| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| FORM N-CSR | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED | |

| MANAGEMENT INVESTMENT COMPANIES | |

| Investment Company Act file number 811-21777 | |

| John Hancock Funds III | |

| (Exact name of registrant as specified in charter) | |

| 601 Congress Street, Boston, Massachusetts 02210 | |

| (Address of principal executive offices) (Zip code) | |

| Salvatore Schiavone | |

| Treasurer | |

| 601 Congress Street | |

| Boston, Massachusetts 02210 | |

| (Name and address of agent for service) | |

| Registrant's telephone number, including area code: 617-663-4497 | |

| Date of fiscal year end: | March 31 |

| Date of reporting period: | March 31, 2012 |

ITEM 1. REPORTS TO STOCKHOLDERS.

A look at performance

Total returns for the period ended March 31, 2012

| Average annual total returns (%) | Cumulative total returns (%) | ||||||

| with maximum sales charge | with maximum sales charge | ||||||

|

| |||||||

| 1-year | 5-year | 10-year | 1-year | 5-year | 10-year | ||

|

| |||||||

| Class A1 | 1.78 | 1.20 | 4.18 | 1.78 | 6.13 | 50.56 | |

|

| |||||||

| Class B1 | 1.32 | 0.95 | 3.56 | 1.32 | 4.82 | 41.93 | |

|

| |||||||

| Class C1 | 5.27 | 1.32 | 3.56 | 5.27 | 6.77 | 41.87 | |

|

| |||||||

| Class i1,2 | 7.54 | 2.63 | 5.06 | 7.54 | 13.87 | 63.87 | |

|

| |||||||

| Class R11,2 | 6.67 | 1.71 | 3.97 | 6.67 | 8.87 | 47.57 | |

|

| |||||||

| Class R21,2 | 5.69 | 0.70 | 3.09 | 5.69 | 3.53 | 35.51 | |

|

| |||||||

| Class R31,2 | 6.79 | 1.83 | 4.08 | 6.79 | 9.47 | 49.13 | |

|

| |||||||

| Class R41,2 | 7.06 | 2.12 | 4.39 | 7.06 | 11.08 | 53.60 | |

|

| |||||||

| Class R51,2 | 7.42 | 2.44 | 4.70 | 7.42 | 12.78 | 58.31 | |

|

| |||||||

| Class R61,2 | 7.63 | 2.66 | 5.11 | 7.63 | 14.04 | 64.61 | |

|

| |||||||

| Class T1,2 | 1.66 | 0.74 | 3.57 | 1.66 | 3.74 | 42.05 | |

|

| |||||||

| Class AdV 1,2 | 7.26 | 2.37 | 4.80 | 7.26 | 12.42 | 59.77 | |

|

| |||||||

| Class NAV 1,2 | 7.63 | 2.70 | 5.15 | 7.63 | 14.26 | 65.26 | |

|

| |||||||

Performance figures assume all dividends have been reinvested. Figures reflect maximum sales charge on Class A and Class T shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable for the following classes: I, R1, R2, R3, R4, R5, R6, ADV and NAV shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 6-30-12 for Class R1, Class R3, Class R4, Class R5 and Class ADV shares and 6-30-13 for Class R2 shares. Had the fee waivers and expense limitations not been in place gross expenses would apply. For all other classes the net expenses equal the gross expenses. The expense ratios are as follows:

| Class A | Class B | Class C | Class I | Class R1 | Class R2 | Class R3 | Class R4 | Class R5 | Class R6 | Class T | Class ADV | Class NAV | |

| Net (%) | 1.28 | 2.06 | 2.09 | 0.89 | 1.70 | 1.45 | 1.60 | 1.30 | 1.00 | 0.84 | 1.35 | 1.14 | 0.80 |

| Gross (%) | 1.28 | 2.06 | 2.09 | 0.89 | 8.24 | 2.76 | 16.43 | 16.16 | 15.88 | 0.84 | 1.35 | 1.35 | 0.80 |

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

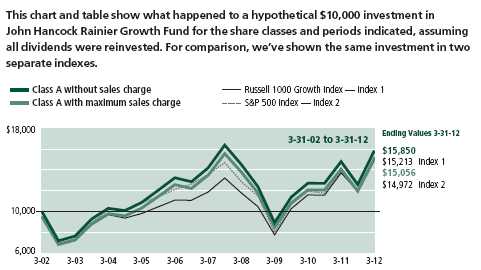

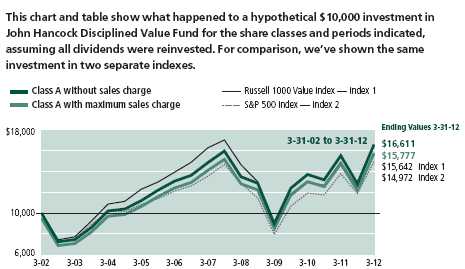

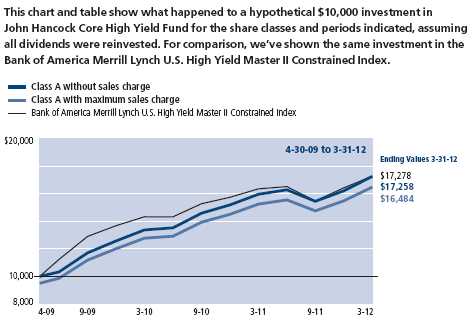

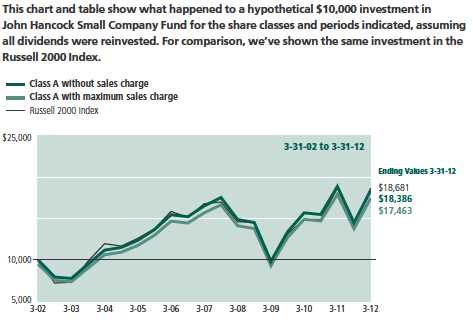

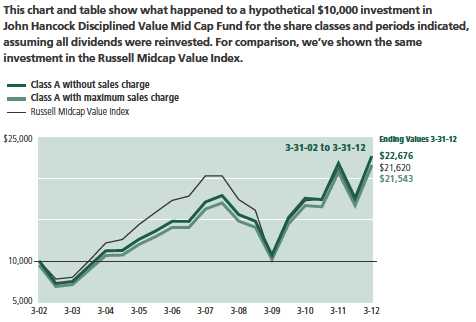

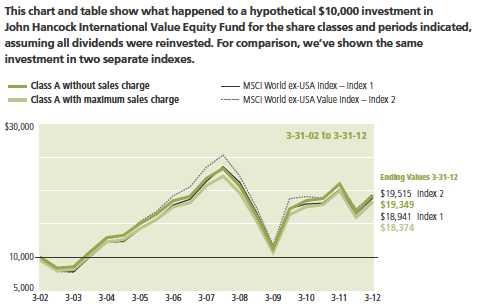

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

| 6 | Rainier Growth Fund | Annual report |

| Without | With maximum | ||||

| Start date | sales charge | sales charge | Index 1 | Index 2 | |

|

| |||||

| Class B 3 | 3-31-02 | $14,193 | $14,193 | $15,213 | $14,972 |

|

| |||||

| Class C3 | 3-31-02 | 14,187 | 14,187 | 15,213 | 14,972 |

|

| |||||

| Class I 2 | 3-31-02 | 16,387 | 16,387 | 15,213 | 14,972 |

|

| |||||

| Class R1 2 | 3-31-02 | 14,757 | 14,757 | 15,213 | 14,972 |

|

| |||||

| Class R22 | 3-31-02 | 13,551 | 13,551 | 15,213 | 14,972 |

|

| |||||

| Class R32 | 3-31-02 | 14,913 | 14,913 | 15,213 | 14,972 |

|

| |||||

| Class R4 2 | 3-31-02 | 15,360 | 15,360 | 15,213 | 14,972 |

|

| |||||

| Class R5 2 | 3-31-02 | 15,831 | 15,831 | 15,213 | 14,972 |

|

| |||||

| Class R6 2 | 3-31-02 | 16,461 | 16,461 | 15,213 | 14,972 |

|

| |||||

| Class T 2 | 3-31-02 | 14,954 | 14,205 | 15,213 | 14,972 |

|

| |||||

| Class ADV 2 | 3-31-02 | 15,977 | 15,977 | 15,213 | 14,972 |

|

| |||||

| Class NAV 2 | 3-31-02 | 16,526 | 16,526 | 15,213 | 14,972 |

|

| |||||

Russell 1000 growth index is an unmanaged index containing those securities in the Russell 1000 Index with a greater-than-average growth orientation.

S&P 500 index is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 On 4-25-08, through a reorganization, the Fund acquired all of the assets of the Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund). On that date, the Predecessor Fund offered its Original Class shares and Institutional Class shares in exchange for Class A and Class I shares, respectively, of John Hancock Rainier Growth Fund. Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class ADV and Class NAV shares of John Hancock Rainier Growth Fund were first offered on 4-28-08. The Predecessor Fund’s Original Class shares’ returns have been recalculated to reflect the gross fees and expenses of Class A shares. The returns prior to 4-28-08 are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class ADV and Class NAV shares, respectively. Class T shares were first offered 10-6-08; the returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class T shares. Class R6 and Class R2 shares were first offered 9-1-11 and 3-1-12, respectively; the returns prior to these dates are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class R6 and Class R2 shares.

2 For certain types of investors, as described in the Fund’s prospectuses.

3 No contingent deferred sales charge is applicable.

| Annual report | Rainier Growth Fund | 7 |

Management’s discussion of

Fund performance

By Rainier investment Management, inc.

Stocks fell sharply in the first half of the year ended March 31, 2012, pressured by fears that Europe’s sovereign debt problems would trigger a financial meltdown and worries that the U.S. was headed for another recession. The market then rebounded sharply in the fourth quarter and into 2012, buoyed by signs of stabilization in Europe and continued economic expansion domestically.

For the 12 months ended March 31, 2012, John Hancock Rainier Growth Fund’s Class A shares returned 7.13%, excluding sales charges. The Fund lagged the 11.02% gain of its benchmark, the Russell 1000 Growth Index, but beat the average 6.93% advance of the Morningstar, Inc. large-cap growth funds category. Bottom-up stock picking, which was focused on companies with above-average earnings growth and reasonable stock valuations, detracted in the information technology, industrials, energy and materials sectors. In tech, the Fund lost ground from not owning large index components, such as Microsoft Corp. and IBM Corp., whose steady growth and mega capitalization attracted investors. One information technology company that performed well was electronic card processor Visa Inc., which profited from the strong secular trend of more people paying with plastic and from the removal of regulatory headwinds. Exposure in the first half of the period to economically sensitive stocks, such as factory automation equipment company Rockwell Automation, Inc. also hurt, as the slowing global economy pressured its return. In energy, shares of energy services provider Baker Hughes Inc. fell as declining natural gas prices negatively affected its pressure pumping business. Conversely, the Fund benefited from stock picks in consumer staples, financials, health care and consumer discretionary. Top individual contributors included energy drink company Monster Beverage Corp. (formerly Hansen Natural Corp.), a consumer staples name benefiting from expansion overseas. Rockwell Automation and Baker Hughes were no longer in the Fund at period end.

This commentary reflects the views of the portfolio management team through the end of the period discussed in this report. The team’s statements reflect its own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| 8 | Rainier Growth Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on October 1, 2011 with the same investment held until March 31, 2012.

| Account value | Ending value | Expenses paid during | |

| on 10-1-11 | on 3-31-12 | period ended 3-31-121 | |

|

| |||

| Class A | $1,000.00 | $1,260.50 | $7.35 |

|

| |||

| Class B | 1,000.00 | 1,266.10 | 11.90 |

|

| |||

| Class C | 1,000.00 | 1,255.50 | 11.84 |

|

| |||

| Class I | 1,000.00 | 1,263.00 | 5.32 |

|

| |||

| Class R1 | 1,000.00 | 1,258.40 | 9.60 |

|

| |||

| Class R3 | 1,000.00 | 1,259.00 | 9.04 |

|

| |||

| Class R4 | 1,000.00 | 1,260.20 | 7.35 |

|

| |||

| Class R5 | 1,000.00 | 1,262.80 | 5.66 |

|

| |||

| Class R6 | 1,000.00 | 1,263.30 | 4.87 |

|

| |||

| Class T | 1,000.00 | 1,260.60 | 7.86 |

|

| |||

| Class ADV | 1,000.00 | 1,261.60 | 6.45 |

|

| |||

| Class NAV | 1,000.00 | 1,263.80 | 4.58 |

|

| |||

For the class noted below, the example assumes an account value of $1,000 on March 1, 2012, with the same investment held until March 31, 2012.

| Account value | Ending value | Expenses paid during | |

| on 3-1-12 | on 3-31-12 | period ended 3-31-122 | |

|

| |||

| Class R2 | $1,000.00 | $1,036.50 | $1.25 |

|

| |||

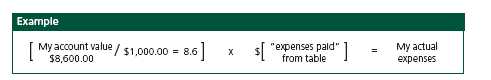

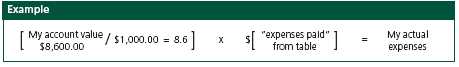

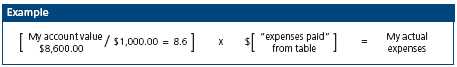

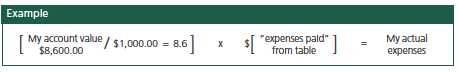

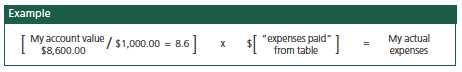

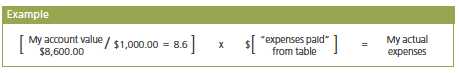

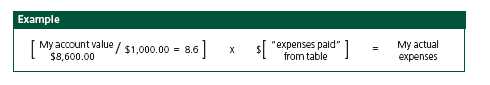

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at March 31, 2012, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| Annual report | Rainier Growth Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on October 1, 2011, with the same investment held until March 31, 2012. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | Ending value | Expenses paid during | |

| on 10-1-11 | on 3-31-12 | period ended 3-31-123 | |

|

| |||

| Class A | $1,000.00 | $1,018.50 | $6.56 |

|

| |||

| Class B | 1,000.00 | 1,014.50 | 10.58 |

|

| |||

| Class C | 1,000.00 | 1,014.50 | 10.58 |

|

| |||

| Class I | 1,000.00 | 1,020.30 | 4.75 |

|

| |||

| Class R1 | 1,000.00 | 1,016.50 | 8.57 |

|

| |||

| Class R2 | 1,000.00 | 1,017.80 | 7.31 |

|

| |||

| Class R3 | 1,000.00 | 1,017.00 | 8.07 |

|

| |||

| Class R4 | 1,000.00 | 1,018.50 | 6.56 |

|

| |||

| Class R5 | 1,000.00 | 1,020.00 | 5.05 |

|

| |||

| Class R6 | 1,000.00 | 1,020.70 | 4.34 |

|

| |||

| Class T | 1,000.00 | 1,018.10 | 7.01 |

|

| |||

| Class ADV | 1,000.00 | 1,019.30 | 5.76 |

|

| |||

| Class NAV | 1,000.00 | 1,021.00 | 4.09 |

|

| |||

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.30%, 2.10%, 2.10%, 0.94%, 1.70%, 1.60%, 1.30%, 1.00%, 0.86% 1.39%, 1.14% and 0.81% for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class R6, Class T, Class ADV and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

2 Expenses are equal to the Fund’s annualized expense ratio of 1.45% for Class R2 shares, respectively, multiplied by the average account value over the period, multiplied by 31/365 (to reflect the period).

3 Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

| 10 | Rainier Growth Fund | Annual report |

Portfolio summary

| Top 10 Holdings (28.0% of Net Assets on 3-31-12)1,2 | ||||

|

| ||||

| Apple, Inc. | 6.8% | Precision Castparts Corp. | 2.2% | |

|

|

| |||

| Google, Inc., Class A | 3.3% | Costco Wholesale Corp. | 2.1% | |

|

|

| |||

| QUALCOMM, Inc. | 3.1% | EMC Corp. | 2.0% | |

|

|

| |||

| Schlumberger, Ltd. | 2.4% | American Tower Corp. | 1.9% | |

|

|

| |||

| Philip Morris International, Inc. | 2.4% | Allergan, Inc. | 1.8% | |

|

|

| |||

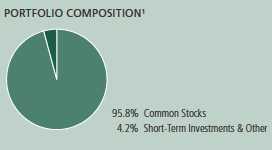

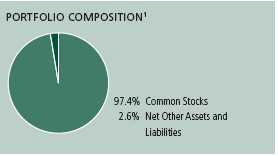

| Sector Composition1,3 | ||||

|

| ||||

| Information Technology | 33.8% | Energy | 6.8% | |

|

|

| |||

| Consumer Discretionary | 15.3% | Financials | 5.2% | |

|

|

| |||

| Health Care | 11.9% | Materials | 4.5% | |

|

|

| |||

| Consumer Staples | 10.4% | Telecommunication Services | 1.9% | |

|

|

| |||

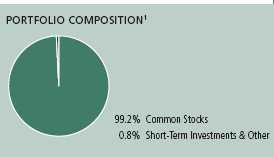

| Industrials | 9.4% | Short-Term Investments & Other | 0.8% | |

|

|

| |||

1 As a percentage of net assets on 3-31-12.

2 Cash and cash equivalents not included.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| Annual report | Rainier Growth Fund | 11 |

Fund’s investments

As of 3-31-12

| Shares | Value | |

| Common Stocks 99.2% | $1,248,840,331 | |

|

| ||

| (Cost $953,947,647) | ||

| Consumer Discretionary 15.3% | 192,165,634 | |

| Auto Components 0.8% | ||

|

| ||

| BorgWarner, Inc. (I)(L) | 120,790 | 10,187,429 |

| Hotels, Restaurants & Leisure 2.1% | ||

|

| ||

| Las Vegas Sands Corp. | 193,040 | 11,113,313 |

|

| ||

| Starbucks Corp. | 272,720 | 15,242,321 |

| Internet & Catalog Retail 1.8% | ||

|

| ||

| Amazon.com, Inc. (I) | 47,990 | 9,718,455 |

|

| ||

| priceline.com, Inc. (I)(L) | 17,840 | 12,800,200 |

| Media 1.0% | ||

|

| ||

| DIRECTV, Class A (I) | 255,150 | 12,589,101 |

| Specialty Retail 5.0% | ||

|

| ||

| Bed Bath & Beyond, Inc. (I) | 133,310 | 8,767,799 |

|

| ||

| Dick’s Sporting Goods, Inc. | 184,210 | 8,856,817 |

|

| ||

| Limited Brands, Inc. | 233,870 | 11,225,760 |

|

| ||

| O’Reilly Automotive, Inc. (I) | 106,490 | 9,727,862 |

|

| ||

| PetSmart, Inc. | 245,510 | 14,048,082 |

|

| ||

| Tractor Supply Company | 117,610 | 10,650,762 |

| Textiles, Apparel & Luxury Goods 4.6% | ||

|

| ||

| Coach, Inc. | 209,830 | 16,215,662 |

|

| ||

| Lululemon Athletica, Inc. (I) | 93,500 | 6,982,580 |

|

| ||

| NIKE, Inc., Class B | 201,915 | 21,895,663 |

|

| ||

| Ralph Lauren Corp. | 69,660 | 12,143,828 |

| Consumer Staples 10.4% | 131,457,006 | |

| Beverages 2.7% | ||

|

| ||

| Monster Beverage Corp. (I) | 214,640 | 13,326,998 |

|

| ||

| The Coca-Cola Company | 287,140 | 21,251,231 |

| Food & Staples Retailing 3.6% | ||

|

| ||

| Costco Wholesale Corp. | 292,520 | 26,560,816 |

|

| ||

| Whole Foods Market, Inc. | 224,110 | 18,645,952 |

| Personal Products 1.7% | ||

|

| ||

| The Estee Lauder Companies, Inc., Class A (L) | 355,770 | 22,036,394 |

| Tobacco 2.4% | ||

|

| ||

| Philip Morris International, Inc. | 334,450 | 29,635,615 |

| 12 | Rainier Growth Fund | Annual report | See notes to financial statements |

| Shares | Value | |

| Energy 6.8% | $85,980,117 | |

| Energy Equipment & Services 3.1% | ||

|

| ||

| Ensco International PLC, ADR | 164,630 | 8,713,866 |

|

| ||

| Schlumberger, Ltd. | 432,500 | 30,244,725 |

| Oil, Gas & Consumable Fuels 3.7% | ||

|

| ||

| Anadarko Petroleum Corp. | 177,170 | 13,879,498 |

|

| ||

| Noble Energy, Inc. | 158,980 | 15,545,064 |

|

| ||

| Plains Exploration & Production Company (I) | 412,590 | 17,596,964 |

| Financials 5.2% | 65,874,904 | |

| Capital Markets 1.5% | ||

|

| ||

| Invesco, Ltd. | 706,700 | 18,847,689 |

| Commercial Banks 1.5% | ||

|

| ||

| Wells Fargo & Company | 548,170 | 18,714,524 |

| Consumer Finance 1.2% | ||

|

| ||

| American Express Company | 263,500 | 15,246,110 |

| Diversified Financial Services 1.0% | ||

|

| ||

| IntercontinentalExchange, Inc. (I) | 95,085 | 13,066,581 |

| Health Care 11.9% | 149,224,520 | |

| Biotechnology 3.4% | ||

|

| ||

| Alexion Pharmaceuticals, Inc. (I) | 151,880 | 14,103,577 |

|

| ||

| Biogen Idec, Inc. (I) | 143,680 | 18,099,370 |

|

| ||

| Gilead Sciences, Inc. (I) | 209,980 | 10,257,523 |

| Health Care Equipment & Supplies 1.0% | ||

|

| ||

| Intuitive Surgical, Inc. (I) | 24,080 | 13,045,340 |

| Health Care Technology 1.3% | ||

|

| ||

| Cerner Corp. (I)(L) | 207,620 | 15,812,339 |

| Life Sciences Tools & Services 0.9% | ||

|

| ||

| Agilent Technologies, Inc. | 253,920 | 11,301,979 |

| Pharmaceuticals 5.3% | ||

|

| ||

| Allergan, Inc. | 241,095 | 23,007,696 |

|

| ||

| Novo Nordisk A/S, ADR (L) | 69,870 | 9,691,668 |

|

| ||

| Perrigo Company | 98,640 | 10,190,498 |

|

| ||

| Shire PLC, ADR | 141,160 | 13,374,910 |

|

| ||

| Valeant Pharmaceuticals International, Inc. (Toronto Exchange) (I)(L) | 192,580 | 10,339,620 |

| Industrials 9.4% | 118,045,830 | |

| Aerospace & Defense 2.2% | ||

|

| ||

| Precision Castparts Corp. | 162,960 | 28,175,784 |

| Air Freight & Logistics 1.1% | ||

|

| ||

| FedEx Corp. | 145,240 | 13,356,270 |

| Construction & Engineering 1.1% | ||

|

| ||

| Fluor Corp. | 222,940 | 13,385,318 |

| Electrical Equipment 1.8% | ||

|

| ||

| AMETEK, Inc. | 468,440 | 22,724,024 |

| Machinery 2.0% | ||

|

| ||

| Eaton Corp. | 260,390 | 12,975,234 |

|

| ||

| Joy Global, Inc. | 165,120 | 12,136,320 |

| See notes to financial statements | Annual report | Rainier Growth Fund | 13 |

| Shares | Value | |

| Professional Services 0.5% | ||

|

| ||

| Verisk Analytics, Inc., Class A (I) | 132,820 | $6,238,555 |

| Road & Rail 0.7% | ||

|

| ||

| CSX Corp. | 420,740 | 9,054,325 |

| Information Technology 33.8% | 425,717,475 | |

| Communications Equipment 6.6% | ||

|

| ||

| BancTec, Inc. (I)(R)(S) | 197,026 | 591,078 |

|

| ||

| Cisco Systems, Inc. | 667,630 | 14,120,375 |

|

| ||

| F5 Networks, Inc. (I) | 88,460 | 11,938,562 |

|

| ||

| JDS Uniphase Corp. (I) | 511,280 | 7,408,447 |

|

| ||

| QUALCOMM, Inc. | 568,640 | 38,678,893 |

|

| ||

| Riverbed Technology, Inc. (I) | 366,210 | 10,283,177 |

| Computers & Peripherals 8.8% | ||

|

| ||

| Apple, Inc. (I) | 143,420 | 85,975,987 |

|

| ||

| EMC Corp. (I) | 845,365 | 25,259,506 |

| Electronic Equipment, Instruments & Components 1.0% | ||

|

| ||

| Trimble Navigation, Ltd. (I) | 229,480 | 12,488,302 |

| Internet Software & Services 5.3% | ||

|

| ||

| Baidu, Inc., ADR (I) | 66,450 | 9,686,417 |

|

| ||

| eBay, Inc. (I) | 426,770 | 15,743,545 |

|

| ||

| Google, Inc., Class A (I) | 65,140 | 41,770,374 |

| IT Services 6.4% | ||

|

| ||

| Accenture PLC, Class A | 306,980 | 19,800,210 |

|

| ||

| Cognizant Technology Solutions Corp., Class A (I) | 163,460 | 12,578,247 |

|

| ||

| MasterCard, Inc., Class A | 47,290 | 19,887,337 |

|

| ||

| Teradata Corp. (I) | 139,910 | 9,534,867 |

|

| ||

| Visa, Inc., Class A | 160,475 | 18,936,050 |

| Semiconductors & Semiconductor Equipment 0.9% | ||

|

| ||

| Avago Technologies, Ltd. | 273,800 | 10,669,986 |

| Software 4.8% | ||

|

| ||

| Autodesk, Inc. (I) | 365,810 | 15,481,079 |

|

| ||

| Check Point Software Technologies, Ltd. (I) | 212,190 | 13,546,210 |

|

| ||

| Citrix Systems, Inc. (I) | 129,540 | 10,222,001 |

|

| ||

| Intuit, Inc. | 209,370 | 12,589,418 |

|

| ||

| Salesforce.com, Inc. (I)(L) | 55,190 | 8,527,407 |

| Materials 4.5% | 56,849,485 | |

| Chemicals 4.5% | ||

|

| ||

| Ecolab, Inc. | 293,640 | 18,123,461 |

|

| ||

| Monsanto Company | 242,080 | 19,308,301 |

|

| ||

| Praxair, Inc. | 169,380 | 19,417,723 |

| Telecommunication Services 1.9% | 23,525,360 | |

| Diversified Telecommunication Services 1.9% | ||

|

| ||

| American Tower Corp. | 373,300 | 23,525,360 |

| 14 | Rainier Growth Fund | Annual report | See notes to financial statements |

| Yield (%) | Shares | Value | |

| Securities Lending Collateral 4.1% | $51,298,236 | ||

|

| |||

| (Cost $51,283,040) | |||

| John Hancock Collateral Investment Trust (W) | 0.3698 (Y) | 5,125,416 | 51,298,236 |

| Par value | Value | ||

| Short-Term Investments 1.0% | $13,152,000 | ||

|

| |||

| (Cost $13,152,000) | |||

| Repurchase Agreement 1.0% | 13,152,000 | ||

| Repurchase Agreement with State Street Corp. dated 3-30-12 at | |||

| 0.010% to be repurchased at $13,152,011 on 4-2-12, collateralized | |||

| by $13,400,000 Federal Home Loan Mortgage Corp., 0.400% due | |||

| 2-27-14 (valued at $13,416,750, including interest) | $13,152,000 | 13,152,000 | |

| Total investments (Cost $1,018,382,687)† 104.3% | $1,313,290,567 | ||

|

| |||

| Other assets and liabilities, net (4.3%) | ($54,184,098) | ||

|

| |||

| Total net assets 100.0% | $1,259,106,469 | ||

|

| |||

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

ADR American Depositary Receipts

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of 3-31-12.

(R) Direct placement securities are restricted to resale and the Fund has limited rights to registration under the Securities Act of 1933.

| Value as a percentage of | Value as of | |||

| Issuer, description | Acquisition date | Acquisition cost | Fund’s net assets | 3-31-12 |

|

| ||||

| BancTec, Inc. | 6-20-07 | $4,728,640 | 0.05% | $591,078 |

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(W) Investment is an affiliate of the Fund, the adviser and/or subadviser. Also, it represents the investment of securities lending collateral received.

(Y) The rate shown is the annualized seven-day yield as of 3-31-12.

† At 3-31-12, the aggregate cost of investment securities for federal income tax purposes was $1,027,053,446. Net unrealized appreciation aggregated $286,237,121, of which $294,458,148 related to appreciated investment securities and $8,221,027 related to depreciated investment securities.

| See notes to financial statements | Annual report | Rainier Growth Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 3-31-12

This Statement of assets and liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| Assets | |

|

| |

| Investments in unaffiliated issuers, at value (Cost $967,099,647) including | |

| $50,266,191 of securities loaned | $1,261,992,331 |

| Investments in affiliated issuers, at value (Cost $51,283,040) | 51,298,236 |

| Total investments, at value (Cost $1,018,382,687) | 1,313,290,567 |

| Cash | 170 |

| Receivable for investments sold | 10,277,348 |

| Receivable for fund shares sold | 823,009 |

| Dividends and interest receivable | 1,054,148 |

| Receivable for securities lending income | 12,396 |

| Receivable due from adviser | 873 |

| Other receivables and prepaid expenses | 268,355 |

| Total assets | 1,325,726,866 |

| Liabilities | |

|

| |

| Payable for investments purchased | 5,994,822 |

| Payable for fund shares repurchased | 8,962,117 |

| Payable upon return of securities loaned | 51,284,304 |

| Payable to affiliates | |

| Accounting and legal services fees | 19,146 |

| Transfer agent fees | 107,733 |

| Distribution and service fees | 79 |

| Trustees’ fees | 72,075 |

| Other liabilities and accrued expenses | 180,121 |

| Total liabilities | 66,620,397 |

| Net assets | |

|

| |

| Paid-in capital | $1,156,455,234 |

| Accumulated net investment loss | (746,014) |

| Accumulated net realized loss on investments and foreign | |

| currency transactions | (191,510,631) |

| Net unrealized appreciation (depreciation) on investments | 294,907,880 |

| Net assets | $1,259,106,469 |

| 16 | Rainier Growth Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| Net asset value per share | |

|

| |

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($368,580,748 ÷ 16,138,319 shares) | $22.84 |

| Class B ($25,131,951 ÷ 1,131,277 shares)1 | $22.22 |

| Class C ($19,702,233 ÷ 887,156 shares)1 | $22.21 |

| Class I ($255,961,001 ÷ 11,015,042 shares) | $23.24 |

| Class R1 ($279,941 ÷ 12,416 shares) | $22.55 |

| Class R2 ($103,651 ÷ 4,454 shares) | $23.27 |

| Class R3 ($100,830 ÷ 4,452 shares) | $22.65 |

| Class R4 ($102,025 ÷ 4,452.36 shares) | $22.91 |

| Class R5 ($103,235 ÷ 4,458 shares) | $23.16 |

| Class R6 ($4,192,488 ÷ 180,174 shares) | $23.27 |

| Class T ($77,126,602 ÷ 3,399,737 shares) | $22.69 |

| Class ADV ($20,446,930 ÷ 887,132 shares) | $23.05 |

| Class NAV ($487,274,834 ÷ 20,933,205 shares) | $23.28 |

| Maximum offering price per share | |

|

| |

| Class A (net asset value per share ÷ 95%)2 | $24.04 |

| Class T (net asset value per share ÷ 95%)2 | $23.88 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| See notes to financial statements | Annual report | Rainier Growth Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 3-31-12

This Statement of operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

|

| |

| Dividends | $11,488,301 |

| Securities lending | 167,163 |

| Interest | 1,254 |

| Less foreign taxes withheld | (118,787) |

| Total investment income | 11,537,931 |

| Expenses | |

|

| |

| Investment management fees | 10,548,332 |

| Distribution and service fees | 1,645,048 |

| Accounting and legal services fees | 219,160 |

| Transfer agent fees | 1,214,509 |

| Trustees’ fees | 99,154 |

| State registration fees | 167,454 |

| Printing and postage | 138,797 |

| Professional fees | 157,485 |

| Custodian fees | 189,341 |

| Registration and filing fees | 44,885 |

| Other | 19,904 |

| Total expenses | 14,444,069 |

| Less expense reductions | (104,477) |

| Net expenses | 14,339,592 |

| Net investment loss | (2,801,661) |

| Realized and unrealized gain (loss) | |

|

| |

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | 120,268,276 |

| Investments in affiliated issuers | (1,558) |

| Capital gain distributions received from affiliated underlying funds | 2,220 |

| Foreign currency transactions | 525 |

| 120,269,463 | |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | (57,592,223) |

| Investments in affiliated issuers | 13,032 |

| Translation of assets and liabilities in foreign currencies | (544) |

| (57,579,735) | |

| Net realized and unrealized gain | 62,689,728 |

| Increase in net assets from operations | $59,888,067 |

| 18 | Rainier Growth Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of changes in net assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| Year | Year | ||

| ended | ended | ||

| 3-31-12 | 3-31-11 | ||

| Increase (decrease) in net assets | |||

|

| |||

| From operations | |||

| Net investment loss | ($2,801,661) | ($892,366) | |

| Net realized gain | 120,269,463 | 130,626,108 | |

| Change in net unrealized appreciation (depreciation) | (57,579,735) | 102,962,390 | |

| Increase in net assets resulting from operations | 59,888,067 | 232,696,132 | |

| Distributions to shareholders | |||

| From net investment income | |||

| Class I | — | (217,850) | |

| Class R5 | — | (41) | |

| Class NAV | — | (907,978) | |

| Total distributions | — | (1,125,869) | |

| From Fund share transactions | (422,108,385) | (72,729,494) | |

| Total increase (decrease) | (362,220,318) | 158,840,769 | |

| Net assets | |||

|

| |||

| Beginning of year | 1,621,326,787 | 1,462,486,018 | |

| End of year | $1,259,106,469 | $1,621,326,787 | |

| Accumulated net investment loss | ($746,014) | ($54,521) | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 19 |

Financial highlights

The Financial highlights show how the Fund’s net asset value for a share has changed during the period.

| CLASS A SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | 3-31-082 |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.32 | $18.31 | $12.84 | $20.91 | $20.44 |

| Net investment loss | (0.09)3 | (0.06)3 | (0.03)3 | (0.01)3 | (0.02) |

| Net realized and unrealized gain (loss) on investments | 1.61 | 3.07 | 5.50 | (8.06) | 0.49 |

| Total from investment operations | 1.52 | 3.01 | 5.47 | (8.07) | 0.47 |

| Net asset value, end of period | $22.84 | $21.32 | $18.31 | $12.84 | $20.91 |

| Total return (%)4 | 7.13 | 16.44 | 42.605 | (38.59)5 | 2.305 |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $369 | $413 | $384 | $193 | $164 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.27 | 1.30 | 1.45 | 1.47 | 1.176 |

| Expenses net of fee waivers | 1.27 | 1.30 | 1.38 | 1.18 | 1.196 |

| Expenses net of fee waivers and credits | 1.27 | 1.30 | 1.34 | 1.18 | 1.196 |

| Net investment loss | (0.45) | (0.33) | (0.18) | (0.04) | (0.27) |

| Portfolio turnover (%) | 90 | 90 | 102 | 101 | 86 |

1 After the close of business on 4-25-08, holders of Original Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class A shares of the John Hancock Rainier Growth Fund. These shares were first offered on 4-28-08. Additionally, the accounting and performance history of the Original Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class A.

2 Audited by previous independent registered public accounting firm.

3 Based on the average daily shares outstanding.

4 Does not reflect the effect of sales charges, if any.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Prior to the reorganization, the Fund was subject to a contractual expense reimbursement and recoupment plan.

| CLASS B SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $20.90 | $18.10 | $12.79 | $22.46 | |

| Net investment loss2 | (0.25) | (0.21) | (0.15) | (0.09) | |

| Net realized and unrealized gain (loss) on investments | 1.57 | 3.01 | 5.46 | (9.58) | |

| Total from investment operations | 1.32 | 2.80 | 5.31 | (9.67) | |

| Net asset value, end of period | $22.22 | $20.90 | $18.10 | $12.79 | |

| Total return (%)3 | 6.32 | 15.474 | 41.524 | (43.05)4,5 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $25 | $31 | $37 | $27 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 2.07 | 2.13 | 2.45 | 2.826 | |

| Expenses net of fee waivers | 2.07 | 2.10 | 2.11 | 2.056 | |

| Expenses net of fee waivers and credits | 2.07 | 2.10 | 2.09 | 2.046 | |

| Net investment loss | (1.24) | (1.13) | (0.94) | (0.75)6 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1017 | |

1 The inception date for Class B shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| 20 | Rainier Growth Fund | Annual report | See notes to financial statements |

| CLASS C SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $20.90 | $18.10 | $12.79 | $22.46 | |

| Net investment loss2 | (0.26) | (0.21) | (0.15) | (0.09) | |

| Net realized and unrealized gain (loss) on investments | 1.57 | 3.01 | 5.46 | (9.58) | |

| Total from investment operations | 1.31 | 2.80 | 5.31 | (9.67) | |

| Net asset value, end of period | $22.21 | $20.90 | $18.10 | $12.79 | |

| Total return (%)3,4 | 6.27 | 15.47 | 41.52 | (43.05)5 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $20 | $22 | $24 | $15 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 2.11 | 2.16 | 2.34 | 2.826 | |

| Expenses net of fee waivers | 2.10 | 2.10 | 2.21 | 2.056 | |

| Expenses net of fee waivers and credits | 2.10 | 2.10 | 2.09 | 2.046 | |

| Net investment loss | (1.27) | (1.13) | (0.93) | (0.77)6 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1017 | |

1 The inception date for Class C shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| CLASS I SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | 3-31-082 |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.61 | $18.50 | $12.92 | $20.98 | $20.44 |

| Net investment income (loss)3 | (0.02) | 0.02 | 0.04 | 0.04 | —4 |

| Net realized and unrealized gain (loss) on investments | 1.65 | 3.11 | 5.54 | (8.09) | 0.54 |

| Total from investment operations | 1.63 | 3.13 | 5.58 | (8.05) | 0.54 |

| Less distributions | |||||

| From net investment income | — | (0.02) | —4 | (0.01) | — |

| Net asset value, end of period | $23.24 | $21.61 | $18.50 | $12.92 | $20.98 |

| Total return (%) | 7.54 | 16.93 | 43.20 | (38.36) | 2.64 |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $256 | $237 | $208 | $133 | $136 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 0.91 | 0.86 | 0.90 | 0.86 | 0.925 |

| Expenses net of fee waivers and credits | 0.91 | 0.86 | 0.90 | 0.86 | 0.945 |

| Net investment income (loss) | (0.08) | 0.10 | 0.26 | 0.22 | (0.02) |

| Portfolio turnover (%) | 90 | 90 | 102 | 101 | 86 |

1 After the close of business on 4-25-08, holders of Institutional Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class I shares of the John Hancock Rainier Growth Fund. These shares were first offered on 4-28-08. Additionally, the accounting and performance history of the Institutional Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class I.

2 Audited by previous independent registered public accounting firm.

3 Based on the average daily shares outstanding.

4 Less than ($0.005) per share.

5 Prior to the reorganization, the Fund was subject to a contractual expense reimbursement and recoupment plan.

| See notes to financial statements | Annual report | Rainier Growth Fund | 21 |

| CLASS R1 SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.14 | $18.23 | $12.84 | $22.46 | |

| Net investment loss2 | (0.17) | (0.14) | (0.11) | (0.08) | |

| Net realized and unrealized gain (loss) on investments | 1.58 | 3.05 | 5.50 | (9.54) | |

| Total from investment operations | 1.41 | 2.91 | 5.39 | (9.62) | |

| Net asset value, end of period | $22.55 | $21.14 | $18.23 | $12.84 | |

| Total return (%)3 | 6.67 | 15.96 | 41.98 | (42.83)4 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —5 | —5 | —5 | —5 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 7.03 | 8.39 | 13.91 | 8.706 | |

| Expenses net of fee waivers and credits | 1.70 | 1.72 | 1.78 | 1.646 | |

| Net investment loss | (0.86) | (0.75) | (0.65) | (0.50)6 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1017 | |

1 The inception date for Class R1 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| CLASS R2 SHARES Period ended | 3-31-121 |

| Per share operating performance | |

|

| |

| Net asset value, beginning of period | $22.45 |

| Net investment loss2 | —3 |

| Net realized and unrealized gain on investments | 0.82 |

| Total from investment operations | 0.82 |

| Net asset value, end of period | $23.27 |

| Total return (%)4 | 3.655 |

| Ratios and supplemental data | |

|

| |

| Net assets, end of period ended (in millions) | —6 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 15.967 |

| Expenses net of all fee waivers and credits | 1.457 |

| Net investment loss | (0.12)7 |

| Portfolio turnover (%) | 908 |

1 The inception date for Class R2 shares is 3-1-12.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from 4-1-11 to 3-31-12.

| 22 | Rainier Growth Fund | Annual report | See notes to financial statements |

| CLASS R3 SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.21 | $18.27 | $12.85 | $22.46 | |

| Net investment loss2 | (0.16) | (0.12) | (0.07) | (0.06) | |

| Net realized and unrealized gain (loss) on investments | 1.60 | 3.06 | 5.49 | (9.55) | |

| Total from investment operations | 1.44 | 2.94 | 5.42 | (9.61) | |

| Net asset value, end of period | $22.65 | $21.21 | $18.27 | $12.85 | |

| Total return (%)3 | 6.79 | 16.09 | 42.18 | (42.79)4 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —5 | —5 | —5 | —5 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 15.86 | 16.72 | 13.68 | 8.576 | |

| Expenses net of fee waivers and credits | 1.59 | 1.61 | 1.62 | 1.546 | |

| Net investment loss | (0.76) | (0.64) | (0.46) | (0.40)6 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1017 | |

1 The inception date for Class R3 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| CLASS R4 SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.40 | $18.38 | $12.88 | $22.46 | |

| Net investment loss2 | (0.10) | (0.06) | (0.03) | (0.02) | |

| Net realized and unrealized gain (loss) on investments | 1.61 | 3.08 | 5.53 | (9.56) | |

| Total from investment operations | 1.51 | 3.02 | 5.50 | (9.58) | |

| Net asset value, end of period | $22.91 | $21.40 | $18.38 | $12.88 | |

| Total return (%)3 | 7.06 | 16.43 | 42.70 | (42.65)4 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —5 | —5 | —5 | —5 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 15.46 | 16.45 | 13.33 | 8.266 | |

| Expenses net of fee waivers and credits | 1.29 | 1.31 | 1.32 | 1.246 | |

| Net investment loss | (0.46) | (0.34) | (0.16) | (0.10)6 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1017 | |

1 The inception date for Class R4 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| See notes to financial statements | Annual report | Rainier Growth Fund | 23 |

| CLASS R5 SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.56 | $18.47 | $12.91 | $22.46 | |

| Net investment income (loss)2 | (0.03) | (0.02) | 0.02 | 0.03 | |

| Net realized and unrealized gain (loss) on investments | 1.63 | 3.12 | 5.54 | (9.57) | |

| Total from investment operations | 1.60 | 3.10 | 5.56 | (9.54) | |

| Less distributions | |||||

| From net investment income | — | (0.01) | —3 | (0.01) | |

| Net asset value, end of period | $23.16 | $21.56 | $18.47 | $12.91 | |

| Total return (%)4 | 7.42 | 16.78 | 43.07 | (42.48)5 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —6 | —6 | —6 | —6 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 15.07 | 16.17 | 12.97 | 7.957 | |

| Expenses net of fee waivers and credits | 0.99 | 1.01 | 1.02 | 0.947 | |

| Net investment income | (0.16) | (0.03) | 0.14 | 0.207 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1018 | |

1 The inception date for Class R5 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| CLASS R6 SHARES Period ended | 3-31-121 |

| Per share operating performance | |

|

| |

| Net asset value, beginning of period | $20.01 |

| Net investment income2 | 0.03 |

| Net realized and unrealized gain on investments | 3.23 |

| Total from investment operations | 3.26 |

| Net asset value, end of period | $23.27 |

| Total return (%)3 | 16.294 |

| Ratios and supplemental data | |

|

| |

| Net assets, end of period (in millions) | $4 |

| Ratios (as a percentage of average net assets): | |

| Expenses before reductions | 1.585 |

| Expenses net of fee waivers and credits | 0.865 |

| Net investment income | 0.205 |

| Portfolio turnover (%) | 906 |

1 The inception date for Class R6 shares is 9-1-11.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Annualized.

6 Portfolio turnover is shown for the period from 4-1-11 to 3-31-12.

| 24 | Rainier Growth Fund | Annual report | See notes to financial statements |

| CLASS T SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.20 | $18.24 | $12.86 | $16.59 | |

| Net investment loss2 | (0.11) | (0.09) | (0.11) | (0.05) | |

| Net realized and unrealized gain (loss) on investments | 1.60 | 3.05 | 5.49 | (3.68) | |

| Total from investment operations | 1.49 | 2.96 | 5.38 | (3.73) | |

| Net asset value, end of period | $22.69 | $21.20 | $18.24 | $12.86 | |

| Total return (%)3 | 7.03 | 16.23 | 41.84 | (22.48)4,5 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $77 | $83 | $83 | $72 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.37 | 1.47 | 1.84 | 2.076 | |

| Expenses net of fee waivers | 1.37 | 1.47 | 1.84 | 1.996 | |

| Expenses net of fee waivers and credits | 1.37 | 1.47 | 1.84 | 1.986 | |

| Net investment loss | (0.54) | (0.50) | (0.69) | (0.74)6 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1017 | |

1 The inception date for Class T shares is 10-6-08.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| CLASS ADV SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.49 | $18.43 | $12.90 | $22.46 | |

| Net investment income (loss)2 | (0.06) | (0.03) | —3 | (0.01) | |

| Net realized and unrealized gain (loss) on investments | 1.62 | 3.09 | 5.53 | (9.55) | |

| Total from investment operations | 1.56 | 3.06 | 5.53 | (9.56) | |

| Net asset value, end of period | $23.05 | $21.49 | $18.43 | $12.90 | |

| Total return (%) | 7.264 | 16.604 | 42.874 | (42.56)5 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $20 | $22 | $18 | $17 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.35 | 1.37 | 1.25 | 1.146 | |

| Expenses net of fee waivers and credits | 1.14 | 1.14 | 1.14 | 1.146 | |

| Net investment income (loss) | (0.31) | (0.17) | 0.01 | (0.04)6 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1017 | |

1 The inception date for Class ADV shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| See notes to financial statements | Annual report | Rainier Growth Fund | 25 |

| CLASS NAV SHARES Period ended | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 | |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $21.63 | $18.51 | $12.91 | $22.46 | |

| Net investment income2 | 0.01 | 0.03 | 0.05 | 0.04 | |

| Net realized and unrealized gain (loss) on investments | 1.64 | 3.11 | 5.55 | (9.57) | |

| Total from investment operations | 1.65 | 3.14 | 5.60 | (9.53) | |

| Less distributions | |||||

| From net investment income | — | (0.02) | —3 | (0.02) | |

| Net asset value, end of period | $23.28 | $21.63 | $18.51 | $12.91 | |

| Total return (%) | 7.63 | 17.00 | 43.38 | (42.44)4 | |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $487 | $813 | $708 | $400 | |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 0.80 | 0.80 | 0.82 | 0.835 | |

| Expenses net of fee waivers and credits | 0.80 | 0.80 | 0.82 | 0.835 | |

| Net investment income | 0.05 | 0.16 | 0.33 | 0.265 | |

| Portfolio turnover (%) | 90 | 90 | 102 | 1016 | |

1 The inception date for Class NAV shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Not annualized.

5 Annualized.

6 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| 26 | Rainier Growth Fund | Annual report | See notes to financial statements |

Notes to financial statements

Note 1 — Organization

John Hancock Rainier Growth Fund (the Fund) is a series of John Hancock Funds III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek to maximize long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A, Class B and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R1, Class R2, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Class R6 shares are available only to certain retirement plans, institutions and other investors. Class T and Class ADV shares are closed to new investors. Class NAV shares are sold to John Hancock affiliated funds of funds. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, printing and postage, transfer agent fees and state registration fees for each class may differ. Class B shares convert to Class A shares eight years after purchase. Certain Class I shares may be exchanged for Class R6 shares within one year after the commencement of operations of Class R6.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

| Annual report | Rainier Growth Fund | 27 |

The following is a summary of the values by input classification of the Fund’s investments as of March 31, 2012, by major security category or type:

| LEVEL 3 | ||||

| LEVEL 2 | SIGNIFICANT | |||

| TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE | |

| VALUE AT 3-31-12 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS | |

|

| ||||

| Common Stocks | ||||

| Consumer Discretionary | $192,165,634 | $192,165,634 | — | — |

| Consumer Staples | 131,457,006 | 131,457,006 | — | — |

| Energy | 85,980,117 | 85,980,117 | — | — |

| Financials | 65,874,904 | 65,874,904 | — | — |

| Health Care | 149,224,520 | 149,224,520 | — | — |

| Industrials | 118,045,830 | 118,045,830 | — | — |

| Information Technology | 425,717,475 | 425,126,397 | — | $591,078 |

| Materials | 56,849,485 | 56,849,485 | — | — |

| Telecommunication | ||||

| Services | 23,525,360 | 23,525,360 | — | — |

| Securities Lending | ||||

| Collateral | 51,298,236 | 51,298,236 | — | — |

| Short-Term Investments | 13,152,000 | — | $13,152,000 | — |

|

| ||||

| Total Investments in | ||||

| Securities | $1,313,290,567 | $1,299,547,489 | $13,152,000 | $591,078 |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. During the year ended March 31, 2012, there were no significant transfers into or out of Level 1, Level 2 or Level 3.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Investments by the Funds in open-end mutual funds, including John Hancock Collateral Investment Trust (JHCIT), are valued at their respective net asset values each business day. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees.

Repurchase agreements. The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement, it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income is recorded when the Fund becomes aware of the dividends. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

| 28 | Rainier Growth Fund | Annual report |

Securities lending. The Fund may lend its securities to earn additional income. It receives cash collateral from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, an affiliate of the Fund, and as a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Net income received from JHCIT is a component of securities lending income as recorded on the Statement of operations.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any Fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with Citibank N.A. which enables them to participate in a $100 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. For the year ended March 31, 2012, the Fund had no borrowings under the line of credit.

Expenses. Expenses that are directly attributable to an individual fund are allocated to the Fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses, and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net asset value of the class. Class-specific expenses, such as distribution and service fees, if any, printing and postage, transfer agent fees and state registration fees, for all classes, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Any losses incurred during those taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

For federal income tax purposes, the Fund has a capital loss carryforward of $154,254,966 available to offset future net realized capital gains as of March 31, 2012.

| Annual report | Rainier Growth Fund | 29 |

The following table details the capital loss carryforward available as of March 31, 2012:

| CAPITAL LOSS CARRYFORWARD EXPIRING AT MARCH 31 | |||

| 2016 | 2017 | 2018 | |

|

|

|||

| $17,658,687 | $20,700,267 | $115,896,012 | |

Availability of a certain amount of the loss carryforward, which was acquired in a merger, may be limited in a given year. Net capital losses of $28,584,906, that are the result of security transactions occurring after October 31, 2011, are treated as occurring on April 1, 2012, the first day of the Fund’s next taxable year.

Qualified late year ordinary losses of $689,951 are treated as occurring on April 1, 2012, the first day of the Fund’s next taxable year.

As of March 31, 2012, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, annually. The tax character of distributions for the year ended March 31, 2012 and year ended March 31, 2011 was as follows:

| MARCH 31, 2012 | MARCH 31, 2011 | |||

|

|

||||

| Ordinary Income | — | $1,125,869 | ||

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class. As of March 31, 2012, the Fund has no distributable earnings on a tax basis.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to net operating losses, expiration of capital loss carryforward, wash sale loss deferrals and litigation proceeds.

New accounting pronouncement. In May 2011, Accounting Standards Update 2011-04 (ASU 2011-04), Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs, was issued and is effective during interim and annual periods beginning after December 15, 2011. ASU 2011-04 may result in additional disclosure for transfers between levels as well as expanded disclosure for securities categorized as Level 3 under the fair value hierarchy.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

| 30 | Rainier Growth Fund | Annual report |

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Fund. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser based on aggregate net assets of the Fund and John Hancock Growth Equity Trust (Growth Equity). Growth Equity is a series of John Hancock Variable Insurance Trust (JHVIT), an affiliate of the Fund, managed by the Adviser. The management fee is equivalent, on an annual basis, to the sum of: (a) 0.750% of the first $3,000,000,000 of the Fund’s aggregate net assets; (b) 0.725% of the next $3,000,000,000; and (c) 0.700% of the Fund’s aggregate net assets in excess of $6,000,000,000. The Adviser has a subadvisory agreement with Rainier Investment Management, Inc. The Fund is not responsible for payment of the subadvisory fees.

The Adviser has agreed to reimburse or limit certain expenses for each share class of the Fund. This agreement excludes certain expenses such as taxes, portfolio brokerage commissions, interest expense, litigation and indemnification expenses, shareholder services fees and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The fee waivers and/or expense reimbursements are such that these expenses will not exceed 1.35%, 2.10%, 2.10%, 1.04%, 1.70%, 1.45%, 1.60%, 1.30%, 1.00%, 0.86%, 1.40% and 1.14% for Class A, Class B, Class C, Class I, Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class T and Class ADV shares, respectively. The fee waivers and/or expense reimbursements will continue in effect until June 30, 2012 for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class T and Class ADV shares and June 30, 2013 for Class R2 and Class R6 shares, unless renewed by mutual agreement of the Fund and the Adviser based upon a determination that this is appropriate under the circumstances at the time. Prior to August 1, 2011, the fee waivers and/or reimbursements were such that the above expenses would not exceed 1.69%, 1.59%, 1.29% and 0.99% for Class R1, Class R3, Class R4 and Class R5 shares, respectively and the limits for the remainder of the share classes above were unchanged.

For the year ended March 31, 2012, expense reductions amounted to the following:

| EXPENSE | |||||

| CLASS | REDUCTIONS | ||||

|

|

|||||

| Class A | — | ||||

| Class B | — | ||||

| Class C | $1,688 | ||||

| Class I | — | ||||

| Class R1 | 12,427 | ||||

| Class R2 | 1,215 | ||||

| Class R3 | 12,950 | ||||

| Class R4 | 12,993 | ||||

| Class R5 | 13,039 | ||||

| Class R6 | 8,548 | ||||

| Class T | — | ||||

| Class ADV | 41,617 | ||||

| Total | $104,477 | ||||

The investment management fees, including the impact of the waivers and expense reimbursements described above, incurred for the year ended March 31, 2012 were equivalent to the net annual effective rate of 0.74% of the Fund’s average daily net assets.

| Annual report | Rainier Growth Fund | 31 |

Accounting and legal services. Pursuant to a service agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred These accounting and legal services fees incurred for the year ended March 31, 2012 amounted to an annual rate of 0.02% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A, Class B, Class C, Class R1, Class R2, Class R3, Class R4, Class T and Class ADV shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. In addition, under a service plan for Class R1, Class R2, Class R3, Class R4 and Class R5 shares, the Fund pays for certain other services. The Fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares.

| CLASS | 12b–1 FEE | SERVICE FEE | ||

|

|

||||

| Class A | 0.30% | — | ||

| Class B | 1.00% | — | ||

| Class C | 1.00% | — | ||

| Class R1 | 0.50% | 0.25% | ||

| Class R2 | 0.25% | 0.25% | ||

| Class R3 | 0.50% | 0.15% | ||

| Class R4 | 0.25% | 0.10% | ||

| Class R5 | — | 0.05% | ||

| Class T | 0.30% | — | ||

| Class ADV | 0.25% | — | ||

Currently, only 0.25% is charged to Class A shares for 12b-1 fees.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $105,725 for the year ended March 31, 2012. Of this amount, $12,059 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $76,225 was paid as sales commissions to broker-dealers and $17,441 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a broker-dealer affiliate of the Adviser.

Class B and Class C shares are subject to contingent deferred sales charges (CDSC). Class B shares that are redeemed within six years of purchase are subject to CDSC, at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC on the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the year ended March 31, 2012, CDSCs received by the Distributor amounted to $31,878 and $841 for Class B and Class C shares, respectively.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Adviser. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of

| 32 | Rainier Growth Fund | Annual report |