UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21780

MFS SERIES TRUST XII

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30

Date of reporting period: October 31, 2020

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

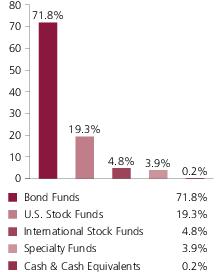

| MFS Limited Maturity Fund | 20.3% |

| MFS Total Return Bond Fund | 20.2% |

| MFS Government Securities Fund | 10.1% |

| MFS Inflation-Adjusted Bond Fund | 10.1% |

| MFS Global Bond Fund | 5.1% |

| MFS High Income Fund | 3.0% |

| MFS Blended Research Mid Cap Equity Fund | 2.9% |

| MFS Blended Research International Equity Fund | 2.4% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS Global Real Estate Fund | 1.9% |

| MFS Value Fund | 1.9% |

| MFS Blended Research Value Equity Fund | 1.9% |

| MFS Research Fund | 1.9% |

| MFS Growth Fund | 1.9% |

| MFS Blended Research Core Equity Fund | 1.9% |

| MFS Blended Research Growth Equity Fund | 1.9% |

| MFS Mid Cap Growth Fund | 1.5% |

| MFS Research International Fund | 1.5% |

| MFS Mid Cap Value Fund | 1.4% |

| MFS Emerging Markets Debt Local Currency Fund | 1.0% |

| MFS Blended Research Small Cap Equity Fund | 1.0% |

| MFS International Intrinsic Value Fund | 0.5% |

| MFS New Discovery Fund | 0.5% |

| MFS New Discovery Value Fund | 0.5% |

| MFS International Growth Fund | 0.5% |

| Cash & Cash Equivalents | 0.2% |

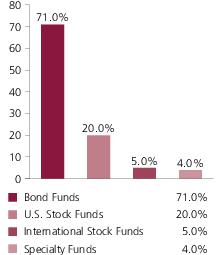

| MFS Limited Maturity Fund | 20.3% |

| MFS Total Return Bond Fund | 20.3% |

| MFS Government Securities Fund | 10.2% |

| MFS Inflation-Adjusted Bond Fund | 10.1% |

| MFS Global Bond Fund | 5.1% |

| MFS High Income Fund | 3.0% |

| MFS Blended Research Mid Cap Equity Fund | 2.9% |

| MFS Blended Research International Equity Fund | 2.3% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Value Fund | 1.9% |

| MFS Growth Fund | 1.9% |

| MFS Blended Research Value Equity Fund | 1.9% |

| MFS Research Fund | 1.9% |

| MFS Blended Research Core Equity Fund | 1.9% |

| MFS Blended Research Growth Equity Fund | 1.9% |

| MFS Research International Fund | 1.5% |

| MFS Mid Cap Growth Fund | 1.5% |

| MFS Mid Cap Value Fund | 1.4% |

| MFS Emerging Markets Debt Local Currency Fund | 1.0% |

| MFS Blended Research Small Cap Equity Fund | 1.0% |

| MFS International Intrinsic Value Fund | 0.5% |

| MFS New Discovery Fund | 0.5% |

| MFS International Growth Fund | 0.5% |

| MFS New Discovery Value Fund | 0.5% |

| Cash & Cash Equivalents (o) | 0.0% |

| (o) | Less than 0.1%. |

| MFS Total Return Bond Fund | 15.3% |

| MFS Limited Maturity Fund | 10.3% |

| MFS Government Securities Fund | 10.2% |

| MFS Inflation-Adjusted Bond Fund | 10.1% |

| MFS Global Bond Fund | 5.1% |

| MFS High Income Fund | 5.0% |

| MFS Blended Research International Equity Fund | 3.9% |

| MFS Blended Research Mid Cap Equity Fund | 3.9% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Value Fund | 2.9% |

| MFS Blended Research Value Equity Fund | 2.9% |

| MFS Research Fund | 2.9% |

| MFS Growth Fund | 2.9% |

| MFS Blended Research Core Equity Fund | 2.9% |

| MFS Blended Research Growth Equity Fund | 2.9% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS Global Real Estate Fund | 1.9% |

| MFS Research International Fund | 1.9% |

| MFS Mid Cap Growth Fund | 1.9% |

| MFS Mid Cap Value Fund | 1.9% |

| MFS International Intrinsic Value Fund | 1.0% |

| MFS Blended Research Small Cap Equity Fund | 1.0% |

| MFS International Growth Fund | 1.0% |

| MFS New Discovery Fund | 0.5% |

| MFS New Discovery Value Fund | 0.5% |

| Cash & Cash Equivalents | 0.2% |

| MFS Government Securities Fund | 10.3% |

| MFS Total Return Bond Fund | 8.3% |

| MFS Inflation-Adjusted Bond Fund | 7.2% |

| MFS Blended Research Mid Cap Equity Fund | 6.8% |

| MFS Blended Research International Equity Fund | 5.9% |

| MFS Global Bond Fund | 5.1% |

| MFS High Income Fund | 5.1% |

| MFS Value Fund | 3.9% |

| MFS Blended Research Value Equity Fund | 3.9% |

| MFS Research Fund | 3.9% |

| MFS Growth Fund | 3.9% |

| MFS Blended Research Core Equity Fund | 3.9% |

| MFS Blended Research Growth Equity Fund | 3.9% |

| MFS Mid Cap Growth Fund | 3.4% |

| MFS Mid Cap Value Fund | 3.4% |

| MFS Emerging Markets Debt Fund | 3.1% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Research International Fund | 2.9% |

| MFS Emerging Markets Debt Local Currency Fund | 2.1% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS Blended Research Small Cap Equity Fund | 1.5% |

| MFS International Growth Fund | 1.4% |

| MFS International New Discovery Fund | 1.0% |

| MFS New Discovery Fund | 0.8% |

| MFS New Discovery Value Fund | 0.7% |

| Cash & Cash Equivalents | 0.1% |

| MFS Limited Maturity Fund (o) | 0.0% |

| (o) | Less than 0.1%. |

| MFS Blended Research Mid Cap Equity Fund | 8.9% |

| MFS Blended Research International Equity Fund | 8.4% |

| MFS Value Fund | 5.4% |

| MFS Blended Research Value Equity Fund | 5.4% |

| MFS Growth Fund | 5.4% |

| MFS Blended Research Growth Equity Fund | 5.4% |

| MFS Inflation-Adjusted Bond Fund | 5.2% |

| MFS High Income Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.4% |

| MFS Mid Cap Value Fund | 4.4% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Research Fund | 4.0% |

| MFS Blended Research Core Equity Fund | 3.9% |

| MFS Research International Fund | 3.5% |

| MFS Total Return Bond Fund | 3.2% |

| MFS Emerging Markets Debt Fund | 3.1% |

| MFS International Intrinsic Value Fund | 2.5% |

| MFS International Growth Fund | 2.4% |

| MFS Global Bond Fund | 2.1% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Blended Research Small Cap Equity Fund | 2.0% |

| MFS New Discovery Fund | 1.0% |

| MFS New Discovery Value Fund | 1.0% |

| MFS Blended Research Emerging Markets Equity Fund | 0.5% |

| MFS Emerging Markets Equity Fund | 0.5% |

| MFS Government Securities Fund | 0.1% |

| Cash & Cash Equivalents | 0.1% |

| MFS Blended Research International Equity Fund | 9.7% |

| MFS Blended Research Mid Cap Equity Fund | 9.4% |

| MFS Value Fund | 5.7% |

| MFS Blended Research Value Equity Fund | 5.7% |

| MFS Growth Fund | 5.7% |

| MFS Blended Research Growth Equity Fund | 5.7% |

| MFS Mid Cap Growth Fund | 4.7% |

| MFS Mid Cap Value Fund | 4.7% |

| MFS Commodity Strategy Fund | 4.6% |

| MFS Global Real Estate Fund | 4.5% |

| MFS Research Fund | 4.0% |

| MFS Blended Research Core Equity Fund | 4.0% |

| MFS Inflation-Adjusted Bond Fund | 3.9% |

| MFS Research International Fund | 3.7% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International New Discovery Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.8% |

| MFS High Income Fund | 2.6% |

| MFS Blended Research Small Cap Equity Fund | 2.3% |

| MFS Emerging Markets Debt Fund | 1.6% |

| MFS New Discovery Fund | 1.1% |

| MFS New Discovery Value Fund | 1.1% |

| MFS Emerging Markets Debt Local Currency Fund | 1.0% |

| MFS Global Bond Fund | 1.0% |

| MFS Blended Research Emerging Markets Equity Fund | 0.8% |

| MFS Emerging Markets Equity Fund | 0.7% |

| Cash & Cash Equivalents (o) | 0.0% |

| (o) | Less than 0.1%. |

| MFS Blended Research International Equity Fund | 10.9% |

| MFS Blended Research Mid Cap Equity Fund | 9.9% |

| MFS Value Fund | 6.0% |

| MFS Blended Research Value Equity Fund | 6.0% |

| MFS Growth Fund | 5.9% |

| MFS Blended Research Growth Equity Fund | 5.9% |

| MFS Commodity Strategy Fund | 5.1% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Mid Cap Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Research International Fund | 4.0% |

| MFS Research Fund | 4.0% |

| MFS Blended Research Core Equity Fund | 4.0% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS International Growth Fund | 3.5% |

| MFS Inflation-Adjusted Bond Fund | 2.6% |

| MFS Total Return Bond Fund | 2.6% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS New Discovery Value Fund | 1.2% |

| MFS New Discovery Fund | 1.2% |

| MFS Blended Research Emerging Markets Equity Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 1.0% |

| MFS High Income Fund | 0.1% |

| Cash & Cash Equivalents | 0.1% |

| MFS Emerging Markets Debt Fund (o) | 0.0% |

| MFS Global Bond Fund (o) | 0.0% |

| MFS Emerging Markets Debt Local Currency Fund (o) | 0.0% |

| (o) | Less than 0.1%. |

| MFS Blended Research International Equity Fund | 11.0% |

| MFS Blended Research Mid Cap Equity Fund | 9.9% |

| MFS Value Fund | 6.0% |

| MFS Blended Research Value Equity Fund | 6.0% |

| MFS Growth Fund | 5.9% |

| MFS Blended Research Growth Equity Fund | 5.9% |

| MFS Commodity Strategy Fund | 5.1% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Mid Cap Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Research International Fund | 4.0% |

| MFS Research Fund | 4.0% |

| MFS Blended Research Core Equity Fund | 4.0% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS International Growth Fund | 3.5% |

| MFS Total Return Bond Fund | 2.6% |

| MFS Inflation-Adjusted Bond Fund | 2.6% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS New Discovery Value Fund | 1.2% |

| MFS New Discovery Fund | 1.2% |

| MFS Blended Research Emerging Markets Equity Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 1.0% |

| Cash & Cash Equivalents | 0.1% |

| MFS Blended Research International Equity Fund | 10.9% |

| MFS Blended Research Mid Cap Equity Fund | 9.9% |

| MFS Blended Research Value Equity Fund | 6.0% |

| MFS Value Fund | 6.0% |

| MFS Growth Fund | 6.0% |

| MFS Blended Research Growth Equity Fund | 5.9% |

| MFS Commodity Strategy Fund | 5.1% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Mid Cap Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Research International Fund | 4.0% |

| MFS Research Fund | 4.0% |

| MFS Blended Research Core Equity Fund | 4.0% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS International Growth Fund | 3.5% |

| MFS Total Return Bond Fund | 2.6% |

| MFS Inflation-Adjusted Bond Fund | 2.6% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS New Discovery Value Fund | 1.2% |

| MFS New Discovery Fund | 1.2% |

| MFS Blended Research Emerging Markets Equity Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 1.0% |

| Cash & Cash Equivalents | 0.1% |

| MFS Blended Research International Equity Fund | 11.0% |

| MFS Blended Research Mid Cap Equity Fund | 10.0% |

| MFS Blended Research Value Equity Fund | 6.0% |

| MFS Value Fund | 6.0% |

| MFS Growth Fund | 6.0% |

| MFS Blended Research Growth Equity Fund | 6.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS Mid Cap Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Research International Fund | 4.0% |

| MFS Blended Research Core Equity Fund | 4.0% |

| MFS Research Fund | 4.0% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS International Growth Fund | 3.5% |

| MFS Total Return Bond Fund | 2.5% |

| MFS Inflation-Adjusted Bond Fund | 2.5% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS New Discovery Value Fund | 1.2% |

| MFS New Discovery Fund | 1.2% |

| MFS Blended Research Emerging Markets Equity Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 1.0% |

| Cash & Cash Equivalents | 0.1% |

May 1, 2020 through October 31, 2020

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.23% | $1,000.00 | $1,068.91 | $1.20 |

| Hypothetical (h) | 0.23% | $1,000.00 | $1,024.05 | $1.17 | |

| B | Actual | 0.98% | $1,000.00 | $1,064.99 | $5.10 |

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.27 | $4.99 | |

| C | Actual | 0.98% | $1,000.00 | $1,065.86 | $5.10 |

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.27 | $4.99 | |

| I | Actual | 0.00% | $1,000.00 | $1,070.22 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 0.98% | $1,000.00 | $1,065.76 | $5.10 |

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.27 | $4.99 | |

| R2 | Actual | 0.48% | $1,000.00 | $1,068.42 | $2.50 |

| Hypothetical (h) | 0.48% | $1,000.00 | $1,022.79 | $2.45 | |

| R3 | Actual | 0.23% | $1,000.00 | $1,068.91 | $1.20 |

| Hypothetical (h) | 0.23% | $1,000.00 | $1,024.05 | $1.17 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,070.22 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,071.32 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| 529A | Actual | 0.27% | $1,000.00 | $1,068.26 | $1.41 |

| Hypothetical (h) | 0.27% | $1,000.00 | $1,023.84 | $1.38 | |

| 529B | Actual | 0.90% | $1,000.00 | $1,065.34 | $4.69 |

| Hypothetical (h) | 0.90% | $1,000.00 | $1,020.67 | $4.58 | |

| 529C | Actual | 1.03% | $1,000.00 | $1,065.34 | $5.36 |

| Hypothetical (h) | 1.03% | $1,000.00 | $1,020.01 | $5.24 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.24% | $1,000.00 | $1,070.13 | $1.25 |

| Hypothetical (h) | 0.24% | $1,000.00 | $1,024.00 | $1.22 | |

| B | Actual | 0.99% | $1,000.00 | $1,065.72 | $5.15 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.21 | $5.04 | |

| C | Actual | 0.99% | $1,000.00 | $1,066.88 | $5.16 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.21 | $5.04 | |

| I | Actual | 0.00% | $1,000.00 | $1,071.15 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 0.99% | $1,000.00 | $1,066.46 | $5.16 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.21 | $5.04 | |

| R2 | Actual | 0.49% | $1,000.00 | $1,068.20 | $2.55 |

| Hypothetical (h) | 0.49% | $1,000.00 | $1,022.74 | $2.50 | |

| R3 | Actual | 0.24% | $1,000.00 | $1,070.13 | $1.25 |

| Hypothetical (h) | 0.24% | $1,000.00 | $1,024.00 | $1.22 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,071.21 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,072.04 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.24% | $1,000.00 | $1,082.35 | $1.26 |

| Hypothetical (h) | 0.24% | $1,000.00 | $1,024.00 | $1.22 | |

| B | Actual | 1.00% | $1,000.00 | $1,078.32 | $5.24 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| C | Actual | 1.00% | $1,000.00 | $1,078.70 | $5.24 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| I | Actual | 0.00% | $1,000.00 | $1,084.44 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,079.05 | $5.24 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,081.17 | $2.62 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.68 | $2.55 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,082.48 | $1.31 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,084.31 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,084.24 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.24% | $1,000.00 | $1,101.30 | $1.27 |

| Hypothetical (h) | 0.24% | $1,000.00 | $1,024.00 | $1.22 | |

| B | Actual | 0.99% | $1,000.00 | $1,097.16 | $5.23 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.21 | $5.04 | |

| C | Actual | 0.99% | $1,000.00 | $1,097.14 | $5.23 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.21 | $5.04 | |

| I | Actual | 0.00% | $1,000.00 | $1,102.79 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 0.99% | $1,000.00 | $1,097.71 | $5.23 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.21 | $5.04 | |

| R2 | Actual | 0.49% | $1,000.00 | $1,100.21 | $2.59 |

| Hypothetical (h) | 0.49% | $1,000.00 | $1,022.74 | $2.50 | |

| R3 | Actual | 0.24% | $1,000.00 | $1,101.58 | $1.27 |

| Hypothetical (h) | 0.24% | $1,000.00 | $1,024.00 | $1.22 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,103.40 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,104.08 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.25% | $1,000.00 | $1,122.55 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| B | Actual | 1.00% | $1,000.00 | $1,118.25 | $5.34 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| C | Actual | 1.00% | $1,000.00 | $1,118.21 | $5.34 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| I | Actual | 0.00% | $1,000.00 | $1,123.73 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,118.98 | $5.34 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,120.73 | $2.67 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.68 | $2.55 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,122.46 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,123.29 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,125.45 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.25% | $1,000.00 | $1,127.11 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| B | Actual | 1.00% | $1,000.00 | $1,122.62 | $5.35 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| C | Actual | 1.00% | $1,000.00 | $1,122.93 | $5.35 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| I | Actual | 0.00% | $1,000.00 | $1,127.43 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,122.52 | $5.35 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,125.17 | $2.68 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.68 | $2.55 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,126.35 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,127.85 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,129.18 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.25% | $1,000.00 | $1,131.39 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| B | Actual | 1.00% | $1,000.00 | $1,126.43 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| C | Actual | 0.99% | $1,000.00 | $1,127.25 | $5.31 |

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.21 | $5.04 | |

| I | Actual | 0.00% | $1,000.00 | $1,132.86 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,127.42 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,129.29 | $2.68 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.68 | $2.55 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,130.78 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,132.25 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,132.96 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.25% | $1,000.00 | $1,131.25 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| B | Actual | 1.00% | $1,000.00 | $1,126.57 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| C | Actual | 1.00% | $1,000.00 | $1,127.33 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| I | Actual | 0.00% | $1,000.00 | $1,132.59 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,126.58 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,129.24 | $2.68 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.68 | $2.55 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,131.08 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,132.59 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,133.18 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.25% | $1,000.00 | $1,131.31 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| B | Actual | 1.00% | $1,000.00 | $1,127.00 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| C | Actual | 1.00% | $1,000.00 | $1,126.66 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| I | Actual | 0.00% | $1,000.00 | $1,131.82 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,127.27 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,129.95 | $2.68 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.68 | $2.55 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,131.31 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,131.96 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,133.24 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Share

Class |

Annualized

Expense Ratio |

Beginning

Account Value 5/01/20 |

Ending

Account Value 10/31/20 |

Expenses

Paid During Period (p) 5/01/20-10/31/20 | |

| A | Actual | 0.25% | $1,000.00 | $1,132.44 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| B | Actual | 1.00% | $1,000.00 | $1,127.22 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| C | Actual | 1.00% | $1,000.00 | $1,127.91 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| I | Actual | 0.00% | $1,000.00 | $1,133.39 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R1 | Actual | 1.00% | $1,000.00 | $1,127.66 | $5.36 |

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.16 | $5.09 | |

| R2 | Actual | 0.50% | $1,000.00 | $1,130.67 | $2.69 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.68 | $2.55 | |

| R3 | Actual | 0.25% | $1,000.00 | $1,132.21 | $1.34 |

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.95 | $1.28 | |

| R4 | Actual | 0.00% | $1,000.00 | $1,133.51 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 | |

| R6 | Actual | 0.00% | $1,000.00 | $1,134.16 | $0.00 |

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.21 | $0.00 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

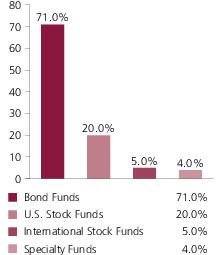

| Bond Funds – 71.8% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 882,940 | $ 12,917,416 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 1,011,369 | 6,412,079 | ||

| MFS Global Bond Fund - Class R6 | 3,380,008 | 32,211,472 | ||

| MFS Government Securities Fund - Class R6 | 6,239,992 | 64,646,317 | ||

| MFS High Income Fund - Class R6 | 5,803,247 | 19,324,811 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 5,735,555 | 64,467,638 | ||

| MFS Limited Maturity Fund - Class R6 | 21,300,326 | 129,718,986 | ||

| MFS Total Return Bond Fund - Class R6 | 11,296,237 | 129,341,919 | ||

| $ 459,040,638 | ||||

| International Stock Funds – 4.8% | ||||

| MFS Blended Research International Equity Fund - Class R6 | 1,480,031 | $ 15,510,724 | ||

| MFS International Growth Fund - Class R6 | 83,040 | 3,073,328 | ||

| MFS International Intrinsic Value Fund - Class R6 | 64,517 | 3,101,354 | ||

| MFS Research International Fund - Class R6 | 489,177 | 9,269,896 | ||

| $ 30,955,302 | ||||

| Specialty Funds – 3.9% | ||||

| MFS Commodity Strategy Fund - Class R6 | 2,613,434 | $ 12,701,287 | ||

| MFS Global Real Estate Fund - Class R6 | 786,679 | 12,437,403 | ||

| $ 25,138,690 | ||||

| U.S. Stock Funds – 19.3% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 438,013 | $ 12,290,655 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 701,824 | 12,260,856 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,628,782 | 18,454,103 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 511,774 | 6,156,640 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,046,036 | 12,322,305 | ||

| MFS Growth Fund - Class R6 | 81,951 | 12,311,478 | ||

| MFS Mid Cap Growth Fund - Class R6 | 354,519 | 9,288,396 | ||

| MFS Mid Cap Value Fund - Class R6 | 412,715 | 9,269,570 | ||

| MFS New Discovery Fund - Class R6 | 81,136 | 3,084,805 | ||

| MFS New Discovery Value Fund - Class R6 | 231,682 | 3,081,376 | ||

| MFS Research Fund - Class R6 | 260,899 | 12,319,648 | ||

| MFS Value Fund - Class R6 | 312,019 | 12,352,813 | ||

| $ 123,192,645 | ||||

| Money Market Funds – 0.2% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 1,192,532 | $ 1,192,532 | ||

| Total Investment Companies (Identified Cost, $553,926,964) | $639,519,807 | |||

| Other Assets, Less Liabilities – (0.0)% | (4,629) | |||

| Net Assets – 100.0% | $639,515,178 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.1% | ||||

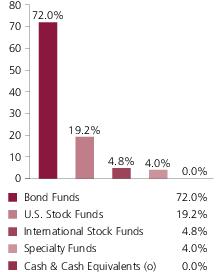

| Bond Funds – 72.0% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 494,382 | $ 7,232,812 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 565,285 | 3,583,909 | ||

| MFS Global Bond Fund - Class R6 | 1,890,196 | 18,013,570 | ||

| MFS Government Securities Fund - Class R6 | 3,497,362 | 36,232,674 | ||

| MFS High Income Fund - Class R6 | 3,244,451 | 10,804,020 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 3,215,255 | 36,139,459 | ||

| MFS Limited Maturity Fund - Class R6 | 11,916,036 | 72,568,660 | ||

| MFS Total Return Bond Fund - Class R6 | 6,329,201 | 72,469,353 | ||

| $ 257,044,457 | ||||

| International Stock Funds – 4.8% | ||||

| MFS Blended Research International Equity Fund - Class R6 | 824,980 | $ 8,645,791 | ||

| MFS International Growth Fund - Class R6 | 46,376 | 1,716,352 | ||

| MFS International Intrinsic Value Fund - Class R6 | 36,040 | 1,732,431 | ||

| MFS Research International Fund - Class R6 | 273,302 | 5,179,076 | ||

| $ 17,273,650 | ||||

| Specialty Funds – 4.0% | ||||

| MFS Commodity Strategy Fund - Class R6 | 1,458,412 | $ 7,087,884 | ||

| MFS Global Real Estate Fund - Class R6 | 441,531 | 6,980,604 | ||

| $ 14,068,488 | ||||

| U.S. Stock Funds – 19.2% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 244,216 | $ 6,852,693 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 391,626 | 6,841,714 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 907,246 | 10,279,099 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 284,654 | 3,424,385 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 583,090 | 6,868,805 | ||

| MFS Growth Fund - Class R6 | 45,729 | 6,869,826 | ||

| MFS Mid Cap Growth Fund - Class R6 | 197,652 | 5,178,485 | ||

| MFS Mid Cap Value Fund - Class R6 | 229,496 | 5,154,474 | ||

| MFS New Discovery Fund - Class R6 | 45,143 | 1,716,356 | ||

| MFS New Discovery Value Fund - Class R6 | 128,590 | 1,710,245 | ||

| MFS Research Fund - Class R6 | 145,432 | 6,867,292 | ||

| MFS Value Fund - Class R6 | 173,861 | 6,883,152 | ||

| $ 68,646,526 | ||||

| Money Market Funds – 0.1% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 227,791 | $ 227,791 | ||

| Total Investment Companies (Identified Cost, $306,516,005) | $357,260,912 | |||

| Other Assets, Less Liabilities – (0.1)% | (183,293) | |||

| Net Assets – 100.0% | $357,077,619 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

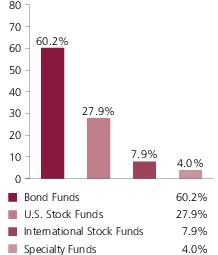

| Bond Funds – 61.0% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 861,716 | $ 12,606,905 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 1,310,256 | 8,307,024 | ||

| MFS Global Bond Fund - Class R6 | 2,206,445 | 21,027,425 | ||

| MFS Government Securities Fund - Class R6 | 4,083,544 | 42,305,515 | ||

| MFS High Income Fund - Class R6 | 6,276,282 | 20,900,018 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 3,753,809 | 42,192,810 | ||

| MFS Limited Maturity Fund - Class R6 | 7,054,216 | 42,960,175 | ||

| MFS Total Return Bond Fund - Class R6 | 5,568,329 | 63,757,371 | ||

| $ 254,057,243 | ||||

| International Stock Funds – 7.8% | ||||

| MFS Blended Research International Equity Fund - Class R6 | 1,543,147 | $ 16,172,176 | ||

| MFS International Growth Fund - Class R6 | 108,404 | 4,012,027 | ||

| MFS International Intrinsic Value Fund - Class R6 | 84,060 | 4,040,746 | ||

| MFS Research International Fund - Class R6 | 426,898 | 8,089,723 | ||

| $ 32,314,672 | ||||

| Specialty Funds – 3.9% | ||||

| MFS Commodity Strategy Fund - Class R6 | 1,704,087 | $ 8,281,863 | ||

| MFS Global Real Estate Fund - Class R6 | 518,540 | 8,198,117 | ||

| $ 16,479,980 | ||||

| U.S. Stock Funds – 27.1% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 429,765 | $ 12,059,207 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 688,691 | 12,031,441 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,420,467 | 16,093,889 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 335,686 | 4,038,305 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,026,195 | 12,088,575 | ||

| MFS Growth Fund - Class R6 | 80,330 | 12,067,940 | ||

| MFS Mid Cap Growth Fund - Class R6 | 308,480 | 8,082,182 | ||

| MFS Mid Cap Value Fund - Class R6 | 359,371 | 8,071,474 | ||

| MFS New Discovery Fund - Class R6 | 53,130 | 2,020,013 | ||

| MFS New Discovery Value Fund - Class R6 | 151,825 | 2,019,271 | ||

| MFS Research Fund - Class R6 | 255,696 | 12,073,953 | ||

| MFS Value Fund - Class R6 | 305,603 | 12,098,822 | ||

| $ 112,745,072 | ||||

| Money Market Funds – 0.2% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 735,993 | $ 735,993 | ||

| Total Investment Companies (Identified Cost, $368,350,237) | $416,332,960 | |||

| Other Assets, Less Liabilities – (0.0)% | (630) | |||

| Net Assets – 100.0% | $416,332,330 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

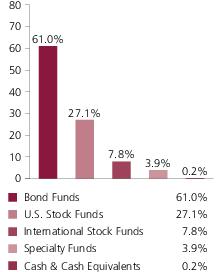

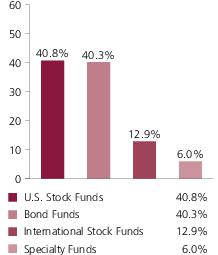

| Bond Funds – 41.2% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 1,395,812 | $ 20,420,727 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 2,127,441 | 13,487,975 | ||

| MFS Global Bond Fund - Class R6 | 3,558,199 | 33,909,637 | ||

| MFS Government Securities Fund - Class R6 | 6,578,426 | 68,152,503 | ||

| MFS High Income Fund - Class R6 | 10,173,156 | 33,876,610 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 4,248,669 | 47,755,045 | ||

| MFS Limited Maturity Fund - Class R6 | 28,915 | 176,090 | ||

| MFS Total Return Bond Fund - Class R6 | 4,793,346 | 54,883,807 | ||

| $ 272,662,394 | ||||

| International Stock Funds – 12.7% | ||||

| MFS Blended Research International Equity Fund - Class R6 | 3,720,551 | $ 38,991,372 | ||

| MFS International Growth Fund - Class R6 | 261,305 | 9,670,904 | ||

| MFS International Intrinsic Value Fund - Class R6 | 202,946 | 9,755,622 | ||

| MFS International New Discovery Fund - Class R6 | 189,012 | 6,466,103 | ||

| MFS Research International Fund - Class R6 | 1,026,169 | 19,445,907 | ||

| $ 84,329,908 | ||||

| Specialty Funds – 6.0% | ||||

| MFS Commodity Strategy Fund - Class R6 | 4,105,204 | $ 19,951,291 | ||

| MFS Global Real Estate Fund - Class R6 | 1,243,441 | 19,658,806 | ||

| $ 39,610,097 | ||||

| U.S. Stock Funds – 40.0% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 919,080 | $ 25,789,379 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,473,047 | 25,734,136 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 3,978,294 | 45,074,066 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 804,591 | 9,679,232 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 2,195,995 | 25,868,825 | ||

| MFS Growth Fund - Class R6 | 171,995 | 25,838,810 | ||

| MFS Mid Cap Growth Fund - Class R6 | 865,614 | 22,679,083 | ||

| MFS Mid Cap Value Fund - Class R6 | 1,007,326 | 22,624,544 | ||

| MFS New Discovery Fund - Class R6 | 127,451 | 4,845,674 | ||

| MFS New Discovery Value Fund - Class R6 | 363,844 | 4,839,122 | ||

| MFS Research Fund - Class R6 | 547,297 | 25,843,356 | ||

| MFS Value Fund - Class R6 | 654,666 | 25,918,239 | ||

| $ 264,734,466 | ||||

| Money Market Funds – 0.1% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 687,282 | $ 687,281 | ||

| Total Investment Companies (Identified Cost, $527,945,615) | $662,024,146 | |||

| Other Assets, Less Liabilities – 0.0% | 59,258 | |||

| Net Assets – 100.0% | $662,083,404 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 20.9% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 791,913 | $ 11,585,682 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 1,205,712 | 7,644,215 | ||

| MFS Global Bond Fund - Class R6 | 823,448 | 7,847,456 | ||

| MFS Government Securities Fund - Class R6 | 33,707 | 349,205 | ||

| MFS High Income Fund - Class R6 | 5,768,843 | 19,210,247 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 1,726,244 | 19,402,982 | ||

| MFS Total Return Bond Fund - Class R6 | 1,031,171 | 11,806,909 | ||

| $ 77,846,696 | ||||

| International Stock Funds – 19.8% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 142,204 | $ 1,851,500 | ||

| MFS Blended Research International Equity Fund - Class R6 | 2,984,449 | 31,277,021 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 52,446 | 1,844,526 | ||

| MFS International Growth Fund - Class R6 | 247,081 | 9,144,483 | ||

| MFS International Intrinsic Value Fund - Class R6 | 191,462 | 9,203,599 | ||

| MFS International New Discovery Fund - Class R6 | 215,396 | 7,368,698 | ||

| MFS Research International Fund - Class R6 | 680,161 | 12,889,043 | ||

| $ 73,578,870 | ||||

| Specialty Funds – 8.0% | ||||

| MFS Commodity Strategy Fund - Class R6 | 3,102,124 | $ 15,076,323 | ||

| MFS Global Real Estate Fund - Class R6 | 939,698 | 14,856,631 | ||

| $ 29,932,954 | ||||

| U.S. Stock Funds – 51.2% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 523,328 | $ 14,684,589 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,148,653 | 20,066,960 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 2,909,318 | 32,962,568 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 609,154 | 7,328,122 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,713,010 | 20,179,262 | ||

| MFS Growth Fund - Class R6 | 134,075 | 20,142,076 | ||

| MFS Mid Cap Growth Fund - Class R6 | 631,748 | 16,551,806 | ||

| MFS Mid Cap Value Fund - Class R6 | 736,211 | 16,535,306 | ||

| MFS New Discovery Fund - Class R6 | 96,382 | 3,664,447 | ||

| MFS New Discovery Value Fund - Class R6 | 275,245 | 3,660,762 | ||

| MFS Research Fund - Class R6 | 311,506 | 14,709,291 | ||

| MFS Value Fund - Class R6 | 510,030 | 20,192,076 | ||

| $ 190,677,265 | ||||

| Money Market Funds – 0.1% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 389,551 | $ 389,551 | ||

| Total Investment Companies (Identified Cost, $312,702,197) | $372,425,336 | |||

| Other Assets, Less Liabilities – (0.0)% | (43,908) | |||

| Net Assets – 100.0% | $372,381,428 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

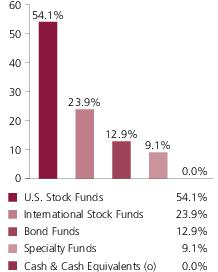

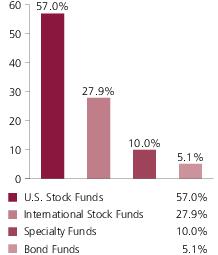

| Bond Funds – 12.9% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 498,710 | $ 7,296,124 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 768,211 | 4,870,459 | ||

| MFS Global Bond Fund - Class R6 | 510,492 | 4,864,983 | ||

| MFS High Income Fund - Class R6 | 3,656,553 | 12,176,323 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 1,608,653 | 18,081,264 | ||

| MFS Total Return Bond Fund - Class R6 | 1,159,947 | 13,281,387 | ||

| $ 60,570,540 | ||||

| International Stock Funds – 23.9% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 271,009 | $ 3,528,533 | ||

| MFS Blended Research International Equity Fund - Class R6 | 4,345,689 | 45,542,814 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 100,008 | 3,517,293 | ||

| MFS International Growth Fund - Class R6 | 376,210 | 13,923,535 | ||

| MFS International Intrinsic Value Fund - Class R6 | 291,492 | 14,012,029 | ||

| MFS International New Discovery Fund - Class R6 | 409,227 | 13,999,652 | ||

| MFS Research International Fund - Class R6 | 923,386 | 17,498,170 | ||

| $ 112,022,026 | ||||

| Specialty Funds – 9.1% | ||||

| MFS Commodity Strategy Fund - Class R6 | 4,403,515 | $ 21,401,081 | ||

| MFS Global Real Estate Fund - Class R6 | 1,340,681 | 21,196,175 | ||

| $ 42,597,256 | ||||

| U.S. Stock Funds – 54.1% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 662,181 | $ 18,580,806 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,525,242 | 26,645,975 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 3,894,165 | 44,120,894 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 868,267 | 10,445,249 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 2,271,146 | 26,754,106 | ||

| MFS Growth Fund - Class R6 | 177,938 | 26,731,619 | ||

| MFS Mid Cap Growth Fund - Class R6 | 844,675 | 22,130,485 | ||

| MFS Mid Cap Value Fund - Class R6 | 985,085 | 22,125,001 | ||

| MFS New Discovery Fund - Class R6 | 137,518 | 5,228,438 | ||

| MFS New Discovery Value Fund - Class R6 | 392,384 | 5,218,711 | ||

| MFS Research Fund - Class R6 | 394,221 | 18,615,101 | ||

| MFS Value Fund - Class R6 | 676,774 | 26,793,465 | ||

| $ 253,389,850 | ||||

| Money Market Funds – 0.0% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 8,990 | $ 8,990 | ||

| Total Investment Companies (Identified Cost, $345,736,127) | $468,588,662 | |||

| Other Assets, Less Liabilities – 0.0% | 24,231 | |||

| Net Assets – 100.0% | $468,612,893 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 5.3% | ||||

| MFS Emerging Markets Debt Fund - Class R6 | 3,658 | $ 53,517 | ||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 5,618 | 35,617 | ||

| MFS Global Bond Fund - Class R6 | 3,749 | 35,726 | ||

| MFS High Income Fund - Class R6 | 26,775 | 89,161 | ||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 612,459 | 6,884,043 | ||

| MFS Total Return Bond Fund - Class R6 | 599,503 | 6,864,313 | ||

| $ 13,962,377 | ||||

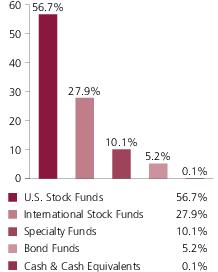

| International Stock Funds – 27.9% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 203,853 | $ 2,654,171 | ||

| MFS Blended Research International Equity Fund - Class R6 | 2,753,292 | 28,854,497 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 75,235 | 2,646,023 | ||

| MFS International Growth Fund - Class R6 | 247,198 | 9,148,792 | ||

| MFS International Intrinsic Value Fund - Class R6 | 191,231 | 9,192,446 | ||

| MFS International New Discovery Fund - Class R6 | 307,365 | 10,514,964 | ||

| MFS Research International Fund - Class R6 | 553,844 | 10,495,339 | ||

| $ 73,506,232 | ||||

| Specialty Funds – 10.1% | ||||

| MFS Commodity Strategy Fund - Class R6 | 2,754,869 | $ 13,388,665 | ||

| MFS Global Real Estate Fund - Class R6 | 837,614 | 13,242,667 | ||

| $ 26,631,332 | ||||

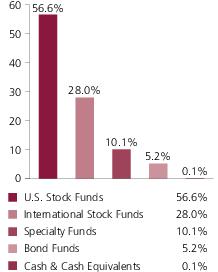

| U.S. Stock Funds – 56.6% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 373,132 | $ 10,470,084 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 896,485 | 15,661,598 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 2,310,463 | 26,177,540 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 543,675 | 6,540,405 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,336,461 | 15,743,514 | ||

| MFS Growth Fund - Class R6 | 104,525 | 15,702,793 | ||

| MFS Mid Cap Growth Fund - Class R6 | 500,396 | 13,110,385 | ||

| MFS Mid Cap Value Fund - Class R6 | 584,135 | 13,119,668 | ||

| MFS New Discovery Fund - Class R6 | 85,940 | 3,267,433 | ||

| MFS New Discovery Value Fund - Class R6 | 245,980 | 3,271,540 | ||

| MFS Research Fund - Class R6 | 221,898 | 10,478,015 | ||

| MFS Value Fund - Class R6 | 397,763 | 15,747,455 | ||

| $ 149,290,430 | ||||

| Money Market Funds – 0.1% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 365,715 | $ 365,715 | ||

| Total Investment Companies (Identified Cost, $221,311,974) | $263,756,086 | |||

| Other Assets, Less Liabilities – (0.0)% | (42,562) | |||

| Net Assets – 100.0% | $263,713,524 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 5.2% | ||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 633,725 | $ 7,123,067 | ||

| MFS Total Return Bond Fund - Class R6 | 623,893 | 7,143,584 | ||

| $ 14,266,651 | ||||

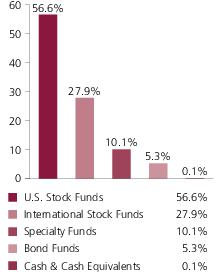

| International Stock Funds – 28.0% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 213,225 | $ 2,776,185 | ||

| MFS Blended Research International Equity Fund - Class R6 | 2,872,349 | 30,102,219 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 78,706 | 2,768,074 | ||

| MFS International Growth Fund - Class R6 | 257,717 | 9,538,117 | ||

| MFS International Intrinsic Value Fund - Class R6 | 199,737 | 9,601,350 | ||

| MFS International New Discovery Fund - Class R6 | 321,651 | 11,003,692 | ||

| MFS Research International Fund - Class R6 | 577,288 | 10,939,610 | ||

| $ 76,729,247 | ||||

| Specialty Funds – 10.1% | ||||

| MFS Commodity Strategy Fund - Class R6 | 2,875,250 | $ 13,973,716 | ||

| MFS Global Real Estate Fund - Class R6 | 874,521 | 13,826,167 | ||

| $ 27,799,883 | ||||

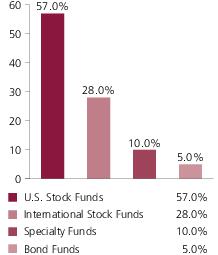

| U.S. Stock Funds – 56.6% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 388,278 | $ 10,895,092 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 933,105 | 16,301,346 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 2,405,472 | 27,254,001 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 566,547 | 6,815,560 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 1,392,043 | 16,398,265 | ||

| MFS Growth Fund - Class R6 | 108,850 | 16,352,446 | ||

| MFS Mid Cap Growth Fund - Class R6 | 521,358 | 13,659,573 | ||

| MFS Mid Cap Value Fund - Class R6 | 608,539 | 13,667,794 | ||

| MFS New Discovery Fund - Class R6 | 89,548 | 3,404,614 | ||

| MFS New Discovery Value Fund - Class R6 | 256,326 | 3,409,140 | ||

| MFS Research Fund - Class R6 | 230,935 | 10,904,729 | ||

| MFS Value Fund - Class R6 | 414,320 | 16,402,931 | ||

| $ 155,465,491 | ||||

| Money Market Funds – 0.1% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 345,105 | $ 345,105 | ||

| Total Investment Companies (Identified Cost, $223,496,550) | $274,606,377 | |||

| Other Assets, Less Liabilities – (0.0)% | (55,744) | |||

| Net Assets – 100.0% | $274,550,633 | |||

| Issuer | Shares/Par | Value ($) | ||

| Investment Companies (h) – 100.0% | ||||

| Bond Funds – 5.2% | ||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 336,660 | $ 3,784,065 | ||

| MFS Total Return Bond Fund - Class R6 | 331,382 | 3,794,321 | ||

| $ 7,578,386 | ||||

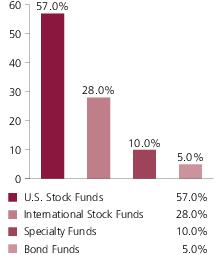

| International Stock Funds – 27.9% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 113,422 | $ 1,476,758 | ||

| MFS Blended Research International Equity Fund - Class R6 | 1,534,386 | 16,080,367 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 41,868 | 1,472,504 | ||

| MFS International Growth Fund - Class R6 | 137,933 | 5,104,903 | ||

| MFS International Intrinsic Value Fund - Class R6 | 106,585 | 5,123,528 | ||

| MFS International New Discovery Fund - Class R6 | 171,354 | 5,862,008 | ||

| MFS Research International Fund - Class R6 | 308,427 | 5,844,684 | ||

| $ 40,964,752 | ||||

| Specialty Funds – 10.1% | ||||

| MFS Commodity Strategy Fund - Class R6 | 1,532,103 | $ 7,446,018 | ||

| MFS Global Real Estate Fund - Class R6 | 466,884 | 7,381,438 | ||

| $ 14,827,456 | ||||

| U.S. Stock Funds – 56.7% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 207,769 | $ 5,830,003 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 498,823 | 8,714,440 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,288,509 | 14,598,813 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 303,460 | 3,650,620 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 745,653 | 8,783,788 | ||

| MFS Growth Fund - Class R6 | 58,143 | 8,734,863 | ||

| MFS Mid Cap Growth Fund - Class R6 | 278,359 | 7,292,998 | ||

| MFS Mid Cap Value Fund - Class R6 | 325,860 | 7,318,826 | ||

| MFS New Discovery Fund - Class R6 | 47,874 | 1,820,162 | ||

| MFS New Discovery Value Fund - Class R6 | 137,433 | 1,827,856 | ||

| MFS Research Fund - Class R6 | 123,504 | 5,831,865 | ||

| MFS Value Fund - Class R6 | 221,773 | 8,779,981 | ||

| $ 83,184,215 | ||||

| Money Market Funds – 0.1% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 171,718 | $ 171,718 | ||

| Total Investment Companies (Identified Cost, $128,139,999) | $146,726,527 | |||

| Other Assets, Less Liabilities – 0.0% | 29,590 | |||

| Net Assets – 100.0% | $146,756,117 | |||

| Issuer | Shares/Par | Value ($) | ||

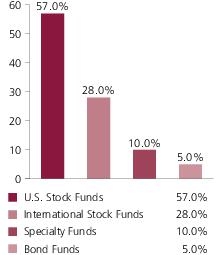

| Investment Companies (h) – 99.9% | ||||

| Bond Funds – 5.0% | ||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 83,087 | $ 933,904 | ||

| MFS Total Return Bond Fund - Class R6 | 81,785 | 936,437 | ||

| $ 1,870,341 | ||||

| International Stock Funds – 28.0% | ||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 28,601 | $ 372,383 | ||

| MFS Blended Research International Equity Fund - Class R6 | 390,841 | 4,096,010 | ||

| MFS Emerging Markets Equity Fund - Class R6 | 10,586 | 372,311 | ||

| MFS International Growth Fund - Class R6 | 35,212 | 1,303,193 | ||

| MFS International Intrinsic Value Fund - Class R6 | 27,115 | 1,303,398 | ||

| MFS International New Discovery Fund - Class R6 | 43,538 | 1,489,451 | ||

| MFS Research International Fund - Class R6 | 78,597 | 1,489,418 | ||

| $ 10,426,164 | ||||

| Specialty Funds – 10.0% | ||||

| MFS Commodity Strategy Fund - Class R6 | 383,369 | $ 1,863,171 | ||

| MFS Global Real Estate Fund - Class R6 | 118,561 | 1,874,455 | ||

| $ 3,737,626 | ||||

| U.S. Stock Funds – 56.9% | ||||

| MFS Blended Research Core Equity Fund - Class R6 | 53,072 | $ 1,489,206 | ||

| MFS Blended Research Growth Equity Fund - Class R6 | 127,754 | 2,231,856 | ||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 328,731 | 3,724,525 | ||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 77,428 | 931,460 | ||

| MFS Blended Research Value Equity Fund - Class R6 | 190,109 | 2,239,487 | ||

| MFS Growth Fund - Class R6 | 14,863 | 2,232,830 | ||

| MFS Mid Cap Growth Fund - Class R6 | 71,002 | 1,860,246 | ||

| MFS Mid Cap Value Fund - Class R6 | 83,055 | 1,865,411 | ||

| MFS New Discovery Fund - Class R6 | 12,235 | 465,189 | ||

| MFS New Discovery Value Fund - Class R6 | 35,052 | 466,186 | ||

| MFS Research Fund - Class R6 | 31,536 | 1,489,149 | ||

| MFS Value Fund - Class R6 | 56,467 | 2,235,515 | ||

| $ 21,231,060 | ||||

| Money Market Funds – 0.0% | ||||

| MFS Institutional Money Market Portfolio, 0.1% (v) | 11,632 | $ 11,632 | ||

| Total Investment Companies (Identified Cost, $34,699,276) | $37,276,823 | |||

| Other Assets, Less Liabilities – 0.1% | 27,936 | |||

| Net Assets – 100.0% | $37,304,759 | |||

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of each fund’s investments in affiliated issuers were as follows: |

| Affiliated Issuers | |

| MFS Lifetime Income Fund | $639,519,807 |

| MFS Lifetime 2020 Fund | 357,260,912 |

| MFS Lifetime 2025 Fund | 416,332,960 |

| MFS Lifetime 2030 Fund | 662,024,146 |

| MFS Lifetime 2035 Fund | 372,425,336 |

| MFS Lifetime 2040 Fund | 468,588,662 |

| MFS Lifetime 2045 Fund | 263,756,086 |

| MFS Lifetime 2050 Fund | 274,606,377 |

| MFS Lifetime 2055 Fund | 146,726,527 |

| MFS Lifetime 2060 Fund | 37,276,823 |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| MFS

Lifetime Income Fund |

MFS

Lifetime 2020 Fund |

MFS

Lifetime 2025 Fund |

MFS

Lifetime 2030 Fund |

MFS

Lifetime 2035 Fund | |

| Assets | |||||

| Investments in affiliated issuers, at value (identified cost, $553,926,964, $306,516,005, $368,350,237, $527,945,615, and $312,702,197, respectively) | $639,519,807 | $357,260,912 | $416,332,960 | $662,024,146 | $372,425,336 |

| Receivables for | |||||

| Investments sold | 480,517 | 464,003 | 458,462 | 725,992 | 960 |

| Fund shares sold | 250,267 | 130,507 | 791,483 | 877,782 | 690,163 |

| Receivable from investment adviser | 124,212 | 81,791 | 91,684 | 129,193 | 88,503 |

| Other assets | 44,552 | 42,361 | 43,701 | 45,595 | 43,096 |

| Total assets | $640,419,355 | $357,979,574 | $417,718,290 | $663,802,708 | $373,248,058 |

| Liabilities | |||||

| Payables for | |||||

| Distributions | $31,106 | $— | $— | $— | $— |

| Investments purchased | 72,816 | 112,982 | 723,862 | 339,421 | 549,519 |

| Fund shares reacquired | 503,959 | 587,940 | 482,319 | 1,118,670 | 140,834 |

| Payable to affiliates | |||||

| Administrative services fee | 144 | 144 | 144 | 144 | 144 |

| Shareholder servicing costs | 208,599 | 158,991 | 139,804 | 209,737 | 137,888 |

| Distribution and service fees | 16,976 | 5,043 | 4,209 | 9,550 | 4,024 |

| Program manager fee | 715 | — | — | — | — |

| Accrued expenses and other liabilities | 69,862 | 36,855 | 35,622 | 41,782 | 34,221 |

| Total liabilities | $904,177 | $901,955 | $1,385,960 | $1,719,304 | $866,630 |

| Net assets | $639,515,178 | $357,077,619 | $416,332,330 | $662,083,404 | $372,381,428 |

| Net assets consist of | |||||

| Paid-in capital | $565,147,645 | $305,197,718 | $366,702,266 | $526,041,156 | $316,355,012 |

| Total distributable earnings (loss) | 74,367,533 | 51,879,901 | 49,630,064 | 136,042,248 | 56,026,416 |

| Net assets | $639,515,178 | $357,077,619 | $416,332,330 | $662,083,404 | $372,381,428 |

| MFS

Lifetime Income Fund |

MFS

Lifetime 2020 Fund |

MFS

Lifetime 2025 Fund |

MFS

Lifetime 2030 Fund |

MFS

Lifetime 2035 Fund | |

| Net assets | |||||

| Class A | $136,284,982 | $41,742,707 | $26,199,517 | $68,420,567 | $23,743,021 |

| Class B | 4,791,636 | 2,179,732 | 1,439,898 | 6,136,974 | 1,501,224 |

| Class C | 95,052,495 | 8,162,893 | 4,088,250 | 13,463,984 | 2,857,715 |

| Class I | 40,207,227 | 4,069,746 | 2,772,367 | 4,123,917 | 901,083 |

| Class R1 | 1,874,746 | 2,820,620 | 2,314,227 | 8,239,859 | 2,374,088 |

| Class R2 | 12,505,361 | 34,268,623 | 22,637,297 | 57,187,824 | 19,955,023 |

| Class R3 | 71,482,744 | 81,773,280 | 101,524,765 | 167,705,007 | 104,353,938 |

| Class R4 | 31,231,886 | 53,720,224 | 79,682,106 | 110,484,799 | 73,401,085 |

| Class R6 | 72,335,179 | 128,339,794 | 175,673,903 | 226,320,473 | 143,294,251 |

| Class 529A | 138,309,640 | — | — | — | — |

| Class 529B | 4,009,439 | — | — | — | — |

| Class 529C | 31,429,843 | — | — | — | — |

| Total net assets | $639,515,178 | $357,077,619 | $416,332,330 | $662,083,404 | $372,381,428 |

| Shares of beneficial interest outstanding | |||||

| Class A | 10,458,445 | 3,073,251 | 1,898,450 | 4,251,350 | 1,534,209 |

| Class B | 367,701 | 161,911 | 105,629 | 388,121 | 97,998 |

| Class C | 7,297,519 | 616,716 | 301,294 | 857,424 | 187,665 |

| Class I | 3,084,610 | 296,999 | 199,907 | 254,606 | 58,025 |

| Class R1 | 143,704 | 209,236 | 169,599 | 520,348 | 154,915 |

| Class R2 | 959,316 | 2,543,451 | 1,649,406 | 3,592,654 | 1,294,822 |

| Class R3 | 5,485,800 | 6,021,985 | 7,365,275 | 10,451,819 | 6,736,537 |

| Class R4 | 2,397,017 | 3,922,685 | 5,737,197 | 6,811,427 | 4,709,928 |

| Class R6 | 5,535,076 | 9,372,587 | 12,635,857 | 13,946,759 | 9,181,876 |

| Class 529A | 12,994,559 | — | — | — | — |

| Class 529B | 376,498 | — | — | — | — |

| Class 529C | 2,953,839 | — | — | — | — |

| Total shares of beneficial interest outstanding | 52,054,084 | 26,218,821 | 30,062,614 | 41,074,508 | 23,955,975 |

| Class A shares | |||||

| Net

asset value per share (net assets / shares of beneficial interest outstanding) |

$13.03 | $13.58 | $13.80 | $16.09 | $15.48 |

| Offering price per share (100 / 95.75 x net asset value per share) | $13.61 | $— | $— | $— | $— |

| Offering price per share (100 / 94.25 x net asset value per share) | $— | $14.41 | $14.64 | $17.07 | $16.42 |

| Class B shares | |||||

| Net

asset value and offering price per share (net assets / shares of beneficial interest outstanding) |

$13.03 | $13.46 | $13.63 | $15.81 | $15.32 |

| Class C shares | |||||

| Net

asset value and offering price per share (net assets / shares of beneficial interest outstanding) |

$13.03 | $13.24 | $13.57 | $15.70 | $15.23 |

| Class I shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$13.03 | $13.70 | $13.87 | $16.20 | $15.53 |

| Class R1 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$13.05 | $13.48 | $13.65 | $15.84 | $15.33 |

| Class R2 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$13.04 | $13.47 | $13.72 | $15.92 | $15.41 |

| Class R3 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$13.03 | $13.58 | $13.78 | $16.05 | $15.49 |

| MFS

Lifetime Income Fund |

MFS

Lifetime 2020 Fund |

MFS

Lifetime 2025 Fund |

MFS

Lifetime 2030 Fund |

MFS

Lifetime 2035 Fund | |

| Class R4 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$13.03 | $13.69 | $13.89 | $16.22 | $15.58 |

| Class R6 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$13.07 | $13.69 | $13.90 | $16.23 | $15.61 |

| Class 529A shares | |||||

| Net

asset value and redemption price per share (net assets / shares of beneficial interest outstanding) |

$10.64 | $— | $— | $— | $— |

| Offering price per share (100 / 95.75 x net asset value per share) | $11.11 | $— | $— | $— | $— |

| Class 529B shares | |||||

| Net

asset value and offering price per share (net assets / shares of beneficial interest outstanding) |

$10.65 | $— | $— | $— | $— |

| Class 529C shares | |||||

| Net

asset value and offering price per share (net assets / shares of beneficial interest outstanding) |

$10.64 | $— | $— | $— | $— |

| On sales of $100,000 or more, the maximum offering price of Class A and Class 529A shares is reduced for the MFS Lifetime Income Fund. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced for all other funds. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, Class C, Class 529B, and Class 529C shares. | |||||

| At 10/31/20 | MFS

Lifetime 2040 Fund |

MFS

Lifetime 2045 Fund |

MFS

Lifetime 2050 Fund |

MFS

Lifetime 2055 Fund |

MFS

Lifetime 2060 Fund |

| Assets | |||||

| Investments in affiliated issuers, at value (identified cost, $345,736,127, $221,311,974, $223,496,550, $128,139,999, and $34,699,276, respectively) | $468,588,662 | $263,756,086 | $274,606,377 | $146,726,527 | $37,276,823 |

| Receivables for | |||||

| Investments sold | 198,380 | 9,821 | — | 60,221 | — |

| Fund shares sold | 727,829 | 755,409 | 575,289 | 431,573 | 245,247 |

| Receivable from investment adviser | 101,331 | 72,856 | 75,059 | 57,105 | 28,560 |

| Other assets | 42,751 | 42,386 | 42,317 | 41,629 | 41,514 |

| Total assets | $469,658,953 | $264,636,558 | $275,299,042 | $147,317,055 | $37,592,144 |

| Liabilities | |||||

| Payables for | |||||

| Investments purchased | $474,424 | $720,745 | $346,171 | $411,862 | $236,464 |

| Fund shares reacquired | 351,887 | 47,886 | 233,950 | 17,514 | 9,362 |

| Payable to affiliates | |||||

| Administrative services fee | 144 | 144 | 144 | 144 | 144 |

| Shareholder servicing costs | 174,127 | 117,233 | 126,989 | 93,197 | 14,630 |

| Distribution and service fees | 6,695 | 2,865 | 3,605 | 2,149 | 431 |

| Accrued expenses and other liabilities | 38,783 | 34,161 | 37,550 | 36,072 | 26,354 |

| Total liabilities | $1,046,060 | $923,034 | $748,409 | $560,938 | $287,385 |

| Net assets | $468,612,893 | $263,713,524 | $274,550,633 | $146,756,117 | $37,304,759 |

| Net assets consist of | |||||

| Paid-in capital | $350,621,298 | $224,530,850 | $226,618,431 | $129,885,240 | $35,230,262 |

| Total distributable earnings (loss) | 117,991,595 | 39,182,674 | 47,932,202 | 16,870,877 | 2,074,497 |

| Net assets | $468,612,893 | $263,713,524 | $274,550,633 | $146,756,117 | $37,304,759 |

| MFS

Lifetime 2040 Fund |

MFS

Lifetime 2045 Fund |

MFS

Lifetime 2050 Fund |

MFS

Lifetime 2055 Fund |

MFS

Lifetime 2060 Fund | |

| Net assets | |||||

| Class A | $44,820,052 | $14,381,040 | $17,320,806 | $10,122,776 | $3,880,125 |

| Class B | 3,342,755 | 765,213 | 1,469,391 | 567,833 | 153,406 |

| Class C | 8,647,141 | 1,724,912 | 3,353,694 | 2,005,486 | 538,842 |

| Class I | 2,737,804 | 1,293,666 | 630,888 | 262,979 | 148,438 |

| Class R1 | 5,113,417 | 1,308,012 | 1,505,478 | 2,185,819 | 67,708 |

| Class R2 | 45,043,468 | 13,561,545 | 23,717,972 | 14,245,480 | 1,420,204 |

| Class R3 | 120,504,290 | 81,950,293 | 84,194,821 | 46,410,111 | 11,201,214 |

| Class R4 | 87,478,223 | 57,271,612 | 56,857,283 | 30,442,169 | 5,356,860 |

| Class R6 | 150,925,743 | 91,457,231 | 85,500,300 | 40,513,464 | 14,537,962 |

| Total net assets | $468,612,893 | $263,713,524 | $274,550,633 | $146,756,117 | $37,304,759 |

| Shares of beneficial interest outstanding | |||||

| Class A | 2,688,760 | 902,790 | 901,043 | 618,529 | 304,551 |

| Class B | 202,803 | 48,515 | 77,866 | 34,974 | 12,105 |

| Class C | 531,886 | 110,029 | 178,702 | 124,552 | 42,715 |

| Class I | 162,827 | 80,725 | 32,820 | 16,034 | 11,568 |

| Class R1 | 311,788 | 83,062 | 80,143 | 135,625 | 5,324 |

| Class R2 | 2,723,602 | 857,658 | 1,250,810 | 876,167 | 111,663 |

| Class R3 | 7,228,710 | 5,150,384 | 4,414,239 | 2,835,920 | 877,928 |

| Class R4 | 5,190,596 | 3,577,664 | 2,958,139 | 1,847,900 | 417,979 |

| Class R6 | 8,947,778 | 5,707,759 | 4,445,688 | 2,455,011 | 1,131,181 |

| Total shares of beneficial interest outstanding | 27,988,750 | 16,518,586 | 14,339,450 | 8,944,712 | 2,915,014 |

| Class A shares | |||||

| Net

asset value per share (net assets / shares of beneficial interest outstanding) |

$16.67 | $15.93 | $19.22 | $16.37 | $12.74 |

| Offering price per share (100 / 94.25 x net asset value per share) | $17.69 | $16.90 | $20.39 | $17.37 | $13.52 |

| Class B shares | |||||

| Net

asset value and offering price per share (net assets / shares of beneficial interest outstanding) |

$16.48 | $15.77 | $18.87 | $16.24 | $12.67 |

| Class C shares | |||||

| Net

asset value and offering price per share (net assets / shares of beneficial interest outstanding) |

$16.26 | $15.68 | $18.77 | $16.10 | $12.61 |

| Class I shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$16.81 | $16.03 | $19.22 | $16.40 | $12.83 |

| Class R1 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$16.40 | $15.75 | $18.78 | $16.12 | $12.72 |

| Class R2 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$16.54 | $15.81 | $18.96 | $16.26 | $12.72 |

| Class R3 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$16.67 | $15.91 | $19.07 | $16.37 | $12.76 |

| Class R4 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$16.85 | $16.01 | $19.22 | $16.47 | $12.82 |

| MFS

Lifetime 2040 Fund |

MFS

Lifetime 2045 Fund |

MFS

Lifetime 2050 Fund |

MFS

Lifetime 2055 Fund |

MFS

Lifetime 2060 Fund | |

| Class R6 shares | |||||

| Net

asset value, offering price, and redemption price per share (net assets / shares of beneficial interest outstanding) |

$16.87 | $16.02 | $19.23 | $16.50 | $12.85 |

| On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. | |||||

| MFS

Lifetime Income Fund |

MFS

Lifetime 2020 Fund |

MFS

Lifetime 2025 Fund |

MFS

Lifetime 2030 Fund |

MFS

Lifetime 2035 Fund | |

| Net investment income (loss) | |||||

| Dividends from affiliated issuers | $5,473,695 | $3,039,728 | $3,038,863 | $3,575,702 | $1,364,909 |

| Other | 95 | 61 | 59 | 95 | 58 |

| Excess expense reimbursement from investment adviser | 39,313 | 75,510 | 105,286 | 139,364 | 87,953 |

| Total investment income | $5,513,103 | $3,115,299 | $3,144,208 | $3,715,161 | $1,452,920 |

| Expenses | |||||

| Distribution and service fees | $1,185,634 | $336,213 | $273,536 | $628,152 | $271,144 |

| Shareholder servicing costs | 452,815 | 242,728 | 253,221 | 407,967 | 260,078 |

| Program manager fees | 43,342 | — | — | — | — |

| Administrative services fee | 8,823 | 8,823 | 8,823 | 8,823 | 8,823 |

| Independent Trustees' compensation | 7,235 | 4,284 | 4,274 | 7,261 | 4,285 |

| Custodian fee | 12,212 | 5,309 | 5,394 | 7,574 | 5,352 |

| Shareholder communications | 27,152 | 8,205 | 7,232 | 10,656 | 7,746 |

| Audit and tax fees | 19,766 | 18,907 | 18,499 | 18,939 | 18,498 |

| Legal fees | 3,110 | 2,014 | 2,005 | 3,215 | 1,988 |

| Registration fees | 69,046 | 63,865 | 68,181 | 68,828 | 67,069 |

| Miscellaneous | 19,232 | 17,912 | 18,243 | 20,683 | 19,135 |

| Total expenses | $1,848,367 | $708,260 | $659,408 | $1,182,098 | $664,118 |

| Reduction of expenses by investment adviser and distributor | (676,748) | (377,377) | (384,670) | (562,230) | (390,131) |

| Net expenses | $1,171,619 | $330,883 | $274,738 | $619,868 | $273,987 |

| Net investment income (loss) | $4,341,484 | $2,784,416 | $2,869,470 | $3,095,293 | $1,178,933 |

| Realized and unrealized gain (loss) | |||||

| Realized gain (loss) (identified cost basis) | |||||

| Investments in affiliated issuers | $4,179,828 | $2,935,534 | $445,338 | $6,834,934 | $(3,253,426) |

| Capital gain distributions from affiliated issuers | 67,422 | 38,330 | 55,383 | 123,319 | 96,512 |

| Net realized gain (loss) | $4,247,250 | $2,973,864 | $500,721 | $6,958,253 | $(3,156,914) |

| Change in unrealized appreciation or depreciation | |||||

| Affiliated issuers | $32,209,646 | $16,938,165 | $26,139,397 | $50,135,528 | $43,301,456 |

| Net realized and unrealized gain (loss) | $36,456,896 | $19,912,029 | $26,640,118 | $57,093,781 | $40,144,542 |

| Change in net assets from operations | $40,798,380 | $22,696,445 | $29,509,588 | $60,189,074 | $41,323,475 |

| Six months ended 10/31/20 | MFS