Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on April 1, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BOISE CASCADE COMPANY*

(Exact name of registrant as specified in its charter)

Delaware |

5030 (Primary Standard Industrial Classification Code Number) |

20-1496201 (I.R.S. Employer Identification No.) |

1111 West Jefferson Street, Suite 300

Boise, Idaho 83702-5389

(208) 384-6161

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

John T. Sahlberg

Senior Vice President, Human Resources and General Counsel

1111 West Jefferson Street, Suite 300

Boise, Idaho 83702-5389

(208) 384-6161

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copy to: | ||

Carol Anne Huff Ellen K. McIntosh Kirkland & Ellis LLP 300 North LaSalle Street Chicago, Illinois 60654 (312) 862-2000 |

||

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the "Securities Act"), check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Securities Exchange Act of 1934 (Check One): o

| Large accelerated filer: o | Accelerated filer: o | Non-accelerated filer: ý (Do not check if a smaller reporting company) |

Smaller reporting company: o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer): o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer): o

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to Be Registered(1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||

|---|---|---|---|---|

63/8% Senior Notes due 2020 |

$250,000,000 | $34,100 | ||

Guarantees related to the 63/8% Senior Notes due 2020(2) |

N/A | N/A | ||

Total |

$250,000,000 | $34,100 | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(o) promulgated under the Securities Act.

- (2)

- No separate consideration will be received for the guarantees, and no separate fee is payable, pursuant to Rule 457(n) under the Securities Act.

THE REGISTRANTS HEREBY AMEND THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANTS SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

- *

- The co-registrants listed on the next page are also included in this Form S-4 Registration Statement as additional registrants.

TABLE OF ADDITIONAL REGISTRANTS

Name of Additional Registrants*

|

State or Other Jurisdiction of Incorporation or Formation |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

|||

|---|---|---|---|---|---|---|

Boise Cascade Building Materials Distribution, L.L.C. |

DE | 5030 | 20-1559691 | |||

Boise Cascade Wood Products Holdings Corp. |

DE | 5030 | 20-1619919 | |||

Boise Cascade Wood Products, L.L.C. |

DE | 2430 | 20-1529142 | |||

BC Chile Investment Corporation |

DE | 2430 | — | |||

Stack Rock Capital, L.L.C. |

DE | 5030 | 61-1665764 |

- *

- Address and telephone numbers of principal executive offices are the same as those of Boise Cascade Company.

The information in this preliminary prospectus is not complete and may be changed. This preliminary prospectus is not an offer to sell these securities and it is not a solicitation of an offer to buy these securities in any jurisdiction where the offering is not permitted.

Subject to Completion, dated April 1, 2013

Preliminary Prospectus

$250,000,000

Boise Cascade Company

Exchange Offer for

63/8% Senior Notes due 2020

Offer (the "Exchange Offer") for outstanding 63/8% senior notes due 2020, in the aggregate principal amount of $250,000,000 (the "Outstanding Notes") in exchange for up to $250,000,000 in aggregate principal amount of 63/8% senior notes due 2020 which have been registered under the Securities Act of 1933, as amended (the "Exchange Notes" and, together with the Outstanding Notes, the "notes").

Material Terms of the Exchange Offer:

- •

- Expires at 11:59 p.m., New York City time, on , 2013, unless extended.

- •

- You may withdraw tendered Outstanding Notes any time before the expiration of the Exchange Offer.

- •

- Not subject to any condition other than that the Exchange Offer does not violate applicable law or any interpretation of

the staff of the United States Securities and Exchange Commission (the "SEC").

- •

- We can amend or terminate the Exchange Offer.

- •

- We will not receive any proceeds from the Exchange Offer.

- •

- The exchange of Outstanding Notes for the Exchange Notes should not be a taxable exchange for United States federal income tax purposes. See "Certain United States Federal Income Tax Considerations."

Terms of the Exchange Notes:

- •

- The terms of the Exchange Notes are substantially identical to those of the Outstanding Notes, except the transfer

restrictions, registration rights and additional interest provisions relating to the Outstanding Notes do not apply to the Exchange Notes.

- •

- The Exchange Notes and the related guarantees will be our general unsecured senior obligations, will rank (i) equal

in right of payment with our and the guarantors' existing and future senior indebtedness, and (ii) senior in right of payment to our and the guarantors' existing and future subordinated

indebtedness, and will be (A) effectively subordinated to our and our guarantors' secured indebtedness, including indebtedness under our senior secured revolving credit facility (the "Revolving

Credit Facility"), to the extent of the value of the collateral securing such indebtedness and (B) structurally subordinated to the indebtedness of any subsidiaries that do not guarantee the

Exchange Notes.

- •

- The Exchange Notes will mature on November 1, 2020. The Exchange Notes will bear interest semi-annually

in cash in arrears on May 1 and November 1 of each year. No interest will be paid on either the Exchange Notes or the Outstanding Notes at the time of the exchange. The Exchange Notes

will accrue interest from and including the last interest payment date on which interest has been paid on the Outstanding Notes, and, if no interest has been paid, the Exchange Notes will accrue

interest since the issue date of the Outstanding Notes.

- •

- The Exchange Notes will be redeemable, in whole or in part, on the redemption dates and at the redemption prices specified under "Description of the Exchange Notes—Optional Redemption." At any time prior to November 1, 2015, we may redeem up to 35% of the Exchange Notes with the proceeds of one or more equity offerings at the redemption price set forth in this prospectus. At any time prior to May 1, 2014, we may redeem all of the Exchange Notes upon the occurrence of a change of control at a redemption price equal to 109% of their principal amount plus accrued and unpaid interest, if any, to the redemption date. If we sell certain of our assets or if we experience specific kinds of changes in control, we must offer to repurchase the Exchange Notes. See "Description of the Exchange Notes—Change of Control." In each case, we must also pay accrued and unpaid interest, if any, to the redemption date.

For a discussion of the specific risks that you should consider before tendering your Outstanding Notes in the Exchange Offer, see "Risk Factors" beginning on page 19 of this prospectus.

There is no established trading market for the Outstanding Notes or the Exchange Notes.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the Exchange Offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. A broker-dealer who acquired Outstanding Notes as a result of market-making or other trading activities may use this Exchange Offer prospectus, as supplemented or amended from time to time, in connection with any resales of the Exchange Notes.

Neither the SEC nor any state securities commission has approved or disapproved of the Exchange Notes or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013

Each broker-dealer that receives Exchange Notes for its own account in exchange for Outstanding Notes that were acquired as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"). A broker-dealer who acquired Outstanding Notes as a result of market-making or other trading activities may use this prospectus, as supplemented or amended from time to time, in connection with any resales of the Exchange Notes. We have agreed that, for a period ending on the earlier of (i) 90 days from the date on which the registration statement, of which this prospectus forms a part, is declared effective and (ii) the date on which broker-dealers are no longer required to deliver a prospectus in connection with such market-making activities or other trading activities, we will make this prospectus available for use in connection with any such resale. See "Plan of Distribution."

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with information different from that contained in this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities other than those specifically offered hereby or an offer to sell any securities offered hereby in any jurisdiction where, or to any person whom, it is unlawful to make such an offer or solicitation. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our 63/8% Senior Notes due 2020.

Boise Cascade Company, a Delaware corporation ("Boise Cascade"), was formed under the name Boise Cascade, L.L.C., a Delaware limited liability company. On February 4, 2013, Boise Cascade converted from a limited liability company into a Delaware corporation. On February 5, 2013, our registration statement on Form S-1 (File No. 333-184964) was declared effective for our initial public offering, and on February 6, 2013, our common stock began trading on the New York Stock Exchange ("NYSE") under the symbol "BCC." On March 28, 2013, the co-issuer of the Outstanding Notes, Boise Cascade Finance Corporation, a Delaware corporation and a former direct subsidiary of Boise Cascade ("Boise Finance"), was merged with and into Boise Cascade, with Boise Cascade as the surviving company (the "Boise Finance Merger").

In this prospectus, unless the context requires otherwise, references to "we," "us" or "our" refer to Boise Cascade and its predecessor, Boise Cascade, L.L.C., together with its subsidiaries, which, prior to the consummation of the Boise Finance Merger, include Boise Finance. References to "the issuers," "an issuer," the "co-issuers" or "a co-issuer" refer to Boise Cascade and/or Boise Finance, as applicable, prior to consummation of the Boise Finance Merger and to Boise Cascade only, after consummation of the Boise Finance Merger.

We refer to the terms "EBITDA" and "Adjusted EBITDA" in various places in this prospectus. EBITDA and Adjusted EBITDA, as presented in this prospectus, are supplemental measures of our performance and liquidity that are not required by or presented in accordance with generally accepted accounting principles in the United States ("GAAP"). EBITDA is defined as income (loss) before interest (interest expense and interest income), income taxes and depreciation and amortization.

EBITDA is the primary measure used by our chief operating decision maker to evaluate segment operating performance and to decide how to allocate resources to segments. We believe EBITDA is useful to investors because it provides a means to evaluate the operating performance of our segments and our company on an ongoing basis using criteria that are used by our internal decision makers and because it is frequently used by investors and other interested parties when comparing companies in our industry that have different financing and capital structures and/or tax rates. We believe EBITDA is a meaningful measure because it presents a transparent view of our recurring operating performance and allows management to readily view operating trends, perform analytical comparisons and identify strategies to improve operating performance. EBITDA, however, is not a measure of our liquidity or financial performance under GAAP and should not be considered as an alternative to net income (loss), income (loss) from operations, or any other performance measure derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. The use of EBITDA instead of net income (loss) or segment income (loss) has limitations as an analytical tool, including the inability to determine profitability; the exclusion of interest expense, interest income and associated significant cash requirements; and the exclusion of depreciation and amortization, which represent unavoidable operating costs. Management compensates for the limitations of EBITDA by relying on our GAAP results. Our measure of EBITDA is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation.

See "Prospectus Summary—Summary Historical Consolidated Financial Data" for a quantitative reconciliation of EBITDA to the most directly comparable GAAP financial performance measure, net income (loss) and a reconciliation of Adjusted EBITDA to EBITDA.

We obtained the industry, market and competitive position data used throughout this prospectus from our own internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties. Third party industry publications include APA—The

Engineered Wood Association's Fourth Quarter Engineered Wood Statistics (published in January 2013), Resource Information Systems Inc.'s ("RISI") 2012 Capacity Report (published in August 2012) and the Home Improvement Research Institute's ("HIRI") Home Improvement Products Market Forecast (published in September 2012), as well as data published by the Blue Chip Economic Indicators as of March 2013, Random Lengths as of February 2013, IHS Global Insight as of March 2013 and the U.S. Census Bureau as of March 2013. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. The information derived from the sources cited in this prospectus represents the most recently available data and, therefore, we believe such data remains reliable. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source.

This prospectus includes trademarks, such as "Boise Cascade," which are protected under applicable intellectual property laws and are our or our subsidiaries' property. This prospectus also contains trademarks, service marks, trade names and copyrights, of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus, including BOISE CASCADE® and the TREE-IN-A-CIRCLE® logo, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

This summary highlights selected information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to participate in the Exchange Offer. You should carefully read the entire prospectus, including the section entitled "Risk Factors" beginning on page 19 and our financial statements and the notes to those financial statements included elsewhere in this prospectus.

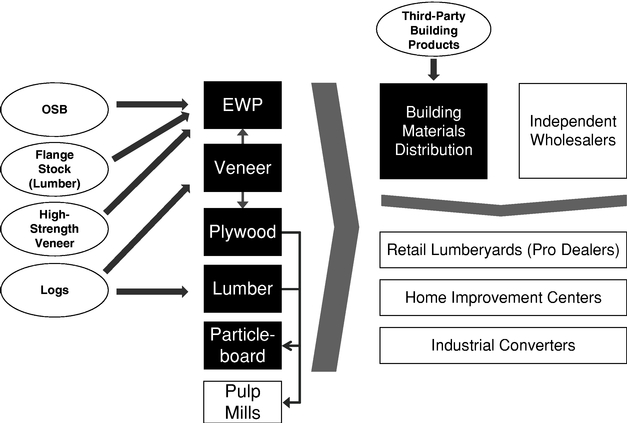

We are a large, vertically-integrated wood products manufacturer and building materials distributor with widespread operations throughout the United States and Canada. We believe we are one of the largest stocking wholesale distributors of building products in the United States. We are also the second largest manufacturer of laminated veneer lumber ("LVL"), I-joists (together "engineered wood products" or "EWP") and of plywood in North America, according to RISI's Capacity Report. Our broad line of products is used primarily in new residential construction, residential repair-and-remodeling projects, light commercial construction and industrial applications. We have a broad base of more than 4,500 customers, which includes a diverse mix of retail lumberyards, home improvement centers, leading wholesalers and industrial converters. We believe our large, vertically-integrated operations provide us with significant advantages over less integrated competitors and position us to optimally serve our customers. For the year ended December 31, 2012, we generated sales of $2,779.1 million, net income of $41.5 million and EBITDA of $96.6 million.

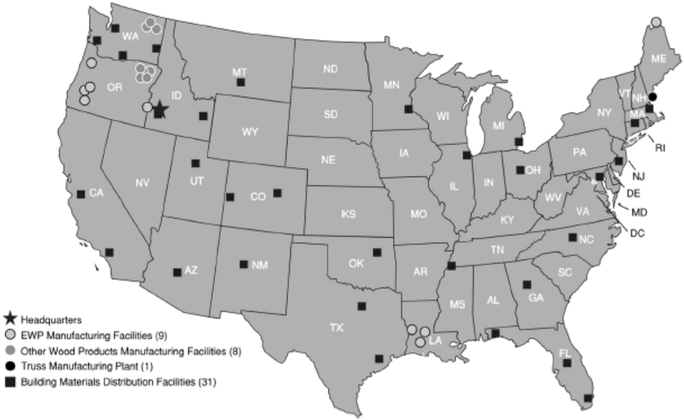

We supply our customers through 49 strategically located facilities (consisting of 18 manufacturing facilities and 31 distribution facilities). In addition to the vertical integration between our manufacturing and distribution operations, our EWP manufacturing facilities are closely integrated with our nearby plywood operations, which allows us to optimize both production processes. Throughout the housing downturn, we have continued to make strategic capital investments to increase our manufacturing capacity and expand our building materials distribution network. We believe that our scale, closely integrated businesses and significant capital investments throughout the downturn provide us with substantial operating leverage to benefit from a recovery in the U.S. housing market.

We operate our company through two primary segments: our Wood Products segment and our Building Materials Distribution segment. The charts below summarize the breakdown of our business for the year ended December 31, 2012.

2012 SALES BY SEGMENT(1)

|

2012 EBITDA BY SEGMENT(2)

|

|

|---|---|---|

|

|

- (1)

- Segment

percentages are calculated before intersegment eliminations.

- (2)

- Segment percentages exclude Corporate and Other segment expenses.

1

Wood Products ($80.2 million, or 71% of EBITDA for 2012). Our Wood Products segment is the second largest manufacturer of EWP and of plywood in North America, according to RISI's Capacity Report, with a highly integrated national network of 17 manufacturing facilities. Our wood products are used primarily in new residential construction, residential repair and remodeling projects and light commercial construction. We manufacture LVL, I-joists and laminated beams, which are high-grade, value-added structural products used in applications where additional strength and consistent quality are required. We also produce plywood, studs, particleboard and ponderosa pine lumber, a premium lumber grade sold primarily to manufacturers of specialty wood windows, moldings and doors. Our EWP manufacturing facilities are closely integrated with our nearby plywood operations to optimize our veneer utilization by enabling us to dedicate higher quality veneers to higher margin applications and lower quality veneers to plywood products, giving us an advantage over our less integrated competitors. For the year ended December 31, 2012, EWP, plywood and lumber accounted for 34%, 45% and 9%, respectively, of our Wood Products sales. Most of our wood products are sold to leading wholesalers (including our Building Materials Distribution segment), home improvement centers, retail lumberyards and industrial converters. For the year ended December 31, 2012, approximately 38% of our Wood Products sales, including approximately 73% of our EWP sales, were to our Building Materials Distribution segment. For the year ended December 31, 2012, our Wood Products segment generated sales, income before interest and taxes and EBITDA of $943.3 million, $55.8 million and $80.2 million, respectively.

Building Materials Distribution ($32.9 million, or 29% of EBITDA for 2012). We believe we are one of the largest national stocking wholesale distributors of building materials in the United States. Our nationwide network of 31 strategically-located distribution facilities sells a broad line of building materials, including EWP, oriented strand board ("OSB"), plywood, lumber and general line items such as framing accessories, composite decking, roofing, siding and insulation. We also operate a truss manufacturing plant located in Maine. Our products are used in the construction of new residential housing, including single-family, multi-family and manufactured homes, repair and remodeling projects and the construction of light industrial and commercial buildings. Except for EWP, we purchase most of these building materials from more than 1,000 third-party suppliers ranging from large manufacturers, such as James Hardie Building Products, Trex Company, Louisiana-Pacific and Georgia-Pacific, to smaller regional producers.

We market our products primarily to retail lumberyards and home improvement centers that then sell the products to end customers, who are typically professional builders, independent contractors and homeowners engaged in residential construction projects. We also market our products to industrial converters, which use our products to assemble windows, doors, agricultural bins and other value-added products used in industrial and repair and remodel applications. Unlike many of our competitors who focus primarily on a narrow range of products, we are a one-stop resource for our customers' building materials needs, which allows for more cost-efficient ordering, delivery and receiving. For the year ended December 31, 2012, our Building Materials Distribution segment generated sales, income before interest and taxes and EBITDA of $2,190.2 million, $24.0 million and $32.9 million, respectively.

The building products manufacturing and distribution industry in North America is highly competitive, with a number of producers manufacturing and selling a broad range of products. Demand for our products is principally influenced by new residential construction, light commercial construction and repair-and-remodeling activity in the United States. Drivers of new residential construction, light commercial construction and repair-and-remodeling activity include new household formation, the age of the housing stock, availability of credit and other macroeconomic factors, such as GDP growth, population growth, migration, interest rates, employment and consumer sentiment. Purchasing decisions

2

made by the customers who buy our wood products are generally based on price, quality and, particularly with respect to EWP, customer service and product support.

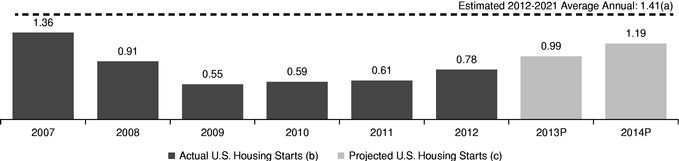

From 2005 to 2012, total housing starts in the United States declined by more than 60%. According to the U.S. Census Bureau, total housing starts in the United States were 0.59 million in 2010, 0.61 million in 2011 and 0.78 million in 2012. While 2012 housing starts increased from 2011 levels, they remained significantly less than the 50-year average rate of 1.5 million. Prior to 2008, the housing market had not experienced a year with total housing starts below 1.0 million since the U.S. Census Bureau began its annual recordkeeping in 1959.

As of March 2013, the Blue Chip Economic Indicators median consensus forecast of single- and multi-family housing starts in the U.S. was approximately 0.99 million units for 2013 and approximately 1.19 million units for 2014, which represent annual increases of 27% and 20%, respectively. We believe that over the long-term, there is considerable growth potential in the U.S. housing sector. As of March 2013, IHS Global Insight estimates that total U.S. single- and multi-family housing starts will average 1.41 million units per year from 2012 through 2021, levels that are in line with the 50-year historical average.

Our products are not only used in new residential construction, but also in residential repair and remodeling projects. Residential repair and remodeling spending increased significantly over the past 15 years. According to the Home Improvement Research Institute ("HIRI"), total home improvement product sales increased 81.5% from $165 billion in 1996 to a peak of $300 billion in 2006. Repair and remodeling spending declined between 2006 and 2010 but posted modest growth thereafter, with total spending in 2012 equaling $274 billion. The overall age of the U.S. housing stock, increased focus on making homes more energy efficient, rising home prices and availability of consumer capital at low interest rates are expected to drive long-term growth in repair and remodeling expenditures. HIRI estimates that total U.S. sales of home maintenance, repair and improvement products will grow at a compounded annual rate of 4.7% from 2012 through 2017.

We believe the following key competitive strengths have contributed to our success and will enable us to execute our growth strategy:

Leadership Positions in Wood Products Manufacturing and Building Materials Distribution on a National Scale

We believe we are one of the leading manufacturers in the North American wood products industry. According to RISI's Capacity Report, we are the second largest producer of EWP and of plywood in North America and we are the largest producer of plywood in the Western United States. We also operate the two largest EWP facilities in North America, as reported in RISI's Capacity Report. From 2005 to 2012, we increased our sales of LVL and I-joists per North American housing start by 69% and 37%, respectively. We have positioned ourselves to take advantage of improving demand in our core markets by expanding our EWP and plywood capacity through capital investments in low-cost, internal veneer manufacturing.

We believe we are one of the largest national stocking wholesale distributors of building materials in the United States and we believe we offer one of the broadest product lines in the industry. Measured on a sales-per-housing start basis, our Building Materials Distribution business has grown significantly from 2005 to 2012, with penetration increasing from $1,476 to $2,808, or approximately 90%, per U.S. housing start. Our national platform of 31 strategically-located distribution facilities supplies products to all major markets in the United States and provides us with significant scale and capacity relative to most of our competitors; however, certain of our competitors are larger than we are and may have greater scale and capacity than we do.

3

Strongly Situated to Serve our Customers with Vertically-Integrated Manufacturing and Distribution Operations

We believe that we are the only large-scale manufacturer of plywood and EWP in North America that is vertically-integrated from log procurement through distribution. The integration of our manufacturing and distribution operations allows us to make procurement, manufacturing, veneer merchandising and marketing decisions that reduce our manufacturing and supply chain costs and allow us to more effectively control quality and working capital. Furthermore, our vertically-integrated operations combined with our national distribution network significantly enhance our ability to assure product supply for our end customers. We believe our vertical integration was an important factor in our ability to increase market share during the recent housing downturn.

Low-Cost Manufacturing and Distribution Footprint

We believe that we have a highly competitive asset base across both of our operating segments, in part because we continued to strategically invest throughout the housing downturn. Our large-scale EWP production facilities are integrated with our nearby plywood operations to optimize our veneer utilization, which we believe helps position us as a competitive manufacturer in the growing EWP business. In the past three years, we completed a number of initiatives in our Wood Products segment that strengthened our asset base, substantially reduced our costs and enhanced our operating performance.

We believe that our plywood facilities in Kettle Falls, Washington and Elgin, Oregon are among the lowest cost Douglas fir plywood facilities in North America. Additionally, in the active timberland markets in which we operate, our manufacturing facilities are clustered to enable us to efficiently utilize fiber resources and to shift production depending on demand. We believe we are the only manufacturer in the inland Pacific Northwest with the integrated primary and secondary facilities necessary to process all softwood species.

Significant Capital Invested to Position us for Growth as the Housing Market Recovers

Our operations are well-positioned to serve our customers and take advantage of the recovery that we believe is underway in the U.S. housing market. From 2005 to 2012, we invested approximately $300 million (excluding acquisitions) to upgrade and maintain our Wood Products facilities and opportunistically expand our Building Materials Distribution facilities. Since 2005, we have increased our covered warehouse space by over 65% and have more than doubled our outdoor storage acreage. We expect to make further capital investments in cost and operational improvements, primarily related to internal veneer production, which will further enhance our competitive position and allow us to capture growth opportunities. For the year ended December 31, 2012, we operated our EWP facilities at approximately 52% of LVL press capacity, providing us with substantial unused capacity. Additionally, we believe that our Building Materials Distribution facilities can support a considerable ramp-up in housing starts with no significant requirement for new capacity and will allow us to double our sales without increasing our existing footprint.

Experienced Management Team and Principal Equityholder

Madison Dearborn Partners, LLC ("Madison Dearborn") has a long and successful track record of investing in manufacturing and distribution businesses. Our senior management team has an average of approximately 30 years of experience in forest products manufacturing and building materials distribution with a track record of financial and operational excellence in both favorable and challenging market conditions.

4

We intend to capitalize on our strong market position in wood products manufacturing and building materials distribution to increase revenues and profits and maximize cash flow as the U.S. housing market recovers. We seek to achieve this objective by executing on the following strategies:

Grow our Wood Products Segment Operations with a Focus on Expanding our Market Position in EWP

We will continue to expand our market position in EWP by focusing on our large-scale manufacturing position, comprehensive customer service, design support capabilities and efficient distribution network. We have positioned ourselves to take advantage of expected increases in the demand for EWP per housing start by expanding our capacity through capital investments in low-cost, internal veneer manufacturing. We have also developed strategic relationships with third-party veneer suppliers to support additional EWP production as needed. Additionally, we intend to grow our Wood Products business through strategic acquisitions.

Grow Market Share in our Building Materials Distribution Segment

We intend to grow our Building Materials Distribution business in existing markets by adding products and services to better serve our customers. We also plan to opportunistically expand our Building Materials Distribution business into nearby geographies that we currently serve using off-site storage arrangements or longer truck routes. We will continue to grow our Building Materials Distribution business by opportunistically acquiring facilities, adding new products, opening new locations, relocating and expanding capacity at existing facilities and capturing local market share through our superior supply chain capabilities and customer service.

Further Differentiate our Products and Services to Capture Market Share

We seek to continue to differentiate ourselves from our competitors by providing a broad line of high-quality products and superior customer service. Our highly efficient logistics system allows us to deliver superior customer service and assist our customers in optimizing their working capital. Our national distribution platform, coupled with the manufacturing capabilities of our Wood Products segment differentiates us from most of our competitors and is critical to servicing retail lumberyards, home improvement centers and industrial converters. Additionally, this system allows us to procure product more efficiently and to develop and maintain stronger relationships with our vendors. Because of these relationships and our national presence, many of our vendors have offered us favorable pricing and provide us with enhanced product introductions and ongoing marketing support.

Continue to Improve our Competitiveness through Operational Excellence

We use a disciplined cost management approach to maximize our competitiveness without sacrificing our ability to react to future growth opportunities. Additionally, we have made capital investments and process improvements in certain facilities, which have decreased our production costs and allowed us to produce lower-cost, higher-quality veneers. Beginning in 2009, we adopted a data-driven process improvement program to further strengthen our manufacturing operations. Because of the significant gains we continue to see from this program, we believe there are opportunities to apply similar techniques and methods to different functional areas (including sales and marketing) to realize efficiencies in those areas.

5

In anticipation of the initial public offering of our common stock, on February 4, 2013, Boise Cascade, L.L.C., our predecessor and a Delaware limited liability company, converted into Boise Cascade Company. On February 5, 2013, our registration statement on Form S-1 (File No. 333-184964) was declared effective for our initial public offering, pursuant to which we registered the offering and sale of 13,529,412 shares of our common stock, including 1,764,706 additional shares pursuant to the underwriters' option to purchase additional shares, at a public offering price of $21.00 per share. On February 6, 2013, our common stock began trading on the NYSE under the symbol "BCC."

Our initial public offering was consummated on February 11, 2013. We received net proceeds of approximately $263 million, after deducting underwriting discounts and commissions of approximately $19 million and offering expenses of approximately $2 million. We used $25 million of the net proceeds from the offering to repay borrowings under the Revolving Credit Facility and intend to use the remainder for general corporate purposes.

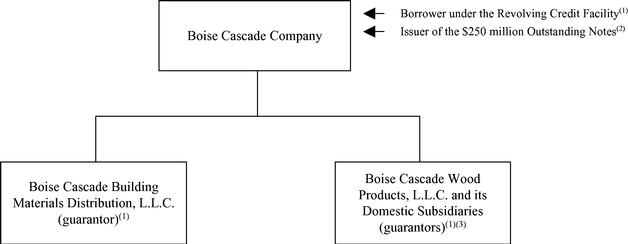

The following chart reflects certain relevant aspects of our corporate structure and principal indebtedness as of April 1, 2013, after giving effect to the Boise Finance Merger:

- (1)

- At

December 31, 2012, we had $25 million aggregate principal amount of outstanding borrowings under the Revolving Credit Facility and

approximately $10 million of outstanding letters of credit, which reduced our borrowing capacity under the Revolving Credit Facility by an equivalent amount. On February 12, 2013, we

repaid the $25 million of outstanding borrowings with a portion of the net proceeds from our initial public offering. Boise Cascade Building Materials Distribution, L.L.C. and Boise Cascade

Wood Products, L.L.C. are co-borrowers under the Revolving Credit Facility.

- (2)

- The notes are guaranteed by each of Boise Cascade's existing and future direct or indirect domestic subsidiaries that is a guarantor or co-borrower under the Revolving Credit Facility. For the year ended December 31, 2012, the co-issuers and the guarantors represented 99.5% of our consolidated net revenue after elimination of intercompany sales. For the year ended December 31, 2012, the co-issuers and the guarantors represented 107.0% of our income from operations. As of December 31, 2012, the co-issuers and the guarantors represented 98.1% of our consolidated total assets and 99.7% of our consolidated total liabilities, after elimination of intercompany balances. For additional information regarding the consolidating financial information for Boise Cascade, the guarantors and the nonguarantors for each of the periods

6

presented, see Note 18, "Consolidating Guarantor and Nonguarantor Financial Information," to our audited consolidated financial statements included elsewhere in this prospectus.

- (3)

- This chart does not reflect certain foreign indirect subsidiaries of Boise Cascade Wood Products, L.L.C. formed to conduct operations or own assets in Canada, Chile, the United Kingdom and Taiwan. None of these subsidiaries guarantees the notes.

Our principal stockholder, Boise Cascade Holdings, L.L.C. ("BC Holdings"), is controlled by Forest Products Holdings, L.L.C. ("FPH"), an entity controlled by an investment fund managed by Madison Dearborn. Madison Dearborn, based in Chicago, is an experienced private equity investment firm that has raised over $18 billion of capital. Since its formation in 1992, Madison Dearborn's investment funds have invested in approximately 125 companies across a broad spectrum of industries, including basic industries; business and government services; consumer; financial services; healthcare; and telecom, media and technology services. Madison Dearborn's objective is to invest in companies with strong competitive characteristics that it believes have the potential for significant long-term equity appreciation. To achieve this objective, Madison Dearborn seeks to partner with outstanding management teams that have a solid understanding of their businesses as well as track records of building stockholder value.

We were formed under the name Boise Cascade, L.L.C., a Delaware limited liability company, in October 2004 in connection with our acquisition of OfficeMax's forest products and paper assets. On February 4, 2013, we converted from a limited liability company into a Delaware corporation and became Boise Cascade Company. Our principal executive offices are located at 1111 West Jefferson Street, Suite 300, Boise, Idaho 83702. Our telephone number at that location is (208) 384-6161. Our website address is www.bc.com. The reference to our website is a textual reference only. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

Our key registered trademarks include BOISE CASCADE® and the TREE-IN-A-CIRCLE® logo. This prospectus also refers to the products or services of other companies by the trademarks and trade names used and owned by those companies.

7

The summary below describes the principal terms of the Exchange Offer. Certain of the terms and conditions described below are subject to important limitations and exceptions. The "Description of the Exchange Offer" section of this prospectus contains a more detailed description of the terms and conditions of the Exchange Offer.

Initial Offering of Outstanding Notes |

On October 22, 2012, Boise Cascade and Boise Finance sold, through a private placement exempt from the registration requirements of the Securities Act, $250,000,000 of our 63/8% senior notes due 2020, all of which are eligible to be exchanged for Exchange Notes. | |

|

On March 28, 2013, in accordance with the terms of the indenture governing the notes, Boise Finance was merged with and into Boise Cascade Company, with Boise Cascade Company as the surviving entity. After giving effect to the Boise Finance Merger, Boise Cascade survives as the sole issuer of the notes. |

|

Registration Rights Agreement |

Simultaneously with the initial offering of the Outstanding Notes, we entered into a registration rights agreement with the initial purchasers of the Outstanding Notes (the "Registration Rights Agreement"). Under the Registration Rights Agreement, we are required to file a registration statement with the SEC for substantially identical debt securities (and related guarantees), which will be issued in exchange for the Outstanding Notes. You may exchange your Outstanding Notes for Exchange Notes in this Exchange Offer. You should read the discussion under the headings "—Summary of Terms of the Exchange Notes," "Exchange Offer" and "Description of the Exchange Notes" for further information regarding the Exchange Notes. |

|

Exchange Notes Offered |

$250,000,000 aggregate principal amount of 63/8% senior notes due 2020. |

|

Exchange Offer |

We are offering to exchange the Outstanding Notes for a like principal amount at maturity of the Exchange Notes. Outstanding Notes may be exchanged only in denominations of $2,000 and integral multiples of $1,000 in excess thereof. The Exchange Offer is being made pursuant to the Registration Rights Agreement which grants the initial purchasers and any subsequent holders of the Outstanding Notes certain exchange and registration rights. This Exchange Offer is intended to satisfy those exchange and registration |

8

|

rights with respect to the Outstanding Notes. After the Exchange Offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your Outstanding Notes. |

|

Expiration Date; Withdrawal of Tender |

The Exchange Offer will expire at 11:59 p.m., New York City time, on , 2013, or a later time if we choose to extend the Exchange Offer in our sole and absolute discretion. You may withdraw your tender of Outstanding Notes at any time prior to the expiration date. All Outstanding Notes that are validly tendered and not validly withdrawn will be exchanged. Any Outstanding Notes not accepted by us for exchange for any reason will be returned to you at our expense as promptly as possible after the expiration or termination of the Exchange Offer. |

|

Broker-Dealer |

Each broker-dealer acquiring Exchange Notes issued for its own account in exchange for Outstanding Notes, which it acquired through market-making activities or other trading activities, must acknowledge that it will deliver a proper prospectus when any Exchange Notes issued in the Exchange Offer are transferred. A broker-dealer may use this prospectus for an offer to resell, a resale or other retransfer of the Exchange Notes issued in the Exchange Offer. |

|

Prospectus Recipients |

We mailed this prospectus and the related exchange offer documents to registered holders of the Outstanding Notes as of , 2013. |

|

Conditions to the Exchange Offer |

Our obligation to accept for exchange, or to issue the Exchange Notes in exchange for, any Outstanding Notes is subject to certain customary conditions, including our determination that the Exchange Offer does not violate any law, statute, rule, regulation or interpretation by the staff of the SEC or any regulatory authority or other foreign, federal, state or local government agency or court of competent jurisdiction, some of which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See "Exchange Offer—Conditions to the Exchange Offer." |

|

Procedures for Tendering Outstanding Notes Held in the Form of Book-Entry Interests |

The Outstanding Notes were issued as global securities and were deposited upon issuance with U.S. Bank National Association, as custodian for The Depository Trust Company ("DTC"). |

9

|

Beneficial interests in the Outstanding Notes, which are held by direct or indirect participants in DTC, are shown on, and transfers of the Outstanding Notes can only be made through, records maintained in book-entry form by DTC. |

|

|

You may tender your Outstanding Notes by instructing your broker or bank where you keep the Outstanding Notes to tender them for you. In some cases you may be asked to submit the letter of transmittal that may accompany this prospectus. By tendering your Outstanding Notes you will be deemed to have acknowledged and agreed to be bound by the terms set forth under "Exchange Offer." Your Outstanding Notes must be tendered in denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

|

|

In order for your tender of Outstanding Notes for Exchange Notes in the Exchange Offer to be considered valid, you must transmit to the exchange agent on or before 11:59 p.m., New York City time on the expiration date either: |

|

|

• an original or facsimile of a properly completed and duly executed copy of the letter of transmittal, which accompanies this prospectus, together with your Outstanding Notes and any other documentation required by the letter of transmittal, at the address provided on the cover page of the letter of transmittal; or |

|

|

• if the Outstanding Notes you own are held of record by DTC, in book-entry form and you are making delivery by book-entry transfer, a computer-generated message transmitted by means of the Automated Tender Offer Program System of DTC ("ATOP"), in which you acknowledge and agree to be bound by the terms of the letter of transmittal and which, when received by the exchange agent, forms a part of a confirmation of book-entry transfer. As part of the book-entry transfer, DTC will facilitate the exchange of your Outstanding Notes and update your account to reflect the issuance of the Exchange Notes to you. ATOP allows you to electronically transmit your acceptance of the Exchange Offer to DTC instead of physically completing and delivering a letter of transmittal to the exchange agent. |

10

|

In addition, you must deliver, to the exchange agent on or before 11:59 p.m., New York City time on the expiration date, a timely confirmation of book-entry transfer of your Outstanding Notes into the account of the exchange agent at DTC if you are effecting delivery via book-entry transfer. |

|

Special Procedures for Beneficial Holders |

If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of Outstanding Notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or Outstanding Notes in the Exchange Offer, you should contact the person in whose name your book-entry interests or Outstanding Notes are registered promptly and instruct that person to tender on your behalf. |

|

United States Federal Income Tax Considerations |

The Exchange Offer should not result in any income, gain or loss to the holders of Outstanding Notes for United States federal income tax purposes. See "Certain United States Federal Income Tax Considerations." |

|

Use of Proceeds |

We will not receive any proceeds from the issuance of the Exchange Notes in the Exchange Offer. |

|

Exchange Agent |

U.S. Bank National Association is serving as the exchange agent for the Exchange Offer. |

|

Shelf Registration Statement |

In limited circumstances, holders of Outstanding Notes may require us to register their Outstanding Notes under a shelf registration statement. |

11

Consequences of Not Exchanging Outstanding Notes

If you do not exchange your Outstanding Notes in the Exchange Offer, your Outstanding Notes will continue to be subject to the restrictions on transfer currently applicable to the Outstanding Notes. In general, you may offer or sell your Outstanding Notes only:

- •

- if they are registered under the Securities Act and applicable state securities laws;

- •

- if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities

laws; or

- •

- if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws.

We do not currently intend to register the Outstanding Notes under the Securities Act. Under some circumstances, however, holders of the Outstanding Notes, including holders who are not permitted to participate in the Exchange Offer or who may not freely resell Exchange Notes received in the Exchange Offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of Outstanding Notes by these holders. For more information regarding the consequences of not tendering your Outstanding Notes and our obligation to file a shelf registration statement, see "Exchange Offer—Consequences of Failure to Exchange" and "—Shelf Registration."

12

Summary of Terms of the Exchange Notes

Issuer |

After consummation of the Boise Finance Merger, Boise Cascade Company, a Delaware corporation, survives as the sole issuer of the notes. Boise Cascade Company and its former wholly-owned subsidiary, Boise Cascade Finance Corporation, a Delaware corporation, were the original co-issuers of the Outstanding Notes. | |

Securities |

$250,000,000 aggregate principal amount of 63/8% senior notes due 2020. |

|

Maturity |

The Exchange Notes will mature on November 1, 2020. |

|

Interest Rate |

The Exchange Notes will bear interest at 63/8% per annum, payable semi-annually in cash in arrears on May 1 and November 1. |

|

Interest Payment Dates |

No interest will be paid on either the Exchange Notes or the Outstanding Notes at the time of the exchange. The Exchange Notes will accrue interest from and including the last interest payment date on which interest has been paid on the Outstanding Notes, and, if no interest has been paid, the Exchange Notes will accrue interest since the issue date of the Outstanding Notes. |

|

|

Accordingly, the holders of Outstanding Notes that are accepted for exchange will not receive accrued but unpaid interest on such Outstanding Notes at the time of tender. Rather, that interest will be payable on the Exchange Notes delivered in exchange for the Outstanding Notes on the first interest payment date after the expiration date of the Exchange Offer. |

|

Ranking |

The Exchange Notes and the related guarantees will be our general unsecured senior obligations and will: |

|

|

• rank senior in right of payment to our existing and future indebtedness and other obligations that expressly provide for their subordination to the notes and the guarantees; |

|

|

• rank equally in right of payment with all of our existing and future senior indebtedness; and |

|

|

• be effectively subordinated to our secured indebtedness to the extent of the value of the collateral securing such indebtedness. |

13

Guarantees |

The Exchange Notes will be fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis by each of our existing and future direct or indirect domestic subsidiaries that is a guarantor or co-borrower under the Revolving Credit Facility. As of the date of this prospectus, all of our domestic Restricted Subsidiaries (as defined in the indenture governing the notes), guarantee the Outstanding Notes. |

|

|

For the year ended December 31, 2012, the co-issuers and the guarantors represented 99.5% of our consolidated net revenue after elimination of intercompany sales. For the year ended December 31, 2012, the co-issuers and the guarantors represented 107.0% of our income from operations. As of December 31, 2012, the co-issuers and the guarantors represented 98.1% of our consolidated total assets and 99.7% of our consolidated total liabilities, after elimination of intercompany balances. For additional information regarding the consolidating financial information for Boise Cascade, the guarantors and the nonguarantors for each of the periods presented, see Note 18, "Consolidating Guarantor and Nonguarantor Financial Information," to our audited consolidated financial statements included elsewhere in this prospectus. |

|

|

On the issue date of the Outstanding Notes, the Outstanding Notes were guaranteed by BC Holdings. Pursuant to the indenture governing the notes, BC Holdings' guarantee of the notes was automatically released when our common stock was registered under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and was listed on the NYSE. |

|

Optional Redemption |

On or after November 1, 2015, we may redeem some or all of the Exchange Notes at any time at the redemption prices described in the section "Description of the Exchange Notes—Optional Redemption," plus accrued and unpaid interest to the redemption date. We may also redeem some or all of the Exchange Notes before November 1, 2015 at a redemption price of 100% of the principal amount plus accrued and unpaid interest to the redemption date, plus an applicable premium. In addition, we may redeem up to 35% of the aggregate principal amount of the Exchange Notes before November 1, 2015 with the proceeds of certain equity offerings at a redemption price of 106.375% of the principal amount plus accrued and unpaid interest to the redemption date. At any time prior to May 1, 2014 we may redeem all of the Exchange Notes upon the occurrence of a change of control at a redemption price equal to 109% of the principal amount of the Exchange Notes redeemed, plus accrued and unpaid interest, if any, to the redemption date. See "Description of the Exchange Notes—Optional Redemption." |

14

Mandatory Offer to Repurchase; Change of Control and Asset Sales |

If a change of control occurs, we must give holders of the Exchange Notes an opportunity to sell the Exchange Notes at a purchase price of 101% of the principal amount of such Exchange Notes, plus accrued and unpaid interest, to the date of repurchase. The term "change of control" is defined under "Description of the Exchange Notes—Certain Definitions." |

|

|

If we or any of our restricted subsidiaries sell assets under certain circumstances, we will be required to make an offer to purchase the Exchange Notes at their face amount, plus accrued and unpaid interest, if any, to the date of repurchase. See "Description of the Exchange Notes—Certain Covenants—Limitation on Sales of Assets and Subsidiary Stock." |

|

Certain Indenture Provisions |

The indenture under which the Outstanding Notes were issued will govern the Exchange Notes. The indenture contains covenants limiting our ability and the ability of some of our subsidiaries to: |

|

|

• incur additional debt; |

|

|

• declare or pay dividends, redeem stock or make other distributions to stockholders; |

|

|

• make investments; |

|

|

• create liens or use assets as security in other transactions; |

|

|

• merge or consolidate, or sell, transfer, lease or dispose of substantially all of our assets; |

|

|

• enter into transactions with affiliates; and |

|

|

• sell or transfer certain assets. |

|

|

If the notes are rated investment grade by the credit rating agencies, we and our restricted subsidiaries will no longer be subject to certain of these covenants and will become subject to certain other limitations. These covenants are subject to a number of important qualifications and limitations. See "Description of the Exchange Notes—Certain Covenants—Covenant Termination" and "—Investment Grade Covenants." |

|

Use of Proceeds |

We will not receive any proceeds from the issuance of the Exchange Notes in the Exchange Offer. |

|

Absence of an Established Market for the Exchange Notes |

The Exchange Notes will be a new class of securities for which there is currently no market. We cannot assure you that a liquid market for the Exchange Notes will develop or be maintained, your ability to sell the Exchange Notes or the price at which you would be able to sell the Exchange Notes. |

15

You should consider carefully all of the information included in this prospectus and, in particular, the information under the heading "Risk Factors" beginning on page 19 prior to deciding to tender your Outstanding Notes in the Exchange Offer.

16

Summary Historical Consolidated Financial Data

The following tables set forth our summary consolidated historical financial data. You should read the information set forth below in conjunction with "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated historical financial statements and notes thereto included elsewhere in this prospectus. The statements of operations data for each of the years ended December 31, 2010, 2011 and 2012 and the balance sheet data as of December 31, 2012 set forth below are derived from our audited consolidated financial statements included elsewhere in this prospectus. See "Index to Consolidated Financial Statements."

| |

Year Ended December 31 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

| |

(in thousands, except ratio) |

|||||||||

Statements of Operations Data |

||||||||||

Sales |

$ | 2,240,591 | $ | 2,248,088 | $ | 2,779,062 | ||||

Costs and expenses(1) |

2,253,753 | 2,275,134 | 2,715,931 | |||||||

Income (loss) from operations |

(13,162 | ) | (27,046 | ) | 63,131 | |||||

Foreign exchange gain (loss) |

352 | (497 | ) | 37 | ||||||

Gain on repurchase of long-term debt(2) |

28 | — | — | |||||||

Interest expense |

(21,005 | ) | (18,987 | ) | (21,757 | ) | ||||

Interest income |

790 | 407 | 392 | |||||||

|

(19,835 | ) | (19,077 | ) | (21,328 | ) | ||||

Income (loss) before income taxes |

(32,997 | ) | (46,123 | ) | 41,803 | |||||

Income tax provision |

(300 | ) | (240 | ) | (307 | ) | ||||

Net income (loss) |

$ | (33,297 | ) | $ | (46,363 | ) | $ | 41,496 | ||

Other Financial Data |

||||||||||

Depreciation and amortization |

$ | 34,899 | $ | 37,022 | $ | 33,407 | ||||

Capital expenditures(3) |

35,751 | 39,319 | 29,741 | |||||||

EBITDA(4) |

22,117 | 9,479 | 96,575 | |||||||

Adjusted EBITDA(4) |

17,476 | 9,479 | 96,575 | |||||||

Ratio of earnings to fixed charges(5) |

— | — | 2.51 | |||||||

| |

Year Ended December 31, 2012 |

|||

|---|---|---|---|---|

| |

(in thousands) |

|||

Balance Sheet Data |

||||

Cash and cash equivalents |

$ | 54,507 | ||

Total current assets |

527,457 | |||

Property and equipment, net |

265,924 | |||

Total assets |

836,398 | |||

Total long-term debt |

275,000 | |||

Total stockholder's equity |

97,764 | |||

- (1)

- In

2010, costs and expenses include $4.6 million of income associated with receiving proceeds from a litigation settlement related to vendor product

pricing. In 2011, costs and expenses include $3.8 million of expense related to the closure of a laminated beam plant and noncash asset write-downs.

- (2)

- Represents gain on the repurchase of $8.6 million of our senior subordinated notes in 2010.

17

- (3)

- 2011

includes $5.8 million of cash paid for the acquisition of a laminated beam and decking manufacturing plant in Homedale, Idaho. For 2012,

includes $2.4 million for the acquisition of a sawmill in Arden, Washington.

- (4)

- EBITDA

is defined as income (loss) before interest (interest expense and interest income), income taxes and depreciation and amortization. EBITDA is the

primary measure used by our chief operating decision maker to evaluate segment operating performance and to decide how to allocate resources to segments. We believe EBITDA is useful to investors

because it provides a means to evaluate the operating performance of our segments and our company on an ongoing basis using criteria that are used by our internal decision makers and because it is

frequently used by investors and other interested parties when comparing companies in our industry that have different financing and capital structures and/or tax rates. We believe EBITDA is a

meaningful measure because it presents a transparent view of our recurring operating performance and allows management to readily view operating trends, perform analytical comparisons and identify

strategies to improve operating performance. EBITDA, however, is not a measure of our liquidity or financial performance under GAAP and should not be considered as an alternative to net income (loss),

income (loss) from operations, or any other performance measure derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. The use of

EBITDA instead of net income (loss) or segment income (loss) has limitations as an analytical tool, including the inability to determine profitability; the exclusion of interest expense, interest

income and associated significant cash requirements; and the exclusion of depreciation and amortization, which represent unavoidable operating costs. Management compensates for the limitations of

EBITDA by relying on our GAAP results. Our measure of EBITDA is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of

calculation.

Adjusted EBITDA is defined as EBITDA before certain other unusual items, including gain on the repurchase of long-term debt and a litigation gain.

The following is a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA:

| |

Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

| |

(in millions) |

|||||||||

Net income (loss) |

$ | (33.3 | ) | $ | (46.4 | ) | $ | 41.5 | ||

Interest expense |

21.0 | 19.0 | 21.8 | |||||||

Interest income |

(0.8 | ) | (0.4 | ) | (0.4 | ) | ||||

Income tax provision |

0.3 | 0.2 | 0.3 | |||||||

Depreciation and amortization |

34.9 | 37.0 | 33.4 | |||||||

EBITDA |

$ | 22.1 | $ | 9.5 | $ | 96.6 | ||||

Gain on repurchase of long-term debt(a) |

(0.0 | ) | — | — | ||||||

Litigation gain(b) |

(4.6 | ) | — | — | ||||||

Adjusted EBITDA |

$ | 17.5 | $ | 9.5 | $ | 96.6 | ||||

- (a)

- See

Note (2) above.

- (b)

- See Note (1) above.

- (5)

- For purposes of calculating earnings to fixed charges, earnings consist of pre-tax income (loss) plus fixed charges and amortization of deferred financing costs less capitalized interest. Fixed charges include interest, whether expensed or capitalized, amortization, discounts and capitalized debt expense and the portion of rental expense that is representative of the interest factors in these rentals. Earnings were insufficient to cover fixed charges by approximately $33.0 million and $46.1 million for the years ended December 31, 2010 and 2011, respectively.

18

Investing in the notes and participating in the Exchange Offer are subject to a number of important risks and uncertainties, some of which are described below. Any of the following risks could materially and adversely affect our business, cash flows, financial condition or results of operations. In such a case, you may lose all or part of your investment in the notes.

You should carefully consider the following factors in addition to the other information included in this prospectus before deciding to invest in the notes or to participate in the Exchange Offer.

Risks Relating to the Exchange Offer

Because there is no public market for the Exchange Notes, you may not be able to resell your notes.

The Exchange Notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market, and there can be no assurance as to:

- •

- the liquidity of any trading market that may develop;

- •

- the ability of holders to sell their Exchange Notes; or

- •

- the price at which the holders would be able to sell their Exchange Notes.

If a trading market were to develop, the Exchange Notes may trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar securities and our financial performance.

We offered the Outstanding Notes in reliance upon an exemption from registration under the Securities Act and applicable state securities laws. Therefore, the Outstanding Notes may be transferred or resold only in a transaction registered under or exempt from the Securities Act and applicable state securities laws. We are conducting the Exchange Offer pursuant to an effective registration statement, whereby we are offering to exchange the Outstanding Notes for substantially identical notes that you will be able to trade without registration under the Securities Act provided you are not one of our affiliates. We cannot assure you that the Exchange Offer will be conducted in a timely fashion. Moreover, we cannot assure you that an active or liquid trading market for the Exchange Notes will develop. For more information, see "Exchange Offer."

You must comply with the Exchange Offer procedures in order to receive new, freely tradable Exchange Notes.

Delivery of Exchange Notes in exchange for Outstanding Notes tendered and accepted for exchange pursuant to the Exchange Offer will be made only in compliance with the procedures set forth in "Exchange Offer—Procedures for Tendering Outstanding Notes." We are not required to notify you of defects or irregularities in tenders of Outstanding Notes for exchange. Exchange Notes that are not tendered or that are tendered but we do not accept for exchange will, following consummation of the Exchange Offer, continue to be subject to the existing transfer restrictions under the Securities Act and, upon consummation of the Exchange Offer, certain registration and other rights under the Registration Rights Agreement will terminate. See "Exchange Offer—Procedures for Tendering Outstanding Notes" and "Exchange Offer—Consequences of Failure to Exchange."

Holders of Outstanding Notes who fail to exchange their Outstanding Notes in the Exchange Offer will continue to be subject to restrictions on transfer.

If you do not exchange your Outstanding Notes for Exchange Notes in the Exchange Offer, you will continue to be subject to the restrictions on transfer applicable to the Outstanding Notes. The restrictions on transfer of your Outstanding Notes arise because we issued the Outstanding Notes under exemptions from, or in transactions not subject to, the registration requirements of the Securities Act

19

and applicable state securities laws. In general, you may only offer or sell the Outstanding Notes if they are registered under the Securities Act and applicable state securities laws, or offered and sold under an exemption from these requirements. We do not plan to register the Outstanding Notes that are not exchanged pursuant to the Exchange Offer under the Securities Act. For further information regarding the consequences of tendering your Outstanding Notes in the Exchange Offer, see the discussion herein under the caption "Exchange Offer—Consequences of Failure to Exchange."

Some holders who exchange their Outstanding Notes may be deemed to be underwriters, and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your Outstanding Notes in the Exchange Offer for the purpose of participating in a distribution of the Exchange Notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

Risks Relating to the Notes

Our substantial level of debt could adversely affect our financial condition and prevent us from fulfilling our obligations under the notes.

As of December 31, 2012, without giving effect to our conversion from a limited liability company to a corporation and the completion of our initial public offering and the use of proceeds therefrom, the co-issuers had approximately $275 million aggregate principal amount of outstanding indebtedness under the Revolving Credit Facility and the Outstanding Notes. In the future, we may incur additional indebtedness. Our high level of debt could have important consequences to the holders of the notes, including the following:

- •

- making it more difficult for us to satisfy our obligations with respect to the notes and their other debt;

- •

- requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes,

thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes;

- •

- limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or

other general corporate requirements;

- •

- increasing our vulnerability to general adverse economic and industry conditions;

- •

- exposing us to the risk of increased interest rates as certain of our borrowings are at variable rates of interest;

- •

- limiting our flexibility in planning for and reacting to changes in the industry in which we compete;

- •

- placing us at a disadvantage compared to other, less leveraged competitors; and

- •

- increasing our cost of borrowing.

Our ability to service our indebtedness will depend on our future performance, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors. Some of these factors are beyond our control. If we cannot service our indebtedness and meet our other obligations and commitments, we might be required to refinance our debt or to dispose of assets to obtain funds for such purpose. We cannot assure you that refinancing or asset dispositions could be effected on a timely basis or on satisfactory terms, if at all, or would be permitted by the terms of our debt instruments.

20

Despite our high level of indebtedness, we will still be able to incur significant additional amounts of debt, which could further exacerbate the risks associated with our substantial indebtedness.

We may be able to incur substantial additional debt in the future. After giving effect to our conversion from a limited liability company to a corporation and the completion of our initial public offering and the use of proceeds therefrom, $10.0 million of outstanding letters of credit and borrowing base limitations, as of December 31, 2012, we would have had up to $220.6 million available for borrowing under the Revolving Credit Facility. Although the indenture governing the notes and the Revolving Credit Facility contain restrictions on the incurrence of additional debt, these restrictions are subject to a number of significant qualifications and exceptions, and under certain circumstances, the amount of debt that could be incurred in compliance with these restrictions could be substantial. In addition, the indenture governing the notes and the Revolving Credit Facility will not prevent us from incurring other obligations that do not constitute indebtedness under those agreements. If new debt is added to our existing debt levels, the risks associated with our substantial indebtedness described above, including our possible inability to service our debt, will increase.

The terms of the Revolving Credit Facility and the indenture governing the notes restrict, and covenants governing indebtedness in the future may restrict, us from capitalizing on business opportunities.

The Revolving Credit Facility and the indenture governing the notes impose, and the terms of any future indebtedness may impose, significant operating and financial restrictions on us. These restrictions limit our ability, among other things, to:

- •

- incur additional indebtedness or enter into sale and leaseback financings;

- •

- pay certain dividends or make certain distributions on our capital stock or repurchase or redeem our capital stock;

- •

- make certain capital expenditures;

- •

- make certain loans, investments or other restricted payments;

- •

- place restrictions on the ability of our subsidiaries to pay dividends or make other payments to us;

- •

- engage in transactions with stockholders or affiliates;

- •

- sell certain assets or engage in mergers, acquisitions and other business combinations;

- •

- amend or otherwise alter the terms of our indebtedness;

- •

- guarantee indebtedness or incur other contingent obligations; and

- •

- create liens.

In addition, the Revolving Credit Facility provides that if an event of default occurs or excess availability under the Revolving Credit Facility drops below a threshold amount equal to the greater of 12.5% of the aggregate commitments thereunder or $31.25 million (and until such time as excess availability for two consecutive fiscal months exceeds that threshold amount and no event of default has occurred and is continuing), we will be required to maintain a monthly minimum fixed coverage charge ratio of 1.0:1.0, determined on a trailing twelve-month basis. Our ability to comply with this covenant is dependent, in part, on our future performance, which will be subject to many factors, some of which are beyond our control.

As a result of these covenants and restrictions, we will be limited as to how we conduct our business and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur could include more restrictive covenants. We cannot assure you that we will be able to maintain

21

compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lenders or noteholders and/or amend any of these covenants.