Rule 497(e)

Registration Nos. 333-125751 and 811-21774

Registration Nos. 333-125751 and 811-21774

|

First Trust

Exchange-Traded Fund |

Prospectus

FT Cboe Vest Gold Strategy Quarterly Buffer ETF

|

Ticker Symbol: |

BGLD |

|

Exchange: |

Cboe BZX |

FT Cboe Vest Gold Strategy Quarterly Buffer ETF (the “Fund”) lists and principally trades its shares on the Cboe BZX Exchange, Inc. (“Cboe BZX” or the “Exchange”). Market prices may differ to some degree from the net asset value of the shares. Unlike mutual funds, the Fund issues and redeems shares at net asset value, only in large blocks of shares called "Creation Units."

The Fund is a series of First Trust Exchange-Traded Fund (the “Trust”) and an actively-managed exchange-traded fund organized as a separate series of a registered management investment company.

Except when aggregated in Creation Units, the shares are not redeemable securities of the Fund.

The Securities and Exchange Commission has not approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

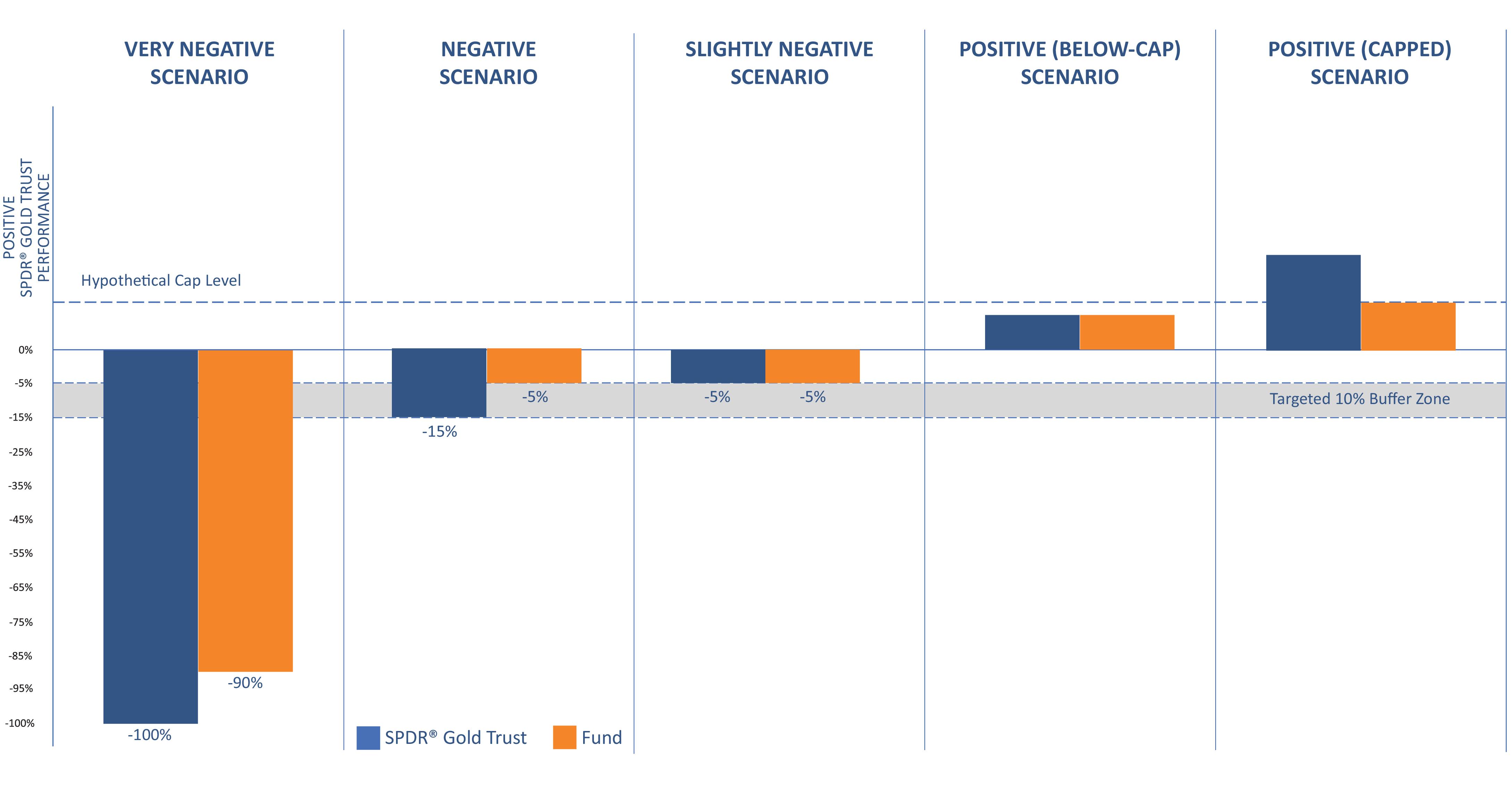

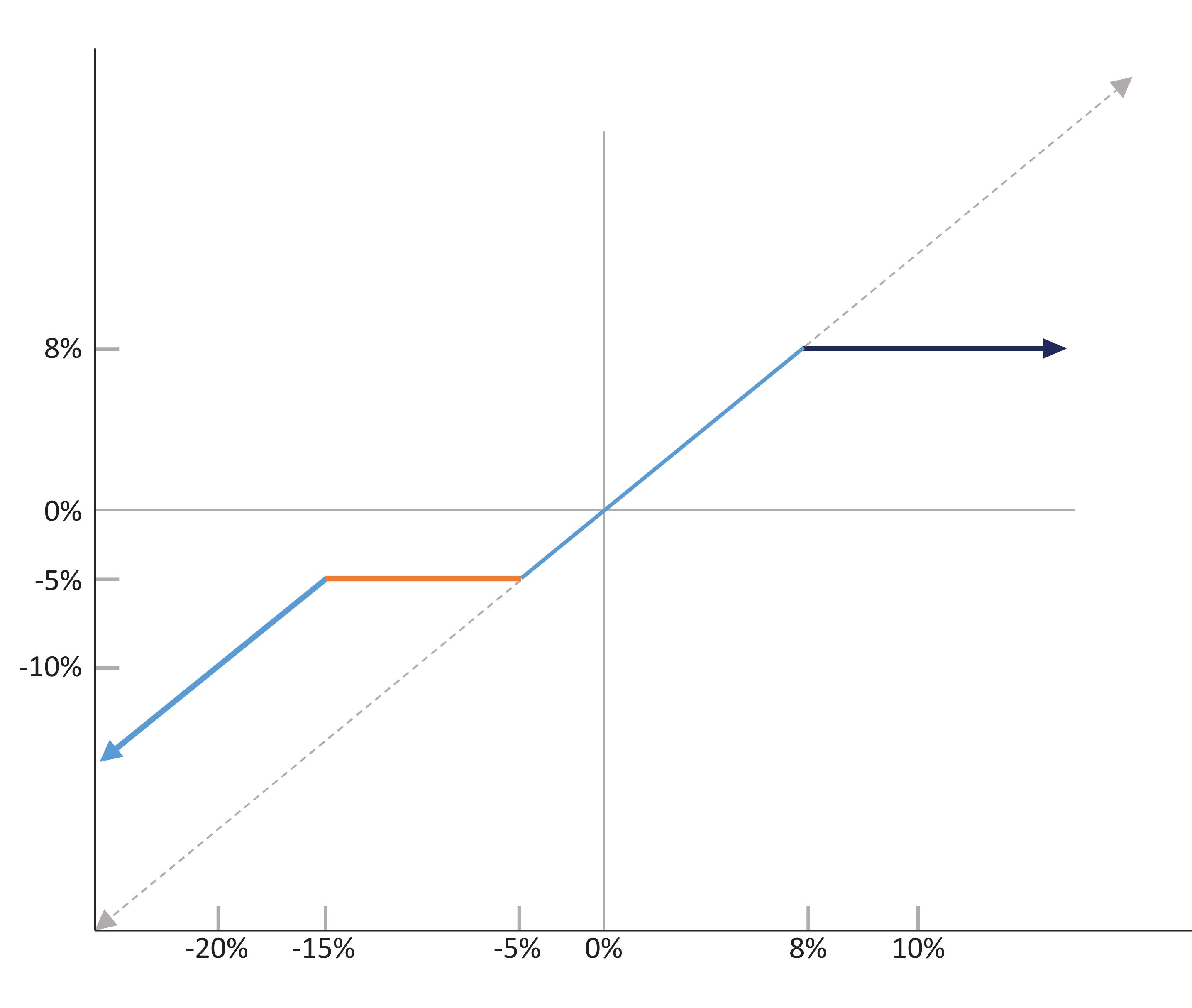

The Fund is designed to participate in positive price returns of the SPDR® Gold Trust (the “Underlying ETF”) up to a cap of 10.50% (before fees and expenses), while seeking to provide a buffer against losses between -5% and -15% (before fees and expenses) of the Underlying ETF (“Outcomes”) over the period from December 1, 2023 through February 29, 2024 (the “Target Outcome Period”). When the Fund's fees and expenses are taken into account, the cap is 10.28% and the buffer is between -5.23% and -15.23%. The cap and buffer will be further reduced by any brokerage commissions, trading fees, taxes and extraordinary expenses not included in the Fund's management fee. At the end of the Target Outcome Period, the Fund will reset for a new Target Outcome Period tied to the same Underlying ETF and buffer, but the cap may change based on market rates as of the start of the new Target Outcome Period. The Fund seeks to achieve specified Outcomes but there is no guarantee that the Outcomes for a Target Outcome Period will be achieved. You may lose some or all of your money by investing in the Fund. The Fund has characteristics unlike many other typical investment products and may not be suitable for all investors. It is important that investors understand the Fund’s investment strategy before making an investment in the Fund.

The Outcomes described in this prospectus are specifically designed to apply only if you hold shares on the first day of the Target Outcome Period and continue to hold them on the last day of the period. If you purchase shares after the Target Outcome Period starts or sell your shares before the Target Outcome Period ends, you may receive a very different return based on the Fund’s current value. Investors purchasing shares of the Fund after the Target Outcome Period begins can see their expected Outcome until the end of the period by visiting the Fund’s website, www.ftportfolios.com/retail/etf/EtfSummary.aspx?Ticker=BGLD.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

December 1, 2023

Summary Information

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

3

4

5

6

7

8

9

10

11

12

13

The Fund has characteristics unlike many other traditional investment products and may not be suitable for all investors.

|

You should only consider this investment if: |

You should not consider this investment if: |

|

•you fully understand the risks inherent in an investment in

the Fund; |

•you do not fully understand the risks inherent in an

investment in the Fund; |

|

•you desire to invest in a product with a return that

depends upon the performance of the Underlying ETF

over the Target Outcome Period; |

•you do not desire to invest in a product with a return that

depends upon the performance of the Underlying ETF

over the Target Outcome Period; |

14

|

You should only consider this investment if: |

You should not consider this investment if: |

|

•you are willing to hold shares for the duration of the

Target Outcome Period in order to achieve the outcomes

that the Fund seeks to provide; |

•you are unwilling to hold shares for the duration of the

Target Outcome Period in order to achieve the outcomes

that the Fund seeks to provide; |

|

•you fully understand that investments made when the

Fund is at or near to the cap may have limited to no

upside; |

•you do not fully understand that investments made when

the Fund is at or near to the cap may have limited to no

upside; |

|

•you are willing to forgo any gains in excess of the cap; |

•you are unwilling to forgo any gains in excess of the cap; |

|

•you are not seeking an investment that provides

dividends to shareholders; |

•you are seeking an investment that provides dividends to

shareholders; |

|

•you fully understand that investments made after the

Target Outcome Period has begun may not fully benefit

from the buffer; |

•you do not fully understand that investments made after

the Target Outcome Period has begun may not fully

benefit from the buffer; |

|

•you are willing to accept the risk of losing your entire

investment; and |

•you are unwilling to accept the risk of losing your entire

investment; and |

|

•you have visited the Fund’s website and understand the

investment outcomes available to you based upon the

time of your purchase. |

•you have not visited the Fund’s website and do not

understand the investment outcomes available to you

based upon the timing of your purchase. |

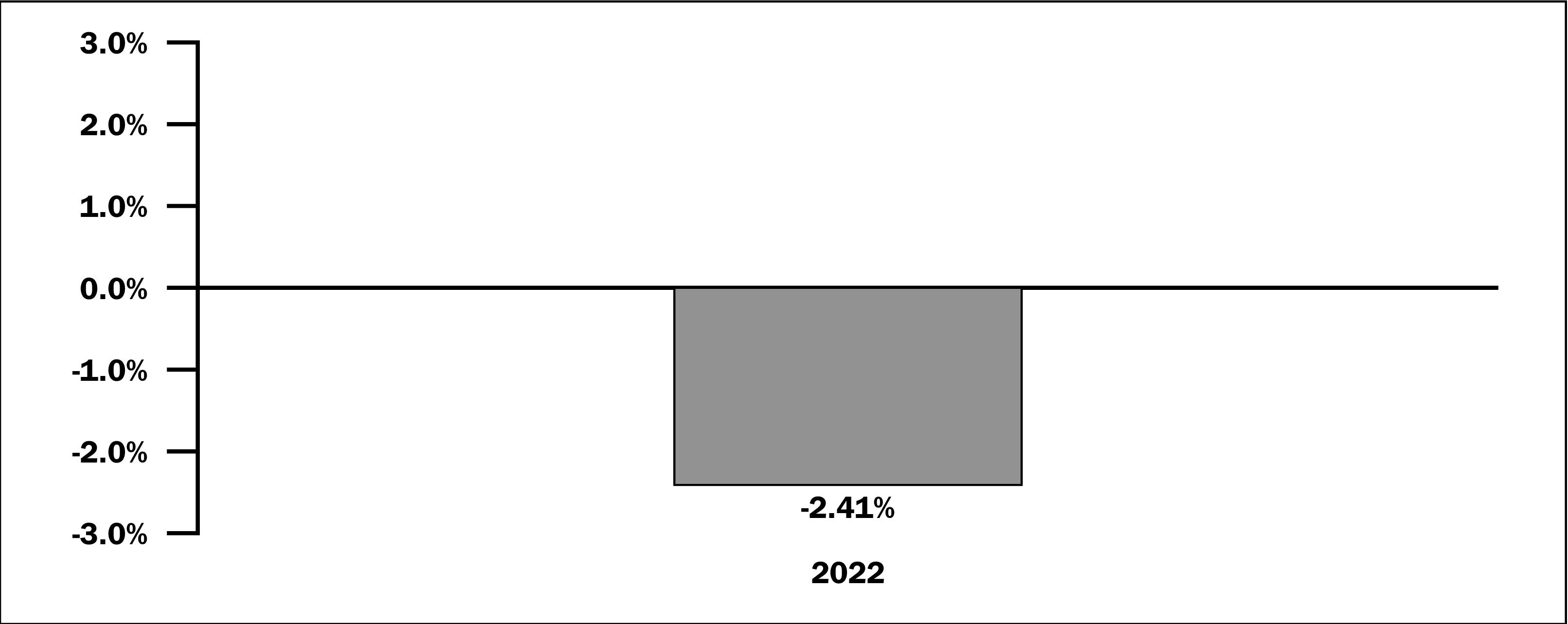

Calendar Year Total Returns as of 12/31

|

|

|

|

|

|

|

|

|

|

15

|

|

1 Year |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

- |

- |

|

|

Return After Taxes on Distributions |

- |

- |

|

|

Return After Taxes on Distributions and Sale of Fund Shares |

- |

- |

|

|

LBMA Gold Price (reflects no deduction for fees, expenses or taxes) |

- |

- |

|

|

S&P 500® Index - Price Return (reflects no deduction for fees, expenses or

taxes) |

- |

- |

|

Management

Investment Advisor

First Trust Advisors L.P. (“First Trust” or the “Advisor”)

Investment Sub-Advisor

Cboe VestSM Financial LLC (“Cboe Vest” or the “Sub-Advisor”)

Portfolio Managers

The following persons serve as the portfolio managers of the Fund:

•

Karan Sood, Managing Director of Cboe Vest

•

Howard Rubin, Managing Director of Cboe Vest

The portfolio managers are primarily and jointly responsible for the day-to-day management of the Fund. Each portfolio manager has served as a part of the portfolio management team of the Fund since 2021.

Purchase and Sale of Fund Shares

The Fund issues and redeems shares on a continuous basis, at net asset value, only in large blocks of shares called “Creation Units.” Individual shares of the Fund may only be purchased and sold on the secondary market through a broker-dealer. Since shares of the Fund trade on securities exchanges in the secondary market at their market price rather than their net asset value, the Fund’s shares may trade at a price greater than (premium) or less than (discount) the Fund’s net asset value. An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (the “bid-ask spread”). Recent information, including the Fund’s net asset value, market price, premiums and discounts, bid-ask spreads and the median bid-ask spread for the Fund’s most recent fiscal year, is available online at https://www.ftportfolios.com/Retail/etf/home.aspx.

Tax Information

The Fund’s distributions are taxable and will generally be taxed as ordinary income or capital gains. Distributions on shares held in a tax-deferred account, while not immediately taxable, will be subject to tax when the shares are no longer held in a tax-deferred account.

16

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer, registered investment adviser, bank or other financial intermediary (collectively, “intermediaries”), First Trust and First Trust Portfolios L.P., the Fund’s distributor, may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

17

Additional Information on the Fund's Investment Objective and Strategies

The Fund is a series of First Trust Exchange-Traded Fund and is regulated as an “investment company” under the 1940 Act. The Fund is actively managed and does not seek to track the performance of an index. The Fund’s investment objective is non-fundamental and may be changed by the Board of Trustees of the Trust (the “Board”) without shareholder approval. Unless an investment policy is identified as being fundamental, all investment policies included in this prospectus and the Fund’s Statement of Additional Information (“SAI”) are non-fundamental and may be changed by the Board without shareholder approval. If there is a material change to the Fund's principal investment strategies, you should consider whether the Fund remains an appropriate investment for you. There is no guarantee that the Fund will achieve its investment objective.

The Fund may not invest 25% or more of the value of its total assets in securities of issuers in any one industry or group of industries except to the extent that the Underlying ETF invests more than 25% of its assets in an industry or group of industries. This restriction does not apply to obligations issued or guaranteed by the U.S. government, its agencies or instrumentalities, or securities of other investment companies.

While it is not expected that the Fund will invest in the securities of other investment companies, any such investments would be subject to limitations imposed by the 1940 Act and the related rules and interpretations. The Fund has adopted a policy that it will not invest in other investment companies in excess of 1940 Act limits in reliance on Sections 12(d)(l)(F) or 12(d)(l)(G) of the 1940 Act.

While it is not expected that the Fund will invest in the securities of other investment companies, any such investments would be subject to limitations imposed by the 1940 Act and the related rules and interpretations. The Fund has adopted a policy that it will not invest in other investment companies in excess of 1940 Act limits in reliance on Sections 12(d)(l)(F) or 12(d)(l)(G) of the 1940 Act.

Fund Investments

Principal Investments

FLEX Options

FLEX Options are customized equity or index option contracts that trade on an exchange, but provide investors with the ability to customize key contract terms like exercise prices, styles and expiration dates. FLEX Options are guaranteed for settlement by the OCC.

The Fund, through the Subsidiary, will purchase and sell call and put FLEX Options based on the performance of the Underlying ETF. The FLEX Options that the Fund will hold through the Subsidiary that reference the Underlying ETF may be either physically settled (options that give the Fund the right to receive, or require the Fund to deliver, shares of the Underlying ETF on the option expiration date at a strike price) or cash settled (options that give the Fund the right to receive, or require the Fund to deliver, a cash payment on the option expiration date based upon the difference between the Underlying ETF’s value and a strike price). The FLEX Options held by the Fund are European style options, which are exercisable at the strike price only on the FLEX Option expiration date.

To the extent the Fund enters into derivatives transactions, it will do so pursuant to Rule 18f-4 under the 1940 Act. Rule 18f-4 requires the Fund to implement certain policies and procedures designed to manage its derivatives risks, dependent upon the Fund’s level of exposure to derivative instruments.

To the extent the Fund enters into derivatives transactions, it will do so pursuant to Rule 18f-4 under the 1940 Act. Rule 18f-4 requires the Fund to implement certain policies and procedures designed to manage its derivatives risks, dependent upon the Fund’s level of exposure to derivative instruments.

U.S. Government Securities

The Fund will generally invest in short-term U.S. government securities, including those that may be structured as zero coupon securities. U.S. government securities include U.S. Treasury obligations and securities issued or guaranteed by various agencies of the U.S. government, or by various instrumentalities that have been established or sponsored by the U.S. government. U.S. Treasury obligations are backed by the “full faith and credit” of the U.S. government. Securities issued or guaranteed by federal agencies and U.S. government sponsored instrumentalities may or may not be backed by the full faith and credit of the U.S. government.

Cash Equivalents and Short-Term Investments

The Fund may invest in securities with maturities of less than one year or cash equivalents, or may hold cash. The percentage of the Fund invested in such holdings varies and depends on several factors, including market conditions. For temporary defensive purposes and during periods of high cash inflows or outflows, the Fund may depart from its principal investment strategies and invest all of its assets in these securities, or it may hold cash. During such periods, the Fund may not be able to achieve its investment objective. The Fund may adopt a temporary defensive strategy when the portfolio managers believe

18

securities in which the Fund normally invests have elevated risks due to political or economic factors and in other extraordinary circumstances. For more information on eligible short-term investments, see the SAI.

Disclosure of Portfolio Holdings

The Fund’s portfolio holdings are available on the Fund's website at www.ftportfolios.com. A description of the policies and procedures with respect to the disclosure of the Fund's portfolio securities is included in the Fund's SAI, which is also available on the Fund's website.

Risks of Investing in the Fund

Risk is inherent in all investing. Investing in the Fund involves risk, including the risk that you may lose all or part of your investment. There can be no assurance that the Fund will meet its stated objective. Before you invest, you should consider the following disclosure pertaining to the Principal Risks set forth above as well as additional Non-Principal Risks set forth below in this prospectus. The order of the below risk factors does not indicate the significance of any particular risk factor.

The risks of the Fund will result from both the Fund’s direct investments and its indirect investments made through the Subsidiary. Accordingly, the risks that result from the Subsidiary’s activities will be described herein as the Fund’s risks.

Principal Risks

ABSENCE OF AN ACTIVE MARKET RISK. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares due to a limited number of market markers or authorized participants. The Fund may rely on a small number of third-party market makers to provide a market for the purchase and sale of shares and market makers are under no obligation to make a market in the Fund’s shares. Additionally, only a limited number of institutions act as authorized participants for the Fund and only an authorized participant may engage in creation or redemption transactions directly with the Fund and are not obligated to submit purchase or redemption orders for Creation Units. Decisions by market makers or authorized participants to reduce their role or step away from these activities in times of market stress could inhibit the effectiveness of the arbitrage process in maintaining the relationship between the underlying values of the Fund’s portfolio securities and the Fund’s market price. Any trading halt or other problem relating to the trading activity of these market makers or any issues disrupting the authorized participants’ ability to proceed with creation and/or redemption orders could result in a dramatic change in the spread between the Fund’s net asset value and the price at which the Fund’s shares are trading on the Exchange, which could result in a decrease in value of the Fund’s shares. This reduced effectiveness could result in Fund shares trading at a premium or discount to net asset value and also in greater than normal intraday bid-ask spreads for Fund shares.

BUFFERED LOSS RISK. There can be no guarantee that the Fund will be successful in its strategy to buffer against Underlying ETF losses if the Underlying ETF decreases over the Target Outcome Period by -5% to -15%. A shareholder may lose their entire investment. The Fund’s strategy seeks to deliver returns that match the price return of the Underlying ETF (up to the cap), while limiting downside losses, if shares are bought on the first day of the Target Outcome Period and held until the end of the Target Outcome Period. In the event an investor purchases shares after the first day of the Target Outcome Period or sells shares prior to the end of the Target Outcome Period, the buffer that the Fund seeks to provide may not be available.

CAP CHANGE RISK. A new cap is established at the beginning of each Target Outcome Period and is dependent on prevailing market conditions. As a result, the cap may rise or fall from one Target Outcome Period to the next and is unlikely to remain the same for consecutive Target Outcome Periods.

CAPPED UPSIDE RISK. The Fund’s strategy seeks to provide returns (before fees and expenses) that match those of the Underlying ETF for Fund shares purchased on the first day of a Target Outcome Period and held for the entire Target Outcome Period, subject to a pre-determined upside cap. If an investor does not hold its Fund shares for an entire Target Outcome Period, the returns realized by that investor may not match those the Fund seeks to achieve. If the Underlying ETF experiences gains during a Target Outcome Period, the Fund will not participate in those gains beyond the cap. A new cap is established at the beginning of each Target Outcome Period and is dependent on prevailing market conditions. The cap may rise or fall from one Target Outcome Period to the next. In the event an investor purchases Fund shares after the first day of a Target Outcome Period and the Fund has risen in value to a level near to the cap, there may be little or no ability for that investor to experience an investment gain on their Fund shares; however, the investor will remain vulnerable to downside risks. As a result of the Fund's fees and expenses and because the Fund's returns are subject to a cap, the return of the Fund could represent a return that is worse than the performance of the Underlying ETF.

19

CASH TRANSACTIONS RISK. The Fund will effect some or all of its creations and redemptions for cash rather than in-kind. As a result, an investment in the Fund may be less tax-efficient than an investment in an ETF that effects its creations and redemptions only in-kind. ETFs are able to make in-kind redemptions and avoid being taxed on gains on the distributed portfolio securities at the fund level. A Fund that effects redemptions for cash may be required to sell portfolio securities in order to obtain the cash needed to distribute redemption proceeds. Any recognized gain on these sales by the Fund will generally cause the Fund to recognize a gain it might not otherwise have recognized, or to recognize such gain sooner than would otherwise be required if it were to distribute portfolio securities only in-kind. The Fund intends to distribute these gains to shareholders to avoid being taxed on this gain at the fund level and otherwise comply with the special tax rules that apply to it. This strategy may cause shareholders to be subject to tax on gains they would not otherwise be subject to, or at an earlier date than if they had made an investment in a different ETF. Moreover, cash transactions may have to be carried out over several days if the securities market is relatively illiquid and may involve considerable brokerage fees and taxes. These brokerage fees and taxes, which will be higher than if the Fund sold and redeemed its shares entirely in-kind, will be passed on to those purchasing and redeeming Creation Units in the form of creation and redemption transaction fees. In addition, these factors may result in wider spreads between the bid and the offered prices of the Fund’s shares than for ETFs that distribute portfolio securities in-kind. The Fund’s use of cash for creations and redemptions could also result in dilution to the Fund and increased transaction costs, which could negatively impact the Fund’s ability to achieve its investment objective.

COMMODITIES RISK. Commodity prices can have significant volatility, and exposure to commodities can cause the value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. The values of physical commodities may be affected by changes in overall market movements, real or perceived inflationary trends, commodity index volatility, changes in interest rates or currency exchange rates, population growth and changing demographics, international economic, political and regulatory developments, and factors affecting a particular region, industry or commodity, such as drought, floods, or other weather conditions, livestock disease, changes in storage costs, trade embargoes, competition from substitute products, transportation bottlenecks or shortages, fluctuations in supply and demand, and tariffs. The commodity markets are subject to temporary distortions or other disruptions due to, among other factors, lack of liquidity, the participation of speculators, and government regulation and other actions.

COUNTERPARTY RISK. If the Fund enters into an investment or transaction that depends on the performance of another party, the Fund becomes subject to the credit risk of that counterparty. The Fund's ability to profit from these types of investments and transactions depends on the willingness and ability of the Fund’s counterparty to perform its obligations. If a counterparty fails to meet its contractual obligations, the Fund may be unable to terminate or realize any gain on the investment or transaction, resulting in a loss to the Fund. The Fund may experience significant delays in obtaining any recovery in an insolvency, bankruptcy, or other reorganization proceeding involving a counterparty (including recovery of any collateral posted by it) and may obtain only a limited recovery or may obtain no recovery in such circumstances. If the Fund holds collateral posted by its counterparty, it may be delayed or prevented from realizing on the collateral in the event of a bankruptcy or insolvency proceeding relating to the counterparty. Under applicable law or contractual provisions, including if the Fund enters into an investment or transaction with a financial institution and such financial institution (or an affiliate of the financial institution) experiences financial difficulties, then the Fund may in certain situations be prevented or delayed from exercising its rights to terminate the investment or transaction, or to realize on any collateral and may result in the suspension of payment and delivery obligations of the parties under such investment or transactions or in another institution being substituted for that financial institution without the consent of the Fund. Further, the Fund may be subject to “bail-in” risk under applicable law whereby, if required by the financial institution's authority, the financial institution's liabilities could be written down, eliminated or converted into equity or an alternative instrument of ownership. A bail-in of a financial institution may result in a reduction in value of some or all of securities and, if the Fund holds such securities or has entered into a transaction with such a financial security when a bail-in occurs, the Fund may also be similarly impacted.

CREDIT RISK. An issuer or other obligated party of a debt security may be unable or unwilling to make dividend, interest and/or principal payments when due. In addition, the value of a debt security may decline because of concerns about the issuer’s ability or unwillingness to make such payments. Debt securities are subject to varying degrees of credit risk which are often reflected in credit ratings. The credit rating of a debt security may be lowered if the issuer or other obligated party suffers adverse changes to its financial condition. These adverse changes may lead to greater volatility in the price of the debt security and affect the security’s liquidity. High yield and comparable unrated debt securities, while generally offering higher yields than investment grade debt with similar maturities, involve greater risks, including the possibility of dividend or interest deferral, default or bankruptcy, and are regarded as predominantly speculative with respect to the issuer’s capacity to pay dividends or interest and repay principal. To the extent that a Fund holds debt securities that are secured or guaranteed by financial institutions, changes in credit quality of such financial institutions could cause values of the debt security to deviate.

20

CYBER SECURITY RISK. The Fund is susceptible to operational risks through breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption or lose operational capacity. Such events could cause the Fund to incur regulatory penalties, reputational damage, additional compliance costs associated with corrective measures and/or financial loss. These risks typically are not covered by insurance. In general, cyber incidents can result from deliberate attacks or unintentional events. Cyber incidents include, but are not limited to, gaining unauthorized access to digital systems (e.g., through “hacking” or malicious software coding) for purposes of misappropriating assets or sensitive information, corrupting data or causing operational disruption. Cyber attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites (i.e., efforts to make network services unavailable to intended users). Cyber security failures by or breaches of the systems of the Advisor, distributor and other service providers (including, but not limited to, sub-advisors, index providers, fund accountants, custodians, transfer agents and administrators), market makers, authorized participants or the issuers of securities in which the Fund invests, have the ability to cause disruptions and impact business operations, potentially resulting in: financial losses; interference with the Fund’s ability to calculate its net asset value; disclosure of confidential trading information; impediments to trading; submission of erroneous trades or erroneous creation or redemption orders; the inability of the Fund or its service providers to transact business; violations of applicable privacy and other laws; regulatory fines penalties, reputational damage, reimbursement or other compensation costs; or additional compliance costs. Substantial costs may be incurred by the Fund in order to resolve or prevent cyber incidents in the future. While the Fund has established business continuity plans in the event of, and risk management systems to prevent, such cyber attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified and that prevention and remediation efforts will not be successful. Furthermore, the Fund cannot control the cyber security plans and systems put in place by service providers to the Fund, issuers in which the Fund invests, market makers or authorized participants. However, there is no guarantee that such efforts will succeed, and the Fund and its shareholders could be negatively impacted as a result.

DEBT SECURITIES RISK. Investments in debt securities subject the holder to the credit risk of the issuer. Credit risk refers to the possibility that the issuer or other obligor of a security will not be able or willing to make payments of interest and principal when due. Generally, the value of debt securities will change inversely with changes in interest rates. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply. During periods of falling interest rates, the income received by the Fund may decline. If the principal on a debt security is prepaid before expected, the prepayments of principal may have to be reinvested in obligations paying interest at lower rates. Debt securities generally do not trade on a centralized securities exchange making them generally less liquid and more difficult to value than common stock. The values of debt securities may also increase or decrease as a result of market fluctuations, actual or perceived inability or unwillingness of issuers, guarantors or liquidity providers to make scheduled principal or interest payments or illiquidity in debt securities markets generally.

DERIVATIVES RISK. The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include: (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. Such prices are influenced by numerous factors that affect the markets, including, but not limited to: changing supply and demand relationships; government programs and policies; national and international political and economic events, changes in interest rates, inflation and deflation and changes in supply and demand relationships. Trading derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities. Derivative contracts ordinarily have leverage inherent in their terms. The low margin deposits normally required in trading derivatives, including futures contracts, permit a high degree of leverage. Accordingly, a relatively small price movement may result in an immediate and substantial loss. The use of leverage may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations. The use of leveraged derivatives can magnify potential for gain or loss and, therefore, amplify the effects of market volatility on share price.

FLEX OPTIONS RISK. Trading FLEX Options involves risks different from, or possibly greater than, the risks associated with investing directly in securities. The Fund may experience substantial downside from specific FLEX Option positions and certain FLEX Option positions may expire worthless. The FLEX Options are listed on an exchange; however, no one can guarantee that a liquid secondary trading market will exist for the FLEX Options. In the event that trading in the FLEX Options is limited or absent, the value of the Fund's FLEX Options may decrease. In a less liquid market for the FLEX Options, liquidating the FLEX Options may require the payment of a premium (for written FLEX Options) or acceptance of a discounted price (for purchased FLEX Options) and may take longer to complete. A less liquid trading market may adversely impact the value of

21

the FLEX Options and Fund shares and result in the Fund being unable to achieve its investment objective. Less liquidity in the trading of the Fund’s FLEX Options could have an impact on the prices paid or received by the Fund for the FLEX Options in connection with creations and redemptions of the Fund’s shares. Depending on the nature of this impact to pricing, the Fund may be forced to pay more for redemptions (or receive less for creations) than the price at which it currently values the FLEX Options. Such overpayment or under collection may impact the value of the Fund and whether the Fund can satisfy its investment objective. Additionally, in a less liquid market for the FLEX Options, the liquidation of a large number of options may more significantly impact the price. A less liquid trading market may adversely impact the value of the FLEX Options and the value of your investment. The trading in FLEX Options may be less deep and liquid than the market for certain other exchange-traded options, non-customized options or other securities.

Transactions in FLEX Options are required to be centrally cleared. In a transaction involving FLEX Options, the Fund's counterparty is the OCC, rather than a bank or broker. Since the Fund is not a member of the OCC and only members (“clearing members”) can participate directly in the OCC, the Fund will hold its FLEX Options through accounts at clearing members. Although clearing members guarantee performance of their clients’ obligations to the OCC, there is a risk that a clearing member may default. The OCC collects margin, maintains a clearing fund specifically to mitigate a clearing member default and segregates all customer accounts from a clearing member’s proprietary accounts, which further acts to protect a clearing member’s customers from the default of the clearing member. However, there is still a risk that the assets of the Fund might not be fully protected in the event of a clearing member’s default. If the Fund's clearing member defaults, the OCC may transfer customer accounts to another clearing member. The OCC may also close out positions and convert deposits of the defaulting clearing member to cash. As a result of this process, the Fund would be limited to recovering only a pro rata share of all available funds segregated on behalf of the clearing member’s customers for the relevant account class. Therefore, the Fund could experience and significant loss in the event of a clearing member’s default. Additionally, the OCC may be unable to perform its obligations under the FLEX Options contracts due to unexpected events, which could negatively impact the value of the Fund.

FLEX OPTIONS VALUATION RISK. The FLEX Options held by the Fund will be exercisable at the strike price only on their expiration date. Prior to the expiration date, the value of the FLEX Options will be determined based upon market quotations or using other recognized pricing methods. The FLEX Options are also subject to correlation risk, meaning the value of the FLEX Options does not increase or decrease at the same rate as the Underlying ETF (although they generally move in the same direction) or its underlying securities. The value of the FLEX Options prior to the expiration date may vary because of factors other than the value of the Underlying ETF, such as interest rate changes, changing supply and demand, decreased liquidity of the FLEX Options, a change in the actual and perceived volatility of the stock market and the Underlying ETF and the remaining time to expiration. FLEX Option prices may also be highly volatile and may fluctuate substantially during a short period of time. During periods of reduced market liquidity or in the absence of readily available market quotations for the holdings of the Fund, the ability of the Fund to value the FLEX Options becomes more difficult and the judgment of the Fund's investment adviser (employing the fair value procedures adopted by the Board of Trustees of the Trust) may play a greater role in the valuation of the Fund's holdings due to reduced availability of reliable objective pricing data. Consequently, while such determinations may be made in good faith, it may nevertheless be more difficult for the Fund to accurately assign a daily value. Under those circumstances, the value of the FLEX Options will require more reliance on the investment adviser’s judgment than that required for securities for which there is an active trading market. This creates a risk of mispricing or improper valuation of the FLEX Options which could impact the value paid for shares of the Fund.

INCOME RISK. The Fund’s income may decline when interest rates fall. This decline can occur because the Fund may subsequently invest in lower-yielding securities as debt securities in its portfolio mature, are near maturity or are called, or the Fund otherwise needs to purchase additional debt securities. In addition, the Fund’s income could decline when the Fund experiences defaults on the debt securities it holds.

INDEX OR MODEL CONSTITUENT RISK. The Fund may be a constituent of one or more indices or ETF models. As a result, the Fund may be included in one or more index-tracking ETFs or mutual funds. Being a component security of such a vehicle could greatly affect the trading activity involving the Fund's shares, the size of the Fund and the market volatility of the Fund’s shares. Inclusion in an index could increase demand for the Fund and removal from an index could result in outsized selling activity in a relatively short period of time. As a result, the Fund’s net asset value could be negatively impacted and the Fund’s market price may be below the Fund’s net asset value during certain periods. In addition, index rebalances may potentially result in increased trading activity. To the extent buying or selling activity increases, the Fund can be exposed to increased brokerage costs and adverse tax consequences and the market price of the Fund can be negatively affected.

INFLATION RISK. Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the present value of the Fund’s assets and distributions may

22

decline.This risk is more prevalent with respect to debt securities held by the Fund. Inflation creates uncertainty over the future real value (after inflation) of an investment. Inflation rates may change frequently and drastically as a result of various factors, including unexpected shifts in the domestic or global economy, and the Fund’s investments may not keep pace with inflation, which may result in losses to Fund investors.

INTEREST RATE RISK. The value of debt securities held by the Fund will fluctuate in value with changes in interest rates. In general, debt securities will increase in value when interest rates fall and decrease in value when interest rates rise. The Fund may be subject to a greater risk of rising interest rates than would normally be the case due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. Interest rate risk is generally lower for shorter term investments and higher for longer term investments. Duration is a common measure of interest rate risk. Duration measures a debt security’s expected life on a present value basis, taking into account the debt security’s yield, interest payments and final maturity. Duration is a reasonably accurate measure of a debt security’s price sensitivity to changes in interest rates. The longer the duration of a debt security, the greater the debt security’s price sensitivity is to changes in interest rates. Rising interest rates also may lengthen the duration of debt securities with call features, since exercise of the call becomes less likely as interest rates rise, which in turn will make the securities more sensitive to changes in interest rates and result in even steeper price declines in the event of further interest rate increases. An increase in interest rates could also cause principal payments on a debt security to be repaid at a slower rate than expected. This risk is particularly prevalent for a callable debt security where an increase in interest rates could cause the issuer of that security to not redeem the security as anticipated on the call date, effectively lengthening the security’s expected maturity, in turn making that security more vulnerable to interest rate risk and reducing its market value. When interest rates fall, the Fund may be required to reinvest the proceeds from the sale, redemption or early prepayment of a debt security at a lower interest rate.

MANAGEMENT RISK. The Fund is subject to management risk because it is an actively managed portfolio. In managing the Fund’s investment portfolio, the portfolio managers will apply investment techniques and risk analyses that may not produce the desired result. There can be no guarantee that the Fund will meet its investment objective(s), meet relevant benchmarks or perform as well as other funds with similar objectives.

MARKET RISK. Market risk is the risk that a particular security, or shares of the Fund in general, may fall in value. Securities are subject to market fluctuations caused by such factors as economic, political, regulatory or market developments, changes in interest rates and perceived trends in securities prices. Shares of the Fund could decline in value or underperform other investments due to short-term market movements or any longer periods during more prolonged market downturns. In addition, local, regional or global events such as war, acts of terrorism, spread of infectious diseases or other public health issues, recessions, natural disasters, or other events could have a significant negative impact on the Fund and its investments. For example, the coronavirus disease 2019 (COVID-19) global pandemic and the ensuing policies enacted by governments and central banks have caused and may continue to cause significant volatility and uncertainty in global financial markets, negatively impacting global growth prospects. While vaccines have been developed, there is no guarantee that vaccines will be effective against future variants of the disease. Additionally, in February 2022, Russia invaded Ukraine which has caused and could continue to cause significant market disruptions and volatility within the markets in Russia, Europe, and the United States. The hostilities and sanctions resulting from those hostilities could have a significant impact on certain Fund investments as well as Fund performance. These events also adversely affect the prices and liquidity of the Fund’s portfolio securities or other instruments and could result in disruptions in the trading markets. Recent and potential future bank failures could result in disruption to the broader banking industry or markets generally and reduce confidence in financial institutions and the economy as a whole, which may also heighten market volatility and reduce liquidity. Any of such circumstances could have a materially negative impact on the value of the Fund’s shares and result in increased market volatility. During any such events, the Fund’s shares may trade at increased premiums or discounts to their net asset value and the bid/ask spread on the Fund’s shares may widen.

NON-DIVERSIFICATION RISK. The Fund is operated in a non-diversified manner. As a “non-diversified” fund, the Fund may hold a smaller number of portfolio securities than many other funds and may be more sensitive to any single economic, business, political or regulatory occurrence than a diversified fund. To the extent the Fund invests in a relatively small number of issuers due to the high percentage of the Fund’s assets invested in that security, a decline in the market value of a particular security held by the Fund may affect its value more than if it invested in a larger number of issuers. The value of the Fund’s shares may be more volatile than the values of shares of more diversified funds.

OPERATIONAL RISK. The Fund is subject to risks arising from various operational factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third-parties, failed

23

or inadequate processes and technology or systems failures. The Fund relies on third-parties for a range of services, including custody. Any delay or failure relating to engaging or maintaining such service providers may affect the Fund’s ability to meet its investment objective. Although the Fund and the Fund’s investment advisor seek to reduce these operational risks through controls and procedures, there is no way to completely protect against such risks.

PREMIUM/DISCOUNT RISK. The market price of the Fund’s shares will generally fluctuate in accordance with changes in the Fund’s net asset value as well as the relative supply of and demand for shares on the Exchange. First Trust cannot predict whether shares will trade below, at or above their net asset value because the shares trade on the Exchange at market prices and not at net asset value. Price differences may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for shares will be closely related, but not identical, to the same forces influencing the prices of the holdings of the Fund trading individually or in the aggregate at any point in time. However, given that shares can only be purchased and redeemed in Creation Units, and only to and from broker-dealers and large institutional investors that have entered into participation agreements (unlike shares of closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their net asset value), First Trust believes that large discounts or premiums to the net asset value of shares should not be sustained absent disruptions to the creation and redemption mechanism, extreme market volatility or potential lack of authorized participants. During stressed market conditions, the market for the Fund’s shares may become less liquid in response to deteriorating liquidity in the market for the Fund’s underlying portfolio holdings, which could in turn lead to differences between the market price of the Fund’s shares and their net asset value and the bid/ask spread on the Fund’s shares may widen.

SIGNIFICANT EXPOSURE RISK. To the extent that the Fund invests a significant percentage of its assets in a single asset class or industry or sector, an adverse economic, business or political development that affected a particular asset class, region or industry may affect the value of the Fund’s investments more than if the Fund were more broadly diversified. A significant exposure makes the Fund more susceptible to any single occurrence and may subject the Fund to greater volatility and market risk than a fund that is more broadly diversified.

SUBSIDIARY INVESTMENT RISK. The Subsidiary is not registered under the 1940 Act and is not subject to all of the investor protections of the 1940 Act. Thus, the Fund, as an investor in the Subsidiary, will not have all of the protections offered to investors in registered investment companies. In addition, changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary is organized, respectively, could result in the inability of the Fund and/or the Subsidiary to operate as intended and could negatively affect the Fund and its shareholders.

TARGET OUTCOME PERIOD RISK. The Fund’s investment strategy is designed to deliver returns that match the Underlying ETF if Fund shares are bought on the day on which the Fund enters into the FLEX Options (i.e., the first day of a Target Outcome Period) and held until those FLEX Options expire at the end of the Target Outcome Period subject to the cap. In the event an investor purchases Fund shares after the first day of a Target Outcome Period or sells shares prior to the expiration of the Target Outcome Period, the value of that investor’s investment in Fund shares may not be buffered against a decline in the value of the Underlying ETF and may not participate in a gain in the value of the Underlying ETF up to the cap for the investor’s investment period.

TAX RISK. The Fund intends to treat any income it may derive from FLEX Options on the Underlying ETF received by the Subsidiary as “qualifying income” under the provisions of the Internal Revenue Code of 1986, as amended, applicable to “regulated investment companies” (“RICs”). The Internal Revenue Service had issued numerous private letter rulings (“PLRs”) provided to third parties not associated with the Fund or its affiliates (which only those parties may rely on as precedent) concluding that similar arrangements resulted in qualifying income. Many of such PLRs have now been revoked by the Internal Revenue Service. In March of 2019, the Internal Revenue Service published Regulations that concluded that income from a corporation similar to the Subsidiary would be qualifying income, if the income is related to the Fund’s business of investing in stocks or securities. Although the Regulations do not require distributions from the Subsidiary, the Fund intends to cause the Subsidiary to make distributions that would allow the Fund to make timely distributions to its shareholders. The Fund generally will be required to include in its own taxable income the income of the Subsidiary for a tax year, regardless of whether the Fund receives a distribution of the Subsidiary’s income in that tax year, and this income would nevertheless be subject to the distribution requirement for qualification as a regulated investment company and would be taken into account for purposes of the 4% excise tax.

If the Fund did not qualify as a RIC for any taxable year and certain relief provisions were not available, the Fund’s taxable income would be subject to tax at the Fund level and to a further tax at the shareholder level when such income is distributed. In such event, in order to re-qualify for taxation as a RIC, the Fund might be required to recognize unrealized gains, pay substantial taxes and interest and make certain distributions. This would cause investors to incur higher tax liabilities than

24

they otherwise would have incurred and would have a negative impact on Fund returns. In such event, the Fund’s Board of Trustees may determine to reorganize or close the Fund or materially change the Fund’s investment objective and strategies. In the event that the Fund fails to qualify as a RIC, the Fund will promptly notify shareholders of the implications of that failure.

TRADING ISSUES RISK. Trading in Fund shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable. In addition, trading in Fund shares on the Exchange is subject to trading halts caused by extraordinary market volatility pursuant to the Exchange’s “circuit breaker” rules. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged. The Fund may have difficulty maintaining its listing on the Exchange in the event the Fund’s assets are small, the Fund does not have enough shareholders, or if the Fund is unable to proceed with creation and/or redemption orders.

UNDERLYING ETF GOLD RISK. The Fund will have exposure to gold through its investments (through the Subsidiary) in FLEX Options on the Underlying ETF, which invests substantially all of its assets in physical gold bullion. The price of gold bullion can be significantly affected by international monetary and political developments such as currency devaluation or revaluation, central bank movements, economic and social conditions within a country, transactional or trade imbalances, or trade or currency restrictions between countries. Physical gold bullion has sales commission, storage, insurance and auditing expenses. Investments in gold generally may be speculative and subject to greater price volatility than investments in other types of assets. The price of metals, such as gold, is related to, among other things, worldwide metal prices and extraction and production costs. Worldwide metal prices may fluctuate substantially over short periods of time, and as a result, the Fund’s share price may be more volatile than other types of investments. There is a risk that some or all of the Underlying ETF’s gold bars held by its custodian or any subcustodian could be lost, damaged or stolen. Access to the Underlying ETF’s gold bars could also be restricted by natural events (such as an earthquake) or human actions (such as a terrorist attack). Any of these events may adversely affect the operations of the Underlying ETF and, consequently, an investment based on the value of the Underlying ETF’s shares. Additionally, the Underlying ETF does not insure its gold and a loss may be suffered with respect to the Underlying ETF’s gold which is not covered by insurance and for which no party is liable for damages.

UNDERLYING ETF RISK. The Subsidiary invests in FLEX Options that reference an ETF, which subjects the Subsidiary to certain of the risks of owning shares of an ETF as well as the types of instruments in which the Underlying ETF invests. The value of an ETF will fluctuate over time based on fluctuations in the values of the securities held by the ETF, which may be affected by changes in general economic conditions, expectations for future growth and profits, interest rates and the supply and demand for those securities. In addition, ETFs are subject to the absence of an active market risk, premium/discount risk, tracking error risk and trading issues risk. Certain options on an ETF may not qualify as "Section 1256 contracts" under Section 1256 of the Code, and disposition of such options will likely result in short-term or long-term capital gains or losses depending on the holding period.

U.S. GOVERNMENT SECURITIES RISK. The Fund may invest in U.S. government securities. U.S. government securities are subject to interest rate risk but generally do not involve the credit risks associated with investments in other types of debt securities. As a result, the yields available from U.S. government securities are generally lower than the yields available from other debt securities. U.S. government securities are guaranteed only as to the timely payment of interest and the payment of principal when held to maturity.

Non-Principal Risks

BORROWING AND LEVERAGE RISK. If the Fund borrows money, it must pay interest and other fees, which may reduce the Fund’s returns. Any such borrowings are intended to be temporary. However, under certain market conditions, including periods of decreased liquidity, such borrowings might be outstanding for longer periods of time. As prescribed by the 1940 Act, the Fund will be required to maintain specified asset coverage of at least 300% with respect to any bank borrowing immediately following such borrowing and at all times thereafter. The Fund may be required to dispose of assets on unfavorable terms if market fluctuations or other factors reduce the Fund’s asset coverage to less than the prescribed amount.

DEPENDENCE ON KEY PERSONNEL RISK. The Sub-Advisor is dependent upon the experience and expertise of the Fund's portfolio managers in providing advisory services with respect to the Fund's investments. If the Sub-Advisor were to lose the services of any of these portfolio managers, its ability to service the Fund could be adversely affected. There can be no assurance that a suitable replacement could be found for any of the portfolio managers in the event of their death, resignation, retirement or inability to act on behalf of the Sub-Advisor.

FAILURE TO QUALIFY AS A REGULATED INVESTMENT COMPANY RISK. If, in any year, the Fund fails to qualify as a regulated investment company under the applicable tax laws, the Fund would be taxed as an ordinary corporation. In such circumstances,

25

the Fund could be required to recognize unrealized gains, pay substantial taxes and interest and make substantial distributions before requalifying as a regulated investment company that is accorded special tax treatment.

Fund Organization

The Fund is a series of the Trust, an investment company registered under the 1940 Act. The Fund is treated as a separate fund with its own investment objectives and policies. The Trust is organized as a Massachusetts business trust. The Board is responsible for the overall management and direction of the Trust. The Board elects the Trust’s officers and approves all significant agreements, including those with the Advisor, Sub-Advisor, distributor, custodian and fund administrative and accounting agent.

Management of the Fund

First Trust Advisors L.P., 120 East Liberty Drive, Wheaton, Illinois 60187, is the investment advisor to the Fund. In this capacity, First Trust is responsible for overseeing the Sub-Advisor in the selection and ongoing monitoring of the securities in the Fund's portfolio and certain other services necessary for the management of the portfolio.

First Trust is a limited partnership with one limited partner, Grace Partners of DuPage L.P., and one general partner, The Charger Corporation. Grace Partners of DuPage L.P. is a limited partnership with one general partner, The Charger Corporation, and a number of limited partners. The Charger Corporation is an Illinois corporation controlled by James A. Bowen, the Chief Executive Officer of First Trust. First Trust discharges its responsibilities subject to the policies of the Fund.

First Trust serves as advisor or sub-advisor for 9 mutual fund portfolios, 10 exchange-traded funds consisting of 207 series and 14 closed-end funds. It is also the portfolio supervisor of certain unit investment trusts sponsored by First Trust Portfolios L.P. (“FTP”), an affiliate of First Trust, 120 East Liberty Drive, Wheaton, Illinois 60187. FTP specializes in the underwriting, trading and distribution of unit investment trusts and other securities. FTP is the principal underwriter of the shares of the Fund.

The Trust, on behalf of the Fund, and First Trust have retained Cboe VestSM Financial LLC ("Cboe Vest" or the "Sub-Advisor") to serve as investment sub-advisor pursuant to a sub-advisory agreement (the "Sub-Advisory Agreement"). In this capacity, Cboe Vest is responsible for the selection and ongoing monitoring of the securities in the Fund’s investment portfolio. Cboe Vest, with principal offices at 8350 Broad St., Suite 240, McLean, Virginia 22102, was founded in 2012, and is a Delaware LLC. Cboe Vest had approximately $10.8 billion under management or committed to management as of February 28, 2023.

The Sub-Advisor is a subsidiary of Cboe Vest Group, Inc. (“Cboe VG”). First Trust Capital Partners, LLC (“FTCP”), an affiliate of First Trust, is the largest single holder of voting shares in Cboe VG. The remaining voting shares of Cboe VG are owned by Cboe Vest, LLC, a wholly-owned subsidiary of Cboe Global Markets, Inc., and certain individuals who operate Cboe VG and the Sub-Advisor. Cboe VG was organized in 2012. Cboe® is a registered trademark of Cboe Global Markets, Inc. VestSM is a service mark of Cboe VG.

Karan Sood and Howard Rubin are the Fund’s portfolio managers and are jointly and primarily responsible for the day-to-day management of the Fund’s investment portfolio.

•

Mr. Sood has over 10 years of experience in derivative based investment strategy design and trading. Mr. Sood joined Cboe Vest in 2012. Prior to joining Cboe Vest Mr. Sood worked at ProShare Advisors LLC. Prior to ProShare, Mr. Sood worked as a Vice President at Barclays Capital. Last based in New York, he was responsible for using derivatives to design structured investment strategies and solutions for the firm’s institutional clients in the Americas. Prior to his role in New York, Mr. Sood worked in similar capacity in London with Barclays Capital’s European clients. Mr. Sood received a master’s degree in Decision Sciences & Operations Research from London School of Economics & Political Science. He also holds a bachelor’s degree in engineering from the Indian Institute of Technology, Delhi.

•

Mr. Rubin has over 25 years of experience as a Portfolio Manager. Mr. Rubin joined Cboe Vest in 2017. Prior to joining Cboe Vest, Mr. Rubin served as Director of Portfolio Management at ProShare Advisors LLC from December 2007 to September 2013. Mr. Rubin also served as Senior Portfolio Manager of ProFund Advisors LLC since November 2004 and Portfolio Manager of ProFund Advisors LLC from April 2000 through November 2004. Mr. Rubin holds the Chartered Financial Analyst (CFA) designation. Mr. Rubin received a master’s degree in Finance from George Washington University. He also holds a bachelor’s degree in economics from Wharton School of Finance, University of Pennsylvania.

26

For additional information concerning First Trust and the Sub-Advisor, including a description of the services provided to the Fund, see the Fund’s SAI. Additional information about the portfolio managers’ compensation, other accounts managed by the portfolio managers and ownership by the portfolio managers of shares of the Fund is provided in the SAI.

Management of the Subsidiary

The Subsidiary is a wholly-owned subsidiary of the Fund. The Subsidiary is organized under the laws of the Cayman Islands and overseen by its own board of directors. The Fund is the sole shareholder of the Subsidiary, and it is currently expected that shares of the Subsidiary will not be sold or offered to other investors. The Fund and the Subsidiary in the aggregate are managed to comply with the compliance policies and procedures of the Fund. As a result, in managing the Fund’s and the Subsidiary’s portfolios, First Trust will comply with the investment policies and restrictions that apply to the management of the Fund and the Subsidiary (on a consolidated basis), and, in particular, to the requirements relating to leverage, liquidity, brokerage, capital structure and the timing and method of the valuation of the Fund’s and the Subsidiary’s portfolio investments. The Trust’s Chief Compliance Officer oversees implementation of the Subsidiary’s policies and procedures and makes periodic reports to the Trust’s Board of Trustees regarding the Subsidiary’s compliance with its policies and procedures. First Trust serves as the investment advisor of the Subsidiary and Cboe Vest serves as investment sub-advisor to the Subsidiary. The investment advisor (First Trust) and investment sub-advisor (Cboe Vest) to the Subsidiary comply with provisions of the 1940 Act relating to investment advisory contracts. The Subsidiary does not pay either the Advisor or Sub-Advisor a management fee for investment management services. While the Subsidiary has also entered into separate contracts for the provision of custody, transfer agency and audit services, the Advisor will pay for these expenses.

Management Fee

Pursuant to an investment management agreement between First Trust and the Trust, on behalf of the Fund (the "Investment Management Agreement"), First Trust oversees the Sub-Advisor’s management of the Fund’s assets and pays the Sub-Advisor for its services as Sub-Advisor. First Trust is paid an annual unitary management fee by the Fund equal to 0.90% of the Fund's average daily net assets and is responsible for the Fund’s expenses, including the cost of transfer agency, sub-advisory, custody, fund administration, legal, audit and other services, but excluding fee payments under the Investment Management Agreement, interest, taxes, brokerage commissions and other expenses connected with the execution of portfolio transactions, distribution and service fees payable pursuant to a 12b-1 plan, if any, and extraordinary expenses.

As approved by the Trust’s Board of Trustees, the management fee paid to First Trust will be reduced at certain levels of Fund net assets (“breakpoints”). See the Fund's Statement of Additional Information for more information on the breakpoints. A discussion regarding the basis for the Board’s approval of the amendment to the Investment Management Agreement incorporating the breakpoints is available in the Fund's Annual Report to Shareholders for the fiscal period ended December 31, 2022.

As approved by the Trust’s Board of Trustees, the management fee paid to First Trust will be reduced at certain levels of Fund net assets (“breakpoints”). See the Fund's Statement of Additional Information for more information on the breakpoints. A discussion regarding the basis for the Board’s approval of the amendment to the Investment Management Agreement incorporating the breakpoints is available in the Fund's Annual Report to Shareholders for the fiscal period ended December 31, 2022.

A discussion regarding the Board’s approval of the continuation of the Investment Management Agreement and Investment Sub-Advisory Agreement is available in the Fund’s Semi-Annual Report to shareholders for the fiscal period ended June 30, 2022.

How to Buy and Sell Shares

Most investors buy and sell shares of the Fund in secondary market transactions through brokers. Shares of the Fund are listed for trading on the secondary market on one or more national securities exchanges. Shares can be bought and sold throughout the trading day like other publicly traded shares. There is no minimum investment when buying shares on the Exchange. Although shares are generally purchased and sold in “round lots” of 100 shares, brokerage firms typically permit investors to purchase or sell shares in smaller “odd lots,” at no per-share price differential. When buying or selling shares through a broker, investors should expect to pay brokerage commissions, investors may receive less than the net asset value of the shares because shares are bought and sold at market prices rather than at net asset value, and investors may pay some or all of the bid-ask spread for each transaction (purchase or sale) of Fund shares. Share prices are reported in dollars and cents per share.

Under normal circumstances, the Fund will pay out redemption proceeds to a redeeming authorized participant within two days after the authorized participant’s redemption request is received, in accordance with the process set forth in the Fund’s SAI and in the agreement between the authorized participant and the Fund’s distributor. However, the Fund reserves the right, including under stressed market conditions, to take up to seven days after the receipt of a redemption request to pay an authorized participant, all as permitted by the 1940 Act. If the Fund has foreign investments in a country where a local market holiday, or series of consecutive holidays, or the extended delivery cycles for transferring foreign investments to redeeming

27

authorized participants prevents the Fund from delivering such foreign investments to an authorized participant in response to a redemption request, the Fund may take up to 15 days after the receipt of the redemption request to deliver such investments to the authorized participant.

For purposes of the 1940 Act, the Fund is treated as a registered investment company, and the acquisition of shares by other registered investment companies and companies relying on Sections 3(c)(1) and 3(c)(7) of the 1940 Act is subject to the restrictions of Section 12(d)(1) of the 1940 Act and the related rules and interpretations.

Book Entry

Shares are held in book-entry form, which means that no share certificates are issued. The Depository Trust Company (“DTC”) or its nominee is the record owner of all outstanding shares of the Fund and is recognized as the owner of all shares for all purposes.

Investors owning shares are beneficial owners as shown on the records of DTC or its participants. DTC serves as the securities depository for all shares. Participants in DTC include securities brokers and dealers, banks, trust companies, clearing corporations and other institutions that directly or indirectly maintain a custodial relationship with DTC. As a beneficial owner of shares, you are not entitled to receive physical delivery of share certificates or to have shares registered in your name, and you are not considered a registered owner of shares. Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. These procedures are the same as those that apply to any other stocks that you hold in book-entry or “street name” form.

Share Trading Prices

The trading price of shares of the Fund on the secondary market is based on market price and may differ from the Fund’s daily net asset value and can be affected by market forces of supply and demand, economic conditions and other factors.

Frequent Purchases and Redemptions of the Fund's Shares

The Fund imposes no restrictions on the frequency of purchases and redemptions (“market timing”). In determining not to approve a written, established policy, the Board evaluated the risks of market timing activities by the Fund's shareholders. The Board considered that the Fund's shares can only be purchased and redeemed directly from the Fund in Creation Units by broker-dealers and large institutional investors that have entered into participation agreements (i.e., authorized participants (“APs”)) and that the vast majority of trading in the Fund's shares occurs on the secondary market. Because the secondary market trades do not involve the Fund directly, it is unlikely those trades would cause many of the harmful effects of market timing, including dilution, disruption of portfolio management, increases in the Fund's trading costs and the realization of capital gains. With respect to trades directly with the Fund, to the extent effected in‑kind (i.e., for securities), those trades do not cause any of the harmful effects that may result from frequent cash trades. To the extent that the Fund may effect the purchase or redemption of Creation Units in exchange wholly or partially for cash, the Board noted that such trades could result in dilution to the Fund and increased transaction costs, which could negatively impact the Fund's ability to achieve its investment objective. However, the Board noted that direct trading by APs is critical to ensuring that the shares trade at or close to net asset value. In addition, the Fund imposes fixed and variable transaction fees on purchases and redemptions of Creation Units to cover the custodial and other costs incurred by the Fund in effecting trades. Finally, the Advisor monitors purchase and redemption orders from APs for patterns of abusive trading and the Fund reserves the right to not accept orders from APs that the Advisor has determined may be disruptive to the management of the Fund.

Dividends, Distributions and Taxes

Dividends from net investment income of the Fund, if any, are declared and paid annually by the Fund. The Fund distributes its net realized capital gains, if any, to shareholders at least annually.

Distributions in cash may be reinvested automatically in additional whole shares only if the broker through whom you purchased shares makes such option available. Such shares will generally be reinvested by the broker based upon the market price of those shares and investors may be subject to customary brokerage commissions charged by the broker.

Federal Tax Matters

This section summarizes some of the main U.S. federal income tax consequences of owning shares of the Fund. This section is current as of the date of this prospectus. Tax laws and interpretations change frequently, and these summaries do not describe

28

all of the tax consequences to all taxpayers. For example, these summaries generally do not describe your situation if you are a corporation, a non-U.S. person, a broker-dealer, or other investor with special circumstances. In addition, this section does not describe your state, local or non-U.S. tax consequences.

This federal income tax summary is based in part on the advice of counsel to the Fund. The Internal Revenue Service ("IRS") could disagree with any conclusions set forth in this section. The following disclosure may not be sufficient for you to use for the purpose of avoiding penalties under federal tax law.

As with any investment, you should seek advice based on your individual circumstances from your own tax advisor.

Fund Status

The Fund intends to continue to qualify as a “regulated investment company” (a “RIC”) under the federal tax laws. If the Fund qualifies as a RIC and distributes its income as required by the tax law, the Fund generally will not pay federal income taxes. Although the Subsidiary’s options positions provide exposure to the Underlying ETF, and not gold directly, the Underlying ETF is a grantor trust and its shareholders are treated, for U.S. federal income tax purposes, as if they directly owned a pro rata share of the Underlying ETF’s assets.

For federal income tax purposes, you are treated as the owner of Fund shares and not of the assets held by the Fund. Taxability issues are taken into account at the Fund level. Your federal income tax treatment of income from the Fund is based on the distributions paid by the Fund.

Subject to certain reasonable cause and de minimis exceptions, to qualify for the favorable U.S. federal income tax treatment generally accorded to RICs, the Fund must, among other things, (i) derive in each taxable year at least 90% of its gross income from dividends, interest, payments with respect to securities loans and gains from the sale or other disposition of stock, securities or foreign currencies or other income derived with respect to its business of investing in such stock, securities or currencies, or net income derived from interests in certain publicly traded partnerships; (ii) diversify its holdings so that, at the end of each quarter of the taxable year, (a) at least 50% of the market value of the Fund’s assets is represented by cash and cash items (including receivables),U.S. government securities, the securities of other RICs and other securities, with such other securities of any one issuer generally limited for the purposes of this calculation to an amount not greater than 5% of the value of the Fund’s total assets and not greater than 10% of the outstanding voting securities of such issuer, and (b) not more than 25% of the value of its total assets is invested in the securities (other than U.S. government securities or the securities of other RICs) of any one issuer, or two or more issuers which the Fund controls which are engaged in the same, similar or related trades or businesses, or the securities of one or more of certain publicly traded partnerships; and (iii) distribute at least 90% of its investment company taxable income(which includes, among other items, dividends, interest and net short-term capital gains in excess of long-term capital losses) and at least 90% of its net tax-exempt interest income each taxable year. There are certain exceptions for failure to qualify if the failure is for reasonable cause or is de minimis, and certain corrective action is taken and certain tax payments are made by the Fund.

Income from commodities is generally not qualifying income for RICs. The Fund intends to treat any income it may derive from FLEX Options on the Underlying ETF received by the Subsidiary as “qualifying income” under the provisions of the Internal Revenue Code of 1986, as amended, applicable to RICs. The Internal Revenue Service had issued numerous PLRs provided to third parties not associated with the Fund or its affiliates (which only those parties may rely on as precedent) concluding that similar arrangements resulted in qualifying income. Many of such PLRs have now been revoked by the Internal Revenue Service. In March of 2019, the Internal Revenue Service published Regulations that concluded that income from a corporation similar to the Subsidiary would be qualifying income, if the income is related to the Fund’s business of investing in stocks or securities. Although the Regulations do not require distributions from the Subsidiary, the Fund intends to cause the Subsidiary to make distributions that would allow the Fund to make timely distributions to its shareholders. The Fund generally will be required to include in its own taxable income the income of the Subsidiary for a tax year, regardless of whether the Fund receives a distribution of the Subsidiary’s income in that tax year, and this income would nevertheless be subject to the distribution requirement for qualification as a regulated investment company and would be taken into account for purposes of the 4% excise tax.

The Fund has undertaken to not hold more than 25% of its assets in the Subsidiary at the end of any quarter. If the Fund fails to limit itself to the 25% ceiling and fails to correct the issue within 30 days after the end of the quarter, the Fund may fail the RIC diversification tests described above.

Subject to certain reasonable cause and de minimis exceptions, if the Fund fails to qualify as a RIC or fails to satisfy the 90% distribution requirement in any taxable year, the Fund will be taxed as an ordinary corporation on its taxable income (even if

29