Q3 2024Stockholder Letter

To Our Fellow Stockholders As we continue to navigate the turnaround of TrueCar’s legacy business while simultaneously laying the foundation for what TrueCar aims to become, we acknowledge that the TrueCar story is nuanced and requires investors to evaluate and underwrite the distinct opportunities that exist for both our legacy and future businesses. Driving strong near-term growth of the legacy business requires that we embrace and lean into the unique competitive advantages that, over nearly two decades, have helped TrueCar forge its identity as a leading vehicle listings and lead gen provider. However, for us to effectively innovate and carve out our role in the future of automotive retail, we must be willing to evolve the identity we have long embraced. This year alone, we have launched a broad suite of digital marketing solutions for both dealers and original equipment manufacturers (“OEMs”) and we became the first and only digital marketplace that enables consumers to buy a new, certified pre-owned, or used vehicle entirely online. Furthermore, we have taken steps to begin monetizing our rich proprietary datasets, recognizing the potential to unlock powerful insights for our partners and enable an increased level of personalization across the consumer buying journey. While these initiatives represent a natural extension of our unique competitive strengths, they also represent a departure from the traditional role of a third-party listings and lead gen provider. As such, we want to take this opportunity to better define and articulate the diverse range of opportunities TrueCar envisions across these segments. TRUECAR REIMAGINED 1 - Legacy Business: Core Lead Generation & OEM Incentives TrueCar has long been recognized for empowering its network of TrueCar Certified Dealers to connect with high-intent car shoppers that trust TrueCar for its delivery of transparent pricing on new, certified pre-owned, and used vehicles. Since 2005, TrueCar has scaled to play a critical role within the automotive retail ecosystem by leveraging several distinct competitive advantages that have earned us a reputation for providing high-quality new car leads and made TrueCar a trusted partner for nearly every major franchise dealer group in the United States. These unique competitive strengths include: 1. New Vehicle Shopper UX: TrueCar is the preeminent listings site for new car buyers due to its differentiated consumer experience that leverages our integrated OEM vehicle build data to empower new car shoppers visiting TrueCar to customize their new vehicle search in order to match the most detailed trim-specific build criteria. Outside of TrueCar, shoppers can only find this new-vehicle build experience on OEM or franchise dealer sites. These platforms are inherently challenging to navigate for consumers who are interested in cross-shopping different brands. On TrueCar, however, consumers can shop across nearly 11,500 TrueCar Certified Dealers that collectively boast approximately 1.2 million new vehicle listings, representing over 40% of new vehicle inventory nationwide. 2. Exclusive Affinity Network: One of TrueCar’s primary competitive advantages is its Affinity Network, which comprises over 250 membership organizations such as Sam's Club, AAA and Navy Federal Credit Union. These partnerships are uniquely tailored to reflect the distinct attributes and member bases of TrueCar’s Affinity Partners and are actively maintained to evolve and grow in the face of changing markets and consumer habits. As the exclusive auto-buying partner to nearly all of these organizations, TrueCar powers 2

white-labeled/co-branded car-buying sites for the benefit of their members who can gain access to private targeted offers from Certified Dealers and OEMs alike. As the only third-party listings site with a powerful network of Affinity Partners, TrueCar is able to provide its dealer partners with access to a closed ecosystem of high-converting car shoppers that are already engaged with the TrueCar platform and cannot be replicated by competitors. 2. OEM Incentive Programs: In addition to providing TrueCar Certified Dealers with access to unique high-quality leads, the Affinity Network enables TrueCar to power targeted incentive programs on behalf of OEMs. As the only third-party platform with the ability to offer targeted OEM incentives to a closed ecosystem of car shoppers, TrueCar uniquely addresses a common challenge faced by all OEMs: offering discounts and incentives to strategically increase market share without eroding residual values. TrueCar’s competitive strengths and differentiated position among competing third-party listings sites enabled the Company to grow its penetration of U.S. franchise dealers to greater than 50% in 2020 before the global chip shortage drove new vehicle supply to unprecedented lows. Such macroeconomic challenges contributed to more than one-third of TrueCar’s franchise dealer base leaving the platform from 2020 to 2022. In an environment where demand for new vehicles far outstripped supply and the average new vehicle retailed well above the manufacturer’s suggested retail price (“MSRP”), TrueCar’s competitive strengths and value proposition were diminished from the perspective of most franchise dealers. Similarly, OEMs that were unable to produce enough vehicles to meet demand ceased virtually all incentives. Over this period, our unique positioning and differentiated value proposition, which had enabled us to penetrate over half of all U.S. franchise dealers, disproportionately impacted our business relative to our competitors over this period. However, over the last 18 months, these unprecedented conditions that presented profound headwinds have begun to shift into tailwinds for growth. With new vehicle supply continuing its trajectory towards pre-pandemic levels and franchise dealer lots beginning to bloat, we are gradually but consistently rebuilding our franchise dealer base. Meanwhile, OEMs have begun to re-enter the market with incentives to stimulate new-vehicle demand in the face of high consumer financing costs and with that, our unique incentive program capabilities are increasingly in demand. Therefore, while the post-pandemic market environment disproportionately impacted TrueCar’s business, current conditions and the market’s projected trajectory over the next several years appear to favor TrueCar and its unique competitive strengths, positioning the Company for strong near-term growth and market share gains across its core franchise lead generation and OEM business lines. 3

2 - TrueCar Marketing Solutions The value of TrueCar also lies in the innovative offerings and new business lines it has recently launched as well as the untapped monetization opportunities that exist within the Company’s rich proprietary data sets. Facing the recent headwinds discussed above, TrueCar has taken significant steps to evolve its product offerings to better meet the needs of today’s consumers, dealers and OEMs. These products include: 1. TrueCar Marketing Solutions (“TCMS”): Launched in Q1 2024, TCMS is a suite of marketing products designed to leverage TrueCar's proprietary data sets to help dealers more effectively target and acquire consumers. These products are tailored to address the significant decline in marketing efficiency that many dealers have experienced over the last several years and represent a sizable expansion of TrueCar's addressable market given that franchise dealers in the U.S. spend roughly $9 billion annually on advertising1, a large share of which is allocated to traditional search engine marketing and paid social channels that have recently experienced sharp efficiency declines. 2. OEM Ad Sales: While TrueCar’s legacy business model derives revenues from OEMs through its targeted incentive programs, the Company has never sold ad placements as a way to monetize its monthly audience of over 7 million unique shoppers. Seeing the opportunity to build ad placements into the site in a manner that actually enhances rather than detracts from the consumer experience, TrueCar recently augmented its website with an integrated ad server that enables OEMs to effectively advertise and drive consumer awareness for their brands, marking the Company’s initial expansion into the large addressable market of OEM digital advertising, which totaled $19 billion in 20232. Most importantly, enabling OEMs to compete for impressions and capture share of new car buyers is a natural and complementary extension of TrueCar’s existing OEM incentive programs that is expected to deepen the Company’s existing OEM partnerships. 3 - The TRUE Online Transaction Marketplace: TC+ (with Wholesale) TrueCar+ (“TC+”): Arguably the most consequential new product that TrueCar has developed, TC+ enables consumers to buy a new, certified pre-owned, or used vehicle entirely online from the comfort of their couch. With the beta launch of TC+ within California on July 17, 2024, which followed several years of product development and millions of dollars of R&D, TrueCar became the first and only automotive marketplace to enable a fully-digital car buying experience. The significance of this milestone cannot be overstated because despite the many companies that claim to sell cars online, few of them have solved the myriad complexities of a fully-digital end-to-end transaction. TC+ establishes the first marketplace platform through which consumers can complete the essential transaction steps for purchasing a new, certified pre-owned, or used vehicle in less than 10 minutes from the comfort of their couch. Once scaled nationwide, TC+ has the potential to disrupt the automotive retail ecosystem and break down the barriers that have limited e-commerce adoption by providing consumers with the convenience and flexibility to buy a car online anywhere in the country while providing dealers with a retailing solution that expands their addressable market and grows their bottom line through 4 1 National Automobile Dealers Association, 2023 Annual Financial Profile of America’s Franchised New-Car Dealership 2 Statista, “Automotive Industry Digital Advertising Spending”

sales efficiencies and enhanced pricing power. Moreover, an analysis of consumer verticals that have experienced a shift towards e-commerce over the last 20 years shows that the adoption of online buying within each vertical is quickly followed by the emergence of a digital marketplace that rapidly achieves scale by providing buyers and sellers across fragmented markets with an easy way to transact. TC+ seeks to become the modern marketplace for car buying and selling. Also, an efficient and fully-deployed marketplace combined with all of the Company’s transaction data positions the Company to establish more accurate real-time trade-in values. As such, we believe that TC+ has the potential to effectively replace the traditional wholesale market as it will allow dealers to have direct access to the most up-to-date and efficient end-consumer pricing, avoiding the need to go through wholesalers. 4 - Data Monetization & AI/ML Platform Opportunities The Company has a robust technology and data foundation utilizing key partnerships for data management and is implementing a development approach governed by artificial intelligence (“AI”) and machine learning (“ML”). To enable future value creation, TrueCar is rapidly growing its marketing technology (“MarTech”) stack, leveraging industry leading technologies that will allow the Company to further enhance the consumer and dealer experience through AI/ML driven solutions as well as operationalize a full-fledged retail media network supporting OEM marketing and rolling out advanced generative AI use cases. After a thorough evaluation of TrueCar’s extensive proprietary data sets in Q3, we identified several near- and medium-term use cases that have the potential to drive outsized value across three themes: 1. Optimized Consumer Shopping Experience - driving consumer traffic and loyalty by offering a personalized car-buying experience that leverages rich clickstream data and TrueCar’s proprietary incentive, purchase, and lending configuration data. Specific use cases include ML-driven car recommendations, personalized price ratings, real-time inventory badging, and a generative AI shopping assistant. 2. Value Driven Dealer Experience - enhancing our value proposition for dealers by leveraging TrueCar’s closed-loop attribution capabilities, first-party consumer data and integrations with third-party data vendors to provide dealers with actionable insights and analytics on every lead. TrueCar’s rich historical data can be effectively utilized to develop high-accuracy lead classification and consumer-propensity models. 3. Retail Media Network - utilizing TrueCar’s consumer intelligence, DMS sales integrations, and lookalike modeling capabilities to provide OEMs and dealers with access to high-quality audiences through tailored media assets that can be published across a range of platforms and channels. We are prioritizing key use cases across each of these themes and developing robust future state roadmaps against them. In addition, we have made significant enhancements to our data practices and architecture to strengthen the capabilities of our MarTech stack as well as enable the development of specific modular AI/ML models that will unlock key improvements to the consumer and dealer experiences on TrueCar. 5

Q3 PERFORMANCE Now that we have defined TrueCar’s unique advantages, which we are leveraging to drive near-term growth and position TrueCar for a much larger role in the future of automotive retail, let us turn to highlights from the third quarter which we believe demonstrate strong traction against these near-term and longer-term goals. The launch of the TC+ pilot on July 17, 2024 was an incredible milestone for the Company. The excitement we felt at launch was quickly eclipsed when we successfully fulfilled the first used vehicle order followed by our first new vehicle order. These orders were completed 100% online without any offline interactions between the dealer and consumer. The significance of this cannot be overstated, as it represents a new way of buying and selling a vehicle that, simply put, has not been done before. With these orders successfully fulfilled, the pilot’s primary objective has been achieved and each subsequent order has provided new learnings and insights that are driving the refinement of both the consumer and dealer experiences. In total, approximately 30 consumers have completed the entire process online, each culminating with the digital execution of a Retail Installment Contract (“RIC”) and, more importantly, these orders came from consumers across 13 different states, providing strong early evidence that TC+ has the power to significantly expand a dealer’s addressable market beyond its backyard. And while the total number of transactions might not seem significant at first, thus far, TC+ has only been exposed to a subset of consumers within specific flows on TrueCar.com that collectively account for a fraction of our total monthly unit sales. In fact, over the past 30 days, TC+ accounted for roughly half of the volume that the pilot dealer traditionally generates through those flows, suggesting that when fully enabled, TC+ can account for a significant share of a dealer’s total volume. This deliberate and controlled approach to opening up the consumer aperture and expanding the number of shoppers going through the TC+ flow has allowed the team to closely measure and monitor each step of the process for insights and opportunities that have already helped us refine and improve the product and remove friction from both the consumer and dealer experience. Now in the next phase of the pilot, we are preparing to introduce TC+ on certain Affinity Partner auto-buying sites which will significantly expand access to the TC+ flow and should allow TrueCar to observe key differences in consumer adoption across a diverse set of audiences. Beyond expanding consumer access to TC+, our focus and objectives for the pilot in Q4 include integrating AI-powered tools that strengthen our ability to detect and mitigate the risk of consumer fraud and continuing to enhance our integration with our dealers’ backend systems to further streamline the TC+ buying process on the dealer side. These first 90 days have been richly rewarding through the validation and learnings they have offered and as we look ahead, the team is incredibly excited and energized by the opportunity that TC+ represents. Finally, we are extremely grateful for the partnership shown by the dealer group piloting our product and are looking forward to adding additional dealers throughout California and beyond over the next several months. Turning now to a summary of Q3 financial and operational highlights. Total revenue in Q3 was $46.5 million, representing a $5.4 million (or 13.1%) increase from the same period last year and a $4.7 million (or 11.4%) increase from the prior quarter. Our Q3 net loss decreased to $5.8 million from $7.9 million in Q3 2023 and we achieved adjusted EBITDA3 profitability of $0.2 million, down from $0.8 million in the same period last year, primarily due to $0.8 million of non-recurring consulting expenses.

Our core franchise dealer business continued to strengthen in Q3 with franchise dealer revenue growing 12.7% YoY and 5.5% QoQ. Most importantly, despite the industry’s 1.3% YoY decline in industry new vehicle retail sales in Q3, TrueCar grew new vehicle sales by 16.3% YoY driven, in part, by the incremental marketing investments we have been making over the last six months. This equates to nearly seven new unit sales per franchise dealer, which is the highest level since Q3 2021! As we have previously articulated, a key building block for achieving our long-term growth objectives is to regain our share of franchise dealers through activating new dealers and minimizing churn and in order to achieve that we must demonstrate TrueCar’s ability to capture share of total new vehicle sales by delivering strong new unit growth in excess of the overall industry growth. Another sign of the strengthening of our core franchise dealer business is the adoption of TrueCar Marketing Solutions (“TCMS”) and in Q3, this relatively new product offering contributed $1.0 million of dealer revenue. Even more encouraging is the performance being achieved by this suite of marketing products. By leveraging our first-party data to help dealers reach highly targeted audiences across a variety of channels, TrueCar is helping dealers achieve significant improvements in their marketing efficiency while growing their overall sales volumes. Given that growing revenue per dealer is another core building block for achieving our 2026 revenue target, TCMS is allowing us to capture a greater share of wallet and drive real traction against this building block. In addition to the momentum of our franchise dealer business, our OEM business remains strong and positioned for near-term growth. Despite being down 11.5% YoY, a decline attributed to two heavily marketed incentive programs during the same period last year, Q3 OEM revenue increased by $1.4M (or 45%) from the second quarter driven by strong performance of an incentive program that reactivated in June. As we have discussed previously, factors that impact the performance of incentive programs include the incentive amounts being offered, the breadth of models eligible for incentives, and the number of affinity partners targeted through the program. 7 3 Adjusted EBITDA is a non-GAAP financial measure. Refer to “Use of Non-GAAP Financial Measures,” below, for its definition and a reconciliation to net loss, the most comparable financial measure calculated and presented in accordance with GAAP.

8 Jantoon Reigersman President and Chief Executive Officer Oliver Foley Chief Financial Officer 4 Statista, “Automotive Industry Digital Advertising Spending” 5 Free cash flow and free cash flow margin are non-GAAP financial measures. Refer to “Use of Non-GAAP Financial Measures,” below, for the definition of each such measure. We are unable to provide a reconciliation of forward-looking free cash flow or forward-looking free cash flow margin to the most comparable financial measures calculated and presented in accordance with GAAP without unreasonable effort because we cannot reliably quantify certain of the necessary components of such forward-looking GAAP measures. Beyond incentives, TrueCar signed up its first two OEM advertisers in Q3, marking the launch of a new advertising service to complement our incentive program capabilities and deepen our OEM partnerships. These deals were enabled by recent investments we have made to strengthen our MarTech stack through an integrated ad server capable of running dynamic targeted advertisements across a variety of onsite placements. Priced on a fee per impression basis, these placements offer OEMs an effective way to drive awareness and consideration among the 7 million in-market car shoppers that visit TrueCar each month and do it in a way that is effectively integrated into the superior shopping experience that TrueCar is known for. Furthermore, the launch of ad sales represents a high-margin opportunity for TrueCar to incrementally monetize TrueCar’s millions of unique visitors and opens us up to capture a share of the estimated $19 billion spent annually on digital marketing by OEMs4. Finally, we remain committed to the three-year target that we set last year to grow revenue back to $300 million with a 10% free cash flow margin by the end of 2026. Achieving that goal requires strong execution against the four key building blocks we have discussed and for us to continue pushing to build a better version of TrueCar that deserves to play a key role in the automotive retail ecosystem. To that end, in Q4 we aim to accelerate YoY revenue growth beyond the 13.1% achieved in Q3 and we seek to deliver positive free cash flow in the quarter5. To infinity and beyond!

Table of Contents Market Environment ……………………………………………..……………………………………..… Page 10 Third Quarter 2024 Financial Highlights …………………….…………….………………………. Page 18 Q3 2024 Financial Discussion …………………………………………………….………..…..…..… Page 19 Live Call and Webcast Details ……………….………………………………………….…………..… Page 24 About TrueCar …………………………………………………………………………………...….…..… Page 24 Forward-Looking Statements …………………………………………….……….…………………… Page 25 Use of Non-GAAP Financial Measures ………………………………………….….……………..… Page 27 Financial Statements and Non-GAAP Financial Measures ……………………………..……… Page 29 9

10 Market Environment Overview New vehicle inventory continues to improve steadily. However, demand seems to be lagging due to ongoing affordability concerns. While pricing trends such as lower transaction prices and reduced interest rates have made new cars seem more accessible compared to recent years, average monthly payments remain near record highs and OEM incentives remain well below historical levels. Although monthly payments for used cars also remain near their historic highs, the spread between the average new and used monthly payments grew in Q3, seemingly contributing to many buyers opting to purchase used cars, as evidenced by YoY and QoQ increases in used vehicle sales. Vehicle Sales Volumes New vehicle retail sales in Q3 2024 totaled 3.5 million units, representing a 1.3% decline YoY. Through the end of August, Q3 new vehicle retail sales were up 4.1% YoY but were offset by September sales volumes coming in 11.9% lower than prior year. Despite significantly higher new vehicle supply and a modest decline in new vehicle list prices versus last year, new vehicle affordability continues to challenge many consumers. Used vehicle retail sales in Q3 totaled 4.5 million units, representing 9.8% growth YoY as the affordability of used car purchases improved from last year driven by a 2.4% decrease in the average list price of used vehicles and a 3.2% decrease in the average monthly payment on a used car loan. Source: Motor Intelligence and Cox Automotive MONTHLY NEW AND USED VEHICLE RETAIL SALES (Industry) Used Vehicle SalesNew Vehicle Sales

11 Inventory and Supply Trends In September 2024, new vehicle inventory hit the highest level since April 2020 reaching 2.89 million units, an increase of 63 thousand units (or 2%) QoQ and 875 thousand units (or 43%) YoY. The QoQ growth was driven primarily by Korean brands, which accounted for 51 thousand units (or 81%) of the overall increase. Meanwhile, inventory levels for domestic, Japanese, and European brands remained relatively flat. YoY, the industry saw significant gains across the board, with domestic brands increasing by 353 thousand units (29%), Japanese brands increasing by 217 thousand units (43%), Korean brands by 169 thousand units (146%), and European brands by 126 thousand units (81%). Despite the sustained recovery in new inventory, it continues to remain well below 2019 levels, which ranged between 3.5 million and 4.1 million units. Source: Motor Intelligence NEW VEHICLE INVENTORY (Industry) 2.89M YoY +43%

12 New Vehicle Inventory Growth (Industry) Source: Motor Intelligence YoY or Since September 2023 QoQ or Since June 2024

13 As of the end of September, average days' supply for new vehicles stood at 56 days compared to 55 days and 39 days as of the end of June 2024 and September 2023, respectively. Notably, Mazda and Kia experienced the largest 90-day increases in days’ supply with Mazda rising from 32 to 49 days and Kia growing from 36 to 47 days. In contrast, Mitsubishi and BMW saw significant declines since June dropping from 61 to 31 days and 48 to 36 days, respectively. On a YoY basis, domestic, Japanese, European, and Korean brands increased their days’ supply by 16 days (28%), 12 days (42%), 25 days (84%) and 30 days (144%), respectively. Source: Motor Intelligence DAYS’ SUPPLY ACROSS BRANDS (Industry) - September 2024

14 Vehicle Pricing and Affordability In September 2024, the Consumer Price Index (CPI, not seasonally adjusted) for new vehicles reached 177.4, reflecting little change since Q1 2023. However, to provide context, pre-pandemic CPI levels for new vehicles consistently ranged between 146 and 149 from 2014 to 2019, underscoring how elevated prices remain today. This substantial increase highlights the continued affordability challenges in the new vehicle market. Further illustrating these challenges, approximately 17% of new vehicles were sold above MSRP in September 2024. Although this represents a decline from 19% in June 2024 and 39% from September 2023, it remains substantially higher than the pre-pandemic range of 3.9% to 6.1%. The average new vehicle list price in September was $48.7 thousand, a 3.6% decline from $50.5 thousand in the prior year, and largely unchanged from June 2024. However, when compared to the September 2020 average list price of $36.3 thousand, today’s new vehicles are priced 34% above where they stood four years ago. This represents a four-year compounded annual growth rate of nearly 8%, which far outstrips the rate of inflation and wage growth over that period and is a stark deviation from the historical rate of growth for new vehicle prices. Source: Cox Automotive, Q3 2024 Industry Insights and Sales Forecast Call ESTIMATED MONTHLY TRANSACTION PRICES

15 An analysis of new vehicle list prices on TrueCar highlights this pricing shift with nearly 59% of TrueCar inventory priced above $40.0 thousand as compared to 35% in 2019 and 2020. Moreover, the share of new inventory listed below $30.0 thousand has declined from 40% in 2020 to approximately 16% in 2024, which is likely contributing to a large share of U.S. consumers being priced out of the new vehicle market. Source: TrueCar NEW VEHICLE INVENTORY SHARE BY LIST PRICE >$60K $50K - $60K $40K - $50K $30K - $40K $20K - $30K < $20K Share of Inventory > $40K 58.5% vs. 35.3% in 2019 and 35.1% in 2020

16 OEM incentives on new vehicles continued to rise in Q3 2024, averaging $3.5 thousand per new vehicle sold, a 50% increase YoY and a 16% increase QoQ. Compared to 2019’s average incentive amount per new vehicle of $3.8 thousand, the incentive amount per new vehicle in September 2024 was only 7% lower, suggesting that the industry has nearly returned to pre-pandemic levels; however, to appropriately compare today’s OEM incentives to those of the past, the average new vehicle list price must be accounted for. In 2019, the average incentive amount per new vehicle was 10.3% of the new vehicle list price, whereas in Q3 2024 it represented 7.1%. As such, if OEMs were to provide new vehicle incentives comparable to 2019 and equal to 10.3% of the new vehicle list price, the average incentive amount in Q3 2024 would need to be $5.0 thousand per vehicle - an additional $1.6 thousand per vehicle (or 45% increase) from current levels. This discrepancy is very likely contributing to new vehicle sales growth not keeping pace with the growth of new vehicle supply. Source: Motor Intelligence OEM NEW VEHICLE INCENTIVES - Avg. $ per Vehicle vs. % of List Price Incentives as % of List PriceIncentives per Vehicle

17 In addition, incentives offered over the past 18 months have primarily involved OEMs leveraging their captive financing arms to offer low APRs and attractive lease terms. As such, through the first half of 2024, captives accounted for 61% of new auto loans, up from 46% in 20226. Even more striking is the YTD growth in the share of new vehicle sales that are leased, which has increased from 19% in 2022 to over 25% in 2024. The reason why one in four new vehicle sales are being leased is that the average monthly lease payment on a new vehicle is $148 (or 20%) lower than the monthly payment on a new vehicle loan, highlighting the extent to which OEMs have been leaning into attractive lease terms to incentivize demand. Finally, looking at auto loan financing trends more broadly, the average APR on a new vehicle loan decreased during Q3 to 6.9% in September 2024, down from 7.6% in September 2023 and 7.2% in June 2024. Despite the more favorable financing terms, the average monthly payment on a new vehicle loan increased during the quarter to $778, up from $768 in both June 2024 and September 2023, driven by an increase in the average amount financed. For used vehicles, CPI showed a YoY decline of 5.1%. In the market, the average list price fell by 2.4% YoY to $30.1 thousand, with the average monthly payment decreasing by 3.2% to $569. Interest rates for used car loans also declined from 11.3% in Q3 2023 to 11.1% in Q3 2024. Used NEW AND USED VEHICLE FINANCING TRENDS Source: Motor Intelligence New Average Loan Term in Months Average APR Average Amount Financed Finally, a noteworthy trend in automotive finance is the continued shift towards prime and super-prime buyers. Subprime and deep subprime buyers accounted for only 14.9% of vehicle loan and lease transactions in Q2 2024, down from 20.7% in 2019. Conversely, prime and super-prime buyers now make up 69.4% of transactions, reflecting a shift in the lending landscape that may influence future sales trends.7 6 & 7 Experian, State of the Automotive Finance Market Q2 2024. September 5, 2024.

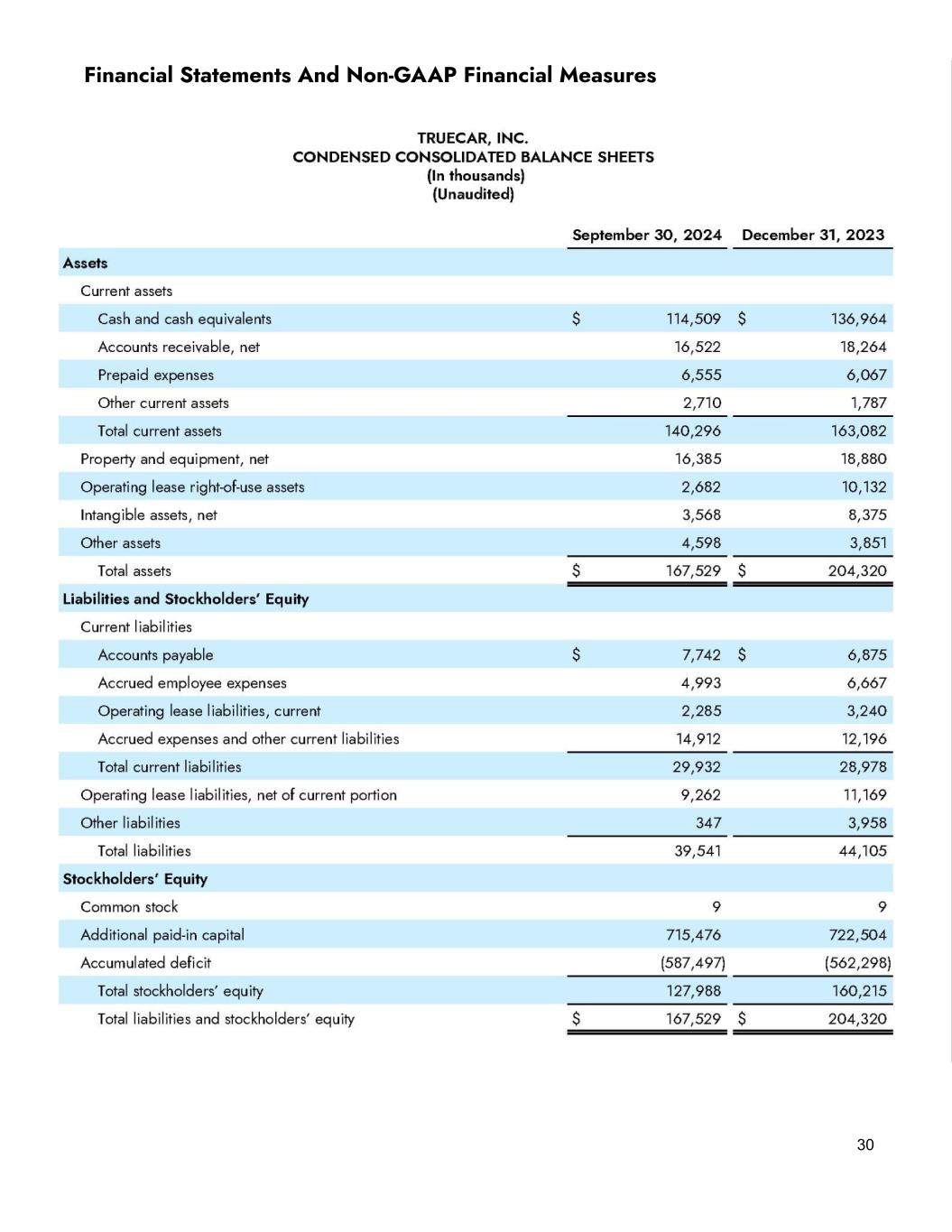

18 Third Quarter 2024 Financial Highlights Revenue: $46.5 million, up 13.1% YoY and up 11.4% from the second quarter of 2024. Net Loss8: ($5.8) million, as compared to ($7.9) million in the third quarter of 2023 and ($13.5) million in the second quarter of 2024. Adjusted EBITDA9: $0.2 million, as compared to $0.8 million in the third quarter of 2023 and $0.1 million in the second quarter of 2024. Financial Flexibility: Our balance sheet remains strong with cash and equivalents of approximately $114.5 million and no debt as of September 30, 2024. Share Repurchases: Repurchased and retired 3.9 million shares of common stock for a total of $12.6 million. Revenue $46.5 million vs. $41.1 million in Q3 2023 Dealers 11,409 vs. 11,503 in Q3 2023 Net Loss8 ($5.8) million vs. ($7.9) million in Q3 2023 Units 95K vs. 83K in Q3 2023 Adj. EBITDA9 $0.2 million vs. 0.8 million in Q3 2023 Monetization $490/unit vs. $495/unit in Q3 2023 Cash & Equivalents10 $114.5 million vs. $145.5 million in Q3 2023 8In the third quarter of 2023, net loss is inclusive of non-recurring severance costs of $1.8 million associated with the realignment of the Company’s leadership structure in the third quarter of 2023. 9 Adjusted EBITDA is a non-GAAP financial measure. Refer to “Use of Non-GAAP Financial Measures,” below, for its definition and reconciliation of Adjusted EBITDA to net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP. 10 Cash and cash equivalents included $0 and $2.2 million restricted cash as of September 30, 2024 and 2023, respectively, that was used to collateralize a letter of credit to secure certain of our obligations under one of our office leases. 11 Traffic refers to average Monthly Unique Visitors. THIRD QUARTER 2024 METRICS Traffic11 6.9 million vs. 8.1 million in Q3 2023

19 Q3 2024 Financial Discussion Revenue Revenue of $46.5 million increased by 13.1% YoY and rose 11.4% compared to the previous quarter. Total dealer revenue grew by $5.9 million (or 16.3%) YoY, primarily driven by a $3.3 million (or 12.7%) increase in franchise dealer revenue, $1.0 million of incremental revenue from TrueCar Marketing Solutions (TCMS), and a $2.3 million (or 182%) increase from the expansion of TrueCar Wholesale Solutions inclusive of the Sell Your Car product offering, partially offset by a $0.6 million (or 8.8%) decline in independent dealer revenue. OEM and other revenue ended the quarter at $4.4 million and $0.2 million, respectively. OEM revenue decreased by $0.6M (or 11.5%) YoY attributed to two heavily marketed incentive programs during Q3 2023. Sequentially, OEM revenue was up $1.4 million (or 45%) from the second quarter of 2024, primarily driven by strong performance of a reactivated incentive program that was only live for one month during the second quarter and partially driven by the $0.4 million estimated impact of the CDK outage on our second quarter OEM revenue. We maintain our belief that OEM incentives will be pivotal to driving new vehicle sales across the industry over the near term and are actively partnering with several brands to reintroduce and broaden their incentive programs on the TrueCar platform. (Millions)

Quarterly Metrics Dealer count at the end of the third quarter was 11,409, comprising 8,303 franchise dealers and 3,106 independent dealers. Independent dealer count declined by 8.8% YoY and 2.9% sequentially, partly attributed to the sustained trend of dealer consolidations and shutdowns. Meanwhile, franchise dealer count increased by 2.5% YoY and 0.4% sequentially, driven by the onboarding of new franchise dealers and reactivation of dealers that left our network when the supply of new vehicle inventory was constrained. Consumer traffic averaged 6.9 million monthly unique visitors in the third quarter of 2024, down from 8.1 million in Q3 2023 and from 7.7 million in Q2 2024. The YoY and sequential decline in monthly unique visitors is attributed to a more efficient allocation of customer acquisition spend to channels with high-converting audiences. 20

21 Total third quarter units were 95 thousand as compared to 83 thousand during the same quarter last year and 89 thousand in the second quarter of 2024. Total units grew by 14.2% YoY and 6.4% sequentially with new units increasing 16.3% YoY and 7.3% sequentially. The mix of new vehicles as a percentage of total units was 57.0% in the third quarter of 2024 as compared to 56.0% of total units in the third quarter of 2023 and 56.5% in the second quarter of 2024. Monetization per unit decreased to $490 from $495 during the third quarter of 2023 and was up from $468 in the second quarter of 2024. The YoY decrease in monetization is attributed to unit growth exceeding revenue growth on a YoY basis, while the sequential increase in monetization was primarily driven by the strong QoQ growth in OEM incentives revenue.

22 Expenses and Margin (Reconciliations of non-GAAP metrics used in this letter to their nearest GAAP equivalents are provided at the end of this letter under “Financial Statements and Non-GAAP Financial Measures”). Third quarter gross profit, defined as revenues less cost of revenue, was $38.8 million which is an increase of $1.5 million (or 4.0%) YoY and $2.5 million (or 6.9%) QoQ. This represents a gross margin of 83.4% on a GAAP basis, which was down from 90.7% in the same period last year and 86.9% in the second quarter. The YoY and sequential decrease in gross margin is primarily attributed to the growth of TCMS and wholesale revenue which have a lower gross margin than core dealer revenue. Technology and development expenses were $7.2 million on a GAAP basis and $6.7 million on a non-GAAP basis in the third quarter of 2024, down 23.1% and 10.6%, respectively, versus the same period last year. The YoY decreases primarily resulted from reduced recurring headcount, software, and hosting costs and one time severance costs during the prior year. Sequentially, technology and development expenses decreased 3.4% on a GAAP basis and increased 2.2% on a non-GAAP basis. The sequential decline on a GAAP basis primarily stemmed from severance costs during the prior quarter while the sequential increase on a non-GAAP basis is driven by increased headcount expenses in the third quarter. General and administrative expenses were $9.6 million on a GAAP basis and $7.4 million on a non-GAAP basis in the third quarter of 2024, up 0.4% and up 7.9% YoY, respectively. On a GAAP basis, the YoY increases were largely driven by an increase in non-recurring third-party consulting expenses partially offset by lower severance and lease exit costs. On a non-GAAP basis, the YoY increase in non-recurring third-party consulting was not offset by the severance and lease exit costs. Sequentially, general and administrative expenses decreased 38.1% on a GAAP basis and increased 16.9% on a non-GAAP basis. The sequential GAAP decrease was mainly the result of a $6.9 million impairment of our right-of-use asset associated with terminating an office lease in the second quarter of 2024 while on a non-GAAP basis, the sequential increase in general and administrative expenses was largely driven by an increase in non-recurring third-party consulting fees. (Millions) (Millions)

23 Sales and marketing, our largest expense category, was $25.0 million on a GAAP basis and $24.6 million on a non-GAAP basis in the third quarter of 2024, up 8.2% and 10.7%, respectively, versus the third quarter of 2023. Sequentially, sales and marketing expenses were up 4.6% on a GAAP basis and 5.1% on a non-GAAP basis. Within sales and marketing expense, TrueCar.com acquisition expense was $5.7 million, up 7.5% YoY and down 14.9% sequentially. Cost per sale for TrueCar.com units was $197, up 7.2% YoY and down 17.7% sequentially. Partner marketing spend was $10.1 million in the third quarter, up 20.2% YoY and 11.3% sequentially driven by the strong growth in units attributed to the partner network. Cost per sale for partner marketing was $154, down 1.2% YoY and up 3.2% sequentially. Finally, headcount-related and other sales and marketing expenses were $9.2 million on a GAAP basis and $8.8 million on a non-GAAP basis in the third quarter of 2024, down 2.2% and up 3.3% YoY, respectively. The YoY increase on a non-GAAP basis was primarily driven by higher recurring headcount expenses. However, on a GAAP basis this increase was offset by a decrease in severance costs compared to the prior year. Sequentially, headcount and other sales and marketing expenses increased 13.2% on a GAAP basis and 15.1% on a non-GAAP basis. The sequential increases were primarily due to increased sales commission costs associated with the increased revenue in the third quarter of 2024. In summary, we maintained our focus on managing expenses while making key investments in growing unit sales for our dealer partners and initiatives aligned with our key building blocks to achieve our long-term growth targets. Balance sheet and cash usage We ended the third quarter of 2024 with approximately $114.5 million in cash and equivalents, as compared to $145.5 million at the end of the third quarter of 2023 and $128.0 million at the end of the second quarter of 2024. During the third quarter of 2024, $12.7 million in cash was used to repurchase and retire shares of common stock. We continue to have no debt.

24 Investor relations: investors@truecar.com Media: TrueCar media line: +1-844-469-8442 (US toll-free) pr@truecar.com Live Call and Webcast Details TrueCar’s management will host a call to discuss third quarter financial results on Thursday, November 7, 2024 at 9:00 a.m. Eastern Time. A live webcast of the call can be accessed from the Investor Relations section of our website and by using this link. Investors and analysts can also participate in the call by dialing 1-833-816-1391 (domestic) or 1-412-317-0484 (international). An archived replay of the call will be available upon completion on the Investor Relations section of our website at ir.truecar.com. During the call, TrueCar’s management may discuss and answer questions concerning business and financial developments and trends that have occurred after quarter-end. Responses to questions, as well as other matters discussed during the call, may contain or constitute information that has not been disclosed previously. TrueCar has used and intends to continue to use its Investor Relations website (ir.truecar.com), LinkedIn (https://www.linkedin.com/company/truecar-inc-), X (@TrueCar) and Facebook (www.facebook.com/TrueCar) as means of disclosing material non-public information and for complying with disclosure obligations under Regulation FD. About TrueCar TrueCar is a leading automotive digital marketplace that lets auto buyers and sellers connect to our nationwide network of Certified Dealers. With access to an expansive inventory provided by our Certified Dealers, we are building the industry’s most personalized and efficient auto shopping experience as we seek to bring more of the process online. Consumers who visit our marketplace will find a suite of vehicle discovery tools, price ratings and market context on new, used and Certified Pre-Owned vehicles. When they are ready, shoppers in TrueCar’s marketplace can connect with a Certified Dealer in our network, who shares our belief that truth, transparency and fairness are the foundation of a great auto shopping experience. As part of our marketplace, TrueCar powers auto-buying programs for over 250 leading brands, including Sam’s Club, Navy Federal Credit Union and AAA.

25 Forward-Looking Statements This document contains forward-looking statements. All statements contained herein other than statements of historical fact are forward-looking statements, including statements regarding our revenue growth, including our ability to surpass year-over-year revenue growth of 13.1% in the fourth quarter of 2024 while achieving positive free cash flow, as well as aspirational goals regarding 2026 revenue and free cash flow margin, the near and long-term growth and revenue opportunities of our core, OEM and marketing business lines, our ability to monetize our proprietary data for the benefit of dealers and our affinity partners and generate value through an improved marketing technology stack, including through the implementation of artificial intelligence and machine learning capabilities, our ability to regain or activate new dealers and limit dealer churn, grow our TrueCar Marketing Solutions product offering, and our ability to scale our TrueCar+ offering in California and nationwide and its potential to disrupt the automotive retail ecosystem, including wholesale markets, and benefit dealers once scaled as well as our expectations about the macroeconomic environment, including possible developments that may benefit our business, such as increases in inventory levels and in OEM incentive offers, the likelihood of consumers being priced out of new vehicles, the impact of the shift in automotive lending to prime and super-prime borrowers and the importance of OEM incentive in driving near-term growth. These forward-looking statements are subject to a number of risks, uncertainties and assumptions that may prove incorrect, any of which could cause our results to differ materially from those expressed or implied by such forward-looking statements, and include, among others, those risks and uncertainties described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission, or SEC, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 filed with the SEC, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 to be filed with the SEC. These risks include, but are not limited to, the following: ● Our business is subject to risks related to the larger automotive ecosystem, including recent low automobile inventory supply levels, which adversely impacted our business, results of operations and prospects. ● If our lead quality or quantity declines, our unit volume could as well, and dealers could leave our network or insist on lower subscription rates, which could reduce our revenue and harm our business. ● If we are not successful in rolling out new offerings, including our TC+ offering, providing a compelling value proposition to consumers using these offerings, integrating our current and future offerings into such experiences or monetizing them, our business and prospects could be adversely affected. ● Actions that we have taken in the past and may take in the future to restructure our business in alignment with our strategic priorities may not be as effective as anticipated.

26 ● The growth of our business relies significantly on our ability to maintain and increase the revenues that we derive from dealers in our network of TrueCar Certified Dealers. Failure to do so would harm our financial performance. ● We may not be able to provide a compelling car-buying experience to our users, which could cause the number of transactions between our users and dealers, and therefore our revenues, to decline. ● Economic and other conditions that impact consumer demand for automobiles, including interest rates, inflation, fuel prices and the impacts of public health events, may have a material adverse effect on our business, financial condition and results of operations. ● We may fail to meet our publicly announced guidance or other expectations about our business and future operating results, which could cause our stock price to decline. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. All forward-looking statements in this document are based on information available to our management as of the date of this press release and, except as required by law, management assumes no obligation to update those forward-looking statements, which speak only as of their respective dates.

Use of Non-GAAP Financial Measures This document includes non-GAAP financial measures we refer to as Adjusted EBITDA, free cash flow and free cash flow margin. We define Adjusted EBITDA as net loss adjusted to exclude interest income, depreciation and amortization, stock-based compensation, changes in the fair value of contingent consideration liability, impairment of right-of-use (“ROU”) assets, interest accretion for terminated leases, restructuring charges, and income taxes. The expense categories utilized to derive Adjusted EBITDA are also utilized to derive Non-GAAP expenses by financial statement line item (“FSLI”). We have provided below a reconciliation of Adjusted EBITDA to net loss as well as the GAAP expenses by FSLI to the non-GAAP expense by FSLI, the most directly comparable GAAP financial measures. Adjusted EBITDA should not be considered as an alternative to net loss or any other measure of financial performance calculated and presented in accordance with GAAP, and non-GAAP expenses should not be considered as an alternative to expenses presented in accordance with GAAP. In addition, our Adjusted EBITDA and non-GAAP expense measures may not be comparable to similarly titled measures of other organizations as they may not calculate Adjusted EBITDA or non-GAAP expenses in the same manner as we calculate this measure. We use Adjusted EBITDA as an operating performance measure because it is (i) an integral part of our reporting and planning processes; (ii) used by our management and board of directors to assess our operational performance, and together with operational objectives, as a measure in evaluating employee compensation and bonuses; and (iii) used by our management to make financial and strategic planning decisions regarding future operating investments. We believe that using Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis because it excludes variations primarily caused by changes in the excluded items noted above. In addition, we believe that Adjusted EBITDA and similar measures are widely used by investors, securities analysts, rating agencies and other parties in evaluating companies as measures of financial performance and debt service capabilities. Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: ● Adjusted EBITDA does not reflect the receipt of interest or the payment of income taxes; ● Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; ● although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditures or any other contractual commitments; ● Adjusted EBITDA does not reflect impairment charges on our ROU assets associated with subleasing; ● Adjusted EBITDA does not reflect interest accretion for the terminated office lease at 1401 Ocean Avenue, Santa Monica, California; 27

28 ● Adjusted EBITDA does not reflect changes in the fair value of our contingent consideration liability; ● Adjusted EBITDA does not reflect the charges associated with the Restructuring Plan initiated and completed in the second quarter of 2023 to improve efficiency and reduce expenses or a realignment of the Company’s leadership structure initiated in the third quarter of 2023; ● Adjusted EBITDA does not consider the potentially dilutive impact of shares issued or to be issued in connection with stock-based compensation; and ● other companies, including companies in our own industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. We define free cash flow as net cash flow from operating activities less capital expenditures, and free cash flow margin as free cash flow divided by revenue. Free cash flow and free cash flow margin should not be considered as alternatives to net cash flow from operating activities or any other measure of liquidity calculated and presented in accordance with GAAP. In addition, our free cash flow and free cash flow margin measures may not be comparable to similarly titled measures of other organizations as they may not calculate them in the same manner as we calculate these measures. We use free cash flow and free cash flow margin as liquidity measures because they are used by management to make financial and strategic planning decisions based on cash availability after maintaining the needs of our primary business activities. We believe that using free cash flow and free cash flow margin facilitates comparison of cash available for potential future investment opportunities because it excludes cash flows that are not in support of the core business operations or are from external financing. Our use of free cash flow and free cash flow margin has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: ● free cash flow and free cash flow margin may not reflect future contractual commitments; ● free cash flow does not reflect cash flow provided by or used in financing activities, including payments made for contingent consideration, taxes on net share settlement of equity awards, proceeds from exercise of common stock options, or repurchase of common stock; ● free cash flow does not reflect cash sources or uses from investing activities that are not directly associated with capital expenditures; and ● other companies, including companies in our own industry, may calculate free cash flow and free cash flow margin differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, you should consider Adjusted EBITDA, free cash flow and free cash flow margin alongside other financial performance and liquidity measures, including our net loss, our other GAAP results and various cash flow metrics. In addition, in evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses such as those that are the subject of adjustments in deriving Adjusted EBITDA and you should not infer from our presentation of Adjusted EBITDA that our future results will not be affected by these expenses or any unusual or non-recurring items.

29 Financial Statements And Non-GAAP Financial Measures

30 Financial Statements And Non-GAAP Financial Measures

31 Financial Statements And Non-GAAP Financial Measures

Financial Statements And Non-GAAP Financial Measures 32

Thank You