| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| FORM N-CSR | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED | |

| MANAGEMENT INVESTMENT COMPANIES | |

| Investment Company Act file number 811-21777 | |

| John Hancock Funds III | |

| (Exact name of registrant as specified in charter) | |

| 601 Congress Street, Boston, Massachusetts 02210 | |

| (Address of principal executive offices) (Zip code) | |

| Salvatore Schiavone | |

| Treasurer | |

| 601 Congress Street | |

| Boston, Massachusetts 02210 | |

| (Name and address of agent for service) | |

| Registrant's telephone number, including area code: 617-663-4497 | |

| Date of fiscal year end: | February 28 |

| Date of reporting period: | February 28, 2011 |

ITEM 1. REPORTS TO STOCKHOLDERS.

Management’s discussion of

Fund performance

By Grantham, Mayo, Van Otterloo & Co. LLC

U.S. stocks delivered solid gains during the 12 months ended February 28, 2011, all of them occurring in the second half of the period. The first six months saw the market struggle with concern about the European sovereign debt crisis, weakness in the energy sector following a massive oil spill in the Gulf of Mexico and tepid data on the U.S. economy. However, after Fed Chairman Ben Bernanke proposed another round of quantitative easing at the end of August to stimulate economic growth, his remarks ignited an impressive rally that boosted the S&P 500 Index to a gain of 22.57%, while the average large blend fund monitored by Morningstar, Inc. advanced 20.92%.

During the 12-month period, John Hancock U.S. Core Fund’s Class A shares returned 14.26% at net asset value, trailing the S&P 500 Index and the Morningstar peer average. The Fund’s emphasis on quality was the main factor weighing on its results, particularly overweightings in health care and consumer staples, which underperformed the broader market. Conversely, the Fund had light exposures to outperforming cyclical sectors such as energy, materials and industrials. At the stock level, Microsoft Corp. was the Fund’s biggest detractor and largest holding at period end. In health care, drug manufacturer Merck & Company, Inc., health/personal products maker Johnson & Johnson and medical device maker Medtronic, Inc. held back performance. Positions in consumer staples holdings Wal-Mart Stores, Inc. and The Procter & Gamble Company also were unrewarding. Additionally, underweighting strong-performing energy companies Exxon Mobil Corp. and Schlumberger, Ltd. detracted. On the positive side, the Fund benefited from underweighting or not owning several weak-performing commercial banks, notably Bank of America Corp. and JPMorgan Chase & Co. Overweighting consumer electronics and computer maker Apple, Inc. also added value, as did wireless infrastructure manufacturer QUALCOMM, Inc. and enterprise software maker Oracle Corp.

This commentary reflects the views of the portfolio management team through the end of the Fund’s period discussed in this report. The team’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| 6 | U.S. Core Fund | Annual report |

A look at performance

For the period ended February 28, 2011

| Average annual total returns (%) | Cumulative total returns (%) | ||||||||

| with maximum sales charge (POP) | with maximum sales charge (POP) | ||||||||

|

| |||||||||

| Since | Since | ||||||||

| 1-year | 5-year | 10-year | inception | 1-year | 5-year | 10-year | inception | ||

|

| |||||||||

| Class A1 | 8.53 | — | — | –0.02 | 8.53 | — | — | –0.08 | |

|

| |||||||||

| Class B1 | 8.51 | — | — | –0.02 | 8.51 | — | — | –0.09 | |

|

| |||||||||

| Class C1 | 12.52 | — | — | 0.38 | 12.52 | — | — | 1.79 | |

|

| |||||||||

| Class i1,2 | 14.81 | — | — | 1.50 | 14.81 | — | — | 7.28 | |

|

| |||||||||

| Class R11,2 | 13.92 | — | — | 0.84 | 13.92 | — | — | 4.03 | |

|

| |||||||||

| Class R32,3 | 13.99 | — | — | 20.21 | 13.99 | — | — | 38.64 | |

|

| |||||||||

| Class R42,3 | 14.37 | — | — | 20.57 | 14.37 | — | — | 39.38 | |

|

| |||||||||

| Class R52,3 | 14.68 | — | — | 20.93 | 14.68 | — | — | 40.12 | |

|

| |||||||||

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B shares and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable for Class I, Class R1, Class R3, Class R4 and Class R5 shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 6-30-11. The net expenses are as follows: Class A — 1.35%, Class B — 2.05%, Class C — 2.05%, Class I — 0.89%, Class R1 — 1.64%. Class R3 — 1.54%, Class R4 — 1.24% and Class R5 — 0.94%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.91%, Class B —7.27%, Class C — 3.86%, Class I — 1.33%, Class R1 — 19.92%, Class R3 — 7.43%, Class R4 — 7.17% and Class R5 — 6.92%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

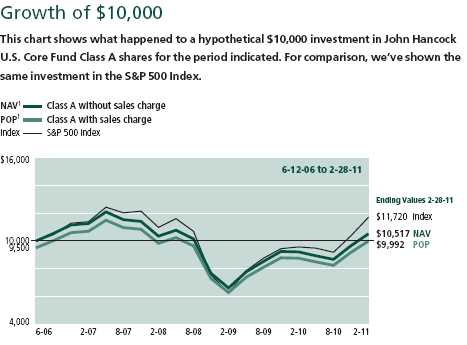

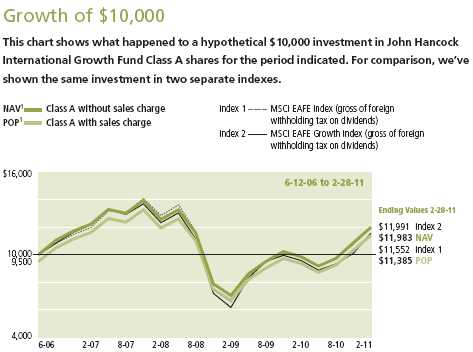

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

1 From 6-12-06.

2 For certain types of investors, as described in the Fund’s Class I, Class R1, Class R3, Class R4 and Class R5 share prospectuses.

3 From 5-22-09.

| Annual report | U.S. Core Fund | 7 |

A look at performance

| Period | Without | With maximum | ||

| beginning | sales charge | sales charge | Index | |

|

| ||||

| Class B | 6-12-06 | $10,184 | $9,991 | $11,720 |

|

| ||||

| Class C2 | 6-12-06 | 10,179 | 10,179 | 11,720 |

|

| ||||

| Class I3 | 6-12-06 | 10,728 | 10,728 | 11,720 |

|

| ||||

| Class R13 | 6-12-06 | 10,403 | 10,403 | 11,720 |

|

| ||||

| Class R33 | 5-22-09 | 13,864 | 13,864 | 15,489 |

|

| ||||

| Class R43 | 5-22-09 | 13,938 | 13,938 | 15,489 |

|

| ||||

| Class R53 | 5-22-09 | 14,012 | 14,012 | 15,489 |

|

| ||||

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C, Class I, Class R1, Class R3, Class R4 and Class R5 shares, respectively, as of 2-28-11. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

S&P 500 Index is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 The contingent deferred sales charge, if any, is not applicable.

3 For certain types of investors, as described in the Fund’s Class I, Class R1, Class R3, Class R4 and Class R5 shares prospectuses.

| 8 | U.S. Core Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on September 1, 2010 with the same investment held until February 28, 2011.

| Account value | Ending value on | Expenses paid during | |

| on 9-1-10 | 2-28-11 | period ended 2-28-111 | |

|

| |||

| Class A | $1,000.00 | $1,214.50 | $7.41 |

|

| |||

| Class B | 1,000.00 | 1,210.50 | 11.24 |

|

| |||

| Class C | 1,000.00 | 1,210.70 | 11.24 |

|

| |||

| Class I | 1,000.00 | 1,217.30 | 4.84 |

|

| |||

| Class R1 | 1,000.00 | 1,213.30 | 9.00 |

|

| |||

| Class R3 | 1,000.00 | 1,213.80 | 8.51 |

|

| |||

| Class R4 | 1,000.00 | 1,215.70 | 6.87 |

|

| |||

| Class R5 | 1,000.00 | 1,217.50 | 5.17 |

|

| |||

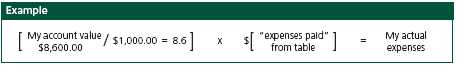

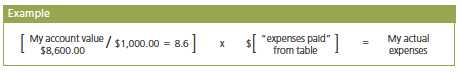

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at February 28, 2011, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| Annual report | U.S. Core Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on September 1, 2010, with the same investment held until February 28, 2011. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | Ending value on | Expenses paid during | |

| on 9-1-10 | 2-28-11 | period ended 2-28-111 | |

|

| |||

| Class A | $1,000.00 | $1,018.10 | $6.76 |

|

| |||

| Class B | 1,000.00 | 1,014.60 | 10.24 |

|

| |||

| Class C | 1,000.00 | 1,014.60 | 10.24 |

|

| |||

| Class I | 1,000.00 | 1,020.30 | 4.41 |

|

| |||

| Class R1 | 1,000.00 | 1,016.70 | 8.20 |

|

| |||

| Class R3 | 1,000.00 | 1,017.10 | 7.75 |

|

| |||

| Class R4 | 1,000.00 | 1,018.60 | 6.26 |

|

| |||

| Class R5 | 1,000.00 | 1,020.10 | 4.71 |

|

| |||

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.35%, 2.05%, 2.05%, 0.88%, 1.64%, 1.55%, 1.25% and 0.94% for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4 and Class R5 shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| 10 | U.S. Core Fund | Annual report |

Portfolio summary

| Top 10 Holdings1 | ||||

|

| ||||

| Microsoft Corp. | 4.7% | The Procter & Gamble Company | 2.7% | |

|

|

| |||

| Pfizer, Inc. | 4.6% | Johnson & Johnson | 2.6% | |

|

|

| |||

| Google, Inc., Class A | 4.1% | Merck & Company, Inc. | 2.5% | |

|

|

| |||

| Wal-Mart Stores, Inc. | 3.9% | International Business Machines Corp. | 2.4% | |

|

|

| |||

| Oracle Corp. | 3.6% | The Coca-Cola Company | 2.3% | |

|

|

| |||

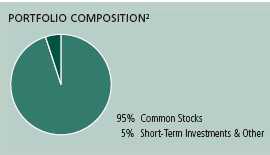

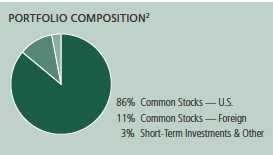

| Sector Composition2,3 | ||||

|

| ||||

| Information Technology | 27% | Energy | 4% | |

|

|

| |||

| Health Care | 25% | Financials | 4% | |

|

|

| |||

| Consumer Staples | 19% | Telecommunication Services | 3% | |

|

|

| |||

| Consumer Discretionary | 8% | Materials | 1% | |

|

|

| |||

| Industrials | 4% | Short-Term Investments & Other | 5% | |

|

|

| |||

1 As a percentage of net assets on 2-28-11. Cash and cash equivalents are not included in Top 10 Holdings.

2 As a percentage of net assets on 2-28-11.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| Annual report | U.S. Core Fund | 11 |

Fund’s investments

As of 2-28-11

| Shares | Value | |

| Common Stocks 94.50% | $64,985,279 | |

|

| ||

| (Cost $57,685,254) | ||

| Consumer Discretionary 8.63% | 5,931,530 | |

| Auto Components 0.12% | ||

|

| ||

| Autoliv, Inc. | 500 | 37,445 |

|

| ||

| TRW Automotive Holdings Corp. (I) | 800 | 45,440 |

| Distributors 0.14% | ||

|

| ||

| Genuine Parts Company | 1,800 | 94,842 |

| Diversified Consumer Services 0.36% | ||

|

| ||

| Apollo Group, Inc., Class A (I) | 3,000 | 135,780 |

|

| ||

| ITT Educational Services, Inc. (I) | 500 | 37,925 |

|

| ||

| Strayer Education, Inc. | 50 | 6,872 |

|

| ||

| Weight Watchers International, Inc. | 1,100 | 67,243 |

| Hotels, Restaurants & Leisure 2.13% | ||

|

| ||

| Chipotle Mexican Grill, Inc. (I) | 160 | 39,200 |

|

| ||

| Darden Restaurants, Inc. | 900 | 42,417 |

|

| ||

| Las Vegas Sands Corp. (I) | 3,800 | 177,232 |

|

| ||

| McDonald’s Corp. | 13,700 | 1,036,816 |

|

| ||

| Yum! Brands, Inc. | 3,300 | 166,089 |

| Household Durables 0.15% | ||

|

| ||

| Fortune Brands, Inc. | 1,000 | 61,860 |

|

| ||

| Mohawk Industries, Inc. (I) | 700 | 40,677 |

| Internet & Catalog Retail 0.22% | ||

|

| ||

| Liberty Media Corp. — Interactive, Series A (I) | 5,200 | 83,512 |

|

| ||

| Netflix, Inc. (I)(L) | 330 | 68,201 |

| Leisure Equipment & Products 0.06% | ||

|

| ||

| Hasbro, Inc. | 900 | 40,410 |

| Media 1.55% | ||

|

| ||

| Charter Communications, Inc., Class A (I) | 1,000 | 45,770 |

|

| ||

| Comcast Corp., Class A | 13,400 | 345,184 |

|

| ||

| Gannett Company, Inc. | 2,900 | 47,879 |

|

| ||

| Liberty Global, Inc., Series A (I) | 1,300 | 54,730 |

|

| ||

| The McGraw-Hill Companies, Inc. | 2,200 | 85,096 |

|

| ||

| The Washington Post Company, Class B | 80 | 34,647 |

|

| ||

| Time Warner Cable, Inc. | 1,800 | 129,924 |

|

| ||

| Time Warner, Inc. | 6,100 | 233,020 |

|

| ||

| Viacom, Inc., Class B | 2,000 | 89,320 |

| 12 | U.S. Core Fund | Annual report | See notes to financial statements |

| Shares | Value | |

| Multiline Retail 0.71% | ||

|

| ||

| Dollar Tree, Inc. (I) | 2,300 | $115,736 |

|

| ||

| Family Dollar Stores, Inc. | 1,600 | 80,128 |

|

| ||

| Macy’s, Inc. | 3,700 | 88,430 |

|

| ||

| Sears Holdings Corp. (I)(L) | 2,000 | 166,620 |

|

| ||

| Target Corp. | 700 | 36,785 |

| Specialty Retail 1.91% | ||

|

| ||

| Advance Auto Parts, Inc. | 1,600 | 100,288 |

|

| ||

| Aeropostale, Inc. (I) | 4,549 | 118,001 |

|

| ||

| AutoNation, Inc. (I)(L) | 2,400 | 80,736 |

|

| ||

| AutoZone, Inc. (I) | 760 | 196,042 |

|

| ||

| Best Buy Company, Inc. | 4,400 | 141,856 |

|

| ||

| Foot Locker, Inc. | 1,900 | 37,753 |

|

| ||

| Home Depot, Inc. | 5,000 | 187,350 |

|

| ||

| Jos. A. Bank Clothiers, Inc. (I) | 359 | 16,553 |

|

| ||

| Limited Brands, Inc. | 1,700 | 54,434 |

|

| ||

| O’Reilly Automotive, Inc. (I) | 1,200 | 66,696 |

|

| ||

| PetSmart, Inc. | 900 | 36,783 |

|

| ||

| Ross Stores, Inc. | 1,100 | 79,244 |

|

| ||

| TJX Companies, Inc. | 3,400 | 169,558 |

|

| ||

| Tractor Supply Company | 600 | 31,242 |

| Textiles, Apparel & Luxury Goods 1.28% | ||

|

| ||

| Coach, Inc. (L) | 3,400 | 186,728 |

|

| ||

| Fossil, Inc. (I) | 600 | 46,044 |

|

| ||

| NIKE, Inc., Class B | 6,300 | 560,889 |

|

| ||

| VF Corp. | 900 | 86,103 |

| Consumer Staples 19.62% | 13,492,030 | |

| Beverages 4.51% | ||

|

| ||

| Brown Forman Corp., Class B | 1,900 | 131,385 |

|

| ||

| Coca-Cola Enterprises, Inc. | 3,600 | 94,680 |

|

| ||

| Hansen Natural Corp. (I) | 1,500 | 86,325 |

|

| ||

| PepsiCo, Inc. | 18,600 | 1,179,612 |

|

| ||

| The Coca-Cola Company | 25,200 | 1,610,784 |

| Food & Staples Retailing 5.77% | ||

|

| ||

| Costco Wholesale Corp. | 2,400 | 179,496 |

|

| ||

| CVS Caremark Corp. | 3,500 | 115,710 |

|

| ||

| Safeway, Inc. | 2,400 | 52,368 |

|

| ||

| SUPERVALU, Inc. | 2,000 | 17,260 |

|

| ||

| Sysco Corp. | 7,600 | 211,204 |

|

| ||

| The Kroger Company | 5,900 | 135,110 |

|

| ||

| Wal-Mart Stores, Inc. | 51,640 | 2,684,247 |

|

| ||

| Walgreen Company | 13,300 | 576,422 |

| Food Products 1.93% | ||

|

| ||

| Campbell Soup Company (L) | 3,600 | 121,176 |

|

| ||

| Dean Foods Company (I) | 900 | 9,504 |

|

| ||

| Flowers Foods, Inc. | 1,600 | 42,560 |

|

| ||

| General Mills, Inc. | 6,700 | 248,838 |

|

| ||

| H.J. Heinz Company | 2,000 | 100,440 |

| See notes to financial statements | Annual report | U.S. Core Fund | 13 |

| Shares | Value | |

| Food Products (continued) | ||

|

| ||

| Hormel Foods Corp. | 4,000 | $109,600 |

|

| ||

| Kellogg Company | 4,000 | 214,240 |

|

| ||

| Kraft Foods, Inc., Class A | 5,400 | 171,936 |

|

| ||

| McCormick & Company, Inc., Class B | 1,600 | 76,240 |

|

| ||

| Sara Lee Corp. | 2,800 | 47,936 |

|

| ||

| The Hershey Company | 3,500 | 183,120 |

| Household Products 4.08% | ||

|

| ||

| Church & Dwight Company, Inc. | 800 | 60,352 |

|

| ||

| Clorox Company | 2,000 | 135,520 |

|

| ||

| Colgate-Palmolive Company | 5,600 | 439,712 |

|

| ||

| Kimberly-Clark Corp. | 4,800 | 316,320 |

|

| ||

| The Procter & Gamble Company | 29,400 | 1,853,670 |

| Personal Products 0.48% | ||

|

| ||

| Avon Products, Inc. | 2,200 | 61,182 |

|

| ||

| Herbalife, Ltd. | 1,000 | 78,410 |

|

| ||

| The Estee Lauder Companies, Inc., Class A | 2,000 | 188,820 |

| Tobacco 2.85% | ||

|

| ||

| Altria Group, Inc. | 27,900 | 707,823 |

|

| ||

| Lorillard, Inc. | 2,161 | 165,900 |

|

| ||

| Philip Morris International, Inc. | 14,918 | 936,552 |

|

| ||

| Reynolds American, Inc. | 4,300 | 147,576 |

| Energy 3.79% | 2,607,664 | |

| Energy Equipment & Services 0.35% | ||

|

| ||

| Halliburton Company | 241 | 11,313 |

|

| ||

| National Oilwell Varco, Inc. | 1,900 | 151,183 |

|

| ||

| Rowan Companies, Inc. (I) | 900 | 38,403 |

|

| ||

| Schlumberger, Ltd. | 455 | 42,506 |

| Oil, Gas & Consumable Fuels 3.44% | ||

|

| ||

| Anadarko Petroleum Corp. | 217 | 17,757 |

|

| ||

| Apache Corp. | 108 | 13,459 |

|

| ||

| Chevron Corp. | 5,697 | 591,064 |

|

| ||

| ConocoPhillips | 14,773 | 1,150,374 |

|

| ||

| Exxon Mobil Corp. | 1,228 | 105,031 |

|

| ||

| Marathon Oil Corp. | 4,400 | 218,240 |

|

| ||

| Occidental Petroleum Corp. | 680 | 69,340 |

|

| ||

| Pioneer Natural Resources Company | 600 | 61,404 |

|

| ||

| Sunoco, Inc. | 1,200 | 50,232 |

|

| ||

| Valero Energy Corp. | 3,100 | 87,358 |

| Financials 2.70% | 1,857,394 | |

| Commercial Banks 0.21% | ||

|

| ||

| CapitalSource, Inc. | 5,700 | 43,206 |

|

| ||

| CIT Group, Inc. (I) | 1,500 | 64,980 |

|

| ||

| First Citizens BancShares, Inc. | 50 | 10,100 |

|

| ||

| TCF Financial Corp. | 700 | 11,361 |

|

| ||

| Valley National Bancorp | 900 | 12,267 |

| 14 | U.S. Core Fund | Annual report | See notes to financial statements |

| Shares | Value | |

| Consumer Finance 0.10% | ||

|

| ||

| SLM Corp. (I) | 4,900 | $72,618 |

| Diversified Financial Services 0.14% | ||

|

| ||

| Bank of America Corp. | 6,610 | 94,457 |

| Insurance 2.08% | ||

|

| ||

| Allied World Assurance Company Holdings, Ltd. | 800 | 49,368 |

|

| ||

| American Financial Group, Inc. | 1,400 | 48,482 |

|

| ||

| American International Group, Inc. (I)(L) | 7,600 | 281,656 |

|

| ||

| Arch Capital Group, Ltd. (I) | 600 | 54,300 |

|

| ||

| Aspen Insurance Holdings, Ltd. | 1,000 | 29,550 |

|

| ||

| Assurant, Inc. | 1,100 | 44,693 |

|

| ||

| Axis Capital Holdings, Ltd. | 1,000 | 36,320 |

|

| ||

| Brown & Brown, Inc. | 1,900 | 49,666 |

|

| ||

| Chubb Corp. | 1,000 | 60,680 |

|

| ||

| Endurance Specialty Holdings, Ltd. | 600 | 29,754 |

|

| ||

| Everest Re Group, Ltd. | 400 | 35,460 |

|

| ||

| Hartford Financial Services Group, Inc. | 1,900 | 56,240 |

|

| ||

| PartnerRe, Ltd. | 500 | 39,650 |

|

| ||

| Platinum Underwriters Holdings, Ltd. | 200 | 8,340 |

|

| ||

| Prudential Financial, Inc. | 1,500 | 98,745 |

|

| ||

| RenaissanceRe Holdings, Ltd. | 600 | 40,212 |

|

| ||

| StanCorp Financial Group, Inc. | 200 | 9,200 |

|

| ||

| The Travelers Companies, Inc. | 4,900 | 293,657 |

|

| ||

| Torchmark Corp. | 600 | 39,150 |

|

| ||

| Transatlantic Holdings, Inc. | 600 | 30,558 |

|

| ||

| Validus Holdings, Ltd. | 1,800 | 55,710 |

|

| ||

| W.R. Berkley Corp. | 1,400 | 41,930 |

| Real Estate Investment Trusts 0.17% | ||

|

| ||

| Annaly Capital Management, Inc. | 4,900 | 87,857 |

|

| ||

| National Retail Properties, Inc. | 500 | 12,845 |

|

| ||

| Omega Healthcare Investors, Inc. | 600 | 14,382 |

| Health Care 24.66% | 16,960,349 | |

| Biotechnology 1.65% | ||

|

| ||

| Amgen, Inc. (I) | 12,300 | 631,359 |

|

| ||

| Biogen Idec, Inc. (I)(L) | 2,300 | 157,320 |

|

| ||

| Cephalon, Inc. (I) | 600 | 33,786 |

|

| ||

| Gilead Sciences, Inc. (I) | 8,000 | 311,840 |

| Health Care Equipment & Supplies 3.86% | ||

|

| ||

| Alere, Inc. (I) | 2,659 | 102,744 |

|

| ||

| Baxter International, Inc. | 7,863 | 417,918 |

|

| ||

| Becton, Dickinson & Company | 2,600 | 208,000 |

|

| ||

| C.R. Bard, Inc. | 800 | 78,208 |

|

| ||

| DENTSPLY International, Inc. | 1,300 | 48,581 |

|

| ||

| Edwards Lifesciences Corp. (I) | 1,480 | 125,859 |

|

| ||

| Gen-Probe, Inc. (I) | 500 | 31,440 |

|

| ||

| IDEXX Laboratories, Inc. (I)(L) | 900 | 69,930 |

|

| ||

| Intuitive Surgical, Inc. (I) | 160 | 52,472 |

|

| ||

| Kinetic Concepts, Inc. (I) | 1,100 | 53,867 |

|

| ||

| Medtronic, Inc. | 16,400 | 654,688 |

| See notes to financial statements | Annual report | U.S. Core Fund | 15 |

| Shares | Value | |

| Health Care Equipment & Supplies (continued) | ||

|

| ||

| ResMed, Inc. (I)(L) | 1,700 | $53,720 |

|

| ||

| St. Jude Medical, Inc. (I) | 3,400 | 162,792 |

|

| ||

| STERIS Corp. | 400 | 13,540 |

|

| ||

| Stryker Corp. | 4,200 | 265,692 |

|

| ||

| Varian Medical Systems, Inc. (I) | 1,200 | 83,136 |

|

| ||

| Zimmer Holdings, Inc. (I) | 3,700 | 230,658 |

| Health Care Providers & Services 4.56% | ||

|

| ||

| Aetna, Inc. | 4,200 | 156,912 |

|

| ||

| AMERIGROUP Corp. (I) | 500 | 28,675 |

|

| ||

| AmerisourceBergen Corp. | 4,800 | 181,968 |

|

| ||

| Cardinal Health, Inc. | 3,900 | 162,396 |

|

| ||

| Catalyst Health Solutions, Inc. (I) | 300 | 13,563 |

|

| ||

| Coventry Health Care, Inc. (I) | 2,000 | 60,400 |

|

| ||

| Express Scripts, Inc. (I) | 5,300 | 297,966 |

|

| ||

| Health Net, Inc. (I) | 1,400 | 41,188 |

|

| ||

| Henry Schein, Inc. (I) | 900 | 62,082 |

|

| ||

| Humana, Inc. (I) | 2,300 | 149,523 |

|

| ||

| Laboratory Corp. of America Holdings (I) | 1,500 | 135,195 |

|

| ||

| Lincare Holdings, Inc. (L) | 3,340 | 97,996 |

|

| ||

| McKesson Corp. | 1,500 | 118,920 |

|

| ||

| MEDNAX, Inc. (I) | 600 | 38,958 |

|

| ||

| Omnicare, Inc. | 1,100 | 31,493 |

|

| ||

| Owens & Minor, Inc. | 300 | 9,360 |

|

| ||

| Patterson Companies, Inc. | 1,400 | 46,732 |

|

| ||

| Quest Diagnostics, Inc. | 1,900 | 107,825 |

|

| ||

| Triple-S Management Corp., Class B (I) | 3,591 | 70,958 |

|

| ||

| UnitedHealth Group, Inc. | 21,356 | 909,338 |

|

| ||

| VCA Antech, Inc. (I) | 700 | 17,528 |

|

| ||

| WellPoint, Inc. (I) | 5,986 | 397,889 |

| Health Care Technology 0.11% | ||

|

| ||

| Cerner Corp. (I)(L) | 720 | 72,324 |

| Life Sciences Tools & Services 0.38% | ||

|

| ||

| Covance, Inc. (I) | 600 | 33,858 |

|

| ||

| Mettler-Toledo International, Inc. (I) | 490 | 83,971 |

|

| ||

| Pharmaceutical Product Development, Inc. | 1,500 | 41,205 |

|

| ||

| Techne Corp. | 300 | 21,507 |

|

| ||

| Waters Corp. (I) | 1,000 | 83,050 |

| Pharmaceuticals 14.10% | ||

|

| ||

| Abbott Laboratories | 19,400 | 933,140 |

|

| ||

| Allergan, Inc. | 3,900 | 289,263 |

|

| ||

| Bristol-Myers Squibb Company | 20,200 | 521,362 |

|

| ||

| Eli Lilly & Company | 24,900 | 860,544 |

|

| ||

| Endo Pharmaceuticals Holdings, Inc. (I) | 2,900 | 103,008 |

|

| ||

| Forest Laboratories, Inc. (I) | 7,000 | 226,800 |

|

| ||

| Johnson & Johnson | 28,700 | 1,763,328 |

|

| ||

| Merck & Company, Inc. | 52,683 | 1,715,885 |

|

| ||

| Pfizer, Inc. | 165,488 | 3,183,989 |

|

| ||

| Warner Chilcott PLC, Class A | 4,337 | 102,700 |

| 16 | U.S. Core Fund | Annual report | See notes to financial statements |

| Shares | Value | |

| Industrials 4.44% | $3,055,280 | |

| Aerospace & Defense 1.15% | ||

|

| ||

| General Dynamics Corp. | 3,700 | 281,644 |

|

| ||

| L-3 Communications Holdings, Inc. | 800 | 63,432 |

|

| ||

| Northrop Grumman Corp. | 1,300 | 86,684 |

|

| ||

| Precision Castparts Corp. | 970 | 137,498 |

|

| ||

| Rockwell Collins, Inc. | 1,200 | 77,328 |

|

| ||

| United Technologies Corp. | 1,700 | 142,018 |

| Air Freight & Logistics 0.35% | ||

|

| ||

| C.H. Robinson Worldwide, Inc. | 2,400 | 173,736 |

|

| ||

| Expeditors International of Washington, Inc. | 1,400 | 66,920 |

| Airlines 0.09% | ||

|

| ||

| United Continental Holdings, Inc. (I) | 2,600 | 62,504 |

| Commercial Services & Supplies 0.36% | ||

|

| ||

| Copart, Inc. (I)(L) | 1,000 | 42,010 |

|

| ||

| Pitney Bowes, Inc. | 2,800 | 70,504 |

|

| ||

| Rollins, Inc. | 2,250 | 44,145 |

|

| ||

| Stericycle, Inc. (I) | 1,100 | 95,062 |

| Industrial Conglomerates 1.02% | ||

|

| ||

| 3M Company | 7,600 | 700,948 |

| Machinery 1.07% | ||

|

| ||

| Caterpillar, Inc. | 1,700 | 174,981 |

|

| ||

| Cummins, Inc. | 1,070 | 108,198 |

|

| ||

| Danaher Corp. | 5,500 | 278,300 |

|

| ||

| Deere & Company | 1,300 | 117,195 |

|

| ||

| Joy Global, Inc. | 600 | 58,428 |

| Professional Services 0.13% | ||

|

| ||

| Dun & Bradstreet Corp. | 400 | 32,320 |

|

| ||

| IHS, Inc., Class A (I) | 700 | 58,590 |

| Road & Rail 0.17% | ||

|

| ||

| Union Pacific Corp. | 1,200 | 114,492 |

| Trading Companies & Distributors 0.10% | ||

|

| ||

| Fastenal Company (L) | 1,100 | 68,343 |

| Information Technology 26.84% | 18,457,845 | |

| Communications Equipment 3.07% | ||

|

| ||

| Aruba Networks, Inc. (I) | 400 | 12,180 |

|

| ||

| Cisco Systems, Inc. (I) | 36,600 | 679,296 |

|

| ||

| F5 Networks, Inc. (I) | 580 | 68,446 |

|

| ||

| Harris Corp. | 800 | 37,328 |

|

| ||

| QUALCOMM, Inc. | 21,800 | 1,298,844 |

|

| ||

| Tellabs, Inc. | 2,400 | 12,936 |

| Computers & Peripherals 3.51% | ||

|

| ||

| Apple, Inc. (I) | 4,310 | 1,522,335 |

|

| ||

| Dell, Inc. (I) | 11,015 | 174,367 |

|

| ||

| Hewlett-Packard Company | 9,300 | 405,759 |

|

| ||

| Lexmark International, Inc., Class A (I) | 900 | 33,777 |

|

| ||

| NCR Corp. (I) | 1,800 | 34,380 |

| See notes to financial statements | Annual report | U.S. Core Fund | 17 |

| Shares | Value | |

| Computers & Peripherals (continued) | ||

|

| ||

| NetApp, Inc. (I) | 1,700 | $87,822 |

|

| ||

| Seagate Technology PLC (I) | 2,900 | 36,830 |

|

| ||

| Western Digital Corp. (I) | 3,919 | 119,843 |

| Electronic Equipment, Instruments & Components 0.21% | ||

|

| ||

| Dolby Laboratories, Inc., Class A (I) | 1,500 | 75,855 |

|

| ||

| Ingram Micro, Inc., Class A (I) | 2,600 | 51,818 |

|

| ||

| Tech Data Corp. (I) | 300 | 14,874 |

| Internet Software & Services 4.92% | ||

|

| ||

| eBay, Inc. (I) | 17,500 | 586,338 |

|

| ||

| Google, Inc., Class A (I) | 4,567 | 2,801,398 |

| IT Services 4.61% | ||

|

| ||

| Accenture PLC, Class A | 5,900 | 303,732 |

|

| ||

| Amdocs, Ltd. (I) | 2,400 | 71,616 |

|

| ||

| Automatic Data Processing, Inc. | 3,700 | 185,000 |

|

| ||

| Broadridge Financial Solutions, Inc. | 1,700 | 38,964 |

|

| ||

| Cognizant Technology Solutions Corp., Class A (I) | 3,700 | 284,419 |

|

| ||

| Computer Sciences Corp. | 900 | 43,317 |

|

| ||

| Fiserv, Inc. (I) | 1,100 | 69,597 |

|

| ||

| Global Payments, Inc. | 1,200 | 57,588 |

|

| ||

| International Business Machines Corp. | 10,321 | 1,670,763 |

|

| ||

| Jack Henry & Associates, Inc. | 1,300 | 41,483 |

|

| ||

| MasterCard, Inc., Class A | 907 | 218,188 |

|

| ||

| NeuStar, Inc., Class A (I) | 200 | 5,050 |

|

| ||

| Paychex, Inc. | 4,000 | 134,520 |

|

| ||

| Total Systems Services, Inc. (L) | 2,500 | 44,375 |

| Office Electronics 0.14% | ||

|

| ||

| Xerox Corp. | 8,800 | 94,600 |

| Semiconductors & Semiconductor Equipment 0.16% | ||

|

| ||

| Texas Instruments, Inc. | 3,100 | 110,391 |

| Software 10.22% | ||

|

| ||

| Adobe Systems, Inc. (I) | 2,300 | 79,350 |

|

| ||

| ANSYS, Inc. (I) | 600 | 33,792 |

|

| ||

| BMC Software, Inc. (I) | 1,900 | 94,050 |

|

| ||

| Citrix Systems, Inc. (I) | 1,600 | 112,256 |

|

| ||

| FactSet Research Systems, Inc. | 820 | 86,002 |

|

| ||

| Informatica Corp. (I) | 1,400 | 65,814 |

|

| ||

| Intuit, Inc. (I) | 5,600 | 294,448 |

|

| ||

| McAfee, Inc. (I) | 900 | 43,155 |

|

| ||

| MICROS Systems, Inc. (I) | 1,300 | 61,932 |

|

| ||

| Microsoft Corp. | 122,241 | 3,249,166 |

|

| ||

| Oracle Corp. | 74,147 | 2,439,436 |

|

| ||

| Quest Software, Inc. (I) | 1,700 | 45,543 |

|

| ||

| Salesforce.com, Inc. (I) | 610 | 80,685 |

|

| ||

| Symantec Corp. (I) | 9,100 | 164,073 |

|

| ||

| TIBCO Software, Inc. (I) | 1,200 | 29,544 |

|

| ||

| VMware, Inc., Class A (I) | 1,800 | 150,570 |

| 18 | U.S. Core Fund | Annual report | See notes to financial statements |

| Shares | Value | |||

| Materials 0.73% | $497,786 | |||

| Chemicals 0.55% | ||||

|

| ||||

| E.I. Du Pont de Nemours & Company | 3,900 | 213,993 | ||

|

| ||||

| Ecolab, Inc. | 2,000 | 97,280 | ||

|

| ||||

| Sigma-Aldrich Corp. | 1,000 | 63,890 | ||

| Metals & Mining 0.02% | ||||

|

| ||||

| Commercial Metals Company | 600 | 10,002 | ||

| Paper & Forest Products 0.16% | ||||

|

| ||||

| Schweitzer-Mauduit International, Inc. | 2,054 | 112,621 | ||

| Telecommunication Services 3.09% | 2,125,401 | |||

| Diversified Telecommunication Services 2.97% | ||||

|

| ||||

| AT&T, Inc. | 28,000 | 794,640 | ||

|

| ||||

| CenturyLink, Inc. (L) | 1,900 | 78,242 | ||

|

| ||||

| Verizon Communications, Inc. | 31,700 | 1,170,364 | ||

| Wireless Telecommunication Services 0.12% | ||||

|

| ||||

| MetroPCS Communications, Inc. (I) | 2,200 | 31,680 | ||

|

| ||||

| Telephone & Data Systems, Inc. | 1,500 | 50,475 | ||

| Investment Companies 1.01% | $692,247 | |||

|

| ||||

| (Cost $635,987) | ||||

| Financials 1.01% | 692,247 | |||

| SPDR S&P 500 ETF Trust | 5,199 | 692,247 | ||

| Yield | Shares | Value | ||

| Securities Lending Collateral 1.63% | $1,124,229 | |||

|

| ||||

| (Cost $1,124,155) | ||||

|

| ||||

| John Hancock Collateral Investment Trust (W) | 0.2855% (Y) | 112,340 | 1,124,229 | |

| Short-Term Investments 3.34% | $2,299,518 | |||

|

| ||||

| (Cost $2,299,512) | ||||

| Maturity | ||||

| Yield* | date | Par value | Value | |

| U.S. Government 0.43% | 299,993 | |||

| U.S. Treasury Bill | 0.180% | 3-10-11 | $300,000 | 299,993 |

| Shares | Value | |||

| Short-Term Securities 2.91% | 1,999,525 | |||

| State Street Institutional Treasury Money | ||||

| Market Fund | 0.0453% (Y) | 1,999,525 | 1,999,525 | |

| Total investments (Cost $61,744,908)† 100.48% | $69,101,273 | |||

|

| ||||

| Other assets and liabilities, net (0.48%) | ($329,900) | |||

|

| ||||

| Total net assets 100.00% | $68,771,373 | |||

|

| ||||

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

| See notes to financial statements | Annual report | U.S. Core Fund | 19 |

Notes to Schedule of Investments

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of 2-28-11.

(W) Investment is an affiliate of the Fund, the adviser and/or subadviser. Also, it represents the investment of securities lending collateral received.

(Y) The rate shown is the annualized seven-day yield as of 2-28-11.

† At 2-28-11, the aggregate cost of investment securities for federal income tax purposes was $62,554,907. Net unrealized appreciation aggregated $6,546,366, of which $6,969,277 related to appreciated investment securities and $422,911 related to depreciated investment securities.

| 20 | U.S. Core Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 2-28-11

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| Assets | |

|

| |

| Investments in unaffiliated issuers, at value (Cost $60,620,753) including | |

| $1,091,259 of securities loaned (Note 2) | $67,977,044 |

| Investments in affiliated issuers, at value (Cost $1,124,155) (Note 2) | 1,124,229 |

| Total investments, at value (Cost $61,744,908) | 69,101,273 |

| Receivable for fund shares sold | 791,944 |

| Dividends and interest receivable | 142,140 |

| Receivable for securities lending income | 2,226 |

| Other receivables and prepaid expenses | 6,271 |

| Total assets | 70,043,854 |

| Liabilities | |

|

| |

| Payable for investments purchased | 4,513 |

| Payable for fund shares repurchased | 14,187 |

| Payable upon return of securities loaned (Note 2) | 1,125,131 |

| Payable to affiliates | |

| Accounting and legal services fees | 874 |

| Transfer agent fees | 12,832 |

| Distribution and service fees | 3 |

| Trustees’ fees | 615 |

| Due to adviser | 102,961 |

| Other liabilities and accrued expenses | 11,365 |

| Total liabilities | 1,272,481 |

| Net assets | |

|

| |

| Capital paid-in | $63,928,417 |

| Undistributed net investment income | 144,998 |

| Accumulated net realized loss on investments and futures contracts | (2,658,407) |

| Net unrealized appreciation (depreciation) on investments | 7,356,365 |

| Net assets | $68,771,373 |

| See notes to financial statements | Annual report | U.S. Core Fund | 21 |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| Net asset value per share | |

|

| |

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($31,179,454 ÷ 1,608,524 shares) | $19.38 |

| Class B ($824,284 ÷ 42,665 shares)1 | $19.32 |

| Class C ($2,377,992 ÷ 123,169 shares)1 | $19.31 |

| Class I ($34,172,344 ÷ 1,761,956 shares) | $19.39 |

| Class R1 ($113,771 ÷ 5,879 shares) | $19.35 |

| Class R3 ($34,510 ÷ 1,779.359 shares) | $19.39 |

| Class R4 ($34,509 ÷ 1,779.359 shares) | $19.39 |

| Class R5 ($34,509 ÷ 1,779.359 shares) | $19.39 |

| Maximum offering price per share | |

|

| |

| Class A (net asset value per share ÷ 95%)2 | $20.40 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| 22 | U.S. Core Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 2-28-11

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

|

| |

| Dividends | $1,070,628 |

| Securities lending | 11,561 |

| Interest | 2,090 |

| Less foreign taxes withheld | (18) |

| Total investment income | 1,084,261 |

| Expenses | |

|

| |

| Investment management fees (Note 5) | 386,107 |

| Distribution and service fees (Note 5) | 106,110 |

| Accounting and legal services fees (Note 5) | 6,737 |

| Transfer agent fees (Note 5) | 62,533 |

| Trustees’ fees (Note 5) | 3,510 |

| State registration fees (Note 5) | 56,044 |

| Printing and postage (Note 5) | 11,383 |

| Professional fees | 48,721 |

| Custodian fees | 12,140 |

| Registration and filing fees | 32,269 |

| Other | 7,702 |

| Total expenses | 733,256 |

| Less expense reductions (Note 5) | (140,827) |

| Net expenses | 592,429 |

| Net investment income | 491,832 |

| Realized and unrealized gain (loss) | |

|

| |

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | 1,571,228 |

| Investments in affiliated issuers | (819) |

| Futures contracts (Note 3) | 89,593 |

| 1,660,002 | |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 5,111,297 |

| Investments in affiliated issuers | (137) |

| Futures contracts (Note 3) | (18,147) |

| Translation of assets and liabilities in foreign currencies | 215 |

| 5,093,228 | |

| Net realized and unrealized gain | 6,753,230 |

| Increase in net assets from operations | $7,245,062 |

| See notes to financial statements | Annual report | U.S. Core Fund | 23 |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| Year | Year | |

| ended | ended | |

| 2-28-11 | 2-28-10 | |

| Increase (decrease) in net assets | ||

|

| ||

| From operations | ||

| Net investment income | $491,832 | $197,722 |

| Net realized gain (loss) | 1,660,002 | (1,312,068) |

| Change in net unrealized appreciation (depreciation) | 5,093,228 | 7,710,519 |

| Increase in net assets resulting from operations | 7,245,062 | 6,596,173 |

| Distributions to shareholders | ||

| From net investment income | ||

| Class A | (167,314) | (77,787) |

| Class I | (207,682) | (124,896) |

| Class R1 | (282) | (22) |

| Class R3 | (117) | (34) |

| Class R4 | (209) | (113) |

| Class R5 | (301) | (193) |

| Total distributions | (375,905) | (203,045) |

| From Fund share transactions (Note 6) | 20,847,789 | 22,212,754 |

| Total increase | 27,716,946 | 28,605,882 |

| Net assets | ||

|

| ||

| Beginning of year | 41,054,427 | 12,448,545 |

| End of year | $68,771,373 | $41,054,427 |

| Undistributed net investment income | $144,998 | $29,071 |

| 24 | U.S. Core Fund | Annual report | See notes to financial statements |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| CLASS A SHARES Period ended | 2-28-11 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.06 | $12.25 | $19.42 | $22.24 | $20.00 |

| Net investment income2 | 0.14 | 0.11 | 0.15 | 0.16 | 0.12 |

| Net realized and unrealized gain (loss) on investments | 2.29 | 4.76 | (7.19) | (1.88) | 2.41 |

| Total from investment operations | 2.43 | 4.87 | (7.04) | (1.72) | 2.53 |

| Less distributions | |||||

| From net investment income | (0.11) | (0.06) | (0.13) | (0.17) | (0.09) |

| From net realized gain | — | — | — | (0.93) | (0.20) |

| Total distributions | (0.11) | (0.06) | (0.13) | (1.10) | (0.29) |

| Net asset value, end of period | $19.38 | $17.06 | $12.25 | $19.42 | $22.24 |

| Total return (%)3,4 | 14.26 | 39.78 | (36.34) | (8.16) | 12.645 |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $31 | $22 | $11 | $18 | $19 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.50 | 1.766 | 1.75 | 1.86 | 1.937 |

| Expenses net of fee waivers | 1.35 | 1.356 | 1.35 | 1.34 | 1.347 |

| Expenses net of fee waivers and credits | 1.35 | 1.356 | 1.35 | 1.34 | 1.347 |

| Net investment income | 0.82 | 0.72 | 0.86 | 0.70 | 0.767 |

| Portfolio turnover (%) | 78 | 44 | 61 | 81 | 36 |

1 The inception date for Class A shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Includes the impact of proxy expenses, which amounted to 0.02% of average net assets.

7 Annualized.

| See notes to financial statements | Annual report | U.S. Core Fund | 25 |

| CLASS B SHARES Period ended | 2-28-11 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.02 | $12.26 | $19.38 | $22.20 | $20.00 |

| Net investment income2 | 0.03 | 0.01 | 0.04 | —3 | 0.02 |

| Net realized and unrealized gain (loss) on investments | 2.27 | 4.75 | (7.16) | (1.88) | 2.40 |

| Total from investment operations | 2.30 | 4.76 | (7.12) | (1.88) | 2.42 |

| From net investment income | — | — | — | (0.01) | (0.02) |

| From net realized gain | — | — | — | (0.93) | (0.20) |

| Total distributions | — | — | — | (0.94) | (0.22) |

| Net asset value, end of period | $19.32 | $17.02 | $12.26 | $19.38 | $22.20 |

| Total return (%)4,5 | 13.51 | 38.83 | (36.74) | (8.84) | 12.076 |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $1 | —7 | —7 | —7 | —7 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 3.02 | 7.678 | 8.79 | 6.98 | 13.589 |

| Expenses net of fee waivers | 2.05 | 2.088 | 2.40 | 2.05 | 2.049 |

| Expenses net of fee waivers and credits | 2.05 | 2.058 | 2.05 | 2.05 | 2.049 |

| Net investment income | 0.19 | 0.03 | 0.24 | —10 | 0.129 |

| Portfolio turnover (%) | 78 | 44 | 61 | 81 | 36 |

1 The inception date for Class B shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Does not reflect the effect of sales charges, if any.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Less than $500,000.

8 Includes the impact of proxy expenses, which amounted to 0.03% of average net assets.

9 Annualized.

10 Less than 0.005%.

| CLASS C SHARES Period ended | 2-28-11 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.01 | $12.26 | $19.39 | $22.21 | $20.00 |

| Net investment income2 | 0.02 | —3 | 0.01 | —4 | 0.03 |

| Net realized and unrealized gain (loss) on investments | 2.28 | 4.75 | (7.14) | (1.88) | 2.40 |

| Total from investment operations | 2.30 | 4.75 | (7.13) | (1.88) | 2.43 |

| From net investment income | — | — | — | (0.01) | (0.02) |

| From net realized gain | — | — | — | (0.93) | (0.20) |

| Total distributions | — | — | — | (0.94) | (0.22) |

| Net asset value, end of period | $19.31 | $17.01 | $12.26 | $19.39 | $22.21 |

| Total return (%)5,6 | 13.52 | 38.74 | (36.77) | (8.84) | 12.127 |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $2 | $2 | $1 | $3 | $3 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 2.40 | 3.928 | 3.43 | 2.94 | 3.829 |

| Expenses net of fee waivers | 2.05 | 2.068 | 2.07 | 2.05 | 2.049 |

| Expenses net of fee waivers and credits | 2.05 | 2.058 | 2.05 | 2.05 | 2.049 |

| Net investment income (loss) | 0.12 | —10 | 0.06 | (0.01) | 0.169 |

| Portfolio turnover (%) | 78 | 44 | 61 | 81 | 36 |

1 The inception date for Class C shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Less than $0.005 per share.

5 Does not reflect the effect of sales charges, if any.

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Not annualized.

8 Includes the impact of proxy expenses, which amounted to 0.02% of average net assets.

9 Annualized.

10 Less than (0.005%).

| 26 | U.S. Core Fund | Annual report | See notes to financial statements |

| CLASS I SHARES Period ended | 2-28-11 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.06 | $12.25 | $19.43 | $22.26 | $20.00 |

| Net investment income2 | 0.24 | 0.16 | 0.21 | 0.25 | 0.18 |

| Net realized and unrealized gain (loss) on investments | 2.28 | 4.79 | (7.19) | (1.89) | 2.41 |

| Total from investment operations | 2.52 | 4.95 | (6.98) | (1.64) | 2.59 |

| Less distributions | |||||

| From net investment income | (0.19) | (0.14) | (0.20) | (0.26) | (0.13) |

| From net realized gain | — | — | — | (0.93) | (0.20) |

| Total distributions | (0.19) | (0.14) | (0.20) | (1.19) | (0.33) |

| Net asset value, end of period | $19.39 | $17.06 | $12.25 | $19.43 | $22.26 |

| Total return (%)3 | 14.81 | 40.35 | (36.06) | (7.82) | 12.954 |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | $34 | $16 | —5 | —5 | —5 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.12 | 1.396 | 10.44 | 12.79 | 17.837 |

| Expenses net of fee waivers | 0.88 | 0.876 | 0.95 | 0.95 | 0.957 |

| Expenses net of fee waivers and credits | 0.88 | 0.876 | 0.95 | 0.95 | 0.957 |

| Net investment income | 1.34 | 0.94 | 1.19 | 1.10 | 1.167 |

| Portfolio turnover (%) | 78 | 44 | 61 | 81 | 36 |

1 The inception date for Class I shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Less than $500,000.

6 Includes the impact of proxy expenses, which amounted to less than 0.005% of average net assets.

7 Annualized.

| CLASS R1 SHARES Period ended | 2-28-11 | 2-28-10 | 2-28-09 | 2-29-08 | 2-28-071 |

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.03 | $12.23 | $19.37 | $22.20 | $20.00 |

| Net investment income2 | 0.09 | 0.07 | 0.13 | 0.13 | 0.06 |

| Net realized and unrealized gain (loss) on investments | 2.28 | 4.73 | (7.16) | (1.88) | 2.42 |

| Total from investment operations | 2.37 | 4.80 | (7.03) | (1.75) | 2.48 |

| Less distributions | |||||

| From net investment income | (0.05) | —3 | (0.11) | (0.15) | (0.08) |

| From net realized gain | — | — | — | (0.93) | (0.20) |

| Total distributions | (0.05) | —3 | (0.11) | (1.08) | (0.28) |

| Net asset value, end of period | $19.35 | $17.03 | $12.23 | $19.37 | $22.20 |

| Total return (%)4 | 13.92 | 39.28 | (36.37) | (8.32) | 12.385 |

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —6 | —6 | —6 | —6 | —6 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 4.66 | 20.807 | 19.51 | 15.98 | 21.128 |

| Expenses net of fee waivers | 1.67 | 1.667 | 1.95 | 1.45 | 1.698 |

| Expenses net of fee waivers and credits | 1.67 | 1.667 | 1.45 | 1.45 | 1.698 |

| Net investment income | 0.48 | 0.43 | 0.76 | 0.59 | 0.418 |

| Portfolio turnover (%) | 78 | 44 | 61 | 81 | 36 |

1 The inception date for Class R1 shares is 6-12-06.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Less than $500,000.

7 Includes the impact of proxy expenses, which amounted to 0.03% of average net assets.

8 Annualized.

| See notes to financial statements | Annual report | U.S. Core Fund | 27 |

| CLASS R3 SHARES Period ended | 2-28-11 | 2-28-101 | |||

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.07 | $14.05 | |||

| Net investment income2 | 0.10 | 0.03 | |||

| Net realized and unrealized gain on investments | 2.29 | 3.01 | |||

| Total from investment operations | 2.39 | 3.04 | |||

| Less distributions | |||||

| From net investment income | (0.07) | (0.02) | |||

| Net asset value, end of period | $19.39 | $17.07 | |||

| Total return (%)3 | 13.99 | 21.634 | |||

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —5 | —5 | |||

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 39.27 | 9.876 | |||

| Expenses net of fee waivers | 1.58 | 1.666 | |||

| Expenses net of fee waivers and credits | 1.58 | 1.666 | |||

| Net investment income | 0.57 | 0.216 | |||

| Portfolio turnover (%) | 78 | 44 | |||

1 The inception date for Class R3 shares is 5-22-09.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

| CLASS R4 SHARES Period ended | 2-28-11 | 2-28-101 | |||

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.06 | $14.05 | |||

| Net investment income2 | 0.15 | 0.06 | |||

| Net realized and unrealized gain on investments | 2.30 | 3.01 | |||

| Total from investment operations | 2.45 | 3.07 | |||

| Less distributions | |||||

| From net investment income | (0.12) | (0.06) | |||

| Net asset value, end of period | $19.39 | $17.06 | |||

| Total return (%)3 | 14.37 | 21.874 | |||

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —5 | —5 | |||

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 39.00 | 9.616 | |||

| Expenses net of fee waivers | 1.28 | 1.366 | |||

| Expenses net of fee waivers and credits | 1.28 | 1.366 | |||

| Net investment loss | 0.87 | 0.506 | |||

| Portfolio turnover (%) | 78 | 44 | |||

1 The inception date for Class R4 shares is 5-22-09.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

| 28 | U.S. Core Fund | Annual report | See notes to financial statements |

| CLASS R5 SHARES Period ended | 2-28-11 | 2-28-101 | |||

| Per share operating performance | |||||

|

| |||||

| Net asset value, beginning of period | $17.06 | $14.05 | |||

| Net investment income2 | 0.21 | 0.10 | |||

| Net realized and unrealized gain on investments | 2.29 | 3.02 | |||

| Total from investment operations | 2.50 | 3.12 | |||

| Less distributions | |||||

| From net investment income | (0.17) | (0.11) | |||

| Net asset value, end of period | $19.39 | $17.06 | |||

| Total return (%)3 | 14.68 | 22.184 | |||

| Ratios and supplemental data | |||||

|

| |||||

| Net assets, end of period (in millions) | —5 | —5 | |||

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 38.74 | 9.366 | |||

| Expenses net of fee waivers | 0.98 | 1.066 | |||

| Expenses net of fee waivers and credits | 0.98 | 1.066 | |||

| Net investment income | 1.17 | 0.816 | |||

| Portfolio turnover (%) | 78 | 44 | |||

1 The inception date for Class R5 shares is 5-22-09.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

| See notes to financial statements | Annual report | U.S. Core Fund | 29 |

Notes to financial statements

Note 1 — Organization

John Hancock U.S. Core Fund (the Fund) is a diversified series of John Hancock Funds III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek a high total return.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A, Class B and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R1, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, printing and postage, registration and transfer agent fees for each class may differ. Class B shares convert to Class A shares eight years after purchase.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of February 28, 2011, all investments of the Fund are categorized as Level 1 under the hierarchy described above, except U.S. Treasury Bills, which are Level 2. Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. During the year ended February 28, 2011, there were no significant transfers in or out of Level 1 or Level 2 assets.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Investments in open-end mutual funds, including John Hancock Collateral Investment Trust (JHCIT), are valued at their closing net asset values each day. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the

| 30 | U.S. Core Fund | Annual report |

close of trading. Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-date.

Securities lending. The Fund may lend its securities to earn additional income. It receives and maintains cash collateral received from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, an affiliate of the Fund, and as a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Income received from JHCIT is a component of securities lending income as recorded on the Statement of Operations.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to a Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with State Street Bank and Trust Company (SSBT) which enables them to participate in a $100 million unsecured committed line of credit. Prior to March 31, 2010, the amount of the line of credit was $150 million. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of Operations. For the year ended February 28, 2011, the Fund had no borrowings under the line of credit.

Effective March 30, 2011, the line of credit with SSBT expired and a similar arrangement was established with Citibank N.A.

Expenses. The majority of expenses are directly attributable to an individual fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses, and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net asset value of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage, for all classes, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

| Annual report | U.S. Core Fund | 31 |

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has a capital loss carryforward of $1,848,409 available to offset future net realized capital gains as of February 28, 2011. The loss carryforward expires as follows: February 28, 2018 — $1,848,409.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

As of February 28, 2011, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, annually. The tax character of distributions for the years ended February 28, 2011 and 2010 was as follows:

| FEBRUARY 28, 2011 | FEBRUARY 28, 2010 | |||

|

|

||||

| Ordinary Income | $375,905 | $203,045 | ||

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class. As of February 28, 2011, the components of distributable earnings on a tax basis included $145,320 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sales loss deferrals.

Note 3 — Derivative instruments

The Fund may invest in derivatives in order to meet its investment objectives. The use of derivatives may involve risks different from, or potentially greater than, the risks associated with investing directly in securities. Specifically, derivatives expose the Fund to the risk that the counterparty to an over-the-counter (OTC) derivatives contract will be unable or unwilling to make timely settlement payments or otherwise honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction. If the counterparty defaults, the Fund will have contractual remedies, but there is no assurance that the counterparty will meet its contractual obligations or that the Fund will succeed in enforcing them.

| 32 | U.S. Core Fund | Annual report |

Futures. A futures contract is a contractual agreement to buy or sell a particular commodity, currency, or financial instrument at a pre-determined price in the future. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values and/or interest rates and potential losses in excess of the amounts recognized on the Statement of Assets and Liabilities.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. Upon entering into a futures contract, the Fund is required to deposit initial margin with the broker in the form of cash or securities. The amount of required margin is generally based on a percentage of the contract value; this amount is the initial margin for the trade. The margin deposit must then be maintained at the established level over the life of the contract. Futures contracts are marked-to-market daily and an appropriate payable or receivable for the change in value (variation margin) is recorded by the Fund.

During the year ended February 28, 2011, the Fund used futures contracts to gain market exposure. During year ended February 28, 2011, the Fund held futures contracts with notional absolute values ranging from zero to $1.9 million, as measured at each quarter end. There were no open futures contracts as of February 28, 2011.

Effect of derivative instruments on the Statement of Operations

The table below summarizes the net realized gain (loss) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the year ended February 28, 2011:

| STATEMENT OF | ||||

| OPERATIONS | FUTURES | |||

| RISK | LOCATION | CONTRACTS | ||

|

|

||||

| Equity contracts | Net realized gain | $89,593 | ||

The table below summarizes the net change in unrealized appreciation (depreciation) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the year ended February 28, 2011:

| STATEMENT OF | ||||

| OPERATIONS | FUTURES | |||

| RISK | LOCATION | CONTRACTS | ||

|

|

||||

| Equity contracts | Change in | ($18,147) | ||

| unrealized | ||||

| appreciation | ||||

| (depreciation) | ||||

Note 4 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 5 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

| Annual report | U.S. Core Fund | 33 |

Management fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.78% of the first $500,000,000 of the Fund’s average daily net assets; (b) 0.76% of the next $500,000,000; (c) 0.75% of the next $1,000,000,000; (d) 0.74% of the next $1,000,000,000; and (e) 0.72% of the Fund’s average daily net assets in excess of $3,000,000,000. The Adviser has a subadvisory agreement with Grantham, Mayo Van Otterloo & Co. LLC. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the year ended February 28, 2011 were equivalent to an annual effective rate of 0.78% of the Fund’s average daily net assets.

The Adviser has contractually agreed to waive fees and/or reimburse certain expenses for each share class of the Fund. This agreement excludes taxes, portfolio brokerage commissions, interest, litigation and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The fee waivers and/or reimbursements are such that these expenses will not exceed 1.35%, 2.05%, 2.05%, 0.89%, 1.64%, 1.54%, 1.24% and 0.94% for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4 and Class R5 shares, respectively. The fee waivers and/or reimbursements will continue in effect until June 30, 2011. Prior to July 1, 2010, the fee waivers and/or reimbursements were such that the above expenses would not exceed 0.87%, 1.75%, 1.65%, 1.35% and 1.05% for Class I, Class R1, Class R3, Class R4 and Class R5 shares, respectively.

Effective June 26, 2010, the Adviser has voluntarily agreed to waive fees and/or reimburse certain other fund level expenses. This agreement excludes advisory, interest, overdraft, litigation, Rule 12b-1, class specific and other extraordinary expenses not incurred in the ordinary course of business. The fee waivers and/or reimbursement are such that these expenses will not exceed 0.04% of average daily net assets. During the period from May 1, 2010 to June 26, 2010, the fee waiver and/or reimbursement was such that these expenses did not exceed 0.09% of average daily net assets.

Accordingly, these expense reductions amounted to $40,615, $5,407, $7,461, $48,692, $2,975, $11,875, $11,890 and $11,912 for Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4 and Class R5 shares, respectively, for the year ended February 28, 2011.