UNITED STATES

|

Maryland

|

20-2287134

|

|

|

(State or other jurisdiction

of incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

712 5th Avenue, 12th Floor, New York, NY 10019

|

||

|

(Address of principal executive offices) (Zip code)

|

||

|

(212) 506-3870

|

||

|

(Registrant’s telephone number, including area code)

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Common Stock, $.001 par value

|

New York Stock Exchange (NYSE)

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

None

|

||

|

Large accelerated filer ¨

|

Accelerated filer R

|

|

|

Non-accelerated filer ¨

|

(Do not check if a smaller reporting company)

|

Smaller reporting company¨

|

|

Page

|

|||

|

PART I

|

|||

|

Item 1:

|

3

|

||

|

Item 1A:

|

15

|

||

|

Item 1B:

|

32

|

||

|

Item 2:

|

32

|

||

|

Item 3:

|

32

|

||

|

Item 4:

|

32

|

||

|

PART II

|

|||

|

Item 5:

|

32

|

||

|

Item 6:

|

34

|

||

|

Item 7:

|

35

|

||

|

Item 7A:

|

67

|

||

|

Item 8:

|

69

|

||

|

Item 9:

|

117

|

||

|

Item 9A:

|

117

|

||

|

Item 9B:

|

119

|

||

|

PART III

|

|||

|

Item 10:

|

119

|

||

|

Item 11:

|

124

|

||

|

Item 12:

|

128

|

||

|

Item 13:

|

130

|

||

|

Item 14:

|

132

|

||

|

PART IV

|

|||

|

Item 15:

|

133

|

||

|

135

|

|||

|

|

●

|

the factors described in this report, including those set forth under the sections captioned “Risk Factors,” “Business,” and “Management’s Discussion and Analysis of Financial Conditions and Results of Operations;”

|

|

|

●

|

changes in our industry, interest rates, the debt securities markets, real estate markets or the general economy;

|

|

|

●

|

increased rates of default and/or decreased recovery rates on our investments;

|

|

|

●

|

availability, terms and deployment of capital;

|

|

|

●

|

availability of qualified personnel;

|

|

|

●

|

changes in governmental regulations, tax rates and similar matters;

|

|

|

●

|

changes in our business strategy;

|

|

|

●

|

availability of investment opportunities in commercial real estate-related and commercial finance assets;

|

|

|

●

|

the degree and nature of our competition;

|

|

|

●

|

the adequacy of our cash reserves and working capital; and

|

|

|

●

|

the timing of cash flows, if any, from our investments.

|

|

BUSINESS

|

|

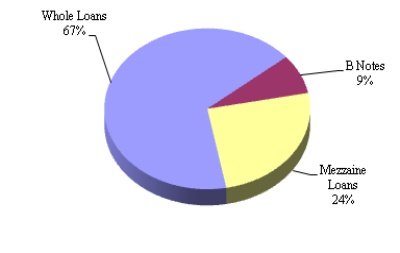

Asset Class

|

Principal Investments

|

|

|

Commercial real estate-related assets

|

● First mortgage loans, which we refer to as whole loans;

● First priority interests in first mortgage real estate loans, which we refer to as A notes;

● Subordinated interests in first mortgage real estate loans, which we refer to as B notes;

● Mezzanine debt related to commercial real estate that is senior to the borrower’s equity position but

subordinated to other third-party financing;

● Commercial mortgage-backed securities, which we refer to as CMBS;

|

|

|

Commercial finance assets

|

● Senior secured corporate loans, which we refer to as bank loans;

● Other asset-backed securities, which we refer to as other ABS;

● Lease receivables, principally small- and middle-ticket commercial direct financing leases and notes;

● Structured note investments, which comprise our trading securities portfolio;

● Debt tranches of collateralized debt obligations and collateralized loan obligations, which we refer to

as CDOs and CLOs, respectively.

|

|

Amortized

cost

|

Estimated fair value (1)

|

Percent of portfolio

|

Weighted

average

coupon

|

|||||||||||||

|

Loans Held for Investment:

|

||||||||||||||||

|

Commercial real estate loans:

|

||||||||||||||||

|

Mezzanine loans

|

$ | 117,245 | $ | 134,330 | 8.09% | 4.48% | ||||||||||

|

B notes

|

57,451 | 56,644 | 3.41% | 5.62% | ||||||||||||

|

Whole loans

|

441,372 | 398,538 | 24.01% | 4.17% | ||||||||||||

|

Bank loans

|

856,436 | 850,500 | 51.24% | 3.57% | ||||||||||||

| 1,472,504 | 1,440,012 | 86.75% | ||||||||||||||

|

Loans held for sale:

|

||||||||||||||||

|

Bank loans

|

4,027 | 4,027 | 0.24% | 3.07% | ||||||||||||

|

Commercial loans

|

24,566 | 24,566 | 1.48% | 5.90% | ||||||||||||

| 28,593 | 28,593 | 1.72% | ||||||||||||||

|

Investments in Available-for-Sale Securities:

|

||||||||||||||||

|

CMBS

|

83,224 | 63,938 | 3.85% | 5.08% | ||||||||||||

|

Other ABS

|

− | 22 | −% | −% | ||||||||||||

| 83,224 | 63,960 | 3.85% | ||||||||||||||

|

Investment Securities-Trading:

|

||||||||||||||||

|

Structured notes

|

7,984 | 17,723 | 1.07% | −% | ||||||||||||

|

Investment in lease receivables:

|

109,682 | 109,612 | 6.61% | 10.50% | ||||||||||||

|

Total portfolio/weighted average

|

$ | 1,701,987 | $ | 1,659,900 | 100.00% | |||||||||||

|

(1)

|

The fair value of our investments represents our management’s estimate of the price that a market participant would pay for such assets. Management bases this estimate on the underlying interest rates and credit spreads for fixed-rate securities and, to the extent available, quoted market prices.

|

|

Diversified/conglomerate manufacturing

|

3.3%

|

|

Leisure, amusement, motion pictures, entertainment

|

3.1%

|

|

Aerospace and defense

|

3.0%

|

|

Hotels, motels, inn and gaming

|

2.4%

|

|

Finance

|

1.9%

|

|

Machinery (non-agriculture, non-construction, non-electronic)

|

1.7%

|

|

Ecological

|

1.6%

|

|

Cargo transport

|

1.5%

|

|

Utilities

|

1.4%

|

|

Oil and gas

|

1.3%

|

|

Buildings and real estate

|

1.3%

|

|

Diversified natural resources, precious metals and minerals

|

1.2%

|

|

Personal and nondurable consumer products (mfg. only)

|

1.2%

|

|

Mining, steel, iron and non-precious metals

|

1.1%

|

|

Farming and agriculture

|

1.0%

|

|

Packaging and forest products

|

0.9%

|

|

Beverage, food and tobacco

|

0.6%

|

|

Containers, packaging and glass

|

0.6%

|

|

Home and office furnishings, housewares and durable consumer products

|

0.4%

|

|

Textiles and leather

|

0.3%

|

|

Temporary staffing

|

0.1%

|

|

Insurance

|

0.1%

|

|

|

●

|

general office equipment, such as office machinery, furniture and telephone and computer systems;

|

|

|

●

|

medical and dental practices and equipment for diagnostic and treatment use;

|

|

|

●

|

energy and climate control systems;

|

|

|

●

|

industrial equipment, including manufacturing, material handling and electronic diagnostic systems; and

|

|

|

●

|

agricultural equipment and facilities.

|

|

|

●

|

A monthly base management fee equal to 1/12th of the amount of our equity multiplied by 1.50%. Under the management agreement, ‘‘equity’’ is equal to the net proceeds from any issuance of shares of common stock less offering-related costs, plus or minus our retained earnings (excluding non-cash equity compensation incurred in current or prior periods) less any amounts we have paid for common stock repurchases. The calculation is adjusted for one-time events due to changes in accounting principles generally accepted in the United States, which we refer to as GAAP, as well as other non-cash charges, upon approval of our independent directors.

|

|

|

●

|

Incentive compensation calculated as follows: (i) 25% of the dollar amount by which (A) our adjusted operating earnings (before incentive compensation but after the base management fee) for such quarter per common share (based on the weighted average number of common shares outstanding for such quarter) exceeds (B) an amount equal to (1) the weighted average of the price per share of the common shares in the initial offering by us and the prices per share of the common shares in any subsequent offerings by us, in each case at the time of issuance thereof, multiplied by (2) the greater of (a) 2.00% and (b) 0.50% plus one-fourth of the Ten Year Treasury Rate for such quarter, multiplied by (ii) the weighted average number of common shares outstanding during such quarter subject to adjustment to exclude events pursuant to changes in GAAP or the application of GAAP, as well as non-recurring or unusual transactions or events, after discussion between the Manager and the Independent Directors and approval by a majority of the Independent Directors in the case of non-recurring or unusual transactions or events.

|

|

|

●

|

Reimbursement of out-of-pocket expenses and certain other costs incurred by the Manager that relate directly to us and our operations.

|

|

|

●

|

Pursuant to an amendment on October 16, 2009, the Manager will, in addition to a Chief Financial Officer, provide us with three accounting professionals, each of whom will be exclusively dedicated to our operations, and a director of investor relations who will be 50% dedicated to our operations. The amendment also provides that we will reimburse the Manager for the expense of the wages, salaries and benefits of the Chief Financial Officer and three accounting professionals and 50% of the salary and benefits of the director of investor relations. In addition, we began reimbursing our Chairman for wages, salary and benefits in February 2010.

|

|

|

●

|

if such shares are traded on a securities exchange, at the average of the closing prices of the shares on such exchange over the thirty day period ending three days prior to the issuance of such shares;

|

|

|

●

|

if such shares are actively traded over-the-counter, at the average of the closing bid or sales price as applicable over the thirty day period ending three days prior to the issuance of such shares; and

|

|

|

●

|

if there is no active market for such shares, at the fair market value as reasonably determined in good faith by our board of directors.

|

|

|

●

|

the Manager’s continued material breach of any provision of the management agreement following a period of 30 days after written notice thereof;

|

|

|

●

|

the Manager’s fraud, misappropriation of funds, or embezzlement against us;

|

|

|

●

|

the Manager’s gross negligence in the performance of its duties under the management agreement;

|

|

|

●

|

the bankruptcy or insolvency of the Manager, or the filing of a voluntary bankruptcy petition by the Manager;

|

|

|

●

|

the dissolution of the Manager; and

|

|

|

●

|

a change of control (as defined in the management agreement) of the Manager if a majority of our independent directors determines, at any point during the 18 months following the change of control, that the change of control was detrimental to the ability of the Manager to perform its duties in substantially the same manner conducted before the change of control.

|

|

RISK FACTORS

|

|

|

●

|

the cash provided by our operating activities will not be sufficient to meet required payments of principal and interest,

|

|

|

●

|

the cost of financing may increase relative to the income from the assets financed, reducing the income we have available to pay distributions, and

|

|

|

●

|

our investments may have maturities that differ from the maturities of the related financing and, consequently, the risk that the terms of any refinancing we obtain will not be as favorable as the terms of existing financing.

|

|

|

●

|

If we accumulate assets for a CDO on a short-term credit facility and do not complete the CDO financing, or if a default occurs under the facility, the short-term lender will sell the assets and we would be responsible for the amount by which the original purchase price of the assets exceeds their sale price, up to the amount of our investment or guaranty.

|

|

|

●

|

An event of default under one short-term facility may constitute a default under other credit facilities we may have, potentially resulting in asset sales and losses to us, as well as increasing our financing costs or reducing the amount of investable funds available to us.

|

|

|

●

|

We may be unable to acquire a sufficient amount of eligible assets to maximize the efficiency of a CDO issuance, which would require us to seek other forms of term financing or liquidate the assets. We may not be able to obtain term financing on acceptable terms, or at all, and liquidation of the assets may be at prices less than those we paid, resulting in losses to us.

|

|

|

●

|

Using short-term financing to accumulate assets for a CDO issuance may require us to obtain new financing as the short-term financing matures. Residual financing may not be available on acceptable terms, or at all. Moreover, an increase in short-term interest rates at the time that we seek to enter into new borrowings would reduce the spread between the income on our assets and the cost of our borrowings. This would reduce returns on our assets, which would reduce earnings and, in turn, cash available for distribution to our stockholders.

|

|

|

●

|

We will lose money on our repurchase transactions if the counterparty to the transaction defaults on its obligation to resell the underlying security back to us at the end of the transaction term, or if the value of the underlying security has declined as of the end of the term or if we default on our obligations under the repurchase agreements.

|

|

|

●

|

Available interest rate hedges may not correspond directly with the interest rate risk against which we seek protection.

|

|

|

●

|

The duration of the hedge may not match the duration of the related liability.

|

|

|

●

|

Interest rate hedging can be expensive, particularly during periods of rising and volatile interest rates. Hedging costs may include structuring and legal fees and fees payable to hedge counterparties to execute the hedge transaction.

|

|

|

●

|

Losses on a hedge position may reduce the cash available to make distributions to stockholders, and may exceed the amounts invested in the hedge position.

|

|

|

●

|

The amount of income that a REIT may earn from hedging transactions, other than through a TRS, is limited by federal tax provisions governing REITs.

|

|

|

●

|

The credit quality of the party owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction.

|

|

|

●

|

The party owing money in the hedging transaction may default on its obligation to pay.

|

|

|

●

|

tenant mix, success of tenant businesses and property management decisions,

|

|

|

●

|

property location and condition,

|

|

|

●

|

competition from comparable types of properties,

|

|

|

●

|

changes in laws that increase operating expenses or limit rents that may be charged,

|

|

|

●

|

any need to address environmental contamination at the property,

|

|

|

●

|

the occurrence of any uninsured casualty at the property,

|

|

|

●

|

changes in national, regional or local economic conditions and/or the conditions of specific industry segments in which our lessees may operate,

|

|

|

●

|

declines in regional or local real estate values,

|

|

|

●

|

declines in regional or local rental or occupancy rates,

|

|

|

●

|

increases in interest rates, real estate tax rates and other operating expenses,

|

|

|

●

|

increases in costs of construction material;

|

|

|

●

|

changes in governmental rules, regulations and fiscal policies, including environmental legislation, and

|

|

|

●

|

acts of God, terrorism, social unrest and civil disturbances.

|

|

|

●

|

There are ownership limits and restrictions on transferability and ownership in our charter. For purposes of assisting us in maintaining our REIT qualification under the Internal Revenue Code, our charter generally prohibits any person from beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of any class or series of our outstanding capital stock. This restriction may:

|

|

|

–

|

discourage a tender offer or other transactions or a change in the composition of our board of directors or control that might involve a premium price for our shares or otherwise be in the best interests of our stockholders; or

|

|

|

–

|

result in shares issued or transferred in violation of such restrictions being automatically transferred to a trust for a charitable beneficiary, resulting in the forfeiture of those shares.

|

|

|

●

|

Our charter permits our board of directors to issue stock with terms that may discourage a third party from acquiring us. Our board of directors may amend our charter without stockholder approval to increase the total number of authorized shares of stock or the number of shares of any class or series and issue common or preferred stock having preferences, conversion or other rights, voting powers, restrictions, limitations as to distributions, qualifications, or terms or conditions of redemption as determined by our board. Thus, our board could authorize the issuance of stock with terms and conditions that could have the effect of discouraging a takeover or other transaction in which holders of some or a majority of our shares might receive a premium for their shares over the then-prevailing market price.

|

|

|

●

|

Our charter and bylaws contain other possible anti-takeover provisions. Our charter and bylaws contain other provisions that may have the effect of delaying or preventing a change in control of us or the removal of existing directors and, as a result, could prevent our stockholders from being paid a premium for their common stock over the then-prevailing market price.

|

|

|

●

|

any person who beneficially owns ten percent or more of the voting power of the corporation’s shares; or

|

|

|

●

|

an affiliate or associate of the corporation who, at any time within the two-year period before the date in question, was the beneficial owner of ten percent or more of the voting power of the then outstanding voting stock of the corporation.

|

|

|

●

|

80% of the votes entitled to be cast by holders of outstanding shares of voting stock of the corporation; and

|

|

|

●

|

two-thirds of the votes entitled to be cast by holders of voting stock of the corporation other than shares held by the interested stockholder with whom or with whose affiliate the business combination is to be effected or held by an affiliate or associate of the interested stockholder.

|

|

|

●

|

actual receipt of an improper benefit or profit in money, property or services; or

|

|

|

●

|

a final judgment based upon a finding of active and deliberate dishonesty by the director or officer that was material to the cause of action adjudicated.

|

|

|

●

|

85% of our ordinary income for that year;

|

|

|

●

|

95% of our capital gain net income for that year; and

|

|

|

●

|

100% our undistributed taxable income from prior years.

|

|

UNRESOLVED STAFF COMMENTS

|

|

PROPERTIES

|

|

LEGAL PROCEEDINGS

|

|

[OMITTED AND RESERVED]

|

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

High

|

Low

|

Dividends Declared

|

||||||||||

|

Fiscal 2010

|

||||||||||||

|

Fourth Quarter

|

$ | 7.65 | $ | 6.27 | $ | 0.25 | (1) | |||||

|

Third Quarter

|

$ | 6.68 | $ | 5.17 | $ | 0.25 | ||||||

|

Second Quarter

|

$ | 7.47 | $ | 5.15 | $ | 0.25 | ||||||

|

First Quarter

|

$ | 7.18 | $ | 5.05 | $ | 0.25 | ||||||

|

Fiscal 2009

|

||||||||||||

|

Fourth Quarter

|

$ | 5.40 | $ | 4.33 | $ | 0.25 | ||||||

|

Third Quarter

|

$ | 6.21 | $ | 2.76 | $ | 0.30 | ||||||

|

Second Quarter

|

$ | 3.89 | $ | 2.96 | $ | 0.30 | ||||||

|

First Quarter

|

$ | 3.83 | $ | 1.50 | $ | 0.30 | ||||||

|

(1)

|

We distributed a regular dividend of $0.25 on January 26, 2011, to stockholders of record as of December 31, 2010.

|

|

SELECTED FINANCIAL DATA

|

|

As of and for the years ended

|

||||||||||||||||||||

|

December 31,

|

||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Consolidated Statement of Operations Data:

|

||||||||||||||||||||

|

REVENUES:

|

||||||||||||||||||||

|

Interest income

|

$ | 103,911 | $ | 97,593 | $ | 134,341 | $ | 176,995 | $ | 137,075 | ||||||||||

|

Interest expense

|

36,466 | 45,427 | 79,619 | 121,564 | 101,851 | |||||||||||||||

|

Net interest income

|

67,445 | 52,166 | 54,722 | 55,431 | 35,224 | |||||||||||||||

|

OPERATING EXPENSES

|

32,608 | 16,059 | 12,438 | 13,415 | 11,144 | |||||||||||||||

| 34,837 | 36,107 | 42,284 | 42,016 | 24,080 | ||||||||||||||||

|

OTHER (EXPENSES) REVENUES:

|

||||||||||||||||||||

|

Impairment losses on investment securities

|

(29,042 | ) | (27,490 | ) | (26,611 | ) | (48,853 | ) | (2,612 | ) | ||||||||||

|

Recognized in other comprehensive loss

|

(2,238 | ) | (14,019 | ) | (26,611 | ) | (22,576 | ) | (2,612 | ) | ||||||||||

|

Net impairment losses recognized in earnings

|

(26,804 | ) | (13,471 | ) | − | (26,277 | ) | − | ||||||||||||

|

Net realized gain (loss) on investment securities

available-for-sale and loans

|

4,821 | 1,890 | (1,637 | ) | (15,098 | ) | (8,627 | ) | ||||||||||||

|

Net realized gain on investments securities-trading

|

5,052 | − | − | − | − | |||||||||||||||

|

Net unrealized gain on investments securities-trading

|

9,739 | − | − | − | − | |||||||||||||||

|

Gain on deconsolidation

|

− | − | − | 14,259 | − | |||||||||||||||

|

Provision for loan and lease losses

|

(43,321 | ) | (61,383 | ) | (46,160 | ) | (6,211 | ) | − | |||||||||||

|

Gain on the extinguishment of debt

|

34,610 | 44,546 | 1,750 | − | − | |||||||||||||||

|

Gain on the settlement of loan

|

− | − | 574 | − | − | |||||||||||||||

|

Other income (expense)

|

513 | (1,350 | ) | 115 | 201 | 153 | ||||||||||||||

|

Total other (expense) revenue

|

(15,390 | ) | (29,768 | ) | (45,358 | ) | (33,126 | ) | (8,474 | ) | ||||||||||

|

NET INCOME (LOSS)

|

$ | 19,447 | $ | 6,339 | $ | (3,074 | ) | $ | 8,890 | $ | 15,606 | |||||||||

|

Consolidated Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 29,488 | $ | 51,991 | $ | 14,583 | $ | 6,029 | $ | 5,354 | ||||||||||

|

Restricted cash

|

168,192 | 85,125 | 60,394 | 119,482 | 30,721 | |||||||||||||||

|

Investment securities-trading

|

17,723 | − | − | − | − | |||||||||||||||

|

Investment securities available-for-sale, pledged as

collateral, at fair value

|

57,998 | 39,304 | 22,466 | 65,464 | 420,997 | |||||||||||||||

|

Investment securities available-for-sale, at fair value

|

5,962 | 5,238 | 6,794 | − | − | |||||||||||||||

|

Investment securities held-to-maturity, pledged as

collateral

|

29,036 | 31,401 | 28,157 | 18,517 | 3,978 | |||||||||||||||

|

Property available-for-sale

|

4,444 | − | − | − | − | |||||||||||||||

|

Loans, pledged as collateral and net of

allowances of $34.2 million, $47.1 million,

$43.9 million, $0 and $0

|

1,443,271 | 1,557,757 | 1,684,622 | 1,748,122 | 1,236,310 | |||||||||||||||

|

Loans held for sale

|

28,593 | 8,050 | − | − | − | |||||||||||||||

|

Lease receivables, net of allowances of $70,000, $1.1

million, $450,000, $293,000 and $0, net of

unearned income

|

109,612 | 927 | 104,015 | 95,030 | 88,970 | |||||||||||||||

|

Total assets

|

1,934,200 | 1,791,404 | 1,936,031 | 2,072,148 | 1,802,829 | |||||||||||||||

|

Borrowings

|

1,543,251 | 1,534,874 | 1,699,763 | 1,760,969 | 1,463,853 | |||||||||||||||

|

Total liabilities

|

1,585,874 | 1,562,574 | 1,749,726 | 1,800,542 | 1,485,278 | |||||||||||||||

|

Total stockholders’ equity

|

348,326 | 228,830 | 186,305 | 271,606 | 317,551 | |||||||||||||||

|

Per Share Data:

|

||||||||||||||||||||

|

Dividends declared per common share

|

$ | 1.00 | $ | 1.15 | $ | 1.60 | $ | 1.62 | $ | 1.49 | ||||||||||

|

Net income (loss) per share – basic

|

$ | 0.41 | $ | 0.25 | $ | (0.12 | ) | $ | 0.36 | $ | 0.89 | |||||||||

|

Net income (loss) per share − diluted

|

$ | 0.41 | $ | 0.25 | $ | (0.12 | ) | $ | 0.36 | $ | 0.87 | |||||||||

|

Weighted average number of shares outstanding - basic

|

47,715,082 | 25,205,403 | 24,757,386 | 24,610,468 | 17,538,273 | |||||||||||||||

|

Weighted average number of shares outstanding - diluted

|

47,907,281 | 25,355,821 | 24,757,386 | 24,860,184 | 17,881,355 | |||||||||||||||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

|

|

|

●

|

$17.7 million of commercial real estate loans paid off;

|

|

|

●

|

$31.7 million of commercial real estate loan principal repayments;

|

|

|

●

|

$36.8 million at commercial real estate loan sale proceeds;

|

|

|

●

|

$267.0 million of bank loan principal repayments; and

|

|

|

●

|

$57.6 million of bank loan sale proceeds.

|

|

Years Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Interest income:

|

||||||||||||

|

Interest income from loans:

|

||||||||||||

|

Bank loans

|

$ | 43,970 | $ | 35,770 | $ | 53,172 | ||||||

|

Commercial real estate loans

|

32,866 | 48,793 | 63,936 | |||||||||

|

Total interest income from loans

|

76,836 | 84,563 | 117,108 | |||||||||

|

Interest income from securities:

|

||||||||||||

|

CMBS-private placement

|

9,768 | 5,404 | 4,425 | |||||||||

|

Securities held-to-maturity

|

1,466 | 1,807 | 1,934 | |||||||||

|

Other ABS

|

200 | 14 | 19 | |||||||||

|

Total interest income from securities available-for-sale

|

11,434 | 7,225 | 6,378 | |||||||||

|

Leasing

|

11,306 | 4,336 | 8,180 | |||||||||

|

Interest income – other:

|

||||||||||||

|

Interest income – other (1)

|

− | − | 997 | |||||||||

|

Preference payments on structured notes

|

3,112 | − | − | |||||||||

|

Temporary investment in over-night repurchase

agreements

|

1,223 | 1,469 | 1,678 | |||||||||

|

Total interest income – other

|

4,335 | 1,469 | 2,675 | |||||||||

|

Total interest income

|

$ | 103,911 | $ | 97,593 | $ | 134,341 | ||||||

|

(1)

|

Represents cash received on our 90% equity investment in Ischus CDO II in excess of our investment. Income on this investment was recognized using the cost recovery method.

|

|

Year Ended

|

Year Ended

|

Year Ended

|

||||||||||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

December 31, 2008

|

||||||||||||||||||||||

|

Weighted Average

|

Weighted Average

|

Weighted Average

|

||||||||||||||||||||||

|

Yield

|

Balance

|

Yield

|

Balance

|

Yield

|

Balance

|

|||||||||||||||||||

|

Interest income:

|

||||||||||||||||||||||||

|

Interest income from loans:

|

||||||||||||||||||||||||

|

Bank loans

|

4.82% | $ | 907,582 | 3.87% | $ | 943,854 | 5.62% | $ | 947,753 | |||||||||||||||

|

Commercial real estate loans

|

4.68% | $ | 694,153 | 6.12% | $ | 785,380 | 7.48% | $ | 840,874 | |||||||||||||||

|

Interest income from securities:

|

||||||||||||||||||||||||

|

CMBS-private placement

|

6.97% | $ | 140,377 | 5.90% | $ | 90,784 | 5.76% | $ | 76,216 | |||||||||||||||

|

Securities held-to-maturity

|

4.12% | $ | 35,295 | 5.28% | $ | 33,249 | 7.72% | $ | 25,782 | |||||||||||||||

|

Other ABS

|

8.71% | $ | 2,300 | 4.98% | $ | 281 | 0.32% | $ | 6,000 | |||||||||||||||

|

Leasing

|

15.61% | $ | 75,008 | 6.88% | $ | 65,300 | 8.68% | $ | 94,864 | |||||||||||||||

|

Type of Security

|

Coupon

Interest

|

Unamortized (Discount) Premium

|

Net Amortization

/Accretion

|

Interest

Income

|

Fee Income

|

Total

|

|||||||||||||||||

|

Year Ended December 31, 2010:

|

|||||||||||||||||||||||

|

Bank loans

|

3.24% | $ | (26,568 | ) | $ | 13,919 | $ | 30,051 | $ | − | $ | 43,970 | |||||||||||

|

Commercial real estate loans

|

4.50% | $ | (171 | ) | (15 | ) | 32,163 | 718 | 32,866 | ||||||||||||||

|

Total interest income from loans

|

13,904 | 62,214 | 718 | 76,836 | |||||||||||||||||||

|

CMBS-private placement

|

3.79% | $ | (23,294 | ) | 4,359 | 5,410 | − | 9,768 | |||||||||||||||

|

Securities held-to-maturity

|

2.45% | $ | (2,844 | ) | 409 | 1,056 | − | 1,466 | |||||||||||||||

|

Other ABS

|

− | 200 | − | 200 | |||||||||||||||||||

|

Total interest income from

securities

|

4,768 | 6,666 | − | 11,434 | |||||||||||||||||||

|

Leasing

|

− | 11,306 | − | 11,306 | |||||||||||||||||||

|

Preference payments on

structured notes

|

− | 3,112 | − | 3,112 | |||||||||||||||||||

|

Other

|

− | 1,223 | − | 1,223 | |||||||||||||||||||

|

Total interest income – other

|

− | 4,335 | − | 4,335 | |||||||||||||||||||

|

Total interest income

|

$ | 18,672 | $ | 84,521 | $ | 718 | $ | 103,911 | |||||||||||||||

|

Year Ended December 31, 2009:

|

|||||||||||||||||||||||

|

Bank loans

|

3.13% | $ | (27,682 | ) | $ | 6,955 | $ | 28,815 | $ | − | $ | 35,770 | |||||||||||

|

Commercial real estate loans

|

5.96% | $ | (30 | ) | 66 | 48,094 | 633 | 48,793 | |||||||||||||||

|

Total interest income from loans

|

7,021 | 76,909 | 633 | 84,563 | |||||||||||||||||||

|

CMBS-private placement

|

4.28% | $ | (29,030 | ) | 1,460 | 3,944 | − | 5,404 | |||||||||||||||

|

Securities held-to-maturity

|

4.54% | $ | (3,103 | ) | 238 | 1,569 | − | 1,807 | |||||||||||||||

|

Other ABS

|

− | 14 | − | 14 | |||||||||||||||||||

|

Total interest income from

securities

|

1,698 | 5,527 | − | 7,225 | |||||||||||||||||||

|

Leasing

|

− | 4,336 | − | 4,336 | |||||||||||||||||||

|

Preference payments on

structured notes

|

− | − | − | − | |||||||||||||||||||

|

Other

|

− | 1,469 | − | 1,469 | |||||||||||||||||||

|

Total interest income – other

|

− | 1,469 | − | 1,469 | |||||||||||||||||||

|

Total interest income

|

$ | 8,719 | $ | 88,241 | $ | 633 | $ | 97,593 | |||||||||||||||

|

Year Ended December 31, 2008:

|

|||||||||||||||||||||||

|

Bank loans

|

5.53% | $ | (8,459 | ) | $ | 946 | $ | 52,226 | $ | − | $ | 53,172 | |||||||||||

|

Commercial real estate loans

|

7.18% | $ | (8 | ) | 88 | 63,059 | 789 | 63,936 | |||||||||||||||

|

Total interest income from loans

|

1,034 | 115,285 | 789 | 117,108 | |||||||||||||||||||

|

CMBS-private placement

|

5.18% | $ | (3,680 | ) | 444 | 3,981 | − | 4,425 | |||||||||||||||

|

Securities held-to-maturity

|

7.54% | $ | (87 | ) | − | 1,934 | − | 1,934 | |||||||||||||||

|

Other ABS

|

− | 19 | − | 19 | |||||||||||||||||||

|

Total interest income from

securities

|

444 | 5,934 | − | 6,378 | |||||||||||||||||||

|

Leasing

|

− | 8,180 | − | 8,180 | |||||||||||||||||||

|

Preference payments on

structured notes

|

− | − | − | − | |||||||||||||||||||

|

Other

|

− | 2,675 | − | 2,675 | |||||||||||||||||||

|

Total interest income – other

|

− | 2,675 | − | 2,675 | |||||||||||||||||||

|

Total interest income

|

$ | 1,478 | $ | 132,074 | $ | 789 | $ | 134,341 | |||||||||||||||

|

|

●

|

a decrease in the weighted average balance of assets of $91.2 million to $694.2 million for the year ended December 31, 2010 from $785.4 million for the year ended December 31, 2009 primarily as a result of payoffs and paydowns and to a lesser extent write-offs of impaired loans; and

|

|

|

●

|

a decrease in the weighted average yield on our assets to 4.68% for the year ended December 31, 2010 from 6.12% for the year ended December 31, 2009 primarily due to decreases in LIBOR floors, which is a reference index for the rates payable on these loans, from loan modifications during 2009 and 2010. There were $310.9 million of loans with a weighted average LIBOR floor of 2.37% as of December 31, 2009 that decreased to $157.4 million of loans with a weighted average LIBOR floor of 2.24% as of December 31, 2010.

|

|

|

●

|

an increase in the weighted average balance of assets of $49.6 million to $140.0 million for the year ended December 31, 2010 from $90.8 million for the year ended December 31, 2009, principally as a result of the purchase of $37.1 million par value of assets during the year ended December 31, 2010, and during the last half of the year ended December 31, 2009. This was partially offset by the impairment and subsequent non-payment of $24.8 million par value of assets during the fourth quarter of 2009 and in 2010; and

|

|

|

●

|

an increase in the weighted average yield to 6.97% for the year ended December 31, 2010 from 5.90% for the year ended December 31, 2009 primarily as a result of an increase of $2.9 million in accretion income to $4.4 million during the year ended December 31, 2010 from $1.5 million during the year ended December 31, 2009. The increase in accretion income resulted from the purchase of $91.9 million of CMBS at discounts during the last quarter of 2009 and during 2010 and accretion of those discounts into income. We make these discounted security purchases as we reinvest the proceeds from the loan and security payoffs from our borrowers and from the loans and securities we have sold, typically for credit reasons.

|

|

|

●

|

a decrease in the weighted average balance of assets of $55.5 million to $785.4 million for the year ended December 31, 2009 from $840.9 million for the year ended December 31, 2008 primarily as a result of payoffs and paydowns and to a lesser extent as a result of valuation allowances resulting from interest adjustments taken on several loans; and

|

|

|

●

|

a decrease in the weighted average yield on our assets to 6.12% for the year ended December 31, 2009 from 7.48% for the year ended December 31, 2008 primarily due to decreases in LIBOR floors, which is a reference index for the rates payable on these loans from loan modifications during 2009. Management determined that five of these modifications were due to financial distress of the borrowers and, accordingly, qualified as a troubled debt restructuring. There were $401.3 million of loans with a weighted average LIBOR floor of 4.71% as of December 31, 2008 which decreased to $310.9 million of loans with a weighted average LIBOR floor of 2.37% as of December 31, 2009.

|

|

|

●

|

an increase in the weighted average balance of assets of $14.6 million to $90.8 million for the year ended December 31, 2009 from $76.2 million for the year ended December 31, 2008 principally as a result of the purchase of $54.8 million par value of assets during the year ended December 31, 2009, largely during the last half of the year; and

|

|

|

●

|

an increase in the weighted average yield to 5.90% for the year ended December 31, 2009 from 5.76% for the year ended December 31, 2008 primarily as a result of an increase of $1.0 million in accretion income from assets purchased at discounts during the year ended December 31, 2009.

|

|

|

●

|

A decrease in interest income-other to $0 for the year ended December 31, 2009, as compared to $997,000 for the year ended December 31, 2008. The decrease is the result of our having written down our equity investment in Ischus CDO II to $0 in December 2008. Prior to that disposition, we used the cost recovery method to recognize the income on this investment. We sold our interest in Ischus CDO II in November 2007 and, as a result, deconsolidated it at that time. For the three months ended March 31, 2008, $997,000 of interest income was recognized on this investment. No such income has been recognized since March 2008.

|

|

|

●

|

A decrease in interest from temporary investments in over-night repurchase agreements of $209,000 (12%) to $1.5 million for the year ended December 31, 2009, as compared to $1.7 million for the year ended December 31, 2008 primarily as a result of lower rates earned on our over-night repurchase agreements.

|

|

Years Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Interest expense:

|

||||||||||||

|

Bank loans

|

$ | 9,573 | $ | 15,394 | $ | 35,165 | ||||||

|

Commercial real estate loans

|

8,068 | 11,072 | 27,924 | |||||||||

|

CMBS-private placement

|

− | − | 163 | |||||||||

|

Leasing

|

5,737 | 2,143 | 4,357 | |||||||||

|

General

|

13,088 | 16,818 | 12,010 | |||||||||

|

Total interest income

|

$ | 36,466 | $ | 45,427 | $ | 79,619 | ||||||

|

Year Ended

|

Year Ended

|

Year Ended

|

||||||||||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

December 31, 2008

|

||||||||||||||||||||||

|

Weighted Average

|

Weighted Average

|

Weighted Average

|

||||||||||||||||||||||

|

Yield

|

Balance

|

Yield

|

Balance

|

Yield

|

Balance

|

|||||||||||||||||||

|

Interest expense:

|

||||||||||||||||||||||||

|

Bank loans

|

1.04% | $ | 906,000 | 1.68% | $ | 906,000 | 3.82% | $ | 906,000 | |||||||||||||||

|

Commercial real estate loans

|

1.46% | $ | 543,345 | 1.70% | $ | 649,258 | 3.91% | $ | 696,492 | |||||||||||||||

|

CMBS-private placement

|

N/A | $ | − | N/A | $ | − | 4.34% | $ | 3,597 | |||||||||||||||

|

Leasing

|

8.81% | $ | 65,176 | 4.42% | $ | 44,388 | 4.67% | $ | 89,778 | |||||||||||||||

|

General

|

5.45% | $ | 231,821 | 5.01% | $ | 322,720 | 3.00% | $ | 383,860 | |||||||||||||||

|

|

●

|

a decrease in the weighted average balance of the related financings of $106.0 million to $543.3 million for the year ended December 31, 2010 as compared to $649.3 million for the year ended December 31, 2009, primarily due to the repurchase of $146.9 million of notes in 2009 and 2010; and

|

|

|

●

|

a decrease in the weighted average yield on our financings to 1.46% for the year ended December 31, 2010 from 1.70% for the year ended December 31, 2009 primarily due to the decrease in LIBOR which is a reference index for the rates payable on most of these notes.

|

|

|

●

|

a decrease in the weighted average yield on our financings to 1.70% for the year ended December 31, 2009 from 3.91% for the year ended December 31, 2008 primarily due to the decrease in LIBOR which is a reference index for the rates payable on most of these notes; and

|

|

|

●

|

a decrease in the weighted average balance of the related financings of $47.2 million to $649.3 million for the year ended December 31, 2009 from $696.5 million for the year ended December 31, 2008 as a result of our buyback of $55.5 million in notes and the payoff of $17.1 million in repurchase agreement debt during the year.

|

|

Years Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Non-investment expenses:

|

||||||||||||

|

Management fees-related party

|

$ | 13,216 | $ | 8,363 | $ | 6,301 | ||||||

|

Equity compensation-related party

|

2,221 | 1,240 | 540 | |||||||||

|

Professional services

|

3,627 | 3,866 | 3,349 | |||||||||

|

Insurance

|

759 | 828 | 641 | |||||||||

|

Depreciation on operating leases

|

4,003 | − | − | |||||||||

|

General and administrative

|

3,061 | 1,764 | 1,848 | |||||||||

|

Income tax expense (benefit)

|

5,721 | (2 | ) | (241 | ) | |||||||

|

Total non-investment expenses

|

$ | 32,608 | $ | 16,059 | $ | 12,438 | ||||||

|

Years Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Impairment losses on investment securities

|

$ | (29,042 | ) | $ | (27,490 | ) | $ | (26,611 | ) | |||

|

Recognized in other comprehensive loss

|

(2,238 | ) | (14,019 | ) | (26,611 | ) | ||||||

|

Net impairment losses recognized in earnings

|

(26,804 | ) | (13,471 | ) | − | |||||||

|

Net realized gains (losses) on investment securities

available-for sale and loans

|

4,821 | 1,890 | (1,637 | ) | ||||||||

|

Net realized gain on investment securities-trading

|

5,052 | − | − | |||||||||

|

Net unrealized gain on investment securities-trading

|

9,739 | − | − | |||||||||

|

Provision for loan and lease losses

|

(43,321 | ) | (61,383 | ) | (46,160 | ) | ||||||

|

Gain on the extinguishment of debt

|

34,610 | 44,546 | 1,750 | |||||||||

|

Gain on the settlement of a loan

|

− | − | 574 | |||||||||

|

Other income (expense)

|

513 | (1,350 | ) | 115 | ||||||||

|

Total

|

$ | (15,390 | ) | $ | (29,768 | ) | $ | (45,358 | ) | |||

|

Year Ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

CRE loan portfolio

|

$ | 44,357 | $ | 31,856 | ||||

|

Bank loan portfolio

|

(1,348 | ) | 26,855 | |||||

|

Lease receivables

|

312 | 2,672 | ||||||

| $ | 43,321 | $ | 61,383 | |||||

|

Year Ended

|

||||||||

|

December 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

CRE loan portfolio

|

$ | 31,856 | $ | 14,817 | ||||

|

Bank loan portfolio

|

26,855 | 30,442 | ||||||

|

Lease receivables

|

2,672 | 901 | ||||||

| $ | 61,383 | $ | 46,160 | |||||

|

Amortized

cost (3)

|

Dollar

price

|

Net carrying amount

|

Dollar

price

|

Net carrying amount less amortized cost

|

Dollar

price

|

|||||||||||||||||||

|

December 31, 2010

|

||||||||||||||||||||||||

|

Floating rate

|

||||||||||||||||||||||||

|

CMBS-private placement

|

$ | 31,127 | 100.00% | $ | 9,569 | 30.74% | $ | (21,558 | ) | -69.26% | ||||||||||||||

|

Structured notes

|

7,984 | 34.09% | 17,723 | 75.67% | 9,739 | 41.58% | ||||||||||||||||||

|

Other ABS

|

− | 0.00% | 22 | 0.26% | 22 | 0.26% | ||||||||||||||||||

|

B notes (1)

|

26,485 | 99.94% | 26,071 | 98.38% | (414 | ) | -1.56% | |||||||||||||||||

|

Mezzanine loans (1)

|

83,699 | 100.00% | 82,680 | 98.78% | (1,019 | ) | -1.22% | |||||||||||||||||

|

Whole loans (1)

|

441,372 | 99.92% | 419,207 | 94.91% | (22,165 | ) | -5.01% | |||||||||||||||||

|

Bank loans (2)

|

856,436 | 96.99% | 850,500 | 96.32% | (5,936 | ) | -0.67% | |||||||||||||||||

|

Loans held for sale (3)

|

13,593 | 55.92% | 13,593 | 55.92% | − | 0.00% | ||||||||||||||||||

|

ABS held-to-maturity (4)

|

29,036 | 91.08% | 25,941 | 81.37% | (3,095 | ) | -9.71% | |||||||||||||||||

|

Total floating rate

|

1,489,732 | 95.86% | 1,445,306 | 93.01% | (44,426 | ) | -2.85% | |||||||||||||||||

|

Fixed rate

|

||||||||||||||||||||||||

|

CMBS – private placement

|

52,097 | 48.30% | 54,369 | 50.41% | 2,272 | 2.11% | ||||||||||||||||||

|

B notes (1)

|

30,966 | 99.53% | 30,482 | 97.97% | (484 | ) | -1.56% | |||||||||||||||||

|

Mezzanine loans (1)

|

38,545 | 100.23% | 31,012 | 80.64% | (7,533 | ) | -19.59% | |||||||||||||||||

|

Loans held for sale (3)

|

15,000 | 75.00% | 15,000 | 75.00% | − | 0.00% | ||||||||||||||||||

|

Lease receivables (5)

|

109,682 | 100.00% | 109,612 | 99.94% | (70 | ) | -0.06% | |||||||||||||||||

|

Total fixed rate

|

246,290 | 80.20% | 240,475 | 78.30% | (5,815 | ) | -1.90% | |||||||||||||||||

|

Grand total

|

$ | 1,736,022 | 93.28% | $ | 1,685,781 | 90.58% | $ | (50,241 | ) | -2.70% | ||||||||||||||

|

December 31, 2009

|

||||||||||||||||||||||||

|

Floating rate

|

||||||||||||||||||||||||

|

CMBS-private placement

|

$ | 32,043 | 100.00% | $ | 11,185 | 34.91% | $ | (20,858 | ) | -65.09% | ||||||||||||||

|

Other ABS

|

24 | 0.29% | 24 | 0.29% | − | −% | ||||||||||||||||||

|

B notes (1)

|

26,479 | 99.92% | 26,263 | 99.11% | (216 | ) | -0.81% | |||||||||||||||||

|

Mezzanine loans (1)

|

124,048 | 100.00% | 123,058 | 99.20% | (990 | ) | -0.80% | |||||||||||||||||

|

Whole loans (1)

|

403,230 | 99.81% | 381,710 | 94.49% | (21,520 | ) | -5.32% | |||||||||||||||||

|

Bank loans (2)

|

857,202 | 96.87% | 798,614 | 90.25% | (58,588 | ) | -6.62% | |||||||||||||||||

|

Loans held for sale (3)

|

8,050 | 78.88% | 8,050 | 78.88% | − | −% | ||||||||||||||||||

|

ABS held-to-maturity (4)

|

31,401 | 88.77% | 21,287 | 60.18% | (10,114 | ) | -28.59% | |||||||||||||||||

|

Total floating rate

|

1,482,477 | 97.23% | 1,370,191 | 89.82% | (112,286 | ) | -7.41% | |||||||||||||||||

|

Fixed rate

|

||||||||||||||||||||||||

|

CMBS – private placement

|

60,067 | 64.08% | 33,333 | 35.56% | (26,734 | ) | -28.52% | |||||||||||||||||

|

B notes (1)

|

54,977 | 100.05% | 54,527 | 99.23% | (450 | ) | -0.82% | |||||||||||||||||

|

Mezzanine loans (1)

|

58,638 | 100.28% | 53,200 | 90.98% | (5,438 | ) | -9.30% | |||||||||||||||||

|

Whole loans (1)

|

80,305 | 99.78% | 79,647 | 98.96% | (658 | ) | -0.82% | |||||||||||||||||

|

Lease receivables (5)

|

2,067 | 100.05% | 927 | 44.87% | (1,140 | ) | -55.18% | |||||||||||||||||

|

Total fixed rate

|

256,054 | 88.38% | 221,634 | 76.50% | (34,420 | ) | -11.88% | |||||||||||||||||

|

Grand total

|

$ | 1,738,531 | 95.78% | $ | 1,591,800 | 87.70% | $ | (146,731 | ) | -8.08% | ||||||||||||||

|

(1)

|

Net carrying amount includes an allowance for loan losses of $31.6 million at December 31, 2010, allocated as follows: B notes ($899,000), mezzanine loans ($8.5 million) and whole loans ($22.2 million). Net carrying amount includes an allowance for loan losses of $29.3 million at December 31, 2009, allocated as follows: B notes ($666,000), mezzanine loans ($6.4 million) and whole loans ($22.2 million).

|

|

(2)

|

The bank loan portfolio is carried at amortized cost less allowance for loan loss and was $853.8 million at December 31, 2010. The amount disclosed represents net realizable value at December 31, 2010, which includes a $2.6 million allowance for loan losses at December 31, 2010. The bank loan portfolio was $839.4 million (net of allowance of $17.8 million) at December 31, 2009.

|

|

(3)

|

Loans held for sale are carried at the lower of cost or market. Amortized cost is equal to fair value.

|

|

(4)

|

ABS held-to-maturity are carried at amortized cost less other-than-temporary impairments.

|

|

(5)

|

Net carrying amount includes a $70,000 and $1.1 million allowance for lease receivable losses at December 31, 2010 and 2009, respectively.

|

|

|

●

|

the length of time the market value has been less than amortized cost;

|

|

|

●

|

the severity of the impairment;

|

|

|

●

|

the expected loss of the security as generated by third party software;

|

|

|

●

|

credit ratings from the rating agencies;

|

|

|

●

|

underlying credit fundamentals of the collateral backing the security; and

|

|

|

●

|

whether, based upon our intent, it is more likely than not that we will sell the security before the recovery of the amortized cost basis.

|

|

|

●

|

dealer quotes, as described above;

|

|

|

●

|

quotes on more actively-traded, higher-rated securities issued in a similar time period, adjusted for differences in rating and seniority; and

|

|

|

●

|

the value resulting from an internal valuation model using an income approach based upon an appropriate risk-adjusted yield, time value and projected losses using default assumptions based upon an historical analysis of underlying loan performance.

|

|

December 31, 2010

|

December 31, 2009

|

|||||||||||||||

|

Amortized Cost

|

Dollar Price

|

Amortized Cost

|

Dollar Price

|

|||||||||||||

|

Moody’s Ratings Category:

|

||||||||||||||||

|

Aaa

|

$ | − | −% | $ | 11,690 | 64.70% | ||||||||||

|

Aa1 through Aa3

|

3,345 | 66.90% | 9,639 | 50.73% | ||||||||||||

|

A1 through A3

|

16,853 | 81.24% | 4,826 | 56.14% | ||||||||||||

|

Baa1 through Baa3

|

24,763 | 67.26% | 2,021 | 33.68% | ||||||||||||

|

Ba1 through Ba3

|

1,604 | 14.70% | 10,443 | 100.00% | ||||||||||||

|

B1 through B3

|

4,678 | 93.56% | 24,449 | 85.27% | ||||||||||||

|

Caa1 through Caa3

|

24,603 | 97.57% | 12,832 | 98.71% | ||||||||||||

|

Ca through C

|

7,377 | 20.90% | 16,210 | 73.68% | ||||||||||||

|

Total

|

$ | 83,223 | 59.88% | $ | 92,110 | 73.23% | ||||||||||

|

S&P Ratings Category:

|

||||||||||||||||

|

AAA

|

$ | − | −% | $ | 5,997 | 59.97% | ||||||||||

|

AA+ through AA-

|

− | −% | 3,659 | 40.65% | ||||||||||||

|

A+ through A-

|

9,306 | 86.60% | 6,544 | 62.75% | ||||||||||||

|

BBB+ through BBB-

|

31,072 | 70.91% | 11,955 | 59.49% | ||||||||||||

|

BB+ through BB-

|

6,575 | 50.58% | 7,847 | 78.76% | ||||||||||||

|

B+ through B-

|

− | −% | 9,081 | 90.81% | ||||||||||||

|

CCC+ through CCC-

|

36,211 | 64.52% | 47,027 | 83.54% | ||||||||||||

|

D

|

59 | 0.39% | − | |||||||||||||

|

Total

|

$ | 83,223 | 59.88% | $ | 92,110 | 73.23% | ||||||||||

|

Weighted average rating factor

|

3,653 | 2,971 | ||||||||||||||

|

Amortized Cost

|

Unrealized Gains

|

Unrealized Losses

|

Fair

Value

|

|||||||||||||

|

December 31, 2010:

|

||||||||||||||||

|

Structured notes

|

$ | 7,984 | $ | 9,739 | $ | − | $ | 17,723 | ||||||||

|

Total

|

$ | 7,984 | $ | 9,739 | $ | − | $ | 17,723 | ||||||||

|

Description

|

Number of Loans

|

Amortized

Cost

|

Contracted

Interest Rates

|

Maturity Dates (4)

|

|||||||

|

December 31, 2010:

|

|||||||||||

|

Whole loans, floating rate (1)

|

25 | $ | 441,372 |

LIBOR plus 1.50% to

LIBOR plus 5.75%

|

May 2011 to

January 2018

|

||||||

|

B notes, floating rate

|

2 | 26,485 |

LIBOR plus 2.50% to

LIBOR plus 3.01%

|

July 2011 to

October 2011

|

|||||||

|

B notes, fixed rate

|

2 | 30,966 |

7.00% to 8.68%

|

July 2011 to

April 2016

|

|||||||

|

Mezzanine loans, floating rate

|

6 | 93,266 |

LIBOR plus 2.15% to

LIBOR plus 3.00%

|

May 2011 to

January 2013

|

|||||||

|

Mezzanine loans, fixed rate (3)

|

5 | 53,545 |

8.14% to 11.00%

|

January 2016 to

September 2016

|

|||||||

|

Total (2)

|

40 | $ | 645,634 | ||||||||

|

December 31, 2009:

|

|||||||||||

|

Whole loans, floating rate (1)

|

22 | $ | 403,230 |

LIBOR plus 1.50% to

LIBOR plus 4.40%

|

May 2010 to

February 2017

|

||||||

|

Whole loans, fixed rate (1)

|

5 | 80,305 |

6.98% to 10.00%

|

May 2010 to

August 2012

|

|||||||

|

B notes, floating rate

|

2 | 26,479 |

LIBOR plus 2.50% to

LIBOR plus 3.01%

|

July 2010 to

October 2010

|

|||||||

|

B notes, fixed rate

|

3 | 54,977 |

7.00% to 8.68%

|

July 2011 to

July 2016

|

|||||||

|

Mezzanine loans, floating rate

|

7 | 124,048 |

LIBOR plus 2.15% to

LIBOR plus 3.45%

|

May 2010 to

January 2013

|

|||||||

|

Mezzanine loans, fixed rate

|

5 | 58,638 |

8.14% to 11.00%

|

May 2010 to

September 2016

|

|||||||

|

Total (2)

|

44 | $ | 747,677 | ||||||||

|

(1)

|

Whole loans had $5.0 million and $5.6 million in unfunded loan commitments as of December 31, 2010 and 2009, respectively. These commitments are funded as the loans require additional funding and the related borrowers have satisfied the requirements to obtain this additional funding.

|

|

(2)

|

The total does not include an allowance for loan losses of $31.6 million and $29.3 million recorded as of December 31, 2010 and 2009, respectively.

|

|

(3)

|

Fixed rate mezzanine loan dates exclude a loan that matured in May 2010 and is in default and has been on non-accrual status as of December 31, 2010 and December 31, 2009, respectively..

|

|

(4)

|

Maturity dates do not include possible extension options that may be available to the borrowers.

|

|

December 31, 2010

|

December 31, 2009

|

||||||||||||||||

|

Amortized cost

|

Dollar price

|

Amortized cost

|

Dollar price

|

||||||||||||||

|

Moody’s ratings category:

|

|||||||||||||||||

|

Baa1 through Baa3

|

$ | 27,262 | 98.94% | $ | 38,419 | 98.09% | |||||||||||

|

Ba1 through Ba3

|

432,153 | 97.27% | 404,345 | 96.91% | |||||||||||||

|

B1 through B3

|

351,147 | 96.31% | 355,456 | 96.33% | |||||||||||||

|

Caa1 through Caa3

|

20,879 | 95.73% | 44,265 | 99.79% | |||||||||||||

|

Ca

|

7,062 | 100.00% | 13,697 | 88.68% | |||||||||||||

|

No rating provided

|

21,960 | 96.02% | 9,070 | 91.64% | |||||||||||||

|

Total

|

$ | 860,463 | 96.88% | $ | 865,252 | 96.67% | |||||||||||

|

S&P ratings category:

|

|||||||||||||||||

|

BBB+ through BBB-

|

$ | 54,560 | 99.13% | $ | 73,495 | 98.23% | |||||||||||

|

BB+ through BB-

|

373,971 | 97.25% | 353,595 | 97.11% | |||||||||||||

|

B+ through B-

|

360,581 | 96.21% | 337,208 | 96.12% | |||||||||||||

|

CCC+ through CCC-

|

29,707 | 95.43% | 42,198 | 96.65% | |||||||||||||

|

CC+ through CC-

|

1,633 | 100.18% | 3,104 | 100.13% | |||||||||||||

|

C+ through C-

|

− | −% | − | −% | |||||||||||||

| D | 1,050 | 100.00% | 8,602 | 95.91% | |||||||||||||

|

No rating provided

|

38,961 | 97.39% | 47,050 | 94.85% | |||||||||||||

|

Total

|

$ | 860,463 | 96.88% | $ | 865,252 | 96.67% | |||||||||||

|

Weighted average rating factor

|

2,061 | 2,131 | |||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||||||||||

|

Amortized cost

|

Dollar price

|

Amortized cost

|

Dollar price

|

|||||||||||||

|

Moody’s ratings category:

|

||||||||||||||||

|

Aa1 through Aa3

|

$ | 2,766 | 85.40% | $ | 2,854 | 82.89% | ||||||||||

|

A1 through A3

|

7,625 | 79.02% | 303 | 75.75% | ||||||||||||

|

Baa1 through Baa3

|

1,950 | 100.00% | − | −% | ||||||||||||

|

Ba1 through Ba3

|

2,503 | 93.57% | 4,427 | 95.72% | ||||||||||||

|

B1 through B3

|

4,998 | 98.10% | 4,319 | 97.63% | ||||||||||||

|

Caa1 through Caa3

|

9,194 | 99.16% | 9,913 | 99.14% | ||||||||||||

|

Ca

|

− | −% | 3,550 | 79.22% | ||||||||||||

|

No rating provided

|

− | −% | 6,035 | 75.44% | ||||||||||||

|

Total

|

$ | 29,036 | 91.08% | $ | 31,401 | 88.77% | ||||||||||

|

S&P ratings category:

|

||||||||||||||||

|

AA+ through AA-

|

$ | 5,099 | 83.41% | $ | − | −% | ||||||||||

|

A+ through A-

|

5,292 | 78.96% | − | −% | ||||||||||||

|

BBB+ through BBB-

|

3,516 | 96.99% | − | −% | ||||||||||||

|

B+ through B-

|

3,062 | 97.98% | − | −% | ||||||||||||

|

No rating provided

|

12,067 | 98.57% | 31,401 | 88.77% | ||||||||||||

|

Total

|

$ | 29,036 | 91.08% | $ | 31,401 | 88.77% | ||||||||||

|

Weighted average rating factor

|

3,105 | 4,028 | ||||||||||||||

|

Amortized Cost (1)

|

||||||||||||||||

|

Apidos I

|

Apidos III

|

Apidos Cinco

|

Total

|

|||||||||||||

|

December 31, 2010:

|

||||||||||||||||

|

Loans held for investment:

|

||||||||||||||||

|

First lien loans

|

$ | 288,163 | $ | 236,142 | $ | 296,208 | $ | 820,513 | ||||||||

|

Second lien loans

|

12,902 | 10,011 | 11,513 | 34,426 | ||||||||||||

|

Subordinated second lien loans

|

163 | 122 | − | 285 | ||||||||||||

|

Defaulted second lien loans

|

− | − | 362 | 362 | ||||||||||||

|

Total

|

301,228 | 246,275 | 308,083 | 855,586 | ||||||||||||

|

First lien loans held for sale at fair value

|

2,822 | − | 1,205 | 4,027 | ||||||||||||

|

Total

|

$ | 304,050 | $ | 246,275 | $ | 309,288 | $ | 859,613 | ||||||||

|

December 31, 2009:

|

||||||||||||||||

|

Loans held for investment:

|

||||||||||||||||

|

First lien loans

|

$ | 284,564 | $ | 232,861 | $ | 295,457 | $ | 812,882 | ||||||||

|

Second lien loans

|

11,507 | 9,096 | 10,657 | 31,260 | ||||||||||||

|

Subordinated second lien loans

|

163 | 122 | − | 285 | ||||||||||||

|

Defaulted first lien loans

|

4,511 | 5,579 | 1,685 | 11,775 | ||||||||||||

|

Defaulted second lien loans

|

500 | 500 | − | 1,000 | ||||||||||||

|

Total

|

301,245 | 248,158 | 307,799 | 857,202 | ||||||||||||

|

First lien loans held for sale at fair value

|

4,064 | 2,077 | 1,909 | 8,050 | ||||||||||||

|

Total

|

$ | 305,309 | $ | 250,235 | $ | 309,708 | $ | 865,252 | ||||||||

|

(1)

|

All loans are senior and secured unless otherwise noted.

|

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Leases, net of unearned income

|

$ | 75,908 | $ | 1,397 | ||||

|

Operating leases

|

17,900 | − | ||||||

|

Notes receivable

|

15,874 | 670 | ||||||

|

Subtotal

|

109,682 | 2,067 | ||||||

|

Allowance for lease losses

|

(70 | ) | (1,140 | ) | ||||

|

Total

|

$ | 109,612 | $ | 927 | ||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Fixed assets

|

$ | − | $ | 1 | ||||

|

Other receivables

|

1,374 | 555 | ||||||

|

Prepaid assets

|

590 | 612 | ||||||

|

Principal paydown

|

468 | 1,084 | ||||||

|

Total

|

$ | 2,432 | $ | 2,252 | ||||

|

Benchmark rate

|

Notional value

|

Strike rate

|

Effective date

|

Maturity date

|

Fair value

|

|||||||||||

|

Interest rate swap

|

1 month LIBOR

|

$ | 12,965 | 4.63% |

12/04/06

|

07/01/11

|

$ | (282 | ) | |||||||

|

Interest rate swap

|

1 month LIBOR

|

12,150 | 5.44% |

06/08/07

|

03/25/12

|

(759 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

12,750 | 5.27% |

07/25/07

|

08/06/12

|

(971 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

34,255 | 4.13% |

01/10/08

|

05/25/16

|

(2,309 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

1,681 | 5.72% |

07/09/07

|

10/01/16

|

(161 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

1,880 | 5.68% |

07/13/07

|

03/12/17

|

(350 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

81,556 | 5.58% |

06/08/07

|

04/25/17

|

(7,603 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

1,726 | 5.65% |

06/28/07

|

07/15/17

|

(159 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

3,850 | 5.65% |

07/19/07

|

07/15/17

|

(355 | ) | |||||||||

|

Interest rate swap

|

1 month LIBOR

|

4,023 | 5.41% |

08/07/07

|

07/25/17

|

(343 | ) | |||||||||

|

Total

|

$ | 166,836 | 5.17% | $ | (13,292 | ) | ||||||||||

|

|

●

|

In June 2007, we closed RREF CDO 2007-1, a $500.0 million CDO transaction that provided financing for commercial real estate loans. The investments held by RREF CDO 2007-1 collateralized $390.0 million of senior notes issued by the CDO vehicle, of which RCC Real Estate, Inc., or RCC Real Estate, a subsidiary of ours, purchased 100% of the class H senior notes, class K senior notes, class L senior notes and class M senior notes for $68.0 million at closing, $5.0 million of the Class J senior notes purchased in February 2008, $2.5 million of the Class J senior notes in November 2009, $11.9 million of the Class E senior notes, $11.9 million of the Class F senior notes and $7.3 million of the Class G senior notes in December 2009, an additional $250,000 of the Class J senior notes in January 2010, $7.5 million of Class B senior notes in June 2010 and $15.0 million of Class A-2 note in December 2010. In addition, RREF 2007-1 CDO Investor, LLC, a subsidiary of RCC Real Estate, purchased a $41.3 million equity interest representing 100% of the outstanding preference shares. At December 31, 2010, the notes issued to outside investors, net of repurchased notes, had a weighted average borrowing rate of 0.82%.

|

|

|

●

|

In May 2007, we closed Apidos Cinco CDO, a $350.0 million CDO transaction that provided financing for bank loans. The investments held by Apidos Cinco CDO collateralized $322.0 million of senior notes issued by the CDO vehicle, of which RCC Commercial Inc., or RCC Commercial, a subsidiary of ours, purchased a $28.0 million equity interest representing 100% of the outstanding preference shares. At December 31, 2010, the notes issued to outside investors had a weighted average borrowing rate of 0.79%.

|

|

|

●

|

In August 2006, we closed RREF CDO 2006-1, a $345.0 million CDO transaction that provided financing for commercial real estate loans. The investments held by RREF CDO 2006-1 collateralized $308.7 million of senior notes issued by the CDO vehicle, of which RCC Real Estate purchased 100% of the class J senior notes and class K senior notes for $43.1 million at closing and $7.5 million of the Class F senior notes in June 2009, $3.5 million of the Class E senior note and $4.0 million of the Class F senior notes in September 2009, an additional $20.0 million of Class A-1 senior notes in February 2010, $12.0 million of Class A-2 senior notes, $6.9 million of Class B senior notes, $7.7 million of Class C senior notes in April 2010, $7.5 million of Class D senior notes in June 2010 and $20.0 million of Class A-1 senior notes in July 2010. In addition, RREF 2006-1 CDO Investor, LLC, a subsidiary of RCC Real Estate, purchased a $36.3 million equity interest representing 100% of the outstanding preference shares. At December 31, 2010, the notes issued to outside investors, net of repurchased notes had a weighted average borrowing rate of 1.33%.

|

|

|

●

|

In May 2006, we closed Apidos CDO III, a $285.5 million CDO transaction that provided financing for bank loans. The investments held by Apidos CDO III collateralized $262.5 million of senior notes issued by the CDO vehicle, of which RCC Commercial purchased $23.0 million equity interest representing 100% of the outstanding preference shares. At December 31, 2010, the notes issued to outside investors had a weighted average borrowing rate of 0.75%.

|

|

|

●

|

In August 2005, we closed Apidos CDO I, a $350.0 million CDO transaction that provided financing for bank loans. The investments held by Apidos CDO I collateralize $321.5 million of senior notes issued by the CDO vehicle, of which RCC Commercial purchased $28.5 million equity interest representing 100% of the outstanding preference shares. At December 31, 2010, the notes issued to outside investors had a weighted average borrowing rate of 0.87%.

|

|

Commercial Real Estate Loans

|

Bank Loans

|

Lease Receivables

|

Loans Receivable-Related Party

|

Total

|

||||||||||||||||

|

December 31, 2010:

|

||||||||||||||||||||

|

Allowance for losses at

January 1, 2010

|

$ | 29,297 | $ | 17,825 | $ | 1,140 | $ | − | $ | 48,262 | ||||||||||

|

Provision for loan loss

|

44,357 | (1,348 | ) | 312 | − | 43,321 | ||||||||||||||

|

Loans charged-off

|

(42,037 | ) | (13,861 | ) | (1,432 | ) | − | (57,330 | ) | |||||||||||

|

Recoveries

|

− | − | 50 | − | 50 | |||||||||||||||

|

Allowance for losses at

December 31, 2010

|

$ | 31,617 | $ | 2,616 | $ | 70 | $ | − | $ | 34,303 | ||||||||||

|

Ending balance:

|

||||||||||||||||||||

|

Individually evaluated for

impairment

|

$ | 20,844 | $ | 112 | $ | 4,107 | $ | − | $ | 25,063 | ||||||||||

|

Collectively evaluated for

impairment

|

$ | 10,773 | $ | 2,504 | $ | 70 | $ | − | $ | 13,347 | ||||||||||

|

Loans acquired with

deteriorated credit quality

|

$ | − | $ | − | $ | − | $ | − | $ | − | ||||||||||

|

Loans:

|

||||||||||||||||||||

|

Ending balance:

|

||||||||||||||||||||

|

Individually evaluated for

impairment

|

$ | 42,219 | $ | 362 | $ | 10,024 | $ | − | $ | 52,605 | ||||||||||

|

Collectively evaluated for

impairment

|

$ | 603,415 | $ | 860,101 | $ | 99,658 | $ | 9,927 | $ | 1,573,101 | ||||||||||

|

Loans acquired with

deteriorated credit quality

|

$ | − | $ | − | $ | − | $ | − | $ | − | ||||||||||

|

December 31, 2009:

|

||||||||||||||||||||

|

Allowance for losses at

January 1, 2009

|

$ | 15,109 | $ | 28,758 | $ | 450 | $ | − | $ | 44,317 | ||||||||||

|

Provision for loan loss

|

31,856 | 26,855 | 2,672 | − | 61,383 | |||||||||||||||

|

Loans charged-off

|

(17,668 | ) | (37,788 | ) | (1,994 | ) | − | (57,450 | ) | |||||||||||

|

Recoveries

|