Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to __________

Commission File Number: 1-32733

RESOURCE CAPITAL CORP.

(Exact name of registrant as specified in its charter) |

| | |

Maryland | | 20-2287134 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification No.) |

| | |

712 Fifth Avenue, 12th Floor, New York, New York 10019 |

(Address of principal executive offices) (Zip Code) |

| | |

(212) 506-3870 |

(Registrant's telephone number, including area code) |

| | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Name of each exchange on which registered |

Common Stock, $.001 par value | | New York Stock Exchange |

8.50% Series A Cumulative Redeemable Preferred Stock | | New York Stock Exchange |

8.25% Series B Cumulative Redeemable Preferred Stock | | New York Stock Exchange |

8.625% Series C Cumulative Redeemable Preferred Stock | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer | ¨ | | Accelerated filer | þ |

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes R No

The aggregate market value of the voting common equity held by non-affiliates of the registrant, based on the closing price of such stock on the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2016) was approximately $375,434,727.

The number of outstanding shares of the registrant’s common stock on March 10, 2017 was 31,398,186 shares.

RESOURCE CAPITAL CORP. AND SUBSIDIARIES

INDEX TO ANNUAL REPORT

ON FORM 10-K

|

| | |

| | PAGE |

| | |

| | |

PART I | | |

Item 1: | | |

Item 1A: | | |

Item 1B: | | |

Item 2: | | |

Item 3: | | |

Item 4: | | |

PART II | | |

Item 5: | | |

Item 6: | | |

Item 7: | | |

Item 7A: | | |

Item 8: | | |

Item 9: | | |

Item 9A: | | |

Item 9B: | | |

PART III | | |

Item 10: | | |

Item 11: | | |

Item 12: | | |

Item 13: | | |

Item 14: | | |

PART IV | | |

Item 15: | | |

| | |

| |

FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as "anticipate", "believe", "could", "estimate", "expects", "intend", "may", "plan", "potential", "project", "should", "will" and "would" or the negative of these terms or other comparable terminology.

Forward-looking statements contained in this report are based on our beliefs, assumptions and expectations regarding our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Forward-looking statements we make in this report are subject to various risks and uncertainties that could cause actual results to vary from our forward-looking statements, including:

| |

• | the factors described in this report, including those set forth under the sections captioned "Risk Factors", "Business", and "Management's Discussion and Analysis of Financial Conditions and Results of Operations"; |

| |

• | changes in our industry, interest rates, the debt securities markets, real estate markets or the general economy; |

| |

• | increased rates of default and/or decreased recovery rates on our investments; |

| |

• | availability, terms and deployment of capital; |

| |

• | availability of qualified personnel; |

| |

• | changes in governmental regulations, tax rates and similar matters; |

| |

• | changes in our business strategy; |

| |

• | availability of investment opportunities in commercial real estate-related and commercial finance assets; |

| |

• | the degree and nature of our competition; |

| |

• | the adequacy of our cash reserves and working capital; and |

| |

• | the timing of cash flows, if any, from our investments. |

We caution you not to place undue reliance on these forward-looking statements which speak only as of the date of this report. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable law or regulation, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this filing or to reflect the occurrence of unanticipated events.

PART I

General

We are a real estate finance company that is organized and conducts its operations to qualify as a real estate investment trust, or REIT, for federal income tax purposes under Subchapter M of the Internal Revenue Code of 1986, as amended. Our investment strategy focuses primarily on originating, holding and managing commercial mortgage loans and other commercial real estate-related debt investments. We have historically made other residential real estate and commercial finance investments.

Our investment strategy targets the following core asset class:

|

| | | |

CRE/Core Asset Class | | Principal Investments |

| | | |

Commercial real estate-related assets | | Ÿ | First mortgage loans, which we refer to as whole loans; |

| | Ÿ | First priority interests in first mortgage loans, which we refer to as A notes; |

| | Ÿ | Subordinated interests in first mortgage loans, which we refer to as B notes; |

| | Ÿ | Mezzanine debt related to CRE that is senior to the borrower's equity position but subordinated to other third-party debt; |

| | Ÿ | Commercial mortgage-backed securities, which we refer to as CMBS; and |

| | Ÿ | Commercial real estate, or CRE, primarily multifamily properties. |

|

In November 2016, we received approval from our board of directors to execute a strategic plan, or the Plan, to focus our strategy on CRE debt investments. The Plan contemplates disposing of certain legacy CRE debt investments, exiting underperforming non-core asset classes and establishing a dividend policy based on sustainable earnings. Legacy CRE loans are loans underwritten prior to 2010. The non-core asset classes in which we have historically invested are expected to be substantially disposed of over the next 12 to 24 months and are described in the following table of non-core asset classes: |

|

Non-Core Asset Classes | | | |

Residential real estate-related assets | | Ÿ | Residential mortgage loans; and |

| | Ÿ | Residential mortgage-backed securities, which we refer to as RMBS, which comprise our available for sale portfolio. |

| | | |

Commercial finance assets | | Ÿ | Middle-market secured corporate loans and preferred equity investments; and |

| | Ÿ | Asset-backed securities, which we refer to as ABS, backed by senior secured corporate loans; |

| | Ÿ | Debt tranches of collateralized debt obligations and collateralized loan obligations, which we refer to as CDOs and CLOs, respectively, and sometimes, collectively, as CDOs; |

| | Ÿ | Structured note investments, which comprise our trading securities portfolio; |

| | Ÿ | Syndicated corporate loans; |

| | Ÿ | Preferred equity investment in a commercial leasing enterprise that originates and holds small- and middle-ticket commercial direct financing leases and notes. |

Our objective is to provide our stockholders with total returns over time, including quarterly distributions and capital appreciation, while seeking to manage the risks associated with our investment strategies. We have financed a substantial portion of our portfolio investments through borrowing strategies seeking to match the maturities and repricing dates of our financings with the maturities and repricing dates of those investments, and we have sought to mitigate interest rate and foreign currency risk through derivative investments.

We are externally managed by Resource Capital Manager, Inc., or our Manager, an indirect wholly-owned subsidiary of Resource America, Inc. (formerly traded on NASDAQ: REXI), or Resource America. On September 8, 2016, Resource America was acquired by C-III Capital Partners LLC, or C-III, a leading CRE services company engaged in a broad range of activities, including primary and special loan servicing, loan origination, fund management, CDO management, principal investment, investment sales and multifamily property management. Our Manager now draws upon C-III's and Resource America’s management teams and their collective investment experience to provide its services. With respect to the strategic Plan, two non-

core segments: (i) residential mortgage loans and mortgage-backed securities and (ii) middle-market secured corporate loans and preferred equity investments have been reclassified as held for sale and are considered discontinued operations at December 31, 2016. As we exit these non-core asset classes, we expect to deploy the incremental capital primarily into our CRE lending business and CMBS investments. We began to implement the Plan during the fourth quarter of 2016.

During the latter half of 2015 our common shares began to trade at prices well below our book value per share. We had previously sought to enhance shareholder value through our $50.0 million securities repurchase program authorized by our board in August 2015. Through December 31, 2016, we repurchased $38.3 million of our common and preferred shares. However, in September 2016 we halted the buy-back program and instead began to marshal resources as part of our strategy to transform our operations into a CRE debt focused enterprise.

In August 2016, we sold our interest in Northport TRS, LLC and the self-originated piece of our middle market lending operation, which generated $104.2 million of proceeds that we began to use to make new CRE loans.

Beginning in the fourth quarter of 2016 and through February 2017, we liquidated several non-core assets. This included liquidating Apidos Cinco (our last syndicated corporate loan CLO) a partial monetization of our interest in Pelium Capital Partners, L.P., sales of several middle market loans, the sale of certain mortgage servicing rights related to our residential mortgage origination platform and a partial liquidation of our ABS portfolio. These liquidations generated $78.4 million of liquidity.

During 2015 and 2016, we originated 50 new CRE loans totaling $940.9 million. These loans were initially financed in part through our CRE term facilities and CRE securitizations. As a result of the planned dispositions coupled with available debt financing at December 31, 2016 of $301.2 million, we intend to grow our CRE lending operation.

Our Business Strategy

The core components of our business strategy are:

Investment in real estate assets. We expect to invest in CRE whole loans, CRE mezzanine loans and investment grade and non-investment grade CMBS bonds. We have historically invested in commercial finance assets, through directly-originated middle-market loans and syndicated corporate loan securitizations and in other ABS, structured note investments and debt tranches of CDOs and CLOs. We exited the directly-originated piece of our middle market lending business in August 2016 and liquidated our last syndicated corporate loan securitization in November 2016. We expect to recycle this capital into our CRE lending business, subject to the availability of investment opportunities. Our goal as we implement our strategy is to target a CRE equity allocation of 90%-100% . At December 31, 2016, our invested equity capital was allocated as follows: 74% in CRE assets; 14% in commercial finance assets; 6% in the residential mortgage lending business; and 6% in other investments.

Managing our investment portfolio. At December 31, 2016, we managed $1.9 billion of assets, including $761.4 million of assets that were financed and held in variable interest entities, or VIEs. The core of our management process is credit analysis, which our Manager, as well as C-III and Resource America, use to actively monitor our existing investments and as a basis for evaluating new investments. Senior management of our Manager, C-III and Resource America have extensive experience in underwriting the credit risk associated with our targeted asset classes and conduct detailed due diligence on all credit-sensitive investments. After we make investments, our Manager, C-III and Resource America actively monitor them for early detection of trouble or deterioration. If a default occurs, we will use our senior management team's asset management experience in seeking to mitigate the severity of any loss and to optimize the recovery from assets collateralizing the investment.

Managing our interest rate and liquidity risk. We generally seek to manage interest rate and liquidity risk so as to reduce the effects of interest rate changes on us. In our long-term financings, we seek to match the maturity and repricing dates of our investments with the maturities and repricing dates of our financings. Historically, we have used CDO and CLO vehicles structured for us by our Manager to achieve this goal, and subject to the markets for CDO and CLO financings remaining open, we expect to continue to use those vehicles in the future. We engage in a number of business activities that are vulnerable to interest rate and liquidity risk. Our hedging strategy is intended to take advantage of commonly available derivative investments such as interest rate swaps and caps to reduce, to the extent possible, interest rate and cash flow risks.

We manage our interest rate and liquidity risk on our short-term financings, principally repurchase agreements, by limiting the amount of our financial exposure under the facilities to either a stated investment amount or a fixed guaranty amount. At December 31, 2016, our Wells Fargo CMBS facility had $22.5 million of short-term debt secured by $28.5 million of collateral. Our equity at risk was $6.1 million, including net interest due on the financings. Our Wells Fargo CRE facility had a balance of $215.3 million of short-term debt at year end 2016 and and was secured by $313.1 million of collateral. Our equity at risk was $97.5 million, including net interest due. These borrowings were made on a floating rate basis. For more information concerning our credit and repurchase facilities, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources" and Note 13 of the Notes to Consolidated Financial Statements contained in Item 8 of this report. We obtained three waivers for violation of the EBITDA to fixed charge coverage ratio financial covenants for our CRE repurchase

facilities and Wells Fargo CMBS repurchase facility as of December 31, 2016. We continuously monitor our compliance with all of the financial covenants. We are in compliance with all other financial covenants as defined in the respective agreements as of December 31, 2016.

Diversification of investments. We intend to manage our investment risk by maintaining a diversified portfolio of commercial mortgage loans and real estate-related assets. As funds become available for investment or reinvestment, we seek to maintain diversification by property type and geographic location while allocating our capital to investment opportunities that we believe are the most economically attractive. The percentage of assets that we have invested in certain non-core and real estate-related asset classes is subject to the federal income tax requirements for REIT qualification and the requirements for exclusion from regulation under the Investment Company Act of 1940, which we refer to as the Investment Company Act.

Our Operating Policies

Investment guidelines. We have established investment policies, procedures and guidelines that are reviewed and approved by our investment committee and board of directors. The investment committee meets regularly to consider and approve proposed specific investments. The board of directors monitors the execution of our overall investment strategies and targeted asset classes. We acquire our investments primarily for income. We do not have a policy that requires us to focus our investments in one or more particular geographic areas or industries.

Financing policies. We have used leverage in order to increase potential returns to our stockholders and for financing our portfolio. We do not speculate on changes in interest rates. Although we have identified leverage targets for each of our targeted asset classes, our investment policies do not have any minimum or maximum leverage limits. Our investment committee has the discretion, without the need for further approval by our board of directors, to increase the amount of leverage we incur above our targeted range for individual asset classes subject, however, to any leverage constraints that may be imposed by existing financing arrangements.

We have historically used borrowing and securitization strategies, substantially through CDOs, to accomplish our long-term match funding financing strategy. Based upon current conditions in the credit markets for CDOs and CLOs, we expect to modestly increase leverage through new CLO securitizations and the continued use of our Wells Fargo facilities and our Morgan Stanley facilities in 2017. We may also seek other credit arrangements to finance new investments that we believe we can generate attractive risk-adjusted returns, subject to availability.

Hedging and interest rate management policies. We use derivative financial instruments to hedge a portion of the interest rate risk associated with our borrowings. Under the federal income tax laws applicable to REITs, we generally will be able to enter into transactions to hedge indebtedness that we may incur, or plan to incur, to acquire or carry real estate assets, provided that our total gross income from qualifying hedges does not exceed 25% of our total gross income and non-qualifying hedges does not exceed 5% of our total gross income. We generally seek to minimize interest rate risk with a strategy that is expected to result in the least amount of volatility under general accepted accounting principles while still meeting our strategic economic objectives and maintaining adequate liquidity and flexibility. These hedging transactions may include interest rate swaps, collars, caps or floors, puts, calls, options and foreign currency exchange protection.

Credit and risk management policies. Our Manager focuses its attention on credit and risk assessment from the earliest stage of the investment selection process. In addition, our Manager screens and monitors all potential investments to determine their impact on maintaining our REIT qualification under federal income tax laws and our exclusion from investment company status under the Investment Company Act. Portfolio risks, including risks related to credit losses, interest rate volatility, liquidity and counterparty credit, are generally managed on a portfolio-by-portfolio basis by Resource America's asset management division.

General

The table below summarizes the amortized cost and net carrying amount of our investment portfolio at December 31, 2016, classified by asset type (in thousands, except percentages):

|

| | | | | | | | | | | | |

At December 31, 2016 | Amortized

Cost | | Net Carrying Amount | | Percent of

Portfolio | | Weighted

Average Coupon |

Loans Held for Investment: | | | | | | | |

CRE whole loans (1) | $ | 1,290,107 |

| | $ | 1,286,278 |

| | 69.46 | % | | 5.63% |

|

|

| |

|

| |

|

| | |

Loans Held for Sale: | | | | | | | |

Syndicated corporate loans(2) | 1,007 |

| | 1,007 |

| | 0.05 | % | | 5.54% |

|

| |

| |

|

| | |

Investments in Available-for-Sale Securities: | | | | | | | |

CMBS | 98,525 |

| | 98,087 |

| | 5.30 | % | | 5.38% |

RMBS | 1,526 |

| | 1,601 |

| | 0.09 | % | | 5.43% |

ABS | 21,365 |

| | 25,280 |

| | 1.35 | % | | N/A(4) |

| 121,416 |

| | 124,968 |

| | 6.74 | % | | |

Investment Securities-Trading: | | | | | | | |

Structured notes | 6,242 |

| | 4,492 |

| | 0.24 | % | | N/A (4) |

|

|

| |

|

| |

|

| | |

Other (non-interest bearing): | | | | | | | |

Investments in unconsolidated entities | 87,919 |

| | 87,919 |

| | 4.76 | % | | N/A (4) |

Direct financing leases(3) | 992 |

| | 527 |

| | 0.03 | % | | 5.66% |

| 88,911 |

| | 88,446 |

| | 4.79 | % | | |

Other Assets Held for Sale: | | | | | | | |

Residential mortgage loans | 148,140 |

| | 148,140 |

| | 8.00 | % | | 3.79% |

Middle market loans | 52,382 |

| | 40,443 |

| | 2.18 | % | | 5.87% |

CRE legacy loans | 158,192 |

| | 158,178 |

| | 8.54 | % | | 2.90% |

| 358,714 |

| | 346,761 |

| | 18.72 | % | | |

| | | | | | | |

Total Investment Portfolio | $ | 1,866,397 |

| | $ | 1,851,952 |

| | 100.00 | % | | |

| |

(1) | Net carrying amount includes an allowance for loan losses of $3.8 million at December 31, 2016. |

| |

(2) | The fair value option was elected for syndicated corporate loans, held for sale. |

| |

(3) | Net carrying amount includes an allowance for lease losses of $465,000 at December 31, 2016. |

| |

(4) | There is no stated rate associated with these securities. |

Core Asset Classes

Commercial Real Estate Debt Investments

Whole loans. We predominantly originate first mortgage loans, or whole loans, directly to borrowers. The direct origination of whole loans enables us to better control the structure of the loans and to maintain direct lending relationships with borrowers. We may create tranches of a loan we originate, consisting of an A note (described below) and a B note (described below), as well as mezzanine loans or other participations, which we may hold or sell to third parties. We do not obtain ratings on these investments. With respect to our portfolio at December 31, 2016, our whole loan investments had loan to value, or LTV, ratios that typically do not exceed 80%. Typically, whole loans will have terms of three to five years and are generally structured with an original term of up to three years, with one-year extensions that bring the loan to a maximum term of five years. Substantially all of our CRE loans held at December 31, 2016 were whole loans. We expect to hold our whole loans to their maturity.

Senior interests in whole loans (A notes). Historically, we have invested in senior interests in whole mortgage loans, referred to as A notes, either directly originated or purchased from third parties. We do not obtain ratings on these investments. Our typical A note investments had an LTV ratio not exceeding 70%, and were generally held to their maturity. We did not hold any A note investments at December 31, 2016.

Subordinate interests in whole loans (B notes). To a lesser extent, we have invested in subordinate interests in whole loans, referred to as B notes, which we either directly originate or have purchased from third parties. B notes are loans secured by a first mortgage but are subordinated to an A note. The subordination of a B note is generally evidenced by an intercreditor or participation agreement between the holders of the A note and the B note. In some instances, the B note lender may require a security interest in the stock or other equity interests of the borrower as part of the transaction. B note lenders have the same obligations, collateral and borrower as the A note lender, but typically are subordinated in recovery upon a default to the A note lender. B notes share certain credit characteristics with second mortgages in that both are subject to greater credit risk with respect to the underlying mortgage collateral than the corresponding first mortgage or A note. We do not obtain ratings on these investments. Our typical B note investments have had LTV ratios between 55% and 80%, had terms of three to five years and were generally structured with an original term of up to three years, with one-year extensions that bring the loan to a maximum term of five years. We expect to hold any B note investments we make or purchase to their maturity. We did not hold any B note investments at December 31, 2016.

In addition to the interest payable on a B note, we may earn fees charged to the borrower under the note or additional income by receiving principal payments in excess of the discounted price (below par value) we paid to acquire the note. Our ownership of a B note with controlling class rights may, in the event the financing fails to perform according to its terms, cause us to pursue our remedies as owner of the B note, which may include foreclosure on, or modification of, the note. In some cases, the owner of the A note may be able to foreclose or modify the note against our wishes as owner of the B note. As a result, our economic and business interests may diverge from the interests of the owner of the A note.

Mezzanine financing. Historically, we have also invested in mezzanine loans that are senior to the borrower's equity in, and subordinate to a mortgage loan on, a property. A mezzanine loan is typically secured by a pledge of the ownership interests in the entity that directly owns the real property. In addition mezzanine loans typically include credit enhancements such as letters of credit, personal guarantees of the principals of the borrower, or collateral unrelated to the property. A mezzanine loan may be structured so that we receive a stated fixed or variable interest rate on the loan as well as a percentage of gross revenues and a percentage of the increase in the fair market value of the property securing the loan, payable upon maturity, refinancing or sale of the property. Mezzanine loans may also have prepayment lockouts, penalties, minimum profit hurdles and other mechanisms to protect and enhance returns in the event of premature repayment. Our mezzanine investments have LTV ratios between 65% and 90%. The stated maturity of mezzanine financings typically range from three to five years and are held to maturity. We have no basis in any mezzanine loan investments at December 31, 2016.

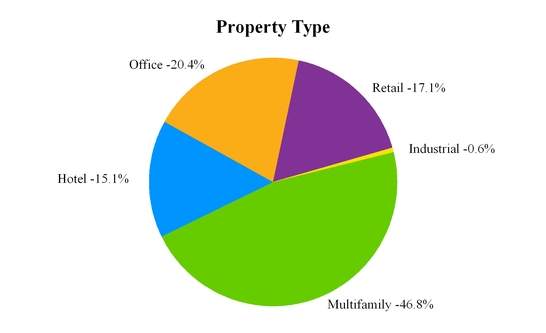

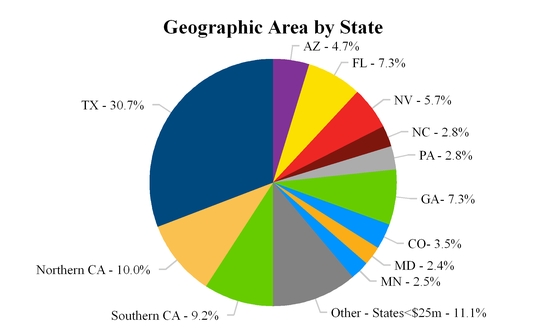

The following charts describe the property type and the geographic breakdown of our CRE loan portfolio at December 31, 2016 (based on carrying value), excluding our legacy CRE loans classified as assets held for sale:

The CRE collateralizing our loan portfolio comprises a diversified mix of property types, as follows (based on carrying value): multifamily – 47%; office – 20%,;retail – 17%; hotel – 15%; and industrial – 1%.

Approximately 31% of our portfolio is in Texas. Within Texas, our portfolio consists of whole loans collateralized by two property types: multifamily – 70% and office – 17%. We also hold 19% of our portfolio in California, which we split into Southern (9%) and Northern (10%) regions. Within the Southern California region, our portfolio consists of whole loans concentrated in two property types: multifamily – 46% and retail – 43%. Within the Northern California region, our portfolio consists of whole loans collateralized by two property types: office – 55% and retail – 40%. We view our investment and credit strategies as being adequately diversified across property type in the Southern and Northern California regions and in Texas.

As part of the Plan, certain underperforming legacy CRE whole loans were classified as held for sale at December 31, 2016. These legacy CRE whole loans are in three property types: hotel – 54%; retail – 39%; and office – 7%. Of these loans, 84% are within California and 16% in Arizona.

CMBS

We invest in CMBS, which are securities that are secured by, or evidence interests, in a pool of mortgage loans secured by commercial properties. These securities may be senior or subordinate and may be either investment grade or non-investment grade. The majority of our CMBS investments have been rated by at least one nationally recognized rating agency.

The yields on CMBS depend on the timely payment of interest and principal due on the underlying mortgage loans, and defaults by the borrowers on such loans may ultimately result in deficiencies and defaults on the CMBS. In the event of a default, the trustee for the benefit of the holders of CMBS has recourse only to the underlying pool of mortgage loans and, if a loan is in default, to the mortgaged property securing such mortgage loan. After the trustee has exercised all of the rights of a lender under a defaulted mortgage loan and the related mortgaged property has been liquidated, no further remedy is available. However, holders of relatively senior classes of a CMBS trust will be protected to a certain degree by the structural features of the securitization transaction, such as the subordination of junior classes of the CMBS trust.

Commercial Real Estate Equity Investments

In 2011, we began to invest directly in the ownership of CRE, restructuring two real estate loans to take control of properties where we believed we could protect capital and ultimately generate capital appreciation. We primarily used a related party, Resource Real Estate, a subsidiary of Resource America, to manage any CRE investments we hold on our behalf. We later acquired two multi-family real estate assets, one through a joint venture and the other wholly-owned by us, as well as a hotel property. We sold the wholly-owned multi-family property at a substantial gain of $16.6 million in 2013, and divested the remaining CRE assets during 2014 at a gain of $6.1 million. At December 31, 2016 and December 31, 2015, we were not directly invested in the ownership of any CRE assets.

Other Real Estate Investments

We have invested in a joint venture that makes high-yield investments in a broad range of CRE assets through a variety of debt investments, including mezzanine loans, B notes, preferred equity, and whole loans including bridge financing. Our joint venture investment balance was $17.0 million at December 31, 2016.

Non-Core Asset Classes

Structured Note Investments and Residential Mortgage-Backed Securities, or RMBS

We have invested in structured notes and RMBS as part of our trading portfolio. Structured note investments are investments in structured finance vehicles that are typically among the most junior debt securities, or are equity securities, issued by the vehicle. The majority of our structured notes have not been rated by any nationally recognized rating agency. These notes and equity securities typically receive quarterly interest payments or distributions only after the more senior debt securities issued by the vehicle have received all amounts contractually then owned to them. We also invest in RMBS, which are securities that are secured or evidenced by interests in pools of residential mortgage loans. These securities may be issued by government-sponsored agencies or other entities and may or may not be rated investment grade by rating agencies. We expect that our RMBS will include loan pools with home equity loans (loans that are secured by subordinate liens), residential B or C loans (loans where the borrower's FICO score, a measure used to rate the financial strength of the borrower, is low, generally below 625), "Alt-A" loans (where the borrower's FICO score is between 675 and 725) and "high LTV" loans (loans where the LTV is 95% or greater).

Residential Mortgage Origination

Primary Capital Mortgage, LLC, or PCM, is a residential mortgage lender and servicer offering home loans in 42 states at December 31, 2016, primarily through wholesale channels. PCM primarily originates agency and non-agency mortgage loans for the purpose of selling those loans to the appropriate federal agency and other investors. PCM originated $1.8 billion of agency mortgage loans and $127.2 million of prime jumbo loans in 2016. At December 31, 2016, PCM serviced over $3.4 billion of residential mortgage loans. As part of our Plan to exit non-core asset classes, PCM's operations were moved to discontinued operations in the fourth quarter of 2016 and its assets and liabilities were marked to the lower of cost or fair market value and transferred to held for sale status.

Commercial Finance Investments

Subject to limitations imposed by REIT qualification standards and requirements for exclusion from regulation under the Investment Company Act, we have invested in the following commercial finance assets, which we have no plans to invest in after they are disposed:

Middle market loans. We have made both senior and subordinated, secured and unsecured loans to middle market companies either through directly originated transactions or purchases from third parties. However, in August 2016 we completed the sale of Northport TRS, LLC, or Northport, and retained substantially all of the portfolio of broadly syndicated loans purchased through third parties, and one directly originated loan classified as held for sale, with an aggregate carrying value of $40.4 million at December 31, 2016. As part of our Plan to exit non-core asset classes, our middle market business was moved to discontinued operations in the fourth quarter of 2016. As such, the remaining assets were required to be marked to the lower of cost or fair market value and transferred to held for sale status at December 31, 2016.

Syndicated corporate loans. We have acquired senior and subordinated, secured and unsecured loans made by banks or other financial entities that were financed primarily by CLOs. However, our last remaining CLO, Apidos Cinco, was called and liquidated in November 2016. We have received substantially all of the call proceeds from the trustee in connection with the liquidation, and we expect to receive the balance of the proceeds in 2017.

Equipment leases. We have a preferred equity investment in an equipment leasing company that invests in small- and middle-ticket equipment leases. Although previously we had maintained an equipment lease receivable portfolio, we transferred that portfolio to the leasing company in return for the preferred equity interest. We do not expect to invest in an equipment leasing portfolio in the future.

Trust preferred securities and other ABS. We did not have any investments in trust preferred securities or other ABS at December 31, 2016. With certain exceptions relating to smaller banking institutions, the Dodd-Frank Act provided for a phase out of the use of trust preferred securities as primary regulatory capital for financial institutions, which has resulted in a lack of new issuances. Accordingly, we do not expect to make trust preferred securities investments in the future.

Competition

See Item 1A "Risk Factors - Risks Related to Our Investments" "We may face competition for suitable investments."

Management Agreement

We have a management agreement with our Manager, pursuant to which our Manager provides the day-to-day management of our operations. On September 8, 2016, Resource America was acquired by C-III, as a result of which C-III now controls our Manager. The agreement has been amended several times over the years. The management agreement requires our Manager to manage our business affairs in conformity with the policies and investment guidelines established by our board of directors. Our Manager's provides its services under the supervision and direction of our board of directors. Our Manager is responsible for the selection, purchase and sale of our portfolio investments, our financing activities and providing us with investment advisory services. Our Manager also provides us with a Chief Financial Officer, Chief Accounting Officer, several accounting and tax professionals and an investor relations officer. Our Manager receives fees and is reimbursed for its expenses as follows:

| |

• | A monthly base management fee equal to 1/12th of the amount of our equity multiplied by 1.50%. Under the management agreement, ''equity'' is equal to the net proceeds from issuances of shares of capital stock less offering-related costs, plus or minus our retained earnings (excluding non-cash equity compensation incurred in current or prior periods) less any amounts we have paid for common stock and preferred stock repurchases. The calculation is adjusted for one-time events due to changes in accounting principles generally accepted in the United States, which we refer to as GAAP, as well as other non-cash charges, upon approval of our independent directors. |

| |

• | Incentive compensation, calculated as follows: (i) 25% of the dollar amount by which (A) our adjusted operating earnings (before incentive compensation but after the base management fee) per common share (based on the weighted average number of common shares outstanding for such quarter) for a quarter exceeds (B) an amount equal to (1) the weighted average of the price per share of our common stock in our initial offering and the prices per share of our common stock in any of our subsequent offerings, in each case at the time of issuance thereof, multiplied by (2) the greater of (a) 2.00% and (b) 0.50% plus one-fourth of the Ten Year Treasury Rate for such quarter, multiplied by (ii) the weighted average number of shares of common stock outstanding during such quarter, subject to adjustment to exclude events pursuant to changes in GAAP or the application of GAAP as well as non-recurring or unusual transactions or events, after discussion between our Manager and the independent directors and approval by a majority of the independent directors in the case of non-recurring or unusual transactions or events. |

| |

• | Reimbursement of out-of-pocket expenses and certain other costs incurred by our Manager that relate directly to us |

and our operations.

| |

• | Reimbursement of our Manager's expenses for the wages, salaries and benefits of our Chief Financial Officer, Chief Accounting Officer, several accounting and tax professionals and 50% of the salary and benefits of the director of investor relations. Until the closing of C-III's acquisition of Resource America on September 8, 2016, we also reimbursed our Manager for of the wages, salary and benefits of our Chairman. |

In November 2013, we amended the management agreement to allow an ancillary operating subsidiary to directly incur and pay all of its own operating costs and expenses, including compensation to employees and reimbursement of any compensation costs incurred by our Manager for the personnel principally devoted to such ancillary operating subsidiary.

Incentive compensation is calculated and payable quarterly to our Manager to the extent it is earned. Up to 75% of the incentive compensation is payable in cash and at least 25% is payable in the form of an award of common stock. Our Manager may elect to receive more than 25% of its incentive compensation in common stock. All shares are fully vested upon issuance. However, our Manager may not sell such shares for one year after the incentive compensation becomes due and payable unless the management agreement is terminated. Shares payable as incentive compensation are valued as follows:

| |

• | if such shares are traded on a securities exchange, at the average of the closing prices of the shares on such exchange over the 30-day period ending three days prior to the issuance of such shares; |

| |

• | if such shares are actively traded over-the-counter, at the average of the closing bid or sales price as applicable over the 30-day period ending three days prior to the issuance of such shares; and |

| |

• | if there is no active market for such shares, at the fair market value as reasonably determined in good faith by our board of directors. |

The management agreement's initial contract term ends on March 31, 2017. The agreement provides for automatic one year renewals on such date and on each March 31 thereafter until terminated. Our board of directors reviews our Manager's performance annually. The management agreement may be terminated annually upon the affirmative vote of at least two-thirds of our independent directors, or by the affirmative vote of the holders of at least a majority of the outstanding shares of our common stock, based upon unsatisfactory performance that is materially detrimental to us or a determination by our independent directors that the management fees payable to our Manager are not fair, subject to our Manager's right to prevent such a compensation termination by accepting a mutually acceptable reduction of management fees. Our board of directors must provide 180 days' prior notice of any such termination. If we terminate the management agreement, our Manager is entitled to a termination fee equal to four times the sum of the average annual base management fee and the average annual incentive compensation earned by our Manager during the two 12-month periods immediately preceding the date of termination, calculated as of the end of the most recently completed fiscal quarter before the date of termination.

We may also terminate the management agreement for cause with 30 days' prior written notice from our board of directors. No termination fee is payable in the event of a termination for cause. The management agreement defines cause as:

| |

• | our Manager's continued material breach of any provision of the management agreement following a period of 30 days after written notice thereof; |

| |

• | our Manager's fraud, misappropriation of funds, or embezzlement against us; |

| |

• | our Manager's gross negligence in the performance of its duties under the management agreement; |

| |

• | our bankruptcy or insolvency of our Manager, or the filing of a voluntary bankruptcy petition by our Manager; |

| |

• | our dissolution of our Manager; or |

| |

• | a change of control (as defined in the management agreement) of our Manager if a majority of our independent directors determines, at any point during the 18 months following the change of control, that the change of control was detrimental to the ability of our Manager to perform its duties in substantially the same manner conducted before the change of control. |

Cause does not include unsatisfactory performance that is materially detrimental to our business.

Our Manager may terminate the management agreement at its option, without payment of a termination fee by us, if we become regulated as an investment company under the Investment Company Act, with such termination deemed to occur immediately before such event.

Regulatory Aspects of Our Investment Strategy: Exclusion from Regulation Under the Investment Company Act

We operate our business so as to be excluded from regulation under the Investment Company Act. Because we conduct our business through wholly-owned subsidiaries, we must ensure not only that we qualify for an exclusion from regulation under

the Investment Company Act, but also that each of our subsidiaries also qualifies.

We believe that RCC Real Estate, Inc., the subsidiary that at December 31, 2016 held all of our CRE loan assets, is excluded from Investment Company Act regulation under Section 3(c)(5)(C), a provision designed for companies that do not issue redeemable securities and are primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate. To qualify for this exclusion, at least 55% of RCC Real Estate's assets must consist of mortgage loans and other assets that are considered the functional equivalent of mortgage loans for purposes of the Investment Company Act and interests in real properties, which we refer to as "qualifying real estate assets." Moreover, 80% of RCC Real Estate's assets must consist of qualifying real estate assets and other real estate-related assets. RCC Real Estate has not issued, and does not intend to issue, redeemable securities.

We treat our investments in CRE whole loans, A notes and specific types of B notes and specific types of mezzanine loans as qualifying real estate assets for purposes of determining our eligibility for the exclusion provided by Section 3(c)(5)(C) to the extent such treatment is consistent with guidance provided by the Securities and Exchange Commission, or SEC, or its staff. We believe that SEC staff guidance allows us to treat B notes as qualifying real estate assets where we have unilateral rights to instruct the servicer to foreclose upon a defaulted mortgage loan, replace the servicer in the event the servicer, in its discretion, elects not to foreclose on such a loan, and purchase the A note in the event of a default on the mortgage loan. We believe, based upon an analysis of existing SEC staff guidance, that we may treat mezzanine loans as qualifying real estate assets where (i) the borrower is a special purpose bankruptcy-remote entity whose sole purpose is to hold all of the ownership interests in another special purpose entity that owns commercial real property, (ii) both entities are organized as limited liability companies or limited partnerships, (iii) under their organizational documents and the loan documents, neither entity may engage in any other business, (iv) the ownership interests of either entity have no value apart from the underlying real property which is essentially the only asset held by the property-owning entity, (v) the value of the underlying property in excess of the amount of senior obligations is in excess of the amount of the mezzanine loan, (vi) the borrower pledges its entire interest in the property-owning entity to the lender which obtains a perfected security interest in the collateral and (vii) the relative rights and priorities between the mezzanine lender and the senior lenders with respect to claims on the underlying property are set forth in an intercreditor agreement between the parties which gives the mezzanine lender certain cure and purchase rights in case there is a default on the senior loan. If the SEC staff provides future guidance that these investments are not qualifying real estate assets, then we will treat them, for purposes of determining our eligibility for the exclusion provided by Section 3(c)(5)(C), as real estate-related assets or miscellaneous assets, as appropriate. Historically, we have held "whole pool certificates" in mortgage loans, although, at December 31, 2016 and 2015, we had no whole pool certificates in our portfolios. Pursuant to existing SEC staff guidance, we consider whole pool certificates to be qualifying real estate assets. A whole pool certificate is a certificate that represents the entire beneficial interest in an underlying pool of mortgage loans. By contrast, a certificate that represents less than the entire beneficial interest in the underlying mortgage loans is not considered to be a qualifying real estate asset for purposes of the 55% test, but constitutes a real estate-related asset for purposes of the 80% test. We do not expect that investments in CDOs, ABS, syndicated corporate loans, lease receivables, trust preferred securities or private equity will constitute qualifying real estate assets. Moreover, to the extent that these investments are not backed by mortgage loans or other interests in real estate, they will not constitute real estate-related assets. Instead, they will constitute miscellaneous assets, which can constitute no more than 20% of RCC Real Estate's assets.

To the extent RCC Real Estate holds its CRE loan assets through wholly or majority-owned CDO subsidiaries, RCC Real Estate also intends to conduct its operations so that it will not come within the definition of an investment company set forth in Section 3(a)(1)(C) of the Investment Company Act because less than 40% of the value of its total assets (exclusive of government securities and cash items) on an unconsolidated basis will consist of "investment securities," which we refer to as the 40% test. "Investment securities" exclude U.S. government securities and securities of majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company under Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act. Certain of the wholly-owned CDO subsidiaries of RCC Real Estate rely on Section 3(c)(5)(C) for their Investment Company Act exemption, with the result that RCC Real Estate's interests in the CDO subsidiaries do not constitute "investment securities" for the purpose of the 40% test.

Our other subsidiaries, RCC Commercial, Inc. ("RCC Commercial"), RCC Commercial II, Inc. ("Commercial II"), RCC Commercial III, Inc. ("Commercial III"), Resource TRS, LLC, RSO EquityCo, LLC ("RSO Equity"), RCC Residential Portfolio, Inc. ("RCC Resi Portfolio") and RCC Residential Portfolio TRS, Inc. ("RCC Resi TRS"), do not qualify for the Section 3(c)(5)(C) exclusion. However, we believe they qualify for exclusion under either Section 3(c)(1) or 3(c)(7). As required by these exclusions, we will not allow any of these entities to make, or propose to make, a public offering of its securities. In addition, with respect to those subsidiaries for which we rely upon the Section 3(c)(1) exclusion, and as required thereby, we limit the number of holders of their securities to not more than 100 persons calculated in accordance with the attribution rules of Section 3(c)(1), and with respect to those subsidiaries for which we rely on the Section 3(c)(7) exclusion, and as required thereby, we limit ownership of their securities to "qualified purchasers." If we form other subsidiaries, we must ensure that they qualify for an exemption or exclusion from regulation under the Investment Company Act.

Moreover, we must ensure that Resource Capital Corp. itself qualifies for an exclusion from regulation under the Investment Company Act. We do so by monitoring the value of our interests in our subsidiaries so that we can ensure that Resource Capital Corp. satisfies the 40% test. Our interest in RCC Real Estate does not constitute an "investment security" for purposes of the 40% test, but our interests in RCC Commercial, Commercial II, Commercial III, Resource TRS, LLC, RSO Equity, RCC Resi Portfolio and RCC Resi TRS do. Accordingly, we must monitor the value of our interests in those subsidiaries to ensure that the value of our interests in them does not exceed 40% of the value of our total assets.

We have not received, nor have we sought, a no-action letter from the SEC regarding how our investment strategy fits within the exclusions from regulation under the Investment Company Act. To the extent that the SEC provides more specific or different guidance regarding the treatment of assets as qualifying real estate assets or real estate-related assets, we may have to adjust our investment strategy. Any additional guidance from the SEC could inhibit our ability to pursue our investment strategy.

Employees

We have no direct employees, except for those who work for PCM, our residential mortgage origination company acquired in 2013. Under our management agreement, our Manager provides us with all management and support personnel and services necessary for our day-to-day operations, except for PCM's operations. To provide its services, our Manager draws upon the expertise and experience of C-III and Resource America. In April 2012, Resource America and its affiliated entities formed a joint venture, CVC Credit Partners, in which Resource America currently owns a 24% equity interest. We rely on the expertise of employees of this venture to manage certain of our assets. Under our management agreement, our Manager also must provide us with our Chief Financial Officer, Chief Accounting Officer and several accounting and tax professionals, each of whom is exclusively dedicated to our operations, as well as a director of investor relations. We bear the expense of the wages, salaries and benefits of our Chief Financial Officer, Chief Accounting Officer and the accounting and tax professionals dedicated to us, and 50% of the salary and benefits of the director of investor relations. Until the closing of C-III's acquisition of Resource America on September 8, 2016, we also bore the expense of the wages, salary and benefits of our Chairman.

Corporate Governance and Internet Address

We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our board of directors consists of a majority of independent directors, as defined in the Securities Exchange Act of 1934, as amended, and relevant New York Stock Exchange, or NYSE, rules. The audit, compensation and nominating and governance committees of our board of directors are composed exclusively of independent directors. We have adopted corporate governance guidelines and a code of business conduct and ethics, which delineate our standards for our officers and directors and the employees of our Manager who provide us services.

Our internet address is www.resourcecapitalcorp.com. We make available, free of charge through a link on our site, all reports filed with the SEC as soon as reasonably practicable after such filing. Our site also contains our code of business conduct and ethics, corporate governance guidelines and the charters of the audit committee, nominating and governance committee and compensation committee of our board of directors. A complete list of our filings is available on the SEC's website at www.sec.gov. Our SEC filings are also available at the Securities and Exchange Commission's Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The Public Reference Room may be contacted at telephone number (800) 732-0330 for further information.

This section describes material risks affecting our business. In connection with the forward-looking statements that appear in this annual report, you should carefully review the factors discussed below and the cautionary statements referred to in "Forward-Looking Statements."

Impact of Current Economic Conditions

If current economic and market conditions were to deteriorate, our ability to obtain the capital and financing necessary for growth may be limited, which could limit our profitability, ability to make distributions and the market price of our common stock.

We depend upon the availability of adequate debt and equity capital for growth in our operations. Although we have been able to raise both debt and equity capital in the past three years, recent market and economic conditions have made obtaining additional equity capital highly dilutive to existing shareholders and may possibly affect our ability to raise debt capital. If current economic conditions were to deteriorate, our ability to access debt or equity capital on acceptable terms, could be further limited, which could limit our ability to generate growth, our profitability, our ability to make distributions and the market price of our common stock. In addition, as a REIT, we must distribute annually at least 90% of our REIT taxable income, determined without regard to the deduction for dividends paid and excluding net capital gain, to our stockholders and are therefore not able to retain significant amounts of our earnings for new investments. While we may, through our taxable REIT subsidiaries, or TRSs, retain earnings as new capital, we are subject to REIT qualification requirements which limit the value of TRS stock and securities relative to the other assets owned by a REIT.

We cannot predict the effects on us of actions taken by the U.S. government and governmental agencies in response to economic conditions in the United States.

In response to economic and market conditions, U.S. and foreign governments and governmental agencies have established or proposed a number of programs designed to improve the financial system and credit markets, and to stimulate economic growth. Many governments, including federal, state and local governments in the U.S., are incurring substantial budget deficits and seeking financing in international and national credit markets as well as proposing or enacting austerity programs that seek to reduce government spending, raise taxes, or both. Many credit providers, including banks, may need to obtain additional capital before they will be able to expand their lending activities. We are unable to evaluate the effects these programs and conditions will have upon our financial condition, income, or ability to make distributions to our stockholders.

Our strategic plan involves the disposition of our investments in non-core businesses, including the middle market lending and residential real estate lending segments as well as several legacy CRE assets and other miscellaneous non-CRE investments and economic conditions may impede our ability to dispose of these investments.

Our board of directors approved the Plan to dispose of non-core businesses in November 2016. Economic conditions may hinder our ability to dispose of these assets and businesses in the time frame of 12-24 months that we have indicated as a goal. We have adjusted the amount of these assets to fair market value at December 31, 2016. However, we may not be able to dispose of these businesses at prices that would allow us to recover the book value of our investments and we may incur further losses as a result of difficult economic conditions and / or lack of buying interest.

Risks Related to Our Financing

Our portfolio has been financed in material part through the use of leverage, which may reduce the return on our investments and cash available for distribution.

Our portfolio has been financed in material part through the use of leverage and, as credit market conditions permit, we will seek such financing in the future. Using leverage subjects us to risks associated with debt financing, including the risks that:

| |

• | the cash provided by our operating activities will not be sufficient to meet required payments of principal and interest, |

| |

• | the cost of financing may increase relative to the income from the assets financed, reducing the income we have available to pay distributions, and |

| |

• | our investments may have maturities that differ from the maturities of the related financing and, consequently, the risk that the terms of any refinancing we obtain will not be as favorable as the terms of existing financing. |

If we are unable to secure refinancing of our currently outstanding financing, when due, on acceptable terms, we may be forced to dispose of some of our assets at disadvantageous terms or to obtain financing at unfavorable terms, either of which may result in losses to us or reduce the cash flow available to meet our debt service obligations or to pay distributions.

Financing that we may obtain, and financing we have obtained through CDO and CLOs, typically requires, or will require, us to maintain a specified ratio of the amount of the financing to the value of the assets financed. A decrease in the value of these assets may lead to margin calls or calls for the pledge of additional assets which we will have to satisfy. We may not have sufficient funds or unpledged assets to satisfy any such calls, which could result in our loss of distributions from and interests in affected CDOs and CLOs, which would reduce our assets, income and ability to make distributions.

Our repurchase agreements, warehouse facilities and other short-term financings have credit risks that could result in losses.

If we accumulate assets for a CDO or CLO on a short-term credit facility and do not complete the CDO financing, or if a default occurs under the facility, the short-term lender will sell the assets and we would be responsible for the amount by which the original purchase price of the assets exceeds their sale price, up to the amount of our investment or guaranty.

We will lose money on our repurchase transactions if the counterparty to the transaction defaults on its obligation to resell the underlying security back to us at the end of the transaction term, or if the value of the underlying security has declined as of the end of the term or if we default on our obligations under the repurchase agreements.

We are exposed to loss if lenders under our repurchase agreements, warehouse facilities, or other short-term lenders liquidate the assets securing those facilities. Moreover, assets acquired by us pursuant to our repurchase agreements, warehouse facilities or other short-term debt may not be suitable for refinancing through long-term arrangements which may require us to liquidate some or all of the related assets.

We have entered into repurchase agreements and warehouse facilities and expect in the future to seek additional debt to finance our growth. Lenders typically have the right to liquidate assets securing or acquired under these facilities upon the occurrence of specified events, such as an event of default. We are exposed to loss if the proceeds received by the lender upon liquidation are insufficient to satisfy our obligation to the lender. We are also subject to the risk that the assets subject to such repurchase agreements, warehouse facilities or other debt might not be suitable for long-term refinancing or securitization transactions. If we are unable to refinance these assets on a long-term basis, or if long-term financing is more expensive than we anticipated at the time of our acquisition of the assets to be financed, we might be required to liquidate assets.

We will incur losses on our repurchase transactions if the counterparty to the transactions defaults on its obligation to resell the underlying assets back to us at the end of the transaction term, or if the value of the underlying assets has declined as of the end of the term or if we default in our obligations to purchase the assets.

When engaged in repurchase transactions, we generally sell assets to the transaction counterparty and receive cash from the counterparty. The counterparty must resell the assets back to us at the end of the term of the transaction. Because the cash we receive from the counterparty when we initially sell the assets is less than the market value of those assets, if the counterparty defaults on its obligation to resell the assets back to us we will incur a loss on the transaction. We will also incur a loss if the value of the underlying assets has declined as of the end of the transaction term, as we will have to repurchase the assets for their initial value but would receive assets worth less than that amount. If we default upon our obligation to repurchase the assets, the counterparty may liquidate them at a loss, which we are obligated to repay. Any losses we incur on our repurchase transactions would reduce our earnings, and thus our cash available for distribution to our stockholders.

Financing our REIT qualifying assets with repurchase agreements and warehouse facilities could adversely affect our ability to qualify as a REIT.

We have entered into and intend to enter into, sale and repurchase agreements under which we nominally sell certain REIT qualifying assets to a counterparty and simultaneously enter into an agreement to repurchase the sold assets. We believe that we will be treated for U.S. federal income tax purposes as the owner of the assets that are the subject of any such agreement notwithstanding that we may transfer record ownership of the assets to the counterparty during the term of the agreement. It is possible, however, that the Internal Revenue Service, or IRS, could assert that we did not own the assets during the term of the sale and repurchase agreement, in which case our ability to qualify as a REIT would be adversely affected. If any of our REIT qualifying assets are subject to a repurchase agreement and are sold by the counterparty in connection with a margin call, the loss of those assets could impair our ability to qualify as a REIT. Accordingly, unlike other REITs, we may be subject to additional risk regarding our ability to qualify and maintain our qualification as a REIT.

Historically, we have financed most of our investments through CDOs and have retained the equity. CDO equity receives distributions from the CDO only if the CDO generates enough income to first pay the holders of its debt securities and its expenses.

Historically, we have financed most of our investments through CDOs (including CLOs) in which we retained the equity interest. Depending on market conditions and credit availability, we intend to use CDOs to finance our investments in the future. The equity interests of a CDO are subordinate in right of payment to all other securities issued by the CDO. The equity is usually

entitled to all of the income generated by the CDO after the CDO pays all of the interest due on the debt securities and its other expenses. However, there will be little or no income available to the CDO equity if there are excessive defaults by the issuers of the underlying collateral which would significantly reduce the value of that interest. Reductions in the value of the equity interests we have in a CDO, if we determine that they are other than temporary, will reduce our earnings. In addition, the liquidity of the equity securities of CDOs is constrained and, because they represent a leveraged investment in the CDO's assets, the value of the equity securities will generally have greater fluctuations than the value of the underlying collateral.

If our CDO financings fail to meet their performance tests, including over-collateralization requirements, our net income and cash flow from these CDOs will be eliminated.

Our CDOs generally provide that the principal amount of their assets must exceed the principal balance of the related securities issued by them by a certain amount, commonly referred to as "over-collateralization." If delinquencies and/or losses exceed specified levels, based on the analysis by the rating agencies (or any financial guaranty insurer) of the characteristics of the assets collateralizing the securities issued by the CDO issuer, the required level of over-collateralization may be increased or may be prevented from decreasing as would otherwise be permitted if losses or delinquencies did not exceed those levels. A failure by a CDO to satisfy an over-collateralization test typically results in accelerated distributions to the holders of the senior debt securities issued by the CDO entity, resulting in reduction or elimination of distributions to more junior securities until the over-collateralization requirements have been met or the senior debt securities have been paid in full.

Our equity holdings and, when we acquire debt interests in CDOs, our debt interests, if any, generally are subordinate in right of payment to the other classes of debt securities issued by the CDO entity. Accordingly, if overcollateralization tests are not met, distributions on the subordinated debt and equity we hold in these CDOs will cease, resulting in a substantial reduction in our cash flow. Other tests (based on delinquency levels, interest coverage or other criteria) may restrict our ability to receive cash distributions from assets collateralizing the securities issued by the CDO entity. Although at December 31, 2016, all of our CDOs met their performance tests, we cannot assure you that our CDOs will satisfy the performance tests in the future. For information concerning compliance by our CDOs with their over-collateralization tests, see "Management's Discussion and Analysis of Financial Condition and Results of Operation - Summary of CDO and CLO Performance Statistics."

If any of our CDOs fails to meet collateralization or other tests relevant to the most senior debt issued and outstanding by the CDO issuer, an event of default may occur under that CDO. If that occurs, our Manager's ability to manage the CDO likely would be terminated and our ability to attempt to cure any defaults in the CDO would be limited, which would increase the likelihood of a reduction or elimination of cash flow and returns to us in those CDOs for an indefinite time.

If we issue debt securities, the terms may restrict our ability to make cash distributions, require us to obtain approval to sell our assets or otherwise restrict our operations in ways which could make it difficult to execute our investment strategy and achieve our investment objectives.

Any debt securities we may issue in the future will likely be governed by an indenture or other instrument containing covenants restricting our operating flexibility. Holders of senior securities may be granted the right to hold a perfected security interest in certain of our assets, to accelerate payments due under the indenture if we breach financial or other covenants, to restrict distributions, and to require us to obtain their approval to sell assets. These covenants could limit our ability to operate our business or manage our assets effectively. Additionally, any convertible or exchangeable securities that we issue may have rights, preferences and privileges more favorable than those of our common stock. We, and indirectly our stockholders, will bear the cost of issuing and servicing such securities.

Depending upon market conditions, we intend to seek financing through CDOs, which would expose us to risks relating to the accumulation of assets for use in the CDOs.

Historically, we have financed a significant portion of our assets through the use of CDOs and CLOs, and have accumulated assets for these financings through short-term credit facilities, typically repurchase agreements or warehouse facilities. Depending upon market condition, and, consequently, the extent to which such financing is available to us, we expect to seek similar financing arrangements in the future. In addition to risks discussed above, these arrangements could expose us to other credit risks, including the following:

| |

• | An event of default under one short-term facility may constitute a default under other credit facilities we may have, potentially resulting in asset sales and losses to us, as well as increasing our financing costs or reducing the amount of investable funds available to us. |

| |

• | We may be unable to acquire a sufficient amount of eligible assets to maximize the efficiency of a CDO or CLO issuance, which would require us to seek other forms of term financing or liquidate the assets. We may not be able to obtain term financing on acceptable terms, or at all, and liquidation of the assets may be at prices less than those we paid, resulting in losses to us. |

| |

• | Using short-term financing to accumulate assets for a CDO or CLO issuance may require us to obtain new financing as the short-term financing matures. Residual financing may not be available on acceptable terms, or at all. Moreover, an increase in short-term interest rates at the time that we seek to enter into new borrowings would reduce the spread between the income on our assets and the cost of our borrowings. This would reduce returns on our assets, which would reduce earnings and, in turn, cash available for distribution to our stockholders. |

Our hedging transactions may not completely insulate us from interest rate risk and may result in poorer overall investment performance than if we had not engaged in any hedging transactions.

Subject to maintaining our qualification as a REIT, we pursue various hedging strategies to seek to reduce our exposure to losses from adverse changes in interest rates. Our interest rate hedging activity varies in scope depending upon market conditions relating to, among other factors, the level and volatility of interest rates and the type of assets we hold. There are practical limitations on our ability to insulate our portfolio from all of the negative consequences associated with changes in short-term interest rates, including:

| |

• | Available interest rate hedges may not correspond directly with the interest rate risk against which we seek protection. |

| |

• | The duration of the hedge may not match the duration of the related liability. |

| |

• | Interest rate hedging can be expensive, particularly during periods of rising and volatile interest rates. Hedging costs may include structuring and legal fees and fees payable to hedge counterparties to execute the hedge transaction. |

| |

• | Losses on a hedge position may reduce the cash available to make distributions to stockholders, and may exceed the amounts invested in the hedge position. |

| |

• | The amount of income that a REIT may earn from hedging transactions, other than through a TRS, is limited by federal tax provisions governing REITs. |

| |

• | The credit quality of the party owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction. |

| |

• | The party owing money in the hedging transaction may default on its obligation to pay. |

We have adopted written policies and procedures governing our hedging activities. Under these policies and procedures, our board of directors is responsible for approving the types of hedging instruments we may use, absolute limits on the notional amount and term of a hedging instrument and parameters for the credit-worthiness of hedge counterparties. The senior managers responsible for each of our targeted asset classes are responsible for executing transactions using the services of independent interest rate risk management consultants, documenting the transactions, monitoring the valuation and effectiveness of the hedges, and providing reports concerning our hedging activities and the valuation and effectiveness of our hedges to the audit committee of our board of directors no less often than quarterly. Our guidelines also require us to engage one or more experienced third-party advisors to provide us with assistance in the identification of interest rate risks, the analysis, selection and timing of risk protection strategies, the administration and negotiation of hedge documentation, settlement or disposition of hedges, compliance with hedge accounting requirements and measurement of hedge effectiveness and valuation.

Hedging against a decline in the values of our portfolio positions does not eliminate the possibility of fluctuations in the values of the positions or prevent losses if the values of the positions decline. Hedging transactions may also limit the opportunity for gain if the values of the portfolio positions should increase. Moreover, we may not be able to hedge against an interest rate fluctuation that is generally anticipated by the market.

The success of our hedging transactions will depend on our Manager's ability to correctly predict movements of interest rates. Therefore, unanticipated changes in interest rates may result in poorer overall investment performance than if we had not engaged in any such hedging transactions. In addition, the degree of correlation between price movements of the instruments used in a hedging strategy and price movements in the portfolio positions being hedged may vary. Moreover, for a variety of reasons, we may not seek to establish a perfect correlation between such hedging instruments and the portfolio holdings being hedged. Any such imperfect correlation may prevent us from achieving the intended hedge and expose us to risk of loss.