UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21780

MFS SERIES TRUST XII

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30

Date of reporting period: April 30, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

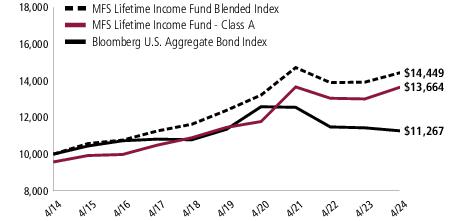

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/29/2005 | 5.03% | 3.58% | 3.62% | N/A |

| B | 9/29/2005 | 4.25% | 2.79% | 2.85% | N/A |

| C | 9/29/2005 | 4.34% | 2.81% | 2.85% | N/A |

| I | 9/29/2005 | 5.38% | 3.84% | 3.89% | N/A |

| R1 | 9/29/2005 | 4.25% | 2.81% | 2.86% | N/A |

| R2 | 9/29/2005 | 4.77% | 3.31% | 3.35% | N/A |

| R3 | 9/29/2005 | 5.03% | 3.57% | 3.62% | N/A |

| R4 | 9/29/2005 | 5.29% | 3.84% | 3.87% | N/A |

| R6 | 8/29/2016 | 5.41% | 3.94% | N/A | 4.19% |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| MFS Lifetime Income Fund Blended Index (f)(z) | 3.75% | 3.13% | 3.75% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | 0.88% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| 1-yr | 5-yr | 10-yr | Life (t) | |

| A With Initial Sales Charge (4.25%) | 0.57% | 2.69% | 3.17% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 0.25% | 2.44% | 2.85% | N/A |

| C With CDSC (1% for 12 months) (v) | 3.34% | 2.81% | 2.85% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime Income Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at September 29, 2005 (the fund’s inception date) and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Bloomberg U.S. Aggregate Bond Index | 71.0% | 71.0% |

| Standard & Poor’s 500 Stock Index | 20.0% | 20.0% |

| MSCI EAFE Index (net div) | 5.0% | 5.0% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 2.0% | 2.0% |

| Bloomberg Commodity Index | 2.0% | 2.0% |

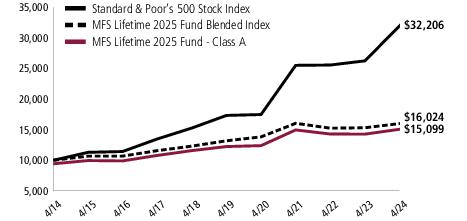

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 5.77% | 4.28% | 4.83% | N/A |

| B | 11/02/2012 | 5.00% | 3.50% | 4.03% | N/A |

| C | 11/02/2012 | 4.96% | 3.50% | 4.03% | N/A |

| I | 11/02/2012 | 6.06% | 4.52% | 5.07% | N/A |

| R1 | 11/02/2012 | 4.99% | 3.48% | 4.03% | N/A |

| R2 | 11/02/2012 | 5.60% | 4.02% | 4.56% | N/A |

| R3 | 11/02/2012 | 5.76% | 4.27% | 4.82% | N/A |

| R4 | 11/02/2012 | 6.11% | 4.52% | 5.07% | N/A |

| R6 | 8/29/2016 | 6.12% | 4.67% | N/A | 5.49% |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2025 Fund Blended Index (f)(z) | 4.60% | 3.97% | 4.83% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| A With Initial Sales Charge (5.75%) | (0.31)% | 3.05% | 4.21% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 1.00% | 3.15% | 4.03% | N/A |

| C With CDSC (1% for 12 months) (v) | 3.96% | 3.50% | 4.03% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2025 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Bloomberg U.S. Aggregate Bond Index | 67.70% | 65.50% |

| Standard & Poor’s 500 Stock Index | 22.40% | 24.00% |

| MSCI EAFE Index (net div) | 5.90% | 6.50% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 2.00% | 2.00% |

| Bloomberg Commodity Index | 2.00% | 2.00% |

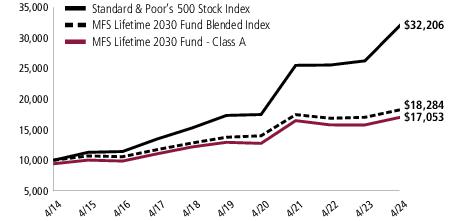

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/29/2005 | 8.06% | 5.68% | 6.11% | N/A |

| B | 9/29/2005 | 7.27% | 4.89% | 5.31% | N/A |

| C | 9/29/2005 | 7.21% | 4.90% | 5.31% | N/A |

| I | 9/29/2005 | 8.35% | 5.95% | 6.35% | N/A |

| R1 | 9/29/2005 | 7.24% | 4.90% | 5.31% | N/A |

| R2 | 9/29/2005 | 7.82% | 5.42% | 5.84% | N/A |

| R3 | 9/29/2005 | 8.06% | 5.69% | 6.11% | N/A |

| R4 | 9/29/2005 | 8.36% | 5.95% | 6.37% | N/A |

| R6 | 8/29/2016 | 8.49% | 6.09% | N/A | 7.11% |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2030 Fund Blended Index (f)(z) | 7.38% | 5.84% | 6.22% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| A With Initial Sales Charge (5.75%) | 1.84% | 4.44% | 5.48% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 3.27% | 4.56% | 5.31% | N/A |

| C With CDSC (1% for 12 months) (v) | 6.21% | 4.90% | 5.31% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2030 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Bloomberg U.S. Aggregate Bond Index | 54.00% | 50.00% |

| Standard & Poor’s 500 Stock Index | 31.90% | 34.50% |

| MSCI EAFE Index (net div) | 9.50% | 10.50% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 2.30% | 2.50% |

| Bloomberg Commodity Index | 2.30% | 2.50% |

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 11.13% | 7.28% | 7.22% | N/A |

| B | 11/02/2012 | 10.24% | 6.46% | 6.41% | N/A |

| C | 11/02/2012 | 10.27% | 6.46% | 6.41% | N/A |

| I | 11/02/2012 | 11.44% | 7.55% | 7.47% | N/A |

| R1 | 11/02/2012 | 10.25% | 6.43% | 6.40% | N/A |

| R2 | 11/02/2012 | 10.85% | 7.00% | 6.95% | N/A |

| R3 | 11/02/2012 | 11.14% | 7.27% | 7.21% | N/A |

| R4 | 11/02/2012 | 11.45% | 7.54% | 7.49% | N/A |

| R6 | 8/29/2016 | 11.59% | 7.70% | N/A | 8.54% |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2035 Fund Blended Index (f)(z) | 11.01% | 7.85% | 7.43% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| A With Initial Sales Charge (5.75%) | 4.74% | 6.02% | 6.59% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 6.24% | 6.15% | 6.41% | N/A |

| C With CDSC (1% for 12 months) (v) | 9.27% | 6.46% | 6.41% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end. The comparative benchmark performance information provided for the “life” period is from the inception date of the Class A shares. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2035 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Standard & Poor’s 500 Stock Index | 44.30% | 46.50% |

| Bloomberg U.S. Aggregate Bond Index | 34.00% | 30.00% |

| MSCI EAFE Index (net div) | 15.10% | 16.50% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 3.30% | 3.50% |

| Bloomberg Commodity Index | 3.30% | 3.50% |

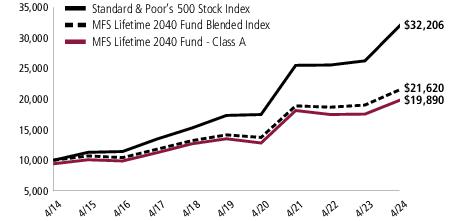

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/29/2005 | 13.33% | 8.04% | 7.75% | N/A |

| B | 9/29/2005 | 12.50% | 7.22% | 6.94% | N/A |

| C | 9/29/2005 | 12.46% | 7.23% | 6.95% | N/A |

| I | 9/29/2005 | 13.60% | 8.30% | 7.99% | N/A |

| R1 | 9/29/2005 | 12.46% | 7.21% | 6.94% | N/A |

| R2 | 9/29/2005 | 13.03% | 7.75% | 7.47% | N/A |

| R3 | 9/29/2005 | 13.31% | 8.03% | 7.75% | N/A |

| R4 | 9/29/2005 | 13.58% | 8.30% | 8.02% | N/A |

| R6 | 8/29/2016 | 13.72% | 8.44% | N/A | 9.22% |

| Standard & Poor's 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2040 Fund Blended Index (f)(z) | 13.60% | 8.84% | 8.02% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| A With Initial Sales Charge (5.75%) | 6.81% | 6.77% | 7.12% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 8.50% | 6.92% | 6.94% | N/A |

| C With CDSC (1% for 12 months) (v) | 11.46% | 7.23% | 6.95% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2040 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Standard & Poor's 500 Stock Index | 52.75% | 53.25% |

| MSCI EAFE Index (net div) | 21.20% | 22.00% |

| Bloomberg U.S. Aggregate Bond Index | 17.75% | 16.25% |

| Bloomberg Commodity Index | 4.15% | 4.25% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 4.15% | 4.25% |

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 13.87% | 8.40% | 7.97% | N/A |

| B | 11/02/2012 | 12.99% | 7.58% | 7.17% | N/A |

| C | 11/02/2012 | 12.99% | 7.59% | 7.17% | N/A |

| I | 11/02/2012 | 14.11% | 8.66% | 8.26% | N/A |

| R1 | 11/02/2012 | 12.93% | 7.56% | 7.15% | N/A |

| R2 | 11/02/2012 | 13.59% | 8.12% | 7.70% | N/A |

| R3 | 11/02/2012 | 13.85% | 8.39% | 7.97% | N/A |

| R4 | 11/02/2012 | 14.11% | 8.66% | 8.24% | N/A |

| R6 | 8/29/2016 | 14.27% | 8.82% | N/A | 9.52% |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2045 Fund Blended Index (f)(z) | 14.71% | 9.46% | 8.37% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| A With Initial Sales Charge (5.75%) | 7.33% | 7.12% | 7.34% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 8.99% | 7.27% | 7.17% | N/A |

| C With CDSC (1% for 12 months) (v) | 11.99% | 7.59% | 7.17% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2045 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Standard & Poor’s 500 Stock Index | 55.25% | 55.75% |

| MSCI EAFE Index (net div) | 25.20% | 26.00% |

| Bloomberg U.S. Aggregate Bond Index | 10.25% | 8.75% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 4.65% | 4.75% |

| Bloomberg Commodity Index | 4.65% | 4.75% |

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/15/2010 | 14.17% | 8.47% | 8.01% | N/A |

| B | 9/15/2010 | 13.32% | 7.66% | 7.21% | N/A |

| C | 9/15/2010 | 13.33% | 7.66% | 7.21% | N/A |

| I | 9/15/2010 | 14.46% | 8.73% | 8.28% | N/A |

| R1 | 9/15/2010 | 13.32% | 7.66% | 7.21% | N/A |

| R2 | 9/15/2010 | 13.89% | 8.20% | 7.74% | N/A |

| R3 | 9/15/2010 | 14.18% | 8.46% | 8.01% | N/A |

| R4 | 9/15/2010 | 14.49% | 8.73% | 8.28% | N/A |

| R6 | 8/29/2016 | 14.60% | 8.90% | N/A | 9.56% |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2050 Fund Blended Index (f)(z) | 15.40% | 9.67% | 8.47% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| A With Initial Sales Charge (5.75%) | 7.60% | 7.19% | 7.37% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 9.32% | 7.36% | 7.21% | N/A |

| C With CDSC (1% for 12 months) (v) | 12.33% | 7.66% | 7.21% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2050 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Standard & Poor's 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

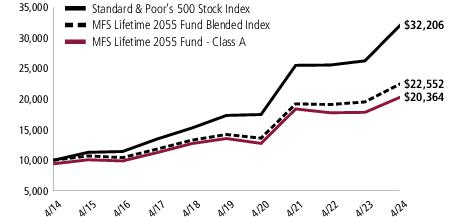

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 14.17% | 8.48% | 8.01% | N/A |

| B | 11/02/2012 | 13.32% | 7.66% | 7.20% | N/A |

| C | 11/02/2012 | 13.34% | 7.67% | 7.21% | N/A |

| I | 11/02/2012 | 14.49% | 8.74% | 8.23% | N/A |

| R1 | 11/02/2012 | 13.34% | 7.68% | 7.20% | N/A |

| R2 | 11/02/2012 | 13.89% | 8.22% | 7.74% | N/A |

| R3 | 11/02/2012 | 14.16% | 8.47% | 8.01% | N/A |

| R4 | 11/02/2012 | 14.47% | 8.75% | 8.28% | N/A |

| R6 | 8/29/2016 | 14.66% | 8.92% | N/A | 9.57% |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2055 Fund Blended Index (f)(z) | 15.40% | 9.67% | 8.47% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| A With Initial Sales Charge (5.75%) | 7.61% | 7.20% | 7.37% | N/A |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 9.32% | 7.36% | 7.20% | N/A |

| C With CDSC (1% for 12 months) (v) | 12.34% | 7.67% | 7.21% | N/A |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2055 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Standard & Poor’s 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

| Share Class | Class Inception Date | 1-yr | 5-yr | Life (t) |

| A | 12/06/2016 | 14.12% | 8.49% | 9.54% |

| B | 12/06/2016 | 13.27% | 7.67% | 8.74% |

| C | 12/06/2016 | 13.30% | 7.68% | 8.74% |

| I | 12/06/2016 | 14.39% | 8.76% | 9.83% |

| R1 | 12/06/2016 | 14.15% | 7.95% | 8.92% |

| R2 | 12/06/2016 | 13.92% | 8.22% | 9.29% |

| R3 | 12/06/2016 | 14.12% | 8.49% | 9.55% |

| R4 | 12/06/2016 | 14.45% | 8.74% | 9.81% |

| R6 | 12/06/2016 | 14.65% | 8.90% | 9.95% |

| Standard & Poor's 500 Stock Index (f) | 22.66% | 13.19% | 13.79% |

| MFS Lifetime 2060 Fund Blended Index (f)(z) | 15.40% | 9.67% | 10.36% |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | 3.93% |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 0.79% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 1.85% |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 7.37% |

| A With Initial Sales Charge (5.75%) | 7.56% | 7.21% | 8.67% |

| B With CDSC (Declining over six years from 4% to 0%) (v) | 9.27% | 7.37% | 8.74% |

| C With CDSC (1% for 12 months) (v) | 12.30% | 7.68% | 8.74% |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2060 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Standard & Poor’s 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

| Share Class | Class Inception Date | 1-yr | Life (t) |

| A | 9/01/2021 | 14.19% | 1.37% |

| C | 9/01/2021 | 13.47% | 0.66% |

| I | 9/01/2021 | 14.58% | 1.67% |

| R1 | 9/01/2021 | 13.33% | 0.63% |

| R2 | 9/01/2021 | 13.99% | 1.17% |

| R3 | 9/01/2021 | 14.20% | 1.38% |

| R4 | 9/01/2021 | 14.47% | 1.63% |

| R6 | 9/01/2021 | 14.66% | 1.70% |

| Standard & Poor's 500 Stock Index (f) | 22.66% | 5.76% |

| MFS Lifetime 2065 Fund Blended Index (f)(z) | 15.40% | 3.48% |

| Bloomberg Commodity Index (f) | 2.89% | 5.70% |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (4.67)% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (8.41)% |

| MSCI EAFE Index (net div) (f) | 9.28% | 1.47% |

| A With Initial Sales Charge (5.75%) | 7.62% | (0.85)% |

| C With CDSC (1% for 12 months) (v) | 12.47% | 0.66% |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2065 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| 4/30/24 | 4/30/23 | |

| Standard & Poor’s 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

| (a) | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

| (c) | FTSE International Limited (“FTSE”)© FTSE 2019. “FTSE®” is a trademark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. “FT-SE®”, “FOOTSIE®” and “FTSE4GOOD®” are trademarks of the London Stock Exchange Group companies. “Nareit®” is a trademark of the National Association of Real Estate Investment Trusts (“Nareit”) and “EPRA®” is a trademark of the European Public Real Estate Association (“EPRA”) and all are used by FTSE under license. The FTSE EPRA Nareit Developed Real Estate Index is calculated by FTSE. Neither FTSE, Euronext N.V., Nareit, nor EPRA sponsor, endorse, or promote this product and are not in any way connected to it and do not accept any liability. All intellectual property rights in the index values and constituent list vests in FTSE, Euronext N.V., Nareit, and EPRA. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE's express written consent. |

| (e) | Morgan Stanley Capital International (“MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| (g) | “Standard & Poor's®” and “S&P®” are registered trademarks of Standard & Poor's Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS's product(s) is not sponsored, endorsed, sold, or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the advisability of investing in such product(s). |

November 1, 2023 through April 30, 2024

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.24% | $1,000.00 | $1,086.53 | $1.25 |

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.67 | $1.21 | |

| B | Actual | 0.99% | $1,000.00 | $1,082.53 | $5.13 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,019.94 | $4.97 | |

| C | Actual | 0.99% | $1,000.00 | $1,083.49 | $5.13 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,019.94 | $4.97 | |

| I | Actual | 0.00% | $1,000.00 | $1,088.77 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 0.99% | $1,000.00 | $1,082.43 | $5.13 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,019.94 | $4.97 | |

| R2 | Actual | 0.49% | $1,000.00 | $1,085.21 | $2.54 |

| Hypothetical (h) | 0.49% | $1,000.00 | $1,022.43 | $2.46 | |

| R3 | Actual | 0.24% | $1,000.00 | $1,086.53 | $1.25 |

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.67 | $1.21 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,088.83 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,089.18 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,093.99 | $1.30 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,089.81 | $5.20 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,089.84 | $5.20 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,095.10 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,090.29 | $5.20 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,093.24 | $2.60 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,094.03 | $1.30 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,095.57 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,095.61 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,117.63 | $1.32 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,113.74 | $5.26 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,113.50 | $5.25 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,119.71 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,114.08 | $5.26 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,117.10 | $2.63 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,117.83 | $1.32 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,119.62 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,120.26 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,147.93 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,142.76 | $5.33 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,142.76 | $5.33 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,149.45 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,142.75 | $5.33 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,145.78 | $2.67 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,147.27 | $1.33 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,148.60 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,150.11 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,168.32 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,163.48 | $5.38 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,163.78 | $5.38 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,169.40 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,163.25 | $5.38 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,166.13 | $2.69 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,168.18 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,169.72 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,169.77 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,175.28 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,170.75 | $5.40 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,171.13 | $5.40 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,176.71 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,170.73 | $5.40 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,173.94 | $2.70 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,175.79 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,176.65 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,177.64 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,179.87 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,176.00 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,175.87 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,181.08 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,175.53 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,178.08 | $2.71 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,179.74 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,181.35 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,181.93 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,179.93 | $1.36 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,175.45 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,175.48 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,181.70 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,175.98 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,178.45 | $2.71 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,179.75 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,181.93 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,182.45 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.25% | $1,000.00 | $1,179.52 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| B | Actual | 1.00% | $1,000.00 | $1,175.07 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| C | Actual | 1.00% | $1,000.00 | $1,174.90 | $5.41 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,019.89 | $5.02 | |

| I | Actual | 0.00% | $1,000.00 | $1,181.01 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R1 | Actual | 0.25% | $1,000.00 | $1,179.51 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,178.31 | $2.71 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.38 | $2.51 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,179.43 | $1.35 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.62 | $1.26 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,180.83 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,182.76 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,024.86 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 11/01/23 | Ending Account Value 4/30/24 | Expenses Paid During Period (p) 11/01/23-4/30/24 | |

| A | Actual | 0.22% | $1,000.00 | $1,179.85 | $1.19 |

| Hypothetical (h) | 0.22% | $1,000.00 | $1,023.77 | $1.11 | |

| C | Actual | 0.97% | $1,000.00 | $1,176.87 | $5.25 |

| Hypothetical (h) | 0.97% | $1,000.00 | $1,020.04 | $4.87 | |

| I | Actual | 0.01% | $1,000.00 | $1,182.32 | $0.05 |

| Hypothetical (h) | 0.01% | $1,000.00 | $1,024.81 | $0.05 | |

| R1 | Actual | 0.97% | $1,000.00 | $1,175.38 | $5.25 |

| Hypothetical (h) | 0.97% | $1,000.00 | $1,020.04 | $4.87 | |

| R2 | Actual | 0.47% | $1,000.00 | $1,179.28 | $2.55 |

| Hypothetical (h) | 0.47% | $1,000.00 | $1,022.53 | $2.36 | |

| R3 | Actual | 0.22% | $1,000.00 | $1,179.99 | $1.19 |

| Hypothetical (h) | 0.22% | $1,000.00 | $1,023.77 | $1.11 | |

| R4 | Actual | 0.01% | $1,000.00 | $1,181.25 | $0.05 |

| Hypothetical (h) | 0.01% | $1,000.00 | $1,024.81 | $0.05 | |

| R6 | Actual | 0.01% | $1,000.00 | $1,183.19 | $0.05 |

| Hypothetical (h) | 0.01% | $1,000.00 | $1,024.81 | $0.05 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 69.8% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 532,597 | $6,258,015 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 1,160,207 | 6,207,107 | ||

| MFS Global Opportunistic Bond Fund - Class R6 | 5,540,281 | 43,712,819 | ||

| MFS Government Securities Fund - Class R6 | 6,964,501 | 58,014,294 | ||

| MFS High Income Fund - Class R6 | 4,154,878 | 12,547,730 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 6,903,335 | 61,646,782 | ||

| MFS Limited Maturity Fund - Class R6 | 21,868,774 | 125,089,385 | ||

| MFS Total Return Bond Fund - Class R6 | 13,123,411 | 120,472,917 | ||

| $433,949,049 | ||||

| International Stock Funds – 5.0% | ||||

| MFS Blended Research International Equity Fund - Class R6 | 1,225,749 | $15,517,979 | ||

| MFS International Growth Fund - Class R6 | 75,993 | 3,094,429 | ||

| MFS International Intrinsic Value Fund - Class R6 | 78,746 | 3,089,232 | ||

| MFS Research International Fund - Class R6 | 416,369 | 9,305,847 | ||

| $31,007,487 | ||||

| Non-Traditional Funds – 3.9% | ||||

| MFS Commodity Strategy Fund - Class R6 | 3,414,989 | $12,293,959 | ||

| MFS Global Real Estate Fund - Class R6 | 775,934 | 12,104,575 | ||

| $24,398,534 | ||||

| U.S. Stock Funds – 18.3% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 288,832 | $9,979,138 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 467,673 | 9,914,674 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,315,112 | 18,411,563 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 412,150 | 6,116,310 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 773,542 | 12,353,463 | ||

| MFS Growth Fund - Class R6 | 51,218 | 9,855,908 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 299,529 | 9,102,690 | ||

| MFS Mid Cap Value Fund - Class R6 | 289,025 | 9,271,917 | ||

| MFS New Discovery Fund - Class R6 (a) | 103,990 | 3,037,542 | ||

| MFS New Discovery Value Fund - Class R6 | 175,210 | 3,080,190 | ||

| MFS Research Fund - Class R6 | 178,216 | 9,940,874 | ||

| MFS Value Fund - Class R6 | 251,593 | 12,385,948 | ||

| $113,450,217 | ||||

| Money Market Funds – 3.0% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 18,701,436 | $18,701,436 | ||

| Total Investment Companies (Identified Cost, $571,425,819) | $621,506,723 | |||

| Other Assets, Less Liabilities – 0.0% | 37,878 | |||

| Net Assets – 100.0% | $621,544,601 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 66.6% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 426,159 | $5,007,364 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 932,443 | 4,988,572 | ||

| MFS Global Opportunistic Bond Fund - Class R6 | 3,442,902 | 27,164,495 | ||

| MFS Government Securities Fund - Class R6 | 4,327,365 | 36,046,954 | ||

| MFS High Income Fund - Class R6 | 3,316,411 | 10,015,561 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 4,285,187 | 38,266,718 | ||

| MFS Limited Maturity Fund - Class R6 | 11,632,689 | 66,538,982 | ||

| MFS Total Return Bond Fund - Class R6 | 7,555,700 | 69,361,327 | ||

| $257,389,973 | ||||

| International Stock Funds – 5.8% | ||||

| MFS Blended Research International Equity Fund - Class R6 | 892,758 | $11,302,319 | ||

| MFS International Growth Fund - Class R6 | 60,782 | 2,475,045 | ||

| MFS International Intrinsic Value Fund - Class R6 | 62,961 | 2,469,943 | ||

| MFS Research International Fund - Class R6 | 283,536 | 6,337,042 | ||

| $22,584,349 | ||||

| Non-Traditional Funds – 4.0% | ||||

| MFS Commodity Strategy Fund - Class R6 | 2,129,965 | $7,667,872 | ||

| MFS Global Real Estate Fund - Class R6 | 489,184 | 7,631,272 | ||

| $15,299,144 | ||||

| U.S. Stock Funds – 20.6% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 212,093 | $7,327,797 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 344,587 | 7,305,242 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 899,885 | 12,598,388 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 258,442 | 3,835,277 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 550,543 | 8,792,175 | ||

| MFS Growth Fund - Class R6 | 37,863 | 7,286,028 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 206,608 | 6,278,821 | ||

| MFS Mid Cap Value Fund - Class R6 | 197,513 | 6,336,229 | ||

| MFS New Discovery Fund - Class R6 (a) | 65,445 | 1,911,638 | ||

| MFS New Discovery Value Fund - Class R6 | 109,210 | 1,919,903 | ||

| MFS Research Fund - Class R6 | 131,209 | 7,318,848 | ||

| MFS Value Fund - Class R6 | 178,776 | 8,801,165 | ||

| $79,711,511 | ||||

| Money Market Funds – 3.0% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 11,641,572 | $11,641,572 | ||

| Total Investment Companies (Identified Cost, $364,014,613) | $386,626,549 | |||

| Other Assets, Less Liabilities – (0.0)% | (48,972) | |||

| Net Assets – 100.0% | $386,577,577 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

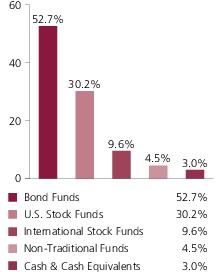

| Bond Funds – 52.7% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 1,546,857 | $18,175,574 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 2,908,501 | 15,560,478 | ||

| MFS Global Opportunistic Bond Fund - Class R6 | 6,394,282 | 50,450,887 | ||

| MFS Government Securities Fund - Class R6 | 8,779,234 | 73,131,017 | ||

| MFS High Income Fund - Class R6 | 10,551,573 | 31,865,749 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 7,953,201 | 71,022,086 | ||

| MFS Limited Maturity Fund - Class R6 | 9,698,078 | 55,473,008 | ||

| MFS Total Return Bond Fund - Class R6 | 10,701,947 | 98,243,876 | ||

| $413,922,675 | ||||

| International Stock Funds – 9.6% | ||||

| MFS Blended Research International Equity Fund - Class R6 | 2,890,933 | $36,599,212 | ||

| MFS International Growth Fund - Class R6 | 221,373 | 9,014,324 | ||

| MFS International Intrinsic Value Fund - Class R6 | 230,844 | 9,056,016 | ||

| MFS International New Discovery Fund - Class R6 | 74,006 | 2,325,255 | ||

| MFS Research International Fund - Class R6 | 810,628 | 18,117,528 | ||

| $75,112,335 | ||||

| Non-Traditional Funds – 4.5% | ||||

| MFS Commodity Strategy Fund - Class R6 | 5,016,855 | $18,060,680 | ||

| MFS Global Real Estate Fund - Class R6 | 1,125,880 | 17,563,722 | ||

| $35,624,402 | ||||

| U.S. Stock Funds – 30.2% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 659,688 | $22,792,219 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,067,600 | 22,633,121 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 2,737,196 | 38,320,749 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 599,558 | 8,897,440 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,629,525 | 26,023,513 | ||

| MFS Growth Fund - Class R6 | 116,981 | 22,510,615 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 620,662 | 18,861,931 | ||

| MFS Mid Cap Value Fund - Class R6 | 602,236 | 19,319,731 | ||

| MFS New Discovery Fund - Class R6 (a) | 151,759 | 4,432,864 | ||

| MFS New Discovery Value Fund - Class R6 | 257,164 | 4,520,948 | ||

| MFS Research Fund - Class R6 | 406,995 | 22,702,201 | ||

| MFS Value Fund - Class R6 | 529,065 | 26,045,852 | ||

| $237,061,184 | ||||

| Money Market Funds – 3.0% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 23,943,988 | $23,943,987 | ||

| Total Investment Companies (Identified Cost, $675,482,982) | $785,664,583 | |||

| Other Assets, Less Liabilities – (0.0)% | (67,540) | |||

| Net Assets – 100.0% | $785,597,043 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 32.9% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 1,522,257 | $17,886,519 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 2,208,927 | 11,817,758 | ||

| MFS Global Opportunistic Bond Fund - Class R6 | 3,320,712 | 26,200,415 | ||

| MFS Government Securities Fund - Class R6 | 4,687,982 | 39,050,895 | ||

| MFS High Income Fund - Class R6 | 7,949,762 | 24,008,280 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 4,200,847 | 37,513,565 | ||

| MFS Total Return Bond Fund - Class R6 | 4,232,123 | 38,850,887 | ||

| $195,328,319 | ||||

| International Stock Funds – 15.1% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 68,464 | $902,358 | ||

| MFS Blended Research International Equity Fund - Class R6 | 3,183,473 | 40,302,762 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 27,279 | 899,120 | ||

| MFS International Growth Fund - Class R6 | 260,676 | 10,614,726 | ||

| MFS International Intrinsic Value Fund - Class R6 | 271,021 | 10,632,170 | ||

| MFS International New Discovery Fund - Class R6 | 244,246 | 7,674,212 | ||

| MFS Research International Fund - Class R6 | 835,024 | 18,662,791 | ||

| $89,688,139 | ||||

| Non-Traditional Funds – 6.6% | ||||

| MFS Commodity Strategy Fund - Class R6 | 5,473,907 | $19,706,066 | ||

| MFS Global Real Estate Fund - Class R6 | 1,232,623 | 19,228,913 | ||

| $38,934,979 | ||||

| U.S. Stock Funds – 42.4% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 664,532 | $22,959,592 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,076,352 | 22,818,667 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 3,196,350 | 44,748,902 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 654,194 | 9,708,239 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,595,592 | 25,481,600 | ||

| MFS Growth Fund - Class R6 | 118,124 | 22,730,586 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 727,500 | 22,108,726 | ||

| MFS Mid Cap Value Fund - Class R6 | 703,753 | 22,576,402 | ||

| MFS New Discovery Fund - Class R6 (a) | 164,907 | 4,816,944 | ||

| MFS New Discovery Value Fund - Class R6 | 277,995 | 4,887,142 | ||

| MFS Research Fund - Class R6 | 410,526 | 22,899,142 | ||

| MFS Value Fund - Class R6 | 518,418 | 25,521,700 | ||

| $251,257,642 | ||||

| Money Market Funds – 3.0% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 17,826,374 | $17,826,374 | ||

| Total Investment Companies (Identified Cost, $498,231,957) | $593,035,453 | |||

| Other Assets, Less Liabilities – (0.0)% | (78,085) | |||

| Net Assets – 100.0% | $592,957,368 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 17.1% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 1,683,350 | $19,779,366 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 2,435,925 | 13,032,201 | ||

| MFS Global Opportunistic Bond Fund - Class R6 | 2,499,238 | 19,718,985 | ||

| MFS High Income Fund - Class R6 | 8,788,454 | 26,541,132 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 3,914,255 | 34,954,296 | ||

| MFS Total Return Bond Fund - Class R6 | 1,871,951 | 17,184,508 | ||

| $131,210,488 | ||||

| International Stock Funds – 21.4% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 346,374 | $4,565,214 | ||

| MFS Blended Research International Equity Fund - Class R6 | 5,447,186 | 68,961,378 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 137,417 | 4,529,245 | ||

| MFS International Growth Fund - Class R6 | 497,459 | 20,256,523 | ||

| MFS International Intrinsic Value Fund - Class R6 | 520,969 | 20,437,608 | ||

| MFS International New Discovery Fund - Class R6 | 562,156 | 17,662,935 | ||

| MFS Research International Fund - Class R6 | 1,227,201 | 27,427,943 | ||

| $163,840,846 | ||||

| Non-Traditional Funds – 8.3% | ||||

| MFS Commodity Strategy Fund - Class R6 | 9,027,136 | $32,497,689 | ||

| MFS Global Real Estate Fund - Class R6 | 1,995,363 | 31,127,660 | ||

| $63,625,349 | ||||

| U.S. Stock Funds – 50.9% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 1,018,553 | $35,191,012 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,681,369 | 35,645,023 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 4,998,528 | 69,979,392 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 1,058,992 | 15,715,434 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 2,442,208 | 39,002,064 | ||

| MFS Growth Fund - Class R6 | 184,517 | 35,506,550 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 1,133,086 | 34,434,479 | ||

| MFS Mid Cap Value Fund - Class R6 | 1,096,864 | 35,187,407 | ||

| MFS New Discovery Fund - Class R6 (a) | 267,746 | 7,820,859 | ||

| MFS New Discovery Value Fund - Class R6 | 452,605 | 7,956,790 | ||

| MFS Research Fund - Class R6 | 628,169 | 35,039,295 | ||

| MFS Value Fund - Class R6 | 793,493 | 39,063,682 | ||

| $390,541,987 | ||||

| Money Market Funds – 2.3% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 18,000,995 | $18,000,995 | ||

| Total Investment Companies (Identified Cost, $576,366,570) | $767,219,665 | |||

| Other Assets, Less Liabilities – (0.0)% | (20,721) | |||

| Net Assets – 100.0% | $767,198,944 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 9.6% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 461,915 | $5,427,498 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 668,781 | 3,577,977 | ||

| MFS Global Opportunistic Bond Fund - Class R6 | 685,490 | 5,408,515 | ||

| MFS High Income Fund - Class R6 | 2,411,648 | 7,283,176 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 1,880,689 | 16,794,558 | ||

| MFS Total Return Bond Fund - Class R6 | 1,099,537 | 10,093,749 | ||

| $48,585,473 | ||||

| International Stock Funds – 25.3% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 325,414 | $4,288,960 | ||

| MFS Blended Research International Equity Fund - Class R6 | 4,100,780 | 51,915,878 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 129,539 | 4,269,613 | ||

| MFS International Growth Fund - Class R6 | 391,464 | 15,940,398 | ||

| MFS International Intrinsic Value Fund - Class R6 | 408,070 | 16,008,573 | ||

| MFS International New Discovery Fund - Class R6 | 534,181 | 16,783,978 | ||

| MFS Research International Fund - Class R6 | 869,294 | 19,428,709 | ||

| $128,636,109 | ||||

| Non-Traditional Funds – 9.3% | ||||

| MFS Commodity Strategy Fund - Class R6 | 6,687,790 | $24,076,044 | ||

| MFS Global Real Estate Fund - Class R6 | 1,484,608 | 23,159,885 | ||

| $47,235,929 | ||||

| U.S. Stock Funds – 53.4% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 673,874 | $23,282,351 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,172,262 | 24,851,959 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 3,487,376 | 48,823,259 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 787,676 | 11,689,107 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,695,627 | 27,079,160 | ||

| MFS Growth Fund - Class R6 | 128,565 | 24,739,865 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 791,755 | 24,061,425 | ||

| MFS Mid Cap Value Fund - Class R6 | 764,987 | 24,540,796 | ||

| MFS New Discovery Fund - Class R6 (a) | 199,084 | 5,815,230 | ||

| MFS New Discovery Value Fund - Class R6 | 336,111 | 5,908,832 | ||

| MFS Research Fund - Class R6 | 415,947 | 23,201,527 | ||

| MFS Value Fund - Class R6 | 550,394 | 27,095,918 | ||

| $271,089,429 | ||||

| Money Market Funds – 2.4% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 12,013,472 | $12,013,472 | ||

| Total Investment Companies (Identified Cost, $409,846,061) | $507,560,412 | |||

| Other Assets, Less Liabilities – (0.0)% | (138,461) | |||

| Net Assets – 100.0% | $507,421,951 | |||

| Issuer | Shares/Par | Value ($) | ||

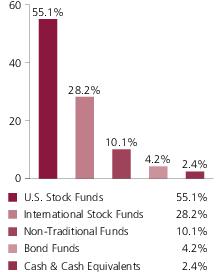

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 4.2% | ||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 1,486,044 | $13,270,373 | ||

| MFS Total Return Bond Fund - Class R6 | 1,083,123 | 9,943,063 | ||

| $23,213,436 | ||||

| International Stock Funds – 28.2% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 428,176 | $5,643,363 | ||

| MFS Blended Research International Equity Fund - Class R6 | 4,812,332 | 60,924,123 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 170,173 | 5,608,895 | ||

| MFS International Growth Fund - Class R6 | 470,414 | 19,155,240 | ||

| MFS International Intrinsic Value Fund - Class R6 | 488,142 | 19,149,819 | ||

| MFS International New Discovery Fund - Class R6 | 700,531 | 22,010,684 | ||

| MFS Research International Fund - Class R6 | 981,913 | 21,945,767 | ||

| $154,437,891 | ||||

| Non-Traditional Funds – 10.1% | ||||

| MFS Commodity Strategy Fund - Class R6 | 7,781,227 | $28,012,415 | ||

| MFS Global Real Estate Fund - Class R6 | 1,739,613 | 27,137,965 | ||

| $55,150,380 | ||||

| U.S. Stock Funds – 55.1% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 727,212 | $25,125,171 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,309,900 | 27,769,882 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 3,891,325 | 54,478,557 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 916,896 | 13,606,730 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,887,840 | 30,148,806 | ||

| MFS Growth Fund - Class R6 | 143,790 | 27,669,553 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 888,808 | 27,010,865 | ||

| MFS Mid Cap Value Fund - Class R6 | 856,667 | 27,481,889 | ||

| MFS New Discovery Fund - Class R6 (a) | 231,989 | 6,776,407 | ||

| MFS New Discovery Value Fund - Class R6 | 390,278 | 6,861,085 | ||

| MFS Research Fund - Class R6 | 449,350 | 25,064,751 | ||

| MFS Value Fund - Class R6 | 613,864 | 30,220,506 | ||

| $302,214,202 | ||||

| Money Market Funds – 2.4% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 12,963,873 | $12,963,873 | ||

| Total Investment Companies (Identified Cost, $436,345,757) | $547,979,782 | |||

| Other Assets, Less Liabilities – (0.0)% | (64,831) | |||

| Net Assets – 100.0% | $547,914,951 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 4.2% | ||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 970,773 | $8,669,006 | ||

| MFS Total Return Bond Fund - Class R6 | 707,087 | 6,491,058 | ||

| $15,160,064 | ||||

| International Stock Funds – 28.2% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 280,396 | $3,695,617 | ||

| MFS Blended Research International Equity Fund - Class R6 | 3,140,220 | 39,755,187 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 111,297 | 3,668,360 | ||

| MFS International Growth Fund - Class R6 | 306,931 | 12,498,235 | ||

| MFS International Intrinsic Value Fund - Class R6 | 318,563 | 12,497,235 | ||

| MFS International New Discovery Fund - Class R6 | 457,458 | 14,373,324 | ||

| MFS Research International Fund - Class R6 | 640,845 | 14,322,871 | ||

| $100,810,829 | ||||

| Non-Traditional Funds – 10.1% | ||||

| MFS Commodity Strategy Fund - Class R6 | 5,120,728 | $18,434,623 | ||

| MFS Global Real Estate Fund - Class R6 | 1,135,317 | 17,710,940 | ||

| $36,145,563 | ||||

| U.S. Stock Funds – 55.1% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 474,776 | $16,403,509 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 854,804 | 18,121,851 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 2,543,738 | 35,612,338 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 598,752 | 8,885,478 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,232,333 | 19,680,363 | ||

| MFS Growth Fund - Class R6 | 93,790 | 18,047,983 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 579,792 | 17,619,873 | ||

| MFS Mid Cap Value Fund - Class R6 | 559,099 | 17,935,894 | ||

| MFS New Discovery Fund - Class R6 (a) | 151,381 | 4,421,833 | ||

| MFS New Discovery Value Fund - Class R6 | 254,900 | 4,481,142 | ||

| MFS Research Fund - Class R6 | 293,282 | 16,359,269 | ||

| MFS Value Fund - Class R6 | 400,610 | 19,722,017 | ||

| $197,291,550 | ||||

| Money Market Funds – 2.4% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 8,454,120 | $8,454,120 | ||

| Total Investment Companies (Identified Cost, $301,547,921) | $357,862,126 | |||

| Other Assets, Less Liabilities – (0.0)% | (50,945) | |||

| Net Assets – 100.0% | $357,811,181 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

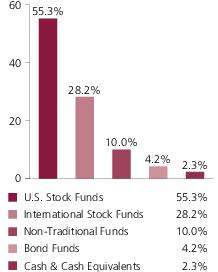

| Bond Funds – 4.2% | ||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 520,257 | $4,645,899 | ||

| MFS Total Return Bond Fund - Class R6 | 380,874 | 3,496,418 | ||

| $8,142,317 | ||||

| International Stock Funds – 28.2% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 148,891 | $1,962,390 | ||

| MFS Blended Research International Equity Fund - Class R6 | 1,687,838 | 21,368,026 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 59,560 | 1,963,085 | ||

| MFS International Growth Fund - Class R6 | 165,680 | 6,746,491 | ||

| MFS International Intrinsic Value Fund - Class R6 | 171,653 | 6,733,969 | ||

| MFS International New Discovery Fund - Class R6 | 246,906 | 7,757,775 | ||

| MFS Research International Fund - Class R6 | 345,792 | 7,728,444 | ||

| $54,260,180 | ||||

| Non-Traditional Funds – 10.0% | ||||

| MFS Commodity Strategy Fund - Class R6 | 2,677,191 | $9,637,887 | ||

| MFS Global Real Estate Fund - Class R6 | 617,045 | 9,625,899 | ||

| $19,263,786 | ||||

| U.S. Stock Funds – 55.3% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 256,976 | $8,878,527 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 463,380 | 9,823,647 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,372,094 | 19,209,312 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 323,485 | 4,800,523 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 663,788 | 10,600,697 | ||

| MFS Growth Fund - Class R6 | 50,981 | 9,810,297 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 315,111 | 9,576,214 | ||

| MFS Mid Cap Value Fund - Class R6 | 301,308 | 9,665,948 | ||

| MFS New Discovery Fund - Class R6 (a) | 82,086 | 2,397,748 | ||

| MFS New Discovery Value Fund - Class R6 | 137,178 | 2,411,586 | ||

| MFS Research Fund - Class R6 | 159,026 | 8,870,494 | ||

| MFS Value Fund - Class R6 | 215,749 | 10,621,334 | ||

| $106,666,327 | ||||

| Money Market Funds – 2.3% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 4,467,900 | $4,467,901 | ||

| Total Investment Companies (Identified Cost, $172,595,280) | $192,800,511 | |||

| Other Assets, Less Liabilities – (0.0)% | (9,177) | |||

| Net Assets – 100.0% | $192,791,334 | |||

| Issuer | Shares/Par | Value ($) | ||

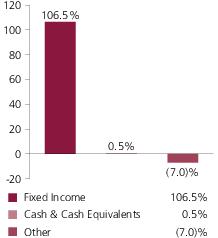

| Investment Companies (h) – 100.1% | ||||

| Bond Funds – 4.2% | ||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 49,240 | $439,719 | ||

| MFS Total Return Bond Fund - Class R6 | 36,064 | 331,066 | ||

| $770,785 | ||||

| International Stock Funds – 28.1% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 13,992 | $184,410 | ||

| MFS Blended Research International Equity Fund - Class R6 | 158,592 | 2,007,781 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 5,590 | 184,252 | ||

| MFS International Growth Fund - Class R6 | 15,681 | 638,532 | ||

| MFS International Intrinsic Value Fund - Class R6 | 16,270 | 638,262 | ||

| MFS International New Discovery Fund - Class R6 | 23,320 | 732,703 | ||

| MFS Research International Fund - Class R6 | 32,673 | 730,238 | ||

| $5,116,178 | ||||

| Non-Traditional Funds – 10.0% | ||||

| MFS Commodity Strategy Fund - Class R6 | 253,080 | $911,087 | ||

| MFS Global Real Estate Fund - Class R6 | 58,485 | 912,373 | ||

| $1,823,460 | ||||

| U.S. Stock Funds – 55.5% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 24,401 | $843,043 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 44,060 | 934,078 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 130,168 | 1,822,350 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 30,700 | 455,586 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 62,809 | 1,003,057 | ||

| MFS Growth Fund - Class R6 | 4,853 | 933,984 | ||

| MFS Mid Cap Growth Fund - Class R6 (a) | 29,982 | 911,144 | ||

| MFS Mid Cap Value Fund - Class R6 | 28,444 | 912,491 | ||

| MFS New Discovery Fund - Class R6 (a) | 7,798 | 227,781 | ||

| MFS New Discovery Value Fund - Class R6 | 12,962 | 227,871 | ||

| MFS Research Fund - Class R6 | 15,113 | 843,017 | ||

| MFS Value Fund - Class R6 | 20,386 | 1,003,602 | ||

| $10,118,004 | ||||

| Money Market Funds – 2.3% | ||||

| MFS Institutional Money Market Portfolio, 5.38% (v) | 425,051 | $425,051 | ||

| Total Investment Companies (Identified Cost, $16,845,394) | $18,253,478 | |||

| Other Assets, Less Liabilities – (0.1)% | (26,685) | |||

| Net Assets – 100.0% | $18,226,793 | |||

| (a) | Non-income producing security. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of each fund’s investments in affiliated issuers were as follows: |

| Affiliated Issuers | |

| MFS Lifetime Income Fund | $621,506,723 |

| MFS Lifetime 2025 Fund | 386,626,549 |

| MFS Lifetime 2030 Fund | 785,664,583 |

| MFS Lifetime 2035 Fund | 593,035,453 |

| MFS Lifetime 2040 Fund | 767,219,665 |

| MFS Lifetime 2045 Fund | 507,560,412 |

| MFS Lifetime 2050 Fund | 547,979,782 |

| MFS Lifetime 2055 Fund | 357,862,126 |

| MFS Lifetime 2060 Fund | 192,800,511 |

| MFS Lifetime 2065 Fund | 18,253,478 |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| MFS Lifetime Income Fund | MFS Lifetime 2025 Fund | MFS Lifetime 2030 Fund | |

| Assets | |||

| Investments in affiliated issuers, at value (identified cost, $571,425,819, $364,014,613, and $675,482,982, respectively) | $621,506,723 | $386,626,549 | $785,664,583 |

| Receivables for | |||

| Investments sold | 1,539,180 | 66,197 | 81,624 |

| Fund shares sold | 196,615 | 674,533 | 549,500 |

| Receivable from investment adviser | 111,050 | 68,907 | 147,725 |

| Other assets | 1,617 | 1,001 | 1,760 |

| Total assets | $623,355,185 | $387,437,187 | $786,445,192 |

| Liabilities | |||

| Payables for | |||

| Distributions | $84,255 | $— | $— |

| Investments purchased | — | 401,446 | 49,675 |

| Fund shares reacquired | 1,485,431 | 315,457 | 555,253 |

| Payable to affiliates | |||

| Administrative services fee | 97 | 97 | 97 |

| Shareholder servicing costs | 168,275 | 85,904 | 172,659 |

| Distribution and service fees | 6,077 | 2,512 | 5,960 |

| Payable for independent Trustees' compensation | 12 | 13 | 14 |

| Payable for audit and tax fees | 37,492 | 36,089 | 36,913 |

| Accrued expenses and other liabilities | 28,945 | 18,092 | 27,578 |

| Total liabilities | $1,810,584 | $859,610 | $848,149 |

| Net assets | $621,544,601 | $386,577,577 | $785,597,043 |

| Net assets consist of | |||

| Paid-in capital | $588,510,896 | $366,117,797 | $674,403,237 |

| Total distributable earnings (loss) | 33,033,705 | 20,459,780 | 111,193,806 |

| Net assets | $621,544,601 | $386,577,577 | $785,597,043 |

| MFS Lifetime Income Fund | MFS Lifetime 2025 Fund | MFS Lifetime 2030 Fund | |

| Net assets | |||

| Class A | $186,276,085 | $36,141,779 | $91,171,594 |

| Class B | 838,556 | 511,881 | 2,224,366 |

| Class C | 23,192,421 | 2,766,389 | 7,386,526 |

| Class I | 41,571,291 | 2,845,962 | 5,534,963 |

| Class R1 | 2,702,689 | 333,081 | 3,054,729 |

| Class R2 | 22,746,818 | 12,647,770 | 35,219,879 |

| Class R3 | 121,319,539 | 106,722,360 | 220,766,306 |

| Class R4 | 18,412,363 | 29,500,234 | 38,081,339 |

| Class R6 | 204,484,839 | 195,108,121 | 382,157,341 |

| Total net assets | $621,544,601 | $386,577,577 | $785,597,043 |

| Shares of beneficial interest outstanding | |||

| Class A | 15,506,191 | 2,786,693 | 5,806,084 |

| Class B | 69,798 | 39,530 | 143,019 |

| Class C | 1,931,670 | 216,100 | 480,121 |

| Class I | 3,459,643 | 218,403 | 350,103 |

| Class R1 | 224,635 | 25,544 | 195,934 |

| Class R2 | 1,893,268 | 976,234 | 2,262,146 |

| Class R3 | 10,099,149 | 8,235,590 | 14,107,440 |

| Class R4 | 1,533,474 | 2,255,882 | 2,399,853 |

| Class R6 | 16,969,733 | 14,934,423 | 24,125,058 |

| Total shares of beneficial interest outstanding | 51,687,561 | 29,688,399 | 49,869,758 |

| Class A shares | |||

| Net asset value per share (net assets / shares of beneficial interest outstanding) | $12.01 | $12.97 | $15.70 |

| Offering price per share (100 / 95.75 x net asset value per share) | $12.54 | $— | $— |

| Offering price per share (100 / 94.25 x net asset value per share) | $— | $13.76 | $16.66 |

| Class B shares | |||

| Net asset value and offering price per share (net assets / shares of beneficial interest outstanding) | $12.01 | $12.95 | $15.55 |

| Class C shares | |||

| Net asset value and offering price per share (net assets / shares of beneficial interest outstanding) | $12.01 | $12.80 | $15.38 |

| Class I shares | |||

| Net asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) | $12.02 | $13.03 | $15.81 |

| Class R1 shares | |||

| Net asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) | $12.03 | $13.04 | $15.59 |

| Class R2 shares | |||

| Net asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) | $12.01 | $12.96 | $15.57 |

| Class R3 shares | |||

| Net asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) | $12.01 | $12.96 | $15.65 |

| Class R4 shares | |||

| Net asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) | $12.01 | $13.08 | $15.87 |

| MFS Lifetime Income Fund | MFS Lifetime 2025 Fund | MFS Lifetime 2030 Fund | |

| Class R6 shares | |||