UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-52596

Dividend Capital Diversified Property Fund Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 30-0309068 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 518 Seventeenth Street, 17th Floor, Denver, CO | 80202 | |

| (Address of principal executive offices) | (Zip Code) | |

(303) 228-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Unclassified Shares of Common Stock, $0.01 par value

Class A Shares of Common Stock, $0.01 par value

Class W Shares of Common Stock, $0.01 par value

Class I Shares of Common Stock, $0.01 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There is no established market for the Registrant’s shares of common stock. The Registrant publishes a daily net asset value (“NAV”), based on procedures and methodologies established by its board of directors, with an NAV on June 28, 2013, the last business day of the Registrant’s most recently completed second fiscal quarter, of $6.83 per share for its unclassified shares of common stock (referred to as “Class E” shares) and each of its Class A, Class W and Class I classes of common stock. As of December 31, 2013, the daily NAV was $6.93 per share for each of its Class E, Class A, Class W and Class I classes of common stock.

There were approximately 173,822,809 outstanding shares of Class E common stock, 12,375 outstanding shares of Class A common stock, 12,375 outstanding shares of Class W common stock, and 1,556,036 outstanding shares of Class I common stock, held by non-affiliates, as of June 28, 2013, the last business day of the Registrant’s most recently completed second fiscal quarter.

As of February 28, 2014, 171,984,070 shares of Class E common stock, 457,206 shares of Class A common stock, 324,525 shares of Class W common stock, and 4,341,011 shares of Class I common stock of the Registrant, each with a par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Registrant’s Proxy Statement for the 2014 Annual Meeting of Stockholders, which we will file no later than April 30, 2014, are incorporated by reference in Part III.

DIVIDEND CAPITAL DIVERSIFIED PROPERTY FUND INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2013

TABLE OF CONTENTS

| PART I | ||||||

| Item 1. |

4 | |||||

| Item 1A. |

13 | |||||

| Item 1B. |

55 | |||||

| Item 2. |

55 | |||||

| Item 3. |

57 | |||||

| Item 4. |

57 | |||||

| PART II | ||||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 58 | ||||

| Item 6. |

Selected Financial Data | 68 | ||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 70 | ||||

| Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk | 95 | ||||

| Item 8. |

Financial Statements and Supplementary Data | 96 | ||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 96 | ||||

| Item 9A. |

Controls and Procedures | 97 | ||||

| Item 9B. |

Other Information | 97 | ||||

| PART III | ||||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 98 | ||||

| Item 11. |

Executive Compensation | 98 | ||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 98 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence | 98 | ||||

| Item 14. |

Principal Accountant Fees and Services | 98 | ||||

| PART IV | ||||||

| Item 15. |

99 | |||||

- 2 -

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K includes certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” Such forward-looking statements relate to, without limitation, our future capital expenditures, distributions and acquisitions (including the amount and nature thereof), other developments and trends of the real estate industry, business strategies, and the expansion and growth of our operations. These statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Such statements are subject to a number of assumptions, risks and uncertainties which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements are generally identifiable by the use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “project,” “continue,” or the negative of these words, or other similar words or terms. Readers are cautioned not to place undue reliance on these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

| • | the impact of macroeconomic trends, such as the unemployment rate and availability of credit, which may have a negative effect on the following, among other things: |

| • | the fundamentals of our business, including overall market occupancy, tenant space utilization, and rental rates; |

| • | the financial condition of our tenants, some of which are financial, legal and other professional firms, our lenders, and institutions that hold our cash balances and short-term investments, which may expose us to increased risks of breach or default by these parties; and |

| • | the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis; |

| • | general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); |

| • | our ability to effectively raise and deploy proceeds from our ongoing public offering of Class A, Class W and Class I shares; |

| • | risks associated with the availability and terms of debt and equity financing and the use of debt to fund acquisitions and developments, including the risk associated with interest rates impacting the cost and/or availability of financing; |

| • | the business opportunities that may be presented to and pursued by us, changes in laws or regulations (including changes to laws governing the taxation of real estate investment trusts (“REITs”)); |

| • | conflicts of interest arising out of our relationships with Dividend Capital Total Advisors Group LLC (the “Sponsor”), Dividend Capital Total Advisors LLC (the “Advisor”), and their affiliates; |

| • | changes in accounting principles, policies and guidelines applicable to REITs; |

| • | environmental, regulatory and/or safety requirements; and |

| • | the availability and cost of comprehensive insurance, including coverage for terrorist acts. |

For further discussion of these and other factors, see “Item 1A. Risk Factors” in this Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of future events, new information or otherwise.

- 3 -

| ITEM 1. | BUSINESS |

Overview

Dividend Capital Diversified Property Fund Inc. is a Maryland corporation formed on April 11, 2005 to invest in a diverse portfolio of real property and real estate-related investments. As used herein, “the Company,” “we,” “our” and “us” refer to Dividend Capital Diversified Property Fund Inc. and its consolidated subsidiaries and partnerships except where the context otherwise requires.

We believe we have operated in such a manner to qualify as a real estate investment trust (“REIT”) for federal income tax purposes, commencing with the taxable year ended December 31, 2006, when we first elected REIT status. We utilize an Umbrella Partnership Real Estate Investment Trust (“UPREIT”) organizational structure to hold all or substantially all of our assets through our operating partnership, Dividend Capital Total Realty Operating Partnership, LP (our “Operating Partnership”). Furthermore, our Operating Partnership wholly owns a taxable REIT subsidiary, DCTRT Leasing Corp. (the “TRS”), through which we execute certain business transactions that might otherwise have an adverse impact on our status as a REIT if such business transactions were to occur directly or indirectly through our Operating Partnership.

Our Advisor

We are managed by the Advisor, which is wholly owned by our Sponsor. Our Advisor was formed as a Delaware limited liability company in April 2005. Subject to oversight by our board of directors, we rely on our Advisor to manage our day-to-day activities and to implement our investment strategy. In addition, subject to the oversight, review and approval of our board of directors, our Advisor undertakes to, among other things, research, identify, review and make investments in and dispositions of real property and real estate-related investments on our behalf consistent with our investment policies and objectives. Our Advisor performs its duties and responsibilities under an advisory agreement with us (the “Advisory Agreement”) as a fiduciary of ours and our stockholders. The term of the Advisory Agreement is for one year, subject to renewals by our board of directors for an unlimited number of successive one-year periods. The current term of the Advisory Agreement expires on June 30, 2014. Our officers and our two interested directors are all employees of an affiliate of our Advisor.

Our Offerings

On July 12, 2012, we commenced an ongoing public offering of Class A, Class W and Class I shares of our common stock. Immediately thereafter, we changed our name from Dividend Capital Total Realty Trust Inc. to Dividend Capital Diversified Property Fund Inc. The Registration Statement applies to the offer and sale of up to $3,000,000,000 of our shares of common stock, of which $2,250,000,000 of shares are expected to be offered to the public in a primary offering and $750,000,000 of shares are expected to be offered to our stockholders pursuant to an amended and restated distribution reinvestment plan (subject to our right to reallocate such amounts). In the offering, we are offering to the public three classes of shares: Class A shares, Class W shares and Class I shares with net asset value (“NAV”) based pricing. We are offering to sell any combination of Class A shares, Class W shares and Class I shares with a dollar value up to the maximum offering amount.

Dividend Capital Securities LLC, which we refer to as the “Dealer Manager,” is distributing the shares of our common stock in the Class A, Class W and Class I offering on a “best efforts” basis. The Dealer Manager is an entity related to the Advisor and is a member of the Financial Industry Regulatory Authority, Inc., or FINRA. The Dealer Manager coordinates our distribution effort and manages our relationships with participating broker-dealers and financial advisors and provides assistance in connection with compliance matters relating to marketing the offering.

- 4 -

We also continue to sell shares of our unclassified common stock, which we refer to as “Class E” shares, pursuant to our distribution reinvestment plan offering.

Since commencing formal business operations on April 3, 2006, through December 31, 2013, we had raised approximately $1.7 billion in net proceeds from public and private offerings of common stock and OP Units (defined below). As of December 31, 2013, we had approximately 171,254,036 Class E shares, 216,745 Class A shares, 208,889 Class W shares, and 4,327,085 Class I shares outstanding, and our Operating Partnership had outstanding OP Units held by third-party investors representing approximately a 7.0% limited partnership interest.

Our Classes of Common Stock

We have four classes of common stock: Class E, Class A, Class W and Class I shares. The payment of class-specific expenses results in different amounts of distributions being paid with respect to each class of shares. In addition, as a result of the different ongoing fees and expenses allocable to each share class, each share class could have a different NAV per share. If the NAV of our classes are different, then changes to our assets and liabilities that are allocable based on NAV may also be different for each class. Our four classes of common stock also have different rights upon liquidation to the extent that their NAV per share differs. In the event of a liquidation event, our assets, or the proceeds therefrom, will be distributed ratably in proportion to the respective NAV for each class until the NAV for each class has been paid. Other than differing allocable fees and expenses and liquidation rights, Class E shares, Class A shares, Class W shares, and Class I shares have identical rights and privileges.

Our Operating Partnership

We own all of our interests in our investments through our Operating Partnership or its subsidiaries. We are the sole general partner of our Operating Partnership. In addition, we have contributed 100% of the proceeds received from our offerings of common stock to our Operating Partnership in exchange for partnership units representing our interest as a limited partner of the Operating Partnership. As of December 31, 2013, we had invested approximately $1.6 billion in the Operating Partnership in exchange for a 93.0% limited partnership interest. We refer to partnership units in the Operating Partnership as “OP Units.” As of December 31, 2013, our Operating Partnership had outstanding OP Units held by third-party investors representing approximately a 7.0% limited partnership interest. These units were issued by the Operating Partnership in connection with its exercise of options to acquire certain tenancy-in-common interests sold to such investors pursuant to private placements previously conducted by the Operating Partnership. The holders of OP Units (other than us) generally have the right to cause the Operating Partnership to redeem all or a portion of their OP Units for, at our sole discretion, shares of our common stock, cash, or a combination of both.

Our Operating Partnership has classes of OP Units that correspond to our four classes of common stock: Class E OP Units, Class A OP Units, Class W OP Units and Class I OP Units. The OP Units held by third parties are all Class E OP Units and are economically equivalent to our Class E shares. Accordingly, for purposes of our NAV procedures described below and the calculation of certain fees to the Advisor, we sometimes consider the OP Units held by third parties as a fifth class of security issued by us. We sometimes refer to our Class E shares, Class A shares, Class W shares and Class I shares, along with the Class E OP Units held by third parties, collectively as “Fund Interests” because they all represent interests held by investors in our Operating Partnership, through which we own all of our investments and conduct all of our operations. We sometimes refer to the NAV of all of the Fund Interests as the “Aggregate Fund NAV.”

Net Asset Value Calculation and Valuation Procedures

Our board of directors, including a majority of our independent directors, has adopted valuation procedures that contain a comprehensive set of methodologies to be used in connection with the calculation of our NAV.

- 5 -

One fundamental element of the valuation process, the valuation of our real property portfolio, is managed by Altus Group U.S., Inc., an independent valuation firm approved by our board of directors, including a majority of our independent directors (the “Independent Valuation Firm”). Altus Group is a multidisciplinary provider of independent, commercial real estate consulting and advisory services in multiple offices around the world, including Canada, the U.K., Australia, the United States and Asia Pacific. Altus Group is engaged in the business of valuing commercial real estate properties and is not affiliated with us or the Advisor.

Our NAV is calculated for each of our share classes after the end of each business day that the New York Stock Exchange is open for unrestricted trading by ALPS Fund Services Inc., a third-party firm approved by our board of directors, including a majority of our independent directors (our “NAV Accountant”). Our NAV is not audited by our independent registered public accounting firm. See Part II, Item 5 and Exhibit 99.1 of this Annual Report on Form 10-K for a more detailed description of our valuation procedures and valuation components, and our NAV as of December 31, 2013.

Our Portfolio

We are currently invested in a diverse portfolio of real properties and, to a lesser extent, real estate-related debt investments. Our investment in real property consists of office, industrial, and retail properties located in North America. As of December 31, 2013, our real property portfolio was approximately 93.6% leased. Additionally, we are invested in certain real estate-related debt investments, including originating and participating in mortgage loans secured by real estate, junior portions of first mortgages on commercial properties (“B-notes”), and mezzanine debt (herein referred to as “debt related investments”).

As of December 31, 2013, we had total gross investments with an estimated fair value of approximately $2.6 billion (calculated in accordance with our valuation procedures), comprised of approximately $2.5 billion in gross investments in real property and approximately $123.9 million in net debt related investments.

As of December 31, 2013, we had four reportable operating segments: office property, industrial property, retail property and debt related investments. Operating results from our business segments are discussed further in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 13 to our financial statements beginning on page F-1 of this Annual Report on Form 10-K.

Whenever we refer to the “fair value” of our real estate investments in this Annual Report on Form 10-K, we are referring to the fair value as determined pursuant to our valuation procedures, unless stated otherwise.

Investment Objectives

Our primary investment objectives are:

| • | providing current income to our stockholders in the form of quarterly cash distributions; |

| • | preserving and protecting our stockholders’ capital investments; |

| • | realizing capital appreciation in our share price from active investment management and asset management; and |

| • | providing portfolio diversification in the form of multi-asset class investing in direct real estate. |

There is no assurance that we will attain our investment objectives. Our charter places numerous limitations on us with respect to the manner in which we may invest our funds. In most cases these limitations cannot be changed unless our charter is amended, with the approval of our stockholders.

- 6 -

Investment Strategy

Our investment strategy is designed to focus first on generating income to support the quarterly dividend, second, to focus on protecting capital and third to grow net asset value over time. We seek to leverage our extensive knowledge of targeted real estate markets and property types to capitalize on opportunities where there is a disconnect between our assessment of an investment’s intrinsic value relative to market value. In addition, we seek to optimize the value of our portfolio through strategic financing, diligent asset management and selective asset disposition.

We believe that the more opportunities we see to invest our capital, the more selective we can be in choosing strategic and accretive investments, which we believe may result in attractive total returns for our stockholders. Seeing more opportunities may also allow us to be consistent and meaningful investors throughout different cycles. We invest across multiple markets, so when we believe one market is overvalued we patiently wait and focus on another market that we believe is overlooked.

We also believe that value is based on the investment’s ability to produce cash flow and not what the next buyer will pay at any point in time. We focus on select, targeted markets that exhibit characteristics of being supply-constrained with strong demand from tenants seeking quality space.

We primarily target direct investments, through equity interests and/or joint ventures, in our four target property categories of office, industrial, retail and multifamily. Although we do not currently own multifamily investments, we will consider multifamily investment opportunities going forward. To a lesser extent we may invest in other types of real estate including, but not limited to, hospitality, medical offices, student housing and unimproved land. We anticipate that the majority of our real property investments will be made in the United States, although we may also invest in Canada and Mexico, and potentially elsewhere on a limited basis, to the extent that opportunities exist that may help us meet our investment objectives.

To provide diversification to our portfolio, we have and may continue to invest in real estate-related debt, which will generally include originating and participating in mortgage loans secured by real estate, mezzanine debt and other related investments. Any investments in real estate-related securities will generally focus on debt and equity issued by public and private real estate companies and certain other securities, with the primary goal of such investments being the preservation of liquidity in support of our share redemption program.

Diversification Across Real Estate Investment Types

Our objective is to build a high-quality, diversified real estate portfolio. Although there can be no assurance that we will achieve this objective, we intend to diversify our portfolio by key portfolio attributes including, but not limited to, (1) property type, (2) target market, with consideration given to geographic concentrations, (3) average lease terms and portfolio occupancy expectations, (4) tenant concentrations, including credit and exposure to particular businesses or industries and (5) debt profile with the goal of maximizing flexibility while seeking to minimize cost and mitigate the risks associated with changes in interest rates and debt maturities.

As of December 31, 2013, our real estate portfolio primarily consists of investments in real property and debt related investments, which comprise approximately 95% and 5%, respectively, of the fair value of our real estate investments.

Real Property

We generally utilize a long-term hold strategy for strategic investments within our portfolio of real estate assets. The majority of our current portfolio consists of primarily “core” or “core-plus” properties that have significant operating histories and existing leases whereby a significant portion of the total investment return is expected to be derived from current income. In addition, we have invested in a relatively smaller proportion of “value added” opportunities that have arisen in circumstances where we have determined that a real property may

- 7 -

be situationally undervalued or where product re-positioning, capital expenditures and/or improved property management may increase cash flows, and where the total investment return is generally expected to have a relatively larger component derived from capital appreciation. As of December 31, 2013, we had invested in a total of 82 operating properties located in 30 geographic markets throughout the United States at a total gross investment amount of approximately $2.6 billion aggregating approximately 15.3 million net rentable square feet. Furthermore, we have also invested in a small number of “opportunistic” real property investments that are either in various stages of development or that have a significant portion of the total investment return derived from capital appreciation.

Debt Related Investments

To date, our debt related investments have consisted primarily of (i) originations of and participations in commercial mortgage loans secured by real estate, (ii) B-notes, and (iii) mezzanine debt and other related investments secured by equity interests in entities that indirectly own real properties. As of December 31, 2013, we had 14 distinct debt related investments secured by real properties (or by equity interests in entities that indirectly own real properties) located in 12 geographic markets with a total net investment amount of approximately $123.9 million.

Diversification Across Real Property Sectors

Through our investments in real properties and debt related investments, we made direct investments, via equity interests and/or joint ventures, in real properties in multiple sectors, including office, industrial, and retail. In the future, we may also invest in multifamily, hospitality, and other real property types.

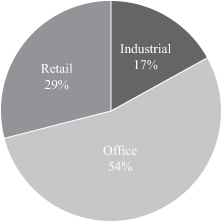

The chart below describes the diversification of our investment portfolio across real property type. Percentages in the chart correspond to the fair value as of December 31, 2013.

- 8 -

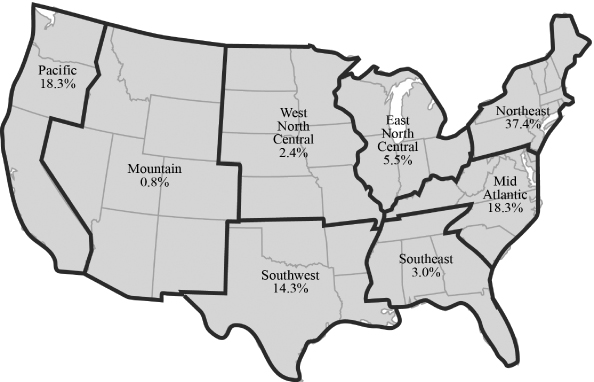

Diversification Across Geographic Regions

Through our investments in real property and debt related investments, we also seek diversification across multiple geographic regions primarily located in the United States. The chart below shows the current allocations of our investments across geographic regions within the continental United States, as defined by the National Council of Real Estate Investment Fiduciaries (“NCREIF”), for our operating real property and debt related investments. Percentages in the chart correspond to our fair value as of December 31, 2013. As of December 31, 2013, our real property investments were geographically diversified across 30 markets throughout eight regions. Our debt related investments are located in six additional markets resulting in a combined portfolio allocation across 36 markets and eight regions.

To date, and for the foreseeable future, the majority of our real property investments will be made in the United States, although we may also invest in Canada and Mexico, and potentially elsewhere on a limited basis, to the extent opportunities exist that may help us meet our investment objectives.

- 9 -

Diversification Across Tenant Profiles and Lease Terms

We believe that the tenant base that occupies our real property assets is generally stable and well-diversified. As of December 31, 2013, our consolidated operating real properties had leases with approximately 450 tenants. We intend to maintain a well-diversified mix of tenants to limit our exposure to any single tenant or industry. Our diversified investment strategy inherently provides for tenant diversity, and we continue to monitor our exposure relative to our larger tenant industry sectors. The following table describes our top ten tenant industry sectors based on annualized base rent as of December 31, 2013.

| Industry Sector |

Number of Leases |

Annualized Base Rent (1) |

% of Annualized Base Rent |

Occupied Square Feet |

% of Occupied Square Feet |

|||||||||||||||

| Professional, Scientific and Technical Services |

68 | $ | 27,534 | 13.9 | % | 1,292 | 9.1 | % | ||||||||||||

| Securities, Commodities, Fin. Inv./Rel. Activites |

22 | 25,349 | 12.8 | % | 683 | 4.8 | % | |||||||||||||

| Food and Beverage Stores |

34 | 22,440 | 11.4 | % | 1,499 | 10.5 | % | |||||||||||||

| Publishing Information (except Internet) |

3 | 17,479 | 8.8 | % | 410 | 2.9 | % | |||||||||||||

| Computer and Electronic Product Manufacturing |

10 | 6,801 | 3.4 | % | 609 | 4.3 | % | |||||||||||||

| Administrative and Support Services |

23 | 6,468 | 3.3 | % | 332 | 2.3 | % | |||||||||||||

| Insurance Carriers and Related Activities |

12 | 5,977 | 3.0 | % | 449 | 3.1 | % | |||||||||||||

| Truck Transportation |

5 | 5,874 | 3.0 | % | 973 | 6.8 | % | |||||||||||||

| Miscellaneous Store Retailers |

18 | 5,722 | 2.9 | % | 955 | 6.7 | % | |||||||||||||

| Chemical Manufacturing |

6 | 5,545 | 2.8 | % | 503 | 3.5 | % | |||||||||||||

| Other (2) |

351 | 68,324 | 34.7 | % | 6,565 | 46.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

552 | $ | 197,513 | 100.0 | % | 14,270 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Annualized base rent represents the annualized monthly base rent of executed leases as of December 31, 2013. |

| (2) | Other industry sectors include 49 additional sectors. |

Our properties are generally leased to tenants for the longer term and as of December 31, 2013, the weighted average remaining term of our leases was approximately 7.1 years, based on contractual remaining base rent, and 4.7 years, based on leased square footage. See Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K for a schedule of expiring leases for our consolidated operating properties by annualized base rent and square footage as of December 31, 2013.

Tenant Concentration

Revenue from our lease with Charles Schwab & Co., Inc, as master tenant of one of our office properties, represented approximately 11.7% of our total revenue from continuing operations for the year ended December 31, 2013. For the year ended December 31, 2013, with respect to our entire real property and debt related investment portfolio, we did not earn revenues from any other single tenant or borrower in excess of 10% of our total revenue. See “Concentration of Credit Risk” in Note 3 to our financial statements beginning on page F-1 of this Annual Report on Form 10-K for information regarding the top five tenants as a percentage of consolidated annual base rent and occupied square feet.

Leverage

We use financial leverage to provide additional funds to support our investment activities. We calculate our leverage for reporting purposes as our total borrowings, calculated on the basis of accounting principles generally accepted in the United States (“GAAP”), divided by the fair value of our real property and debt related

- 10 -

investments. Based on this methodology, as of December 31, 2013, our leverage was 50%. There are other methods of calculating our overall leverage ratio that may differ from this methodology, such as the methodology used in determining our compliance with corporate borrowing covenants. Our current leverage target is between 40-60%. Although we will generally work to maintain the targeted leverage ratio over the near term, we may change our targeted leverage ratio from time to time. In addition, we may vary from our target leverage ratio from time to time, and there are no assurances that we will maintain the targeted range disclosed above or achieve any other leverage ratio that we may target in the future. Our board of directors may from time to time modify our borrowing policy in light of then-current economic conditions, the relative costs of debt and equity capital, the fair values of our properties, general conditions in the market for debt and equity securities, growth and acquisition opportunities or other factors.

Competition

We believe that the current market for investing in real property and debt related investments is extremely competitive and we continue to see a flight to quality for both equity and debt capital. Higher quality investments located in desirable markets are subject to strong competition. We compete with many different types of companies engaged in real estate investment activities, including other REITs, pension funds and their advisors, foreign investors, bank and insurance company investment accounts, real estate limited partnerships, various forms of banks and specialty finance companies, mutual funds, private equity funds, hedge funds, individuals and other entities. Some of these competitors, including larger REITs, have substantially greater financial and other resources than we do and generally may be able to accept more risk and leverage. They may also possess significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies.

In addition to competing for attractive investment opportunities, the current leasing and operating environment is also extremely competitive. While real estate fundamentals, such as vacancy and rental rates, are showing signs of improvement, it is still generally considered a “tenant’s market” as supply still exceeds demand for commercial real estate in most geographical markets. We continue to compete with similar owners and operators of commercial real estate and, as a result, we may have to provide free rent, incur charges for tenant improvements or offer other inducements in order to compete, all of which may have an adverse impact on our results of operations.

Conflicts of Interest

We are subject to various conflicts of interest arising out of our relationship with the Advisor and other affiliates, including: (i) conflicts related to the compensation arrangements between the Advisor, certain affiliates and us, (ii) conflicts with respect to the allocation of the time of the Advisor and its key personnel and (iii) conflicts with respect to the allocation of investment opportunities. Our independent directors have an obligation to function on our behalf in all situations in which a conflict of interest may arise and have a fiduciary obligation to act on behalf of our stockholders. See “Item 13. Certain Relationships and Related Transactions, and Director Independence” of this Annual Report on Form 10-K for a description of the conflicts of interest that arise as a result of our relationships with the Advisor and its affiliates.

Compliance with Federal, State and Local Environmental Laws

Properties that we may acquire, and the properties underlying our investments, are subject to various federal, state and local environmental laws, ordinances and regulations. Under these laws, ordinances and regulations, a current or previous owner of real estate (including, in certain circumstances, a secured lender that succeeds to ownership or control of a property) may become liable for the costs of removal or remediation of certain hazardous or toxic substances or petroleum product releases at, on, under or in its property. These laws typically impose cleanup responsibility and liability without regard to whether the owner or control party knew of or was responsible for the release or presence of the hazardous or toxic substances. The costs of investigation,

- 11 -

remediation or removal of these substances may be substantial and could exceed the value of the property. An owner or control party of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. Certain environmental laws also impose liability in connection with the handling of or exposure to materials containing asbestos. These laws allow third parties to seek recovery from owners of real properties for personal injuries associated with materials containing asbestos. Our operating costs and the values of these assets may be adversely affected by the obligation to pay for the cost of complying with existing environmental laws, ordinances and regulations, as well as the cost of complying with future legislation, and our income and ability to make distributions to our stockholders could be affected adversely by the existence of an environmental liability with respect to our properties. We will endeavor to ensure our properties are in compliance in all material respects with all federal, state and local laws, ordinances and regulations regarding hazardous or toxic substances or petroleum products.

Employees

The Advisory Agreement provides that our Advisor will assume principal responsibility for managing our affairs, and as a result we have no employees. See “Item 10. Directors, Executive Officers and Corporate Governance” of this Annual Report on Form 10-K for additional discussion regarding our directors and executive officers.

Available Information

This Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, as well as any amendments to those reports, and proxy statements that we file with the Securities and Exchange Commission (the “Commission”) are available free of charge as soon as reasonably practicable through our website at http://www.dividendcapitaldiversified.com. The information contained on our website is not incorporated into this Annual Report on Form 10-K.

- 12 -

| ITEM 1A. | RISK FACTORS |

RISKS RELATED TO INVESTING IN SHARES OF OUR COMMON STOCK

There is no public trading market for the shares of our common stock and we do not expect that there will ever be a public trading market for our shares; therefore, your ability to dispose of your shares will likely be limited to redemption by us. If you do sell your shares to us, you may receive less than the price you paid.

There is no public market for the shares of our common stock and we currently have no obligation or plans to apply for listing on any public securities market. Therefore, redemption of shares by us will likely be the only way for you to dispose of your shares. We will redeem shares at a price equal to the NAV per share of the class of shares being redeemed on the date of redemption, and not based on the price at which you initially purchased your shares. We may redeem Class A, Class W or Class I shares if holders of such shares fail to maintain a minimum balance of $2,000 in shares, even if your failure to meet the minimum balance is caused solely by a decline in our NAV. Subject to limited exceptions, Class A, Class W or Class I shares redeemed within 365 days of the date of purchase will be subject to a short-term trading discount equal to 2% of the gross proceeds otherwise payable with respect to the redemption, which will inure indirectly to the benefit of our remaining stockholders. As a result of this and the fact that our NAV will fluctuate, you may receive less than the price you paid for your shares upon redemption by us pursuant to our share redemption programs.

Our ability to redeem your shares may be limited, and our board of directors may modify, suspend or terminate our share redemption programs at any time.

Generally, our Class A, Class W and Class I share redemption program imposes a quarterly cap on net redemptions of each of our Class A, Class W and Class I share classes equal to the amount of shares of such class with an aggregate value (based on the redemption price per share on the day the redemption is effected) of up to 5% of the NAV of such class as of the last day of the previous calendar quarter. Our Class E share redemption program is even more limited, as it generally does not permit redemptions during any consecutive 12-month period in excess of 5% of the number of Class E shares of common stock outstanding at the beginning of such 12-month period. If we do not raise significant proceeds in the Class A, Class W and Class I offering, we do not currently expect to reach the redemption volume limit of our Class E share redemption program.

The vast majority of our assets will consist of properties which cannot generally be readily liquidated on short notice without impacting our ability to realize full value upon their disposition. Therefore, we may not always have a sufficient amount of cash to immediately satisfy redemption requests. Our board of directors may modify, suspend or terminate our share redemption programs. As a result, your ability to have your shares redeemed by us may be limited, and our shares should be considered as having only limited liquidity and at times may be illiquid. See Part II, Item 5 “Share Redemption Program and Other Redemptions” for more information.

A portion of the proceeds raised in the Class A, Class W and Class I offering are intended to be used to redeem Class E shares, and such portion of the proceeds may be substantial.

We intend to use a portion of the proceeds from the Class A, Class W and Class I offering to enhance liquidity for our Class E stockholders through our Class E share redemption program. Each calendar quarter we intend to make available for Class E share redemptions an amount equal to (i) funds received from the sale of Class E shares under our distribution reinvestment plan during such calendar quarter, plus (ii) 50% of the difference between (a) the proceeds (net of sales commissions) received by us from the sale of Class A, Class W and Class I shares in any public primary offering and under our distribution reinvestment plan during the most recently completed calendar quarter, and (b) the dollar amount used to redeem Class A, Class W and Class I shares during the most recently completed calendar quarter pursuant to the Class A, Class W and Class I share redemption program, less (iii) funds used for redemptions of Class E shares in the most recently completed quarter in excess of such quarter’s applicable redemption cap due to qualifying death or disability requests of a stockholder during such calendar quarter. However, our board of directors may from time to time authorize funds for redemptions of Class E shares in greater or lower amounts. If we cannot provide this amount of liquidity

- 13 -

under our Class E share redemption program due to the program’s volume limitations, our board of directors may consider authorizing one or more self tender offers for outstanding Class E shares, but there is no assurance it will do so.

Our share redemption program for Class E shares imposes greater restrictions on the amount of Class E shares that can be redeemed in any given quarter, compared with our share redemption program for Class A, Class W, and Class I shares. As a result of such restrictions, coupled with higher demand for redemptions, we have honored Class E share redemption requests on a pro rata basis since March 2009, being unable to satisfy all requests. There is significant pent up demand from Class E holders to redeem their shares under our current Class E share redemption program, and we plan to use a portion of the proceeds from the Class A, Class W and Class I offering to satisfy such redemption requests. As a result, we may have fewer offering proceeds available to retire debt or acquire additional properties, which may result in reduced liquidity and profitability or restrict our ability to grow our NAV.

You will not have the opportunity to evaluate future investments we will make with the proceeds raised in our Class A, Class W and Class I offering prior to purchasing shares of our common stock.

We have not identified future investments that we will make with the proceeds of our Class A, Class W and Class I offering. As a result, you will not be able to evaluate the economic merits, transaction terms or other financial or operational data concerning our future investments prior to purchasing shares of our common stock. You must rely on the Advisor and our board of directors to implement our investment policies, to evaluate our investment opportunities and to structure the terms of our investments. Because you cannot evaluate all of the investments we will make in advance of purchasing shares of our common stock, this additional risk may hinder your ability to achieve your own personal investment objectives related to portfolio diversification, risk-adjusted investment returns and other objectives.

Even if we are able to raise substantial funds in our Class A, Class W and Class I offering, investors in our common stock are subject to the risk that our offering, business and operating plans may change.

Although we intend to operate as a perpetual-life REIT with an ongoing offering and share redemption programs, this is not a requirement of our charter. Even if we are able to raise substantial funds in the Class A, Class W and Class I offering, if circumstances change such that our board of directors believes it is in the best interest of our stockholders to terminate our Class A, Class W and Class I offering or to terminate our share redemption programs, we may do so without stockholder approval. Our board of directors may also change our investment objectives, borrowing policies, or other corporate policies without stockholder approval. In addition, we may change the way our fees and expenses are incurred and allocated to different classes of stockholders if the tax rules applicable to REITs change such that we could do so without adverse tax consequences. Our board of directors may decide that certain significant transactions that require stockholder approval such as dissolution, merger into another entity, consolidation or the sale or other disposition of all or substantially all of our assets, are in the best interests of our stockholders. Holders of all classes of our common stock have equal voting rights with respect to such matters and will vote as a single group rather than on a class-by-class basis. Accordingly, investors in our common stock are subject to the risk that our offering, business and operating plans may change.

Valuations and appraisals of our properties, real estate-related assets and real estate-related liabilities are estimates of value and may not necessarily correspond to realizable value.

The valuation methodologies used to value our properties and certain real estate-related assets involve subjective judgments regarding such factors as comparable sales, rental revenue and operating expense data, the capitalization or discount rate, and projections of future rent and expenses based on appropriate analysis. In addition, we do not undertake to mark to market our debt investments or real estate-related liabilities, but rather these assets and liabilities are generally included in our determination of NAV at an amount determined in accordance with GAAP. As a result, valuations and appraisals of our properties, real estate-related assets and real

- 14 -

estate-related liabilities are only estimates of current market value. Ultimate realization of the value of an asset or liability depends to a great extent on economic and other conditions beyond our control and the control of the Independent Valuation Firm and other parties involved in the valuation of our assets and liabilities. Further, these valuations may not necessarily represent the price at which an asset or liability would sell, because market prices of assets and liabilities can only be determined by negotiation between a willing buyer and seller. Valuations used for determining our NAV also are made without consideration of the expenses that would be incurred in connection with disposing of assets and liabilities. Therefore, the valuations of our properties, our investments in real estate-related assets and our liabilities may not correspond to the timely realizable value upon a sale of those assets and liabilities. Our NAV does not currently represent enterprise value and may not accurately reflect the actual prices at which our assets could be liquidated on any given day, the value a third party would pay for all or substantially all of our shares, or the price that our shares would trade at on a national stock exchange. There will be no retroactive adjustment in the valuation of such assets or liabilities, the price of our shares of common stock, the price we paid to redeem shares of our common stock or NAV-based fees we paid to the Advisor and the Dealer Manager to the extent such valuations prove to not accurately reflect the true estimate of value and are not a precise measure of realizable value. Because the price you will pay for shares of our common stock in our offerings, and the price at which your shares may be redeemed by us pursuant to our share redemption programs, are based on our estimated NAV per share, you may pay more than realizable value or receive less than realizable value for your investment.

In order to disclose a daily NAV, we are reliant on the parties that we engage for that purpose, in particular the Independent Valuation Firm and the appraisers that we hire to value and appraise our real estate portfolio.

In order to disclose a daily NAV, our board of directors, including a majority of our independent directors, has adopted valuation procedures and caused us to engage independent third parties such as the Independent Valuation Firm, to value our real estate portfolio on a daily basis, and independent appraisal firms, to provide periodic appraisals with respect to our properties. We have also engaged a firm to act as the NAV Accountant and may engage other independent third parties or our Advisor to value other assets or liabilities. Although our board of directors, with the assistance of the Advisor, oversees all of these parties and the reasonableness of their work product, we will not independently verify our NAV or the components thereof, such as the appraised values of our properties. Our management’s assessment of the market values of our properties may also differ from the appraised values of our properties as determined by the Independent Valuation Firm. If the parties engaged by us to determine our daily NAV are unable or unwilling to perform their obligations to us, our NAV could be inaccurate or unavailable, and we could decide to suspend our offerings and our share redemption programs.

Our NAV is not subject to GAAP, will not be independently audited and will involve subjective judgments by the Independent Valuation Firm and other parties involved in valuing our assets and liabilities.

Our valuation procedures and our NAV are not subject to GAAP and will not be subject to independent audit. Our NAV may differ from equity (net assets) reflected on our audited financial statements, even if we are required to adopt a fair value basis of accounting for GAAP financial statement purposes. Additionally, we are dependent on our Advisor to be reasonably aware of material events specific to our properties (such as tenant disputes, damage, litigation and environmental issues) that may cause the value of a property to change materially and to promptly notify the Independent Valuation Firm so that the information may be reflected in our real estate portfolio valuation. In addition, the implementation and coordination of our valuation procedures include certain subjective judgments of our Advisor, such as whether the Independent Valuation Firm should be notified of events specific to our properties that could affect their valuations, as well as of the Independent Valuation Firm and other parties we engage, as to whether adjustments to asset and liability valuations are appropriate. Accordingly, you must rely entirely on our board of directors to adopt appropriate valuation procedures and on the Independent Valuation Firm and other parties we engage in order to arrive at our NAV, which may not correspond to realizable value upon a sale of our assets.

- 15 -

No rule or regulation requires that we calculate our NAV in a certain way, and our board of directors, including a majority of our independent directors, may adopt changes to the valuation procedures.

There are no existing rules or regulatory bodies that specifically govern the manner in which we calculate our NAV. As a result, it is important that you pay particular attention to the specific methodologies and assumptions we use to calculate our NAV. Other public REITs may use different methodologies or assumptions to determine their NAV. In addition, each year our board of directors, including a majority of our independent directors, will review the appropriateness of our valuation procedures and may, at any time, adopt changes to the valuation procedures. For example, we currently do not undertake to mark to market our debt investments or real estate-related liabilities, but rather these assets and liabilities are generally included in our determination of NAV at an amount determined in accordance with GAAP. As a result, the realizable value of specific debt investments and real property assets encumbered by debt that are used in the calculation of our NAV may be higher or lower than the value that would be derived if such debt investments or property-related liabilities were marked to market. In some cases such difference may be significant. We also do not currently include any enterprise value or real estate acquisition costs in our assets calculated for purposes of our NAV. If we acquire real property assets as a portfolio, we may pay a premium over the amount that we would pay for the assets individually. Our board of directors may change these or other aspects of our valuation procedures, which changes may have an adverse effect on our NAV and the price at which you may redeem shares under our share redemption programs. See Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities — Net Asset Value Calculation” and our valuation procedures attached as Exhibit 99.1 to this Annual Report on Form 10-K for more details regarding our valuation methodologies, assumptions and procedures.

Our NAV per share may suddenly change if the valuations of our properties materially change from prior valuations or the actual operating results materially differ from what we originally budgeted.

It is possible that the annual appraisals of our properties may not be spread evenly throughout the year and may differ from the most recent daily valuation. As such, when these appraisals are reflected in our Independent Valuation Firm’s valuation of our real estate portfolio, there may be a sudden change in our NAV per share for each class of our common stock. In addition, actual operating results may differ from what we originally budgeted, which may cause a sudden increase or decrease in the NAV per share amounts. We accrue estimated income and expenses on a daily basis based on annual budgets as adjusted from time to time to reflect changes in the business throughout the year. On a periodic basis, we adjust the income and expense accruals we estimated to reflect the income and expenses actually earned and incurred. We will not retroactively adjust the NAV per share of each class for any adjustments. Therefore, because actual results from operations may be better or worse than what we previously budgeted, the adjustment to reflect actual operating results may cause the NAV per share for each class of our common stock to increase or decrease.

The NAV per share that we publish may not necessarily reflect changes in our NAV that are not immediately quantifiable.

From time to time, we may experience events with respect to our investments that may have a material impact on our NAV. For example, and not by way of limitation, changes in governmental rules, regulations and fiscal policies, environmental legislation, acts of God, terrorism, social unrest, civil disturbances and major disturbances in financial markets may cause the value of a property to change materially. The NAV per share of each class of our common stock as published on any given day may not reflect such extraordinary events to the extent that their financial impact is not immediately quantifiable. As a result, the NAV per share that we publish may not necessarily reflect changes in our NAV that are not immediately quantifiable, and the NAV per share of each class published after the announcement of a material event may differ significantly from our actual NAV per share for such class until such time as the financial impact is quantified and our NAV is appropriately adjusted in accordance with our valuation procedures. The resulting potential disparity in our NAV may inure to the benefit of redeeming stockholders or non-redeeming stockholders and new purchasers of our common stock, depending on whether our published NAV per share for such class is overstated or understated.

- 16 -

The realizable value of specific properties may change before the value is adjusted by the Independent Valuation Firm and reflected in the calculation of our NAV.

Our valuation procedures generally provide that the Independent Valuation Firm will adjust a real property’s valuation, as necessary, based on known events that have a material impact on the most recent value (adjustments for non-material events may also be made). We are dependent on our Advisor to be reasonably aware of material events specific to our properties (such as tenant disputes, damage, litigation and environmental issues, as well as positive events such as new lease agreements) that may cause the value of a property to change materially and to promptly notify the Independent Valuation Firm so that the information may be reflected in our real estate portfolio valuation. Events may transpire that, for a period of time, are unknown to us or the Independent Valuation Firm that may affect the value of a property, and until such information becomes known and is processed, the value of such asset may differ from the value used to determine our NAV. In addition, although we may have information that suggests a change in value of a property may have occurred, there may be a delay in the resulting change in value being reflected in our NAV until such information is appropriately reviewed, verified and processed. For example, we may receive an unsolicited offer, from an unrelated third party, to sell one of our assets at a price that is materially different than the price included in our NAV. Or, we may be aware of a new lease, lease expiry, or entering into a contract for capital expenditure. Where possible, adjustments generally are made based on events evidenced by proper final documentation. It is possible that an adjustment to the valuation of a property may occur prior to final documentation if the Independent Valuation Firm determines that events warrant adjustments to certain assumptions that materially affect value. However, to the extent that an event has not yet become final based on proper documentation, its impact on the value of the applicable property may not be reflected (or may be only partially reflected) in the calculation of our NAV.

Because we generally do not mark our debt investments or real estate-related liabilities to market, the realizable value of specific debt investments and real property assets that are encumbered by debt may be higher or lower than the value used in the calculation of our NAV.

We do not undertake to mark to market our debt investments or real estate-related liabilities, but rather these assets and liabilities are generally included in our determination of NAV at an amount determined in accordance with GAAP. As a result, the realizable value of specific debt investments and real property assets that are encumbered by debt used in the calculation of our NAV may be higher or lower than the value that would be derived if such debt investments or liabilities were marked to market. In some cases such difference may be significant. For example, in Note 8 to our financial statements beginning on page F-1 of this Annual Report on Form 10-K for the year ended December 31, 2013, we disclosed that the estimated fair value of our debt liabilities, net of the fair value of our debt investments, was $40.6 million higher than the GAAP carrying balance, meaning that if we used the fair value of our debt rather than the carrying balance, our NAV would have been lower by approximately $40.6 million as of December 31, 2013.

Due to daily fluctuations in our NAV, the price at which your purchase is executed could be higher than our NAV per share at the time you submit your purchase order, and the price at which your redemption is executed could be lower than our NAV per share at the time you submit your redemption request.

The purchase and redemption price for shares of our common stock will be determined at the end of each business day based on our NAV and will not be based on any established trading price. In our Class A, Class W and Class I offering, each accepted purchase order will be executed at a price equal to our NAV per share for the class of shares being purchased next determined after the purchase order is received in good order, plus, for Class A shares sold in the primary offering only, any applicable selling commissions. For example, if a purchase order is received in good order on a business day and before the close of business (4:00 p.m. Eastern time) on that day, the purchase order will be executed at a purchase price equal to our NAV per share for the class of shares being purchased determined after the close of business on that day, plus, for Class A shares sold in the primary offering only, any applicable selling commissions. If a purchase order is received in good order on a business day, but after the close of business on that day, the purchase order will be executed at a purchase price equal to our NAV per share for the class of shares being purchased determined after the close of business on the

- 17 -

next business day, plus, for Class A shares sold in the primary offering only, any applicable selling commissions. Similarly, redemption requests received in good order will be effected at a redemption price equal to the next-determined NAV per share for the class of shares being redeemed (subject to a 2% short-term trading discount in certain circumstances). In addition, there may be a delay between your purchase or redemption decision and the execution date caused by time necessary for you and your participating broker-dealer to put a purchase order or redemption request in “good order,” which means, for these purposes, that all required information has been completed, all proper signatures have been provided, and, for purchase orders, funds for payment have been provided. As a result of this process, you will not know the purchase or redemption price at the time you submit your purchase order or redemption request. The purchase price per share at which your purchase order is executed could be higher than the NAV per share on the date you submitted your purchase order, and the redemption price per share at which your redemption request is executed could be lower than the NAV per share on the date you submitted your redemption request.

For the years ended December 31, 2012 and 2011, we experienced annual net losses and in the future we may experience additional losses that could adversely impact our NAV and our ability to conduct operations, make investments and pay distributions.

For the years ended December 31, 2012 and 2011, we had respective net losses, as determined in accordance with GAAP, of approximately $22.4 million and $64.6 million. In the event that we continue to incur net losses in the future, we may have less money available to make investments and pay distributions, and our NAV, financial condition, results of operations, cash flow and ability to service our indebtedness may be adversely impacted.

Our NAV and the NAV of your shares may be diluted in connection with our Class A, Class W and Class I offering and future securities offerings.

In connection with the Class A, Class W and Class I offering, we incur fees and expenses. Excluding selling commissions (which are effectively paid by purchasers of Class A shares in the primary offering at the time of purchase, because the purchase price of such shares is equal to the NAV per Class A share plus the selling commission, and therefore have no effect on our NAV), we expect to incur up to $15 million in primary dealer fees and approximately $16.8 million in organization and offering expenses, which will decrease the amount of cash we have available for operations and new investments. In addition, because the prices of shares sold in the Class A, Class W and Class I offering are based on our NAV, the offering may be dilutive if our NAV procedures do not fully capture the value of our shares and/or we do not utilize the proceeds accretively.

In the future we may conduct other offerings of common stock (whether existing or new classes), preferred stock, debt securities or of interests in our Operating Partnership. We may also amend the terms of the Class A, Class W and Class I offering. We may structure or amend such offerings to attract institutional investors or other sources of capital in connection with efforts to provide additional Class E liquidity or otherwise. The terms of the Class A, Class W and Class I offering will reduce the NAV of your shares over time in accordance with our valuation procedures and the terms of the Class A, Class W and Class I offering and future offerings (such as the offering price and the distribution fees and expenses) may negatively impact our ability to pay distributions and your overall return.

Investors do not have the benefit of an independent due diligence review in connection with our Class A, Class W and Class I offering which increases the risk of your investment.

Because the Advisor and the Dealer Manager are related, investors do not have the benefit of an independent due diligence review and investigation in connection with the Class A, Class W and Class I offering of the type normally performed by an unrelated, independent underwriter in connection with a securities offering. In addition, DLA Piper LLP (US) has acted as counsel to us, the Advisor and the Dealer Manager in connection with the Class A, Class W and Class I offering and, therefore, investors do not have the benefit of a due diligence

- 18 -

review that might otherwise be performed by independent counsel. Under applicable legal ethics rules, DLA Piper LLP (US) may be precluded from representing us due to a conflict of interest between us and the Dealer Manager. If any situation arises in which our interests are in conflict with those of the Dealer Manager or its related parties, we would be required to retain additional counsel and may incur additional fees and expenses. The lack of an independent due diligence review and investigation increases the risk of your investment.

Our investors may be at a greater risk of loss than the Advisor and members of our management team, because they have a limited equity investment in us.

As of December 31, 2013, the Advisor and members of our management team (excluding our independent directors, who each own 30,000 Class E shares) have invested approximately $1.7 million in us. Therefore, they have relatively little exposure to loss. Our investors may be at a greater risk of loss because the Advisor and other members of our management do not have as much to lose from a decrease in the value of our shares.

The availability and timing of cash distributions to you is uncertain.

We currently make and expect to continue to make quarterly distributions to our stockholders. However, the payment of class-specific expenses results in different amounts of distributions being paid with respect to each class of shares. In addition, we bear all expenses incurred in our operations, which reduce the amount of cash available for distribution to our stockholders. Distributions may also be negatively impacted by the failure to deploy our net proceeds on an expeditious basis, the inability to find suitable investments that are not dilutive to our distributions, the poor performance of our investments, an increase in expenses for any reason (including expending funds for redemptions) and due to numerous other factors. Any request by the holders of our OP Units to redeem some or all of their OP Units for cash may also impact the amount of cash available for distribution to our stockholders. In addition, our board of directors, in its discretion, may retain any portion of such funds for working capital. We cannot assure you that sufficient cash will be available to make distributions to our stockholders or that the amount of distributions will not either decrease or fail to increase over time. From time to time, we may adjust our distribution level and we may make such an adjustment at any time.

We may have difficulty funding our distributions with funds provided by our operations.

In prior years, our distributions had been funded through a combination of both our operations and borrowings. Although our distributions during 2013 and 2012 were fully funded from our operations, in the future we may fund distributions from other sources. Our long-term strategy is to fund the payment of quarterly distributions to our stockholders entirely from our operations over time. However, if we are unsuccessful in investing the capital we raise in our Class A, Class W and Class I offering on an effective and efficient basis, we may be required to fund our quarterly distributions to our stockholders from a combination of our operations and financing activities, which include net proceeds of our Class A, Class W and Class I offering and borrowings (including borrowings secured by our assets). Using certain of these sources may result in a liability to us, which would require a future repayment. The use of these sources for distributions and the ultimate repayment of any liabilities incurred could adversely impact our ability to pay distributions in future periods, decrease the amount of cash we have available for new investments, repayment of debt, share redemptions and other corporate purposes, and potentially reduce your overall return and adversely impact and dilute the value of your investment in shares of our common stock. We may pay distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings or offering proceeds.

If we raise substantial offering proceeds in a short period of time, we may not be able to invest all of the net offering proceeds promptly, which may cause our distributions and the long-term returns to our investors to be lower than they otherwise would.

We could suffer from delays in locating suitable investments. The more money we raise in our Class A, Class W and Class I offering, the more difficult it will be to invest the net offering proceeds promptly. Therefore, the large size of our Class A, Class W and Class I offering increases the risk of delays in investing our net

- 19 -

offering proceeds. Our reliance on the Advisor to locate suitable investments for us at times when the management of the Advisor is simultaneously seeking to locate suitable investments for other entities sponsored or advised by affiliates of the Advisor could also delay the investment of the proceeds of our Class A, Class W and Class I offering. Delays we encounter in the selection, acquisition and development of income-producing properties would likely negatively affect our NAV, limit our ability to pay distributions to you and reduce your overall returns.

We are required to pay substantial compensation to the Advisor and its affiliates, which may be increased or decreased during our Class A, Class W and Class I offering or future offerings by a majority of our board of directors, including a majority of the independent directors.

Pursuant to our agreements with the Advisor and its affiliates, we are obligated to pay substantial compensation to the Advisor and its affiliates. Subject to limitations in our charter, the fees, compensation, income, expense reimbursements, interests and other payments that we are required to pay to the Advisor and its affiliates may increase or decrease during our Class A, Class W and Class I offering or future offerings if such change is approved by a majority of our board of directors, including a majority of the independent directors. These payments to the Advisor and its affiliates will decrease the amount of cash we have available for operations and new investments and could negatively impact our NAV, our ability to pay distributions and your overall return.

The performance component of the advisory fee is calculated on the basis of the overall non-compounded investment return provided to holders of Fund Interests over a calendar year, so it may not be consistent with the return on your shares.

The performance component of the advisory fee is calculated on the basis of the overall non-compounded investment return provided to holders of Fund Interests (i.e., our Class E shares, Class A shares, Class W shares and Class I shares, along with the Class E OP Units held by third parties) over a calendar year such that the Advisor will receive 25% of the overall return in excess of 6%; provided that in no event will the performance component exceed 10% of the overall return for such year. The overall non-compounded investment return provided to holders of Fund Interests over any applicable period is a dollar amount defined as the product of (i) the amount, if any, by which (A) the sum of (1) the weighted-average distributions per Fund Interest over the applicable period, and (2) the ending weighted-average NAV per Fund Interest, exceeds (B) the beginning weighted-average NAV per Fund Interest and (ii) the weighted-average number of Fund Interests outstanding during the applicable period. The weighted-average NAV per Fund Interest calculated on the last trading day of a calendar year shall be the amount against which changes in weighted-average NAV per Fund Interest are measured during the subsequent calendar year. However, the performance component will not be earned on any increase in the weighted-average NAV per Fund Interest except to the extent that it exceeds the historically highest year-end weighted-average NAV per Fund Interest since the commencement of our daily NAV calculations ($6.93 as of December 31, 2013). The foregoing NAV thresholds are subject to adjustment by our board of directors. Therefore, payment of the performance component of the advisory fee (1) is contingent upon the overall return to the holders of Fund Interests exceeding the 6% return, (2) will vary in amount based on our actual performance, (3) cannot cause the overall return to the holders of Fund Interests for the year to be reduced below 6%, and (4) is payable to the Advisor if the overall return to the holders of Fund Interests exceeds the 6% return in a particular calendar year, even if the overall return to the holders of Fund Interests on a cumulative basis over any longer or shorter period has been less than 6% per annum. Additionally, the Advisor will provide us with a waiver of a portion of its fees generally equal to the amount of the performance component that would have been payable with respect to the Class E shares and the Class E OP Units held by third parties until the NAV of such shares or units exceeds $10.00 per share or unit, the benefit of which will be shared among all holders of Fund Interests.