Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial statements and supplementary data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED March 31, 2013 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 001-34818

RealD Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

77-0620426 (I.R.S. Employer Identification No.) |

100 N. Crescent Drive, Suite 200

Beverly Hills, California 90210

(Address of Principal Executive Offices, Zip code)

(310) 385-4000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common stock, par value $0.0001 per share | New York Stock Exchange | |

|---|---|---|

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No ý

The aggregate market value of the common stock held by non-affiliates of the registrant was $429,774,957 based on the last reported sale price of the registrant's common stock on September 21, 2012 (the last business day of the registrant's most recently completed second fiscal quarter) as reported by the New York Stock Exchange ($9.17 per share). As of May 30, 2013, there were 49,427,042 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant's Proxy Statement for its 2013 Annual Meeting of Stockholders, which will be filed on or before June 26, 2013. With the exception of the sections of the registrant's 2013 Proxy Statement specifically incorporated herein by reference, the registrant's Proxy Statement for its 2013 Annual Meeting of Stockholders is not deemed to be filed as part of this Form 10-K.

RealD Inc.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED

March 31, 2013

TABLE OF CONTENTS

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND

OTHER INDUSTRY DATA

This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, about our future expectations, plans or prospects and our business. All statements contained in this Annual Report on Form 10-K, other than statements of historical fact, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "intends," "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue" or the negative of these terms or other comparable terminology, but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements include, among other things, statements concerning anticipated future financial and operating performance; our expectations regarding demand and acceptance for our technologies; RealD's ability to continue to derive substantial revenue from the licensing of RealD's 3D technologies for use in the motion picture industry, as well asour ability to generate revenue from the licensing of RealD's 3D technologies for use in 3D-enabled display devices; 3D motion picture releases and conversions scheduled for fiscal 2014 ending March 2014 and beyond, their commercial success and domestic consumer preferences that, in recent periods, have trended in favor of 2D over 3D; our ability to increase our revenues, the number of RealD-enabled screens in domestic and international markets and our market share; our ability to supply our solutions to our customers on a timely basis; our relationships with exhibitor and studio partners and the business model for 3D eyewear in North America; the progress, timing and amount of expenses associated with RealD's research and development activities, which may increase in future periods; market and industry trends, including growth in 3D content; our plans, strategies and expected opportunities; the deployment of and demand for our products and products incorporating our technologies; and competitive pressures in domestic and international cinema markets impacting licensing and product revenues; and RealD's projected operating results.

Actual results may differ materially from those discussed in these forward-looking statements due to a number of factors, including the risks set forth in the section entitled "Risk factors" in Part I, Item 1A of this Annual Report on Form 10-K and elsewhere in this filing. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements. We are under no duty to update any of the forward-looking statements after the date of this Annual Report on Form 10-K to conform our prior statements to actual results.

This Annual Report on Form 10-K also contains estimates and other information concerning our industry, including business segment and growth rates, that we obtained from industry publications, surveys and forecasts. Unless we otherwise specify, industry and market data is given on a calendar year basis and is current as of December 31, 2012. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. Although we believe the information in these industry publications, surveys and forecasts is reliable, we have not independently verified the accuracy or completeness of the information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled "Risk factors" in Part I, Item 1A of this Annual Report on Form 10-K.

RealD and the RealD logo are trademarks of RealD Inc. All other trademarks and service marks appearing in this Annual Report on Form 10-K are the property of their respective holders and all rights are reserved. The absence of a trademark or service mark or logo from this Annual Report on Form 10-K does not constitute a waiver of trademark or other intellectual property rights of RealD Inc., its affiliates and/or licensors.

3

Overview

We are a leading global licensor of 3D technologies. Our extensive intellectual property portfolio is used in applications that enable a premium 3D viewing experience in the theater, the home and elsewhere. We license our RealD Cinema Systems to motion picture exhibitors that show 3D motion pictures and alternative 3D content. We also provide our RealD Display, active and passive eyewear and RealD Format technologies to consumer electronics manufacturers, content providers and distributors to enable the delivery and viewing of 3D content on a variety of visual displays and devices.

Competitive strengths

Our competitive strengths include the following:

Innovative technology

Our technical expertise has allowed us to develop new and innovative technologies for viewing 3D content in the motion picture industry, the home and elsewhere. Working with Disney to release Chicken Little in 3D in 2005, we became the first company to commercially enable 3D theater screens using digital projection. Our patented RealD Cinema Systems deliver superior light output, providing for a high quality, brighter image and enabling display on larger theater screens than most competing technologies. Many of our licensees, including American Multi-Cinema, Inc., or AMC, Cinemark USA, Inc., or Cinemark, Regal Cinemas, Inc., or Regal, Carmike Cinemas, Inc., or Carmike, and Cineplex Theatres, or Cineplex, deploy our RealD Cinema Systems on their own premium-branded large-screen auditoriums. Our RealD Display, active and passive eyewear and RealD Format technologies provide our consumer electronics licensees the ability to display high quality 3D content that can be delivered through the current cable, satellite and broadcast infrastructure. We continually develop next generation 3D display technology for televisions, personal computers, laptops, tablets, smart phones and other mobile devices. Our extensive intellectual property portfolio, which is based on years of research and development, contains approximately 191 individual issued patents and approximately 369 pending patent applications in approximately 18 jurisdictions worldwide. Content producers use our technologies to enhance and accelerate their production of 3D content. Our research, development and engineering teams have expertise in many disciplines, including:

- •

- polarization control (the manipulation of light);

- •

- photonics (the application of electromagnetic energy, incorporating laser technology, electrical engineering, materials

science and information storage and processing);

- •

- optics (the branch of physics that deals with light and vision);

- •

- liquid crystal physics (the application of elements at the border between the solid and liquid phase to the creation of

nanoscale devices); and

- •

- digital image processing (the use of computer algorithms to perform image processing on digital images).

Global leader in 3D-enabled theater screens

As of March 31, 2013, our RealD Cinema Systems were deployed on approximately 22,700 theater screens in 68 countries, which we believe are substantially more 3D screens than all of our competitors. 14 of the world's top 17 motion picture exhibition groups utilize RealD Cinema Systems in their theaters, including Regal, AMC, Cinemark, Carmike, Cinepolis, Cineplex, Wanda, ODEON, Cineworld

4

and EuroPalaces. Our licensees include approximately 1,000 motion picture exhibitors and we are actively engaged with other motion picture exhibitors regarding potential new license agreements. During our fiscal year ended March 31, 2013, domestic box office on RealD-enabled screens represented approximately 80% of total domestic 3D box office and we estimate that worldwide box office on RealD-enabled screens represented approximately 50% of the total worldwide 3D box office.

Pioneer in emerging 3D visual display technologies

We believe that the success of major 3D motion pictures is leading to the creation and distribution of 3D content and products for 3D consumer electronics. Although 3D consumer electronics technologies are new and developing, we have already entered into agreements to provide our RealD Display, active and passive eyewear and RealD Format technologies to leading consumer electronics manufacturers. Our licensees also include content distributors, including cable television services and satellite television services.

Premium brand

We believe our brand is well-recognized among licensees and consumers as a result of motion picture studios and exhibitors co-branding with us and moviegoers having worn our branded RealD eyewear more than one billion times. We believe the prominence of our brand in the motion picture industry will enhance our marketing efforts of 3D consumer electronics technologies.

Scalable licensing model

We license our 3D technologies under a highly scalable business model with recurring revenue from those licensees. As an example, our multi-year (typically five years or longer), generally exclusive agreements with motion picture exhibitors generate revenue on a per-admission, periodic fixed-fee or per-motion picture basis at limited incremental direct cost to us. We believe motion picture exhibitors prefer our licensing model, which includes technological upgrades and maintenance, because it reduces their capital expenditures and the risk they may purchase equipment that will become obsolete. We believe our motion picture exhibitor licensees also prefer our low-cost RealD eyewear because it requires fewer personnel (no active collecting or washing by motion picture exhibitors) and reduces motion picture exhibitors' loss from theft and breakage. Although we have not yet generated material revenue licensing our other 3D visual display technologies, we anticipate that our relationships with consumer electronics manufacturers and others will generate future license fees on 3D consumer electronics technologies on a per unit basis.

Extensive industry relationships and strong technical expertise

Our experienced management team, including Michael V. Lewis, our Chairman and Chief Executive Officer, Joseph Peixoto, President of Worldwide Cinema, and Leo Bannon, Executive Vice President of Global Operations, have extensive, long-term relationships with content producers and distributors, major motion picture studios and exhibitors, and consumer electronics manufacturers that help us drive the proliferation of 3D content, delivery and viewing in theaters, the home and elsewhere. Our research and development team, primarily based in our Boulder, Colorado facility, is comprised of leaders in the invention, development and commercialization of innovative 3D technologies.

5

Strategy

Key elements of our strategy include:

Continue to innovate and develop new technologies

We continue to develop proprietary technologies to perfect the visual image and create additional revenue opportunities. We endeavor to improve our RealD Cinema Systems and other cinema technologies to deliver an even better and more immersive 3D viewing experience to consumers in theaters. For example, during 2013, we introduced Precision White Screen technology for cinema projection that features improved screen efficiency, resulting in 40% more total light coming off the screen and providing more uniform brightness than a standard silver screen. We are also working to enhance our other 3D visual display technologies to enable consumers to enjoy 3D at home and elsewhere. We have patented technologies that we believe will in the future enable consumers to enjoy 3D content without eyewear. We believe our licensing of 3D technologies for professional and other non-theatrical applications will continue to provide a strong foundation for our development of new 3D technologies for viewing 3D content at motion picture theaters, non-theatrical locations like theme parks or museums, and on other visual display devices. We also selectively pursue technology acquisitions to expand and enhance our intellectual property portfolio in areas that complement our existing and new market opportunities and to supplement our internal research and development efforts.

Increase our leading global share in 3D-enabled theater screens, particularly in international markets

We continue to work with our existing motion picture exhibitor licensees to deploy additional RealD Cinema Systems. We also plan to enter into agreements with new motion picture exhibitor licensees to increase the number of deployed RealD Cinema Systems worldwide. We believe there is a significant opportunity for us to continue to expand our business internationally and to license our 3D technologies to international motion picture exhibitors based on a licensing model that is similar to our domestic model. In particular, China, Russia and Latin America are fast-growing cinema markets where moviegoing consumers have strongly embraced 3D films. For example, rapid growth in Chinese cinema screens has helped to drive an increase in total Chinese box office receipts of more than 30 percent annually for the past several years. In fact, China's total box office is widely expected to surpass North America to become the largest cinema market worldwide by 2020.

Encourage filmmakers and studios to create additional 3D films

We continue to work with film studios and filmmakers to encourage their production of additional 3D films. Our efforts include further educating the filmmaking community about 3D trends and ensuring that the entire ecosystem fully appreciates the powerful economic benefits of 3D filmmaking, particularly in growing cinema markets overseas where moviegoers' interest in 3D cinema has increased in recent years. A positive driver of the compelling economics for studios is that the incremental cost of 3D filmmaking has declined considerably in recent years, while the quality of 3D filmmaking has continued to improve. Our efforts also include encouraging studios and film directors to consider 3D as a creative tool for films beyond the typical 3D genres of live action and animated films. The theatrical success of the recent dramatic 3D films Life of Pi and The Great Gatsby demonstrates early progress towards our initiative to promote an expansion of 3D filmmaking genres.

Expand our emerging 3D visual display technology business

We continue to work with consumer electronics manufacturers, content producers and distributors and other licensees to enable a premium 3D viewing experience in the home and elsewhere using our technologies. We endeavor to incorporate our 3D technologies in visual displays for laptop computers,

6

personal computers, tablets, mobile phones and other devices, and to enable the delivery of 3D content across a variety of distribution platforms.

Build upon the strength of our RealD brand

It is our goal to make RealD the best known 3D technology brand in the world, associated with delivering the highest quality 3D viewing experience in the global marketplace. We will further leverage the strength of our brand to generate stronger licensee and consumer preference for a RealD experience in 3D consumer electronics and other applications. We continue to actively encourage motion picture studios and exhibitors to prominently feature our brand in their motion picture advertising and marketing, at theater locations, online and on consumer electronics products and packaging. We will also continue our advertising efforts to strengthen our brand in the theatrical and consumer electronics industries. We plan to use our brand to drive the continued adoption of our 3D technologies in existing and new applications.

Industry

History of 3D

First used commercially in a public theater in 1922, 3D technology has been used by content producers in an effort to enhance the viewing experience. 3D imagery is created using stereoscopic photography, which is a process that creates the illusion of 3D by using a pair of 2D images. Each image represents a different perspective of the same object, emulating the different perspectives that binocular vision captures. When the two images are viewed by each eye, the brain fuses the two images to form a single picture, creating the illusion of 3D. 3D technology has a wide range of applications including entertainment, research and development, scientific exploration and manufacturing.

Innovation in 3D technology has centered on optimizing the projection of stereoscopic images as well as the filtering of the image intended for each eye. Early 3D exhibition required the use of two projectors, one to project the reel for each eye to create the stereoscopic image, which required synchronization that was difficult to achieve due to the manual operation of projectors. To view a stereoscopic image, audiences utilized 3D eyewear that employed different filters that did not maintain the quality of a standard motion picture image and caused discomfort including eye strain and headaches.

Benefiting from the continuing adoption of digital projection, the newest wave of 3D projection uses digital technologies that address many of the limitations of previous methods of 3D projection. The use of high definition digital projectors, advances in the construction of silver screens and the use of polarization filters and polarized lenses have broadened the color spectrum, and reduced eyestrain and synchronization issues that caused headaches, thus greatly improving the 3D viewing experience.

The launch of modern 3D digital projection for motion pictures was marked by the presentation of Chicken Little by Disney in November 2005, which debuted on approximately 100 RealD-enabled screens. Since the debut of Chicken Little in 2005 through March 31, 2013, more than 125 major 3D motion pictures have been released on RealD-enabled screens including six of the top 10 grossing films of all time. In addition, six of the 10 highest grossing motion pictures released in 2012 were exhibited in RealD 3D.

Cutting-edge 3D technology has also been deployed in other applications including scientific research. For example, NASA has utilized 3D technology to analyze damage to the Space Shuttle and to navigate the Mars Rover. Industrial applications for 3D technology include the use of 3D visualization by biotech firms for the development of pharmaceuticals, by aircraft and motor vehicle manufacturers like McDonnell Douglas Corp., Caterpillar Inc. and Harley Davidson, Inc. for the design of new prototypes and by major energy companies such as Chevron that utilize 3D technology to

7

reduce the cost and environmental impact of exploration by analyzing oil and gas fields in virtual 3D environments.

Market opportunity

Our 3D technologies can be used in many different applications and businesses, including entertainment, consumer electronics, education, aerospace, defense and healthcare. Our 3D technologies are primarily used in motion pictures, consumer electronics and professional applications.

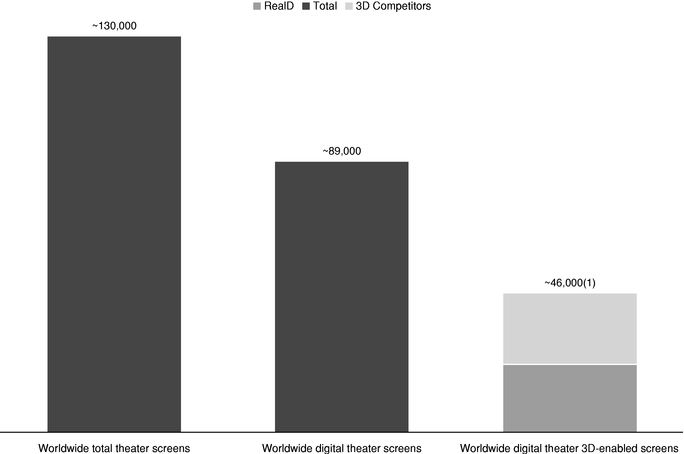

The shift in the motion picture industry from analog to digital over the past decade has created an opportunity for new and transformative 3D technologies. As of December 31, 2012, approximately 89,000 digital theater screens were deployed worldwide, representing approximately 68% of the worldwide installed base. Certain major film studios have stated that they will stop making available analog versions of their motion pictures within the next few years, which should contribute to further migration of cinema screens to digital projection, thereby expanding our growth opportunity. RealD's Cinema Systems function as an enhancement to digital projectors and, therefore, require cinemas to be equipped with a digital projector prior to installation.

The following chart illustrates, as of December 31, 2012, the approximate total number of theater screens worldwide, the approximate number of theater screens that have been converted to digital and the approximate number of digital theater screens that are 3D-enabled.

- (1)

- Of the estimated 46,000 worldwide digital theater 3D-enabled screens as of December 31, 2012 (per Screen Digest), 22,200 were RealD-enabled screens, representing a nearly 50% share. As of March 31, 2013, RealD had deployed approximately 22,700 screens worldwide.

8

The growth in 3D screens worldwide combined with growth in the number of 3D motion pictures has led to an increase in the worldwide box office generated by 3D screens in recent years. In 2012, 3D-enabled screens generated an estimated $7.3 billion in worldwide 3D box office (according to provisional figures from IHS), representing 21% of the $34.7 billion in total worldwide box office in 2012. Six of the top 10 grossing films worldwide in 2012 were exhibited in RealD 3D. We anticipate that continued growth in the number of 3D films and the number of 3D-enabled screens will lead to further growth in the worldwide 3D box office. We anticipate that approximately 36 3D motion pictures produced by domestic studios will be released worldwide in our fiscal year 2014, including sequels to successful major motion picture franchises, such as Iron Man, Thor, The Hobbit, Star Trek, 300, Monsters, Despicable Me, The Smurfs, and Cloudy with a Chance of Meatballs

In addition to major 3D releases produced by domestic film studios, an increasing number of 3D motion pictures are being produced overseas for release in various international markets. For example, Journey to the West 3D generated nearly $200 million in total box office during 2013 and Painted Skin 2 3D generated $115 million in total box office during 2012. Both films were produced in China, the second-largest cinema market in the world. Similarly, Stalingrad 3D is currently scheduled for release in Russia during August 2013.

9

The following table shows the major 3D motion pictures released or scheduled for release on domestic 3D-enabled screens for the fiscal year 2014 ending on March 31, 2014. Information provided includes the motion picture studios and the release dates for those motion pictures (announced as of June 6, 2013):

Film

|

Motion Picture Studio | Domestic Release Date |

||

|---|---|---|---|---|

Jurassic Park (re-release) |

Universal | 4/5/2013 | ||

Iron Man 3 |

Disney/Marvel | 5/3/2013 | ||

The Great Gatsby |

Warner Bros. | 5/10/2013 | ||

Star Trek Into Darkness |

Paramount | 5/16/2013 | ||

Epic |

Fox | 5/24/2013 | ||

Man of Steel |

Warner Bros./Legendary | 6/14/2013 | ||

World War Z |

Paramount | 6/21/2013 | ||

Monsters University |

Disney/Pixar | 6/21/2013 | ||

Despicable Me 2 |

Universal | 7/3/2013 | ||

Pacific Rim |

Warner Bros. / Legendary | 7/12/2013 | ||

Turbo |

Dreamworks Animation/Fox | 7/17/2013 | ||

R.I.P.D. |

Universal | 7/19/2013 | ||

The Wolverine |

Fox | 7/26/2013 | ||

The Smurfs 2 |

Sony Pictures Animation/Columbia Pictures | 7/31/2013 | ||

Percy Jackson: Sea of Monsters |

Fox | 8/7/2013 | ||

Planes |

Disney Animation | 8/9/2013 | ||

One Direction: This Is Us |

Sony Pictures | 8/30/2013 | ||

Battle of the Year: The Dream Team |

Sony/Screen Gems | 9/13/2013 | ||

Cloudy With a Chance of Meatballs 2 |

Sony Animation | 9/27/2013 | ||

Sin City: A Dame to Die For |

Dimenstion Films/The Weinstein Company | 10/4/2013 | ||

Gravity |

Warner Bros. | 10/4/2013 | ||

Metallica: Through the Never |

Picturehouse Entertainment | 10/4/2013 | ||

The Seventh Son |

Warner Bros. | 10/18/2013 | ||

Free Birds |

Relativity/Reel | 11/1/2013 | ||

Thor 2: The Dark World |

Disney/Marvel | 11/8/2013 | ||

Frozen |

Disney | 11/27/2013 | ||

Postman Pat: The Movie—You Know You're the One |

Classic Media | 11/27/2013 | ||

The Hobbit 2: The Desolation of Smaug |

Warner Bros. | 12/13/2013 | ||

Walking With Dinosaurs |

Fox | 12/20/2013 | ||

47 Ronin |

Universal | 12/25/2013 | ||

The Nut Job |

Open Road | 1/17/2014 | ||

I, Frankenstein |

Lionsgate | 1/24/2014 | ||

The Lego Movie |

Warner Bros. | 2/7/2014 | ||

Pompeii |

Sony Tristar | 2/28/2014 | ||

Mr. Peabody and Sherman |

Dreamworks Animation/Fox | 3/7/2014 | ||

300: Rise of an Empire |

Warner Bros. / Legendary | 3/7/2014 |

We believe that more 3D-enabled theater screens will be needed in the future, particularly in fast-growing international markets such as China, Russia and Latin America, to accommodate the expected growth in the number of 3D motion pictures being released and to provide the necessary capacity to fully capitalize on commercially successful 3D motion pictures.

10

We believe that the success of major 3D motion pictures and the recent establishment of an industry consortium called Digital Cinema Distribution Coalition (DCDC), which will enable the digital distribution of content via a satellite distribution network, will further stimulate the production and distribution of new and alternative 3D content for digital cinema. In particular, we anticipate that there will be more live broadcast events in 3D, including sporting events, concerts, cultural and other live events. Live 3D events broadcast in RealD cinemas to date have included Wimbledon tennis, FIFA World Cup soccer, Ultimate Fighting Championship (UFC) matches, and music concerts.

We believe that the recent success of 3D motion pictures is also leading to the production and distribution of new 3D content for consumer electronics applications. There are currently a growing number of 3D channels available worldwide including linear broadcast channels and VOD systems on major broadcast services including DirecTV, Virgin Media, Sky, Foxtel and Comcast. 3D channels are currently being programmed from major content brands including ESPN (ESPN3D), British Sky Broadcasting (Sky 3D), and Discovery Communications (3net). Examples of major sporting events broadcast live in 3D include The Masters golf tournament, Premier League soccer, NCAA football, NCAA men's basketball, NBA basketball and boxing.

The proliferation of high definition televisions, laptops, tablets, smartphones and other displays represents a new market opportunity for revenue arising from the release of 3D-enabled consumer electronics products. For example, market researcher DisplaySearch estimates that the number of 3D-enabled televisions shipped worldwide will increase significantly from an estimated 41 million units in 2012 to approximately 70 million units in 2013. We believe growth in the installed base of 3D-enabled TVs and other consumer displays gives film studios even more incentive to create a 3D version of their major film releases in order to take advantage of the downstream revenue opportunity to display the film's 3D version in the home.

Key applications

We believe that we possess innovative technology, a significant market presence, a premium brand and a scalable licensing model in our key applications.

We design, manufacture, license and market our RealD Cinema Systems that enable digital cinema projectors to show 3D motion pictures and alternative 3D content to consumers wearing our RealD eyewear.

Technology. We believe our patented 3D digital projection technology delivers double the amount of light output compared to any other 3D digital projection technology on the market, which is the most significant factor in producing a high quality 3D image. As a result, we believe we are able to reach larger screens with our RealD digital projection technology than the majority of other 3D digital projection technology providers for use in motion picture theaters. For example, using a single digital DLP (digital light processing, based on Texas Instruments chip technology) projector and the same lamp and lamp power as a 2D presentation, our RealD XL Cinema System, using our polarizing technology, can deliver crisp, clear 3D content to screens. Our RealD Cinema Systems:

- •

- are relatively inexpensive to deploy and include maintenance and free upgrades at no additional charge to the exhibitor;

- •

- produce full color, unlike stereoscopic/spectral 3D that relies on eyewear with red and green color filters that cause a

substantial loss of available colors;

- •

- reduce most "ghost images" caused by the left eye seeing a small portion of the right-eye frames and vice

versa;

- •

- can be viewed with our circular polarized passive RealD eyewear, which allow consumers to move around with reduced image distortion.

11

- •

- can further enhance the visual image for 2D and 3D presentation by projecting on RealD's Precision White Screen technology, which is available only to RealD customers. The Precision White Screen technology's greater efficiency results in more total light coming off the cinema screen, providing more uniform brightness than a standard silver screen

Market presence. Our RealD Cinema Systems are the world's most widely deployed digital 3D cinema technology based on the number of theater screens installed worldwide. As of March 31, 2013, our RealD Cinema Systems were deployed on approximately 22,700 theater screens in 68 countries worldwide. As of December 31, 2012, our RealD Cinema Systems accounted for more than 80% of the estimated domestic 3D-enabled theater screens and nearly 50% of the 3D-enabled theater screens deployed worldwide. During our fiscal year ended March 31, 2013, domestic box office on RealD-enabled screens represented approximately 80% of total domestic 3D box office and we estimate that worldwide box office on RealD-enabled screens represented approximately 50% of the total worldwide 3D box office. We expect to continue to grow our cinema business based on an increasing number of theater screens becoming RealD-enabled and an increasing number of RealD-compatible 3D motion pictures being released.

The following chart illustrates the number of theater locations with RealD-enabled screens and the total number of RealD-enabled screens:

| |

Year ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

(approximate numbers)

|

March 31, 2013 |

March 23, 2012 |

March 25, 2011 |

|||||||

Number of RealD enabled screens (at period end) |

||||||||||

Total domestic RealD enabled screens |

12,800 | 11,700 | 8,700 | |||||||

Total international RealD enabled screens |

9,900 | 8,500 | 6,300 | |||||||

Total RealD enabled screens |

22,700 | 20,200 | 15,000 | |||||||

Number of locations with RealD enabled screens (at period end) |

||||||||||

Total domestic locations with RealD enabled screens |

2,800 | 2,600 | 2,300 | |||||||

Total international locations with RealD enabled screens |

2,700 | 2,500 | 2,200 | |||||||

Total locations with RealD enabled screens |

5,500 | 5,100 | 4,500 | |||||||

Number of 3D motion pictures (released domestically during period) |

35 | 36 | 26 | |||||||

At most RealD theater locations, there are multiple RealD-enabled screens. We believe that having more RealD-enabled screens per location will allow us to accommodate simultaneous 3D motion picture releases and provide the necessary capacity to fully capitalize on commercially successful 3D motion pictures. We believe the commercial success of 3D motion pictures will facilitate and further encourage the conversion of theater screens to digital and 3D. After motion picture exhibitors convert their projectors to digital cinema, they must install a silver screen and our RealD Cinema Systems in order to display motion pictures in RealD 3D.

Content. While the number of 3D films exhibited on our RealD domestic cinema systems decreased from 36 in fiscal year 2012 to 35 in fiscal year 2013, it grew significantly from 26 major motion pictures in our fiscal year 2011. As of June 6, 2013, we expect approximately 36 3D motion pictures to be released on our domestic screens during our fiscal year 2014, which ends on March 31, 2014, all of which we expect will be exhibited using our RealD Cinema Systems. In addition, we expect a growing number of foreign 3D films produced overseas to be released on our international RealD-enabled screens during our fiscal year 2014.

We believe that the recent success of major 3D motion pictures, and the recent establishment of an industry consortium called Digital Cinema Distribution Coalition (DCDC), which will enable the digital distribution of content via a satellite distribution network, will drive the creation and theatrical

12

distribution of more alternative content and live broadcast events in 3D. To facilitate the display of alternative content, we introduced RealD LIVE, which enables live event 3D broadcast capabilities in theaters. RealD-enabled screens and the RealD Format have been used to exhibit other new and alternative 3D content, including sports, concerts, cultural events and other live events.

Brand. Motion picture studios often co-brand RealD in motion picture marketing and advertising. Motion picture exhibitors display our brand at theaters, on-screen and online. Moviegoers have worn our branded RealD eyewear more than one billion times. Our in-theater branding includes signage at the box office where tickets are purchased, signage in the lobby and in poster cases in and around the theater, branded recycling bins located at each auditorium entrance and exit, an on-screen animated 3D preview informing consumers when to put on their eyewear and reminding them to recycle their eyewear after the motion picture and a promotional trailer that plays immediately before the motion picture. Our brand also appears on major online ticketing websites aligned with show times at theaters equipped with our RealD technology. We believe our branded 3D experience will lead to increased admissions as consumers recognize our brand as the leading choice for 3D viewing, prompting motion picture exhibitors to select us as their 3D technology licensor.

Licensing model. We license our RealD Cinema Systems to motion picture exhibitors under multi-year (typically five years or longer) agreements that are generally exclusive and from which we generally receive license fees on a per-admission basis. Our agreements with motion picture exhibitors provide us with recurring revenue as 3D motion pictures are exhibited using our 3D technologies. Based on the number of deployed RealD-enabled screens, the number of additional RealD Cinema Systems that we will work with our existing motion picture exhibitor licensees to deploy, our market presence and the number of 3D motion pictures slated for future release, we believe our cinema business will continue to grow.

We license and market systems to motion picture exhibitors based on the type of digital projector installed and theater configuration: our RealD Cinema System, RealD XL Cinema System, RealD XLS Cinema System, and the RealD XLW Cinema System, which is designed specifically for premium large screen auditoriums with stadium seating configurations. Our RealD XL Cinema System can be displayed on screens up to 82 feet wide, and our RealD Cinema Systems will be scalable to larger formats as projector technology evolves. The RealD XLW Cinema System, introduced in January 2011, can accommodate a throw ratio as wide as 1.0 (projection distance divided by screen width), and is designed for use in premium large screen motion picture auditoriums, theme parks and specialty theaters with stadium seating. We also recently introduced a RealD Cinema System for dual projector installations that is capable of delivering twice the light of other dual-projector 3D systems. Based on our actual experience, we believe we can upgrade almost any theater that has an existing digital cinema projector with our RealD Cinema Systems within a few hours. Under our agreements with motion picture exhibitors, we provide technological upgrades and maintenance on our RealD Cinema Systems at no additional charge to the exhibitor.

We believe our RealD Cinema Systems are a compelling and scalable technology for the motion picture industry. Motion picture producers can tell their stories in more creative and compelling ways through the use of 3D technology. As evidenced by the record-setting performance of The Avengers in May 2012, releasing content on RealD-enabled screens can result in increased ticket sales at premium prices, enhanced monetization of a motion picture's initial release as well as enhanced monetization of a film's downstream revenue sources (such as pay television rights), which are often negotiated based on a film's theatrical success at the box office. As a result, 3D filmmaking can provide a more attractive return on investment to motion picture producers and distributors with only limited incremental costs compared to producing a film in 2D. Motion picture exhibitors share in the benefit of increased motion picture ticket sales at premium prices despite requiring very limited up-front costs to deploy RealD's Cinema Systems. We also believe consumers benefit from a superior 3D entertainment experience.

13

Other visual display technologies and applications

We actively seek to have our 3D technologies incorporated into new 3D-enabled visual display devices by making them available to licensees, including consumer electronics manufacturers, content producers and content distributors.

Technology. We continue our development efforts of next-generation 3D display technologies, including glasses-free technologies that will allow the viewing of 3D content on a variety of visual display devices witout the need for 3D glasses. Our patented high brightness, passive eyewear-based 3D display could be used with high definition displays without significantly degrading image resolution as experienced with competing passive eyewear 3D display technologies.

Many of the 3D-enabled visual display devices sold today utilize active shuttering 3D eyewear. To address this opportunity, we have developed technology to create active 3D eyewear, which are compatible with 3D-enabled visual display devices from various major consumer electronics brands.

Our RealD Format is based on multiplexing technology (which packs two images in a single space) to deliver and display high definition 3D content via today's existing infrastructure for cable, satellite, broadcast, packaged media and the Internet. Our technology can grow with the content distribution infrastructure to deliver the highest quality, premium 3D viewing experience across a variety of distribution systems and consumer electronics products. Our 3D technologies can also be used for 3D-enabled interactive gaming by game developers and publishers. Our technologies for interactive gaming include those that adjust viewing angles in a game, assure 3D across depth of field and enable in-frame 3D effects.

Competitive presence. Our 3D technologies can be deployed across the entire range of consumer electronics. We have made available our RealD Display, active and passive eyewear and RealD Format technologies to consumer electronics manufacturers, content producers and distributors to enable high definition televisions, laptops, tablets, smart phones and other displays to be viewed in 3D in the home and elsewhere. Although we have not yet generated material revenue licensing our consumer electronics technologies, we have agreements in place with a wide range of leading consumer electronics manufacturers and content providers.

Content. Building on the recent success of major 3D motion pictures released in theaters, we believe consumers' desire for 3D consumer electronics will be stimulated with the creation and distribution of new motion pictures and other forms of 3D content. We anticipate that the demand for live broadcast events in 3D, including sporting events, concerts, cultural and other live events, for 3D interactive games, as well as other new and alternative 3D content for the home and elsewhere, will further stimulate the demand for RealD-enabled consumer electronics products.

Brand. We believe the strength of our brand in the motion picture industry will assist us in the 3D consumer electronics space. We are working with our licensees to incorporate RealD branding in their consumer electronics product advertising, marketing and packaging.

Licensing model. We have entered into multi-year licensing agreements with participants in the consumer electronics industry to further integrate our RealD Format and other technologies into their products. Although we have not yet generated material revenue from our current agreements in the consumer electronics industry, and may never generate material revenue from those agreements, we believe there will be future revenue opportunities for licensing our 3D technologies to consumer electronics manufacturers, component and accessories manufacturers, eyewear manufacturers, mobile device companies and others as the 3D consumer electronics opportunity continues to develop.

Professional and Non-Theatrical Applications. Our 3D visual display technologies are utilized by Fortune 500 companies, government, academic institutions, and research and development

14

organizations for a variety of applications. Our 3D technologies have also been used for theme park installations, including LEGOLAND®.

Our history

RealD was founded in 2003 with the goal of bringing a premium 3D viewing experience to audiences everywhere. In 2005, we acquired Stereographics Corporation, or Stereographics, a company founded in 1980 and one of the largest providers of 3D technologies at the time of the acquisition. In 2007, we acquired ColorLink Inc., or ColorLink, a polarization control, photonics and optics company with an extensive patent portfolio. ColorLink, which was founded in 1995, had played an instrumental role collaborating with RealD to develop our first cinema system. In March 2005, we demonstrated our initial RealD Cinema System to motion picture exhibitors and studios. In November 2005, Disney released Chicken Little in 3D on approximately 100 RealD-enabled screens. In 2008, we established a RealD sales and operating presence in Europe and also entered 3D consumer electronics with a number of 3D technologies for the home and elsewhere. In December 2009, Fox released Avatar worldwide, including on approximately 4,200 RealD-enabled screens. In 2010, we established a RealD sales and operating presence in China and Hong Kong. In 2012, we established a RealD sales and operating presence in Russia. In 2013, RealD surpassed 20,000 3D-equipped cinema screens worldwide and we also established a RealD sales and operating presence in Latin America.

Licensees

In our cinema business, our primary licensees are motion picture exhibitors that use our RealD Cinema Systems, including 14 of the top 17 motion picture exhibition groups in the world. As of March 31, 2013, we had multi-year (typically five years or longer) agreements that are generally exclusive with our motion picture exhibitor licensees in both the domestic and international markets. However, our license agreements typically do not obligate motion picture exhibitors to deploy a specific number of our RealD Cinema Systems according to a specific timeline. License revenue from AMC, Cinemark and Regal together comprised approximately 22% of our gross license revenue in the year ended March 31, 2013, 24% in the year ended March 23, 2012 and 23% in the year ended March 25, 2011. No licensee accounted for more than 10% of our gross license revenue in fiscal 2013, 2012 or 2011.

Sales and marketing

We market and license our technologies throughout the 3D motion picture, 3D consumer electronics and professional industries through an internal sales team. We maintain sales offices in the United States, the United Kingdom, Russia, Japan, Hong Kong, China and Brazil.

We focus our marketing efforts on motion picture studios and exhibitors, consumer electronics manufacturers, interactive game companies, content producers and content distributors. We reach these customers primarily through industry trade shows, public relations and our website and studio events.

Research and development

We believe we must continue to develop or acquire innovative technologies on a regular basis to maintain our competitive edge. We monitor trends in the 3D motion picture, 3D consumer electronics and professional industries to stay abreast of new developments. We further monitor relevant intellectual property and other public domain information. Our research and development is focused on building and testing licensed products that could potentially incorporate our 3D technologies. Once the proof of concepts are built and tested, our 3D technologies are licensed to motion picture exhibitors and consumer electronics manufacturers.

15

Our research and development expenses were $19.5 million for the year ended March 31, 2013, $16.5 million for the year ended March 23, 2012 and $15.6 million for the year ended March 25, 2011. In addition, we have made significant investments in intellectual property through acquisitions, including our acquisitions of Stereographics and ColorLink.

Manufacturing and supply

RealD Cinema Systems. We purchase optical and mechanical components for our RealD Cinema Systems from multiple suppliers. We have also entered into a large number of license and deployment agreements with digital cinema projector and server companies that grant them a limited, royalty-free license related to the use of RealD technology into digital cinema projection systems.

RealD eyewear. Our RealD eyewear is an integral part of our RealD Cinema Systems. Our circular polarized passive RealD eyewear allows consumers to move around with reduced image distortion and is comfortable and sanitary, which we believe provides convenience to consumers. We have entered into non-exclusive agreements with several manufacturers to produce RealD eyewear. We manage worldwide manufacturing and distribution of RealD eyewear. Domestically, we operate a recycling program for our RealD eyewear. Domestically, we provide our RealD eyewear free of charge to motion picture exhibitors and then receive a fee from the motion picture studios for the usage of that RealD eyewear by the motion picture exhibitors' consumers. Most international motion picture exhibitors purchase RealD eyewear directly from us and sell them to consumers as part of their admission or as a concession item. As a result, we are one of the world's largest distributors of passive 3D eyewear. Our recyclable eyewear is designed to fit comfortably on most viewers and easily over prescription eyewear. We also make available kids size RealD 3D eyewear. With the growth of 3D motion picture productions and releases, we anticipate that a market for personal and customized RealD eyewear will emerge.

RealD installation, repair and maintenance services. We hire independent contractors to perform installation, repair and maintenance services related to our RealD Cinema Systems.

Competition

The market for 3D visual display technologies is highly competitive.

Our primary competitors for our RealD Cinema Systems include Dolby Laboratories, Inc., or Dolby, X6D Limited, or xpanD, MasterImage 3D, LLC, or MasterImage, Sony Electronics, or Sony, and IMAX Corporation, or IMAX. As of December 31, 2012, these and other competitors had enabled approximately 23,800 worldwide theater screens, collectively, as compared to our approximately 22,200 RealD-enabled worldwide theater screens (which subsequently increased to approximately 22,700 screens as of March 31, 2013). Consumers may be more familiar with some of our competitors' brands in the motion picture industry. However, we believe we differentiate ourselves from our competitors in the motion picture industry for reasons that include the following:

- •

- we provide premium 3D technologies that are highly regarded by licensees and others in the motion picture industry;

- •

- our RealD Cinema Systems deliver superior light output providing for a high quality image and enabling display on larger

theater screens with one projector than most competing technologies;

- •

- we offer motion picture exhibitors a licensing model that includes technological upgrades and maintenance at no additional charge and reduces their capital expenditures and the risk that they may purchase equipment that will become obsolete;

16

- •

- compared to most of our competitors' eyewear in the motion picture industry, our circular polarized passive RealD eyewear

allows consumers to move around with reduced image distortion; and

- •

- our RealD eyewear model requires fewer personnel (no active collecting or washing by motion picture exhibitors) and reduces motion picture exhibitors' loss from theft and breakage.

Our primary competitors in 3D visual display technologies include consumer electronics companies who are developing 3D visual display devices, including LG and active 3D eyewear manufacturers including Xpand. While the 3D consumer electronics industry is new and rapidly developing, we must compete with companies that enjoy competitive advantages in the consumer electronics industry.

We believe that the principal competitive factors include some or all of the following:

- •

- quality and reliability of technologies;

- •

- technology performance, flexibility and range of application;

- •

- timeliness and relevance of new product introductions;

- •

- relationships with key participants in the motion picture and consumer electronics industries;

- •

- inclusion in explicit or de facto industry standards;

- •

- brand recognition and reputation;

- •

- availability of 3D compatible, high quality content; and

- •

- price.

We believe we compete favorably with respect to many of these factors.

Intellectual property

We have a substantial base of intellectual property assets, including patents, trademarks, copyrights, trade secrets and know-how.

We have multiple patents covering unique aspects and improvements for many of our technologies. As of March 31, 2013, we had over 241 patent families comprising approximately 191 individual issued patents and approximately 369 pending patent applications in approximately 18 jurisdictions worldwide. Our issued patents are scheduled to expire at various times between May 2013 and January 2038. Of these, two patents are scheduled to expire in 2013, five patents are scheduled to expire in 2014, and nine patents are scheduled to expire in 2015. We believe the expiration of these patents will not adversely affect our business. Our patents are used in the areas of algorithms, autostereo, eyewear, projection, format, direct view, retarder stack filters, polarization switches, eyewear protection, color switching and other areas. We currently derive our license revenue principally from our RealD Cinema Systems. Patents relating to our RealD Cinema Systems generally expire between 2013 and 2038. We pursue a general practice of filing patent applications for our technology in the United States and outside of the United States where our licensees manufacture, distribute or sell licensed products and where our competitors manufacture, distribute or sell competing products. We actively pursue new applications to expand our patent portfolio to address new technology innovations. We also from time to time acquire intellectual property through acquisition, such as our purchase of a portfolio of 2D-3D conversion patents from DDMH, and our acquisitions of Stereographics and ColorLink.

We have approximately 67 trademark and service mark registrations and pending applications worldwide for a variety of word marks, logos and slogans. Our registered and common law trademarks are an integral part of our licensing program and licensees typically elect to place our trademarks on

17

their products to inform consumers that their products incorporate our technology and meet our quality specifications.

Employees

As of March 31, 2013, we had 163 employees located in the United States, Canada, the United Kingdom, Japan, Hong Kong, Taiwan, China and Russia. Approximately 36 are engaged in research and development, approximately 38 are in operations, and approximately 89 are in sales and general and administrative functions. None of our employees are represented by a labor union, and we consider our employee relations to be good.

The following risk factors and other information included in this Annual Report on Form 10-K and in our other filings with the Securities and Exchange Commission should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we presently deem less significant may also impair our business, results of operations, financial condition and/or liquidity. If any of these events or the following risks actually occur, our business, operating results and financial condition could be materially adversely affected, and you could lose all or part of your investment.

Risks relating to our business

If motion pictures that can be viewed with RealD Cinema Systems are not made or are not commercially successful, our revenue will decline.

Almost all of our revenue is currently dependent upon both the number of 3D motion pictures released and the commercial success of those 3D motion pictures. Although we have produced alternative content in 3D, such as the production of Carmen in 3D with London's Royal Opera House, we are not actively developing 3D motion pictures or our own 3D content and therefore, we rely on motion picture studios producing and releasing 3D motion pictures compatible with our RealD Cinema Systems. There is no guarantee an increasing number of 3D motion pictures will be released or that motion picture studios will continue to produce 3D motion pictures at all. Motion picture studios may refrain from producing and releasing 3D motion pictures for any number of reasons, including their lack of commercial success, consumer preferences, the lower-cost to produce 2D motion pictures or the availability of other entertainment options. The commercial success of a 3D motion picture depends on a number of factors that are outside of our control, including whether it achieves critical acclaim, timing of the release, cost, marketing efforts and promotional support for the release. In the past, consumer interest in 3D motion pictures was episodic and motion picture studios tended to use 3D motion pictures as a gimmick rather than as an artistic tool to enhance the viewing experience. If consumers' recent renewed interest in the 3D viewing experience fails to grow or, as in recent periods, domestic consumer preferences trend towards viewing motion pictures in 2D rather than 3D, box office performance may suffer and motion picture studios may reduce the number of 3D motion pictures they produce. Poor box office performance of 3D motion pictures, disruption or reduction in 3D motion picture production or conversion of two-dimensional motion pictures into 3D motion pictures, changes in release schedules, cancellations of motion picture releases in 3D versions, a reduction in marketing efforts for 3D motion pictures by motion picture studios or a lack of consumer demand for 3D motion pictures could result in lower 3D motion picture attendance, which would substantially reduce our revenue, which declined in fiscal 2013 compared to fiscal year 2012. Moreover, films can be subject to delays in production or changes in release schedule, and the slippage of a film's release date from one accounting period to another could adversely affect our financial condition, results of operations and business.

18

If motion picture exhibitors do not continue to use our RealD Cinema Systems or experience financial difficulties, our growth and results of operations could be adversely affected.

Our primary licensees in the motion picture industry are motion picture exhibitors. Our license agreements with motion picture exhibitors do not obligate these licensees to deploy a specific number of our RealD Cinema Systems. We cannot predict whether any of our existing motion picture exhibitor licensees will continue to perform under their license agreements with us, whether they will renew their license agreements with us at the end of their term or whether we or any of our existing motion picture exhibitor licensees may now or in the future be in breach of those agreements. If motion picture exhibitors reduce or eliminate the number of 3D motion pictures that are exhibited in theaters, then motion picture studios may not produce and release 3D motion pictures and our revenue could be materially and adversely affected.

In addition, license revenue from AMC, Cinemark and Regal together comprised approximately 22% of our gross license revenue in the year ended March 31, 2013, 24% in the year ended March 23, 2012 and 23% in the year ended March 25, 2011. Any inability or failure by motion picture exhibitors to pay us amounts due in a timely fashion or at all could substantially reduce our cash flow and could materially and adversely impact our financial condition and results of operations.

A deterioration in our relationships with the major motion picture studios could adversely affect our business and results of operations.

The six major motion picture studios accounted for approximately 76% of domestic box office revenue and all 10 of the top 10 grossing 3D motion pictures in calendar year 2012. Such 3D motion pictures are also released internationally. In addition, for our domestic operations, these major motion picture studios pay us a per use fee for our RealD eyewear. To the extent that our relationship with any of these major motion picture studios deteriorates or any of these studios stop making motion pictures that can be viewed at RealD-enabled theater screens, refuse to co-brand with us, stop using or paying for the use of or reduce the amounts paid for our RealD eyewear in domestic markets, our costs could increase and our revenue could decline, which would adversely affect our business and results of operations. We understand that at least one motion picture studio is seeking a change to the 3D eyewear business model in North America to resemble the international model. While we support multiple business models for our RealD eyewear around the world, the uncertainty and any potential dispute with a motion picture studio over the domestic eyewear business model could adversely affect our results of operations, financial condition, business and prospects.

If motion picture exhibitors do not continue converting analog theaters to digital or the pace of conversions slows, our future prospects could be limited and our business could be adversely affected.

Our RealD Cinema Systems only work in theaters equipped with digital cinema projection systems, which enable 3D motion pictures to be delivered, stored and projected electronically, and our systems are not compatible with analog motion picture projectors. Motion picture exhibitors have been converting projectors from analog to digital cinema over the last several years, giving us the opportunity to deploy our RealD Cinema Systems. After motion picture exhibitors convert their projectors to digital cinema, they must install a silver screen and our RealD Cinema System in order to display motion pictures in RealD 3D. The conversion by motion picture exhibitors of their projectors and screens from analog to digital cinema requires significant expense. As of December 31, 2012, approximately 85% of domestic theater screens had converted to digital and approximately 60% of the international theater screens had been converted. If the market for digital cinema develops more slowly than expected, or if the motion picture exhibitors we have agreements with delay or abandon the conversion of their theaters from analog theaters to digital, our ability to grow our revenue and our business could be adversely affected. While DCIP and Cinedigm financing provided funding for the digital conversion of domestic theater screens operated by many of our licensees, there has not been a similar effort to

19

organize digital conversion in certain geographies outside North America. If the pace of digital conversion outside of the United States does not follow that which occurred inside the United States, our revenue may not grow or may decline, and our business could be adversely affected.

If the deployment of our RealD Cinema Systems is delayed or not realized, our future prospects could be limited and our business could be adversely affected.

We have license agreements with motion picture exhibitors that give us the right, subject to certain exceptions, to deploy our RealD Cinema Systems if a location under contract is already equipped with our systems. Under the terms of these agreements, the motion picture exhibitor licensees may choose to install additional 3D digital projector systems. However, our license agreements do not obligate our licensees to deploy a specific number of our RealD Cinema Systems. Numerous factors beyond our control could influence when and whether our RealD Cinema Systems will be deployed, including motion picture exhibitors' ability to fund capital expenditures, or their decision to delay or abandon the conversion of their theaters to digital projection or reduce the number of 3D motion pictures exhibited in their theaters, and our ability to secure adequate supplies of components comprising our RealD Cinema System in any given period. If motion picture exhibitors delay, postpone or decide not to deploy RealD Cinema Systems at the number of screens they have announced, or we are unable to deploy our RealD Cinema Systems in a timely manner, our future prospects could be limited and our business could be adversely affected.

We have a history of net losses and may suffer losses in the future.

While we were profitable in the fiscal year ended March 23, 2012, we incurred net losses in our fiscal years ended 2013, 2011, 2010 and 2009. Our revenues declined in our fiscal year 2013 as compared to the prior year. If we cannot return to sustainable revenue growth and profitability, our financial condition will deteriorate, and we may be unable to achieve our business objectives.

Any inability to protect our intellectual property rights could reduce the value of our 3D technologies and brand, which could adversely affect our financial condition, results of operations and business.

Our business is dependent upon our patents, trademarks, trade secrets, copyrights and other intellectual property rights. Effective intellectual property rights protection, however, may not be available under the laws of every country in which we and our licensees operate, such as China. For example, we believe competitors may be introducing large-screen 3D cinema screen formats that potentially infringe on our intellectual property rights in China to unfairly compete against us. The efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. In addition, protecting our intellectual property rights is costly and time consuming. It may not be practicable or cost effective for us to fully protect our intellectual property rights in some countries or jurisdictions. If we are unable to successfully identify and stop unauthorized use of our intellectual property, we could lose potential revenue and experience increased operational and enforcement costs, which could adversely affect our financial condition, results of operations and business.

It is possible that some of our 3D technologies may not be protectable by patents. In addition, given the costs of obtaining patent protection, we may choose not to protect particular innovations that later turn out to be important. Even where we do have patent protection, the scope of such protection may be insufficient to prevent third parties from designing around our particular patent claims or otherwise avoiding infringement. Furthermore, there is always the possibility that an issued patent may later be found to be invalid or unenforceable, or a competitor may attempt to engineer around our issued patent. Additionally, patents only offer a limited term of protection. Moreover, the intellectual property we maintain as trade secrets could be compromised by third parties, or intentionally or

20

accidentally by our employees, which would cause us to lose the competitive advantage resulting from them.

Any failure to maintain the security of information relating to our customers, employees, licensees and suppliers, whether as a result of cybersecurity attacks or otherwise, could expose us to litigation, government enforcement actions and costly response measures, and could disrupt our operations and harm our reputation.

In connection with the sales and marketing of our products and our entering into licensing arrangements with motion picture exhibitors, we may from time to time transmit confidential information. We also have access to, collect or maintain private or confidential information regarding our customers, employees, licensees and suppliers, as well as our business. We have procedures in place to safeguard such data and information and as a result of those procedures, to our knowledge, computer hackers have been unable to gain access to the information stored in our information systems. However, cyber-attacks are rapidly evolving and becoming increasingly sophisticated. It is possible that computer hackers and others might compromise our security measures or those that we do business with in the future and obtain the personal information of our customers, employees, licensees and suppliers or our business information. A security breach of any kind could expose us to risks of data loss, litigation, government enforcement actions and costly response measures, and could seriously disrupt our operations. Any resulting negative publicity could significantly harm our reputation which could cause us to lose market share and have an adverse effect on our financial results.

We may in the future be subject to intellectual property rights disputes that are costly to defend, could require us to pay damages and could limit our ability to use particular 3D technologies in the future.

We may be exposed to, or threatened with, future litigation or any other disputes by other parties alleging that our 3D technologies infringe their intellectual property rights. Any intellectual property disputes, regardless of their merit, could be time consuming, expensive to litigate or settle and could divert management resources and attention. An adverse determination in any intellectual property dispute could require us to pay damages and/or stop using our 3D technologies, trademarks, copyrighted works and other material found to be in violation of another party's rights and could prevent us from licensing our 3D technologies to others. In order to avoid these restrictions and resolve the dispute, we may have to pay for a license. This license may not be available on reasonable terms, could require us to pay significant license fees and may significantly increase our operating expenses. A license also may not be available to us at all. As a result, we may be required to use and/or develop non-infringing alternatives, which could require significant effort and expense, or which may not be possible. If we cannot obtain a license or develop alternatives for any infringing aspects of our business, we may be forced to limit our 3D technologies and may be unable to compete effectively. In certain instances, we have contractually agreed to provide indemnification to licensees relating to our intellectual property. This may require us to defend or hold harmless motion picture exhibitors, consumer electronics manufacturers or other licensees. We have from time to time corresponded with one or more third parties regarding patent enforcement issues and in-bound and out-bound patent licensing opportunities. In addition, from time to time we may be engaged in disputes regarding the licensing of our intellectual property rights, including matters related to our license fee rates and other terms of our licensing arrangements. These types of disputes can be asserted by our licensees or prospective licensees or by other third parties as part of negotiations with us or in private actions seeking monetary damages or injunctive relief or in regulatory actions. Requests for monetary and injunctive remedies asserted in claims like these could be material and could have a significant impact on our business. Any disputes with our licensees, potential licensees or other third parties could materially and adversely affect our business, results of operations and prospects.

21

Our RealD Cinema Systems and other technologies are generally designed for use with third-party technologies and hardware, and if we are unable to maintain the ability of our RealD Cinema Systems and other technologies to work with these third-party technologies and hardware, our business and operating results could be adversely affected.

Our RealD Cinema Systems and other technologies are generally designed for use with third-party technologies and hardware, such as Christie projectors, Doremi servers, Harkness Hall screens and Sony Electronics 4K SXRD® digital cinema projectors. Third-party technologies and hardware may be modified, re-engineered or removed altogether from the marketplace. In addition, third-party technologies used to interact with our RealD Cinema Systems, RealD Format and other 3D technologies can change without prior notice to us, which could result in increased costs or our inability to provide our 3D technologies to our licensees. If we are unable to maintain the ability of our RealD Cinema Systems, RealD Format and other 3D technologies to work with these third-party technologies and hardware, our business and operating results could be adversely affected.

If we are unable to maintain our brand and reputation for providing high quality 3D technologies, our business, results of operations and prospects could be materially harmed.

Our business, results of operations and prospects depend, in part, on maintaining and strengthening our brand and reputation for providing high quality 3D technologies. If problems with our 3D technologies cause motion picture exhibitors, consumer electronics manufacturers or other licensees to experience operational disruption or failure or delays in the delivery of their products and services to their customers, our brand and reputation could be diminished. Maintaining and strengthening our brand and reputation may be particularly challenging as we enter new businesses in which we have limited experience, such as 3D consumer electronics. If we fail to promote and maintain our brand and reputation successfully, our business, results of operations and prospects could be materially harmed.

Competition from other providers of 3D technologies to the motion picture industry could adversely affect our business.

The motion picture industry is highly competitive, particularly among providers of 3D technologies. Our primary competitors include Dolby, Sony, IMAX, MasterImage and XpanD, with IMAX increasing market share in recent periods. In addition, other companies, including motion picture exhibitors and studios and smaller competitors in international markets, may develop their own 3D technologies in the future. Consumers may also perceive the quality of 3D technologies delivered by some of our competitors to be equivalent or superior to our 3D technologies. In addition, some of our current or future competitors may enjoy competitive advantages, such as greater financial, technical, marketing and other resources than we do, greater market share and name recognition than we have or may have more experience or advantages in the businesses in which we compete that will allow them to offer lower prices or higher quality technologies, products or services. If we do not successfully compete with these providers of 3D technologies, we could lose market share and our business could be adversely affected. In addition, competition could force us to decrease prices and cause our margins to decline, which could adversely affect our business. Pricing pressures in both domestic and international motion picture exhibitor markets continue, and no assurance can be given that our margins in future periods will increase.

22

We face potential competition from companies with greater brand recognition and resources in the consumer electronics industry.

3D consumer electronics technologies are new and rapidly developing, and we must compete with companies that enjoy competitive advantages, including:

- •

- more developed distribution channels and deeper relationships with consumer electronics manufacturers;

- •

- a more extensive customer base;

- •

- technologies that may be better suited for 3D consumer electronics products;

- •

- broader technology, product and service offerings; and

- •

- greater resources for competitive activities, such as research and development, strategic acquisitions, alliances, joint ventures, sales and marketing, and lobbying for changes in industry and government standards.