PROSPECTUS

7,692,308

Shares

of

Common

Stock

of

Platinum

Energy Resources, Inc.

This

prospectus relates to the distribution of 7,692,308 shares of common stock,

$.0001 par value, of Platinum Energy Resources, Inc. (which we refer to in

this

prospectus as “we,” “us,” “Platinum” or the “Company”) by Tandem Energy

Holdings, Inc., a Nevada corporation (which we refer to in this prospectus

as

“Tandem”) to the shareholders of Tandem as part of Tandem’s dissolution and

winding-up of its affairs and distribution of its assets pursuant to Nevada

law.

On October 26, 2007, Platinum consummated the acquisition of substantially

all

of the assets of Tandem Energy Corporation, a Colorado corporation (which we

refer to in this prospectus as “TEC”), then a wholly-owned subsidiary of Tandem.

As part of the consideration for the assets, Platinum issued these 7,692,308

shares of common stock to TEC in a private transaction pursuant to an exemption

from registration provided by Section 4(2) of the Securities Act of 1933, as

amended. TEC was dissolved by a merger with and into Tandem (TEC’s sole

shareholder) effective March 11, 2008. Tandem was the surviving corporation

in the merger and, as such, received the assets of TEC, which consisted of

the

Platinum shares. Tandem was dissolved on June 24, 2008. Immediately

prior to its dissolution, Tandem’s assets consisted of the Platinum common stock

covered by this prospectus that it received, as the sole shareholder of TEC,

in

the merger. The parties to the acquisition had contemplated that, following

the

consummation of the acquisition, TEC would be dissolved and, thereafter, its

parent, Tandem, would dissolve and distribute the Platinum shares to Tandem’s

shareholders.

Our

common stock is quoted on the Over-the-Counter Bulletin Board (“OTCBB ”) under

the symbol PGRI. On August 7, 2008, the last sale price of our common stock

was $3.80 per share.

Investing

in our common stock involves a high degree of risk. You should carefully read

the discussion of material risks of investing in our common stock under the

heading “Risk Factors” beginning on page 4 of this

prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission

has

approved or disapproved of these securities or determined if this prospectus

is

truthful or complete. Any representation to the contrary is a criminal

offense.

_______________________

The

date

of this prospectus is August 11, 2008.

Table

of Contents

|

|

Page

|

|

|

|

|

|

|

PROSPECTUS

SUMMARY

|

1

|

|

|

|

|

|

|

RISK

FACTORS

|

4

|

|

|

|

|

|

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

12

|

|

|

|

|

|

|

USE

OF PROCEEDS

|

12

|

|

|

|

|

|

|

DIVIDEND

POLICY

|

12

|

|

|

|

|

|

|

CAPITALIZATION

|

12

|

|

|

|

|

|

|

MARKET

PRICE AND DIVIDEND DATA FOR PLATINUM SECURITIES; SHARE REPURCHASE

PROGRAM

|

13

|

|

|

|

|

|

|

SELECTED

HISTORICAL FINANCIAL DATA

|

14

|

|

|

|

|

|

|

SELECTED

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION OF PLATINUM

AND MAVERICK

|

16 | |

|

|

||

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

17

|

|

|

|

|

|

|

BUSINESS

|

33

|

|

|

|

|

|

|

DESCRIPTION

OF PROPERTIES

|

39

|

|

|

|

|

|

|

MANAGEMENT

|

43

|

|

|

|

|

|

|

EXECUTIVE

COMPENSATION

|

46

|

|

|

|

|

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

55

|

|

|

|

|

|

|

CERTAIN

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

|

58

|

|

|

|

|

|

|

DESCRIPTION

OF CAPITAL STOCK

|

60

|

|

|

|

|

|

|

SHARES

ELIGIBLE FOR FUTURE SALE

|

62

|

|

|

|

|

|

|

THE

DISTRIBUTION

|

64

|

|

|

|

|

|

|

LEGAL

MATTERS

|

64

|

|

|

|

|

|

|

EXPERTS

|

65

|

|

|

|

|

|

|

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

|

65

|

|

|

|

|

|

|

MANAGEMENT’S

ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

|

65

|

|

|

|

|

|

|

PLATINUM

ENERGY RESOURCES, INC. INDEX TO FINANCIAL STATEMENTS

|

F-1

|

You

should rely only on the information contained in this prospectus. We have not

authorized any other person to provide you with different information. If anyone

provides you with different or inconsistent information, you should not rely

on

it. Tandem is not making an offer to distribute these securities in any

jurisdiction where the offer or sale is not permitted. You should assume that

the information appearing in this prospectus is accurate only as of the date

on

the front cover of this prospectus regardless of the time of delivery of this

prospectus or of any distribution of the shares. Our business, financial

condition, results of operations and prospects may have changed since that

date.

PROSPECTUS

SUMMARY

You

should read the following summary, together with the more detailed information

regarding our company, especially the “Risk Factors” section and our financial

statements and notes to those statements appearing elsewhere in this prospectus,

before deciding to invest in shares of our common stock.

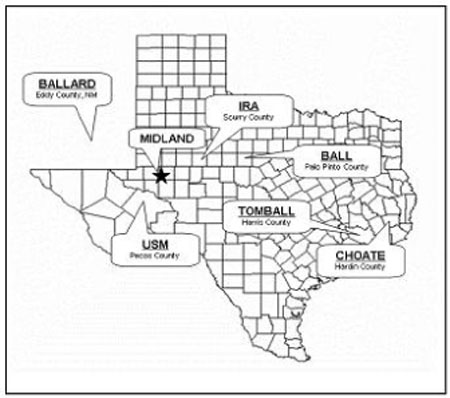

Platinum

Energy Resources, Inc. (which we refer to in this prospectus as “we,” “us,”

“Platinum” or the “Company”) is an independent oil and gas exploration and

production ("E&P") company. We have approximately 37,000 acres under lease

in relatively long-lived fields with well-established production histories,

21,000 of which were acquired as part of the TEC acquisition described below.

Our properties are concentrated primarily in the Gulf Coast region in Texas,

the

Permian Basin in Texas and New Mexico, and the Fort Worth Basin in

Texas.

Our

primary business strategy is to provide long-term growth in stockholder value

by

drilling, developing and exploiting our oil and gas properties. We are currently

engaged in an active drilling and workover program in order to achieve this

goal. Through a number of identifiable synergies, we believe that we are in

a

unique position to exploit our inventory of identified prospects more

effectively and efficiently than many other small independent oil and gas

exploration and production companies (See Business - Business Strategy on page

34.)

We

are

also continually evaluating potential low risk strategic acquisitions that

we

believe will complement our business plan. We believe there exists opportunities

to exploit mature fields that may have substantial remaining reserves. As the

major, large independent oil and gas companies continue to focus on more

costly and risky international and offshore prospects, the smaller independents,

such as Platinum, have an opportunity to take advantage of the

significant reserves left behind. For a discussion of our recent acquisitions,

see Business - Growth Strategy on page 34. We have also recently acquired

Maverick Engineering, Inc. (“Maverick”), a full service engineering company for

$6 million paid at closing, plus $5 million to be paid over the next six years,

pursuant to non-interest bearing cash flow notes, the timing of which related

note payments is related to performance. Following the consummation of this

acquisition, we moved our corporate headquarters to Maverick’s Houston office

and Maverick’s founder and CEO joined us as our Chief Operating Officer. See

Business - Growth Strategy on page 34.

Our

strategy also calls for the use of hedge financing to maximize profit and reduce

risk resulting from volatile energy markets. We believe that there is a gap

in

value between oil and gas reserves and the price of energy commodities and

that

profit can be captured by buying oil and gas companies or reserves, and selling

the underlying oil and gas commodity (See Business - Hedging Strategy on page

36).

TEC

Acquisition

On

October 26, 2007, through our wholly owned subsidiary, then known as PER

Acquisition Corp., a Delaware corporation (which we refer to in this prospectus

as “New TEC” and which has since changed its name to Tandem Energy Corporation)

we consummated the acquisition of substantially all of the assets and assumption

of substantially all of the liabilities of Tandem Energy Corporation, a Colorado

corporation (which we refer to in this prospectus as “TEC”), including

approximately $41.7 million in principal amount of TEC’s debt, in exchange for

the issuance of 7,692,308 shares of Platinum common stock. Prior to the TEC

acquisition, we were a blank check company.

TEC was

dissolved by a merger, effective March 11, 2008, with and into Tandem Energy

Holdings, Inc., a Nevada corporation (TEC’s sole shareholder, which we refer to

in this prospectus as “Tandem”). Tandem was the surviving corporation in the

merger and, as such, received the assets of TEC, which consisted of the

7,692,308 shares of Platinum common stock received in the acquisition. Tandem

was dissolved on June 24, 2008 and, pursuant to this prospectus, Tandem is

distributing the 7,692,308 shares of Platinum common stock (its assets) to

the

Tandem shareholders in accordance with the laws of the State of

Nevada.

1

Corporate

Information

We

were

incorporated in the State of Delaware on April 25, 2005. Our fiscal year ends

on

December 31. Our principal executive offices are located at 11490 Westheimer

Road, Suite 1000, Houston, Texas 77077. Our telephone number is (845) 323-0434.

You can access our web site at www.platenergy.com. Information contained on

our

web site is not a part of this prospectus. In this prospectus, references to

“Platinum,” “we,” “us” and “our” refer to Platinum Energy Resources, Inc., a

Delaware corporation, and our wholly-owned subsidiaries, New TEC, PER Gulf

Coast, Inc., Mixon Drilling, Inc., Red Iron Tool Co., Inc. and

Maverick.

We

formed

New TEC under the laws of the State of Delaware on January 25, 2006, to effect

a

business transaction. TEC was incorporated in Colorado on December 20, 1977.

Since its inception, TEC had been an oil and gas E&P company headquartered

in Midland, Texas. In the TEC acquisition, as described above, New TEC acquired

substantially all of the assets of TEC and we changed the name of New TEC from

“PER Acquisition Corp.” to “Tandem Energy Corporation.” The mailing address and

telephone number of Tandem Energy Corporation is now 200 N. Lorraine, Suite

400,

Midland, Texas and its telephone number is (432) 686-7136.

2

The

Offering

|

Common

stock offered:

|

7,692,308

shares

|

|

|

|

|

|

|

Common

stock outstanding:

|

22,070,762 shares

|

|

|

|

|

|

|

Use

of proceeds:

|

We

will not receive any proceeds from the distribution of the Platinum

shares

by Tandem to its shareholders.

|

|

|

|

|

|

|

OTCBB

symbol:

|

“PGRI”

|

|

|

|

|

|

|

Risk

factors:

|

See

“Risk Factors” and other information included in this prospectus for a

discussion of factors you should consider carefully before investing

in

shares of our common stock.

|

As

of the

date of this prospectus, we have 22,070,762 shares of common stock

outstanding, including the shares covered by this prospectus. This number

excludes the following shares as of the date of this prospectus:

|

|

·

|

14,400,000 shares

of common stock issuable upon exercise of our outstanding warrants

at an

exercise price of $6.00 per share;

|

|

|

·

|

4,000,000

shares of common stock available and reserved for future issuance

under

our 2006 Long-Term Incentive Plan;

|

|

|

·

|

535,714

shares of common stock issuable to Lance Duncan pursuant to a consulting

agreement between Platinum and Mr. Duncan;

and

|

|

|

·

|

1,440,000

shares underlying the purchase option granted to the underwriters

in our

IPO to purchase a total of 720,000 units at $10 per unit, which became

exercisable upon our acquisition of the TEC assets and expires October

24,

2010, consisting of 720,000 shares underlying such units and 720,000

shares issuable upon exercise of the warrants underlying such units

at an

exercise price of $7.50 per share.

|

3

RISK

FACTORS

Any

investment in our common stock involves a high degree of risk. You should

consider the risks described below carefully and all of the information

contained in this prospectus. If any of these risks, as well as other risks

and

uncertainties that are not currently known to us or that we currently believe

are not material, actually occur, our business, financial condition and results

of operations may suffer significantly. As a result, the trading price of our

common stock could decline and you may lose all or part of your investment

in

our common stock.

Since

Tandem, TEC’s parent entity, was a publicly-traded shell corporation, our

acquisition of all of the assets and substantially all liabilities of TEC may

subject us to successor liability for the shell corporation’s known and unknown

liabilities.

On

October 26, 2007, Platinum, through its wholly owned subsidiary, New TEC,

acquired substantially all of the assets and assumed substantially all of the

liabilities of TEC, including approximately $41.7 million of TEC's debt, in

exchange for the issuance of 7,692,308 shares of Platinum common stock. Prior

to

the acquisition, TEC was the wholly owned subsidiary of Tandem.

Tandem

was originally incorporated in Nevada as Las Vegas Major League Sports, Inc.

(“LVMS”) on July 22, 1993 with the plan of engaging in certain business

activities associated with the Canadian Football League. In April 1994, it

completed an initial public offering and began trading under the symbol LVTD.

In

1996, LVMS filed for bankruptcy protection and ceased being a reporting company

and also ceased operations and was considered to be a “shell” corporation. In

1998, LVMS changed its name to Pacific Medical Group, Inc. (“Pacific Medical

Group”) in connection with a share exchange transaction with a privately-held

company whose business plan was to engage in the manufacture and sale of medical

products. To our knowledge, that business was unsuccessful and, again, the

company ceased operations and was considered to be a “shell” corporation. In

February, 2005, Pacific Medical Group changed its name to Tandem Energy

Holdings, Inc. and changed its trading symbol to TDYH.PK. In June, 2005, Tandem

Energy Corporation became a wholly-owned subsidiary of Tandem Energy Holdings,

Inc.

The

risks

and uncertainties that were involved in the TEC acquisition include that we

may

be deemed to be a successor to Tandem, TEC’s parent, and thus subject to the

existing liabilities, including undisclosed liabilities, of the prior shell

corporations arising out of the their prior business operations, financial

activities and equity dealings. These risks and uncertainties

are generally greater when a corporation is used as a shell vehicle

more than once, such as Tandem. There is a risk of litigation by third parties

or governmental investigations or proceedings. Some potential claims against

Tandem that have been identified to date include the following:

|

|

·

|

Tandem

has been informed of a claim of ownership of 2.7 million shares of

Tandem

common stock. Such claim could result in a successor liability claim

against Platinum. These shares are not included in the outstanding

shares

of Tandem.

|

|

|

·

|

Messrs.

Jack and Rex Chambers, former members of Tandem management and significant

shareholders of Tandem, are the subjects of an Order of Permanent

Injunction resulting from proceedings instituted against them in

1984 by

the Securities and Exchange Commission. The Order enjoins Messrs.

Chambers

from, directly or indirectly, engaging in the sale or offer for sale

of

securities in the form of fractional undivided interests in oil or

gas

leases of Chambers Oil and Gas or any other security without a

registration statement being in effect or an exemption from registration

otherwise being available. To the extent a court were to conclude

that the

TEC acquisition constitutes the sale of securities by Messrs. Chambers

in

violation of the Order of Permanent Injunction, Platinum potentially

could

be subject to a successor liability claim to the extent that any

liability

was imposed upon Tandem as a

result.

|

|

|

·

|

Lance

Duncan is a former director and officer of Tandem who entered into

a

consulting agreement with Platinum in October 2006. Mr. Duncan played

a

key role in connection with the acquisition by Tandem of the stock

of TEC

and the assets of Shamrock Energy Corporation, a Texas corporation.

It is

possible that a court could determine that Mr. Duncan acted as an

unlicensed broker-dealer in connection with such transactions. In

that

event, Platinum potentially could be subject to a successor liability

claim to the extent that any liability was imposed upon Tandem as

a

result.

|

4

|

|

·

|

Tandem

has been unsuccessful in its efforts to locate corporate records

and other

material agreements and documents relating to itself and its predecessors

in name for periods prior to mid-March 2005. As a result, no assurance

can

be given that certain actions taken with respect to Tandem were authorized

by the necessary corporate action on the part of Tandem’s board of

directors and its shareholders. Further, no assurance can be given

that

additional shares had not been issued by Tandem’s predecessors in name and

that therefore Tandem’s current capitalization is accurate. If

theoretically all of the 50,000,000 authorized shares of common stock

of

Pacific Medical Group (Tandem’s immediate predecessor in name) were issued

and outstanding, there would be an additional 83,678 shares (post

1:500

stock split) of Tandem common stock currently outstanding and Platinum

could be subject to a successor liability claim for up to approximately

$212,000 to the extent that the holders of the additional shares

do not

receive their full proportion of the Platinum common stock distributed

to

shareholders upon the liquidation and dissolution of Tandem. Platinum

potentially also could be subject to substantially higher successor

liability claims for other actions of the predecessors to Tandem’s current

management that were not properly authorized and implemented, including

any shares that Messrs. Ronald G. Williams or Lyle Mortensen may

claim to

have acquired in connection with the acquisition of Pacific Medical

Group

that were not disclosed to Tandem and thus not presently reflected

in the

shares currently outstanding.

|

|

|

·

|

Prior

to its acquisition of TEC, Mr. Williams claims to have acquired control

of

Pacific Medical Group from Mr. John Karlsson. Tandem has also been

unsuccessful in its efforts to obtain documentation relating to such

acquisition and, as such, has not been able to determine the amount

or

percentage of the outstanding shares of Pacific Medical Group that

Mr.

Williams acquired. Platinum could be subject to potential successor

liability claims to the extent that Mr. Williams did not properly

acquire

control of Pacific Medical Group and did not have proper authority

to

enter into the transactions with

TEC.

|

We

did

not receive a legal opinion relating to Tandem’s capitalization or corporate

actions in connection with the closing of the TEC acquisition. Given the

uncertainty regarding Tandem’ s prior corporate history, the lack of corporate

documentation, claims of share ownership and other related concerns, Tandem’s

legal counsel was unwilling to render such an opinion. Accordingly, we did

not

have a legal opinion to support the representation and warranties of Tandem

contained in the TEC acquisition agreement regarding these matters.

The

volatility of oil and natural gas prices due to factors beyond our control

greatly affects our profitability.

Our

revenues, operating results, profitability, future rate of growth and the

carrying value of our oil and natural gas properties depend primarily upon

the

prevailing prices for oil and natural gas. Historically, oil and natural gas

prices have been volatile and are subject to fluctuations in response to changes

in supply and demand, market uncertainty and a variety of additional factors

that are beyond our control. While prices over the past year have increased

dramatically, any significant decline in the price of oil and natural gas or

any

other unfavorable market conditions could have a material adverse effect on

our

operations, financial condition and level of expenditures for the development

of

our oil and natural gas reserves, and may result in write downs of our

investments as a result of our use of the full cost accounting

method.

Prices

for natural gas and crude oil fluctuate widely. These fluctuations in oil and

natural gas prices may result from relatively minor changes in the supply of

and

demand for oil and natural gas, market uncertainty and other factors that are

beyond our control, including:

|

|

·

|

worldwide

and domestic supplies of oil and natural

gas;

|

|

|

·

|

weather

conditions;

|

|

|

·

|

the

level of consumer demand;

|

|

|

·

|

the

price and availability of alternative

fuels;

|

|

|

·

|

the

availability of drilling rigs and completion

equipment;

|

|

|

·

|

the

proximity to, and capacity of transportation

facilities;

|

|

|

·

|

the

price and level of foreign imports;

|

|

|

·

|

the

nature and extent of domestic and foreign governmental regulation

and

taxation;

|

|

|

·

|

the

ability of the members of the Organization of Petroleum Exporting

Countries to agree to and maintain oil price and production

controls;

|

5

|

|

·

|

worldwide

economic and political conditions;

|

|

|

·

|

the

effect of worldwide energy conservation

measures;

|

|

|

·

|

political

instability or armed conflict in oil-producing regions;

and

|

|

|

·

|

the

overall economic environment.

|

These

factors and the volatility of the energy markets make it extremely difficult

to

predict future oil and natural gas price movements with any certainty. Declines

in oil and natural gas prices would not only reduce revenue, but could reduce

the amount of oil and natural gas that we can produce economically and, as

a

result, could have a material adverse effect on our financial condition, results

of operations and reserves.

Hedging

activities may prevent us from benefiting from price increases and may expose

us

to other risks.

Hedging

is a strategy that can help a company to mitigate the volatility of oil and

gas

prices by limiting its losses if oil and gas prices decline; however, this

strategy may also limit the potential gains that a company could realize if

oil

and gas prices increase. From time to time, we use derivative instruments

(primarily collars and price swaps) to hedge the impact of market fluctuations

on natural gas and crude oil prices and net income and cash flow. To the extent

that we engage in hedging activities, we may be prevented from realizing the

benefits of price increases above the levels of the hedges. Further, as a result

of hedges we entered into at fixed prices below current market prices, our

recent hedging activity has generated substantial losses to us. Hedging

activities are subject to risks associated with differences in prices at

different locations, particularly where transportation constraints restrict

a

producer’s ability to deliver oil and gas volumes to the delivery point to which

the hedging transaction is indexed. Additionally, hedging strategies are

normally more effective with companies with a certain volume of production,

and

our current oil production levels may not be sufficient to be able to employ

a

meaningful hedging strategy. When we acquired the TEC assets, there were some

open commodity derivatives. In its financial statements, Tandem did not

designate any of its currently open commodity derivatives as cash flow hedges;

therefore, all changes in the fair value of these contracts prior to maturity,

plus any realized gains or losses at maturity, are recorded as other income

(expense) in Tandem’s statements of operations. Certain “costless collars”

executed in June 2005 were employed to protect Tandem and its creditors from

exposure to lower oil and gas prices. However, in conjunction with that

protection, Tandem periodically incurred settlement losses associated with

the

ceiling component of such hedges when gas prices spiked in late 2005 and oil

prices spiked in mid 2006. As a result of those positions, we have and may

continue to periodically incur settlement losses associated with the ceiling

component of such hedges as oil prices have increased during 2007. For the

year

ended December 31, 2007, we reported a $1.5 million net loss on derivatives.

For

the three months ended March 31, 2008, we reported a $2.0 million net loss

on

derivatives.

Our

ability to sell crude oil and natural gas production could be materially harmed

by failure to obtain adequate services such as transportation and

processing.

The

sale

of crude oil and natural gas production depends on a number of factors beyond

our control, including the availability, proximity and capacity of pipelines,

natural gas gathering systems and processing facilities. Any significant change

in market factors affecting these infrastructure facilities or our failure

to

obtain these services on acceptable terms could materially harm our business.

We

deliver crude oil and natural gas through gathering systems and pipelines that

we do not own. These facilities may be temporarily unavailable due to market

conditions or mechanical reasons or may become unavailable in the

future.

Our

proved reserves will generally decline as reserves are produced and as such,

success will depend on acquiring or finding additional

reserves.

Our

future success depends upon our ability to find, develop or acquire additional

oil and natural gas reserves that are economically recoverable. According to

reports of proved reserves prepared as of December 31, 2007 by Williamson

Petroleum Consultants, Inc., independent petroleum engineers, and by our own

engineers, our proved reserves will decline at a rate of 18% per year as

reserves are produced and, except to the extent that we conduct successful

exploration or development activities or acquire properties containing proved

reserves, or both, such reserves will continue to decline. To increase reserves

and production, we must commence drilling, workover or acquisition activities.

There can be no assurance, however, that we will have sufficient resources

to

undertake these actions, that our drilling and workover projects or other

replacement activities will result in significant additional reserves or that

we

will have success drilling productive wells at low finding and development

costs. Furthermore, although our revenues may increase if prevailing oil and

natural gas prices increase significantly, our finding costs for additional

reserves may also increase.

6

Approximately

63% of our proved reserves are classified as proved

undeveloped.

Approximately

63% of our reserves are classified as proved undeveloped reserves. The future

development of these undeveloped reserves into proved developed reserves

is

highly dependent upon our ability to fund estimated total capital development

cost of approximately $54.7 million, of which $19.4 million, $24.7 million

and

$10.6 million are expected to be incurred in 2008, 2009 and 2010, respectively.

During the first three months of 2008, we expended $3.4 million. If such

development costs are not incurred or are substantially reduced, our proved

undeveloped and total proved reserves could be substantially reduced. The

reduction in such reserves could have a materially negative impact on our

ability to produce profitable future operations. The successful conversion

of

these proved undeveloped reserves into proved developed reserves is dependent

upon the following:

|

|

·

|

The

funding of the estimated proved undeveloped capital development costs

is

highly dependent upon our ability to generate sufficient working

capital

through operating cash flows, and our ability to borrow funds and/or

raise

equity capital.

|

|

|

·

|

Our

ability to generate sufficient operating cash flows is highly dependent

upon successful and profitable future operations and cash flows which

could be negatively impacted by fluctuating oil and gas prices and

increased operating costs. No assurance can be given that we will

have

successful and profitable future operations and positive future cash

flows.

|

|

|

·

|

Our

ability to borrow funds in the future is dependent upon the terms

of

future loan agreements, borrowing base calculations and other lending

and

operating conditions. No assurance can be given that we will be able

to

secure future borrowings at competitive borrowing rates and conditions,

if

at all.

|

|

|

·

|

Our

ability to secure equity funding is dependent upon a number of factors,

including our profitable operations and cash flows, capital market

conditions and general economic conditions. No assurance can be given

that

we will be able to secure adequate equity

funding.

|

|

|

·

|

Our

ability to secure related oilfield equipment and services on a timely

and

competitive basis. Presently, there is great demand for and often

extensive delays in securing oilfield equipment and services at any

price.

No assurance can be given that the requisite oilfield equipment and

services can be secured in a timely and competitive

manner.

|

|

|

·

|

Projections

for proved undeveloped reserves are largely based on their analogy

to

similar producing properties and to volumetric calculations. Reserves

projections based on analogy are subject to change due to subsequent

changes in the analogous properties. Volumetric calculations are

often

based upon limited log and/or core analysis data and incomplete reservoir

fluid and formation rock data. Since these limited data must frequently

be

extrapolated over an assumed drainage area, subsequent production

performance trends or material balance calculations may cause the

need for

significant revisions to the estimates of

reserves.

|

Estimates

of oil and natural gas depend on many assumptions that may vary substantially

from actual production.

There

are

numerous uncertainties inherent in estimating quantities of proved reserves

and

in projecting future rates of production and timing of expenditures, including

many factors beyond our control. The reserve information relating to proved

reserves set forth in this prospectus represents only estimates based on reports

of proved reserves prepared as of December 31, 2007 by Williamson Petroleum

Consultants, independent petroleum engineers, and by our own engineers.

Williamson Petroleum Consultants was not engaged to evaluate and prepare reports

relating to the probable reserves on our properties and interests as these

are

more uncertain than evaluations of proved reserves. Petroleum engineering is

not

an exact science. Information relating to our proved oil and natural gas

reserves is based upon engineering estimates. Estimating quantities of proved

crude oil and natural gas reserves is a complex process. It requires

interpretations of available technical data and various assumptions, including

assumptions relating to economic factors. Any significant inaccuracies in these

interpretations or assumptions or changes of conditions could cause the

quantities of our reserves to be overstated.

To

prepare estimates of economically recoverable crude oil and natural gas reserves

and future net cash flows, engineers analyze many variable factors, such as

historical production from the area compared with production rates from other

producing areas. It is also necessary to analyze available geological,

geophysical, production and engineering data, and the extent, quality and

reliability of this data can vary. The process also involves economic

assumptions relating to commodity prices, production costs, severance and excise

taxes, capital expenditures and workover and remedial costs. For these reasons,

estimates of the economically recoverable quantities of oil and natural gas

attributable to any particular group of properties, classifications of such

reserves based on risk of recovery and estimates of the future net cash flows

expected therefrom prepared by different engineers or by the same engineers

at

different times may vary substantially. Actual production, revenues and

expenditures with respect to our reserves will likely vary from estimates,

and

such variations may be material.

Our

operations entail inherent casualty risks which may not be covered by adequate

insurance.

We

must

continually acquire, explore and develop new oil and natural gas reserves to

replace those produced and sold. Our hydrocarbon reserves and revenues will

decline if we are not successful in our drilling, acquisition or exploration

activities. We hope to maintain our reserve base primarily through successful

exploration and production operations, but we may not be successful in this

regard. Casualty risks and other operating risks could cause reserves and

revenues to decline.

7

Our

operations are subject to inherent casualty risks such as fires, blowouts,

cratering and explosions. Other risks include pollution, the uncontrollable

flows of oil, natural gas, brine or well fluids. These risks may result in

injury or loss of life, suspension of operations, environmental damage or

property and equipment damage, all of which would cause us to experience

substantial financial loss. Our drilling operations involve risks from high

pressures and from mechanical difficulties such as stuck pipes, collapsed

casings and separated cables.

Although

many of our properties are located across Texas and southeast New Mexico and

are

not confined to one geographic area, our Tomball field, the largest producer

in

our current portfolio, and much of our Maverick business are located in the

Gulf

Coast region of Texas, an area that may be subject to catastrophic weather

and

natural disasters such as floods, earthquakes and hurricanes. If such a disaster

were to occur, it could severely disrupt our operations in that area and results

of operations could be materially and adversely affected. In accordance with

customary industry practice, we maintain insurance against some, but not all,

of

these risks. There can be no assurance that any insurance will be adequate

to

cover any losses or liabilities. We cannot predict the continued availability

of

insurance, or its availability at premium levels that justify its purchase.

In

addition, we may be liable for environmental damages caused by previous owners

of properties that we purchased, which liabilities would not be covered by

our

insurance. We are currently unaware of any material liability we may have for

environmental damages caused by previous owners of properties purchased by

us.

Many

of our wells produce at very low production rates while producing waste water

many times that rate.

Many

of

our wells produce at production rates as low as one barrel of oil equivalent

(“Boe”) per day and produce waste water at many times the rate of production.

Even a modest decrease in oil and gas prices may render these wells uneconomic

to produce, when compared to wells which produce at higher rates. Consequently,

these uneconomic wells could cause a downward revision in our oil and gas

reserves.

Our

operations also entail significant operating risks.

Our

drilling activities involve risks, such as drilling non-productive wells or

dry

holes, which are beyond our control. The cost of drilling and operating wells

and of installing production facilities and pipelines is uncertain. Cost

overruns are common risks that often make a project uneconomical. The decision

to purchase and to exploit a property depends on the evaluations made by reserve

engineers, the results of which are often inconclusive or subject to multiple

interpretations. We may also decide to reduce or cease its drilling operations

due to title problems, weather conditions, noncompliance with governmental

requirements or shortages and delays in the delivery or availability of

equipment or fabrication yards.

Our

future operating results could be negatively impacted by increases in costs

from

third party service providers.

Our

future operating results are dependent upon our ability to secure competitive

and timely third party oilfield services. Generally, the demand for and cost

of

oilfield services is directly related to oil and gas commodity prices and the

number of skilled oilfield laborers in the area. Presently, in our area of

operations, there are a limited number of third party services providers, a

limited amount of oilfield service equipment, and a limited number of skilled

oilfield laborers. In addition, many third party service providers are committed

to providing oilfield services to entities that have much greater financial

resources and oilfield demand than our company. These conditions could

significantly increase our cost of third party services and have a negative

impact on our ability to secure oilfield services on a timely basis. No

assurance can be given that our future operations will not be further negatively

impacted by our inability to secure third party services at competitive

prices.

Our

operations are subject to various governmental regulations that require

compliance that can be burdensome and expensive.

Our

oil

and natural gas operations are subject to extensive federal, state and local

governmental regulations that may be changed from time to time in response

to

economic and political conditions. Matters subject to regulation relate to

the

general population’s health and safety and are associated with compliance and

permitting obligations including regulations related to discharge from drilling

operations, use, storage, handling, emission and disposal, drilling bonds,

reports concerning operations, the spacing of wells, unitization and pooling

of

properties and taxation. From time to time, regulatory agencies have imposed

price controls and limitations on production by restricting the rate of flow

of

oil and natural gas wells below actual production capacity to conserve supplies

of oil and natural gas. In addition, the production, handling, storage,

transportation and disposal of oil and natural gas, by-products thereof and

other substances and materials produced or used in connection with oil and

natural gas operations are subject to regulation under federal, state and local

laws and regulations primarily relating to protection of human health and the

environment. These laws and regulations have continually imposed increasingly

strict requirements for water and air pollution control and solid waste

management, and compliance with these laws may cause delays in the additional

drilling and development of our properties. Significant expenditures may be

required to comply with governmental laws and regulations applicable to us.

We

believe the trend of more expansive and stricter environmental legislation

and

regulations will continue. While, historically, TEC did not experience any

material adverse effect from regulatory delays, there can be no assurance that

such delays will not occur for us in the future.

8

Our method

of accounting for investments in oil and natural gas properties may result

in

impairment of asset value, which could affect our stockholder equity and net

profit or loss.

We

follow

the full cost method of accounting for our crude oil and natural gas properties.

Under this method, all direct costs and certain directly related internal costs

associated with acquisition of properties and successful, as well as

unsuccessful, exploration and development activities are capitalized.

Depreciation, depletion and amortization of capitalized crude oil and natural

gas properties and estimated future development costs, excluding unproved

properties, are based on the unit-of-production method based on proved developed

reserves. Net capitalized costs of crude and natural gas properties, as adjusted

for asset retirement obligations, net of salvage value, are limited, by country,

to the lower of unamortized cost or the cost ceiling, defined as the sum of

the

present value of estimated future net revenues from proved reserves based on

unescalated prices discounted at 10%, plus the cost of properties not being

amortized, if any, plus the lower of cost or estimated fair value of unproved

properties included in the costs being amortized, if any, less related income

taxes. Excess costs are charged to proved property impairment expense. No gain

or loss is recognized upon sale or disposition of crude oil and natural gas

properties, except in unusual circumstances.

Properties

that we acquire may not produce as projected, and we may be unable to identify

liabilities associated with the properties or obtain protection from sellers

against them.

As

part

of our business strategy, we continually seek acquisitions of oil and gas

properties. The successful acquisition of oil and natural gas properties

requires assessment of many factors, which are inherently inexact and may be

inaccurate, including the following:

|

|

·

|

future

oil and natural gas prices;

|

|

|

·

|

the

amount of recoverable reserves;

|

|

|

·

|

future

operating costs;

|

|

|

·

|

future

development costs;

|

|

|

·

|

failure

of titles to properties;

|

|

|

·

|

costs

and timing of plugging and abandoning wells;

and

|

|

|

·

|

potential

environmental and other

liabilities.

|

Our

assessment will not necessarily reveal all existing or potential problems,

nor

will it permit us to become familiar enough with the properties to assess fully

their capabilities and deficiencies. With respect to properties on which there

is current production, we may not inspect every well location, every potential

well location, or pipeline in the course of our due diligence. Inspections

may

not reveal structural and environmental problems such as pipeline corrosion

or

groundwater contamination. We may not be able to obtain or recover on

contractual indemnities from the seller for liabilities that it created. We

may

be required to assume the risk of the physical condition of the properties

in

addition to the risk that the properties may not perform in accordance with

our

expectations.

Changes

in technology may render our products or services

obsolete.

The

oil

and gas E&P industry is substantially affected by rapid and significant

changes in technology. These changes may render certain existing energy sources,

such as oil and gas, and certain services and technologies currently used

obsolete. We cannot assure you that the technologies we use or rely upon will

not be subject to such obsolescence. While we may attempt to adapt and apply

the

services we provide to newer technologies, we cannot assure you that we will

have sufficient resources to fund these changes or that these changes will

ultimately prove successful.

Oil

and gas drilling and producing operations can be hazardous and may expose us

to

environmental liabilities.

Our

oil

and gas operations will subject us to many risks, including well blowouts,

cratering and explosions, pipe failure, fires, formations with abnormal

pressures, uncontrollable flows of oil, natural gas, brine or well fluids,

and

other environmental hazards and risks. If any of these risks occur, we could

sustain substantial losses as a result of:

|

|

·

|

injury

or loss of life;

|

|

|

·

|

severe

damage to or destruction of property, natural resources and

equipment;

|

|

|

·

|

pollution

or other environmental damage;

|

|

|

·

|

clean-up

responsibilities;

|

9

|

|

·

|

regulatory

investigations and penalties; and

|

|

|

·

|

suspension

of operations.

|

Our

liability for environmental hazards could include those created either by the

previous owners of properties that we purchase or lease or by acquired companies

prior to the date we acquire them. We expect to maintain insurance against

some,

but not all, of the risks described above. Our insurance may not be adequate

to

cover casualty losses or liabilities. Also, we may not be able to obtain

insurance at premium levels that justify its purchase.

We

depend on key personnel to execute our business

plans.

The

loss

of any key executives or any other key personnel could have a material adverse

effect on our operations. We depend on the efforts and skill of our key

executives and personnel. Moreover, as we continue to grow our asset base

and

the scope of our operations, future profitability will depend on our ability

to

attract and retain qualified personnel. Mr. Tim Culp, our Chairman of the

Board,

was TEC’s President and Chief Executive Officer prior to the consummation of the

TEC acquisition. Following consummation of our recent acquisition of

Maverick, Maverick’s founder and chief executive officer became our Chief

Operating Officer. On August 11, 2008, we hired Lisa Meier as our Chief

Financial Officer and Treasurer. We cannot predict the effect that any change

in

management might have on our operations.

Terrorist

activities and military and other actions could adversely affect our

business.

Terrorist

attacks and the threat of terrorist attacks, whether domestic or foreign, as

well as the military or other actions taken in response to these acts, cause

instability in the global financial and energy markets. The United States

government has issued public warnings that indicate that energy assets might

be

specific targets of terrorist organizations. These actions could adversely

affect us, in unpredictable ways, including the disruption of fuel supplies

and

markets, increased volatility in crude oil and natural gas prices, or the

possibility that the infrastructure on which we rely could be a direct target

or

an indirect casualty of an act of terror.

Our

officers and directors are now and may in the future become affiliated with

entities engaged in business activities similar to ours and, accordingly, may

have conflicts of interest in determining to which entity a particular business

opportunity should be presented.

Our

Chief

Executive Officer and certain of our directors are engaged in other business

endeavors and certain members of management are, and will likely in the future

become, affiliated with entities engaged in the oil and gas E&P industry or

other business activities similar to those of Platinum. For example, Mr. Jim

Dorman, our executive vice president, owns approximately 30% of KD Resources,

LLC, a privately-owned Delaware limited liability company that purchased certain

oil and gas properties in Texas in May 2007. Mr. Dorman’s son, Mr. James T.

Dorman is the chief executive officer of KD Resources, LLC. In addition, Mr.

Barry Kostiner, our Chief Executive Officer and a director of Platinum, is

a 28%

owner of Braesridge Energy LLC, which invests in energy companies, including

ours. Braesridge also owns approximately 65% of KD Resources. Mr. Kostiner

was

the manager of Braesridge Energy LLC until his resignation from such position

on

February 14, 2008. As of the date of this prospectus, Braesridge owns

approximately 3.5 million shares, or about 15.7%, of our outstanding common

stock, plus presently exercisable warrants to purchase an additional

approximately 5.3 million shares of common stock. Braesridge has entered into

an

agreement to purchase 420,603 shares of Platinum common stock from two Platinum

employees, Todd M. Yocham and Tobin Scott, upon the distribution of Tandem’s

assets pursuant to a registration statement of which this prospectus is a part.

Following this purchase, Braesridge will own a total of 3,875,403 shares,

or about 17.6%, of our outstanding common stock.

In

the

course of their current and/or future activities, our officers and directors

may

become aware of business or investment opportunities which may be appropriate

for presentation to us as well as the other entities with which they are or

may

become affiliated. Accordingly, they may have conflicts of interest in

determining to which entity a particular business opportunity should be

presented. In general, officers and directors of a corporation incorporated

under the laws of the State of Delaware are required to present business

opportunities to a corporation if:

|

|

·

|

the

corporation could financially undertake the

opportunity;

|

|

|

·

|

the

opportunity is within the corporation’s line of business;

and

|

|

|

·

|

it

would not be fair to the corporation and its stockholders for the

opportunity not to be brought to the attention of the

corporation.

|

As

a

result of multiple business affiliations, our Chief Executive Officer and

directors may have similar legal obligations relating to presenting business

opportunities meeting the above-listed criteria to multiple entities. In

addition, conflicts of interest may arise when our board of directors evaluates

a particular business opportunity with respect to the above-listed criteria.

We

cannot assure you that any of the above mentioned conflicts will be resolved

in

our favor. For a description of management’s current affiliations, see “Certain

Relationships and Related Party Transactions.”

10

Maverick

Engineering, our wholly owned subsidiary, is dependent upon a small number

of

customers for a large portion of its net revenues, and a decline in sales to

its

major customers could harm Maverick's results of

operations.

A

small

number of customers are responsible for a significant portion of Maverick's

net

revenues. During 2007, Maverick's 5 largest customers accounted for

approximately $22 million out of its $33.8 million of net revenues. Maverick's

customer concentration could increase or decrease depending on future customer

requirements, which will depend in large part on business conditions in the

market sectors in which Maverick's customers participate. The loss of one or

more major customers or a decline in sales to its major customers could

significantly harm Maverick's business and results of operations. If Maverick

is

not able to expand its customer base, it will continue to depend upon a small

number of customers for a significant percentage of its sales. There can be

no

assurance that its current customers will not reduce the amount of services

for

which Maverick is retained or otherwise terminate their relationship with

Maverick.

11

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, including the sections entitled “Prospectus Summary,” “Risk

Factors,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and “Business,” contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended,

and

Section 21E of the Securities Exchange Act of 1934, as amended. These statements

relate to future events or our future financial performance and involve known

and unknown risks, uncertainties and other factors that may cause our or our

industry’s actual results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity, performance

or

achievements expressed or implied by the forward-looking statements. These

risks

and other factors include those listed under “Risk Factors” and elsewhere in

this prospectus. In some cases, you can identify forward-looking statements

by

terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or

the negative of these terms or other comparable terminology. These statements

are only predictions. Actual events or results may differ materially. In

evaluating these statements, you should specifically consider various factors,

including the risks outlined under “Risk Factors.” These factors may cause our

actual results to differ materially from any forward-looking

statement.

Although

we believe that the expectations reflected in the forward-looking statements

are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Moreover, neither we nor any other person assumes

responsibility for the accuracy and completeness of these forward-looking

statements. We are under no duty to update any of the forward-looking statements

after the date of this prospectus to conform our prior statements to actual

results.

USE

OF PROCEEDS

This

prospectus relates to shares of our common stock that Tandem is distributing

to

its shareholders as part of Tandem’s dissolution under Nevada law. Immediately

prior to its dissolution on June 24, 2008, Tandem’s assets consisted of the

Platinum common stock covered by this prospectus. Under Nevada law, as part

of

Tandem’s dissolution, it is required to distribute its assets to its

shareholders. Tandem shareholders will receive these shares as part of the

dissolution by virtue of their ownership of shares of Tandem, and will not

be

paying any consideration to Tandem or Platinum. There will not be any proceeds

from the distribution of the shares covered by this prospectus.

DIVIDEND

POLICY

We

have

not declared or paid any dividends to date. We currently intend to retain future

earnings, if any, to support the development and expansion of our business

and

do not anticipate paying any cash dividends on our common stock in the

foreseeable future. Any future determination to pay dividends will be at the

discretion of our board of directors and will depend on our financial condition,

results of operations, capital requirements and other factors our board deems

relevant.

The

following table summarizes the authorized, issued and outstanding shares and

related additional paid-in-capital of Platinum as of July 16,

2008:

|

STOCKHOLDERS'

EQUITY

|

Shares Issued

and Outstanding |

Amount

|

|||||

|

|

|

|

|||||

|

Preferred

stock, $.0001 par value, 1,000,000 authorized, 0 issued

|

-

|

-

|

|||||

|

Common

stock, $.0001 par value; 75,000,000 shares authorized;

|

24,068,675

|

$

|

2,407

|

||||

|

Additional

paid-in capital

|

155,064,142

|

||||||

|

|

|||||||

|

Treasury

stock - common shares

|

(1,997,913

|

)

|

(15,661,464

|

)

|

|||

|

|

|||||||

|

|

22,070,762

|

$

|

139,405,085

|

||||

The 22,070,762

shares of common stock outstanding as of the date of this prospectus does not

include the following shares:

|

|

·

|

14,400,000

shares of common stock issuable upon exercise of our outstanding

warrants

at an exercise price of $6.00 per

share;

|

|

|

·

|

4,000,000

shares of common stock available and reserved for future issuance

under

our 2006 Long-Term Incentive Plan;

|

12

|

|

·

|

535,714

shares of common stock issuable to Lance Duncan pursuant to a consulting

agreement between Platinum and Mr.

Duncan;

|

|

|

·

|

1,997,913

shares of common stock that have been repurchased by Platinum under

our

share repurchase program and have been designated as treasury shares;

and

|

|

|

·

|

1,440,000

shares underlying the purchase option granted to the underwriters

in our

IPO to purchase a total of 720,000 units at $10 per unit, which purchase

option became exercisable upon our acquisition of the TEC assets

and

expires October 24, 2010, consisting of 720,000 shares underlying

such

units and 720,000 shares issuable upon exercise of the warrants underlying

such units at an exercise price of $7.50 per

share.

|

You

should read this table in conjunction with “Selected Historical Financial Data,”

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and the financial statements and the related notes and schedules

thereto included elsewhere in this prospectus.

MARKET

PRICE AND DIVIDEND DATA FOR PLATINUM SECURITIES;

SHARE

REPURCHASE PROGRAM

Platinum

consummated its IPO on October 28, 2005. In the IPO, we sold 14,400,000 units.

Each unit consists of one share of Platinum’s common stock and one redeemable

common stock purchase warrant. Platinum common stock, warrants and units are

quoted on the OTCBB under the symbols “PGRI”, “PGRIW” and “PGRIU”, respectively.

Platinum’s units commenced public trading on October 28, 2005 and its common

stock and warrants commenced separate public trading on December 9, 2005. The

high and low bid prices of our units, common stock and warrants as reported

by

the OTCBB for the quarter indicated are as follows. Such inter-dealer quotations

do not necessarily represent actual transactions and do not reflect retail

mark-ups, mark-downs or commissions:

|

|

Units

|

Common Stock

|

Warrants

|

||||||||||||||||

|

|

High

|

Low

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

2008:

|

|

|

|

|

|

|

|||||||||||||

|

Third

Quarter (through August 7)

|

$

|

6.39

|

$

|

4.01

|

$

|

4.70

|

$

|

3.72

|

$

|

0.96

|

$

|

0.73

|

|||||||

|

Second

Quarter

|

$

|

6.39

|

$

|

5.50

|

$

|

5.15

|

$

|

4.40

|

$

|

1.10

|

$

|

0.84

|

|||||||

|

First

Quarter

|

$

|

8.40

|

$

|

6.00

|

$

|

6.97

|

$

|

4.60

|

$

|

1.85

|

$

|

1.00

|

|||||||

|

2007:

|

|||||||||||||||||||

|

Fourth

Quarter

|

$

|

10.00

|

$

|

8.19

|

$

|

7.99

|

$

|

6.60

|

$

|

2.21

|

$

|

0.63

|

|||||||

|

Third

Quarter

|

$

|

8.45

|

$

|

7.85

|

$

|

7.65

|

$

|

7.50

|

$

|

0.81

|

$

|

0.35

|

|||||||

|

Second

Quarter

|

$

|

8.25

|

$

|

7.83

|

$

|

7.60

|

$

|

7.40

|

$

|

0.74

|

$

|

0.31

|

|||||||

|

First

Quarter

|

$

|

7.95

|

$

|

7.60

|

$

|

7.41

|

$

|

7.26

|

$

|

0.57

|

$

|

0.43

|

|||||||

|

2006:

|

|||||||||||||||||||

|

Fourth

Quarter

|

$

|

8.10

|

$

|

7.60

|

$

|

7.30

|

$

|

7.08

|

$

|

0.85

|

$

|

0.47

|

|||||||

|

Third

Quarter

|

$

|

8.22

|

$

|

7.70

|

$

|

7.30

|

$

|

7.08

|

$

|

1.00

|

$

|

0.55

|

|||||||

|

Second

Quarter

|

$

|

8.88

|

$

|

7.98

|

$

|

7.40

|

$

|

7.07

|

$

|

1.39

|

$

|

0.78

|

|||||||

|

First

Quarter

|

$

|

8.38

|

$

|

7.78

|

$

|

7.24

|

$

|

6.90

|

$

|

1.12

|

$

|

0.84

|

|||||||

Holders

As

of

August 1, 2008, there was one holder of record of the units, eleven holders

of

record of the common stock and one holder of record of the warrants. Platinum

believes that, as of this date, there were approximately 50 beneficial holders

of the units, 150 beneficial holders of the common stock and 200

beneficial holders of the warrants.

Share

Repurchase Program

In

November 2006, our board approved a share repurchase program to repurchase

Platinum shares of Platinum common stock in open market transactions in an

amount up to $80 million, following the consummation of a business combination.

Effective November 1, 2007, our board of directors instituted the initial stage

of this share repurchase program and established a plan in conformity with

the

provisions of Rules 10b5-1 to purchase up to 2,000,000 shares of Platinum common

stock in open market transactions during the month of November 2007, subject

to

the broker, volume, price and timing restrictions of Rule 10b-18 under the

Securities Exchange Act of 1934. We purchased 1,997,913 shares for an aggregate

of $15,661,464 in November 2007 under this stage of the repurchase program,

which we financed with available cash. Our initial share repurchase plan expired

at the end of November, but we may resume repurchases in the future, pursuant

to

our share repurchase program.

Dividends

Platinum

has not paid any cash dividends on its common stock to date. It is the present

intention of the board of directors to retain all earnings, if any, for use

in

the business operations, and accordingly, the board does not anticipate

declaring any dividends in the foreseeable future. The payment of any dividends

will be within the discretion of the board of directors and will be contingent

upon our financial condition, results of operations, capital requirements and

other factors our board deems relevant.

13

Platinum

Selected Historical Financial Information

The

following table sets forth certain selected consolidated financial information

of Platinum. The selected financial information presented below was derived

from

Platinum’s audited consolidated financial statements for the period from April

25, 2005 (inception) to December 31, 2005, and for the years ended December

31,

2006 and 2007, and Platinum’s unaudited condensed consolidated financial

statements for the three months ended March 31, 2008. All of the data should

be

read together with Platinum’s historical financial statements for the period

from April 25, 2005 (inception) to December 31, 2005, for the years ended

December 31, 2006 and 2007 and for the three months ended March 31, 2007 and

2008 and the related notes thereto and Platinum’s Management’s Discussion and

Analysis of Financial Condition and Results of Operations presented elsewhere

herein. Data for the three months ended March 31, 2007 are not presented since

it preceded the date of acquisition of TEC. The selected data provided are

not

necessarily indicative of Platinum’s future results of operations or financial

performance.

|

Period From

April 25, 2005 (Inception) to December 31, |

Year Ended

December 31, |

Year Ended

December 31, |

For the Three

Months Ended

March 31,

|

||||||||||

|

2005

|

2006

|

2007

|

2008

|

||||||||||

|

Income

Statement Data :

|

|||||||||||||

|

Operating

revenues

|

$

|

—

|

$

|

—

|

$

|

4,308,184

|

$

|

7,134,804

|

|||||

|

Lease

and other operating expenses

|

$

|

—

|

$

|

—

|

$

|

1,776,247

|

$

|

2,456,306

|

|||||

|

Operating

Expenses

|

$

|

167,274

|

$

|

786,300

|

$

|

28,015

|

$ | — | |||||

|

Stock

based compensation

|

$

|

—

|

$

|

—

|

$

|

1,250,000

|

$

|

—

|

|||||

|

Depreciation,

depletion and amortization

|

$

|

—

|

$

|

—

|

$

|

1,253,026

|

$

|

2,063,289

|

|||||

|

Other

Income - Interest, net

|

$

|

471,102

|

$

|

2,565,979

|

$

|

2,716,187

|

$ | 159,693 | |||||

|

Change

in fair value of derivatives - increase (decrease)

|

$

|

—

|

$

|

—

|

$

|

(1,472,522

|

)

|

$

|

(2,035,923

|

)

|

|||

|

Net

income (loss)

|

$

|

275,728

|

$

|

1,659,679

|

$

|

(373,032

|

)

|

$ | (1,000,517 | ) | |||

|

Weighted

average common stock and common stock equivalents outstanding:

|

|||||||||||||

|

Basic

|

6,549,489

|

15,121,440

|

18,876,347

|

22,072,762 | |||||||||

|

Diluted

|

6,980,246

|

17,479,194

|

18,876,347

|

22,072,762 | |||||||||

|

Net

Income (Loss) Per Common Share -

|

|||||||||||||

|

Basic

|

$

|

0.04

|

$

|

0.11

|

$

|

(0.02

|

)

|

$ | (0.05 | ) | |||

|

Diluted

|

$

|

0.04

|

$

|

0.09

|

$

|

(0.02

|

)

|

$ | (0.05 | ) | |||

|

Cash

Dividends Declared Per Share

|

$

|

—

|

$

|

—

|

$

|

—

|

— | ||||||

|

|

December 31,

2005 |

December 31,

2006 |

December 31,

2007 |

March 31,

2008

|

|||||||||

|

Balance

Sheet Data

|

|||||||||||||

|

Working

Capital (Deficiency) (Excluding Cash held in trust)

|

$

|

888,439

|

$

|

(1,683,186

|

)

|

$

|

14,158,775

|

$

|

12,324,460

|

||||

|

Cash

Held in Trust

|

$

|

105,884,102

|

$

|

109,213,492

|

$

|

—

|

—

|

||||||

|

Total

Assets

|

$

|

106,905,311

|

$

|

110,955,650

|

198,389,193

|

$

|

206,225,452

|

||||||

|

Long-term

debt, less current maturities

|

$

|

—

|

$

|

—

|

$

|

5,508,767

|

|||||||

|

Common

Stock Subject to Possible Redemption, 2,878,560 Common Shares

at

Conversion Value

|

$

|

21,071,059

|

$

|

21,831,777

|

$

|

—

|

—

|

||||||

|

Total

liabilities

|

$

|

21,203,829

|

$

|

23,594,489

|

$

|

57,421,733

|

$

|

66,258,509

|

|||||

|

Total

stockholders’ equity

|

$

|

85,701,482

|

$

|

87,361,161

|

$

|

140,967,460

|

$

|

139,966,943

|

|||||

|

|

|||||||||||||

|

Cash

flow provided by (used in)

|

|||||||||||||

|

Operating

activities

|

$

|

289,787

|

$

|

2,111,707

|

$

|