UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21779

JOHN HANCOCK FUNDS II

---------------------------------------------------------

(Exact name of registrant as specified in charter)

601 CONGRESS STREET, BOSTON, MA 02210-2805

-------------------------------------------------------------

(Address of principal executive offices) (Zip code)

SALVATORE SCHIAVONE, 601 CONGRESS STREET, BOSTON, MA 02210-2805

------------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 663-4497

-------------------

Date of fiscal year end: 7/31

Date of reporting period: 1/31/16

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared nine semiannual reports to shareholders for the period ended January 31, 2016. The first report applies to the Technical Opportunities Fund, the second report applies to the Global Income Fund, the third report applies to the Short Duration Credit Opportunities Fund, the fourth report applies to the Absolute Return Currency Fund, the fifth report applies to the Fundamental All Cap Core Fund, the sixth report applies to the Fundamental Large Cap Core Fund, the seventh report applies to the Fundamental Large Cap Value Fund, the eighth report applies to the Diversified Strategies Fund, and the ninth report applies to the Global Absolute Return Strategies Fund.

John Hancock

Technical Opportunities Fund

Semiannual report 1/31/16

A message to shareholders

Dear shareholder,

The six-month period has been a challenging time for all investors. Oil prices, having already dropped precipitously, continued to slide in the back half of 2015, and by January oil frequently traded at multi-year lows. Concerns about slowing global growth added to negative investor psychology, and stock prices fell steeply around the world. Stocks were not the only investment that faced headwinds; all risk assets struggled over the past six months and these types of declines are unsettling.

Although volatility returned in force to the markets, much of the global economic picture continues to move in the right direction. In December, the U.S. Federal Reserve raised short-term interest rates for the first time in nine years on the evidence that the persistent strength in the labor markets warranted a somewhat less accommodative stance. Central banks outside of the United States continue to signal that they would take action to support economies and markets.

At John Hancock Investments, portfolio risk management is a critical part of our role as an asset manager, and our dedicated risk team is focused on these issues every day. We continually strive for new ways to analyze potential risks and have liquidity tools in place, such as a credit facility and an interfund lending program. In times like these, your best resource is your financial advisor, who can ensure your portfolio is sufficiently diversified to meet your long-term objectives and to withstand the inevitable bumps along the way.

On behalf of everyone at John Hancock Investments, I'd like to take this opportunity to thank you for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and Chief Executive Officer

John Hancock Investments

This commentary reflects the CEO's views as of January 31, 2016. They are subject to change at any time. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Technical Opportunities Fund

INVESTMENT OBJECTIVE

The fund seeks long-term capital appreciation.

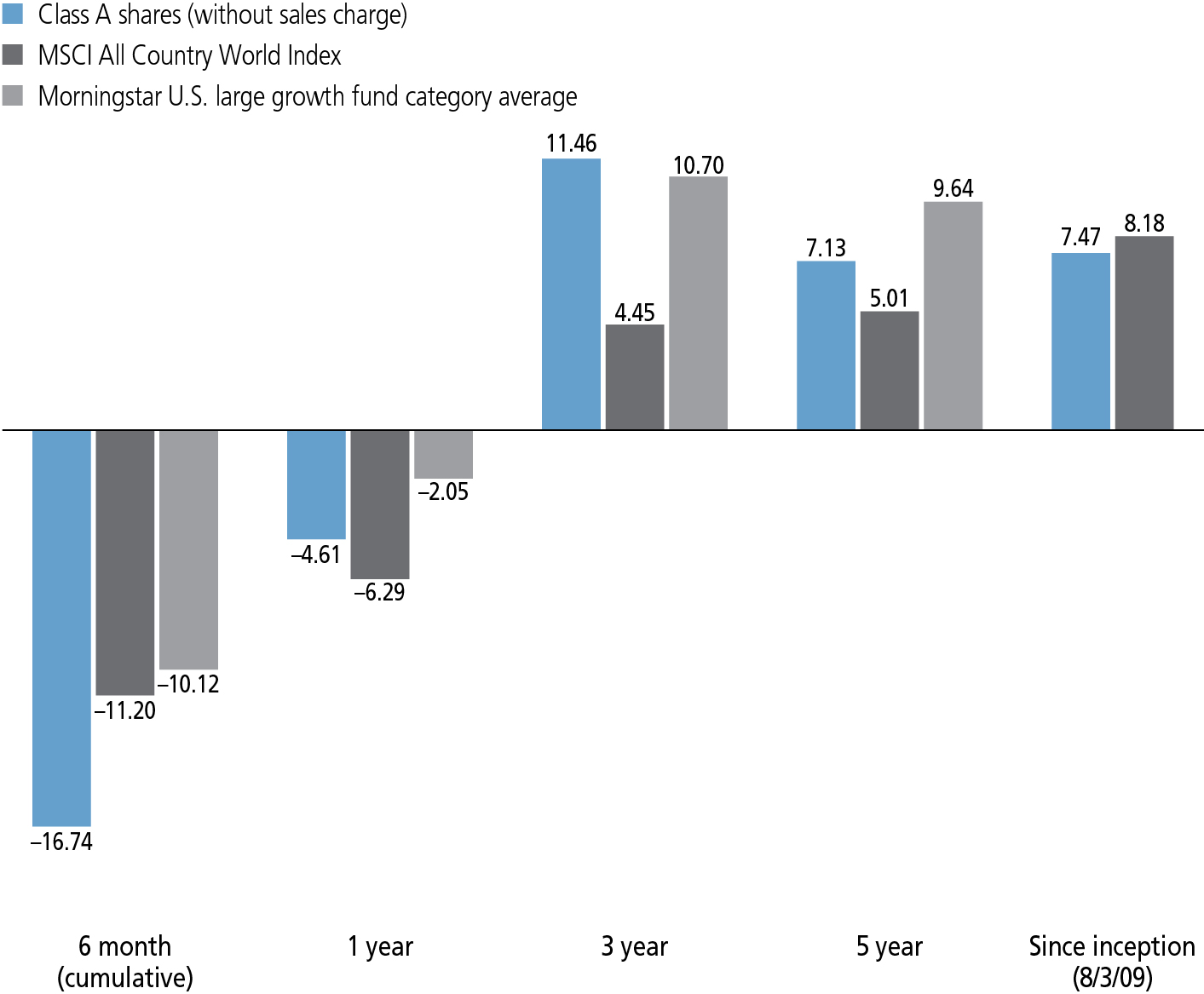

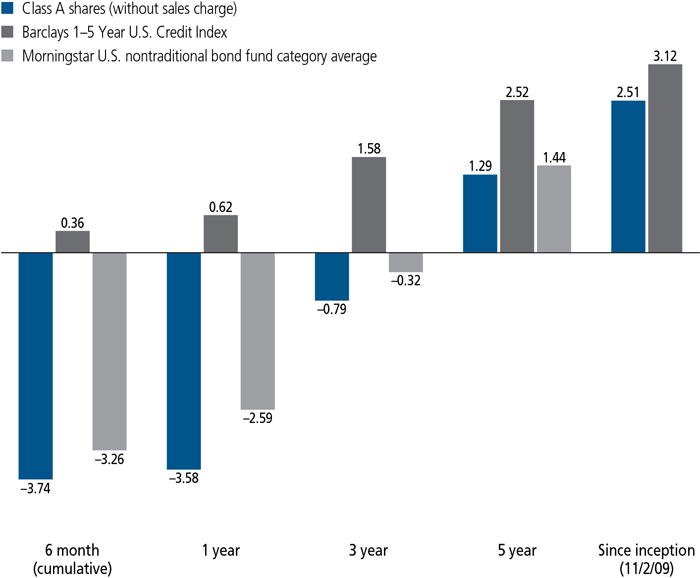

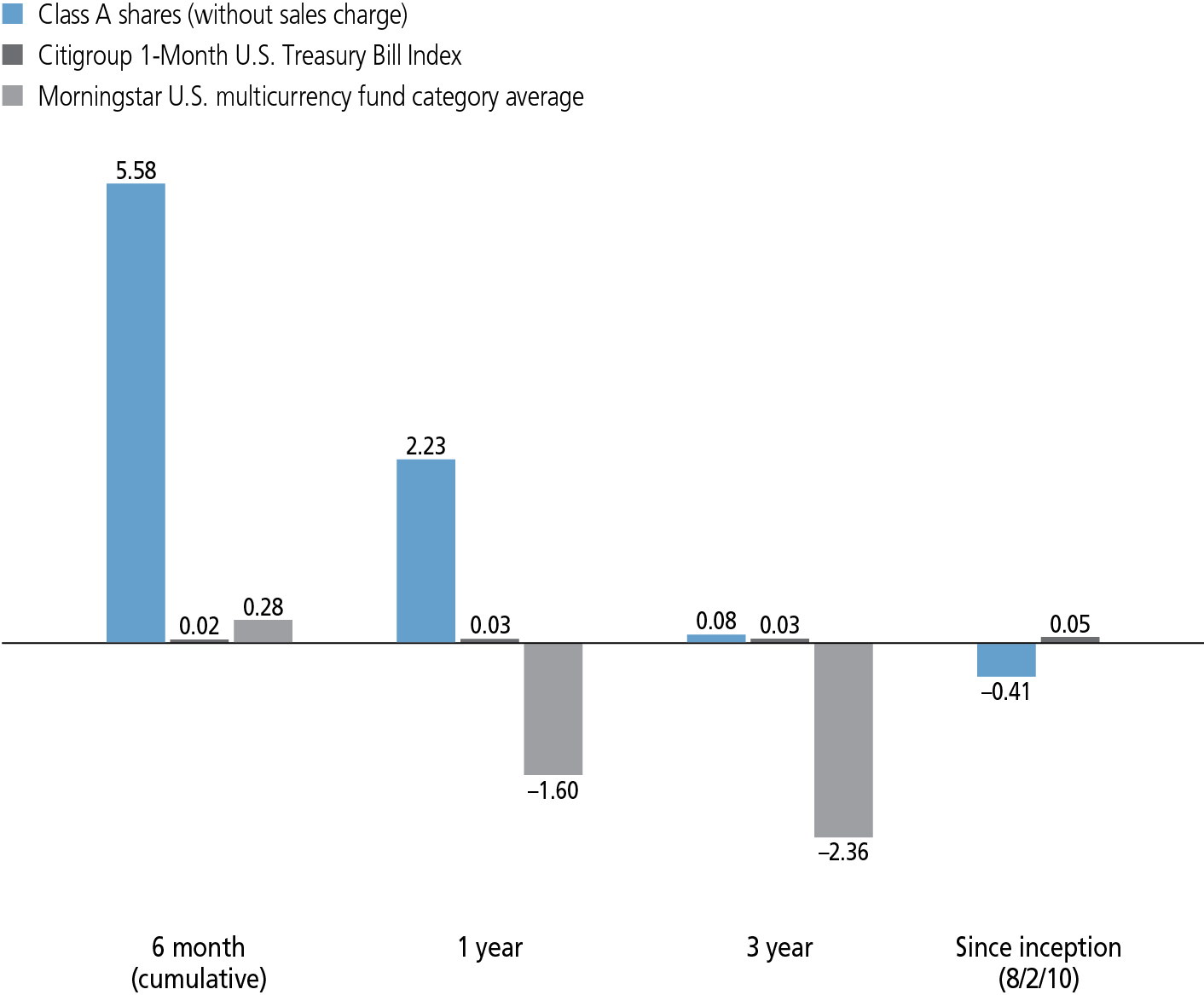

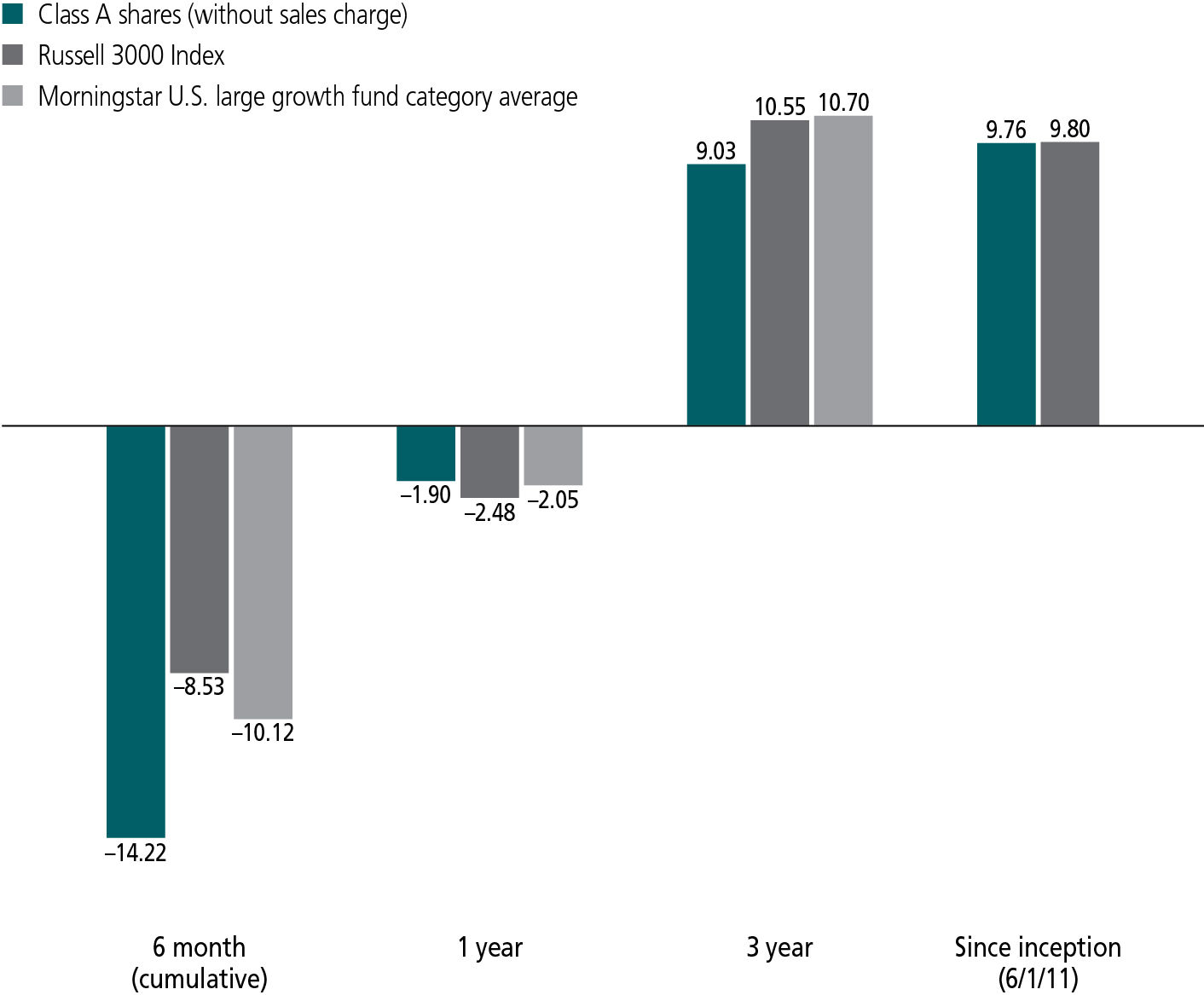

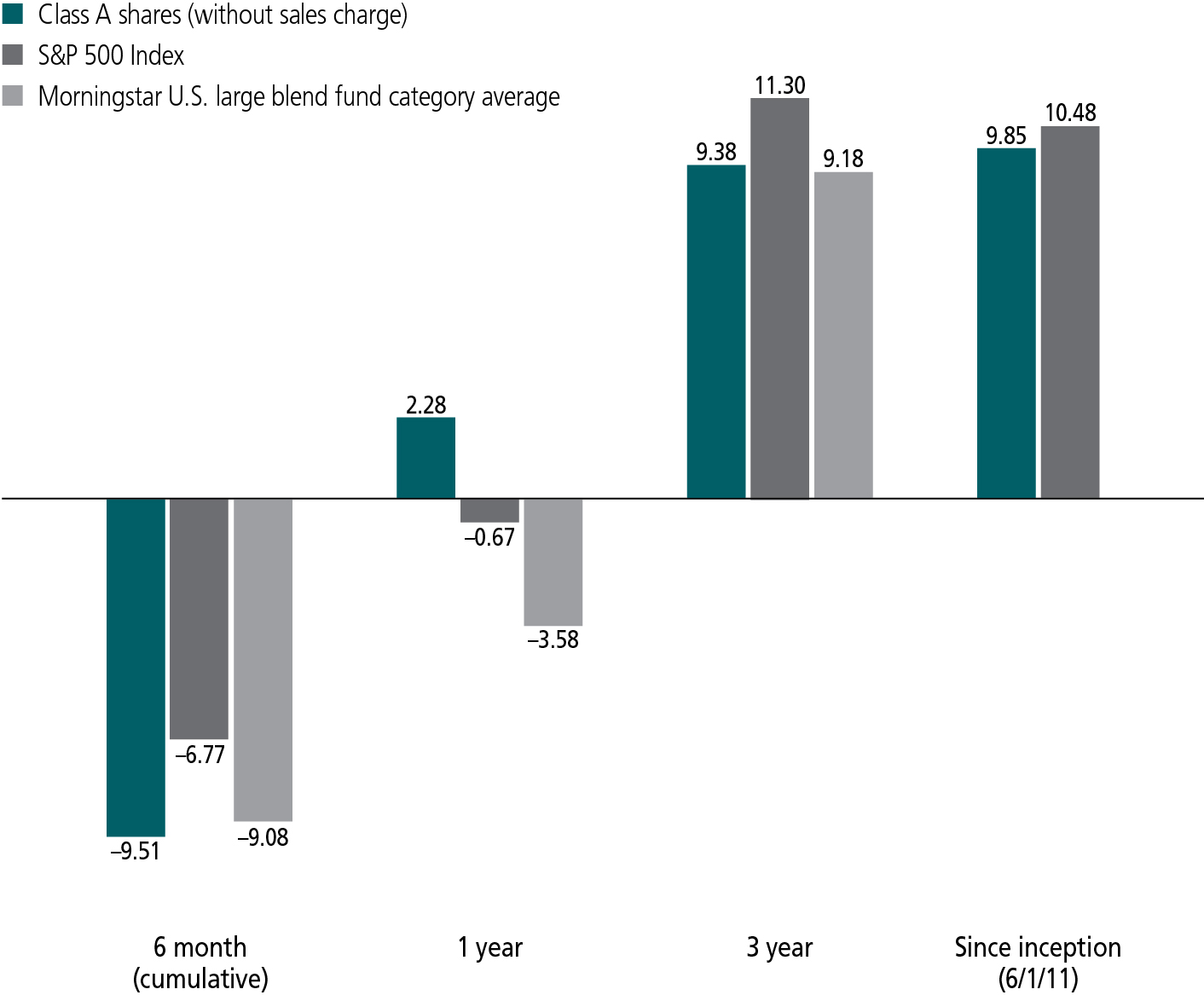

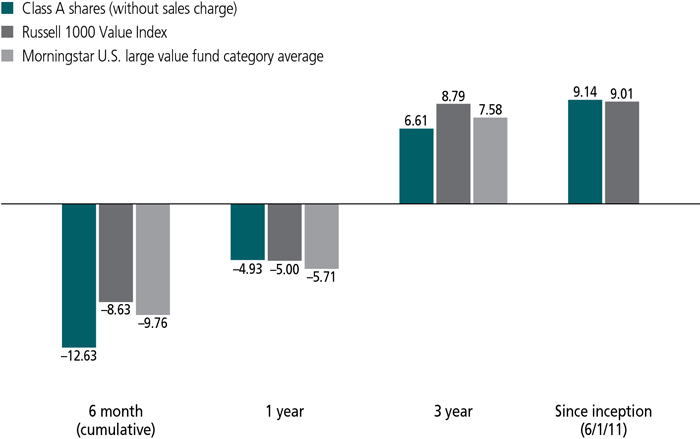

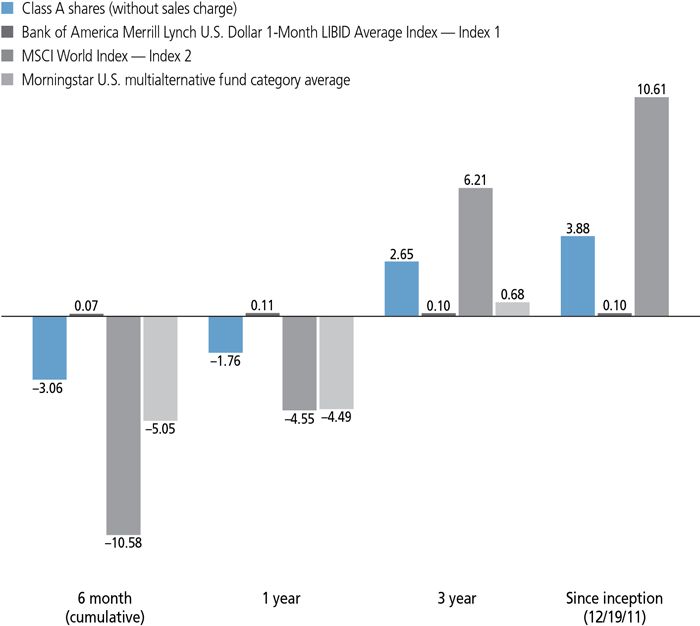

AVERAGE ANNUAL TOTAL RETURNS AS OF 1/31/16 (%)

The MSCI All Country World Index (gross of foreign withholding tax on dividends) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower. Since-inception returns for the Morningstar fund category average are not available.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Returns for periods shorter than one year are cumulative. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

PERFORMANCE HIGHLIGHTS OVER THE LAST SIX MONTHS

Global equities declined during the period

Slowing economic growth, falling commodity prices, and speculation about U.S. Federal Reserve policy weighed on investor sentiment and pressured the performance of the world stock markets.

The fund underperformed its benchmark

The fund's stock selection in the healthcare sector was the primary factor in its shortfall versus its benchmark, the MSCI AC World Index.

Mixed performance outside of healthcare

While stock selection in the financials and materials sectors added value, selection in the information technology and consumer discretionary sectors detracted.

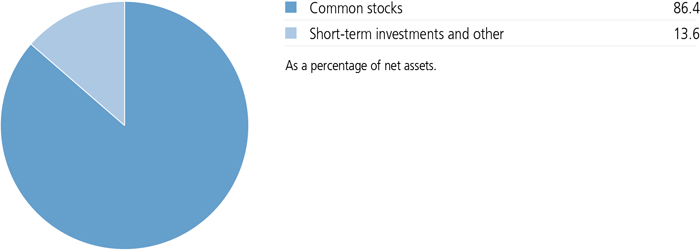

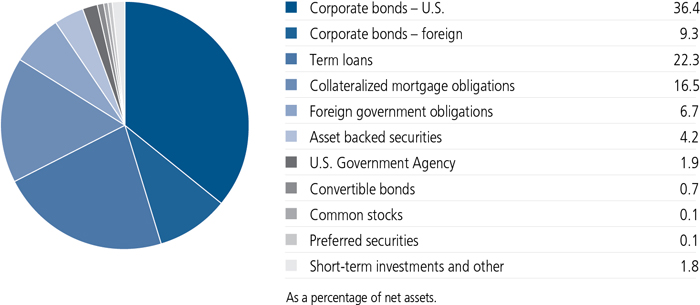

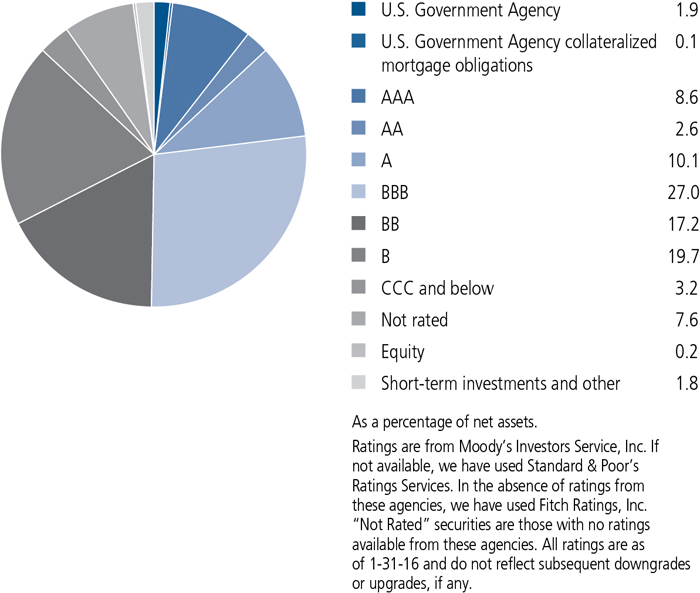

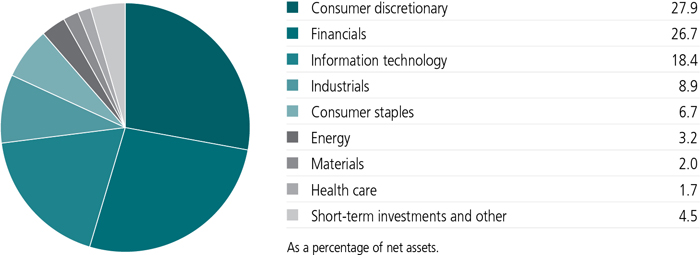

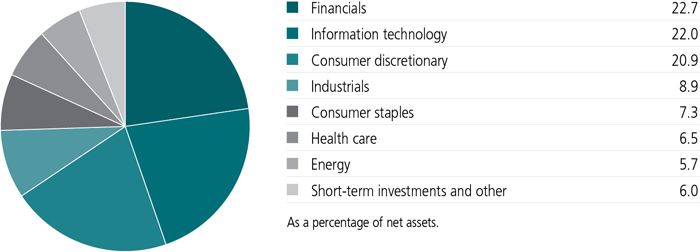

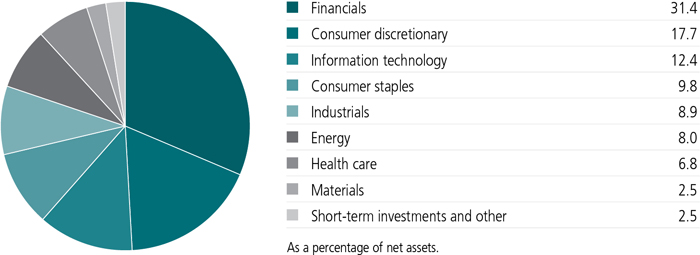

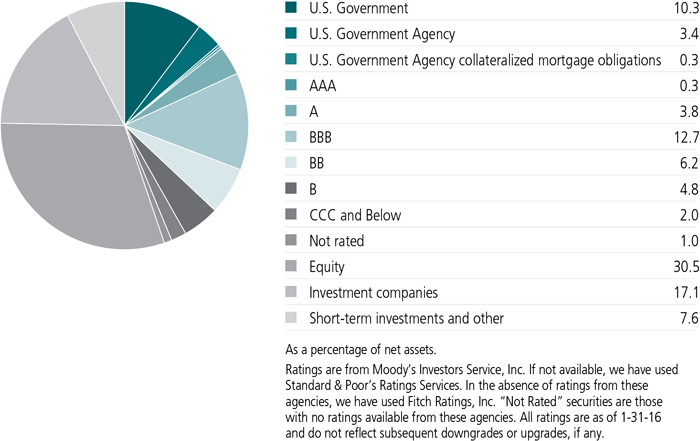

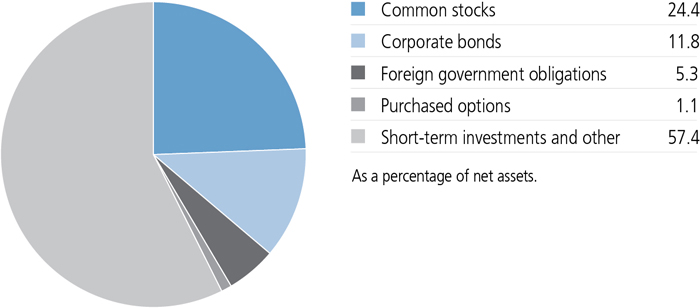

PORTFOLIO COMPOSITION AS OF 1/31/16 (%)

A note about risks

A fund concentrated in one sector or that holds a limited number of securities may fluctuate more than a fund that invests in a wider variety of sectors. Stock prices can be volatile and are affected by both general economic conditions and the financial prospects of individual companies. The value of a company's equity securities is subject to changes in the company's financial condition and overall market and economic conditions. Foreign investing, including emerging markets, has additional risks, such as currency and market volatility and political and social instability. Hedging, derivatives, and other strategic transactions may increase a fund's volatility and could produce disproportionate losses, potentially more than the fund's principal investment. The fund may invest its assets in a small number of issuers. Performance could suffer significantly from adverse events affecting these issuers. Frequent trading may increase fund transaction costs. The fund may invest in initial public offerings, which are frequently volatile in price. The fund can invest up to 100% of its assets in cash, which may cause the fund to not meet its investment objective. Please see the fund's prospectuses for additional risks.

Frank L. Teixeira, CMT, CFA

Portfolio Manager

Wellington Management Company LLP

Can you describe the market environment of the past six months?

The world equity markets declined during the six-month period ended January 31, 2016. The growth slowdown in China and its implications for global commerce fueled investor anxiety. In addition, the weaker outlook for China led to a sharp downturn in the prices of oil and other commodities, weighing heavily on the performance of stocks in the energy and materials sectors. On the other side of the ledger, elevated volatility and concerns about the state of the global economy fueled relative outperformance for the more defensive segments of the market, such as consumer staples, utilities, and telecommunication services.

Uncertainty about the U.S. Federal Reserve's (Fed's) timeline for interest-rate increases also contributed to weaker market sentiment. As many market participants expected, the Fed left rates unchanged at its highly anticipated September meeting. The Fed ultimately enacted a quarter-point rate hike in December, its first increase since 2006. The market initially reacted positively to the news, but volatility remained elevated through the end of 2015 as investors assessed the impact of the rate increase and global economic developments. The markets continued their downward trend in January, with the fund's benchmark, the MSCI AC World Index, losing 6.0% for the month.

From a technical standpoint, we saw a narrowing of potential investment opportunities during the course of the period. While companies offering growth, high-quality recurring revenue streams, steady and growing returns of capital to shareholders, low share price volatility, and exposure to the U.S. consumer performed well through much of 2015, such stocks began to experience weaker relative performance during the second half of the period. Our preference for these types of companies, together with the fund's underweight in the defensive market segments, contributed to the fund's underperformance during the past six months. However, the fund has outpaced its benchmark for the three- and five-year periods ended January 31, 2016.

What other factors detracted from performance during the period?

The fund underperformed its benchmark due largely to weak stock selection in the healthcare sector, where stocks with positive price trends generally reversed course in mid-August and lagged

Selection in the consumer discretionary and information technology sectors also detracted from performance. In the former, the fund lost some ground through positions in Netflix, Inc., Asics Corp., and Expedia Inc. In technology, the leading detractors were HubSpot, Inc., a maker of cloud-based marketing software, and ServiceNow, Inc., a provider of cloud-based technology services. These detractors were offset, to some extent, by the strong performance of the fund's holdings in Facebook, Inc. and Activision Blizzard, Inc. We sold Netflix, Asics, and ServiceNow prior to the end of the period.

What aspects of the fund's positioning aided performance?

On the positive side, the fund was helped by strong stock selection in the financials and materials

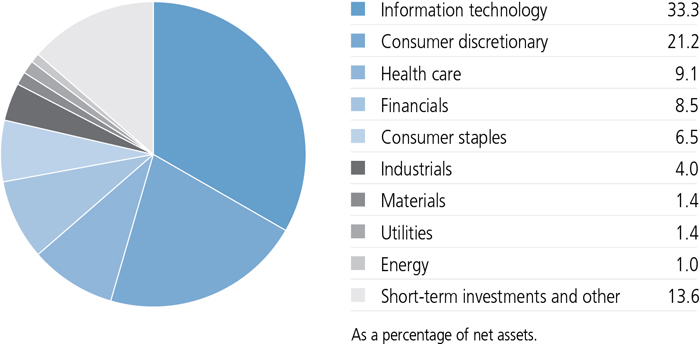

SECTOR COMPOSITION AS OF 1/31/16 (%)

How would you characterize the fund's positioning?

We do not attempt to forecast macroeconomic events or company fundamentals; instead, we use a technical analysis framework to identify sustained price trends and align the portfolio accordingly.

With this in mind, the fund closed the period with overweight positions in the United States and Japan, both of which continued to demonstrate the strongest technical conditions on both an absolute and relative basis. The fund had a significant underweight in the emerging markets, and it remained underweight in Europe, albeit to a smaller extent than it was at the beginning of the period. Information technology was the fund's largest overweight at the sector level, followed by consumer discretionary and healthcare. However, it should be noted that we significantly reduced fund's weighting in healthcare during the course of the period. The fund held a lower weighting in the defensive segments of the market, such as utilities, real estate investment trusts, and

TOP 10 HOLDINGS AS OF 1/31/16 (%)

| Facebook, Inc., Class A | 5.0 |

| Alphabet, Inc., Class A | 4.4 |

| Amazon.com, Inc. | 4.2 |

| Microsoft Corp. | 2.6 |

| Expedia, Inc. | 2.1 |

| Visa, Inc., Class A | 1.9 |

| MasterCard, Inc., Class A | 1.9 |

| ANTA Sports Products, Ltd. | 1.6 |

| Adobe Systems, Inc. | 1.5 |

| Zalando SE | 1.5 |

| TOTAL | 26.7 |

| As a percentage of net assets. | |

| Cash and cash equivalents are not included. | |

MANAGED BY

|

Frank L. Teixeira, CMT, CFA On the fund since 2009 Investing since 1989 |

COUNTRY COMPOSITION AS OF 1/31/16 (%)

| United States | 73.0 |

| Japan | 8.4 |

| Germany | 4.7 |

| United Kingdom | 4.1 |

| China | 3.3 |

| Switzerland | 1.8 |

| Denmark | 1.4 |

| Isle of Man | 1.3 |

| Ireland | 1.2 |

| Netherlands | 0.8 |

| TOTAL | 100.0 |

| As a percentage of net assets. |

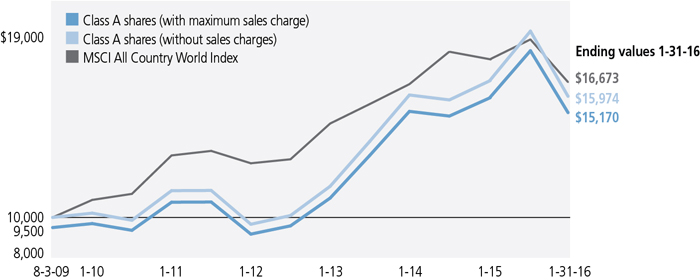

TOTAL RETURNS FOR THE PERIOD ENDED JANUARY 31, 2016

| Average annual total returns (%) with maximum sales charge |

Cumulative total returns (%) with maximum sales charge |

||||||

| 1-year | 5-year | Since inception1 |

6-month | 5-year | Since inception1 |

||

| Class A | -9.35 | 6.03 | 6.62 | -20.89 | 34.01 | 51.70 | |

| Class C2 | -6.08 | 6.43 | 6.77 | -17.71 | 36.54 | 53.10 | |

| Class I3 | -4.25 | 7.49 | 7.84 | -16.51 | 43.48 | 63.43 | |

| Class NAV3 | -4.21 | 7.67 | 8.02 | -16.51 | 44.72 | 65.13 | |

| Index† | -6.29 | 5.01 | 8.18 | -11.20 | 27.69 | 66.73 | |

Performance figures assume all distributions have been reinvested. Figures reflect maximum sales charges on Class A shares of 5.00% and the applicable contingent deferred sales charge (CDSC) on Class C shares. Class C shares sold within one year of purchase are subject to a 1% CDSC. Sales charges are not applicable to Class I and Class NAV shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. The expense ratios are as follows:

| Class A | Class C | Class I | Class NAV | |

| Gross/Net (%) | 1.63 | 2.34 | 1.32 | 1.21 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

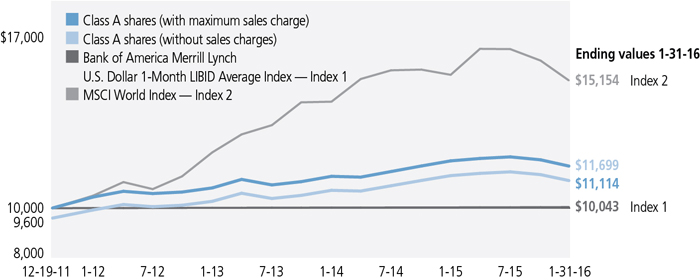

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the MSCI All Country World Index. |

See the following page for footnotes.

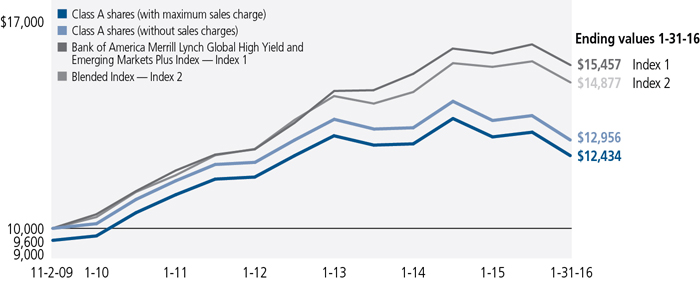

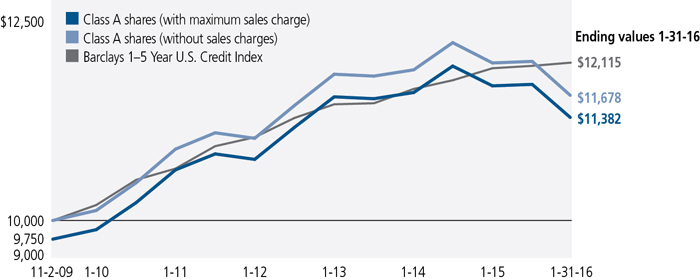

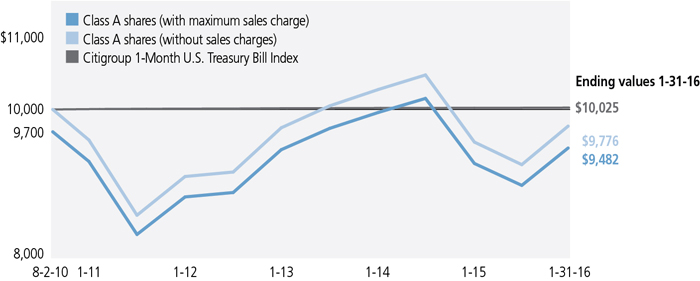

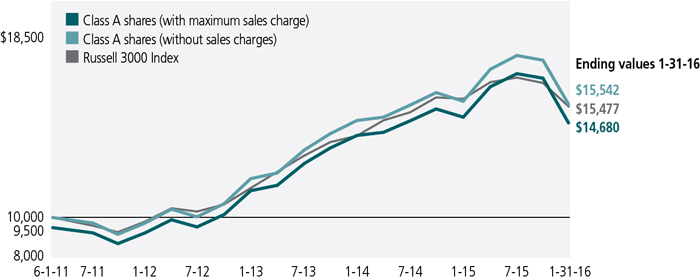

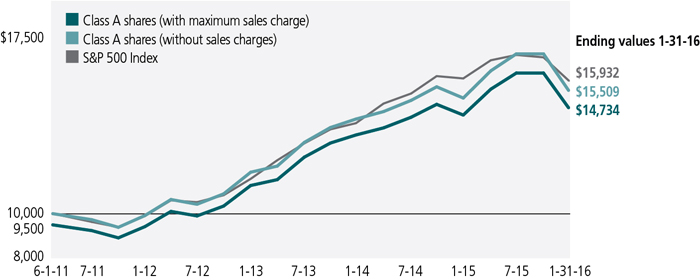

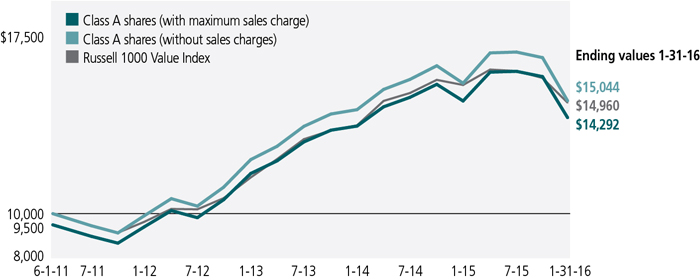

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Technical Opportunities Fund for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the MSCI All Country World Index.

| Start date | With maximum sales charge ($) |

Without sales charge ($) |

Index ($) | |

| Class C2,4 | 8-3-09 | 15,310 | 15,310 | 16,673 |

| Class I3 | 8-3-09 | 16,343 | 16,343 | 16,673 |

| Class NAV3 | 8-3-09 | 16,513 | 16,513 | 16,673 |

The MSCI All Country World Index (gross of foreign withholding tax on dividends) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| 1 | From 8-3-09. |

| 2 | Class C shares were first offered on 8-28-14. The returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class C shares. |

| 3 | For certain types of investors as described in the fund's prospectuses. |

| 4 | The contingent deferred sales charge is not applicable. |

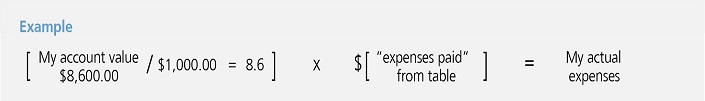

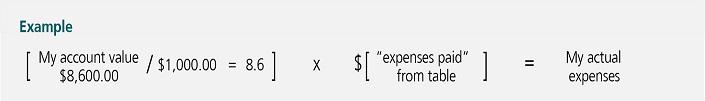

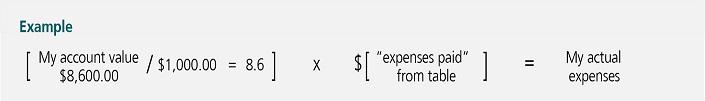

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

| • | Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc. |

| • | Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses. |

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the fund's actual ongoing operating expenses, and is based on the fund's actual return. It assumes an account value of $1,000.00 on August 1, 2015, with the same investment held until January 31, 2016.

| Account value on 8-1-2015 |

Ending value on 1-31-2016 |

Expenses paid during period ended 1-31-20161 |

Annualized expense ratio |

|

| Class A | $1,000.00 | $832.60 | $7.55 | 1.64% |

| Class C | 1,000.00 | 830.30 | 10.81 | 2.35% |

| Class I | 1,000.00 | 834.90 | 6.09 | 1.32% |

| Class NAV | 1,000.00 | 834.90 | 5.63 | 1.22% |

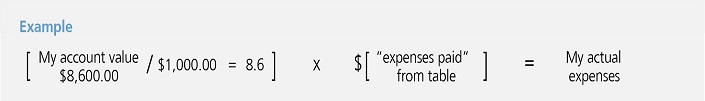

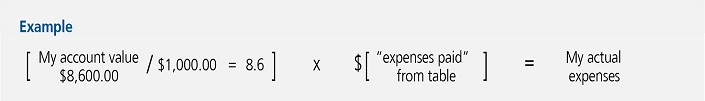

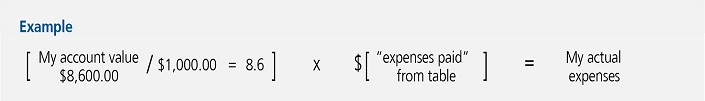

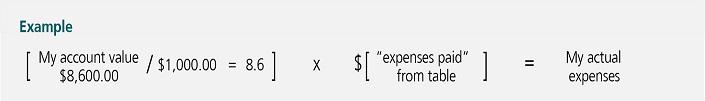

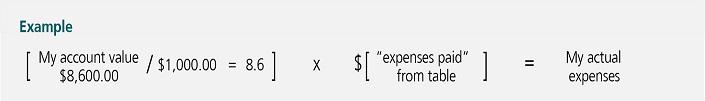

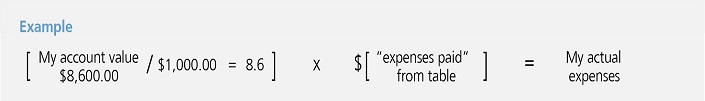

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at January 31, 2016, by $1,000.00, then multiply it by the "expenses paid" for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

This table allows you to compare the fund's ongoing operating expenses with those of any other fund. It provides an example of the fund's hypothetical account values and hypothetical expenses based on each class's actual expense ratio and an assumed 5% annualized return before expenses (which is not the fund's actual return). It assumes an account value of $1,000.00 on August 1, 2015, with the same investment held until January 31, 2016. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| Account value on 8-1-2015 |

Ending value on 1-31-2016 |

Expenses paid during period ended 1-31-20161 |

Annualized expense ratio |

|

| Class A | $1,000.00 | $1,016.90 | $8.31 | 1.64% |

| Class C | 1,000.00 | 1,013.30 | 11.89 | 2.35% |

| Class I | 1,000.00 | 1,018.50 | 6.70 | 1.32% |

| Class NAV | 1,000.00 | 1,019.00 | 6.19 | 1.22% |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectuses for details regarding transaction costs.

| 1 | Expenses are equal to the fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

Fund's investments

| As of 1-31-16 (unaudited) | |||||||||||||||||

| Shares | Value | ||||||||||||||||

| Common stocks 86.4% | $583,575,787 | ||||||||||||||||

| (Cost $543,584,782) | |||||||||||||||||

| Consumer discretionary 21.2% | 143,184,941 | ||||||||||||||||

| Distributors 0.8% | |||||||||||||||||

| Core-Mark Holding Company, Inc. | 63,196 | 5,137,203 | |||||||||||||||

| Diversified consumer services 0.1% | |||||||||||||||||

| Bright Horizons Family Solutions, Inc. (I) | 13,200 | 926,244 | |||||||||||||||

| Hotels, restaurants and leisure 4.0% | |||||||||||||||||

| Chuy's Holdings, Inc. (I) | 46,355 | 1,584,877 | |||||||||||||||

| Darden Restaurants, Inc. | 74,770 | 4,714,996 | |||||||||||||||

| Domino's Pizza, Inc. | 40,984 | 4,669,307 | |||||||||||||||

| McDonald's Corp. | 59,697 | 7,389,295 | |||||||||||||||

| Panera Bread Company, Class A (I) | 10,250 | 1,988,500 | |||||||||||||||

| Starbucks Corp. | 109,685 | 6,665,557 | |||||||||||||||

| Internet and catalog retail 9.0% | |||||||||||||||||

| Amazon.com, Inc. (I) | 48,812 | 28,652,644 | |||||||||||||||

| Ctrip.com International, Ltd., ADR (I) | 114,542 | 4,888,653 | |||||||||||||||

| Expedia, Inc. | 142,343 | 14,382,337 | |||||||||||||||

| Yoox Net-A-Porter Group SpA (I) | 85,766 | 2,950,972 | |||||||||||||||

| Zalando SE (I) | 285,579 | 9,834,876 | |||||||||||||||

| Media 0.5% | |||||||||||||||||

| ProSiebenSat.1 Media AG | 70,916 | 3,543,238 | |||||||||||||||

| Specialty retail 3.7% | |||||||||||||||||

| L Brands, Inc. | 34,436 | 3,311,021 | |||||||||||||||

| Nitori Holdings Company, Ltd. | 42,421 | 3,445,679 | |||||||||||||||

| Ross Stores, Inc. | 119,235 | 6,708,161 | |||||||||||||||

| Ulta Salon Cosmetics & Fragrance, Inc. (I) | 31,354 | 5,680,404 | |||||||||||||||

| Yamada Denki Company, Ltd. | 1,219,673 | 5,906,468 | |||||||||||||||

| Textiles, apparel and luxury goods 3.1% | |||||||||||||||||

| adidas AG | 33,115 | 3,409,939 | |||||||||||||||

| ANTA Sports Products, Ltd. | 4,476,973 | 10,822,625 | |||||||||||||||

| Pandora A/S | 49,123 | 6,571,945 | |||||||||||||||

| Consumer staples 6.5% | 43,642,594 | ||||||||||||||||

| Beverages 1.8% | |||||||||||||||||

| Davide Campari-Milano SpA | 114,676 | 1,001,903 | |||||||||||||||

| Dr. Pepper Snapple Group, Inc. | 35,337 | 3,316,024 | |||||||||||||||

| Molson Coors Brewing Company, Class B | 51,653 | 4,673,563 | |||||||||||||||

| PepsiCo, Inc. | 33,581 | 3,334,593 | |||||||||||||||

| Food and staples retailing 0.6% | |||||||||||||||||

| Ain Holdings, Inc. | 86,275 | 3,920,196 | |||||||||||||||

| Shares | Value | ||||||||||||||||

| Consumer staples (continued) | |||||||||||||||||

| Food products 1.1% | |||||||||||||||||

| Diamond Foods, Inc. (I) | 42,186 | $1,548,226 | |||||||||||||||

| Greencore Group PLC | 171,988 | 955,388 | |||||||||||||||

| Hormel Foods Corp. | 58,320 | 4,689,511 | |||||||||||||||

| Household products 0.5% | |||||||||||||||||

| Kimberly-Clark Corp. | 25,760 | 3,308,099 | |||||||||||||||

| Tobacco 2.5% | |||||||||||||||||

| Altria Group, Inc. | 76,662 | 4,684,815 | |||||||||||||||

| Philip Morris International, Inc. | 51,834 | 4,665,578 | |||||||||||||||

| Reynolds American, Inc. | 151,045 | 7,544,698 | |||||||||||||||

| Energy 1.0% | 6,978,237 | ||||||||||||||||

| Oil, gas and consumable fuels 1.0% | |||||||||||||||||

| Tesoro Corp. | 39,138 | 3,414,791 | |||||||||||||||

| Valero Energy Corp. | 52,504 | 3,563,446 | |||||||||||||||

| Financials 8.5% | 57,717,291 | ||||||||||||||||

| Capital markets 1.8% | |||||||||||||||||

| Interactive Brokers Group, Inc., Class A | 170,520 | 5,502,680 | |||||||||||||||

| Partners Group Holding AG | 19,040 | 6,866,863 | |||||||||||||||

| Diversified financial services 4.8% | |||||||||||||||||

| CBOE Holdings, Inc. | 50,684 | 3,376,568 | |||||||||||||||

| Euronext NV (S) | 115,230 | 5,585,936 | |||||||||||||||

| Intercontinental Exchange, Inc. | 19,303 | 5,092,131 | |||||||||||||||

| Japan Exchange Group, Inc. | 365,502 | 5,196,324 | |||||||||||||||

| London Stock Exchange Group PLC | 140,699 | 4,982,063 | |||||||||||||||

| Markit, Ltd. (I) | 134,911 | 3,826,076 | |||||||||||||||

| Nasdaq, Inc. | 75,399 | 4,674,738 | |||||||||||||||

| Real estate investment trusts 1.9% | |||||||||||||||||

| Equinix, Inc. | 25,663 | 7,970,158 | |||||||||||||||

| Federal Realty Investment Trust | 30,788 | 4,643,754 | |||||||||||||||

| Health care 9.1% | 61,190,728 | ||||||||||||||||

| Biotechnology 0.9% | |||||||||||||||||

| Actelion, Ltd. (I) | 38,759 | 5,107,645 | |||||||||||||||

| Portola Pharmaceuticals, Inc. (I) | 27,541 | 909,679 | |||||||||||||||

| Health care equipment and supplies 2.4% | |||||||||||||||||

| Edwards Lifesciences Corp. (I) | 57,724 | 4,514,594 | |||||||||||||||

| Intuitive Surgical, Inc. (I) | 4,817 | 2,605,274 | |||||||||||||||

| STERIS PLC | 62,490 | 4,326,808 | |||||||||||||||

| Sysmex Corp. | 71,962 | 4,633,819 | |||||||||||||||

| Pharmaceuticals 5.8% | |||||||||||||||||

| Allergan PLC (I) | 24,557 | 6,984,748 | |||||||||||||||

| Bristol-Myers Squibb Company | 132,996 | 8,267,031 | |||||||||||||||

| Shares | Value | ||||||||||||||||

| Health care (continued) | |||||||||||||||||

| Pharmaceuticals (continued) | |||||||||||||||||

| Eli Lilly & Company | 48,563 | $3,841,333 | |||||||||||||||

| Ono Pharmaceutical Company, Ltd. | 49,811 | 8,027,686 | |||||||||||||||

| Santen Pharmaceutical Company, Ltd. | 294,123 | 4,698,590 | |||||||||||||||

| Shionogi & Company, Ltd. | 106,936 | 4,666,626 | |||||||||||||||

| The Medicines Company (I) | 75,431 | 2,606,895 | |||||||||||||||

| Industrials 4.0% | 26,961,062 | ||||||||||||||||

| Aerospace and defense 2.1% | |||||||||||||||||

| Orbital ATK, Inc. | 78,187 | 7,054,813 | |||||||||||||||

| Raytheon Company | 56,344 | 7,225,555 | |||||||||||||||

| Construction and engineering 0.5% | |||||||||||||||||

| Vinci SA | 49,618 | 3,361,481 | |||||||||||||||

| Machinery 0.5% | |||||||||||||||||

| KUKA AG (L) | 42,661 | 3,279,816 | |||||||||||||||

| Road and rail 0.9% | |||||||||||||||||

| DSV A/S | 82,340 | 3,204,375 | |||||||||||||||

| East Japan Railway Company | 30,843 | 2,835,022 | |||||||||||||||

| Information technology 33.3% | 224,994,135 | ||||||||||||||||

| Communications equipment 0.4% | |||||||||||||||||

| Harris Corp. | 30,706 | 2,670,501 | |||||||||||||||

| Internet software and services 13.2% | |||||||||||||||||

| Alphabet, Inc., Class A (I) | 38,813 | 29,550,278 | |||||||||||||||

| Facebook, Inc., Class A (I) | 298,891 | 33,538,562 | |||||||||||||||

| GoDaddy, Inc., Class A (I)(L) | 146,049 | 4,453,034 | |||||||||||||||

| Rightmove PLC | 74,921 | 4,274,889 | |||||||||||||||

| Tencent Holdings, Ltd. | 356,218 | 6,692,157 | |||||||||||||||

| United Internet AG | 118,042 | 6,109,079 | |||||||||||||||

| VeriSign, Inc. (I)(L) | 63,328 | 4,787,597 | |||||||||||||||

| IT services 10.3% | |||||||||||||||||

| Accenture PLC, Class A | 66,580 | 7,026,853 | |||||||||||||||

| EPAM Systems, Inc. (I) | 19,344 | 1,448,866 | |||||||||||||||

| ExlService Holdings, Inc. (I) | 89,138 | 3,891,765 | |||||||||||||||

| Global Payments, Inc. | 149,363 | 8,804,949 | |||||||||||||||

| MasterCard, Inc., Class A | 146,231 | 13,018,946 | |||||||||||||||

| Nomura Research Institute, Ltd. | 94,371 | 3,424,537 | |||||||||||||||

| Obic Company, Ltd. | 85,539 | 4,430,909 | |||||||||||||||

| Paysafe Group PLC (I) | 1,524,684 | 8,784,476 | |||||||||||||||

| Visa, Inc., Class A | 175,022 | 13,037,389 | |||||||||||||||

| Wirecard AG (L) | 114,537 | 5,792,231 | |||||||||||||||

| Software 9.4% | |||||||||||||||||

| Activision Blizzard, Inc. | 139,676 | 4,863,518 | |||||||||||||||

| Shares | Value | ||||||||||||||||

| Information technology (continued) | |||||||||||||||||

| Software (continued) | |||||||||||||||||

| Adobe Systems, Inc. (I) | 111,541 | $9,941,649 | |||||||||||||||

| Guidewire Software, Inc. (I) | 140,050 | 7,708,352 | |||||||||||||||

| HubSpot, Inc. (I) | 176,046 | 7,145,707 | |||||||||||||||

| Manhattan Associates, Inc. (I) | 59,306 | 3,418,991 | |||||||||||||||

| Microsoft Corp. | 315,942 | 17,405,245 | |||||||||||||||

| salesforce.com, Inc. (I) | 95,592 | 6,505,992 | |||||||||||||||

| The Sage Group PLC | 703,119 | 6,267,663 | |||||||||||||||

| Materials 1.4% | 9,479,377 | ||||||||||||||||

| Chemicals 0.8% | |||||||||||||||||

| Daicel Corp. | 368,699 | 5,423,958 | |||||||||||||||

| Containers and packaging 0.6% | |||||||||||||||||

| RPC Group PLC | 377,508 | 4,055,419 | |||||||||||||||

| Utilities 1.4% | 9,427,422 | ||||||||||||||||

| Multi-utilities 1.4% | |||||||||||||||||

| CMS Energy Corp. | 69,281 | 2,693,645 | |||||||||||||||

| NiSource, Inc. | 161,267 | 3,388,220 | |||||||||||||||

| WEC Energy Group, Inc. | 60,575 | 3,345,557 | |||||||||||||||

| Yield (%) | Shares | Value | |||||||||||||||

| Securities lending collateral 3.1% | $21,178,568 | ||||||||||||||||

| (Cost $21,178,453) | |||||||||||||||||

| John Hancock Collateral Trust (W) | 0.4110(Y) | 2,116,841 | 21,178,568 | ||||||||||||||

| Par value^ | Value | ||||||||||||||||

| Short-term investments 8.8% | $59,200,000 | ||||||||||||||||

| (Cost $59,200,000) | |||||||||||||||||

| Repurchase agreement 8.8% | 59,200,000 | ||||||||||||||||

| Bank of America Tri-Party Repurchase Agreement dated 1-29-16 at 0.340% to be repurchased at $59,201,677 on 2-1-16, collateralized by $56,320,052 Government National Mortgage Association 4.000% due 2-20-45 (valued at $60,384,001, including interest). | 59,200,000 | 59,200,000 | |||||||||||||||

| Total investments (Cost $623,963,235)† 98.3% | $663,954,355 | ||||||||||||||||

| Other assets and liabilities, net 1.7% | $11,478,535 | ||||||||||||||||

| Total net assets 100.0% | $675,432,890 | ||||||||||||||||

| The percentage shown for each investment category is the total value

of the category as a percentage of the net assets of the fund.

^All par values are denominated in U.S. dollars unless otherwise indicated. |

|||||||||||||||||

| Key to Security Abbreviations and Legend | |||||||||||||||||

| ADR | American Depositary Receipts | ||||||||||||||||

| (I) | Non-income producing security. | ||||||||||||||||

| (L) | A portion of this security is on loan as of 1-31-16. | ||||||||||||||||

| (S) | These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. | ||||||||||||||||

| (W) | Investment is an affiliate of the fund, the advisor and/or subadvisor. This security represents the investment of cash collateral received for securities lending. | ||||||||||||||||

| (Y) | The rate shown is the annualized seven-day yield as of 1-31-16. | ||||||||||||||||

| † | At 1-31-16, the aggregate cost of investment securities for federal income tax purposes was $627,521,260. Net unrealized appreciation aggregated $36,433,095, of which $47,147,101 related to appreciated investment securities and $10,714,006 related to depreciated investment securities. | ||||||||||||||||

Financial statements

STATEMENT OF ASSETS AND LIABILITIES 1-31-16 (unaudited)

| Assets | ||||||||||||||||||||||||||||||

| Investments in unaffiliated issuers, at value (Cost $602,784,782) including $20,753,681 of securities loaned | $642,775,787 | |||||||||||||||||||||||||||||

| Investments in affiliated issuers, at value (Cost $21,178,453) | 21,178,568 | |||||||||||||||||||||||||||||

| Total investments, at value (Cost $623,963,235) | 663,954,355 | |||||||||||||||||||||||||||||

| Cash | 78,639 | |||||||||||||||||||||||||||||

| Foreign currency, at value (Cost $3,361,562) | 3,361,564 | |||||||||||||||||||||||||||||

| Receivable for investments sold | 139,015,470 | |||||||||||||||||||||||||||||

| Receivable for fund shares sold | 133,950 | |||||||||||||||||||||||||||||

| Unrealized appreciation on forward foreign currency exchange contracts | 3,432,534 | |||||||||||||||||||||||||||||

| Dividends and interest receivable | 161,960 | |||||||||||||||||||||||||||||

| Receivable for securities lending income | 52,255 | |||||||||||||||||||||||||||||

| Other receivables and prepaid expenses | 34,802 | |||||||||||||||||||||||||||||

| Total assets | 810,225,529 | |||||||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||

| Payable for investments purchased | 109,307,018 | |||||||||||||||||||||||||||||

| Unrealized depreciation on forward foreign currency exchange contracts | 2,177,234 | |||||||||||||||||||||||||||||

| Payable for fund shares repurchased | 1,975,083 | |||||||||||||||||||||||||||||

| Payable upon return of securities loaned | 21,231,398 | |||||||||||||||||||||||||||||

| Payable to affiliates | ||||||||||||||||||||||||||||||

| Accounting and legal services fees | 18,370 | |||||||||||||||||||||||||||||

| Transfer agent fees | 16,796 | |||||||||||||||||||||||||||||

| Trustees' fees | 1,552 | |||||||||||||||||||||||||||||

| Other liabilities and accrued expenses | 65,188 | |||||||||||||||||||||||||||||

| Total liabilities | 134,792,639 | |||||||||||||||||||||||||||||

| Net assets | $675,432,890 | |||||||||||||||||||||||||||||

| Net assets consist of | ||||||||||||||||||||||||||||||

| Paid-in capital | $662,350,235 | |||||||||||||||||||||||||||||

| Accumulated net investment loss | (2,401,807 | ) | ||||||||||||||||||||||||||||

| Accumulated net realized gain (loss) on investments and foreign currency transactions | (25,805,589 | ) | ||||||||||||||||||||||||||||

| Net unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies | 41,290,051 | |||||||||||||||||||||||||||||

| Net assets | $675,432,890 | |||||||||||||||||||||||||||||

STATEMENT OF ASSETS AND LIABILITIES (continued)

| Net asset value per share | ||||||||||||||||||

| Based on net asset values and shares outstanding-the fund has an unlimited number of shares authorized with no par value | ||||||||||||||||||

| Class A ($52,591,586 ÷ 4,944,092 shares)1 | $10.64 | |||||||||||||||||

| Class C ($3,195,037 ÷ 292,514 shares)1 | $10.92 | |||||||||||||||||

| Class I ($20,338,362 ÷ 1,854,263 shares) | $10.97 | |||||||||||||||||

| Class NAV ($599,307,905 ÷ 53,817,195 shares) | $11.14 | |||||||||||||||||

| Maximum offering price per share | ||||||||||||||||||

| Class A (net asset value per share ÷ 95%)2 | $11.20 | |||||||||||||||||

| 1 | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||||||||||||||

| 2 | On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced. | ||||||||||||||||

STATEMENT OF OPERATIONS For the six months ended 1-31-16 (unaudited)

| Investment income | ||||||||||||||||||||||||

| Dividends | $2,402,814 | |||||||||||||||||||||||

| Securities lending | 160,834 | |||||||||||||||||||||||

| Interest | 22,196 | |||||||||||||||||||||||

| Less foreign taxes withheld | (71,820 | ) | ||||||||||||||||||||||

| Total investment income | 2,514,024 | |||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||

| Investment management fees | 4,541,023 | |||||||||||||||||||||||

| Distribution and service fees | 105,571 | |||||||||||||||||||||||

| Accounting and legal services fees | 51,029 | |||||||||||||||||||||||

| Transfer agent fees | 56,638 | |||||||||||||||||||||||

| Trustees' fees | 7,247 | |||||||||||||||||||||||

| State registration fees | 33,164 | |||||||||||||||||||||||

| Printing and postage | 7,502 | |||||||||||||||||||||||

| Professional fees | 28,667 | |||||||||||||||||||||||

| Custodian fees | 70,496 | |||||||||||||||||||||||

| Registration and filing fees | 26,263 | |||||||||||||||||||||||

| Other | 9,741 | |||||||||||||||||||||||

| Total expenses | 4,937,341 | |||||||||||||||||||||||

| Less expense reductions | (29,006 | ) | ||||||||||||||||||||||

| Net expenses | 4,908,335 | |||||||||||||||||||||||

| Net investment loss | (2,394,311 | ) | ||||||||||||||||||||||

| Realized and unrealized gain (loss) | ||||||||||||||||||||||||

| Net realized gain (loss) on | ||||||||||||||||||||||||

| Investments in unaffiliated issuers and foreign currency transactions | (17,522,962 | ) | ||||||||||||||||||||||

| Investments in affiliated issuers | (1,122 | ) | ||||||||||||||||||||||

| (17,524,084 | ) | |||||||||||||||||||||||

| Change in net unrealized appreciation (depreciation) of | ||||||||||||||||||||||||

| Investments in unaffiliated issuers and translation of assets and liabilities in foreign currencies | (120,329,007 | ) | ||||||||||||||||||||||

| Investments in affiliated issuers | (137 | ) | ||||||||||||||||||||||

| (120,329,144 | ) | |||||||||||||||||||||||

| Net realized and unrealized loss | (137,853,228 | ) | ||||||||||||||||||||||

| Decrease in net assets from operations | ($140,247,539 | ) | ||||||||||||||||||||||

STATEMENTS OF CHANGES IN NET ASSETS

| Six months ended 1-31-16 | Year ended 7-31-15 | ||||||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||

| Increase (decrease) in net assets | |||||||||||||||||||||||||||||||||||||||||||||

| From operations | |||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss | ($2,394,311 | ) | ($5,518,116 | ) | |||||||||||||||||||||||||||||||||||||||||

| Net realized gain (loss) | (17,524,084 | ) | 90,774,253 | ||||||||||||||||||||||||||||||||||||||||||

| Change in net unrealized appreciation (depreciation) | (120,329,144 | ) | 92,347,365 | ||||||||||||||||||||||||||||||||||||||||||

| Increase (decrease) in net assets resulting from operations | (140,247,539 | ) | 177,603,502 | ||||||||||||||||||||||||||||||||||||||||||

| Distributions to shareholders | |||||||||||||||||||||||||||||||||||||||||||||

| From net realized gain | |||||||||||||||||||||||||||||||||||||||||||||

| Class A | (7,236,588 | ) | (7,064,030 | ) | |||||||||||||||||||||||||||||||||||||||||

| Class C | (411,214 | ) | (17,531 | ) | |||||||||||||||||||||||||||||||||||||||||

| Class I | (2,737,264 | ) | (4,070,058 | ) | |||||||||||||||||||||||||||||||||||||||||

| Class NAV | (77,283,763 | ) | (106,392,068 | ) | |||||||||||||||||||||||||||||||||||||||||

| Total distributions | (87,668,829 | ) | (117,543,687 | ) | |||||||||||||||||||||||||||||||||||||||||

| From fund share transactions | 33,651,799 | (62,339,874 | ) | ||||||||||||||||||||||||||||||||||||||||||

| Total decrease | (194,264,569 | ) | (2,280,059 | ) | |||||||||||||||||||||||||||||||||||||||||

| Net assets | |||||||||||||||||||||||||||||||||||||||||||||

| Beginning of period | 869,697,459 | 871,977,518 | |||||||||||||||||||||||||||||||||||||||||||

| End of period | $675,432,890 | $869,697,459 | |||||||||||||||||||||||||||||||||||||||||||

| Accumulated net investment loss | ($2,401,807 | ) | ($7,496 | ) | |||||||||||||||||||||||||||||||||||||||||

Financial highlights

| Class A Shares Period ended | 1-31-16 | 1 | 7-31-15 | 7-31-14 | 7-31-13 | 7-31-12 | 7-31-11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $14.47 | $13.76 | $13.15 | $9.65 | $11.33 | $9.86 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss2 | (0.06 | ) | (0.14 | ) | (0.14 | ) | (0.08 | ) | (0.10 | ) | (0.09 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | (2.20 | ) | 2.81 | 2.09 | 3.58 | (1.17 | ) | 1.56 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total from investment operations | (2.26 | ) | 2.67 | 1.95 | 3.50 | (1.27 | ) | 1.47 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less distributions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| From net realized gain | (1.57 | ) | (1.96 | ) | (1.34 | ) | — | (0.41 | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, end of period | $10.64 | $14.47 | $13.76 | $13.15 | $9.65 | $11.33 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total return (%)3,4 | (16.74 | ) 5 | 21.46 | 14.86 | 36.27 | (10.93 | ) | 14.91 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net assets, end of period (in millions) | $53 | $66 | $59 | $45 | $51 | $125 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios (as a percentage of average net assets): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses before reductions | 1.65 | 6 | 1.67 | 1.72 | 1.78 | 1.88 | 1.90 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses including reductions | 1.64 | 6 | 1.65 | 1.71 | 1.78 | 1.88 | 1.90 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss | (1.00 | ) 6 | (1.05 | ) | (1.03 | ) | (0.69 | ) | (1.04 | ) | (0.79 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover (%) | 133 | 228 | 306 | 391 | 507 | 361 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Six months ended 1-31-16. Unaudited. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Based on average daily shares outstanding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Does not reflect the effect of sales charges, if any. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Not annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | Annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class C Shares Period ended | 1-31-16 | 1 | 7-31-15 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $14.86 | $14.94 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss3 | (0.11 | ) | (0.27 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | (2.26 | ) | 2.15 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total from investment operations | (2.37 | ) | 1.88 | |||||||||||||||||||||||||||||||||||||||||||||||

| Less distributions | ||||||||||||||||||||||||||||||||||||||||||||||||||

| From net realized gain | (1.57 | ) | (1.96 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, end of period | $10.92 | $14.86 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total return (%)4,5 | (16.97 | ) 6 | 14.41 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net assets, end of period (in millions) | $3 | $2 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios (as a percentage of average net assets): | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses before reductions | 2.36 | 7 | 3.39 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||

| Expenses including reductions | 2.35 | 7 | 2.50 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss | (1.72 | ) 7 | (2.06 | ) 7 | ||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover (%) | 133 | 228 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Six months ended 1-31-16. Unaudited. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | The inception date for Class C shares is 8-28-14. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Based on average daily shares outstanding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Does not reflect the effect of sales charges, if any. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | Not annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | The portfolio turnover is shown for the period from 8-1-14 to 7-31-15. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class I Shares Period ended | 1-31-16 | 1 | 7-31-15 | 7-31-14 | 7-31-13 | 7-31-12 | 7-31-11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $14.84 | $14.03 | $13.35 | $9.77 | $11.42 | $9.89 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss2 | (0.04 | ) | (0.10 | ) | (0.11 | ) | (0.04 | ) | (0.07 | ) | (0.04 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | (2.26 | ) | 2.87 | 2.13 | 3.62 | (1.17 | ) | 1.57 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total from investment operations | (2.30 | ) | 2.77 | 2.02 | 3.58 | (1.24 | ) | 1.53 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less distributions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| From net realized gain | (1.57 | ) | (1.96 | ) | (1.34 | ) | — | (0.41 | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, end of period | $10.97 | $14.84 | $14.03 | $13.35 | $9.77 | $11.42 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total return (%)3 | (16.51 | ) 4 | 21.79 | 15.17 | 36.64 | (10.57 | ) | 15.47 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net assets, end of period (in millions) | $20 | $44 | $30 | $18 | $17 | $63 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios (as a percentage of average net assets): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses before reductions | 1.33 | 5 | 1.35 | 1.44 | 1.48 | 1.55 | 1.49 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses including reductions | 1.32 | 5 | 1.35 | 1.43 | 1.47 | 1.51 | 1.49 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss | (0.65 | ) 5 | (0.74 | ) | (0.75 | ) | (0.39 | ) | (0.69 | ) | (0.37 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover (%) | 133 | 228 | 306 | 391 | 507 | 361 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Six months ended 1-31-16. Unaudited. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Based on average daily shares outstanding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Not annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class NAV Shares Period ended | 1-31-16 | 1 | 7-31-15 | 7-31-14 | 7-31-13 | 7-31-12 | 7-31-11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $15.03 | $14.16 | $13.44 | $9.81 | $11.45 | $9.90 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss2 | (0.04 | ) | (0.08 | ) | (0.08 | ) | (0.02 | ) | (0.04 | ) | (0.03 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | (2.28 | ) | 2.91 | 2.14 | 3.65 | (1.19 | ) | 1.58 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total from investment operations | (2.32 | ) | 2.83 | 2.06 | 3.63 | (1.23 | ) | 1.55 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less distributions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| From net realized gain | (1.57 | ) | (1.96 | ) | (1.34 | ) | — | (0.41 | ) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, end of period | $11.14 | $15.03 | $14.16 | $13.44 | $9.81 | $11.45 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total return (%)3 | (16.51 | ) 4 | 22.02 | 15.38 | 37.00 | (10.45 | ) | 15.66 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net assets, end of period (in millions) | $599 | $758 | $783 | $606 | $433 | $535 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios (as a percentage of average net assets): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses before reductions | 1.23 | 5 | 1.21 | 1.22 | 1.24 | 1.32 | 1.37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses including reductions | 1.22 | 5 | 1.20 | 1.21 | 1.23 | 1.32 | 1.37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment loss | (0.57 | ) 5 | (0.59 | ) | (0.54 | ) | (0.16 | ) | (0.46 | ) | (0.31 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover (%) | 133 | 228 | 306 | 391 | 507 | 361 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Six months ended 1-31-16. Unaudited. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Based on average daily shares outstanding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Not annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Note 1 — Organization

John Hancock Technical Opportunities Fund (the fund) is a series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the fund is to seek long-term capital appreciation.

The fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class NAV shares are offered to John Hancock affiliated funds of funds and certain 529 plans. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees for each class may differ.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. In order to value the securities, the fund uses the following valuation techniques: Equity securities held by the fund are valued at the last sale price or official closing price on the exchange or principal market where the security was acquired or most likely will be sold. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last available bid price. Investments by the fund in open-end mutual funds, including John Hancock Collateral Trust (JHCT), are valued at their respective net asset values each business day. Foreign securities and currencies, including forward foreign currency contracts, are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing vendor. Securities that trade only in the over-the-counter (OTC) market are valued using bid prices.

Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund's Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed. Trading in foreign securities may be completed before the daily close of trading on the NYSE. Significant events at the issuer or market level may affect the values of securities between the time when the valuation of the securities is generally determined and the close of the NYSE. If a significant event occurs, these securities may be fair valued, as determined in good faith by the fund's Pricing Committee, following procedures established by the Board of Trustees. The fund uses fair value adjustment factors provided by an independent pricing vendor to value certain foreign securities in order to adjust for events that may occur between the close of foreign exchanges or markets and the close of the NYSE.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund's own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing

securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the values by input classification of the fund's investments as of January 31, 2016, by major security category or type:

| Total value at 1-31-16 |

Level 1 quoted price |

Level 2 significant observable inputs |

Level 3 significant unobservable inputs |

||

| Common stocks | |||||

| Consumer discretionary | $143,184,941 | $96,699,199 | $46,485,742 | — | |

| Consumer staples | 43,642,594 | 37,765,107 | 5,877,487 | — | |

| Energy | 6,978,237 | 6,978,237 | — | — | |

| Financials | 57,717,291 | 35,086,105 | 22,631,186 | — | |

| Health care | 61,190,728 | 34,056,362 | 27,134,366 | — | |

| Industrials | 26,961,062 | 14,280,368 | 12,680,694 | — | |

| Information technology | 224,994,135 | 179,218,194 | 45,775,941 | — | |

| Materials | 9,479,377 | — | 9,479,377 | — | |

| Utilities | 9,427,422 | 9,427,422 | — | — | |

| Securities lending collateral | 21,178,568 | 21,178,568 | — | — | |

| Short-term investments | 59,200,000 | — | 59,200,000 | — | |

| Total investments in securities | $663,954,355 | $434,689,562 | $229,264,793 | — | |

| Other financial instruments | |||||

| Forward foreign currency contracts | $1,255,300 | — | $1,255,300 | — | |

Repurchase agreements. The fund may enter into repurchase agreements. When the fund enters into a repurchase agreement, it receives collateral that is held in a segregated account by the fund's custodian, or for tri-party repurchase agreements, collateral is held at a third-party custodian bank in a segregated account for the benefit of the fund. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. Collateral received by the fund for repurchase agreements is disclosed in the Fund's investments as part of the caption related to the repurchase agreement.

Repurchase agreements are typically governed by the terms and conditions of the Master Repurchase Agreement and/or Global Master Repurchase Agreement (collectively, MRA). Upon an event of default, the non-defaulting party may close out all transactions traded under the MRA and net amounts owed. Absent an event of default, assets and liabilities resulting from repurchase agreements are not offset in the Statement of assets and liabilities. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline or the counterparty may have insufficient assets to pay back claims resulting from close-out of the transactions.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Interest income is accrued as earned. Foreign taxes are provided for based on the fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Securities lending. The fund may lend its securities to earn additional income. The fund receives cash collateral from the borrower in an amount not less than the market value of the loaned securities. The fund will invest its collateral in JHCT, an affiliate of the fund, which has a floating net asset value and is registered with the Securities and Exchange Commission as an investment company. JHCT invests cash received as collateral as part of the securities lending program in short-term

money market investments. The fund will receive the benefit of any gains and bear any losses generated by JHCT with respect to the cash collateral.

The fund has the right to recall loaned securities on demand. If a borrower fails to return loaned securities when due, then the lending agent is responsible and indemnifies the fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in the value of JHCT.

Although the risk of the loss of the securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification, the fund could experience a delay in recovering securities or could experience a lower than expected return if the borrower fails to return the securities on a timely basis. The fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Net income received from JHCT is a component of securities lending income as recorded on the Statement of operations.

Obligations to repay collateral received by the fund are shown on the Statement of assets and liabilities as Payable upon return of securities loaned and are secured by the loaned securities. As of January 31, 2016, the fund loaned common stocks valued at $20,753,681 and received $21,231,398 of cash collateral.

Foreign currency translation. Assets, including investments and liabilities denominated in foreign currencies, are translated into U.S. dollar values each day at the prevailing exchange rate. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on the value of securities is reflected as a component of the realized and unrealized gains (losses) on investments.

Funds that invest internationally generally carry more risk than funds that invest strictly in U.S. securities. These risks are heightened for investments in emerging markets. Risks can result from differences in economic and political conditions, regulations, market practices (including higher transaction costs), accounting standards and other factors. Foreign investments are also subject to a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Foreign taxes.The fund may be subject to withholding tax on income and/or capital gains or repatriation taxes imposed by certain countries in which the fund invests. Taxes are accrued based upon investment income, realized gains or unrealized appreciation.

Line of credit. The fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund's custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the extent of any overdraft, and to the maximum extent permitted by law.

The fund and other affiliated funds have entered into a syndicated line of credit agreement, with Citibank, N.A. as the administrative agent, that enables them to participate in a $750 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the effective line of credit, is charged to each participating fund on a pro rata basis and is reflected in Other expenses on the Statement of operations. Commitment fees for the six months ended January 31, 2016 were $501. For the six months ended January 31, 2016, the fund had no borrowings under the line of credit.

Expenses. Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund's relative net

assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, and transfer agent fees, are calculated daily for each class, based on the net asset value of the class and the applicable specific expense rates.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of July 31, 2015, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares and pays dividends and capital gain distributions, if any, annually.

Distributions paid by the fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from US GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sale loss deferrals and net operating losses.

Note 3 — Derivative Instruments

The fund may invest in derivatives in order to meet its investment objective. Derivatives include a variety of different instruments that may be traded in the OTC market, on a regulated exchange or through a clearing facility. The risks in using derivatives vary depending upon the structure of the instruments, including the use of leverage, optionality, the liquidity or lack of liquidity of the contract, the creditworthiness of the counterparty or clearing organization and the volatility of the position. Some derivatives involve risks that are potentially greater than the risks associated with investing directly in the referenced securities or other referenced underlying instrument. Specifically, the fund is exposed to the risk that the counterparty to an OTC derivatives contract will be unable or unwilling to make timely settlement payments or otherwise honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction.

Forward foreign currency contracts are typically traded through the OTC market. Certain forwards are regulated by the Commodity Futures Trading Commission (the CFTC) as swaps. Derivative counterparty risk is managed through an ongoing evaluation of the creditworthiness of all potential counterparties and, if applicable, designated clearing organizations. The fund attempts to reduce its exposure to counterparty risk for derivatives traded in the OTC market, whenever possible, by entering into an International Swaps and Derivatives Association (ISDA) Master Agreement with each of its OTC counterparties. The ISDA gives each party to the agreement the right to terminate all transactions traded under the agreement if there is certain deterioration in the credit quality or contractual default of the other party, as defined in the ISDA. Upon an event of default or a termination of the ISDA, the non-defaulting party has the right to close out all transactions and to net amounts owed.

As defined by the ISDA, the fund may have collateral agreements with certain counterparties to mitigate counterparty risk on OTC derivatives. Subject to established minimum levels, collateral for OTC transactions is generally determined based on the net aggregate unrealized gain or loss on contracts with a particular counterparty. Collateral pledged to the fund is held in a segregated account by a third-party agent or held by the custodian bank for the benefit of the fund and can be in the form of cash or debt securities issued by the U.S. government or related agencies; collateral posted by the fund for OTC transactions is

held in a segregated account at the fund's custodian and is noted in the accompanying Fund's investments, or if cash is posted, on the Statement of assets and liabilities. The fund's maximum risk of loss due to counterparty risk is equal to the asset value of outstanding contracts offset by collateral received.

Forward foreign currency contracts. A forward foreign currency contract is an agreement between two parties to buy and sell specific currencies at a price that is set on the date of the contract. The forward contract calls for delivery of the currencies on a future date that is specified in the contract. Risks related to the use of forwards include the possible failure of counterparties to meet the terms of the forward agreement, the failure of the counterparties to timely post collateral if applicable, the risk that currency movements will not favor the fund thereby reducing the fund's total return, and the potential for losses in excess of the amounts recognized on the Statement of assets and liabilities.

The market value of a forward foreign currency contract fluctuates with changes in foreign currency exchange rates. Forward foreign currency contracts are marked-to-market daily and the change in value is recorded by the fund as an unrealized gain or loss. Realized gains or losses, equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed, are recorded upon delivery or receipt of the currency or settlement with the counterparty.

The fund used forward foreign currency contracts to manage against anticipated changes in currency exchange rates. During the six months ended January 31, 2016, the fund held forward foreign currency contracts with USD notional values ranging up to approximately $330.4 million, as measured at each quarter end. The following table summarizes the contracts held at January 31, 2016:

| Contract to buy | Contract to sell | Counterparty | Contractual settlement date |

Unrealized appreciation |

Unrealized depreciation |

Net unrealized appreciation/ (depreciation) |

||||||||||||||||||||||||||

| CHF | 2,260,000 | USD | 2,249,719 | Bank of Montreal | 3/16/2016 | — | ($39,591 | ) | ($39,591 | ) | ||||||||||||||||||||||

| DKK | 6,960,000 | USD | 1,016,504 | Bank of Montreal | 3/16/2016 | — | (4,954 | ) | (4,954 | ) | ||||||||||||||||||||||

| EUR | 6,170,000 | USD | 6,726,164 | Bank of Montreal | 3/16/2016 | — | (34,888 | ) | (34,888 | ) | ||||||||||||||||||||||

| EUR | 3,060,000 | USD | 3,347,120 | Royal Bank of Scotland PLC | 3/16/2016 | — | (28,594 | ) | (28,594 | ) | ||||||||||||||||||||||

| EUR | 4,590,000 | USD | 5,000,571 | HSBC Bank USA | 3/16/2016 | — | (22,782 | ) | (22,782 | ) | ||||||||||||||||||||||

| GBP | 4,165,000 | USD | 5,923,205 | HSBC Bank USA | 3/16/2016 | $11,939 | — | 11,939 | ||||||||||||||||||||||||

| JPY | 2,502,300,000 | USD | 21,289,398 | Bank of Montreal | 3/16/2016 | — | (599,645 | ) | (599,645 | ) | ||||||||||||||||||||||

| JPY | 1,536,500,000 | USD | 12,701,769 | Commonwealth Bank of Australia Sydney |

3/16/2016 | 2,465 | — | 2,465 | ||||||||||||||||||||||||

| JPY | 1,023,800,000 | USD | 8,421,721 | JPMorgan Chase Bank N.A. | 3/16/2016 | 43,359 | — | 43,359 | ||||||||||||||||||||||||

| JPY | 553,000,000 | USD | 4,713,001 | Royal Bank of Scotland PLC | 3/16/2016 | — | (140,634 | ) | (140,634 | ) | ||||||||||||||||||||||

| JPY | 2,359,900,000 | USD | 19,628,555 | Standard Chartered Bank | 3/16/2016 | — | (116,207 | ) | (116,207 | ) | ||||||||||||||||||||||

| USD | 14,131,836 | CHF | 13,920,000 | Credit Suisse International | 3/16/2016 | 519,012 | — | 519,012 | ||||||||||||||||||||||||

| USD | 10,058,359 | DKK | 68,280,000 | UBS AG | 3/16/2016 | 134,711 | — | 134,711 | ||||||||||||||||||||||||

| USD | 51,188,159 | EUR | 46,580,000 | Citibank N.A. | 3/16/2016 | 672,821 | — | 672,821 | ||||||||||||||||||||||||

| USD | 4,081,557 | EUR | 3,765,000 | Commonwealth Bank of Australia Sydney |

3/16/2016 | — | (1,531 | ) | (1,531 | ) | ||||||||||||||||||||||

| USD | 4,049,092 | EUR | 3,690,000 | JPMorgan Chase Bank N.A. | 3/16/2016 | 47,341 | — | 47,341 | ||||||||||||||||||||||||

| USD | 27,190,264 | GBP | 17,905,000 | Citibank N.A. | 3/16/2016 | 1,675,560 | — | 1,675,560 | ||||||||||||||||||||||||

| USD | 2,798,353 | GBP | 1,965,000 | Commonwealth Bank of Australia Sydney |

3/16/2016 | — | (1,781 | ) | (1,781 | ) | ||||||||||||||||||||||

| USD | 6,467,095 | GBP | 4,310,000 | JPMorgan Chase Bank N.A. | 3/16/2016 | 325,326 | — | 325,326 | ||||||||||||||||||||||||

| USD | 119,439,521 | JPY | 14,589,000,000 | UBS AG | 3/16/2016 | — | (1,186,627 | ) | (1,186,627 | ) | ||||||||||||||||||||||

| $3,432,534 | ($2,177,234 | ) | $1,255,300 | |||||||||||||||||||||||||||||

| Currency abbreviations: | |||

| CHF | Swiss Franc | GBP | British Pound |

| DKK | Danish Krone | JPY | Japanese Yen |

| EUR | Euro | USD | US Dollar |

Fair value of derivative instruments by risk category

The table below summarizes the fair value of derivatives held by the fund at January 31, 2016 by risk category:

| Risk | Statement of assets and liabilities location |

Financial instruments location |

Asset derivatives fair value |

Liabilities derivatives fair value |

||||||||||

| Foreign currency | Unrealized appreciation/depreciation on forward foreign currency exchange contracts |

Forward foreign currency contracts |