Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

Dividend Capital Diversified Property Fund Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

April 10, 2015

Dear Fellow Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the annual meeting of stockholders of Dividend Capital Diversified Property Fund Inc., a Maryland corporation, to be held at The Brown Palace Hotel, 321 17th Street, Denver, Colorado 80202, on June 23, 2015 at 2:00 p.m. Mountain Daylight Time (the “Annual Meeting”). The matters to be considered by the stockholders at the Annual Meeting are described in detail in the accompanying materials.

We have elected to provide access to our proxy materials to certain of our stockholders over the Internet under the Securities and Exchange Commission’s “notice and access” rules. On or about April 24, 2015, we will mail (i) to certain of our stockholders, our proxy statement, a proxy card, and our Annual Report for the year ended December 31, 2014 and (ii) to other stockholders, a Notice of Internet Availability of Proxy Materials, which will indicate how to access our proxy materials on the Internet. We believe that providing our proxy materials over the Internet will expedite stockholders’ receipt of proxy materials, lower the costs associated with our Annual Meeting, and conserve natural resources.

IT IS IMPORTANT THAT YOU BE REPRESENTED AT THE ANNUAL MEETING REGARDLESS OF THE NUMBER OF SHARES YOU OWN OR WHETHER YOU ARE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON. Unlike most public companies, no large brokerage houses or affiliated groups of stockholders own substantial blocks of our shares. As a result, in order to achieve a quorum and to avoid delays and additional costs, we need substantial stockholder voting participation by proxy or in person at the Annual Meeting. Let me urge you to vote as soon as possible. You may vote by authorizing a proxy over the Internet, by telephone or, if you received printed proxy materials, by completing, signing, and returning your proxy card in the envelope provided.

Sincerely,

Richard D. Kincaid

Chairman of the Board of Directors

For the Board of Directors of Dividend Capital

Diversified Property Fund Inc.

Table of Contents

DIVIDEND CAPITAL DIVERSIFIED PROPERTY FUND INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 23, 2015

To the Stockholders of Dividend Capital Diversified Property Fund Inc.:

The annual meeting of stockholders of Dividend Capital Diversified Property Fund Inc., a Maryland corporation (the “Company”), will be held at The Brown Palace Hotel, 321 17th Street, Denver, Colorado 80202, on June 23, 2015 at 2:00 p.m. Mountain Daylight Time (the “Annual Meeting”). The matters to be considered by stockholders at the Annual Meeting, which are described in detail in the accompanying materials, are:

| (i) | a proposal to elect five directors to serve until the 2016 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| (ii) | a proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; |

| (iii) | a proposal to approve the Second Amended and Restated Equity Incentive Plan; |

| (iv) | a proposal to approve the Amended and Restated Secondary Equity Incentive Plan; and |

| (v) | any other business that may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. |

Stockholders of record at the close of business on April 8, 2015 will be entitled to notice of, and to vote at, the Annual Meeting. It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings.

We have elected to provide access to our proxy materials to certain of our stockholders over the Internet under the Securities and Exchange Commission’s “notice and access” rules. On or about April 24, 2015, we will mail (i) to certain of our stockholders, our proxy statement, a proxy card, and our Annual Report for the year ended December 31, 2014 and (ii) to other stockholders, a Notice of Internet Availability of Proxy Materials, which will indicate how to access our proxy materials on the Internet. The Notice of Internet Availability of Proxy Materials will also contain instructions on how each of those stockholders can receive a paper copy of our proxy materials, including the proxy statement, our Annual Report for the year ended December 31, 2014, and a proxy card or voting instruction card. We believe that this process will expedite stockholders’ receipt of proxy materials, lower the costs associated with our Annual Meeting, and conserve natural resources.

You may vote by authorizing a proxy over the Internet, by telephone or, if you received printed proxy materials, by completing, signing, and returning your proxy card in the envelope provided. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE AUTHORIZE YOUR PROXY BY ONE OF THESE THREE METHODS. If you are the record holder of your shares and you attend the meeting, you may withdraw your proxy and vote in person, if you so choose. If you have any questions regarding the proxy materials and the proposals to be considered by stockholders at the Annual Meeting, you can call 1-855-835-8315.

By Order of the Board of Directors,

Joshua J. Widoff

Executive Vice President,

General Counsel and Secretary

518 Seventeenth Street, 17th Floor

Denver, Colorado 80202

April 10, 2015

Table of Contents

DIVIDEND CAPITAL DIVERSIFIED PROPERTY FUND INC.

518 Seventeenth Street, 17th Floor, Denver, Colorado 80202

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 23, 2015

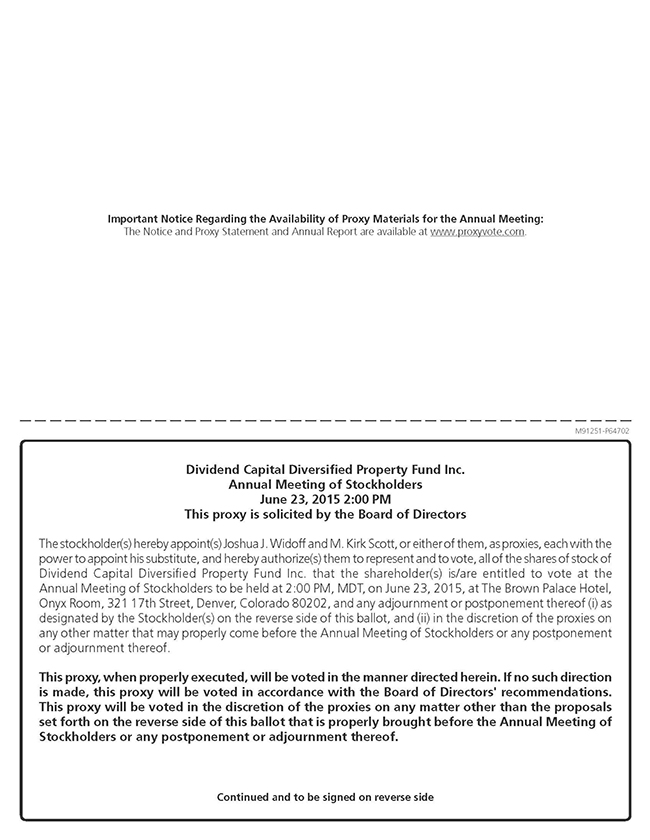

This proxy statement (the “Proxy Statement”) and the accompanying proxy card and notice of annual meeting are provided in connection with the solicitation of proxies by and on behalf of the Board of Directors of Dividend Capital Diversified Property Fund Inc., a Maryland corporation, for use at the annual meeting of stockholders to be held on June 23, 2015, and any postponements or adjournments thereof (the “Annual Meeting”). “We,” “our,” “us,” and “the Company” each refers to Dividend Capital Diversified Property Fund Inc.

The mailing address of our executive offices is 518 Seventeenth Street, 17th Floor, Denver, Colorado 80202. This Proxy Statement, the attached proxy card, our Annual Report for the year ended December 31, 2014 (the “2014 Annual Report”), and a copy of the Notice of the Annual Meeting of Stockholders (the “Annual Meeting Notice”), or the notice of internet availability of proxy materials (the “Internet Availability Notice”), as applicable, will be mailed to holders of our common stock, par value $0.01 per share, on or about April 24, 2015. When we refer to our common stock in this Proxy Statement, we are referring to our unclassified shares of common stock (which we often refer to as our “Class E” shares), as well as our Class A, Class W and Class I shares of common stock, unless the context otherwise requires.

A proxy may confer discretionary authority to vote with respect to any matter presented at the Annual Meeting. As of the date hereof, management has no knowledge of any business that will be presented for consideration at the Annual Meeting and which would be required to be set forth in this Proxy Statement or the related proxy card other than the matters set forth in the Annual Meeting Notice. If any other matter is properly presented at the Annual Meeting for consideration, it is intended that the persons named in the enclosed form of proxy and acting thereunder will vote in accordance with their discretion on any such matter.

Date, Time, and Place for the Annual Meeting

The Annual Meeting will be held on June 23, 2015 at The Brown Palace Hotel, 321 17th Street, Denver, Colorado 80202 at 2:00 p.m. Mountain Daylight Time. Directions to the Annual Meeting can be obtained by calling Investor Relations at (303) 228-2200.

Matters to be Considered at the Annual Meeting

At the Annual Meeting, holders of record of the Company’s common stock as of the close of business on April 8, 2015 will be asked to consider and vote upon:

| (i) | a proposal to elect five directors to serve until the 2016 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| (ii) | a proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015; |

| (iii) | a proposal to approve the Second Amended and Restated Equity Incentive Plan; |

| (iv) | a proposal to approve the Amended and Restated Secondary Equity Incentive Plan; and |

| (v) | any other business that may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on June 23, 2015. This Proxy Statement, the proxy card, and our 2014 Annual Report are available online at www.proxyvote.com.

Table of Contents

Table of Contents

INFORMATION ABOUT THE MEETING AND VOTING

What is the date of the Annual Meeting and where will it be held?

The Annual Meeting will be held on June 23, 2015 at The Brown Palace Hotel, 321 17th Street, Denver, Colorado 80202 at 2:00 p.m. Mountain Daylight Time.

Who is entitled to vote at the Annual Meeting?

Our Board of Directors has fixed the close of business on April 8, 2015 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on April 8, 2015 are entitled to vote at the Annual Meeting.

How many shares of common stock are outstanding?

As of the close of business on April 8, 2015, there were approximately 178,391,749 shares of our common stock outstanding and entitled to vote.

How many votes do I have?

You are entitled to one vote for each share of our common stock that you held as of the record date.

What will I be voting on at the Annual Meeting?

At the Annual Meeting, you will be asked to:

| • | elect five directors to serve until the 2016 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| • | ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015; |

| • | approve the Second Amended and Restated Equity Incentive Plan; |

| • | approve the Amended and Restated Secondary Equity Incentive Plan; and |

| • | act on any other business that may properly come before the Annual Meeting. |

How does the Board of Directors recommend that I vote on each proposal?

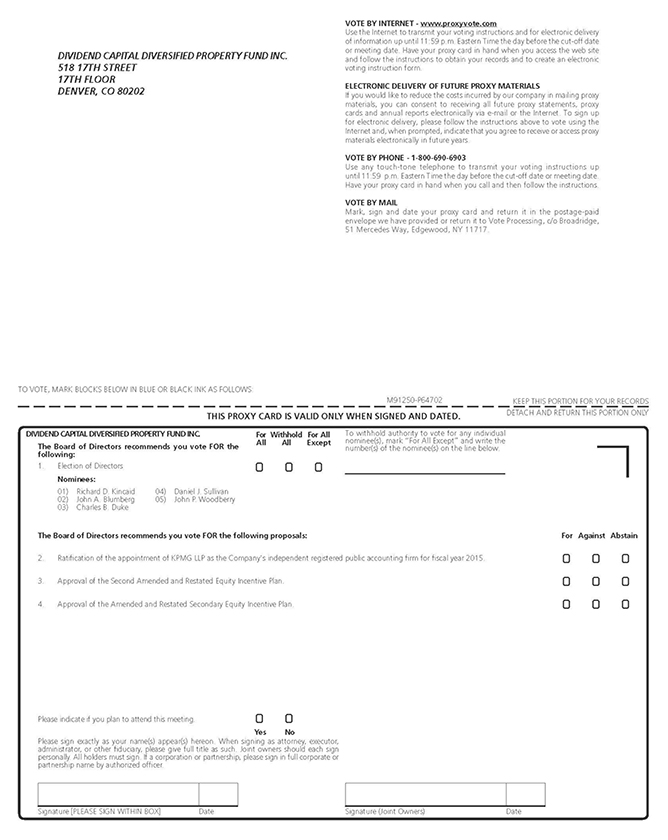

The Board of Directors recommends a vote:

| • | FOR the election of the nominees to our Board of Directors; |

| • | FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015; |

| • | FOR the approval of the Second Amended and Restated Equity Incentive Plan; and |

| • | FOR the approval of the Amended and Restated Secondary Equity Incentive Plan. |

What is the quorum requirement for the Annual Meeting?

A quorum will be present if the holders of 50% of the outstanding shares of our common stock entitled to vote are present, in person or by proxy, at the Annual Meeting. If you have returned a valid proxy or, if you hold your shares in your own name as holder of record and you attend the Annual Meeting in person, your shares will be counted for the purpose of determining whether there is a quorum. Broker “non-votes” are also counted as

1

Table of Contents

present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a broker holding shares of our common stock for a beneficial owner is present at the meeting, in person or by proxy, and entitled to vote, but does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

If a quorum is not present, the Annual Meeting may be adjourned by the chairman of the meeting until a quorum has been obtained.

What vote is required to approve each proposal?

Provided that a quorum is present, (i) the election of the nominees to our Board of Directors requires the affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the Annual Meeting, and (ii) the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015, the approval of the Second Amended and Restated Equity Incentive Plan, and the approval of the Amended and Restated Secondary Equity Incentive Plan require the affirmative vote of a majority of the votes cast at the Annual Meeting. There is no cumulative voting in the election of directors.

Withheld votes and broker “non-votes,” if any, will have the effect of votes against the election of the nominees to our Board of Directors. Abstentions and broker “non-votes”, if any, will have no effect on the result of the ratification of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015, the approval of the Second Amended and Restated Equity Incentive Plan, the approval of the Amended and Restated Secondary Equity Incentive Plan or any other matter for which the required vote is a majority of the votes cast.

How can I vote?

You can vote in person at the Annual Meeting or by proxy. If you hold your shares of our common stock in your own name as a holder of record, you have the following three options for submitting your vote by proxy:

| 1. | if you received printed proxy materials, by signing, dating, and mailing the proxy card in the postage-paid envelope provided; |

| 2. | via the Internet at www.proxyvote.com, as provided in the proxy card, the Internet Availability Notice, and in this Proxy Statement; or |

| 3. | by (i) touch-tone telephone at the toll-free number provided in the proxy card and the Internet Availability Notice, or (ii) with a live agent by telephone at 1-855-835-8315 between 9:00 a.m. and 9:00 p.m. EST, as provided in this Proxy Statement. |

For those stockholders with Internet access, we encourage you to vote via the Internet, since this method of voting is quick, convenient, and cost-efficient. When you vote via the Internet or by telephone prior to the Annual Meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted.

If your shares of our common stock are held on your behalf by a broker, bank, or other nominee, you will receive instructions from them that you must follow to have your shares voted at the Annual Meeting.

How will proxies be voted?

Shares represented by valid proxies will be voted as specified on the proxy unless it is properly revoked prior thereto. If no specification is made on the proxy as to any one or more of the proposals, the shares of our common stock represented by the proxy will be voted as follows:

| • | FOR the election of the nominees to our Board of Directors; |

| • | FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015; |

2

Table of Contents

| • | FOR the approval of the Second Amended and Restated Equity Incentive Plan; |

| • | FOR the approval of the Amended and Restated Secondary Equity Incentive Plan; and |

| • | in the discretion of the proxy holder on any other business that properly comes before the Annual Meeting. As of the date of this Proxy Statement, we are not aware of any other matter to be raised at the Annual Meeting. |

How can I change my vote or revoke a proxy?

If you hold shares of our common stock in your own name as a holder of record, you may revoke your proxy at any time prior to the date and time of the Annual Meeting through any of the following methods:

| • | send written notice of revocation, prior to the Annual Meeting, to our Executive Vice President, General Counsel and Secretary, Mr. Joshua J. Widoff, at 518 Seventeenth Street, 17th Floor, Denver, Colorado 80202; |

| • | properly sign, date, and mail a new proxy card to our Secretary; |

| • | dial the toll-free number provided in the proxy card, the Internet Availability Notice, and in this Proxy Statement and authorize your proxy again; |

| • | log onto the Internet site provided in the proxy card, the Internet Availability Notice, and in this Proxy Statement and authorize your proxy again; or |

| • | attend the Annual Meeting and vote your shares in person. |

Please note that merely attending the Annual Meeting, without further action, will not revoke your proxy. If shares of our common stock are held on your behalf by a broker, bank, or other nominee, you must contact them to receive instructions as to how you may revoke your proxy.

Who is soliciting my proxy, and who pays the cost of this proxy solicitation?

The enclosed proxy is solicited by and on behalf of our Board of Directors. The expense of preparing, printing, and mailing this Proxy Statement and the proxies solicited hereby will be borne by the Company. In addition to the use of the mail, proxies may be solicited by officers and directors, without additional remuneration, by personal interview, telephone, or otherwise. The Company will also request brokerage firms, nominees, custodians, and fiduciaries to forward proxy materials to the beneficial owners of shares held of record as of the close of business on the record date and will provide reimbursement for the cost of forwarding the material.

The Company has engaged Broadridge Investor Communications Solutions, Inc. (“Broadridge”) to solicit proxies for the Annual Meeting. The services to be performed by Broadridge will include consultation pertaining to the planning and organization of the solicitation, as well as assisting the Company in the solicitation of proxies from the Company’s stockholders entitled to vote at the Annual Meeting. The anticipated cost for such services is expected to be between $90,000 and $110,000.

Where can I find the voting results after the Annual Meeting?

American Election Services LLC, our independent tabulating agent, will count the votes and act as the Inspector of Election. We will publish the voting results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (the “Commission”) within four business days after the Annual Meeting. We keep all proxies, ballots, and voting tabulations confidential as a matter of practice. We permit only our Inspector of Election, American Election Services LLC, to examine these documents.

3

Table of Contents

Where can I find the Company’s Annual Report on Form 10-K?

A copy of our Annual Report on Form 10-K for our fiscal year ended December 31, 2014, as filed with the Commission on March 3, 2015, will be included in the 2014 Annual Report that will be delivered, or made available on the Internet as provided in the Internet Availability Notice, to stockholders entitled to vote at the Annual Meeting, and is available without charge to stockholders upon written request to: Dividend Capital Diversified Property Fund Inc., 518 Seventeenth Street, 17th Floor, Denver, Colorado 80202, Attention: Investor Relations. You can also find an electronic version of our Annual Report on Form 10-K for the year ended December 31, 2014 on our website at www.dividendcapitaldiversified.com.

4

Table of Contents

Our Board of Directors consists of five directors, three of whom are independent directors, as determined by our Board of Directors. Our charter and bylaws provide that a majority of the entire Board of Directors may establish, increase, or decrease the number of directors, provided that the number of directors shall never be less than three nor more than 15. The foregoing is the exclusive means of fixing the number of directors.

Our Board of Directors has determined that Messrs. Charles B. Duke, Daniel J. Sullivan, and John P. Woodberry are independent within the meaning of the applicable (i) provisions set forth in our charter, (ii) requirements set forth in the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the applicable Commission rules, and (iii) although our shares are not listed on the New York Stock Exchange (“NYSE”), independence rules set forth in the NYSE Listed Company Manual. To be considered independent under the NYSE rules, our Board of Directors must determine that a director does not have a material relationship with us and/or our consolidated subsidiaries (either directly or as a partner, stockholder, or officer of an organization that has a relationship with any of those entities).

Our charter defines an “independent director” as a person who has not been, directly or indirectly, associated with our Sponsor (as defined in our charter) or the Company’s advisor, Dividend Capital Total Advisors LLC (the “Advisor”), within the previous two years by virtue of:

| • | ownership interests in our Sponsor, our Advisor, or any of their affiliates; |

| • | employment by our Sponsor, our Advisor, or any of their affiliates; |

| • | service as an officer or director of our Sponsor, our Advisor, or any of their affiliates; |

| • | performance of services, other than as a director for us; |

| • | service as a director or trustee of more than three real estate investment trusts organized by our Sponsor or advised by our Advisor; or |

| • | maintenance of a material business or professional relationship with our Sponsor, our Advisor, or any of their affiliates. |

We refer to our directors who are not independent as our “interested directors.” Our charter sets forth the material business or professional relationships that cause a person to be associated with us and therefore not eligible to serve as an independent director. A business or professional relationship is per se material if the prospective independent director received more than five percent of his annual gross income in the last two years from our Sponsor, our Advisor, or any affiliate of our Sponsor or Advisor, or if more than five percent of his net worth, on a fair market value basis, has come from our Sponsor, our Advisor, or any affiliate of our Sponsor or Advisor.

5

Table of Contents

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Board of Directors has recommended that Messrs. Richard D. Kincaid, John A. Blumberg, Charles B. Duke, Daniel J. Sullivan, and John P. Woodberry be elected to serve on the Board of Directors, each until the annual meeting of stockholders for 2016 and until their respective successors are duly elected and qualified.

Each nominee has consented to being named in this Proxy Statement and to serve if elected. If, prior to the Annual Meeting, any nominee should become unavailable to serve, the shares of voting securities represented by a properly executed and returned proxy will be voted for such additional person as shall be designated by the Board of Directors, unless the Board of Directors determines to reduce the number of directors in accordance with the Company’s charter and bylaws.

Set forth below is certain information about our directors, including their respective position, age, biographical information, directorships held in the previous five years, and the experience, qualifications, attributes, and/or skills that led the Board of Directors to determine that the person should serve as our director. All of our directors have terms expiring on the date of the Annual Meeting and are being nominated for re-election to serve until the 2016 annual meeting of stockholders or until his or her successor is elected and qualified. For information regarding each director’s beneficial ownership of shares of our common stock, see the “Security Ownership of Certain Beneficial Owners and Management” section, and the notes thereto, included in this Proxy Statement.

| Richard D. Kincaid Chairman of the Board of Directors

Age: 53

Director since 2012

Member of Audit Committee Member of Investment Committee |

Richard D. Kincaid has served as our Chairman of the Board of Directors since September 2012. Prior to joining our Board of Directors, Mr. Kincaid was a Trustee and the President of Equity Office Properties Trust from November 2002, and the Chief Executive Officer from April 2003, until Equity Office Properties Trust was acquired by the Blackstone Group in February 2007. From March 1997 until November 2002, Mr. Kincaid was Executive Vice President of Equity Office Properties Trust and was Chief Operating Officer from September 2001 until November 2002. He also was Chief Financial Officer of Equity Office Properties Trust from March 1997 until August 2002, and Senior Vice President from October 1996 until March 1997.

Prior to joining Equity Office Properties Trust in 1995, Mr. Kincaid was Senior Vice President of Finance for Equity Group Investments, Inc., where he oversaw debt financing activities for the public and private owners of real estate controlled by Mr. Samuel Zell. During his tenure at Equity Group Investments and Equity Office Properties Trust, Mr. Kincaid supervised more than $11 billion in financing transactions, including property level loans encumbering office buildings, apartments, and retail properties, as well as unsecured debt, convertible debt securities, and preferred stock. Prior to joining Equity Group Investments in 1990, Mr. Kincaid held positions with Barclays Bank PLC and The First National Bank of Chicago. Richard Kincaid is currently the President and Founder of the BeCause Foundation. The BeCause Foundation is a nonprofit corporation that heightens awareness about a number of complex social problems and promotes change through the power of film. Mr. Kincaid is also an active private investor in early stage companies. Mr. Kincaid is on the board of directors of Rayonier Inc. (NYSE: RYN), an international real estate investment trust (“REIT”) that specializes in timber and specialty fibers. He also serves on the board of directors of Vail Resorts (NYSE: MTN), a mountain resort operator, |

6

Table of Contents

| and Strategic Hotels and Resorts (NYSE: BEE), an owner of upscale and luxury hotels in North America and Europe. He also serves on the board of directors of the Street Medicine Institute. Mr. Kincaid received his Master’s Degree in Business Administration from the University of Texas, and his Bachelor’s Degree from Wichita State University. | ||

| We believe that Mr. Kincaid’s qualifications to serve on our Board of Directors include his significant leadership experience as a Trustee, the President and the Chief Executive Officer of Equity Office Properties Trust and his director positions with other public companies. He also has demonstrated strategic insight with respect to large, growing real estate companies, as he developed the financial, technology and integration strategies for Equity Office Properties Trust during its tremendous growth, which included nearly $17 billion in acquisitions. We believe that his leadership and experience are valuable additions to our Board in connection with our ongoing offering and our transition to a perpetual-life REIT. | ||

| John A. Blumberg Director

Age: 55

Director since 2006

Chairman of Investment Committee |

John A. Blumberg has served as a director of our Board of Directors since January 2006 and also as our Chairman of the Board of Directors from January 2006 to September 2012. Mr. Blumberg has also been a manager of our Advisor since April 2005. From October 2009 to March 2010, Mr. Blumberg served as the Chairman of the Board of Directors of Industrial Income Trust Inc. (“Industrial Income Trust”), a Denver, Colorado-based REIT focusing on industrial real estate, and is currently a manager of Industrial Income Advisors LLC, the advisor to Industrial Income Trust. Mr. Blumberg is also a manager of Industrial Property Advisors LLC, the advisor to Industrial Property Trust Inc. (Industrial Property Trust”), a Denver, Colorado-based REIT.

Mr. Blumberg is a principal of both Dividend Capital Group LLC and Black Creek Group LLC, a Denver based real estate investment firm which he co-founded in 1993. In 2014, Mr. Blumberg joined the Board of Directors for Rayonier Inc. Since 2006, Mr. Blumberg has also been chairman of Mexico Retail Properties, a fully integrated retail real estate company that acquires, develops and manages retail properties throughout Mexico. Mr. Blumberg has been active in real estate acquisition, development and redevelopment activities since 1993 and, as of December 31, 2014, with affiliates, has overseen directly, or indirectly through affiliated entities, the acquisition, development, redevelopment, financing and sale of real properties having combined value of approximately $13.6 billion. Prior to co-founding Black Creek Group LLC, Mr. Blumberg was President of JJM Investments, which owned over 100 shopping center properties in Texas. During the 12 years prior to joining JJM Investments, Mr. Blumberg served in various positions with Manufacturer’s Hanover Real Estate, Inc., Chemical Bank and Chemical Real Estate, Inc., most recently as President of Chemical Real Estate, Inc. Mr. Blumberg holds a Bachelor’s Degree from the University of North Carolina at Chapel Hill.

We believe that Mr. Blumberg’s qualifications to serve on our Board of Directors are demonstrated by his extensive experience in real estate | |

7

Table of Contents

| investments, including his over 20 years of experience with Black Creek Group LLC as a co-founder of the company, his position as a principal of Dividend Capital Group LLC, his leadership experience as an executive officer of, and an advisor to, non-traded REITs and other real estate investment companies, and his experience in real estate investment banking. | ||

| Charles B. Duke Director

Age: 57

Director since 2006

Chairman of Audit Committee Member of Investment Committee |

Charles B. Duke has served as an independent director of our Board of Directors since January 2006. Mr. Duke has also served as an independent director on the Board of Directors of Industrial Income Trust since December 2009 and as an Independent Director on the board of Industrial Property Trust since March 2013. Mr. Duke is currently founder and CEO of To-Table Inc. (“To-Table”), a retailer of specialty gourmet foods. Prior to founding To-Table in November 2014, Mr. Duke was involved in the management of two ink jet cartridge remanufacturers and aftermarket suppliers: Mr. Duke served as Executive Vice President of IJR, Inc. in Phoenix, Arizona, from October 2012 to July 2014, and as the founder, President and Chief Executive Officer of Legacy Imaging, Inc. from 1996 through 2012. Mr. Duke has been active in entrepreneurial and general business activities since 1980 and has held several executive and management roles throughout his career, including founder, president, and owner of Careyes Corporation, a private bank, registered investment advisor and a member of the Financial Industry Regulatory Authority (“FINRA”) based in Denver, Colorado, Chief Financial Officer at Particle Measuring Systems, a global technology leader in the environmental monitoring industry based in Boulder, Colorado, and Vice President of Commercial Loans at Colorado National Bank. Mr. Duke also spent four years with Kirkpatrick Pettis, the investment-banking subsidiary of Mutual of Omaha, as Vice President of Corporate Finance, involved in primarily mergers and acquisitions, financing, and valuation activities. Mr. Duke graduated from Hamilton College in 1980 with a Bachelor’s Degree in Economics and English.

We believe that Mr. Duke’s qualifications to serve on our Board of Directors include his considerable experience in financial matters, including specifically his experience as founder and president of a private bank and as Chief Financial Officer of a significant organization, and we believe his business management experience is valuable in terms of providing director leadership. | |

| Daniel J. Sullivan Director

Age: 50

Director since 2006

Member of Audit Committee Member of Investment Committee Member of Conflicts Resolution Committee |

Daniel J. Sullivan has served as an independent director of our Board of Directors since January 2006. From 2003 to 2013, Mr. Sullivan was a private consultant and also the assistant editor of Humanitas, an academic journal published by the National Humanities Institute. Prior to that, from 1998 to 2002, he was Director of Business Development at Jordan Industries Inc. Mr. Sullivan has eighteen years of international business, consulting, and private equity investment experience, including over four years, from 1987 through 1991, in the real estate industry as an appraiser, property analyst, and investment banker with Manufacturers Hanover Real Estate Investment Banking Group in New York. During that time, Mr. Sullivan participated in the structuring and private placement of over $1 billion in long term, fixed-rate, and multi-property mortgage financings | |

8

Table of Contents

| for the bank’s corporate clients. Mr. Sullivan holds a Master of Arts Degree in Political Theory from The Catholic University of America in Washington, D.C. and a Bachelor of Arts Degree in History from Boston College in Chestnut Hill, Massachusetts.

We believe that Mr. Sullivan’s diverse background in education, journalism, international business, consulting, and private equity investment adds a unique perspective to our Board of Directors in fulfilling its duties. His qualifications to serve on our Board are also demonstrated by his experience in international business, finance, and real estate investments. | ||

| John P. Woodberry Director

Age: 52

Director since 2006

Member of Conflicts Resolution Committee Member of Investment Committee |

John P. Woodberry has served as an independent director of our Board of Directors since January 2006. Mr. Woodberry has been active in finance and investing activities since 1991. From 2007 to 2012, Mr. Woodberry served as the Portfolio Manager for the India and Capital Markets Group of Passport Capital, LLC, a San Francisco-based hedge fund. From 2004 to 2007, Mr. Woodberry was the President and Portfolio Manager of Independence Capital Asset Partners, LLC. Previously, from 2001 to 2004, Mr. Woodberry was a Senior Research Analyst at Cobalt Capital, LLC, a New York City-based hedge fund. From 1998 to 2001, Mr. Woodberry worked for Minute Man Capital Management, LLC and Trident Investment Management, LLC, each a New York City-based hedge fund. From 1995 to 1998, Mr. Woodberry worked at Templeton Investment Council Ltd. Mr. Woodberry has a Master’s Degree in Business Administration from Harvard Business School and a Bachelor of Arts Degree from Stanford University.

We believe that Mr. Woodberry’s qualifications to serve on our Board of Directors include his depth of experience in finance, capital markets, and investment management. His managerial roles at various hedge funds, including his experience as President and Portfolio Manager of Independence Capital Asset Partners, LLC, provide him with leadership experience that we believe is valuable to our Board of Directors in fulfilling its duties. | |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

ELECTION OF THE NOMINEES FOR DIRECTORS IDENTIFIED ABOVE.

9

Table of Contents

Board Leadership Structure

We separate the roles of Chief Executive Officer and Chairman of our Board of Directors because we currently believe that the different roles can best be filled by different people who have different experiences and perspectives. Mr. Jeffrey L. Johnson, as our Chief Executive Officer, is responsible for the execution of our business strategy and day-to-day operations. One of our interested directors, Mr. Kincaid, serves as Chairman of our Board of Directors, and, in such capacity, is responsible for presiding over our Board of Directors in its identification and execution of our operational and investment objectives, and oversight of our management team. We believe that Mr. Kincaid’s experience and background make him highly qualified to lead our Board of Directors in the fulfillment of its duties.

As an interested director, Mr. Kincaid may not participate as a director in determining the compensation of our Advisor, the renewal of the advisory agreement, or any other transactions or arrangements that we may enter into with regard to our Advisor or its affiliates. Our independent directors maintain authority with regard to any and all transactions and arrangements made with our Advisor. For additional discussion regarding the role that our independent directors play with regard to transactions and arrangements made with our Advisor see “Certain Relationships and Related Party Transactions” in this Proxy Statement.

Oversight of Risk Management

Our Board of Directors, either directly or through designated committees, including the Audit Committee, discussed further below, oversees our risk management through its involvement in our investment, financing, financial reporting, and compliance activities.

We, through our Advisor, maintain internal audit and legal departments that serve our Board of Directors and our Audit Committee in their risk management oversight. Further, our management team provides our Board of Directors and our Audit Committee with periodic updates that comprehensively address areas of our business that may pose significant risks to us.

We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our Board of Directors consists of a majority of independent directors. Our Conflicts Resolution Committee consists entirely of independent directors, and our Audit Committee consists of a majority of independent directors.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics, which applies to all employees of our Advisor, and our officers and directors, including our Chief Executive Officer and our Chief Financial Officer. Additionally, our Board of Directors has adopted a Code of Ethics specifically for the unique and critical roles of our Chief Executive Officer and our Senior Financial Officers, including our Chief Financial Officer. Copies of the Code of Business Conduct and Ethics and the Code of Ethics for our Chief Executive Officer and our Senior Financial Officers may be found on our website at www.dividendcapitaldiversified.com. Our Board of Directors must approve any amendment to or waiver of the Code of Business Conduct and Ethics as well as the Code of Ethics for our Chief Executive Officer and our Senior Financial Officers. We presently intend to disclose amendments and waivers, if any, of the Code of Ethics for our Chief Executive Officer and our Senior Financial Officers on our website.

Our Internet address is www.dividendcapitaldiversified.com. We make available, free of charge through a link on our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports, if any, as filed with the Commission as soon as reasonably

10

Table of Contents

practicable after such filing. You may also obtain these documents in print by writing us at 518 Seventeenth Street, 17th Floor, Denver, Colorado 80202, Attention: Investor Relations.

Board and Committee Meetings

During the year ended December 31, 2014, our Board of Directors held 14 meetings. No director attended fewer than 75 percent of the aggregate of all meetings held by our Board of Directors and the committees on which such director served. The Board of Directors has three standing committees: the Audit Committee, the Investment Committee, and the Conflicts Resolution Committee. During 2014, the Audit Committee met four times, and the Investment Committee did not meet since all investment decisions were made by the Board of Directors in 2014. The Conflicts Resolution Committee has not yet held a meeting. Although director attendance at our Annual Meeting each year is encouraged, we do not have an attendance policy. In 2014, one of our directors attended the Annual Meeting in person.

Our Board of Directors also adopted a delegation of authority policy on December 5, 2013 and, pursuant to such policy, has established a Management Committee and delegated the authority for certain actions to the Management Committee. The Management Committee is not a committee of our Board of Directors.

Audit Committee. The members of our Audit Committee are Messrs. Duke, Kincaid and Sullivan. Messrs. Duke and Sullivan are each an independent director and Mr. Kincaid is an interested director. Our Audit Committee operates under a written charter, a copy of which is available under the “Corporate Governance” section of our website at www.dividendcapitaldiversified.com. The Board of Directors has determined that each member of our Audit Committee is financially literate as such qualification is interpreted by our Board of Directors. Our Board of Directors has determined that Mr. Duke qualifies as an “Audit Committee Financial Expert” as defined by the rules of the Commission.

Our Audit Committee meets on a regular basis, at least quarterly and more frequently as necessary. Our Audit Committee’s primary function is to assist our Board of Directors in fulfilling its oversight responsibilities by reviewing the financial information to be provided to stockholders and others, reviewing our system of internal controls, which management has established, overseeing the audit and financial reporting process, including the preapproval of services performed by our independent registered public accounting firm, and overseeing certain areas of risk management.

Investment Committee. The members of our Investment Committee are Messrs. Blumberg, Kincaid, Duke, Sullivan, and Woodberry. Messrs. Duke, Sullivan, and Woodberry are each an independent director, and Messrs. Kincaid and Blumberg are each an interested director. Our Board of Directors has delegated to the Investment Committee (a) certain responsibilities with respect to specific real property and real estate-related debt and securities investments proposed by the Advisor and its product specialists and (b) the authority to review our investment policies and procedures on an ongoing basis and recommend any changes to our Board.

Our Board of Directors has delegated to our Investment Committee the authority to approve any real property acquisitions and developments (including real property portfolio acquisitions and developments), for a purchase price or total project cost of up to $25,000,000. Our Board of Directors, including a majority of our independent directors, must approve all real property acquisitions and developments, including real property portfolio acquisitions and developments, for a purchase price or total project cost greater than $25,000,000, including the financing of such acquisitions and developments. During the year ended December 31, 2014, all real property acquisitions were approved by our Board of Directors.

With respect to real estate-related debt and securities, our Board of Directors has delegated to the Investment Committee the authority to approve real estate-related debt and securities investment thresholds as well as certain responsibilities for approving ongoing monitoring and rebalancing measures within the context of our Board of Directors’ approved real estate-related debt and securities investment strategy and asset allocation framework.

11

Table of Contents

Conflicts Resolution Committee. The members of our Conflicts Resolution Committee are Messrs. Sullivan and Woodberry, each of whom is an independent director. Our Board of Directors has delegated to our Conflicts Resolution Committee the responsibility to consider and resolve all conflicts that may arise between us, Industrial Income Trust, and Industrial Property Trust, including conflicts that may arise as a result of the investment allocation methodology that our Advisor utilizes for allocating investment opportunities that are suitable for us and are also suitable for Industrial Income Trust and/or Industrial Property Trust.

Compensation Committee. We do not have a standing Compensation Committee. Our Board of Directors may establish a Compensation Committee in the future to administer our equity incentive plans. The primary function of a Compensation Committee would be to administer the granting of awards to our independent directors and selected employees of our Advisor, based upon recommendations from our Advisor, and to set the terms and conditions of such awards in accordance with the equity incentive plans. A Compensation Committee, if formed, will consist entirely of our independent directors. We do not have a charter that governs the process of setting compensation. For information regarding the determination of compensation to our Advisor and its affiliates, see the “Compensation to our Advisor and its Affiliates” section included in this Proxy Statement.

Nominating Committee. We do not have a standing Nominating Committee. Our Board of Directors has determined that it is appropriate for us not to have a Nominating Committee because all of the matters for which a Nominating Committee would be responsible are presently considered by our entire Board of Directors. We do not have a charter that governs the director nomination process.

Each member of our Board of Directors participates in the consideration of director nominees although our independent directors nominate replacements for vacancies among the independent directors’ positions. The process followed by our Board of Directors to identify and evaluate director candidates includes requests to members of our Board of Directors and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by members of our Board of Directors. In considering whether to recommend any particular candidate for inclusion in its slate of recommended director nominees, our Board of Directors considers various criteria including the candidate’s integrity, business acumen, knowledge of our business and industry, age, experience, diligence, conflicts of interest, and ability to act in the interests of all stockholders. Our Board of Directors does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. Our Board of Directors does not have a policy with regard to the consideration of diversity in identifying director candidates, but our Board of Directors believes that the backgrounds and qualifications of its directors, considered as a whole, should provide a composite mix of experience, knowledge, and abilities that will allow our Board of Directors to fulfill its responsibilities.

Stockholders may recommend individuals to our Board of Directors for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials. Assuming that appropriate biographical and background material has been provided on a timely basis, our Board of Directors will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Management Committee. The members of our Management Committee are Jeffrey L. Johnson, M. Kirk Scott, Richard D. Kincaid, Joshua J. Widoff, Gregory M. Moran, Gary M. Reiff (the general counsel of the Advisor), John A. Blumberg, James R. Mulvihill, Evan H. Zucker (Messrs. Blumberg, Mulvihill and Zucker are the managers of the Advisor), and, if deciding upon a disposition, Andrea L. Karp (our Senior Vice President of Real Estate).

With respect to real property investments, the Board of Directors has delegated to the Management Committee the authority to approve all real property dispositions, including real property portfolio dispositions, for a sales price of up to $25,000,000, provided that the total dispositions approved by the Management Committee in any quarter may not exceed $50,000,000. The Board of Directors, including a majority of the

12

Table of Contents

independent directors, must approve all real property dispositions, including real property portfolio dispositions, (i) for a sales price greater than $25,000,000, and (ii) once the total dispositions approved by the Management Committee in any quarter equals $50,000,000, for any sales price through the end of such quarter.

With respect to the lease of real property, the Board of Directors has delegated (i) to the President of the Company the authority to approve any lease of real property, on such terms as the President deem necessary, advisable, or appropriate, for total base rent not to exceed $10,000,000 over the base term of the lease, and (ii) to the Management Committee the authority to approve the lease of real property, on such terms as the Management Committee deems necessary, advisable, or appropriate, for total base rent not to exceed $50,000,000 over the base term of the lease.

With respect to capital expenditures (excluding capital expenditures approved by the Board of Directors in the ordinary course of budget approvals), (i) the President of the Company is authorized to approve any capital expenditure of up to $1,000,000 over the line item approved by the Board of Directors in the budget for the specified property, and (ii) the Management Committee is authorized to approve any capital expenditure of up to $5,000,000 over the line item approved by the Board of Directors in the budget for the specified property.

With respect to borrowing and refinancing decisions, the Board of Directors has authorized (i) the Chief Financial Officer to review and approve any proposed new borrowing or refinancing (secured or unsecured) for an amount of up to $25,000,000, (ii) the Management Committee to review and approve any proposed new borrowing (secured or unsecured) for an amount of up to $50,000,000, provided that the total new borrowings approved by the Management Committee in any quarter may not exceed $100,000,000, and (iii) the Management Committee to review and approve any proposed new refinancing (secured or unsecured) for an amount of up to $100,000,000, provided that the total new refinancings approved by the Management Committee in any quarter may not exceed $100,000,000.

Stockholder and Interested Party Communications with Directors

We provide the opportunity for our stockholders and other interested parties to communicate with any member, or all members, of our Board of Directors by mail. To communicate with our Board of Directors, correspondence should be addressed to our Board of Directors or any one or more individual directors or group or committee of directors by either name or title. All such correspondence should be sent to the following address:

The Board of Directors of Dividend Capital Diversified Property Fund Inc.

c/o Mr. Joshua J. Widoff, Executive Vice President, General Counsel and Secretary

518 Seventeenth Street, 17th Floor

Denver, Colorado 80202

All communications received as described above will be opened by our Secretary for the sole purpose of determining whether the contents constitute a communication to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the director or directors to whom it is addressed. In the case of communications to our Board of Directors or to any group of directors, our Secretary will make sufficient copies of the contents to send to each addressee.

13

Table of Contents

The following table shows the names and ages of our current executive officers and the positions held by each individual. A description of the business experience of each individual for at least the past five years follows the table. All officers serve at the discretion of our Board of Directors.

| Name |

Age | Position | ||||

| Jeffrey L. Johnson |

55 | Chief Executive Officer | ||||

| J. Michael Lynch |

62 | President | ||||

| M. Kirk Scott |

36 | Chief Financial Officer and Treasurer | ||||

| Joshua J. Widoff |

44 | Executive Vice President, General Counsel and Secretary | ||||

| Gregory M. Moran |

42 | Executive Vice President | ||||

Jeffrey L. Johnson has served as our Chief Executive Officer since January 2013. Mr. Johnson served as Managing Principal of Lakeshore Holdings, LLC, a private equity real estate firm that he founded, from 2007 through December 2012. Mr. Johnson has also served as the Chief Executive Officer of our Advisor since January 2013. From December 2009 to June 2011, he also served as founder and Managing Principal of Reunion Office Holdings, LLC, a private equity real estate firm, and from January 2009 to November 2009, he served as Chief Investment Officer and Managing Director of Transwestern Investment Company, a private equity real estate firm now known as Pearlmark Real Estate Partners. From 2003 until Equity Office Properties Trust was acquired by the Blackstone Group in February 2007, Mr. Johnson served as Chief Investment Officer, Executive Vice President and Chairman of the Investment Committee of Equity Office Properties Trust. Equity Office Properties Trust was a publicly traded REIT and at that time was the largest publicly traded owner and manager of office properties in the United States. While at Equity Office Properties Trust, Mr. Johnson restructured the investment group and implemented an investment strategy that resulted in over $12.5 billion in transaction volume, providing capital for a $2.6 billion stock repurchase. From 1990 to 1999, Mr. Johnson was a senior executive at Equity Office Properties Trust and its predecessor entities, most recently serving as Chief Investment Officer. Mr. Johnson was instrumental in completing Equity Office Property Trust’s initial public offering in July 1997, setting investment strategies and completing over $9 billion of real estate operating company transactions and property acquisitions. From 1990 to 1996, he was a senior acquisitions officer where he was responsible for acquiring over $1.2 billion of office properties. From 2000 through 2003, Mr. Johnson served as a Managing Director, founding Partner and Co-Head of U.S. Investments for Lehman Brothers Holdings, Inc.’s real estate private equity group, where he was one of six founding members that raised a $1.6 billion first-time fund, built an international investment group and executed a process that resulted in $580 million of equity investments, in over $6.9 billion of real estate, during the fund’s first 30 months.

During his career, Mr. Johnson has overseen acquisition and disposition activity in various real estate and real estate-related investments, including core office properties, development projects, joint ventures, international investments, mezzanine loans and multi-asset class portfolio transactions. He has also been instrumental in numerous significant public and private capital markets and mergers and acquisitions transactions. Mr. Johnson serves on the Northwestern University Kellogg Real Estate Advisory Board. Mr. Johnson is also a member of each of the Urban Land Institute and the Chicago Commonwealth Club. Mr. Johnson received his Master’s Degree in Business Administration from Northwestern University’s Kellogg Graduate School of Management and his Bachelor’s Degree from Denison University.

J. Michael Lynch has served as our President since July 2013. Mr. Lynch has over 30 years of real estate development and investment experience. Prior to joining the Company, Mr. Lynch served as Chief Investment Officer of Arden Realty, Inc., a GE Capital Real Estate Company, from May 2007 to June 2013. While with Arden Realty, Mr. Lynch oversaw capital market activities for a $4.5 billion office and industrial portfolio and led a team responsible for approximately $2 billion in acquisition and disposition activity. From May 2004 to March 2007, he served as Senior Vice President of Investments for Equity Office Properties Trust. While at Equity Office Properties Trust, Mr. Lynch managed office investment activity in major cities in the Western U.S.

14

Table of Contents

and development activity throughout the U.S. and completed transactions valued at over $1.5 billion of core and core-plus properties.

Mr. Lynch serves as an Advisory Board member for American Homes 4 Rent. Mr. Lynch received his Bachelor of Science Degree in Economics, cum laude, from Mount Saint Mary’s College and his Master’s Degree in Architecture from Virginia Polytechnic Institute.

M. Kirk Scott has served as our Chief Financial Officer and Treasurer since April 2009 and served as our Vice President and Controller from April 2008 to September 2011. Since joining us in April 2008, Mr. Scott has overseen and developed investor and lender relations, finance, financial reporting, accounting, budgeting, forecasting, internal audit, securities and tax compliance, lender relations and other related areas of responsibilities. Prior to joining us in 2008, Mr. Scott was Controller of Denver-based NexCore Group, a fully-integrated real estate development and operating company primarily focused within the medical office sector that has developed or acquired over 4.7 million square feet of facilities. Within his capacity as Controller, Mr. Scott directed and oversaw the accounting, financial reporting and compliance, budgeting, forecasting and investor relation functions for the NexCore Group. From 2002 until 2006, Mr. Scott was Assistant Controller at Dividend Capital Group and DCT Industrial Trust Inc. (NYSE: DCT) during that company’s growth from inception to more than $2 billion in assets under management where he was responsible for establishing the organization’s accounting and financial reporting function including compliance with the rules and regulations of the Commission, FINRA, the Internal Revenue Service and various state blue sky laws. Prior thereto, Mr. Scott was an auditor with KPMG focused on various real estate assignments. Mr. Scott holds a Bachelor’s Degree in Accounting, cum laude, from the University of Wyoming.

Joshua J. Widoff has served as Executive Vice President, General Counsel and Secretary since October 2010, and served as Senior Vice President, Secretary and General Counsel from September 2007 to October 2010. Mr. Widoff has served as the Executive Vice President, General Counsel and Secretary of Industrial Income Trust since December 2013 and as its Senior Vice President, General Counsel and Secretary since May 2009 and has served as the Executive Vice President, General Counsel and Secretary of Industrial Property Trust since September 2012. He has also served as a Managing Director of Black Creek Group LLC, a Denver-based private equity real estate firm, since September 2007, and as Executive Vice President of Dividend Capital Group since October 2010. Prior to joining us in September 2007, Mr. Widoff was a partner from October 2002 to July 2007 at the law firm of Brownstein Hyatt Farber Schreck, P.C., where he was active in the management of the firm, serving as chairman of both the firm’s Associate and Recruiting Committees and overseeing an integrated team of attorneys and paralegals servicing clients primarily in the commercial real estate business. During more than a dozen years of private practice, he managed transactions involving the acquisition, development, leasing, financing and disposition of various real estate assets, including vacant land, apartment and office buildings, hotels, casinos, industrial/warehouse facilities and shopping centers. He also participated in asset and stock acquisition transactions, convertible debt financings, private offerings and complex joint venture negotiations. Mr. Widoff served as general business counsel on a variety of contract and operational issues to a wide range of clients in diverse businesses. Mr. Widoff currently serves as a Vice-Chair and Commissioner for the Denver Urban Renewal Authority. Mr. Widoff received his Bachelor’s Degree from Trinity University in Texas and his Juris Doctor Degree from the University of Colorado School of Law.

Gregory M. Moran has served as Executive Vice President since July 2013. Mr. Moran also has served as a Vice President of Investments of Dividend Capital Group LLC and Dividend Capital Total Advisors Group LLC since August 2005. Mr. Moran has been an active participant in the institutional real estate community since 1998. From December 2001 through July 2005, Mr. Moran was a Portfolio Manager in the Real Estate Investment Group for the Public Employees’ Retirement Association of Colorado where he was directly involved in the ongoing management of a global real estate investment portfolio with over $2 billion of invested equity. Mr. Moran was responsible for sourcing and underwriting new investment opportunities, ongoing asset management of existing portfolio investments and relationship management for over a dozen joint venture partners and advisors of the fund. From September 1998 through December 2001, Mr. Moran worked in the

15

Table of Contents

Capital Markets Group at Sonnenblick Goldman Company, most recently as a Vice President. During this time, Mr. Moran was responsible for raising and structuring debt and equity investments in commercial real estate projects on behalf of public and private real estate investment companies. Mr. Moran received his Bachelor’s Degree in Business Administration and Master’s Degree in Professional Accounting from the University of Texas at Austin — McCombs School of Business. He is also a CFA Charterholder, and a member of the CFA Institute, Urban Land Institute and Pension Real Estate Association.

16

Table of Contents

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Compensation of Directors

We pay each of our independent directors $8,750 per quarter plus $2,000 for each regular Board of Directors meeting attended in person, $1,000 for each regular Board of Directors meeting attended by telephone, and $2,000 for each committee meeting and each special Board of Directors meeting attended in person or by telephone. We also pay the chairman of the Audit Committee an annual retainer of $7,500 (prorated for a partial term). All directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attending Board meetings. If a director is also one of our officers, we will not pay additional compensation for services rendered as a director. The amount and form of compensation payable to our independent directors for their service to us is determined by our independent directors, based upon recommendations from our Advisor. Certain of our executive officers may, in their capacities as officers and/or employees our Advisor, participate in recommending compensation for our directors.

RSU Awards

In addition, at each annual meeting of stockholders the independent directors will automatically, upon election, receive an award (“Annual Award”), pursuant to either the Equity Incentive Plan or the Secondary Plan (as defined below under “Equity Incentive Plans”), of $10,000 in restricted stock units (“RSUs”) with respect to Class I shares of our common stock, with the number of RSUs based on the NAV per Class I share as of the end of the day of the annual meeting. Independent directors appointed after an annual meeting will, upon appointment, receive a pro rata Annual Award, with the number of RSUs based on the Class I NAV as of the end of the day of appointment and reflecting the number of days remaining until the one-year anniversary of the prior annual meeting of stockholders (or, if earlier and if scheduled as of the day of appointment, the date of the next scheduled annual meeting of stockholders).

RSUs will vest if and when the director completes the term for which he or she was elected/appointed. Unvested awards will also vest in the event of death or disability of the director or upon a change of control of our company. Unvested awards will be forfeited if the director’s term in office terminates prematurely for any other reason. The directors may elect to defer settlement of vested awards in shares pursuant to Section 409A of Internal Revenue Code of 1986, as amended (the “Code”).

The following table sets forth information concerning the compensation of our independent directors for the year ended December 31, 2014:

| Name |

Fees Earned or Paid in Cash (1) |

Stock Awards (2) | Total | |||||||||

| Charles B. Duke |

$ | 93,125 | $ | 14,880 | $ | 108,005 | ||||||

| Daniel J. Sullivan |

83,750 | 14,880 | 98,630 | |||||||||

| John P. Woodberry |

71,750 | 14,880 | 86,630 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 248,625 | $ | 44,640 | $ | 293,265 | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | This column includes fees earned in 2013 and paid in 2014. The amounts earned in 2013 and paid in 2014 are: $16,625 for Mr. Duke, $12,750 for Mr. Sullivan, and $12,750 for Mr. Woodberry. This column also includes fees earned in 2014, a portion of which were paid in 2015. The amounts paid in 2015 are: $20,625 for Mr. Duke, $18,750 for Mr. Sullivan, and $14,750 for Mr. Woodberry. |

| (2) | Includes (i) a pro rata Annual Award made on January 2, 2014, to each independent director then in office, with the number of RSUs based on the Class I NAV as of the end of the day on January 2, 2014, and reflecting the number of days remaining until the one-year anniversary of the 2013 annual meeting of stockholders, and (ii) an Annual Award made on June 25, 2014, to each independent director then in office, with the number of RSUs based on the Class I NAV as of the end of the day on June 25, 2014, and reflecting the number of days remaining until the one-year anniversary of the 2014 annual meeting of stockholders. |

17

Table of Contents

Executive Compensation

Compensation Discussion and Analysis

Because our advisory agreement provides that our Advisor assumes principal responsibility for managing our affairs, we have no employees, and our executive officers, in their capacities as such, do not receive compensation from us, nor do they work exclusively on our affairs. In their capacities as officers or employees of our Advisor or its affiliates, they devote such portion of their time to our affairs as is required for the performance of the duties of our Advisor under the advisory agreement. The compensation received by our executive officers is not paid or determined by us, but rather by an affiliate of the Advisor based on all of the services provided by these individuals. See “Certain Relationships and Related Party Transactions” below for a summary of the fees and expenses payable to our Advisor and its affiliates.

Compensation Committee Report

We do not currently have a Compensation Committee, however, our Compensation Committee, if formed, would be comprised entirely of independent directors. In lieu of a formal Compensation Committee, our independent directors perform an equivalent function. Our independent directors have reviewed and discussed the Compensation Discussion and Analysis above with management. Based on the independent directors’ review of the CD&A and their discussions of the CD&A with management, the independent directors recommended to the Board of Directors, and the Board of Directors has approved, that the CD&A be included in this Proxy Statement.

INDEPENDENT DIRECTORS:

Charles B. Duke

Daniel J. Sullivan

John P. Woodberry

The foregoing report shall not be deemed to be “soliciting material” or incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such Acts.

Compensation Committee Interlocks and Insider Participation

We do not currently have a Compensation Committee, however, we intend that our Compensation Committee, if formed, would be comprised entirely of independent directors. In lieu of a formal Compensation Committee, our independent directors perform an equivalent function. None of our independent directors served as one of our officers or employees or as an officer or employee of any of our subsidiaries during the fiscal year ended December 31, 2014, or formerly served as one of our officers or as an officer of any of our subsidiaries. In addition, during the fiscal year ended December 31, 2014, none of our executive officers served as a director or member of a compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board of Directors) of any entity that has one or more executive officers or directors serving as a member of our Board of Directors.

We do not expect that any of our executive officers will serve as a director or member of the compensation committee of any entity whose executive officers include a member of our Compensation Committee, if formed.

Equity Incentive Plans

Amended and Restated Equity Incentive Plan

On December 5, 2013, our Board of Directors adopted the Amended and Restated Equity Incentive Plan (the “Equity Incentive Plan”).

18

Table of Contents

The Equity Incentive Plan provides for the granting of stock options, stock appreciation rights, restricted stock, stock units and/or other stock-based awards to our employees (if we have any in the future), our independent directors, employees of the Advisor or its affiliates and other advisors and consultants of ours and of the Advisor selected by the plan administrator for participation in the Equity Incentive Plan. Any such stock options, stock appreciation rights, restricted stock, stock units and/or other stock-based awards will provide for exercise prices, where applicable, that are not less than the fair market value of shares of our common stock on the date of the grant.

Our Board of Directors administers the Equity Incentive Plan as the plan administrator, with sole authority to select participants, determine the types of awards to be granted and determine all the terms and conditions of the awards, including whether the grant, vesting or settlement of awards may be subject to the attainment of one or more performance goals. No awards will be granted under the plan if the grant, vesting and/or exercise of the awards would jeopardize our status as a real estate investment trust for tax purposes or otherwise violate the ownership and transfer restrictions imposed under our charter. Unless determined by the plan administrator, no award granted under the Equity Incentive Plan will be transferable except through the laws of descent and distribution.

An aggregate maximum of 5.0 million shares may be issued upon grant, vesting or exercise of awards under the Equity Incentive Plan, although the Board of Directors, to date, has only authorized and reserved for issuance a total of 2.0 million shares of our common stock under the Equity Incentive Plan. In addition, to any individual in any single calendar year no more than 200,000 shares may be made subject to stock options or stock appreciation rights under the Equity Incentive Plan and no more than 200,000 shares may be made subject to other stock-based awards under the Equity Incentive Plan. Further, our Board of Directors adopted an administrative rule, which is subject to change at any time, to the effect that it will not approve the issuance of new awards under the plan (other than the initial grant of options to our independent directors) if, after giving pro forma effect to such issuance, the aggregate number of shares of our common stock subject to all outstanding awards exceeds 4% of the sum of (i) the number of shares of our then outstanding common stock and (ii) the number of then outstanding OP Units in the Company’s operating partnership, Dividend Capital Total Operating Partnership LP (the “Operating Partnership”), other than those held by us. If any shares subject to an award under the Equity Incentive Plan are forfeited, cancelled, exchanged or surrendered or an award terminates or expires without a distribution of shares or if shares are surrendered or withheld as payment of either the exercise price of an award or withholding taxes in respect of an award, such number of shares will again be available for awards under the Equity Incentive Plan. In the event of certain corporate transactions affecting our common stock, such as, for example, a reorganization, recapitalization, merger, spin-off, split-off, stock dividend or extraordinary dividend, our Board of Directors will have the sole authority to determine whether and in what manner to equitably adjust the number and type of shares and the exercise prices applicable to outstanding awards under the plan, the number and type of shares reserved for future issuance under the plan, and, if applicable, performance goals applicable to outstanding awards under the plan.

Under the Equity Incentive Plan, our Board of Directors will determine the treatment of awards in the event of a change in our control. The Equity Incentive Plan will automatically expire on January 12, 2016, unless extended or earlier terminated by our Board of Directors. Our Board of Directors may terminate the Equity Incentive Plan at any time. The expiration or other termination of the Equity Incentive Plan will have no adverse impact on any award that is outstanding at the time the Equity Incentive Plan expires or is terminated without the consent of the holder of the outstanding award. Our Board of Directors may amend the Equity Incentive Plan at any time, but no amendment will adversely affect any award on a retroactive basis without the consent of the holder of the outstanding award, and no amendment to Equity Incentive Plan will be effective without the approval of our stockholders if such approval is required by any law, regulation or rule applicable to the Equity Incentive Plan.

On March 12, 2015, our Board of Directors adopted the Second Amended and Restated Equity Incentive Plan, subject to stockholder approval. See Proposal No. 3 for a description of the Second Amended and Restated Equity Incentive Plan.

19

Table of Contents

Secondary Equity Incentive Plan

On December 5, 2013, the Board of Directors also adopted the Secondary Equity Incentive Plan (the “Secondary Plan”). The Secondary Plan is substantially similar to the Equity Incentive Plan, except that under the Secondary Plan, an eligible participant is any person, trust, association or entity to which the plan administrator desires to grant an award. An aggregate maximum of 5.0 million shares may be issued upon grant, vesting or exercise of awards under the Secondary Plan, although the Board of Directors, to date, has only authorized and reserved for issuance a total of 2.0 million shares of our common stock under the Secondary Plan.

On March 12, 2015, our Board of Directors adopted the Amended and Restated Secondary Equity Incentive Plan, subject to stockholder approval. See Proposal No. 4 for a description of the Amended and Restated Secondary Equity Incentive Plan.

The following table gives information regarding our equity incentive plans as of December 31, 2014.

| Equity Compensation Plans Information | ||||||||||||

| Plan Category |

Number of Securities To Be Issued Upon Exercise of Outstanding Options, Warrants, and Rights |