bcc-20220331000132858112/312022Q1FALSE1http://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesCurrent00013285812022-01-012022-03-3100013285812022-04-29xbrli:sharesiso4217:USD00013285812021-01-012021-03-31iso4217:USDxbrli:shares00013285812022-03-3100013285812021-12-3100013285812020-12-3100013285812021-03-310001328581us-gaap:CommonStockMember2021-12-310001328581us-gaap:TreasuryStockCommonMember2021-12-310001328581us-gaap:AdditionalPaidInCapitalMember2021-12-310001328581us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001328581us-gaap:RetainedEarningsMember2021-12-310001328581us-gaap:RetainedEarningsMember2022-01-012022-03-310001328581us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001328581us-gaap:CommonStockMember2022-01-012022-03-310001328581us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001328581us-gaap:CommonStockMember2022-03-310001328581us-gaap:TreasuryStockCommonMember2022-03-310001328581us-gaap:AdditionalPaidInCapitalMember2022-03-310001328581us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001328581us-gaap:RetainedEarningsMember2022-03-310001328581us-gaap:CommonStockMember2020-12-310001328581us-gaap:TreasuryStockCommonMember2020-12-310001328581us-gaap:AdditionalPaidInCapitalMember2020-12-310001328581us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001328581us-gaap:RetainedEarningsMember2020-12-310001328581us-gaap:RetainedEarningsMember2021-01-012021-03-310001328581us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001328581us-gaap:CommonStockMember2021-01-012021-03-310001328581us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001328581us-gaap:CommonStockMember2021-03-310001328581us-gaap:TreasuryStockCommonMember2021-03-310001328581us-gaap:AdditionalPaidInCapitalMember2021-03-310001328581us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001328581us-gaap:RetainedEarningsMember2021-03-31bcc:segment0001328581us-gaap:ShippingAndHandlingMemberbcc:BuildingMaterialsDistributionMember2022-01-012022-03-310001328581us-gaap:ShippingAndHandlingMemberbcc:BuildingMaterialsDistributionMember2021-01-012021-03-310001328581srt:MaximumMember2022-03-310001328581us-gaap:LandMember2022-03-310001328581us-gaap:LandMember2021-12-310001328581us-gaap:BuildingMember2022-03-310001328581us-gaap:BuildingMember2021-12-310001328581bcc:BuildingandLeaseholdImprovementsMember2022-03-310001328581bcc:BuildingandLeaseholdImprovementsMember2021-12-310001328581bcc:MobileequipmentinformationtechnologyandofficefurnitureMember2022-03-310001328581bcc:MobileequipmentinformationtechnologyandofficefurnitureMember2021-12-310001328581us-gaap:MachineryAndEquipmentMember2022-03-310001328581us-gaap:MachineryAndEquipmentMember2021-12-310001328581us-gaap:ConstructionInProgressMember2022-03-310001328581us-gaap:ConstructionInProgressMember2021-12-310001328581us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-03-310001328581us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001328581us-gaap:CarryingReportedAmountFairValueDisclosureMemberbcc:A4875SeniorNotesDue2030Member2021-12-310001328581us-gaap:CarryingReportedAmountFairValueDisclosureMemberbcc:A4875SeniorNotesDue2030Member2022-03-310001328581bcc:A4875SeniorNotesDue2030Memberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-03-310001328581bcc:A4875SeniorNotesDue2030Memberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001328581bcc:ABLTermLoanDue2025Member2022-03-310001328581bcc:ABLTermLoanDue2025Memberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001328581us-gaap:InterestRateSwapMember2021-12-31bcc:Derivative0001328581bcc:InterestRateSwap50MillionNotionalAmountFixedAt039Memberus-gaap:NondesignatedMember2022-03-310001328581us-gaap:NondesignatedMemberbcc:InterestRateSwap50millionnotionalamountfixedat1.007Member2022-02-28xbrli:pure0001328581us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2022-03-310001328581us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2021-12-310001328581us-gaap:FairValueInputsLevel2Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2021-12-310001328581us-gaap:CreditConcentrationRiskMemberbcc:CustomerOneMemberus-gaap:AccountsReceivableMember2022-01-012022-03-310001328581us-gaap:CreditConcentrationRiskMemberus-gaap:AccountsReceivableMemberbcc:CustomerTwoMember2022-01-012022-03-310001328581us-gaap:CreditConcentrationRiskMemberbcc:CustomerOneMemberus-gaap:AccountsReceivableMember2021-01-012021-12-310001328581us-gaap:CreditConcentrationRiskMemberus-gaap:AccountsReceivableMemberbcc:CustomerTwoMember2021-01-012021-12-310001328581srt:MinimumMember2022-03-310001328581us-gaap:RevolvingCreditFacilityMember2022-03-310001328581us-gaap:RevolvingCreditFacilityMember2021-12-310001328581bcc:ABLTermLoanDue2025Member2021-12-310001328581bcc:A4875SeniorNotesDue2030Member2022-03-310001328581bcc:A4875SeniorNotesDue2030Member2021-12-310001328581us-gaap:RevolvingCreditFacilityMember2015-05-150001328581bcc:ABLTermLoanDue2025Member2015-05-150001328581bcc:AssetBasedCreditFacilityMember2022-01-012022-03-310001328581bcc:AssetBasedCreditFacilityMember2022-03-310001328581srt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001328581srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001328581srt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2022-01-012022-03-310001328581srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2022-01-012022-03-310001328581us-gaap:RevolvingCreditFacilityMember2022-01-012022-03-310001328581bcc:ABLTermLoanDue2025Membersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001328581srt:MaximumMemberbcc:ABLTermLoanDue2025Memberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-03-310001328581bcc:ABLTermLoanDue2025Membersrt:MinimumMemberus-gaap:BaseRateMember2022-01-012022-03-310001328581srt:MaximumMemberbcc:ABLTermLoanDue2025Memberus-gaap:BaseRateMember2022-01-012022-03-310001328581bcc:ABLTermLoanDue2025Member2022-01-012022-03-310001328581us-gaap:SeniorNotesMemberbcc:A4875SeniorNotesDue2030Member2020-07-270001328581us-gaap:SeniorNotesMemberbcc:A4875SeniorNotesDue2030Member2022-01-012022-03-31bcc:stock_awards0001328581us-gaap:PerformanceSharesMemberbcc:OfficersandotheremployeesMember2022-01-012022-03-310001328581us-gaap:PerformanceSharesMembersrt:OfficerMember2022-01-012022-03-310001328581us-gaap:PerformanceSharesMemberbcc:OtheremployeesMember2022-01-012022-03-310001328581us-gaap:PerformanceSharesMemberbcc:OfficersandotheremployeesMember2021-01-012021-03-310001328581us-gaap:PerformanceSharesMembersrt:OfficerMember2021-01-012021-12-310001328581us-gaap:PerformanceSharesMemberbcc:OtheremployeesMember2021-01-012021-12-31bcc:tranch0001328581us-gaap:RestrictedStockUnitsRSUMemberbcc:OfficersAndOtherEmployeesAndNonemploymentDirectorsMember2022-01-012022-03-310001328581us-gaap:RestrictedStockUnitsRSUMemberbcc:OfficersAndOtherEmployeesAndNonemploymentDirectorsMember2021-01-012021-03-310001328581us-gaap:RestrictedStockUnitsRSUMemberbcc:OfficersandotheremployeesMember2022-01-012022-03-310001328581us-gaap:RestrictedStockUnitsRSUMemberbcc:NonemployeeDirectorsMember2022-01-012022-03-310001328581us-gaap:PerformanceSharesMember2021-12-310001328581us-gaap:RestrictedStockUnitsRSUMember2021-12-310001328581us-gaap:PerformanceSharesMember2022-01-012022-03-310001328581us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-310001328581us-gaap:PerformanceSharesMember2022-03-310001328581us-gaap:RestrictedStockUnitsRSUMember2022-03-310001328581us-gaap:PerformanceSharesMember2021-01-012021-03-310001328581us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-03-310001328581us-gaap:SubsequentEventMember2022-05-052022-05-050001328581us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberbcc:LouisianaTimberProcurementCompanyLLCMember2022-01-012022-03-310001328581bcc:LouisianaTimberProcurementCompanyLLCMemberbcc:PackagingCorporationofAmericaPCAMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-03-310001328581us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-01-012022-03-310001328581us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2021-01-012021-03-310001328581bcc:LaminatedVeneerLumberMemberbcc:WoodProductsMember2022-01-012022-03-310001328581bcc:LaminatedVeneerLumberMemberbcc:WoodProductsMember2021-01-012021-03-310001328581bcc:IjoistsMemberbcc:WoodProductsMember2022-01-012022-03-310001328581bcc:IjoistsMemberbcc:WoodProductsMember2021-01-012021-03-310001328581bcc:OtherEngineeredWoodProductsMemberbcc:WoodProductsMember2022-01-012022-03-310001328581bcc:OtherEngineeredWoodProductsMemberbcc:WoodProductsMember2021-01-012021-03-310001328581bcc:WoodProductsMemberbcc:PlywoodAndVeneerMember2022-01-012022-03-310001328581bcc:WoodProductsMemberbcc:PlywoodAndVeneerMember2021-01-012021-03-310001328581bcc:WoodProductsMemberbcc:LumberMember2022-01-012022-03-310001328581bcc:WoodProductsMemberbcc:LumberMember2021-01-012021-03-310001328581bcc:WoodProductsMemberbcc:ByproductsMember2022-01-012022-03-310001328581bcc:WoodProductsMemberbcc:ByproductsMember2021-01-012021-03-310001328581bcc:OtherWoodProductsMemberbcc:WoodProductsMember2022-01-012022-03-310001328581bcc:OtherWoodProductsMemberbcc:WoodProductsMember2021-01-012021-03-310001328581bcc:WoodProductsMember2022-01-012022-03-310001328581bcc:WoodProductsMember2021-01-012021-03-310001328581bcc:CommodityProductLineMemberbcc:BuildingMaterialsDistributionMember2022-01-012022-03-310001328581bcc:CommodityProductLineMemberbcc:BuildingMaterialsDistributionMember2021-01-012021-03-310001328581bcc:GeneralLineMemberbcc:BuildingMaterialsDistributionMember2022-01-012022-03-310001328581bcc:GeneralLineMemberbcc:BuildingMaterialsDistributionMember2021-01-012021-03-310001328581bcc:EngineeredWoodProductsMemberbcc:BuildingMaterialsDistributionMember2022-01-012022-03-310001328581bcc:EngineeredWoodProductsMemberbcc:BuildingMaterialsDistributionMember2021-01-012021-03-310001328581bcc:BuildingMaterialsDistributionMember2022-01-012022-03-310001328581bcc:BuildingMaterialsDistributionMember2021-01-012021-03-310001328581us-gaap:OperatingSegmentsMemberbcc:WoodProductsMember2022-01-012022-03-310001328581us-gaap:OperatingSegmentsMemberbcc:WoodProductsMember2021-01-012021-03-310001328581us-gaap:OperatingSegmentsMemberbcc:BuildingMaterialsDistributionMember2022-01-012022-03-310001328581us-gaap:OperatingSegmentsMemberbcc:BuildingMaterialsDistributionMember2021-01-012021-03-310001328581us-gaap:IntersegmentEliminationMember2022-01-012022-03-310001328581us-gaap:IntersegmentEliminationMember2021-01-012021-03-310001328581us-gaap:OperatingSegmentsMember2022-01-012022-03-310001328581us-gaap:OperatingSegmentsMember2021-01-012021-03-310001328581us-gaap:CorporateNonSegmentMember2022-01-012022-03-310001328581us-gaap:CorporateNonSegmentMember2021-01-012021-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| | | | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the quarterly period ended | March 31, 2022 |

| | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the transition period from to |

Commission File Number: 001-35805

Boise Cascade Company

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 20-1496201 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1111 West Jefferson Street Suite 300

Boise, Idaho 83702-5389

(Address of principal executive offices) (Zip Code)

(208) 384-6161

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | BCC | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No x

There were 39,447,442 shares of the registrant's common stock, $0.01 par value per share, outstanding on April 29, 2022.

Table of Contents

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Boise Cascade Company

Consolidated Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31 | | | |

| | 2022 | | 2021 | | | | | |

| | (thousands, except per-share data) | |

| Sales | $ | 2,326,282 | | | $ | 1,821,316 | | | | | | |

| | | | | | | | |

| Costs and expenses | | | | | | | | |

| Materials, labor, and other operating expenses (excluding depreciation) | 1,729,896 | | | 1,450,434 | | | | | | |

| Depreciation and amortization | 20,543 | | | 19,539 | | | | | | |

| Selling and distribution expenses | 146,651 | | | 120,917 | | | | | | |

| General and administrative expenses | 26,052 | | | 25,262 | | | | | | |

| | | | | | | | |

| Other (income) expense, net | (2,488) | | | (97) | | | | | | |

| | 1,920,654 | | | 1,616,055 | | | | | | |

| | | | | | | | |

| Income from operations | 405,628 | | | 205,261 | | | | | | |

| | | | | | | | |

| Foreign currency exchange gain | 132 | | | 154 | | | | | | |

| Pension expense (excluding service costs) | (171) | | | (19) | | | | | | |

| Interest expense | (6,254) | | | (5,875) | | | | | | |

| Interest income | 65 | | | 59 | | | | | | |

| Change in fair value of interest rate swaps | 2,066 | | | 1,024 | | | | | | |

| | | | | | | | |

| | (4,162) | | | (4,657) | | | | | | |

| | | | | | | | |

| Income before income taxes | 401,466 | | | 200,604 | | | | | | |

| Income tax provision | (98,866) | | | (51,448) | | | | | | |

| Net income | $ | 302,600 | | | $ | 149,156 | | | | | | |

| | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | 39,474 | | | 39,355 | | | | | | |

| Diluted | 39,768 | | | 39,630 | | | | | | |

| | | | | | | | |

| Net income per common share: | | | | | | | | |

| Basic | $ | 7.67 | | | $ | 3.79 | | | | | | |

| Diluted | $ | 7.61 | | | $ | 3.76 | | | | | | |

| | | | | | | | |

| Dividends declared per common share | $ | 0.12 | | | $ | 0.10 | | | | | | |

See accompanying condensed notes to unaudited quarterly consolidated financial statements.

Boise Cascade Company

Consolidated Statements of Comprehensive Income

(unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31 | | |

| 2022 | | 2021 | | | | |

| (thousands) |

| Net income | $ | 302,600 | | | $ | 149,156 | | | | | |

| Other comprehensive income (loss), net of tax | | | | | | | |

| Defined benefit pension plans | | | | | | | |

| | | | | | | |

Amortization of actuarial (gain) loss, net of tax of $5 and $(1), respectively | 16 | | | (4) | | | | | |

Effect of settlements, net of tax of $32 and $—, respectively | 98 | | | — | | | | | |

| Other comprehensive income (loss), net of tax | 114 | | | (4) | | | | | |

| Comprehensive income | $ | 302,714 | | | $ | 149,152 | | | | | |

See accompanying condensed notes to unaudited quarterly consolidated financial statements.

Boise Cascade Company

Consolidated Balance Sheets

(unaudited)

| | | | | | | | | | | |

| | March 31,

2022 | | December 31,

2021 |

| | (thousands) |

| ASSETS | | | |

| Current | | | |

| Cash and cash equivalents | $ | 922,721 | | | $ | 748,907 | |

| | | |

| Receivables | | | |

Trade, less allowances of $3,110 and $2,054 | 665,136 | | | 444,325 | |

| Related parties | 184 | | | 211 | |

| Other | 14,926 | | | 17,692 | |

| Inventories | 804,668 | | | 660,671 | |

| | | |

| Prepaid expenses and other | 15,270 | | | 14,072 | |

| Total current assets | 2,422,905 | | | 1,885,878 | |

| | | |

| Property and equipment, net | 491,395 | | | 495,240 | |

| Operating lease right-of-use assets | 60,007 | | | 62,663 | |

| Finance lease right-of-use assets | 28,409 | | | 29,057 | |

| Timber deposits | 8,954 | | | 9,461 | |

| | | |

| Goodwill | 60,382 | | | 60,382 | |

| Intangible assets, net | 15,045 | | | 15,351 | |

| Deferred income taxes | 8,822 | | | 6,589 | |

| Other assets | 10,008 | | | 8,019 | |

| Total assets | $ | 3,105,927 | | | $ | 2,572,640 | |

See accompanying condensed notes to unaudited quarterly consolidated financial statements.

Boise Cascade Company

Consolidated Balance Sheets (continued)

(unaudited)

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| (thousands, except per-share data) |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current | | | |

| | | |

| Accounts payable | | | |

| Trade | $ | 493,732 | | | $ | 334,985 | |

| Related parties | 1,557 | | | 1,498 | |

| Accrued liabilities | | | |

| Compensation and benefits | 103,778 | | | 128,518 | |

| Income taxes payable | 93,393 | | | — | |

| Interest payable | 4,998 | | | 9,886 | |

| | | |

| Other | 182,705 | | | 165,859 | |

| Total current liabilities | 880,163 | | | 640,746 | |

| | | |

| Debt | | | |

| Long-term debt | 444,836 | | | 444,628 | |

| | | |

| Other | | | |

| Compensation and benefits | 28,062 | | | 28,365 | |

| Operating lease liabilities, net of current portion | 52,449 | | | 55,263 | |

| Finance lease liabilities, net of current portion | 31,451 | | | 31,898 | |

| Deferred income taxes | 5,112 | | | 3,641 | |

| Other long-term liabilities | 15,165 | | | 15,480 | |

| | 132,239 | | | 134,647 | |

| | | |

| Commitments and contingent liabilities | | | | | |

| | | |

| Stockholders' equity | | | |

Preferred stock, $0.01 par value per share; 50,000 shares authorized, no shares issued and outstanding | — | | | — | |

Common stock, $0.01 par value per share; 300,000 shares authorized, 44,815 and 44,698 shares issued, respectively | 448 | | | 447 | |

Treasury stock, 5,367 shares at cost | (138,909) | | | (138,909) | |

| Additional paid-in capital | 541,737 | | | 543,249 | |

| Accumulated other comprehensive loss | (933) | | | (1,047) | |

| Retained earnings | 1,246,346 | | | 948,879 | |

| Total stockholders' equity | 1,648,689 | | | 1,352,619 | |

| Total liabilities and stockholders' equity | $ | 3,105,927 | | | $ | 2,572,640 | |

See accompanying condensed notes to unaudited quarterly consolidated financial statements.

Boise Cascade Company

Consolidated Statements of Cash Flows

(unaudited)

| | | | | | | | | | | |

| | Three Months Ended

March 31 |

| | 2022 | | 2021 |

| | (thousands) |

| Cash provided by (used for) operations | | | |

| Net income | $ | 302,600 | | | $ | 149,156 | |

| Items in net income not using (providing) cash | | | |

| Depreciation and amortization, including deferred financing costs and other | 20,993 | | | 19,950 | |

| Stock-based compensation | 2,392 | | | 2,092 | |

| Pension expense | 171 | | | 19 | |

| Deferred income taxes | (729) | | | (2,244) | |

| Change in fair value of interest rate swaps | (2,066) | | | (1,024) | |

| | | |

| Other | (2,412) | | | 4 | |

| | | |

| Decrease (increase) in working capital | | | |

| Receivables | (218,018) | | | (161,833) | |

| Inventories | (143,997) | | | (108,220) | |

| Prepaid expenses and other | (3,227) | | | (2,444) | |

| Accounts payable and accrued liabilities | 147,425 | | | 125,064 | |

| Pension contributions | (655) | | | (78) | |

| Income taxes payable | 95,352 | | | 52,565 | |

| | | |

| Other | 1,116 | | | (756) | |

| Net cash provided by operations | 198,945 | | | 72,251 | |

| | | |

| Cash provided by (used for) investment | | | |

| Expenditures for property and equipment | (17,448) | | | (13,301) | |

| | | |

| | | |

| Proceeds from sales of assets and other | 2,581 | | | 136 | |

| Net cash used for investment | (14,867) | | | (13,165) | |

| | | |

| Cash provided by (used for) financing | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Dividends paid on common stock | (5,939) | | | (4,440) | |

| Tax withholding payments on stock-based awards | (3,930) | | | (2,729) | |

| | | |

| | | |

| Other | (395) | | | (317) | |

| Net cash used for financing | (10,264) | | | (7,486) | |

| | | |

| Net increase in cash and cash equivalents | 173,814 | | | 51,600 | |

| | | |

| Balance at beginning of the period | 748,907 | | | 405,382 | |

| | | |

| Balance at end of the period | $ | 922,721 | | | $ | 456,982 | |

See accompanying condensed notes to unaudited quarterly consolidated financial statements.

Boise Cascade Company

Consolidated Statements of Stockholders' Equity

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Treasury Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Shares | | Amount | | Shares | | Amount | | | | |

| | (thousands) |

| Balance at December 31, 2021 | 44,698 | | | $ | 447 | | | 5,367 | | | $ | (138,909) | | | $ | 543,249 | | | $ | (1,047) | | | $ | 948,879 | | | $ | 1,352,619 | |

| Net income | | | | | | | | | | | | | 302,600 | | | 302,600 | |

| Other comprehensive income | | | | | | | | | | | 114 | | | | | 114 | |

| Common stock issued | 117 | | | 1 | | | | | | | | | | | | | 1 | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | | | 2,392 | | | | | | | 2,392 | |

Common stock dividends ($0.12 per share) | | | | | | | | | | | | | (5,133) | | | (5,133) | |

| Tax withholding payments on stock-based awards | | | | | | | | | (3,930) | | | | | | | (3,930) | |

| Proceeds from exercise of stock options | | | | | | | | | 27 | | | | | | | 27 | |

| Other | | | | | | | | | (1) | | | | | | | (1) | |

| Balance at March 31, 2022 | 44,815 | | | $ | 448 | | | 5,367 | | | $ | (138,909) | | | $ | 541,737 | | | $ | (933) | | | $ | 1,246,346 | | | $ | 1,648,689 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

See accompanying condensed notes to unaudited quarterly consolidated financial statements.

Boise Cascade Company

Consolidated Statements of Stockholders' Equity (continued)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Treasury Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Shares | | Amount | | Shares | | Amount | | | | |

| | (thousands) |

| Balance at December 31, 2020 | 44,568 | | | $ | 446 | | | 5,367 | | | $ | (138,909) | | | $ | 538,006 | | | $ | (1,078) | | | $ | 452,334 | | | $ | 850,799 | |

| Net income | | | | | | | | | | | | | 149,156 | | | 149,156 | |

| Other comprehensive loss | | | | | | | | | | | (4) | | | | | (4) | |

| Common stock issued | 130 | | | 1 | | | | | | | | | | | | | 1 | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | | | 2,092 | | | | | | | 2,092 | |

Common stock dividends ($0.10 per share) | | | | | | | | | | | | | (4,116) | | | (4,116) | |

| Tax withholding payments on stock-based awards | | | | | | | | | (2,729) | | | | | | | (2,729) | |

| Proceeds from exercise of stock options | | | | | | | | | 63 | | | | | | | 63 | |

| Other | | | | | | | | | (1) | | | | | | | (1) | |

| Balance at March 31, 2021 | 44,698 | | | $ | 447 | | | 5,367 | | | $ | (138,909) | | | $ | 537,431 | | | $ | (1,082) | | | $ | 597,374 | | | $ | 995,261 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

See accompanying condensed notes to unaudited quarterly consolidated financial statements.

Condensed Notes to Unaudited Quarterly Consolidated Financial Statements

1. Nature of Operations and Consolidation

Nature of Operations

Boise Cascade Company is a building products company headquartered in Boise, Idaho. As used in this Form 10-Q, the terms "Boise Cascade," "we," and "our" refer to Boise Cascade Company and its consolidated subsidiaries. We are one of the largest producers of engineered wood products (EWP) and plywood in North America and a leading United States wholesale distributor of building products.

We operate our business using two reportable segments: (1) Wood Products, which primarily manufactures EWP and plywood, and (2) Building Materials Distribution (BMD), which is a wholesale distributor of building materials. For more information, see Note 10, Segment Information.

Consolidation

The accompanying quarterly consolidated financial statements have not been audited by an independent registered public accounting firm but, in the opinion of management, include all adjustments necessary to present fairly the financial position, results of operations, cash flows, and stockholders' equity for the interim periods presented. Except as disclosed within these condensed notes to unaudited quarterly consolidated financial statements, the adjustments made were of a normal, recurring nature. Certain information and footnote disclosures normally included in our annual consolidated financial statements have been condensed or omitted. The quarterly consolidated financial statements include the accounts of Boise Cascade and its subsidiaries after elimination of intercompany balances and transactions. Quarterly results are not necessarily indicative of results that may be expected for the full year. These condensed notes to unaudited quarterly consolidated financial statements should be read in conjunction with our 2021 Form 10-K and the other reports we file with the Securities and Exchange Commission.

2. Summary of Significant Accounting Policies

Accounting Policies

The complete summary of significant accounting policies is included in Note 2, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements in "Item 8. Financial Statements and Supplementary Data" in our 2021 Form 10-K.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP) requires management to make estimates and assumptions about future events. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about contingent assets and liabilities, and reported amounts of revenues and expenses. Such estimates include the valuation of accounts receivable, inventories, goodwill, intangible assets, and other long-lived assets; legal contingencies; guarantee obligations; indemnifications; assumptions used in retirement, medical, and workers' compensation benefits; assumptions used in the determination of right-of-use (ROU) assets and related lease liabilities; stock-based compensation; fair value measurements; income taxes; and vendor and customer rebates, among others. These estimates and assumptions are based on management's best estimates and judgment. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment, which management believes to be reasonable under the circumstances. We adjust such estimates and assumptions when facts and circumstances dictate. As future events and their effects cannot be determined with precision, actual results could differ significantly from these estimates. Changes in these estimates resulting from continuing changes in the economic environment will be reflected in the consolidated financial statements in future periods.

Revenue Recognition

Revenues are recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. For revenue disaggregated by major product line for each reportable segment, see Note 10, Segment Information.

Fees for shipping and handling charged to customers for sales transactions are included in "Sales" in our Consolidated Statements of Operations. When control over products has transferred to the customer, we have elected to recognize costs related to shipping and handling as fulfillment costs. For our Wood Products segment, costs related to shipping and handling are included in "Materials, labor, and other operating expenses (excluding depreciation)" in our Consolidated Statements of Operations. In our Wood Products segment, we view our shipping and handling costs as a cost of the manufacturing process and the movement of product to our end customers. For our BMD segment, costs related to shipping and handling of $56.3 million and $46.5 million, for the three months ended March 31, 2022 and 2021, respectively, are included in "Selling and distribution expenses" in our Consolidated Statements of Operations. In our BMD segment, our activities relate to the purchase and resale of finished product, and excluding shipping and handling costs from “Materials, labor, and other operating expenses (excluding depreciation)” provides us a clearer view of our operating performance and the effectiveness of our sales and purchasing functions.

Customer Rebates and Allowances

Rebates are provided to our customers and our customers' customers based on the volume of their purchases, among other factors such as customer loyalty, conversion, and commitment, as well as temporary protection from price increases. We provide the rebates to increase the sell-through of our products. Rebates are generally estimated based on the expected amount to be paid and recorded as a decrease in "Sales." At March 31, 2022 and December 31, 2021, we had $147.2 million and $138.1 million, respectively, of rebates payable to our customers recorded in "Accrued liabilities, Other" on our Consolidated Balance Sheets. We adjust our estimate of revenue at the earlier of when the probability of rebates paid changes or when the amounts become fixed. There have not been significant changes to our estimates of rebates, although it is reasonably possible that a change in the estimate may occur.

Vendor Rebates and Allowances

We receive rebates and allowances from our vendors under a number of different programs, including vendor marketing programs. At March 31, 2022 and December 31, 2021, we had $10.4 million and $13.0 million, respectively, of vendor rebates and allowances recorded in "Receivables, Other" on our Consolidated Balance Sheets. Rebates and allowances received from our vendors are recognized as a reduction of "Materials, labor, and other operating expenses (excluding depreciation)" when the product is sold, unless the rebates and allowances are linked to a specific incremental cost to sell a vendor's product. Amounts received from vendors that are linked to specific selling and distribution expenses are recognized as a reduction of "Selling and distribution expenses" in the period the expense is incurred.

Leases

We primarily lease land, building, and equipment under operating and finance leases. We determine if an arrangement is a lease at inception and assess lease classification as either operating or finance at lease inception or upon modification. Substantially all of our leases with initial terms greater than one year are for real estate, including distribution centers, corporate headquarters, land, and other office space. Substantially all of these lease agreements have fixed payment terms based on the passage of time and are recorded in our BMD segment. Many of our leases include fixed escalation clauses, renewal options and/or termination options that are factored into our determination of lease term and lease payments when appropriate. Renewal options generally range from one to ten years with fixed payment terms similar to those in the original lease agreements. Some lease agreements provide us with the option to purchase the leased property at market value. Our lease agreements do not contain any residual value guarantees.

ROU assets represent our right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the lease commencement date based on the estimated present value of fixed lease payments over the lease term. The current portion of our operating and finance lease liabilities are recorded in "Accrued liabilities, Other" on our Consolidated Balance Sheets.

We use our estimated incremental borrowing rate, which is derived from information available at the lease commencement date, in determining the present value of lease payments. In determining our incremental borrowing rates, we

give consideration to publicly available interest rates for instruments with similar characteristics, including credit rating, term, and collateralization.

For purposes of determining straight-line rent expense, the lease term is calculated from the date we first take possession of the facility, including any periods of free rent and any renewal option periods we are reasonably certain of exercising. Variable lease expense generally includes reimbursement of actual costs for common area maintenance, property taxes, and insurance on leased real estate and are recorded as incurred. Most of our operating lease expense was recorded in "Selling and distribution expenses" in our Consolidated Statements of Operations. In addition, we do not separate lease and non-lease components for all of our leases.

Our short-term leases primarily include equipment rentals with lease terms on a month-to-month basis, which provide for our seasonal needs and flexibility in the use of equipment. Our short-term leases also include certain real estate for which either party has the right to cancel upon providing notice of 30 to 90 days. We do not recognize ROU assets or lease liabilities for short-term leases.

Inventories

Inventories included the following (work in process is not material):

| | | | | | | | | | | | | | |

| | | March 31,

2022 | | December 31,

2021 |

| | | (thousands) |

| Finished goods and work in process | | $ | 712,938 | | | $ | 573,908 | |

| Logs | | 51,437 | | | 47,401 | |

| Other raw materials and supplies | | 40,293 | | | 39,362 | |

| | | $ | 804,668 | | | $ | 660,671 | |

Property and Equipment

Property and equipment consisted of the following asset classes:

| | | | | | | | | | | | | | |

| | | March 31,

2022 | | December 31,

2021 |

| | | (thousands) |

| Land | | $ | 51,564 | | | $ | 51,564 | |

| Buildings | | 179,044 | | | 178,323 | |

| Improvements | | 67,539 | | | 66,492 | |

| Mobile equipment, information technology, and office furniture | | 194,395 | | | 191,134 | |

| Machinery and equipment | | 739,626 | | | 735,979 | |

| Construction in progress | | 37,533 | | | 35,912 | |

| | | 1,269,701 | | | 1,259,404 | |

| Less: accumulated depreciation | | (778,306) | | | (764,164) | |

| | | $ | 491,395 | | | $ | 495,240 | |

Fair Value

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy under GAAP gives the highest priority to quoted market prices (Level 1) and the lowest priority to unobservable inputs (Level 3). In general, and where applicable, we use quoted prices in active markets for identical assets or liabilities to determine fair value (Level 1). If quoted prices in active markets for identical assets or liabilities are not available to determine fair value, we use quoted prices for similar assets and liabilities or inputs that are observable either directly or indirectly (Level 2). If quoted prices for identical or similar assets are not available or are unobservable, we may use internally developed valuation models, whose inputs include bid prices, and third-party valuations utilizing underlying asset assumptions (Level 3).

Financial Instruments

Our financial instruments are cash and cash equivalents, accounts receivable, accounts payable, long-term debt, and interest rate swaps. Our cash is recorded at cost, which approximates fair value, and our cash equivalents are money market funds. As of March 31, 2022 and December 31, 2021, we held $859.1 million and $701.6 million, respectively, in money market funds that are measured at fair value on a recurring basis using Level 1 inputs. The recorded values of accounts receivable and accounts payable approximate fair values based on their short-term nature. At March 31, 2022 and December 31, 2021, the book value of our fixed-rate debt for each period was $400.0 million, and the fair value was estimated to be $391.0 million and $420.0 million, respectively. The difference between the book value and the fair value is derived from the difference between the period-end market interest rate and the stated rate of our fixed-rate, long-term debt. We estimated the fair value of our fixed-rate debt using quoted market prices of our debt in inactive markets (Level 2 inputs). The interest rate on our variable-rate debt is based on market conditions such as the London Interbank Offered Rate (LIBOR) or a base rate. Because the interest rate on the variable-rate debt is based on current market conditions, we believe that the estimated fair value of the outstanding balance on our variable-rate debt approximates book value. As discussed below, we also have interest rate swaps to mitigate our variable interest rate exposure, the fair value of which is measured based on Level 2 inputs.

Interest Rate Risk and Interest Rate Swaps

We are exposed to interest rate risk arising from fluctuations in variable-rate LIBOR on our term loan and when we have loan amounts outstanding on our Revolving Credit Facility. At March 31, 2022, we had $50.0 million of variable-rate debt outstanding based on one-month LIBOR. Our objective is to limit the variability of interest payments on our debt. To meet this objective, we enter into receive-variable, pay-fixed interest rate swaps to change the variable-rate cash flow exposure to fixed-rate cash flows. In accordance with our risk management strategy, we actively monitor our interest rate exposure and use derivative instruments from time to time to manage the related risk. We do not speculate using derivative instruments.

At December 31, 2021, we had two interest rate swap agreements. Under the interest rate swaps, we receive one-month LIBOR-based variable interest rate payments and make fixed interest rate payments, thereby fixing the interest rate on $50.0 million of variable rate debt exposure. Payments on one interest rate swap, entered into in 2016, with a notional principal amount of $50.0 million were due on a monthly basis at an annual fixed rate of 1.007%, and this swap expired in February 2022 (Initial Swap). During 2020, we entered into another forward interest rate swap agreement which commenced on the expiration date of the Initial Swap. Payments on this interest rate swap with a notional principal amount of $50.0 million are due on a monthly basis at an annual fixed rate of 0.39%, and this swap expires in June 2025.

The interest rate swap agreements were not designated as cash flow hedges, and as a result, all changes in the fair value are recognized in "Change in fair value of interest rate swaps" in our Consolidated Statements of Operations rather than through other comprehensive income. At March 31, 2022, we recorded a long-term asset of $3.3 million in "Other assets" on our Consolidated Balance Sheets, representing the fair value of the interest rate swap agreement. At December 31, 2021, we recorded a long-term asset of $1.2 million in "Other assets" on our Consolidated Balance Sheets, and we also recorded a long-term liability of $0.1 million in "Other long-term liabilities" on our Consolidated Balance Sheets, representing the fair value of the interest rate swap agreements. The swaps were valued based on observable inputs for similar assets and liabilities and other observable inputs for interest rates and yield curves (Level 2 inputs).

Concentration of Credit Risk

We are exposed to credit risk related to customer accounts receivable. In order to manage credit risk, we consider customer concentrations and current economic trends and monitor the creditworthiness of significant customers based on ongoing credit evaluations. At March 31, 2022, receivables from two customers accounted for approximately 18% and 12% of total receivables. At December 31, 2021, receivables from these two customers accounted for approximately 20% and 12% of total receivables. No other customer accounted for 10% or more of total receivables.

New and Recently Adopted Accounting Standards

In October 2021, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, which is intended to improve the accounting for acquired revenue contracts with customers in a business combination by addressing diversity in practice and inconsistency related to recognition of an acquired contract liability and payment terms and their effect on subsequent revenue recognized by the acquirer. This ASU requires an acquirer to account for revenue contracts in accordance with Topic 606 as if it had originated the contracts. To achieve this, an acquirer may assess how the acquiree applied Topic 606 to determine what to record for the acquired revenue contracts. The updated guidance is effective for fiscal years beginning after December 15, 2022, with early adoption permitted. We are currently evaluating the effects of this ASU on our consolidated financial statements and disclosures.

There were no other accounting standards recently issued that had or are expected to have a material impact on our consolidated financial statements and associated disclosures.

3. Income Taxes

For the three months ended March 31, 2022 and 2021, we recorded $98.9 million and $51.4 million, respectively, of income tax expense and had an effective rate of 24.6% and 25.6%, respectively. For both periods, the primary reason for the difference between the federal statutory income tax rate of 21% and the effective tax rate was the effect of state taxes.

During the three months ended March 31, 2022 and 2021, cash paid for taxes, net of refunds received, were $4.2 million and $1.0 million, respectively.

4. Net Income Per Common Share

Basic net income per common share is computed by dividing net income by the weighted average number of common shares outstanding during the period. Weighted average common shares outstanding for the basic net income per common share calculation includes certain vested restricted stock units (RSUs) and performance stock units (PSUs) as there are no conditions under which those shares will not be issued. Diluted net income per common share is computed by dividing net income by the combination of the weighted average number of common shares outstanding during the period and other potentially dilutive weighted average common shares. Other potentially dilutive weighted average common shares include the dilutive effect of stock options, RSUs, and PSUs for each period using the treasury stock method. Under the treasury stock method, the exercise price of a share and the amount of compensation expense, if any, for future service that has not yet been recognized are assumed to be used to repurchase shares in the current period.

The following table sets forth the computation of basic and diluted net income per common share:

| | | | | | | | | | | | | | | |

| | Three Months Ended

March 31 | | |

| | 2022 | | 2021 | | | | |

| | (thousands, except per-share data) |

| Net income | $ | 302,600 | | | $ | 149,156 | | | | | |

| Weighted average common shares outstanding during the period (for basic calculation) | 39,474 | | | 39,355 | | | | | |

| Dilutive effect of other potential common shares | 294 | | | 275 | | | | | |

| Weighted average common shares and potential common shares (for diluted calculation) | 39,768 | | | 39,630 | | | | | |

| | | | | | | |

| Net income per common share - Basic | $ | 7.67 | | | $ | 3.79 | | | | | |

| Net income per common share - Diluted | $ | 7.61 | | | $ | 3.76 | | | | | |

The computation of the dilutive effect of other potential common shares excludes stock awards representing an insignificant number of shares of common stock in both the three months ended March 31, 2022 and 2021. Under the treasury stock method, the inclusion of these stock awards would have been antidilutive.

5. Debt

Long-term debt consisted of the following:

| | | | | | | | | | | |

| | March 31,

2022 | | December 31,

2021 |

| | (thousands) |

| Asset-based revolving credit facility due 2025 | $ | — | | | $ | — | |

| Asset-based credit facility term loan due 2025 | 50,000 | | | 50,000 | |

| | | |

| 4.875% senior notes due 2030 | 400,000 | | | 400,000 | |

| | | |

| Deferred financing costs | (5,164) | | | (5,372) | |

| Long-term debt | $ | 444,836 | | | $ | 444,628 | |

| | | |

| | | |

Asset-Based Credit Facility

On May 15, 2015, Boise Cascade and its principal operating subsidiaries, Boise Cascade Wood Products, L.L.C., and Boise Cascade Building Materials Distribution, L.L.C., as borrowers, and Boise Cascade Wood Products Holdings Corp., as guarantor, entered into an Amended and Restated Credit Agreement, as amended, (Amended Agreement) with Wells Fargo Capital Finance, LLC, as administrative agent, and the banks named therein as lenders. The Amended Agreement includes a $350 million senior secured asset-based revolving credit facility (Revolving Credit Facility) and a $50.0 million term loan (ABL Term Loan) maturing on March 13, 2025. Interest on borrowings under our Revolving Credit Facility and ABL Term Loan are payable monthly. Borrowings under the Amended Agreement are constrained by a borrowing base formula dependent upon levels of eligible receivables and inventory reduced by outstanding borrowings and letters of credit (Availability).

The Amended Agreement is secured by a first-priority security interest in substantially all of our assets, except for property and equipment. The proceeds of borrowings under the agreement are available for working capital and other general corporate purposes.

The Amended Agreement contains customary nonfinancial covenants, including a negative pledge covenant and restrictions on new indebtedness, investments, distributions to equity holders, asset sales, and affiliate transactions, the scope of which are dependent on the Availability existing from time to time. The Amended Agreement also contains a requirement that we meet a 1:1 fixed-charge coverage ratio (FCCR), applicable only if Availability falls below 10% of the aggregate revolving lending commitments (or $35 million). Availability exceeded the minimum threshold amounts required for testing of the FCCR at all times since entering into the Amended Agreement, and Availability at March 31, 2022 was $346.0 million.

The Amended Agreement permits us to pay dividends only if at the time of payment (i) no default has occurred or is continuing (or would result from such payment) under the Amended Agreement, and (ii) pro forma Excess Availability (as defined in the Amended Agreement) is equal to or exceeds 25% of the aggregate Revolver Commitments (as defined in the Amended Agreement) or (iii) (x) pro forma Excess Availability is equal to or exceeds 15% of the aggregate Revolver Commitment and (y) our fixed-charge coverage ratio is greater than or equal to 1:1 on a pro forma basis.

Revolving Credit Facility

Interest rates under the Revolving Credit Facility are based, at our election, on either LIBOR or a base rate, as defined in the Amended Agreement, plus a spread over the index elected that ranges from 1.25% to 1.50% for loans based on LIBOR and from 0.25% to 0.50% for loans based on the base rate. The spread is determined on the basis of a pricing grid that results in a higher spread as average quarterly Availability declines. Letters of credit are subject to a fronting fee payable to the issuing bank and a fee payable to the lenders equal to the LIBOR margin rate. In addition, we are required to pay an unused commitment fee at a rate of 0.25% per annum of the average unused portion of the lending commitments.

At both March 31, 2022 and December 31, 2021, we had no borrowings outstanding under the Revolving Credit Facility and $4.0 million of letters of credit outstanding. These letters of credit and borrowings, if any, reduce availability under the Revolving Credit Facility by an equivalent amount.

ABL Term Loan

The ABL Term Loan was provided by institutions within the Farm Credit system. Borrowings under the ABL Term Loan may be repaid from time to time at the discretion of the borrowers without premium or penalty. However, any principal amount of ABL Term Loan repaid may not be subsequently re-borrowed.

Interest rates under the ABL Term Loan are based, at our election, on either LIBOR or a base rate, as defined in the Amended Agreement, plus a spread over the index elected that ranges from 1.75% to 2.00% for LIBOR rate loans and from 0.75% to 1.00% for base rate loans, both dependent on the amount of Average Excess Availability (as defined in the Amended Agreement). During the three months ended March 31, 2022, the average interest rate on the ABL Term Loan was approximately 1.92%.

We have received and expect to continue receiving patronage credits under the ABL Term Loan. Patronage credits are distributions of profits from banks in the Farm Credit system, which are cooperatives that are required to distribute profits to their members. Patronage distributions, which are generally made in cash, are received in the year after they are earned. Patronage credits are recorded as a reduction to interest expense in the year earned. After giving effect to expected patronage distributions, the effective average net interest rate on the ABL Term Loan was approximately 0.9% during the three months ended March 31, 2022.

2030 Notes

On July 27, 2020, we issued $400 million of 4.875% senior notes due July 1, 2030 (2030 Notes) through a private placement that was exempt from the registration requirements of the Securities Act. Interest on our 2030 Notes is payable semiannually in arrears on January 1 and July 1. The 2030 Notes are guaranteed by each of our existing and future direct or indirect domestic subsidiaries that is a guarantor under our Amended Agreement.

The 2030 Notes are senior unsecured obligations and rank equally with all of the existing and future senior indebtedness of Boise Cascade Company and of the guarantors, senior to all of their existing and future subordinated indebtedness, effectively subordinated to all of their present and future senior secured indebtedness (including all borrowings with respect to our Amended Agreement to the extent of the value of the assets securing such indebtedness), and structurally subordinated to the indebtedness of any subsidiaries that do not guarantee the 2030 Notes.

The terms of the indenture governing the 2030 Notes, among other things, limit the ability of Boise Cascade and our restricted subsidiaries to: incur additional debt; declare or pay dividends; redeem stock or make other distributions to stockholders; make investments; create liens on assets; consolidate, merge or transfer substantially all of their assets; enter into transactions with affiliates; and sell or transfer certain assets. The indenture governing the 2030 Notes permits us to pay dividends only if at the time of payment (i) no default has occurred or is continuing (or would result from such payment) under the indenture, and (ii) our consolidated leverage ratio is no greater than 3.5:1, or (iii) the dividend, together with other dividends since the issue date, would not exceed our "builder" basket under the indenture. In addition, the indenture includes certain specific baskets for the payment of dividends.

The indenture governing the 2030 Notes provides for customary events of default and remedies.

Interest Rate Swaps

For information on interest rate swaps, see Interest Rate Risk and Interest Rate Swaps of Note 2, Summary of Significant Accounting Policies.

Cash Paid for Interest

For the three months ended March 31, 2022 and 2021, cash payments for interest were $10.6 million and $8.7 million, respectively.

6. Leases

Lease Costs

The components of lease expense were as follows:

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31 | | |

| 2022 | | 2021 | | | | |

| (thousands) |

| Operating lease cost | $ | 3,561 | | | $ | 3,363 | | | | | |

| Finance lease cost | | | | | | | |

| Amortization of right-of-use assets | 626 | | | 606 | | | | | |

| Interest on lease liabilities | 587 | | | 592 | | | | | |

| Variable lease cost | 1,034 | | | 785 | | | | | |

| Short-term lease cost | 1,312 | | | 1,083 | | | | | |

| Sublease income | (112) | | | (30) | | | | | |

| Total lease cost | $ | 7,008 | | | $ | 6,399 | | | | | |

Other Information

Supplemental cash flow information related to leases was as follows:

| | | | | | | | | | | | |

| Three Months Ended

March 31 | |

| 2022 | | 2021 | |

| (thousands) | |

| Cash paid for amounts included in the measurement of lease liabilities | | | | |

| Operating cash flows from operating leases | 3,440 | | | 3,250 | | |

| Operating cash flows from finance leases | 587 | | | 586 | | |

| Financing cash flows from finance leases | 422 | | | 380 | | |

| Right-of-use assets obtained in exchange for lease obligations | | | | |

| Operating leases | — | | | — | | |

| Finance leases | — | | | — | | |

Other information related to leases was as follows:

| | | | | | | | | | | | | | | |

| |

| March 31, 2022 | | December 31, 2021 | | | | |

| | | | | | | |

| Weighted-average remaining lease term (years) | | | | | | | |

| Operating leases | 7 | | 7 | | | | |

| Finance leases | 15 | | 15 | | | | |

| Weighted-average discount rate | | | | | | | |

| Operating leases | 5.9 | % | | 5.9 | % | | | | |

| Finance leases | 7.5 | % | | 7.5 | % | | | | |

As of March 31, 2022, our minimum lease payment requirements for noncancelable operating and finance leases are as follows:

| | | | | | | | | | | | | | |

| | Operating Leases | | Finance Leases |

| | (thousands) |

| Remainder of 2022 | | $ | 10,810 | | | $ | 3,014 | |

| 2023 | | 14,657 | | | 4,058 | |

| 2024 | | 12,593 | | | 4,051 | |

| 2025 | | 10,472 | | | 3,735 | |

| 2026 | | 6,415 | | | 3,580 | |

| Thereafter | | 24,308 | | | 36,809 | |

| Total future minimum lease payments | | 79,255 | | | 55,247 | |

| Less: interest | | (15,625) | | | (22,084) | |

| Total lease obligations | | 63,630 | | | 33,163 | |

| Less: current obligations | | (11,181) | | | (1,712) | |

| Long-term lease obligations | | $ | 52,449 | | | $ | 31,451 | |

7. Stock-Based Compensation

In first quarter 2022 and 2021, we granted two types of stock-based awards under our incentive plan: performance stock units (PSUs) and restricted stock units (RSUs).

PSU and RSU Awards

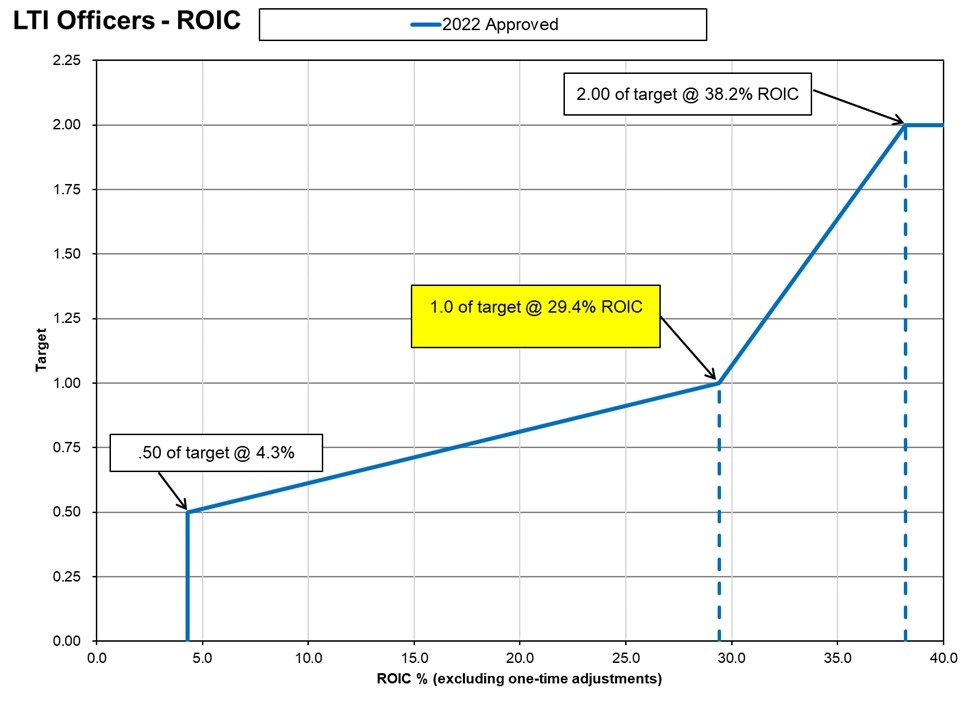

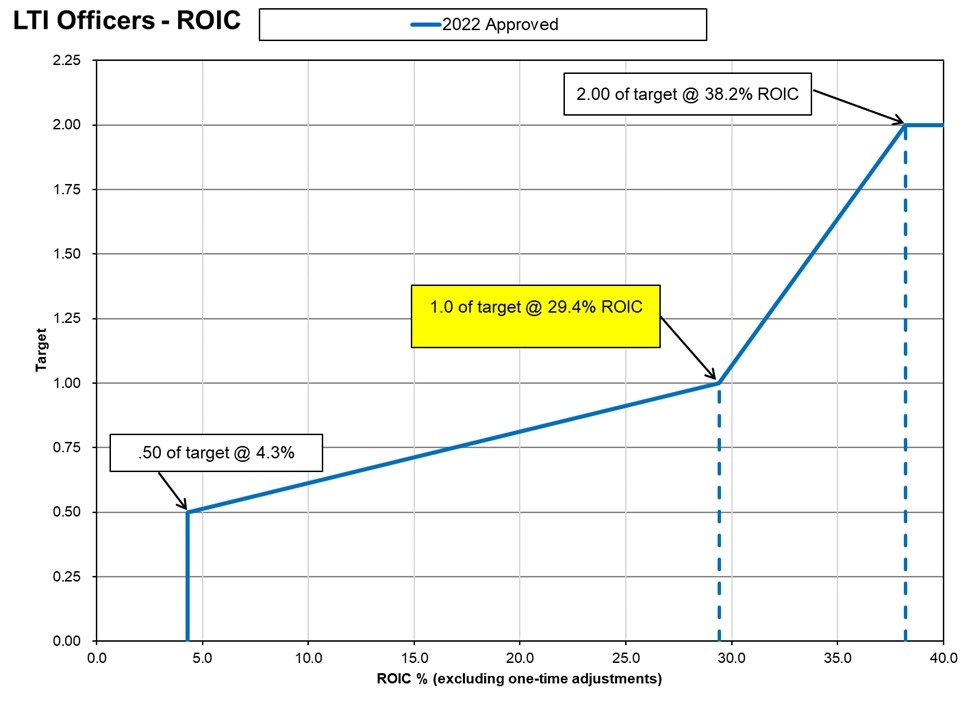

During the three months ended March 31, 2022, we granted 66,180 PSUs to our officers and other employees, subject to performance and service conditions. For the officers, the number of shares actually awarded will range from 0% and 200% of the target amount, depending upon Boise Cascade's 2022 return on invested capital (ROIC), as approved by our Compensation Committee in accordance with the related grant agreement. We define ROIC as net operating profit after taxes (NOPAT) divided by average invested capital (based on a rolling thirteen-month average). We define NOPAT as net income plus after-tax financing expense. Invested capital is defined as total assets plus capitalized lease expense, less current liabilities, excluding short-term debt. For our other employees, the number of shares actually awarded will range from 0% to 200% of the target amount, depending upon Boise Cascade’s 2022 EBITDA, defined as income before interest (interest expense and interest income), income taxes, and depreciation and amortization, as approved by executive management, determined in accordance with the related grant agreement. Because the PSUs contain a performance condition, we record compensation expense over the requisite service period based on the most probable number of shares expected to vest.

During the three months ended March 31, 2021, we granted 73,265 PSUs to our officers and other employees, subject to performance and service conditions. During the 2021 performance period, officers and other employees both earned 200% of the target based on Boise Cascade’s 2021 ROIC and EBITDA, as applicable, determined by our Compensation Committee and executive management in accordance with the related grant agreements.

The PSUs granted to officers generally vest in a single installment three years from the date of grant, while the PSUs granted to other employees vest in three equal tranches each year after the grant date.

During the three months ended March 31, 2022 and 2021, we granted an aggregate of 81,523 and 96,622 RSUs, respectively, to our officers, other employees, and nonemployee directors with only service conditions. The RSUs granted to officers and other employees vest in three equal tranches each year after the grant date. The RSUs granted to nonemployee directors vest over a one year period.

We based the fair value of PSU and RSU awards on the closing market price of our common stock on the grant date. During the three months ended March 31, 2022 and 2021, the total fair value of PSUs and RSUs vested was $12.0 million and $9.2 million, respectively.

The following summarizes the activity of our PSUs and RSUs awarded under our incentive plan for the three months ended March 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| PSUs | | RSUs |

| Number of shares | | Weighted Average Grant-Date Fair Value | | Number of shares | | Weighted Average Grant-Date Fair Value |

| Outstanding, December 31, 2021 | 246,210 | | | $ | 39.50 | | | 161,300 | | | $ | 45.08 | |

| Granted | 66,180 | | | 79.81 | | | 81,523 | | | 79.81 | |

| Performance condition adjustment (a) | 64,399 | | | 52.45 | | | — | | | — | |

| Vested | (58,935) | | | 34.41 | | | (91,327) | | | 43.47 | |

| Forfeited | — | | | — | | | — | | | — | |

| Outstanding, March 31, 2022 | 317,854 | | | $ | 51.46 | | | 151,496 | | | $ | 64.74 | |

_______________________________

(a) Represents additional PSUs granted during the three months ended March 31, 2022, related to the 2021 performance condition adjustment described above.

Compensation Expense

We record compensation expense over the awards' vesting period and account for share-based award forfeitures as they occur, rather than making estimates of future forfeitures. Any shares not vested are forfeited. We recognize compensation expense for stock awards with only service conditions on a straight-line basis over the requisite service period. Most of our share-based compensation expense was recorded in "General and administrative expenses" in our Consolidated Statements of Operations. Total stock-based compensation recognized from PSUs and RSUs, net of forfeitures, was as follows:

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31 | | |

| 2022 | | 2021 | | | | |

| (thousands) |

| PSUs | $ | 1,306 | | | $ | 1,089 | | | | | |

| RSUs | 1,086 | | | 1,003 | | | | | |

| | | | | | | |

| Total | $ | 2,392 | | | $ | 2,092 | | | | | |

The related tax benefit for the three months ended March 31, 2022 and 2021, was $0.6 million and $0.5 million respectively. As of March 31, 2022, total unrecognized compensation expense related to nonvested share-based compensation arrangements was $20.5 million. This expense is expected to be recognized over a weighted-average period of 2.2 years.

8. Stockholders' Equity

Dividends

On November 14, 2017, we announced that our board of directors approved a dividend policy to pay quarterly cash dividends to holders of our common stock. For more information regarding our dividend declarations and payments made during each of the three months ended March 31, 2022 and 2021, see "Common stock dividends" on our Consolidated Statements of Stockholders' Equity.

On May 5, 2022, our board of directors declared a quarterly dividend of $0.12 per share on our common stock, as well as a supplemental dividend of $2.50 per share on our common stock, both payable on June 15, 2022, to stockholders of record on June 1, 2022. For a description of the restrictions in our asset-based credit facility and the indenture governing our senior notes on our ability to pay dividends, see Note 5, Debt.

Future dividend declarations, including amount per share, record date and payment date, will be made at the discretion of our board of directors and will depend upon, among other things, legal capital requirements and surplus, our future operations and earnings, general financial condition, material cash requirements, restrictions imposed by our asset-based credit facility and the indenture governing our senior notes, applicable laws, and other factors that our board of directors may deem relevant.

Accumulated Other Comprehensive Loss

The following table details the changes in accumulated other comprehensive loss for the three months ended March 31, 2022 and 2021:

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31 | | |

| 2022 | | 2021 | | | | |

| (thousands) |

Beginning balance, net of taxes | $ | (1,047) | | | $ | (1,078) | | | | | |

| | | | | | | |

| Amortization of actuarial (gain) loss, before taxes (a) | 21 | | | (5) | | | | | |

| Effect of settlements, before taxes (a) | 130 | | | — | | | | | |

| Income taxes | (37) | | | 1 | | | | | |

| Ending balance, net of taxes | $ | (933) | | | $ | (1,082) | | | | | |

___________________________________

(a) Represents amounts reclassified from accumulated other comprehensive loss. These amounts are included in the computation of net periodic pension cost.

9. Transactions With Related Party

Louisiana Timber Procurement Company, L.L.C. (LTP) is an unconsolidated variable-interest entity that is 50% owned by us and 50% owned by Packaging Corporation of America (PCA). LTP procures sawtimber, pulpwood, residual chips, and other residual wood fiber to meet the wood and fiber requirements of us and PCA in Louisiana. We are not the primary beneficiary of LTP as we do not have power to direct the activities that most significantly affect the economic performance of LTP. Accordingly, we do not consolidate LTP's results in our financial statements.

Sales

Related-party sales to LTP from our Wood Products segment in our Consolidated Statements of Operations were $3.7 million and $3.3 million, respectively, during the three months ended March 31, 2022 and 2021. These sales are recorded in "Sales" in our Consolidated Statements of Operations.

Costs and Expenses

Related-party wood fiber purchases from LTP were $20.8 million and $20.3 million, respectively, during the three months ended March 31, 2022 and 2021. These costs are recorded in "Materials, labor, and other operating expenses (excluding depreciation)" in our Consolidated Statements of Operations.

10. Segment Information

We operate our business using two reportable segments: Wood Products and BMD. Unallocated corporate costs are presented as reconciling items to arrive at operating income. There are no differences in our basis of measurement of segment profit or loss from those disclosed in Note 16, Segment Information, of the Notes to Consolidated Financial Statements in "Item 8. Financial Statements and Supplementary Data" in our 2021 Form 10-K.

Wood Products and BMD segment sales to external customers, including related parties, by product line are as follows:

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31 | | |

| 2022 | | 2021 | | | | |

| (millions) |

| Wood Products (a) | | | | | | | |

| LVL (b) | $ | 1.7 | | | $ | 6.0 | | | | | |

| I-joists (b) | (2.2) | | | 4.8 | | | | | |

| Other engineered wood products (b) | 11.8 | | | 10.6 | | | | | |

| Plywood and veneer | 161.2 | | | 122.9 | | | | | |

| Lumber | 17.7 | | | 18.9 | | | | | |

| Byproducts | 19.1 | | | 17.6 | | | | | |

| | | | | | | |

| Other | 5.2 | | | 5.8 | | | | | |

| 214.5 | | | 186.5 | | | | | |

| | | | | | | |

| Building Materials Distribution | | | | | | | |

| Commodity | 1,102.0 | | | 906.2 | | | | | |

| General line | 615.1 | | | 472.7 | | | | | |

| Engineered wood products | 394.7 | | | 255.9 | | | | | |

| 2,111.8 | | | 1,634.8 | | | | | |

| $ | 2,326.3 | | | $ | 1,821.3 | | | | | |

___________________________________

(a) Amounts represent sales to external customers. Sales are calculated after intersegment sales eliminations to our BMD segment.

(b) Sales of EWP to external customers are net of the cost of all EWP rebates and sales allowances provided at various stages of the supply chain (including distributors, dealers, and homebuilders). For the three months ended March 31, 2022 and 2021, approximately 79% and 78%, respectively, of Wood Products' EWP sales volumes were to our BMD segment.

An analysis of our operations by segment is as follows:

| | | | | | | | | | | | | | | |

| | Three Months Ended

March 31 | | |

| | 2022 | | 2021 | | | | |

| | (thousands) |

| Net sales by segment | | | | | | | |

| Wood Products | $ | 558,944 | | | $ | 432,335 | | | | | |

| Building Materials Distribution | 2,111,833 | | | 1,634,777 | | | | | |

| Intersegment eliminations (a) | (344,495) | | | (245,796) | | | | | |

| Total net sales | $ | 2,326,282 | | | $ | 1,821,316 | | | | | |

| | | | | | | |

| Segment operating income | | | | | | | |

| Wood Products | $ | 190,116 | | | $ | 97,052 | | | | | |

| Building Materials Distribution | 225,892 | | | 120,219 | | | | | |

| Total segment operating income | 416,008 | | | 217,271 | | | | | |

| Unallocated corporate costs | (10,380) | | | (12,010) | | | | | |

| Income from operations | $ | 405,628 | | | $ | 205,261 | | | | | |

| | | | | | | |

___________________________________

(a) Primarily represents intersegment sales from our Wood Products segment to our BMD segment.

11. Commitments, Legal Proceedings and Contingencies, and Guarantees

Commitments

We are a party to a number of long-term log supply agreements that are discussed in Note 17, Commitments, Legal Proceedings and Contingencies, and Guarantees, of the Notes to Consolidated Financial Statements in "Item 8. Financial Statements and Supplementary Data" in our 2021 Form 10-K. In addition, we have purchase obligations for goods and services, capital expenditures, and raw materials entered into in the normal course of business. As of March 31, 2022, there have been no material changes to the above commitments disclosed in the 2021 Form 10-K.

Legal Proceedings and Contingencies

We are a party to legal proceedings that arise in the ordinary course of our business, including commercial liability claims, premises claims, environmental claims, and employment-related claims, among others. As of the date of this filing, we believe it is not reasonably possible that any of the legal actions against us will, individually or in the aggregate, have a material adverse effect on our financial position, results of operations, or cash flows.

Guarantees

We provide guarantees, indemnifications, and assurances to others. Note 17, Commitments, Legal Proceedings and Contingencies, and Guarantees, of the Notes to Consolidated Financial Statements in "Item 8. Financial Statements and Supplementary Data" in our 2021 Form 10-K describes the nature of our guarantees, including the approximate terms of the guarantees, how the guarantees arose, the events or circumstances that would require us to perform under the guarantees, and the maximum potential undiscounted amounts of future payments we could be required to make. As of March 31, 2022, there have been no material changes to the guarantees disclosed in the 2021 Form 10-K.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Understanding Our Financial Information

This Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our consolidated financial statements and related notes in "Item 1. Financial Statements" of this Form 10-Q, as well as our 2021 Form 10-K. The following discussion includes statements regarding our expectations with respect to our future performance, liquidity, and capital resources. Such statements, along with any other nonhistorical statements in the discussion, are forward-looking. These forward-looking statements include, without limitation, any statement that may predict, indicate, or imply future results, performance, or achievements and may contain the words "may," "will," "expect," "believe," "should," "plan," "anticipate," and other similar expressions. All of these forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described in "Item 1A. Risk Factors" in our 2021 Form 10-K, as well as those factors listed in other documents we file with the Securities and Exchange Commission (SEC). We do not assume an obligation to update any forward-looking statement. Our future actual results may differ materially from those contained in or implied by any of the forward-looking statements in this Form 10-Q.

Background

Boise Cascade Company is a building products company headquartered in Boise, Idaho. As used in this Form 10-Q, the terms "Boise Cascade," "we," and "our" refer to Boise Cascade Company and its consolidated subsidiaries. Boise Cascade is a large, vertically-integrated wood products manufacturer and building materials distributor. We have two reportable segments: (i) Wood Products, which primarily manufactures engineered wood products (EWP) and plywood; and (ii) Building Materials Distribution (BMD), which is a wholesale distributor of building materials. Our products are used in the construction of new residential housing, including single-family, multi-family, and manufactured homes, the repair-and-remodeling of existing housing, the construction of light industrial and commercial buildings, and industrial applications. For more information, see Note 10, Segment Information, of the Condensed Notes to Unaudited Quarterly Consolidated Financial Statements in "Item 1. Financial Statements" of this Form 10-Q.

Executive Overview

We recorded income from operations of $405.6 million during the three months ended March 31, 2022, compared with income from operations of $205.3 million during the three months ended March 31, 2021. In our Wood Products segment, income increased $93.1 million to $190.1 million for the three months ended March 31, 2022, from $97.1 million for the three months ended March 31, 2021, due primarily to higher EWP and plywood sales prices, offset partially by higher wood fiber and other manufacturing costs. In our BMD segment, income increased $105.7 million to $225.9 million for the three months ended March 31, 2022, from $120.2 million for the three months ended March 31, 2021, driven by a gross margin increase of $133.6 million, resulting from improved gross margins across substantially all product lines. The margin improvement was offset partially by increased selling and distribution expenses and general and administrative expenses of $25.5 million and $1.6 million, respectively. These changes are discussed further in "Our Operating Results" below.

We ended first quarter 2022 with $922.7 million of cash and cash equivalents and $346.0 million of undrawn committed bank line availability, for total available liquidity of $1,268.7 million. We had $444.8 million of outstanding debt at March 31, 2022. We generated $173.8 million of cash during the three months ended March 31, 2022, as cash provided by operations was offset partially by capital spending, dividends paid on our common stock, and tax withholding payments on stock-based awards. A further description of our cash sources and uses for the three month comparative periods are discussed in "Liquidity and Capital Resources" below.

Demand for the products we manufacture, as well as the products we purchase and distribute, is correlated with new residential construction, residential repair-and-remodeling activity and light commercial construction. Current demographics in the United States (U.S.), as well as continuation of work-from-home practices by many in the economy, continue to create a favorable demand environment for new residential construction. We expect demand to remain strong during 2022, with April 2022 Blue Chip Economic Indicators consensus forecasts for 2022 single- and multi-family housing starts in the U.S. of 1.65 million units compared with actual housing starts of 1.60 million in 2021, as reported by the U.S. Census Bureau. In addition, limited new and existing home inventory availability and the age of the U.S. housing stock will continue to provide a favorable