UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal year ended

OR

For the transition period from to

Commission

File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

| (Address of principal executive office) | (Zip Code) |

Registrant’s

telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The

aggregate market value of our common stock held by non-affiliates as of June 30, 2022, was approximately $

The number of shares outstanding of the registrant’s Common Stock as of April 17, 2023 was shares.

DOCUMENTS INCORPORATED BY REFERENCE

PART I

ITEM 1. BUSINESS

Cautionary Note Regarding Forward-Looking Statements; Risk Factor Summary

This Annual Report on Form 10-K contains “forward-looking statements,” which include information relating to future events, future financial performance, financial projections, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements are based on information we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to a number of risks, and uncertainties and assumptions that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks are more fully described in the “Risk Factors” section of this Annual Report on Form 10-K. The following is a summary of such risks:

| ● | Our history of losses and expectation of continued losses. | |

| ● | Global economic and political instability and conflicts, such as the conflict between Russia and Ukraine, could adversely affect our business, financial condition or results of operations | |

| ● | Increasing inflation could adversely affect our business, financial condition, results of operations or cash flows. | |

| ● | The geographic, social and economic impact of COVID-19 on the Company’s business operations. | |

| ● | Our ability to raise funding for, and the timing of, clinical studies and eventual U.S. Food and Drug Administration (“FDA”) approval of our product candidates. | |

| ● | Regulatory actions that could adversely affect the price of or demand for our approved products. | |

| ● | Market acceptance of existing and new products. | |

| ● | Favorable or unfavorable decisions about our products from government regulators, insurance companies or other third-party payers. | |

| ● | Risks of product liability claims and the availability of insurance. | |

| ● | Our ability to successfully develop and commercialize our products. | |

| ● | Our ability to generate internal growth. | |

| ● | Risks related to computer system failures and cyber-attacks. | |

| ● | Our ability to obtain regulatory approval in foreign jurisdictions. | |

| ● | Uncertainty regarding the success of our clinical trials for our products in development. | |

| ● | Risks related to our operations in Israel, including political, economic and military instability. | |

| ● | The price of our securities is volatile with limited trading volume | |

| ● | Our ability to comply with the continued listing requirements of the Nasdaq capital market. | |

| ● | Our ability to maintain effective internal control over financial reporting and to remedy identified material weaknesses. | |

| ● | We are a “smaller reporting company” and have reduced disclosure obligations that may make our stock less attractive to investors. | |

| ● | Our intellectual property portfolio and our ability to protect our intellectual property rights. | |

| ● | Our ability to recruit and retain qualified regulatory and research and development personnel. | |

| ● | Unforeseen changes in healthcare reimbursement for any of our approved products. | |

| ● | The adoption of health policy changes and health care reform. | |

| ● | Lack of financial resources to adequately support our operations. | |

| ● | Difficulties in maintaining commercial scale manufacturing capacity and capability. | |

| ● | Changes in our relationship with key collaborators. | |

| ● | Changes in the market valuation or earnings of our competitors or companies viewed as similar to us. | |

| ● | Our failure to comply with regulatory guidelines. |

| 1 |

| ● | Uncertainty in industry demand and patient wellness behavior. | |

| ● | General economic conditions and market conditions in the medical device industry. | |

| ● | Future sales of large blocks of our common stock, which may adversely impact our stock price. | |

| ● | Depth of the trading market in our common stock. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Item 1A. Risk Factors” for additional risks which could adversely impact our business and financial performance. Moreover, new risks regularly emerge, and it is not possible for us to predict or articulate all risks we face, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Form 10-K are based on information available to us on the date hereof. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Unless the context otherwise indicates or requires, the terms “we,” “our,” “us,” “NanoVibronix,” and the “Company,” as used in this Annual Report on Form 10-K, refer to NanoVibronix, Inc. and its subsidiaries as a combined entity, except where otherwise stated or where it is clear that the terms mean only NanoVibronix, Inc. exclusive of its subsidiaries.

Overview

We were organized as a Delaware corporation in October 2003. Through our wholly-owned subsidiary, NanoVibronix Ltd., a private company incorporated under the laws of the State of Israel, we focus on noninvasive biological response-activating devices that target biofilm prevention, pain therapy, and wound healing and can be administered at home, without the assistance of medical professionals. Our primary products, which are in various stages of clinical and market development, currently consist of:

| ● | UroShield™, an ultrasound-based product that is designed to prevent bacterial colonization and biofilm in urinary catheters, increase antibiotic efficacy and decrease pain and discomfort associated with urinary catheter use, which has been marketed in the U.S. under FDA’s policy of enforcement discretion during the COVID-19 pandemic and is currently undergoing clinical testing that will, hopefully, support 510(k) clearance; | |

| ● | PainShield™, a patch-based therapeutic ultrasound technology to treat pain, muscle spasm and joint contractures by delivering a localized ultrasound effect to treat pain and induce soft tissue healing in a targeted area. Our PainShield family of products include: |

| ● | PainShield™ MD, a single patch-based therapeutic ultrasound technology to treat pain, muscle spasm and joint contractures by delivering a localized ultrasound effect to treat pain and induce soft tissue healing in a targeted area. | |

| ● | PainShield™ Plus, a dual patch-based therapeutic ultrasound technology to treat pain, muscle spasm and joint contractures by delivering a localized ultrasound effect to treat pain and induce soft tissue healing in a targeted area. Similar to PainShield MD, it has a dual ultrasound delivery; and, |

| ● | WoundShield™, a patch-based therapeutic ultrasound device intended to facilitate tissue regeneration and wound healing by using ultrasound to increase local capillary perfusion and tissue oxygenation. |

Each of our UroShield, PainShield, and WoundShield products employs a small, disposable transducer that transmits low frequency, low intensity ultrasound acoustic waves that seek to repair and regenerate tissue, musculoskeletal and vascular structures, and decrease biofilm formation on urinary catheters and associated urinary tract infections. Through their size, effectiveness and ease of use, these products are intended to eliminate the need for technicians and medical personnel to manually administer ultrasound treatment through large transducers, thereby promoting patient independence and enabling more cost-effective home-based care.

| 2 |

PainShield™, MD is currently cleared for marketing in the United States by the U.S. Food and Drug Administration (“FDA”). In September 2020, the FDA exercised its Enforcement Discretion to allow distribution of the UroShield device in the U.S. during the COVID-19 health emergency. While the permitted use is currently temporary, it does permit the import of the UroShield to the U.S. during the ongoing COVID-19 pandemic. Our understanding is that this permitted use will be terminated six months after the health emergency is officially ended. All three of our products have CE Mark approval in the European Union, and a certificate allowing us to sell PainShield and UroShield in Israel. We are able to sell PainShield and UroShield in India and Ecuador based on our CE Mark. We have consummated sales of PainShield and UroShield in the relevant markets, and we saw sales increase in 2021, but decline slightly in 2022. WoundShield has not generated significant revenue to date. Outside of the United States we generally apply, through our distributor, for approval in a particular country for a particular product only when we have a distributor in place with respect to such product.

In the United States, PainShield and UroShield require a prescription from a licensed healthcare practitioner. If FDA clearance is obtained, we anticipate that WoundShield will require a prescription from a licensed healthcare practitioner in the United States. As stated previously, UroShield has been approved through the FDA under Enforcement Discretion for the duration of the Covid-19 health emergency and is intended to be sold directly to health care facilities and individuals. Individuals will require a prescription but healthcare facilities will deploy based upon clinical need. However, in other countries in which we sell PainShield, UroShield, and WoundShield, such products are eligible for sale without a prescription.

In addition to the need to obtain regulatory approvals, we anticipate that sales volumes and prices of our UroShield and PainShield, products will depend in large part on the availability of insurance coverage and reimbursement from third party payers. Third party payers include governmental programs such as Medicare and Medicaid in the United States, private insurance plans and workers’ compensation plans. We do not currently have reimbursement codes for use of WoundShield in any of the markets in which we have regulatory authority to sell WoundShield. Of the markets in which we have regulatory authority to sell PainShield, prior to January 2020, we only had reimbursement codes in the United States (i.e., CPT codes) for clinical use only. Effective as of January 2020, the U.S. Centers for Medicare and Medicaid Services (“CMS”) approved our PainShield™ for reimbursement for Medicare beneficiaries on a national basis. However, the company continues to work toward a reimbursement value from CMS. We are working with qualified legal representation toward that goal. The company was denied reimbursement in September 2022 due to a lack of “life-cycle” testing. The company has engaged Carmel Labs in Israel to conduct this testing. We are approximately 85% of the way through this testing, with all devices working properly. In January 2023, we submitted another application to CMS with “life-cycle” testing pending. Along with our application, we submitted an interim report which was positive in nature. The latest CMS application will include both PainShield and UroShield products and supplies. With respect to UroShield, which may be used in a clinical and home setting, we do not currently have reimbursement codes in any of the markets in which we have regulatory authority to sell UroShield. We are seeking reimbursement codes for use of our products in the markets in which we have regulatory authority, including the United States, to sell such products. Our current ongoing research and planned research may facilitate our ability to obtain reimbursement codes and there is no guarantee that we will be successful in obtaining such codes quickly, or at all. We have engaged a reimbursement expert, the law firm of Brown and Fortunato as regulatory counsel, to help facilitate our applications, potentially leading to reimbursement.

We have completed seven separate clinical studies with UroShield that together evaluated approximately 220 patients with urinary catheters. In patients where the UroShield product was used there were no serious adverse events reported, while a variety of clinical beneficial observations were seen including: catheter biofilm reduction, reduction in catheter associated pain, reduction in urinary tract infections, and a significant decrease in bacteriuria rates. We completed a double blind clinical trial for UroShield in the United States in October 2018. The results of the study, entitled “The Effect of Surface Acoustic Waves on Bacterial Load and Preventing Catheter-Associated Urinary Tract Infections (CAUTI) in Long Term Indwelling Catheters,” were published in the December 2018 issue of Medical & Surgical Urology, a peer-reviewed journal in the field of urology. In the study, 55 patients in skilled nursing facilities treated with long term indwelling catheters were evaluated. There was a significant difference between the treated group and the placebo group in the number of colony forming units (“CFU”) present upon evaluation, as well as on the number of treated urinary tract infections (“UTI”), and the effect lasted beyond the time of active treatment. The study concluded that the UroShield™ device was shown to be effective in significantly reducing the number of CFUs in patients with indwelling catheters. The study also concluded that the UroShield™ device was shown to be effective in reducing the number of treated UTIs in this patient population, and surface acoustic waves in the form of the UroShield™ device is an effective tool in the prevention of catheter-associated UTI and while further evaluation is encouraged, can be safely utilized with a high likelihood of success. In July 2017, we engaged Idonea Solutions, Inc., an FDA consultant, to assist in our efforts to obtain clearance under the FDA’s Enforcement Discretion, and obtain 510(k) clearance which is still ongoing. If we are successful, we intend to pursue obtaining reimbursement codes and to target completion of partnerships with leading catheter product companies and distributors for sales and marketing efforts in the United States. The Company has entered into recent distribution partnerships for UroShield in the U.K., Australia, and Malta.

| 3 |

We have one clinical study recently completed for our product UroShield. We announced positive interim results from an independent, real world patient study of UroShield at Southampton University Health Sciences in December 2021. The independent study, which was launched in the first half of 2021, was devised to evaluate how UroShield helps to reduce infection by preventing bacteria colonization and the buildup of biofilms on long-term indwelling urinary catheters in real world patients and to better understand the patient benefits and experiences of using UroShield. The study consists of both laboratory and patient studies and is nearing completion. At the conclusion of the study, Southern Health reported a significant reduction in catheter blockage and a positive effect on the microbiome. Full results of the study are expected to be published in 2023.

In addition, we continue to expand our clinical development and marketing efforts in North America with respect to PainShield. In February 2018, we completed a clinical trial to evaluate the effect of PainShield in patients with trigeminal neuralgia. The double blinded, crossover trial was conducted across the United States and included 59 patients with a diagnosis of unilateral trigeminal neuralgia. Among the 59 patients, 30 were in the active treatment group and 29 were in the control group. The values which were assessed included the Visual Analog Scale (“VAS”) pain score, both baseline prior to trial and VAS pain score at the end of the study. The study also assessed breakthrough medications per week at the start of the trial and breakthrough medications per week at the end of the trial, with a particular focus on the use of opioids. Breakthrough medications are used for chronic pain directly related to the pre-existing trigeminal neuralgia condition. There was a significant difference in the outcomes of the two groups relative to pain, quality of life, and breakthrough medications taken, which was directly correlated to pain experienced during treatment. Specifically, the control group saw an improvement in baseline scores of 2.3% versus the treatment group, which saw a 55.2% improvement in baseline scores. Additionally, the control group saw a reduction in breakthrough pain medication of 1.5% versus the treatment group, which saw a 46.4% reduction in breakthrough pain medication.

We are currently in advanced negotiations with a major teaching medical university to conduct a study on UroShield, which is intended to satisfy the FDA requirements for traditional 510k clearance. We expect that study to commence in either the third or fourth quarter of 2023.

In 2019, the Company completed a study which was intended to assess the PainShield’s ability to effectively treat Lateral Epicondylitis (Tennis Elbow). This was a double blinded, randomized control trial. The study has been completed and we are contemplating submission to an appropriate journal. The interim results were reported as follows:

| ● | 91% of the patients in the PainShield treatment group had complete or partial resolution of symptoms. Patients used PainShield in conjunction with over-the-counter medication, as needed, but without the benefit of opioid-based prescription medication. |

We believe results of the Birmingham study could further reinforce that PainShield is safe, easy-to-use and highly effective in treating soft tissue pain. Patients in the study who wore our device reported marked reduction in pain and when combined with over-the-counter, anti-inflammatory medications, those same patients reported a complete resolution of symptoms within 10 days.

Dr. David Lemak, MD, Lead Investigator of the Birmingham Study, added, “Patient outcomes were markedly improved with the use of PainShield and importantly, no patients returned with signs or symptoms of an exacerbation. Most encouraging are the results we were able to achieve for our patients without the use of prescription opioid medications, which can often lead to prolonged use and addiction.”

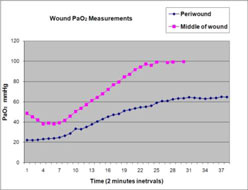

WoundShield has been evaluated in two published clinical studies done to-date that suggest improved localized blood flow and oxygenation, and improved topical oxygen saturation (Morykwas M, “Oxygen Therapy with Surface Acoustic Waveform Sonication,” European Wound Management Association 2011; Covington S, “Ultrasound-Mediated Oxygen Delivery to Lower Extremity Wounds,” Wounds 2012; 24(8)). We supplied devices for these studies but had no further involvement with them.

| 4 |

Recent Developments

On March 21, 2023 we announced that we filed a new provisional patent application with the United States Patent and Trademark Office (“USPTO”) entitled “Multiple Frequency Surface Acoustic Waves for Internal Medical Device” (the “Patent Application”) related to its UroShield. The Patent Application covers a recently developed enhancement to the UroShield product, UroShield “Ultra”, which incorporates improvements to the Company’s original UroShield. The next generation UroShield Ultra includes modified housing that is designed to improve catheter coupling and incorporates multiple actuators that work in sequence to discourage bacterial docking by delivering SAWs at multiple frequencies directly to indwelling catheters.

On March 15, 2023 we announced the positive evaluation results for our UroShield device, presented at a recent medical conference by clinicians from the Royal National Orthopaedic Hospital (“RNOH”). The report concluded that our UroShield device showed a decrease in the number of blockages and infections and an increase in catheter satisfaction in the patients studied. In addition, evaluators concluded that the device has the potential to improve quality of life and reduce healthcare associated costs for patients with spinal cord injuries who experience recurrent blockages or infections and who have complicated catheter issues.

In April 2022, we announced that UroShield was approved for sale by NHS Supply Chain through a new contract. This new contract with NHS Supply Chain provides a dedicated end-to-end supply chain service of our UroShield for every NHS healthcare organization. UroShield will be available to all patients who need the device with full clinical support, through the NHS supply chain. On September 23, 2022, UroShield was approved for sale by the NHS Supply Chain through a new contract. The new contract, which is designed to provide new innovative products for healthcare providers, begins in October 2022 and will merge with the existing Urology and Stoma framework contract in February 2024 with optional extension periods.

PainShield was granted a dedicated reimbursement code (K1004) by CMS in 2021, which was an initial step towards paving the way for many millions of beneficiaries enrolled in Medicare to have access to our product. In addition, CMS expanded its reimbursement approval of the company’s PainShield™ product by adding the device to its Durable Medical Equipment (DME) schedule. ricing was not established at that time, and our efforts to obtain favorable pricing resulted in a denial, pending further testing of the device’s life expectancy. Testing to gather life expectancy data began in October 2022, and we are preparing to demonstrate the life expectancy in the next few months. We are hopeful of a positive outcome that will allow us to secure pricing and remove the barriers for distribution to beneficiaries under Medicare.

On February 26, 2021, Protrade Systems, Inc. (“Protrade”) filed a Request for Arbitration (the “Request”) with the International Court of Arbitration (the “ICA”) of the International Chamber of Commerce alleging the Company is in breach of an Exclusive Distribution Agreement dated March 7, 2019 (the “Agreement”) between Protrade and the Company. Protrade alleges, in part, that the Company has breached the Agreement by discontinuing the manufacture of the DV0057 Painshield MD device in favor of an updated 10-100-001 Painshield MD device. Protrade claims damages estimated at $3 million. The Company vigorously defended the claims asserted by Protrade.

| 5 |

On March 15, 2022, the arbitrator issued a final award, which, although denied all Protrade’s claims, nevertheless awarded Protrade about $1.5 million, on the grounds that the Company allegedly failed to fulfill an order for reusable hydrogel patches placed after the Agreement was terminated. The arbitrator based her decision on the basis of testimony of Protrade’s president who asserted that a patient would use in excess of 33 reusable patches per each device, which the Company believes is a grossly inflated number.

On April 5, 2022, Protrade filed a Petition with the Supreme Court of New York Nassau County seeking to confirm the Award. On April 13, 2022, the Company submitted an application to the ICA seeking to correct an error in the award based on the evidence that the Company only sold 2-3 reusable patches per device contrary to the 33 reusable patches claimed by Protrade. The same arbitrator who issued the award, denied the application.

On July 22, 2022, the Company filed a cross-motion seeking to vacate the arbitration award on the grounds that the arbitrator exceeded her authority, that the award was procured by fraud, and that the arbitrator failed to follow procedures established by New York law. In particular, the Company averred in its motion that Protrade’s witness made false statements in arbitration, and that the arbitrator resolved a claim that was never raised by Protrade and that has no factual basis.

On October 3, 2022, the court issued a decision granting Protrade its petition to confirm the Award and denying the cross-motion.

On November 9, 2022, the Company filed a motion to re-argue and renew its cross-motion to vacate the arbitration decision based on newel information that was not available during the initial hearing. On the same day, the Company also filed a notice of appeal with the Appellate Division, Second Department. On March 21, 2023, the Court denied the motion to re-argue and renew. The Company intends to file a notice of appeal with the Appellate Division, Second Department and to continue to vigorously pursue its opposition to the award in all appropriate fora. As of December 31, 2022, the Company accrued the amount of the award to Protrade amounting to $1,846,794 with $1,500,250 as part of “General and administrative expenses” and $346,544 as part of “Interest expense”, and the full amount included in “Other accounts payable and accrued expenses”.

Business Model

All of our products consist of a reusable controller device and a disposable component, which includes a transducer, and in the case of PainShield, a 30 day supply of adhering patches. The controllers have a life expectancy of three years, while the UroShield disposable transducer has a life expectancy of up to a month and must be replaced to provide the intended therapy. The components are purchased by either the distributor or end user for use in any of the intended applications. Once the controller is purchased by the end user, recurring revenue will be realized by purchases of replacement disposables to the extent that the end user continues treatment with our product.

Our products are intended to be distributed directly by the company, independent distributors, and potential licensees. Distributor cost is discounted to account for their intended margins, based upon purchase volumes and/or periodic purchase commitments, with the disposable transducer sold and distributed in the same fashion. We currently have an established distributor network and are implementing certain criteria within such network to ensure the appropriate assignment of a distributor or licensee. We are in the process of adding additional distributors to our network, and continue our efforts to identify market leaders in various segments to private label both PainShield and UroShield.

We also have a direct sales component, where we sell directly to consumers, in order to satisfy customer demand generated through on-line advertising and social media. We have seen an increase in demand as a direct result of an expanded social media and on-line advertising presence.

Our business plan continues to focus on these types of transactions/agreements. We continue to focus on the foundational aspects of each respective product, including the design and performance of each, the reimbursement, regulatory status, and quality control, in order to strengthen our position with prospective partners.

| 6 |

Ultrasound Technology and Our Products

As noted above, our primary products are based on the use of low frequency ultrasound, which delivers energy through mechanical vibrations in the form of sound waves. Ultrasound has long been used in physical therapy, physical medicine, rehabilitation and sports medicine.

Our proprietary PainShield technology consists of a small, thin (1 millimeter) transducer that is capable of transmitting ultrasonic acoustic waves onto treatment surfaces with a radius of up to 10 centimeters beyond the transducer. This technology allows us to treat pain by implanting our transducers into a small, portable self-adhering acoustic patch, thereby eliminating the need for technicians and medical personnel to manually administer ultrasound therapy, which should reduce the cost of therapy. Moreover, we believe that, based upon the body of evidence, the delivery of ultrasound through our portable devices may provide a competitive advantage over other existing therapies marketed for similar intended use(s) (e.g., to treat pain associated with muscle, tendon, and contractures), as our technology is positioned to directly target the affected areas of the body within the scope of the applicable FDA clearance.

While there are currently a number of products on the market that treat pain through ultrasound therapy, we believe that our products may be preferable in certain instances because they are portable, without the requirement to be plugged into an outlet and they have a frequency of 100kHz (in contrast to other devices, which have a frequency of closer to 1MHz and above), which means our products, when functioning as intended and in accordance with applicable design specifications, should not produce excessive heat that can damage tissue. Our products can therefore (i) be self-administered by the patient without the need to be moved about the treated area by the patient or a clinician, (ii) be applied for a significantly longer period without the risk of tissue damage and (iii) do not require the use of gel. We are also aware of one product, the SAM® Sport family of products, which received FDA approval and has CE Mark approval, marketed by ZetrOZ, Inc., that we understand may eliminate certain of these requirements and limitations, namely the requirement to be plugged in, the need for movement around the treated area and the relatively short safe treatment period. However, we understand that this product does not generate surface acoustic waves as our products do, which means that the treatment area is generally limited to that under the transducer, that the use of transmission gel is still required, and that the transducer thickness is significantly greater than ours (approximately 1.5cm). It is also our understanding that the FDA has issued contraindications which do not apply to the PainShield product.

There has been an article published in 2019 on SAM® Sport4 regarding clinical evidence demonstrating that ultrasound dose timing (i.e. daily treatment) and duration significantly impact benefits and treatment results, we are aware of a prospective randomized, double-blinded, placebo-controlled study on the effects of the long-duration low-intensity ultrasound treatment using SAM® Sport4 suggesting that ultrasound may be used as a conservative non-pharmaceutical and non-invasive treatment option for patients with knee osteoarthritis.

In general, ultrasound offers the benefits by increasing local blood circulation, increasing vascular wall permeability, promoting protein secretion, promoting enzymatic reactions, accelerating nitric oxide production, promoting angiogenesis (the formation of new blood vessels from pre-existing vessels) and promoting fibroblast proliferation (fibroblasts are a type of cell that play a critical role in soft tissue healing). We believe that the body of evidence, and the positive therapeutic effect that ultrasound has for various indications, potentially provides for future product development opportunities for us.

| 7 |

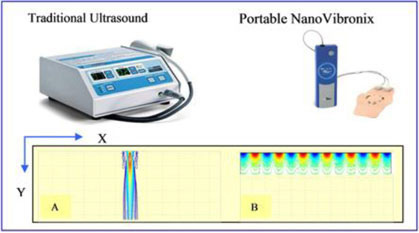

Traditional ultrasound device and our portable ultrasound patch-based device and a comparison of their energy distribution, where the X-axis represents treatment surface, and the Y-axis represents ultrasound energy penetration depth within tissue.

The PainShield Plus was introduced in March 2022. The new product design provides the same therapy as PainShield MD, but through two transducers which alternate in its duty cycle. This dual transducer design provides for a broader treatment are with three hours of therapy.

In a comparison of a traditional ultrasound device and our portable ultrasound patch-based device, the bulk wave conventional ultrasound machines with handheld transducers distribute the energy deeply into the body, as shown above in diagram (A) on the left. In comparison, our device distributes the energy on the surface, as shown in diagram (B), thereby meaningfully increasing the treatment area. Our transducers may also be incorporated into treatment patches, including patches that are designed to deliver medicine and other compounds through the skin. The generation and delivery of low frequency ultrasound over a period of time to a specific area has been termed “targeted slow-release ultrasound”. We believe that this delivery method of ultrasound may be comparable to that of slow release medication in the pharmaceutical industry. This “targeted slow-release” capability is intended to allow for more frequent targeting of the intended treatment area and thus may result in a more effective therapeutic response.

Micro Vibrations Technology and Our Products

In a 2007 study, mean blood flow increase was higher in the vibration group than the placebo group. Improvements in local blood flow may be beneficial in the therapeutic alleviation of pain or other symptoms resulting from acute or chronic injuries (C. Button et al., “The effect of multidirectional mechanical vibration on peripheral circulation of humans”, University of Otago New Zealand, Clinical Physiology and functional Imaging, 2007 27, p211-216). A study on the effect of whole body vibration on lower extremity skin blood flow suggests, that short duration vibration alone significantly increases lower extremity skin blood flow, doubling skin blood for a minimum of 10 minutes following treatment (Lohman et al., “The effect of whole body vibration on lower extremity skin blood flow in normal subjects”, Department of Physical Therapy, Loma Linda university, USA, Med Sci Monit, 2007; 13(2) 71-76). Vibration has also been shown to stimulate angiogenesis and growth factors such as vascular endothelial growth factor (Suhr F et al., “Effects of short-term vibration and hypoxia during high intensity cycling exercise on circulating level of angiogenic regulators in humans”, J Appl Physiol, 2007, 103:474-483, Yue Z. et al., “On the cardiovascular effects of whole-body vibration I. Longitudinal effects: hydrodynamic analysis”, Studies Appl Math, 2007, 119:95-109).

| 8 |

Relative to soft tissue repair, it is well established that increasing blood flow to the wound and peri-wound area helps accelerate the healing of ischemic wounds. Micro-vibrations applied on the skin tissue increase local blood flow and oxygen delivery to the wound area and stimulate angiogenesis and growth factors that are helpful for the wound healing process. Vibration therapy has been found to stimulate blood flow due to mechanical stresses of endothelial cells resulting in increased production of nitric oxide and vasodilation, as well as increase soft tissue and skin circulation. (Maloney-Hinds et al., “The Role of Nitric Oxide in Skin Blood Flow Increases due to vibration in healthy adults and adults with type 2 diabetes,” School of Medicine, Loma Linda University. Ca. Diabetes Technology & Therapeutics, 2009 p. 39-43). In addition, micro vibrations induce skin surface nerve axon reflex and type IIa muscle fibers contraction rates, resulting in vasodilation (Nakagami et al., “Effect of vibration on skin blood flow in an in vivo microcirculatory model”, The University of Tokyo, Bio-Science Trends 2007; 1 (3): 161-166). Ten minutes of vibration therapy with laser doppler revealed a consistent increase in water content of the upper dermis (TJ Ryan et al., “The effect of mechanical forces (vibration or external compression) on the dermal water content of the upper dermis and epidermis, assessed by high frequency ultrasound”, Oxford Wound Healing Institute, Journal of Tissue Viability, 2001. Of import with respect to diabetic wounds, in which a prolonged inflammatory phase occurs, vibration vasodilation has generated an indirect anti-inflammatory action, mainly by suppression of nuclear factor-kβ, the key gene for inflammatory mediators (Sackner, M.A., “Nitric Oxide is released into circulation with whole-body, periodic acceleration”, Chest 2005;127;30-39).

Urinary catheter usage is associated with pain and discomfort caused by the friction between the catheter surface and the urethral tissue. Generally, this friction is treated by applying lubricating gels and low friction catheter coatings. These methods are effective for a short term during the catheter insertion as the lubricating gel is quickly absorbed into the surrounding tissue and loses its effect and the catheter coatings lose their lubricity within a few days, as the coating is covered by a thin film of mucous.

Our UroShield product provides vibrations along the surface of the urinary catheter that is in contact with urethral tissue. We believe that these vibrations create a continuous acoustic lubrication effect along the surface of the indwelling catheter that is in contact with the surrounding tissue, thus reducing catheter-tissue contact time, which may lessen trauma from urethra abrasion and adhesion. We have also shown in animals and in humans that the micro-vibration technology can reduce the level of biofilm formation on urinary catheters.

Our Products

Product Design, Packaging, Identity

All products were redesigned in the fourth quarter 2019, with an updated look and improved performance. These new designs were coupled with new branding, packaging, instructional manuals, and marketing materials. Beginning in the fourth quarter of 2019, our manufacturing in China, Singapore, and Israel have commenced producing the redesigned products for distribution and delivered their first completed units in April 2020.

UroShield

UroShield is intended to prevent bacterial colonization and biofilm formation, increase antibiotic efficacy in the catheter lumen and decrease pain and discomfort associated with urinary catheter use. It is designed to be used with any type of indwelling urinary catheter regardless of the material or coating. Use of the device is contraindicated for use while there is an active Urinary Tract Infection. We believe that UroShield may be the first medical device on the market that attempts to simultaneously address all of the aforementioned catheter-related issues. UroShield is similar in design to PainShield, in that it uses a driver unit that produces low frequency, low intensity ultrasound. The driver unit connects to a disposable transducer that is clipped onto the external portion of the catheter to deliver ultrasound therapy to all catheter surfaces as well as the tissue surrounding the catheter.

| 9 |

Picture of UroShield with actuator

Clinical studies of the UroShield system have supported the following advantageous effects:

| ● | Prevention or Reduction of Biofilm. The low frequency ultrasound generated by UroShield has been shown to decrease adherence of bacteria to catheter surfaces, thereby reducing biofilm. Biofilm is the complex matrix required for bacteria to grow and cause infection. See the discussion of our Heidelberg 1 trial below. | |

| ● | Decreased Catheter Associated Pain and Discomfort. We believe that UroShield creates an acoustic envelope on the surfaces of the catheter, which decreases friction and tissue trauma, pain and discomfort caused by the catheter. In addition, in vivo (rabbit) studies have shown the tissue in contact with the catheter remains healthier and less traumatized as a result of the application of low frequency and low intensity ultrasound (Applebaum I, et.al., “The Effect of Acoustic Energy Induced By UroShield on Foley Catheter Related Trauma and Inflammation in a Rabbit Model” Department of Urology, Shaarey Zedek Medical Center and the Hadassah Hebrew University Medical School). | |

| ● | Acoustically Augmented Antibiotic Therapy. Antibiotic resistance in biofilm bacteria is a well-known phenomenon. Although it has been known that ultrasound can increase antibiotic efficacy in in-vitro models, we do not believe that there has been a practical ultrasound-based medical device that was able to augment antibiotic efficacy in the clinical setting. In a clinical study, UroShield technology has been shown to eradicate biofilm-residing bacteria by greater than 85% when applied simultaneously with an antibiotic in three clinically relevant species, escherichia coli, staphylococcus epidermidis and pseudomonas aeruginosa (Banin E, et al., “Surface acoustic waves increase the susceptibility of Pseudomonas aeruginosa biofilms to antibiotic treatment,” Biofouling, August 2011; we supplied devices for this study, but had no further involvement with it). | |

| ● | Preservation of the Patency of Catheters. We believe that low frequency ultrasound applied to catheters will add an anti-clogging effect and will preserve patency of catheters. This effect is achieved by ultrasound waves creating an acoustic layer on the inner lumen of the urinary catheter, thereby preventing adherence of biological material and biofilm formation. We believe that this anti-clogging benefit will help prevent local infection and sepsis secondary to catheter obstruction. |

UroShield has undergone a number of clinical trials. The Heidelberg 1 trial, conducted in 2005-2006, which we sponsored, was a 22 patient randomized, double blind, sham-controlled, independent trial that tested UroShield’s safety and ability to prevent biofilm in patients with an indwelling Foley catheter. The trial demonstrated that UroShield prevented biofilm in all patients with the active device as compared to biofilm being found in seven of eleven of the control patients. In addition, there was a marked decrease in pain, discomfort and spasm in the active UroShield patients, as evidenced by a statistically significant decrease in the requirement for the medications required to treat urinary catheter associated pain and discomfort (Ikinger U, “Biofilm Prevention by Surface Acoustic Nanowaves: A New Approach to Urinary Tract Infections?,” 25th World Congress of Endourology and SWL, Cancun, Mexico, October 2007).

| 10 |

In a subsequent physician-sponsored trial, known as Heidelberg 2, conducted in 2007, 40 patients who underwent radical prostatectomies were divided into two groups, with the active group receiving one intra-operative dose of antibiotics and UroShield and the control group receiving one intra-operative dose of antibiotics and then five subsequent doses over three days. At the end of the trial, the control group had four cases of bacteriuria, as compared to one in the active group. In a third trial, a physician-sponsored open label trial, 10 patients who received emergency placement of a urinary catheter due to acute obstruction were given a UroShield device and followed with regard to their pain, discomfort, spasm and overall well-being. Within 24 hours, all patients showed improvement and increased toleration of the catheter (Zillich S., Ikinger U, “Biofilmprävention durch akustische Nanowellen: Ein neuer Aspekt bei katheterassoziierten Harnwegsinfektionen?,” Gesellschaft für Urologie, Heilbronn, Germany, May 2008). We supplied devices for this trial, but had no further involvement with it.

As recently announced, the Company submitted to The National Institute for Health and Care Excellence, for review, the findings from an independent evaluation of its UroShield® device on patients who had used the device for up to two years. Clinical data from the study conducted by Coventry University’s Assistant Professor, Ksenija Maravic da Silva, during 2020 reported statistically significant outcomes for the device including a reduced number of urinary tract infections (UTIs), reduced instances of prescribed antibiotics, reduced catheter blockages, reduced the need for unplanned catheter changes and reduced pain reported as a result of catheter associated complications. The study also provided important insights into the lives of those using the device including improvement of overall well-being, relating specifically to decreased levels of worry and increased ability to socialize. In addition, patient feedback on product improvements was addressed and has been incorporated in the present commercially available device.

In September 2022, UroShield was approved for sale by the U.K.’s National Health System’s (NHS) internal supply organization, NHS Supply Chain, through a new contract.

This new contract with NHS Supply Chain provides dedicated end-to-end supply chain service of our UroShield for every NHS healthcare organization. UroShield will be available to all patients who the need the device with full clinical support, through the NHS supply chain. It represents a significant opportunity for us to expand distribution of UroShield as it will now be made available to all clinicians and their patients through the NHS organization’s own supply channel. NHS Supply Chain manages the sourcing, delivery and supply of healthcare products and services for NHS trusts and healthcare organizations across England and Wales. The organization processes more than eight million orders per year across 94,000 order points and 17,465 locations serving as an integral part of the national healthcare system in the U.K. We are ramping up production to meet an increase in demand that we anticipate as a result of this exciting development.

The new contract, which is designed to provide new innovative products for healthcare providers, begins in October 2022 and will merge with the existing Urology and Stoma framework contract in February 2024 with optional extension periods.

Under the contract, NHS Supply Chain describes UroShield as a disposable ultrasound device designed to reduce the risk of catheter-associated urinary tract infection (CAUTI) by reducing bacterial colonization and biofilm formation on indwelling urinary catheters. This ultimately translates into improved outcomes for patients and care provides, reduces the need for antibiotics, catheter changes and washouts and incidence of hospital visits, thereby reducing nursing time, bed days and ambulance transfers.

On March 1, 2023 the Company launched its month-to-month rental program for UroShield.

Market for UroShield

According to the Centers for Disease Control and Prevention, urinary tract infection (UTI) is an infection involving any part of the urinary system, including urethra, bladder, ureters, and kidney. UTIs are the most common type of healthcare-associated infection reported to the National Healthcare Safety Network (NHSN). Among UTIs acquired in the hospital, approximately 75% are associated with a urinary catheter, which is a tube inserted into the bladder through the urethra to drain urine. Between 15-25% of hospitalized patients receive urinary catheters during their hospital stay. The most important risk factor for developing a catheter-acquired urinary tract infection (CAUTI) is prolonged use of the urinary catheter.

This study was written up in the December 2018 issue of “Medical & Surgical Urology”, a leading peer-reviewed journal in the field of urology.

Approximately 15-25% of patients who are admitted to a hospital will have an indwelling catheter at some point during their stay and 7% of nursing home residents are managed by long term catheterization.

CAUTI is the most common nosocomial infection in hospitals and nursing homes, representing over 40% of all hospital-acquired infections (HAIs) and 20% of intensive care unit HAIs (Maki, P and Tambyah, D. Engineering Out the Risk for Infection with Urinary Catheters., Emerging Infectious Diseases., Vol. 7, No. 2, March–April 2001). In addition, CAUTIs are the source for approximately 20% of healthcare acquired bacteremia in acute care and 50% in long-term care facilities (Nicolle, Lindsay E. “Catheter Associated Urinary Tract Infections.” Antimicrobial Resistance and Infection Control 3 (2014). The risk of acquiring CAUTI depends on the method and duration of catheterization and patient susceptibility. Patients requiring a urinary catheter have a daily risk of approximately five percent of developing bacteriuria and approximately 25% of patients develop nosocomial bacteriuria or candiduria over one week (Maki, P and Tambyah, D. Engineering Out the Risk for Infection with Urinary Catheters., Emerging Infectious Diseases., Vol. 7, No. 2, March–April 2001). Virtually all patients requiring indwelling urinary catheters for longer than a month become bacteriuric.

CAUTI occurs because urethral catheters inoculate organisms into the bladder and promote colonization by providing a surface for bacterial adhesion and causing mucosal irritation. The presence of a urinary catheter is the most important risk factor for bacteriuria. Once a catheter is placed, the daily incidence of bacteriuria is 3-10%. Between 10% and 30% of patients who undergo short-term catheterization (i.e., 2-4 days) develop bacteriuria and are asymptomatic. Between 90% and 100% of patients who undergo long-term catheterization develop bacteriuria. About 80% of nosocomial UTIs are related to urethral catheterization; only 5-10% are related to genitourinary manipulation. (John L. Brusch, Catheter-Related Urinary Tract Infection, Medscape, August 18, 2015).

| 11 |

The global catheter market size was valued at USD 37.3 billion in 2018 and is expected to witness a CAGR of 9.7% through 2026. Rising prevalence of chronic disorders leading to hospitalization has fueled the growth of this market. Presence of multi-national manufacturers, improving medical facilities, supportive insurance policies are also some of the key factors propelling the market growth. North America is the largest regional market due to the presence of multi-national manufacturers and sophisticated healthcare infrastructure along with high product awareness levels. Asia Pacific is projected to expand at the maximum CAGR of 10.4%, over the study period. According to a Grandview research report published 2018, there are 25 million Foley catheters sold annually in the United States and 75 million catheters sold elsewhere yielding a total global Foley catheter market of 100 million units worldwide. The cost to treat a simple CAUTI has been estimated at $13,793 per case (AHRQ), and the cost of treating bacteremia has been estimated at $8,355 (NIH) per case, yielding a total healthcare burden of $830 million per year. While there are currently both antibiotic and silver coated catheters in the market, they often sell for approximately $10 above the non-antimicrobial equivalent.

In addition, as of October 1, 2008, Medicare stopped authorizing its payment to hospitals in which patients have developed a catheter-associated urinary tract infection that was not present on admission. This provides hospitals in the United States with a substantial financial incentive to reduce the occurrence of such infections through the use of products such as UroShield, which help prevent infections hospitals would otherwise have to treat without reimbursement. In addition, it has been noted that the Centers for Medicare & Medicaid Services may fine hospitals in the future when their patients develop CAUTI, which will likely increase the incentive of hospitals to invest in technologies that may prevent this complication (Brown J, et al. “Never Events: Not Every Hospital-Acquired Infection Is Preventable, Clinical Infectious Diseases, 2009, 49 (5)).

Competition for UroShield

Several types of products have been introduced to address the growing problem of catheter-acquired infection and biofilm formation on catheter surfaces. Manufacturers offer antibiotic-coated and antiseptic-impregnated catheters. In addition, manufacturers have produced silver-coated catheters, which have been shown in small studies to delay bacteriuria for about two to four days. However, larger studies did not corroborate this result; on the contrary, silver hydrogel was associated with overgrowth of gram positive bacteria in the urine (Riley DK, Classen DC, “A large randomized clinical trial of a silver-impregnated urinary catheter: lack of efficacy and staphylococcal superinfection,” Am. J. Med. 1995 April; 98(4):349-56).

UroShield has been designed to be added to any type of catheter, including Foley catheters and silver-coated catheters, to improve a catheter’s infection prevention performance. However, in the United States, we do not have the requisite regulatory authorization to market UroShield for such use, as we have not yet obtained FDA clearance or approval for UroShield, and the FDA’s temporary, COVID-19-related policy of Enforcement Discretion under which we have been marketing UroShield since September 2020 expressly excludes use with a coated catheter. UroShield is not intended to replace any existing products or technologies, but instead is intended to assist these existing products or technologies in preventing catheter-acquired urinary injury and catheter associated complications. While UroShield was temporarily authorized for use in the United States per FDA’s Enforcement Discretion during the COVID-19 health emergency, the public health emergency has since-been terminated, and the applicable FDA policy under which we have been marketing UroShield will similarly terminate before the end of 2023. In particular, recent FDA guidance confirmed that its medical-device enforcement policies issued during the COVID-19 pandemic will officially expire on November 7, 2023. The guidance outlines a three-phase plan for ensuring that any devices marketed under a specifically listed enforcement policy will be able to be marketed lawfully after the termination of those enforcement policies. During the 180-day period between the termination of the public health emergency and the expiration of FDA’s relevant enforcement policies, manufacturers, like us, who desire to continue marketing their respective devices must submit an appropriate premarket submission, such as a 510(k) application or de novo reclassification request, and bring the device into compliance with applicable FDA regulations. If we do not obtain permanent clearance from the FDA by November 7, 2023, we will have to discontinue distribution of UroShield in the United States until the necessary FDA clearance or approval is granted. We cannot guarantee that FDA will clear or approve UroShield for continued marketing in the United States in a timely manner or at all.

Regulatory Strategy

UroShield received CE Mark approval in September 2007 and was also approved for sale by the Israeli Ministry of Health in 2008. We are able to sell UroShield in India and Ecuador based on our CE Mark. UroShield was granted a Canadian medical device license in September 2016, although, due to a modification of regulatory standards in Canada, we have lost our Canadian license. We are working toward reinstatement of our Canadian license. To that extent, we passed an audit in or around October 2022.

In the European Union, UroShield has been marketed for the prevention of CAUTI and biofilm formation, decreased pain and discomfort associated with urinary catheters and increased antibiotic efficacy.

| 12 |

In September 2020, the FDA exercised its Enforcement Discretion to allow distribution of the UroShield device in the United States. According to the FDA, “UroShield® device can use Intended Use Code (IUC) 081.006: Enforcement discretion per final guidance, and FDA product code QMK (extracorporeal acoustic wave generating accessory to urological indwelling catheter for use during the COVID-19 pandemic)”.

Accordingly, the FDA’s Enforcement Discretion temporarily cleared the way for import of UroShield to the U.S. during the Covid-19 pandemic, immensely expanding the company’s addressable market for the device during this time period, which will officially end in November 2023. The device is designed to aid in the prevention of CAUTI incidence in patients requiring long-term indwelling catheterization, defined as 14 days or greater.

After reviewing the body of scientific evidence that we presented, the FDA took decisive action to clear the way for patient access to UroShield for the duration of the Covid-19 pandemic. We believe the evidence presented to the FDA on UroShield demonstrated decreases in the risk of catheter-associated urinary tract infections and related complications in patients using UroShield who required long-term indwelling catheterization.

We intend to seek long-term marketing authorization from the FDA through the de novo classification process for UroShield, which is a premarket pathway intended for devices that cannot pursue 510(k) clearance because there is no substantially equivalent predicate device but which the applicant believes are sufficiently low-risk that they need not undergo the rigorous premarket approval pathway to be deemed safe and effective for the applicable indications for use. We are currently seeking advice from the FDA prior to submission. We also intend to seek advice and validation of supporting studies we intend to undertake in advance of a De Novo application.

The FDA has made it clear that we will need to generate more clinical study data in order to achieve) de novo reclassification. Our intent is to conduct a community based PRO study (Patient Reported Outcomes) measuring the impact UroShield will have on prevention of CAUTI, Prevention of Blockage, and prevention of Pain. We currently are in the early stages of putting together a team and plan to start this process.

Studies completed to assess the safety of UroShield for human use:

| ● | A large animal model (female sheep) study has been conducted to establish local tissue response from a urinary catheter with UroShield attached as compared to a control group of animals with a urinary catheter with no UroShield attached.

The pre-clinical animal study was intended to demonstrate safety of UroShield device when used for 30-days with a urinary catheter. The study compared local tissue and organ response in two groups of 4 (female) sheep where one group was catheterized (urethral) using an uncoated silicone Foley catheter (only) and the other group was catheterized using an uncoated silicone Foley catheter with UroShield device attached to it. All catheters were identical in their size, material composition and manufacturer.

After 30 days the animals were euthanized and local tissue and organs were examined. The results showed the group with UroShield device had fewer observations of swelling, redness or discharge at the vulva as compared to the group without UroShield. The animals did not exhibit signs of discomfort or pain during study period (of 30 days). The gross and histopathology findings were also very similar between the two groups. | |

| ● | A comparative study of leachables from a urinary catheter with and without UroShield attached has been performed to demonstrate that the leachables with UroShield attached do not exceed toxicological safe limits allowed for a medical device.

The chemical characterization of leachables was intended to demonstrate safety for UroShield device for 30-day use with a urinary catheter. The study compared leachables from a group consisting of 3 uncoated silicone catheters with leachables from a group consisting of 3 uncoated silicone catheters with UroShield attached to it. All catheters were identical in their size, material composition and manufacturer.

The exhaustive extractions were performed with non-polar, polar and aqueous solvents. An additional simulated use extraction using Saline and Ethanol was performed. Overall the extractables from both groups were comparable and toxicological evaluation showed that all compounds from extraction with UroShield were below the tolerable exposure limits. Most of compounds had a margin of safety greater than 10 and 4 compounds had margin of safety between 1.5 and 10. Overall, the toxicological risk for using UroShield with a urinary catheter is similar and at even lower as compared to a catheter without UroShield attached. |

Sales and Marketing

Since the FDA exercised its Enforcement Discretion to allow the distribution of the UroShield device in the United States, we have been actively seeking partnerships for marketing our product in the United States. We believe the business opportunity for UroShield is in the hundreds of millions in U.S. dollars to the extent that UroShield obtains permanent marketing authorization from the FDA, is recognized as effective and becomes widely adopted for use on catheters, none of which can be guaranteed. To that end, we are seeking a strategic partnership with various companies which have an existing “footprint” in the Urology market. Those discussions and negotiations are ongoing at this time. We have appointed distributors for UroShield in the United Kingdom. Malta, and Australia. We recently appointed the Benion group to identify distributor opportunities outside of the United States.

We announced in December 2022 that we have appointed a new distributor in the United Kingdom. The newly appointed distributor is Peak Medical.

From time to time we have had interest from strategic companies in the catheter market to partner, license or acquire the UroShield technology. These strategic partners are active in the urology market and may be interested in integrating UroShield as an accessory, into its range of products. Discussions with these partners are ongoing. There has also been interest from other companies with various invasive line applications.

| 13 |

Clinical Trials

To date, we have conducted the clinical trials set forth below:

| Purpose | Doctor/Location | Time, subjects |

Objectives | Results | ||||

To assess the safety of the UroShield Double Blind, Comparative, Randomized Study for the Safety Evaluation of the UroShield System (HD1)

|

Dr. U. Ikinger, Salem Academic Hospital, University of Heidelberg, Germany | 2005-2006 22 patients |

To demonstrate that the use of the UroShield is safe and that the device is well tolerated by the patients and user friendly to the medical staff. Efficacy objectives were to demonstrate that the UroShield helps in prevention of biofilm formation in comparison with the urinary catheter alone, as well as bacteriuria. |

UroShield was both safe and well tolerated. UroShield proved efficacious in prevention of biofilm. Subjects required significantly less medications than the control group for catheter related pain and discomfort. | ||||

Double Blind, Comparative, Randomized Study for the Safety Evaluation of the UroShield System (HD2 ) Physician initiated |

Dr. U. Ikinger, Salem Academic Hospital, University of Heidelberg, Germany | 2007 40 patients

|

To demonstrate that the use of the UroShield is safe and helps in prevention of biofilm formation and UTI in comparison with the urinary catheter alone, as well as decrease antibiotic use. | In this trial, only 1/20 patients in UroShield device (no antibiotics) group developed urinary tract infection compared to 4/20 patients within control group treated with the antibiotic prophylaxis alone. | ||||

The Effect of UroShield on Pain and Discomfort in Patients Released from the Emergency Room with Urinary Catheter Due to Urine Incontinence Physician initiated |

Shaare Zedek Medical Center Jerusalem, Israel. | 2007 10 patients

|

The study aimed to assess the effectiveness of the UroShield in reducing pain and discomfort levels and improve the well-being of the subjects. Efficacy objectives included reduction of pain, spasm, burning and itching sensation levels of the subjects. | The results demonstrated a reduction in pain, itching, burning and spasm levels. Additionally, the well-being of the subjects showed a significant increase. | ||||

| The Use of the UroShield Device in Patients with Indwelling Urinary Catheters Open labeled, comparative, randomized study | Dr. Shenfeld Shaare Zedek Medical Center Jerusalem, Israel.

|

2007-2009 40 patients

|

Patient complaints related to catheter regarding pain according to VAS scale and discomfort according to 0-10 scale Presence of Clinically Significant UTI Presence of Bacteriuria Presence of Biofilm Use of medication |

UroShield device was effective in reducing postoperative catheter related pain discomfort and bladder spasms. There was also a notable trend towards reduction of bacteriuria. |

| 14 |

| Purpose | Doctor/Location | Time, subjects |

Objectives | Results | ||||

| Evaluation of the UroShield in urinary and nephrostomies to reduce bacteriuria Physician initiated | Prof. P.Tenke, Hungary

|

2010-2011 27 patients

|

● Pain, disability and QOL ● Catheter patency ● Bacteriuria / UTI ● Hospitalization period ● Analgesics and Antibiotics intake |

Showed reduction in pain and significant decrease in bacteriuria rate. | ||||

| Double Blind, Randomized Control Study for Prevention of Bacterial Colonization and UTI associated with Indwelling Urinary Catheters | Dr. Shira Markowitz Buffalo, NY

|

2017 55 patients

|

To demonstrate the use of the UroShield reduces bacterial colonization on the urinary catheter | Final results entitled “The Effect of Surface Acoustic Waves on Bacterial Load and Preventing Catheter-Associated Urinary Tract Infections (CAUTI) in Long Term Indwelling Catheters,” which was published in the December 2018 issue of Medical & Surgical Urology, a leading peer-reviewed journal in the field of urology. | ||||

| Mean improvement advantage in treatment vs control was 87.2K CFU, (t (53) 18.1, p<0.001) at thirty days. At 60 days the mean improvement advantage in treatment vs control was 87.5K CFU, (t (53) 18.1, p<0.001). At 90 days the mean improvement advantage in treatment vs control was 79.3K CFU, (t (53) 12.4, p<0.001). |

| 15 |

| Purpose | Doctor/Location | Time, subjects |

Objectives | Results | ||||

After cessation of treatment in the active group at 30 days, there was a minimal increase in CFU count at both 60 and 90 days. In the same group, there was no statistical difference in the decrease of CFU count from 30 to 60 days after treatment, t (28)=1. p= .326, however there was a marginally significant increase in CFU from 60 to 90 days for the active group (28)=1.7 p= 0.09.

At baseline, every enrolled patient had been treated for infection during the 90 days prior to enrollment. Compared to baseline, the treatment group showed significant statistical and clinical improvement (100%) at 30 days relative to the sham control (73%). There were no reported infections in the Treatment Group while in the control group there were seven reported infections.

At 90 days after treatment, the treatment group showed a significantly stronger improvement (89.7%) compared to the sham control (46.2%). There were three reported infection in the Treatment group, while in the control group there were fourteen reported infections requiring antimicrobial therapy. (logistic regression B=2.3, Wald Chi-Square (df=1) =10.1, p=0.001.) |

| 16 |

| Purpose | Doctor/Location | Time, subjects |

Objectives | Results | ||||

| UroShield Randomized Control trial | 5 different nursing facilities | 2017 - 2018 51 subjects |

51 subjects were evaluated with 26 in the active/treatment group and 25 in the control group. All patients had been treated for at least one incident of a catheter-acquired urinary tract infection (CAUTI) requiring antibiotics in the preceding 6 months prior to trial initiation. | At the 90-day evaluation, 13 of 25 subjects (52%) in the control group developed a CAUTI requiring systemic antibiotics while only 1 of 26 patients (4%) in the UroShield™ group required antibiotic. All study subjects had an initial colony count of greater than 100,000 CFU cultured from their urinary tract. At thirty days, all subjects within the control group showed no change in the number of their bacteria count which was greater than 100,000 CFU, while those in the treatment group showed a reduction to 10,000 CFU in 15 of 26 subjects and only 1,000 CFU in 10 of 26 subjects, proving a decrease in both bacterial colonization and the incidence of Urinary Tract Infection. |

| 17 |

Recently Completed, Current, Ongoing and Planned Clinical Trial

If we are able to locate a strategic partner or otherwise obtain sufficient funding, we anticipate conducting the following clinical trial:

| Trial | Place | Start Date/Timing | Objectives | |||

| UroShield FDA Administration trial ~300 patient trial | To be determined | To be determined Intended to begin in 2023 |

Safety and efficacy of UroShield in urinary catheter related pain and infection and biofilm formation.

The results of previous clinical trials may not be predictive of future results, and the results of our planned clinical trial, if we are able to locate a strategic partner or otherwise obtain sufficient funding, may not satisfy the requirements of the FDA. |

PainShield®

PainShield is an ultrasound device, consisting of a reusable driver unit and a disposable patch, which contains our proprietary therapeutic transducer. It delivers a localized ultrasound effect to treat pain and induce soft tissue healing in a targeted area, while keeping the level of ultrasound energy at a safe and consistent level of 0.4 watts. We believe that PainShield is the smallest and most portable therapeutic ultrasound device on the market and the only product in which the ultrasound transducer is integrated in a therapeutic disposable application patch.

We believe the existing ultrasound therapy devices being used for pain reduction are primarily large devices used exclusively by clinicians in medical settings. PainShield is able to deliver ultrasound therapy without being located in a health care facility or clinic because it is portable, due to it being lightweight and battery operated. Because it is patch based and easy to apply, PainShield does not require medical personnel to apply ultrasound therapy to the patient. Some patient benefits reported in prior studies included ease of application and use, relatively quick recovery time, high patient compliance, and potentially increased safety and efficacy over certain other devices that rely on higher-frequency ultrasound (Adahan M, et al, “A Sound Solution to Tendonitis: Healing Tendon Tears With a Novel Low-Intensity, Low-Frequency Surface Acoustic Ultrasound Patch,” American Academy of Physical Medicine and Rehabilitation Vol. 2, 685-687, July 2010). PainShield can be used by patients at home or work or in a clinical setting and can be used even while the patient is sleeping. Its range of applications includes acute and chronic pain reduction and anti-inflammatory treatment.

Picture of PainShield with Patch

In other countries outside the United States where the product is approved for such use, PainShield is used to treat tendon disease and trigeminal neuralgia (a chronic pain condition that affects the trigeminal or 5th cranial nerve, one of the most widely distributed nerves in the head); previously, the therapeutic options for these disorders have been very limited. In the United States, PainShield is only cleared to treat pain, muscle spasms, and joint contractures associated with or caused by various conditions or diseases. It has also been used to treat pelvic and abdominal pain. To date, to the best of our knowledge, the primary treatment options for several of these conditions are pain medication and surgery. Several additional causes of pain, and the treatment of that pain with the PainShield product, can be explored through clinical trials.

| 18 |

On March 1, 2023 the Company launched its month-to-month rental program for Painshield.

Market for PainShield

Pain-related complaints are one of the most common reasons patients seek treatment from physicians (Prince V, “Pain Management in Patients with Substance-Use Disorders,” Pain Management, PSAP-VII, Chronic Illnesses). According to Landro L, “New Ways to Treat Pain: Tricking the Brain, Blocking the Nerves in Patients When all Else Has Failed,” Wall Street Journal, May 11, 2010, approximately 26% of adult Americans, or approximately 76.5 million people, suffer from chronic pain. The National Center for Health Statistics has estimated that approximately 54% of the adult population experiences musculoskeletal pain. Studies have shown that low-frequency ultrasound treatment has yielded positive results for a variety of indications, including tendon injuries and short-term pain relief (Warden SJ, “A new direction for ultrasound therapy in sports medicine,” Sports Med. 2003; 33 (2):95-107), chronic low back pain (Ansari NN, Ebadi S, Talebian S, Naghdi S, Mazaheri H, Olyaei G, Jalaie SA, “Randomized, single blind placebo controlled clinical trial on the effect of continuous ultrasound on low back pain,” Electromyogr Clin Neurophysiol. 2006 Nov; 46(6):329-36) and sinusitis (Ansari NN, Naghdi S, Farhadi M, Jalaie S, “A preliminary study into the effect of low-intensity pulsed ultrasound on chronic maxillary and frontal sinusitis,” Physiother Theory Pract. 2007 Jul-Aug; 23(4):211-8). We believe that PainShield’s technology, portability and ease of use may result in it becoming an attractive product in the pain management and therapy field.

Competition

There are numerous products and approaches currently utilized to treat chronic pain. The pharmacological approach, which may be the most common, focuses on drug-related treatments with the over-the-counter internal analgesic market estimated at $19 billion in 2019. Alternatively, there are a large number of non-pharmacological pain treatment options available, such as ultrasound, transcutaneous electrical nerve stimulation, or TENS, laser therapy and pulsed electromagnetic treatment. In addition, there are some technologies and devices in the market that utilize low frequency ultrasound or patch technology. Many patients are initially prescribed anti-pain medication; however, ongoing use of drugs may cause substantial side effects and lead to addiction. Therefore, patients and clinicians have shown increased interest in alternative pain therapy using medical devices that do not carry these side effects.