Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration Statement Nos. 333-166936

and

333-166936-01 through 333-166936-12

PROSPECTUS

Boise Paper Holdings, L.L.C.

Boise Finance Company

$300,000,000

9% Senior Notes Due 2017

Offer to exchange $300,000,000 aggregate principal amount of 9% Senior Notes due 2017 (CUSIPs 09747F AA3 and U77439 AA2) for 9% Senior Notes due 2017 (CUSIP 09747F AC9) that have been registered under the Securities Act of 1933, as amended.

The exchange offer will expire at 5:00 p.m., New York City time, on July 14, 2010, unless we extend the exchange offer in our sole and absolute discretion.

Terms of the Exchange Offer:

| • | We refer to the registered notes offered in this exchange offer as the “new notes” and to all $300,000,000 outstanding principal amount 9% Senior Notes due 2017 issued on October 26, 2009 as the “old notes.” |

| • | We will exchange the new notes to be issued for all outstanding old notes that are validly tendered and not withdrawn prior to the expiration or termination of the exchange offer. |

| • | The new notes are being registered with the Securities and Exchange Commission and are being offered in exchange for the old notes that were previously issued in an offering exempt from the Securities and Exchange Commission registration requirements. The terms of the exchange offer are summarized below and more fully described in this prospectus. |

| • | You may withdraw tenders of old notes at any time prior to the expiration of the exchange offer. |

| • | The terms of the new notes are substantially identical to those of the outstanding old notes, except that the transfer restrictions, registration rights and additional interest provisions relating to the old notes do not apply to the new notes. |

| • | An exchange of old notes for new notes pursuant to the exchange offer will be ignored for United States federal income tax purposes. Consequently, a holder of old notes will not recognize gain or loss for United States federal income tax purposes as a result of exchanging old notes for new notes pursuant to the exchange offer. See “Material United States Federal Income Tax Consequences” for more information. |

| • | We will not receive any proceeds from the exchange offer. |

| • | There is no established trading market for the new notes. |

See “Risk Factors” section beginning on page 15 of this prospectus for a discussion of risks you should consider prior to tendering your old notes for exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 14, 2010

Table of Contents

| ii | ||

| iii | ||

| 1 | ||

| 15 | ||

| 28 | ||

| 29 | ||

| 30 | ||

| 31 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

33 | |

| 80 | ||

| 93 | ||

| 101 | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

130 | |

| 134 | ||

| 136 | ||

| 139 | ||

| 185 | ||

| 192 | ||

| 193 | ||

| 194 | ||

| 194 | ||

| 194 | ||

| F-1 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is an offer to exchange only the notes offered by this prospectus and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains summaries of the material terms of certain documents. Copies of these documents, except for certain exhibits and schedules, will be made available to you without charge upon written or oral request to us. Requests for documents or other additional information should be directed to Boise Inc., 1111 West Jefferson Street, Suite 200, Boise, Idaho 83702-5388, Attention: Investor Relations, telephone (208) 384-7456. To obtain timely delivery of documents or information, we must receive your request no later than five (5) business days before the expiration of the exchange offer.

i

Table of Contents

Certain of the information included in this prospectus constitutes forward-looking statements. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intends” and “continue” or similar words.

There may be events in the future that we are not able to accurately predict or over which we have little or no control. The following factors, among others, may cause actual results to differ materially from the expectations described by us in our forward-looking statements:

| • | paper and packaging industry trends, including factors affecting supply and demand; |

| • | our continued ability to meet the requirements of our credit facilities and other indebtedness; |

| • | cost of raw materials and energy; |

| • | legislation or regulatory environments, requirements or changes affecting the businesses in which we are engaged; |

| • | our customer concentration; |

| • | labor and personnel relations; |

| • | successfully realizing the benefits of operational restructurings and capital investments; |

| • | changing interpretations of generally accepted accounting principles; |

| • | credit or currency risks affecting our revenue and profitability; |

| • | continued compliance with government regulations; |

| • | general economic conditions; and |

| • | those factors listed under “Risk Factors” in this prospectus. |

You should not place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus.

All forward-looking statements included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

ii

Table of Contents

This prospectus includes information with respect to market share and industry conditions, including the size of certain markets and our position and the position of our competitors within these markets, which are based upon internal estimates and various third-party sources, including Resource Information Systems Inc. (“RISI”) and the American Forest & Paper Association (“AF&PA”). While we believe that such data is reliable, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying assumptions relied upon therein. Similarly, our internal research is based upon management’s understanding of industry conditions, and such information has not been verified by any independent sources. Accordingly, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

iii

Table of Contents

This summary contains a general summary of certain information contained in this prospectus. This summary is not complete and does not contain all of the information that is important to you. It is qualified in its entirety by the more detailed information included elsewhere in this prospectus. You should carefully consider the information contained in this entire prospectus, including the information set forth in the section entitled “Risk Factors” beginning on page 15 of this prospectus. Except where otherwise indicated or the context otherwise requires, the words “we,” “us,” “our” and similar terms, as well as references to the “Company,” “Boise” or “Boise Inc.,” refer to Boise Inc. and all of its consolidated subsidiaries, including the co-issuers, Boise Paper Holdings, L.L.C. (“Boise Paper Holdings”) and Boise Finance Company (“Boise Finance,” and together with Boise Paper Holdings, the “Issuers”). References to “Parent” refer to Boise Inc. exclusive of its subsidiaries. Parent is not and will not be following the exchange offer an obligor in respect of the old notes or the new notes.

Company Overview

We are a large, diverse United States-based manufacturer of packaging products and papers, including corrugated containers, containerboard, label and release and flexible packaging papers, imaging papers for the office and home, printing and converting papers, newsprint and market pulp. We own pulp and paper mill operations in the following locations: Jackson, Alabama; International Falls, Minnesota; St. Helens, Oregon; and Wallula, Washington, all of which manufacture uncoated freesheet paper. We also own a mill in DeRidder, Louisiana, which produces containerboard (linerboard) and newsprint. In addition, we have a network of five corrugated container plants located in the Pacific Northwest, a corrugated sheet plant in Nevada and a corrugated sheet feeder plant in Texas. We are headquartered in Boise, Idaho and have approximately 4,100 employees. For the three months ended March 31, 2010 and the year ended December 31, 2009, we had sales of $494 million and $1,978 million, respectively.

We operate our business in three reportable segments—Paper, Packaging, and Corporate and Other (support services).

| Three months ended March 31, 2010 sales, by reporting segment (1) |

Year ended December 31, 2009 sales, by reporting segment (2) | |

| ||

| (1) | Excludes Corporate and Other sales and intersegment eliminations of $7.6 million. |

| (2) | Excludes Corporate and Other sales and intersegment eliminations of $30.2 million. |

1

Table of Contents

Paper segment

Through our Paper segment, we manufacture and sell a range of papers, including communication-based papers, packaging-demand-driven papers and market pulp. We categorize these papers as:

| • | Communication-based, commodity and premium papers |

| • | Cut-size office papers |

| • | Printing and converting papers |

| • | Envelope |

| • | Forms |

| • | Commercial printing |

| • | Packaging-demand-driven papers |

| • | Label and release |

| • | Flexible packaging |

| • | Corrugating medium |

| • | Other |

| • | Market pulp |

We classify cut-size office papers, printing and converting papers, label and release, and flexible packaging products as uncoated freesheet. The majority of our communication-based paper sales are cut-size office papers, which accounted for approximately 63% of total Paper segment sales for the year ended December 31, 2009 and 58% for the quarter ended March 31, 2010. Annual capacity for the Paper segment, including corrugating medium and market pulp, was approximately 1.5 million short tons (a short ton is equal to 2,000 pounds) at December 31, 2009 and March 31, 2010.

We focus our product mix on office and packaging-demand-driven papers to better align ourselves with changing end-markets. Many traditional communication paper markets have declined as electronic document transmission and storage alternatives have developed. These declines have varied by specific products. For example, the use of business forms has declined significantly, while cut-size office paper consumption has declined more modestly over the past several years, as increased printer placements in home and manufacturing environments have offset reductions in office consumption. Some paper markets, such as label and release papers and flexible packaging papers, are not as sensitive to electronic substitution.

Packaging segment

Through our Packaging segment, we manufacture and sell corrugated containers and sheets as well as linerboard and newsprint. Containerboard is used in the production of corrugated containers and sheets. Our corrugated containers are used in the packaging of fresh fruit and vegetables, processed food, beverages and other industrial and consumer products. Corrugated sheets are sold primarily to converting operations, which finish the sheets into corrugated container products. For the year ended December 31, 2009, our Packaging segment produced approximately 544,000 short tons of linerboard, and our Paper segment produced approximately 126,000 short tons of corrugating medium, both of which are used in the production of corrugated containers. For the year ended December 31, 2009, our corrugated container and sheet feeder plants consumed approximately 451,000 short tons of containerboard (including both linerboard and corrugating medium) or the equivalent of 67% of our containerboard production. During the three months ended March 31, 2010, our Packaging segment produced approximately 139,000 short tons of linerboard, and our Paper segment produced approximately 32,000 short tons of corrugating medium. During the three months ended March 31, 2010, our

2

Table of Contents

corrugated container and sheet feeder plants consumed approximately 119,000 short tons of containerboard (including both linerboard and corrugating medium) or the equivalent of 70% of our containerboard production.

We operate our Packaging segment to maximize profitability through integration between our containerboard and converting operations and through operational improvements in our facilities to lower costs and improve efficiency. We plan to increase our integration levels and leverage our corrugated box position in the agricultural and food markets. We are a low-volume producer of newsprint, and we believe that our newsprint production has a low delivered cost to the southern U.S. markets.

On February 22, 2008, Parent completed the acquisition (the “Acquisition”) of Boise Paper Holdings and other assets and liabilities from Boise Cascade, L.L.C. (“Boise Cascade”) for $1,252.3 million in cash, $58.3 million in a subordinated promissory note and 37.9 million shares of Parent common stock. The business we acquired is referred to in this prospectus as the “Predecessor.”

Competitive Strengths

Well positioned in a consolidating industry—We believe that we are well positioned in an industry that is consolidating. According to RISI, the North American market share of the top three producers by capacity in the uncoated freesheet and linerboard industries has risen from 36% and 31%, respectively, in 1994, to 67% and 59%, respectively, in 2009. In uncoated freesheet, we believe that we are the third largest competitor. We operate to maximize our profitability by focusing our two largest uncoated freesheet paper manufacturing machines on cut-size commodity office paper while dedicating as much production as possible on our smaller machines to premium office papers and specialty packaging papers for a variety of markets and end-uses. We believe that our uncoated freesheet market positions are aligned with end-markets and niches that offer more favorable trends than the industry overall. We also believe that our lower cost virgin linerboard mill, complemented by a strong regional corrugated box position, provides us competitive strength in the containerboard market.

Industry leading value proposition in office paper channel—We have a long-term supply agreement with OfficeMax Incorporated (“OfficeMax”) to supply its North American requirements for cut-size office paper. This agreement allows us to utilize our largest uncoated freesheet paper machines to produce cut-size office paper in long, high-volume production runs. This relationship allows us to continue to improve capacity utilization of our largest paper machines, achieve supply chain efficiencies and develop and test product and packaging innovations. We leverage the expertise developed in this relationship to better serve our other customers and to develop new customer relationships and products while pursuing productivity improvements and cost reductions. We operate a distribution network that we believe to be an industry leader in on-time delivery performance, allowing our customers to reduce their inventory and augment their returns on capital. Additionally, we offer a complete suite of premium cut-size office papers and we believe that we are the largest producer of recycled cut-size office papers, which is an important product offering to our customers whose consumers have become increasingly environmentally sensitive. We believe that our value proposition will position us to continue to capture the operational benefits of stable demand and build and improve relationships with our customers.

Cost competitive uncoated freesheet assets with above average margins—The focus of our two largest uncoated freesheet paper machines is on the manufacture of cut-size office papers, where demand has proven more stable than in other uncoated freesheet grades. Given our exposure to more profitable and dependable end markets and the value proposition that we offer to our customers, we believe we are able to achieve above average margins relative to our competitors, whose portfolios tend to be weighted more heavily to printing and converting grades.

Corrugated box position focused on food and agricultural markets—We have a focused position in the agricultural and food markets for corrugated boxes, with over 70% of our corrugated box output used in these markets. We service these less cyclical end markets with our five strategically-located corrugated container

3

Table of Contents

plants, a corrugated sheet feeder plant and a corrugated sheet plant. With our regional focus and footprint, we are better able to service our customer needs from multiple plants, schedule operating runs to maximize productivity and reduce waste and better utilize different paper roll sizes. We believe this position in favorable end-markets creates greater stability than industrial markets generally and has contributed to increases in our profitability.

Expected future benefits from recent investments—We have undertaken several significant capital investment projects, the benefits of which have not been fully realized in our historical financial information. We spent approximately $80 million in the aggregate in 2006 and 2007 to modify our uncoated freesheet paper machine at our Wallula, Washington mill, which historically produced a variety of commodity paper grades, to enable it to produce pressure sensitive (label and release) papers as well as commodity grades. In 2008, we completed an investment of approximately $23 million for a new shoe press for our linerboard machine in DeRidder, Louisiana, increasing our annual capacity by approximately 36,000 short tons to 50,000 short tons, depending on grade mix, extending our product range capabilities and reducing our per ton energy usage rates. Additionally, we restructured our St. Helens, Oregon mill in the fourth quarter of 2008, discontinuing production of the least profitable papers, eliminating a significant number of products and the associated sales and marketing overhead, improving our system-wide product loading and reducing working capital and ongoing capital investment needs. We are also receiving benefits from pulp integration with the Wallula mill.

Strong management team—Our management team benefits from strong global insight and domestic experience. Our management has led our transition from an asset-focused company to a market and customer-focused company. While our management has been able to increase profitability by cutting costs and making investments in projects with high-return potential, management has also increased employee engagement and our commercial excellence, which continues to be an important part of this transformation process, driving productivity, cost savings and safety improvements. On average, our senior management team has over 20 years of experience in the industry.

Strategy

Our business strategy is to continue to align our capital investments and assets with end-markets with favorable trends and to lower our costs to improve our overall financial performance and returns on capital.

Grow premium office papers and packaging-demand-driven papers—We are increasing our presence in the premium office papers and packaging-demand-driven papers markets, while simultaneously reducing our exposure to more mature and lower margin markets. Specialty packaging papers, such as label and release and flexible packaging, have not been as sensitive to electronic substitution, have greater customer focus on specifications and product quality and offer a price premium to other, more commodity-like uncoated freesheet grades. We have improved the Wallula #3 paper machine and structured our sales and marketing teams to profitably and organically grow our market share in these niche, less commodity-like markets. For the year ended December 31, 2009, sales volumes of label and release, flexible packaging and premium office papers grew 4%, compared with the combined year ended December 31, 2008. Sales volumes in our label and release, flexible packaging, and premium office grades grew 17% in first quarter 2010 compared with first quarter 2009.

Increase integration and explore strategic growth in containerboard—We operate our containerboard business to optimize cash flow through direct and indirect integration between our containerboard and converting operations, as we believe that our system earns a higher return selling corrugated boxes to end-customers, as opposed to selling containerboard to converters. We will continue to evaluate opportunities for strategic and organic growth. Since 2006, we have purchased Central Texas Corrugated (“CTC”), a sheet feeder plant in Texas, for $43.8 million and a sheet plant in Sparks, Nevada for $0.8 million to further improve integration.

4

Table of Contents

Increase energy self-sufficiency—We believe we can improve our energy self-sufficiency should natural gas and other fossil fuels increase in cost. We have identified a number of potentially high return projects to reduce energy consumption and utilize lower cost renewable sources. We expect to further evaluate and implement these projects if an appropriate return on capital can be achieved.

Industry

The markets in which we operate are large and highly competitive. Our products and services compete with similar products manufactured and distributed by others both domestically and globally. Many factors influence our competitive position in each of our operating segments, including price, service, quality, product selection, convenience of location and our manufacturing and overhead costs.

North American uncoated freesheet producers shipped approximately 11 million short tons in 2009 and three major manufacturers accounted for approximately 67% of capacity, according to RISI and our estimates, as of December 31, 2009. We believe that we are the third-largest producer of uncoated freesheet paper in North America. Our largest competitors include Domtar Corporation, International Paper Company and Georgia-Pacific LLC.

According to RISI, demand for uncoated freesheet in North America declined by 1.5 million short tons, or 12%, in 2009 compared to 2008. In 2009, our sales volumes of uncoated freesheet paper declined by 13%, in large part due to the restructuring of our St. Helens, Oregon paper mill, and net sales prices for our uncoated freesheet paper increased by 3%. U.S. industry demand for uncoated freesheet improved in first quarter 2010, compared with the same period in 2009. According to AF&PA, year-to-date 2010 U.S. industry shipments through March improved 2.6% compared with the same period in 2009, and March 2010 industry operating rates in the U.S. were at 91%, according to the most recent data available.

North American containerboard (corrugating medium and linerboard) manufacturers produced 33 million short tons in 2009 and five major manufacturers account for approximately 72% of capacity, according to RISI and our estimates. Our largest competitors include International Paper Company, Smurfit-Stone Container Corporation, Georgia-Pacific LLC, Temple-Inland, Inc. and Packaging Corporation of America. Our corrugated container operations in the Pacific Northwest have a leading regional market position and compete with several national and regional manufacturers. According to RISI, the containerboard industry serves a number of end-markets, some of which have been impacted by negative real GDP growth in North America. Our corrugated product pricing remained steady in 2009, as packaging demand in agriculture, food and beverage markets, which have historically been less correlated to broad economic activity, have remained relatively stable. According to RISI, demand for containerboard in North America declined by 2.2 million short tons, or 7%, for 2009 compared to 2008. In 2009, our sales volumes of corrugated boxes and sheets declined 5% while sales volumes of linerboard increased by 10%. During the same time period, net sales prices for corrugated boxes and sheets increased 2% while net sales prices for linerboard declined by 24%. During the three months ended March 31, 2010, our sales volumes of corrugated boxes and sheets increased by 14% while sales volumes of linerboard increased by 62% over first quarter 2009. During the same time periods, net sales prices for corrugated boxes and sheets declined by 12% and net sales prices of linerboard declined by 16%.

5

Table of Contents

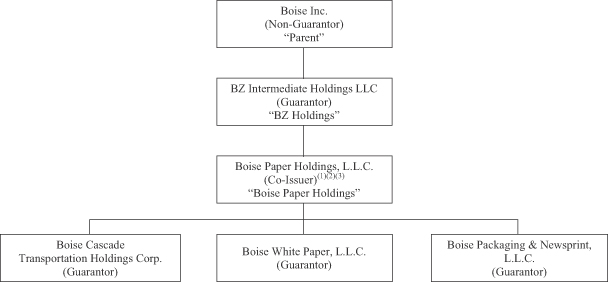

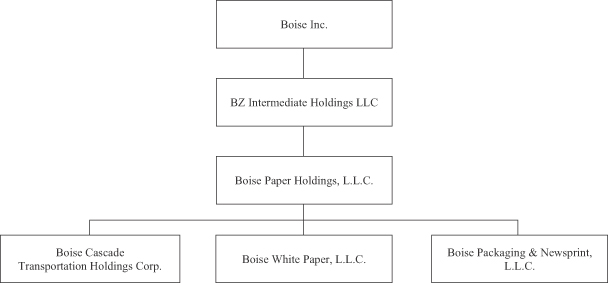

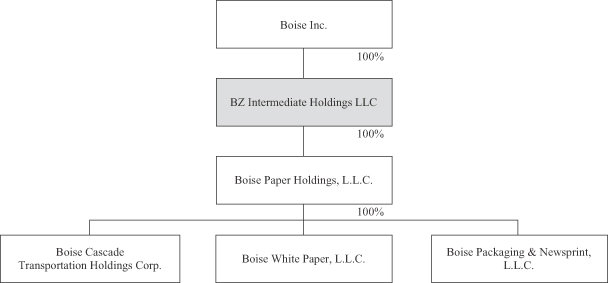

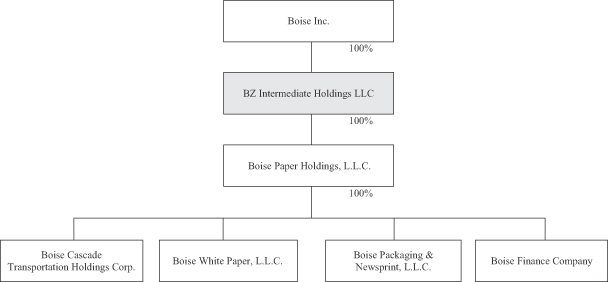

Corporate Structure

Boise Paper Holdings, L.L.C. is a holding company that conducts substantially all of its operations through its subsidiaries. Boise Finance was incorporated solely to facilitate the offering of the old notes and will not have any operations or more than de minimis assets and will not have any sales.

The following chart summarizes our operating structure at March 31, 2010:

| (1) | Boise Finance and Boise Co-Issuer Company (“Boise Co-Issuer”), wholly owned subsidiaries of Boise Paper Holdings, are not shown on this chart. Boise Finance was incorporated to serve as co-issuer of the old notes in order to facilitate the offering of the old notes. This chart also does not include Boise Paper Holdings’ indirect subsidiaries which, in the case of foreign indirect subsidiaries and indirect subsidiaries that are not majority-owned, will not be guarantors of the new notes. Currently we have no significant non-guarantor subsidiaries. |

| (2) | Boise Paper Holdings is the borrower under our credit facilities described in this prospectus. These credit facilities are guaranteed by each of Boise Paper Holdings’ existing and subsequently acquired domestic subsidiaries. |

| (3) | Boise Paper Holdings and Boise Co-Issuer are the issuers of $300 million aggregate principal amount of 8% Senior Notes due 2020 (the “8% Notes”), issued in March 2010. Boise Co-Issuer was incorporated to serve as co-issuer of the 8% Notes in order to facilitate the offering of the 8% Notes. The 8% Notes are guaranteed by BZ Holdings and each existing and future subsidiary of BZ Holdings (other than the Issuers and Boise Finance) that is a borrower or guarantor under our credit facilities. |

Boise Inc. is incorporated in Delaware, and the address of our principal executive office is 1111 West Jefferson Street, Suite 200, Boise, Idaho 83702-5388. Our telephone number is (208) 384-7000. Our internet address is www.boiseinc.com. Information found on our website is not incorporated into or otherwise part of this prospectus.

6

Table of Contents

THE EXCHANGE OFFER

| Old Notes |

$300.0 million in aggregate principal amount of 9% senior notes due 2017 which were originally issued by us on October 26, 2009. |

| New Notes |

$300.0 million in aggregate principal amount of 9% senior notes due 2017, the issuance of which has been registered under the Securities Act of 1933, as amended (the “Securities Act”). The form and terms of the new notes are substantially identical to the old notes, except that certain transfer restrictions, registration rights and provisions relating to an increase in the stated rate of interest thereon upon the occurrence of a registration default do not apply to the new notes. |

| Exchange Offer |

We are offering to issue up to $300,000,000 aggregate principal amount of new notes in exchange for a like principal amount of old notes to satisfy our obligations under the Registration Rights Agreement that we entered into when the old notes were issued. |

The old notes were issued in a private placement in reliance upon the exemption from registration provided by Rule 144A and Regulation S under the Securities Act.

| Expiration Date; Tenders |

The exchange offer will expire at 5:00, New York City time, on July 14, 2010, unless extended in our sole and absolute discretion. |

By tendering your old notes, you represent that:

| • | any new notes you receive in the exchange offer are being acquired by you in the ordinary course of your business; |

| • | at the time of the commencement of the exchange offer, you have no arrangement or understanding with any person to participate in the distribution, as defined in the Securities Act, of the new notes; |

| • | you are not an “affiliate,” as defined in Rule 405 under the Securities Act of us or any of our guarantor subsidiaries; |

| • | if you are a broker-dealer, you will receive the new notes for your own account in exchange for old notes that were acquired by you as a result of your market-making or other trading activities and you will deliver a prospectus (or, to the extent permitted by law, make available a prospectus to purchasers) in connection with any resale of the new notes you receive. For further information regarding resales of the new notes by participating broker-dealers, see the discussion under the caption “Plan of Distribution.” |

| Withdrawal; Non-Acceptance |

You may withdraw any old notes tendered in the exchange offer at any time prior to 5:00 p.m., New York City time, on July 14, 2010. If we decide for any reason not to accept any old notes tendered for exchange, the old notes will be returned to the registered holder at our |

7

Table of Contents

| expense promptly after the expiration or termination of the exchange offer. In the case of old notes tendered by book-entry transfer into the exchange agent’s account at The Depository Trust Company (“DTC”), any withdrawn or unaccepted old notes will be credited to the tendering holder’s account at DTC. For further information regarding the withdrawal of tendered old notes, see “The Exchange Offer—Terms of the Exchange Offer; Period for Tendering Old Notes” and “The Exchange Offer—Withdrawal Rights.” |

| Conditions to the Exchange Offer |

We are not required to accept for exchange or to issue new notes in exchange for any old notes, and we may terminate or amend the exchange offer if any of the following events occur prior to our acceptance of the old notes: |

| • | the exchange offer violates any applicable law or applicable interpretation of the staff of the SEC; |

| • | an action or proceeding shall have been instituted or threatened in any court or by any governmental agency that might materially impair our or our guarantors’ ability to proceed with the exchange offer; |

| • | we do not receive all the governmental approvals that we believe are necessary to consummate the exchange offer; or |

| • | there has been proposed, adopted or enacted any law, statute, rule or regulation that, in our reasonable judgment, would materially impair our ability to consummate the exchange offer. |

We may waive any of the above conditions in our reasonable discretion. See the discussion below under the caption “The Exchange Offer—Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer.

| Procedures for Tendering Old Notes |

Unless you comply with the procedures described below under the caption “The Exchange Offer—Guaranteed Delivery Procedures,” you must do one of the following on or prior to the expiration or termination of the exchange offer to participate in the exchange offer; |

| • | tender your old notes by sending certificates for your old notes, in proper form for transfer, a properly completed and duly executed letter of transmittal and all other documents required by the letter of transmittal, to Wells Fargo Bank, National Association, as exchange agent, at one of the addresses listed below under the caption “The Exchange Offer—Exchange Agent”; or |

| • | tender your old notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly executed letter of transmittal, or an agent’s message instead of the letter of transmittal, to Wells Fargo Bank, National Association, as exchange agent. In order for a book-entry transfer to constitute a valid tender of your old notes in the |

8

Table of Contents

| exchange offer, Wells Fargo Bank, National Association, as exchange agent, must receive a confirmation of book-entry transfer of your old notes into the exchange agent’s account at DTC prior to the expiration or termination of the exchange offer. For more information regarding the use of book-entry transfer procedures, including a description of the required agent’s message, see the discussion below under the caption “The Exchange Offer—Book-Entry Transfers.” |

| Guaranteed Delivery Procedures |

If you are a registered holder of old notes and wish to tender your old notes in the exchange offer, but: |

| • | the old notes are not immediately available; |

| • | time will not permit your old notes or other required documents to reach the exchange agent before the expiration or termination of the exchange offer; or |

| • | the procedure for book-entry transfer cannot be completed prior to the expiration or termination of the exchange offer, |

then you may tender old notes by following the procedures described below under the caption “The Exchange Offer—Guaranteed Delivery Procedures.”

| Special Procedures for Beneficial Owners |

If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the exchange offer, you should promptly contact the person in whose name the old notes are registered and instruct the person to tender on your behalf. If you wish to tender in the exchange offer on your own behalf, prior to completing and executing the letter of transmittal and delivering your old notes, you must either make appropriate arrangements to register ownership of the old notes in your name, or obtain a properly completed bond power from the person in whose name the old notes are registered. |

| Material United States Federal Income Tax Consequences |

An exchange of old notes for new notes pursuant to the exchange offer will be ignored for United States federal income tax purposes. Consequently, a holder of old notes will not recognize gain or loss for United Stated federal income tax purposes as a result of exchanging old notes for new notes pursuant to the exchange offer. See the discussion below under the caption “Material United States Federal Income Tax Consequences” for more information. |

| Use of Proceeds |

We will not receive any cash proceeds from the exchange offer. |

| Exchange Agent |

Wells Fargo Bank, National Association is the exchange agent for the exchange offer. You can find the address and telephone number of the exchange agent below under the caption “The Exchange Offer—Exchange Agent.” |

9

Table of Contents

| Resales |

Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties, we believe that the new notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: |

| • | you are not an affiliate of ours or a broker-dealer that acquired the old notes directly from us; |

| • | you are acquiring the new notes in the ordinary course of your business; and |

| • | you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in a distribution of the old notes or the new notes. |

| If you are an affiliate of ours or are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in the distribution of the old notes or the new notes: |

| • | you cannot rely on the applicable interpretations of the staff of the SEC; and |

| • | you must comply with the registration requirements of the Securities Act in connection with any resale transaction. |

Each broker or dealer that receives new notes for its own account in exchange for old notes that were acquired as a result of market-making or other trading activities may be deemed an underwriter and thus must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer, resale, or other transfer of the new notes issued in the exchange offer, including the delivery of a prospectus that contains information with respect to any selling holder required by the Securities Act in connection with any resale of the new notes.

Furthermore, any broker-dealer that acquired any of its old notes directly from us may not rely on the applicable interpretation of the SEC staff contained in no-action letters for Exxon Capital Holdings Corp., (available May 13, 1988), Morgan Stanley & Co. Incorporated, (available June 5, 1991) and Shearman & Sterling, (available July 2, 1993).

As a condition to participation in the exchange offer, each holder will be required to represent that it is not our affiliate or a broker-dealer that acquired the old notes directly from us.

| Broker-Dealer |

Each broker-dealer that receives new notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. See “Plan of Distribution.” |

10

Table of Contents

| Registration Rights Agreement |

When we issued the old notes on October 26, 2009, we entered into a Registration Rights Agreement with J.P. Morgan Securities Inc., as representative of the initial purchasers of the old notes. Under the terms of the Registration Rights Agreement, we agreed to: |

| • | file with the SEC, and cause to become effective, a registration statement relating to an offer to exchange the old notes for the new notes; |

| • | use our reasonable best efforts to complete the exchange offer not later than 60 days after the effective date of the exchange offer; |

| • | use our reasonable best efforts to have such registration statement remain effective until the earlier of such time as the participating broker-dealers shall have disposed of the old notes and 180 days after the closing of the exchange offer; and |

| • | file a shelf registration statement for the resale of the old notes if we cannot effect an exchange offer within the specified time period and in certain other circumstances described in this prospectus. |

If we fail to comply with our obligations under the registration agreement, we will be required to pay additional interest to holders of the old notes as described in the Registration Rights Agreement.

| Consequences of Not Exchanging Old Notes |

If you do not exchange your old notes in the exchange offer, you will continue to be subject to the restrictions on transfer described in the legend on your old notes. In general, you may offer or sell your old notes only: |

| • | if they are registered under the Securities Act and applicable state securities laws; |

| • | if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

| • | if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

We do not currently intend to register the old notes under the Securities Act. Under some circumstances, however, holders of the old notes, including holders who are not permitted to participate in the exchange offer or who may not freely sell new notes received in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of the old notes by these holders. For more information regarding the consequences of not tendering your old notes and our obligations to file a shelf registration statement, see “The Exchange Offer—Consequences of Exchanging or Failing to Exchange Old Notes.”

11

Table of Contents

SUMMARY DESCRIPTION OF THE NEW NOTES

| Co-issuers |

Boise Paper Holdings, L.L.C., a Delaware limited liability company, and Boise Finance Company, a Delaware corporation. |

| Notes Offered |

$300.0 million in aggregate principal amount of 9% senior notes due 2017. |

| Maturity Date |

November 1, 2017. |

| Interest Payment Dates |

May 1 and November 1 of each year, beginning on May 1, 2010. |

| Guarantees |

The new notes will be jointly and severally guaranteed on a senior unsecured basis by BZ Holdings and each existing and future subsidiary of BZ Holdings (other than the Issuers) that is a borrower or guarantor under our credit facilities. See “Description of the New Notes—Guarantees” and “—Certain Covenants—Future Subsidiary Guarantors.” |

Neither Boise Inc. nor any existing or future subsidiary of Boise Inc., other than BZ Holdings or any subsidiary of BZ Holdings (except for the Issuers), will guarantee the new notes.

| Ranking |

The new notes will be senior unsecured obligations of the Issuers and will rank equally with all of the Issuers’ present and future senior indebtedness, including the old notes and the 8% Notes, senior to all of the Issuers’ future subordinated indebtedness and effectively subordinated to all present and future senior secured indebtedness of the Issuers (including all borrowings under our Credit Facilities) to the extent of the value of the assets securing such indebtedness. Each guarantee of the new notes will be a senior unsecured obligation of the applicable guarantor and will rank equally with all of the applicable guarantor’s present and future senior indebtedness, including the old notes and the 8% Notes, senior to all of the applicable guarantor’s future subordinated indebtedness and effectively subordinated to all present and future senior secured indebtedness of the applicable guarantor (including all borrowings under our Credit Facilities) to the extent of the value of the assets securing such indebtedness. The new notes will be effectively subordinated to all of the liabilities and obligations in respect of preferred stock of those subsidiaries of the Issuers that do not guarantee the new notes. |

As of March 31, 2010 (i) the Issuers’ outstanding senior indebtedness was $792.2 million, of which $192.2 million was secured indebtedness, (ii) the guarantors’ outstanding senior indebtedness was $792.2 million, of which $192.2 million was secured indebtedness and (iii) the non-guarantor subsidiaries had $5.5 million of outstanding liabilities.

12

Table of Contents

| Optional Redemption |

On or after November 1, 2013, the Issuers may redeem some or all of the new notes at the redemption prices listed under “Description of the New Notes—Optional Redemption.” In addition, prior to November 1, 2013, the Issuers may redeem some or all of the new notes pursuant to a make-whole provision. See “Description of the New Notes—Make-Whole Redemption.” |

At any time prior to November 1, 2012, the Issuers may, on one or more occasions, redeem up to 35% of the outstanding new notes at a redemption price of 109% of the principal amount thereof, plus accrued and unpaid interest, with the net cash proceeds of one or more qualified equity offerings.

Our other existing and future indebtedness may contain provisions that limit the Issuers’ ability to make any optional redemption.

See “Description of the New Notes—Optional Redemption.”

| Mandatory Repurchase Offer |

If a change of control occurs, the Issuers must offer to repurchase the new notes at 101% of their principal amount, plus accrued and unpaid interest. If BZ Holdings or any of its restricted subsidiaries (including the Issuers) sell certain assets, the Issuers must, subject to certain exceptions, either reinvest the proceeds of such sale or use the proceeds to repay certain indebtedness or offer to repurchase new notes at 100% of their principal amount, plus accrued and unpaid interest. See “Description of the New Notes—Change of Control” and “—Certain Covenants—Limitation on Sales of Assets and Subsidiary Stock.” |

| Certain Covenants |

The old notes are and the new notes will be governed by an indenture with Wells Fargo Bank, National Association, which acts as trustee. The indenture, among other things, restricts BZ Holdings’ ability and the ability of the restricted subsidiaries (including the Issuers) to: |

| • | incur additional debt and issue preferred stock; |

| • | make certain investments and other restricted payments; |

| • | create liens; |

| • | create restrictions on distributions from restricted subsidiaries; |

| • | engage in specified sales of assets and subsidiary stock; |

| • | enter into transactions with affiliates; |

| • | enter new lines of business; and |

| • | engage in consolidations, mergers and acquisitions. |

These covenants are subject to a number of important exceptions and qualifications as described under “Description of the New Notes—Certain Covenants.”

13

Table of Contents

| Absence of Public Market for the Notes |

The new notes will be a new class of security and there is currently no established trading market for the new notes. As a result, a liquid market for the new notes may not be available if you wish to sell your new notes. We do not intend to apply for a listing of the new notes on any securities exchange or any automated dealer quotation system. |

| Risk Factors |

You should consider carefully all of the information set forth in this prospectus and, in particular, you should evaluate the specific factors under “Risk Factors.” |

14

Table of Contents

You should carefully consider the following information together with the other information contained in this prospectus before deciding to tender your old notes in the exchange offer. The risk factors set forth below, other than those that discuss the risks relating to the exchange offer, are generally applicable to both the old notes and the new notes. Additional risks or uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. We cannot assure you that any of the events discussed in the risk factors below will not occur.

Risks Related to Our Business

Adverse business and economic conditions may have a material adverse effect on our business, results of operations and financial position.

Adverse general economic conditions adversely affect the demand and production of consumer goods, employment levels, the availability and cost of credit and, ultimately, the profitability of our business. High unemployment rates, lower family income, lower corporate earnings, lower business investment and lower consumer spending typically result in decreased demand for our products. These conditions are beyond our control and may have a significant impact on our business, results of operations, cash flows and financial position.

Risks Related to Industry Conditions

The paper industry experiences cyclicality; changes in the prices of our products could materially affect our financial condition, results of operations and cash flows.

Historically, macroeconomic conditions and fluctuations in industry capacity have created cyclical changes in prices, sales volumes and margins for our products. Most of our paper products, including our cut size office paper, containerboard and newsprint, are commodities that are widely available from other domestic and international producers. Even our noncommodity products, such as premium papers, are affected by commodity prices since the prices of these grades are often tied to commodity prices. Commodity products have few distinguishing qualities from producer to producer, and as a result, competition for these products is based primarily on price, which is determined by supply relative to demand.

The overall levels of demand for the commodity products we make and distribute, and consequentially our sales and profitability, reflect fluctuations in levels of end user demand, which depend in large part on general macroeconomic conditions in North America and regional economic conditions in our markets, as well as foreign currency exchange rates. In recent years, particularly since 2000, demand for some grades of paper has decreased as electronic transmission and document storage alternatives have become more prevalent. Newsprint demand in North America has been in decline for almost a decade as electronic media have increasingly displaced paper as a medium for information and communication.

Changing industry conditions can influence paper and packaging producers to idle or permanently close individual machines or entire mills. In addition, to avoid substantial cash costs in connection with idling or closing a mill, some producers will choose to continue to operate at a loss, sometimes even a cash loss, which could prolong weak pricing environments due to oversupply. Oversupply in these markets can also result from producers introducing new capacity in response to favorable short-term pricing trends.

Industry supply is also influenced by overseas production capacity, which has grown in recent years and is expected to continue to grow. A weak U.S. dollar tends to mitigate the levels of imports, while a strong U.S. dollar tends to increase imports of commodity paper products from overseas, putting downward pressure on prices.

15

Table of Contents

Prices for all of our products are driven by many factors outside our control and we have little influence over the timing and extent of price changes, which are often volatile. Market conditions beyond our control determine the prices for our commodity products, and, as a result, the price for any one or more of these products may fall below our cash production costs, requiring us to either incur short-term losses on product sales or cease production at one or more of our manufacturing facilities. From time to time, we have taken downtime (or slowed production) at some of our mills to balance our production with the market demand for our products, and we may continue to do so in the future. Some of our competitors may also close or reduce production at their operating facilities, some of which could reopen and increase production capacity. This potential supply and demand imbalance could cause prices to fall. Therefore, our ability to achieve acceptable operating performance and margins is principally dependent on managing our cost structure, managing changes in raw materials prices (which represent a large component of our operating costs and fluctuate based upon factors beyond our control) and general conditions in the paper market. If the prices of our products decline or if our raw material costs increase, it could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Some of our paper products are vulnerable to long-term declines in demand due to competing technologies or materials.

Our uncoated freesheet papers and newsprint compete with electronic data transmission, document storage alternatives, and paper grades we do not produce. Increasing shifts to these alternatives have had and are likely to continue to have an adverse effect on traditional print media and paper usage. Neither the timing nor the extent of this shift can be predicted with certainty. Because of these trends, demand for paper products may shift from one grade of paper to another or be eliminated altogether. Demand for our containerboard may also decline as corrugated paper packaging may be replaced with other packaging materials, such as plastic.

We face strong competition in our markets.

The paper and packaging and newsprint industries are highly competitive. We face competition from numerous competitors, domestic as well as foreign. Some of our competitors are large, vertically integrated companies that have greater financial and other resources, greater manufacturing economies of scale, greater energy self-sufficiency or lower operating costs, compared with our company. We may be unable to compete with other companies in the market during the various stages of the business cycle and particularly during any downturns. Some of the factors that may adversely affect our ability to compete in the markets in which we participate include the entry of new competitors (including foreign producers) into the markets we serve, our competitors’ pricing strategies, our failure to anticipate and respond to changing customer preferences and our inability to maintain the cost-efficiency of our facilities.

Increases in the cost of our raw materials, including wood fiber, chemicals and energy could affect our profitability.

We rely heavily on raw materials, including wood fiber and chemicals and energy sources, such as natural gas and electricity. Our profitability has been, and will continue to be, affected by changes in the costs and availability of such raw materials. For most of our products, the relationship between industry supply and demand, rather than changes in the cost of raw materials, determines our ability to increase prices. Consequently, we may be unable to pass increases in our operating costs on to our customers in the short term. Any sustained increase in raw material costs, coupled with our inability to increase prices, would reduce our operating margins and potentially require us to limit or cease operations of one or more of our machines or facilities.

Wood fiber is our principal raw material, accounting for approximately 27% and 17%, respectively, of the aggregate amount of materials, labor and other operating expenses, including fiber costs, for our Paper and Packaging segments for the year ended December 31, 2009, and 32% and 17%, respectively, for the three months ended March 31, 2010. Wood fiber is a commodity, and prices have historically been cyclical. In addition, wood

16

Table of Contents

fiber, including wood chips, sawdust and shavings, is a byproduct in the manufacture of building products, and the availability of wood fiber is often negatively affected if demand for building products declines. Severe or sustained shortages of fiber could cause us to curtail our own operations, resulting in material and adverse effects on our sales and profitability. Future domestic or foreign legislation and litigation concerning the use of timberlands, the protection of endangered species and forest health can also affect log and fiber supply. Availability of harvested logs and fiber may be further limited by fire, insect infestation, disease, ice storms, wind storms, hurricanes, flooding and other natural and man made causes, thereby reducing supply and increasing prices.

Energy accounts for approximately 12% and 10%, respectively, of the aggregate amount of materials, labor and other operating expenses, including fiber costs, for our Paper and Packaging segments for the year ended December 31, 2009, and 15% and 14% respectively, for the three months ended March 31, 2010. Energy prices, particularly for electricity, natural gas and fuel oil, have been volatile in recent years. These fluctuations affect our manufacturing costs and can contribute significantly to earnings volatility.

Other raw materials we use include various chemical compounds, such as starch, caustic soda, precipitated calcium carbonate, sodium chlorate and dyes. Purchases of chemicals accounted for approximately 15% and 7%, respectively, of the aggregate amount of materials, labor and other operating expenses, including fiber costs, for our Paper and Packaging segments for the year ended December 31, 2009, and 14% and 5%, respectively, for the three months ended March 31, 2010. The costs of these chemicals have been volatile historically and are influenced by capacity utilization, energy prices and other factors beyond our control.

Risk Related to Our Operations

We depend on OfficeMax for a significant portion of our business.

Our largest customer, OfficeMax, accounted for approximately 28% and 26% of our total sales in the year ended December 31, 2009 and the three months ended March 31, 2010, respectively. In October 2004, OfficeMax agreed to purchase, from our Predecessor, its full North American requirements for cut-size office paper, to the extent we choose to supply such paper to them, through December 2012. If this contract is not renewed or not renewed on terms similar to the existing terms, our future business operations may be adversely affected. If OfficeMax was unable to pay, our financial performance could be affected significantly and negatively. Any significant deterioration in the financial condition of OfficeMax or a significant change in its business that would affect its willingness to continue to purchase our products could have a material adverse effect on our business, financial condition, results of operations and cash flows.

A material disruption at one of our manufacturing facilities could prevent us from meeting customer demand, reduce our sales or negatively affect our net income.

Any of our manufacturing facilities, or any of our machines within an otherwise operational facility, could cease operations unexpectedly due to a number of events, including:

| • | maintenance outages; |

| • | prolonged power failures; |

| • | equipment failure; |

| • | disruption in the supply of raw materials, such as wood fiber, energy or chemicals; |

| • | a chemical spill or release; |

| • | closure because of environmental-related concerns; |

| • | explosion of a boiler; |

| • | the effect of a drought or reduced rainfall on our water supply; |

17

Table of Contents

| • | disruptions in the transportation infrastructure, including roads, bridges, railroad tracks and tunnels; |

| • | fires, floods, earthquakes, hurricanes or other catastrophes; |

| • | terrorism or threats of terrorism; |

| • | labor difficulties; or |

| • | other operational problems. |

Any such downtime or facility damage could prevent us from meeting customer demand for our products or require us to make unplanned capital expenditures. If our machines or facilities were to incur significant downtime, our ability to meet our production capacity targets and satisfy customer requirements would be impaired, resulting in lower sales and having a negative effect on our financial results.

Labor disruptions or increased labor costs could materially adversely affect our business.

While we believe we have good labor relations, we could experience a material labor disruption, strike or significantly increased labor costs at one or more of our facilities, either in the course of negotiations of a labor agreement or otherwise. Any of these situations could prevent us from meeting customer demands or result in increased costs, thereby reducing our sales and profitability. As of March 31, 2010, we had approximately 4,100 employees. Approximately 60% of these employees work pursuant to collective bargaining agreements. As of March 31, 2010, approximately 33% of our employees were working pursuant to collective bargaining agreements that have expired or will expire within one year, including agreements at the following facility locations: Wallula, Washington; DeRidder, Louisiana; Jackson, Alabama; St. Helens, Oregon; and Nampa, Idaho. The labor contract at our paper mill in Wallula, Washington (332 employees represented by the Association of Western Pulp & Paper Workers (the “AWPPW”)) expired in March 2009 and was terminated by the AWPPW in October 2009. In February 2010, the union employees at Wallula rejected a new collective bargaining agreement that union leadership had recommended unanimously, and we declared an impasse in the bargaining process and implemented the terms of the last contract offer. We are currently negotiating the labor contract at our mill in DeRidder, Louisiana (387 employees represented by the United Steelworkers), which expired in February 2010, and at our mill in St. Helens, Oregon (122 employees represented by the AWPPW), which expired in March 2010.

Our potential inability to reach a mutually acceptable labor contract at any of our other facilities, could result in, among other things, strikes or other work stoppages or slowdowns by the affected employees. While the company has in place contingency plans to address labor disturbances, we could experience disruption to our operations that could have a material adverse effect on our results of operations, financial condition and liquidity. Future labor agreements could increase our costs of healthcare, retirement benefits, wages and other employee benefits. Additionally, labor issues that affect our suppliers could also have a material adverse effect on us if those issues interfere with our ability to obtain raw materials on a cost-effective and timely basis.

We are subject to significant environmental, health and safety laws and regulations, as well as other environmental liabilities, the cost of which could adversely affect our business and results of operation.

We are subject to a wide range of general and industry-specific environmental, health and safety laws and regulations, particularly with respect to air emissions, waste water discharges, solid and hazardous waste management and site remediation. If we fail to comply with these laws and regulations, we may face civil or criminal fines, penalties or enforcement actions, including orders limiting our operations or requiring corrective measures, installation of pollution control equipment or other remedial actions.

We anticipate that governmental regulation of our operations will continue to become more burdensome and that we will continue to incur significant capital and operating expenditures in order to maintain compliance with

18

Table of Contents

applicable laws. For example, we may be affected if laws concerning climate change are enacted that regulate greenhouse gas (“GHG”) emissions. Such laws may require buying allowances for mill GHG emissions or capital expenditures to reduce GHG emissions. Because environmental regulations are not consistent worldwide, our capital and operating expenditures for environmental compliance may adversely affect our ability to compete.

Some of our properties have a long history of industrial operations. As an owner and operator of real estate, we may also be liable under environmental laws for cleanup and other damages, including tort liability, resulting from releases of hazardous substances on or from our properties or locations where we have disposed of wastes. We may have liability under these laws whether or not we knew of or were responsible for the presence of these substances on our property, and in some cases, our liability may exceed the value of the property.

During the year ended December 31, 2009, capital expenditures for environmental compliance were $2.2 million. We expect to spend approximately $1.4 million on environmental items in 2010. Enactment of new environmental laws or regulations or changes in existing laws or regulations might require significant additional expenditures. We may be unable to generate funds or other sources of liquidity and capital to fund unforeseen environmental liabilities or expenditures.

We may engage in future acquisitions that could materially affect our business, operating results and financial condition.

We may seek to acquire other businesses, products, or assets. However, we may not be able to find suitable acquisition candidates, and we may not be able to complete acquisitions on favorable terms, if at all. If we do complete acquisitions, we may not strengthen our competitive position or achieve our goals. Acquisitions may disrupt our ongoing operations, divert management from day-to-day responsibilities, increase our expenses, and adversely affect our business, operating results and financial condition. Future acquisitions may reduce our cash available for operations and other uses. There can be no assurance that we will be able to manage the integration of acquired businesses effectively or be able to retain and motivate key personnel from those businesses. Any difficulties we encounter in the integration process could increase our expenses and have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Economic and Financial Factors

We have substantial indebtedness, and our ability to repay our debt is dependent on our ability to generate cash from operations.

As discussed below in “—Risks Related to the New Notes”, we have a high level of indebtedness. This level of indebtedness will require us to devote a material portion of our cash flow to our debt service obligations. Our ability to repay our indebtedness and to fund planned capital expenditures depends on our ability to generate cash from future operations. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. For example, decreases in the demand for paper products, deterioration in the general economy and weakness in any of our product markets negatively affect our business and our ability to generate cash. As a result, it is possible we will not generate sufficient cash flow from our operations to enable us to repay our indebtedness, make interest payments and fund other liquidity needs. If we do not generate sufficient cash flow to meet these requirements, it would affect our ability to operate as a going concern. If we are unable to generate sufficient cash flow to meet our debt service and other cash obligations, we may need to obtain additional debt, refinance all or a portion of our indebtedness on or before maturity, sell assets or raise equity. We may not be able to obtain additional debt, refinance any of our indebtedness, sell assets or raise equity on commercially reasonable terms or at all, which could cause us to default on our obligations and materially impair our liquidity. Our inability to generate sufficient cash flow to satisfy our debt obligations, to obtain additional debt or to refinance our obligations on commercially reasonable terms would have a material adverse effect on our business, financial condition and results of operations.

19

Table of Contents

Our operations require substantial capital, and we may not have adequate capital resources to provide for all of our capital requirements.

Our businesses are capital-intensive, and we regularly incur capital expenditures to maintain our equipment, increase our operating efficiency and comply with environmental laws. In addition, significant amounts of capital are required to modify our equipment to produce alternative or additional products or to make significant improvements in the characteristics of our current products. During the year ended December 31, 2009, our total capital expenditures, excluding acquisitions, were $77.1 million. We expect to spend approximately $100 million on capital expenditures for 2010 excluding acquisitions and extraordinary capital improvements. We currently expect our capital expenditures to be between $90 million and $120 million annually over the next five years, excluding acquisitions and extraordinary capital improvements.

If we require funds for operating needs and capital expenditures beyond those generated from operations, we may not be able to obtain them on favorable terms or at all. In addition, our debt service obligations will reduce our available cash flows. If we cannot maintain or upgrade our equipment as necessary for our continued operations or as needed to ensure environmental compliance, we could be required to cease or curtail some of our manufacturing operations, or we may become unable to manufacture products that can compete effectively in one or more of our markets.

A default under our indebtedness may have a material adverse effect on our business and financial condition.

In the event of a default under our Credit Facilities, the indenture governing the 8% Notes or the indenture governing the old notes and the new notes, the lenders or respective holders generally would be able to declare all such indebtedness, together with interest, to be due and payable. In addition, borrowings under the Credit Facilities are secured by first-priority liens on all of the assets of our subsidiaries that guarantee, or are borrowers under, our Credit Facilities, and in the event of a default under those facilities, the lenders generally would be entitled to seize the collateral. Moreover, upon an event of default, the commitment of the lenders to make any further loans would be terminated. Accordingly, a default under any debt instrument, unless cured or waived, would likely have a material adverse effect on our overall business, the results of our operations and our financial condition.

If we became unable to meet our financial obligations, it could also cause concern for our customers, vendors or trade creditors. If any significant customer, vendor or trade creditor changed its relationship with us by stopping work, ceasing sales, requiring sales on cash terms or making other changes, these changes would materially affect our cash flows and results of operations.

We anticipate significant future funding obligations for pension benefits.

In December 2008, we enacted a freeze on our defined benefit pension plan for salaried employees (the “Salaried Plan”); however, we continue to maintain defined benefit pension plans for most of our union employees. Despite the freeze of the Salaried Plan, we will continue to have significant obligations for pension benefits. As of March 31, 2010, our pension assets had a market value of $315 million, compared with $302 million at December 31, 2009. In March 2010, we made a $5.5 million voluntary cash contribution to our qualified pension plans. Assuming a return on plan assets of 7.25% in 2010 and 2011, and the minimum contributions are made in both years, we estimate that we will be required to contribute approximately $1 million in 2010 and approximately $21 million in 2011. The amount of required contributions will depend, among other things, on actual returns on plan assets, changes in interest rates that affect our discount rate assumptions, changes in pension funding requirement laws and modifications to our plans. Our estimates may change materially depending upon the impact of these and other factors, and the amount of our contributions may adversely affect our cash flows, financial condition and results of operations.

20

Table of Contents

Risks Relating to the Exchange Offer

Holders who fail to exchange their old notes will continue to be subject to restrictions on transfer and may have difficulty selling the old notes that they do not exchange.

If you do not exchange your old notes for new notes in the exchange offer, you will continue to be subject to the restrictions on transfer of your old notes described in the legend on your old notes. The restrictions on transfer of your old notes arise because we issued the old notes under exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. In general, you may only offer or sell the old notes if they are registered under the Securities Act and applicable state securities laws, are offered and sold under an exemption from registration under the Securities Act and applicable state securities laws or are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. We do not plan to register the old notes under the Securities Act. To the extent old notes are tendered and accepted in the exchange offer, the trading market, if any, for the old notes may be adversely affected. For further information regarding the consequences of not tendering your old notes in the exchange offer, see “The Exchange Offer—Consequences of Exchanging or Failing to Exchange Old Notes.”

Some holders who exchange their old notes may be deemed to be underwriters and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your old notes in the exchange offer for the purpose of participating in a distribution of the new notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. See “Plan of Distribution.”

Late deliveries of old notes or any other failure to comply with the exchange offer procedures could prevent a holder from exchanging its old notes.

Noteholders are responsible for complying with all exchange offer procedures. The issuance of new notes in exchange for old notes will only occur upon completion of the procedures described in this prospectus under “The Exchange Offer.” Therefore, holders of old notes who wish to exchange them for new notes should allow sufficient time for timely completion of the exchange procedures. Neither we nor the exchange agent are obligated to extend the offer or notify you of any failure to follow the proper procedures.

Risks Related to the New Notes

Neither the Issuers’ nor the guarantors’ assets will secure the new notes, and consequently the new notes will be effectively subordinated to the Issuers’ and the guarantors’ existing and future secured indebtedness.

The new notes are unsecured and rank behind all of the Issuers’ and the guarantors’ senior secured indebtedness to the extent of the value of the assets securing such indebtedness. As a result, upon any distribution to our creditors in a bankruptcy, liquidation or reorganization or similar proceeding relating to us or our property, the holders of secured debt, including the lenders under our Credit Facilities, will be entitled to exercise the remedies available to a secured lender under applicable law and pursuant to the instruments governing such debt and to be paid in full from the assets securing that secured debt before any payment may be made with respect to the new notes. In that event, because the new notes will not be secured by any of the Issuers’ or the guarantors’ assets, it is possible that there will be no assets from which claims of holders of the new notes can be satisfied or, if any assets remain, that the remaining assets will be insufficient to satisfy those claims in full. If the value of such remaining assets is less than the aggregate outstanding principal amount of the new notes and all other debt ranking pari passu with the new notes, including the old notes and the 8% Notes, we may be unable to fully satisfy our obligations under the new notes. In addition, if we fail to meet our payment or other obligations under

21

Table of Contents

our secured debt, the holders of that secured debt would be entitled to foreclose on our assets securing that secured debt and liquidate those assets. Accordingly, we may not have sufficient funds to pay amounts due on the new notes. As a result, you may lose a portion of or the entire value of your investment in the new notes.

Substantially all of the assets of the Issuers and the guarantors of the new notes are subject to liens under our Credit Facilities. On an as adjusted basis, giving effect to the exchange of the new notes for the old notes as of March 31, 2010, the new notes would have been effectively subordinated to approximately $192 million of senior secured debt and $227.9 million, which is net of $22.1 million of outstanding letters of credit, would have been available for borrowing as additional senior secured debt under our Credit Facilities. Further, the terms of the new notes permit us to incur additional secured indebtedness. Your new notes will be effectively subordinated to any such additional secured indebtedness.

Our substantial indebtedness could adversely affect our financial health, which could reduce the value of our securities.

As of March 31, 2010, our total indebtedness was $792.2 million. We may issue more debt securities or refinance existing debt securities if available on favorable terms.

Our substantial indebtedness could have important consequences to you. For example, it could:

| • | increase our vulnerability to general adverse economic and industry conditions; |

| • | limit our ability to fund future working capital, capital expenditures, research and development costs and other general corporate financing needs; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes; |