0001326801DEF 14AFALSE00013268012023-01-012023-12-31iso4217:USD00013268012022-01-012022-12-3100013268012021-01-012021-12-3100013268012020-01-012020-12-310001326801meta:AdjustmentExclusionOfEquityAwardsMember2023-01-012023-12-310001326801meta:AdjustmentInclusionOfOutstandingAndUnvestedAwardsGrantedMember2023-01-012023-12-310001326801meta:AdjustmentInclusionOfYearOverYearChangeInFairValueOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMember2023-01-012023-12-310001326801meta:AdjustmentInclusionOfFairValueOfAwardsGrantedAndVestedMember2023-01-012023-12-310001326801meta:AdjustmentInclusionOfYearOverYearChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedInCoveredYearMember2023-01-012023-12-310001326801meta:AdjustmentExclusionOfAwardsForfeitedMember2023-01-012023-12-310001326801meta:AdjustmentExclusionOfIncrementalDividendsOrEarningsPaidOnAwardsMember2023-01-012023-12-31000132680112023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

____________________________________________

Filed by the Registrant. ý Filed by a Party other than the Registrant. ¨

Check the appropriate box:

| | | | | |

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material under § 240.14a-12 |

Meta Platforms, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ý | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

| | | | | | | | |

| | |

| | |

| INTRODUCTION | | Page No. |

| | |

| | |

| | |

| | |

| | |

CORPORATE GOVERNANCE | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| COMPENSATION AND SECURITY OWNERSHIP | | |

| | |

| | |

| | |

| | |

| | |

| | |

SHAREHOLDER PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| INFORMATION ABOUT THE ANNUAL MEETING | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

|

|

| To Our Shareholders |

|

I'd like to invite you to attend the 2024 Annual Meeting of Shareholders of Meta Platforms, Inc. to be held on May 29, 2024, at 10:00 a.m. Pacific Time. We'll begin the meeting with the items of business described in this proxy statement, including the election of directors, ratification of the appointment of our independent registered public accounting firm, approval of an amendment to our Amended and Restated Certificate of Incorporation, approval of an amendment to our 2012 Equity Incentive Plan, and consideration of shareholder proposals. We'll also provide a company update and hold a question and answer session at the meeting. You can submit a question in advance of the meeting by visiting www.proxyvote.com, and you can also submit a question at any time during the meeting by visiting www.virtualshareholdermeeting.com/META2024. I'm excited to welcome John Arnold and Hock Tan to our board of directors. As president and CEO of Broadcom, Hock brings substantial leadership, global business, and compliance experience as well as considerable expertise in building core technology infrastructure. John has extensive business experience and deep knowledge of finance and energy. Their insight and expertise will help us execute our long-term vision for the company, including for AI. I also want to thank Sheryl Sandberg for her distinguished service as a member of our board since 2012. Sheryl will be retiring from our board when her term concludes at the Annual Meeting. Sheryl has made extraordinary contributions to our company and community, and her dedication and guidance have been instrumental in driving our success. I am deeply grateful for her commitment to Meta over the years. |

| | Thank you for your continued investment in Meta. We hope your shares will be represented at the Annual Meeting.

Mark Zuckerberg, Founder, Chairman, and Chief Executive Officer |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 29, 2024: THIS PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT www.proxyvote.com |

| | | | | | | | |

| | |

| Fellow Shareholders, |

|

2023 was Meta’s "year of efficiency." In this pivotal period, we focused on making Meta a stronger technology company and improving the business to give Meta the stability to deliver on its ambitious long-term vision, including for AI and the metaverse. The board of directors worked closely with management to develop and implement a strategy of being a leaner company to execute better and faster, which are values Meta will carry forward as a permanent part of how the company operates. On behalf of the entire board, I would like to share some key highlights from the board’s governance and oversight work this year: •We focused on board oversight of strategy to lay the foundation for the long-term success of our company and deliver value for our community and shareholders. In the past year, not only did Meta achieve its efficiency goals, but it returned to strong revenue growth, had strong community engagement across its apps, launched a number of new products like Threads, next generation Ray-Ban Meta smart glasses, and mixed reality in Quest 3, and established a world-class AI effort to serve as the foundation for many of its future products. The board worked closely with management on a strategy of increasing Meta's operating discipline and delivering strong execution across Meta’s product priorities, and also provided oversight around Meta's regulatory readiness efforts as well as the initiation of a dividend as part of its capital return program to shareholders. •We focused on board effectiveness, refreshment, and independence while increasing transparency on key topics. As Lead Independent Director, I am actively involved in setting the agenda topics for board discussions and promoting strong independent board leadership. We have continued to refresh our board with the addition of new independent directors in the last several years, including the elections of John Arnold and Hock Tan in February 2024, whose skills and experiences will provide key insights to help oversee the company's long-term business strategy. The board also remains committed to oversight of the company's risk management efforts, including key and evolving risks in areas such as AI, child safety, and human rights, with a view to promoting transparency and accountability. To that end, we were pleased to release Meta's inaugural Responsible Business Practices Report in July 2023, highlighting Meta's impact on society. We also published our second annual Human Rights Report in September 2023, which detailed how we identify and address salient human rights risks. •We remain committed to understanding and being responsive to shareholder perspectives. Shareholder input remains an important consideration in the board's decision-making process and has guided our actions on key topics, including data privacy and safety, content governance, civil rights, cybersecurity, environmental sustainability, human capital management, and expense management. We will continue our governance and oversight work with a view to promoting transparency and accountability and enhancing long-term value for Meta shareholders. Please know that your board is highly focused on the responsibility we have to you, our shareholders, as well as to the broader communities we serve. We take that responsibility very seriously. |

| | Together with my fellow board members, I thank you for your support of Meta and look forward to continuing our important work as stewards of the company. Sincerely, Robert M. Kimmitt, Lead Independent Director |

Notice of Annual Meeting of Shareholders to be held on May 29, 2024

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

| | | | | | |

Date and Time

May 29, 2024 10:00 a.m. Pacific Time | | | Place

The 2024 Annual Meeting of Shareholders (Annual Meeting) of Meta Platforms, Inc. will be a virtual meeting of shareholders conducted via live audio webcast. You will be able to attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/META2024.

| | | Record Date

April 1, 2024 |

| | | | | | |

We are holding the Annual Meeting for the following purposes, which are more fully described in the proxy statement accompanying this Notice:

| | |

•To elect the ten directors nominated by our board of directors, all of whom are currently serving on our board of directors, each to serve until the next annual meeting of shareholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal. |

•To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

•To approve an amendment to our Amended and Restated Certificate of Incorporation to limit liability of officers as permitted by Delaware law. |

•To approve an amendment to our 2012 Equity Incentive Plan. |

•To consider and vote upon ten shareholder proposals, if properly presented. |

•To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Only shareholders of record at the close of business on April 1, 2024 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. The Notice of Internet Availability of Proxy Materials (Notice), proxy statement and form of proxy are being distributed and made available on the internet on or about April 19, 2024.

By Order of the Board of Directors,

| | |

| Katherine R. Kelly |

Vice President and Corporate Secretary |

| Menlo Park, California |

Whether or not you expect to attend the Annual Meeting, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail.

Proxy Statement Summary

This proxy statement summary highlights information described in more detail elsewhere in this proxy statement and does not contain all of the information you should consider. Please read the entire proxy statement before voting.

OUR MISSION

Our mission is to give people the power to build community and bring the world closer together. When Facebook launched in 2004, it changed the way people connect. Apps like Messenger, Instagram, and WhatsApp further empowered billions around the world. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology.

2023 COMPANY PRIORITIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Build awesome things. | | | Make our business successful. | | | Make progress on societal issues related to our business. | | | Go out and tell our story. |

2023 BUSINESS HIGHLIGHTS

2023 was our "year of efficiency," where we pursued several initiatives aimed at making us a better technology company and improving our financial performance so that we are positioned to execute our long-term vision. We delivered strong business performance, including the following financial and community highlights:

•Revenue was $134.90 billion for full year 2023.

•Costs and expenses were $88.15 billion for full year 2023.

•Income from operations was $46.75 billion for full year 2023, representing a 35% operating margin.

•Family daily active people was 3.19 billion on average for December 2023.

We continued to invest based on our company priorities, with 80% of our 2023 total costs and expenses recognized in our Family of Apps segment and 20% in our Reality Labs segment.

For additional information about our 2023 financial results and community metrics, see our Annual Report on Form 10-K for the year ended December 31, 2023.

OUR PRINCIPLES

Our principles embody what we stand for and guide our approach to how we build technology for people and their relationships.

| | | | | | | | |

| | |

| Give People a Voice | People deserve to be heard and to have a voice—even when that means defending the right of people we disagree with. |

| | |

| | |

| Build Connection and Community | Our services help people connect, and when they're at their best, they bring people closer together. |

| | |

| | |

| Serve Everyone | We work to make technology accessible to everyone, and our business model is ads so our services can be free. |

| | |

| | |

| Keep People Safe and Protect Privacy | We have a responsibility to promote the best of what people can do together by keeping people safe and preventing harm. |

| | |

| | |

| Promote Economic Opportunity | Our tools help level the playing field so businesses grow, create jobs and strengthen the economy. |

| | |

OUR VALUES

Our six values are the signposts that guide our work, how we spend our time, and how we work together. By working at Meta, we each commit to bring these values to our work, each and every day.

| | | | | | | | |

| | |

| Move Fast | Move Fast helps us to build and learn faster than anyone else. This means acting with urgency and not waiting until next week to do something you could do today. At our scale, this also means we continuously work to speed up our highest priority initiatives by methodically removing barriers that get in the way. It's about moving fast in one direction together as a company and as individuals. |

| | |

| | |

| Focus on Long-Term Impact | Focus on Long-Term Impact emphasizes long-term thinking that encourages us to extend the timeline for the impact we have, rather than optimizing for near-term wins. We should take on the challenges that will be the most impactful, even if the full results won't be seen for years. |

| | |

| | |

| Build Awesome Things | Build Awesome Things pushes us to ship things that are not just good, but also awe-inspiring. We've already built products that are useful to billions of people. In our next chapter we'll focus more on inspiring people as well, in everything we do. |

| | |

| | |

| Live in the Future | Live in the Future guides us to build the future of work that we want, with an in-person focus designed to support a strong, valuable experience for our people who have chosen to work from the office, and a thoughtful and intentional approach to where we invest in remote work. This also means being early adopters of the future products we build to help people feel present together wherever they are. |

| | |

| | |

| Be Direct and Respect Your Colleagues | Be Direct and Respect Your Colleagues is about creating a culture where we are straightforward and willing to have hard conversations with each other. At the same time, we are also respectful and when we share feedback we recognize that many of the world's leading experts work here. |

| | |

| | |

| Meta, Metamates, Me | Meta, Metamates, Me is about being good stewards of our company and mission. It's about the sense of responsibility we have for our collective success and to each other as teammates. It's about taking care of our company and each other. |

| | |

BOARD HIGHLIGHTS

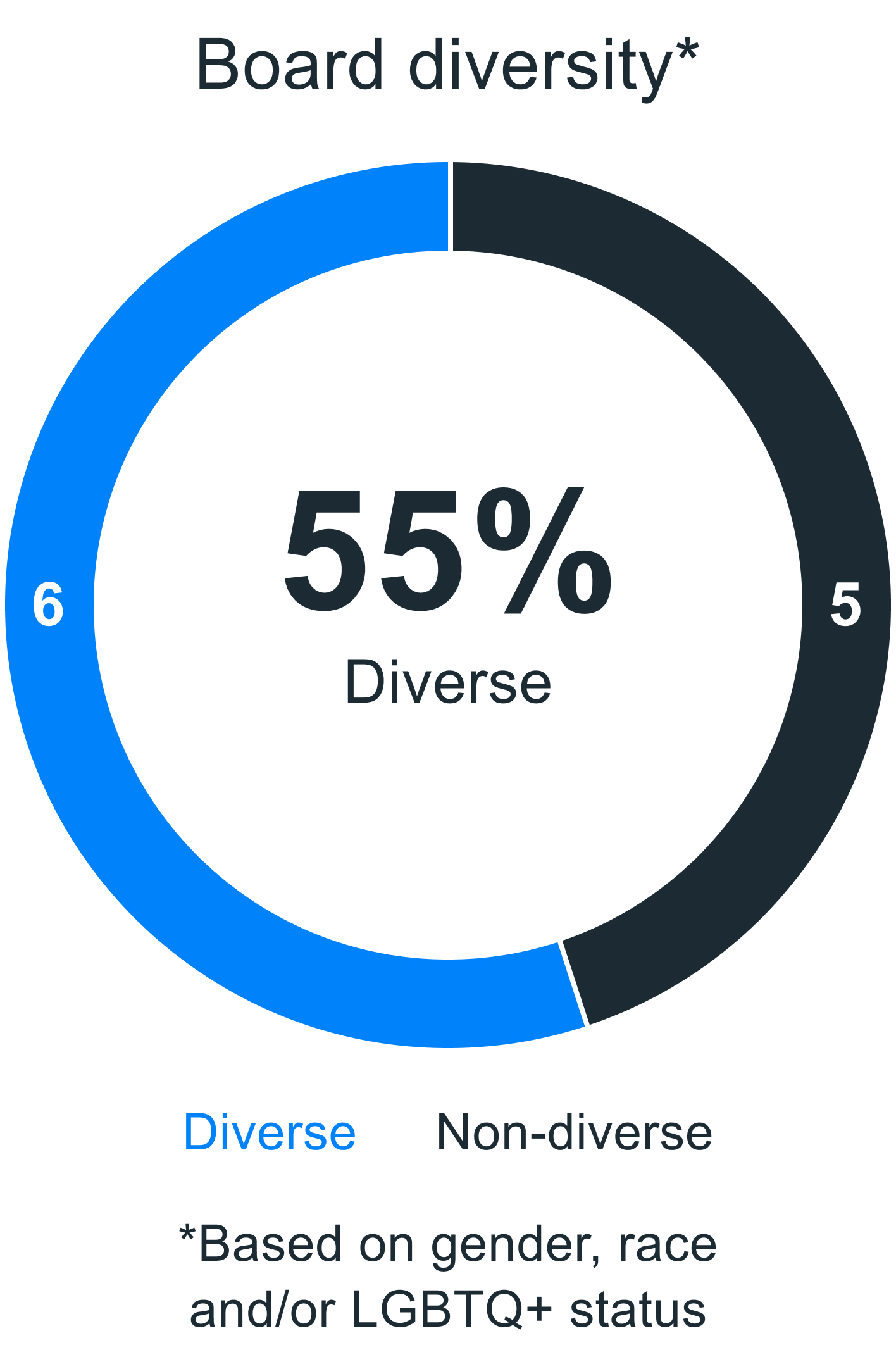

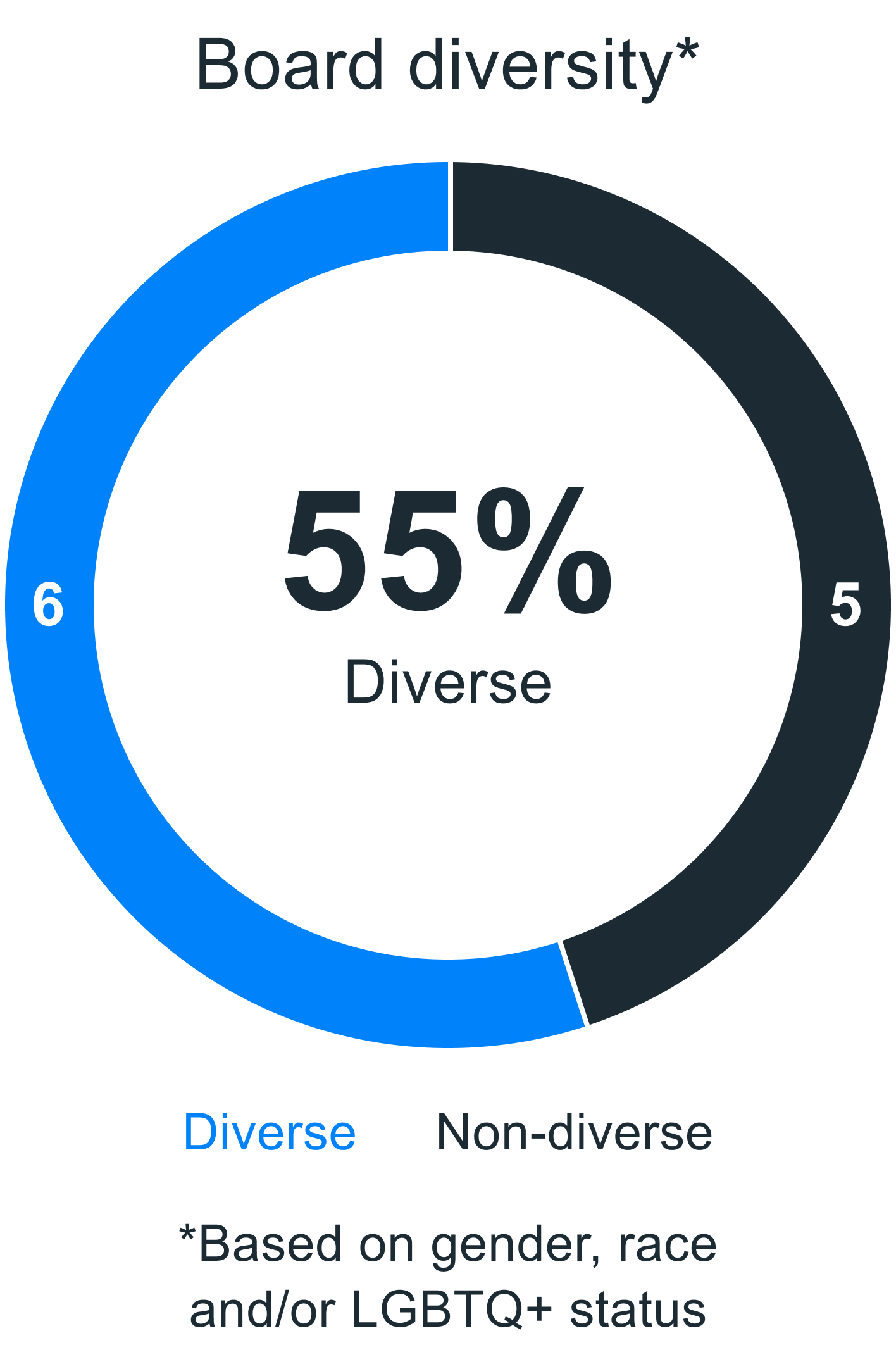

Our board of directors believes that having a diverse set of directors with complementary qualifications, expertise, experience, and backgrounds best ensures effective oversight, allows us to represent the interests of our shareholders, and provides practical insights and varied perspectives. The skills and qualifications of our director nominees are more fully described in the sections of this proxy statement entitled "Director Nominees and Executive Officers" and "Corporate Governance." The following tables provide information regarding the diversity, age, and tenure of our directors as of April 19, 2024:

OUR DIRECTOR NOMINEES

The following table provides summary information about our director nominees. See the sections of this proxy statement entitled "Director Nominees and Executive Officers" and "Corporate Governance" for more information.

| | | | | | | | | | | |

| Name | Director Since | Primary Employment | Independent |

| Peggy Alford | 2019 | Former Executive Vice President, Global Sales, PayPal Holdings | ü |

| Marc L. Andreessen | 2008 | Co-founder and General Partner, Andreessen Horowitz | ü |

John Arnold | 2024 | Co-founder and Co-chair, Arnold Ventures | ü |

| Andrew W. Houston | 2020 | Co-founder and Chief Executive Officer, Dropbox | ü |

| Nancy Killefer | 2020 | Retired Senior Partner, McKinsey & Company | ü |

| Robert M. Kimmitt | 2020 | Senior International Counsel, WilmerHale | ü |

| Hock E. Tan | 2024 | President and Chief Executive Officer, Broadcom | ü |

| Tracey T. Travis | 2020 | Executive Vice President and Chief Financial Officer, The Estée Lauder Companies | ü |

| Tony Xu | 2022 | Co-founder and Chief Executive Officer, DoorDash | ü |

| Mark Zuckerberg | 2004 | Founder, Chairman, and Chief Executive Officer, Meta | |

RESPONSIBLE BUSINESS PRACTICES HIGHLIGHTS

We are committed to operating our business responsibly.

We invest in ongoing efforts across our company, including in key areas such as data privacy and cybersecurity, human rights, responsible artificial intelligence, and community safety and support. We made progress on a number of key initiatives in 2023, including:

•We grew our product, engineering, and operations teams that are focused primarily on privacy across the company to more than 3,000 people at the end of 2023.

•We published our second annual human rights report, including key findings from our salient risk assessment. The analysis identified as highest priority the following salient human rights risks: freedom of opinion and expression, privacy, equality and non-discrimination, life, liberty and security of the person, best interests of the child, public participation, to vote, and to be elected, freedom of association and assembly and right to health. The salient risk assessment will continue to support our work in identifying the most critical human rights issues for the company.

•Meta's data centers and offices are supported by 100% renewable energy and have reached net zero operational greenhouse gas emissions.

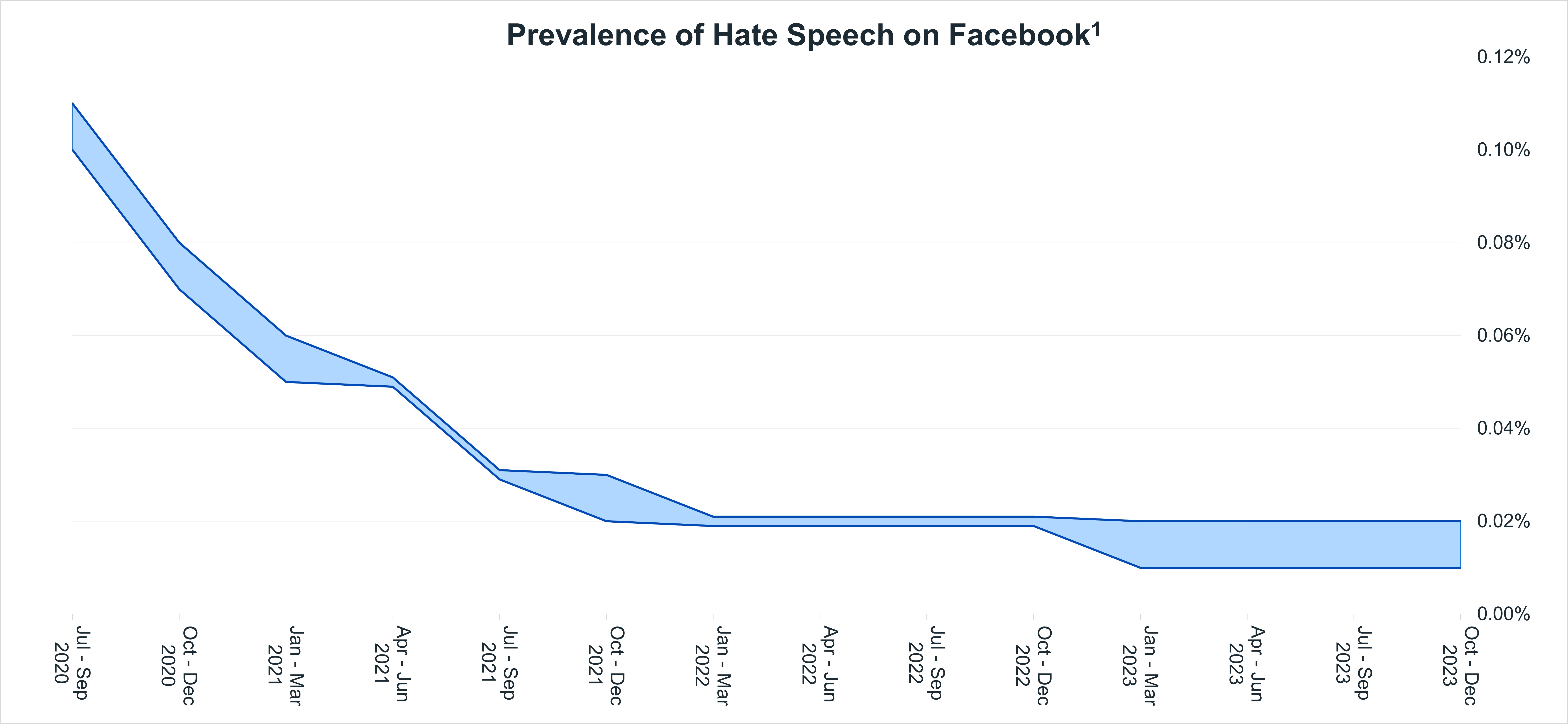

We also continued to focus on enforcing our community standards to help ensure the safety and security of our platforms. We regularly issue Community Standards Enforcement Reports that track our record of enforcing our content policies on Facebook and Instagram. For example, we reported in our latest Community Standards Enforcement Report that from the third quarter of 2020 to the fourth quarter of 2023, the prevalence of hate speech on Facebook decreased from a range of approximately 0.10% to 0.11% to a range of approximately 0.01% to 0.02%.

See the section of this proxy statement entitled "Responsible Business Practices" for more information about our efforts in these and other key areas such as building responsibly, human capital, and environmental sustainability.

SHAREHOLDER ENGAGEMENT

We are committed to maintaining an active dialogue with our shareholders and broader stakeholder community, understanding investor viewpoints, hearing feedback, and being responsive. To that end, we believe that effective corporate governance includes regular, transparent, and constructive communication with our various stakeholders to understand their perspectives and priorities, as well as to answer inquiries and elaborate upon our initiatives. Our shareholder engagement program includes various forums for discussion throughout the year, including direct engagement efforts, topic-specific group calls, conferences, and other opportunities.

In 2023, we continued making progress on our engagement efforts and taking a more proactive approach to sharing the work of our team and ensuring that investor perspectives informed our practices.

| | | | | | | | |

2023 Shareholder Engagement Overview(1) |

| | |

Over 50 Shareholders Engaged | | Representing Over 40% of Outstanding Shares Engaged |

| | |

(1) Reflects reported share ownership as of December 31, 2023 and includes engagement meetings conducted through March 2024.

Key shareholder engagement topics included:

•Company strategy

•Corporate governance and our board of directors

•Executive compensation

•Environmental and social matters, including human capital management, human rights, content governance, data privacy, and responsible AI

Our shareholder engagement program is more fully described in the section of this proxy statement entitled "Shareholder Engagement."

EXECUTIVE COMPENSATION HIGHLIGHTS

We are focused on our mission to give people the power to build community and bring the world closer together. All of our products, including our apps, share the vision of helping to bring the metaverse to life. And across our work, we are innovating in artificial intelligence technologies to build new experiences that help make our platform more social, useful, and immersive, as well as creating new content and features for Meta smart glasses and mixed reality technology. For us to be successful, we design our executive compensation programs to attract and retain a talented team of engineering, product, sales, and business professionals who can help achieve this mission through the successful pursuit of our company priorities.

| | |

|

|

Objectives

•Attract the top talent in our leadership positions and motivate our executives to deliver the highest level of individual and team impact and results •Encourage our executives to focus on our company priorities •Ensure each of our executives receives a total compensation package that encourages his or her long-term retention •Reward high levels of impact with commensurate levels of compensation •Align the interests of our executives with those of our shareholders in the overall success of our company by emphasizing long-term incentives |

|

|

Design

•Program is heavily weighted towards equity compensation in the form of restricted stock units, with cash compensation that is generally below market relative to executive cash compensation at our peer companies •Annual cash incentives are designed to motivate executive officers to focus on our company priorities and reward them for company results and achievements •Service-based vesting conditions for equity awards •Our CEO continues to receive a base salary of $1 per year in addition to his overall security program, and he does not participate in the annual bonus plan or receive additional equity awards |

|

|

Compensation Best Practices

•Our compensation, nominating & governance committee is comprised of solely independent directors and advised by an independent compensation consultant •Annual review and approval of our compensation strategy, including a review of our compensation-related risk profile •Pay philosophy heavily weighted towards equity compensation to best align executive officer interests with the long-term interests of shareholders •Robust stock ownership guidelines that require our executive officers to maintain significant ownership of our common stock |

|

For more information regarding our executive compensation philosophy and practices, see the section of this proxy statement entitled "Compensation Discussion and Analysis."

VOTING MATTERS AND RECOMMENDATIONS

The following table provides summary information about the proposals to be voted on at the Annual Meeting. See the pages of this proxy statement listed below for more information.

| | | | | | | | |

Proposal | Board Voting Recommendation | Rationale |

| Management Proposals: | | |

1. The election of ten directors (page 26) | FOR each nominee | •Slate of highly qualified director nominees with broad and diverse backgrounds, experiences, and skill sets aligned to Meta's unique business. |

| | | | | | | | |

Proposal | Board Voting Recommendation | Rationale |

2. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (page 47) | FOR | •The audit & risk oversight committee has selected Ernst & Young LLP to serve as our independent registered public accounting firm. •Ernst & Young LLP is an independent accounting firm with the breadth of expertise and knowledge necessary to effectively audit Meta’s financial statements. |

3. An amendment to our Amended and Restated Certificate of Incorporation (page 48) | FOR | •The amendment provides for the elimination of monetary liability of certain officers in certain limited circumstances as permitted by recent amendments to Delaware law. •We believe this amendment will help attract and retain talented officers, and the board has determined that it is in the best interests of the company and our shareholders to adopt the amendment. |

4. An amendment to our 2012 Equity Incentive Plan (page 49) | FOR | •The amendment will allow for the award of share-settled dividend equivalents on awards of restricted stock and restricted stock units granted under the 2012 Equity Incentive Plan. •We believe that this amendment will allow us to structure equity awards in a manner reflective of the fact that we intend to continue to pay dividends going forward, subject to board approval, and give us the flexibility to settle dividend equivalents in shares of Meta stock. |

| Shareholder Proposals: | | |

5. A shareholder proposal regarding dual class capital structure (page 80) | AGAINST | •Our board of directors evaluates Meta's capital structure on a regular basis and continues to believe that our current capital structure is in the best interest of the company and its shareholders. •Our current capital structure allows our board of directors and management team to focus on the long term. •Our board of directors provides robust independent oversight and ensures that the interests of our shareholders are considered. •The requested change to our capital structure is unnecessary and is not in the best interest of Meta and its shareholders at this time. |

6. A shareholder proposal regarding report on generative AI misinformation and disinformation risks (page 82) | AGAINST | •Our artificial intelligence (AI) work is guided by Meta's five pillars of Responsible AI and the related risks are overseen by our board of directors. •We have made significant investments in our safety and security efforts to combat misinformation and disinformation, including content policies and enforcement, AI tools, and partnerships. •We have developed tools to help people understand when content has been created using our Meta AI feature, and have ongoing efforts to help identify other AI-generated content on our apps. •We provide visibility into the impact of our products, effectiveness of our policies and the way we oversee risks associated with mis- and disinformation. •Given our ongoing efforts to address this topic, the board of directors believes that the requested report is unnecessary and would not provide additional benefit to our shareholders. |

| | | | | | | | |

| | 2024 Proxy Statement | 10 |

| | | | | | | | |

Proposal | Board Voting Recommendation | Rationale |

7. A shareholder proposal regarding disclosure of voting results based on class of shares (page 85) | AGAINST | •Our existing disclosures around our capital structure and security ownership already provide transparency to the general public and our shareholders. •Our board of directors remains committed to effective oversight and responsiveness to shareholder concerns, regardless of which class of common stock our shareholders own. •The requested disclosure is unnecessary and would not provide additional benefit to our shareholders. |

8. A shareholder proposal regarding report on human rights risks in non-US markets (page 87) | AGAINST | •We are committed to respecting human rights and have robust policies and processes designed to fulfill our human rights commitments, as well as board-level oversight to ensure accountability. •Our corporate human rights policy helps ensure that Meta incorporates consideration of the United Nations Guiding Principles on Business and Human Rights (UNGPs) into our decisions and actions. •We are an industry leader in human rights reporting and engage with shareholders on a regular basis to continually enhance our reporting and disclosures. •We have strengthened our governance systems to advance our work toward respecting human rights across all of our products and services globally. •The requested report is unnecessary and would not provide additional benefit to shareholders in light of our existing practices, oversight, and disclosures regarding human rights. |

9. A shareholder proposal regarding amendment of Corporate Governance Guidelines (page 89) | AGAINST | •The proposed update to our Corporate Governance Guidelines is unnecessary in light of the existing responsibilities of our Lead Independent Director and our process for executive sessions of independent directors. |

10. A shareholder proposal regarding human rights impact assessment on AI systems driving targeted advertising (page 90) | AGAINST | •We are committed to respecting human rights. •The requested Human Rights Impact Assessment is unnecessary in light of the Comprehensive Human Rights Salient Risk Assessment Meta conducted in 2022 - 2023. •We believe the best advertising experiences are personalized and are committed to mitigating risks related to targeted advertising. •The requested report is unnecessary and would not provide additional benefit to shareholders in light of our existing practices, oversight, and disclosures regarding human rights. |

| | | | | | | | |

11 | 2024 Proxy Statement | | |

| | | | | | | | |

Proposal | Board Voting Recommendation | Rationale |

11. A shareholder proposal regarding report on child safety impacts and actual harm reduction to children (page 93) | AGAINST | •We want people, especially young people, to foster their online relationships in a safe, positive, and supportive environment, and we work closely with a broad range of stakeholders to inform our approach to safety. •Our policies prohibit harmful content, as well as content or behavior that exploits young people. We recently introduced enhanced protections designed to give teens more age-appropriate experiences on our apps and are focused on building features and tools that help people connect online safely and responsibly. •We seek to prevent child exploitation through a number of measures, including using sophisticated technology, to proactively find and take action on such content. •We have invested in a combination of technologies and tools designed to provide options to verify age, and protect young people's privacy, even in the absence of clear standards regarding online age verification. •We are committed to providing families with the tools they need to promote safe and age-appropriate social media usage. •We publish Community Standards Enforcement Reports quarterly to track and demonstrate our commitment to online safety and inclusivity. •The board of directors provides oversight of this topic through its audit & risk oversight committee. •Given our ongoing efforts to address this topic, the board of directors believes that the requested report is unnecessary and would not provide additional benefit to our shareholders. |

12. A shareholder proposal regarding report and advisory vote on minimum age for social media (page 97) | AGAINST | •We already have minimum age requirements for our users and have invested in a combination of technologies and tools designed to provide options to verify age, and protect young people's privacy, even in the absence of clear industry standards regarding online age verification. •We want people, especially young people, to foster their online relationships in a safe, positive, and supportive environment, and we work closely with a broad range of stakeholders to inform our approach to safety. •We seek to prevent child exploitation through a number of measures, including using sophisticated technology, to proactively find and take action on such content. •Our policies prohibit harmful content, as well as content or behavior that exploits young people. We recently introduced enhanced protections designed to give teens more age-appropriate experiences on our apps and are focused on building features and tools that help people connect online safely and responsibly. •The board of directors provides oversight of this topic through its audit & risk oversight committee. •Implementing the requested report and advisory vote would impose substantial burdens and costs on the company, without providing any meaningful benefit to its shareholders. |

| | | | | | | | |

| | 2024 Proxy Statement | 12 |

| | | | | | | | |

Proposal | Board Voting Recommendation | Rationale |

13. A shareholder proposal regarding report on political advertising and election cycle enhanced actions (page 100) | AGAINST | •We make preparing for elections one of our highest priorities and invest a significant amount of effort and resources not just during election periods but at all times. •Our approach to political ads is grounded in Meta's fundamental belief in free expression, respect for the democratic process, and the belief that, especially in mature democracies with a free press, political speech is the most scrutinized speech there is. •We seek to provide industry-leading transparency for ads about social issues, elections, or politics, and we continue to expand on these efforts. •The board of directors provides oversight of this topic through its audit & risk oversight committee. •Given our ongoing efforts to address this topic, the board of directors believes that the requested report is unnecessary and would not provide additional benefit to our shareholders. |

14. A shareholder proposal regarding report on framework to assess company lobbying alignment with climate goals (page 103) | AGAINST | •We are committed to fighting climate change, and we embrace our responsibility and the opportunity to impact the world beyond our operations. •We are committed to thorough and robust reporting processes around our political contributions and lobbying activities, including board-level oversight of Meta's lobbying activities. •We have a robust process in place designed to ensure that our climate policy work aligns with our stated priorities. •Given our ongoing commitment to fighting climate change and transparency regarding our lobbying practices, the board of directors believes that the requested report is unnecessary. |

| | | | | | | | |

13 | 2024 Proxy Statement | | |

Director Nominees and Executive Officers

The following section provides information regarding our director nominees and executive officers as of April 19, 2024. Our executive officers are designated by, and serve at the discretion of, our board of directors. There are no family relationships among any of our directors or executive officers.

DIRECTOR NOMINEES

Our director nominees have diverse backgrounds and perspectives that enable them to provide valuable guidance on both strategic and operational issues. Our nominees have extensive leadership and compliance experience, as well as corporate governance expertise arising from service on other boards of directors. Many of our nominees have global business experience, including through service as CEO or in other senior corporate leadership positions involving management of complex operations, business challenges, risks, and growth. Several nominees have experience with technology or product innovation and development, entrepreneurship, commerce, and the dynamics of our industry. Other nominees have significant public sector experience from serving in high-level government positions, including experience with significant regulatory and public policy issues. Our board of directors benefits from these qualifications, as well as the perspective of our Chairman who has in-depth knowledge of our company through service as our CEO. The skills and qualifications of our director nominees are more fully described below.

| | | | | |

Mark Zuckerberg - Founder, Chairman, and Chief Executive Officer |

| |

Director Since: 2004

Age: 39

Meta Committees: None | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Mr. Zuckerberg should serve as a member of our board of directors due to the perspective and experience he brings as our founder and CEO, and as our largest and controlling shareholder •Mr. Zuckerberg's vision and tenure as our founder, CEO, and Chairman provide our board of directors with unique and invaluable experience and understanding of our company’s priorities and the needs of the people and businesses that use our services Professional Experience: •Meta Platforms, Inc. Founder & Chief Executive Officer (2004-present) Chairman of the board of directors (2012-present) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •None Education: •Attended Harvard University (studied computer science) |

| |

| | | | | | | | |

| | 2024 Proxy Statement | 14 |

| | | | | |

Robert M. Kimmitt - Lead Independent Director |

| |

Director Since: 2020

Age: 76

Meta Committees: Privacy | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Ambassador Kimmitt should serve as a member of our board of directors due to his distinguished public service and experience with legal, regulatory, compliance, and public policy issues, his finance experience, and his extensive private and public sector leadership, including service on other public company boards of directors •Ambassador Kimmitt's legal and compliance experience, prior service in senior U.S. government roles and on outside boards, and international experience provide our board of directors with relevant skills and perspective to navigate the challenges of the dynamic regulatory and geopolitical environments, execute on our strategic priorities, and provide effective oversight of management Professional Experience: •Wilmer Cutler Pickering Hale and Dorr LLP (international law firm) Senior International Counsel (2009-present) •U.S. Department of the Treasury Deputy Secretary (2005-2009) General Counsel (1985-1987) •Time Warner Inc. Executive Vice President of Global Public Policy (2001-2005) •Commerce One Vice Chairman & President (2000-2001) •Wilmer Cutler & Pickering Partner (1997-2000) •Lehman Brothers Managing Director (1993-1997) •United States Ambassador to Germany (1991-1993) •Under Secretary of State for Political Affairs (1989-1991) •Sidley & Austin LLP Partner (1987-1989) •National Security Council Executive Secretary & General Counsel (1983-1985) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •None Education: •United States Military Academy at West Point (B.S.) •Georgetown University Law Center (J.D.) Military Service: •Ambassador Kimmitt is a decorated combat veteran of the Vietnam War and attained the rank of Major General in the U.S. Army Reserve |

| |

| | | | | | | | |

15 | 2024 Proxy Statement | | |

| | | | | |

Peggy Alford - Independent Director |

| |

Director Since: 2019

Age: 52

Meta Committees: Compensation, Nominating & Governance (Chair) Audit & Risk Oversight Privacy | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Ms. Alford should serve as a member of our board of directors due to her extensive leadership, business, and compliance experience, as well as her experience with finance and product development •Ms. Alford's global business, leadership, and compliance experience in both operational and financial oversight roles, as well as her experience as a senior executive within the technology industry, provide our board of directors with insights related to our sector that are relevant to our evolving strategy, business, and operations Professional Experience: •PayPal Holdings, Inc. (digital payments company) Executive Vice President, Global Sales (2020-2024) Senior Vice President, Core Markets (2019-2020) Various other positions (2011-2017) •Chan Zuckerberg Initiative (philanthropic organization) Chief Financial Officer & Head of Operations (2017-2019) •Rent.com (an eBay Inc. company) President & General Manager (2007-2011) Chief Financial Officer (2005-2009) •eBay Inc. Marketplace Controller and Director of Accounting Policy (2002-2005) Other Current Public Company Directorships: •The Macerich Company Former Public Company Directorships Held in the Past Five Years: •None Education: •University of Dayton (B.S. in accounting and business administration) |

| |

| | | | | | | | |

| | 2024 Proxy Statement | 16 |

| | | | | |

Marc L. Andreessen - Independent Director |

| |

Director Since: 2008

Age: 52

Meta Committees: Compensation, Nominating & Governance | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Mr. Andreessen should serve as a member of our board of directors due to his extensive leadership and business experience as an internet entrepreneur, venture capitalist, and technologist, as well as his service on numerous public and private boards of directors •Mr. Andreessen's finance and investment expertise, as well as his extensive leadership, business, technology, and entrepreneurship experience, support our strategic and operational decision-making Professional Experience: •Andreessen Horowitz (venture capital firm) Co-founder & General Partner (2009-present) •Opsware, Inc. (formerly known as Loudcloud Inc.) Co-founder & Chairman of the board of directors (1999-2007) •America Online, Inc. Chief Technology Officer (1999) •Netscape Communications Corporation Co-founder & various other positions, including Chief Technology Officer & Executive Vice President of Products (1994-1999) Other Current Public Company Directorships: •Coinbase Global, Inc. •Samsara Inc. Former Public Company Directorships Held in the Past Five Years: •None Education: •University of Illinois at Urbana-Champaign (B.S. in computer science) |

| |

| | | | | | | | |

17 | 2024 Proxy Statement | | |

| | | | | |

John Arnold - Independent Director |

| |

Director Since: 2024

Age: 50

Meta Committees: Audit & Risk Oversight | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Mr. Arnold should serve as a member of our board of directors due to his extensive leadership and business experience as an entrepreneur, as well as his financial expertise and experience as an investor, including serving as a founder and chief executive officer of a multi-billion dollar energy-focused investment fund •Mr. Arnold's extensive leadership experience, as well as his experience as an investor, provides our board of directors with expertise to support oversight of corporate strategy; he also has a deep understanding of various societal issues as the founder of a philanthropic venture fund focused on solving systemic problems through transformative and evidence-based policy solutions which supports our mission of building an online community Professional Experience: •Arnold Ventures Co-founder & Co-Chair (2006-present) •Grid United Co-founder & Chairman (2021-present) •Centaurus Capital, LLC Founder & Principal (2006-present) •Centaurus Energy, LLC Founder & CEO (2002-2012) •Enron Vice President (1995-2002) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •None Education: •Vanderbilt University (B.A. in math and economics) |

| |

| | | | | | | | |

| | 2024 Proxy Statement | 18 |

| | | | | |

Andrew W. Houston - Independent Director |

| |

Director Since: 2020

Age: 41

Meta Committees: Compensation, Nominating & Governance | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Mr. Houston should serve as a member of our board of directors due to his extensive leadership, entrepreneurship, and business experience as chief executive officer of a large technology company, as well as his experience with product innovation and development •Mr. Houston's extensive leadership, entrepreneurship, business, technology, and product innovation and development experience, as well as his deep understanding of the dynamics of our industry as chief executive officer and founder of a large technology company, provide our board of directors with insights related to the management of technology companies and dynamics of a founder-led company Professional Experience: •Dropbox, Inc. (global collaboration platform) Chief Executive Officer & Chairman of the board of directors (2007-present) Other Current Public Company Directorships: •Dropbox, Inc. Former Public Company Directorships Held in the Past Five Years: •None Education: •Massachusetts Institute of Technology (B.S. in electrical engineering and computer science) |

| |

| | | | | | | | |

19 | 2024 Proxy Statement | | |

| | | | | |

Nancy Killefer - Independent Director |

| |

Director Since: 2020

Age: 70

Meta Committees: Audit & Risk Oversight Privacy (Chair) | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Ms. Killefer should serve as a member of our board of directors due to her extensive leadership and compliance experience in both the public and private sector, as well as her finance experience and extensive service on other boards of directors •Ms. Killefer provides our board of directors with strong oversight gained through her experience as a trusted advisor and strategist working with leaders of corporations and governments, as well as relevant skills and perspectives to navigate the challenges of the dynamic regulatory and geopolitical environments Professional Experience: •McKinsey & Company (international management consulting firm) Senior Partner (1992-2013) Governing Board Member (2000-2006 and 2007-2013) Head and Founder of global public sector practice (2005-2012) Head of Washington, D.C. office (2000-2007) Various other positions (1979-1992) •U.S. Department of the Treasury Assistant Secretary for Management, Chief Financial Officer & Chief Operating Officer (1997-2000) •IRS Oversight Board Member (2000-2005) Chair (2002-2004) Other Current Public Company Directorships: •Cardinal Health, Inc. •Certara, Inc. Former Public Company Directorships Held in the Past Five Years: •Avon Products, Inc. •Natura & Company •Taubman Centers, Inc. Education: •Vassar College (B.A. in economics) •Massachusetts Institute of Technology (M.S.M. in finance) |

| |

| | | | | | | | |

| | 2024 Proxy Statement | 20 |

| | | | | |

Hock E. Tan - Independent Director |

| |

Director Since: 2024

Age: 72

Meta Committees: Audit & Risk Oversight

| Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Mr. Tan should serve as a member of our board of directors due to his extensive leadership, global business, and compliance experience as chief executive officer of a large multinational company, as well as his experience with technology, innovation, and business development •Mr. Tan's extensive leadership, global business, compliance, technology, innovation, and business development experience provides our board of directors with critical insights to oversee our business operations, capital planning, risk oversight, and corporate strategy as a large, global technology company Professional Experience: •Broadcom Inc. President, Chief Executive Officer & Director (2006-present) •The President's National Security and Telecommunications Advisory Committee Member (2020-present) •Integrated Device Technology, Inc. Chairman of the Board of Directors (2005-2008) •Integrated Circuit Systems, Inc. President & Chief Executive Officer (1999-2005) Chief Operating Officer (1996-1999) Senior Vice President & Chief Financial Officer (1995-1999) •Commodore International, Ltd. Vice President of Finance (1992-1994) •Pacven Investment, Ltd. Co-founder & Managing Director (1988-1992) •Hume Industries Ltd. Managing Director (1983-1988) Other Current Public Company Directorships: •Broadcom Inc. Former Public Company Directorships Held in the Past Five Years: •None Education: •Harvard University (M.B.A.) •Massachusetts Institute of Technology (B.S. and M.S.) |

| |

| | | | | | | | |

21 | 2024 Proxy Statement | | |

| | | | | |

Tracey T. Travis - Independent Director |

| |

Director Since: 2020

Age: 61

Meta Committees: Audit & Risk Oversight (Chair and Audit Committee Financial Expert) | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Ms. Travis should serve as a member of our board of directors due to her extensive leadership and business experience, including service on other boards of directors, as well as her financial expertise and experience with consumer products •Ms. Travis' global business and financial experience as a chief financial officer of multiple global companies provides our board of directors with extensive financial and operational expertise to support oversight of our evolving strategy, capital allocation practices, and international presence Professional Experience: •The Estée Lauder Companies Inc. (manufacturer and marketer of skin care, makeup, fragrance, and hair care products) Executive Vice President & Chief Financial Officer (2012-present) •Ralph Lauren Corporation Senior Vice President & Chief Financial Officer (2005-2012) •Limited Brands Senior Vice President of Finance (2002-2004) •Intimate Brands Inc. Chief Financial Officer (2001-2002) •Americas Group of American National Can Group, Inc. Chief Financial Officer (1999-2001) •PepsiCo/Pepsi Bottling Group Various positions (1989-1999) Other Current Public Company Directorships: •Accenture plc Former Public Company Directorships Held in the Past Five Years: •None Education: •University of Pittsburgh (B.S.E. in industrial engineering) •Columbia University (M.B.A. in finance and operations) |

| |

| | | | | | | | |

| | 2024 Proxy Statement | 22 |

| | | | | |

Tony Xu - Independent Director |

| |

Director Since: 2022

Age: 39

Meta Committees: Compensation, Nominating & Governance | Key Qualifications and Notable Experience Aligned with Meta's Strategy: •We believe that Mr. Xu should serve as a member of our board of directors due to his extensive leadership, entrepreneurship, and business experience as chief executive officer of a large technology company, as well as his experience with product innovation and the consumer experience •Mr. Xu's extensive leadership, entrepreneurship, business, technology, and product innovation and development experience, as well as his deep understanding of the dynamics of our industry as chief executive officer and founder of a large technology company, provide our board of directors with insights related to the management of technology companies and dynamics of a founder-led company Professional Experience: •DoorDash, Inc. (local commerce platform) Co-founder & Chief Executive Officer (2013-present) Chairman of the board of directors (2020-present) Other Current Public Company Directorships: •DoorDash, Inc. Former Public Company Directorships Held in the Past Five Years: •None Education: •University of California, Berkeley (B.S. in industrial engineering and operations research) •Stanford Graduate School of Business (M.B.A.) |

| |

EXECUTIVE OFFICERS

| | | | | |

Javier Olivan - Chief Operating Officer |

| |

Age: 46

| Professional Experience: •Meta Platforms, Inc. Chief Operating Officer (2022-present) Chief Growth Officer & Vice President, Cross-Meta Products and Infrastructure (2022-2022) Vice President, Central Products (2018-2022) Vice President, Growth (2011-2018) Head of International Growth (2007-2011) •Siemens AG Various positions (2003-2005) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •VY Global Growth •MercadoLibre.com Education: •University of Navarra (M.S. in both electrical engineering and industrial engineering) •Stanford Graduate School of Business (M.B.A.) |

| |

| | | | | | | | |

23 | 2024 Proxy Statement | | |

| | | | | |

Nick Clegg - President, Global Affairs |

| |

Age: 57

| Professional Experience: •Meta Platforms, Inc. President, Global Affairs (2022-present) Vice President, Global Affairs and Communications (2018-2022) •United Kingdom Deputy Prime Minister (2010-2015) •Liberal Democrats Party Leader (2007-2015) •U.K. Parliament, House of Commons Member for Sheffield Hallam (2005-2017) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •None Education: •Robinson College, Cambridge (M.A. in social anthropology) |

| |

| | | | | |

Susan Li - Chief Financial Officer |

| |

Age: 38

| Professional Experience: •Meta Platforms, Inc. Chief Financial Officer (2022-present) Vice President, Finance (2016-2022) Various other positions (2008-2016) •Morgan Stanley Analyst (2005-2008) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •Alaska Air Group Education: •Stanford University (B.A. in economics, B.S. in mathematical & computational science) |

| |

| | | | | |

Andrew Bosworth - Chief Technology Officer |

| |

Age: 42 | Professional Experience: •Meta Platforms, Inc. Chief Technology Officer (2022-present) Vice President, Reality Labs (2017-2022) Various other positions (2006-2017) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •None Education: •Harvard University (A.B. in computer science) |

| |

| | | | | | | | |

| | 2024 Proxy Statement | 24 |

| | | | | | | | |

Christopher K. Cox - Chief Product Officer |

| |

Age: 41 | Professional Experience: •Meta Platforms, Inc. Chief Product Officer (2014-2019 and 2020-present) Vice President, Product (2009-2014) Various other positions (2005-2009) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •None Education: •Stanford University (B.S. in symbolic systems with a concentration in artificial intelligence) |

| | |

| | | | | |

Jennifer G. Newstead - Chief Legal Officer |

| |

Age: 54 | Professional Experience: •Meta Platforms, Inc. Chief Legal Officer (2021-present) Vice President and General Counsel (2019-2021) Secretary (2021-2021) •U.S. Department of State Legal Adviser (2018-2019) •Davis Polk & Wardwell LLP (international law firm) Partner (2006-2018) •Office of Management and Budget General Counsel (2003-2005) •White House Special Assistant to the President and Associate White House Counsel (2002-2003) •U.S. Department of Justice Principal Deputy Assistant Attorney General of the Office of Legal Policy (2001-2002) Other Current Public Company Directorships: •None Former Public Company Directorships Held in the Past Five Years: •None Education: •Harvard University (A.B. in government) •Yale Law School (J.D.) Judiciary and Academic Experience: •Ms. Newstead previously served as a law clerk for Justice Stephen Breyer of the United States Supreme Court and Judge Laurence Silberman of the U.S. Court of Appeals for the D.C. Circuit, and as an Adjunct Professor of Law at Georgetown University Law Center |

| |

| | | | | | | | |

25 | 2024 Proxy Statement | | |

Proposal One: Election of Directors

Our board of directors has set the authorized number of directors at ten, effective as of the Annual Meeting. The following ten individuals are nominated for election to the board of directors at the 2024 Annual Meeting of Shareholders, all of whom are currently serving on our board of directors:

| | | | | | | | | | | |

| Name | Director Since | Primary Employment | Independent |

| Peggy Alford | 2019 | Former Executive Vice President, Global Sales, PayPal Holdings | ü |

| Marc L. Andreessen | 2008 | Co-founder and General Partner, Andreessen Horowitz | ü |

| John Arnold | 2024 | Co-founder and Co-chair, Arnold Ventures | ü |

| Andrew W. Houston | 2020 | Co-founder and Chief Executive Officer, Dropbox | ü |

| Nancy Killefer | 2020 | Retired Senior Partner, McKinsey & Company | ü |

| Robert M. Kimmitt | 2020 | Senior International Counsel, WilmerHale | ü |

| Hock E. Tan | 2024 | President and Chief Executive Officer, Broadcom | ü |

| Tracey T. Travis | 2020 | Executive Vice President and Chief Financial Officer, The Estée Lauder Companies | ü |

| Tony Xu | 2022 | Co-founder and Chief Executive Officer, DoorDash | ü |

| Mark Zuckerberg | 2004 | Founder, Chairman, and Chief Executive Officer, Meta | |

If elected, each of these individuals will serve until the next annual meeting of shareholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal. In the event that any nominee for any reason is unable or unwilling to stand for election, the proxies will be voted for such substitute nominee as our board of directors may determine or we may adjust the authorized number of directors of the board.

The relevant experiences, qualifications, attributes, or skills of each nominee that led our board of directors to recommend the above persons as a nominee for director are described in the sections of this proxy statement entitled "Director Nominees and Executive Officers" and "Corporate Governance."

The board of directors recommends a vote FOR the election of each of the nominated directors.

Corporate Governance

BOARD OF DIRECTORS

Our board of directors may establish the authorized number of directors from time to time by resolution. The current authorized number of directors is eleven. Our board of directors has set the number of directors at ten, effective as of the 2024 Annual Meeting of Shareholders (Annual Meeting), following Ms. Sandberg's departure from the board. Each of our director nominees, if elected, will serve as a director until the next annual meeting of shareholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal.

| | | | | | | | |

| | 2024 Proxy Statement | 26 |

| | | | | | | | | | | | | | | | | | | | |

| | | Strong Independent Leadership

Ambassador Kimmitt has significant responsibilities as our Lead Independent Director, including working with the Chairman to set agendas for meetings of our board of directors and having authority to call special meetings of our board of directors, and is appointed annually by our independent directors. | | | Independent Nominations

Our independent compensation, nominating & governance committee has sole authority to recommend nominees to our board of directors and recommend the appointment of candidates to our privacy committee. |

Board Leadership and Independence Highlights

|

| | | | | | |

| | | | | | |

Nearly All Directors Are Independent

All of our director nominees are independent, with the exception of our CEO. All members of our standing committees are independent. | | | Executive Sessions

Independent directors regularly meet in executive sessions, which are led by our Lead Independent Director without management present. | | | Balanced Board Tenure

Eight out of ten of our director nominees have a tenure of less than five years, and the remaining nominees have a tenure of greater than ten years. |

| | | | | | |

BOARD COMPOSITION

Our board of directors believes that its composition appropriately reflects the knowledge, experience, skills, diversity, and other characteristics required to fulfill its duties. The following tables provide information regarding the diversity, age, and tenure of our directors as of April 19, 2024:

| | | | | | | | | | | | | | |

Board Diversity Matrix (as of April 19, 2024) | | | | |

| Total Number of Directors | 11 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

Directors | 4 | 7 | - | - |

| Number of Directors who Identify in Any of the Categories Below: | | | | |

| African American or Black | 2 | - | - | - |

Alaskan Native or Native American | - | - | - | - |

Asian | - | 2 | - | - |

Hispanic or Latinx | 1 | - | - | - |

Native Hawaiian or Pacific Islander | - | - | - | - |

White | 3 | 5 | - | - |

| Two or more races or ethnicities | 1 | - | - | - |

| LGBTQ+ | - |

Did not disclose demographic background | - |

| | | | | | | | |

27 | 2024 Proxy Statement | | |

BOARD LEADERSHIP STRUCTURE

We believe that our current board structure is effective in supporting strong board leadership. The board of directors has determined in its judgment that the company benefits from having a combined Chairman and CEO position at this time. Mr. Zuckerberg's unique perspective and experience, as highlighted more fully below, are valuable in setting the overall direction and business and product strategy for the company. As a counter-balance to Mr. Zuckerberg's combined Chairman/CEO role, the board has a strong Lead Independent Director role to further promote effective corporate governance. Our Lead Independent Director is appointed annually by our independent directors, and Ambassador Kimmitt currently serves in this role.

Mr. Zuckerberg brings valuable insight to our board of directors due to his perspective and experience as our founder and CEO. As a result of his leadership since our inception, Mr. Zuckerberg has unparalleled knowledge of our business, products, and operations, as well as experience navigating opportunities and challenges particular to our company. As our largest and controlling shareholder, Mr. Zuckerberg is also invested in our long-term success. Ambassador Kimmitt brings extensive governance, legal, and compliance experience, including through service in the public sector and experience navigating complex business opportunities and challenges in the private sector, and plays a significant and meaningful role in leading our board of directors.

The Chairman and the Lead Independent Director work together to facilitate effective oversight, governance, and policy- and decision-making by the board of directors. The Chairman and the Lead Independent Director collaborate to set the agenda for meetings of the board of directors, and either may call special meetings of the board of directors. As Chairman, Mr. Zuckerberg presides over meetings of the board of directors. As our Lead Independent Director, Ambassador Kimmitt provides independent oversight and promotes effective communication between our board of directors and management, including Mr. Zuckerberg. As more fully described in our corporate governance guidelines, our Lead Independent Director role also includes the following authority and responsibilities, among others:

•presiding at all meetings of the board of directors at which the Chairman is not present, including executive sessions of the independent directors;

•calling separate meetings of the independent directors;

•facilitating discussion and open dialogue among the independent directors during meetings of the board of directors, executive sessions, and otherwise;

•serving as principal liaison between the independent directors and the Chairman;

•providing the Chairman with feedback and counsel concerning his interactions with the board of directors;

•providing leadership to the board of directors if circumstances arise in which the role of the Chairman may be, or may be perceived to be, in conflict;

•taking into account input from other independent directors in coordinating with the Chairman to set the agenda for meetings of the board of directors; and

•leading our board of directors in governance matters in coordination with our compensation, nominating & governance committee, including the evaluation of the performance of the CEO, the selection of committee chairs and memberships, and our annual board of directors and committee self-evaluations.

Our Lead Independent Director also performs such additional duties as the board of directors may otherwise determine and delegate.

INDEPENDENT BOARD OVERSIGHT

We believe that our current board structure enables independent board oversight. All of the standing committees of our board of directors are comprised of independent directors. The board of directors also establishes ad hoc special committees of independent directors from time to time, as appropriate. We have a Lead Independent Director who has authority that mirrors that of the Chairman, including coordinating board meeting agendas and the ability to call special meetings of the board of directors. Our Lead Independent Director regularly interacts with the independent directors on an individual basis, and also meets with the chief executive officer and shares perspectives from the independent directors.

The independent compensation, nominating & governance committee reviews and approves the compensation of our chief executive officer, including perquisites related to executive security. In addition, the performance of our Chairman and chief executive officer is evaluated by all of the independent directors of the board, and our Lead Independent Director provides our chief executive officer with feedback regarding his performance.

| | | | | | | | |

| | 2024 Proxy Statement | 28 |

BOARD COMMITTEES

Our board of directors has established an audit & risk oversight committee, a compensation, nominating & governance committee, and a privacy committee, each of which has the composition and responsibilities described below. Our board of directors has adopted a written charter for each of these standing committees, which are available at investor.fb.com/leadership-and-governance. From time to time, the board of directors may also establish ad hoc committees to address particular matters.

| | | | | | | | | | | | | | | | | | | | |

Director Nominee | | Audit & Risk Oversight Committee | | Compensation, Nominating & Governance Committee | | Privacy Committee |

| Peggy Alford | | | | | | |

| Marc L. Andreessen | | | | | | |

John Arnold | | | | | | |

| Andrew W. Houston | | | | | | |

| Nancy Killefer | | | | | | |

| Robert M. Kimmitt | | | | | | |

Hock E. Tan | | | | | | |

| Tracey T. Travis | | | | | | |

| Tony Xu | | | | | | |

Mark Zuckerberg | | | | | | |

| | | | | | | | | | | |

| Committee member | | Committee chair |

The charts below provide information about the responsibilities and membership of our standing committees.

| | | | | | | | |

AUDIT & RISK OVERSIGHT COMMITTEE |

| | |

Chair: Tracey T. Travis Other Members: Peggy Alford John Arnold Nancy Killefer Hock E. Tan Committee Meetings in 2023: 10 | | Principal Responsibilities •Selecting the independent registered public accounting firm to audit our financial statements •Ensuring the independence of the independent registered public accounting firm •Discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results •Developing procedures to enable submission of anonymous concerns about accounting or auditing matters •Considering the adequacy of our internal accounting controls and audit procedures •Reviewing related party transactions •Reviewing our program for promoting and monitoring compliance with applicable legal and regulatory requirements •Reviewing our environmental, social, and governance program and strategy •Overseeing our major risk exposures (including in the areas of financial and enterprise risk, legal and regulatory compliance, cybersecurity, and special topics including content governance, community safety and security, human rights, and civil rights) and the steps management has taken to monitor and control such exposures, and assisting our board of directors in overseeing the risk management of our company •Pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm •Overseeing our internal audit function •Overseeing significant financial matters, including our tax policies, planning, and compliance, treasury policies, and share repurchase activities

Independence and Other Qualifications •Each committee member satisfies the independence standards for audit committees established by applicable SEC rules and Nasdaq rules. •Ms. Travis qualifies as an audit committee financial expert, as that term is defined under SEC rules, and possesses financial sophistication as defined under Nasdaq rules. |

| | |

| | | | | | | | |

29 | 2024 Proxy Statement | | |

| | | | | | | | |

COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE |

| | |

Chair: Peggy Alford

Other Members: Marc L. Andreessen Andrew W. Houston Tony Xu

Committee Meetings in 2023: 6 | | Principal Responsibilities •Evaluating the performance of our executive officers •Evaluating, recommending, approving and reviewing executive officer compensation arrangements, plans, policies and programs maintained by us •Administering our equity-based compensation plans and our annual bonus plan •Considering and making recommendations regarding non-employee director compensation •Considering and making recommendations to our board of directors regarding its remaining responsibilities relating to executive compensation •Reviewing and developing policies regarding the desired knowledge, experience, skills, diversity, independence, and other characteristics of members of our board of directors and its committees, as well as our director nomination and committee appointment processes •Identifying, evaluating, and recommending potential candidates for nomination to and membership on our board of directors and certain of its committees, including having sole authority to recommend nominees to our board of directors •Having sole authority to recommend the appointment of candidates to, or removal of members from, our privacy committee •Monitoring succession planning for our board of directors and certain of our key executives •Developing and recommending corporate governance guidelines and policies •Overseeing the annual self-evaluation process for our board of directors and committees thereof •Reviewing and granting proposed waivers of the code of conduct for executive officers •Reviewing and approving policies and procedures with respect to the clawback or recoupment of compensation from our current or former officers, employees, directors, or other individuals •Advising our board of directors on corporate governance matters and board of director performance matters, including recommendations regarding the size, structure, and composition of our board of directors and committees thereof

Independence and Other Qualifications •Each committee member satisfies the independence standards for compensation committees established by applicable SEC rules and Nasdaq rules, and otherwise meets the independence requirements under our FTC consent order. •Each committee member is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. |

| | |

| | | | | | | | |

PRIVACY COMMITTEE |

| | |

Chair: Nancy Killefer

Other Members: Peggy Alford Robert M. Kimmitt

Committee Meetings in 2023: 6 | | Principal Responsibilities •Overseeing our comprehensive privacy program adopted in compliance with our FTC consent order •Overseeing management's periodic assessment of the privacy program and any related policies with respect to risk assessment and risk management •Overseeing the selection and performance of employees to coordinate and be responsible for the privacy program •Overseeing the selection of an independent, third-party assessor to review our privacy practices, as well as the assessor's biennial assessments of the privacy program •Overseeing the activities of the internal audit function related to privacy and data use •Overseeing our compliance with the European Digital Markets Act and other privacy and data use laws

Independence and Other Qualifications •Each committee member is an independent director under Nasdaq rules, and otherwise meets the independence requirements under our FTC consent order. •Our compensation, nominating & governance committee has recommended the appointment of each member to the privacy committee and determined that each such member meets the privacy and compliance baseline requirements for committee membership under our FTC consent order. |

| | |

Equity Subcommittee

The charter for our compensation, nominating & governance committee allows the committee from time to time to delegate its authority to subcommittees and to our officers as it deems appropriate and to the extent permitted under applicable law, Securities and Exchange Commission (SEC) and The Nasdaq Stock Market LLC (Nasdaq) rules, and our certificate of incorporation and bylaws (except with respect to the recommendation of director nominees and other actions within the sole authority of the compensation, nominating & governance committee). To ease with the administration of our broad employee

| | | | | | | | |

| | 2024 Proxy Statement | 30 |

equity program, our compensation, nominating & governance committee has delegated the authority to review and approve grants of restricted stock units (RSUs) to employees and consultants, other than to our directors and executive officers, to an equity subcommittee. This subcommittee is currently comprised of Ms. Li and Ms. Newstead, and they can act individually or jointly. RSU grants to our directors and executive officers are reviewed and approved by our compensation, nominating & governance committee.

BOARD ROLE IN RISK OVERSIGHT

Our board of directors has responsibility for overseeing our risk management and believes that a thorough and strategic approach to risk oversight is critical. The board of directors exercises this oversight responsibility directly and through its committees. The oversight responsibility of the board of directors and its committees is informed by regular reports from our management team, including senior personnel that lead a variety of functions across the business, our internal audit department, and input from external advisors, as appropriate. These reports are designed to provide timely visibility to the board of directors and its committees about the identification and assessment of key risks, our risk mitigation strategies, and ongoing developments. Each committee also provides regular reports to the full board of directors regarding its oversight activities.

The following table presents a summary of the specific allocation of general risk oversight functions among the board, the board's committees, and management:

| | | | | | | | |

BOARD OF DIRECTORS |

|

•Strategic and business risk management •CEO succession planning |

|

| | | | | | | | | | | | | | |

AUDIT & RISK OVERSIGHT COMMITTEE | | PRIVACY COMMITTEE | | COMPENSATION, NOMINATING & GOVERNANCE COMMITTEE |

| | | | |

•Financial and enterprise risk •Legal and regulatory compliance •Environmental, social, and governance policies and practices •Cybersecurity •Risks associated with special topics including content governance, community safety and security, human rights, and civil rights •Policies and procedures for assessing and managing risk •Internal audit function

| | •Privacy and data use, including legal and regulatory compliance •Compliance with comprehensive privacy program adopted in compliance with FTC consent order •Steps taken or planned to monitor or mitigate privacy and data use risks •Selection of independent, third-party assessor to review our privacy practices, oversight of the biennial assessments, and regular engagement with the assessor •Other privacy and product-related matters including artificial intelligence as well as youth and well-being | | •Director elections and corporate governance practices •Compensation policies and practices, including compensation philosophy, objectives, and design •Succession planning for our board of directors, including sole responsibility for director nominations and appointments to and removals from the Privacy Committee •Succession planning for certain key executives other than the CEO |

| | | | |

| | | | | | | | |

SENIOR MANAGEMENT |

|

•The identification and assessment of key risks, risk mitigation strategies, and ongoing developments, and regularly reporting to our board of directors and its committees on the most significant risks and management's plans to address those risks |

|

| | | | | | | | |

31 | 2024 Proxy Statement | | |