Table of Contents

As filed with the Securities and Exchange Commission on June 13, 2013

No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TRONOX FINANCE LLC

Additional Registrants Listed on Schedule A Hereto

(Exact name of registrant as specified in its charter)

| Delaware | 2810 | 46-0699347 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

| One Stamford Plaza | ||

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael J. Foster

General Counsel

Tronox Limited

One Stamford Plaza

263 Tresser Boulevard, Suite 1106

Stamford, Connecticut 06901

(203) 705-3800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Christian O. Nagler

Kirkland & Ellis LLP

601 Lexington Avenue

New York, NY 10022

(212) 446-4800

Approximate date of commencement of proposed sale to the public:

The exchange will occur as soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross Border Issuer Tender Offer): ¨

Exchange Act Rule 14d-1(d) (Cross Border Third-Party Tender Offer): ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||

| Title of Each Class of Securities to be Registered |

Amount Registered |

Proposed Maximum Offering Price Per Unit |

Amount of Registration Fee | |||

| 6.375% Senior Notes due 2020 |

$900,000,000 | $100% | $122,760(1) | |||

| Guarantees on 6.375% Senior Notes due 2020(2) |

— | — | — (3) | |||

|

| ||||||

|

| ||||||

| (1) | Calculated in accordance with Rule 457 under the Securities Act of 1933, as amended. |

| (2) | The notes will be issued by Tronox Finance LLC (the “Issuer”) and initially guaranteed by the Issuer’s parent company, Tronox Limited (the “Parent”), and certain of the subsidiaries of the Parent that guarantee the obligations under its credit facilities on the date the notes were issued. |

| (3) | Pursuant to Rule 457(n), no separate fee is payable with respect to the guarantees being registered hereby. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Schedule A

| Exact Name of Additional Registrants |

Jurisdiction of Incorporation or Formation |

Principal Executive |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. | ||||

| Tronox Incorporated | Delaware | Tronox Technical Center 331 N.W. 150th Street P.O. Box 268859 Oklahoma City, OK 73134 |

2810 | 20-2868245 | ||||

| Tronox LLC | Delaware | Tronox Technical Center 331 N.W. 150th Street P.O. Box 268859 Oklahoma City, OK 73134 |

2810 | 41-2070700 | ||||

| Tronox US Holdings Inc. | Delaware | One Stamford Plaza 263 Tresser Boulevard, Suite 1100 Stamford, Connecticut 06901 |

2810 | 45-4154060 | ||||

| Tronox Australia Holdings Pty Limited | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 68-0682438 | ||||

| Tronox Australia Pigments Holdings Pty Limited |

Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 72-1621945 | ||||

| Tronox Global Holdings Pty Limited | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1034351 | ||||

| Tronox Limited | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1026700 | ||||

| Tronox Pigments Australia Holdings Pty Limited |

Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1034342 | ||||

| Tronox Pigments Australia Pty Limited | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | N/A | ||||

| Tronox Pigments Western Australia Pty Limited |

Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1034346 | ||||

Table of Contents

| Exact Name of Additional Registrants |

Jurisdiction of Incorporation or Formation |

Principal Executive |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. | ||||

| Tronox Pigments LLC | Delaware | Tronox Technical Center |

2810 | 46-1388039 | ||||

| Tronox Sands Holdings Pty Limited | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1034353 | ||||

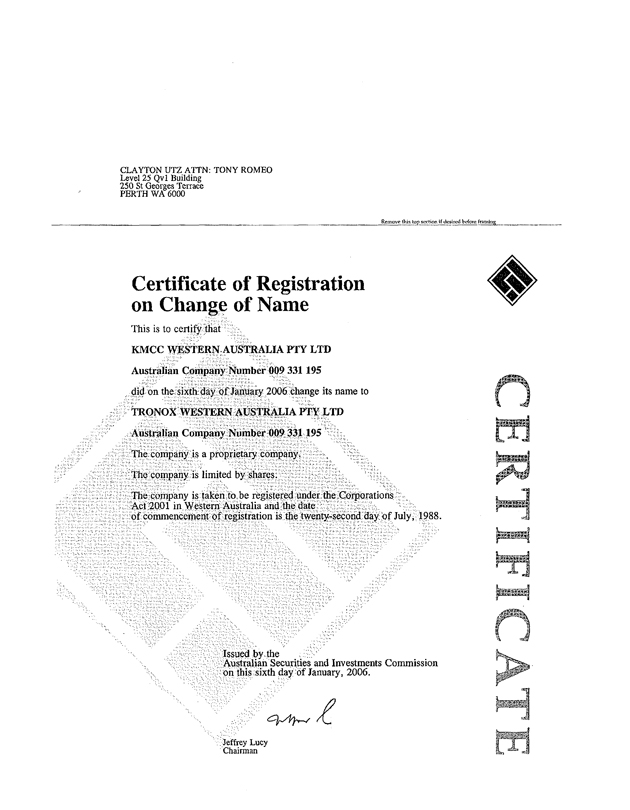

| Tronox Western Australia Pty Ltd | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065700 | ||||

| Tronox Worldwide Pty Limited | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1095681 | ||||

| Tronox Holdings (Australia) Pty Limited |

Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065537 | ||||

| Tronox Investments (Australia) Pty Ltd | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065545 | ||||

| Tronox Australia Sands Pty Ltd | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065692 | ||||

| Ticor Resources Pty Ltd | Western, Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065723 | ||||

| Ticor Finance (A.C.T.) Pty Ltd | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065754 | ||||

| TiO2 Corporation Pty Ltd | Western Australia, Australia |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065736 | ||||

3

Table of Contents

| Exact Name of Additional Registrants |

Jurisdiction of Incorporation or Formation |

Principal Executive |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. | ||||

| Yalgoo Minerals Pty. Ltd. | Australia | 1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065554 | ||||

| Tific Pty. Ltd. | Australia | 1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065748 | ||||

| Synthetic Rutile Holdings Pty Ltd | Australia | 1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065744 | ||||

| Senbar Holdings Pty Ltd | Australia | 1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065698 | ||||

| Pigment Holdings Pty Ltd | Australia | 1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-1065556 | ||||

| Tronox Mineral Sales Pty Ltd | Australia | 1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | N/A | ||||

| Tronox Management Pty Ltd | Australia | 1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | N/A | ||||

| Tronox International Finance LLP | United Kingdom |

7 Abermarle Street London, W1S 4HQ United Kingdom |

2810 | 98-1065448 | ||||

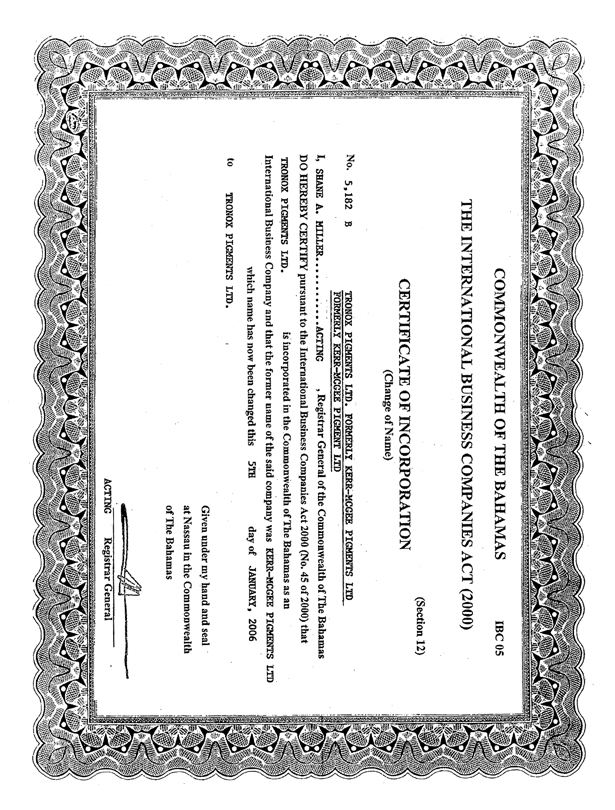

| Tronox Pigments Ltd. | Bahama Islands |

Tronox Technical Center 3301 N.W. 150th Street Oklahoma City, OK 73134 |

2810 | 47-0934867 | ||||

| Tronox Holdings Europe C.V. | The Netherlands |

1 Brodie Hall Drive Technology Park Bentley, Australia 6102 |

2810 | 98-0565177 | ||||

| Tronox Holdings Coöperatief U.A. | The Netherlands |

World Trade Centre Amsterdam, Tower B, 17th Floor Strawinskylaan 1725 P.O. Box 7241 1007, JE Amsterdam |

2810 | 98-1052521 | ||||

4

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 13, 2013

PRELIMINARY PROSPECTUS

Tronox Finance LLC

Exchange Offer for

$900 million 6.375% Senior Notes due 2020

(CUSIP: 897050AA8 & U8968XAA5)

We are offering to exchange:

up to $900 million of our new 6.375% Senior Notes due 2020

(which we refer to as the “Exchange Notes”)

for

a like amount of our outstanding 6.375% Senior Notes due 2020

(which we refer to as the “Old Notes”).

We refer to the Exchange Notes and Old Notes collectively as the “notes.”

Material Terms of Exchange Offer:

| • | The terms of the Exchange Notes to be issued in the exchange offer are substantially identical to the Old Notes, except that the transfer restrictions and registration rights relating to the Old Notes will not apply to the Exchange Notes. |

| • | The Exchange Notes will be guaranteed by Tronox Limited, the Issuer’s parent company (the “Parent”), and certain of the subsidiaries of the Parent that guarantee the obligations under our credit facilities on the date the notes are issued. |

| • | There is no existing public market for the Exchange Notes. We do not intend to list the Exchange Notes on any securities exchange or seek approval for quotation through any automated trading system. |

| • | You may withdraw your tender of notes at any time before the expiration of the exchange offer. We will exchange all of the Old Notes that are validly tendered and not withdrawn. |

| • | The exchange offer expires at 11:59 p.m., New York City time, on , 2013, unless extended. |

| • | The exchange of Old Notes for the Exchange Notes should not be a taxable exchange for United States federal income tax purposes. See “Material United States Federal Income Tax Considerations.” |

| • | The exchange offer is subject to certain customary conditions, including that it not violate applicable law or any applicable interpretation of the Staff of the Securities and Exchange Commission (the “SEC”). |

| • | We will not receive any proceeds from the exchange offer. |

For a discussion of certain factors that you should consider before participating in this exchange offer, see “Risk Factors” beginning on page 22 of this prospectus.

Neither the SEC nor any state securities commission has approved the notes to be distributed in the exchange offer, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. A broker dealer who acquired Old Notes as a result of market making or other trading activities may use this exchange offer prospectus, as supplemented or amended from time to time, in connection with any resales of the Exchange Notes.

, 2013

Table of Contents

| ii | ||||

| ii | ||||

| 1 | ||||

| 11 | ||||

| 13 | ||||

| 14 | ||||

| 22 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

54 | |||

| 79 | ||||

| 109 | ||||

| 115 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

140 | |||

| 142 | ||||

| 143 | ||||

| 145 | ||||

| 208 | ||||

| 218 | ||||

| 220 | ||||

| 221 | ||||

| 223 | ||||

| 223 | ||||

| 223 | ||||

| F-1 | ||||

In this prospectus, references to “R,” “Rand” or “South African Rand” are to the legal currency of the Republic of South Africa. Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them. In this prospectus, “we,” “us,” and “our” and the “Company” refer to Tronox Limited (as defined below) and, where appropriate, its subsidiaries, when discussing the business following completion of the Transaction (as defined below), and to Tronox Incorporated (as defined below) and, where appropriate, its subsidiaries, when discussing the business prior to completion of the Transaction unless expressly indicated or the context otherwise requires.

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements regarding management’s expectations, beliefs, strategies, goals, outlook and other non-historical matters. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project,” “likely,” “can have” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks and uncertainties outlined in “Risk Factors.”

These risks and uncertainties are not exhaustive. Other sections of this prospectus may include additional factors, which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this prospectus to conform our prior statements to actual results or revised expectations and we do not intend to do so.

We are committed to providing timely and accurate information to the investing public, consistent with our legal and regulatory obligations. To that end, we use our websites to convey information about our businesses, including the anticipated release of quarterly financial results, quarterly financial and statistical and business-related information. Investors can link to the Tronox Limited website through http://www.tronox.com. Our websites and the information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus.

This prospectus includes market share, market position and industry data and forecasts. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. We participate in various trade associations, such as the Titanium Dioxide Manufacturers Association (“TDMA”), and subscribes to various industry research publications, such as those produced by TZ Minerals International Pty Ltd (“TZMI”). While we have taken reasonable actions to ensure that the information is extracted accurately and in its proper context, we have not independently verified the accuracy of any of the data from third party sources or ascertained the underlying economic assumptions relied upon therein. Unless otherwise indicated, statements as to Tronox Limited (as defined below) and Tronox Incorporated (as defined below) combined market share and market position are based on TZMI 2012 Annual Reports, which are based on year-end 2011 reported figures. We also rely on certain information provided by TDMA in determining some of the management estimates referred to in this prospectus.

ii

Table of Contents

This summary highlights selected information contained in this prospectus and does not contain all the information that may be important to you. We urge you to read carefully this prospectus in its entirety. For additional information see the section entitled “Where You Can Find Additional Information.”

Unless otherwise indicated or required by context, as used in this prospectus, references to “we,” “us,” and “our” refer to Tronox Limited (as defined below), when discussing the business following completion of the Transaction (as defined below), and to Tronox Incorporated (as defined below), when discussing the business prior to completion of the Transaction.

Our Company

Overview

Tronox Limited, a public limited company registered under the laws of the State of Western Australia, Australia, and its subsidiaries (collectively referred to as “Tronox” or “the Company”) is a global leader in the production and marketing of titanium- bearing mineral sands and titanium dioxide pigment (“TiO2”). Our world-class, high performance TiO2 products are critical components of everyday applications such as paint and other coatings, plastics, paper and other applications. Our mineral sands business consists primarily of two product streams—titanium feedstock and zircon. Titanium feedstock is used primarily to manufacture TiO2. Zircon, a hard, glossy mineral, is used for the manufacture of ceramics, refractories, TV glass and a range of other industrial and chemical products. We have global operations in North America, Europe, South Africa and Australia.

Tronox Limited was formed on September 21, 2011 for the purpose of the Transaction (see below). Prior to the completion of the Transaction, the Company was wholly-owned by Tronox Incorporated, and had no operating assets or operations. Tronox Incorporated, a Delaware corporation (“Tronox Incorporated”), was formed on May 17, 2005, in preparation for the contribution and transfer by Kerr-McGee Corporation of certain entities, including those comprising substantially all of its chemical business into a separate operating company.

For the three months ended March 31, 2013, we had net sales of $470 million, adjusted EBITDA of $73 million and a net loss attributable to Tronox Limited of $57 million. As of March 31, 2013, we had approximately $2,411 million of total indebtedness outstanding. For the year ended December 31, 2012, we had net sales of $1,832 million, adjusted EBITDA of $503 million and net income attributable to Tronox Limited of $1,134 million. As of December 31, 2012, we had approximately $1,645 million of total indebtedness outstanding.

Acquisition of Mineral Sands Operations

Consistent with our strategy to become a fully integrated global producer of mineral sands and TiO2 with production facilities and sales and marketing presence strategically positioned throughout the world, on June 15, 2012 (the “Transaction Date”), we combined the existing business of Tronox Incorporated with Exxaro Resources Ltd’s (“Exxaro”) mineral sands operations, which includes its Namakwa Sands and KwaZulu-Natal (“KZN”) Sands mines, separation and slag furnaces in South Africa, along with Exxaro’s 50% share of the Tiwest Joint Venture in Western Australia (together, the “mineral sands business”) (the “Transaction”).

The Transaction was completed in two principal steps. First, Tronox Incorporated became a subsidiary of Tronox Limited, with Tronox Incorporated shareholders receiving one Class A ordinary share (“Class A Share”) and $12.50 in cash (“Merger Consideration”) for each Tronox Incorporated common share. Second, Tronox Limited issued 9,950,856 Class B ordinary shares (“Class B Shares”) to Exxaro and one of its subsidiaries in

1

Table of Contents

consideration for the mineral sands business. Upon completion of the Transaction, former Tronox Incorporated shareholders held 15,413,083 Class A Shares and Exxaro held 9,950,856 Class B Shares, representing approximately 60.8% and 39.2%, respectively, of the voting power in Tronox Limited. Exxaro retained a 26% ownership interest in the South African operations that are part of the mineral sands business in order to comply with the Black Economic Empowerment (“BEE”) legislation of South Africa.

During 2012, we repurchased approximately 12.6 million Class A Shares, which was approximately 10% of our total voting securities. During October 2012, Exxaro purchased 1.4 million Class A Shares in market purchases. At March 31, 2013 and December 31, 2012, Exxaro held approximately 44.4% and 44.6%, respectively, of our voting securities.

Prior to the Transaction Date, Tronox Incorporated and Exxaro Australia Sands Pty Ltd., a subsidiary of Exxaro, operated the Tiwest Joint Venture, which included a chloride process TiO2 plant located in Kwinana, Western Australia, a mining operation in Cooljarloo, Western Australia, and a mineral separation plant and a synthetic rutile processing facility, both in Chandala, Western Australia. As part of the Transaction, we acquired Exxaro Australia Sands Pty Ltd. and therefore Exxaro’s 50% interest in the Tiwest Joint Venture. As such, as of the Transaction Date, we own 100% of the operations formerly operated by the Tiwest Joint Venture.

Principal Business Lines

Subsequent to the Transaction, we have two reportable operating segments, Mineral Sands and Pigment. Additionally, our corporate activities include our electrolytic manufacturing and marketing operations.

Mineral Sands Operations

The Mineral Sands segment includes the exploration, mining and beneficiation of mineral sands deposits. “Mineral sands” refers to concentrations of heavy minerals in an alluvial environment (sandy or sedimentary deposits near a sea, river or other water source). We separate these minerals from these primary sources. We process ilmenite into either slag or synthetic rutile. Other than zircon, all of these materials are sometimes referred to as titanium feedstock. Titanium feedstock is the most significant raw material used in the manufacture of TiO2.

We acquired the mineral sands business from Exxaro on the Transaction Date. The mineral sands business operations are comprised of the KZN Sands and Namakwa Sands mines, both located in South Africa, and Cooljarloo Sands mine located in Western Australia, which have a combined production capacity of 753,000 metric tons (“tonnes”) of titanium feedstock and 265,000 tonnes of zircon. The KZN Sands operations involve the exploration, mining and beneficiation of mineral sands deposits in the KwaZulu-Natal province of South Africa, and the Namakwa Sands operations involve the exploration, mining and beneficiation of mineral sands deposits in the Western Cape province of South Africa. The Tiwest operations conduct the exploration, mining and processing of mineral sands deposits and the production of titanium dioxide pigment in Western Australia.

We are the third largest global producer of titanium feedstock and a global leader in zircon production. Titanium feedstock is the most significant raw material used in the manufacture of TiO2. We believe annual production of titanium feedstock from our mineral sands operations will continue to exceed the raw material supply requirement for our TiO2 operations. Zircon is primarily used for the manufacture of ceramics, a market which has grown substantially during the previous decade and is favorably positioned to long-term development trends in the emerging markets, principally China.

The table set forth under “The Businesses—Property—Mineral Reserves” summarizes Tronox Limited’s proven and probable ore reserves and estimated mineral resources as of December 31, 2012.

2

Table of Contents

Pigment Operations

We are the world’s third-largest producer and marketer of TiO2 manufactured via chloride technology. The pigment segment primarily produces and markets TiO2, and has production facilities at the following locations: Hamilton, Mississippi; Botlek, the Netherlands; and Kwinana, Western Australia, representing an aggregate of 465,000 tonnes of annual TiO2 production capacity.

TiO2 is used in a wide range of products due to its ability to impart whiteness, brightness and opacity, and is designed, marketed and sold based on specific end-use applications. TiO2 is used extensively in the manufacture of paint and other coatings, plastics and paper and in a wide range of other applications, including inks, fibers, rubber, food, cosmetics and pharmaceuticals. According to TZMI data, the paint and coatings sector is the largest consumer of pigment averaging approximately 58% of total pigment consumption in 2011. The plastics sector accounted for approximately 22% of TiO2 consumption in 2011, while the remaining 20% was divided between paper, inks, fibers and other.

TiO2 is a critical component of everyday consumer applications due to its superior ability to cover or mask other materials effectively and efficiently relative to alternative white pigments and extenders. TiO2 is considered to be a quality of life product and some research indicates that consumption generally increases as disposable income increases. We believe that, at present, TiO2 has no effective mineral substitute because no other white pigment has the physical properties for achieving comparable opacity and brightness or can be incorporated in as cost-effective a manner.

We supply and market TiO2 under the brand name TRONOX® to more than 1,000 customers in approximately 90 countries, including market leaders in each of the key end-use markets for TiO2, and have supplied each of our top ten customers with TiO2 for more than ten years. These top ten customers represented approximately 46% of our total TiO2 sales in 2012. The tables below summarize our 2012 TiO2 sales volume by geography and end-use market:

| 2012 Sales Volume by Geography |

2012 Sales Volume by End-Use Market |

|||||||||

| Americas |

48% | Paints and Coatings | 78% | |||||||

| Europe |

24% | Plastics | 19% | |||||||

| Asia-Pacific |

28% | Paper and Specialty | 3% | |||||||

We operate three TiO2 facilities at the following locations: Hamilton, Mississippi; Botlek, the Netherlands; and Kwinana, Australia, representing an aggregate of 465,000 tonnes of annual TiO2 production capacity. We are one of a limited number of TiO2 producers in the world with chloride production technology, which we believe is preferred for many of the largest end-use applications compared to TiO2 manufactured by other TiO2 production technologies. We hold more than 200 patents worldwide and have a highly skilled work force.

Electrolytic and Other Chemical Products Operations

Our electrolytic and other chemical products operations are primarily focused on advanced battery materials, sodium chlorate and specialty boron products. Battery material end-use applications include alkaline batteries for flashlights, electronic games, medical and industrial devices as well as lithium batteries for power tools, hybrid electric vehicles, laptops and power supplies. Sodium chlorate is used in the pulp and paper industry in pulp bleaching applications. Specialty boron product end-use applications include semiconductors, pharmaceuticals, high-performance fibers, specialty ceramics and epoxies as well as igniter formulations.

We operate two electrolytic and other chemical facilities in the United States: one in Hamilton, Mississippi producing sodium chlorate and one in Henderson, Nevada producing electrolytic manganese dioxide (“EMD”) and boron products.

3

Table of Contents

Industry Background and Outlook

Titanium Feedstock Industry Background and Outlook

Titanium feedstock is considered to be a single product, although it can be segmented based on the level of titanium contained within the feedstock, with substantial overlap between each segment. Different grades of titanium feedstock have similar characteristics, and are generally suitable substitutes for one another; therefore, TiO2 producers generally source a variety of feedstock grades, and supply a wide variety of feedstock grades to the TiO2 producers.

Titanium minerals (ilmenite, rutile and leucoxene), titanium slag (chloride slag and sulphate slag) and synthetic rutile are all used primarily as feedstock for the production of TiO2 pigment. According to the latest data provided by TZMI, approximately 90% of the world’s consumption of titanium feedstock is used for the production of TiO2 pigment.

There are a small number of large mining companies or groups that are involved in the production of titanium feedstock. We believe we are the third largest titanium feedstock producer with approximately 10% of global titanium feedstock production. Rio Tinto, through its ownership of Canadian based Fer et Titane, its share in Richards Bay Minerals (“RBM”) in South Africa and ownership of QMM Madagascar, is the largest producer of titanium feedstock in the world. Australian-based Iluka Resources Limited is the second largest manufacturer, with operations in Australia and the United States. A number of other manufacturers, such as Cristal Global (Saudi Arabia), Eramet SA (France), Kenmare Resources plc (Ireland), Kronos Worldwide Inc. (Europe), Pangang Titanium Industry Co Ltd (China), Kerala Mines and Metals Limited (India) and Ostchem Holding AG (Eastern Europe) also supply titanium feedstock to the global market.

Beyond our structurally assured, relative low cost position, our competitive advantages are our depth of experience in various mining methods and technologies, our ability and know-how to produce upgraded products by means of direct current smelting of ilmenite and the synthetic rutile process, and our capacity to market zircon and rutile for use in a broad range of end-use applications. We are furthermore in a position to supply TiO2 feedstock, zircon and high purity pig iron from any one of several production units in different geographical locations.

Although we use agents and distribution for some sales in the Asia-Pacific region, direct relationship marketing is the primary technique that we employ for the marketing of titanium feedstocks. Multi-year contracts are negotiated with periodic pricing for the pigment industry, while the contract period for other industries tends to be less than one year (either per shipment, quarterly, half-year or one year). Pricing for titanium feedstocks is usually adjusted either on a quarterly or half-year basis. In some instances, we use traders or agents for the sale of titanium feedstocks.

The geographic market for titanium feedstock is global in scope, and TiO2 producers regularly source and transport titanium feedstock from suppliers located around the world.

Zircon Industry Background and Outlook

Zircon is extracted, alongside ilmenite and rutile, as part of the initial mineral sands beneficiation process. Zircon is a mineral which is primarily used as an additive in ceramic glazes to add hardness, which makes the ceramic glaze more water, chemical and abrasion resistant. It is also used for the production of zirconium and zirconium chemicals, in refractories, as a molding sand in foundries, and for TV glass, where it is noted for its structural stability at high temperatures and resistance to abrasive and corrosive conditions.

Zircon typically represents a relatively low proportion of heavy mineral sands mining but has high value compared to other heavy mineral products, resulting in it contributing a significant portion to total revenue. Refractories containing zircon are expensive and are only used in demanding, high-wear and corrosive

4

Table of Contents

applications in the glass, steel and cement industries. Foundry applications use zircon when casting articles of high quality and value where accurate sizing is crucial, such as aerospace, automotive, medical and other high-end applications. Historically, zircon has constituted a relatively minor part of the total value produced as a result of the mining and processing of titanium minerals. However, from early 2000, zircon has increased in value as a co-product, although it remains dependent on the mining of titanium minerals for its supply.

Pigment Industry Background and Outlook

TiO2 is used in a wide range of products due to its ability to impart whiteness, brightness and opacity, and is designed, marketed and sold based on specific end-use applications. TiO2 is used extensively in the manufacture of paint and other coatings, plastics and paper and in a wide range of other applications, including inks, fibers, rubber, food, cosmetics and pharmaceuticals. According to TZMI data, the paint and coatings sector is the largest consumer of pigment averaging approximately 58% of total pigment consumption in 2011. The plastics sector accounted for approximately 22% of TiO2 consumption in 2011, while the remaining 20% was divided between paper, inks, fibers and other.

TiO2 is a critical component of everyday consumer applications due to its superior ability to cover or mask other materials effectively and efficiently relative to alternative white pigments and extenders. TiO2 is considered to be a quality of life product and some research indicates that consumption generally increases as disposable income increases. We believe that, at present, TiO2 has no effective mineral substitute because no other white pigment has the physical properties for achieving comparable opacity and brightness or can be incorporated in as cost-effective a manner.

According to the latest TZMI data, industry production capacity grew to 6.4 million tonnes from 6 million tonnes in the prior year. The global market in which our TiO2 business operates is competitive. Competition is based on a number of factors such as price, product quality and service. We face competition from major international producers, including DuPont, Cristal Global, Huntsman, and Kronos, as well as smaller regional competitors such as Sachtleben Chemie GmbH and Ishihara Sangyo Kaisha, which operate multiple plants on single continents. We estimate that, based on nameplate capacity, these seven companies accounted for more than 64% of the global market share. During 2012, we had global TiO2 production capacity of 465,000 tonnes per year, which was approximately 7% of global pigment capacity. In addition to the major competitors discussed above, we compete with numerous smaller, regional producers, including producers in China that have expanded their sulphate production capacity during the previous five years.

Worldwide, we believe that we and the other major producers mentioned above are the only companies that have perfected and successfully commercialized the chloride process technology for the production of TiO2. According to TZMI, among the seven largest multi-national producers, 77% of available capacity uses the chloride process, compared to smaller producers who, on average, produce 6% of products using the chloride process, whileTiO2 produced using chloride process technology is generally preferred for some TiO2 end-use and specialty applications.

We have global operations with production facilities and a sales and marketing presence in the Americas, Europe and the Asia-Pacific regions. Our global presence enables us to sell our products to a diverse portfolio of customers with whom we have well-established relationships.

In recent years, demand growth has increased in Asia-Pacific, Central and Eastern Europe, the Middle East and Africa and South America more than in the mature economies of North America, Western Europe and Japan. Capacity growth over the next ten or so years is expected to be driven by the above global average demand growth in such emerging markets. While there are several chloride projects planned in China, it is unlikely that they will contribute any significant output before 2014. The probability of new greenfield projects (locations where there is not an existing infrastructure) is limited, given the limitations in feedstock supply, as well as

5

Table of Contents

financial risks associated with the large investments in a facility, a long lead time and difficulty in achieving permitting (in particular, environmental permitting). As a result no significant new chloride TiO2 facility has been built since 1994; however, over the years, the industry has increased capacity through expansion of existing plants and debottlenecking, and we expect this to continue going forward.

TiO2 is produced using one of two commercial production processes: the chloride process and the sulphate process. The chloride process is a newer technology, and we believe it has several advantages over the sulphate process: it generates less waste, uses less energy, is less labor intensive and permits the direct recycle of chlorine, a major process chemical, back into the production process. The sulphate process can use lower quality (and therefore less expensive) feedstock. Commercial production of TiO2 results in one of two different crystal forms, either rutile or anatase. Rutile TiO2 is preferred over anatase TiO2 for many of the largest end-use applications, such as coatings and plastics, because its higher refractive index imparts better hiding power at lower quantities than the anatase crystal form and it is more suitable for outdoor use because it is more durable. Although rutile TiO2 can be produced using either the chloride process or the sulphate process, some customers prefer rutile produced using the chloride process because it typically has a bluer undertone and greater durability.

We are one of a limited number of TiO2 producers in the world with chloride production technology. TiO2 produced using the chloride process is preferred for some of the largest end-use applications. As a result of these advantages, the chloride process currently accounts for substantially all of the industry-wide TiO2 production capacity in North America and approximately 50% of industry-wide capacity globally. All of our TiO2 is produced using the chloride process.

Our Competitive Strengths

Leading Global Market Positions

We are among the world’s largest producers and marketers of TiO2 products with approximately 7% of of global pigment capacity in 2012, and one of the world’s largest integrated TiO2 producers. We are the third largest global producer and marketer of TiO2 manufactured via chloride technology, which we believe is preferred for many applications compared to TiO2 manufactured by other TiO2 production technologies. We are the third largest titanium feedstock producer and a leader in global zircon production. Additionally, our fully integrated and global production facilities and sales and marketing presence in the Americas, Europe, Africa and the Asia-Pacific region enables us to provide customers in over 90 countries with a reliable supply of our products. The diversity of the geographic regions we serve increases our exposure to faster growing geographies, such as the Asia-Pacific region, and also mitigates our exposure to regional economic downturns because we can shift supply from weaker to stronger regions. We believe our relative size and vertical integration provides us with a competitive advantage in retaining existing customers and obtaining new business.

Well Positioned to Capitalize on Trends in the Feedstock and TiO2 Industries

We believe the markets in which we participate have been, and will be, supply-constrained over the medium term. In the medium term, we anticipate no extended periods during which the supply of higher grade titanium feedstock and TiO2 will exceed demand for each of these products. Because our production of titanium feedstock exceeds or required consumption, we believe that we will be well positioned to benefit from these market conditions.

Vertically Integrated Platform with Security of Titanium Feedstock Supply

As of March 31, 2013, our integration plan is on track to more fully demonstrate the material cost advantages it gives us. The vertical integration of titanium feedstock and TiO2 production provides us with a secure and cost competitive supply of high grade titanium feedstock over the long-term. Our ability to supply all

6

Table of Contents

of the feedstock that our pigment operations require enables us to balance our consumption and sales in ways that we believe our competitors cannot. During the first quarter of 2013, titanium feedstock sold internally to the pigment segment increased. As a result, during the first quarter of 2013, we cancelled contracts with two external ore suppliers.

Low Cost and Efficient Production Network

We believe our TiO2 operations, and specifically our plant in Hamilton, Mississippi, are among the lowest cost producers of TiO2 globally. This is of particular importance as it positions us to be competitive through all facets of the TiO2 cycle. Moreover, our three TiO2 production facilities are strategically positioned in key geographies. The Hamilton facility is the third largest TiO2 production facility in the world and has the size and scale to service customers in North America and around the globe. Our plant in Kwinana, Australia is well positioned to service growing demand from Asia. Our Botlek facility in the Netherlands services our European customers and certain specialized applications globally. Combined with our titanium feedstock assets in South Africa and Australia, this network of TiO2 and titanium feedstock facilities gives us the flexibility to optimize asset and feedstock utilization and generate operational, logistical and market efficiencies.

TiO2 and Titanium Feedstock Production Technology

We are one of a limited number of TiO2 producers in the world with chloride production technology. Our production capacity exclusively uses this process technology, which is the subject of numerous patents worldwide. Although we do not operate sulphate process plants and therefore cannot make a direct comparison, we believe the chloride production process generates less waste, uses less energy and is less labor intensive than the alternative sulphate process. Additionally, our titanium feedstock operations in South Africa and Australia are one of a limited number of feedstock producers with the expertise and technology to produce upgraded titanium feedstock (i.e., synthetic rutile and chloride slag) for use in the chloride process.

Innovative, High-Performance Products

We offer innovative, high-performance products for nearly every major TiO2 end-use application. We seek to develop new products and enhance our current product portfolio to better serve our customers and respond to the increasingly stringent demands of their end-use sectors. Our new product development pipeline has yielded successful grade launches specifically targeting the plastics markets. In addition, we have completed mid-cycle improvement initiatives on our key coatings grades resulting in more robust products across a wide range of coatings formulations.

Experienced Management Team and Staff

The diversity of our management team’s business experience provides a broad array of skills that contributes to the successful execution of our business strategy. Our TiO2 operations team and plant managers, who have manufacturing experience, participate in the development and execution of strategies that have resulted in production volume growth, production efficiency improvements and cost reductions. Our mineral sands operations team and plant managers have a deep reservoir of experience in mining, engineering and processing skills gained over many years in various geographies. Additionally, the experience, stability and leadership of our sales organization have been instrumental in growing sales, developing and expanding customer relationships.

Business Strategy

Our business strategy is to grow the company and to enhance our shareholder equity value by optimizing the beneficial effects of our present business attributes. We expect to implement this strategy through a disciplined

7

Table of Contents

focus on cost reduction and operating efficiencies. We also plan to grow the business through a combined focus on the expanded production of our existing products and through strategic acquisitions and business partnerships in areas related to our industry to increase our standing in our global markets.

More specifically, our strategy includes the following components:

Maintain Operational Excellence

We are continually evaluating our business to identify opportunities to increase operational efficiency throughout our production network with a focus on maintaining operational excellence and maximizing asset efficiency. Our focus on enhancing operational excellence positions us to maximize yields, minimize operating costs and meet market growth over the short term without investing additional capital for capacity expansion. In addition, we intend to continue focusing on increasing manufacturing efficiencies through selected capital projects, process improvements and best practices in order to maximize yields, lower unit costs and improve our margins.

Leverage Our Low-Cost Production Network and Vertical Integration to Deliver Profitability and Cash Flow

We currently have TiO2 manufacturing facilities designed to produce approximately 465,000 tonnes of TiO2 annually. We expect that (assuming variable conversion costs per tonne remain constant or decline) increased production from this fixed cost base should increase margins and profitability. In addition, by assuring ourselves of the availability of the supply of titanium feedstock that these production facilities require, and by participating in the profitability of the mineral sands market directly, we have several different means of optimizing profitability and cash flow generation.

Ore In Use Optimization

We take advantage of the integrated nature and scale of the combined business, which provides the opportunity to capitalize on a wide range of titanium feedstock grades due to the ability to optimize internal ore usage and pursue external titanium feedstock end-markets that provide superior profit margins

Expand Global Leadership

We plan to continue to capitalize on our strong global market position to drive profitability and cash flow by enhancing existing customer relationships, providing high quality products and offering technical expertise to our customers. Furthermore, our vertically integrated global operations provide us with a solid platform for future growth in the TiO2, titanium feedstock, zircon and pig iron markets. Our broad product offering allows us to participate in a variety of end-use sectors and pursue those market segments that we believe have attractive growth prospects and profit margins. Our operations position us to participate in developing regions such as Asia, Eastern Europe and Latin America, which we expect to provide attractive growth opportunities. We will also seek to increase margins by focusing our sales efforts on those end-use segments and geographic areas that we believe offer the most attractive growth prospects and where we believe we can realize relatively higher selling prices over the long-term than in alternate sectors. We believe our global operations network, distribution infrastructure and technology will enable us to continue to pursue global growth.

Maintain Strong Customer Focus

We continue to target our key customer groups with innovative, high-performance products that provide enhanced value to our customers at competitive prices. A key component of our business strategy is to continually enhance our product portfolio with high-quality, market-driven product development. We design our

8

Table of Contents

TiO2 products to satisfy our customers’ specific requirements for their end-use applications and align our business to respond quickly and efficiently to changes in market demands. We continue to execute on product improvement initiatives for our major coatings and plastics products. These improvement strategies will provide value in the form of better optical properties, stability, and durability to our customers. Further, new and enhanced grades are in the pipeline for 2013 and 2014.

Principal Executive Offices

Our principal executive offices are located at One Stamford Plaza, 263 Tresser Boulevard, Suite 1100, Stamford, Connecticut 06901 and 1 Brodie Hall Drive, Technology Park, Bentley, Australia 6102. Our telephone number in the United States is (203) 705-3800. Our website address is http://www.tronox.com. Our website and the information contained on our website are not part of this prospectus.

9

Table of Contents

Corporate Structure

The following diagram is a simplified illustration of our corporate structure:

10

Table of Contents

On August 20, 2012, we sold, through a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), $900 million of our 6.375% Senior Notes due 2020, which are eligible to be exchanged for Exchange Notes. We refer to the 6.375% Senior Notes due 2020 as “Old Notes” in this prospectus.

Simultaneously with the private placement, we entered into a registration rights agreement with the initial purchasers of the Old Notes (as amended, the “Registration Rights Agreement”). Under the Registration Rights Agreement, we are required to use our reasonable best efforts to cause a registration statement for substantially identical Notes, which will be issued in exchange for the Old Notes, to be filed with the SEC as soon as practicable after the date of issuance of the Old Notes and to cause such registration statement to become effective within 360 days of the date of issuance of the Old Notes. We refer to the notes to be registered under this exchange offer registration statement as “Exchange Notes” and collectively with the Old Notes, we refer to them as the “notes” in this prospectus. You may exchange your Old Notes for the applicable Exchange Notes in this exchange offer. You should read the discussion under the headings “Summary of Exchange Offer,” “Exchange Offer” and “Description of Notes” for further information regarding the Exchange Notes.

| Securities Offered |

$900 million aggregate principal amount of new 6.375% Senior Notes due 2020 and guarantees thereon (the “Exchange Guarantees”). |

| Exchange Offer |

We are offering to exchange the Old Notes for a like principal amount at maturity of the Exchange Notes. |

| Old Notes may be exchanged only in minimum principal amounts of $2,000 and integral multiples of $1,000 in excess thereof. |

| The exchange offer is being made pursuant to the Registration Rights Agreement, which grants the initial purchasers and any subsequent holders of the Old Notes certain exchange and registration rights. This exchange offer is intended to satisfy those exchange and registration rights with respect to the Old Notes. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your Old Notes. |

| Expiration Date; Withdrawal of Tender |

The exchange offer will expire at 11:59 p.m., New York City time, on , 2013, or a later time if we choose to extend this exchange offer in our sole and absolute discretion. You may withdraw your tender of Old Notes at any time prior to 11:59 p.m., New York City time on the expiration date. All outstanding Old Notes that are validly tendered and not validly withdrawn will be exchanged. Any Old Notes not accepted by us for exchange for any reason will be returned to you at our expense promptly after the expiration or termination of the exchange offer. |

| Resales |

We believe that you can offer for resale, resell and otherwise transfer the Exchange Notes without complying with the registration and prospectus delivery requirements of the Securities Act so long as: |

| • | you acquire the Exchange Notes in the ordinary course of business; |

11

Table of Contents

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the Exchange Notes; |

| • | you are not an affiliate of ours; and |

| • | you are not a broker-dealer. |

| If any of these conditions is not satisfied and you transfer any Exchange Notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We do not assume, or indemnify you against, any such liability. |

| Broker-Dealer |

Each broker-dealer acquiring Exchange Notes issued for its own account in exchange for Old Notes, which it acquired through market-making activities or other trading activities, must acknowledge that it will deliver a proper prospectus when any Exchange Notes issued in the exchange offer are transferred. A broker-dealer may use this prospectus for an offer to resell, a resale or other retransfer of the Exchange Notes issued in the exchange offer. |

| Conditions to the Exchange Offer |

Our obligation to accept for exchange, or to issue the Exchange Notes in exchange for, any Old Notes is subject to certain customary conditions, including our determination that the exchange offer does not violate any law, statute, rule, regulation or interpretation by the Staff of the SEC or any regulatory authority or other foreign, federal, state or local government agency or court of competent jurisdiction, some of which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See “Exchange Offer—Conditions to the Exchange Offer.” |

| Procedures for Tendering Old Notes Held in the Form of Book-Entry Interests |

The Old Notes were issued as global securities and were deposited upon issuance with Wilmington Trust, National Association, which issued uncertificated depositary interests in those outstanding Old Notes, which represent a 100% interest in those Old Notes, to The Depository Trust Company (“DTC”). |

| Beneficial interests in the outstanding Old Notes, which are held by direct or indirect participants in DTC, are shown on, and transfers of the Old Notes can only be made through, records maintained in book-entry form by DTC. |

| You may tender your outstanding Old Notes by instructing your broker or bank where you keep the Old Notes to tender them for you. In some cases you may be asked to submit the letter of transmittal that may accompany this prospectus. By tendering your Old Notes you will be deemed to have acknowledged and agreed to be bound by the terms set forth under “Exchange Offer.” |

12

Table of Contents

| Your outstanding Old Notes must be tendered in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| In order for your tender to be considered valid, the exchange agent must receive a confirmation of book-entry transfer of your outstanding Old Notes into the exchange agent’s account at DTC, under the procedure described in this prospectus under the heading “Exchange Offer,” on or before 11:59 p.m., New York City time, on the expiration date of the exchange offer. |

| United States Federal Income Tax Considerations |

The exchange offer should not result in any income, gain or loss to the holders of Old Notes or to us for United States federal income tax purposes. See “Material United States Federal Income Tax Considerations.” |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the Exchange Notes in the exchange offer. |

| Exchange Agent |

Wilmington Trust, National Association is serving as the exchange agent for the exchange offer. |

| Shelf Registration Statement |

In limited circumstances, holders of Old Notes may require us to register their Old Notes under a shelf registration statement. |

CONSEQUENCES OF NOT EXCHANGING OLD NOTES

If you do not exchange your Old Notes in the exchange offer, your Old Notes will continue to be subject to the restrictions on transfer currently applicable to the Old Notes. In general, you may offer or sell your Old Notes only:

| • | if they are registered under the Securities Act and applicable state securities laws; |

| • | if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

| • | if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

We do not currently intend to register the Old Notes under the Securities Act. Under some circumstances, however, holders of the Old Notes, including holders who are not permitted to participate in the exchange offer or who may not freely resell Exchange Notes received in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of notes by these holders. For more information regarding the consequences of not tendering your Old Notes and our obligation to file a shelf registration statement, see “Exchange Offer—Consequences of Failure to Exchange,” and “Description of Notes—Registration Rights Agreement.”

13

Table of Contents

SUMMARY OF TERMS OF EXCHANGE NOTES

The summary below describes the principal terms of the Exchange Notes, the guarantees and the related indentures. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Notes” section of this prospectus contain more detailed descriptions of the terms and conditions of the notes and the related indentures.

| Issuer |

Tronox Finance LLC. |

| Securities offered |

$900 million in aggregate principal amount of new 6.375% Senior Notes due 2020. |

| Maturity date |

The Exchange Notes will mature on August 15, 2020. |

| Interest rate |

The Exchange Notes will accrue interest at the rate of 6.375% per annum. |

| Interest payment dates |

Interest on the Exchange Notes will be payable on February 15 and August 15 of each year, commencing on August 15, 2013. |

| Ranking |

The Exchange Notes and the Exchange Guarantees will be general unsecured senior obligations of the Issuer and each guarantor, respectively, and |

| • | will rank equally in right of payment with all of the Issuer’s and the guarantors’ respective existing and future unsecured senior indebtedness; |

| • | will rank senior in right of payment to existing and future subordinated indebtedness of the Issuer or the guarantors, respectively; |

| • | will be effectively subordinated to all of the Issuer’s and the guarantors’ respective existing and future secured indebtedness to the extent of the assets securing such indebtedness; and |

| • | will be structurally subordinated to all existing and future indebtedness and other liabilities of subsidiaries of the Parent that do not guarantee the notes. |

| Guarantees |

The Exchange Notes will be guaranteed by the Parent and all of the subsidiaries of the Parent that guarantee any obligations under the credit facilities on the date the Old Notes were issued. Restricted subsidiaries of the Parent that incur or guarantee any indebtedness under certain of our credit facilities are required to become guarantors of the notes, other than excluded entities. See “Description of Notes—Brief Description of the Notes and the Note Guarantees—The Note Guarantees.” |

| Optional Redemption |

The Issuer has an option to redeem all or a portion of the Exchange Notes at any time before August 15, 2015, at a redemption price equal to 100% of the aggregate principal amount of the notes to be |

14

Table of Contents

| redeemed plus a “make-whole” premium and accrued and unpaid interest and additional interest, if any, up to, but excluding, the redemption date. |

| The Issuer also has the option to redeem all or a portion of the Exchange Notes at any time on or after August 15, 2015 at the redemption prices set forth in this prospectus plus accrued and unpaid interest and additional interest, if any, up to, but excluding, the redemption date. |

| In addition, before August 15, 2015, the Issuer may redeem up to 35% of the aggregate principal amount of the Exchange Notes with the net cash proceeds of certain equity offerings at a redemption price equal to 106.375% of the aggregate principal amount of the Exchange Notes to be redeemed plus accrued and unpaid interest and additional interest, if any, up to, but excluding, the redemption date. |

| See “Description of Notes—Optional Redemption.” |

| Mandatory Offers to Purchase |

The occurrence of certain changes of control will be a triggering event requiring the Issuer to offer to purchase from you all or a portion of your Exchange Notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest and additional interest, if any, up to, but excluding, the date of purchase. |

| Certain asset dispositions will be triggering events which may require the Issuer to use the proceeds from those asset dispositions to make an offer to purchase the Exchange Notes at 100% of their principal amount, plus accrued and unpaid interest and additional interest, if any, up to, but excluding, the date of purchase. |

| Certain covenants |

The indenture governing the Exchange Notes contains, among other things, covenants limiting our ability and the ability of our restricted subsidiaries to: |

| • | incur certain additional indebtedness and issue preferred stock; |

| • | make certain dividends, distributions, investments and other restricted payments; |

| • | sell certain assets; |

| • | incur liens; |

| • | agree to any restrictions on the ability of restricted subsidiaries to make payments to us; |

| • | consolidate or merge with or into, or sell substantially all of our assets to, another person; |

| • | enter into transactions with affiliates; and |

| • | enter into new lines of business. |

| These covenants will be subject to a number of important exceptions and qualifications. For more details, see “Description of Notes.” |

15

Table of Contents

| Events of default |

For a discussion of events that will permit acceleration of the payment of the principal of and accrued interest on the Exchange Notes, see “Description of the Notes—Events of Default.” |

| No prior market |

The Exchange Notes will be new securities for which there is currently no market. We cannot assure you as to the liquidity of markets that may develop for the Exchange Notes, your ability to sell the notes or the price at which you would be able to sell the Exchange Notes. See “Risk Factors—Risks related to the Exchange Notes— There is no existing public trading market for the Exchange Notes, and your ability to sell such notes will be limited.” |

| Listing |

We do not intend to list the Exchange Notes on any securities exchange. |

| Use of proceeds |

We will not receive any proceeds from the issuance of the Exchange Notes. |

| Form and denomination |

The Exchange Notes will be delivered in fully-registered form. The Exchange Notes will be represented by one or more global notes, deposited with the trustee as a custodian for DTC and registered in the name of Cede & Co., DTC’s nominee. Beneficial interests in the global notes will be shown on, and any transfers will be effective only through, records maintained by DTC and its participants. |

| The Exchange Notes will be issued in denominations of $2,000 and integral multiples of $1,000. |

| Governing law |

The Exchange Notes and the indentures governing the Exchange Notes will be governed by, and construed in accordance with, the laws of the State of New York. |

| Trustee |

Wilmington Trust, National Association |

16

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth selected historical financial data for the periods indicated. The statement of operations data and supplemental information for the three months ended March 31, 2013 reflect the consolidated operating results of Tronox Limited. The statement of operations data and supplemental information for the three months ended March 31, 2012 reflect the consolidated operating results of Tronox Incorporated. The statement of operations data and supplemental information for the year ended December 31, 2012 reflect the consolidated operating results of Tronox Incorporated prior to June 15, 2012, and, from June 15, 2012 through December 31, 2012, reflect the consolidated operating results of Tronox Limited. The statement of operations data and the supplemental information for the eleven months ended December 31, 2011, one month ended January 31, 2011, and years ended December 31, 2010, 2009 and 2008 reflect the consolidated operating results of Tronox Incorporated. The balance sheet data at March 31, 2013 and December 31, 2012 relates to Tronox Limited. The balance sheet data at March 31, 2012, and December 31, 2011, 2010, 2009 and 2008 relates to Tronox Incorporated.

This information should be read in conjunction with our unaudited Condensed Consolidated Financial Statements (including the notes thereto) for the three months ended March 31, 2013 and 2012, our Consolidated Financial Statements (including the notes thereto) for the years ended December 31, 2012, 2011 and 2010, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in this prospectus.

17

Table of Contents

| Successor | Predecessor | |||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2013 |

Three Months Ended March 31, 2012 |

Year Ended December 31, 2012 |

Eleven Months Ended December 31, 2011 |

One Month Ended January 31, 2011 |

Year Ended December 31, |

|||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||

| (Millions of dollars, except per share data) | ||||||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||||||

| Net Sales |

$ | 470 | $ | 434 | $ | 1,832 | $ | 1,543 | $ | 108 | $ | 1,218 | $ | 1,070 | $ | 1,246 | ||||||||||||||||

| Cost of goods sold |

438 | 277 | (1,568 | ) | (1,104 | ) | (83 | ) | (996 | ) | (932 | ) | (1,133 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross Margin |

32 | 157 | 264 | 439 | 25 | 222 | 138 | 113 | ||||||||||||||||||||||||

| Selling, general and administrative expenses |

51 | 44 | (239 | ) | (152 | ) | (5 | ) | (59 | ) | (72 | ) | (114 | ) | ||||||||||||||||||

| Litigation/arbitration settlement |

— | — | — | 10 | — | — | — | — | ||||||||||||||||||||||||

| Gain on land sales |

— | — | — | — | — | — | 1 | 25 | ||||||||||||||||||||||||

| Impairment of long-lived assets(1) |

— | — | — | — | — | — | — | (25 | ) | |||||||||||||||||||||||

| Restructuring charges(2) |

— | — | — | — | — | — | (17 | ) | (10 | ) | ||||||||||||||||||||||

| Net loss on deconsolidation of subsidiary |

— | — | — | — | — | — | (24 | ) | — | |||||||||||||||||||||||

| Provision for environmental remediation and restoration, net of reimbursements(3) |

— | — | — | 5 | — | 47 | — | (73 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income (Loss) from Operations |

(19 | ) | 113 | 25 | 302 | 20 | 210 | 26 | (84 | ) | ||||||||||||||||||||||

| Interest and debt expense(4) |

(27 | ) | (8 | ) | (65 | ) | (30 | ) | (3 | ) | (50 | ) | (36 | ) | (54 | ) | ||||||||||||||||

| Loss on extinguishment of debt |

(4 | ) | — | — | — | — | — | — | — | |||||||||||||||||||||||

| Other income (expense) |

6 | (1 | ) | (7 | ) | (10 | ) | 2 | (8 | ) | (11 | ) | (10 | ) | ||||||||||||||||||

| Gain on bargain purchase |

— | — | 1,055 | — | — | — | — | — | ||||||||||||||||||||||||

| Reorganization income (expense) |

— | — | — | — | 613 | (145 | ) | (10 | ) | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income (Loss) from Continuing Operations before Income Taxes |

(44 | ) | 104 | 1,008 | 262 | 632 | 7 | (31 | ) | (148 | ) | |||||||||||||||||||||

| Income tax benefit (provision) |

(1 | ) | (18 | ) | 125 | (20 | ) | (1 | ) | (2 | ) | 2 | 2 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income (Loss) from Continuing Operations |

— | — | 1,133 | 242 | 631 | 5 | (29 | ) | (146 | ) | ||||||||||||||||||||||

| Income (Loss) from discontinued operations, net of income tax benefit (provision) |

— | — | — | — | — | 1 | (10 | ) | (189 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net Income (Loss) |

(45 | ) | 86 | 1,133 | 242 | 631 | 6 | (39 | ) | (335 | ) | |||||||||||||||||||||

| (Income) loss attributable to noncontrolling interest |

(12 | ) | — | 1 | — | — | — | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income attributable to Tronox Limited Shareholders |

$ | (57 | ) | $ | 86 | $ | 1,134 | $ | 242 | $ | 631 | $ | 6 | $ | (39 | ) | $ | (335 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Earnings (Loss) from Continuing Operations per Share(5): |

||||||||||||||||||||||||||||||||

| Basic |

$ | (0.50 | ) | $ | 1.14 | $ | 11.37 | $ | 3.22 | $ | 15.28 | $ | 0.11 | $ | (0.70 | ) | $ | (3.55 | ) | |||||||||||||

| Diluted |

$ | (0.50 | ) | $ | 1.10 | $ | 11.10 | $ | 3.10 | $ | 15.25 | $ | 0.11 | $ | (0.70 | ) | $ | (3.55 | ) | |||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||||||

| Working capital(6) |

$ | 2,330 | $ | 704 | $ | 1,706 | $ | 488 | $ | 458 | $ | 483 | $ | 489 | $ | (247 | ) | |||||||||||||||

| Property, plant and equipment, net and Mineral leasehold, net |

$ | 2,737 | 559 | $ | 2,862 | 542 | 318 | 316 | 314 | 347 | ||||||||||||||||||||||

| Total assets |

$ | 6,015 | $ | 1,903 | $ | 5,511 | $ | 1,657 | $ | 1,091 | $ | 1,098 | $ | 1,118 | $ | 1,045 | ||||||||||||||||

| Noncurrent liabilities: |

||||||||||||||||||||||||||||||||

| Long-term debt(6) |

$ | 2,396 | $ | 552 | $ | 1,605 | $ | 421 | $ | 421 | $ | 421 | $ | 423 | $ | — | ||||||||||||||||

| Environmental remediation and/or restoration(7) |

— | 1 | — | 1 | 1 | 1 | — | 546 | ||||||||||||||||||||||||

| All other noncurrent liabilities |

543 | 207 | 557 | 203 | 153 | 154 | 50 | 125 | ||||||||||||||||||||||||

| Total liabilities(9) |

$ | 3,319 | $ | 1,055 | $ | 2,629 | $ | 905 | $ | 848 | $ | 828 | $ | 683 | $ | 1,642 | ||||||||||||||||

| Liabilities subject to compromise |

$ | — | $ | — | $ | — | $ | — | $ | 897 | $ | 900 | $ | 1,048 | $ | — | ||||||||||||||||

| Total equity |

$ | 2,696 | $ | 848 | $ | 2,882 | $ | 752 | $ | (654 | ) | $ | (630 | ) | $ | (613 | ) | $ | (598 | ) | ||||||||||||

| Supplemental Information: |

||||||||||||||||||||||||||||||||

| Depreciation, depletion and amortization expense |

$ | 73 | $ | 22 | $ | 211 | $ | 79 | $ | 4 | $ | 50 | $ | 53 | $ | 76 | ||||||||||||||||

| Capital expenditures |

$ | 45 | $ | 21 | $ | 166 | $ | 133 | $ | 6 | $ | 45 | $ | 24 | $ | 34 | ||||||||||||||||

| EBITDA(8) |

$ | 55 | $ | 134 | $ | 1,284 | $ | 371 | $ | 639 | $ | 108 | $ | 49 | $ | (207 | ) | |||||||||||||||

| Adjusted EBITDA(8) |

$ | 73 | $ | 151 | $ | 503 | $ | 468 | $ | 24 | $ | 203 | $ | 142 | $ | 99 | ||||||||||||||||

18

Table of Contents

| (1) | In 2008, Tronox Incorporated recorded impairment charges for long-lived assets of approximately $3 million related to Savannah, Georgia, and approximately $22 million related to Botlek, the Netherlands. |

| (2) | Restructuring charges in 2009 were primarily the result of the idling of Tronox Incorporated’s Savannah plant. Restructuring charges in 2008 resulted primarily from work force reduction programs, along with asset retirement obligation adjustments. |

| (3) | In 2010, Tronox Incorporated recorded receivables from its insurance carrier related to environmental clean-up obligations at the Henderson facility. Due to the accounting for certain legacy liabilities, the obligation for this clean-up work had been recorded in 2008 and prior years. |

| (4) | Excludes $3 million, $33 million and $32 million in the one month ended January 31, 2011 and years ended December 31, 2010 and 2009, respectively, that would have been payable under the terms of the 9.5% senior unsecured notes. |

| (5) | On June 26, 2012, the Board of Directors of Tronox Limited approved a 5-to-1 share split for holders of its Class A ordinary shares and Class B ordinary shares at the close of business on July 20, 2012, by issuance of four additional shares for each share of the same class by way of bonus issue. All references to number of shares and per share data in the Successor’s consolidated financial statements have been adjusted to reflect the share split, unless otherwise noted. See Note 15 of Notes to Consolidated Financial Statements for additional information regarding the Company’s share split. |

| (6) | Working capital is defined as the excess (deficit) of current assets over current liabilities. Due to Tronox Incorporated’s financial condition at December 31, 2008, the entire balance of our outstanding debt of $563 million was classified as current obligations, resulting in long-term debt having a balance of $0 and working capital being a deficit. In 2009, the $350 million senior unsecured notes were reclassified to Liabilities Subject to Comprise. |

| (7) | As a result of the bankruptcy filing and certain legacy liabilities accounting, environmental remediation and/or restoration liabilities were reclassified to Liabilities Subject to Compromise in 2009. |