UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| (Name of Registrant as Specified in its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| March 24, 2023 |

Fellow Shareholders:

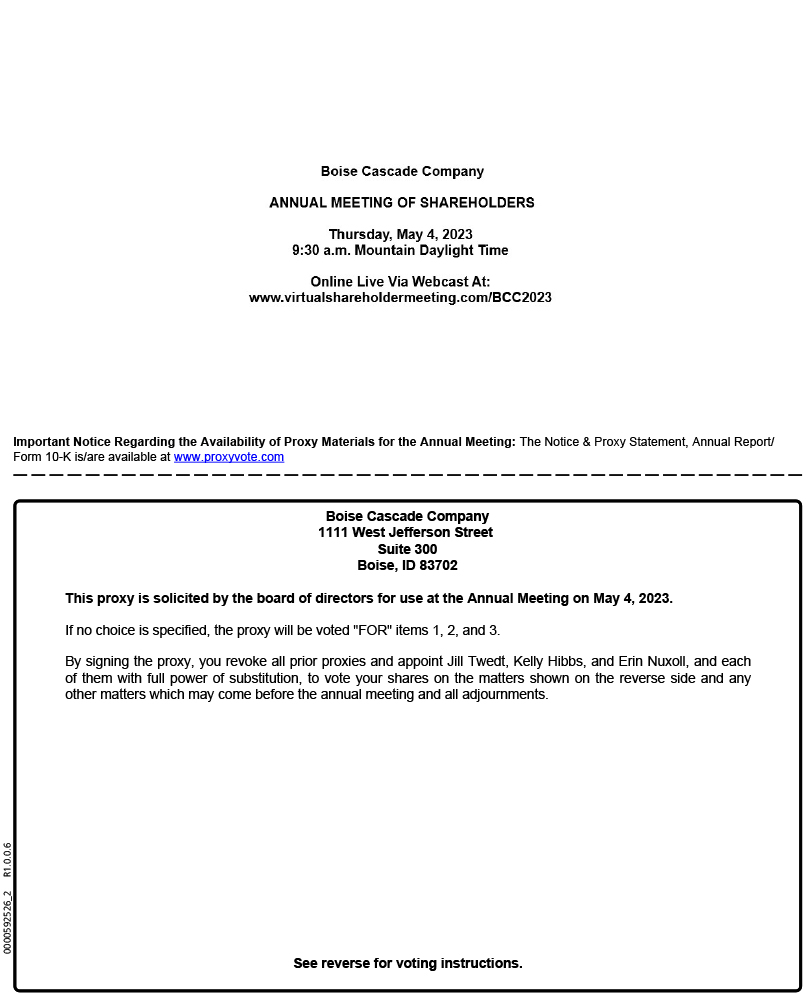

You are cordially invited to join us for our 2023 exclusively virtual annual meeting of shareholders, which will be held on Thursday, May 4, 2023, at 9:30 a.m. Mountain Daylight Time via live webcast. You will be able to attend the 2023 Annual Meeting online where you can attend the meeting, vote your shares electronically, and submit questions by visiting www.virtualshareholdermeeting.com/BCC2023. The Notice of Annual Meeting of Shareholders and the Proxy Statement that follow describe the business to be conducted at the meeting.

As we look forward to our 2023 annual meeting of shareholders, it is worth reflecting on the year just completed:

Leadership Changes and Ongoing Board and Committee Refreshment

In 2022, we executed on our succession plan and experienced several leadership changes, including the election of three new officers (adding bench strength to our leadership team) and the promotion of two officers to senior leadership positions. In addition to our senior leadership changes, two new Directors were elected, Amy Humphreys and Craig Dawson, who both assumed positions on our audit committee.

Board Oversight of Corporate Strategy

The Board’s role is critical in overseeing Boise Cascade’s corporate strategy and operations, and we continue to work closely with the management team on matters regarding the business and its performance. Throughout the year, the Board meeting agendas regularly included significant business and organizational initiatives, updates concerning our COVID-19 response, capital allocation strategies, and business development opportunities. Though the impact of COVID-19 to our business decreased throughout the year, we still experienced some continued supply chain disruptions due to the pandemic. We have historically experienced volatility in commodity markets which was no different in 2022, but we succeeded in that environment and were able to manage that volatility with strong sales of our engineered wood and general line products. Despite the challenges of the pandemic, strong market conditions and great execution by both of our business segments, helped us deliver outstanding results.

Capital Allocation Strategy and Return of Capital to Shareholders

In 2022, we invested approximately $515 million to acquire Coastal Plywood, and its manufacturing operations in Havana, Florida and Chapman, Alabama, and $114 million in capital spending on other projects such as, replacement of the final of three dryers at our Chester, South Carolina plant, expansion of our distribution facilities in Cincinnati, Ohio and Minneapolis, Minnesota, began the relocation of our Marion, Ohio facility, and the purchase of property for the development of new distribution facilities to be constructed near Charleston, South Carolina and San Antonio, Texas. We returned $159.6 million of cash to our shareholders, by increasing our quarterly dividend 25% to $0.15 per share in December, and paying two special dividends totaling $3.50 per share. We believe that our continued execution on our long-term growth plan and thoughtful stewardship of your capital will help ensure that you receive the benefits of our strategy and investments in the years to come.

Whether or not you plan to attend the annual meeting, your vote is important, and we encourage you to vote your shares promptly. You may vote your shares using a toll-free telephone number or the Internet. If you received a paper copy of the proxy card by mail, you may sign, date, and mail the proxy card in the envelope provided. Instructions regarding the three methods of voting are contained on the Notice of Internet Availability of Proxy Materials and the proxy card.

Sincerely,

|

|

| Thomas Carlile | Mack Hogans |

| Board Chair | Lead Independent Director |

Boise Cascade Company

1111 West Jefferson Street

Suite 300

Boise, ID 83702

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

VIRTUAL MEETING ONLY – NO PHYSICAL LOCATION

May 4, 2023, at 9:30 a.m., Mountain Daylight Time

To participate in the live online annual meeting, please visit www.virtualshareholdermeeting.com/BCC2023. Please note that you will need the 12-digit control number included on your proxy card in order to access the annual meeting.

A list of the names of shareholders of record entitled to vote at the annual meeting will be available during the entire time of the annual meeting on the annual meeting website.

To the Shareholders of Boise Cascade Company:

The 2023 annual meeting of shareholders of Boise Cascade Company will be held online at the above date and time for the following purposes:

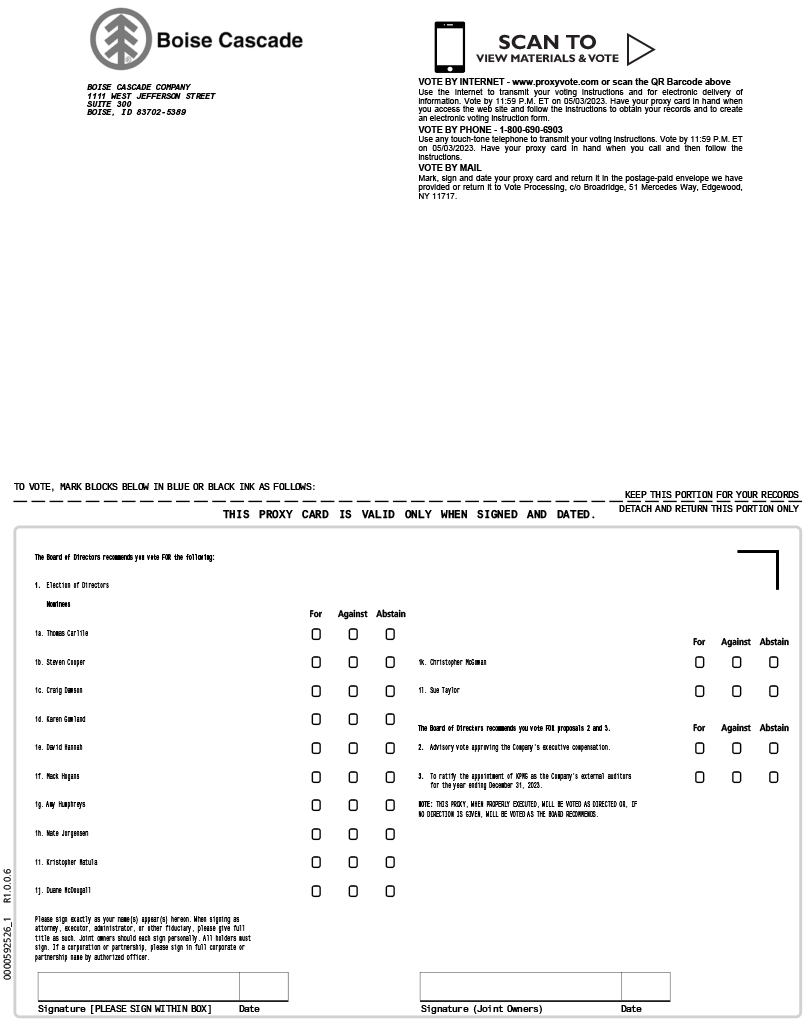

| 1. | To elect twelve directors (each a Director, and collectively, Directors) to the Company's board of directors (Board), each to serve a one-year term; |

| 2. | To approve, on an advisory basis, the Company’s executive compensation; |

| 3. | To ratify the appointment of KPMG LLP (KPMG) as the Company's independent registered public accounting firm for the year ending December 31, 2023; and |

| 4. | To conduct other business properly presented at the meeting. |

To vote on the matters brought before the meeting, you may submit your proxy vote by telephone or Internet, as described in the Notice of Internet Availability of Proxy Materials and the following proxy statement, no later than 11:59 p.m. Eastern Daylight Time on Wednesday, May 3, 2023, for any shares you hold directly. If you received a paper copy of the proxy card by mail, you may sign, date, and mail the proxy card in the envelope provided. The envelope is addressed to our vote tabulator, Broadridge Financial Solutions, Inc., and no postage is required if mailed in the United States. Holders of record of the Company’s common stock at the close of business on March 6, 2023, are entitled to notice of, and to vote at, the annual meeting.

Many of Boise Cascade’s shareholders received their 2023 proxy materials and annual report electronically. If we mailed you a Notice of Internet Availability of Proxy Materials or a printed copy of our proxy statement and annual report, we encourage you to help us efficiently and cost-effectively communicate with you by receiving these materials by email in the future. You can choose this option by:

| ● | Following the instructions provided on your proxy card or voting instruction form if you received a paper copy of the proxy materials; |

| ● | Following the instructions provided when you vote over the Internet; or |

| ● | Reaching out to your broker for its specific instructions. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 4, 2023. The Notice of the Annual Meeting of Shareholders, Proxy Statement, and 2022 Annual Report are available at www.proxyvote.com, as set out in the proxy card, and on page 50 of the proxy statement.

By order of the Board,

|

| Jill Twedt |

Senior Vice President, General Counsel and Corporate Secretary

Boise, Idaho

March 24, 2023

| TABLE OF CONTENTS |

PROXY STATEMENT SUMMARY

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting. As used in this proxy statement, unless the context otherwise indicates, the references to “Boise Cascade,” the “Company,” “we,” “our,” or “us” refer to Boise Cascade Company.

Our proxy statement and 2022 Annual Report are available at www.proxyvote.com as set forth on page 50. The proxy materials, including this proxy statement and form of proxy, are first being distributed and made available to shareholders on or about March 24, 2023.

Note About Forward-Looking Statements

This proxy statement includes statements about our expectations of future operational and financial performance that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act). Forward-looking statements may appear throughout this report, including this Proxy Statement Summary and Part 2 – Named Executive Officer Compensation. Statements preceded or followed by, or that otherwise include, the words “believes,” “expects,” “anticipates,” “intends,” “project,” “estimates,” “plans,” “forecast,” “is likely to,” and similar expressions or future or conditional verbs such as “will,” “may,” “would,” “should,” and “could” are generally forward-looking in nature and not historical facts. Forward-looking statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties. The accuracy of such statements is subject to a number of risks, uncertainties, and assumptions that could cause our actual results to differ materially from those projected, including, but not limited to, prices for building products, changes in the competitive position of our products, commodity input costs, the effect of general economic conditions, our ability to efficiently and effectively integrate the Coastal Plywood acquisition, mortgage rates and availability, housing demand, housing vacancy rates, governmental regulations, unforeseen production disruptions, as well as natural disasters. These and other factors that could cause actual results to differ materially from such forward-looking statements are discussed in greater detail in our filings with the Securities and Exchange Commission (SEC). Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise, except as required by law.

Any and all website addresses included in this proxy statement are included as textual references only, and none of the information contained in such websites (or accessed through them) is incorporated into this proxy statement or shall be regarded as part of this proxy statement.

Purpose and Strategy

Boise Cascade’s strategy is to continue to grow as a premier integrated manufacturing and wholesale distribution company for building products. As a leading manufacturer and distributor of building materials, we bring people, products, and services together to build strong homes, businesses, and communities that stand the test of time. At Boise Cascade, we truly care about relationships with our employees, customers, suppliers, shareholders, and the communities where we operate. We approach the way we do business with these core values:

| ● | Integrity | |

| We are our word. Integrity goes beyond the lasting structural strength of our products. Integrity is our uncompromising commitment to do the right thing. We nurture long-term relationships every day, in everything that we do. |

| ● | Safety | |

| We each have the responsibility for our own safety and the safety of those around us, both at work and at home. Together, we strive to create an injury-free environment by identifying risks, eliminating hazards, and requiring safe behaviors. |

| ● | Respect | |

| We cultivate a climate of mutual respect, camaraderie, and teamwork. We welcome diverse backgrounds, views, and skills because we believe it results in stronger teams, inspired solutions, and greater agility as an organization. |

PROXY STATEMENT SUMMARY

| ● | Pursuit of Excellence | |

| We are committed to the continuous improvement of people, processes, and the quality of products that we deliver. We apply best practices in our environmental management and forest stewardship. We all have the autonomy to apply our knowledge and experience to solve problems, make decisions, and implement new ideas to drive sustainable results. |

Executing our Strategy

Our strategy focuses on the “critical few” deliverables over the next two to five years to provide clarity and focus on our goals and adopt a common language around our collective opportunities ahead. Specifically, we intend to continue to:

| ● | Increase our earnings and the stability of our earnings by growing our market position in our Engineered Wood Products and expanding our distribution capabilities. |

| ● | Leverage our integrated business model and superior access to the market for our Wood Products’ manufacturing segment through our Building Materials Distribution (BMD) segment. |

| ● | Drive operational excellence by improving veneer self-sufficiency, data-driven process improvement programs, and highly efficient logistics systems. |

| ● | Accelerate the pace of innovation, digital technology, and diversity, equity, and inclusion (DEI). |

2022 Business Highlights

In 2022, we navigated many twists and turns, including supply chain constraints, transportation challenges, commodity pricing swings, labor challenges, weather and fire events, and issues related to the pandemic, by fully leveraging our values and creativity. Despite those challenges, we successfully executed on our strategy and were able to:

| ● | Declare $3.50 per-share in special dividends and increase our quarterly dividend in December by 25%; |

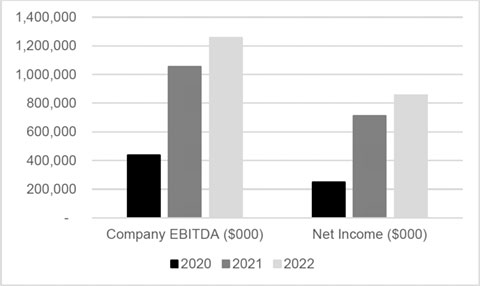

| ● | Deliver the highest EBITDA in the history of both our Wood Products and BMD segments; |

| ● | Make significant progress on our goals around DEI; and |

| ● | Accelerate the pace of our digital technology innovation with the launch of a new human capital management (HCM) system. |

Additionally, in our Wood Products segment, we completed the acquisition of Coastal Plywood and its manufacturing operations in Havana, Florida and Chapman, Alabama which provided us with additional veneer self-sufficiency, and we replaced the final of three dryers in Chester, South Carolina. In our BMD segment, we expanded our distribution facilities in Cincinnati, Ohio and Minneapolis, Minnesota, began the relocation of our Marion, Ohio facility, purchased property for the development of new distribution facilities to be constructed near Charleston, South Carolina and San Antonio, Texas, and entered into a contract for a millwork configuration, marketing, and sales software package.

Ready to Respond to Market Changes and Well-Positioned for Continued Growth

As we head into a potential economic slowdown and a deceleration in housing starts, we believe we are well-positioned to come out strong on the other side. We will adjust our business where needed and seek ways to control expenses and variable costs without sacrificing the high service levels expected by our vendor and customer partners. Despite the slowdown in new residential construction, a supportive climate exists for homeowner repair-and-remodel spending in 2023. We will continue to make investments to grow our Company and enhance the workplace experience to retain and attract employees. In 2023, we plan to continue executing our strategy and creating attractive returns on capital by:

| ● | Continuing to improve our competitiveness through operational excellence; |

| ● | Using our Boise Improvement Cycle (BIC) process and business optimization group to continue to (i) increase productivity, (ii) increase equipment efficiency, and (iii) lower our costs of manufacturing; |

| ● | Pursuing organic growth opportunities and in-fill opportunities in strategic locations across the country for our distribution business; |

PROXY STATEMENT SUMMARY

| ● | Continuing our growth in millwork and door assembly operations; and |

| ● | Continuing to explore manufacturing and distribution opportunities in adjacent businesses. |

2023 Annual Meeting Information

| Date and Time | Place | Record Date | Admission |

|

May 4, 2023

9:30 a.m.,

|

To participate in the live online annual meeting,

www.virtualshareholdermeeting.com/BCC2023

|

March 6, 2023 |

Only holders of record of the Company’s common stock as of the record date will be entitled to notice and to vote.

Please note that you will need the 12-digit control number included on your Notice of Internet Availability of Proxy Materials or, if you receive paper copies of your proxy materials, on your proxy card in order to access the annual meeting.

|

This year’s annual meeting will be a completely virtual meeting of shareholders, which will be conducted via live webcast. You are entitled to participate in the annual meeting only if you were a shareholder as of the close of business on March 6, 2023, or if you hold a valid proxy for the annual meeting. You will be able to participate in the annual meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/BCC2023.

Although our annual meeting will be virtual this year, shareholders will be able to participate as if at an in-person meeting. During the live Q&A session of the meeting, members of our executive leadership team and our Board chair will answer questions as they come in, as time permits. To ensure the meeting is conducted in a manner that is fair to all shareholders, the Board chair (or such other person designated by our Board) may exercise broad discretion in recognizing shareholders who wish to participate, the order in which questions are asked, and the amount of time devoted to any one question. We reserve the right to edit or reject questions we deem profane or otherwise inappropriate. Detailed guidelines for submitting written questions during the meeting are available at www.virtualshareholdermeeting.com/BCC2023.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the meeting or during the meeting, please call the phone number provided on the virtual meeting login page.

Voting Matters

| Proposal | Board Recommendation | Additional Information Page Reference | Vote Requirement | Broker Discretionary Voting Allowed? | Effect of Abstentions | Effect of Broker Non-Vote |

| 1. Election of Directors | FOR each nominee | page 7 | Majority of votes present and entitled to vote | No | Counted as vote “against” | No effect |

| 2. Approval of Executive Compensation | FOR | page 13 | Majority of votes present and entitled to vote | No | Counted as vote “against” | No effect |

| 3. Ratification of Independent Registered Public Accounting Firm | FOR | page 13 | Majority of votes present and entitled to vote | Yes | Counted as vote “against” | N/A |

PROXY STATEMENT SUMMARY

Directors

Our Board is now fully declassified and all twelve Directors are standing for election for a one-year term.

The following table provides summary information about each of the Directors. Our Board recommends a FOR vote for each Director because it believes each is qualified to serve as a Director and has made and will continue to make positive contributions to the Board. In 2022, our Board met a total of 9 times, and our committees met a total of 14 times. For information on our Director competencies and demographics, please see the Director Skills Matrix on page 8.

| Director Name and Age |

Director Since |

Occupation | Independent | Committee Memberships |

Other Public Company Boards |

||

| Audit(1) | Compensation | Corporate Governance and Nominating |

|||||

|

Thomas Carlile

Age – 71 |

2013 | Retired Chief Executive Officer, Boise Cascade Company | X | IDACORP, Inc., and its primary subsidiary Idaho Power Company | |||

|

Steven Cooper

Age – 60 |

2015 | Chief Executive Officer, TrueBlue, Inc. | X | X | TrueBlue, Inc. | ||

|

Craig Dawson(2)

Age – 60 |

2022 | President & Chief Executive Officer, Retail Lockbox, Inc. | X | X | None | ||

|

Karen Gowland

Age – 64 |

2014 | Retired Senior Vice President, General Counsel & Corporate Secretary, Boise Inc. | X |

X Chair |

X | None | |

|

David Hannah

Age – 71 |

2014 | Retired Chief Executive Officer, Executive Chair, Reliance Steel & Aluminum Co. | X | X |

X |

None | |

|

Mack Hogans

Age – 74 |

2014 | Retired Senior Vice President Corporate Affairs, Weyerhaeuser Co. | X |

X Lead Independent Director & Chair |

None | ||

|

Amy Humphreys(3)

Age – 56 |

2022 | Former President, Chief Executive Officer, Bristol Bay Seafoods Investments | X | X | None | ||

|

Nate Jorgensen

Age – 58 |

2020 | Chief Executive Officer, Boise Cascade Company | None | ||||

|

Kristopher Matula

Age – 60 |

2014 | Retired President, Chief Operating Officer, Buckeye Technologies Inc. | X | X | X | None | |

PROXY STATEMENT SUMMARY

| Director Name and Age |

Director Since |

Occupation | Independent | Committee Memberships |

Other Public Company Boards |

||

| Audit(1) | Compensation | Corporate Governance and Nominating |

|||||

|

Duane McDougall(4)

Age – 71 |

2013 | Retired President & Chief Executive Officer, Willamette Industries, Inc. | X | X | X | None | |

|

Christopher McGowan

Age – 51 |

2013 | General Partner CJM Ventures, LLC/OPTO Holdings, L.P. | X |

X Chair |

None | ||

|

Sue Taylor

Age – 65 |

2019 |

Retired Chief Information Officer, Bill and Melinda Gates Foundation |

X | X | None | ||

| (1) | Mr. McGowan, Mr. Cooper, and Ms. Humphreys are audit committee financial experts, as defined in Item 407(d)(5) of Regulation S-K under the Securities Act. |

| (2) | Mr. Dawson joined the audit committee upon his election to the Board effective May 5, 2022. |

| (3) | Ms. Humphreys joined the audit committee upon her election to the Board effective May 5, 2022. |

| (4) | Mr. McDougall moved to the corporate governance and nominating committee from the audit committee effective May 4, 2022. |

2022 Select Performance Highlights

2022 Business Highlights

| ● | The Company issued two special dividends totaling $3.50 per share in the second and fourth quarters and increased the quarterly dividend in December by 25%, returning $159.6 million to shareholders through quarterly and special dividends; |

| ● | The Company made significant progress on our goals around DEI; |

| ● | The Company accelerated the pace of our digital technology innovation with the launch of a new HCM system; |

| ● | Our BMD segment continued pursuing its strategy to enlarge its footprint to better serve and support its customers by enlarging our distribution facilities in Cincinnati, Ohio and Minneapolis, Minnesota, beginning the relocation of its Marion, Ohio facility, purchasing property for the development of new distribution facilities to be constructed near Charleston, South Carolina and San Antonio, Texas, and entering into a contract for a millwork configuration, marketing, and sales software package; |

| ● | Our Wood Products segment acquired Coastal Plywood and its manufacturing operations in Havana, Florida and Chapman, Alabama, increasing its internal veneer manufacturing capabilities, and replaced the final of three dryers in Chester, South Carolina; and |

| ● | We continued improvement of our safety programs across our business, including reinforcing, “Nobody Gets Hurt,” which enabled our Wood Products segment to finish the year with the lowest incident rate since the Company’s founding. |

Executive Compensation Highlights

We provide highlights of our executive compensation program below. It is important to review the Compensation Discussion & Analysis (CD&A) and compensation tables in this proxy statement for a complete understanding of our compensation program and philosophy (page 30).

| ● | We target compensation at the 50th percentile of comparable market compensation data, with actual compensation amounts taking into account each person’s role, performance, contributions to the Company’s success, level of experience, and other distinguishing characteristics. |

PROXY STATEMENT SUMMARY

| ● | We provide at-risk performance-based pay opportunities in the form of short-term and long-term incentives. |

| ● | Our chief executive officer’s total compensation is 52% at-risk, while our other named executive officers’ (NEO) total compensation is an average 47% at-risk. |

| ● | Short-term and long-term incentives comprise a significant portion of each officer’s total compensation opportunity and are designed to motivate and reward our officers for growing the Company and maximizing long-term shareholder value. |

| ● | Long-term performance is the most important measure of our success because we manage our operations and business affairs for the long-term benefit of our shareholders. |

| ● | For 2022, our NEOs received long-term equity incentive compensation opportunities in a combination of Performance Stock Units (PSUs) and Restricted Stock Units (RSUs). |

| ● | Our clawback policy allows us to claw back any or all short-term and long-term incentive awards received by an officer where the amount of award was calculated based upon financial results that were subsequently affected by a restatement of the Company’s financial statements and the award received would have been lower had the financial results been properly calculated when reported and/or where an award was predicated upon achieving financial results that were subsequently determined to be due to a fraudulent act by the officer. |

| ● | Our annual incentive compensation opportunities are tied to the achievement of corporate goals and, in some cases, business segment financial goals. |

| ● | Our Insider Trading Policy prohibits all of our directors, officers, employees, and consultants from participating in any hedging, pledging, or monetizing transaction to lock in the value of any of our securities they hold, including the purchase of any financial instrument designed to offset the risk of future declines in the market value of any of our securities. |

Say on Pay

Over the past five years, our shareholders have shown strong support for our executive compensation program with annual vote results of over 98% from 2018 to 2022. Our compensation committee continues to examine our executive compensation program to ensure alignment between our executives and the long-term interests of our shareholders.

We ask that our shareholders approve, on an advisory basis, the compensation of our NEOs as further described in Proposal 2 (page 13).

2022 Key Compensation Actions and Decisions

2022 PSUs under our long-term equity-based incentive plan (LTIP) under our 2016 Boise Cascade Omnibus Incentive Plan (2016 Incentive Plan) were earned above target based on solid execution of our business strategy and strong market conditions yielding 152% of target payout based on ROIC(1) measures.(2) These awards were granted in 2022, performance against target ROIC was determined in February 2023, and shares will be distributed in March 2025, three years from the grant date. The Company believes the long-term holding period for these shares aligns management with long-term shareholder value.

| (1) | ROIC, for any period means Net Operating Profit After Taxes (NOPAT) divided by average invested capital (based on a rolling thirteen-month average), as determined by the compensation committee, and adjusted for non-recurring items. NOPAT means net income plus after-tax financing expense. Invested capital means total assets plus capitalized lease expense, less current liabilities excluding short-term debt. |

| (2) | For more specifics on the compensation committee’s goal-setting process, see page 30. |

PROPOSALS TO BE VOTED ON

Corporate Governance Practices and Highlights

Board Structure

| ● | Over 90% of Directors are independent |

| ● | 100% independent audit, compensation, and corporate governance and nominating committee members |

| ● | Lead Independent Director with robust and defined responsibilities |

| ● | Board access to senior management and independent advisors |

| ● | Executive sessions of independent Directors at least twice per year at regular Board meetings |

Board Composition

| ● | 25% gender diversity and 25% racial/ethnic diversity among Directors which increased over the last few years. |

| ● | The chair of the compensation committee is a woman and the lead independent director/chair of corporate governance and nominating committee is a person of color. |

Shareholder Rights and Engagement

| ● | Annual election of all Directors |

| ● | Majority vote standard in uncontested Director elections |

| ● | Shareholder outreach program |

| ● | No shareholder rights plan |

| ● | Annual advisory vote on NEO compensation |

Policies and Practices

| ● | Clawback, anti-hedging, and anti-pledging policies |

| ● | Annual Board, Board chair, committee, and individual Director evaluation processes and review of management |

| ● | Robust stock ownership guidelines: |

| ● | Directors: 5 times annual cash retainer |

| ● | Chief executive officer: 5 times base salary |

| ● | Other NEOs: 2 times base salary |

| ● | Overboarding policy |

| ● | Mandatory Director retirement age of 75 |

| ● | Code of Ethics for Directors, officers, and employees |

Ratification of Independent Registered Accounting Firm

We are asking our shareholders to ratify the appointment of KPMG as our independent auditor for the year ending December 31, 2023 (page 13).

PROPOSALS TO BE VOTED ON

Proposal No. 1 – Election of Twelve Directors

Our Board is fully declassified and all Directors are nominated for election at our 2023 annual meeting for a one-year term.

Shares will be voted according to shareholder instructions. If no voting instructions are provided, a broker may not vote on the matter. For 2023, our Directors are running unopposed. Therefore, to be elected to our Board in 2023, each Director must receive an affirmative vote of the majority of the votes of the shares present in person or by proxy at the meeting of the shareholders and entitled to vote.

The Directors have confirmed their availability for election. If any of the Directors becomes unavailable to serve as a Director for any reason prior to the annual meeting, our Board may substitute another person as a Director. In that case, if a shareholder has voted for the original Director, those shares will be voted FOR the substitute Director.

Additional information follows for the Directors, particularly concerning their business experience and qualifications, as well as attributes and skills that led our Board to conclude that they should serve as a Director.

|

Our Board recommends shareholders vote FOR all of our Directors. |

PROPOSALS TO BE VOTED ON

Director Skills Matrix

Provided below in a Board Skills Matrix is a summary of each Director’s skills and experience as well as gender and racial/ethnic diversity information. The skills categories included in the matrix are tied to the Company’s strategic goals, and the intent of the matrix is that the Directors collectively possess qualities that facilitate effective oversight of the Company’s strategic plans. While the matrix is useful for determining the collective skills of the Board as a whole, it is not a comparative measure of the value of Directors; a Director with more focused experience could nonetheless contribute broadly and effectively.

The chart below identifies the principal skills and any gender and racial/ethnic diversity characteristics that the corporate governance and nominating committee considered for each Director when evaluating the Director’s experience and qualifications to serve as a Director. Each mark indicates a strength that was self-selected by each Director. Additional information about the Director’s background and business experience is provided below in the biographical information.

| Carlile | Cooper | Dawson | Gowland | Hannah | Hogans | Humphreys | Jorgensen | Matula | McDougall | McGowan | Taylor | TOTAL | |

| Knowledge, Skills, Experience | |||||||||||||

| Accounting/Financial – Accounting and financial reporting experience are important to accurately and transparently measure and report financial and operating performance, ensure compliance with applicable law and assess financial merits of strategic opportunities. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 | ||

| Industry Experience and Supply Chain – Industry experience helps inform our views on markets and economics, technology, supply chain, compliance, manufacturing, and distribution. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 | ||

| IT/Cyber Security/ Digital Business – Innovation and technology experience is important in overseeing the business in changing markets and physical and cyber threats. | ● | ● | ● | 3 | |||||||||

| Mergers/Acquisitions/Divestitures – Knowledge of mergers, acquisitions and divestitures helps guide our strategic initiative for growth. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 12 |

| Former/Current C-Suite Officer and/or Public Company Board Service – CEO/executive management leadership skills and public company board service are important to gain a practical understanding of organizations, corporate governance and ethics, and strategic planning. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 12 |

| Legal/Regulatory – Government, public policy and regulatory insights, including environmental compliance and regulation, are important to help shape policy initiatives for the benefit of our employees, customers, and shareholders. | ● | ● | ● | ● | ● | 5 | |||||||

| HR/Compensation – Human capital management and executive compensation knowledge and experience help the Company recruit, retain, and develop key talent essential to Company operations. | ● | ● | ● | ● | ● | ● | ● | ● | ● | 9 | |||

| Corporate Governance/Ethics – Understanding of corporate governance and ethics provides reinforcement of the Company’s values and ethics and overall governance framework, including its ESG strategies. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 12 |

| Diversity – Diverse attributes reflect the Company’s commitment to diversity and inclusion | |||||||||||||

| Race/Ethnicity | ● | ● | ● | 3 | |||||||||

| Gender | ● | ● | ● | 3 | |||||||||

PROPOSALS TO BE VOTED ON

| Directors |

| THOMAS CARLILE Age: 71 Director Since: 2013 Independent Committees: None |

Biographical Information: Mr. Carlile has been one of our directors since our initial public offering in February 2013 and Board chair since 2015. He was a director of our former parent company, Boise Cascade Holdings, L.L.C., from August 2009 until its dissolution in September 2014. Mr. Carlile served as the Company’s chief executive officer from 2009 until his retirement in 2015. From February 2008 to August 2009, Mr. Carlile served as our executive vice president and chief financial officer, following the divestiture of our paper and packaging businesses, and from October 2004 to January 2008, he served as our senior vice president and chief financial officer. Mr. Carlile is a current director of IDACORP, Inc. (2014 to present), and a current director of its primary subsidiary Idaho Power Company (2014 to present). |

||

| Qualifications: Mr. Carlile’s position as our former chief executive officer, and his 43 years’ experience with the Company and its predecessors allows him to advise the Board on operational and industry matters affecting the Company. | |||

| STEVEN COOPER Age: 60 Director Since: 2015 Independent Committees: Audit |

Biographical Information: Mr. Cooper has served as the chief executive officer of TrueBlue, Inc., a New York Stock Exchange listed industrial staffing company based in Tacoma, Washington since June 2022, and as a member of the board of directors since 2006. Mr. Cooper previously served as the chief executive officer at TrueBlue, Inc. from 2006 to 2018 and as chair of the board from January 2019 to July 2022. Prior to joining TrueBlue in 1999, Mr. Cooper held various professional positions at Arthur Andersen, Albertsons, and Deloitte. |

||

| Qualifications: Mr. Cooper’s experience as a chief executive officer and as a director allows him to provide insight on strategic and operational issues and valuable business knowledge. He also provides strong accounting and financial expertise and experience in workforce management to our Board. | |||

| CRAIG DAWSON Age: 60 Director Since: 2022 Independent Committees: Audit |

Biographical Information: Mr. Dawson has been the chief executive officer and president of Lockbox, Inc. since 1994 when he founded the company, which is an industry leader in remittance processing, credit card payments, and document management services, headquartered in Seattle, WA. From 1985 to 1994, he held a number of senior sales positions with Unisys Corporation, a publicly traded, international provider of computer and systems solutions. Mr. Dawson is the past chair (2020 – 2021) of the Federal Reserve Bank of San Francisco, Seattle Branch, and served as a board member from 2015-2021. |

||

| Qualifications: Mr. Dawson’s experience as a chief executive officer allows him to provide vision-setting and strategic direction to our Board. | |||

PROPOSALS TO BE VOTED ON

| KAREN GOWLAND Age: 64 Director Since: 2014 Independent Committees: Compensation (Chair) Corp. Governance & Nominating |

Biographical Information: Ms. Gowland currently serves as the chair of the compensation committee. Before her retirement in March 2014, Ms. Gowland was the senior vice president, general counsel, and corporate secretary for Boise Inc. (a manufacturer of packaging and paper products) from August 2010 until its acquisition by Packaging Corporation of America in late 2013. From February 2008 to July 2010, she served as Boise Inc.’s vice president, general counsel, and secretary. From October 2004 to February 2008, Ms. Gowland served as vice president, general counsel, and corporate secretary of Boise Cascade, L.L.C. During her 30 years in the forest products industry, Ms. Gowland held various legal and compliance positions, which included over 15 years of experience as a corporate secretary for various public and private entities in the forest products industry. |

||

| Qualifications: Ms. Gowland has relevant industry and company experience and provides strong corporate governance and compliance skills to our Board. | |||

| DAVID HANNAH Age: 71 Director Since: 2014 Independent Committees: Compensation Corp. Governance & Nominating |

Biographical Information: Mr. Hannah was the chief executive officer and executive chair until he retired in August 2016, and a director until May 2021, of Reliance Steel & Aluminum Co., a New York Stock Exchange listed operator of metals service centers. Before becoming a director and the chief executive officer and executive chair of Reliance, he served in various roles of increasing responsibility since joining Reliance in 1981. Prior to that, Mr. Hannah held various professional positions at Ernst & Whinney, a predecessor firm to Ernst & Young, LLP. Mr. Hannah is a certified public accountant. |

||

| Qualifications: Mr. Hannah’s experience as a chief executive officer of a major distribution company allows him to provide valuable insight on operational and industry issues. He also provides strong accounting and financial expertise to our Board. | |||

| MACK HOGANS Age: 74 Director Since: 2014 Independent (Lead Independent Director) Committees: Corp. Governance & Nominating (Chair) |

Biographical Information: Mr. Hogans currently serves as lead independent director. Mr. Hogans was the senior vice president of corporate affairs with Weyerhaeuser Company, a New York Stock Exchange listed timberlands and wood products company, until his retirement in 2004. Mr. Hogans currently operates a consulting services business. Prior to joining Weyerhaeuser in 1979, Mr. Hogans was employed by the U.S. Forest Service, Maryland National Capital Parks & Planning Commission, and the National Park Service. Mr. Hogans served on the board of US Ecology, Inc. from February 2021 until May 2022 when it was purchased by Republic Services. |

||

| Qualifications: Mr. Hogans has relevant industry experience and provides strong corporate governance and compliance skills to our Board. | |||

PROPOSALS TO BE VOTED ON

| AMY HUMPHREYS Age: 56 Director Since: 2022 Independent Committees: Audit |

Biographical Information: Ms. Humphreys has 25 years of experience in manufacturing, commodities, global marketing, and distribution, during which she has held executive leadership roles. Ms. Humphreys served as president and chief executive officer of Bristol Bay Seafood Investments from January 2020 until March 2021, and chief financial officer of Darigold, a Pacific Northwest dairy cooperative from May 2015 to November 2018. She has served on multiple boards in various roles, including Red Lion Hotels Corporation (2018 – 2020), a New York Stock Exchange listed company. From 2010 to April 2022. Ms. Humphreys was a director of Philly Shipyard ASA, a public company listed on the Oslo Stock Exchange. |

||

| Qualifications: Ms. Humphreys brings experience in strategic leadership, business development, financial management, capital structure strategies, and commodity and enterprise risk management to our Board. | |||

| NATE JORGENSEN Age: 58 Director Since: 2020 Non-Independent Committees: None |

Biographical Information: Mr. Jorgensen has served as our chief executive officer since March 6, 2020, and is not an independent director. He serves on no committees. Prior to his position as chief executive officer, he served in various roles, including chief operating officer and senior vice president of engineered wood products in our Wood Products segment. Prior to joining Boise Cascade in 2015, Mr. Jorgensen was employed with Weyerhaeuser Company, a New York Stock Exchange listed timberlands and wood products company, as vice president of its distribution business. |

||

| Qualifications: Mr. Jorgensen has over 30 years of industry experience in manufacturing and distribution. As chief executive officer, he is also able to provide valuable insight on the Company, as well as operational and financial information that is critical to Board discussions. | |||

| KRISTOPHER MATULA Age: 60 Director Since: 2014 Independent Committees: Compensation Corp. Governance & Nominating |

Biographical Information: Mr. Matula is currently a private consultant. Mr. Matula retired from Buckeye Technologies Inc. in 2012, where he served as president, chief operating officer, and a director. Buckeye Technologies, Inc., a publicly traded producer of cellulose-based specialty products, was acquired by Georgia-Pacific in 2013. During his career at Buckeye Technologies, Inc., Mr. Matula also served as chief financial officer and head of its nonwovens business. Prior to joining Buckeye Technologies, Inc. in 1994, Mr. Matula was employed by Procter & Gamble Company. |

||

| Qualifications: Mr. Matula’s experience as president, chief operating officer, and director allows him to provide insight on strategic and operational issues and valuable business knowledge. He also provides relevant industry experience and strong corporate governance and compliance skills to our Board. | |||

PROPOSALS TO BE VOTED ON

| DUANE MCDOUGALL Age: 71 Director Since: 2013 Independent Committees: Compensation Corp. Governance & Nominating |

Biographical Information: Mr. McDougall was the board chair from December 2008 until 2013 and a director from 2005 to 2013 of Boise Cascade Holdings, L.L.C. He became a Boise Cascade Company director and Board chair in February 2013 in connection with our initial public offering. Mr. McDougall also served as chief executive officer of Boise Cascade, L.L.C. from December 2008 to August 2009. Prior to joining our Company, Mr. McDougall was president and chief executive officer of Willamette Industries, an international paper and forest products company, until its sale in 2002. During his 23-year career with Willamette, Mr. McDougall held numerous operating and finance positions with increasing responsibilities before becoming president and chief executive officer. Mr. McDougall was a director of The Greenbrier Companies, Inc. (2003 to January 2022), and is currently a director of StanCorp Financial Group, Inc. (2009 to present; publicly traded until 2016). |

||

| Qualifications: Mr. McDougall’s experience as a chief executive officer of a major forest products company allows him to provide our Board with valuable insight on operational and industry issues. He also provides strong accounting and financial expertise to our Board. | |||

| CHRISTOPHER MCGOWAN Age: 51 Director Since: 2013 Independent Committees: Audit (Chair) |

Biographical Information: Mr. McGowan currently serves as the chair of our audit committee. He became a Boise Cascade Company director in February 2013 in connection with our initial public offering. Prior to February 2013, he was a director of our former parent company, Boise Cascade Holdings, L.L.C. from 2004 to 2013. In August 2014, he became a general partner of CJMV-GMC-AHSS, L.P. (d/b/a Autism Home Support Services, Inc.), a provider of therapy and counseling services for children with autism. In 2012, Mr. McGowan began teaching at The University of Chicago Booth School of Business and currently serves as an Adjunct Professor, Investor in Residence, and Faculty Adviser. In September 2011, he became a general partner of CJM Ventures, L.L.C. and OPTO Holdings, L.P. (d/b/a OPTO International, Inc.). From 1999 until 2011, he was employed by Madison Dearborn Partners, L.L.C. and served as a managing director concentrating on investments in the basic industries sector. Prior to joining Madison Dearborn, Mr. McGowan was with AEA Investors, Inc. and Morgan Stanley & Co. Incorporated. Mr. McGowan is a current director of Cedar Capital, LLC, a registered investment adviser that operates registered investment companies (2012 to present). |

||

| Qualifications: Mr. McGowan provides strong financial and governance skills to our Board. | |||

| SUE TAYLOR Age: 65 Director Since: 2019 Independent Committees: Audit |

Biographical Information: Ms. Taylor retired from the role of chief information officer for the Bill and Melinda Gates Foundation in Seattle, Washington in July 2020. Prior to joining the foundation in 2016, Ms. Taylor was vice president of the Applications and Project Management Office at Honeywell Automation and Control Solutions, where she delivered global integrated system platforms. Prior to joining Honeywell in 2014, she served as chief information officer at Intermec, where she led the company’s IT and enterprise business analytics department and headed integration and operational excellence for all IT systems when Intermec was acquired by Honeywell. |

||

| Qualifications: Ms. Taylor’s experience as chief information officer allows her to provide insight on strategic and operational issues and valuable business knowledge, particularly as it relates to technology innovation, information security and controls, and implementation of enterprise-wide systems. | |||

PROPOSALS TO BE VOTED ON

Proposal No. 2 – Advisory Vote to Approve Executive Compensation

Pursuant to Section 14A of the Exchange Act, we are providing our shareholders with the opportunity to cast a nonbinding advisory vote regarding the compensation of our NEOs. Our compensation philosophy is designed to emphasize a focus on total compensation, with a large portion of our NEOs’ pay being performance-based and considered variable, “at risk,” and aligned with shareholder interests. We seek to pay for performance so that we can recruit and retain the talented employees necessary to drive superior financial and operational results. We view our compensation program as a strategic tool that supports the successful execution of our business strategy and reinforces a performance-based culture. Our Board has agreed to hold this nonbinding advisory vote on an annual basis, with the next vote following this one expected to occur at the 2024 annual meeting of shareholders.

Shareholders are urged to read the Compensation Discussion and Analysis section in this proxy statement, which discusses how our compensation policies and procedures implement our compensation philosophy. The compensation committee and our Board believe these policies and procedures are effective in implementing our compensation philosophy and in achieving its goals. Our Board has determined the best way to allow shareholders to vote on our executive compensation is through the following resolution:

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis, compensation tables, and narrative discussion in this proxy statement, is hereby APPROVED.

Your vote is important to us. Although this advisory vote is nonbinding, the compensation committee and our Board will review the results of the vote. The compensation committee will consider our shareholders’ views and take them into account in making future determinations concerning our executive compensation.

|

Our Board recommends shareholders vote, on a nonbinding advisory basis, FOR the approval of the resolution set forth above approving the compensation of our named executive officers. |

Proposal No. 3 – Ratification of Independent Accountant for the Year Ending December 31, 2023

The audit committee of our Board is responsible for the engagement of our independent auditor and has appointed KPMG in that capacity for the fiscal year ending December 31, 2023.

Although ratification is not required by our bylaws or otherwise, our Board is submitting the selection of KPMG to our shareholders for ratification because we value our shareholders’ views on our independent registered public accounting firm. If the appointment of KPMG is not ratified, the audit committee will evaluate the basis for the shareholders’ vote when determining whether to continue the firm’s engagement, but the audit committee may ultimately decide to continue the engagement of the firm or another audit firm without resubmitting the matter to shareholders. Even if the selection of KPMG is ratified, the audit committee may, in its sole discretion, change the appointment at any time during the year if it determines a change would be in the best interests of the Company and our shareholders.

It is expected that one or more representatives of KPMG will be available online at our annual meeting to answer questions. They will also have the opportunity to make a statement if they desire to do so.

For information on the services KPMG provided for us in 2022, please refer to the audit committee report at page 28.

|

Our Board recommends shareholders vote FOR the ratification of the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 2023. |

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Code of Ethics for Our Board

The Company Code of Ethics (Code of Ethics) applies to our Directors, officers, and employees. We have a toll-free reporting service available that permits employees to confidentially report violations of our Code of Ethics or other issues of significant concern via phone, text, or website.

If we amend or grant a waiver of one or more of the provisions of our Code of Ethics, we intend to satisfy the requirements under Item 5.05 of Form 8-K regarding the disclosure of amendments to or waivers from provisions of our Code of Ethics by posting the required information on our website.

You may view a copy of our Code of Ethics by visiting our website at www.bc.com and selecting Code of Ethics in the footer at the bottom of the page.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines (Guidelines) to assist the Board in exercising its responsibilities. The Guidelines reflect our Board’s commitment to monitor the effectiveness of policy and decision-making, both at the Board and management levels. Our Board believes the Guidelines will enhance our ability to achieve our goals and long-term success and will assist us in increasing shareholder value. The Guidelines are in addition to and are not intended to change or interpret any federal or state law or regulation, including the Delaware General Corporation Law, our Certificate of Incorporation or bylaws, or the rules of the New York Stock Exchange (NYSE). Our Board may modify the Guidelines from time to time at the recommendation of the corporate governance and nominating committee and as deemed appropriate by our Board.

You may view a copy of the Guidelines by visiting our website at www.bc.com/investors and selecting the Corporate Governance tab to see corporate governance guidelines.

Director Independence

Our Directors believe board independence is important and is key for the Board to function properly, allowing it to provide appropriate oversight and maintain managerial accountability.

We list our common stock on the NYSE. The NYSE rules require that a majority of our Directors be independent from management and that all members of our Board committees be independent. For a Director to be independent under the NYSE’s rules, our Board must determine affirmatively that he or she has no material relationship with the Company. Additionally, he or she cannot violate any of the bright line independence tests set forth in the NYSE listing rules that would prevent our Board from determining that he or she is independent. These rules contain heightened independence tests for members of our audit and compensation committees. Our Board will broadly consider all relevant facts and circumstances to determine the independence of any Director in accordance with the NYSE listing rules.

Our Board has determined that all Directors except Mr. Jorgensen are independent directors as defined under the NYSE’s listing standards. These Directors constitute a majority of our Directors and represent all of our committee members. In making its independence determination, our Board considered the relationship disclosed in the Related-Person Transactions section below.

Additionally, our Board has determined that (i) each member of the audit committee meets the heightened independence standards for audit committee service under the NYSE listing rules and Rule 10A-3 under the Exchange Act; and (ii) each member of the compensation committee meets the heightened independence standards for compensation committee service under the NYSE listing rules and Rule 10C-1 under the Exchange Act. Further, because Mr. Carlile is a past chief executive officer of the Company, our Board appointed the chair of the corporate governance and nominating committee, Mr. Hogans, as its lead independent director.

Our Board and its committees can retain, at their sole discretion and at our expense, independent financial, legal, compensation, or other advisors to represent the independent interests of our Board or its committees.

CORPORATE GOVERNANCE

Related-Person Transactions

Family Relationships

No family relationships exist between any of our Directors and executive officers.

Affiliated-Company Transactions

Mr. Cooper, one of our Directors, is the chief executive officer and a board member of TrueBlue, Inc. (TrueBlue), an industrial staffing company. In 2022, the Company leased commercial drivers and used other temporary labor services from TrueBlue and its subsidiaries and paid approximately $308,000 for those services. Such agreements were entered into in accordance with our policies and processes required for arms-length related party transactions.

Policies and Procedures for Related-Person Transactions

Our written policy regarding transactions with related persons requires that a “related person” (as defined in paragraph (a) of Item 404 of Regulation S-K) must promptly disclose to our general counsel any “related-person transaction” (defined as any transaction that is reportable by us under Item 404(a) of Regulation S-K in which we are or will be a participant and the amount involved exceeds $120,000, and in which any related person has or will have a direct or indirect material interest) and all material facts with respect thereto. The general counsel will promptly communicate such information to our audit committee or another independent body of our Board. No related-person transaction will be entered into without the approval or ratification of our audit committee or another independent body of our Board. It is our policy that Directors recuse themselves from any discussion or decision affecting their personal, business, or professional interests. Our policy does not specify the standards to be applied by our audit committee or another independent body of our Board in determining whether to approve or ratify a related-person transaction.

Role of Compensation Consultant

The compensation committee continued to retain Frederic W. Cook & Co., Inc. (FW Cook) as its independent compensation consultant to assist the committee in discharging its responsibilities. Prior to retaining FW Cook, the compensation committee considered that FW Cook does not provide any other services to the Company or management and determined that there was no conflict of interest according to the factors the compensation committee determined to be relevant, including the independence factors enumerated by the NYSE.

Role of Board in Our Risk Management Processes

Our Board oversees the risk management activities designed and implemented by our management. The Board executes its oversight responsibility for risk management both directly and through its committees. Through our annual enterprise risk management review, the Board also considers specific risk topics, including risks associated with our strategic plan, business operations, cybersecurity, environmental, social and governance (ESG) matters, HCM (including recruitment and retention of talent), and capital structure. In addition, the Board receives regular detailed reports from our senior management and other personnel, including assessments and potential mitigation of the risks and exposures involved with their respective areas of responsibility.

Our Board delegates to the audit committee oversight of our risk management process. Our other committees also consider and address risks related to their respective committee responsibilities. All committees report to the Board as appropriate, including when a matter rises to a material or enterprise-level risk.

Our internal audit department develops annually a risk-based audit plan that is reviewed with the audit committee, along with the results of internal audit reviews and activities. The internal audit department also maintains a high-level assessment of risks and controls for key operations, functions, processes, applications, and systems within the Company. The audit committee meets on a regular basis each year with our director of internal audit, our chief financial officer, and our director of financial reporting. The audit committee also meets at least once per year with our director of information technology (IT) to discuss security as it relates to our data systems.

We have in place a number of independent assurance activities responsible for assessing whether our risk response activities are in place and working effectively, including, but not limited to, data security, data privacy, environmental, and safety audits.

CORPORATE GOVERNANCE

Information Security

The Board and the audit committee engage with management on a quarterly basis with our IT environment, including data security and data privacy, and Wood Products segment’s industrial control systems (ICS) of its manufacturing equipment. The Company’s IT security and data privacy processes are based upon the Control Objectives for Information and Related Technology (COBIT) framework. Our IT, Data Privacy, and Internal Audit teams have individuals who have achieved Certified Governance of Enterprise IT (CGEIT), Certified Data Privacy Solutions Engineer (CDPSE), Certified Information Privacy Manager (CIPM), and Certified Information Systems Auditor (CISA) professional certifications. Continual focus on data breach response readiness by implementing activities such as tabletop exercises is a key initiative for the IT security and data privacy teams. KPMG annually audits our IT general controls to assess our internal control environment and the reliability of information flowing into our financial reporting. In addition, we engage a qualified third party to perform an annual penetration test as part of our ongoing assessment of our IT perimeter security and intrusion detection capabilities. The penetration test organization employs experts with the Certified Information Systems Security Professional (CISSP) and GIAC certified penetration tester (GPEN) professional designations.

Risk Analysis of Employee Compensation Policies and Practices

The compensation committee, with recommendations from management, reviewed our compensation policies and practices for our employees and determined these policies and practices do not induce our employees to take unacceptable levels of business risk for the purpose of increasing their incentive plan awards at the expense of shareholder interests. Some of the considerations in making this determination were:

| ● | None of our businesses presents a high-risk profile because our businesses compete in markets with a high degree of transparency on pricing and costs, as well as clearly defined revenue recognition accounting principles; |

| ● | Our incentive pay structure rewards performance in both the short-term and long-term (i.e., short-term incentives are not paid at the expense of long-term shareholder value); |

| ● | Our incentive pay program has minimum and maximum targets designed to take into account short-term and long-term affordability measures, with payments capped at the maximum target; |

| ● | The compensation committee reserves the right to reduce or eliminate any awards, at its discretion, with respect to our incentive pay programs; |

| ● | We have adopted a clawback policy for our LTIP and our cash-based short-term incentive plan (STIP) that authorizes clawback of any or all awards received by an officer where the amount of award was calculated based upon the financial results that were subsequently affected by a restatement of the Company’s financial statements and the award received would have been lower had the financial results been properly calculated when reported and/or where an officer engages in a fraudulent act leading to the restatement; |

| ● | Our executive compensation program does not encourage our management to take unreasonable risks relating to the business; and |

| ● | Pursuant to the Company’s Insider Trading Policy, we prohibit all of our Directors, officers, employees, and consultants from participating in any hedging, pledging, or monetizing transactions to lock in the value of any of our securities that they hold, including the purchase of any financial instrument designed to offset the risk of future declines in the market value of any of our securities. |

Director Selection Process

Our corporate governance and nominating committee is responsible for, among other matters:

| ● | Identifying individuals qualified to become Directors, consistent with criteria approved by our Board; |

| ● | Recommending to our Board a slate of Directors for election at the annual meeting; and |

| ● | Recommending to our Board persons to fill Board and committee vacancies. |

CORPORATE GOVERNANCE

Through this process, members of the corporate governance and nominating committee consult with our Board chair and accept nominee recommendations from other Directors and/or shareholders in accordance with the terms of our Certificate of Incorporation and bylaws. The invitation to join our Board is extended by our Board through our Board chair and lead independent director.

Suitability of Candidates

In evaluating the suitability of candidates, in addition to our ongoing and emerging business needs, our Board and corporate governance and nominating committee consider many factors, including a candidate’s:

| ● | Experience as a senior officer in a public company, substantial private company experience, or other comparable experience; |

| ● | Experience as a director of a public company; |

| ● | Breadth of knowledge about issues affecting the Company and/or its industry; |

| ● | Expertise in finance, logistics, manufacturing, law, human resources, cybersecurity, technology and innovation, marketing or other areas that our Board determines are important areas of needed expertise; and |

| ● | Personal attributes that include integrity and sound ethical character, absence of legal or regulatory impediments, absence of conflicts of interest, demonstrated track record of achievement, ability to act in an oversight capacity, appreciation for the issues confronting a public company, adequate time to devote to our Board and its committees, and willingness to assume board fiduciary responsibilities on behalf of all shareholders. |

The corporate governance and nominating committee Is committed to a highly functioning board where the composition is reflective of the long-term strategy of the business, and makes decisions primarily on the basis of skills, qualifications, and experience. Input from the Board, management, feedback from shareholders, and Board evaluation processes also help determine desired backgrounds and skills.

Consideration of Diversity in Nomination Process

Our current Board of nine men and three women has a rich mixture of educational, professional, and experiential diversity representing a wide range of perspectives to further enhance the effectiveness of its oversight role. As opportunities to appoint and nominate new directors become available, in addition to the factors set forth above, our Board will consider other factors, including gender, racial, and ethnic diversity for Director recruitment to continue enriching our Board’s diverse perspectives.

Information regarding the skills and diversity of our Directors can be found in the Director Skills Matrix on page 8.

Shareholder Nominations for Directors

In accordance with our bylaws, the corporate governance and nominating committee will consider shareholder nominations for directors (please refer to the Shareholder Proposals for Inclusion in Next Year’s Proxy Statement section in this proxy statement for related instructions, page 51). We did not receive any shareholder nominations or recommendations for a director in connection with the 2023 annual meeting. Other than the procedures set forth in our bylaws, the corporate governance and nominating committee has not adopted formal policies regarding shareholder nominations for directors because the committee does not believe such policy is necessary for the consideration of shareholder nominations.

Board and Committee Self-Evaluations

In December of each year, under the direction of the corporate governance and nominating committee, our Directors complete written surveys to evaluate and assess the overall effectiveness of our Board, its committees, and each Director. The purpose of the Board, committee(s), and individual Director surveys is to continually improve Board performance. Our lead independent director, who also serves as the chair of the corporate governance and nominating committee, and our Board chair review the Directors’ responses and provide the individual Directors, the corporate governance and nominating committee, and the Board with an assessment of the performance of the Board and its committees. The Directors then discuss the results and proposed actions for improvement or change in an executive session chaired by our lead independent director. The lead independent director and Board chair also have one-on-one discussions as necessary with each Director about the feedback received. Through this process, the Board and management work together to refine the meeting materials and topics covered with the Board to educate new members and highlight certain strategic projects.

CORPORATE GOVERNANCE

Director Time Commitment Policy

The Board believes that wider perspectives and best practices learned by Directors serving in other public directorships must be balanced against the time commitment that service on boards entails. Therefore, our Guidelines include a policy whereby our non-employee Directors are limited to no more than three public boards, (in addition to the Board), and our chief executive officer to one additional public board. You may view a copy of the Guidelines by visiting our website at www.bc.com/investors and selecting the Corporate Governance tab to see corporate governance guidelines.

Communications with Our Board

Shareholders and other interested parties may contact our Board, or any of its committees, non-management Directors or any individual Directors by writing to the chair of the corporate governance and nominating committee, at the address or email address shown below. All correspondence will be referred to the chair of the corporate governance and nominating committee, the Board chair, and our general counsel.

Boise Cascade Company

Attention: Chair of the Corporate Governance and Nominating Committee

c/o General Counsel

1111 West Jefferson Street, Suite 300

Boise, ID 83702

Email: legaldepartment@bc.com

We have an email link to our Board on our website at www.bc.com/investors; select the Corporate Governance tab, then click on the Board of Directors link; scroll to the bottom of page for the Contact the Board email form.

Shareholder Engagement

We believe engaging in active dialogue with our shareholders is important to our commitment to deliver sustainable, long-term value to our shareholders. In 2022, we continued our engagements with shareholders representing approximately 34.36% of our outstanding shares, which provided them opportunities to discuss various issues, including our corporate governance, risk oversight, ESG, DEI, responsible forestry and environmental sustainability practices, and forest certification. Shareholder feedback is regularly reviewed and considered by the Board and is reflected in adjustments and enhancements to our policies and practices, including providing more sustainability disclosures on our website that are aligned with the guidelines of the Task Force on Climate-Related Financial Disclosures (TCFD) and Sustainability Accounting Standards Board (SASB).

ESG Governance, Environmental Sustainability, and Human Capital Management

ESG Governance

The corporate governance and nominating committee is primarily responsible for ESG matters, but similar to risk oversight, the Board participates in the process and oversight of ESG strategy. At each meeting, management updates the corporate governance and nominating committee, and the Directors provide guidance on current ESG topics, including climate, HCM, DEI, and other similar issues that impact the Company. On an annual basis, the corporate governance and nominating committee is provided with a more in-depth review of ESG topics by either management or a third-party consultant.

Our Board supports an approach to sustainability and ESG matters that is embedded in our Company purpose to bring people, products, and services together to build strong homes, businesses, and communities that stand the test of time. We are a business built on relationships. Our core values guide our actions, unite our employees, and define our brand. We care about relationships with our employees, customers, suppliers, shareholders, and the communities where we live and operate. We strive to create a diverse and inclusive workplace environment as a way of living our core values of Respect and Pursuit of Excellence where we embrace the power of our differences. We’re committed to fostering an inclusive culture that celebrates diversity and creates connection where everyone feels seen, heard, and valued. We further believe it is our responsibility as an employer and community leader to have a positive influence in the communities where we live and operate.

CORPORATE GOVERNANCE

Environmental Sustainability

Boise Cascade considers environmental responsibility an integral component of our Wood Products and BMD segments. We transform renewable resources, trees, into products that people depend on every day. Our raw materials store carbon for years, giving us the opportunity to respond to the effects of climate change through our environmental stewardship practices when procuring wood. Through conservation and sustainable forestry practices, we actively contribute to the responsible use and protection of the natural environment, which benefits our employees, customers, shareholders, and the communities where we live and operate. We are committed to implementing and achieving sustainable forestry practices where we procure raw materials from other forest landowners, wood suppliers, and manufacturers that help protect and conserve forest habitat and biodiversity. We have rigorous procurement programs to comply with state and provincial laws to protect conservation values and culturally important sites and which include measures to protect water quality and conserve wildlife habitat. Further, we are committed to continually achieving compliance with certification standards, employing management practices within our operations to comply with environmental laws and regulations, and promoting sustainable practices.

We recognize the scientific evidence indicating a changing climate associated with increasing CO2 in the atmosphere, and uses the recommendations of the TCFD for guidance in tracking and communicating our position and performance on climate-related matters. To further enhance our ability to track and report on climate-related issues, the Company formed an ESG working group in 2022 made up of members from several departments across the Company. The working group evaluated material sources of Scope 1 and 2 greenhouse gas (GHG) emissions and undertook a review and selection of technology tools that will allow us to begin tracking GHG emissions and energy metrics.

Human Capital Management

The health and safety of our employees is a core value, and the Company maintains robust safety programs focused on identifying hazards and eliminating risks, as well as safety processes and procedures aimed at eliminating injuries in the workplace. Our continued response to the pandemic involved our prioritizing the health and safety of our employees, customers, and the communities where we live and operate. The Company further responded to changes in the work environment during the pandemic by creating a flexible work policy. We recognize the demands of balancing work, family, and personal obligations and we believe we are better when we work together to serve our customers, find creative solutions, and enrich our culture. Although the nature of most of our jobs in our Wood Products and BMD segments cannot be accomplished remotely or accommodate multiple flexible schedules, we are open to listening, learning, and providing flexible work arrangements where practical and productive.

Our Total Rewards program provides competitive pay, comprehensive health benefits, robust financial security resources, well-being programs, community engagement and opportunities, and career recognition and development. Selecting and developing talent is a vital aspect of our human capital strategy because we believe our employees are at the heart of our purpose and fulfillment of our promise to our shareholders. We focus on developing talent from within our business segments and supplement that talent with finding the right external hires to support key strategic objectives of innovation, digital technology, and DEI. We work towards business continuity and personal growth by developing our employees as individuals through targeted leadership programs. Individual development includes annual performance reviews with development plans, access to a variety of resources, including self-help resources, and continued education opportunities. During 2022, our employees were able to participate in leadership training through a combination of online platforms and in-person. Further, employees contribute service hours to boards, special causes, and nonprofit organizations in the communities where they live and work. These programs enable the Company’s employees to connect with the community, further improve the Company’s reputation locally, and instill a sense of pride in the workforce.