Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-194342

PROSPECTUS

3,000,000 Shares

Adamas Pharmaceuticals, Inc.

Common Stock

This is the initial public offering of shares of common stock of Adamas Pharmaceuticals, Inc. Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock is $16.00 per share. Our common stock has been approved for listing on the NASDAQ Global Market under the symbol "ADMS."

The underwriters have an option to purchase a maximum of 450,000 additional shares to cover over-allotments.

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 10.

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to Adamas |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Per Share | $ | 16.00 | $ | 1.12 | $ | 14.88 | ||||

| Total | $ | 48,000,000 | $ | 3,360,000 | $ | 44,640,000 | ||||

- (1)

- See "Underwriting" beginning on page 137 for additional information regarding underwriting compensation.

Certain of our directors and existing stockholders, or their affiliates, are purchasing an aggregate of 362,500 shares of our common stock in this offering. The shares will be offered and sold on the same terms as the other shares that are being offered and sold in this offering to the public.

Delivery of the shares of common stock will be made on or about April 15, 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | Piper Jaffray | |

William Blair |

Needham & Company |

The date of this prospectus is April 9, 2014

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of its date regardless of the time of delivery of this prospectus or of any sale of common stock.

Through and including May 4, 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this prospectus or any such free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our common stock, you should read this entire prospectus carefully, including the sections of this prospectus entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes. Unless the context otherwise requires, references in this prospectus to the "company," "Adamas," "we," "us" and "our" refer to Adamas Pharmaceuticals, Inc.

Adamas Pharmaceuticals, Inc.

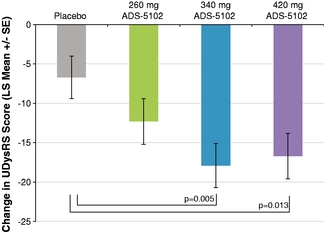

We are a specialty pharmaceutical company driven to improve the lives of those affected by chronic disorders of the central nervous system, or CNS. We achieve this by enhancing the pharmacokinetic profiles of approved drugs to create novel therapeutics for use alone and in fixed-dose combination products. We are developing our lead wholly owned product candidate, ADS-5102, for a complication of Parkinson's disease known as levodopa induced dyskinesia, or LID, and as a treatment for chronic behavioral symptoms associated with traumatic brain injury, or TBI. We have successfully completed a Phase 2/3 clinical trial in which patients receiving ADS-5102 had a statistically significant 43% reduction in LID compared to their baseline LID experienced prior to taking ADS-5102, and we intend to initiate a Phase 3 registration trial of ADS-5102 in LID in 2014. Our late-stage therapeutics portfolio also includes an NDA-submitted fixed-dose combination product candidate, MDX-8704, being co-developed with Forest Laboratories, Inc., or Forest, for the treatment of moderate to severe dementia associated with Alzheimer's disease, and an approved controlled-release product, Namenda XR®, which Forest developed and is marketing in the United States under a license from us. We plan to commercialize our wholly owned product candidates, if approved, by developing a specialty CNS sales force to reach high volume prescribing neurologists and psychiatrists in the United States.

Our market opportunity

We estimate that approximately 36 million people in the United States suffer from chronic CNS disorders such as Alzheimer's disease, Parkinson's disease, TBI, epilepsy, psychosis and depression. CNS diseases are frequently treated with multiple medications having different mechanisms of action with the goal of maximizing symptomatic benefits for patients. Existing CNS drugs often require frequent dosing and may have tolerability issues that limit the amount of the drug that can be taken each day. We believe that many CNS disorders could be better treated if the concentrations of existing CNS drugs as a function of time, or the pharmacokinetic profiles, are altered to enhance tolerability and efficacy and if these enhanced drugs are then combined with other existing CNS drugs to improve and streamline the management of these complicated conditions.

Our strategy

Our goal is to build an independent, CNS-focused specialty pharmaceutical company that creates and commercializes novel therapeutics that address significant unmet clinical needs. This goal is supported by a product development strategy that allows us to discover, patent, develop and commercialize novel therapeutics in a capital efficient manner. Our integrated process combines the following elements:

- •

- Market attractiveness. We identify approved products that

are sub-optimally utilized but, with pharmacokinetic enhancements, can significantly improve the treatment of chronic CNS conditions.

- •

- Intellectual property. We seek to discover novel pharmacokinetic and pharmacodynamic relationships and to obtain patent protection for a range of dose strengths, pharmacokinetic

1

- •

- Regulatory pathways. We intend to use the regulatory

pathway provided by Section 505(b)(2) of the U.S. Food, Drug and Cosmetic Act, or FDCA, to pursue approval for novel therapeutics based on existing drugs with less time and expense than are

typically associated with the standard new drug approval pathway.

- •

- Research and development. We have developed a core competency in identifying, formulating and manufacturing controlled-release drug products utilizing coated pellet technology.

profiles, timing of administration and drug combinations as opposed to protecting just specific formulations.

We are implementing our strategy by focusing on the following key objectives:

- •

- Obtain FDA approval of ADS-5102 for LID;

- •

- Develop ADS-5102 for the treatment of additional CNS indications;

- •

- Commercialize ADS-5102 by developing a specialty sales force;

- •

- Develop additional novel therapeutics based on existing CNS drugs; and

- •

- Support Forest in the NDA review and anticipated commercialization of MDX-8704.

Our therapeutics portfolio

Our initial product and product candidates are based on pharmacokinetic enhancements of two approved CNS drugs, amantadine and memantine, which belong to a class of drugs known as aminoadamantanes. We selected aminoadamantanes as our initial area of focus because they have the ability to modulate multiple neurotransmitter systems, which are the molecular pathways that control brain function, and we believe aminoadamantanes potentially have broader therapeutic utility than previously realized.

The following table describes our therapeutics portfolio:

Product and Product Candidates

|

Target Indication(s) | Development Status | Commercial Rights | |||

|---|---|---|---|---|---|---|

| Wholly Owned | ||||||

ADS-5102 |

Levodopa-Induced Dyskinesia |

Phase 3 |

Adamas, worldwide |

|||

| Amantadine | Traumatic Brain Injury | Phase 2/3 ready | Adamas, worldwide | |||

| Undetermined | Phase 2/3 planning | Adamas, worldwide | ||||

ADS-8800 series ADS-5102 based combination therapies |

Undetermined |

Research, Phase 2/3 planning |

Adamas, worldwide |

|||

| Partnered | ||||||

Namenda XR Memantine |

Moderate to severe Alzheimer's dementia |

Marketed |

U.S.-only; licensed to Forest |

|||

MDX-8704 Memantine/Donepezil |

Moderate to severe Alzheimer's dementia |

NDA submitted |

U.S.-only; licensed to Forest |

|||

Wholly owned product candidates. Our most advanced wholly owned product candidate is ADS-5102, a once-nightly, high dose, controlled-release version of amantadine designed to address many of the limitations of immediate-release amantadine. In patients taking ADS-5102, the amantadine plasma concentration achieved from the early morning through mid-day is approximately two-times that reached following administration of immediate-release amantadine, providing substantial benefit to

2

patients as they engage in their daily activities. Further, the lower concentrations occurs in the evening, reducing the negative impact of amantadine's sleep-related side effects. We are developing ADS-5102 initially for treatment of LID. LID is a movement disorder that frequently occurs in patients with Parkinson's disease after long-term treatment with levodopa, the most widely-used drug for Parkinson's disease. Patients with LID suffer from involuntary non-purposeful movements and reduced control over voluntary movements. We estimate that in 2011 approximately 260,000 Parkinson's disease patients in the United States suffered from motor complications as a result of levodopa therapy and approximately 140,000 of these patients suffered from LID. There are no drugs for the treatment of LID that have been approved for marketing in the United States or Europe. As a result, clinicians typically manage LID by decreasing the dose of levodopa, which can exacerbate symptoms of the underlying Parkinson's disease.

We selected LID as the initial indication for ADS-5102 based on results seen in investigator initiated clinical studies of amantadine and in established preclinical models. In our recently completed Phase 2/3 clinical study, ADS-5102 met its primary endpoint, reduction of LID, and several key secondary endpoints. If our anticipated Phase 3 registration trial of ADS-5102 is successful, we anticipate submitting a New Drug Application, or NDA, to the U.S. Food and Drug Administration, or FDA, for ADS-5102 in the first half of 2016. Amantadine has shown promising results in several other CNS indications, and we expect to initiate in late 2014 a Phase 2/3 study of ADS-5102 in a second CNS indication, possibly for the treatment of chronic behavioral symptoms associated with TBI. We anticipate initiating additional Phase 2/3 studies of ADS-5102 in one or more other indications by the end of 2015.

We are investigating and will potentially develop additional products, our ADS-8800 series, based on combining ADS-5102 with approved CNS drugs. Each combination will be designed to provide clinical benefits in specific indications where it appears that including ADS-5102 in combination therapy can address a significant unmet clinical need. Furthermore, we believe our product development strategy is broadly applicable to addressing limitations of CNS drugs whose pharmacokinetic profiles limit dosing, and we intend to initiate additional programs in this area in 2015.

We intend to use the regulatory pathway provided by Section 505(b)(2) of the FDCA to obtain approval for ADS-5102 and our other wholly owned product candidates. Section 505(b)(2) permits the filing of an NDA where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference. We believe this approach will be more time and capital efficient than the Section 505(b)(1) pathway typically used for new chemical entities.

Partnered product and product candidate. Under our license agreement, Forest currently sells one product, Namenda XR, a treatment for moderate to severe dementia associated with Alzheimer's disease. Namenda XR, a controlled-release version of the approved CNS drug memantine, was launched in the United States in June 2013 and is part of Forest's $1.5 billion Namenda franchise. In addition, Forest and we are co-developing MDX-8704, a once-daily fixed-dose combination of Namenda XR and the FDA-approved CNS drug donepezil, for the treatment of moderate to severe dementia associated with Alzheimer's disease. Forest submitted an NDA to the FDA for MDX-8704 in February 2014 and will be responsible for marketing MDX-8704 in the United States if approved. We received from Forest a $65 million upfront payment in November 2012 and two $20 million development milestone payments in the fourth quarter of 2013 related to the completion of studies that support Forest's NDA filing for MDX-8704. We are eligible to receive up to an additional $55 million in payments based on the achievement of certain regulatory milestones prior to and including the first FDA approval of MDX-8704 and royalty payments related to sales of Namenda XR commencing in June 2018 and to sales of MDX-8704 commencing five years after its commercial launch in the United

3

States. Forest has stated that it projects FDA approval and commercial launch of MDX-8704 in the first half of 2015.

Our management team

We are led by a team of executives and directors with significant experience in drug discovery, development and commercialization. In addition to co-founding Adamas, our chief executive officer co-founded CuraGen Corporation (acquired by Celldex Therapeutics, Inc.), and other members of our management team have held senior positions at Syntex, Bayer, Tularik and Elan. Members of our executive team have played leading roles in the development and commercialization of multiple significant drugs in a wide range of therapeutic areas. Our board of directors brings substantial, relevant experience in reimbursement, drug development and commercialization.

Financial overview

We have developed our current portfolio of late stage therapeutics in a capital efficient manner. As of December 31, 2013, we had raised a total of $87 million from equity financings, had received $105 million from our collaboration with Forest, had recognized $5 million in revenue from other sources and had $86 million in cash and cash equivalents and no debt obligations.

Risk factors

Our business is subject to numerous risks, as more fully described in the section entitled "Risk Factors" immediately following this prospectus summary. You should read these risk factors before you invest in our common stock. In particular, these risks include, but are not limited to, the following:

- •

- Our success depends heavily on the approval and successful commercialization of our lead wholly owned product candidate,

ADS-5102, as well as Forest's successful commercialization of Namenda XR and, if approved, MDX-8704;

- •

- Our product candidates and Namenda XR require a complex manufacturing process, and there are risks associated with

scaling up manufacturing and packaging to commercial scale and maintaining commercial production. For example, in November 2013 Forest recalled three packaged lots of Namenda XR when testing revealed

a failure to meet required manufacturing specifications; Namenda XR is one of the components of Forest's fixed-dose combination product candidate MDX-8704;

- •

- We do not directly market any products, expect to incur substantial and increasing losses for the foreseeable future and

had an accumulated deficit as of December 31, 2013 of $20.6 million;

- •

- If clinical studies of our product candidates fail to demonstrate safety and efficacy to the satisfaction of the FDA, we

will be unable to commercialize our product candidates;

- •

- If significant adverse side effects associated with a product or product candidate are identified during development or

after approval, we may need to abandon development of a product candidate or cease marketing a product;

- •

- If we are unable to obtain favorable coverage, reimbursement and formulary placement decisions from third-party payors,

our financial results will be adversely affected;

- •

- Our business will suffer if other manufacturers are able to obtain approval for generic or other competing versions of current and future products in our therapeutic portfolio, such as the possible result of the ten challenges from generic manufacturers relating to Abbreviated New Drug Applications seeking approval for generic versions of Namenda XR;

4

- •

- Our business may be adversely affected if we are unable to obtain and maintain effective intellectual property rights or

others claim that we infringe their intellectual property rights, such as the pending patent infringement lawsuit brought by Teva Pharmaceuticals USA, Inc. and Mayne Pharma against Forest relating to

Namenda XR;

- •

- Our operating results may fluctuate significantly, are difficult to predict and could fall below expectations; and

- •

- We may need additional funds to support our operations, and such funding may not be available on acceptable terms or at all.

Corporate Information

We were incorporated in Delaware in November 2000 under the name NeuroMolecular, Inc. In December 2004, we changed our name to NeuroMolecular Pharmaceuticals, Inc., and in July 2007 we changed our name to Adamas Pharmaceuticals, Inc. Our principal executive offices are located at 2200 Powell Street, Suite 220, Emeryville, California 94608, and our telephone number is (510) 450-3500. Our website address is www.adamaspharma.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

Implications of being an emerging growth company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

- •

- being permitted to present only two years of audited financial statements and only two years of related Management's

Discussion and Analysis of Financial Condition and Results of Operations in this prospectus;

- •

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of

2002, as amended;

- •

- reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration

statements; and

- •

- exemptions from the requirement to hold a nonbinding advisory vote on executive compensation and to obtain stockholder approval of any golden parachute payments not previously approved.

We may use these provisions until the last day of our fiscal year following the fifth anniversary of the closing of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a "large accelerated filer," our annual gross revenue exceeds $1 billion or we issue more than $1 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

The JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

5

Common stock offered |

3,000,000 shares | |

Common stock to be outstanding immediately after this offering |

16,422,992 shares |

|

Underwriters' option to purchase additional shares |

The underwriters have a thirty-day option to purchase up to 450,000 additional shares of common stock as described in "Underwriting." |

|

Use of proceeds |

The net proceeds from the issuance of our common stock in this offering will be approximately $41.5 million, or approximately $48.2 million if the underwriters exercise in full their over-allotment option to purchase additional shares, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

|

|

We intend to use all of the net proceeds from this offering, along with our other capital resources, to fund ongoing development of our product candidates, including ADS-5102, for commercialization activities related to any wholly owned, approved product candidate, including developing a specialty CNS sales force, and for working capital and other general corporate purposes. We may also use a portion of the net proceeds to acquire or license other products, businesses or technologies, although we have no present commitments for any such acquisitions or licenses. See "Use of Proceeds" for additional information. |

|

Risk factors |

See "Risk Factors" beginning on page 10 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

NASDAQ Global Market symbol |

"ADMS" |

The number of shares of our common stock to be outstanding after this offering is based on 13,422,992 shares of our common stock outstanding as of December 31, 2013 and excludes the following:

- •

- 3,567,858 shares of our common stock issuable upon the exercise of stock options outstanding as of December 31,

2013 at a weighted-average exercise price of $1.445 per share;

- •

- 1,865,000 shares of our common stock issuable upon the exercise of stock options granted after December 31, 2013

with a weighted-average exercise price of $9.47 per share;

- •

- 3,151,940 shares of common stock reserved for future issuance under our 2014 equity incentive plan, or 2014 Plan, which will become effective upon the date the registration statement of which this prospectus forms a part is declared effective (including 1,771,212 shares of common stock reserved for issuance under our 2007 Stock Plan, or 2007 Plan, as of December 31, 2013, which shares were added to the shares reserved under the 2014 Plan) plus up to 3,567,858 additional shares that may be added to the 2014 Plan upon the expiration, termination, forfeiture or other reacquisition of any shares of common stock issuable upon the exercise of stock options outstanding under the 2007 Plan or our 2002 Employee, Director and Consultant

6

- •

- 262,762 shares of our common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan, plus any

automatic increases in the number of shares of common stock reserved for future issuance under the 2014 Employee Stock Purchase Plan; and

- •

- 213,278 shares of our common stock issuable upon the exercise of warrants to purchase common stock outstanding at December 31, 2013 at a weighted-average exercise price of $3.14 per share.

Stock Plan, or 2002 Plan, and any automatic increases in the number of shares of common stock reserved for future issuance under the 2014 Plan;

Unless otherwise indicated, all information in this prospectus reflects and assumes the following:

- •

- the automatic conversion of all outstanding shares of our preferred stock into an aggregate of 3,432,891 shares of our

common stock immediately prior to the closing of this offering;

- •

- the issuance of an aggregate of 474,573 shares of our common stock upon conversion of the Series AA preferred stock

issuable upon the net exercise of warrants to purchase 622,660 shares of Series AA preferred stock with an exercise price of $3.80445 per share and based on a fair market value of $16.00 per

share, the initial public offering price, immediately prior to the closing of this offering;

- •

- the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws

immediately prior to the closing of this offering;

- •

- no exercise of the underwriters' over-allotment option to purchase additional shares of our common stock; and

- •

- a 2-for-1 forward split of our outstanding common stock and preferred stock effected on March 24, 2014.

7

Summary Consolidated Financial Data

The following tables summarize our consolidated financial data and should be read together with the sections in this prospectus entitled "Selected Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

We have derived the consolidated statements of operations data for the years ended December 31, 2012 and 2013 from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that should be expected in the future.

| |

Year Ended December 31, |

||||||

|---|---|---|---|---|---|---|---|

| |

2012 | 2013 | |||||

| |

(in thousands, except per share data) |

||||||

Consolidated Statements of Operations Data: |

|||||||

Revenue |

$ | 37,471 | $ | 71,095 | |||

| | | | | | | | |

Operating expenses |

|||||||

Research and development |

9,192 | 7,410 | |||||

General and administrative |

8,330 | 6,667 | |||||

| | | | | | | | |

Total operating expenses |

17,522 | 14,077 | |||||

| | | | | | | | |

Income from operations |

19,949 | 57,018 | |||||

Interest and other income (expense), net |

(1,537 | ) | (4,818 | ) | |||

Interest expense |

(376 | ) | (88 | ) | |||

| | | | | | | | |

Income before income taxes |

18,036 | 52,112 | |||||

Income tax expense |

(300 | ) | (1,191 | ) | |||

| | | | | | | | |

Net income |

$ | 17,736 | $ | 50,921 | |||

| | | | | | | | |

| | | | | | | | |

Net income attributable to common stockholders(1) |

|||||||

Basic |

$ | 11,441 | $ | 33,068 | |||

| | | | | | | | |

| | | | | | | | |

Diluted |

$ | 11,596 | $ | 35,353 | |||

| | | | | | | | |

| | | | | | | | |

Net income per share attributable to common stockholders(1) |

|||||||

Basic |

$ | 1.21 | $ | 3.48 | |||

| | | | | | | | |

| | | | | | | | |

Diluted |

$ | 1.17 | $ | 3.00 | |||

| | | | | | | | |

| | | | | | | | |

Weighted-average number of shares used in computing net income attributable to common stockholders(1) |

|||||||

Basic |

9,488 | 9,506 | |||||

| | | | | | | | |

| | | | | | | | |

Diluted |

9,924 | 11,806 | |||||

| | | | | | | | |

| | | | | | | | |

Pro forma net income per share attributable to common stockholders (unaudited)(1) |

|||||||

Basic |

$ | 4.13 | |||||

| | | | | | | | |

| | | | | | | | |

Diluted |

$ | 3.51 | |||||

| | | | | | | | |

| | | | | | | | |

Pro forma weighted average number of shares used in computing net income attributable to common stockholders (unaudited)(1) |

|||||||

Basic |

13,414 | ||||||

| | | | | | | | |

| | | | | | | | |

Diluted |

15,790 | ||||||

| | | | | | | | |

| | | | | | | | |

- (1)

- See Notes 2 and 14 to our consolidated financial statements for a description of the method used to compute basic and diluted net income per share.

8

| |

December 31, 2013 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma(1) |

Pro Forma As Adjusted(2) |

|||||||

| |

(in thousands) |

|||||||||

| |

(unaudited) |

|||||||||

Balance sheet data: |

||||||||||

Cash and cash equivalents |

$ | 85,612 | $ | 85,612 | $ | 127,152 | ||||

Working capital |

81,790 | 81,790 | 123,330 | |||||||

Total assets |

86,216 | 86,216 | 127,756 | |||||||

Warrant liability |

6,232 | — | — | |||||||

Convertible preferred stock |

19,149 | — | — | |||||||

Total stockholders' equity |

$ | 56,605 | $ | 81,986 | $ | 123,526 | ||||

- (1)

- The

pro forma column reflects the filing of our amended and restated certificate of incorporation, the automatic conversion of all outstanding shares of our

preferred stock into an aggregate of 3,432,891 shares of common stock immediately prior to the closing of this offering and the reclassification to additional paid-in capital of our preferred stock

warrant liability in connection with the automatic net exercise of our outstanding warrants to purchase shares of preferred stock, and subsequent conversion of preferred stock into common stock

immediately prior to the closing of this offering.

- (2)

- The pro forma as adjusted column reflects the pro forma adjustments described in footnote (1) above and the sale by us of 3,000,000 shares of common stock in this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

9

Investing in our common stock involves a high degree of risk. You should consider carefully the following risks, together with all the other information in this prospectus, including our financial statements and notes thereto, before you invest in our common stock. If any of the following risks actually materializes, our operating results, financial condition and liquidity could be materially adversely affected. As a result, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks related to our financial condition and need for additional capital

Although we reported net income for 2012 and 2013, we incurred significant losses in prior years and expect to incur substantial losses in the future.

We are a clinical-stage specialty pharmaceutical company and do not currently directly market any products. We currently exclusively license U.S. patent rights for one approved product, Namenda XR, to a wholly owned subsidiary of Forest Laboratories, Inc., or Forest, and Forest markets Namenda XR in the United States, but we do not currently receive royalties on the sales of that product. We continue to incur significant research and development and general and administrative expenses related to our product candidates and our operations. Although we reported net income for 2012 and 2013, this was almost entirely due to milestone payments we received pursuant to our license agreement with Forest. We incurred significant operating losses in 2011 and prior years and expect to incur substantial and increasing losses for the foreseeable future. As of December 31, 2013, we had an accumulated deficit of $20.6 million.

To date, we have financed our operations primarily through private placements of our convertible preferred stock, our collaboration with Forest and, to a lesser extent, government grants, venture debt and with the benefit of tax credits made available under a federal stimulus program supporting drug development. We have devoted substantially all of our efforts to research and development, including clinical studies, but have not completed development of any product candidates. We anticipate that our expenses will increase substantially as we:

- •

- initiate a Phase 3 registration trial of our lead wholly owned product candidate, ADS-5102 in levodopa induced

dyskinesia, or LID;

- •

- develop ADS-5102 for treatment of other indications in addition to LID and develop additional product candidates;

- •

- seek regulatory approvals for our product candidates that successfully complete clinical studies;

- •

- establish a specialty CNS sales force and improve our distribution and marketing capabilities to commercialize products

for which we may obtain regulatory approval;

- •

- enhance operational, financial and information management systems and hire more personnel, including personnel to support

development of our product candidates and, if a product candidate is approved, our commercialization efforts;

- •

- continue the research and development of our current product candidates; and

- •

- seek to discover or in-license additional product candidates.

To be profitable in the future, we or our current and future potential collaboration partners must succeed in developing and commercializing products with significant market potential. This will require us or our partners to be successful in a range of activities, including advancing product candidates, completing clinical studies of product candidates, obtaining regulatory approval for those product candidates and manufacturing, marketing and selling those products for which regulatory approval is obtained. We or our partners may not succeed in these activities and, as a result, we may never generate revenue that is sufficient to be profitable in the future. In the near term, our only anticipated

10

source of significant revenue is from certain milestone payments under our license agreement with Forest. We will not be entitled to receive any royalty payments with respect to sales of Namenda XR until June 2018, and with respect to sales of our partnered product candidate, MDX-8704, until five years after its commercial launch in the United States, assuming it is approved and launched.

Although we reported net income for 2012 and 2013, this was primarily due to the recognition of revenue pursuant to our license agreement with Forest. Even if we attain profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to achieve sustained profitability would depress the value of our stock and could impair our ability to raise capital, expand our business, diversify our product candidates, market our product candidates, if approved, or continue our operations.

Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance.

Our quarterly and annual operating results may fluctuate significantly in the future, which makes it difficult for us to predict our future operating results. Our sole anticipated source of significant revenue in the near term is from certain milestone payments under our license agreement with Forest. Accordingly, our revenue will depend on the achievement of these milestones as well as any potential future collaboration and license agreements and sales of our product candidates, if approved. Upfront and milestone payments may vary significantly from period to period and any such variance could cause a significant fluctuation in our operating results from one period to the next. Furthermore, our operating results may fluctuate due to a variety of other factors, many of which are outside of our control and may be difficult to predict, including:

- •

- the timing and cost of, and level of investment in, research and development activities relating to our product

candidates, which may change from time to time;

- •

- cost and reimbursement policies with respect to our products candidates, if approved, and existing and potential future

drugs that compete with our product candidates;

- •

- the cost of manufacturing our product candidates, which may vary depending on the quantity of production and the terms of

our agreements with manufacturers;

- •

- expenditures that we will or may incur to acquire or develop additional product candidates and technologies;

- •

- the level of demand for our products, should any of our product candidates receive approval, which may vary significantly;

- •

- future accounting pronouncements or changes in our accounting policies;

- •

- the timing and success or failure of clinical studies for our product candidates or competing product candidates, or any

other change in the competitive landscape of our industry, including consolidation among our competitors or partners; and

- •

- the changing and volatile U.S., European and global economic environments.

The cumulative effects of these factors could result in large fluctuations and unpredictability in our quarterly and annual operating results. As a result, comparing our operating results on a period-to-period basis may not be meaningful. Investors should not rely on our past results as an indication of our future performance. This variability and unpredictability could also result in our failing to meet the expectations of industry or financial analysts or investors for any period. If our revenue or operating results fall below the expectations of analysts or investors or below any forecasts we may provide to the market, or if the forecasts we provide to the market are below the expectations of analysts or investors, the price of our common stock could decline substantially. Such a stock price

11

decline could occur even when we have met any previously publicly stated revenue and/or earnings guidance we may provide.

We may need additional funds and, if we cannot raise additional capital when needed, we may have to curtail or cease operations.

We are seeking to advance multiple product candidates through the research and clinical development process. The completion of the development and the potential commercialization of our product candidates, should they receive approval, will require substantial funds. As of December 31, 2013, we had approximately $85.6 million in cash and cash equivalents. We believe that our available cash and cash equivalents will be sufficient to fund our anticipated level of operations for at least the next 12 months, but there can be no assurance that this will be the case. Our future financing requirements will depend on many factors, some of which are beyond our control, including:

- •

- the rate of progress and cost of our clinical studies;

- •

- the timing of, and costs involved in, seeking and obtaining approvals from the U.S. Food and Drug Administration, or FDA,

and potentially other regulatory authorities;

- •

- the costs of commercialization activities if any of our product candidates is approved, including expanding our sales,

marketing and distribution activities;

- •

- the degree and rate of market acceptance of any products launched by us, Forest or any future partners;

- •

- the coverage of our products by third-party payors and the formulary tier in which health plans and other payors place our

products, if approved, and the rate at which the products are reimbursed;

- •

- our ability to enter into additional collaboration, licensing, commercialization or other arrangements and the terms and

timing of such arrangements; and

- •

- the emergence of competing technologies or other adverse market developments.

We do not have any committed external source of funds or other support for our development efforts other than our license agreement with Forest which may be terminated by Forest upon delivery of notice. Until we can generate sufficient product and royalty revenue to finance our cash requirements, which we may never do, we expect to finance future cash needs through a combination of public or private equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements and other marketing and distribution arrangements. Additional financing may not be available to us when we need it or it may not be available on favorable terms. If we raise additional capital through marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish certain valuable rights to our product candidates, technologies, future revenue streams or research programs or grant licenses on terms that may not be favorable to us. If we raise additional capital through public or private equity offerings, the ownership interest of our existing stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect our stockholders' rights. If we raise additional capital through debt financing, we may be subject to covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we are unable to obtain adequate financing when needed, we may have to delay, reduce the scope of, or suspend one or more of our clinical studies or research and development programs or our commercialization efforts.

12

Risks related to the development and commercialization of our current and future products

Our success depends heavily on the approval and successful commercialization of ADS-5102, the U.S. approval and successful U.S. commercialization by Forest of MDX-8704 and the successful U.S. commercialization by Forest of Namenda XR. If we are unable to successfully commercialize ADS-5102 or Forest is unable to successfully commercialize MDX-8704 or Namenda XR in the U.S., or either we or Forest experience significant delays in doing so, our business will be materially harmed.

We have invested a significant portion of our efforts and financial resources into the development of ADS-5102, an oral once-nightly controlled-release version of the FDA-approved drug amantadine, and MDX-8704, a fixed-dose combination of the FDA-approved drugs memantine and donepezil. MDX-8704 has been exclusively licensed to Forest in the United States. In addition, we have granted Forest a royalty-bearing license under certain of our patents to commercialize Namenda XR, a controlled-release version of memantine, in the United States. Our ability to generate product and royalty revenue will depend heavily on the successful development, regulatory approval and eventual commercialization of ADS-5102 and MDX-8704 and successful commercialization of Namenda XR. Under the terms of our license agreement with Forest, we will not be entitled to receive royalty payments on the sale of Namenda XR until June 2018 or on the sale of MDX-8704 until five years after it is launched, assuming it is approved and launched. The success of these drugs will depend on numerous factors, including:

- •

- successfully completing clinical studies for ADS-5102;

- •

- receiving marketing approvals from the FDA and, to a lesser extent, similar regulatory authorities outside the United

States for our product candidates;

- •

- establishing commercial manufacturing arrangements with third parties;

- •

- launching commercial sales of any of the product candidates that may be approved;

- •

- the medical community and patients accepting any approved product;

- •

- the placement of any approved products on payors' formulary tiers and the reimbursement rates for the approved products;

- •

- effectively competing with other therapies;

- •

- any approved products continuing to have an acceptable safety profile following approval; and

- •

- obtaining, maintaining, enforcing and defending intellectual property rights and claims.

If we or Forest do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize our product candidates, which would materially harm our business.

If clinical studies of our product candidates fail to demonstrate sufficient safety and efficacy to the satisfaction of the FDA or similar regulatory authorities outside the United States or do not otherwise produce positive results, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates.

Before obtaining regulatory approval for the sale of our product candidates, we must conduct extensive clinical studies to demonstrate the safety and efficacy of our product candidates in humans. Clinical studies are expensive, are difficult to design and implement, can take many years to complete and are uncertain as to outcome. A failure of one or more of our clinical studies could occur at any stage of testing. The outcome of preclinical testing and early clinical studies may not be predictive of the success of later clinical studies, and interim results of a clinical study do not necessarily predict final results. For example, the successful result of our Phase 2/3 study of ADS-5102 for the treatment

13

of LID, including the lack of difference from placebo in the incidence of sleep-related adverse events, may not be repeated in our anticipated Phase 3 registration trial.

We may experience numerous unforeseen events during, or as a result of, clinical studies that could delay or prevent our ability to receive regulatory approval or commercialize our product candidates, including that:

- •

- clinical studies of our product candidates may produce negative or inconclusive results, and we may decide, or regulators

may require us, to conduct additional clinical studies or abandon product development programs;

- •

- the number of patients required for clinical studies of our product candidates may be larger than we anticipate,

enrollment in these clinical studies may be insufficient or slower than we anticipate or patients may drop out of these clinical studies at a higher rate than we anticipate;

- •

- the cost of clinical studies of our product candidates may be greater than we anticipate;

- •

- our third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in

a timely manner, or at all;

- •

- we might have to suspend or terminate clinical studies of our product candidates for various reasons, including a finding

that our product candidates have unanticipated serious side effects or other unexpected characteristics or that the patients are being exposed to unacceptable health risks;

- •

- regulators may not approve our proposed clinical development plans or may require costly modifications to such plans;

- •

- regulators or institutional review boards may not authorize us or our investigators to commence a clinical study or

conduct a clinical study at a prospective study site;

- •

- regulators or institutional review boards may require that we or our investigators suspend or terminate clinical research

for various reasons, including noncompliance with regulatory requirements; and

- •

- the supply or quality of our product candidates or other materials necessary to conduct clinical studies of our product candidates may be insufficient or inadequate.

If we are required to conduct additional clinical studies or other testing of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete clinical studies or other testing of our product candidates, if the results of these studies or tests are not positive or are only modestly positive or if there are safety concerns, we may:

- •

- be delayed in obtaining marketing approval for our product candidates;

- •

- not obtain marketing approval at all;

- •

- obtain approval for indications that are not as broad as intended;

- •

- have the product removed from the market after obtaining marketing approval;

- •

- be subject to additional post-marketing testing requirements; or

- •

- be subject to restrictions on how the product is distributed or used.

Our product development costs will increase if we experience delays in testing or approvals. Significant clinical study delays also could shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do, which would impair our ability to commercialize our product candidates and harm our business and results of operations.

14

Even if clinical studies demonstrate statistically significant efficacy and acceptable safety for a product, the FDA or similar regulatory authorities outside the United States may not approve it for marketing.

Forest has completed the clinical trials that it and we believe are necessary to support the submission to the FDA of a New Drug Application, or NDA, for MDX-8704 for the treatment of moderate to severe dementia in Alzheimer's disease patients. Forest submitted an NDA to the FDA for MDX-8704 in February 2014. We believe those trials indicated that a single dose of MDX-8704 is bioequivalent to separate doses of Namenda XR and donepezil and that MDX-8704 exhibits the same bioavailability whether administered after fasting, after a meal or when sprinkled on apple sauce. We expect to initiate a Phase 3 registration trial of ADS-5102 in 2014 for LID and, if the trial is successful, intend to submit an NDA for ADS-5102 in that indication. It is possible that the FDA may not consider the results of these studies to be sufficient for approval of the product candidates in their proposed indications. If the FDA were to require Forest or us to conduct additional studies of MDX-8704 or ADS-5102 to obtain approval for the product candidates in their currently contemplated indications, our business and financial results would be materially adversely affected.

Our product candidates have never been manufactured on a commercial scale, and there are risks associated with developing manufacturing and packaging processes and scaling them up to commercial scale.

Our product candidates have never been manufactured on a commercial scale, and there are risks associated with developing manufacturing and packaging processes and scaling them up to commercial scale including, among others, cost overruns, potential problems with process scale-up, process reproducibility, stability issues, lot consistency and timely availability of raw materials. These risks can adversely affect regulatory approval of a product candidate. In addition, even if we could otherwise obtain regulatory approval for any product candidate, there is no assurance that our manufacturer will be able to manufacture the approved product to specifications acceptable to the FDA or other regulatory authorities, to produce it in sufficient quantities to meet the requirements for the potential launch of the product or to meet potential future demand. If our manufacturer is unable to produce sufficient quantities of the approved product, our regulatory approval or commercialization efforts would be impaired, which would have an adverse effect on our business, financial condition, results of operations and growth prospects.

Our product candidates and Namenda XR are complex to manufacture, and manufacturing disruptions may occur.

Our product candidates and Namenda XR all include controlled-released versions of existing drugs, and some are combinations of existing drugs. The manufacture and packaging of controlled-release versions of existing drugs or combinations of existing drugs are substantially more complex than the manufacture and packaging of the immediate-release version of a drug alone. Even after the manufacturing process for a controlled-release or combination product has been scaled to commercial levels and numerous commercial lots have been produced, manufacturing disruptions may occur. Such problems may prevent the production of lots that meet the specifications required for sale of the product and may be difficult and expensive to resolve. For example, in November 2013, Forest recalled three packaged lots of Namenda XR because Forest's dissolution testing revealed a failure to meet specification throughout shelf life. Namenda XR is one of the components of Forest's fixed-dose combination product candidate MDX-8704. If any such issues were to arise with respect to our product candidates or future products, if any, or if Forest's sales of Namenda XR or the regulatory approval or Forest's sales of MDX-8704 were to be negatively impacted by such issues our business, financial results or stock price could be adversely affected.

15

If generic manufacturers use litigation and regulatory means to obtain approval for generic versions of products on which our future revenue depends, our business will suffer.

Under the U.S. Food, Drug and Cosmetic Act, or FDCA, the FDA can approve an Abbreviated New Drug Application, or ANDA, for a generic version of a branded drug without the ANDA applicant undertaking the clinical testing necessary to obtain approval to market a new drug. In place of such clinical studies, an ANDA applicant usually needs only to submit data demonstrating that its product has the same active ingredient(s) and is bioequivalent to the branded product, in addition to any data necessary to establish that any difference in strength, dosage form, inactive ingredients, or delivery mechanism does not result in different safety or efficacy profiles, as compared to the reference drug.

The FDCA requires that an applicant for approval of a generic form of a branded drug certify either that its generic product does not infringe any of the patents listed by the owner of the branded drug in the Approved Drug Products with Therapeutic Equivalence Evaluations, also known as the Orange Book, or that those patents are not enforceable. This process is known as a paragraph IV challenge. Upon receipt of the paragraph IV notice, the owner has 45 days to bring a patent infringement suit in federal district court against the company seeking ANDA approval of a product covered by one of the owner's patents. The discovery, trial and appeals process in such suits can take several years. If this type of suit is commenced, the FDCA provides a 30-month stay on the FDA's approval of the competitor's application. This type of litigation is often time-consuming and costly and may result in generic competition if the patents at issue are not upheld or if the generic competitor is found not to infringe the owner's patents. If the litigation is resolved in favor of the ANDA applicant or the challenged patent expires during the 30-month stay period, the stay is lifted and the FDA may thereafter approve the application based on the standards for approval of ANDAs.

For example, as of March 25, 2014, we had received notice that ten companies had submitted ANDAs to the FDA requesting permission to manufacture and market generic versions of Namenda XR, on which we are entitled to receive royalties from Forest beginning in June 2018. In the notices, these companies allege that the patents associated with Namenda XR, one of which is owned by Forest, one of which is exclusively licensed to Forest by Merz Pharma GmbH & Co. KGaA and others of which are owned by us and licensed by us exclusively to Forest in the United States, are invalid, unenforceable or will not be infringed by the companies' manufacture, use or sale of generic versions of Namenda XR. In January and February 2014, we, Forest, Forest Laboratories Holdings Ltd., Merz Pharma GmbH & Co. KGaA and Merz Pharmaceuticals GmbH filed lawsuits for infringement of the relevant patents against the eight of these companies that had then submitted ANDAs. Because these lawsuits were filed within the requisite 45-day period provided in the FDCA, there are stays preventing FDA approval of the ANDAs for 30 months or until a court decision adverse to the patents. The 30-month stay for these ANDAs will expire beginning in June 2016.

For various strategic and commercial reasons, manufacturers of generic medications frequently file ANDAs shortly after FDA approval of a branded drug regardless of the perceived strength and validity of the patents associated with such product. Based on these past practices, we believe it is likely that one or more such generic manufacturers will file ANDAs with respect to MDX-8704 and ADS-5102, if they are approved by the FDA, prior to the expiration of the patents related to those compounds.

The filing of an ANDA as described above with respect to any of our products could have an adverse impact on our stock price. Moreover, if any such ANDAs were to be approved and the patents covering the relevant products were not upheld in litigation, or if a generic competitor is found not to infringe these patents, the resulting generic competition would negatively affect our business, financial condition and results of operations.

16

Any product candidate that we are able to commercialize may become subject to unfavorable pricing regulations, third-party coverage or reimbursement practices or healthcare reform initiatives, thereby harming our business.

The regulations that govern marketing approvals, pricing, coverage and reimbursement for new therapeutic products vary widely from country to country. Some countries require approval of the sale price of a product before it can be marketed. In many countries, the pricing review period begins after marketing or product licensing approval is granted. In some foreign markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, we might obtain regulatory approval for a product in a particular country, but then be subject to price regulations that delay our commercial launch of the product and negatively impact the revenue we are able to generate from the sale of the product in that country. In particular, in many countries, including many major European markets, therapies that are based on existing generic drugs, such as Namenda XR (memantine) and ADS-5102 (amantadine), or combinations of existing generic drugs, such as MDX-8704, generally are not well-reimbursed. As a result, we anticipate that the commercial success of Namenda XR, ADS-5102 and MDX-8704 will be largely dependent on success in the U.S. market.

Our ability to commercialize any products successfully in the United States will depend in part on the extent to which coverage and reimbursement for these products becomes available from third-party payors, including government health administration authorities, such as those that administer the Medicare and Medicaid programs, and private health insurers. Third-party payors decide which medications they will cover and establish reimbursement levels. A primary trend in the U.S. healthcare industry is cost containment. Third-party payors have attempted to control costs by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party payors are requiring that companies provide them with predetermined discounts from list prices and are challenging the prices charged for medical products. We cannot assure you that coverage and reimbursement will be available for any product that we commercialize and, if reimbursement is available, what the level of reimbursement will be. Coverage and reimbursement may impact the demand for, or the price of, any product for which we obtain marketing approval. If coverage and reimbursement is not available or is available only to limited levels, we may not be able to successfully commercialize any product candidate that we successfully develop and Forest may be unable to successfully market Namenda XR or MDX-8704.

There may be significant delays in obtaining coverage and reimbursement for approved products, and coverage may be more limited than the purposes for which the product is approved by the FDA. Moreover, eligibility for reimbursement does not imply that any product will be paid for in all cases or at a rate that covers our costs, including research, development, manufacture, sale and distribution. Interim payments for new products, if applicable, may also not be sufficient to cover our costs and may not be made permanent. Payment rates may vary according to the use of the product and the clinical setting in which it is used, may be based on payments allowed for lower cost products that are already reimbursed and may be incorporated into existing payments for other services. Net prices for products may be reduced by mandatory discounts or rebates required by government healthcare programs or private payors and by any future relaxation of laws that presently restrict imports of products from countries where they may be sold at lower prices than in the United States. In the United States, private third-party payors often rely upon Medicare coverage and reimbursement policies and payment limitations in setting their own coverage and reimbursement policies. Our inability to promptly obtain coverage, reimbursement and profitable payment rates from both government funded and private payors for new products that we develop, or products developed or marketed by Forest under our license agreement, could have a material adverse effect on our operating results, our ability to raise capital needed to commercialize products and our overall financial condition.

17

If serious adverse side effects are identified during the development of ADS-5102 or any other product candidates, we may need to abandon our development of that product candidate.

Our product candidate ADS-5102, along with our other earlier stage product candidates, are still in clinical or pre-clinical development. The risk of failure during development is high. It is impossible to predict when or if any of our product candidates will prove safe and tolerable enough to receive regulatory approval. For example, amantadine, the active pharmaceutical ingredient in ADS-5102, carries the risk of blurred vision, dizziness, lightheadedness, faintness, trouble sleeping, depression or anxiety, hallucinations, swelling of the hands, legs, or feet, difficulty urinating, shortness of breath and rash. These side effects may be the cause of the relatively low rate of acceptance of amantadine by physicians and patients. Although we believe our controlled-release version of amantadine has reduced the risks of these side effects thereby enabling higher doses, there can be no assurance that our proposed Phase 3 registration trial or future studies in other indications will not fail due to safety or tolerability issues. In such an event, we might need to abandon development of ADS-5102 entirely or for certain indications. If we are forced to abandon development of our product candidates, our business, results of operations and financial condition will be harmed.

Safety issues with Namenda XR, MDX-8704 or ADS-5102, or the parent drugs or other components of Namenda XR, MDX-8704 or ADS-5102, or with approved products of third parties that are similar to Namenda XR, MDX-8704 or ADS-5102, could decrease the potential sales of Namenda XR, MDX-8704 or ADS-5102 or give rise to delays in the regulatory approval process, restrictions on labeling or product withdrawal.

Discovery of previously unknown problems, or increased focus on a known problem, with an approved product may result in restrictions on its permissible uses, including withdrawal of the medicine from the market. The label for Namenda XR lists potential side effects such as headache, diarrhea and dizziness, and side effects have been observed in clinical trial subjects taking MDX-8704 and ADS-5102, such as constipation, dizziness, hallucination, dry mouth, fall, confusion, headache, nausea and weakness in the case of ADS-5102 and dizziness, headache and diarrhea in the case of MDX-8704.

If we or others identify additional undesirable side effects caused by Namenda XR, or by MDX-8704 and ADS-5102 after approval:

- •

- regulatory authorities may require the addition of labeling statements, specific warnings, contraindications or field

alerts to physicians and pharmacies;

- •

- regulatory authorities may withdraw their approval of the product and require us to take our approved drug off the market;

- •

- we may be required to change the way the product is administered, conduct additional clinical trials, change the labeling

of the product or implement a Risk Evaluation and Mitigation Strategy;

- •

- we may have limitations on how we promote our drugs;

- •

- third-party payors may limit coverage or reimbursement for our drugs;

- •

- sales of products may decrease significantly;

- •

- we may be subject to litigation or product liability claims; and

- •

- our reputation may suffer.

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product and could substantially increase our commercialization costs and expenses, which in turn could delay or prevent us from generating significant revenue from its sale.

Namenda XR, MDX-8704 or ADS-5102 may also be affected by the safety and tolerability of their parent drugs or drugs with similar mechanisms of action. Although memantine, which is a component

18

of Namenda XR and MDX-8704, donepezil, which is a component MDX-8704, and amantadine, which is a component of ADS-5102, have been used in patients for many years, newly observed toxicities or worsening of known toxicities, in preclinical studies of, or in patients receiving, memantine, donepezil, or amantadine, or reconsideration of known toxicities of compounds in the setting of new indications, could result in increased regulatory scrutiny of our products and product candidates. The FDA has substantial discretion in the NDA approval process and may refuse to approve any application if the FDA concludes that the risk/benefit analysis of a potential drug treatment for a specific indication does not warrant approval. Thus, although the parent drug for, or a drug related to, one of our product candidates may be approved by the FDA in a particular indication, the FDA may conclude that our product candidate's risk/benefit profile does not warrant approval in a different indication, and the FDA may refuse to approve our product candidate. Such conclusion and refusal would prevent us from developing and commercializing our product candidates and severely harm our business and financial condition.

Following consumption, Namenda XR, MDX-8704 and ADS-5102 first are broken down by the body's natural metabolic processes and then release the active drug and other breakdown substances. While these breakdown substances are generally regarded as safe, it is possible that there could be unexpected toxicity associated with them that will cause Namenda XR, MDX-8704 or ADS-5102 to be poorly tolerated by, or toxic to, humans. Any unexpected toxicity of, or suboptimal tolerance to, the product or product candidates could reduce their sales of approved products and delay or prevent commercialization of our product candidates.

In addition, problems with approved products marketed by third parties that utilize the same therapeutic target or that belong to the same therapeutic class as memantine, amantadine or donepezil could adversely affect the commercialization of Namenda XR, MDX-8704 and ADS-5102. For example, the product withdrawals of Vioxx from Merck and Bextra from Pfizer due to safety issues have caused other drugs that have the same therapeutic target, such as Celebrex from Pfizer, to receive additional scrutiny from regulatory authorities.

The marketing of ADS-5102 and MDX-8704, if approved, will be limited to use for the treatment of specific indications, and if we or Forest want to expand the indications for which these product candidates may be marketed, additional regulatory approvals will need to be obtained, which may not be granted.

We are currently seeking regulatory approval of ADS-5102 for the treatment of LID, and Forest is seeking regulatory approval of MDX-8704 for the treatment of moderate to severe dementia related to Alzheimer's disease. If these product candidates are approved, the FDA will restrict our and Forest's ability to market or advertise the products for other indications, which could limit physician and patient adoption. We or Forest may attempt to develop, promote and commercialize new treatment indications and protocols for the products in the future, but we cannot predict when or if the clearances required to do so will be received. In addition, we would be required to conduct additional clinical trials or studies to support approvals for additional indications for ADS-5102, which would be time consuming and expensive, and may produce results that do not support regulatory approvals. If we do not obtain additional regulatory approvals, our ability to expand our business will be limited.

If our product candidates are approved for marketing, and we are found to have improperly promoted off-label uses, or if physicians misuse our products or use our products off-label, we may become subject to prohibitions on the sale or marketing of our products, significant fines, penalties, and sanctions, product liability claims, and our image and reputation within the industry and marketplace could be harmed.

The FDA and other regulatory agencies strictly regulate the marketing and promotional claims that are made about drug products, such as ADS-5102 and MDX-8704, if approved. In particular, a product may not be promoted for uses or indications that are not approved by the FDA or such other regulatory agencies as reflected in the product's approved labeling. For example, if we receive marketing approval for ADS-5102 for the treatment of LID, the first indication we are pursuing, we

19

cannot prevent physicians from using our ADS-5102 products on their patients in a manner that is inconsistent with the approved label. If we are found to have promoted such off-label uses prior to FDA approval for an additional indication, we may receive warning letters and become subject to significant liability, which would materially harm our business. The federal government has levied large civil and criminal fines against companies for alleged improper promotion and has enjoined several companies from engaging in off-label promotion. If we become the target of such an investigation or prosecution based on our marketing and promotional practices, we could face similar sanctions, which would materially harm our business. In addition, management's attention could be diverted from our business operations, significant legal expenses could be incurred, and our reputation could be damaged. The FDA has also requested that companies enter into consent decrees or permanent injunctions under which specified promotional conduct is changed or curtailed. If we are deemed by the FDA to have engaged in the promotion of our products for off-label use, we could be subject to FDA prohibitions on the sale or marketing of our products or significant fines and penalties, and the imposition of these sanctions could also affect our reputation and position within the industry.

Physicians may also misuse our products, potentially leading to adverse results, side effects or injury, which may lead to product liability claims. If our products are misused, we may become subject to costly litigation by our customers or their patients. Product liability claims could divert management's attention from our core business, be expensive to defend and result in sizable damage awards against us that may not be covered by insurance. Furthermore, the use of our products for indications other than those cleared by the FDA may not effectively treat such conditions, which could harm our reputation in the marketplace among physicians and patients. Any of these events could harm our business and results of operations and cause our stock price to decline.

We currently have no sales or distribution personnel and only limited marketing capabilities. If we are unable to develop a sales and marketing and distribution capability, we will not be successful in commercializing ADS-5102 or other future approved products.

We do not have a significant sales or marketing infrastructure and have no experience in the sale, marketing or distribution of therapeutic products. To achieve commercial success for any approved product, we must either develop a sales and marketing organization or outsource these functions to third parties. We expect that the primary focus of our commercialization efforts will be the United States, and we intend to develop our own sales force to commercialize ADS-5102 and our other wholly-owned future approved products in the United States. Commercialization of ADS-5102 and other future approved products outside of the United States, to the extent pursued, is likely to require collaboration with a third party.

There are risks involved with both establishing our own sales and marketing capabilities and entering into arrangements with third parties to perform these services. For example, recruiting and training a sales force is expensive and time-consuming and could delay any product launch. If the commercial launch of a product candidate for which we recruit a sales force and establish marketing capabilities is delayed or does not occur for any reason, we would have prematurely or unnecessarily incurred these commercialization expenses. This may be costly, and our investment would be lost if we cannot retain or reposition our sales and marketing personnel.

In addition, our existing arrangements for the commercialization of Namenda XR and MDX-8704 may not be successful and we also may not be successful entering into new arrangements with third parties to sell and market our future approved products or may be unable to do so on terms that are favorable to us. We have and will in the future be likely to have little control over such third parties, and any of them may fail to devote the necessary resources and attention to sell and market our products effectively and could damage our reputation. If we underestimate the size of sales force required to market our products, our commercialization efforts will be adversely affected. If we do not establish sales and marketing capabilities successfully, either on our own or in collaboration with third parties, we will not be successful in commercializing our future approved products.

20

Our future products may fail to achieve the degree of market acceptance by physicians, patients, healthcare payors and others in the medical community necessary for commercial success.

Our future products may fail to gain sufficient market acceptance by physicians, hospital administrators, patients, healthcare payors and others in the medical community. The degree of market acceptance of our products, after being approved for commercial sale, will depend on a number of factors, including:

- •

- the prevalence and severity of any side effects;

- •

- efficacy, duration of response and potential advantages compared to alternative treatments;

- •

- the price we charge;

- •

- the willingness of physicians to change their current treatment practices;

- •

- convenience and ease of administration compared to alternative treatments;

- •

- the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies;

- •

- the strength of marketing and distribution support; and

- •

- the availability of third-party coverage or reimbursement.