fhlbpgh-20201231000133039912/312020FYfalseX1P1YP10Yus-gaap:OtherAssetsus-gaap:OtherLiabilities00013303992020-01-012020-12-31iso4217:USD00013303992020-06-30xbrli:shares00013303992021-02-2600013303992020-12-3100013303992019-01-012019-12-3100013303992018-01-012018-12-3100013303992019-12-31iso4217:USDxbrli:shares00013303992018-12-3100013303992017-12-310001330399us-gaap:CommonStockMember2017-12-310001330399us-gaap:RetainedEarningsUnappropriatedMember2017-12-310001330399us-gaap:RetainedEarningsAppropriatedMember2017-12-310001330399us-gaap:RetainedEarningsMember2017-12-310001330399us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001330399us-gaap:RetainedEarningsUnappropriatedMember2018-01-012018-12-310001330399us-gaap:RetainedEarningsAppropriatedMember2018-01-012018-12-310001330399us-gaap:RetainedEarningsMember2018-01-012018-12-310001330399us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001330399us-gaap:CommonStockMember2018-01-012018-12-310001330399us-gaap:CommonStockMember2018-12-310001330399us-gaap:RetainedEarningsUnappropriatedMember2018-12-310001330399us-gaap:RetainedEarningsAppropriatedMember2018-12-310001330399us-gaap:RetainedEarningsMember2018-12-310001330399us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001330399us-gaap:RetainedEarningsUnappropriatedMember2019-01-012019-12-310001330399us-gaap:RetainedEarningsAppropriatedMember2019-01-012019-12-310001330399us-gaap:RetainedEarningsMember2019-01-012019-12-310001330399us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001330399us-gaap:CommonStockMember2019-01-012019-12-310001330399us-gaap:CommonStockMember2019-12-310001330399us-gaap:RetainedEarningsUnappropriatedMember2019-12-310001330399us-gaap:RetainedEarningsAppropriatedMember2019-12-310001330399us-gaap:RetainedEarningsMember2019-12-310001330399us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001330399us-gaap:AccountingStandardsUpdate201613Memberus-gaap:RetainedEarningsUnappropriatedMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001330399us-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2020-12-310001330399us-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001330399us-gaap:RetainedEarningsUnappropriatedMember2020-01-012020-12-310001330399us-gaap:RetainedEarningsAppropriatedMember2020-01-012020-12-310001330399us-gaap:RetainedEarningsMember2020-01-012020-12-310001330399us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001330399us-gaap:CommonStockMember2020-01-012020-12-310001330399us-gaap:CommonStockMember2020-12-310001330399us-gaap:RetainedEarningsUnappropriatedMember2020-12-310001330399us-gaap:RetainedEarningsAppropriatedMember2020-12-310001330399us-gaap:RetainedEarningsMember2020-12-310001330399us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-31fhlbpgh:Banksxbrli:pure0001330399srt:MinimumMember2020-12-310001330399srt:MinimumMember2020-01-012020-12-310001330399srt:MaximumMember2020-01-012020-12-310001330399fhlbpgh:SecuritiespurchasedunderagreementstoresellDomain2020-12-310001330399us-gaap:USTreasurySecuritiesMember2020-12-310001330399us-gaap:USTreasurySecuritiesMember2019-12-310001330399us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2020-12-310001330399us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2019-12-310001330399us-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310001330399fhlbpgh:OtherThanMortgageBackedSecuritiesMember2020-12-310001330399fhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2020-12-310001330399srt:SingleFamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399srt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2020-12-310001330399us-gaap:MortgageBackedSecuritiesMember2020-12-310001330399us-gaap:USStatesAndPoliticalSubdivisionsMember2019-12-310001330399fhlbpgh:OtherThanMortgageBackedSecuritiesMember2019-12-310001330399fhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2019-12-310001330399srt:SingleFamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399srt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2019-12-310001330399us-gaap:MortgageBackedSecuritiesMember2019-12-310001330399fhlbpgh:FixedInterestRateMemberfhlbpgh:OtherThanMortgageBackedSecuritiesMember2020-12-310001330399fhlbpgh:FixedInterestRateMemberfhlbpgh:OtherThanMortgageBackedSecuritiesMember2019-12-310001330399fhlbpgh:OtherThanMortgageBackedSecuritiesMemberfhlbpgh:VariableinterestrateMember2020-12-310001330399fhlbpgh:OtherThanMortgageBackedSecuritiesMemberfhlbpgh:VariableinterestrateMember2019-12-310001330399fhlbpgh:FixedInterestRateMemberus-gaap:MortgageBackedSecuritiesMember2020-12-310001330399fhlbpgh:FixedInterestRateMemberus-gaap:MortgageBackedSecuritiesMember2019-12-310001330399us-gaap:MortgageBackedSecuritiesMemberfhlbpgh:VariableinterestrateMember2020-12-310001330399us-gaap:MortgageBackedSecuritiesMemberfhlbpgh:VariableinterestrateMember2019-12-310001330399us-gaap:CertificatesOfDepositMember2020-12-310001330399fhlbpgh:AFSHTMGSEandOtherUSObligationsMember2020-12-310001330399srt:MaximumMember2020-12-310001330399srt:MinimumMember2019-12-310001330399srt:MaximumMember2019-12-310001330399fhlbpgh:FederalHomeLoanBankAdvancesReceivableMember2020-12-310001330399fhlbpgh:FederalHomeLoanBankAdvancesReceivableMember2019-12-310001330399srt:SingleFamilyMemberfhlbpgh:LoansReceivableWithFixedRatesOfInterestLongTermMember2020-12-310001330399srt:SingleFamilyMemberfhlbpgh:LoansReceivableWithFixedRatesOfInterestLongTermMember2019-12-310001330399srt:SingleFamilyMemberfhlbpgh:LoansReceivableWithFixedRatesOfInterestMediumTermMember2020-12-310001330399srt:SingleFamilyMemberfhlbpgh:LoansReceivableWithFixedRatesOfInterestMediumTermMember2019-12-310001330399us-gaap:RealEstateLoanMember2020-12-310001330399us-gaap:RealEstateLoanMember2019-12-310001330399us-gaap:ConventionalLoanMember2020-12-310001330399us-gaap:ConventionalLoanMember2019-12-310001330399us-gaap:UsGovernmentAgencyInsuredLoansMember2020-12-310001330399us-gaap:UsGovernmentAgencyInsuredLoansMember2019-12-310001330399us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConventionalLoanMember2020-12-310001330399us-gaap:FinancingReceivables60To89DaysPastDueMemberus-gaap:ConventionalLoanMember2020-12-310001330399us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConventionalLoanMember2020-12-310001330399us-gaap:ConventionalLoanMemberus-gaap:NonperformingFinancingReceivableMember2020-12-310001330399us-gaap:PerformingFinancingReceivableMemberus-gaap:ConventionalLoanMember2020-12-310001330399us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConventionalLoanMember2019-12-310001330399us-gaap:FinancingReceivables60To89DaysPastDueMemberus-gaap:ConventionalLoanMember2019-12-310001330399us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConventionalLoanMember2019-12-310001330399us-gaap:ConventionalLoanMemberus-gaap:NonperformingFinancingReceivableMember2019-12-310001330399us-gaap:PerformingFinancingReceivableMemberus-gaap:ConventionalLoanMember2019-12-310001330399us-gaap:ConventionalLoanMember2018-12-310001330399us-gaap:ConventionalLoanMember2017-12-310001330399us-gaap:ConventionalLoanMember2020-01-012020-12-310001330399us-gaap:ConventionalLoanMember2019-01-012019-12-310001330399us-gaap:ConventionalLoanMember2018-01-012018-12-310001330399us-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001330399us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2020-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2020-12-310001330399us-gaap:NondesignatedMemberfhlbpgh:InterestRateCapsorFloorsMember2020-12-310001330399us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2020-12-310001330399us-gaap:NondesignatedMember2020-12-310001330399us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2019-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2019-12-310001330399us-gaap:NondesignatedMemberfhlbpgh:InterestRateCapsorFloorsMember2019-12-310001330399us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2019-12-310001330399us-gaap:NondesignatedMember2019-12-310001330399us-gaap:InterestRateSwapMemberfhlbpgh:AdvancesMemberus-gaap:InterestIncomeMember2020-01-012020-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:AvailableforsaleSecuritiesMemberus-gaap:InterestIncomeMember2020-01-012020-12-310001330399us-gaap:MortgageReceivablesMemberus-gaap:InterestRateSwapMemberus-gaap:InterestIncomeMember2020-01-012020-12-310001330399us-gaap:InterestRateSwapMemberfhlbpgh:ConsolidatedObligationsBondsMemberus-gaap:InterestExpenseMember2020-01-012020-12-310001330399us-gaap:InterestRateSwapMemberfhlbpgh:AdvancesMemberus-gaap:InterestIncomeMember2019-01-012019-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:AvailableforsaleSecuritiesMemberus-gaap:InterestIncomeMember2019-01-012019-12-310001330399us-gaap:MortgageReceivablesMemberus-gaap:InterestRateSwapMemberus-gaap:InterestIncomeMember2019-01-012019-12-310001330399us-gaap:InterestRateSwapMemberfhlbpgh:ConsolidatedObligationsBondsMemberus-gaap:InterestExpenseMember2019-01-012019-12-310001330399us-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:InterestRateSwapMemberfhlbpgh:AdvancesMember2018-01-012018-12-310001330399us-gaap:InterestRateSwapMemberfhlbpgh:AdvancesMemberus-gaap:InterestIncomeMember2018-01-012018-12-310001330399us-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:InterestRateSwapMemberus-gaap:AvailableforsaleSecuritiesMember2018-01-012018-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:AvailableforsaleSecuritiesMemberus-gaap:InterestIncomeMember2018-01-012018-12-310001330399us-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:InterestRateSwapMemberfhlbpgh:ConsolidatedObligationsBondsMember2018-01-012018-12-310001330399us-gaap:InterestRateSwapMemberfhlbpgh:ConsolidatedObligationsBondsMemberus-gaap:InterestExpenseMember2018-01-012018-12-310001330399fhlbpgh:AdvancesMember2020-12-310001330399us-gaap:AvailableforsaleSecuritiesMember2020-12-310001330399fhlbpgh:ConsolidatedObligationsBondsMember2020-12-310001330399fhlbpgh:AdvancesMember2019-12-310001330399us-gaap:AvailableforsaleSecuritiesMember2019-12-310001330399fhlbpgh:ConsolidatedObligationsBondsMember2019-12-310001330399us-gaap:InterestRateSwapMember2018-01-012018-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:InterestRateSwapMember2020-01-012020-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:InterestRateSwapMember2019-01-012019-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwapMember2018-01-012018-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberfhlbpgh:InterestRateCapsorFloorsMember2020-01-012020-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberfhlbpgh:InterestRateCapsorFloorsMember2019-01-012019-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberfhlbpgh:InterestRateCapsorFloorsMember2018-01-012018-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberfhlbpgh:NetInterestSettlementsMember2020-01-012020-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberfhlbpgh:NetInterestSettlementsMember2019-01-012019-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberfhlbpgh:NetInterestSettlementsMember2018-01-012018-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberfhlbpgh:TBAsMemberDomain2020-01-012020-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMemberfhlbpgh:TBAsMemberDomain2019-01-012019-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberfhlbpgh:TBAsMemberDomain2018-01-012018-12-310001330399us-gaap:MortgageReceivablesMemberus-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:ForwardContractsMember2020-01-012020-12-310001330399us-gaap:MortgageReceivablesMemberus-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:ForwardContractsMember2019-01-012019-12-310001330399us-gaap:MortgageReceivablesMemberus-gaap:ForwardContractsMember2018-01-012018-12-310001330399us-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2020-01-012020-12-310001330399us-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2019-01-012019-12-310001330399us-gaap:OtherContractMemberus-gaap:NondesignatedMember2018-01-012018-12-310001330399us-gaap:GainLossOnDerivativeInstrumentsMember2020-01-012020-12-310001330399us-gaap:GainLossOnDerivativeInstrumentsMember2019-01-012019-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMember2020-01-012020-12-310001330399us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:GainLossOnDerivativeInstrumentsMember2019-01-012019-12-310001330399us-gaap:OverTheCounterMember2020-12-310001330399us-gaap:OverTheCounterMember2019-12-310001330399us-gaap:ExchangeClearedMember2020-12-310001330399us-gaap:ExchangeClearedMember2019-12-310001330399fhlbpgh:FixedInterestRateMember2020-12-310001330399fhlbpgh:FixedInterestRateMember2019-12-310001330399fhlbpgh:StepupInterestRateMemberMember2020-12-310001330399fhlbpgh:StepupInterestRateMemberMember2019-12-310001330399fhlbpgh:VariableinterestrateMember2020-12-310001330399fhlbpgh:VariableinterestrateMember2019-12-310001330399fhlbpgh:NonCallableMember2020-12-310001330399fhlbpgh:NonCallableMember2019-12-310001330399fhlbpgh:CallableMember2020-12-310001330399fhlbpgh:CallableMember2019-12-310001330399fhlbpgh:EarlierofContractualMaturityorNextCallDateMemberMember2020-12-310001330399fhlbpgh:EarlierofContractualMaturityorNextCallDateMemberMember2019-12-310001330399us-gaap:ShortTermDebtMember2020-12-310001330399us-gaap:ShortTermDebtMember2019-12-31fhlbpgh:numberOfRegulatoryRequirements0001330399fhlbpgh:SubclassB1Member2020-12-310001330399fhlbpgh:SubclassB2Member2020-12-310001330399fhlbpgh:SubclassB1Member2019-12-310001330399fhlbpgh:SubclassB2Member2019-12-31fhlbpgh:Institutions0001330399fhlbpgh:SubclassB2Member2020-02-282020-02-280001330399fhlbpgh:SubclassB1Member2020-02-212020-02-210001330399fhlbpgh:SubclassB2Member2020-02-212020-02-210001330399fhlbpgh:SubclassB1Member2019-02-222019-02-220001330399fhlbpgh:SubclassB2Member2019-02-222019-02-220001330399fhlbpgh:SubclassB1Member2018-02-222018-02-220001330399fhlbpgh:SubclassB2Member2018-02-222018-02-220001330399fhlbpgh:SubclassB1Member2020-04-302020-04-300001330399fhlbpgh:SubclassB2Member2020-04-302020-04-300001330399fhlbpgh:SubclassB1Member2019-04-302019-04-300001330399fhlbpgh:SubclassB2Member2019-04-302019-04-300001330399fhlbpgh:SubclassB1Member2018-04-272018-04-270001330399fhlbpgh:SubclassB2Member2018-04-272018-04-270001330399fhlbpgh:SubclassB1Member2020-07-302020-07-300001330399fhlbpgh:SubclassB2Member2020-07-302020-07-300001330399fhlbpgh:SubclassB1Member2019-07-302019-07-300001330399fhlbpgh:SubclassB2Member2019-07-302019-07-300001330399fhlbpgh:SubclassB1Member2018-07-272018-07-270001330399fhlbpgh:SubclassB2Member2018-07-272018-07-270001330399fhlbpgh:SubclassB1Member2020-10-302020-10-300001330399fhlbpgh:SubclassB2Member2020-10-302020-10-300001330399fhlbpgh:SubclassB1Member2019-10-302019-10-300001330399fhlbpgh:SubclassB2Member2019-10-302019-10-300001330399fhlbpgh:SubclassB1Member2018-10-302018-10-300001330399fhlbpgh:SubclassB2Member2018-10-302018-10-300001330399fhlbpgh:SubclassB1Memberus-gaap:SubsequentEventMember2021-02-262021-02-260001330399us-gaap:SubsequentEventMemberfhlbpgh:SubclassB2Member2021-02-262021-02-260001330399us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-12-310001330399us-gaap:AvailableforsaleSecuritiesMemberus-gaap:AccumulatedOtherThanTemporaryImpairmentMember2017-12-310001330399us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2017-12-310001330399us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-12-310001330399us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-01-012018-12-310001330399us-gaap:AvailableforsaleSecuritiesMemberus-gaap:AccumulatedOtherThanTemporaryImpairmentMember2018-01-012018-12-310001330399us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-01-012018-12-310001330399us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310001330399us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-12-310001330399us-gaap:AvailableforsaleSecuritiesMemberus-gaap:AccumulatedOtherThanTemporaryImpairmentMember2018-12-310001330399us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-12-310001330399us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001330399us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-12-310001330399us-gaap:AvailableforsaleSecuritiesMemberus-gaap:AccumulatedOtherThanTemporaryImpairmentMember2019-01-012019-12-310001330399us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-01-012019-12-310001330399us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001330399us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310001330399us-gaap:AvailableforsaleSecuritiesMemberus-gaap:AccumulatedOtherThanTemporaryImpairmentMember2019-12-310001330399us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-12-310001330399us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001330399us-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001330399us-gaap:AvailableforsaleSecuritiesMemberus-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherThanTemporaryImpairmentMember2020-12-310001330399us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-12-310001330399us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-12-310001330399us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001330399us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001330399us-gaap:AvailableforsaleSecuritiesMemberus-gaap:AccumulatedOtherThanTemporaryImpairmentMember2020-12-310001330399us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-12-310001330399us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001330399fhlbpgh:PentegraDefinedBenefitPlanMember2020-01-012020-12-310001330399fhlbpgh:PentegraDefinedBenefitPlanMember2019-01-012019-12-310001330399fhlbpgh:PentegraDefinedBenefitPlanMember2018-01-012018-12-310001330399fhlbpgh:PentegraDefinedBenefitPlanMember2020-07-010001330399fhlbpgh:PentegraDefinedBenefitPlanMember2019-07-010001330399fhlbpgh:PentegraDefinedBenefitPlanMember2018-07-010001330399us-gaap:NonqualifiedPlanMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2020-12-310001330399us-gaap:NonqualifiedPlanMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2019-12-310001330399us-gaap:NonqualifiedPlanMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2020-01-012020-12-310001330399us-gaap:NonqualifiedPlanMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2019-01-012019-12-310001330399us-gaap:NonqualifiedPlanMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2018-01-012018-12-310001330399us-gaap:NonqualifiedPlanMemberfhlbpgh:MutualFundsMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2020-12-310001330399us-gaap:NonqualifiedPlanMemberfhlbpgh:MutualFundsMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2019-12-310001330399us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMember2020-01-012020-12-310001330399us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMember2020-01-012020-12-310001330399us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001330399us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001330399us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001330399us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-12-310001330399us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-12-310001330399us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberfhlbpgh:MutualFundsMember2020-12-310001330399us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberfhlbpgh:MutualFundsMember2019-12-310001330399us-gaap:PrincipalOwnerMember2020-12-310001330399us-gaap:PrincipalOwnerMember2019-12-310001330399us-gaap:PrincipalOwnerMember2020-01-012020-12-310001330399us-gaap:PrincipalOwnerMember2019-01-012019-12-310001330399us-gaap:PrincipalOwnerMember2018-01-012018-12-310001330399us-gaap:PrincipalOwnerMemberus-gaap:StandbyLettersOfCreditMember2020-01-012020-12-310001330399us-gaap:PrincipalOwnerMemberus-gaap:StandbyLettersOfCreditMember2019-01-012019-12-310001330399us-gaap:PrincipalOwnerMemberus-gaap:StandbyLettersOfCreditMember2018-01-012018-12-310001330399fhlbpgh:FhlbankOfChicagoMember2020-01-012020-12-310001330399fhlbpgh:FhlbankOfChicagoMember2019-01-012019-12-310001330399fhlbpgh:FhlbankOfChicagoMember2018-01-012018-12-310001330399fhlbpgh:FhlbankOfChicagoMember2020-12-310001330399fhlbpgh:FhlbankOfChicagoMember2019-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001330399us-gaap:FairValueInputsLevel1Member2020-12-310001330399us-gaap:FairValueInputsLevel2Member2020-12-310001330399us-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ResidentialPortfolioSegmentMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialPortfolioSegmentMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialPortfolioSegmentMember2020-12-310001330399us-gaap:ResidentialPortfolioSegmentMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMemberfhlbpgh:BankingOnBusinessLoansMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberfhlbpgh:BankingOnBusinessLoansMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberfhlbpgh:BankingOnBusinessLoansMember2020-12-310001330399fhlbpgh:BankingOnBusinessLoansMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399fhlbpgh:BankingOnBusinessLoansMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:UnsecuredDebtMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:UnsecuredDebtMember2020-12-310001330399us-gaap:UnsecuredDebtMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2020-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001330399us-gaap:FairValueInputsLevel1Member2019-12-310001330399us-gaap:FairValueInputsLevel2Member2019-12-310001330399us-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ResidentialPortfolioSegmentMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialPortfolioSegmentMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:ResidentialPortfolioSegmentMember2019-12-310001330399us-gaap:ResidentialPortfolioSegmentMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMemberfhlbpgh:BankingOnBusinessLoansMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberfhlbpgh:BankingOnBusinessLoansMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberfhlbpgh:BankingOnBusinessLoansMember2019-12-310001330399fhlbpgh:BankingOnBusinessLoansMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399fhlbpgh:BankingOnBusinessLoansMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:FairValueInputsLevel1Member2019-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:UnsecuredDebtMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:UnsecuredDebtMember2019-12-310001330399us-gaap:UnsecuredDebtMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2019-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2020-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMembersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:FairValueMeasurementsRecurringMember2020-12-310001330399us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001330399us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfhlbpgh:SingleFamilyMortgagebackedSecuritiesOtherUSObligationsMember2019-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399srt:SingleFamilyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMembersrt:MultifamilyMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:FairValueInputsLevel1Memberus-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:FairValueInputsLevel2Memberus-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:FairValueMeasurementsRecurringMember2019-12-310001330399us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001330399us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AvailableforsaleSecuritiesMember2019-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AvailableforsaleSecuritiesMember2018-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AvailableforsaleSecuritiesMember2017-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AvailableforsaleSecuritiesMember2020-01-012020-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AvailableforsaleSecuritiesMember2019-01-012019-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AvailableforsaleSecuritiesMember2018-01-012018-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AvailableforsaleSecuritiesMember2020-12-310001330399us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-01-012020-12-310001330399us-gaap:StandbyLettersOfCreditMember2020-12-310001330399us-gaap:StandbyLettersOfCreditMember2019-12-310001330399us-gaap:LoanOriginationCommitmentsMember2020-12-310001330399us-gaap:LoanOriginationCommitmentsMember2019-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMember2020-12-310001330399us-gaap:ForwardContractsMemberus-gaap:MortgageReceivablesMember2019-12-310001330399fhlbpgh:ConsolidatedObligationsBondsMember2020-12-310001330399fhlbpgh:ConsolidatedObligationsBondsMember2019-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMember2020-12-310001330399fhlbpgh:FederalHomeLoanBankConsolidatedObligationsDiscountNotesMember2019-12-310001330399fhlbpgh:StandbyLettersOfCreditIssuanceCommitmentsMember2020-12-310001330399fhlbpgh:StandbyLettersOfCreditIssuanceCommitmentsMember2019-12-310001330399fhlbpgh:OpenRepoplusAdvanceProductMember2020-12-310001330399fhlbpgh:OpenRepoplusAdvanceProductMember2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[☒]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

[☐ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-51395

FEDERAL HOME LOAN BANK OF PITTSBURGH

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Federally Chartered Corporation | | 25-6001324 | | | | | | | | | | | | | | | |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer Identification No.) | | | | | | | | | | | | | | | |

| 601 Grant Street | | | | | | | | | | | | | | | | | |

| Pittsburgh, | PA | 15219 | | | | | | | | | | | | | | | |

| (Address of principal executive offices) | | (Zip Code) | | | | | | | | | | | | | | | |

(412) 288-3400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| — | — | — |

| | | | | | | | |

| Securities registered pursuant to Section 12(g) of the Act: |

| Capital Stock, putable, par value $100 |

| (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. []Yes [x]No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. []Yes [x]No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [x]Yes []No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). [x] Yes [] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| o | Large accelerated filer | o | Accelerated filer | ☐ | Emerging growth company |

x | Non-accelerated filer | o | Smaller reporting company | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. []

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Registrant’s stock is not publicly traded and is only issued to members of the registrant. Such stock is issued and redeemed at par value, $100 per share, subject to certain regulatory and statutory limits. At June 30, 2020, the aggregate par value of the stock held by current and former members of the registrant was approximately $2,675.3 million. There were 15,558,431 shares of common stock outstanding at February 26, 2021.

FEDERAL HOME LOAN BANK OF PITTSBURGH

TABLE OF CONTENTS

| | | | | | | | |

| PART I | | |

| Item 1: Business | | |

| Item 1A: Risk Factors | | |

| Item 1B: Unresolved Staff Comments | | |

| Item 2: Properties | | |

| Item 3: Legal Proceedings | | |

| Item 4: Mine Safety Disclosures | | |

| PART II | | |

| Item 5: Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | |

| Item 6: Selected Financial Data | | |

| Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations | | |

| Risk Management | | |

| Item 7A: Quantitative and Qualitative Disclosures about Market Risk | | |

| Item 8: Financial Statements and Supplementary Financial Data | | |

| Financial Statements for the Years 2020, 2019, and 2018 | | |

| Notes to Financial Statements | | |

| Item 9: Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | |

| Item 9A: Controls and Procedures | | |

| Item 9B: Other Information | | |

| PART III | | |

| Item 10: Directors, Executive Officers and Corporate Governance | | |

| Item 11: Executive Compensation | | |

| Item 12: Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | |

| Item 13: Certain Relationships and Related Transactions, and Director Independence | | |

| Item 14: Principal Accountant Fees and Services | | |

| PART IV | | |

| Item 15: Exhibits and Financial Statement Schedules | | |

| Item 16: Form 10-K Summary | | |

| Glossary | | |

| Signatures | | |

PART I

Forward-Looking Information

Statements contained in this Form 10-K, including statements describing the objectives, projections, estimates, or predictions of the future of the Federal Home Loan Bank of Pittsburgh (the Bank), may be “forward-looking statements.” These statements may use forward-looking terms, such as “anticipates,” “believes,” “could,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, the following: economic and market conditions, including, but not limited to, real estate, credit and mortgage markets; volatility of market prices, rates, and indices related to financial instruments; including but not limited to, the possible discontinuance of the London Interbank Offered Rate (LIBOR) and the related effect on the Bank's LIBOR-based financial products, investments and contracts; the occurrence of man-made or natural disasters, endemics, global pandemics, conflicts or terrorist attacks or other geopolitical events; political, legislative, regulatory, litigation, or judicial events or actions; risks related to mortgage-backed securities (MBS); changes in the assumptions used to estimate credit losses; changes in the Bank’s capital structure; changes in the Bank’s capital requirements; changes in expectations regarding the Bank’s payment of dividends; membership changes; changes in the demand by Bank members for Bank advances; an increase in advance prepayments; competitive forces, including the availability of other sources of funding for Bank members; changes in investor demand for consolidated obligations and/or the terms of interest rate exchange agreements and similar agreements; changes in the Federal Home Loan Bank (FHLBank) System’s debt rating or the Bank’s rating; the ability of the Bank to introduce new products and services to meet market demand and to manage successfully the risks associated with new products and services; the ability of each of the other FHLBanks to repay the principal and interest on consolidated obligations for which it is the primary obligor and with respect to which the Bank has joint and several liability; applicable Bank policy requirements for retained earnings and the ratio of the market value of equity to par value of capital stock; the Bank’s ability to maintain adequate capital levels (including meeting applicable regulatory capital requirements); business and capital plan adjustments and amendments; technology and cyber-security risks; and timing and volume of market activity. Information on the Bank's websites referred to in this Form 10-K is not incorporated in, or a part of, this Form 10-K.

Item 1: Business

The Bank’s mission is to provide its members with readily available liquidity, including serving as a low-cost source of funds for housing and community development. The Bank strives to enhance the availability of credit for residential mortgages and targeted community development. The Bank manages its liquidity so that funds are available to meet members’ demand for advances (loans to members and eligible nonmember housing associates). By providing needed liquidity and enhancing competition in the mortgage market, the Bank’s lending programs benefit homebuyers and communities. For additional information regarding the Bank’s financial condition and financial statements, refer to Item 7. Management’s Discussion and Analysis and Item 8. Financial Statements and Supplementary Financial Data in this Form 10-K. For additional information regarding the Bank’s business risks, refer to Item 1A. Risk Factors in this Form 10-K.

General

History. The Bank is one of 11 FHLBanks. The FHLBanks operate as separate entities with their own management, employees and board of directors. The 11 FHLBanks, along with the Office of Finance (OF - the FHLBanks’ fiscal agent) comprise the FHLBank System. The FHLBanks were organized under the authority of the Federal Home Loan Bank Act of 1932, as amended (the Act). The FHLBanks are commonly referred to as government-sponsored enterprises (GSEs), which generally means they are a combination of private capital and public sponsorship. The public sponsorship attributes include:

•being exempt from federal, state and local taxation, except real estate taxes;

•being exempt from registration under the Securities Act of 1933 (the 1933 Act), although the FHLBanks are required by Federal Housing Finance Agency (FHFA or Finance Agency) regulation and the Housing and Economic Recovery Act of 2008 (the Housing Act or HERA) to register a class of their equity securities under the Securities Exchange Act of 1934 (the 1934 Act); and

•having a line of credit with the U.S. Treasury. This line represents the U.S. Treasury’s authority to purchase consolidated obligations in an amount up to $4 billion.

Cooperative. The Bank is a cooperative institution, owned by member financial institutions that are also its primary customers. Any building and loan association, savings and loan association, commercial bank, homestead association, insurance company, savings bank, credit union, community development financial institution (CDFI), or insured depository institution that maintains its principal place of business in Delaware, Pennsylvania or West Virginia and that meets varying requirements can apply for membership in the Bank. All members are required to purchase capital stock in the Bank as a condition of membership. The capital stock of the Bank can be purchased only by members.

Mission. The Bank’s primary mission is to assure the flow of credit to its members to support housing finance and community lending and to provide related services that enhance their businesses and vitalize their communities. The Bank provides credit for housing and community development through two primary programs. First, it provides members with advances secured by residential mortgages and other types of high-quality collateral. Second, the Bank purchases residential mortgage loans originated by or through eligible member institutions. The Bank also offers other credit and noncredit products and services to member institutions. These include letters of credit, affordable housing grants, securities safekeeping, and deposit products and services. The Bank issues debt to the public (consolidated obligation bonds and discount notes) in the capital markets through the OF and uses these funds to provide its member financial institutions with a reliable source of liquidity. The U.S. government does not guarantee the debt securities or other obligations of the Bank or the FHLBank System.

Overview. As a GSE, the Bank is able to raise funds in the capital markets at narrow spreads to the U.S. Treasury yield curve. This fundamental competitive advantage, coupled with the joint and several liability on FHLBank System debt, enables the Bank to provide attractively priced funding to members. Though chartered by Congress, the Bank is privately capitalized by its member institutions, which are voluntary participants in its cooperative structure. The characterization of the Bank as a voluntary cooperative with the status of a federal instrumentality differentiates the Bank from a traditional banking institution in three principal ways:

•Financial institutions choose membership in the Bank principally for access to liquidity, the value of the products offered, and the potential to receive dividends.

•Because the Bank’s customers and shareholders are predominantly the same institutions, normally there is a need to balance the pricing expectations of customers with the dividend expectations of shareholders. By charging wider spreads on loans to customers, the Bank could potentially generate higher earnings and dividends for shareholders. Yet these same shareholders are also customers who would generally prefer narrower loan spreads. The Bank strives to achieve a balance between the goals of providing liquidity and other services to members at advantageous prices and potentially generating an attractive dividend. The Bank typically does not strive to maximize the dividend yield on the stock, but to produce a dividend that compares favorably to short-term interest rates, thus compensating members for the cost of the capital they have invested in the Bank.

•The Bank’s GSE charter is based on a public policy purpose to assure liquidity for its members and to enhance the availability of affordable housing for lower-income households. In upholding its public policy mission, the Bank offers products that consume a portion of its earnings. The cooperative GSE character of this voluntary membership organization leads management to optimize the primary purpose of membership, access to liquidity, as well as the overall value of Bank membership.

Nonmember Borrowers. In addition to member institutions, the Bank is permitted under the Act to make advances to nonmember housing associates that are approved mortgagees under Title II of the National Housing Act. These eligible housing associates must be chartered under law, be subject to inspection and supervision by a governmental agency, and lend their own funds as their principal activity in the mortgage field. The Bank must approve each applicant. Housing associates are not subject to certain provisions of the Act that are applicable to members, such as the capital stock purchase requirements. However, they are generally subject to more restrictive lending and collateral requirements than those applicable to members. As of December 31, 2020, the Bank maintains relationships with three approved state housing finance agencies (HFAs). Each is currently eligible to borrow from the Bank and one of the housing associates had an advance balance of $11.6 million as of December 31, 2020.

Regulatory Oversight, Audits and Examinations

Supervision and Regulation. The Bank's business is subject to regulation and supervision. The laws and regulations to which it is subject cover key aspects of the Bank's business and directly and indirectly affect its product and service offerings, pricing, competitive position and strategic plan, relationship with members and third parties, capital structure, cash needs and uses, and information security. As discussed throughout this Form 10-K, such laws and regulations can affect key drivers of the Bank's results of operations, including, for example, the Bank's capital and liquidity, product and service offerings, risk management, and costs of compliance.

The Bank and OF are supervised and regulated by the Finance Agency, which is an independent agency in the executive branch of the United States government. The Finance Agency ensures that the Bank carries out its housing finance mission, remains adequately capitalized and operates in a safe and sound manner. The Finance Agency establishes regulations, issues advisory bulletins (ABs), and otherwise supervises Bank operations primarily via periodic examinations. The Government Corporation Control Act provides that, before a government corporation issues and offers obligations to the public, the Secretary of the U.S. Treasury has the authority to prescribe the form, denomination, maturity, interest rate, and conditions of the obligations; the way and time issued; and the selling price. The U.S. Treasury receives the Finance Agency’s annual report to Congress and other reports on operations. The Bank is also subject to regulation by the Securities and Exchange Commission (SEC).

Examination. At a minimum, the Finance Agency conducts annual onsite examinations of the operations of the Bank. In addition, the Comptroller General has authority under the Act to audit or examine the Finance Agency and the Bank and to decide the extent to which they fairly and effectively fulfill the purposes of the Act. Furthermore, the Government Corporation Control Act provides that the Comptroller General may review any audit of the financial statements conducted by an independent registered public accounting firm. If the Comptroller General conducts such a review, then he or she must report the results and provide his or her recommendations to Congress, the Office of Management and Budget (OMB), and the FHLBank in question. The Comptroller General may also conduct his or her own audit of the financial statements of the Bank.

Audit. The Bank has an internal audit department that reports directly to the Audit Committee of the Bank’s Board of Directors (Board). In addition, an independent Registered Public Accounting Firm (RPAF) audits the annual financial statements and internal controls over financial reporting of the Bank. The independent RPAF conducts these audits following the Standards of the Public Company Accounting Oversight Board (PCAOB) of the United States of America and Government Auditing Standards issued by the Comptroller General. The Bank, the Finance Agency, and Congress all receive the independent RPAF audit reports.

Advances

Advance Products. The Bank makes advances on the security of pledged mortgage loans and other eligible types of collateral. The following table summarizes the advance products offered by the Bank as of December 31, 2020.

| | | | | | | | | | | | |

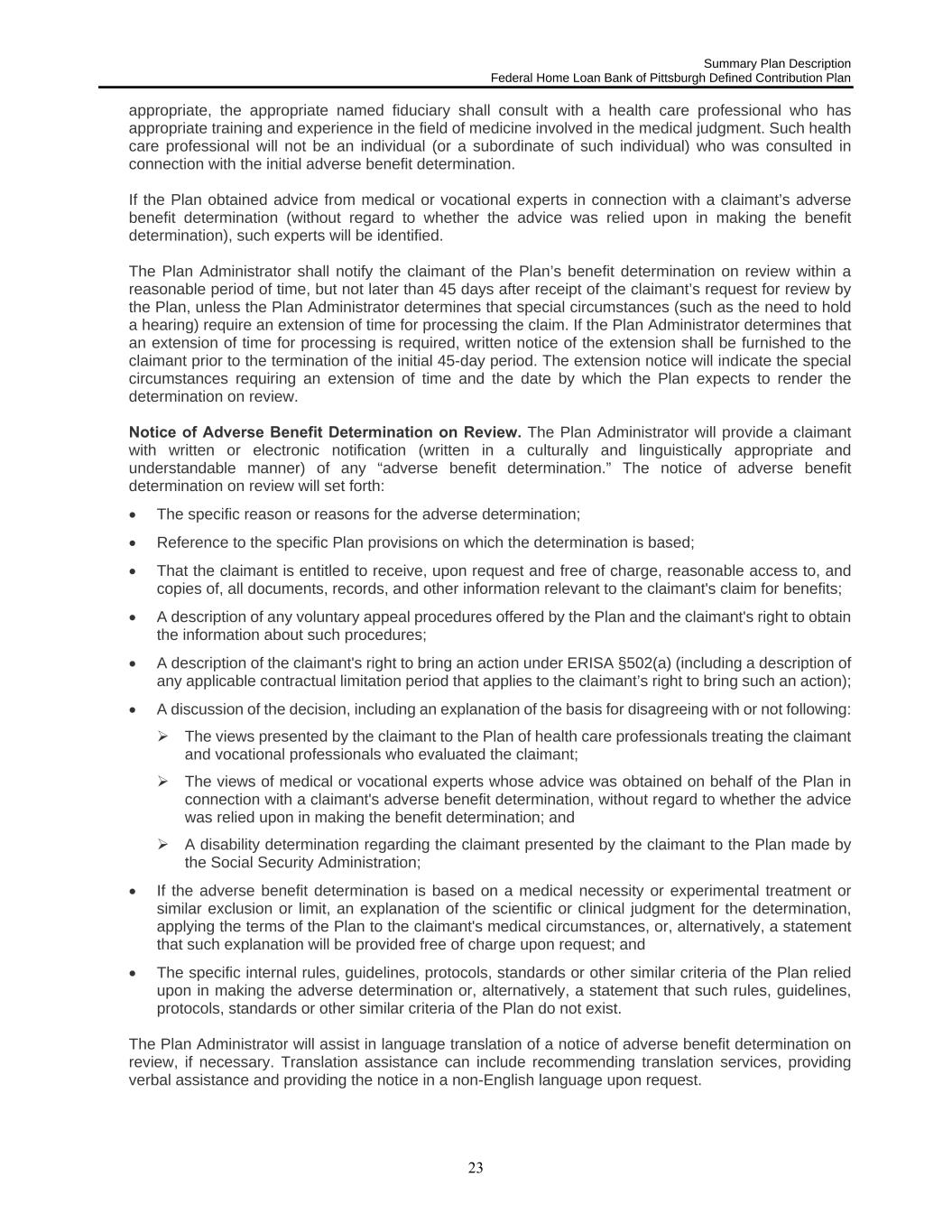

| Product | Description | | Maturity | Key Features |

| RepoPlus | Short-term, fixed-rate advances; principal and interest paid at maturity | | 1 day to 89 days | The RepoPlus advance products serve member short-term liquidity needs. RepoPlus is typically a short-term, fixed-rate product while the Open RepoPlus is a revolving line of credit which allows members to borrow, repay and re-borrow based on the terms of the line of credit. These balances tend to be extremely volatile as members borrow and repay frequently. |

| Mid-Term Repo | Mid-term, fixed-rate and adjustable-rate advances(1); principal paid at maturity; interest paid monthly or quarterly | | 3 months to 3 years (2) | The Mid-Term Repo product assists members with managing intermediate-term interest rate risk. To assist members with managing basis risk, or the risk of a change in the spread relationship between two indices, the Bank offers adjustable-rate Mid-Term Repo advances. The Bank also offers Mid-Term fixed-rate advances. These balances tend to be somewhat unpredictable as these advances are not always replaced as they mature. |

| Core (Term) | Long-term, fixed-rate and adjustable-rate advances(1); principal paid at maturity; interest paid monthly or quarterly (Note: amortizing loans principal and interest paid monthly) | | 1 year to 30 years (2) | For managing longer-term interest rate risk and to assist with asset/liability management, the Bank offers long-term fixed-rate and adjustable-rate advances. Amortizing long-term fixed-rate advances can be fully amortized on a monthly basis over the term of the loan or amortized balloon-style, based on an amortization term longer than the maturity of the loan. |

| Returnable | Short-term and long-term, fixed-rate and adjustable-rate advances with return options owned by member; principal paid at maturity; interest paid monthly or quarterly | | 2 months to 30 years | These advances permit the member to prepay an advance on certain pre-determined date(s) without a fee. |

Notes:

(1) May include loans made under the Community Lending Program (CLP).

(2) Terms dependent upon market conditions.

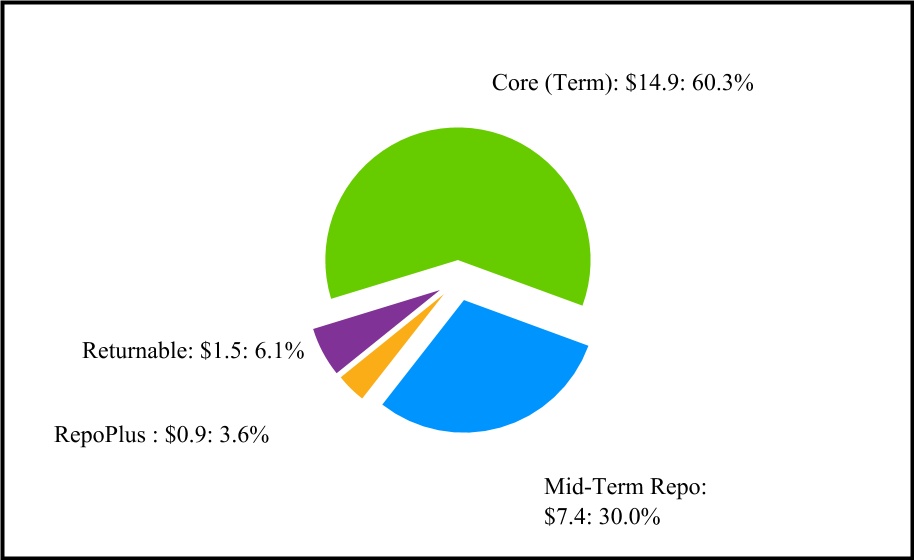

The following chart shows the percentage of advances at par by product type and dollar amount (in billions) as of December 31, 2020.

Letters of Credit. Standby letters of credit are issued by the Bank for a fee on behalf of its members and housing associates to support certain obligations to third-party beneficiaries and are backed by an irrevocable, independent obligation from the Bank. These are subject to the same collateralization and borrowing limits that apply to advances. Standby letters of credit can be valuable tools to support community lending activities, including arranging financing to support bond issuances for community and economic development as well as affordable housing projects. The letters of credit offer customizable terms available to meet unique and evolving needs. If the Bank is required to make payment for a beneficiary’s draw, these amounts are withdrawn from the member/housing associates’ demand deposit account (DDA). Any remaining amounts not covered by the DDA withdrawal are converted into a collateralized overnight advance.

Collateral

The Bank protects against credit risk by fully collateralizing all member and nonmember housing associate advances and other credit products. The Act requires the Bank to obtain and maintain a security interest in eligible collateral at the time it originates or renews an advance.

Collateral Agreements. All members must enter into either the Advances, Collateral Pledge and Security Agreement or the Advances, Specific Collateral Pledge and Security Agreement with the Bank (both hereafter referred to as Master Agreement) in order to obtain advances or other credit products. In both cases, the Bank perfects its security interest under Article 9 of the Uniform Commercial Code (UCC) by filing a financing statement. The Specific Collateral Pledge and Security Agreement covers only those assets or categories of assets identified; the Bank therefore relies on a specific subset of the member’s total eligible collateral as security for the member’s obligations to the Bank. The Bank requires CDFIs, HFAs and insurance companies to sign a specific collateral pledge agreement. See the Credit and Counterparty Risk - TCE and Collateral discussion in Risk Management in Item 7. Management’s Discussion and Analysis in this Form 10-K for a description of blanket and specific agreements.

Collateral Status. The Master Agreement identifies three types of collateral status: undelivered, undelivered detailed listing or specific pledge, and delivered status. All securities pledged must be delivered. A member is assigned a collateral status based on the member’s business needs and on the Bank’s determination of the member’s current financial condition and credit product usage, as well as other available information.

Undelivered Collateral Status. The Bank monitors eligible loan collateral using the Qualifying Collateral Report (QCR), derived from regulatory financial reports which are submitted quarterly (or monthly) to the Bank by the member. For members that submit a QCR, lending value is determined based on a percentage of the unpaid principal balance of qualifying collateral (commonly referred to as the collateral weight). Qualifying collateral is determined by deducting ineligible loans from the gross call report amount for each asset category. In addition, members that do not submit a QCR are required to complete an Annual Collateral Certification Report (ACCR).

Undelivered Collateral Status: Detailed Listing or Specific Pledge. The Bank may require a member to provide a detailed listing of eligible collateral being pledged if the member is under a specific agreement, or if participating in the Bank’s market-value based pricing program, or as determined based on its credit condition. The member typically retains physical possession of collateral pledged to the Bank but provides a listing of assets pledged. In some cases, the member may benefit by choosing to list collateral, in lieu of non-listed status, since it may result in a higher collateral weighting being applied to the collateral. The Bank benefits from detailed listing collateral status because it provides more loan information to calculate a more precise valuation of the collateral.

Delivered Collateral Status. In this case, the Bank requires the member to deliver physical possession, or grant control of, eligible collateral in an amount sufficient to fully secure its total credit exposure (TCE) to the Bank. Typically, the Bank takes physical possession/control of collateral if the financial condition of the member is deteriorating. Delivery of collateral also may be required if there is action taken against the member by its regulator. Collateral delivery status is often required for members borrowing under specific pledge agreements as a practical means for maintaining specifically listed collateral. Securities collateral qualifies on a delivered basis only (i.e., held in a Bank restricted account or at an approved third-party custodian and subject to a control agreement in favor of the Bank). The Bank also requires delivery of collateral from de novo members at least until two consecutive quarters of profitability are achieved and for any other new member where a pre-existing blanket lien is in force with another creditor unless an effective subordination agreement is executed with such other creditor.

With respect to certain specific collateral pledge agreement borrowers (typically CDFIs, HFAs, and insurance companies), the Bank takes control of all collateral pledged at the time the loan is made through the delivery of securities or, where applicable, mortgage loans to the Bank or an approved custodian. See the Credit and Counterparty Risk - TCE and Collateral discussion in Risk Management in Item 7. Management’s Discussion and Analysis in this Form 10-K for further details on collateral status and types.

All eligible collateral securing advances is discounted to protect the Bank from loss in the event of default, including under adverse conditions. These discounts, also referred to as lending value or “haircuts”, vary by collateral type and the value of the collateral. The Bank’s collateral discounted values are presented in the table at the end of this subsection. The discounts typically include margins for estimated costs to sell or liquidate the collateral and the risk of a decline in the collateral value due to market or credit volatility. The Bank reviews the collateral weightings periodically and may adjust them, as well as the members’ reporting requirements to the Bank, for individual borrowers on a case-by-case basis.

The Bank determines the type and amount of collateral each member has available to pledge as security for a member’s obligations to the Bank by reviewing, on a quarterly basis, call reports the members file with their primary regulators. The resulting total value of collateral available to be pledged to the Bank after any collateral weighting is referred to as a member’s maximum borrowing capacity (MBC). A member’s credit product usage and current financial condition dictate the types of reporting that a member must submit to the Bank. All members who are not community financial institutions (CFIs) as defined below must file a QCR or loan listing at least quarterly.

The Bank also performs periodic on-site collateral reviews of its members to confirm the amounts and quality of the eligible collateral pledged for the members’ obligations to the Bank. For certain pledged residential and commercial mortgage loan collateral, as well as delivered and Bank-controlled securities, the Bank employs outside service providers to assist in determining market values. In addition, the Bank has developed and maintains an Internal Credit Rating (ICR) system that assigns each member a numerical credit rating on a scale of one to ten, with one being the best rating. Credit availability and term guidelines are primarily based on a member’s ICR and MBC usage. The Bank reserves the right, at its discretion, to refuse certain collateral or to adjust collateral weightings. In addition, the Bank can require additional or substitute collateral while any obligations of a member to the Bank remain outstanding to protect the Bank’s security interest and ensure that it remains fully secured at all times.

See the Credit and Counterparty Risk - TCE and Collateral discussion in Risk Management in Item 7. Management’s Discussion and Analysis in this Form 10-K for further information on collateral policies and practices and details of eligible collateral, including amounts and percentages of eligible collateral securing members’ obligations to the Bank as of December 31, 2020.

As additional security for each member’s obligations to the Bank, the Bank has a statutory lien on the member’s capital stock in the Bank. In the event of deterioration in the financial condition of a member, the Bank will take possession or control of sufficient eligible collateral to further perfect its security interest in collateral pledged to secure the member’s obligations to the Bank. Members with deteriorating creditworthiness are required to deliver collateral to the Bank or the Bank’s custodian to

secure the members’ obligations with the Bank. Furthermore, the Bank requires specific approval of each of such members’ new or renewed advances.

Priority. The Act affords any security interest granted to the Bank by any member, or any affiliate of a member, priority over the claims and rights of any third party, including any receiver, conservator, trustee or similar party having rights of a lien creditor. The only two exceptions are: (1) claims and rights that would be entitled to priority under otherwise applicable law and are held by actual bona fide purchasers for value; and (2) parties that are secured by actual perfected security interests ahead of the Bank’s security interest. The Bank has detailed liquidation plans in place to promptly exercise the Bank’s rights regarding securities, loan collateral, and other collateral upon the failure of a member. Management believes that adequate policies and procedures are in place to effectively manage the Bank’s credit risk associated with lending to members and nonmember housing associates.

Types of Collateral. Single-family, residential mortgage loans may be used to secure members’ obligations to the Bank. The Bank contracts with a leading provider of comprehensive mortgage analytical pricing to provide market valuations of some listed and delivered residential mortgage loan collateral. In determining borrowing capacity for members with non-listed and non-delivered collateral, the Bank utilizes book value as reported on each member's regulatory call report. Loans that do not have a paper-based promissory note with a “wet ink” signature are ineligible for collateral purposes.

The Bank also may accept other real estate related collateral (ORERC) as eligible collateral if it has a readily ascertainable value and the Bank is able to perfect its security interest in such collateral. Types of eligible ORERC include commercial mortgage loans, multi-family residential mortgage loans, and second-mortgage installment loans. The Bank uses a leading provider of multi-family and commercial mortgage analytical pricing to provide more precise valuations of listed and delivered multi-family and commercial mortgage loan collateral.

A third category of eligible collateral is high quality investment securities as included in the table below. See the Credit and Counterparty Risk - TCE and Collateral discussion in Risk Management in Item 7. Management’s Discussion and Analysis in this Form 10-K for a definition of these securities. Members have the option to deliver such high quality investment securities to the Bank to obtain or increase their MBC. These securities are valued daily upon delivery.

The Bank also accepts FHLBank cash deposits as eligible collateral. In addition, member CFIs may pledge a broader array of collateral to the Bank, including secured small business, small farm, small agri-business and community development loans. The Housing Act defines member CFIs as Federal Deposit Insurance Corporation (FDIC)-insured institutions with no more than $1.2 billion (the limit during 2020) in average assets over the past three years. This limit may be adjusted by the Finance Agency based on changes in the Consumer Price Index. The determination to accept such collateral is at the discretion of the Bank and is made on a case-by-case basis. Advances to CFIs are also collateralized by sufficient levels of non-CFI collateral. See the Credit and Counterparty Risk - TCE and Collateral discussion in Risk Management in Item 7. Management’s Discussion and Analysis in this Form 10-K for the percentage of each type of collateral held by the Bank at December 31, 2020.

The Bank does not accept subprime residential mortgage loans (defined as FICO® score of 660 or below. FICO is a registered trademark of Fair Isaac Corporation) as qualifying collateral unless certain mitigating factors are met. The Bank requires members to identify the amount of subprime and nontraditional mortgage collateral in their QCRs.

Nontraditional residential mortgage loans are defined by the Bank’s Collateral Policy as mortgage loans that allow borrowers to defer payment of principal or interest. These loans exhibit characteristics that may result in increased risk relative to traditional residential mortgage loan products. They may pose even greater risk when granted to borrowers with undocumented or undemonstrated repayment capacity, for example, low or no documentation loans or credit characteristics that would be characterized as subprime. The potential for increased risk is particularly true if the nontraditional residential mortgage loans are not underwritten to the fully indexed rate.

Regarding nontraditional mortgage collateral for the QCR, the Bank requires filing members to stratify their holdings of first lien residential mortgage loans into traditional, qualifying low FICO, and qualifying unknown FICO categories. Under limited circumstances, the Bank allows nontraditional residential mortgage loans that are consistent with Federal Financial Institutions Examination Council (FFIEC) guidance to be pledged as collateral and used to determine a member’s MBC.