Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21780

MFS SERIES TRUST XII

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30*

Date of reporting period: October 31, 2019

| * | This Form N-CSR pertains to the following series of the Registrant: MFS Lifetime Income Fund, MFS Lifetime 2020 Fund, MFS Lifetime 2025 Fund, MFS Lifetime 2030 Fund, MFS Lifetime 2035 Fund, MFS Lifetime 2040 Fund, MFS Lifetime 2045 Fund, MFS Lifetime 2050 Fund, MFS Lifetime 2055 Fund, and MFS Lifetime 2060 Fund. |

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

Semiannual Report

October 31, 2019

MFS® Lifetime® Funds

MFS® Lifetime® Income Fund

MFS® Lifetime® 2020 Fund

MFS® Lifetime® 2025 Fund

MFS® Lifetime® 2030 Fund

MFS® Lifetime® 2035 Fund

MFS® Lifetime® 2040 Fund

MFS® Lifetime® 2045 Fund

MFS® Lifetime® 2050 Fund

MFS® Lifetime® 2055 Fund

MFS® Lifetime® 2060 Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the complete reports will be made available on the fund’s Web site (funds.mfs.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you are already signed up to receive shareholder reports by email, you will not be affected by this change and you need not take any action. You may sign up to receive shareholder reports and other communications from the fund by email by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the fund, by calling 1-800-225-2606 or by logging on to MFS Access at mfs.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you can call 1-800-225-2606 or send an email request to orderliterature@mfs.com to let the fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the MFS fund complex if you invest directly.

LTF-SEM

Table of Contents

MFS® Lifetime® Funds

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Table of Contents

LETTER FROM THE EXECUTIVE CHAIR

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

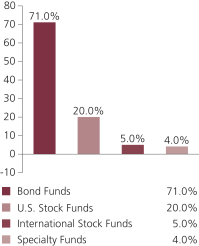

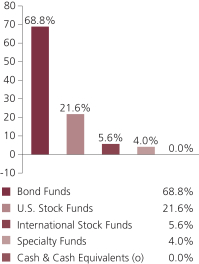

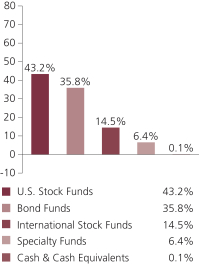

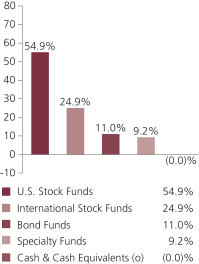

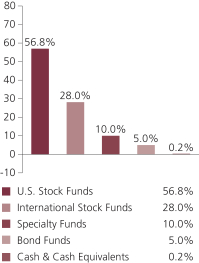

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

2

Table of Contents

Portfolio Composition – continued

| (o) | Less than 0.1%. |

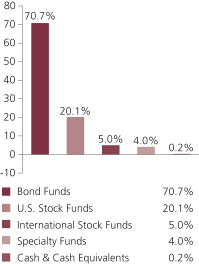

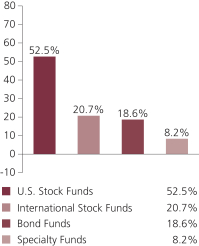

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

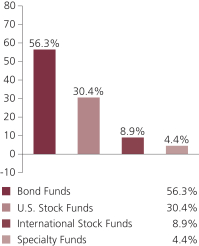

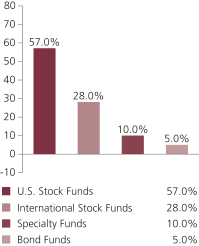

Portfolio Composition – continued

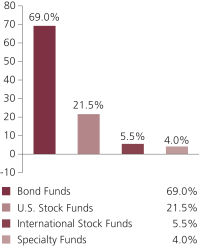

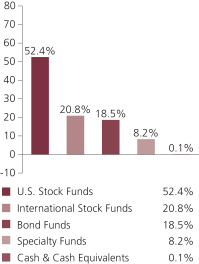

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

4

Table of Contents

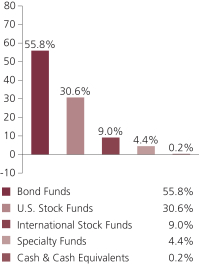

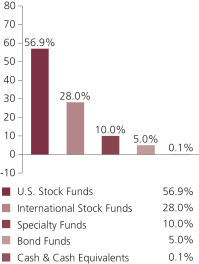

Portfolio Composition – continued

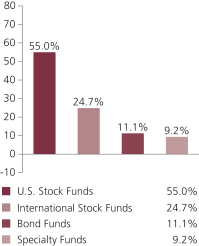

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

5

Table of Contents

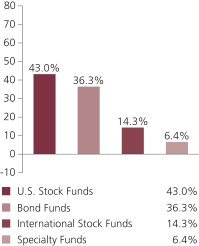

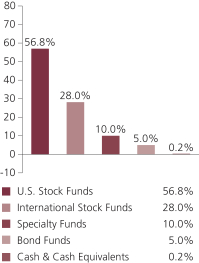

Portfolio Composition – continued

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

6

Table of Contents

Portfolio Composition – continued

| (o) | Less than 0.1%. |

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

From time to time Cash & Cash Equivalents may be negative due to timing of cash receipts.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

7

Table of Contents

Portfolio Composition – continued

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

8

Table of Contents

Portfolio Composition – continued

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

9

Table of Contents

Portfolio Composition – continued

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

10

Table of Contents

Portfolio Composition – continued

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds’ subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds’ Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the Statements of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of October 31, 2019.

The portfolio is actively managed and current holdings may be different.

11

Table of Contents

Fund expenses borne by the shareholders during the period, May 1, 2019 through October 31, 2019

As a shareholder of the funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including distribution and service (12b-1) fees; and other fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the funds and to compare these costs with the ongoing costs of investing in other mutual funds.

In addition to the fees and expenses which each fund bears directly, each fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which each fund invests. Because the underlying funds have varied expenses and fee levels and each fund may own different proportions of the underlying funds at different times, the amount of fees and expenses incurred indirectly by each fund will vary. If these transactional and indirect costs were included, your costs would have been higher.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2019 through October 31, 2019.

Actual Expenses

The first line for each share class in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following tables provides information about hypothetical account values and hypothetical expenses based on each fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12

Table of Contents

Expense Tables – continued

MFS LIFETIME INCOME FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During Period (p) 5/01/19-10/31/19 |

||||||||||||||

| A | Actual | 0.23% | $1,000.00 | $1,041.33 | $1.18 | |||||||||||||

| Hypothetical (h) | 0.23% | $1,000.00 | $1,023.98 | $1.17 | ||||||||||||||

| B | Actual | 0.98% | $1,000.00 | $1,036.63 | $5.02 | |||||||||||||

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.21 | $4.98 | ||||||||||||||

| C | Actual | 0.98% | $1,000.00 | $1,037.47 | $5.02 | |||||||||||||

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.21 | $4.98 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,042.59 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 0.98% | $1,000.00 | $1,037.42 | $5.02 | |||||||||||||

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.21 | $4.98 | ||||||||||||||

| R2 | Actual | 0.48% | $1,000.00 | $1,040.02 | $2.46 | |||||||||||||

| Hypothetical (h) | 0.48% | $1,000.00 | $1,022.72 | $2.44 | ||||||||||||||

| R3 | Actual | 0.23% | $1,000.00 | $1,040.49 | $1.18 | |||||||||||||

| Hypothetical (h) | 0.23% | $1,000.00 | $1,023.98 | $1.17 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,042.62 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,042.94 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| 529A | Actual | 0.27% | $1,000.00 | $1,041.12 | $1.39 | |||||||||||||

| Hypothetical (h) | 0.27% | $1,000.00 | $1,023.78 | $1.37 | ||||||||||||||

| 529B | Actual | 1.02% | $1,000.00 | $1,037.26 | $5.22 | |||||||||||||

| Hypothetical (h) | 1.02% | $1,000.00 | $1,020.01 | $5.18 | ||||||||||||||

| 529C | Actual | 1.03% | $1,000.00 | $1,036.27 | $5.27 | |||||||||||||

| Hypothetical (h) | 1.03% | $1,000.00 | $1,019.96 | $5.23 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

Notes to Expense Table

For the MFS Lifetime Income Fund, each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class 529A, Class 529B, and Class 529C shares, this rebate reduced the expense ratios above by 0.02%, 0.02%, and 0.01%, respectively. See Note 3 in the Notes to Financial Statements for additional information.

13

Table of Contents

Expense Tables – continued

MFS LIFETIME 2020 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During Period (p) 5/01/19-10/31/19 |

||||||||||||||

| A | Actual | 0.24% | $1,000.00 | $1,040.83 | $1.23 | |||||||||||||

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.93 | $1.22 | ||||||||||||||

| B | Actual | 0.99% | $1,000.00 | $1,037.18 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| C | Actual | 0.99% | $1,000.00 | $1,036.98 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,042.85 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 0.99% | $1,000.00 | $1,037.18 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| R2 | Actual | 0.49% | $1,000.00 | $1,039.60 | $2.51 | |||||||||||||

| Hypothetical (h) | 0.49% | $1,000.00 | $1,022.67 | $2.49 | ||||||||||||||

| R3 | Actual | 0.24% | $1,000.00 | $1,040.83 | $1.23 | |||||||||||||

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.93 | $1.22 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,042.08 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,043.68 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

Notes to Expense Table

For the MFS Lifetime 2020 Fund, each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class A shares, this rebate reduced the expense ratio above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

14

Table of Contents

Expense Tables – continued

MFS LIFETIME 2025 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During |

||||||||||||||

| A | Actual | 0.22% | $1,000.00 | $1,041.44 | $1.13 | |||||||||||||

| Hypothetical (h) | 0.22% | $1,000.00 | $1,024.03 | $1.12 | ||||||||||||||

| B | Actual | 0.98% | $1,000.00 | $1,037.90 | $5.02 | |||||||||||||

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.21 | $4.98 | ||||||||||||||

| C | Actual | 0.99% | $1,000.00 | $1,038.10 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,042.81 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 0.99% | $1,000.00 | $1,037.07 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| R2 | Actual | 0.49% | $1,000.00 | $1,040.12 | $2.51 | |||||||||||||

| Hypothetical (h) | 0.49% | $1,000.00 | $1,022.67 | $2.49 | ||||||||||||||

| R3 | Actual | 0.24% | $1,000.00 | $1,041.48 | $1.23 | |||||||||||||

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.93 | $1.22 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,042.75 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,042.75 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

Notes to Expense Table

For the MFS Lifetime 2025 Fund, each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class A and Class B shares, this rebate reduced the expense ratios above by 0.02% and 0.01%, respectively. See Note 3 in the Notes to Financial Statements for additional information.

15

Table of Contents

Expense Tables – continued

MFS LIFETIME 2030 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During Period (p) |

||||||||||||||

| A | Actual | 0.24% | $1,000.00 | $1,039.13 | $1.23 | |||||||||||||

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.93 | $1.22 | ||||||||||||||

| B | Actual | 0.99% | $1,000.00 | $1,035.78 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| C | Actual | 0.99% | $1,000.00 | $1,036.02 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,040.87 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 0.99% | $1,000.00 | $1,035.67 | $5.07 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| R2 | Actual | 0.49% | $1,000.00 | $1,038.24 | $2.51 | |||||||||||||

| Hypothetical (h) | 0.49% | $1,000.00 | $1,022.67 | $2.49 | ||||||||||||||

| R3 | Actual | 0.25% | $1,000.00 | $1,039.25 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,040.82 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,041.45 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

16

Table of Contents

Expense Tables – continued

MFS LIFETIME 2035 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During Period (p) |

||||||||||||||

| A | Actual | 0.24% | $1,000.00 | $1,036.15 | $1.23 | |||||||||||||

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.93 | $1.22 | ||||||||||||||

| B | Actual | 1.00% | $1,000.00 | $1,032.35 | $5.11 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| C | Actual | 0.99% | $1,000.00 | $1,031.80 | $5.06 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,036.74 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 1.00% | $1,000.00 | $1,032.37 | $5.11 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| R2 | Actual | 0.50% | $1,000.00 | $1,034.25 | $2.56 | |||||||||||||

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.62 | $2.54 | ||||||||||||||

| R3 | Actual | 0.25% | $1,000.00 | $1,036.10 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,037.28 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,037.95 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

Notes to Expense Table

For the MFS Lifetime 2035 Fund, each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class A and Class C shares, this rebate reduced the expense ratios above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

17

Table of Contents

Expense Tables – continued

MFS LIFETIME 2040 FUND

|

Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During |

||||||||||||||

| A | Actual | 0.24% | $1,000.00 | $1,034.63 | $1.23 | |||||||||||||

| Hypothetical (h) | 0.24% | $1,000.00 | $1,023.93 | $1.22 | ||||||||||||||

| B | Actual | 0.99% | $1,000.00 | $1,030.60 | $5.05 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| C | Actual | 0.99% | $1,000.00 | $1,030.38 | $5.05 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,035.61 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 1.00% | $1,000.00 | $1,030.12 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| R2 | Actual | 0.50% | $1,000.00 | $1,033.05 | $2.56 | |||||||||||||

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.62 | $2.54 | ||||||||||||||

| R3 | Actual | 0.25% | $1,000.00 | $1,034.63 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,035.52 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,036.12 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

Notes to Expense Table

For the MFS Lifetime 2040 Fund, each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class A and Class B shares, this rebate reduced the expense ratios above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

18

Table of Contents

Expense Tables – continued

MFS LIFETIME 2045 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During 5/01/19-10/31/19 |

||||||||||||||

| A | Actual | 0.25% | $1,000.00 | $1,033.48 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| B | Actual | 1.00% | $1,000.00 | $1,029.16 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| C | Actual | 0.97% | $1,000.00 | $1,029.32 | $4.95 | |||||||||||||

| Hypothetical (h) | 0.97% | $1,000.00 | $1,020.26 | $4.93 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,033.97 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 1.00% | $1,000.00 | $1,029.20 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| R2 | Actual | 0.50% | $1,000.00 | $1,031.78 | $2.55 | |||||||||||||

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.62 | $2.54 | ||||||||||||||

| R3 | Actual | 0.25% | $1,000.00 | $1,032.86 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,034.02 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,034.66 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

Notes to Expense Table

For the MFS Lifetime 2045 Fund, each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class C shares, this rebate reduced the expense ratio above by 0.03%. See Note 3 in the Notes to Financial Statements for additional information.

19

Table of Contents

Expense Tables – continued

MFS LIFETIME 2050 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During 5/01/19-10/31/19 |

||||||||||||||

| A | Actual | 0.25% | $1,000.00 | $1,032.98 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| B | Actual | 1.00% | $1,000.00 | $1,029.11 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| C | Actual | 1.00% | $1,000.00 | $1,028.73 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,034.08 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 1.00% | $1,000.00 | $1,028.71 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| R2 | Actual | 0.50% | $1,000.00 | $1,031.81 | $2.55 | |||||||||||||

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.62 | $2.54 | ||||||||||||||

| R3 | Actual | 0.25% | $1,000.00 | $1,032.67 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,034.10 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,035.18 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

20

Table of Contents

Expense Tables – continued

MFS LIFETIME 2055 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During |

||||||||||||||

| A | Actual | 0.25% | $1,000.00 | $1,033.27 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| B | Actual | 1.00% | $1,000.00 | $1,028.99 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| C | Actual | 0.99% | $1,000.00 | $1,029.21 | $5.05 | |||||||||||||

| Hypothetical (h) | 0.99% | $1,000.00 | $1,020.16 | $5.03 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,034.50 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 1.00% | $1,000.00 | $1,029.19 | $5.10 | |||||||||||||

| Hypothetical (h) | 1.00% | $1,000.00 | $1,020.11 | $5.08 | ||||||||||||||

| R2 | Actual | 0.50% | $1,000.00 | $1,032.20 | $2.55 | |||||||||||||

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.62 | $2.54 | ||||||||||||||

| R3 | Actual | 0.25% | $1,000.00 | $1,033.27 | $1.28 | |||||||||||||

| Hypothetical (h) | 0.25% | $1,000.00 | $1,023.88 | $1.27 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,034.35 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,035.60 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

Notes to Expense Table

For the MFS Lifetime 2055 Fund, each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above and are outside of the expense limitation arrangement. For Class C shares, this rebate reduced the expense ratio above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

21

Table of Contents

Expense Tables – continued

MFS LIFETIME 2060 FUND

| Share Class |

Annualized Expense Ratio |

Beginning Account Value 5/01/19 |

Ending Account Value |

Expenses Paid During Period (p) |

||||||||||||||

| A | Actual | 0.20% | $1,000.00 | $1,033.44 | $1.02 | |||||||||||||

| Hypothetical (h) | 0.20% | $1,000.00 | $1,024.13 | $1.02 | ||||||||||||||

| B | Actual | 0.95% | $1,000.00 | $1,029.39 | $4.85 | |||||||||||||

| Hypothetical (h) | 0.95% | $1,000.00 | $1,020.36 | $4.82 | ||||||||||||||

| C | Actual | 0.95% | $1,000.00 | $1,029.48 | $4.85 | |||||||||||||

| Hypothetical (h) | 0.95% | $1,000.00 | $1,020.36 | $4.82 | ||||||||||||||

| I | Actual | 0.00% | $1,000.00 | $1,034.90 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R1 | Actual | 0.95% | $1,000.00 | $1,030.13 | $4.85 | |||||||||||||

| Hypothetical (h) | 0.95% | $1,000.00 | $1,020.36 | $4.82 | ||||||||||||||

| R2 | Actual | 0.45% | $1,000.00 | $1,032.65 | $2.30 | |||||||||||||

| Hypothetical (h) | 0.45% | $1,000.00 | $1,022.87 | $2.29 | ||||||||||||||

| R3 | Actual | 0.20% | $1,000.00 | $1,034.20 | $1.02 | |||||||||||||

| Hypothetical (h) | 0.20% | $1,000.00 | $1,024.13 | $1.02 | ||||||||||||||

| R4 | Actual | 0.00% | $1,000.00 | $1,034.93 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| R6 | Actual | 0.00% | $1,000.00 | $1,034.87 | $0.00 | |||||||||||||

| Hypothetical (h) | 0.00% | $1,000.00 | $1,025.14 | $0.00 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

22

Table of Contents

10/31/19 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

MFS LIFETIME INCOME FUND

| Investment Companies (h) - 100.0% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 70.7% | ||||||||

| MFS Emerging Markets Debt Fund - Class R6 | 822,081 | $ | 12,092,808 | |||||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 871,325 | 6,055,709 | ||||||

| MFS Global Bond Fund - Class R6 | 3,299,486 | 30,256,286 | ||||||

| MFS Government Securities Fund - Class R6 | 6,020,083 | 60,381,429 | ||||||

| MFS High Income Fund - Class R6 | 5,301,729 | 18,131,914 | ||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 5,756,151 | 60,382,023 | ||||||

| MFS Limited Maturity Fund - Class R6 | 20,091,444 | 120,749,577 | ||||||

| MFS Total Return Bond Fund - Class R6 | 10,933,295 | 120,922,247 | ||||||

| $ | 428,971,993 | |||||||

| International Stock Funds - 5.0% | ||||||||

| MFS Blended Research International Equity Fund - Class R6 | 1,361,407 | $ | 15,166,072 | |||||

| MFS International Growth Fund - Class R6 | 86,222 | 3,074,679 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 67,522 | 3,059,457 | ||||||

| MFS Research International Fund - Class R6 | 484,879 | 9,173,909 | ||||||

| $ | 30,474,117 | |||||||

| Specialty Funds - 4.0% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 2,270,189 | $ | 12,100,108 | |||||

| MFS Global Real Estate Fund - Class R6 | 650,429 | 12,091,484 | ||||||

| $ | 24,191,592 | |||||||

| U.S. Stock Funds - 20.1% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 441,912 | $ | 12,240,962 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 831,140 | 12,226,068 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,492,452 | 18,163,141 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 454,332 | 6,106,216 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 911,393 | 12,185,325 | ||||||

| MFS Growth Fund - Class R6 | 100,634 | 12,197,886 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 422,728 | 9,084,425 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 370,976 | 9,103,754 | ||||||

| MFS New Discovery Fund - Class R6 | 95,999 | 3,039,328 | ||||||

| MFS New Discovery Value Fund - Class R6 | 188,592 | 3,047,651 | ||||||

| MFS Research Fund - Class R6 | 271,424 | 12,170,623 | ||||||

| MFS Value Fund - Class R6 | 286,081 | 12,161,308 | ||||||

| $ | 121,726,687 | |||||||

| Money Market Funds - 0.2% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 1,304,961 | $ | 1,305,091 | |||||

| Total Investment Companies (Identified Cost, $533,516,775) | $ | 606,669,480 | ||||||

| Other Assets, Less Liabilities - (0.0)% | (169,647) | |||||||

| Net Assets - 100.0% | $ | 606,499,833 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

23

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2020 FUND

| Investment Companies (h) - 100.0% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 68.8% | ||||||||

| MFS Emerging Markets Debt Fund - Class R6 | 511,794 | $ | 7,528,493 | |||||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 588,755 | 4,091,849 | ||||||

| MFS Global Bond Fund - Class R6 | 1,878,180 | 17,222,913 | ||||||

| MFS Government Securities Fund - Class R6 | 3,422,766 | 34,330,336 | ||||||

| MFS High Income Fund - Class R6 | 3,394,015 | 11,607,531 | ||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 3,271,107 | 34,313,910 | ||||||

| MFS Limited Maturity Fund - Class R6 | 10,335,027 | 62,113,513 | ||||||

| MFS Total Return Bond Fund - Class R6 | 5,920,140 | 65,476,750 | ||||||

| $ | 236,685,295 | |||||||

| International Stock Funds - 5.6% | ||||||||

| MFS Blended Research International Equity Fund - Class R6 | 861,899 | $ | 9,601,553 | |||||

| MFS International Growth Fund - Class R6 | 57,911 | 2,065,100 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 45,448 | 2,059,244 | ||||||

| MFS Research International Fund - Class R6 | 292,239 | 5,529,173 | ||||||

| $ | 19,255,070 | |||||||

| Specialty Funds - 4.0% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 1,292,707 | $ | 6,890,131 | |||||

| MFS Global Real Estate Fund - Class R6 | 370,484 | 6,887,295 | ||||||

| $ | 13,777,426 | |||||||

| U.S. Stock Funds - 21.6% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 273,748 | $ | 7,582,814 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 515,529 | 7,583,431 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 902,967 | 10,989,109 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 257,456 | 3,460,207 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 565,238 | 7,557,236 | ||||||

| MFS Growth Fund - Class R6 | 62,526 | 7,578,786 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 255,748 | 5,496,028 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 223,908 | 5,494,713 | ||||||

| MFS New Discovery Fund - Class R6 | 54,516 | 1,725,991 | ||||||

| MFS New Discovery Value Fund - Class R6 | 106,917 | 1,727,772 | ||||||

| MFS Research Fund - Class R6 | 168,600 | 7,560,011 | ||||||

| MFS Value Fund - Class R6 | 177,633 | 7,551,179 | ||||||

| $ | 74,307,277 | |||||||

| Money Market Funds - 0.0% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 125,195 | $ | 125,207 | |||||

| Total Investment Companies (Identified Cost, $295,405,702) | $ | 344,150,275 | ||||||

| Other Assets, Less Liabilities - (0.0)% | (99,263) | |||||||

| Net Assets - 100.0% | $ | 344,051,012 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

24

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2025 FUND

| Investment Companies (h) - 100.0% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 55.8% | ||||||||

| MFS Emerging Markets Debt Fund - Class R6 | 650,110 | $ | 9,563,119 | |||||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 920,800 | 6,399,560 | ||||||

| MFS Global Bond Fund - Class R6 | 1,737,538 | 15,933,225 | ||||||

| MFS Government Securities Fund - Class R6 | 3,163,492 | 31,729,819 | ||||||

| MFS High Income Fund - Class R6 | 4,662,237 | 15,944,851 | ||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 2,843,971 | 29,833,260 | ||||||

| MFS Limited Maturity Fund - Class R6 | 4,258,653 | 25,594,504 | ||||||

| MFS Total Return Bond Fund - Class R6 | 3,920,598 | 43,361,818 | ||||||

| $ | 178,360,156 | |||||||

| International Stock Funds - 9.0% | ||||||||

| MFS Blended Research International Equity Fund - Class R6 | 1,264,621 | $ | 14,087,879 | |||||

| MFS International Growth Fund - Class R6 | 98,791 | 3,522,887 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 77,610 | 3,516,511 | ||||||

| MFS International New Discovery Fund - Class R6 | 17,428 | 610,141 | ||||||

| MFS Research International Fund - Class R6 | 372,741 | 7,052,260 | ||||||

| $ | 28,789,678 | |||||||

| Specialty Funds - 4.4% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 1,310,229 | $ | 6,983,521 | |||||

| MFS Global Real Estate Fund - Class R6 | 377,019 | 7,008,782 | ||||||

| $ | 13,992,303 | |||||||

| U.S. Stock Funds - 30.6% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 370,180 | $ | 10,253,988 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 695,255 | 10,227,198 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,201,242 | 14,619,118 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 261,762 | 3,518,084 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 767,056 | 10,255,540 | ||||||

| MFS Growth Fund - Class R6 | 84,159 | 10,200,931 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 338,738 | 7,279,474 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 298,747 | 7,331,247 | ||||||

| MFS New Discovery Fund - Class R6 | 55,268 | 1,749,779 | ||||||

| MFS New Discovery Value Fund - Class R6 | 109,108 | 1,763,192 | ||||||

| MFS Research Fund - Class R6 | 227,504 | 10,201,262 | ||||||

| MFS Value Fund - Class R6 | 240,233 | 10,212,302 | ||||||

| $ | 97,612,115 | |||||||

| Money Market Funds - 0.2% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 771,734 | $ | 771,811 | |||||

| Total Investment Companies (Identified Cost, $281,040,911) | $ | 319,526,063 | ||||||

| Other Assets, Less Liabilities - (0.0)% | (83,041) | |||||||

| Net Assets - 100.0% | $ | 319,443,022 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

25

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2030 FUND

| Investment Companies (h) - 99.9% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 35.8% | ||||||||

| MFS Emerging Markets Debt Fund - Class R6 | 1,231,580 | $ | 18,116,545 | |||||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 1,756,907 | 12,210,501 | ||||||

| MFS Global Bond Fund - Class R6 | 2,906,074 | 26,648,701 | ||||||

| MFS Government Securities Fund - Class R6 | 4,824,844 | 48,393,188 | ||||||

| MFS High Income Fund - Class R6 | 8,848,079 | 30,260,429 | ||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 3,781,213 | 39,664,928 | ||||||

| MFS Total Return Bond Fund - Class R6 | 3,825,882 | 42,314,256 | ||||||

| $ | 217,608,548 | |||||||

| International Stock Funds - 14.5% | ||||||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 45,786 | $ | 586,978 | |||||

| MFS Blended Research International Equity Fund - Class R6 | 3,564,436 | 39,707,815 | ||||||

| MFS Emerging Markets Equity Fund - Class R6 | 16,766 | 589,484 | ||||||

| MFS International Growth Fund - Class R6 | 291,381 | 10,390,655 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 228,334 | 10,345,830 | ||||||

| MFS International New Discovery Fund - Class R6 | 209,342 | 7,329,068 | ||||||

| MFS Research International Fund - Class R6 | 1,006,204 | 19,037,369 | ||||||

| $ | 87,987,199 | |||||||

| Specialty Funds - 6.4% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 3,634,609 | $ | 19,372,463 | |||||

| MFS Global Real Estate Fund - Class R6 | 1,049,354 | 19,507,491 | ||||||

| $ | 38,879,954 | |||||||

| U.S. Stock Funds - 43.2% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 885,626 | $ | 24,531,855 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,779,851 | 26,181,612 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 3,690,954 | 44,918,910 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 729,026 | 9,798,114 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 1,964,190 | 26,261,216 | ||||||

| MFS Growth Fund - Class R6 | 215,149 | 26,078,200 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 1,040,435 | 22,358,950 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 918,971 | 22,551,539 | ||||||

| MFS New Discovery Fund - Class R6 | 153,399 | 4,856,610 | ||||||

| MFS New Discovery Value Fund - Class R6 | 303,401 | 4,902,967 | ||||||

| MFS Research Fund - Class R6 | 543,344 | 24,363,535 | ||||||

| MFS Value Fund - Class R6 | 614,726 | 26,131,987 | ||||||

| $ | 262,935,495 | |||||||

| Money Market Funds - 0.0% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 74,855 | $ | 74,863 | |||||

| Total Investment Companies (Identified Cost, $474,406,331) | $ | 607,486,059 | ||||||

| Other Assets, Less Liabilities - 0.1% | 584,855 | |||||||

| Net Assets - 100.0% | $ | 608,070,914 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

26

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2035 FUND

| Investment Companies (h) - 100.0% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 18.5% | ||||||||

| MFS Emerging Markets Debt Fund - Class R6 | 585,391 | $ | 8,611,094 | |||||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 827,421 | 5,750,577 | ||||||

| MFS Global Bond Fund - Class R6 | 626,932 | 5,748,964 | ||||||

| MFS High Income Fund - Class R6 | 4,187,699 | 14,321,932 | ||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 1,438,175 | 15,086,454 | ||||||

| MFS Total Return Bond Fund - Class R6 | 846,577 | 9,363,144 | ||||||

| $ | 58,882,165 | |||||||

| International Stock Funds - 20.8% | ||||||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 135,383 | $ | 1,735,614 | |||||

| MFS Blended Research International Equity Fund - Class R6 | 2,492,184 | 27,762,932 | ||||||

| MFS Emerging Markets Equity Fund - Class R6 | 49,652 | 1,745,772 | ||||||

| MFS International Growth Fund - Class R6 | 232,902 | 8,305,268 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 182,406 | 8,264,799 | ||||||

| MFS International New Discovery Fund - Class R6 | 200,314 | 7,013,004 | ||||||

| MFS Research International Fund - Class R6 | 599,115 | 11,335,248 | ||||||

| $ | 66,162,637 | |||||||

| Specialty Funds - 8.2% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 2,426,073 | $ | 12,930,967 | |||||

| MFS Global Real Estate Fund - Class R6 | 698,038 | 12,976,528 | ||||||

| $ | 25,907,495 | |||||||

| U.S. Stock Funds - 52.4% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 460,755 | $ | 12,762,918 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,200,547 | 17,660,041 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 2,361,188 | 28,735,663 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 486,574 | 6,539,553 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 1,320,403 | 17,653,793 | ||||||

| MFS Growth Fund - Class R6 | 145,566 | 17,644,096 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 669,271 | 14,382,631 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 587,959 | 14,428,504 | ||||||

| MFS New Discovery Fund - Class R6 | 102,536 | 3,246,293 | ||||||

| MFS New Discovery Value Fund - Class R6 | 202,079 | 3,265,588 | ||||||

| MFS Research Fund - Class R6 | 283,074 | 12,693,051 | ||||||

| MFS Value Fund - Class R6 | 413,928 | 17,596,077 | ||||||

| $ | 166,608,208 | |||||||

| Money Market Funds - 0.1% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 383,653 | $ | 383,692 | |||||

| Total Investment Companies (Identified Cost, $266,408,127) | $ | 317,944,197 | ||||||

| Other Assets, Less Liabilities - (0.0)% | (98,198) | |||||||

| Net Assets - 100.0% | $ | 317,845,999 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

27

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2040 FUND

| Investment Companies (h) - 100.1% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 11.0% | ||||||||

| MFS Emerging Markets Debt Fund - Class R6 | 366,043 | $ | 5,384,484 | |||||

| MFS Emerging Markets Debt Local Currency Fund - Class R6 | 519,376 | 3,609,662 | ||||||

| MFS Global Bond Fund - Class R6 | 391,765 | 3,592,486 | ||||||

| MFS High Income Fund - Class R6 | 2,622,379 | 8,968,536 | ||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 1,480,730 | 15,532,860 | ||||||

| MFS Total Return Bond Fund - Class R6 | 1,083,087 | 11,978,946 | ||||||

| $ | 49,066,974 | |||||||

| International Stock Funds - 24.9% | ||||||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 278,340 | $ | 3,568,318 | |||||

| MFS Blended Research International Equity Fund - Class R6 | 4,027,307 | 44,864,205 | ||||||

| MFS Emerging Markets Equity Fund - Class R6 | 101,996 | 3,586,178 | ||||||

| MFS International Growth Fund - Class R6 | 390,987 | 13,942,599 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 305,804 | 13,855,972 | ||||||

| MFS International New Discovery Fund - Class R6 | 411,013 | 14,389,566 | ||||||

| MFS Research International Fund - Class R6 | 904,347 | 17,110,237 | ||||||

| $ | 111,317,075 | |||||||

| Specialty Funds - 9.2% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 3,823,224 | $ | 20,377,784 | |||||

| MFS Global Real Estate Fund - Class R6 | 1,103,274 | 20,509,869 | ||||||

| $ | 40,887,653 | |||||||

| U.S. Stock Funds - 54.9% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 647,575 | $ | 17,937,818 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 1,762,054 | 25,919,808 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 3,503,787 | 42,641,084 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 767,490 | 10,315,064 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 1,942,687 | 25,973,726 | ||||||

| MFS Growth Fund - Class R6 | 213,133 | 25,833,843 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 989,231 | 21,258,584 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 873,564 | 21,437,251 | ||||||

| MFS New Discovery Fund - Class R6 | 161,157 | 5,102,237 | ||||||

| MFS New Discovery Value Fund - Class R6 | 319,579 | 5,164,398 | ||||||

| MFS Research Fund - Class R6 | 397,480 | 17,823,013 | ||||||

| MFS Value Fund - Class R6 | 608,486 | 25,866,756 | ||||||

| $ | 245,273,582 | |||||||

| Money Market Funds - 0.1% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 311,266 | $ | 311,298 | |||||

| Total Investment Companies (Identified Cost, $325,121,475) | $ | 446,856,582 | ||||||

| Other Assets, Less Liabilities - (0.1)% | (337,860) | |||||||

| Net Assets - 100.0% | $ | 446,518,722 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

28

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2045 FUND

| Investment Companies (h) - 100.0% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 5.0% | ||||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 544,675 | $ | 5,713,642 | |||||

| MFS Total Return Bond Fund - Class R6 | 516,688 | 5,714,569 | ||||||

| $ | 11,428,211 | |||||||

| International Stock Funds - 28.0% | ||||||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 177,680 | $ | 2,277,860 | |||||

| MFS Blended Research International Equity Fund - Class R6 | 2,247,878 | 25,041,355 | ||||||

| MFS Emerging Markets Equity Fund - Class R6 | 64,944 | 2,283,424 | ||||||

| MFS International Growth Fund - Class R6 | 224,589 | 8,008,833 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 176,341 | 7,990,024 | ||||||

| MFS International New Discovery Fund - Class R6 | 261,516 | 9,155,674 | ||||||

| MFS Research International Fund - Class R6 | 483,240 | 9,142,902 | ||||||

| $ | 63,900,072 | |||||||

| Specialty Funds - 10.0% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 2,133,621 | $ | 11,372,200 | |||||

| MFS Global Real Estate Fund - Class R6 | 613,911 | 11,412,601 | ||||||

| $ | 22,784,801 | |||||||

| U.S. Stock Funds - 56.9% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 329,737 | $ | 9,133,725 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 930,269 | 13,684,248 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,860,369 | 22,640,687 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 424,880 | 5,710,389 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 1,023,395 | 13,682,789 | ||||||

| MFS Growth Fund - Class R6 | 112,862 | 13,680,011 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 529,253 | 11,373,649 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 464,042 | 11,387,595 | ||||||

| MFS New Discovery Fund - Class R6 | 89,635 | 2,837,856 | ||||||

| MFS New Discovery Value Fund - Class R6 | 176,709 | 2,855,621 | ||||||

| MFS Research Fund - Class R6 | 203,302 | 9,116,066 | ||||||

| MFS Value Fund - Class R6 | 321,485 | 13,666,316 | ||||||

| $ | 129,768,952 | |||||||

| Money Market Funds - 0.1% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 367,268 | $ | 367,305 | |||||

| Total Investment Companies (Identified Cost, $190,355,193) | $ | 228,249,341 | ||||||

| Other Assets, Less Liabilities - (0.0)% | (82,677) | |||||||

| Net Assets - 100.0% | $ | 228,166,664 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

29

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2050 FUND

| Investment Companies (h) - 100.0% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 5.0% | ||||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 560,022 | $ | 5,874,634 | |||||

| MFS Total Return Bond Fund - Class R6 | 531,252 | 5,875,650 | ||||||

| $ | 11,750,284 | |||||||

| International Stock Funds - 28.0% | ||||||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 182,130 | $ | 2,334,903 | |||||

| MFS Blended Research International Equity Fund - Class R6 | 2,302,359 | 25,648,279 | ||||||

| MFS Emerging Markets Equity Fund - Class R6 | 66,568 | 2,340,533 | ||||||

| MFS International Growth Fund - Class R6 | 230,827 | 8,231,297 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 181,337 | 8,216,380 | ||||||

| MFS International New Discovery Fund - Class R6 | 268,025 | 9,383,569 | ||||||

| MFS Research International Fund - Class R6 | 495,409 | 9,373,137 | ||||||

| $ | 65,528,098 | |||||||

| Specialty Funds - 10.0% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 2,188,005 | $ | 11,662,066 | |||||

| MFS Global Real Estate Fund - Class R6 | 630,174 | 11,714,937 | ||||||

| $ | 23,377,003 | |||||||

| U.S. Stock Funds - 56.9% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 337,921 | $ | 9,360,420 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 954,442 | 14,039,846 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 1,907,180 | 23,210,386 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 434,844 | 5,844,308 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 1,047,503 | 14,005,114 | ||||||

| MFS Growth Fund - Class R6 | 116,023 | 14,063,119 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 543,439 | 11,678,494 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 475,652 | 11,672,504 | ||||||

| MFS New Discovery Fund - Class R6 | 91,934 | 2,910,619 | ||||||

| MFS New Discovery Value Fund - Class R6 | 180,836 | 2,922,302 | ||||||

| MFS Research Fund - Class R6 | 208,601 | 9,353,660 | ||||||

| MFS Value Fund - Class R6 | 329,771 | 14,018,561 | ||||||

| $ | 133,079,333 | |||||||

| Money Market Funds - 0.1% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 311,691 | $ | 311,722 | |||||

| Total Investment Companies (Identified Cost, $186,305,219) | $ | 234,046,440 | ||||||

| Other Assets, Less Liabilities - (0.0)% | (51,067) | |||||||

| Net Assets - 100.0% | $ | 233,995,373 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

30

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2055 FUND

| Investment Companies (h) - 100.0% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 5.0% | ||||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 281,661 | $ | 2,954,620 | |||||

| MFS Total Return Bond Fund - Class R6 | 267,089 | 2,954,008 | ||||||

| $ | 5,908,628 | |||||||

| International Stock Funds - 28.0% | ||||||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 91,422 | $ | 1,172,024 | |||||

| MFS Blended Research International Equity Fund - Class R6 | 1,155,292 | 12,869,950 | ||||||

| MFS Emerging Markets Equity Fund - Class R6 | 33,401 | 1,174,395 | ||||||

| MFS International Growth Fund - Class R6 | 115,845 | 4,131,049 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 90,946 | 4,120,777 | ||||||

| MFS International New Discovery Fund - Class R6 | 134,400 | 4,705,331 | ||||||

| MFS Research International Fund - Class R6 | 248,630 | 4,704,083 | ||||||

| $ | 32,877,609 | |||||||

| Specialty Funds - 10.0% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 1,098,830 | $ | 5,856,767 | |||||

| MFS Global Real Estate Fund - Class R6 | 316,427 | 5,882,371 | ||||||

| $ | 11,739,138 | |||||||

| U.S. Stock Funds - 56.8% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 169,475 | $ | 4,694,464 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 478,651 | 7,040,952 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 956,693 | 11,642,960 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 217,561 | 2,924,018 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 525,342 | 7,023,818 | ||||||

| MFS Growth Fund - Class R6 | 58,195 | 7,053,828 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 272,596 | 5,858,081 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 238,689 | 5,857,442 | ||||||

| MFS New Discovery Fund - Class R6 | 46,105 | 1,459,679 | ||||||

| MFS New Discovery Value Fund - Class R6 | 90,631 | 1,464,601 | ||||||

| MFS Research Fund - Class R6 | 104,646 | 4,692,312 | ||||||

| MFS Value Fund - Class R6 | 165,405 | 7,031,352 | ||||||

| $ | 66,743,507 | |||||||

| Money Market Funds - 0.2% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 199,682 | $ | 199,702 | |||||

| Total Investment Companies (Identified Cost, $101,806,301) | $ | 117,468,584 | ||||||

| Other Assets, Less Liabilities - (0.0)% | (10,947) | |||||||

| Net Assets - 100.0% | $ | 117,457,637 | ||||||

See Portfolio Footnotes and Notes to Financial Statements

31

Table of Contents

Portfolio of Investments (unaudited) – continued

MFS LIFETIME 2060 FUND

| Investment Companies (h) - 99.9% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 5.0% | ||||||||

| MFS Inflation-Adjusted Bond Fund - Class R6 | 40,310 | $ | 422,852 | |||||

| MFS Total Return Bond Fund - Class R6 | 38,204 | 422,539 | ||||||

| $ | 845,391 | |||||||

| International Stock Funds - 28.0% | ||||||||

| MFS Blended Research Emerging Markets Equity Fund - Class R6 | 13,057 | $ | 167,385 | |||||

| MFS Blended Research International Equity Fund - Class R6 | 165,085 | 1,839,047 | ||||||

| MFS Emerging Markets Equity Fund - Class R6 | 4,767 | 167,624 | ||||||

| MFS International Growth Fund - Class R6 | 16,509 | 588,705 | ||||||

| MFS International Intrinsic Value Fund - Class R6 | 12,975 | 587,876 | ||||||

| MFS International New Discovery Fund - Class R6 | 19,180 | 671,493 | ||||||

| MFS Research International Fund - Class R6 | 35,490 | 671,470 | ||||||

| $ | 4,693,600 | |||||||

| Specialty Funds - 10.0% | ||||||||

| MFS Commodity Strategy Fund - Class R6 | 156,966 | $ | 836,628 | |||||

| MFS Global Real Estate Fund - Class R6 | 45,220 | 840,645 | ||||||

| $ | 1,677,273 | |||||||

| U.S. Stock Funds - 56.8% | ||||||||

| MFS Blended Research Core Equity Fund - Class R6 | 24,180 | $ | 669,795 | |||||

| MFS Blended Research Growth Equity Fund - Class R6 | 68,294 | 1,004,600 | ||||||

| MFS Blended Research Mid Cap Equity Fund - Class R6 | 136,994 | 1,667,211 | ||||||

| MFS Blended Research Small Cap Equity Fund - Class R6 | 31,042 | 417,200 | ||||||

| MFS Blended Research Value Equity Fund - Class R6 | 75,032 | 1,003,180 | ||||||

| MFS Growth Fund - Class R6 | 8,287 | 1,004,495 | ||||||

| MFS Mid Cap Growth Fund - Class R6 | 38,924 | 836,480 | ||||||

| MFS Mid Cap Value Fund - Class R6 | 34,088 | 836,511 | ||||||

| MFS New Discovery Fund - Class R6 | 6,593 | 208,742 | ||||||

| MFS New Discovery Value Fund - Class R6 | 12,930 | 208,956 | ||||||

| MFS Research Fund - Class R6 | 14,934 | 669,657 | ||||||

| MFS Value Fund - Class R6 | 23,616 | 1,003,899 | ||||||

| $ | 9,530,726 | |||||||

| Money Market Funds - 0.1% | ||||||||

| MFS Institutional Money Market Portfolio, 1.89% (v) | 14,011 | $ | 14,012 | |||||

| Total Investment Companies (Identified Cost, $15,597,811) | $ | 16,761,002 | ||||||

| Other Assets, Less Liabilities - 0.1% | 23,166 | |||||||

| Net Assets - 100.0% | $ | 16,784,168 | ||||||

Portfolio Footnotes:

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of each fund’s investments in affiliated issuers were as follows: |

| Affiliated Issuers | ||||

| MFS Lifetime Income Fund | $ | 606,669,480 | ||

| MFS Lifetime 2020 Fund | 344,150,275 | |||

| MFS Lifetime 2025 Fund | 319,526,063 | |||

| MFS Lifetime 2030 Fund | 607,486,059 | |||

| MFS Lifetime 2035 Fund | 317,944,197 | |||

| MFS Lifetime 2040 Fund | 446,856,582 | |||

| MFS Lifetime 2045 Fund | 228,249,341 | |||

| MFS Lifetime 2050 Fund | 234,046,440 | |||

| MFS Lifetime 2055 Fund | 117,468,584 | |||

| MFS Lifetime 2060 Fund | 16,761,002 | |||

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

See Notes to Financial Statements

32

Table of Contents

Financial Statements

STATEMENTS OF ASSETS AND LIABILITIES

At 10/31/19 (unaudited)

These statements represent each fund’s balance sheet, which details the assets and liabilities comprising the total value of each fund.

| MFS Lifetime Income Fund |

MFS Lifetime 2020 Fund |

MFS Lifetime 2025 Fund |

MFS Lifetime 2030 Fund |

MFS Lifetime 2035 Fund |

||||||||||||||||

| Assets | ||||||||||||||||||||

| Investments in affiliated issuers, at value (identified cost, $533,516,775, $295,405,702, $281,040,911, $474,406,331, and $266,408,127, respectively) |

$606,669,480 | $344,150,275 | $319,526,063 | $607,486,059 | $317,944,197 | |||||||||||||||

| Receivables for |

||||||||||||||||||||

| Investments sold |

64,218 | 651,553 | 2,093,850 | 2,703,710 | 159,176 | |||||||||||||||

| Fund shares sold |

2,249,590 | 1,576,126 | 356,537 | 585,234 | 462,515 | |||||||||||||||

| Receivable from investment adviser |

119,689 | 83,662 | 79,575 | 123,307 | 78,982 | |||||||||||||||

| Other assets |

45,881 | 43,529 | 44,404 | 47,718 | 42,087 | |||||||||||||||

| Total assets |

$609,148,858 | $346,505,145 | $322,100,429 | $610,946,028 | $318,686,957 | |||||||||||||||

| Liabilities | ||||||||||||||||||||

| Payables for |

||||||||||||||||||||

| Distributions |

$25,643 | $— | $— | $— | $— | |||||||||||||||

| Investments purchased |

1,000,988 | 211,663 | 247,688 | 306,363 | 375,077 | |||||||||||||||

| Fund shares reacquired |

1,250,937 | 2,018,629 | 2,201,464 | 2,224,973 | 240,099 | |||||||||||||||

| Payable to affiliates |

||||||||||||||||||||

| Administrative services fee |

96 | 96 | 96 | 96 | 96 | |||||||||||||||

| Shareholder servicing costs |

297,244 | 180,898 | 169,998 | 290,679 | 186,438 | |||||||||||||||

| Distribution and service fees |

11,585 | 4,034 | 2,483 | 6,803 | 2,618 | |||||||||||||||

| Program manager fee |

442 | — | — | — | — | |||||||||||||||

| Accrued expenses and other liabilities |

62,090 | 38,813 | 35,678 | 46,200 | 36,630 | |||||||||||||||

| Total liabilities |

$2,649,025 | $2,454,133 | $2,657,407 | $2,875,114 | $840,958 | |||||||||||||||

| Net assets |

$606,499,833 | $344,051,012 | $319,443,022 | $608,070,914 | $317,845,999 | |||||||||||||||

| Net assets consist of | ||||||||||||||||||||

| Paid-in capital |

$542,835,833 | $292,358,599 | $277,267,920 | $465,842,004 | $262,692,296 | |||||||||||||||

| Total distributable earnings (loss) |

63,664,000 | 51,692,413 | 42,175,102 | 142,228,910 | 55,153,703 | |||||||||||||||

| Net assets |

$606,499,833 | $344,051,012 | $319,443,022 | $608,070,914 | $317,845,999 | |||||||||||||||

33

Table of Contents