenius SE to refer to that company as a partnership limited by shares, effective on and after January 28, 2011, as well as both before and after the conversion of Fresenius AG from a stock corporation into a European Company on July 13, 2007. The phrase "Fresenius SE and its subsidiaries" refers to Fresenius SE and all of the companies of the Fresenius SE group, other than FMC-AG & Co. KGaA and the subsidiaries of FMC-AG & Co. KGaA. Each of "Management AG", "FMC Management AG" and the "General Partner" refers to Fresenius Medical Care Management AG, FMC-AG & Co. KGaA's general partner and a wholly owned subsidiary of Fresenius SE. "Management Board" and "our Management Board" refer to the members of the management board of Management AG and, except as otherwise specified, "Supervisory Board" and "our Supervisory Board" refer to the supervisory board of FMC-AG & Co. KGaA. "Ordinary shares" refers to the ordinary shares prior to the conversion in 2013 of our preference shares into ordinary shares. Following the conversion, we refer to our ordinary shares as "shares." The term "North America Segment" refers to our North America operating segment; the term "EMEA Segment" refers to the Europe, Middle East and Africa operating segment, the term "Asia-Pacific Segment" refers to our Asia-Pacific operating segment, and the term "Latin America Segment" refers to our Latin America operating segment. The term "Corporate" includes certain headquarters' overhead charges, including accounting and finance, centrally managed production, asset management, quality management and procurement within our Global Manufacturing & Quality and Global Research & Development departments. All references in this report to the notes to our financial statements are to the notes to consolidated financial statements included in this report.

Forward-looking statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). When used in this report, the words "outlook," "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions are generally intended to identify forward looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated, and future events and actual results, financial and otherwise, could differ materially from those set forth in or contemplated by the forward-looking statements contained elsewhere in this report. We have based these forward-looking statements on current estimates and assumptions made to the best of our knowledge. By their nature, such forward-looking statements involve risks, uncertainties, assumptions and other factors which could cause actual results, including our financial condition and profitability, to differ materially positively or negatively relative to the results expressly or implicitly described in or suggested by these statements. Moreover, forward-looking estimates or predictions derived from third parties' studies or information may prove to be inaccurate. Consequently, we cannot give any assurance regarding the future accuracy of the opinions set forth in this report or the actual occurrence of the projected developments described herein. In addition, even if our future results meet the expectations expressed here, those results may not be indicative of our performance in future periods.

1

These risks, uncertainties, assumptions, and other factors, including associated costs, could cause actual results to differ from our projected results include, among others, the following:

- •

- changes in governmental and commercial insurer reimbursement for our complete products and services portfolio, including the United States

("U.S.") Medicare reimbursement system for dialysis and other health care services, including potentially significant changes that could be enacted due to the announced intention of the Trump

administration to continue its efforts to repeal and replace the Patient Protection and Affordable Care Act;

- •

- the outcome of government and internal investigations as well as litigation;

- •

- risks relating to compliance with current and future government regulations applicable to our business including, in the U.S., the

Anti-Kickback Statute, the False Claims Act, the Stark Law, the Health Insurance Portability and Accountability Act, the Health Information Technology for Economic and Clinical Health Act, the Foreign

Corrupt Practices Act, the Food, Drug and Cosmetic Act, and outside the U.S., the EU Medical Device Directive, the EU General Data Protection Regulation, the two invoice policy and the Tendering and

Bidding Law in China and other related local legislation as well as other comparable regulatory regimes in many of the countries where we supply health care services and/or products;

- •

- the influence of commercial insurers and integrated care organizations, including efforts by these organizations to manage costs by limiting

healthcare benefits, reducing provider reimbursement and/or restricting options for patient funding of health insurance premiums;

- •

- the impact of health care, tax and trade law reforms and regulation, including those proposed and enacted by the Trump administration in the

U.S.;

- •

- product liability risks;

- •

- risks relating to our ability to continue to make acquisitions;

- •

- risks relating to our ability to attract and retain skilled employees, including shortages of skilled clinical personnel;

- •

- the impact of currency fluctuations;

- •

- potential impairment loss on assets in the Latin America Segment due to decreases in the recoverable amount of those assets relative to their

book value;

- •

- our ability to protect our information technology systems against cyber security attacks or prevent other data privacy or security breaches;

- •

- changes in our costs of purchasing and utilization patterns for pharmaceuticals;

- •

- introduction of generic or new pharmaceuticals that compete with our products or services or the development of pharmaceuticals that greatly

reduce the progression of chronic kidney disease;

- •

- launch of new technology that competes with our medical equipment and device businesses;

- •

- changes in raw material and energy costs or the inability to procure raw materials;

- •

- collectability of our receivables, which depends primarily on the efficacy of our billing practices and the financial stability and liquidity

of our governmental and commercial payors;

- •

- our ability to achieve cost savings in various health care risk management programs in which we participate or intend to participate; and

- •

- the greater size, market power, experience and product offerings of certain competitors in certain geographic regions and business lines.

Our business is also subject to the risks discussed in this report under "Risk Factors" in Item 3 below, "Key information" and other risks and uncertainties that we describe from time to time in our public filings. Developments in any of these areas could cause our results to differ materially from the results that we or others have projected or may project.

Our reported financial condition and results of operations are sensitive to accounting methods, assumptions and estimates that are the basis of our financial statements. The actual accounting policies, the judgments made in the selection and application of these policies, and the sensitivities of reported results to changes in accounting policies, assumptions and estimates, are factors to be considered along

2

with our financial statements and the discussion under "Results of operations" in Item 5 below, "Operating and financial review and prospects." For a discussion of our critical accounting policies, see note 2 of the notes to the consolidated financial statements included in this report.

Rounding adjustments applied to individual numbers and percentages shown in this and other reports may result in these figures differing immaterially from their absolute values.

Market and industry data

Except as otherwise specified herein, all patient and market data in this report have been derived using our internal information tool called "Market & Competitor Survey" ("MCS"). See Item 4.B, "Information on the Company – Business Overview – Major Markets and Competitive Position."

3

Item 1. Identity of directors, senior management and advisors

Not applicable

Item 2. Other statistics and expected timetable

Not applicable

A. Selected financial data

The following table summarizes the consolidated financial information for our business for each of the years in the five-year period ended December 31, 2017. We derived the selected financial information from our consolidated financial statements. As of January 1, 2017, the consolidated financial statements and other financial information included in our quarterly reports on Form 6-K and this Annual Report on 20-F are prepared solely in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IASB"), using the euro as our reporting currency, and we have discontinued publishing U.S. GAAP financial information as of the end of 2016. KPMG AG Wirtschaftsprüfungsgesellschaft ("KPMG"), an independent registered public accounting firm, audited these financial statements. All American Depositary Share ("ADS") and per ADS data reflect the two-for-one split of the ADSs representing our Ordinary Shares and the ADSs representing our previously outstanding preference shares, which was effective December 3, 2012. You should read this information together with our consolidated financial statements and the notes to those statements appearing elsewhere in this report and the information under Item 5, "Operating and Financial Review and Prospects."

| Selected financial data | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

| |

(in € millions ("M") except share and per share amounts) |

|||||||||||||||

Statement of operations data: |

||||||||||||||||

Revenue |

17,784 |

16,570 |

15,455 |

12,145 |

11,215 |

|||||||||||

Cost of revenues |

11,780 | 10,954 | 10,277 | 8,155 | 7,434 | |||||||||||

Gross profit |

6,004 | 5,616 | 5,178 | 3,990 | 3,781 | |||||||||||

Selling, general and administrative(a) |

3,578 | 3,119 | 2,949 | 2,222 | 2,022 | |||||||||||

Research and development |

131 | 147 | 128 | 94 | 96 | |||||||||||

Income from equity method investees |

(67 | ) | (59 | ) | (28 | ) | (19 | ) | (20 | ) | ||||||

Operating income |

2,362 | 2,409 | 2,129 | 1,693 | 1,683 | |||||||||||

Interest expense, net |

354 | 366 | 353 | 310 | 308 | |||||||||||

Income before income taxes |

2,008 | 2,043 | 1,776 | 1,383 | 1,375 | |||||||||||

Net income attributable to shareholders of FMC-AG & Co. KGaA |

1,280 | 1,144 | 955 | 781 | 811 | |||||||||||

Weighted average shares outstanding |

306,563,400 | 305,748,381 | 304,440,184 | 302,339,124 | 303,815,122 | |||||||||||

Basic earnings per share(b) |

4.17 | 3.74 | 3.14 | 2.58 | 2.67 | |||||||||||

Basic earnings per ADS |

2.09 | 1.87 | 1.57 | 1.29 | 1.34 | |||||||||||

Fully diluted earnings per share(c) |

4.16 | 3.73 | 3.13 | 2.57 | 2.66 | |||||||||||

Fully diluted earnings per ADS |

2.08 | 1.87 | 1.57 | 1.29 | 1.33 | |||||||||||

Dividends paid (€)(c) |

0.96 | 0.80 | 0.78 | 0.77 | 0.75 | |||||||||||

Balance sheet data at December 31: |

||||||||||||||||

Working capital |

1,074 | 1,585 | 2,033 | 2,264 | 1,610 | |||||||||||

Total assets |

24,025 | 25,504 | 23,246 | 20,673 | 16,519 | |||||||||||

Total long-term debt (excluding current portion) |

5,795 | 6,833 | 7,214 | 7,425 | 5,570 | |||||||||||

Shareholders' equity |

10,828 | 11,051 | 9,806 | 8,388 | 6,991 | |||||||||||

Capital stock – nominal value |

308 | 307 | 313 | 311 | 309 | |||||||||||

- (a)

- Included

in Selling, general and administrative are gains on the sale of dialysis clinics in the amount of €7 for 2013.

- (b)

- As

of June 28, 2013 all preference shares for capital stock were converted into Ordinary Shares. As of December 31, 2017, only one class of shares

exists.

- (c)

- Amounts shown for each year from 2017 to 2013 represent dividends paid in each such year with respect to our operations in the year preceding payment. Our General Partner's Management Board has proposed dividends with respect to operations in 2017 of €1.06 per share. These dividends are subject to approval by our shareholders at our Annual General Meeting ("AGM") to be held on May 17, 2018.

4

We conduct our business on a global basis in various currencies with major operations located in the U.S. and Germany. We prepare our consolidated financial statements, from which we derived the selected financial data above, utilizing the euro as our reporting currency. We have converted the balance sheets of our non-euro denominated operations into euro at the exchange rates prevailing at the balance sheet date. Revenues and expenses are translated at the average exchange rates for the respective period, as shown.

A summary of the spot and average exchange rates for the euro to U.S. dollars for the last three years is set forth below. The European Central Bank ("ECB") determines such rates ("Reference Rates") based on the regular daily averaging of rates between central banks within and outside the European banking system. The ECB normally publishes the Reference Rates daily around 4p.m. (CET).

| Exchange rates | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

December 31, 2017 spot exchange rate in € |

December 31, 2016 spot exchange rate in € |

2017 average exchange rate in € |

2016 average exchange rate in € |

2015 average exchange rate in € |

|||||||||||

1 U.S. dollar |

0.83382 | 0.94868 | 0.88519 | 0.90342 | 0.90131 | |||||||||||

| | | | | | | | | | | | | | | | | |

D. Risk factors

Before you invest in our securities, you should be aware that the occurrence of any of the events described in the following risk factors or elsewhere in this report, and other events that we have not predicted or assessed could have a material adverse impact on our business, financial condition and results of operations. If the events described below or other unpredicted events occur, then the trading price of our securities could decline and you may lose all or part of your investment.

Risks relating to regulatory matters.

We operate in a highly regulated industry such that the potential for legislative reform provides uncertainty and potential threats to our operating models and results.

The delivery of healthcare services and products is highly regulated in most of the countries in which we operate. Proposals for legislative reform in these countries are often introduced to improve access to care, address quality of care issues and manage costs of the healthcare system. In the U.S., the Trump Administration and the 115th Congress have publicly announced their desire to pursue, and may enact, significant changes to existing health care programs. Certain health insurance provisions of the Patient Protection and Affordable Care Act of 2010 (Pub.L. 111-148), as amended by the Health Care and Education Reconciliation Act (Pub.L. 111-152) (collectively, "ACA") are targets for change. Changes of such nature could have significant effects on our businesses, both positive and negative, but the outcomes are impossible to predict.

In October 2017, the Trump administration announced its decision to end subsidies, known as cost-sharing reduction (CSR) payments, to health insurance companies to help pay out-of-pocket costs of low-income Americans. Some commercial insurers have stated that they will need much higher premiums and may withdraw from the insurance exchanges created under the ACA if the subsidies were eliminated. However, in February 2018, the Trump administration appears to have altered course and requested $1.2 billion to fund insurance exchanges, including CSR payments, as part of the administration's 2019 budget. A portion of this requested funding is expected to also fund the dismantling of the insurance exchanges. We cannot predict whether the inclusion of this funding in the budget for 2019 will come to pass. As a result, significant increases in insurance premiums and a reduction in the availability of insurance through such exchanges could reduce the number of our commercially insured patients and shift such patients to Medicare and Medicaid. Because Medicare and Medicaid reimbursement rates are generally lower than the reimbursement rates paid by commercial insurers, a shift of commercially insured patient to Medicare and Medicaid could have a material adverse impact on our business, financial condition and results of operations. See "– Changes in reimbursement and/or governmental regulations for health care could materially decrease our revenues and operating profit."

5

Changes in reimbursement and/or governmental regulations for health care could materially decrease our revenues and operating profit.

We receive reimbursement for our healthcare services from both public, government-sponsored payors and private, commercial payors. A large portion of our businesses is reimbursed by government payors, in particular the Medicare and Medicaid program in the U.S. For the year ended December 31, 2017, approximately 34% of our consolidated revenues resulted from Medicare and Medicaid reimbursement. The Medicare and Medicaid programs change their payment methodologies and funding from time to time in ways that are driven by changes in statute, economic conditions, and policy. For example, the Budget Control Act of 2011 ("BCA") effected a 2% reduction to Medicare payments and subsequent activity in Congress, a $1.2 trillion sequester (across-the-board spending cuts) in discretionary programs, took effect on April 1, 2013, which continues in force. In addition, options to restructure the Medicare program in the direction of a defined-contribution, "premium support" model and to shift Medicaid funding to a block grant or per capita arrangement, with greater flexibility for the states, are also likely to be considered. Changes in payment methodologies and funding or payment requirements of (without limitation) the End-Stage Renal Disease Prospective Payment System, the Physician Fee Schedule, the Clinical Laboratory Fee Schedule, and the Ambulatory Surgical Center Payment System may have material effects on our operating results. We have very little opportunity to influence or predict the magnitude of those changes. For further information regarding Medicare and Medicaid reimbursement, see Item 4B, "Information on the Company – Business Overview – Regulatory and Legal Matters – Reimbursement" and Item 5, "Operating and Financial Review and Prospects – Overview."

Government reimbursement programs generally pay less than private insurance. As a result, the payments we receive from private payors generate a substantial portion of the profits we report. Therefore, if the private payors in the North America Segment reduce their payments for our services, or if we experience a material shift in our revenue mix toward Medicare or Medicaid reimbursement, then our revenue, cash flow and earnings would materially decrease. Please see the table below detailing the percentage generated from government reimbursement and private payors in the North America Segment.

| Government reimbursement in the North America Segment | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Amounts in approximate € billions |

||||||||||

| |

|

The North America Segment health care service revenue |

Consolidated health care service revenue |

|||||||

Health care service revenue attributable to government reimbursement: |

€ | 12.0 | € | 14.5 | ||||||

Medicare |

€ | 5.2 | 44% | 36% | ||||||

Medicaid |

€ | 0.8 | 6% | 5% | ||||||

| | | | | | | | | | | |

Total Medicare and Medicaid |

€ | 6.0 | 50% | 41% | ||||||

Health care service revenue attributable to private payors: |

||||||||||

Private (commercial) payors |

€ | 5.0 | 42% | 35% | ||||||

Hospitals |

€ | 1.0 | 8% | 7% | ||||||

| | | | | | | | | | | |

Total private |

€ | 6.0 | 50% | 42% | ||||||

| | | | | | | | | | | |

Any of the following events, among others, could have a material adverse impact on our business, financial condition and results of operations:

- •

- we may be subject to reductions in reimbursement from private payors, including, for example, through their use of lower contract rates rather

than rates based on our billed charges;

- •

- we may experience a reduction in our ability to attract commercially insured patients to utilize our health care services relative to

historical levels;

- •

- a portion of our business that is currently reimbursed by private insurers or hospitals may become reimbursed by integrated care organizations, which may use payment methodologies that reduce reimbursement for our services. There can be no assurance that we can achieve future price increases from private insurers and integrated care organizations offering private insurance coverage to our patients; or

6

- •

- if efforts to restrict or eliminate the charitable funding of patient insurance premiums are successful, a portion of our patients who are currently covered by private insurers may elect to transition to government funded reimbursement programs that reimburse us at lower rates for our services. See Item 4B, "Information on the Company – Business Overview – Regulatory and Legal Matters – Reimbursement – Potential changes impacting our private payors" for further information.

If we do not comply with the numerous governmental regulations applicable to our business, we could be excluded from government healthcare reimbursement programs or our authority to conduct business could be terminated, either of which would result in a material decrease in our revenue.

Our operations in both our health care services business and our products business are subject to extensive governmental regulation in virtually every country in which we operate. We are also subject to other laws of general applicability, including antitrust laws. The applicable regulations, which differ from country to country, cover areas that include:

- •

- regulatory approvals for products or product improvements;

- •

- regulatory approvals and oversight of clinical and certain non-clinical research and development activities;

- •

- the quality, safety and efficacy of medical and pharmaceutical products and supplies;

- •

- the operation and licensure of manufacturing facilities, laboratories, dialysis clinics and other health care facilities;

- •

- product labeling, advertising and other promotion;

- •

- accurate reporting and billing for government and third-party reimbursement, including accurate and complete medical records to support such

billing;

- •

- the discounting of reimbursed drug and medical device products and the reporting of drug prices to government authorities;

- •

- the collection, dissemination, access, use, security and privacy of protected health information or other protected data; and

- •

- compensation of medical directors and other financial arrangements with physicians and other referral sources.

Failure to comply with one or more of these laws or regulations may give rise to a number of adverse legal consequences. These include, in particular, loss or suspension of federal certifications, loss or suspension of licenses under the laws of any state or governmental authority from which we generate substantial revenues, monetary and administrative penalties, increased costs for compliance with government orders, complete or partial exclusion from government reimbursement programs, refunds of payments received from government payors and government health care program beneficiaries due to failures to meet applicable requirements or complete or partial curtailment of our authority to conduct business. Any of these consequences could have a material adverse impact on our business, financial condition and results of operations.

The Company's medical devices and drug products are subject to detailed, rigorous and frequently changing regulation by the U.S. Food and Drug Administration ("FDA"), and numerous other national, supranational, federal and state authorities. In addition, the Company's facilities and procedures and those of its suppliers are subject to periodic inspection by the FDA and other regulatory authorities. The FDA and comparable regulatory authorities outside the U.S. may suspend, revoke, or adversely amend the authority necessary for research, manufacture, marketing, or sale of our products and those of our suppliers. The Company and its suppliers must incur expense and spend time and effort to ensure compliance with these complex regulations, and if such compliance is not maintained, they could be subject to significant adverse administrative and judicial enforcement actions in the future. These possible enforcement actions could include warning letters, injunctions, civil penalties, seizures of the Company's products, and criminal prosecutions as well as dissemination of information to the public about such enforcement actions. These actions could result in, among other things, substantial modifications to the Company's business practices and operations; refunds; a total or partial shutdown of production while the alleged violation is remedied; and withdrawals or suspensions of current products from the market. Any of these events, in combination or alone, could disrupt the Company's business and have a material adverse

7

impact on our business, financial condition and results of operations. For a discussion of our open FDA warning letter, see "Item 4B. "Information on the Company – Business Overview – Regulatory and legal matters – FDA warning letters."

The Company operates many facilities and engages with other business associates to help it carry out its health care activities. In such a decentralized system, it is often difficult to maintain the desired level of oversight and control over the thousands of individuals employed by many affiliated companies and its business associates. We rely on the Company's management structure, regulatory and legal resources and the effective operation of our compliance programs to direct, manage and monitor our operations to comply with government regulations. If employees were to deliberately, recklessly or inadvertently fail to adhere to these regulations, then our authority to conduct business could be terminated and our operations could be significantly curtailed. Any such terminations or reductions could materially reduce our revenues. If we fail to identify in our diligence process or to promptly remediate any non-compliant business practices in companies that we acquire, we could be subject to penalties, claims for repayment or other sanctions. Any such terminations or reductions could materially reduce our revenues, with a resulting material adverse impact on our business, financial condition and results of operations.

By virtue of this regulatory environment, our business activities and practices are subject to extensive review by regulatory authorities and private parties, and continuing audits, subpoenas, other inquiries, claims and litigation relating to the Company's compliance with applicable laws and regulations. We may not always be aware that an inquiry or action has begun, particularly in the case of "qui tam" or "whistle-blower" actions brought by private plaintiffs under the False Claims Act, which are initially filed under seal. We are the subject of a number of governmental inquiries and civil suits by the federal government and private plaintiffs. For information about certain of these pending investigations and lawsuits, see note 22 of the notes to our consolidated financial statements included in this report.

In addition, there may be future legislative or regulatory changes that affect procedures or decision making for approving medical device or drug products. Any such legislation or regulations, if enacted or promulgated, could result in a delay or denial of regulatory approval for our products. If any of our products do not receive regulatory approval, or there is a delay in obtaining approval, this also could have a material adverse impact on our business, financial condition and results of operations.

If we are unable to protect our information technology security systems against cyber attacks or prevent other privacy and data security incidents that result in privacy and data breaches that disrupt our operations or result in the unintended disclosure and access of sensitive personal information or proprietary or confidential information, we could be exposed to significant regulatory fines or penalties, liability or reputational damage, or experience a material adverse impact on our business, financial condition and results of operations.

We routinely process, store and transmit large amounts of data in our operations, including sensitive personal information as well as proprietary or confidential information relating to our business or third-parties. We may be subject to breaches of the information technology security systems we use.

A cyber-attack may penetrate our security controls and result in the misappropriation or compromise of sensitive personal information or proprietary or confidential information, including such information which is stored or transmitted on the systems used by certain of our products, to create system disruptions, cause shutdowns, or deploy viruses, worms, and other malicious software programs that attack our systems. We handle the personal data ("PD") of our patients and beneficiaries throughout the United States and other parts of the world. On occasion, we or our business associates may experience a breach under the U.S. Health Insurance Portability and Accountability Act Privacy and Security Rules, the EU's General Data Protection Regulation and or other similar laws ("Data Protection Laws") when there has been impermissible use, access, or disclosure of unsecured PD, a breach under the Data Protection Laws when the Company or its business associates neglect to implement the required administrative, technical and physical safeguards of its electronic systems and devices, or a data breach that results in impermissible use, access or disclosure of personal identifying information of its employees, patients and beneficiaries. We have redesigned the policies and procedures for internal reporting of potential privacy breaches and external reporting of privacy breaches, as governed by EU law, to comply with the European Union's General Data Protection Regulation. These policies and procedures are intended to help ensure (i) our compliance with the strict reporting deadlines of the EU General Data Protection Regulation and similar laws and regulations and (ii) swift remediation of any process defect.

As we increase the amount of sensitive personal information that we store and share digitally, our exposure to these privacy and data breaches and cyber-attack risks increases, including the risk of

8

undetected attacks, damage, loss or unauthorized disclosure or access, and the cost of attempting to protect against these risks also increases. We have implemented security technologies, processes and procedures to protect sensitive personal information and proprietary or confidential information; however, there are no assurances that such measures will be effective against all types of breaches. Any failure to keep our information technology systems and our patients' and customers' sensitive information secure from attack, damage, loss or unauthorized disclosure or access, whether as a result of our action or inaction or that of our business associates or vendors, could adversely affect our reputation and operations and also expose us to mandatory public disclosure requirements, litigation and governmental enforcement proceedings, material fines, penalties and/or remediation costs, and compensatory, special, punitive and statutory damages, consent orders and other adverse actions, any of which could have a material adverse impact on our business, financial condition and results of operations.

We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws.

The U.S. Foreign Corrupt Practices Act ("FCPA") and similar worldwide anti-corruption laws generally prohibit companies and their intermediaries from making improper payments to public officials for the purpose of obtaining or retaining business. Our internal policies mandate compliance with these anti-corruption laws. We operate many facilities throughout the United States and other parts of the world. Our decentralized system has thousands of persons employed by many affiliated companies, and we rely on our management structure, regulatory and legal resources and effective operation of our compliance program to direct, manage and monitor the activities of these employees and their agents. Despite our training, oversight and compliance programs, we cannot assure you that our internal control policies and procedures always will protect us from deliberate, reckless or inadvertent acts of our employees or agents that contravene the Company's compliance policies or violate applicable laws. Our continued expansion, including in developing countries, could increase the risk of such violations in the future. Violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse impact on our business, financial condition and results of operations. Beginning in 2012, the Company received certain communications alleging conduct in countries outside the U.S. that might violate the FCPA or other anti-bribery laws. Since that time, the Company's Supervisory Board, through its Audit and Corporate Governance Committee, has conducted investigations with the assistance of independent counsel. In a continuing dialogue, the Company voluntarily advised the U.S. Securities and Exchange Commission ("SEC") and the U.S. Department of Justice ("DOJ") about these investigations, while the SEC and DOJ (collectively the "government" or "government agencies") have conducted their own investigations, in which the Company has cooperated. In the course of this dialogue, the Company has identified and reported to the government, and has taken remedial actions including employee disciplinary actions with respect to, conduct that might result in the government agencies' seeking monetary penalties or other sanctions against the Company under the FCPA or other anti-bribery laws and impact adversely the Company's ability to conduct business in certain jurisdictions. The Company has recorded in prior periods a non-material accrual for certain adverse impacts that were identified. The Company has substantially concluded its investigations and undertaken discussions toward a possible settlement with the government agencies that would avoid litigation over government demands related to certain identified conduct. These discussions are continuing and have not yet achieved an agreement-in-principle; failure to reach agreement and consequent litigation with either or both government agencies remains possible. The discussions have revolved around possible bribery and corruption questions principally related to certain conduct in the Company's products business in a number of countries. The Company has recorded a charge of €200 M in the accompanying financial statements. The charge is based on ongoing settlement negotiations that would avoid litigation between the Company and the government agencies and represents an estimate from a range of potential outcomes estimated from current discussions. The charge encompasses government agencies claims for profit disgorgement, as well as accruals for fines or penalties, certain legal expenses and other related costs or asset impairments. The Company continues to implement enhancements to its anti-corruption compliance program, including internal controls related to compliance with international anti-bribery laws. The Company continues to be fully committed to FCPA and other anti-bribery law compliance. See "Item 15B. Management's annual report on internal control over financial reporting" and note 22 of the notes to our consolidated financial statements included in this report.

9

If our joint ventures violate the law, our business could be adversely affected.

A number of the dialysis clinics and health care centers that we operate are owned, or managed, by joint ventures in which one or more hospitals, physicians or physician practice groups hold an interest. Physician owners, who are usually nephrologists, may also provide medical director services and physician owners may refer patients to those centers or other centers we own and operate or to other physicians who refer patients to those centers or other centers we own and operate. Because our relationships with physicians are governed by the federal and state anti-kickback statutes, we have structured our joint venture arrangements to comply with many of the criteria for safe harbor protection under the U.S. Federal Anti-Kickback Statute; however, our investments in these joint venture arrangements do not satisfy all elements of such safe harbor. While we have established comprehensive compliance policies, procedures and programs to ensure ethical and compliant joint venture business operations, if one or more of our joint ventures were found to be in violation of the Anti-Kickback Statute, the Stark Law or other similar laws worldwide, we could be required to restructure or terminate them. We also could be required to repay to Medicare, Medicaid as well as other federal health care program amounts pursuant to any prohibited referrals, and we could be subject to criminal and monetary penalties and exclusion from federal and state healthcare programs. Imposition of any of these penalties could have a material adverse impact on our business, financial condition and results of operations.

Risks relating to our business

If we fail to estimate, price for and manage our medical costs in an effective manner, the profitability of our value-based products and services could decline and could materially and adversely affect our results of operations, financial position and cash flows.

Through our value-based agreements and health insurance products, we assume the risk of both medical and administrative costs for certain patients in return for fixed periodic payments from governmental and commercial insurers. We currently participate in various value-based programs, including (i) the Centers for Medicare and Medicaid Services ("CMS") Bundled Payments for Care Improvement ("BPCI") program and Comprehensive End-Stage Renal Disease ("ESRD") Care initiative, (ii) Medicare Advantage chronic special needs plans and (iii) capitation or shared savings agreements with commercial insurers in which FMCH receives a fixed fee to cover all or a defined portion of the medical costs of a defined population of patients. For information on the value-based programs in which we participate, see Item 4B. "Information on the Company – Business Overview – Care Coordination – Health Plans."

CMS relied on authority granted by the ACA to implement BPCI and the Comprehensive ESRD Care Model, which seeks to deliver better health outcomes for ESRD patients while lowering CMS' costs. Although Congress's efforts to date to repeal the ACA have been unsuccessful, further efforts to repeal or revise the ACA and the posture of CMS in the Trump Administration toward projects of this sort may affect the project's future prospects in ways which we currently cannot quantify or predict.

The reserves that we establish for health insurance policy benefits and other contractual rights and benefits are based upon assumptions and judgments concerning a number of factors, including trends in health care costs, expenses, general economic conditions and other factors. To the extent the actual claims experience is less favorable than estimated based on our underlying assumptions, our incurred losses would increase and future earnings could be adversely affected.

Our profitability in our value based agreements and insurance products is dependent in part upon our ability to contract on favorable terms with hospitals, physicians and other health care providers. The failure to maintain or to secure cost-effective health care provider contracts may result in a loss of beneficiaries or higher medical costs, which could adversely affect our business.

We are exposed to product liability, patent infringement and other claims which could result in significant costs and liability which we may not be able to insure on acceptable terms in the future.

Healthcare companies are typically subject to claims alleging negligence, product liability, breach of warranty, malpractice and other legal theories that may involve large claims and significant defense costs whether or not liability is ultimately imposed. Healthcare products may also be subject to recalls and patent infringement claims which, in addition to monetary penalties, may restrict our ability to sell or use our products. We cannot assure that such claims will not be asserted against us; for example, that significant adverse verdicts will not be reached against us for patent infringements or that large scale

10

recalls of our products will not become necessary. In addition, the laws of some of the countries in which we operate provide legal rights to users of pharmaceutical products that could increase the risk of product liability claims. Product liability and patent infringement claims, other actions for negligence or breach of contract and product recalls or related sanctions could result in significant costs. These costs could have a material adverse impact on our business, financial condition and results of operations. See note 22 of the notes to consolidated financial statements included in this report.

While we have been able to obtain liability insurance in the past to partially cover our business risks, we cannot assure that such insurance will be available in the future either on acceptable terms or at all, or that our insurance carriers will not dispute their coverage obligations. In addition, FMCH, our largest subsidiary, is partially self-insured for professional, product and general liability, auto liability and worker's compensation claims, up to pre-determined levels above which our third-party insurance applies. A successful claim in excess of the limits of our insurance coverage could have a material adverse impact on our business, financial condition and results of operations. Liability claims, regardless of their merit or eventual outcome, also may have a material adverse effect on our business and result in a loss of customer confidence in us or our products, which could have a material adverse impact on our business, financial condition and results of operations.

Our growth depends, in part, on our ability to continue to make acquisitions.

The healthcare industry has experienced significant consolidation in recent years, particularly in the dialysis services sector. Our ability to make future acquisitions depends, in part, on our available financial resources and could be limited by restrictions imposed by the United States or other countries' competition laws or under our credit documents. If we make future acquisitions, we may need to incur additional debt or assume significant liabilities, either of which might increase our financial leverage and cause the prices of our debt securities to decline and increase our future financing costs. In addition, any financing that we might need for future acquisitions might be available to us only on terms that restrict our business. Acquisitions that we complete are also subject to risks relating to, among other matters, integration of the acquired businesses (including combining the acquired company's infrastructure and management information systems with ours, harmonization of its marketing, patient service and logistical procedures with ours and, potentially, reconciling divergent corporate and management cultures), possible non-realization of anticipated synergies from the combination, potential loss of key personnel or customers of the acquired companies, and the risk of assuming unknown liabilities or non-compliant business practices not disclosed by the seller or not uncovered during due diligence. If we are unable to effect acquisitions on reasonable terms or integrate them successfully there could be an adverse effect on our business, financial condition and results of operations.

We also compete with other health care companies in seeking suitable acquisition targets. The continuing consolidation of health care providers and other consolidation in the health care industry generally could adversely affect future growth, including growth of our product sales.

We face specific risks from international operations.

We operate dialysis clinics in around 50 countries and sell a range of products and services to customers in around 150 countries. Our international operations are subject to a number of risks, including but not limited to the following:

- •

- the economic situation in certain countries could deteriorate;

- •

- fluctuations in exchange rates could adversely affect profitability;

- •

- we could face difficulties in enforcing and collecting accounts receivable under some countries' legal systems;

- •

- we could be negatively impacted by the ability of certain countries to service their sovereign debt obligations;

- •

- local regulations could restrict our ability to obtain a direct ownership interest in dialysis clinics or other operations;

- •

- political, social or economic instability, especially in developing and newly industrializing countries, could disrupt our operations;

11

- •

- some customers and governments could increase their payment cycles, with resulting adverse effects on our cash flow;

- •

- some countries could impose additional or higher taxes or fees or restrict the import of our products;

- •

- potential increases in tariffs and trade barriers that could result from withdrawal by the United States or other countries from major

multilateral trade agreements;

- •

- we could fail to receive or could lose required licenses, certifications or other regulatory approvals for the operation of subsidiaries or

dialysis clinics, sale of products and services or acquisitions;

- •

- civil unrest, turmoil, or outbreak of disease in one or more countries in which we have material operations or material product revenue;

- •

- differing labor regulations and difficulty in staffing and managing geographically widespread operations;

- •

- different or less robust regulatory regimes controlling the protection of our intellectual property; and

- •

- transportation delays or interruptions.

International growth and expansion into emerging markets could cause us difficulty due to greater regulatory barriers than in the United States or Western Europe, the necessity of adapting to new regulatory systems, and problems related to entering new markets with different economic, social, legal and political systems and conditions. For example, unstable political conditions or civil unrest could negatively impact our operations and sales in a region or our ability to collect receivables or reimbursements or operate or execute projects in a region.

Any one or more of these or other factors could increase our costs, reduce our revenues, or disrupt our operations, with possible material adverse impact on our business, financial condition and results of operations.

We could be adversely affected if we experience shortages of components or material price increases from our suppliers.

Our purchasing strategy is aimed at developing partnerships with strategic suppliers through long-term contracts and at the same time ensuring, where reasonably practicable, that we have at least two sources for all supply and price-critical primary products (dual sourcing, multiple sourcing). To prevent loss of suppliers, we monitor our supplier relationships on a regular basis. Suppliers which are integral to our procurement functions are subject to performance and risk analyses. Through constant market analyses, a demands-based design of supplier relationships and contracts, as well as the use of financial instruments, we seek to mitigate disruptive component shortages and potential price increases. If we are unable to counteract the risk of bottleneck situations at times of limited availability of components and other materials in spite of our purchasing strategy in combination with ongoing monitoring of market developments, this could result in delays in production and hence have an adverse effect on our results of operations. Similarly, material price increases by suppliers could also adversely affect our result of operations.

If physicians and other referral sources cease referring patients to our health care service businesses and facilities or cease purchasing or prescribing our products, our revenues would decrease.

In providing services within our health care business, we depend upon patients' choosing our health care facilities as the location for their care. Patients may select a facility based, in whole or in part, on the recommendation of their physician. We believe that physicians and other clinicians typically consider a number of factors when recommending a particular dialysis facility, pharmacy, physician practice, vascular surgery center or urgent care center to an ESRD patient, including, but not limited to, the quality of care at a facility, the competency of a facility's staff, convenient scheduling, and a facility's location and physical condition. Physicians may change their facility recommendations at any time, which may result in the movement of new or existing patients to competing facilities, including facilities established by the physicians themselves. At most of our dialysis clinics, a relatively small number of physicians often account for the referral of all or a significant portion of the patient base. Our dialysis business also depends on

12

recommendations by hospitals, managed care plans and other healthcare institutions. We have no ability to dictate these recommendations and referrals. If a significant number of physicians, hospitals or other healthcare institutions cease referring their patients to our clinics, this would reduce our health care revenue and could materially adversely affect our overall operations.

The decision to purchase or prescribe our dialysis products and other services or competing dialysis products and other services will be made in some instances by medical directors and other referring physicians at our dialysis clinics and by the managing medical personnel and referring physicians at other dialysis clinics, subject to applicable regulatory requirements. A decline in physician recommendations or recommendations from other sources for purchases of our products or ancillary services would reduce our dialysis product and other services revenue, and would materially adversely affect our business, financial condition and results of operations.

Our pharmaceutical product business could lose sales to generic drug manufacturers or new branded drugs.

Our branded pharmaceutical product business is subject to significant risk as a result of competition from manufacturers of generic drugs and other new competing medicines or therapies. The expiration or loss of patent protection for one of our products, the "at-risk" launch by a generic manufacturer of a generic version of one of our branded pharmaceutical products or the launch of new branded drugs that compete with one or more of our products could result in the loss of a major portion of sales of that branded pharmaceutical product in a very short time period, which could materially and adversely affect our business, financial condition and results of operations.

Our competitors could develop superior technology or otherwise impact our sales.

We face numerous competitors in both our health care services business and our dialysis products business, some of which may possess substantial financial, marketing or research and development resources. Competition and especially new competitive developments could materially adversely affect the future pricing and sale of our products and services. In particular, technological innovation has historically been a significant competitive factor in the dialysis products business. The introduction of new products by competitors could render one or more of our products or services less competitive or even obsolete.

Global economic conditions as well as further disruptions in financial markets may have an adverse effect on our businesses.

Current and future economic conditions could adversely affect our business and our profitability. Among other things, the potential decline in federal and state revenues that may result from such conditions may create additional pressures to contain or reduce reimbursements for our services from public payors around the world, including Medicare, Medicaid in the United States and other government sponsored programs in the United States and other countries around the world.

Job losses or changes in the unemployment rate in the United States may result in a smaller percentage of our patients being covered by an employer group health plan and a larger percentage being covered by lower paying Medicare and Medicaid programs. Employers and individuals who obtain insurance through exchanges established under the ACA might also begin to select more restrictive commercial plans with lower reimbursement rates. To the extent that payors are negatively impacted by a decline in the economy, we may experience further pressure on commercial rates, a further slowdown in collections and a reduction in the amounts we expect to collect.

We depend on the financial markets for access to capital, as do our renal product customers and commercial healthcare insurers. Limited or more expensive access to capital could make it more difficult for these customers to do business with us, or to do business generally, which could adversely affect our businesses.

In addition, uncertainty in the financial markets could adversely affect the variable interest rates payable under certain of our credit facilities or could make it more difficult to obtain or renew such facilities or to obtain other forms of financing in the future. Any or all of these factors, or other consequences of the continuation, or worsening, of domestic and global economic conditions which cannot currently be predicted, could continue to adversely affect our businesses and results of operations.

13

Any material disruption in federal government operations and funding could have a material adverse impact on our business, financial condition and results of operations.

A substantial portion of our revenues is dependent on federal healthcare program reimbursement, and any disruptions in U.S. government operations could have a material adverse impact on our business, financial condition and results of operations. If the U.S. government defaults on its debt, there could be broad macroeconomic effects that could raise our cost of borrowing funds, and delay or prevent our future growth and expansion. Any future federal government shutdown, U.S. government default on its debt and/or failure of the U.S. government to enact annual appropriations could have a material adverse impact on our business, financial condition and results of operations. Additionally, disruptions in U.S. government operations may negatively impact regulatory approvals and guidance that are important to our operations, and create uncertainty about the pace of upcoming health care regulatory developments.

If we are unable to attract and retain skilled medical, technical and engineering personnel, we may be unable to manage our growth or continue our technological development.

Our continued growth in the health care business will depend upon our ability to attract and retain skilled workforce. Competition for those employees is intense. Moreover, we believe that future success in the provider business will be significantly dependent on our ability to attract and retain qualified physicians to serve as employees of or consultants to our health care services businesses. If we are unable to achieve that goal or if doing so requires us to bear increased costs this could adversely impact our growth and results of operations.

Our health care products business depends on the development of new products, technologies and treatment concepts to be competitive. Competition is also intense for skilled engineers and other technical research and development personnel. If we are unable to obtain and retain the services of key personnel, the ability of our officers and key employees to manage our growth would suffer and our operations could suffer in other respects. These factors could preclude us from integrating acquired companies into our operations, which could increase our costs and prevent us from realizing synergies from acquisitions. Lack of skilled research and development personnel could impair our technological development, which would increase our costs and impair our reputation for production of technologically advanced products.

Diverging views of fiscal authorities could require us to make additional tax payments.

We are subject to ongoing tax audits in the U.S., Germany and other jurisdictions. We could potentially receive notices of unfavorable adjustments and disallowances in connection with certain of these audits. If we are unsuccessful in contesting unfavorable determinations we could be required to make additional tax payments, which could have a material adverse impact on our business, financial condition and results of operations in the relevant reporting period. See Item 5, "Operating and financial review and prospects – IV. Financial position."

A dependency on the payment behavior and decision-making of our business partners can affect the collectability of accounts receivable.

Our health care product business, as well as our dialysis services business outside the U.S. differs across the regions in which we operate. In many cases, our products and services are paid, either directly or indirectly, by government institutions. We believe the risk of default from a government payor is lower in comparison to the commercial payors worldwide. On a country level, the payor base is characterized by distinct customer or payor groups which can range in volume from a few customers to a considerable amount of customer types which have varying levels of risk associated with default or non-payment of receivables. In certain cases, a resulting dependency on the payment behavior and decision-making of our business partners can affect the collectability of accounts receivable and can adversely affect our business, results of operations and financial condition. We continuously seek to mitigate these risks by actively negotiating long-term contracts with major customers, targeted marketing activities, developing new product and pricing models as well as improving our service and quality.

Risks relating to our securities

Our indebtedness may limit our ability to pay dividends or implement certain elements of our business strategy.

At December 31, 2017, we had consolidated debt of €7,448 M and consolidated total shareholders' equity of €10,828 M. Our debt could have significant consequences to our operations and our financial

14

condition. For example, it could require us to dedicate a substantial portion of our cash flow from operations, as well as the proceeds of certain financings and asset dispositions, to payments on our indebtedness, thereby reducing the availability of our cash flow and such proceeds to fund working capital, capital expenditures and for other general corporate purposes.

In October 2012, we entered into a syndicated Credit Agreement, which was amended in November 2014 as well as in July 2017 (the "Amended 2012 Credit Agreement"). Our Amended 2012 Credit Agreement, the indentures relating to our senior notes (generally referred to as "Bonds" in this report) and our accounts receivable securitization program (the "A/R Facility" or the "Accounts Receivable Facility") include covenants that require us to maintain certain financial ratios or meet other financial tests. Under our Amended 2012 Credit Agreement and the A/R Facility, we are obligated to maintain our consolidated leverage at or below an established maximum ratio of consolidated net funded debt to consolidated EBITDA ("Net Leverage Ratio") as these terms are defined in the respective financing agreements.

Our Amended 2012 Credit Agreement and the indentures related to our Bonds include other covenants which, among other things, restrict or could have the effect of restricting our ability to dispose of assets, incur debt, pay dividends and other restricted payments, create liens or make investments or acquisitions. These covenants may otherwise limit our activities. The breach of any of the covenants could result in a default and acceleration of the indebtedness under the credit agreement or the indentures, which could, in turn, create additional defaults and acceleration of the indebtedness under the agreements relating to our other long-term indebtedness which would have an adverse effect on our business, financial condition and results of operations.

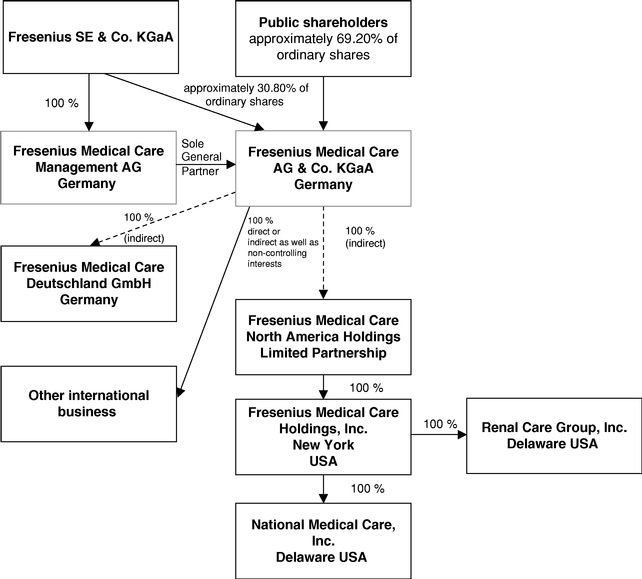

Fresenius SE owns 100% of the shares in the General Partner of our Company and is able to exercise management control of FMC-AG & Co. KGaA.

Fresenius SE owns 30.80% of our outstanding shares, excluding treasury shares that we held, as of February 16, 2018. Fresenius SE also owns 100% of the outstanding shares of Management AG, the General Partner of the Company. As the sole shareholder of the General Partner, Fresenius SE has the sole right to elect the supervisory board of the General Partner which, in turn, appoints the General Partner's Management Board. The Management Board of the General Partner is responsible for the management of the Company. Through its ownership of the General Partner, Fresenius SE is able to exercise de facto management control of FMC-AG & Co. KGaA, even though it owns less than a majority of our outstanding voting shares. Such de facto control limits public shareholder influence on management of the Company and precludes a takeover or change of control of the Company without Fresenius SE's consent, either or both of which could adversely affect the price of our shares. Our Articles of Association require that the General Partner or a parent company hold more than 25% of our share capital, and the necessity for such a significant investment in connection with an acquisition of the General Partner could also discourage or preclude a change of control through acquisition of the General Partner, which also could adversely affect the price of our shares.

Because we are not organized under U.S. law, we are subject to certain less detailed disclosure requirements under U.S. federal securities laws, and we are exempt from most of the governance rules of the New York Stock Exchange.

Under the pooling agreement that we have entered into for the benefit of public holders of our shares (including, in each case, holders of American Depositary Receipts representing beneficial ownership of such shares), we have agreed to file quarterly reports with the SEC and to file information with the SEC with respect to annual and general meetings of our shareholders. As of June 2016, the pooling agreement provides that we may prepare such financial statements in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") or IFRS and, commencing with our report for the first quarter of 2017, we prepare sour quarterly and annual financial statements in accordance with IFRS with the euro as our reporting currency. The pooling agreement also requires that the supervisory board of Management AG, our General Partner, include at least two members who do not have any substantial business or professional relationship with Fresenius SE, Management AG or FMC-AG & Co. KGaA and its affiliates and requires the consent of those independent directors (currently, Mr. Rolf A. Classon and Mr. William P. Johnston, to certain transactions between us and Fresenius SE and its affiliates.

We are a "foreign private issuer," as defined in the SEC's regulations, and consequently we are not subject to all of the same disclosure requirements applicable to domestic companies. We are exempt from the SEC's proxy rules, and our annual reports contain less detailed disclosure than reports of domestic

15

issuers regarding such matters as management, executive compensation and outstanding options, beneficial ownership of our securities and certain related party transactions. Also, our officers, directors and beneficial owners of more than 10% of our equity securities are exempt from the reporting requirements and short – swing profit recovery provisions of Section 16 of the Exchange Act. We are also generally exempt from most of the governance rules applicable to companies listed on the New York Stock Exchange ("NYSE"), including the requirement that our board have a majority of independent directors (as defined in those rules) and the obligation to maintain a compensation committee of independent directors. We are required to maintain an audit committee in accordance with Rule 10A – 3 under the Exchange Act and to provide annual (and, if required, quarterly) affirmations of our compliance. We must also disclose the significant ways in which the governance standards that we follow differ from those applicable to U.S. companies under the NYSE governance rules. Exemptions from many governance rules applicable to U.S. domestic issuers may adversely affect the market prices for our securities. See Item 16G, "Corporate governance."

Item 4. Information on the Company

A. History and Development of the Company

General

Fresenius Medical Care AG & Co. KGaA, is a partnership limited by shares (Kommanditgesellschaft auf Aktien or "KGaA"), formerly known as Fresenius Medical Care AG, a German stock corporation (Aktiengesellschaft or "AG") organized under the laws of Germany.

The Company was originally incorporated on August 5, 1996 as a stock corporation and transformed into a partnership limited by shares upon registration on February 10, 2006. FMC-AG & Co. KGaA is registered with the commercial register of the local court (Amtsgericht) of Hof an der Saale, Germany, under the registration number HRB 4019. Our registered office (Sitz) is Hof an der Saale, Germany. Our registered business address is Else-Kröner-Strasse 1, 61352 Bad Homburg, Germany, telephone +49-6172-609-0.

History

On September 30, 1996, we completed a series of transactions to consummate an Agreement and Plan of Reorganization entered into on February 4, 1996 by Fresenius SE (then Fresenius AG) and W.R. Grace & Co. which we refer to as the "Merger" elsewhere in this report. Pursuant to that agreement, Fresenius SE contributed Fresenius Worldwide Dialysis, its global dialysis business, including its controlling interest in Fresenius USA, Inc., in exchange for 105,630,000 FMC-AG Ordinary Shares. Thereafter, we acquired:

- •

- all of the outstanding common stock of W.R. Grace & Co., whose sole business at the time of the transaction consisted of National

Medical Care, Inc., its global dialysis business, in exchange for 94,080,000 Ordinary Shares; and

- •

- the publicly-held minority interest in Fresenius USA, Inc., in exchange for 10,290,000 Ordinary Shares.

On February 10, 2006, the Company completed the transformation of its legal form under German law as approved by its shareholders during the Extraordinary General Meeting ("EGM") held on August 30, 2005. Upon registration of the transformation of legal form in the commercial register of the local court in Hof an der Saale, on February 10, 2006, Fresenius Medical Care AG's legal form was changed from a German AG to a KGaA with the name Fresenius Medical Care AG & Co. KGaA. The Company as a KGaA is the same legal entity under German law, rather than a successor to the stock corporation. Management AG, a subsidiary of Fresenius SE, which was the majority voting shareholder of FMC-AG prior to the transformation, is the general partner of FMC-AG & Co. KGaA. Shareholders in FMC-AG & Co. KGaA participated in all economic respects, including profits and capital, to the same extent and with the same number of shares in FMC-AG & Co. KGaA as they held in FMC-AG prior to the transformation. Upon effectiveness of the transformation of legal form, the share capital of FMC-AG became the share capital of FMC-AG & Co. KGaA, and persons who were shareholders of FMC-AG became shareholders of the Company in its new legal form.

In March, 2006, we completed the acquisition of Renal Care Group, Inc. ("RCG"), a Delaware corporation with principal offices in Nashville, Tennessee. RCG was the fourth largest dialysis care

16

provider at the time of acquisition. RCG added additional clinics and services to our operations and continues to operate as a subsidiary. Please see Item 4C, "Information on the Company – Organizational Structure."

In 2008, we entered into two separate and independent license and distribution agreements, one for certain countries in Europe and the Middle East (with Galenica AG and Vifor (International) AG) and one for the U.S. (with Luitpold Pharmaceuticals Inc. and American Regent, Inc.), to market and distribute intravenous iron products, such as Venofer® (iron sucrose) and Ferinject® (ferric carboxymaltose) (outside of the U.S.). In December 2010, we announced the expansion of our agreements with Galenica by forming a new renal pharmaceutical company, Vifor Fresenius Medical Care Renal Pharma, ("VFMCRP"), with the intention to develop and distribute products to treat iron deficiency anemia and bone mineral metabolism for pre-dialysis and dialysis patients. FMC-AG & Co. KGaA owns 45% of the company which is headquartered in Switzerland. With VFMCRP, we have distribution arrangements for:

| Venofer® | Ferinject® | Velphoro® | ||

OsvaRen® |

Phosphosorb® |

Mircera® |

||

Retacrit® |

Vadadustat |

Veltassa® |

||

Avacopan (CCX-168) |

CCX-140 |