Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-176765

United States Oil Fund, LP

968,800,000 Units

United States Oil Fund, LP, a Delaware limited partnership, is a commodity pool that issues units that may be purchased and sold on the NYSE Arca. United States Oil Fund, LP is referred to as USOF throughout this document. This is a best efforts offering. USOF will continuously offer creation baskets consisting of 100,000 units to authorized purchasers through ALPS Distributors, Inc., which is the marketing agent. Authorized purchasers will pay a transaction fee of $1,000 for each order placed to create one or more baskets. This is a continuous offering and will not terminate until all of the registered units have been sold. Our units are listed on the NYSE Arca under the symbol “USO.”

The units may be purchased from USOF only in one or more blocks of 100,000 units, as described in “Creation and Redemption of Units.” A block of 100,000 units is called a Basket. USOF issues and redeems units in Baskets on a continuous basis to certain authorized purchasers as described in “Plan of Distribution.” Each creation basket is offered and sold to an authorized purchaser at a price equal to the net asset value of 100,000 units on the day that the order to create the creation basket is accepted by the marketing agent.

The units are offered and sold to the public by authorized purchasers at prices that are expected to reflect, among other factors, the trading price of the units on the NYSE Arca, the net asset value of USOF and the supply of and demand for units at the time of sale. The difference between the price paid by authorized purchasers as underwriters and the price paid to such authorized purchasers by investors will be deemed underwriting compensation. Authorized purchasers will not receive from USOF or any of its affiliates, any fee or other compensation in connection with the sale of units.

USOF is not a mutual fund registered under the Investment Company Act of 1940 and is not subject to regulation under such Act.

Some of the risks of investing in USOF include:

| • | Investing in crude oil interests subjects USOF to the risks of the crude oil industry which could result in large fluctuations in the price of USOF’s units. |

| • | If certain correlations do not exist, then investors may not be able to use USOF as a cost-effective way to invest indirectly in crude oil or as a hedge against the risk of loss in oil-related transactions. |

| • | USOF does not expect to make cash distributions. |

| • | USOF and its general partner may have conflicts of interest, which may permit them to favor their own interests to your detriment. |

Investing in USOF involves other significant risks. See “What Are the Risk Factors Involved with an Investment in USOF?” beginning on page 11.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OFFERED IN THIS PROSPECTUS, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE COMMODITY FUTURES TRADING COMMISSION (“CFTC”) HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS IT PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

This prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both contain important information.

| Per Unit | Per Basket | |||||||

| Price of the units* |

$ | 34.46 | $ | 3,446,000 | ||||

| * | Based on closing net asset value on September 8, 2011. The price may vary based on net asset value in effect on a particular day. |

The date of this prospectus is December 6, 2011.

Table of Contents

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGE 58 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 7.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGE 11.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

i

Table of Contents

UNITED STATES OIL FUND, LP

| Page | ||||

| iv | ||||

| 1 | ||||

| 1 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| What are the Risk Factors Involved with an Investment in USOF? |

11 | |||

| Risks Associated With Investing Directly or Indirectly in Crude Oil |

11 | |||

| 16 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| Other Related Commodity Trading and Investment Management Experience |

37 | |||

| 37 | ||||

| 46 | ||||

| 47 | ||||

| What is the Crude Oil Market and the Petroleum-Based Fuel Market? |

51 | |||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 63 | ||||

| 64 | ||||

| 69 | ||||

| 69 | ||||

| 71 | ||||

| 73 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

ii

Table of Contents

| Page | ||||

| 75 | ||||

| 76 | ||||

| 76 | ||||

| 76 | ||||

| 77 | ||||

| 77 | ||||

| 78 | ||||

| 87 | ||||

| 87 | ||||

| 87 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| 91 | ||||

| 91 | ||||

| A-1 | ||||

| A-1 | ||||

| SAI-1 | ||||

| SAI-3 | ||||

| SAI-14 | ||||

| SAI-15 | ||||

iii

Table of Contents

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” which generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this prospectus and movements in the commodities markets and indexes that track such movements, USOF’s operations, the General Partner’s plans and references to USOF’s future success and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the General Partner has made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the General Partner’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. See “What Are the Risk Factors Involved with an Investment in USOF?” Consequently, all the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the events or developments that will or may occur in the future, including such matters as changes in inflation in the United States movements in the stock market, movements in the U.S. and foreign currencies, actual results or developments the General Partner anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, USOF’s operations or the value of the units.

iv

Table of Contents

This is only a summary of the prospectus and, while it contains material information about USOF and its units, it does not contain or summarize all of the information about USOF and the units contained in this prospectus that is material and/or which may be important to you. You should read this entire prospectus, including “What Are the Risk Factors Involved with an Investment in USOF?” beginning on page 11, before making an investment decision about the units.

United States Oil Fund, LP, a Delaware limited partnership (“USOF” or “Us” or “We”), is a commodity pool that issues units that may be purchased and sold on the NYSE Arca. It is managed and controlled by its general partner, United States Commodity Funds LLC (formerly known as Victoria Bay Asset Management, LLC) (“General Partner”). The General Partner is a single member limited liability company formed in Delaware on May 10, 2005 that is registered as a commodity pool operator (“CPO”) with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”).

The net assets of USOF consist primarily of investments in futures contracts for light, sweet crude oil, other types of crude oil, heating oil, gasoline, natural gas, and other petroleum-based fuels that are traded on the New York Mercantile Exchange (the “NYMEX”), ICE Futures or other U.S. and foreign exchanges (collectively, “Oil Futures Contracts”) and, to a lesser extent, in order to comply with regulatory requirements or in view of market conditions, other oil interests such as cash-settled options on Oil Futures Contracts, forward contracts for oil, cleared swap contracts and non-exchange traded (“over-the-counter”) transactions that are based on the price of oil, other petroleum-based fuels, Oil Futures Contracts and indices based on the foregoing (collectively, “Other Oil-Related Investments”). Market conditions that the General Partner currently anticipates could cause USOF to invest in Other Oil-Related Investments include those allowing USOF to obtain greater liquidity or to execute transactions with more favorable pricing. For convenience and unless otherwise specified, Oil Futures Contracts and Other Oil-Related Investments collectively are referred to as “Oil Interests” in this prospectus. The General Partner is authorized by USOF in its sole judgment to employ, establish the terms of employment for, and terminate commodity trading advisors or futures commission merchants.

The investment objective of USOF is for the daily changes in percentage terms of its units’ NAV to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the price of the futures contract on light, sweet crude oil as traded on the NYMEX that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire, less USOF’s expenses. The General Partner does not intend to operate USOF in a fashion such that its per unit NAV will equal, in dollar terms, the spot price of light, sweet crude oil or any particular futures contract based on light, sweet crude oil. It is not the intent of USOF to be operated in a fashion such that its NAV will reflect the percentage change of the price of any particular futures contract as measured over a time period greater than one day. USOF may invest in interests other than the Benchmark Oil Futures Contract to comply with accountability levels and position limits. For a detailed discussion of accountability levels and position limits, see “What are Oil Futures Contracts?”

In order for a hypothetical investment in Units to break even over the next 12 months, assuming a selling price of $34.53 per Unit, the investment would have to generate a 0.75% return. For more information, see “— Breakeven Analysis.”

1

Table of Contents

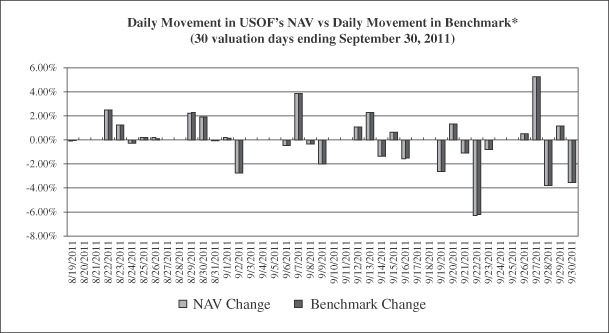

The General Partner endeavors to place USOF’s trades in Oil Futures Contracts and Other Oil-Related Investments and otherwise manage USOF’s investments so that “A” will be within plus/minus 10 percent of “B”, where:

| • | A is the average daily change in USOF’s NAV for any period of 30 successive valuation days, i.e., any NYSE Arca trading day as of which USOF calculates its NAV, and |

| • | B is the average daily percentage change in the price of the Benchmark Oil Futures Contract over the same period. |

The General Partner believes that market arbitrage opportunities will cause daily changes in USOF’s unit price on the NYSE Arca to closely track daily changes in USOF’s NAV per unit. The General Partner further believes that the daily changes in prices of the Benchmark Oil Futures Contract have historically closely tracked the daily changes in spot prices of light, sweet crude oil. The General Partner believes that the net effect of these two expected relationships and the expected relationship described above between USOF’s NAV and the Benchmark Oil Futures Contract, will be that the daily changes in the price of USOF’s units on the NYSE Arca will closely track, in percentage terms, the changes in the spot price of a barrel of light, sweet crude oil, less USOF’s expenses.

The General Partner employs a “neutral” investment strategy intended to track the changes in the price of the Benchmark Oil Futures Contract regardless of whether the price goes up or goes down. USOF’s “neutral” investment strategy is designed to permit investors generally to purchase and sell USOF’s units for the purpose of investing indirectly in crude oil in a cost-effective manner, and/or to permit participants in the oil or other industries to hedge the risk of losses in their crude oil-related transactions. Accordingly, depending on the investment objective of an individual investor, the risks generally associated with investing in crude oil and/or the risks involved in hedging may exist. In addition, an investment in USOF involves the risk that the changes in the price of USOF’s units will not accurately track the changes in the price of the Benchmark Oil Futures Contract, and that changes in the Benchmark Oil Futures Contract will not closely correlate with changes in the spot price of light, sweet crude oil.

As an example, for the year ended December 31, 2010, the actual total return of USOF as measured by changes in its per unit NAV was -0.49%. This is based on an initial per unit NAV of $39.16 on December 31, 2009 and an ending per unit NAV as of December 31, 2010 of $38.97. During this time period, USOF made no distributions to its unitholders. However, if USOF’s daily changes in its per unit NAV had instead exactly tracked the changes in the daily return of the Benchmark Oil Futures Contract, USOF would have had an estimated per unit NAV of $39.23 as of December 31, 2010, for a total return over the relevant time period of 0.001%. The difference between the actual per unit NAV total return of USOF of -0.49% and the expected total return based on the changes in the daily return of the Benchmark Oil Futures Contract of 0.001% was an error over the time period of -0.491%, which is to say that USOF’s actual total return underperformed the benchmark result by that percentage.

In addition, the spot price of light, sweet crude oil for immediate delivery purchased on December 31, 2009 and held to December 31, 2010 increased by 15.15%. USOF’s investment objective is to track the changes in the price of the Benchmark Oil Futures Contract, not to have the market price of its units match, dollar for dollar, changes in the spot price of light, sweet crude oil. Contango and backwardation have impacted the total return on an investment in USOF’s units during the past year relative to a hypothetical direct investment in crude oil and, in the future, it is likely that the relationship between the market price of USOF’s units and changes in the spot prices of light, sweet crude oil will continue to be impacted by contango and backwardation. It is important to note that this comparison ignores the potential costs associated with physically owning and storing crude oil, which could be substantial.

2

Table of Contents

Several factors determine the total return from investing in a futures contract position. One factor that impacts the total return that will result from investing in near month futures contracts and “rolling” those contracts forward each month is the price relationship between the current near month contract and the next month contract. For example, if the price of the near month contract is higher than the next month contract (a situation referred to as “backwardation” in the futures market), then absent any other change there is a tendency for the price of a next month contract to rise in value as it becomes the near month contract and approaches expiration. Conversely, if the price of a near month contract is lower than the next month contract (a situation referred to as “contango” in the futures market), then absent any other change there is a tendency for the price of a next month contract to decline in value as it becomes the near month contract and approaches expiration.

As an example, assume that the price of crude oil for immediate delivery (the “spot” price), was $50 per barrel, and the value of a position in the near month futures contract was also $50. Over time, the price of the barrel of crude oil will fluctuate based on a number of market factors, including demand for oil relative to its supply. The value of the near month contract will likewise fluctuate in reaction to a number of market factors. If investors seek to maintain their position in a near month contract and not take delivery of the oil, every month they must sell their current near month contract as it approaches expiration and invest in the next month contract.

If the futures market is in backwardation, e.g., when the expected price of crude oil in the future would be less, the investor would be buying a next month contract for a lower price than the current near month contract. Using the $50 per barrel price above to represent the front month price, the price of the next month contract would be $49 per barrel, that is 2% cheaper than the front month contract. Hypothetically, and assuming no other changes to either prevailing crude oil prices or the price relationship between the spot price, the near month contract and the next month contract (and ignoring the impact of commission costs and the income earned on cash and/or cash equivalents), the value of the next month contract would rise as it approaches expiration and becomes the new near month contract with a price of $50. In this example, the value of an investment in the second month contract would tend to rise faster than the spot price of crude oil, or fall slower. As a result, it would be possible in this hypothetical example for the spot price of crude oil to have risen 10% after some period of time, while the value of the investment in the second month futures contract would have risen 12%, assuming backwardation is large enough or enough time has elapsed. Similarly, the spot price of crude oil could have fallen 10% while the value of an investment in the futures contract could have fallen to only 8%. Over time, if backwardation remained constant, the difference would continue to increase.

If the futures market is in contango, the investor would be buying a next month contract for a higher price than the current near month contract. Using again the $50 per barrel price above to represent the front month price, the price of the next month contract could be $51 per barrel, that is 2% more expensive than the front month contract. Hypothetically, and assuming no other changes to either prevailing crude oil prices or the price relationship between the spot price, the near month contract and the next month contract (and ignoring the impact of commission costs and the income earned on cash and/or cash equivalents), the value of the next month contract would fall as it approaches expiration and becomes the new near month contract with a price of $50. In this example, it would mean that the value of an investment in the second month contract would tend to rise slower than the spot price of crude oil, or fall faster. As a result, it would be possible in this hypothetical example for the spot price of crude oil to have risen 10% after some period of time, while the value of the investment in the second month futures contract will have risen only 8%, assuming contango is large enough or enough time has elapsed. Similarly, the spot price of crude oil could have fallen 10% while the value of an investment in the second month futures contract could have fallen 12%. Over time, if contango remained constant, the difference would continue to increase.

The Benchmark Oil Futures Contract is changed from the near month contract to the next month contract over a four-day period. See “How Does USOF Operate” for a more extensive discussion of how USOF rolls its positions in Oil Interests on a monthly basis.

3

Table of Contents

USOF creates units only in blocks of 100,000 units called Creation Baskets and redeems units only in blocks of 100,000 units called Redemption Baskets. Only Authorized Purchasers may purchase or redeem Creation Baskets or Redemption Baskets. An Authorized Purchaser is under no obligation to create or redeem baskets, and an Authorized Purchaser is under no obligation to offer to the public units of any baskets it does create. Baskets are generally created when there is sufficient demand for units that the market price per unit is at a premium to the NAV per unit. Authorized Purchasers will then sell such units, which will be listed on the NYSE Arca, to the public at per-unit offering prices that are expected to reflect, among other factors, the trading price of the units on the NYSE Arca, the NAV of USOF at the time the Authorized Purchaser purchased the Creation Baskets and the NAV at the time of the offer of the units to the public, the supply of and demand for units at the time of sale, and the liquidity of the Oil Futures Contracts market and the market for Other Oil-Related Investments. The prices of units offered by Authorized Purchasers are expected to fall between USOF’s NAV and the trading price of the units on the NYSE Arca at the time of sale. Similarly, baskets are generally redeemed when the market price per unit is at a discount to the NAV per unit. Retail investors seeking to purchase or sell units on any day will effect such transactions in the secondary market, on the NYSE Arca, at the market price per unit, rather than in connection with the creation or redemption of baskets.

There is no specified limit on the maximum amount of Creation Baskets that can be sold. At some point, accountability levels and position limits on certain of the Futures Contracts or Other Oil-Related Investments in which USOF intends to invest may practically limit the number of Creation Baskets that will be sold if the General Partner determines that the other investment alternatives available to USOF at that time will not enable it to meet its stated investment objective. In this regard, the General Partner also manages the United States 12 Month Oil Fund, LP (“US12OF”) that currently invests in 12 futures contracts for light, sweet crude oil as traded on the NYMEX, consisting of the near month contract to expire and the contracts for the following eleven months, for a total of 12 consecutive months’ contracts. Any futures contracts held by US12OF or any other Related Public Fund may be aggregated with the ones held by USOF in determining NYMEX accountability levels and position limits.

In managing USOF’s assets, the General Partner does not use a technical trading system that automatically issues buy and sell orders. The General Partner instead employs quantitative methodologies whereby each time one or more baskets are purchased or redeemed, the General Partner will purchase or sell Oil Futures Contracts and Other Oil-Related Investments with an aggregate market value that approximates the amount of Treasuries and/or cash received or paid upon the purchase or redemption of the basket(s).

Principal Offices of USOF and the General Partner

USOF was organized as a limited partnership under Delaware law on May 12, 2005. USOF is operated pursuant to the Fifth Amended and Restated Agreement of Limited Partnership (“LP Agreement”). USOF’s principal office is located at 1320 Harbor Bay Parkway, Suite 145, Alameda, California 94502. The General Partner’s principal office is also located at 1320 Harbor Bay Parkway, Suite 145, Alameda, California 94502. The telephone number for each of USOF and the General Partner is 510.522.9600.

Note to Secondary Market Investors: The units can be directly purchased from or redeemed by USOF only in Creation Baskets or Redemption Baskets, respectively, and only by Authorized Purchasers. Each Creation Basket and Redemption Basket consists of 100,000 units and is expected to be worth millions of dollars. Individual investors, therefore, will not be able to directly purchase units from or redeem units with USOF. Some of the information contained in this prospectus, including information about buying and redeeming units directly from and to USOF is only relevant to Authorized Purchasers. Units are listed and traded on the NYSE Arca under the ticker symbol “USO” and may be purchased and sold as individual units. Individuals interested in purchasing units in the secondary market should contact their broker. Units purchased or sold through a broker may be subject to commissions.

4

Table of Contents

Except when aggregated in Redemption Baskets, units are not redeemable securities. There is no guarantee that units will trade at or near the per-unit NAV.

USOF’s Investments in Oil Interests

A description of the principal types of Oil Interests in which USOF may invest — futures contracts, forward contracts, over-the-counter swap contracts, cleared swap contracts and options on futures contracts, forward contracts or a commodity on the spot market — may be found under the heading “The Commodity Interest Markets.”

Principal Investment Risks of an Investment in USOF

An investment in USOF involves a degree of risk. Some of the risks you may face are summarized below. A more extensive discussion of these risks appears beginning on page 11.

| • | The price relationship between the near month contract to expire and the next month contract to expire that compose the Benchmark Oil Futures Contract will vary and may impact both the total return over time of USOF’s NAV, as well as the degree to which its total return tracks other crude oil price indices’ total returns. In cases in which the near month contract’s price is lower than the next month contract’s price (a situation known as “contango” in the futures markets), then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to decline as it approaches expiration. In cases in which the near month contract’s price is higher than the next month contract’s price (a situation known as “backwardation” in the futures markets), then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to rise as it approaches expiration. |

| • | Unlike mutual funds, commodity pools or other investment pools that manage their investments in an attempt to realize income and gains and distribute such income and gains to their investors, USOF generally does not distribute cash to limited partners or other unitholders. |

| • | Investors may choose to use USOF as a means of investing indirectly in crude oil and there are risks involved in such investments. There are significant risks and hazards that inherent in the crude oil industry that may cause the price of crude oil to widely fluctuate. |

| • | To the extent that investors use USOF as a means of indirectly investing in crude oil, there is the risk that the daily changes in the price of USOF’s units on the NYSE Arca will not closely track the daily changes in the spot price of light, sweet crude oil. |

| • | The General Partner endeavors to manage USOF’s positions in Oil Interests so that USOF’s assets are, unlike those of other commodity pools, not leveraged (i.e., so that the aggregate value of USOF’s unrealized losses from its investments in such Oil Interests at any time will not exceed the value of USOF’s assets). There is no assurance that the General Partner will successfully implement this investment strategy. If the General Partner permits USOF to become leveraged, you could lose all or substantially all of your investment if USOF’s trading positions suddenly turn unprofitable. |

| • | Investors, including those who directly participate in the crude oil market, may choose to use USOF as a vehicle to hedge against the risk of loss and there are risks involved in hedging activities. While hedging can provide protection against an adverse movement in market prices, it can also preclude a hedger’s opportunity to benefit from a favorable market movement. |

| • | Regulation of the commodity interest and energy markets is extensive and constantly changing. On July 21, 2010, a broad financial regulatory reform bill, “The Dodd-Frank Wall Street Reform and Consumer Protection Act,” was signed into law that includes provisions altering the regulation of commodity interests. The CFTC, along with the SEC and other federal regulators, has been tasked with |

5

Table of Contents

| developing the rules and regulations enacting the provisions noted above. The new law and the rules currently being promulgated thereunder may negatively impact USOF’s ability to meet its investment objectives either through limits or requirements imposed on it or upon its counterparties. |

| • | USOF invests primarily in Oil Futures Contracts that are traded in the United States. However, a portion of USOF’s trades may take place in markets and on exchanges outside the United States. Some non-U.S. markets present risks because they are not subject to the same degree of regulation as their U.S. counterparts. |

| • | USOF may also invest in Other Oil-Related Investments, many of which are negotiated contracts that are not as liquid as Oil Futures Contracts and expose USOF to credit risk that its counterparty may not be able to satisfy its obligations to USOF. |

| • | USOF pays fees and expenses that are incurred regardless of whether it is profitable. |

| • | You will have no rights to participate in the management of USOF and will have to rely on the duties and judgment of the General Partner to manage USOF. |

| • | The structure and operation of USOF may involve conflicts of interest. For example, a conflict may arise because the General Partner and its principals and affiliates may trade for themselves. In addition, the General Partner has sole current authority to manage the investments and operations, which may create a conflict with the unitholders’ best interests. The General Partner may also have a conflict to the extent that its trading decisions may be influenced by the effect they would have on the United States Natural Gas Fund, LP (“USNG”), the United States 12 Month Oil Fund, LP (“US12OF”), the United States Gasoline Fund, LP (“UGA”), the United States Heating Oil Fund, LP (“USHO”), the United States Short Oil Fund, LP (“USSO”), the United States 12 Month Natural Gas Fund, LP (“US12NG”), the United States Brent Oil Fund, LP (“USBO”), the United States Commodity Index Fund (“USCI”), the United States Metals Index Fund (“USMI”), the United States Agriculture Fund (“USAI”) and the United States Copper Fund (“USCPR”), the other commodity pools that it manages, or any other commodity pool the General Partner may form and manage in the future. USNG, US12OF, UGA, USHO, USSO, US12NG, USBO, USCI, USMI, USAI and USCPR are referred to herein as the “Related Public Funds.” |

For additional risks, see “What Are the Risk Factors Involved with an Investment in USOF?”

USOF’s NAV is calculated shortly after the close of the core trading session on the NYSE Arca.

For a glossary of defined terms, see Appendix A.

6

Table of Contents

The breakeven analysis below indicates the approximate dollar returns and percentage required for the redemption value of a hypothetical initial investment in a single unit to equal the amount invested twelve months after the investment was made. For purposes of this breakeven analysis, we have assumed an initial selling price of $34.53 per unit which equals the NAV per unit at the close of trading on September 1, 2011. This breakeven analysis refers to the redemption of baskets by Authorized Purchasers and is not related to any gains an individual investor would have to achieve in order to break even. The breakeven analysis is an approximation only.

| Assumed initial selling price per unit |

$ | 34.53 | ||

| Management Fee (0.45%)(1) |

$ | 0.16 | ||

| Creation Basket Fee(2) |

$ | (0.01 | ) | |

| Estimated Brokerage Fee (0.14%)(3) |

$ | 0.05 | ||

| Interest Income (0.01%)(4) |

$ | (0.01 | ) | |

| NYMEX Licensing Fee(5) |

$ | 0.01 | ||

| Independent Directors and Officers’ Fees(6) |

$ | 0.01 | ||

| Fees and expenses associated with tax accounting and reporting(7) |

$ | 0.03 | ||

| Amount of trading income (loss) required for the redemption value at the end of one year to equal the initial selling price of the unit |

$ | 0.24 | ||

| Percentage of initial selling price per unit |

0.70 | % |

| (1) | USOF is contractually obligated to pay the General Partner a management fee based on daily net assets and paid monthly of 0.45% per annum on its average net assets. |

| (2) | Authorized Purchasers are required to pay a Creation Basket fee of $1,000 for each order they place to create one or more baskets. An order must be at least one basket, which is 100,000 units. This breakeven analysis assumes a hypothetical investment in a single unit so the Creation Basket fee is $.01 (1,000/100,000). |

| (3) | This amount is based on the actual brokerage fees for USOF calculated on an annualized basis. |

| (4) | USOF earns interest on funds it deposits with the futures commission merchant and the Custodian and it estimates that the interest rate will be 0.01% based on the current interest rate on three-month Treasury Bills as of August 30, 2011. The actual rate may vary. |

| (5) | Assuming the aggregate assets of USOF and the Related Public Funds, other than USBO and USCI, are $1,000,000,000 or more, and prior to October 19, 2011, the NYMEX licensing fee is expected to be 0.04% on the first $1,000,000 and 0.02% after the first $1,000,000. On and after October 20, 2011, 0.015% on all assets. For more information see “Fees of USOF.” |

| (6) | The foregoing assumes that the assets of USOF are aggregated with those of the Related Public Funds, that the aggregate fees paid to the independent directors for 2010 was $1,107,140, that the allocable portion of the fees borne by USOF equals $413,042 and that USOF has $1.29 billion in assets, which is the amount of assets as of September 1, 2011. |

| (7) | USOF assumed the aggregate costs attributable to tax accounting and reporting for 2010 were estimated to be approximately $1,200,000. The number in the break-even table assumes USOF has $1.29 billion in assets which is the amount as of September 1, 2011. |

7

Table of Contents

| Offering |

USOF is offering Creation Baskets consisting of 100,000 units through ALPS Distributors, Inc. (“Marketing Agent”) as marketing agent to Authorized Purchasers. Authorized Purchasers may purchase Creation Baskets consisting of 100,000 units at USOF’s NAV. This is a continuous offering under Rule 415 of the 1933 Act and is not expected to terminate until all of the registered units have been sold or three years from the date of the prospectus, whichever is earlier, although the offering may be temporarily suspended during such period when suitable investments for USOF are not available or practicable. It is anticipated that when all registered units have been sold pursuant to this registration statement, additional units will be registered in subsequent registration statements |

| Use of Proceeds |

The General Partner applies substantially all of USOF’s assets toward trading in Oil Futures Contracts and Other Oil-Related Investments and investing in Treasuries, cash and/or cash equivalents. The General Partner deposits a portion of USOF’s net assets with the futures commission merchant, UBS Securities LLC, or other custodian to be used to meet its current or potential margin or collateral requirements in connection with its investment in Oil Futures Contracts and Other Oil-Related Investments. USOF uses only Treasuries, cash and/or cash equivalents to satisfy these requirements. The General Partner believes that all entities that will hold or trade USOF’s assets will be based in the United States and will be subject to United States regulations. Approximately 5% to 20% of USOF’s assets are normally committed as margin for Oil Futures Contracts and collateral for Other Oil-Related Investments. However, from time to time, the percentage of assets committed as margin/collateral may be substantially more, or less, than such range. The remaining portion of USOF’s assets, of which the General Partner expects to be the vast majority, is held in Treasuries, cash and/or cash equivalents by the Custodian. All interest income earned on these investments is retained for USOF’s benefit. |

| NYSE Arca Symbol |

“USO” |

| Creation and Redemption |

Currently, authorized Purchasers pay a $1,000 fee for each order to create or redeem one or more Creation Baskets or Redemption Baskets. Authorized Purchasers are not required to sell any specific number or dollar amount of units. The per unit price of units offered in Creation Baskets on any day is the total NAV of USOF calculated shortly after the close of the core trading session of the NYSE Arca on that day divided by the number of issued and outstanding units. The General Partner shall notify the Depository Trust Company (“DTC”) of any change in the transaction fee and will not implement any increase in the fee for Creation or Redemption Baskets until 30 days after the date of notice. |

8

Table of Contents

| Registration Clearance and Settlement |

Individual certificates will not be issued for the units. Instead, units will be represented by one or more global certificates, which will be deposited by the Custodian with the DTC and registered in the name of Cede & Co., as nominee for DTC. |

| The administrator, Brown Brothers Harriman & Co. (“Administrator”) has been appointed registrar and transfer agent for the purpose of registering and transferring units. The General Partner will recognize transfer of units only if such transfer is done in accordance with the LP Agreement, including the delivery of a transfer application. |

| Net Asset Value |

The NAV is calculated by taking the current market value of USOF’s total assets and subtracting any liabilities. Under USOF’s current operational procedures, the Administrator calculates the NAV of USOF once each NYSE Arca trading day. The NAV for a particular trading day is released after 4:00 p.m. New York time. Trading during the core trading session of the NYSE Arca typically closes at 4:00 p.m. New York time. The Administrator uses the NYMEX closing price (determined at the earlier of the close of the NYMEX or 2:30 p.m. New York time) for the contracts held on the NYMEX, but calculates or determines the value of all other USOF investments as of the earlier of the close of the New York Stock Exchange or 4:00 p.m. New York time. The NYSE Arca currently calculates an approximate NAV every 15 seconds throughout each day USOF’s units are traded on the NYSE Arca for as long as the main pricing mechanisms are open for the Futures Exchanges upon which the Benchmark Oil Futures Contracts are traded. |

| Fund Expenses |

USOF pays the General Partner a management fee of 0.45% of NAV on its average net assets. Brokerage fees for Treasuries, Oil Futures Contracts, and Other Oil-Related Investments were 0.14% of average net assets on an annualized basis through September 30, 2011 and were paid to unaffiliated brokers. USOF also pays any licensing fees for the use of intellectual property. Registration fees paid to the SEC, FINRA, or other regulatory agency in connection with the initial offers and sales of the units and the legal, printing, accounting and other expenses associated with such registrations were paid by the General Partner, but the fees and expenses associated with subsequent registrations of units are borne by USOF. The licensing fee paid to the NYMEX is 0.04% of NAV for the first $1,000,000,000 of assets and 0.02% of NAV after the first $1,000,000,000 of assets. The assets of USOF are aggregated with those of the Related Public Funds, other than USBO and USCI, for the purpose of calculating the NYMEX licensing fee. USOF also is responsible for the fees and expenses, which may include directors and officers liability insurance, of the independent directors of the General Partner in connection with their activities with respect to USOF. These director fees and expenses may be shared with other funds managed by the General Partner. These fees and expenses, in total, amounted to $1,107,140 for 2010, |

9

Table of Contents

| and USOF’s portion was $413,042, though these amounts may change in future years. The General Partner, and not USOF, is responsible for payment of the fees of USOF’s Marketing Agent, Administrator and Custodian. USOF and/or the General Partner may be required to indemnify the Marketing Agent, Administrator or Custodian under certain circumstances. USOF also pays the fees and expenses associated with its tax accounting and reporting requirements with the exception of certain base services fees which are paid by the General Partner. |

| Termination Events |

USOF shall continue in effect from the date of its formation in perpetuity, unless sooner terminated upon the occurrence of any one or more of the following events: the death, adjudication of incompetence, bankruptcy, dissolution, withdrawal, or removal of a General Partner who is the sole remaining General Partner, unless a majority in interest of limited partners within ninety (90) days after such event elects to continue the partnership and appoints a successor general partner; or the affirmative vote of a majority in interest of the limited partners subject to certain conditions. Upon termination of the partnership, the affairs of the partnership shall be wound up and all of its debts and liabilities discharged or otherwise provided for in the order of priority as provided by law. The fair market value of the remaining assets of the partnership shall then be determined by the General Partner. Thereupon, the assets of the partnership shall be distributed pro rata to the partners in accordance with their units. |

| Withdrawal |

As discussed in the LP Agreement, if the General Partner gives at least fifteen (15) days’ written notice to a limited partner, then the General Partner may for any reason, in its sole discretion, require any such limited partner to withdraw entirely from the partnership or to withdraw a portion of its partner capital account. If the General Partner does not give at least fifteen (15) days’ written notice to a limited partner, then it may only require withdrawal of all or any portion of the capital account of any limited partner in the following circumstances: |

| (i) the unitholder made a misrepresentation to the General Partner in connection with its purchase of units; or |

| (ii) the limited partner’s ownership of units would result in the violation of any law or regulation applicable to the partnership or a partner. |

| Authorized Purchasers |

USOF has entered into agreements with several Authorized Purchasers. A current list of Authorized Purchasers is available from the Marketing Agent. Authorized Purchasers must be (1) registered broker-dealers or other securities market participants, such as banks and other financial institutions, that are not required to register as broker-dealers to engage in securities transactions, and (2) DTC Participants. To become an Authorized Purchaser, a person must enter into an Authorized Purchaser Agreement with the General Partner. |

10

Table of Contents

WHAT ARE THE RISK FACTORS INVOLVED WITH AN INVESTMENT IN USOF?

You should consider carefully the risks described below before making an investment decision. You should also refer to the other information included in this prospectus as well as information found in our periodic reports, which include USOF’s financial statements and the related notes, that are incorporated by reference. See “Incorporation By Reference of Certain Information.”

Risks Associated With Investing Directly or Indirectly in Crude Oil

Risks Associated With Investing Directly or Indirectly in Crude Oil

Investing in oil interests subjects USOF to the risks of the crude oil industry and this could result in large fluctuations in the price of USOF’s units.

USOF is subject to the risks and hazards of the crude oil industry because it invests in oil interests. The risks and hazards that are inherent in the crude oil industry may cause the price of crude oil to widely fluctuate. If the changes in percentage terms of USOF’s units accurately track the changes in percentage terms of the Benchmark Oil Futures Contract or the spot price of crude oil, then the price of its units may also fluctuate. The exploration and production of crude oil are uncertain processes with many risks. The cost of drilling, completing and operating wells for crude oil is often uncertain, and a number of factors can delay or prevent drilling operations or production of crude oil, including:

| • | unexpected drilling conditions; |

| • | pressure or irregularities in formations; |

| • | equipment failures or repairs; |

| • | fires or other accidents; |

| • | adverse weather conditions; |

| • | pipeline ruptures, spills or other supply disruptions; and |

| • | shortages or delays in the availability of drilling rigs and the delivery of equipment. |

Crude oil transmission, distribution, gathering, and processing activities involve numerous risks that may affect the price of crude oil.

There are a variety of hazards inherent in crude oil transmission, distribution, gathering, and processing, such as leaks, explosions, pollution, release of toxic substances, adverse weather conditions (such as hurricanes and flooding), pipeline failure, abnormal pressures, uncontrollable flows of crude oil, scheduled and unscheduled maintenance, physical damage to the gathering or transportation system, and other hazards which could affect the price of crude oil. To the extent these hazards limit the supply or delivery of crude oil, crude oil prices will increase.

Changes in the political climate could have negative consequences for crude oil prices.

Tensions with Iran, the world’s fourth largest oil exporter, could put oil exports in jeopardy. Other global concerns include civil unrest and sabotage affecting the flow of oil from Nigeria, a large oil exporter. Meanwhile, friction continues between the governments of the United States and Venezuela, a major exporter of oil to the United States. Additionally, a series of production cuts by members of OPEC followed by a refusal to subsequently increase oil production have tightened world oil markets.

11

Table of Contents

Fluctuations in the reserve capacity of crude oil could impact future prices.

In the past, a supply disruption in one area of the world was softened by the ability of major oil-producing nations such as Saudi Arabia to increase output to make up the difference. Now, much of that spare reserve capacity has been absorbed by increased demand. The current global economic downturn, however, has led to a decrease in the demand for oil that lasted through 2009 and a corresponding increase in spare capacities. According to the United States Government’s Energy Information Administration, global oil demand is expected to rise by 1.47 million barrels a day in 2011, to a total global consumption of 86.65 million barrels per day, up from 85.18 million barrels per day in 2010.

Changes in USOF’s NAV may not correlate with changes in the price of the Benchmark Oil Futures Contract. If this were to occur, investors may not be able to effectively use USOF as a way to hedge against crude oil-related losses or as a way to indirectly invest in crude oil.

USCF endeavors to invest USOF’s assets as fully as possible in short-term Oil Futures Contracts and Other Oil Interests so that the changes in percentage terms of the NAV closely correlate with the changes in percentage terms in the price of the Benchmark Oil Futures Contract. However, changes in USOF’s NAV may not correlate with the changes in the price of the Benchmark Oil Futures Contract for several reasons as set forth below:

| • | USOF (i) may not be able to buy/sell the exact amount of Oil Futures Contracts and Other Oil Interests to have a perfect correlation with NAV; (ii) may not always be able to buy and sell Oil Futures Contracts or Other Oil Interests at the market price; (iii) may not experience a perfect correlation between the spot price of light, sweet crude oil and the underlying investments in Oil Futures Contracts, Other Oil Interests and Treasuries, cash and/or cash equivalents; and (iv) is required to pay fees, including brokerage fees and the management fee, which will have an effect on the correlation. |

| • | Short-term supply and demand for light, sweet crude oil may cause the changes in the market price of the Benchmark Oil Futures Contract to vary from the changes in USOF’s NAV if USOF has fully invested in Oil Futures Contracts that do not reflect such supply and demand and it is unable to replace such contracts with Oil Futures Contracts that do reflect such supply and demand. In addition, there are also technical differences between the two markets, e.g., one is a physical market while the other is a futures market traded on exchanges, that may cause variations between the spot price of crude oil and the prices of related futures contracts. |

| • | USOF sells and buys only as many Oil Futures Contracts and Other Oil Interests that it can to get the changes in percentage terms of the NAV as close as possible to the changes in percentage terms in the price of the Benchmark Oil Futures Contract. The remainder of its assets are invested in Treasuries, cash and/or cash equivalents and are used to satisfy initial margin and additional margin requirements, if any, and to otherwise support its investments in oil interests. Investments in Treasuries, cash and/or cash equivalents, both directly and as margin, provide rates of return that vary from changes in the value of the spot price of light, sweet crude oil and the price of the Benchmark Oil Futures Contract. |

| • | In addition, because USOF incurs certain expenses in connection with its investment activities, and holds most of its assets in more liquid short-term securities for margin and other liquidity purposes and for redemptions that may be necessary on an ongoing basis, USCF is generally not able to fully invest USOF’s assets in Oil Futures Contracts or Other Oil Interests and there cannot be perfect correlation between changes in USOF’s NAV and changes in the price of the Benchmark Oil Futures Contract. |

| • | As USOF grows, there may be more or less correlation. For example, if USOF only has enough money to buy three Benchmark Oil Futures Contracts and it needs to buy four contracts to track the price of oil then the correlation will be lower, but if it buys 20,000 Benchmark Oil Futures Contracts and it needs to buy 20,001 contracts then the correlation will be higher. At certain asset levels, USOF may be limited in its ability to purchase the Benchmark Oil Futures Contract or other Oil Futures Contracts due to accountability levels imposed by the relevant exchanges. To the extent that USOF invests in these other Oil Futures Contracts or Other Oil Interests, the correlation with the Benchmark Oil Futures |

12

Table of Contents

| Contract may be lower. If USOF is required to invest in other Oil Futures Contracts and Other Oil Interests that are less correlated with the Benchmark Oil Futures Contract, USOF would likely invest in over-the-counter contracts to increase the level of correlation of USOF’s assets. Over-the-counter contracts entail certain risks described below under “Over-the-Counter Contract Risk.” |

| • | USOF may not be able to buy the exact number of Oil Futures Contracts and Other Oil Interests to have a perfect correlation with the Benchmark Oil Futures Contract if the purchase price of Oil Futures Contracts required to be fully invested in such contracts is higher than the proceeds received for the sale of a Creation Basket on the day the basket was sold. In such case, USOF could not invest the entire proceeds from the purchase of the Creation Basket in such futures contracts (for example, assume USOF receives $4,679,000 for the sale of a Creation Basket and assume that the price of an Oil Futures Contract for light, sweet crude oil is $46,800, then USOF could only invest in 99 Oil Futures Contracts with an aggregate value of $4,633,200). USOF would be required to invest a percentage of the proceeds in cash, Treasuries or other liquid securities to be deposited as margin with the futures commission merchant through which the contracts were purchased. The remainder of the purchase price for the Creation Basket would remain invested in Treasuries, cash and/or cash equivalents or other liquid securities as determined by USCF from time to time based on factors such as potential calls for margin or anticipated redemptions. If the trading market for Oil Futures Contracts is suspended or closed, USOF may not be able to purchase these investments at the last reported price. |

If changes in USOF’s NAV do not correlate with changes in the price of the Benchmark Oil Futures Contract, then investing in USOF may not be an effective way to hedge against oil-related losses or indirectly invest in oil.

The Benchmark Oil Futures Contract may not correlate with the spot price of light, sweet crude oil and this could cause changes in the price of the units to substantially vary from the changes in the spot price of light, sweet crude oil. If this were to occur, then investors may not be able to effectively use USOF as a way to hedge against crude oil-related losses or as a way to indirectly invest in crude oil.

When using the Benchmark Oil Futures Contract as a strategy to track the spot price of light, sweet crude oil, at best the correlation between changes in prices of such oil interests and the spot price of crude oil can be only approximate. The degree of imperfection of correlation depends upon circumstances such as variations in the speculative oil market, supply of and demand for such oil interests and technical influences in oil futures trading. If there is a weak correlation between the oil interests and the spot price of light, sweet crude oil, then the price of units may not accurately track the spot price of light, sweet crude oil and investors may not be able to effectively use USOF as a way to hedge the risk of losses in their oil-related transactions or as a way to indirectly invest in crude oil.

USOF may experience a loss if it is required to sell Treasuries at a price lower than the price at which they were acquired.

The value of Treasuries generally moves inversely with movements in interest rates. If USOF is required to sell Treasuries at a price lower than the price at which they were acquired, USOF will experience a loss. This loss may adversely impact the price of the units and may decrease the correlation between the price of the units, the price of the Benchmark Oil Futures Contract and Other Oil Interests, and the spot price of light, sweet crude oil.

USOF would be negatively impacted if the United States Treasury were to default on its obligations to make payments on Treasuries.

Events in Washington, D.C. regarding passing a fiscal budget have drawn concern regarding the United States Government’s ability to pay its obligations to holders of Treasuries. If USOF is not able to redeem its investments in Treasuries prior to maturity and the U.S. Government cannot pay its obligations, USOF would be negatively impacted. In addition, USOF might also be negatively impacted by its use of money market mutual funds to the extent those funds might themselves be using Treasuries.

13

Table of Contents

Certain of USOF’s investments could be illiquid which could cause large losses to investors at any time or from time to time.

USOF may not always be able to liquidate its positions in its investments at the desired price. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. A market disruption, such as a foreign government taking political actions that disrupt the market in its currency, its crude oil production or exports, or in another major export, can also make it difficult to liquidate a position. Alternatively, limits imposed by futures exchanges or other regulatory organizations, such as accountability levels, position limits and daily price fluctuation limits, may contribute to a lack of liquidity with respect to some commodity interests.

Unexpected market illiquidity may cause major losses to investors at any time or from time to time. In addition, USOF has not and does not intend at this time to establish a credit facility, which would provide an additional source of liquidity and instead relies only on the Treasuries, cash and/or cash equivalents that it holds. The anticipated large value of the positions in Oil Futures Contracts that USCF will acquire or enter into for USOF increases the risk of illiquidity. The Other Oil Interests that USOF invests in, such as negotiated over-the-counter contracts, may have a greater likelihood of being illiquid since they are contracts between two parties that take into account not only market risk, but also the relative credit, tax, and settlement risks under such contracts. Such contracts also have limited transferability that results from such risks and from the contract’s express limitations.

Because both Oil Futures Contracts and Other Oil Interests may be illiquid, USOF’s oil interests may be more difficult to liquidate at favorable prices in periods of illiquid markets and losses may be incurred during the period in which positions are being liquidated.

If the nature of hedgers and speculators in futures markets has shifted such that crude oil purchasers are the predominant hedgers in the market, USOF might have to reinvest at higher futures prices or choose Other Oil Interests.

The changing nature of the hedgers and speculators in the crude oil market influences whether futures prices are above or below the expected future spot price. In order to induce speculators to take the corresponding long side of the same futures contract, crude oil producers must generally be willing to sell futures contracts at prices that are below expected future spot prices. Conversely, if the predominant hedgers in the futures market are the purchasers of the crude oil who purchase futures contracts to hedge against a rise in prices, then speculators will only take the short side of the futures contract if the futures price is greater than the expected future spot price of crude oil. This can have significant implications for USOF when it is time to reinvest the proceeds from a maturing Oil Futures Contract into a new Oil Futures Contract.

While USOF does not intend to take physical delivery of oil under its Oil Futures Contracts, physical delivery under such contracts impacts the value of the contracts.

While it is not the current intention of USOF to take physical delivery of crude oil under any of its Oil Futures Contracts, futures contracts are not required to be cash-settled and it is possible to take delivery under some of these contracts. Storage costs associated with purchasing crude oil could result in costs and other liabilities that could impact the value of Oil Futures Contracts or Other Oil Interests. Storage costs include the time value of money invested in crude oil as a physical commodity plus the actual costs of storing the crude oil less any benefits from ownership of crude oil that are not obtained by the holder of a futures contract. In general, Oil Futures Contracts have a one-month delay for contract delivery and the back month (the back month is any future delivery month other than the spot month) includes storage costs. To the extent that these storage costs change for crude oil while USOF holds Oil Futures Contracts or Other Oil Interests, the value of the Oil Futures Contracts or Other Oil Interests, and therefore USOF’s NAV, may change as well.

14

Table of Contents

The price relationship between the near month contract and the next month contract that compose the Benchmark Oil Futures Contract will vary and may impact both the total return over time of USOF’s NAV, as well as the degree to which its total return tracks other crude oil price indices’ total returns.

The design of USOF’s Benchmark Oil Futures Contract is such that every month it begins by using the near month contract to expire until the near month contract is within two weeks of expiration, when, over a four day period, it transitions to the next month contract to expire as its benchmark contract and keeps that contract as its benchmark until it becomes the near month contract and close to expiration. In the event of a crude oil futures market where near month contracts trade at a higher price than next month to expire contracts, a situation described as “backwardation” in the futures market, then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to rise as it approaches expiration. As a result, the total return of the Benchmark Oil Futures Contract would tend to track higher. Conversely, in the event of a crude oil futures market where near month contracts trade at a lower price than next month contracts, a situation described as “contango” in the futures market, then absent the impact of the overall movement in crude oil prices the value of the benchmark contract would tend to decline as it approaches expiration. As a result the total return of the Benchmark Oil Futures Contract would tend to track lower. When compared to total return of other price indices, such as the spot price of crude oil, the impact of backwardation and contango may lead the total return of USOF’s NAV to vary significantly. In the event of a prolonged period of contango, and absent the impact of rising or falling oil prices, this could have a significant negative impact on USOF’s NAV and total return. See “Summary — Overview of USOF” for a discussion of the potential effects of contango and backwardation.

Regulation of the commodity interests and energy markets is extensive and constantly changing; future regulatory developments are impossible to predict but may significantly and adversely affect USOF.

The futures markets are subject to comprehensive statutes, regulations, and margin requirements. In addition, the CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily price limits and the suspension of trading.

The regulation of commodity interest transactions in the United States is a rapidly changing area of law and is subject to ongoing modification by governmental and judicial action. Considerable regulatory attention has been focused on non-traditional investment pools that are publicly distributed in the United States. Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and otherwise, there is a possibility of future regulatory changes within the United States altering, perhaps to a material extent, the nature of an investment in USOF or the ability of USOF to continue to implement its investment strategy. In addition, various national governments outside of the United States have expressed concern regarding the disruptive effects of speculative trading in the energy markets and the need to regulate the derivatives markets in general. The effect of any future regulatory change on USOF is impossible to predict, but it could be substantial and adverse.

In the wake of the economic crisis of 2008 and 2009, the Administration, federal regulators and Congress are revisiting the regulation of the financial sector, including securities and commodities markets. These efforts are anticipated to result in significant changes in the regulation of these markets.

For a more detailed discussion of the position limits to be imposed by the CFTC under the Dodd-Frank Act and the potential impacts thereof on USOF, see the section of this prospectus entitled, “What are Oil Futures Contracts?”

Investing in USOF for purposes of hedging may be subject to several risks including the possibility of losing the benefit of favorable market movement.

Participants in the crude oil or in other industries may use USOF as a vehicle to hedge the risk of losses in their crude oil-related transactions. There are several risks in connection with using USOF as a hedging device. While hedging can provide protection against an adverse movement in market prices, it can also preclude a

15

Table of Contents

hedger’s opportunity to benefit from a favorable market movement. In a hedging transaction, the hedger may be concerned that the hedged item will increase in price, but must recognize the risk that the price may instead decline and if this happens he will have lost his opportunity to profit from the change in price because the hedging transaction will result in a loss rather than a gain. Thus, the hedger foregoes the opportunity to profit from favorable price movements. In addition, if the hedge is not a perfect one, the hedger can lose on the hedging transaction and not realize an offsetting gain in the value of the underlying item being hedged.

When using futures contracts as a hedging technique, at best, the correlation between changes in prices of futures contracts and of the items being hedged can be only approximate. The degree of imperfection of correlation depends upon circumstances such as: variations in speculative markets, demand for futures and for crude oil products, technical influences in futures trading, and differences between anticipated energy costs being hedged and the instruments underlying the standard futures contracts available for trading. Even a well-conceived hedge may be unsuccessful to some degree because of unexpected market behavior as well as the expenses associated with creating the hedge.

In addition, using an investment in USOF as a hedge for changes in energy costs (e.g., investing in crude oil, heating oil, gasoline, natural gas or other fuels, or electricity) may not correlate because changes in the spot price of crude oil may vary from changes in energy costs because the changes in the spot price of crude oil may not be at the same rate as changes in the price of other energy products, and, in any case, the spot price of crude oil does not reflect the refining, transportation, and other costs that may impact the hedger’s energy costs.

An investment in USOF may provide little or no diversification benefits. Thus, in a declining market, USOF may have no gains to offset losses from other investments, and an investor may suffer losses on an investment in USOF while incurring losses with respect to other asset classes.

Historically, Oil Futures Contracts and Other Oil Interests have generally been non-correlated to the performance of other asset classes such as stocks and bonds. Non-correlation means that there is a low statistically valid relationship between the performance of futures and other commodity interest transactions, on the one hand, and stocks or bonds, on the other hand. However, there can be no assurance that such non-correlation will continue during future periods. If, contrary to historic patterns, USOF’s performance were to move in the same general direction as the financial markets, investors will obtain little or no diversification benefits from an investment in the units. In such a case, USOF may have no gains to offset losses from other investments, and investors may suffer losses on their investment in USOF at the same time they incur losses with respect to other investments.

Variables such as drought, floods, weather, embargoes, tariffs and other political events may have a larger impact on crude oil prices and crude oil-linked instruments, including Oil Futures Contracts and Other Oil Interests, than on traditional securities. These additional variables may create additional investment risks that subject USOF’s investments to greater volatility than investments in traditional securities.

Non-correlation should not be confused with negative correlation, where the performance of two asset classes would be opposite of each other. There is no historic evidence that the spot price of crude oil and prices of other financial assets, such as stocks and bonds, are negatively correlated. In the absence of negative correlation, USOF cannot be expected to be automatically profitable during unfavorable periods for the stock market, or vice versa.

USOF is not a registered investment company so unitholders do not have the protections of the 1940 Act.

USOF is not an investment company subject to the 1940 Act. Accordingly, investors do not have the protections afforded by that statute which, for example, requires investment companies to have a majority of disinterested directors and regulates the relationship between the investment company and its investment manager.

16

Table of Contents

USCF is leanly staffed and relies heavily on key personnel to manage trading activities.

In managing and directing the day-to-day activities and affairs of USOF, USCF relies heavily on Messrs. Howard Mah and John Hyland. If Messrs. Mah or Hyland were to leave or be unable to carry out their present responsibilities, it may have an adverse effect on the management of USOF. Furthermore, Messrs. Mah and Hyland are currently involved in the management of the Related Public Funds. Mr. Mah is also employed by Ameristock Corporation, a registered investment adviser that manages a public mutual fund. It is estimated that Mr. Mah will spend approximately 90% of his time on USOF and Related Public Fund matters. Mr. Hyland will spend approximately 100% of his time on USOF and Related Public Fund matters. To the extent that USCF establishes additional funds, even greater demands will be placed on Messrs. Mah and Hyland, as well as the other officers of USCF and its Board.

Accountability levels, position limits, and daily price fluctuation limits set by the exchanges have the potential to cause a tracking error, which could cause the price of units to substantially vary from the price of the Benchmark Oil Futures Contract and prevent investors from being able to effectively use USOF as a way to hedge against crude oil-related losses or as a way to indirectly invest in crude oil.

U.S. designated contract markets such as the NYMEX have established accountability levels and position limits on the maximum net long or net short futures contracts in commodity interests that any person or group of persons under common trading control (other than as a hedge, which an investment by USOF is not) may hold, own or control. For example, the current accountability level for investments at any one time in the Benchmark Oil Futures Contract is 20,000. While this is not a fixed ceiling, it is a threshold above which the NYMEX may exercise greater scrutiny and control over an investor, including limiting an investor to holding no more than 20,000 Benchmark Oil Futures Contracts.

Position limits differ from accountability levels in that they represent fixed limits on the maximum number of futures contracts that any person may hold and cannot allow such limits to be exceeded without express CFTC authority to do so. With regard to position limits, the NYMEX limits an investor from holding more than 3,000 net futures in the last 3 days of trading in the near month contract to expire.

In addition to accountability levels and position limits, the NYMEX also sets daily price fluctuation limits on futures contracts. The daily price fluctuation limit establishes the maximum amount that the price of a futures contract may vary either up or down from the previous day’s settlement price. Once the daily price fluctuation limit has been reached in a particular futures contract, no trades may be made at a price beyond that limit.

For example, the NYMEX imposes a $10.00 per barrel ($10,000 per contract) price fluctuation limit for the Benchmark Oil Futures Contract. This limit is initially based off of the previous trading day’s settlement price. If any Benchmark Oil Futures Contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes it begins at the point where the limit was imposed and the limit is reset to be $10.00 per barrel in either direction of that point. If another halt were triggered, the market would continue to be expanded by $10.00 per barrel in either direction after each successive five-minute trading halt. There is no maximum price fluctuation limit during any one trading session.

Additionally, the Dodd-Frank Act requires the CFTC to promulgate rules establishing position limits for futures and options contracts on commodities as well as for swaps that are economically equivalent to futures or options. On October 18, 2011, the CFTC adopted new rules, which establish position limits and limit formulas for certain physical commodity futures including Oil Futures Contracts and options on Oil Futures Contracts, executed pursuant to the rules of designated contract markets (i.e., certain regulated exchanges) and commodity swaps that are economically equivalent to such futures and options contracts. The CFTC also adopted aggregate position limits that would apply across different trading venues to contracts based on the same underlying commodity. The position limits will be implemented in two phases: spot-month position limits and non-spot-month position limits. Spot-month limits will be effective sixty days after the term “swap” is defined under the

17

Table of Contents

Dodd-Frank Act. Non-spot-month position limits will go into effect by CFTC order after the CFTC has received one year of open interest data on physical commodity cleared and uncleared swaps under the swaps large trader reporting rule. Based on the General Partner’s current understanding of the final position limit regulations, the General Partner does not anticipate significant negative impact on the ability of USOF to achieve its investment objective. The effect of this future regulatory change on USOF is impossible to predict, but it could be substantial and adverse.

All of these limits may potentially cause a tracking error between the price of the units and the price of the Benchmark Oil Futures Contract. This may in turn prevent investors from being able to effectively use USOF as a way to hedge against crude oil-related losses or as a way to indirectly invest in crude oil.

USOF has not limited the size of its offering and is committed to utilizing substantially all of its proceeds to purchase Oil Futures Contracts and Other Oil Interests. If USOF encounters accountability levels, position limits, or price fluctuation limits for Oil Futures Contracts on the NYMEX, it may then, if permitted under applicable regulatory requirements, purchase Oil Futures Contracts on the ICE Futures or other exchanges that trade listed crude oil futures. The Oil Futures Contracts available on the ICE Futures are comparable to the contracts on the NYMEX, but they may have different underlying commodities, sizes, deliveries, and prices. In addition, certain of the Oil Futures Contracts available on the ICE Futures are subject to accountability levels and position limits.

There are technical and fundamental risks inherent in the trading system USCF employs.