UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21775

Oppenheimer International Diversified Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: April 30

Date of reporting period: 4/29/2016

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 4/29/16*

| Class A Shares of the Fund | |||||||||||||||

|

|

Without Sales Charge | With Sales Charge | MSCI All Country World ex USA Index | ||||||||||||

| 1-Year |

-5.45 | % | -10.89 | % | -11.28 | % | |||||||||

| 5-Year |

2.81 | 1.60 | -0.13 | ||||||||||||

| 10-Year |

4.05 | 3.44 | 1.70 | ||||||||||||

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677).

*April 29, 2016, was the last business day of the Fund’s fiscal year. See Note 2 of the accompanying Notes to Financial Statements. Index returns are calculated through April 30, 2016.

2 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

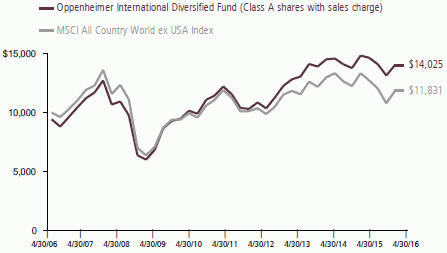

In a volatile environment for global equity markets, the Fund’s Class A shares (without sales charge) produced a total return of -5.45% during the reporting period. However, the Fund outperformed its benchmark, the MSCI All Country World ex USA Index, which produced a return of -11.28% during the same period. The Fund’s outperformance in this environment was supported by our emphasis on secular growth trends and the overall quality of companies held by the underlying funds in which the Fund invests.

MARKET OVERVIEW

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

1. The Fund is invested in Class I shares of all underlying funds discussed in this Fund Performance Discussion, except for Oppenheimer Master International Value Fund, LLC, which does not offer Class I shares.

3 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

4 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

5 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

*April 29, 2016, was the last business day of the Fund’s fiscal year. See Note 2 of the accompanying Notes to Financial Statements.

6 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 4/29/16

|

|

Inception Date |

1-Year | 5-Year | 10-Year | ||||||||||||||||

| Class A (OIDAX) |

9/27/05 | -5.45 | % | 2.81 | % | 4.05 | % | |||||||||||||

| Class B (OIDBX) |

9/27/05 | -6.22 | 1.95 | 3.52 | ||||||||||||||||

| Class C (OIDCX) |

9/27/05 | -6.19 | 2.05 | 3.27 | ||||||||||||||||

| Class I (OIDIX) |

8/28/12 | -5.07 | 8.27 | * | N/A | |||||||||||||||

| Class R (OIDNX) |

9/27/05 | -5.73 | 2.52 | 3.74 | ||||||||||||||||

| Class Y (OIDYX) |

9/27/05 | -5.27 | 3.07 | 4.37 | ||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 4/29/16 | ||||||||||||||||||||

|

|

Inception Date |

1-Year | 5-Year | 10-Year | ||||||||||||||||

| Class A (OIDAX) |

9/27/05 | -10.89 | % | 1.60 | % | 3.44 | % | |||||||||||||

| Class B (OIDBX) |

9/27/05 | -10.91 | 1.58 | 3.52 | ||||||||||||||||

| Class C (OIDCX) |

9/27/05 | -7.12 | 2.05 | 3.27 | ||||||||||||||||

| Class I (OIDIX) |

8/28/12 | -5.07 | 8.27 | * | N/A | |||||||||||||||

| Class R (OIDNX) |

9/27/05 | -5.73 | 2.52 | 3.74 | ||||||||||||||||

| Class Y (OIDYX) |

9/27/05 | -5.27 | 3.07 | 4.37 | ||||||||||||||||

*Shows performance since inception.

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; for Class B shares, the contingent deferred sales charge of 5% (1-year) and 2% (5-year); and for Class C shares, the contingent deferred sales charge (“CDSC”) of 1% for the 1-year period. Prior to 7/1/14, Class R shares were named Class N shares. Beginning 7/1/14, new purchases of Class R shares will no longer be subject to a CDSC upon redemption (any CDSC will remain in effect for purchases prior to 7/1/14). There is no sales charge for Class I and Class Y shares. Because Class B shares convert to Class A shares 72 months after purchase, the since inception return for Class B shares uses Class A performance for the period after conversion.

The Fund’s performance is compared to the performance of the MSCI All Country World ex USA Index. The MSCI All Country World ex USA Index is designed to measure the equity market performance of developed and emerging markets and excludes the U.S. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance

7 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800. CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

8 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended April 29, 2016.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended April 29, 2016” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

| Actual | Beginning Account Value November 1, 2015 |

Ending Account Value April 29, 2016 |

Expenses Paid During 6 Months Ended April 29, 2016 |

|||||||||

| Class A |

$ | 1,000.00 | $ | 994.60 | $ | 3.16 | ||||||

| Class B |

1,000.00 | 989.90 | 6.91 | |||||||||

| Class C |

1,000.00 | 990.30 | 6.86 | |||||||||

| Class I |

1,000.00 | 995.90 | 0.99 | |||||||||

| Class R |

1,000.00 | 993.10 | 4.40 | |||||||||

| Class Y

Hypothetical (5% return before expenses) |

1,000.00 | 995.30 | 1.93 | |||||||||

| Class A |

1,000.00 | 1,021.56 | 3.20 | |||||||||

| Class B |

1,000.00 | 1,017.80 | 7.01 | |||||||||

| Class C |

1,000.00 | 1,017.85 | 6.96 | |||||||||

| Class I |

1,000.00 | 1,023.74 | 1.00 | |||||||||

| Class R |

1,000.00 | 1,020.33 | 4.46 | |||||||||

| Class Y |

1,000.00 | 1,022.80 | 1.95 | |||||||||

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 181/366 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended April 29, 2016 are as follows:

| Class | Expense Ratios | |||

| Class A |

0.64% | |||

| Class B |

1.40 | |||

| Class C |

1.39 | |||

| Class I |

0.20 | |||

| Class R |

0.89 | |||

| Class Y |

0.39 | |||

10 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

STATEMENT OF INVESTMENTS April 29, 2016*

| Shares | Value | |||||||

| Investment Companies—99.9%1 | ||||||||

| Foreign Equity Funds—99.9% |

||||||||

| Oppenheimer Developing Markets Fund, Cl. I |

15,103,945 | $ | 465,805,651 | |||||

| Oppenheimer International Growth Fund, Cl. I |

21,906,567 | 799,370,647 | ||||||

| Oppenheimer International Small-Mid Company Fund, Cl. I |

15,920,804 | 584,293,525 | ||||||

| Oppenheimer International Value Fund, Cl. I |

14,439,776 | 250,096,914 | ||||||

| Oppenheimer Master International Value Fund, LLC

|

47,069,287 | 526,051,994 | ||||||

| Total Investments, at Value (Cost $1,995,766,282) |

99.9 | % | 2,625,618,731 | |||||

| Net Other Assets (Liabilities) |

0.1 | 2,862,594 | ||||||

|

|

|

|||||||

| Net Assets |

100.0 | % | $ | 2,628,481,325 | ||||

|

|

|

|||||||

Footnotes to Statement of Investments

| * | April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes. |

1. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| Shares April 30, 2015 |

Gross Additions |

Gross Reductions |

Shares April 29, 2016a |

|||||||||||||

| Oppenheimer Developing Markets Fund, Cl. I |

15,630,919 | 609,198 | 1,136,172 | 15,103,945 | ||||||||||||

| Oppenheimer International Growth Fund, Cl. I |

22,465,857 | 880,940 | 1,440,230 | 21,906,567 | ||||||||||||

| Oppenheimer International Small-Mid Company Fund, Cl. Ib |

16,414,043 | 461,204 | 954,443 | 15,920,804 | ||||||||||||

| Oppenheimer International Value Fund, Cl. I |

14,284,032 | 155,744 | — | 14,439,776 | ||||||||||||

| Oppenheimer Master International Value Fund, LLC |

49,807,275 | 1,940,271 | 4,678,259 | 47,069,287 | ||||||||||||

| Value | Income | Realized Gain (Loss) |

||||||||||

| Oppenheimer Developing Markets Fund, Cl. I |

$ | 465,805,651 | $ | 4,542,720 | $ | (7,681,712) | ||||||

| Oppenheimer International Growth Fund, Cl. I |

799,370,647 | 10,200,892 | (276,721) | |||||||||

| Oppenheimer International Small-Mid Company Fund, Cl. Ib |

584,293,525 | 2,248,483 | 1,810,800 | |||||||||

| Oppenheimer International Value Fund, Cl. I |

250,096,914 | 2,658,544 | — | |||||||||

| Oppenheimer Master International Value Fund, LLC |

526,051,994 | 11,398,520 | c | (18,186,743) | c | |||||||

|

|

|

|||||||||||

| Total |

$ | 2,625,618,731 | $ | 31,049,159 | $ | (24,334,376) | ||||||

|

|

|

|||||||||||

a. Represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

b. Prior to December 29, 2015, the Fund was named Oppenheimer International Small Company Fund.

c. Represents the amount allocated to the Fund from Oppenheimer Master International Value Fund, LLC.

See accompanying Notes to Financial Statements.

11 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

STATEMENT OF ASSETS AND LIABILITIES April 29, 20161

| Assets | ||

| Investments, at value—see accompanying statement of investments—affiliated companies (cost $1,995,766,282) | $ 2,625,618,731 | |

| Receivables and other assets: |

||

| Shares of beneficial interest sold |

6,355,608 | |

| Investments sold |

1,632,548 | |

| Other |

106,934 | |

| Total assets |

2,633,713,821

| |

| Liabilities | ||

| Bank overdraft |

1,132,605 | |

| Payables and other liabilities: |

||

| Shares of beneficial interest redeemed |

3,506,982 | |

| Distribution and service plan fees |

402,000 | |

| Trustees’ compensation |

138,002 | |

| Shareholder communications |

13,870 | |

| Other |

39,037 | |

| Total liabilities |

5,232,496

| |

| Net Assets | $ 2,628,481,325 | |

| Composition of Net Assets | ||

| Par value of shares of beneficial interest |

$ 188,014 | |

| Additional paid-in capital |

2,551,179,202 | |

| Accumulated net investment loss |

(6,356,362) | |

| Accumulated net realized loss on investments |

(546,381,978) | |

| Net unrealized appreciation on investments |

629,852,449 | |

| Net Assets |

$ 2,628,481,325 | |

12 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

| Net Asset Value Per Share | ||||

|

Class A Shares:

|

||||

| Net asset value and redemption price per share (based on net assets of $1,343,636,137 and 95,930,599 shares of beneficial interest outstanding) | $ | 14.01 | ||

|

Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) |

$ | 14.86 | ||

|

Class B Shares:

|

||||

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $23,560,046 and 1,716,632 shares of beneficial interest outstanding) | $ | 13.72 | ||

|

Class C Shares:

|

||||

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $428,917,145 and 31,332,970 shares of beneficial interest outstanding) | $ | 13.69 | ||

|

Class I Shares:

|

||||

| Net asset value, redemption price and offering price per share (based on net assets of $124,159,078 and 8,741,737 shares of beneficial interest outstanding) | $ | 14.20 | ||

|

Class R Shares:

|

||||

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $165,914,542 and 11,987,550 shares of beneficial interest outstanding) | $ | 13.84 | ||

|

Class Y Shares:

|

||||

| Net asset value, redemption price and offering price per share (based on net assets of $542,294,377 and 38,304,953 shares of beneficial interest outstanding) | $ | 14.16 |

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

See accompanying Notes to Financial Statements.

13 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

STATEMENT OF OPERATIONS For the Year Ended April 29, 20161

| Allocation of Income and Expenses from Master Fund2 | ||

| Net investment income allocated from Oppenheimer Master International Value Fund, LLC: |

||

| Dividends |

$ 11,398,520 | |

| Net expenses |

(4,484,123) | |

| Net investment income allocated from Oppenheimer Master International Value Fund, LLC

|

6,914,397

| |

| Investment Income | ||

| Dividends from affiliated companies |

19,650,639 | |

| Interest |

1,084 | |

| Total investment income

|

19,651,723

| |

| Expenses | ||

| Distribution and service plan fees: |

||

| Class A |

3,474,198 | |

| Class B |

315,084 | |

| Class C |

4,540,260 | |

| Class R |

813,560 | |

| Transfer and shareholder servicing agent fees: |

||

| Class A |

3,079,713 | |

| Class B |

69,396 | |

| Class C |

1,000,009 | |

| Class I |

31,676 | |

| Class R |

358,575 | |

| Class Y |

1,130,097 | |

| Shareholder communications: |

||

| Class A |

25,043 | |

| Class B |

2,002 | |

| Class C |

9,281 | |

| Class I |

631 | |

| Class R |

1,837 | |

| Class Y |

6,233 | |

| Custodian fees and expenses |

51,831 | |

| Trustees’ compensation |

42,316 | |

| Borrowing fees |

35,319 | |

| Other |

71,816 | |

| Total expenses |

15,058,877 | |

| Net Investment Income |

11,507,243 |

14 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

| Realized and Unrealized Loss | ||

| Net realized loss on investments from affiliated companies |

$ (6,147,633) | |

| Net realized loss allocated from Oppenheimer Master International Value Fund, LLC |

(18,186,743) | |

| Net realized loss |

(24,334,376) | |

| Net change in unrealized appreciation/depreciation on investments |

(117,892,862) | |

| Net change in unrealized appreciation/depreciation allocated from Oppenheimer Master |

||

| International Value Fund, LLC |

(33,875,640) | |

| Net change in unrealized appreciation/depreciation |

(151,768,502)

| |

| Net Decrease in Net Assets Resulting from Operations |

$ (164,595,635) | |

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. The Fund invests in an affiliated mutual fund that expects to be treated as a partnership for tax purposes. See Note 4 of the accompanying Notes.

See accompanying Notes to Financial Statements.

15 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Year Ended April 29, 20161 |

Year Ended April 30, 2015 |

|||||||

| Operations | ||||||||

| Net investment income |

$ 11,507,243 | $ | 18,025,929 | |||||

| Net realized gain (loss) |

(24,334,376) | 5,612,780 | ||||||

| Net change in unrealized appreciation/depreciation |

(151,768,502) | 26,407,930 | ||||||

| Net increase (decrease) in net assets resulting from operations

|

(164,595,635)

|

|

50,046,639

|

| ||||

| Dividends and/or Distributions to Shareholders | ||||||||

| Dividends from net investment income: |

||||||||

| Class A |

(13,052,928) | (9,362,295 | ) | |||||

| Class B |

— | — | ||||||

| Class C |

(835,683) | — | ||||||

| Class I |

(1,564,520) | (890,214 | ) | |||||

| Class R2 |

(1,071,703) | (873,978 | ) | |||||

| Class Y |

(6,129,430) | (4,743,610 | ) | |||||

| (22,654,264)

|

|

(15,870,097

|

)

| |||||

| Beneficial Interest Transactions | ||||||||

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | ||||||||

| Class A |

(83,793,909) | (168,593,824 | ) | |||||

| Class B |

(15,509,063) | (21,715,167 | ) | |||||

| Class C |

(38,445,436) | (22,199,734 | ) | |||||

| Class I |

39,701,230 | 12,220,193 | ||||||

| Class R2 |

2,188,806 | (34,043,211 | ) | |||||

| Class Y |

39,109,600 | 56,981,473 | ||||||

| (56,748,772)

|

|

(177,350,270

|

)

| |||||

| Net Assets | ||||||||

| Total decrease |

(243,998,671) | (143,173,728 | ) | |||||

| Beginning of period |

2,872,479,996 | 3,015,653,724 | ||||||

| End of period (including accumulated net investment income (loss) of ($6,356,362) and $4,790,659, respectively) | $ 2,628,481,325 | $ | 2,872,479,996 | |||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Effective July 1, 2014, Class N shares were renamed Class R. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

16 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

| Class A |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 | |||||

| Per Share Operating Data | ||||||||||

| Net asset value, beginning of period |

$14.96 | $14.73 | $13.11 | $11.30 | $13.03 | |||||

| Income (loss) from investment operations: |

||||||||||

| Net investment income2 |

0.07 | 0.10 | 0.09 | 0.12 | 0.22 | |||||

| Net realized and unrealized gain (loss) |

(0.89) | 0.22 | 1.65 | 1.90 | (1.69) | |||||

| Total from investment operations |

(0.82) | 0.32 | 1.74 | 2.02 | (1.47) | |||||

| Dividends and/or distributions to shareholders: |

||||||||||

| Dividends from net investment income |

(0.13) | (0.09) | (0.12) | (0.21) | (0.26) | |||||

| Net asset value, end of period |

$14.01 | $14.96 | $14.73 | $13.11 | $11.30 | |||||

|

|

|

|

|

| ||||||

| Total Return, at Net Asset Value3 | (5.45)% | 2.21% | 13.23% | 18.06% | (11.09)% | |||||

|

|

|

|

|

| ||||||

| Ratios/Supplemental Data | ||||||||||

| Net assets, end of period (in thousands) |

$1,343,636 | $1,527,713 | $1,677,504 | $1,344,557 | $1,153,159 | |||||

| Average net assets (in thousands) |

$1,398,744 | $1,581,956 | $1,511,242 | $1,163,778 | $1,116,268 | |||||

| Ratios to average net assets:4,5 |

||||||||||

| Net investment income |

0.52% | 0.70% | 0.66% | 1.05% | 1.99% | |||||

| Expenses excluding specific expenses listed below |

0.65% | 0.65% | 0.68% | 0.68% | 0.68% | |||||

| Interest and fees from borrowings | 0.00%6 | 0.00% | 0.00% | 0.00% | 0.00% | |||||

| Total expenses7 |

0.65% | 0.65% | 0.68% | 0.68% | 0.68% | |||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 0.65% | 0.65% | 0.68% | 0.67% | 0.68% | |||||

| Portfolio turnover rate |

3% | 7% | 18% | 9% | 13% | |||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from Oppenheimer Master International Value Fund, LLC.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

See accompanying Notes to Financial Statements.

17 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

FINANCIAL HIGHLIGHTS Continued

| Class B |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 | |||||

| Per Share Operating Data | ||||||||||

| Net asset value, beginning of period |

$14.63 | $14.42 | $12.85 | $11.06 | $12.73 | |||||

| Income (loss) from investment operations: |

||||||||||

| Net investment income (loss)2 |

(0.04) | (0.01) | (0.04) | 0.02 | 0.11 | |||||

| Net realized and unrealized gain (loss) |

(0.87) | 0.22 | 1.61 | 1.86 | (1.64) | |||||

| Total from investment operations |

(0.91) | 0.21 | 1.57 | 1.88 | (1.53) | |||||

| Dividends and/or distributions to shareholders: |

||||||||||

| Dividends from net investment income |

0.00 | 0.00 | 0.00 | (0.09) | (0.14) | |||||

| Net asset value, end of period |

$13.72 | $14.63 | $14.42 | $12.85 | $11.06 | |||||

|

|

|

|

|

| ||||||

| Total Return, at Net Asset Value3 | (6.22)% | 1.46% | 12.22% | 17.07% | (11.87)% | |||||

|

|

|

|

|

| ||||||

| Ratios/Supplemental Data | ||||||||||

| Net assets, end of period (in thousands) |

$23,560 | $41,707 | $63,052 | $82,632 | $104,293 | |||||

| Average net assets (in thousands) |

$31,464 | $50,076 | $72,836 | $88,638 | $115,004 | |||||

| Ratios to average net assets:4,5 |

||||||||||

| Net investment income (loss) |

(0.29)% | (0.05)% | (0.22)% | 0.15% | 1.04% | |||||

| Expenses excluding specific expenses listed below |

1.40% | 1.40% | 1.54% | 1.69% | 1.68% | |||||

| Interest and fees from borrowings | 0.00%6 | 0.00% | 0.00% | 0.00% | 0.00% | |||||

| Total expenses7 |

1.40% | 1.40% | 1.54% | 1.69% | 1.68% | |||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 1.40% | 1.40% | 1.52% | 1.57% | 1.57% | |||||

| Portfolio turnover rate |

3% | 7% | 18% | 9% | 13% | |||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from Oppenheimer Master International Value Fund, LLC.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

See accompanying Notes to Financial Statements.

18 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

| Class C |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 | |||||

| Per Share Operating Data | ||||||||||

| Net asset value, beginning of period |

$14.62 | $14.41 | $12.85 | $11.08 | $12.75 | |||||

| Income (loss) from investment operations: |

||||||||||

| Net investment income (loss)2 |

(0.03) | (0.00)3 | (0.02) | 0.04 | 0.13 | |||||

| Net realized and unrealized gain (loss) |

(0.87) | 0.21 | 1.61 | 1.86 | (1.64) | |||||

| Total from investment operations |

(0.90) | 0.21 | 1.59 | 1.90 | (1.51) | |||||

| Dividends and/or distributions to shareholders: |

||||||||||

| Dividends from net investment income |

(0.03) | 0.00 | (0.03) | (0.13) | (0.16) | |||||

| Net asset value, end of period |

$13.69 | $14.62 | $14.41 | $12.85 | $11.08 | |||||

|

|

|

|

|

| ||||||

| Total Return, at Net Asset Value4 | (6.19)% | 1.46% | 12.35% | 17.20% | (11.70)% | |||||

|

|

|

|

|

| ||||||

| Ratios/Supplemental Data | ||||||||||

| Net assets, end of period (in thousands) |

$428,917 | $500,310 | $516,602 | $409,450 | $370,541 | |||||

| Average net assets (in thousands) |

$454,130 | $501,925 | $462,164 | $362,107 | $389,384 | |||||

| Ratios to average net assets:5,6 |

||||||||||

| Net investment income (loss) |

(0.24)% | (0.02)% | (0.09)% | 0.31% | 1.16% | |||||

| Expenses excluding specific expenses listed below |

1.40% | 1.40% | 1.42% | 1.43% | 1.45% | |||||

| Interest and fees from borrowings | 0.00%7 | 0.00% | 0.00% | 0.00% | 0.00% | |||||

| Total expenses8 |

1.40% | 1.40% | 1.42% | 1.43% | 1.45% | |||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 1.40% | 1.40% | 1.42% | 1.42% | 1.45% | |||||

| Portfolio turnover rate |

3% | 7% | 18% | 9% | 13% | |||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Less than $0.005.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Includes the Fund’s share of the allocated expenses and/or net investment income from Oppenheimer Master International Value Fund, LLC.

7. Less than 0.005%.

8. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

See accompanying Notes to Financial Statements.

19 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

FINANCIAL HIGHLIGHTS Continued

| Class I |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Period Ended April 30, 20132 | ||||

| Per Share Operating Data | ||||||||

| Net asset value, beginning of period |

$15.17 | $14.94 | $13.24 | $11.25 | ||||

| Income (loss) from investment operations: |

||||||||

| Net investment income3 |

0.14 | 0.17 | 0.14 | 0.05 | ||||

| Net realized and unrealized gain (loss) |

(0.91) | 0.22 | 1.74 | 2.21 | ||||

| Total from investment operations |

(0.77) | 0.39 | 1.88 | 2.26 | ||||

| Dividends and/or distributions to shareholders: |

||||||||

| Dividends from net investment income |

(0.20) | (0.16) | (0.18) | (0.27) | ||||

| Net asset value, end of period |

$14.20 | $15.17 | $14.94 | $13.24 | ||||

|

|

|

|

| |||||

| Total Return, at Net Asset Value4 | (5.07)% | 2.68% | 14.17% | 20.33% | ||||

|

|

|

|

| |||||

| Ratios/Supplemental Data | ||||||||

| Net assets, end of period (in thousands) |

$124,159 | $90,659 | $77,012 | $10,196 | ||||

| Average net assets (in thousands) |

$105,658 | $82,045 | $43,239 | $4,967 | ||||

| Ratios to average net assets:5,6 |

||||||||

| Net investment income |

0.99% | 1.16% | 1.03% | 0.59% | ||||

| Expenses excluding specific expenses listed below |

0.21% | 0.21% | 0.21% | 0.27% | ||||

| Interest and fees from borrowings | 0.00%7 | 0.00% | 0.00% | 0.00% | ||||

| Total expenses8 |

0.21% | 0.21% | 0.21% | 0.27% | ||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 0.21% | 0.21% | 0.21% | 0.26% | ||||

| Portfolio turnover rate |

3% | 7% | 18% | 9% | ||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. For the period from August 28, 2012 (inception of offering) to April 30, 2013.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Includes the Fund’s share of the allocated expenses and/or net investment income from Oppenheimer Master International Value Fund, LLC.

7. Less than 0.005%.

8. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

See accompanying Notes to Financial Statements.

20 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

| Class R |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 | |||||

| Per Share Operating Data | ||||||||||

| Net asset value, beginning of period |

$14.78 | $14.56 | $12.97 | $11.19 | $12.89 | |||||

| Income (loss) from investment operations: |

||||||||||

| Net investment income2 |

0.04 | 0.07 | 0.05 | 0.09 | 0.19 | |||||

| Net realized and unrealized gain (loss) |

(0.89) | 0.21 | 1.62 | 1.87 | (1.67) | |||||

| Total from investment operations |

(0.85) | 0.28 | 1.67 | 1.96 | (1.48) | |||||

| Dividends and/or distributions to shareholders: |

||||||||||

| Dividends from net investment income |

(0.09) | (0.06) | (0.08) | (0.18) | (0.22) | |||||

| Net asset value, end of period |

$13.84 | $14.78 | $14.56 | $12.97 | $11.19 | |||||

|

|

|

|

|

| ||||||

| Total Return, at Net Asset Value3 | (5.73)% | 1.96% | 12.90% | 17.64% | (11.28)% | |||||

|

|

|

|

|

| ||||||

| Ratios/Supplemental Data | ||||||||||

| Net assets, end of period (in thousands) |

$165,915 | $175,025 | $206,864 | $140,798 | $116,120 | |||||

| Average net assets (in thousands) |

$162,876 | $201,690 | $166,750 | $119,129 | $111,079 | |||||

| Ratios to average net assets:4,5 |

||||||||||

| Net investment income |

0.26% | 0.49% | 0.38% | 0.76% | 1.67% | |||||

| Expenses excluding specific expenses listed below |

0.90% | 0.90% | 0.94% | 1.01% | 1.00% | |||||

| Interest and fees from borrowings | 0.00%6 | 0.00% | 0.00% | 0.00% | 0.00% | |||||

| Total expenses7 |

0.90% | 0.90% | 0.94% | 1.01% | 1.00% | |||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 0.90% | 0.90% | 0.94% | 1.00% | 1.00% | |||||

| Portfolio turnover rate | 3% | 7% | 18% | 9% | 13% | |||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from Oppenheimer Master International Value Fund, LLC.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

See accompanying Notes to Financial Statements

21 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

FINANCIAL HIGHLIGHTS Continued

| Class Y |

Year Ended April 29, 20161 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 | |||||

| Per Share Operating Data | ||||||||||

| Net asset value, beginning of period |

$15.13 | $14.89 | $13.25 | $11.42 | $13.16 | |||||

| Income (loss) from investment operations: |

||||||||||

| Net investment income2 |

0.11 | 0.15 | 0.13 | 0.16 | 0.24 | |||||

| Net realized and unrealized gain (loss) |

(0.91) | 0.22 | 1.66 | 1.91 | (1.70) | |||||

| Total from investment operations |

(0.80) | 0.37 | 1.79 | 2.07 | (1.46) | |||||

| Dividends and/or distributions to shareholders: |

||||||||||

| Dividends from net investment income |

(0.17) | (0.13) | (0.15) | (0.24) | (0.28) | |||||

| Net asset value, end of period |

$14.16 | $15.13 | $14.89 | $13.25 | $11.42 | |||||

|

|

|

|

|

| ||||||

| Total Return, at Net Asset Value3 | (5.27)% | 2.56% | 13.50% | 18.31% | (10.85)% | |||||

|

|

|

|

|

| ||||||

| Ratios/Supplemental Data | ||||||||||

| Net assets, end of period (in thousands) |

$542,294 | $537,066 | $474,620 | $308,400 | $214,653 | |||||

| Average net assets (in thousands) |

$513,532 | $520,362 | $385,307 | $246,307 | $192,114 | |||||

| Ratios to average net assets:4,5 |

||||||||||

| Net investment income |

0.77% | 1.00% | 0.95% | 1.36% | 2.13% | |||||

| Expenses excluding specific expenses listed below |

0.40% | 0.40% | 0.42% | 0.44% | 0.49% | |||||

| Interest and fees from borrowings | 0.00%6 | 0.00% | 0.00% | 0.00% | 0.00% | |||||

| Total expenses7 |

0.40% | 0.40% | 0.42% | 0.44% | 0.49% | |||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 0.40% | 0.40% | 0.42% | 0.43% | 0.49% | |||||

| Portfolio turnover rate | 3% | 7% | 18% | 9% | 13% | |||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from Oppenheimer Master International Value Fund, LLC.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

22 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

NOTES TO FINANCIAL STATEMENTS April 29, 2016

1. Organization

Oppenheimer International Diversified Fund (the “Fund”) is registered under the Investment Company Act of 1940 (“1940 Act”), as amended, as a diversified open-end management investment company. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a subadvisory agreement with OFI.

The Fund offers Class A, Class C, Class I, Class R and Class Y shares, and previously offered Class B shares for new purchase through June 29, 2012. Subsequent to that date, no new purchases of Class B shares are permitted, however reinvestment of dividend and/or capital gain distributions and exchanges of Class B shares into and from other Oppenheimer funds are allowed. As of July 1, 2014, Class N shares were renamed Class R shares. Class N shares subject to a contingent deferred sales charge (“CDSC”) on July 1, 2014, continue to be subject to a CDSC after the shares were renamed. Purchases of Class R shares occurring on or after July 1, 2014, are not subject to a CDSC upon redemption. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C and Class R shares are sold, and Class B shares were sold, without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class R shares are sold only through retirement plans. Retirement plans that offer Class R shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, B, C and R shares have separate distribution and/or service plans under which they pay fees. Class I and Class Y shares do not pay such fees. Class B shares will automatically convert to Class A shares 72 months after the date of purchase.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Reporting Period End Date. The last day of the Fund’s reporting period is the last day the New York Stock Exchange was open for trading during the period. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

23 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. GAAP, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

Investment Income. Dividend distributions received from the Underlying Funds are recorded on the ex-dividend date. Upon receipt of notification from an Underlying Fund, and subsequent to the ex-dividend date, some of the dividend income originally recorded by the Fund may be reclassified as a tax return of capital by reducing the cost basis of the Underlying Fund and/or increasing the realized gain on sales of investments in the Underlying Fund.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdraft at a rate equal to the Prime Rate plus 0.35%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open

24 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

2. Significant Accounting Policies (Continued)

for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended April 29, 2016, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements.

NOTE: if fund has excise tax add the following bold text to the end of the sentence that reads “Therefore, no” , however, during the reporting period, the Fund paid federal excise tax of $xx.

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

| Undistributed Net Investment Income |

Undistributed Long-Term Gain |

Accumulated Loss Carryforward1 |

Net Unrealized Appreciation Based on cost of Securities and Other Investments for Federal Income Tax Purposes |

|||||||||

| $— |

$— | $— | $— | |||||||||

If sum memo has value on Late Year Ordinary Loss Deferral line item, use the following as footnote 1. Footnote generally attached to the “Undistributed Net Investment Income” column.

X. At period end, the Fund elected to defer $ of late year ordinary losses.

1. At period end, the Fund had $ of net capital loss carryforward available to offset future realized capital gains, if any, and thereby reduce future taxable gain distributions. Details of the capital loss carryforwards are included in the table below. Capital loss carryovers with no expiration, if any, must be utilized prior to those with expiration dates.

| Expiring | ||||

| 2015 |

$ | |||

| 2016 |

||||

| 2017 |

||||

| No expiration |

||||

| Total |

$ | |||

NOTE: merger or other disclosure info appears at bottom of sum memo. Use following or associated disclosure at bottom of memo. Of these losses, $x,xxx,xxx are subject to loss limitation rules resulting from merger activity. These limitations generally reduce the utilization of these losses to a maximum of $xxx,xxx per year.

2. At period end, the Fund had $ of post-October losses available to offset future realized capital gains, if any.

3. The Fund had $ of post-October foreign currency losses which were deferred.

4. The Fund had $ of post-October passive foreign investment company losses which were deferred.

5. The Fund had $ of straddle losses which were deferred.

6. During the reporting period, the Fund did not utilize any capital loss carryforward.

7. During the reporting period, the Fund utilized $ of capital loss carryforward to offset capital gains realized in that fiscal year.

8. During the previous reporting period, the Fund did not utilize any capital loss carryforward.

9. During the previous reporting period, the Fund utilized $ of capital loss carryforward to offset capital gains realized in that fiscal year.

10. During the reporting period, $ of unused capital loss carryforward expired.

25 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

NOTES TO FINANCIAL STATEMENTS Continued

2. Significant Accounting Policies (Continued)

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with U.S. GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

Accordingly, the following amounts have been reclassified for the reporting period. Net assets of the Fund were unaffected by the reclassifications.

| Increase (Reduction) to Paid-in Capital |

Increase (Reduction) to Accumulated Net Investment Income (Loss) |

Increase (Reduction) to Accumulated Net Realized Gain (Loss) on Investments |

||||||

| $— |

$— | $— | ||||||

11. $ was distributed in connection with Fund share redemptions.

$ , including $ of long-term capital gain, was distributed in connection with Fund share redemptions. $ , all of which was long-term capital gain, was distributed in connection with Fund share redemptions.

The tax character of distributions paid during the reporting periods:

| Year Ended April 30, 2016 |

Year Ended April 30, 2015 |

|||||||

| Distributions paid from: |

||||||||

| Ordinary income |

$ | 22,654,264 | $ | 15,870,097 | ||||

| Long-term capital gain |

— | — | ||||||

| Return of capital |

— | — | ||||||

|

|

|

|||||||

| Total |

$ | 22,654,264 | $ | 15,870,097 | ||||

|

|

|

|||||||

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| Federal tax cost of securities |

$ | 1,837,891,969 | ||

| Federal tax cost of other investments |

— | |||

|

|

|

|||

| Total federal tax cost |

$ | 1,837,891,969 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 787,726,762 | ||

| Gross unrealized depreciation |

— | |||

|

|

|

|||

| Net unrealized appreciation |

$ | 787,726,762 | ||

|

|

|

|||

Recent Accounting Pronouncement. In May 2015, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”), ASU 2015-07. This is an update to Fair Value Measurement Topic 820. Under the amendments in this ASU, investments for

26 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

2. Significant Accounting Policies (Continued)

which fair value is measured at net asset value per share (or its equivalent) using the practical expedient should not be categorized in the fair value hierarchy. ASU 2015-07 is effective for financial statements issued for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. At period end, the Manager does not believe the adoption of the ASU will have a material effect on the financial statements or disclosures.

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

3. Securities Valuation

The Fund calculates the net asset value of its shares based upon the net asset value of the applicable Underlying Fund. For each Underlying Fund, the net asset value per share for a class of shares is determined as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading by dividing the value of the Underlying Fund’s net assets attributable to that class by the number of outstanding shares of that class on that day, except in the case of a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuations Methods and Inputs

To determine their net asset values, the Underlying Funds’ assets are valued primarily on the basis of current market quotations as generally supplied by third party portfolio pricing services or by dealers. Such market quotations are typically based on unadjusted quoted prices in active markets for identical securities or other observable market inputs.

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security, the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation

27 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

NOTES TO FINANCIAL STATEMENTS Continued

3. Securities Valuation (Continued)

Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those Underlying Funds.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The Fund classifies each of its investments in those Underlying Funds which are publicly offered and reported on an exchange as Level 1, and those Underlying Funds which are not publicly offered are not assigned a level, without consideration as to the classification level of the specific investments held by the Underlying Funds.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities at period end based on valuation input level:

28 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

3. Securities Valuation (Continued)

| Level 1— Unadjusted Quoted Prices |

Level 2— Other Significant |

Level 3— Significant Unobservable Inputs |

Value | |||||||||||||

|

|

||||||||||||||||

| Assets Table |

||||||||||||||||

| Investments, at Value: |

||||||||||||||||

| Investment Companies |

$ | 2,099,566,737 | $ | — | $ | — | $ | 2,099,566,737 | ||||||||

|

|

|

|||||||||||||||

| Total Investments, at Value |

2,099,566,737 | — | — | 2,099,566,737 | ||||||||||||

|

|

|

|||||||||||||||

| Other Financial Instruments: |

||||||||||||||||

| Total Assets excluding investment companies valued using practical expedient | $ | 2,099,566,737 | $ | — | $ | — | 2,099,566,737 | |||||||||

|

|

|

|||||||||||||||

| Investment company valued using practical expedient |

526,051,994 | |||||||||||||||

|

|

|

|||||||||||||||

| Total Assets |

$ | 2,625,618,731 | ||||||||||||||

|

|

|

|||||||||||||||

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

4. Investments and Risks

Risks of Investing in the Underlying Funds. The Fund invests in other mutual funds advised by the Manager. The Underlying Funds are registered open-end management investment companies under the 1940 Act, as amended. The Manager is the investment adviser of, and the Sub-Adviser provides investment and related advisory services to, the Underlying Funds. The Fund’s Investments in Underlying Funds are included in the Statement of Investments. Shares of Underlying Funds are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of the Underlying Funds’ expenses, including their management fee.

Each of the Underlying Funds in which the Fund invests has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Underlying Fund than in another, the Fund will have greater exposure to the risks of that Underlying Fund.

Significant Holdings. At period end, the Fund’s investment in Oppenheimer International Growth Fund, accounted for 30.5% of the Fund’s net assets. Additional information on Oppenheimer International Growth Fund, including the audited financials, can be found on the SEC website.

Investment in Oppenheimer Master Fund. The Fund is permitted to invest in entities sponsored and/or advised by the Manager or an affiliate. Certain of these entities in which the Fund invests are mutual funds registered under the Investment Company Act of 1940 that expect to be treated as partnerships for tax purposes, specifically Oppenheimer Master International Value Fund, LLC (the “Master Fund”). The Master Fund has its own investment

29 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

NOTES TO FINANCIAL STATEMENTS Continued

4. Investments and Risks (Continued)

risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Master Fund than in another, the Fund will have greater exposure to the risks of that Master Fund.

The investment objective of the Master Fund is to seek capital appreciation. The Fund’s investment in the Master Fund is included in the Statement of Investments. The Fund recognizes income and gain (loss) on its investment in the Master Fund according to its allocated pro-rata share, based on its relative proportion of total outstanding Master Fund shares held, of the total net income earned and the net gain (loss) realized on investments sold by the Master Fund. As a shareholder, the Fund is subject to its proportional share of the Master Fund’s expenses, including its management fee. The Fund owns 100.0% of the Master Fund at period end.

5. Market Risk Factors

The Fund’s investments in securities and/or financial derivatives may expose the Fund to various market risk factors:

Commodity Risk. Commodity risk relates to the change in value of commodities or commodity indexes as they relate to increases or decreases in the commodities market. Commodities are physical assets that have tangible properties. Examples of these types of assets are crude oil, heating oil, metals, livestock, and agricultural products.

Credit Risk. Credit risk relates to the ability of the issuer of debt to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield debt securities are subject to credit risk to a greater extent than lower-yield, higher-quality securities.

Equity Risk. Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk. Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar depreciates against the currency.

Interest Rate Risk. Interest rate risk refers to the fluctuations in value of fixed-income securities resulting from the inverse relationship between price and yield. For example, an increase in general interest rates will tend to reduce the market value of already issued fixed-income investments, and a decline in general interest rates will tend to increase their value. In addition, debt securities with longer maturities, which tend to have higher yields, are subject to potentially greater fluctuations in value from changes in interest rates than obligations with shorter maturities.

Volatility Risk. Volatility risk refers to the magnitude of the movement, but not the direction of the movement, in a financial instrument’s price over a defined time period. Large increases or decreases in a financial instrument’s price over a relative time period typically indicate greater volatility risk, while small increases or decreases in its price

30 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

5. Market Risk Factors (Continued)

typically indicate lower volatility risk.

6. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| Year Ended April 29, 20161 | Year Ended April 30, 2015 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

|

|

||||||||||||||||

| Class A |

||||||||||||||||

| Sold |

15,657,053 | $ | 220,961,054 | 21,592,612 | $ | 314,509,673 | ||||||||||

| Dividends and/or distributions reinvested |

864,663 | 11,932,359 | 616,336 | 8,622,533 | ||||||||||||

| Redeemed |

(22,688,248 | ) | (316,687,322 | ) | (34,010,203 | ) | (491,726,030) | |||||||||

|

|

|

|||||||||||||||

| Net decrease |

(6,166,532 | ) | $ | (83,793,909 | ) | (11,801,255 | ) | $ | (168,593,824) | |||||||

|

|

|

|||||||||||||||

|

|

||||||||||||||||

| Class B |

||||||||||||||||

| Sold |

64,961 | $ | 911,001 | 78,796 | $ | 1,131,419 | ||||||||||

| Dividends and/or distributions reinvested |

— | — | — | — | ||||||||||||

| Redeemed |

(1,198,375 | ) | (16,420,064 | ) | (1,601,183 | ) | (22,846,586) | |||||||||

|

|

|

|||||||||||||||

| Net decrease |

(1,133,414 | ) | $ | (15,509,063 | ) | (1,522,387 | ) | $ | (21,715,167) | |||||||

|

|

|

|||||||||||||||

|

|

||||||||||||||||

| Class C |

||||||||||||||||

| Sold |

4,034,511 | $ | 55,791,859 | 5,389,155 | $ | 76,740,521 | ||||||||||

| Dividends and/or distributions reinvested |

56,297 | 761,691 | — | — | ||||||||||||

| Redeemed |

(6,973,404 | ) | (94,998,986 | ) | (7,026,154 | ) | (98,940,255) | |||||||||

|

|

|

|||||||||||||||

| Net decrease |

(2,882,596 | ) | $ | (38,445,436 | ) | (1,636,999 | ) | $ | (22,199,734) | |||||||

|

|

|

|||||||||||||||

|

|

||||||||||||||||

| Class I |

||||||||||||||||

| Sold |

4,277,924 | $ | 61,186,135 | 1,787,220 | $ | 26,457,573 | ||||||||||

| Dividends and/or distributions reinvested |

111,899 | 1,564,344 | 62,814 | 890,073 | ||||||||||||

| Redeemed |

(1,622,429 | ) | (23,049,249 | ) | (1,029,802 | ) | (15,127,453) | |||||||||

|

|

|

|||||||||||||||

| Net increase |

2,767,394 | $ | 39,701,230 | 820,232 | $ | 12,220,193 | ||||||||||

|

|

|

|||||||||||||||

|

|

||||||||||||||||

| Class R2 |

||||||||||||||||

| Sold |

3,637,577 | $ | 50,440,243 | 3,951,077 | $ | 56,675,906 | ||||||||||

| Dividends and/or distributions reinvested |

72,290 | 986,761 | 59,417 | 821,733 | ||||||||||||

| Redeemed |

(3,562,649 | ) | (49,238,198 | ) | (6,380,219 | ) | (91,540,850) | |||||||||

|

|

|

|||||||||||||||

| Net increase (decrease) |

147,218 | $ | 2,188,806 | (2,369,725 | ) | $ | (34,043,211) | |||||||||

|

|

|

|||||||||||||||

|

|

||||||||||||||||

| Class Y |

||||||||||||||||

| Sold |

12,802,683 | $ | 181,005,980 | 15,562,747 | $ | 229,806,066 | ||||||||||

| Dividends and/or distributions reinvested |

404,351 | 5,636,652 | 308,963 | 4,365,644 | ||||||||||||

| Redeemed |

(10,409,113 | ) | (147,533,032 | ) | (12,229,497 | ) | (177,190,237) | |||||||||

|

|

|

|||||||||||||||

| Net increase |

2,797,921 | $ | 39,109,600 | 3,642,213 | $ | 56,981,473 | ||||||||||

|

|

|

|||||||||||||||

1. April 29, 2016 represents the last business day of the Fund’s reporting period. See Note 2.

31 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

NOTES TO FINANCIAL STATEMENTS Continued

6. Shares of Beneficial Interest (Continued)

2. Effective July 1, 2014, Class N shares were renamed Class R. See Note 1.

7. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations, for the reporting period were as follows:

| Purchases | Sales | |||||||

|

|

||||||||

| Investment securities |

$ | 92,161,680 | $ | 170,657,479 | ||||

8. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Manager does not charge a management fee, but rather collects indirect management fees from the Fund’s investments in the Underlying Funds. The weighted indirect management fees collected from the Fund’s investment in the Underlying Funds, as a percent of average daily net assets of the Fund for the reporting period was 0.56%. This amount is gross of any waivers or reimbursements of management fees implemented at the Underlying Fund level. Under the sub-advisory agreement, the Manager pays the Sub-Adviser a percentage of the indirect management fees (after all applicable waivers) from the Fund’s investments in the Underlying Funds.

Sub-Adviser Fees. The Manager has retained the Sub-Adviser to provide the day-to-day portfolio management of the Fund. Under the Sub-Advisory Agreement, the Manager pays the Sub-Adviser an annual fee in monthly installments, equal to a percentage of the investment management fee collected by the Manager from the Fund, which shall be calculated after any investment management fee waivers. The fee paid to the Sub-Adviser is paid by the Manager, not by the Fund.

Transfer Agent Fees. OFI Global (the “Transfer Agent”) serves as the transfer and shareholder servicing agent for the Fund. The Fund pays the Transfer Agent a fee based on annual net assets. Fees incurred and average net assets for each class with respect to these services are detailed in the Statement of Operations and Financial Highlights, respectively.

Sub-Transfer Agent Fees. The Transfer Agent has retained Shareholder Services, Inc., a wholly-owned subsidiary of OFI (the “Sub-Transfer Agent”), to provide the day-to-day transfer agent and shareholder servicing of the Fund. Under the Sub-Transfer Agency Agreement, the Transfer Agent pays the Sub-Transfer Agent an annual fee in monthly installments, equal to a percentage of the transfer agent fee collected by the Transfer Agent from the Fund, which shall be calculated after any applicable fee waivers. The fee paid to the Sub-Transfer Agent is paid by the Transfer Agent, not by the Fund.

Trustees’ Compensation. The Fund has adopted an unfunded retirement plan (the “Plan”) for the Fund’s Independent Trustees. Benefits are based on years of service and fees paid to each Trustee during their period of service. The Plan was frozen with respect to adding new

32 OPPENHEIMER INTERNATIONAL DIVERSIFIED FUND

8. Fees and Other Transactions with Affiliates (Continued)

participants effective December 31, 2006 (the “Freeze Date”) and existing Plan Participants as of the Freeze Date will continue to receive accrued benefits under the Plan. Active Independent Trustees as of the Freeze Date have each elected a distribution method with respect to their benefits under the Plan. During the reporting period, the Fund’s projected benefit obligations, payments to retired Trustees and accumulated liability were as follows:

| Projected Benefit Obligations Increased |

$ | — | ||

| Payments Made to Retired Trustees |

6,991 | |||

| Accumulated Liability as of April 29, 2016 |

48,138 |

The Fund’s Board of Trustees (“Board”) has adopted a compensation deferral plan for Independent Trustees that enables Trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustee under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustee. The Fund purchases shares of the funds selected for deferral by the Trustee in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of Trustees’ fees under the plan will not affect the net assets of the Fund and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.